One in every 16 homes to change hands in 2021

Pent up demand triggered by the pandemic leads to the busiest market for more than a decade as one in every 16 homes is set to be sold to new owners.

One in every 16 privately-owned properties is set to change owners in 2021, making it the busiest year for the housing market since 2007.

The ongoing re-evaluation of homes triggered by the Covid-19 pandemic has continued to drive increased demand throughout the past year.

The high number of buyers in the market, combined with a shortage of properties for sale, has pushed up the average cost of a UK home to £240,000, compared with £200,000 five years ago.

During the past year alone, the typical property has seen £15,500 added to its value, driven in part by buyer appetite for bigger homes, especially in commuter zones and rural areas.

What’s happening to house prices?

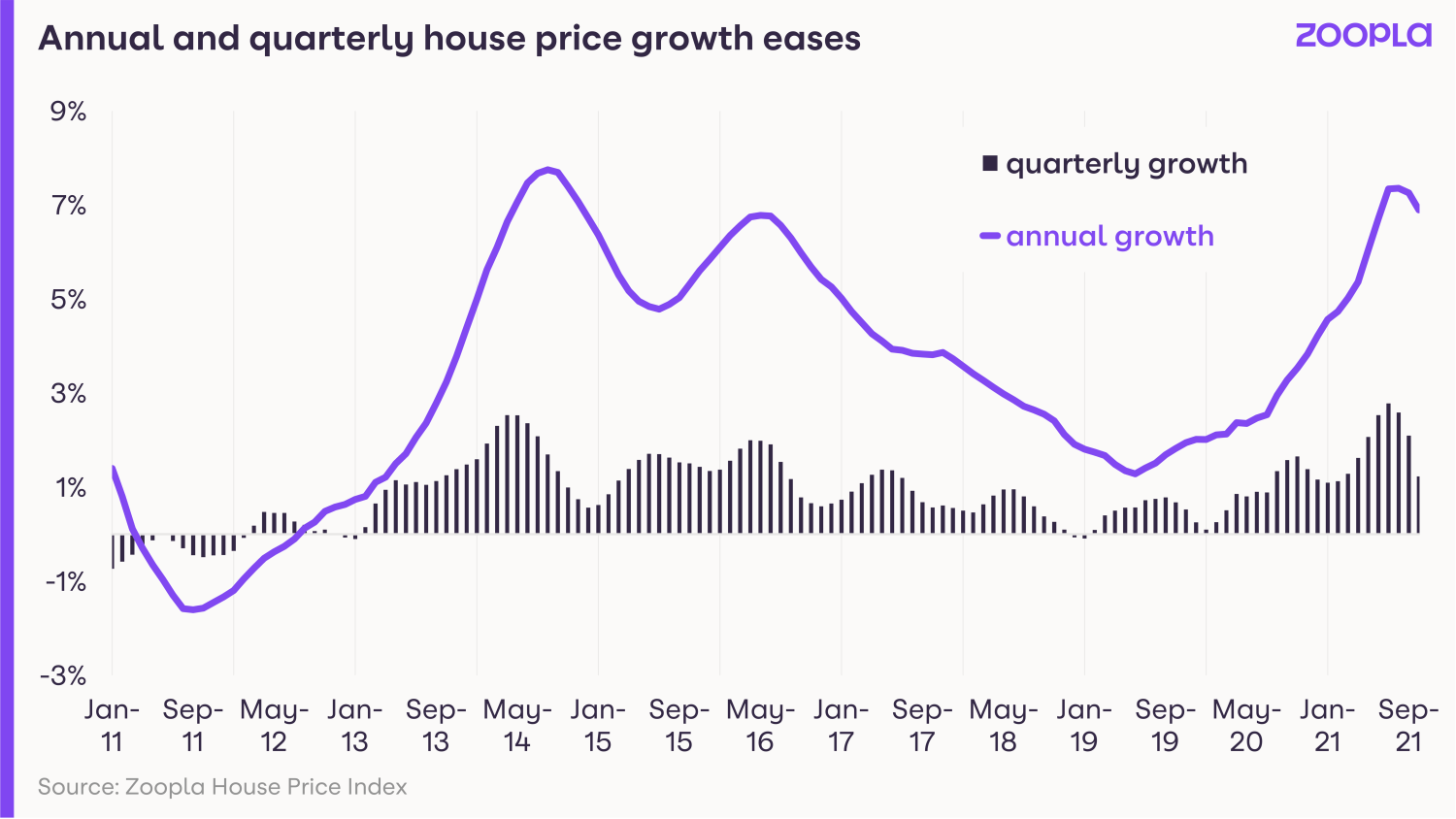

House prices rose at an annual rate of 6.9% in October, double the rate of 3.5% recorded in the same month of 2020.

But the figure represents a slight easing in growth compared with the previous two months, and this trend is expected to continue into next year.

Quarterly figures also suggest the rate of price rises is slowing, with property values increasing by 1.2% in the three months to October, compared with 2.8% in the three months to the end of July.

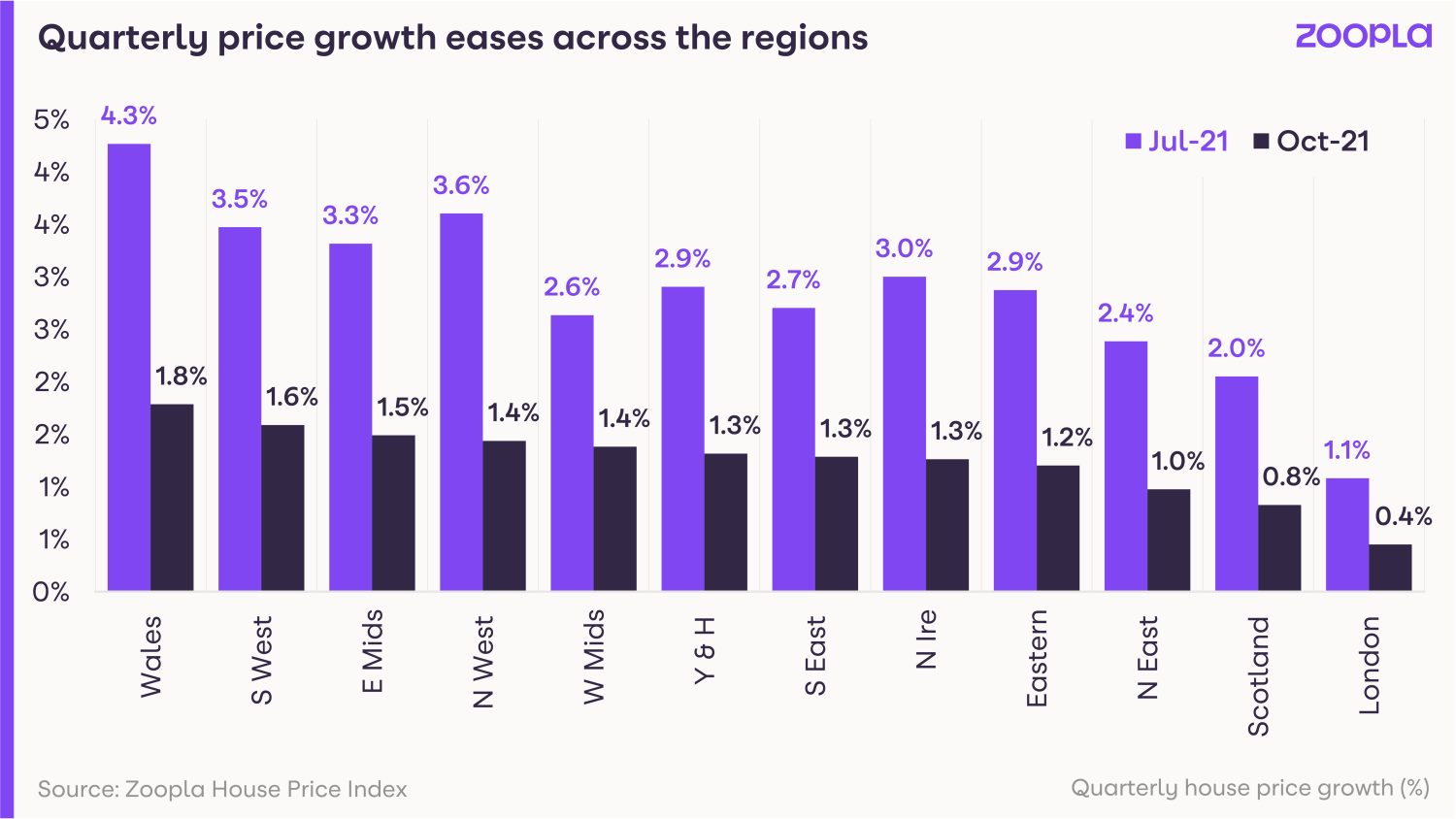

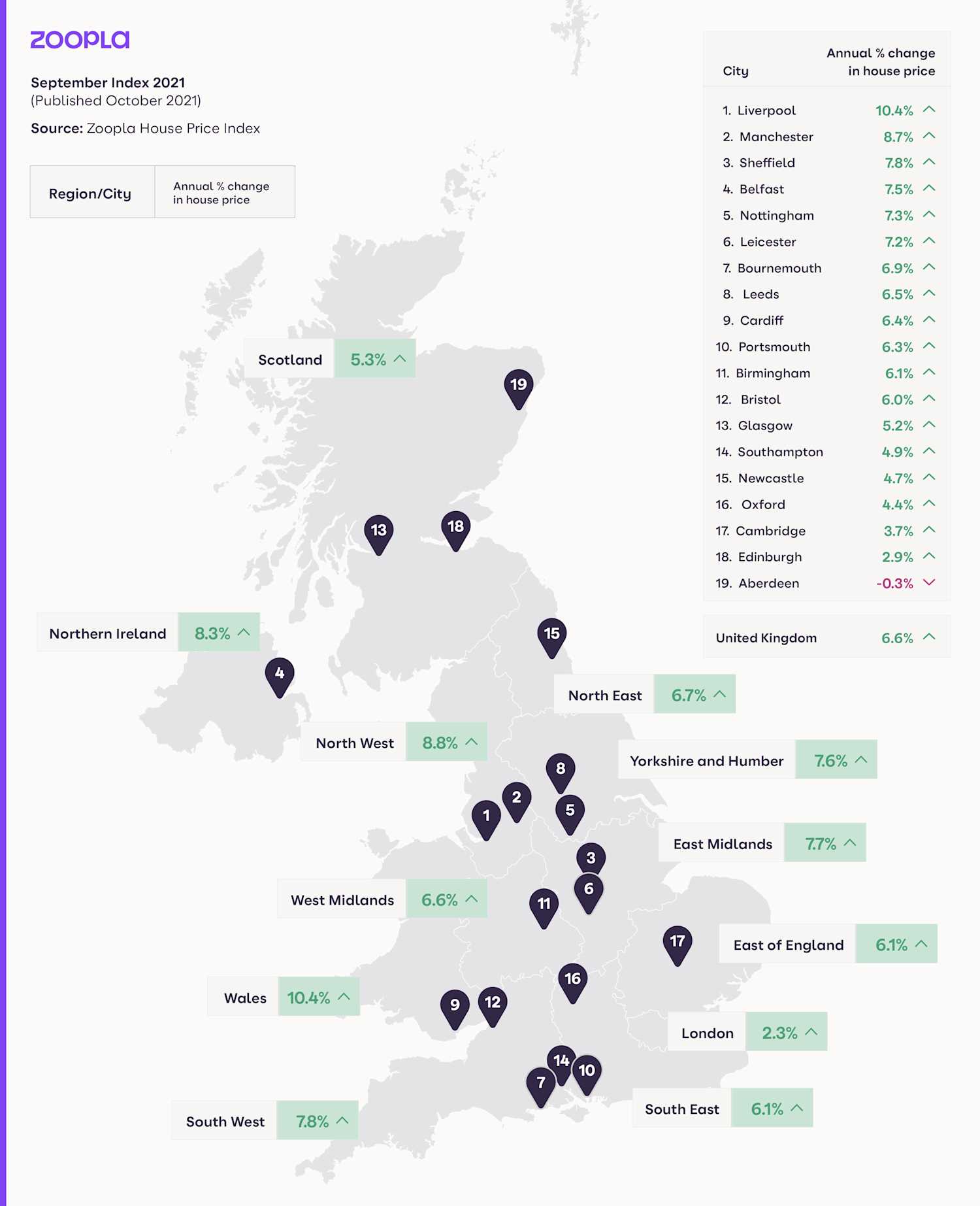

Wales continued to see the strongest gains, with house prices rising 10.8% year-on-year, followed by the North West at 9%.

At the other end of the scale, London saw the slowest growth of just 2.3%.

On a city level, Liverpool, Manchester and Sheffield, where property remains relatively affordable, posted the highest increases of 10.6%, 8.7% and 7.9% respectively.

Here's how prices have grown in cities over the last quarter

How busy is the housing market?

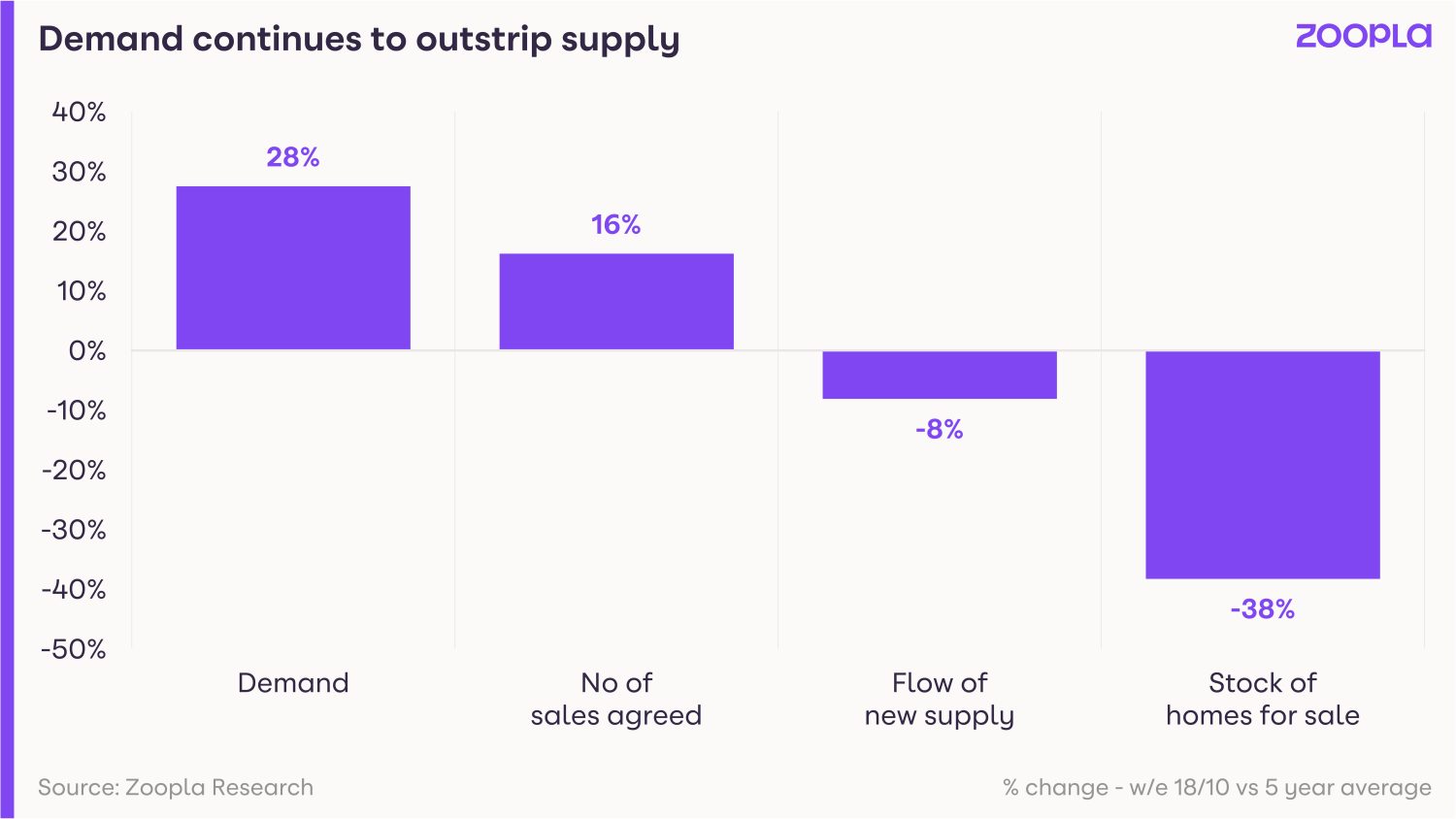

The property market continues to be busy with buyer demand running 28% above the five-year average.

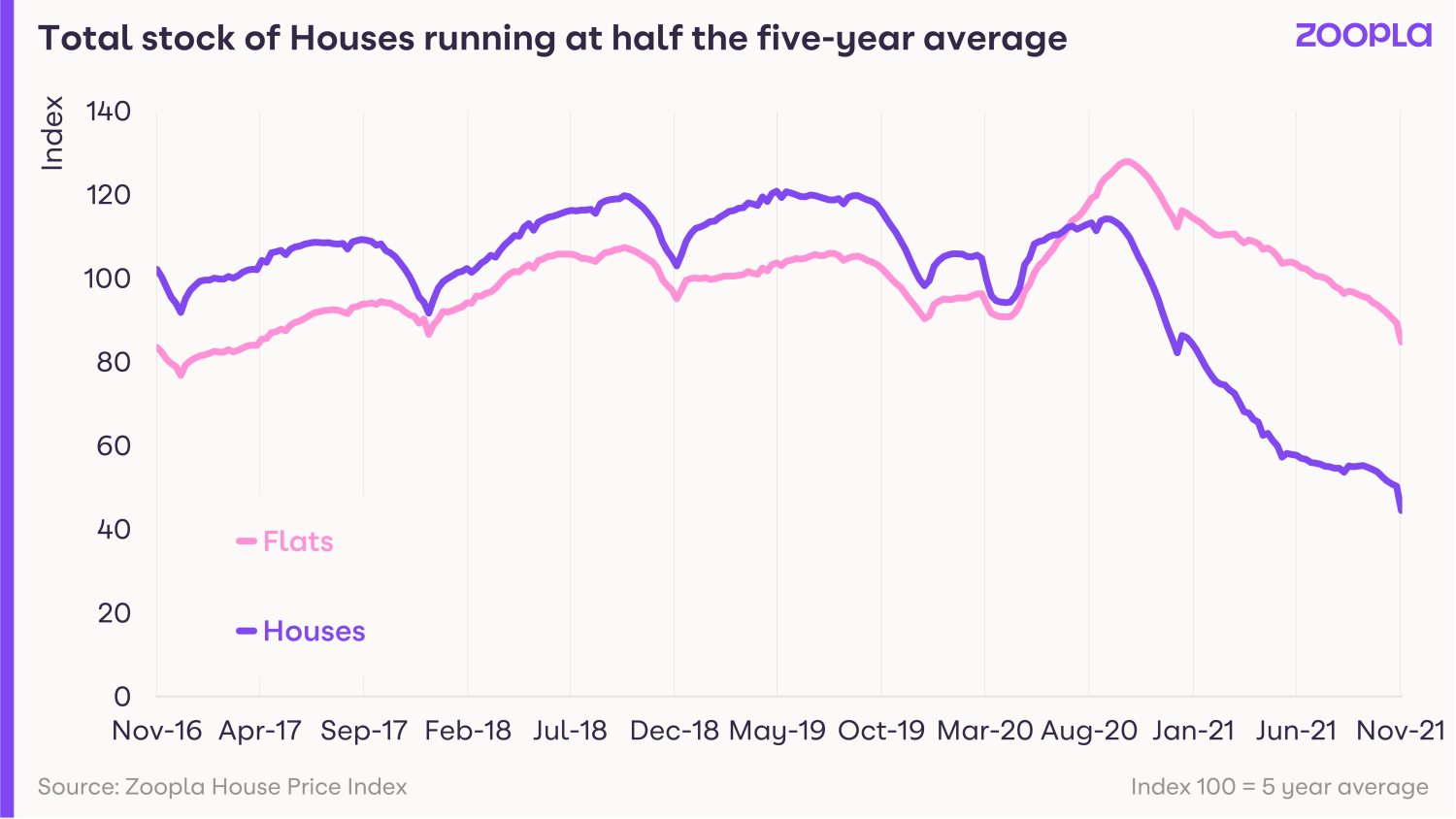

Unfortunately, this strong demand has not been met by an increase in homes being put up for sale, with the number of properties on the market down 42% compared with the five-year average.

Although there is a shortage of both houses and flats, the number of houses listed for sale is more than 55% down on the five-year average, while flats are down by a more moderate 15%.

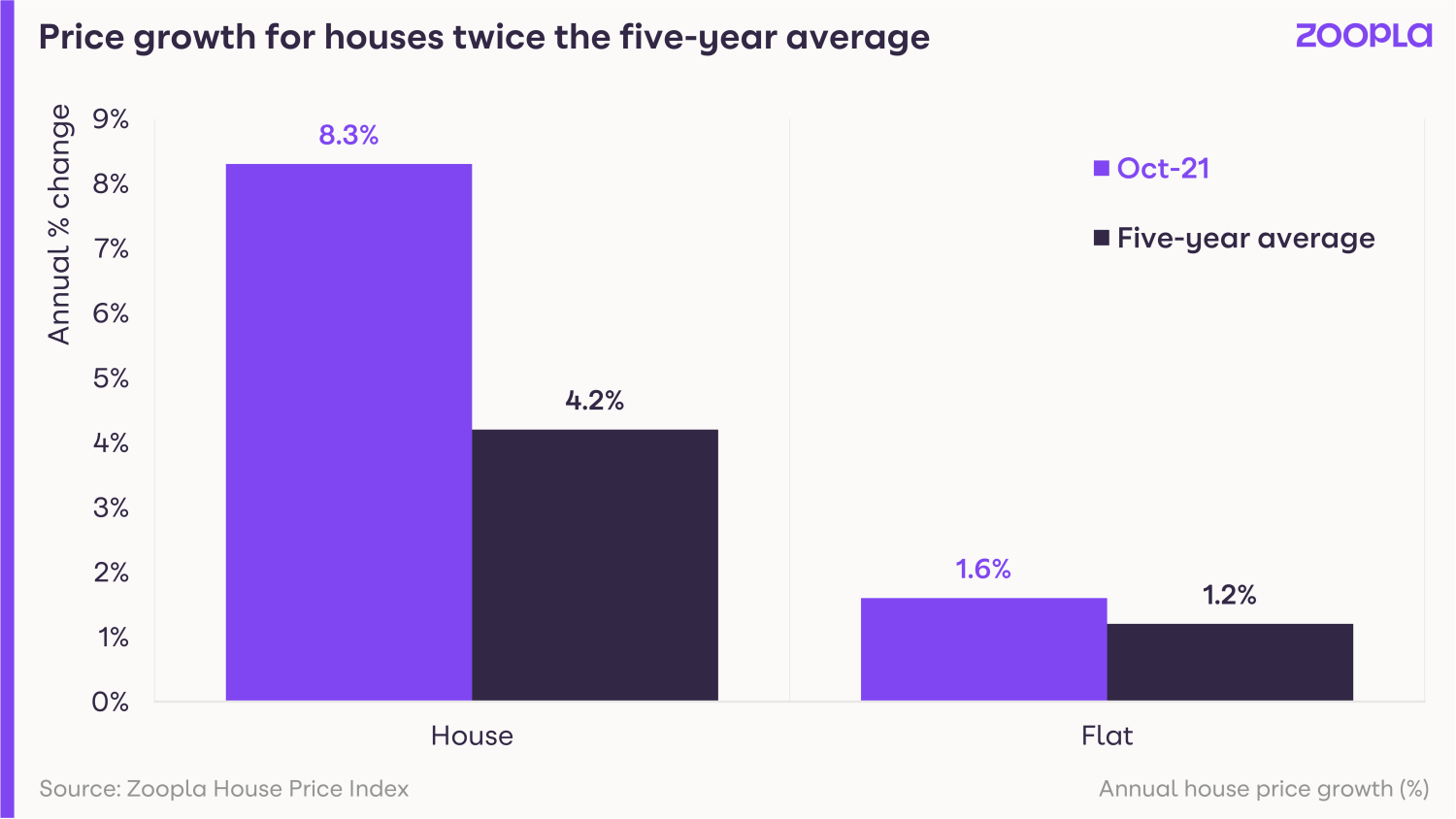

This difference in availability is reflected in price growth, with the average cost of all types of houses jumping by 8.3% during the past year, while the typical cost of a flat has risen by a more moderate 1.6%.

What could this mean for you?

First-time buyers

Intense competition in the market, combined with rising prices, is bad news for first-time buyers.

That said, you can put yourself in a much better position if you're prepared to purchase a flat, rather than a house.

Not only is the shortage of flats for sale less acute than that of houses, but flats have also seen lower price gains in the past year, making them more affordable.

Flats without outdoor space are also taking longer to sell than houses and flats with access to gardens, making this sector of the market less frenzied.

Home-movers

If you have a home you want to sell, particularly if it's a family home or larger house, you're in poll position to obtain both a quick sale and your asking price, as demand for these types of properties remains high.

That said, in the current fast-moving market, co-ordinating your sale with your next purchase could be tricky.

If you do want to sell, you should contact estate agents now to ensure your home is ready to list in January, in time for the New Year rush.

Take the opportunity to get a feel for how fast-paced the market is in your area and how much choice you'll have for your next home. But bear in mind that the market should see a spike in new listings in the New Year.

What will happen in the housing market?

Buyer demand is expected to remain strong going into 2022, but new supply is also likely to come on to the market, as households use the holiday period to make a decision about moving.

The proportion of buyers who are also sellers is expected to increase, helping to ease the shortage of supply.

Grainne Gilmore, head of research at Zoopla, said: “In typical years, the highly seasonal supply of homes being listed for sale slows in the run up to Christmas, but rises sharply in the new year.

“On average, the supply of listings at the end of January runs some 50% higher than the start of December.

“Other factors that will affect prices next year include the looming economic headwinds in the shape of rising inflation – which will push household costs higher.

“Even with some interest-rate rises, mortgage rates are likely to remain relatively low compared to long-run averages, and there is more room for price growth across some of the most affordable housing markets.”

Overall, house prices are expected to rise by 3% in 2022, while around 1.2 million homes are likely to change hands, down from an estimated 1.5 million this year.

UK lender offers 40-year fixed-rate mortgage

The long-term mortgage deal means borrowers will pay the same rate for up to four decades. What are the key advantages and disadvantages?

Buyers now have the option to keep the interest they pay on their mortgage the same for up to 40 years.

Specialist lender Kensington Mortgages has launched a 40-year fixed-rate mortgage.

The deal offers borrowers the chance to pay the same interest rate on their home loan for between 11 and 40 years.

Their interest rate will not change even if the Bank of England increases the official cost of borrowing.

Interest rates are currently at record lows, and buyers who fear the impact of rate rises could benefit from fixing their mortgage now.

The maximum term of a fixed-rate mortgage is usually 10 years.

It is rare in the UK for fixed rate deals to cover the entire “term” of a mortgage, which is usually 25 to 35 years.

“A fixed-rate that covers the entire mortgage term is already very popular in some parts of continental Europe,” said Mark Arnold, CEO of Kensington Mortgages.

“It is likely to become increasingly attractive in a rate-rising environment.”

Why are 40-year fixed mortgages on offer now?

Interest rates are currently at a record low of 0.1%. But the Bank of England is expected to start increasing them in the near future.

If you have a fixed-rate mortgage your repayments stay the same for the product term. The deals typically have terms of two or five years.

Opting for a longer term enables homeowners to benefit from record low rates for longer.

Even so, a term of up to 40 years is highly unusual.

Online broker and lender Habito currently also offers a 40-year fixed rate deal.

A handful of lenders also offer 10-year fixed rate mortgages.

Can I get a 40-year fixed rate mortgage?

One key advantage of the 40-year mortgage is that it judges affordability based on the interest rate the borrower will actually pay.

By contrast, many lenders base affordability on a hypothetical rate if interest rates rise.

As a result, people may be able to borrow more with the Kensington Mortgages product.

What are the disadvantages of a 40-year mortgage?

Borrowers should think carefully before opting for a long-term fixed rate deal.

If you move home during the mortgage term, it should be possible to move the mortgage with you. This is known as “porting”.

But, if you want to pay your mortgage off early, you could face hefty fees.

For example, if you want to leave the mortgage in the first 15 years, you will need to pay a fee worth 7% of the outstanding balance.

The exit penalty gradually falls to 2% of the outstanding debt by year 36.

That said, there are no early redemption penalties if you are selling the property.

Crucially, these fees are also not charged if you are impacted by a critical illness or if the mortgage holder dies.

What else do I need to know about 40-year fixed mortgages?

The Kensingont Mortgage 40-year deal is available to borrowers with deposits of between 40% and 5%.

Interest rates for people fixing for between 36 and 40 years start at 3.34%.

The lowest rate is available to someone with a 40% deposit. This means they are borrowing 60% of their home’s value, and paying a £1,499 arrangement fee.

People with only a 5% deposit will pay a higher rate of 4.16%, if they pay the same arrangement fee.

Lower interest rates are available for people fixing for a shorter period of time.

Rates start at just 2.83% for those fixing for between 11 and 15 years.

Key takeaways

- UK lender Kensington Mortgages has launched a 40-year fixed rate mortgage

- The deal offers borrowers the chance to pay the same interest rate for between 11 and 40 years

- Interest rates for people fixing for between 36 and 40 years start at 3.34%.

Rent increases hit 13-year high as demand in major cities doubles

Rent increases have hit a 13-year high as demand for property doubles in the central zones of major cities. And for the first time in 16 months, London rents are rising.

Rent increases have hit a 13-year high as demand from renters in the central zones of major cities doubles.

The typical cost of renting a home in the UK, excluding London, now stands at £809 per month, according to our latest Rental Market Report.

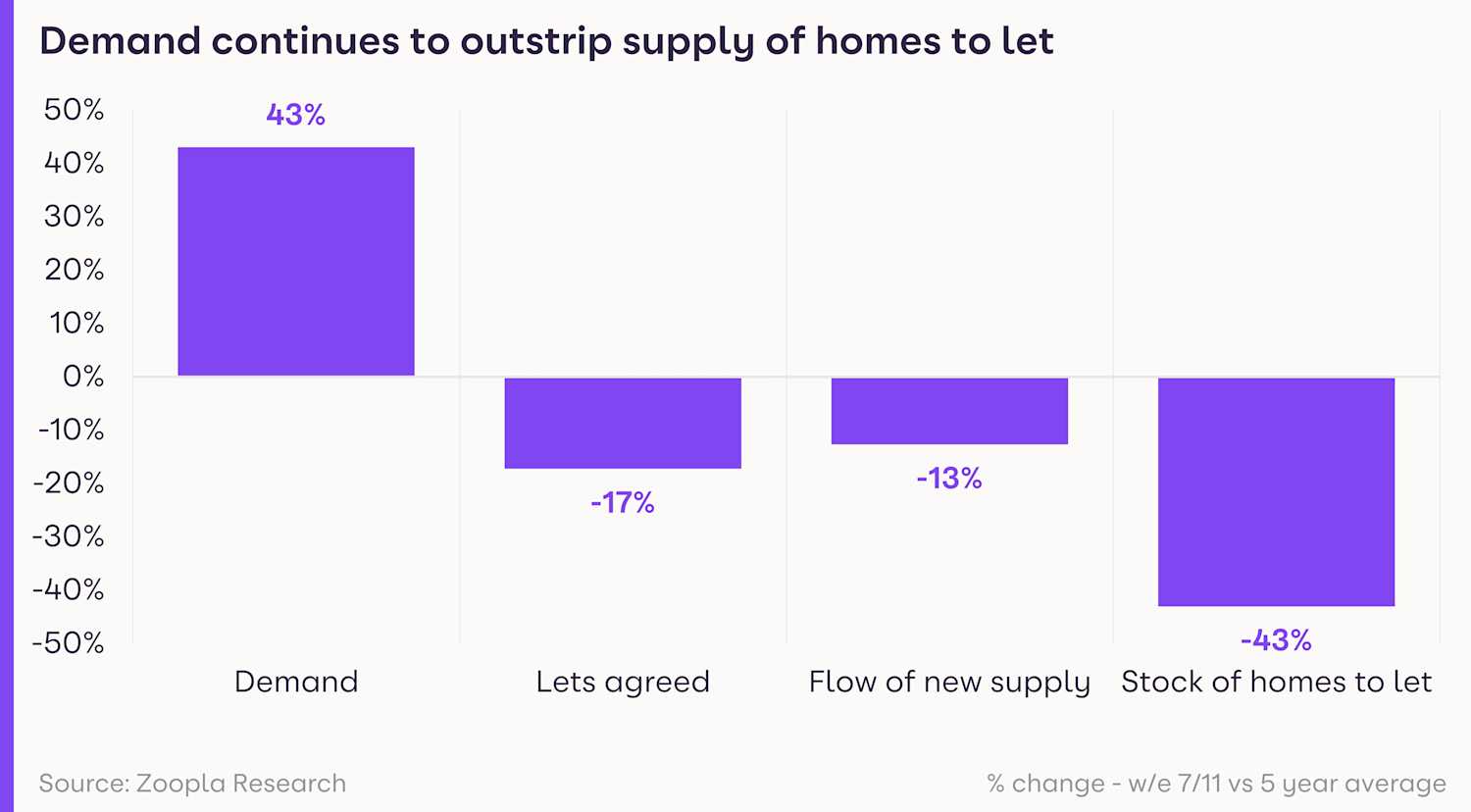

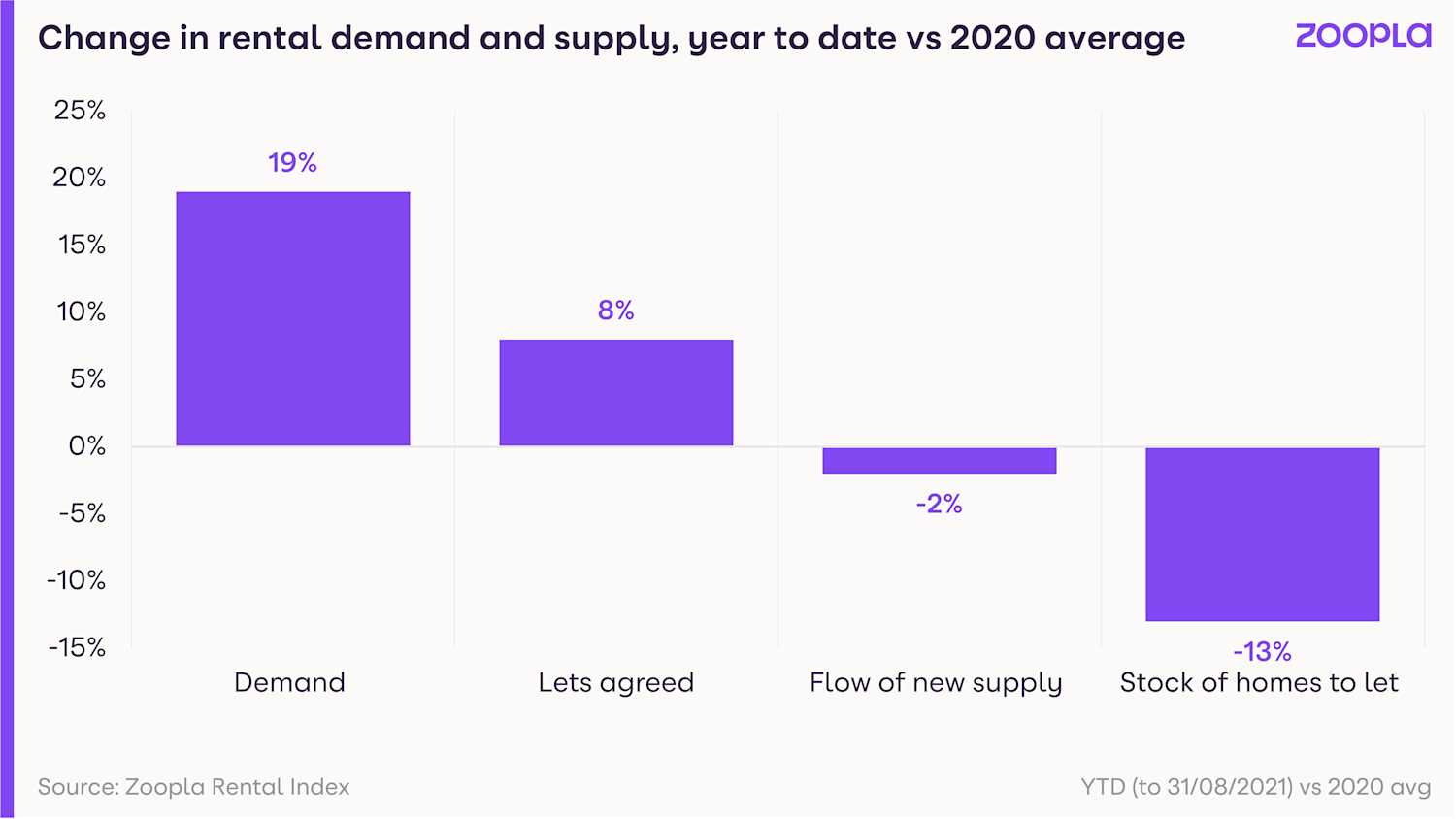

While renters are returning to cities, the rise in demand is not being met by an increase in the number of homes available to rent, forcing rents higher.

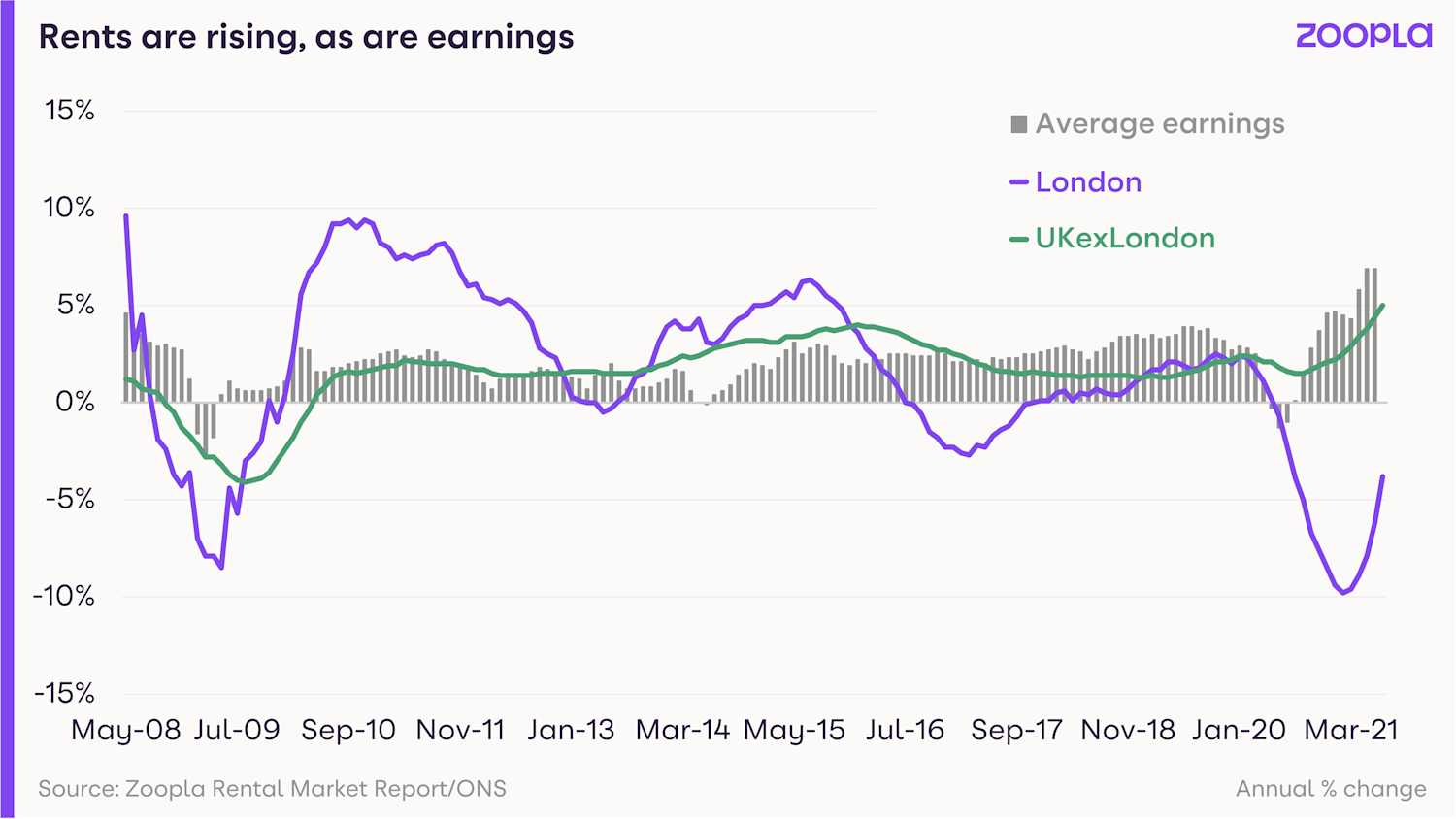

The good news is that despite the increase in rents, affordability has remained largely unchanged thanks to rising pay, with rents accounting for an average of 37% of a single tenant’s monthly income.

Gráinne Gilmore, head of research at Zoopla, said: “Households looking for the flexibility of rental accommodation, especially students and city workers, are back in the market after consecutive lockdowns affected demand levels in major cities.”

What’s happening to rents?

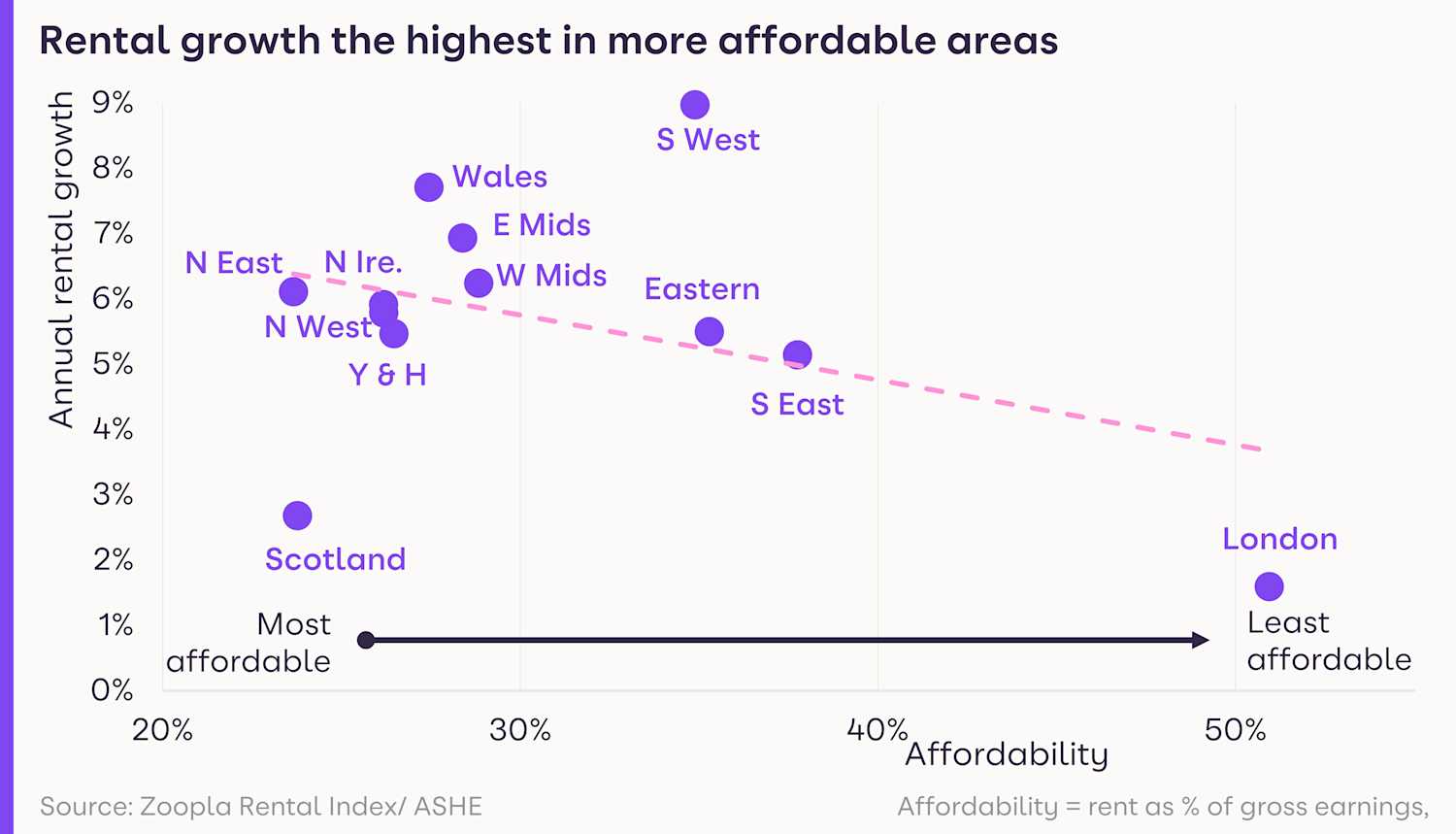

Average UK rents, excluding London, have risen by 6% during the year to the end of September, jumping by 3% in the past three months alone.

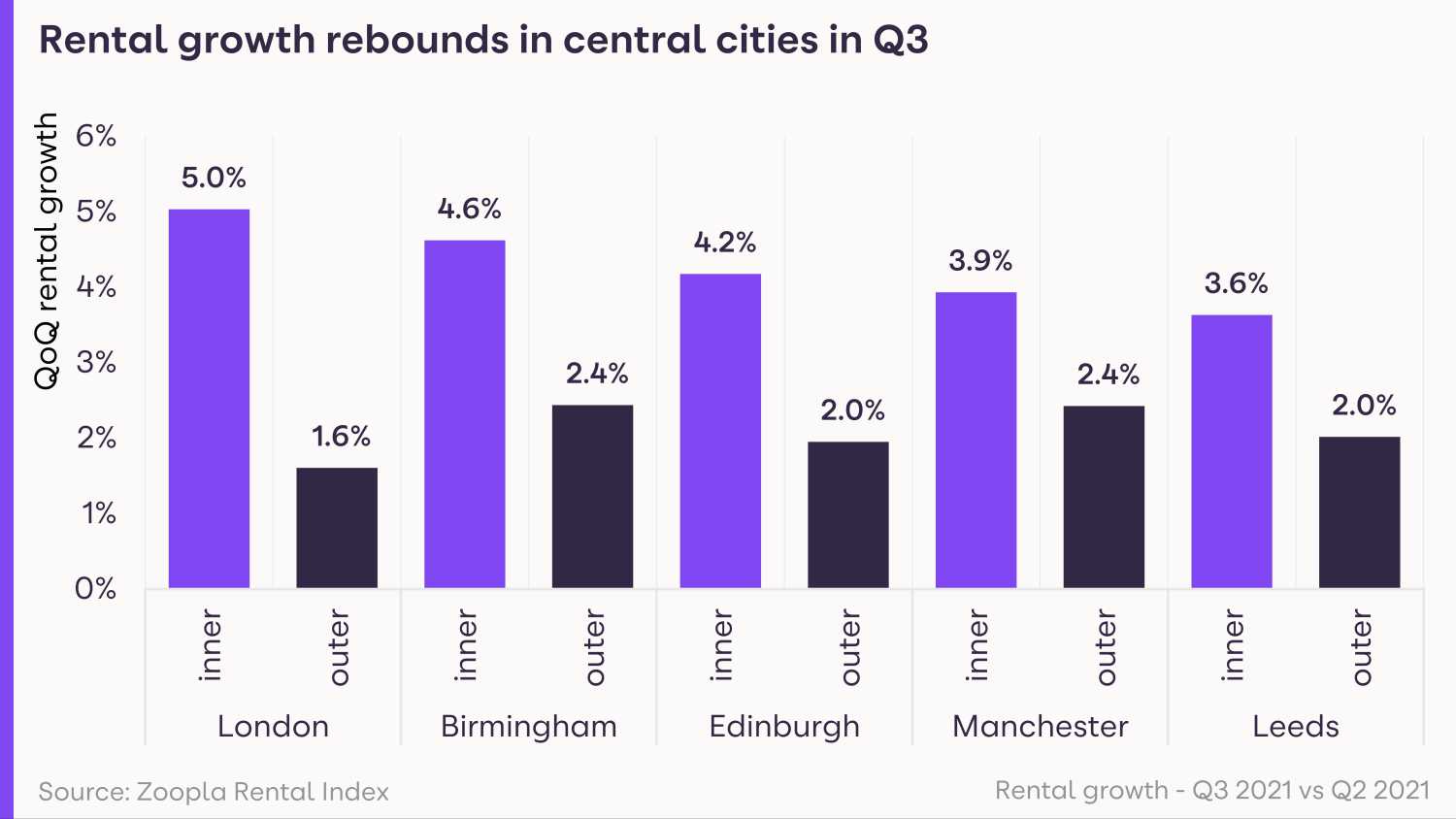

Strong rental growth is being driven by a return of workers to city centres and students to universities.

It can also be explained in part by renters opting for larger, and by extension more expensive, properties as part of the pandemic-induced search for space.

The South West saw the biggest jump in rental growth at 9%, due to its popularity as a place to live, followed by regions where renting remains most affordable, namely Wales, where rents have risen 7.7% year-on-year and the East Midlands at 6.9%.

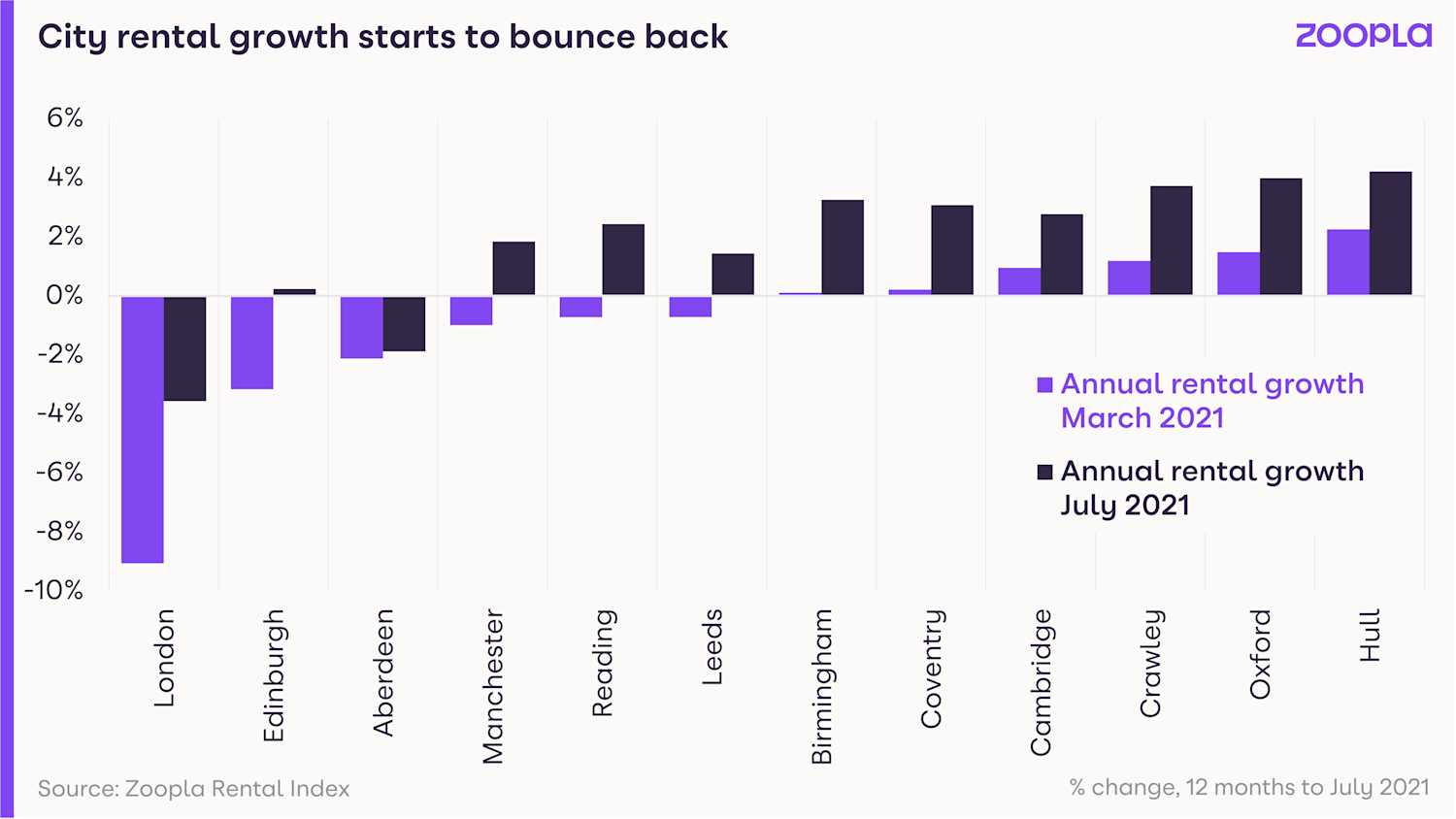

Rent increases are running well ahead of the five-year average in many of the UK’s largest cities, with Bristol seeing the strongest rise of 8.4%, while Nottingham wasn't far behind at 8.3%, and Glasgow was in third place at 7.2%.

Even in London, rents, which had fallen for 15 months in a row, are rising again, increasing by 1.6% in the year to the end of September as offices reopened and city life resumed.

Despite the bounce back, rents in the capital are still 5% lower than they were at the start of the pandemic, following significant falls during the past 18 months.

What’s demand for rental homes like?

Demand in major cities such as Leeds, Manchester, and Edinburgh doubled in the three months to the end of September, compared with the earlier part of the year, as renters rushed back to city centres following the easing of Covid-19 restrictions.

Meanwhile Birmingham has seen a 60% spike and London has seen a 50% jump in demand.

Across the UK as a whole, demand from renters is 43% higher than the five-year average.

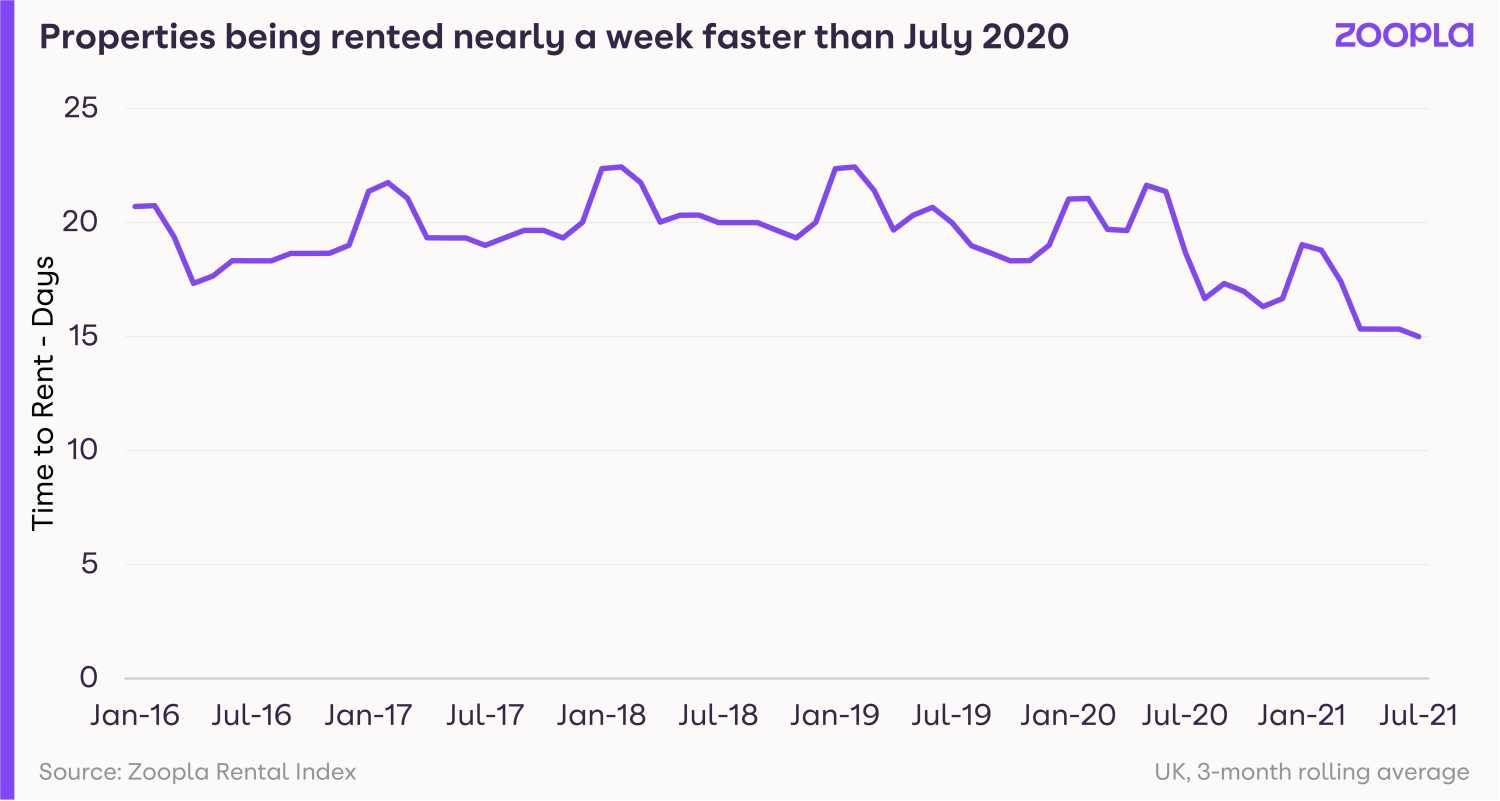

The net result is a fast-paced market with homes taking an average of just 15 days to rent across the UK.

Is there a good supply of homes available to rent?

Unfortunately, this increased demand is not being met a rise in the number of homes available to rent, with properties on the market 43% below the five-year average.

The lack of supply is being driven by a combination of long-term factors which have caused landlords to exit the sector, such as the 3% stamp duty surcharge on additional properties, and the post-lockdown spike in demand.

What could this mean for you?

Tenants

If you're looking for a new home to rent, you have two issues to contend with, namely intense competition and rising rents.

You can register with us to receive alerts when a property meeting your criteria becomes available, helping you to stay ahead of the competition.

You may find you're able to get somewhere with a lower rent if you're prepared to compromise on property type, such as opting for a flat rather than a house, or choosing a less central location.

Landlords

If you're a landlord with a property to rent, the dual trend of rising demand and higher rents is good news for you.

The current buoyancy of the rental market may mean it's a good time to think about extending your property portfolio.

But bear in mind that demand patterns have changed compared with during the height of the pandemic, with renters returning to city centre locations.

What’s the outlook?

Looking ahead, the shortage of homes available to rent looks set to continue due to lower levels of investment by landlords.

Meanwhile, demand is also expected to be strong as the employment market remains relatively robust and there is still pent-up demand, particularly for homes in city centres.

This mismatch between supply and demand will continue to push up rents.

Overall, rents across the UK, excluding London, are likely to end 2022 4.5% higher than they started it, while rents in London are likely to rise by 3.5% to exceed their pre-pandemic levels.

What's in store for the housing market in 2022?

2021 is expected to be a record year for sales with 1.5m transactions taking place. But what can we expect for 2022? Our HPI forecast reveals all.

The end of the stamp duty holiday has failed to dampen demand from potential buyers, which is up 30% on the five-year average.

Thanks to the tapering-off period at the end of the holiday, the anticipated ‘cliff edge’ is nowhere to be seen and the pandemic-induced boom still has further to run.

An estimated 1.5 million homes are expected to change hands in 2021, beating 2007’s previous record, according to our latest House Price Index report.

The combination of a nation re-evaluating what they want from a home, low mortgage rates and the stamp duty holiday have all driven unprecedented levels of demand.

Homes collectively worth £473 billion will be sold this year, that’s up £95 billion on the number of offers accepted in 2020.

However, the level of activity is expected to slow next year as the market faces a number of headwinds.

What’s happening to house prices now?

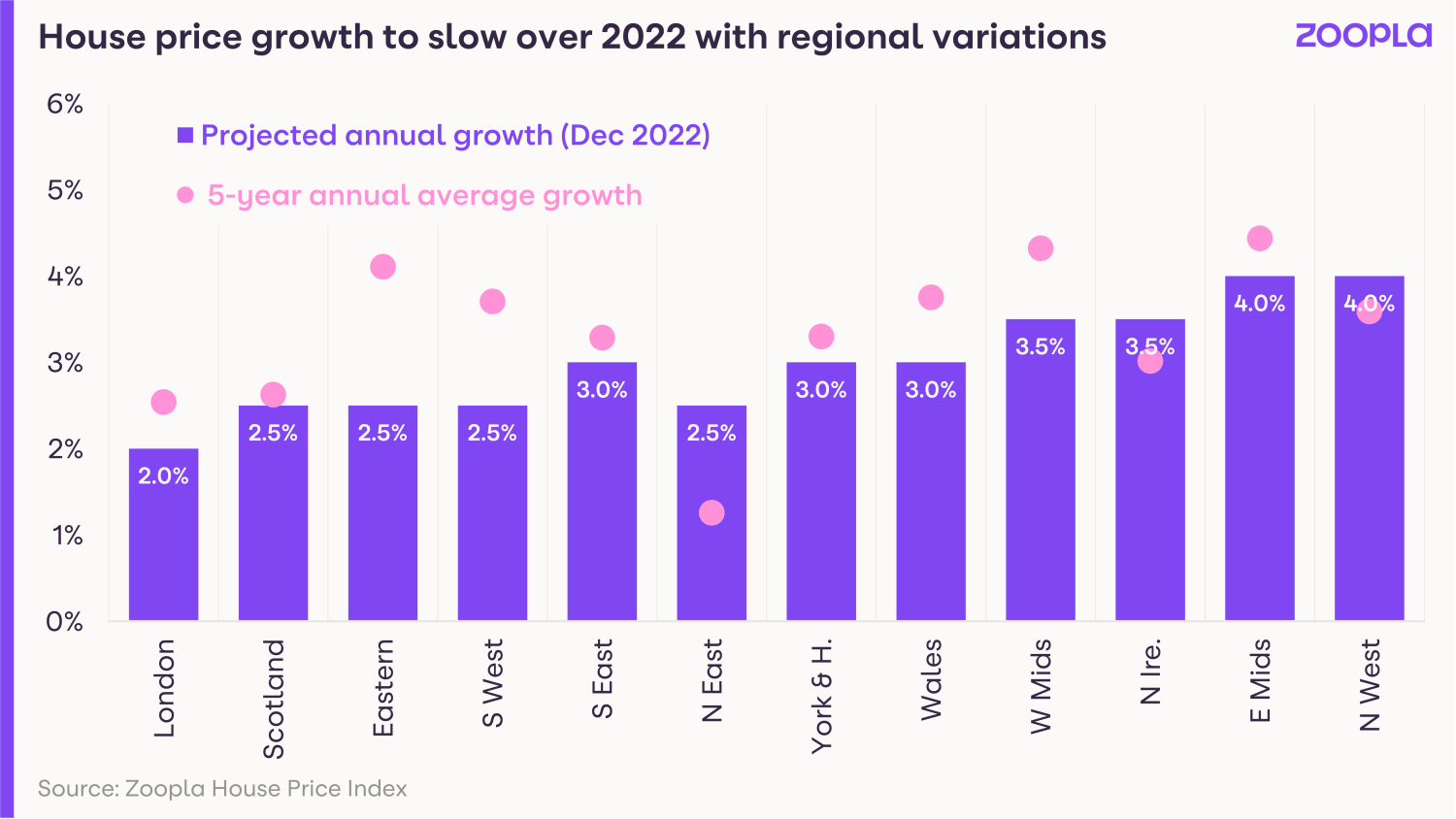

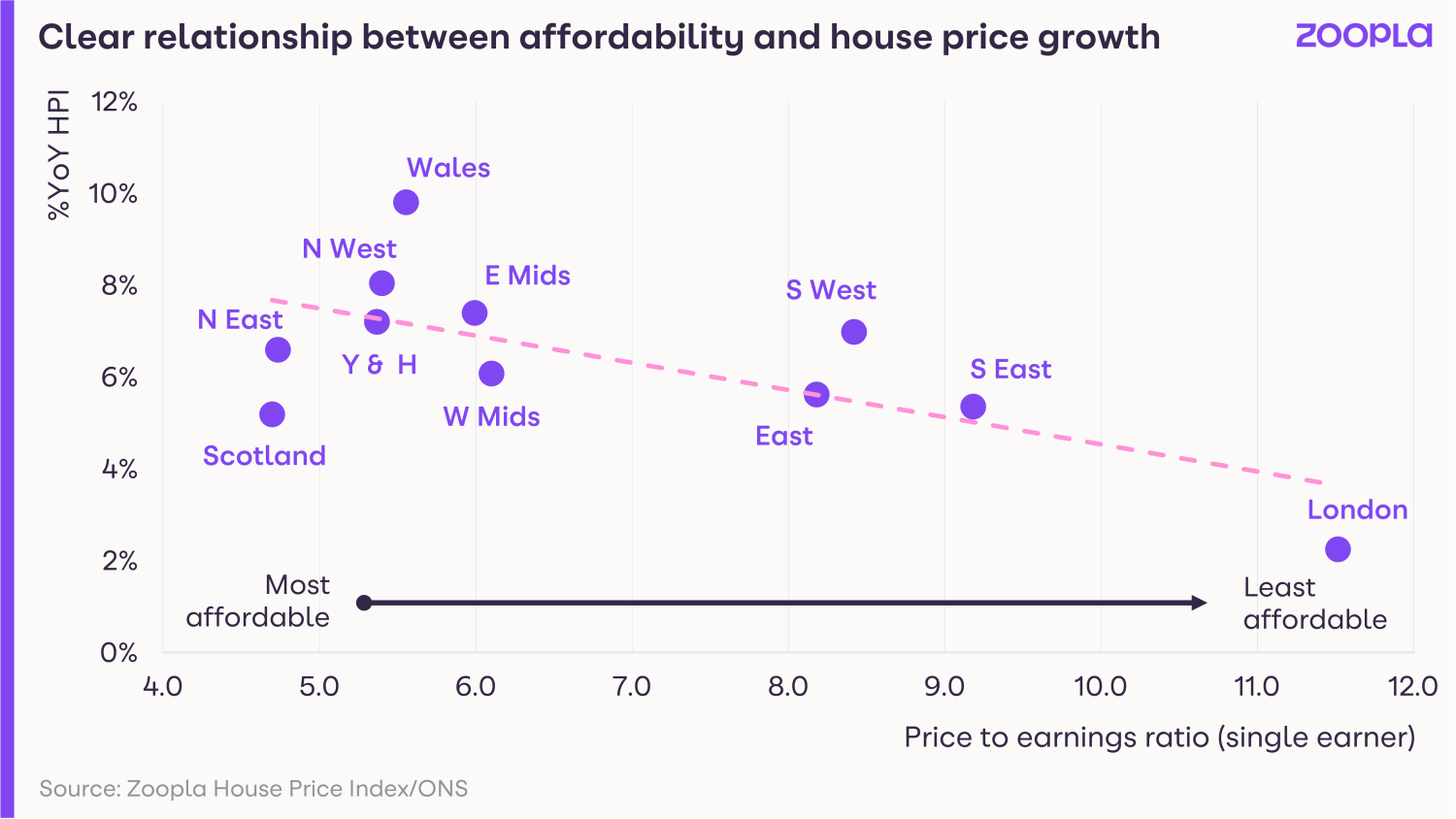

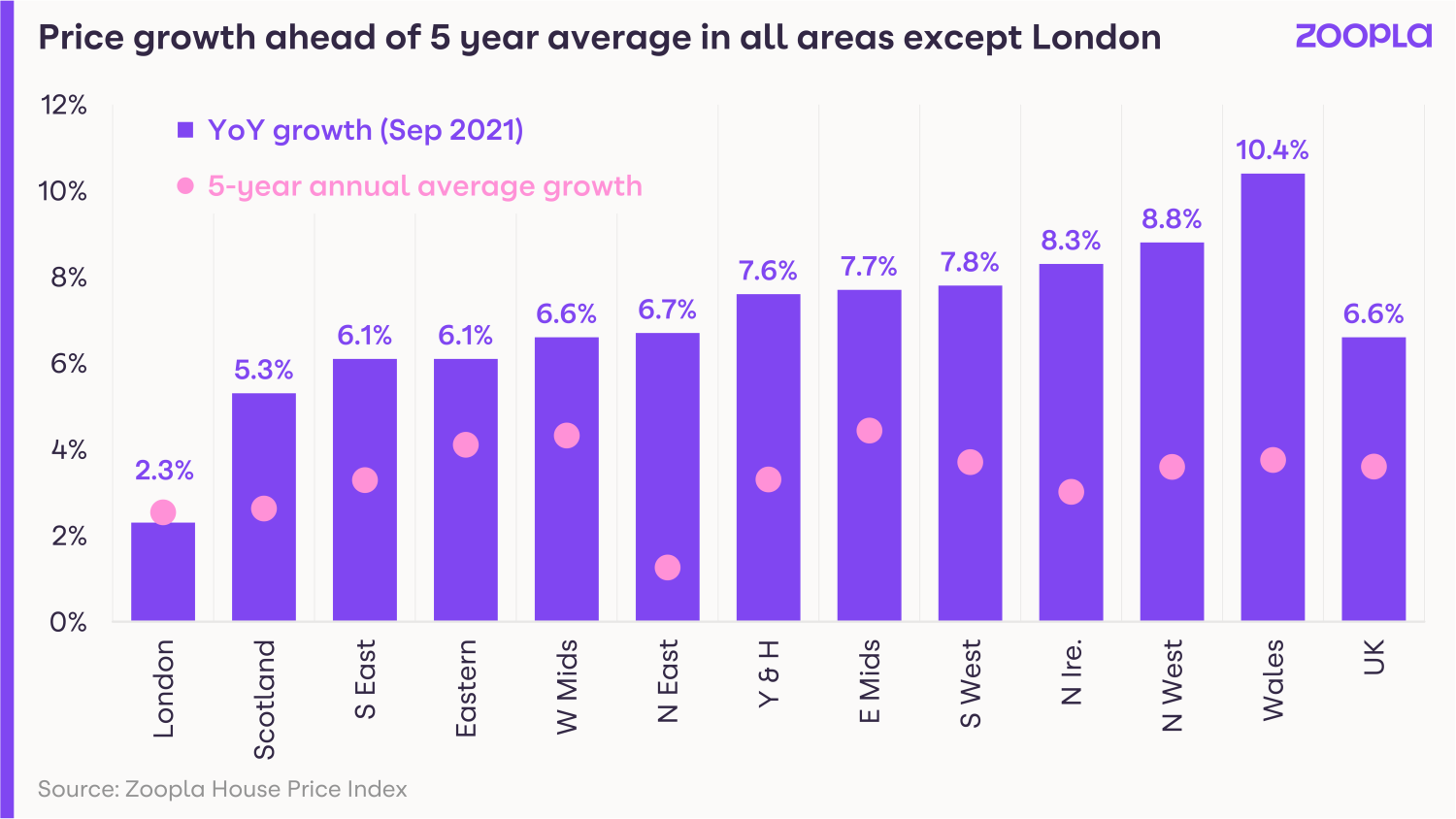

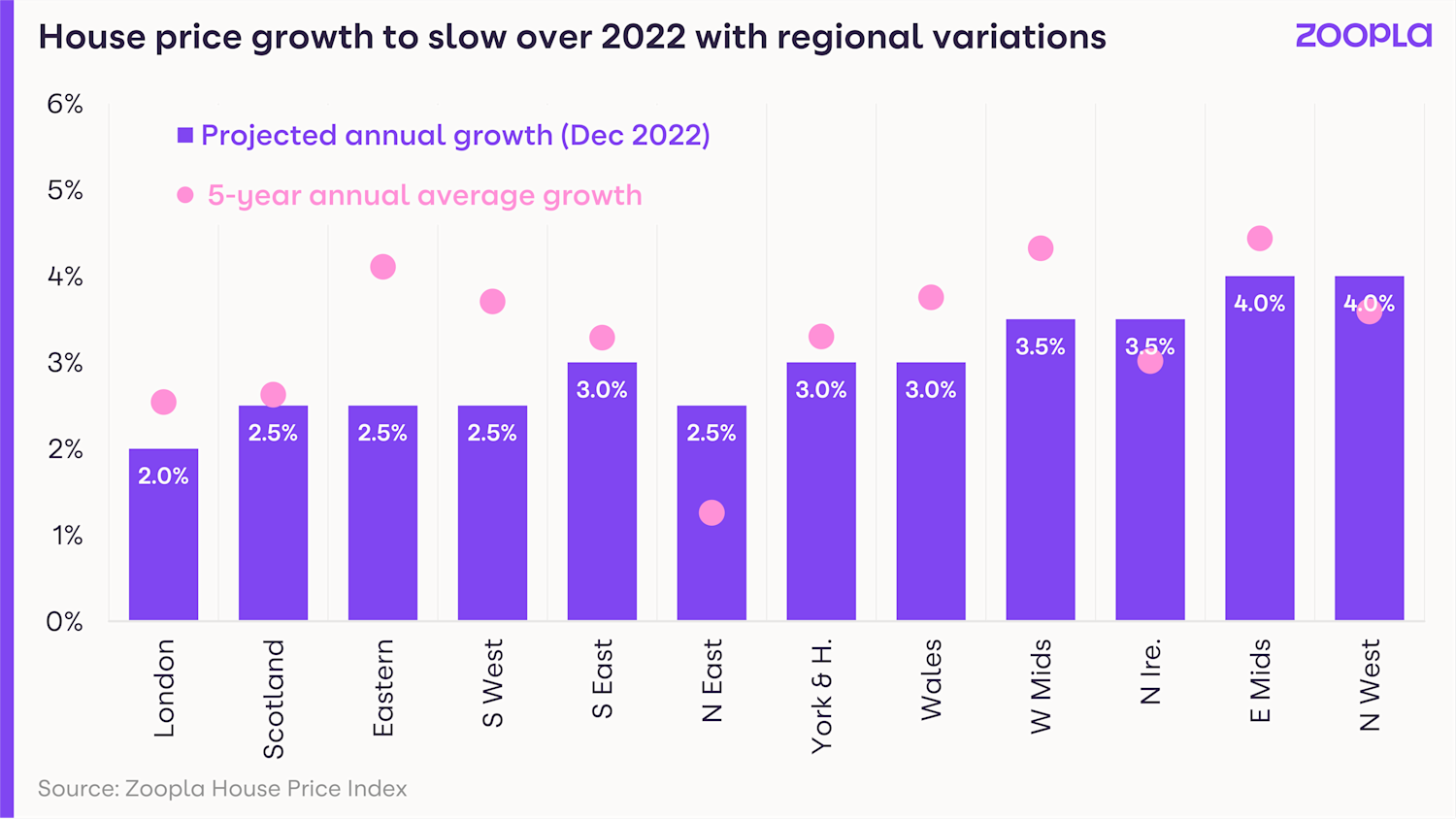

Annual house price growth was running at 6.6% at the end of September, but this headline figure masks significant regional variations.

Price growth continues to be strongest in regions where property remains affordable, with Wales seeing the strongest gains of 10.4%, followed by the North West at 8.8% and Northern Ireland at 8.3%.

Reflecting the regional trend, the cities with the strongest price growth were Liverpool, Manchester and Sheffield, all located in northern regions.

At the other end of the spectrum, London, where the typical property costs 11.5 times average earnings, recorded price growth of just 2.3%.

The capital was the only region in which gains were below the five-year average.

First-time buyers return to the market

Demand from potential buyers has been running at 30% above the five-year average since the summer, and looks set to remain heightened for the rest of 2021 and into 2022.

But the mix of buyers has now changed.

Following the first lockdown in 2020, the market was dominated by wealthier homeowners with high value properties.

In 2021, mortgage availability improved and more first-time buyers returned to the market, leading to a mix of movers that’s more in line with normal levels.

Unfortunately, the increase in demand is not being met by higher supply, with the number of homes listed for sale 38% lower than the five-year average.

This mismatch between supply and demand will continue to put upward pressure on prices.

What will happen to the housing market in 2022?

Moving into 2022, the housing market will be influenced by both positive and negative factors.

On the positive side, the pandemic-induced search for space has further to run.

The ability to work from home has expanded the horizons for many office workers who now feel able to look further afield.

Our research shows that 22% of people currently want to move, significantly higher than the usual 5% in a normal market.

The high levels of equity homeowners have built up during the past 18 months and the shortage of homes on the market is expected to support house price growth well into 2022.

But on the downside, the rising cost of living, combined with an expectation that mortgage rates and taxes will rise next year, will impact affordability.

House price growth is expected to end 2022 at 3%, with growth likely to be strongest in the East Midlands and North West and weakest in London.

Transaction levels are expected to fall by 20% to 1.2 million, in line with the long-running average but still comparatively high compared with the past decade.

Richard Donnell, said: ‘The impact of the pandemic on the housing market has further to run but at a less frenetic pace.

‘We expect the momentum in the market to outweigh some emerging headwinds from higher living costs and the risk of higher mortgage rates.

‘The latest data shows a turning point in the rate of house price growth, which we expect to slow quickly with average UK house prices up 3% by the end of 2022.’

What could this mean for you?

First-time buyers

The market remains fast-moving and is not expected to start slowing down until well into 2022.

As a result, you’ll need to be prepared to move quickly if you see somewhere you like. It’s a good idea to have a mortgage offer agreed in principle before you start house hunting.

With many potential buyers looking for more space, particularly a garden, you may find you have more choice and less pressure if you opt for a flat.

Home-movers

If you’re thinking of moving, it remains a great time to put your home on the market as demand from potential buyers is continuing to outstrip supply.

Unfortunately, these same dynamics may make it challenging to find your next home.

Do as much research as you can before listing your current property and talk to local estate agents to find out how fast the market is moving in your area.

If the market is moving very quickly, you may want to have an offer accepted on a property you want to buy before listing your current home for sale.

Key takeaways

- An estimated 1.5 million homes are expected to change hands in 2021, making it the busiest year for the housing market since 2007

- 22% of people currently want to move, significantly higher than the usual 5% in a normal market

- Annual house price growth was 6.6% at the end of September but is expected to slow to 3% in 2022

Sitting on a gold mine: value of British homes soars by 20% in 5 years

Nearly 12 million homes have increased in value by £49,000 or more since 2016. How much could your home be worth?

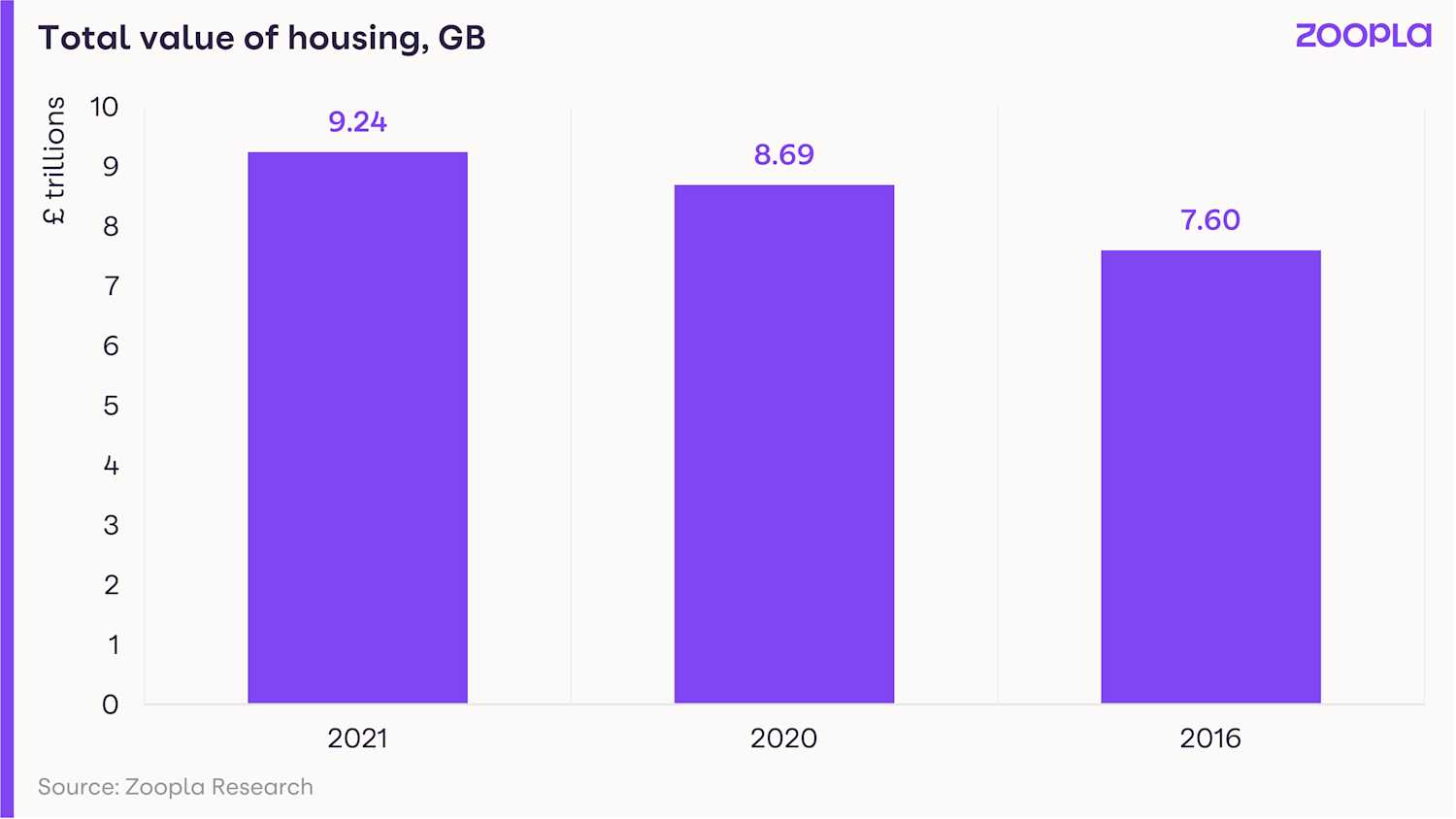

The total value of British homes has soared by 20% in the past five years.

That’s a whopping £1.6 trillion (tn), around the same figure as the market cap of Apple – the world’s most valuable company.

It means that almost 12 million homes have jumped in value by the national average of £49,000 or more since 2016, according to our latest research.

The total value of homes in Britain now stands at a staggering £9.2tn.

To put this eye-watering figure into perspective, it’s more than four times the GDP of the UK – the value of all goods produced and services provided each year.

And it’s more than four times the value of all the companies listed on the FTSE 100.

What’s behind this?

House price growth since 2016 has been underpinned by ultra-low mortgage rates.

And in the past 18 months, the pandemic has driven increased buyer demand as people reassess what they want from a home.

But this demand has been met by only a limited supply of homes for sale, fuelling house price growth.

What could this mean for you?

The steep increase in house prices means your home could be worth more than you think.

If you are thinking of moving, you may have more money for your next purchase than you realised.

Even if you plan to stay put, you could qualify for a cheaper mortgage, as you will be borrowing a lower proportion of its value.

“Understanding the value of your home, and the equity you hold within the property, can help when it comes to making future plans.”

What’s happening in your area?

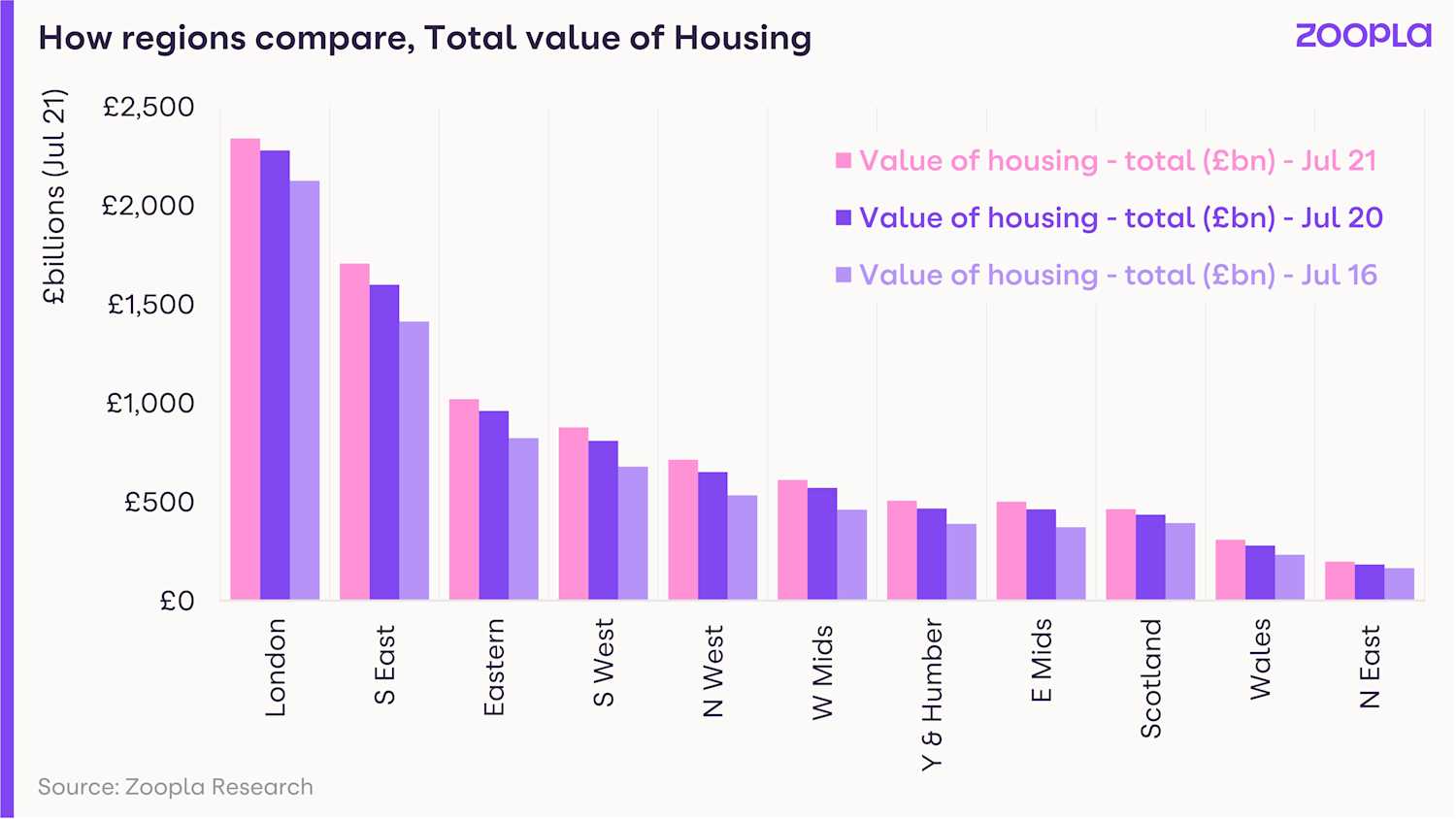

Homes in the south east have seen the biggest increase in value over the past five years, collectively rising by £294 billion (bn).

By comparison, homes in London saw £214bn added to their value over the same timescale.

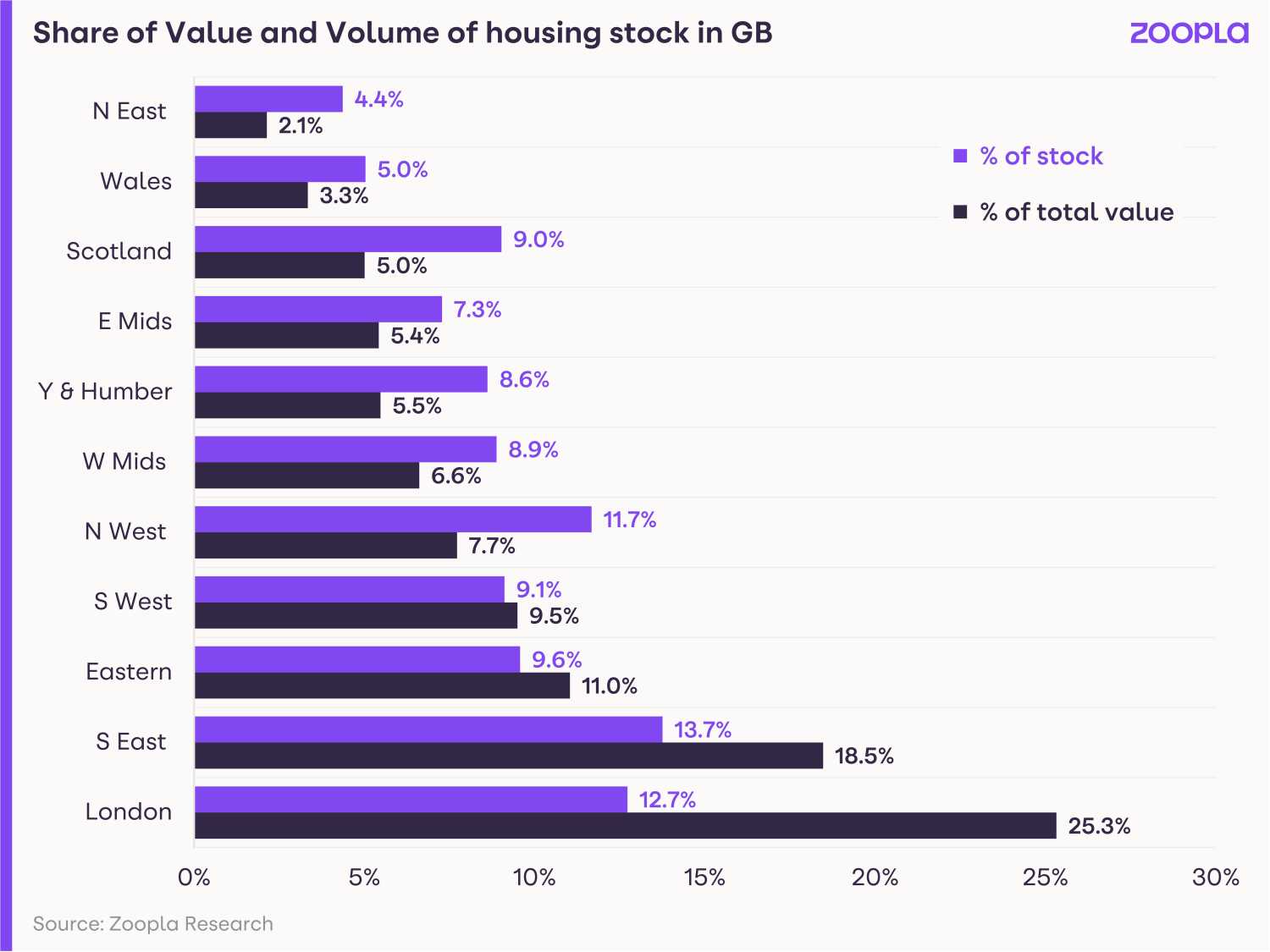

Even so, London is the most valuable region, with homes in the city collectively worth £2.4tn.

It means that although the capital accounts for just 13% of British properties, it is home to a quarter of Britain’s housing wealth.

The south east has the second highest value of homes at £1.7tn, followed by the east of England at £1tn.

At the other end of the scale, homes in the north east are collectively worth £197bn, while those in Wales are valued at £308bn.

Where have homes risen in value the most?

More than two-thirds of homes in 53 of the country’s 367 local authority areas have risen by more than £49,000 since 2016.

Monmouthshire tops the list, with 88% of homes increasing by more than the national average.

It's followed by Hastings at 83% and Trafford at 82%.

Key takeaways

- The total value of British homes has soared by 20% – £1.6 trillion (tn) – in the past five years

- The average property has risen in value by £49,257 since 2016

- The value of Britain’s homes now totals £9.2tn – four times the UK’s GDP

Revealed: Britain’s most expensive streets

Discover which addresses have made it into our top 10. Spoiler alert: a typical home on the most expensive street could set you back a cool £29.9m.

Kensington Palace Gardens has been crowned Britain’s most expensive street for the 13th year running.

With an average property price of just under £29.9m, the street is well known for its embassies and billionaire residents.

It also counts Kensington Palace, home to the Duke and Duchess of Cambridge, among its neighbours.

In fact, all of the top 10 most expensive streets in the country are in London.

And all of the 10 most expensive streets outside of London are within commuting distance of the capital too.

There are now a whopping 11,673 streets in Britain where the average home is valued at £1m or more, our Rist List for 2021 shows.

head of research at Zoopla, explained: “This data illustrates how the type and size of properties coupled with some of the most desirable locations around the country create prime areas, resulting in some of the most valuable residential streets in the country.”

What are the 10 most expensive streets in Britain?

While Kensington Palace Gardens was the priciest street for the 13th year running, Courtenay Avenue, on the edge of Hampstead Heath in London’s Highgate, took second place for the third year running. Homes on the road would set you back £19.4m.

It was followed by Grosvenor Crescent in Belgravia, where homes command an average price tag of £17.2m. The street is just a short stroll from Buckingham Palace Gardens.

There were 3 new entrants in the top 10 this year: The Boltons, Frognal Way, and Carlyle Square.

| Rank | Street | Outcode | Town/city | Average house price |

|---|---|---|---|---|

| 1 | Kensington Palace Gardens | W8 | London | £29.9m |

| 2 | Courtenay Avenue | N6 | London | £19.4m |

| 3 | Grosvenor Crescent | SW1X | London | £17.2m |

| 4 | Ilchester Place | W14 | London | £15.2m |

| 5 | The Boltons | SW10 | London | £14.2m |

| 6 | Manresa Road | SW3 | London | £11.2m |

| 7 | Frognal Way | NW3 | London | £11.1m |

| 8 | Compton Avenue | N6 | London | £10.2m |

| 9 | Cottesmore Gardens | W8 | London | £10m |

| 10 | Carlyle Square | SW3 | London | £9.8m |

What are the 10 most expensive streets outside London?

Titlarks Hill in Ascot, Berkshire, where the average home costs £8.4m, is the most expensive street outside of London, knocking Leatherhead off the top spot.

And Montrose Gardens in Leatherhead, Surrey, located within the exclusive Crown Estate, is the second most expensive place to buy a home outside of the capital.

Meanwhile, 5 of the top 10 most expensive streets outside of London are in Virginia Water, Surrey.

They include Portnall Rise, the third most expensive street outside of the capital.

| Rank | Street | Outcode | Town/city | County | Average house price |

|---|---|---|---|---|---|

| 1 | Titlarks Hill | SL5 | Ascot | Windsor & Maidenhead | £8.4m |

| 2 | Montrose Gardens | KT22 | Leatherhead | Surrey | £7m |

| 3 | Portnall Rise | GU25 | Virginia Water | Surrey | £6.4m |

| 4 | Woodlands Road East | GU25 | Virginia Water | Surrey | £6.2m |

| 5 | Camp End Road | KT13 | Weybridge | Surrey | £6.1m |

| 6 | Fulmer Rise | SL3 | Slough | Berkshire | £6m |

| 7 | Wentworth Drive | GU25 | Virginia Water | Surrey | £5.9m |

| 8 | North Drive | GU25 | Virginia Water | Surrey | £5.7m |

| 9 | Pinewood Road | GU25 | Virginia Water | Surrey | £5.6m |

| 10 | Yaffle Road | KT13 | Weybridge | Surrey | £5.5m |

Zoopla, September 2021

How many expensive streets are there in your region?

Unsurprisingly, London is home to the highest number of streets where the average property is worth £1m or more.

It is closely followed by the south east, with the east of England coming in third place.

At the other end of the scale, Wales has only 9 streets with homes that cost an average of at least £1m.

| Region | Number of streets with £1m-plus homes September 2021 | Number of streets with £1m-plus homes September 2020 | Difference |

|---|---|---|---|

| London | 4,544 | 4,282 | 262 |

| South east England | 4,366 | 3,424 | 942 |

| East of England | 1,464 | 1,263 | 201 |

| South west England | 512 | 334 | 178 |

| North west England | 276 | 218 | 58 |

| West Midlands | 205 | 137 | 68 |

| Scotland | 136 | 101 | 35 |

| East Midlands | 65 | 58 | 7 |

| Yorkshire and the Humber | 55 | 39 | 16 |

| North east England | 41 | 31 | 10 |

| Wales | 9 | 4 | 5 |

| Total | 11,673 | 9,891 | 1,782 |

Which towns have the most million-pound streets?

Guildford took the top spot for the town with the most streets on which homes are valued at an average of £1m or more.

It was followed by other towns within commuting distance of London, including Reading, Sevenoaks and Leatherhead.

Altrincham in Cheshire, an area popular with Premiership footballers, was the only town in a northern region to make it into the top 10.

And it was also the only town in the list not to be within commuting distance of London.

| Town | Number of streets with £1m-plus homes September 2021 | Number of streets with £1m-plus homes September 2020 | Difference |

|---|---|---|---|

| Guildford | 176 | 140 | 36 |

| Reading | 137 | 110 | 27 |

| Sevenoaks | 133 | 113 | 20 |

| Leatherhead | 127 | 112 | 15 |

| Farnham | 116 | 77 | 39 |

| Harpenden | 115 | 100 | 15 |

| Altrincham | 105 | 87 | 18 |

| Maidenhead | 100 | 94 | 6 |

| Henley-on-Thames | 98 | 89 | 9 |

| Woking | 97 | 72 | 25 |

Key takeaways

- Kensington Palace Gardens has been crowned Britain’s most expensive street for the 13th year running.

- All of the top 10 most expensive streets are in London. And all of the 10 most expensive streets outside of London are within commuting distance of the capital.

- There are now 11,673 streets in Britain where the average home is valued at £1m or more.

UK house prices hit record high

The value of the average home has increased by £44 per day in the last 6 months alone.

UK house prices have hit a record high of £235,000 as sales are agreed at their fastest pace for 5 years.

The average home in the UK has increased in value by £44 per day in the past 6 months alone.

This is up from £30 per day between July 2020 and January 2021.

Meanwhile, the time it takes to agree a sale on a home is now less than 30 days, according to our latest House Price Index report.

House prices climbed by 6.1% in the last year – more than double the rate of annual house price growth seen in August 2020.

At a regional level, house prices rose the most in Wales at 9.8%, followed by Northern Ireland at 8.4% and north west England at 8%.

And in terms of cities, Liverpool continued to lead the way. House prices in the city jumped by 9.8%, followed by Manchester and Sheffield at 8.1% and 7.6% respectively.

At the other end of the scale, house price growth continued to lag the national average in London, with property prices edging ahead by just 2.2% in the last year.

The gap between house price growth in Wales and London was one of the widest seen in the past 3 years.

The pandemic-induced search for space continued to fuel house hunting, with buyer demand still 35% higher than the average for the past 5 years.

There was a noticeable uptick in the number of buyers in London, with demand rising by 14% during the past month as many return to office life.

Houses continue to be more popular than flats, with buyer interest in houses up 25% in the capital compared with 6% for flats.

Meanwhile, the fast-approaching deadline for the stamp duty holiday in England and Northern Ireland at the end of this month does not appear to have dampened buyers’ enthusiasm.

The housing market is moving at its fastest pace for 5 years.

The time between listing a property and agreeing a sale has consistently averaged less than 30 days each month since May. Normally, it takes 40 days at this time of year.

And the acute shortage of homes for sale continues, with levels 28% lower so far this year compared with the average for 2020.

What could this mean for you?

First-time buyers

Despite the shortage of homes for sale, there is some good news for people taking their first step onto the property ladder.

There’s evidence that some landlords are selling up. Some 8% of homes that are currently listed for sale have been previously rented, rising to 13% in London. That’s up from a UK-wide average of just 3% 2 years ago.

And this in turn could boost choice for first-time buyers, who are typically interested in buying the same types of homes as landlords.

Also, if you are happy to purchase a flat, you are not only likely to face less competition, but you could also be in a stronger position to negotiate on the price.

Even so, the market remains fast-moving. It pays to get all your ducks in a row before you start your property search, so that you will be in a position to move quickly when you see something you like.

Home-movers

People moving up the property ladder continue to face the challenge of being both a seller and a buyer.

The good news is that if you have a family home to put on the market, you are likely to be able to secure both a top price and a quick sale.

The downside is that you are also likely to face stiff competition from other potential buyers for your next home. Meanwhile, the shortage of homes for sale may mean you have limited choice.

If you need to coordinate the sale of your current home and buy your next one, speak to a local estate agent. They’ll give you a good sense of the pace of your local housing market and whether there are currently many properties up for sale that meet your criteria.

Depending on how quickly the market is moving, you may want to have an offer accepted on a home you like before listing your current one for sale.

What is the best value home?

Wondering how far your budget could stretch? Find out which types of property and locations come up trumps when it comes to getting more bang for your buck.

Want to know where you can get more bang for your buck? It’s worth doing your homework, with the same amount of space costing up to 12 times as much in some areas compared with others.

The average property in the UK costs £282 per square foot, according to our latest report, How home values compare by floorspace.

But the sum rises to an eye-watering £1,491 per square foot in London’s chic enclave of Kensington and Chelsea and drops to just £104 per square foot in Burnley, Lancashire.

In case you’re wondering, we’ve measured property on a price per square foot basis because it’s a useful way of comparing prices. It strips out variations to give a like-for-like benchmark.

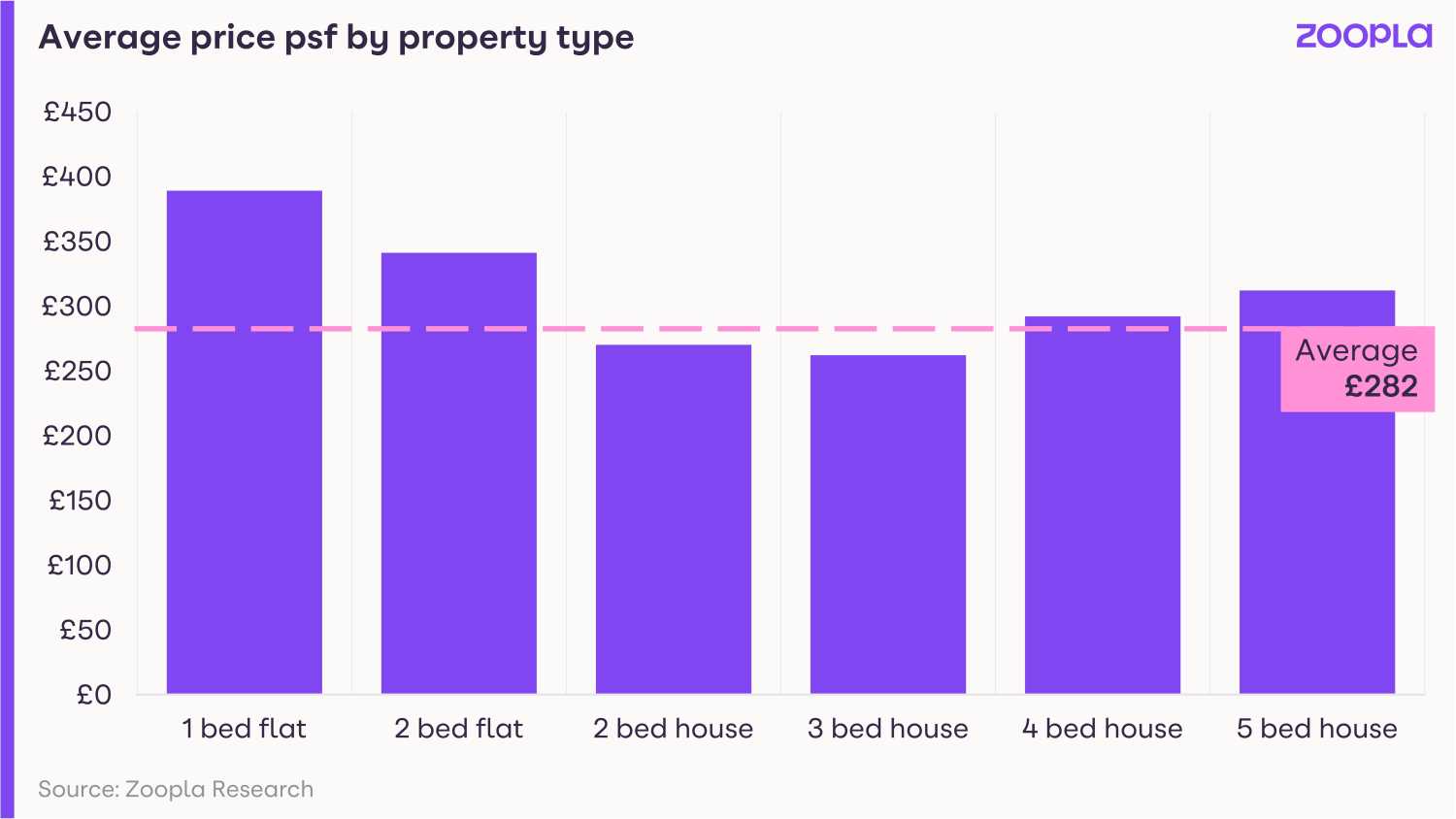

Which type of property offers the best value?

Three-bedroom homes offer the most bang for your buck, costing an average of £262 per square foot.

And at the other end of the spectrum, smaller flats and larger family homes offer the least value for money on a price per square foot basis.

Yes, one-bedroom flats, typically popular among first-time buyers, cost an average £389 per square foot.

This falls to £270 per square foot for two-bedroom houses, and drops again for three-bedroom ones.

But the cost per square foot then rises to £292 for four-bedroom houses and stands at £312 for five-bedroom properties.

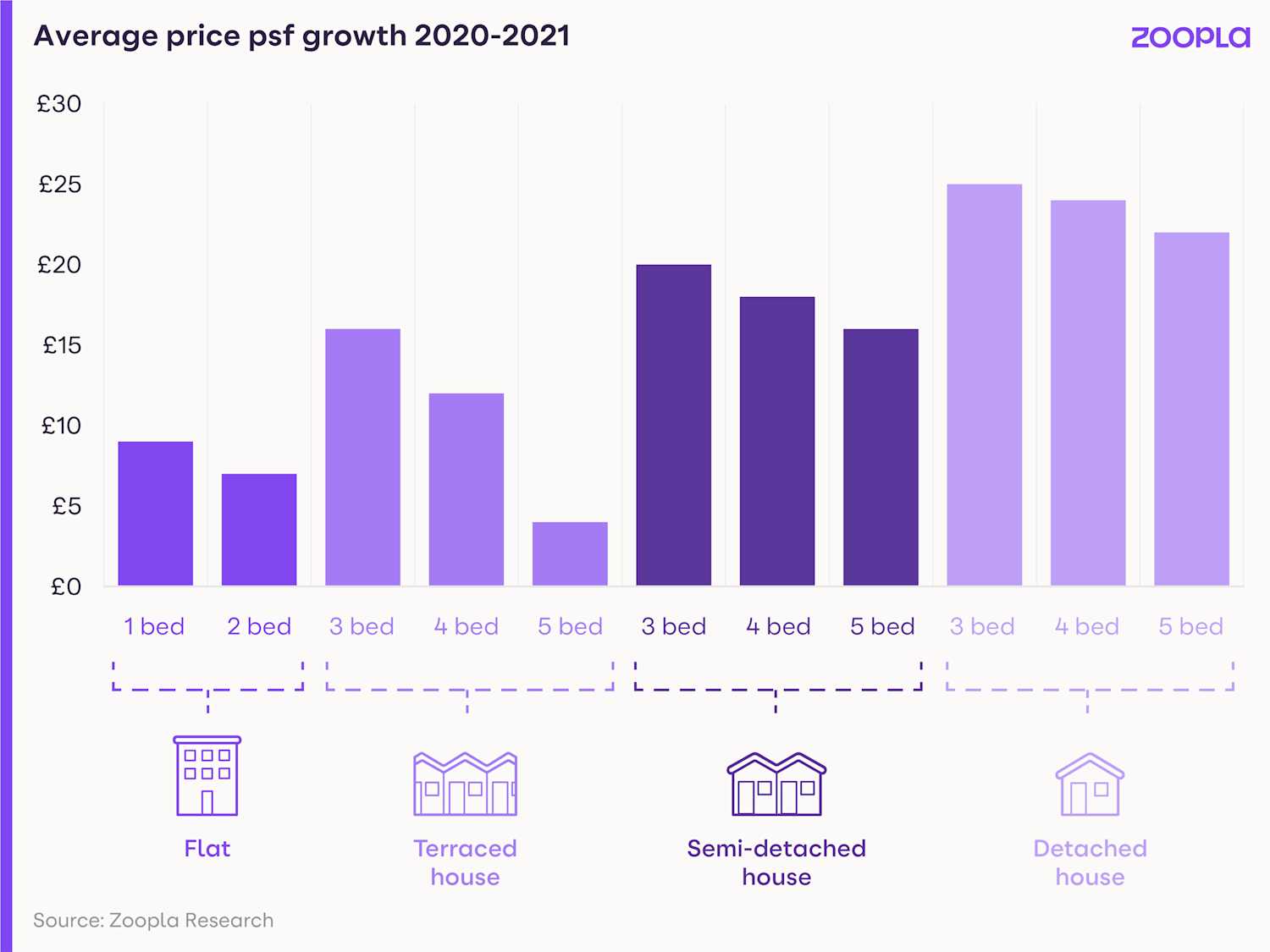

The ‘search for space’ has made three and four-bedroom houses the most sought-after types of property during the pandemic.

It means that the typical cost of a three-bedroom detached house has risen by £25 per square foot, compared with an increase of just £7 per square foot for a two-bedroom flat.

Nicky Stevenson, managing director of Fine & Country UK, said:

"Certain types of properties will command a higher price. This is down to demand. The more buyers interested in a certain type of property, the higher the price they would need to pay to secure it.

"Since the pandemic, space has been the name of the game with buyers wanting homes that offer gardens and an extra bedroom or home office, especially now with so many people working remotely."

Where can you get the most for your money?

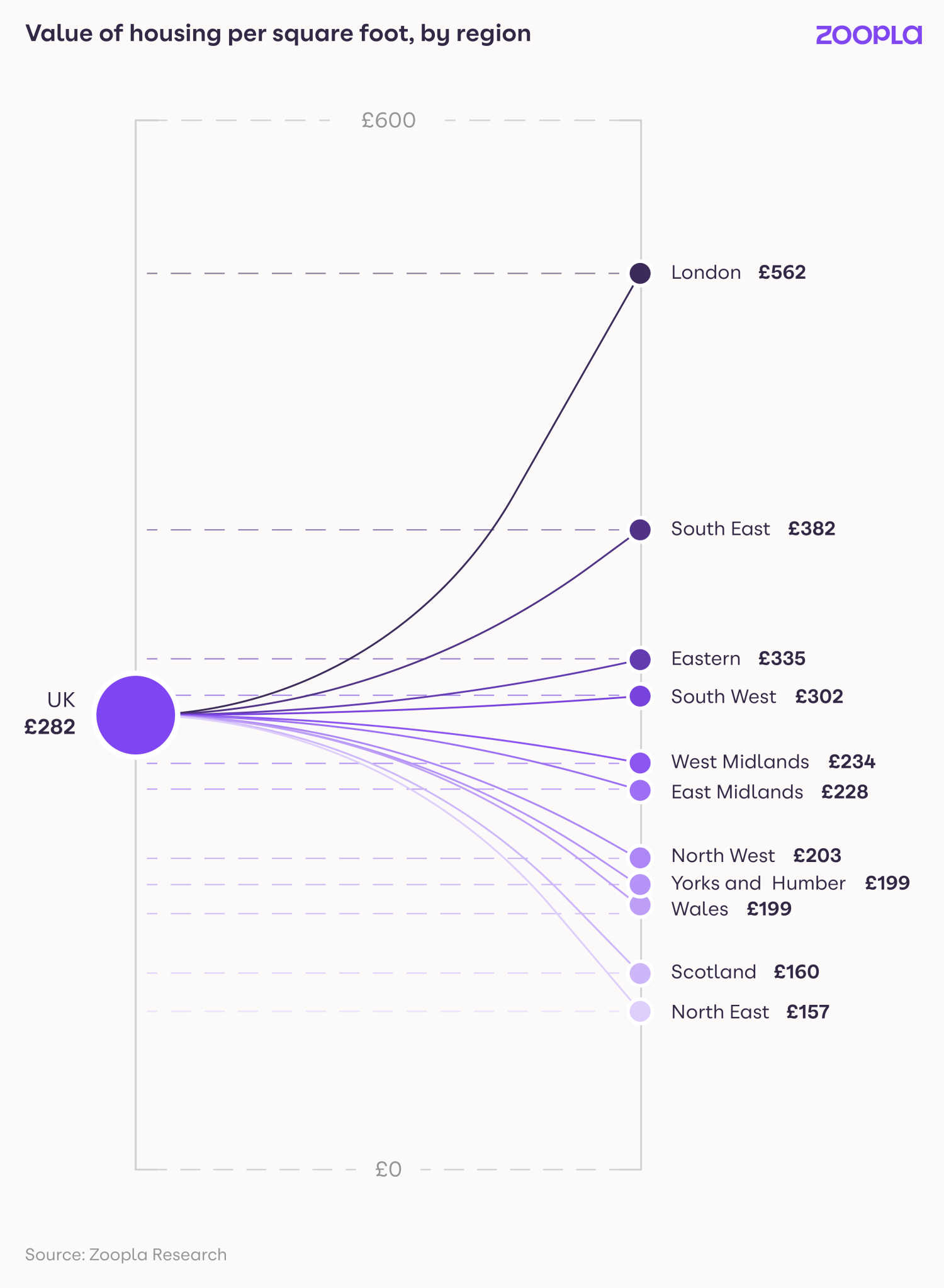

It is not only the type of property that determines the cost of bricks and mortar, but the location too.

The north-east offers the best value for money, with homes costing an average of £157 per square foot.

It’s followed by Scotland at £160 per square foot, and Wales and Yorkshire and the Humber, both at £199 per square foot.

Homes in Burnley are the cheapest in the UK on a price per square foot basis, with the cost coming in at an average of just £123.

Other towns that offer good value are Sunderland, Dundee and Hull.

Head of research said: "The research reveals the scale of difference when it comes to how much space you can get for your money in different parts of the country. It shows that location really is a key driving force behind what a home is worth."

Where are the most expensive areas to buy a home?

Unsurprisingly, the most expensive place in which to buy a home is London, where prices average £562 per square foot – double the national average.

London is significantly pricier than the next most expensive region, the south-east, where homes cost an average of £382 per square foot.

London’s Kensington and Chelsea takes the overall crown, with homes costing a massive £1,491 per square foot.

To put this into perspective, it means the floorspace required for a double bed would cost an eye-watering £46,550.

Cambridge is the second most expensive city after London, where buying space for a double bed would set you back by an average of £15,994.

It's followed by Brighton and Oxford at £14,520 and £14,168 respectively.

Stevenson explained:

"As the old adage says, location, location, location. Properties that are located in sought-after areas will command a higher price. The price per square foot in a location is synonymous with buyer demand, which is driven by factors such as lifestyle offering and proximity to amenities.

"Buyers will pay more for homes in areas with excellent schools, easy access to commuter routes and shopping facilities, as well as lifestyle elements such as green spaces, restaurants and entertainment venues."

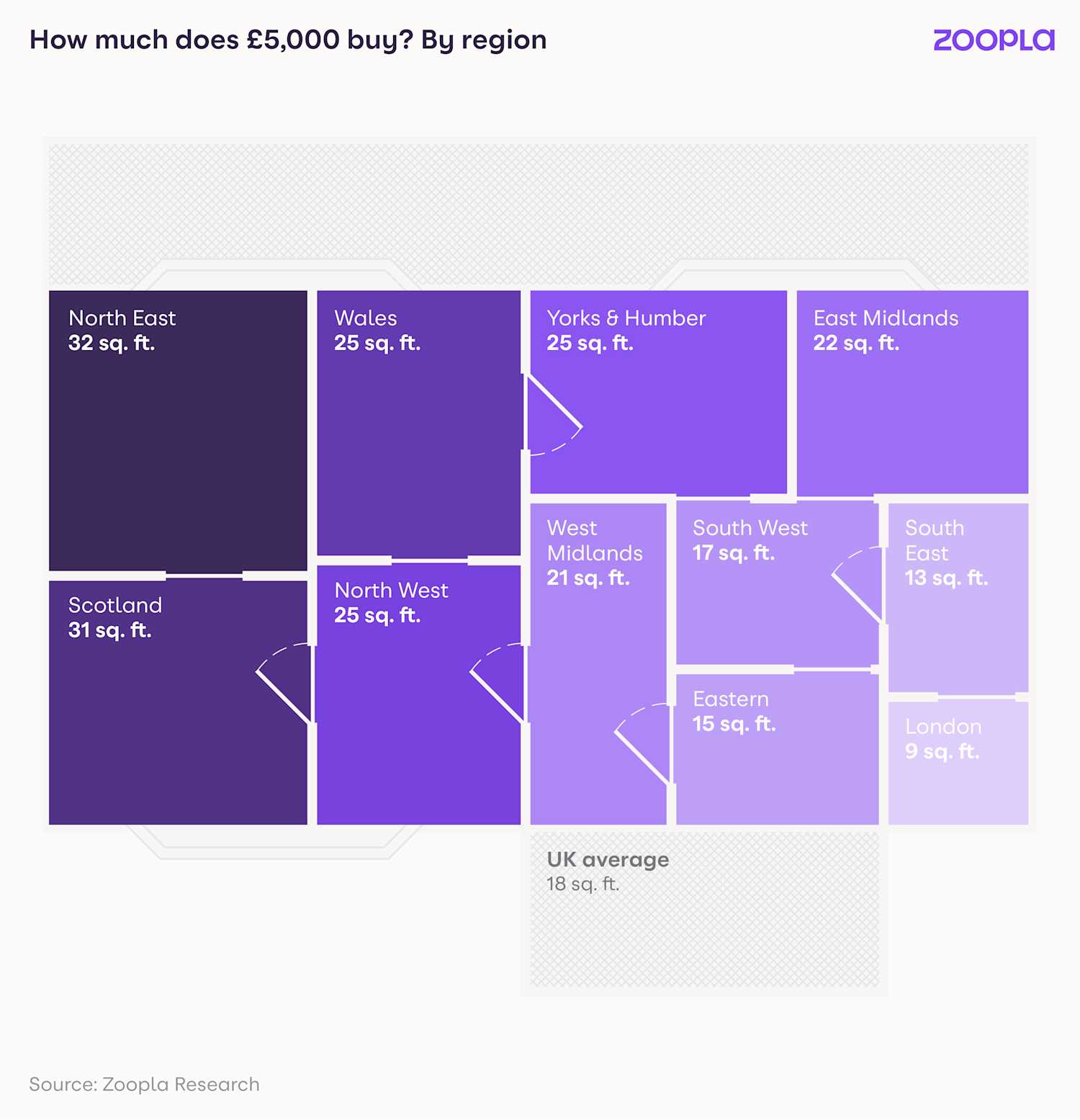

So what can £5,000 get you?

The amount of space you can buy with £5k varies significantly.

On average, £5k will buy you 18 square feet. But the amount nearly doubles to 32 square feet in the north-east, while it will buy you 31 square feet in Scotland.

At the other end of the scale, you would only get 9 square feet for £5k in London and 13 square feet in the south-east.

What does it all mean for you?

It could be good news if you're looking to sell a family house, with values rising the most for three-bedroom detached houses over the last year.

"Given the market conditions since the start of the pandemic, and the ‘search for space’ among many buyers making a move, the value of houses has risen more than the value of flats," Gilmore added.

"As a result, these types of homes are commanding higher values per square foot. Those currently looking to sell a family house could be in pole position."

If you’re looking to move onto or up the housing ladder, knowing how much property costs on a price per square foot basis helps you understand where you can get the most space for your budget.

- The same amount of space in some parts of the UK can cost a whopping 12 times more than in others.

- The floorspace needed for a double bed alone in London's Kensington and Chelsea stands at £43,951.

- Three-bedroom homes offer the best value for buyers seeking more space for their money. But watch out! Prices for this type of property are on the rise.

Rents outside London rise at fastest rate for 13 years

The UK rental market is roaring ahead, with properties letting almost a week faster than in 2020, our research shows.

Rents outside London are rising at their fastest rate since 2008 as people return to city centres.

The typical price of renting a home in the UK, excluding the capital, now stands at £790 a month, costing tenants an additional £456 a year, according to our latest Rental Market Report.

The steep increase has been driven by renters returning to cities. But the surge in tenant demand has not been met by an increase in the number of homes to rent, forcing rents higher.

Our head of research, said: "There has been a sharp rise in demand for rental properties in recent months, especially in central city markets, signalling the return of city life as offices and other leisure and cultural venues continue to open up more fully."

What’s happening to rents?

Rents across the UK, excluding London, have risen by 5% in the last year, the highest level since our index began in 2008 and more than double the 2.2% rise recorded in January.

The south-west saw the biggest hike, with the cost of being a tenant jumping by 7.6% year-on-year. It was followed closely by the East Midlands at 6.8% and the north-east at 6.5%.

Rent increases were particularly strong in some towns and cities, with Wigan and Mansfield seeing hikes of 10.5% and 10% respectively.

Meanwhile, rents in Hastings, Blackburn, Barnsley and Norwich all grew by 9.4% or more.

Despite the rise, these places remain some of the most affordable in which to be a tenant. A single earner has to spend an average of 21% of their income on rent, compared with a UK average of 32%.

At the other end of the scale, rents in London have dropped by 3.8% year-on-year.

Even so, the rate at which rents in the capital are falling is showing signs of bottoming out, as tenants return to the city.

Across the whole of the UK, including the capital, the average rent stands at £943 a month, 2.1% more than a year earlier.

But with average earnings rising faster than rents, rental affordability is holding steady for tenants who are employed.

Kate Eales, head of regional residential agency at Strutt & Parker, said:

"Rents are recording healthy growth in cities, but in the most desirable areas, there’s evidence of growth up to 25%. We recently let a home in the Cotswolds for £3,750 a month when it was previously let out at £2,200 and another was let for £5,500, up from £4,100."

What’s demand for rental homes like?

Tenant demand is soaring. It was nearly 80% higher in August than average levels between 2017 and 2019.

It’s being driven by a resurgence in city centre life, with people being drawn back as offices, bars, restaurants and other leisure facilities reopen.

There are also seasonal factors at play, such as university students looking for accommodation ahead of the new academic year, graduates starting jobs and families moving before the school term starts.

The bounce back has been particularly marked in London, leading to rents in the 12 inner boroughs rising by an average of 2.3% between May and July.

Similar spikes have been seen in Birmingham, Edinburgh, Leeds and Manchester.

It’s reversing the decline seen during the earlier stages of the pandemic, when renters moved back in with families or relocated to more rural areas.

Is there a good supply of homes available to rent?

While demand so far this year has increased by 19%, the level of rental homes available has fallen by 13%.

This mismatch is not only forcing rents up, it is also leading to the rental market moving at its fastest pace since 2016.

The average time between marketing a property for rent and agreeing a tenancy is now just 15 days, compared with 20 in July last year.

Coastal locations, such as Hastings, Worthing, Bournemouth and Plymouth, have the fastest-moving markets, with properties taking just over a week to let.

Rental homes in many large cities, including Liverpool, Cardiff, York, Bristol and Newcastle, are also coming off the market quickly, with the time to rent averaging just under two weeks.

Eales added:

"The recovery in the rental market has, in many ways, mirrored the boom in the sales market, with people looking for homes that accommodate a different set of needs shaped by their lockdown experience.

"Lack of stock and high demand are inevitably driving price growth. This stock depletion is a result in part of many accidental landlords having now sold their properties - benefiting from the soaring demand in the sales market."

What could this mean for you?

Landlords

If you are a landlord with a property to rent, the current surge in tenant demand is good news.

It not only means you are likely to be able to find a tenant quickly, but you are also likely to be able to achieve the rent you want.

It is worth noting the swing back to city life, compared with the earlier stages of the pandemic when people were looking for homes in rural locations and ones with outdoor space.

Tenants

With demand rising and the level of homes to rent falling, you can expect to face significant competition from other tenants to secure a home.

The imbalance is also pushing rents higher, so you may have to pay more than you did a year ago.

If you are finding it hard to find somewhere, consider looking outside of town and city centres.

What’s the outlook?

The high number of people looking for a home to rent during August will ease off in line with seasonal trends.

But demand is expected to remain high in the coming months as the return to city life continues.

Gilmore explained: "As ever, much will be dependent on the extent to which the current rules around Covid-19 continue as they are.

"But given no deviation from the current landscape, the demand for rental property, coupled with lower levels of supply, will continue to put upward pressure on rents.

"In London, this will translate into rental growth returning to positive territory late 2021 or early 2022."

Government to spend £8.6bn on 119,000 affordable homes

The money will deliver nearly 120,000 new properties across England, some of which will be available to buy and others will be for rent.

The government has allocated £8.6bn to help thousands of people across the country get onto the property ladder.

The money will be used to deliver around 119,000 affordable homes, 57,000 of which will be for people to buy.

A further 29,600 of the properties will be delivered for social rent, while 6,250 will be affordable rural homes.

Housing Secretary Robert Jenrick said: “This huge funding package will make the ambition of owning a home a reality for families by making it realistic and affordable.

“We are also ensuring tens of thousands of new homes for rent are built in the years ahead.”

The funding is part of the Affordable Housing Programme, which aims to deliver up to 180,000 new affordable properties.

Why is this happening?

The supply of new homes has been hit by the shutdown of the construction industry during the first lockdown, leading to an 11% fall in completions in the year to the end of March. The sector is also facing a shortage of workers as a result of Brexit.

Meanwhile, the pandemic has increased demand for property, particularly houses, as people reassess their housing needs.

The number of properties for sale has fallen to its lowest level for more than 6 years and is forecast to remain low well into next year.

The net result is a significant mismatch between supply and demand, which is putting upward pressure on prices, making it harder for many people to purchase a home without assistance.

What does it mean for you?

The announcement is good news for people struggling to get on to the housing ladder who want to take advantage of the affordable homes scheme.

The main scheme is shared ownership, under which you can buy a stake of as little as 10% in a property and pay rent on the portion you do not own, with the option to increase your share when you can afford to.

To qualify for a shared ownership home, you must have a household income of £80,000 a year or less, rising to £90,000 in London, and not be able to afford a deposit and mortgage payments for a property that meets your needs on the open market.

Nearly £5.2bn of the latest funding will be used to build properties outside of London, giving a boost to people in the regions who want to get on to the property ladder.

What’s the background?

Affordable homes is just one of a number of government initiatives to help people purchase a property.

The flagship scheme is the Help to Buy equity loan, under which first-time buyers can purchase a new-build property with a 5% deposit, which the government tops up with a 20% equity loan that is interest-free for 5 years.

Other initiatives include First Homes, under which first-time buyers, key workers and local people, can purchase a home at a 30% discount to its market price, while the 95% mortgage guarantee scheme helps buyers get a mortgage with just a 5% deposit.

Those saving for a deposit can also take advantage of the Lifetime ISA, under which they can save £4,000 a year towards purchasing their first home or their retirement, which the Government tops up with a 25% bonus, up to a maximum of £1,000 annually.