Pent up demand triggered by the pandemic leads to the busiest market for more than a decade as one in every 16 homes is set to be sold to new owners.

One in every 16 privately-owned properties is set to change owners in 2021, making it the busiest year for the housing market since 2007.

The ongoing re-evaluation of homes triggered by the Covid-19 pandemic has continued to drive increased demand throughout the past year.

The high number of buyers in the market, combined with a shortage of properties for sale, has pushed up the average cost of a UK home to £240,000, compared with £200,000 five years ago.

During the past year alone, the typical property has seen £15,500 added to its value, driven in part by buyer appetite for bigger homes, especially in commuter zones and rural areas.

What’s happening to house prices?

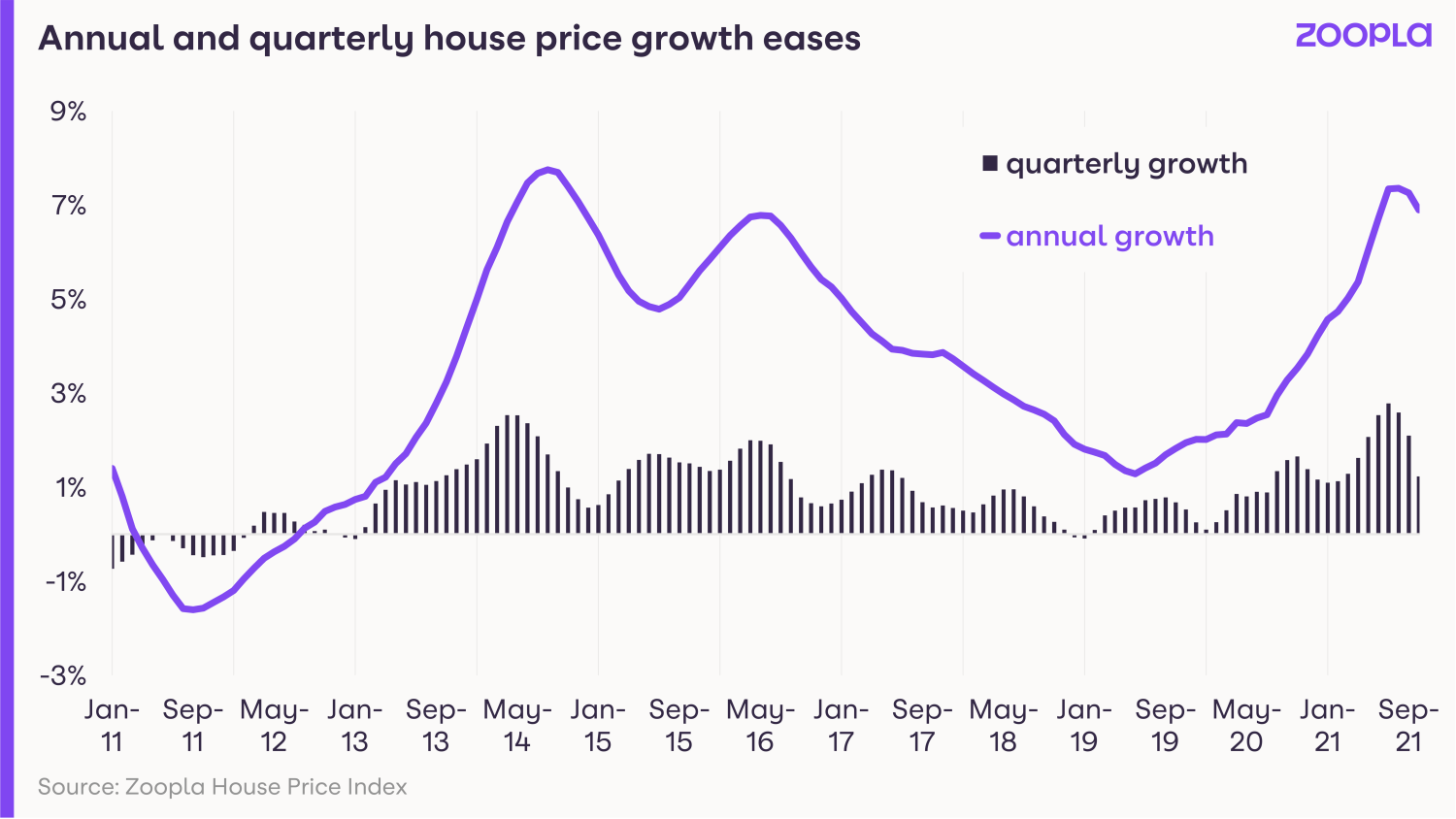

House prices rose at an annual rate of 6.9% in October, double the rate of 3.5% recorded in the same month of 2020.

But the figure represents a slight easing in growth compared with the previous two months, and this trend is expected to continue into next year.

Quarterly figures also suggest the rate of price rises is slowing, with property values increasing by 1.2% in the three months to October, compared with 2.8% in the three months to the end of July.

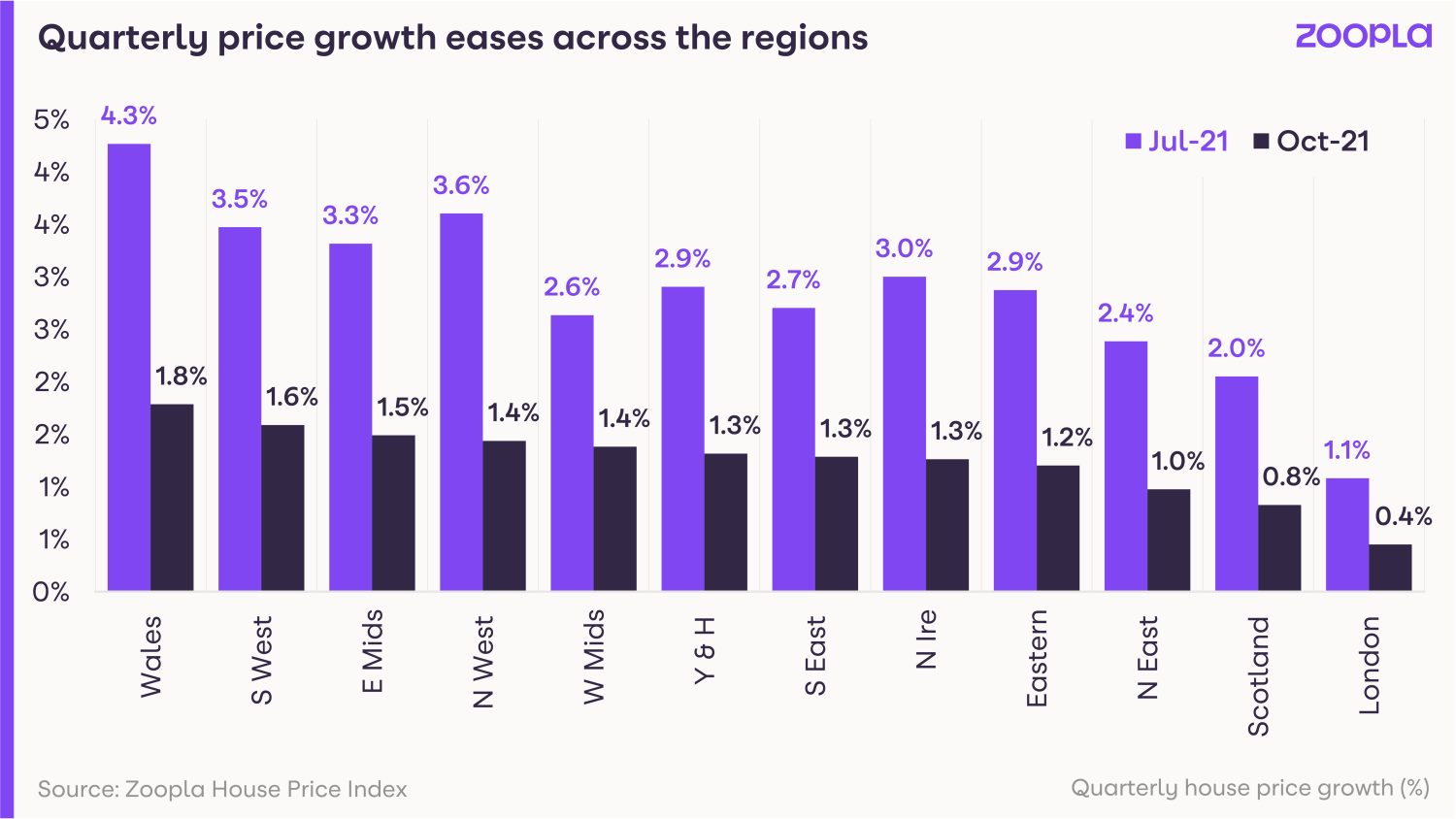

Wales continued to see the strongest gains, with house prices rising 10.8% year-on-year, followed by the North West at 9%.

At the other end of the scale, London saw the slowest growth of just 2.3%.

On a city level, Liverpool, Manchester and Sheffield, where property remains relatively affordable, posted the highest increases of 10.6%, 8.7% and 7.9% respectively.

Here’s how prices have grown in cities over the last quarter

How busy is the housing market?

The property market continues to be busy with buyer demand running 28% above the five-year average.

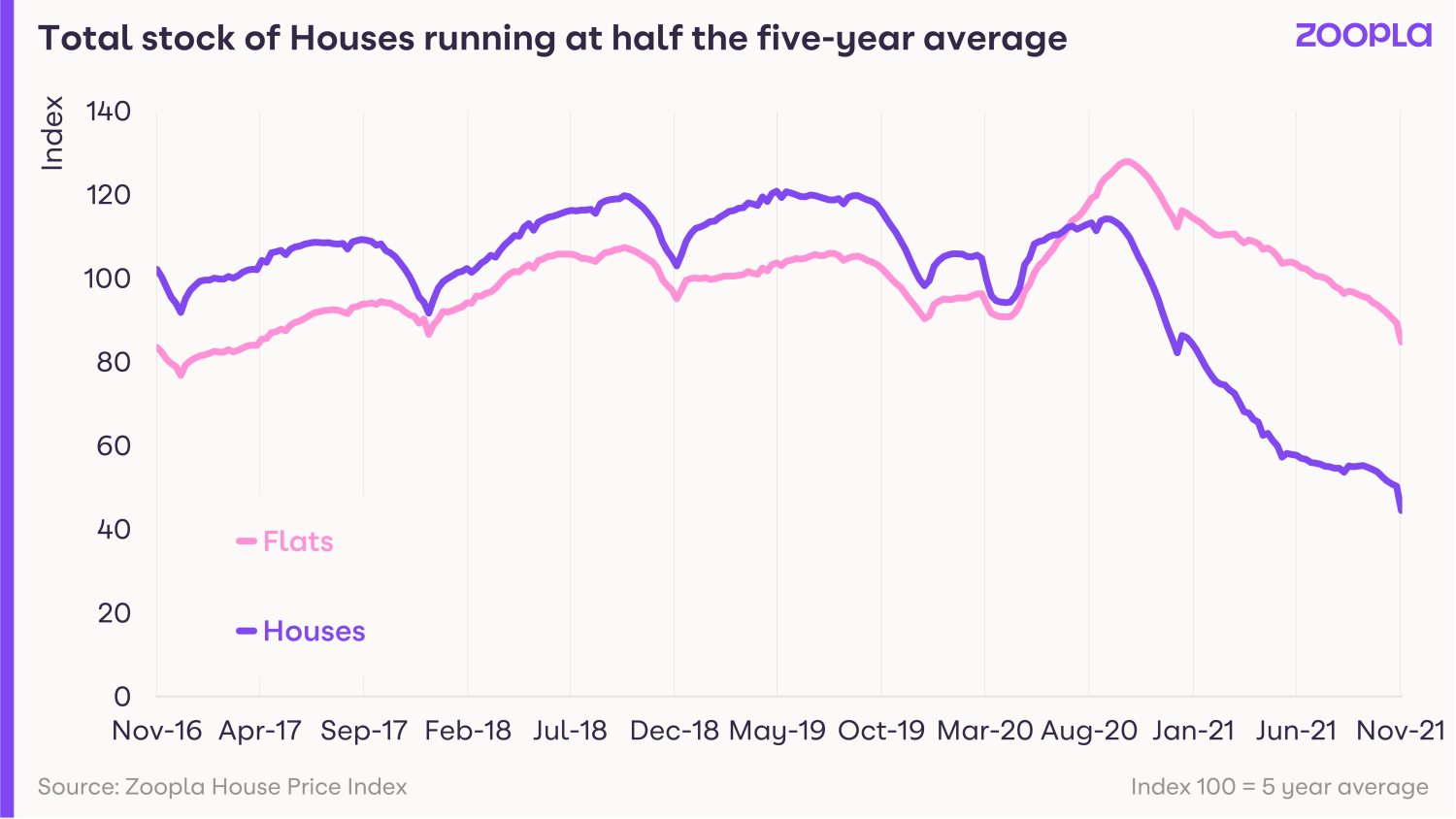

Unfortunately, this strong demand has not been met by an increase in homes being put up for sale, with the number of properties on the market down 42% compared with the five-year average.

Although there is a shortage of both houses and flats, the number of houses listed for sale is more than 55% down on the five-year average, while flats are down by a more moderate 15%.

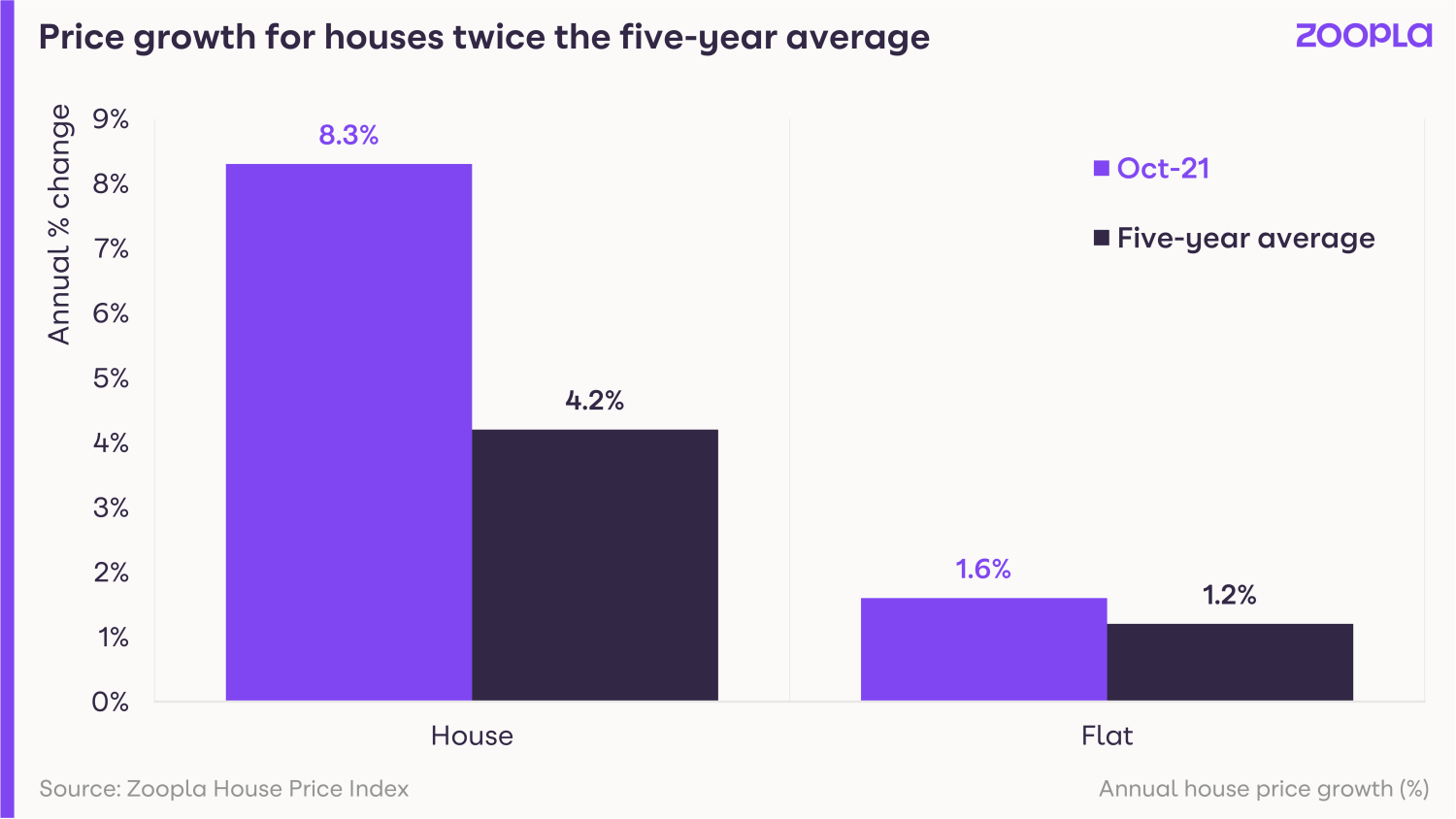

This difference in availability is reflected in price growth, with the average cost of all types of houses jumping by 8.3% during the past year, while the typical cost of a flat has risen by a more moderate 1.6%.

What could this mean for you?

First-time buyers

Intense competition in the market, combined with rising prices, is bad news for first-time buyers.

That said, you can put yourself in a much better position if you’re prepared to purchase a flat, rather than a house.

Not only is the shortage of flats for sale less acute than that of houses, but flats have also seen lower price gains in the past year, making them more affordable.

Flats without outdoor space are also taking longer to sell than houses and flats with access to gardens, making this sector of the market less frenzied.

Home-movers

If you have a home you want to sell, particularly if it’s a family home or larger house, you’re in poll position to obtain both a quick sale and your asking price, as demand for these types of properties remains high.

That said, in the current fast-moving market, co-ordinating your sale with your next purchase could be tricky.

If you do want to sell, you should contact estate agents now to ensure your home is ready to list in January, in time for the New Year rush.

Take the opportunity to get a feel for how fast-paced the market is in your area and how much choice you’ll have for your next home. But bear in mind that the market should see a spike in new listings in the New Year.

What will happen in the housing market?

Buyer demand is expected to remain strong going into 2022, but new supply is also likely to come on to the market, as households use the holiday period to make a decision about moving.

The proportion of buyers who are also sellers is expected to increase, helping to ease the shortage of supply.

Grainne Gilmore, head of research at Zoopla, said: “In typical years, the highly seasonal supply of homes being listed for sale slows in the run up to Christmas, but rises sharply in the new year.

“On average, the supply of listings at the end of January runs some 50% higher than the start of December.

“Other factors that will affect prices next year include the looming economic headwinds in the shape of rising inflation – which will push household costs higher.

“Even with some interest-rate rises, mortgage rates are likely to remain relatively low compared to long-run averages, and there is more room for price growth across some of the most affordable housing markets.”

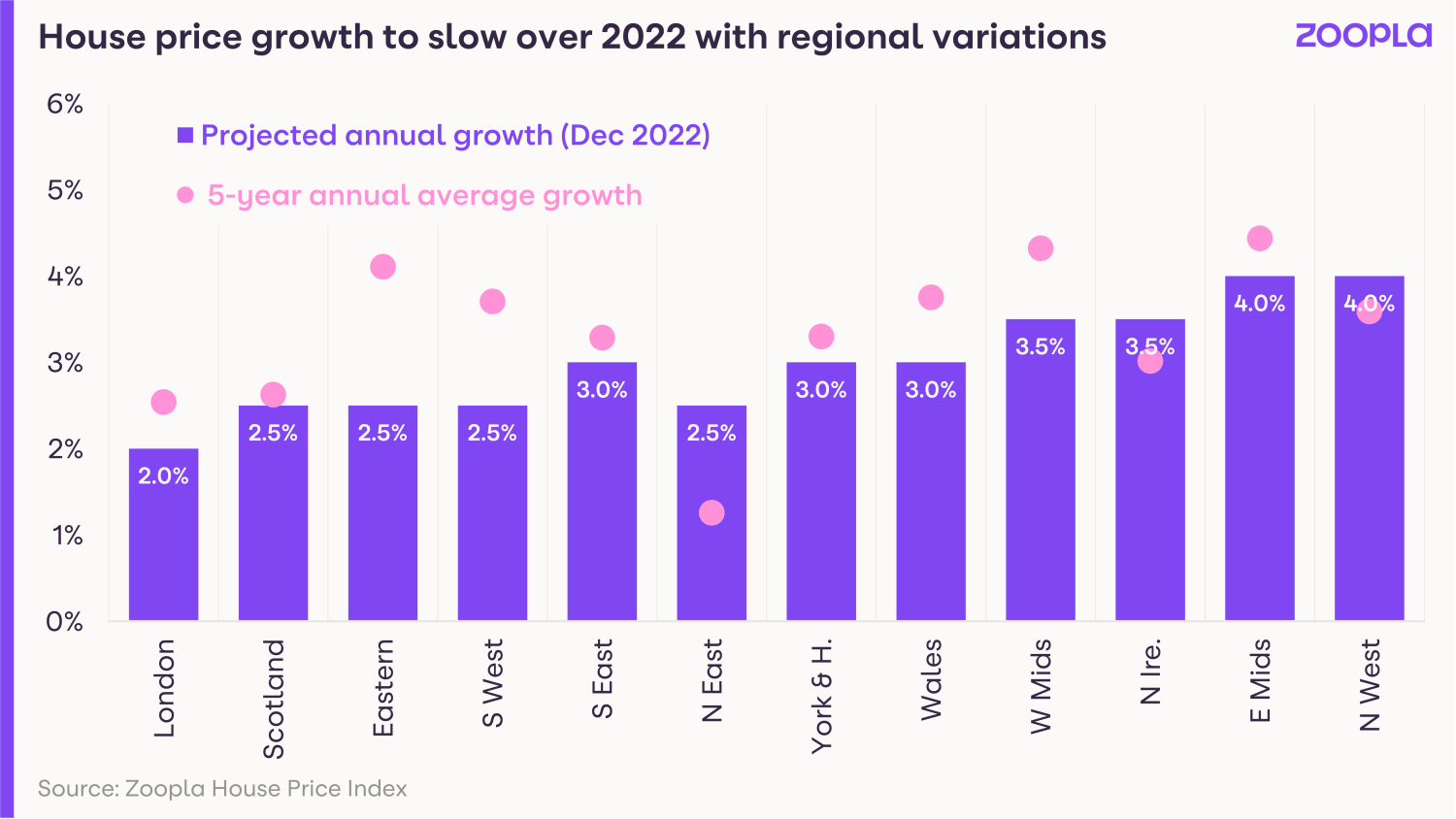

Overall, house prices are expected to rise by 3% in 2022, while around 1.2 million homes are likely to change hands, down from an estimated 1.5 million this year.