Wondering how far your budget could stretch? Find out which types of property and locations come up trumps when it comes to getting more bang for your buck.

Want to know where you can get more bang for your buck? It’s worth doing your homework, with the same amount of space costing up to 12 times as much in some areas compared with others.

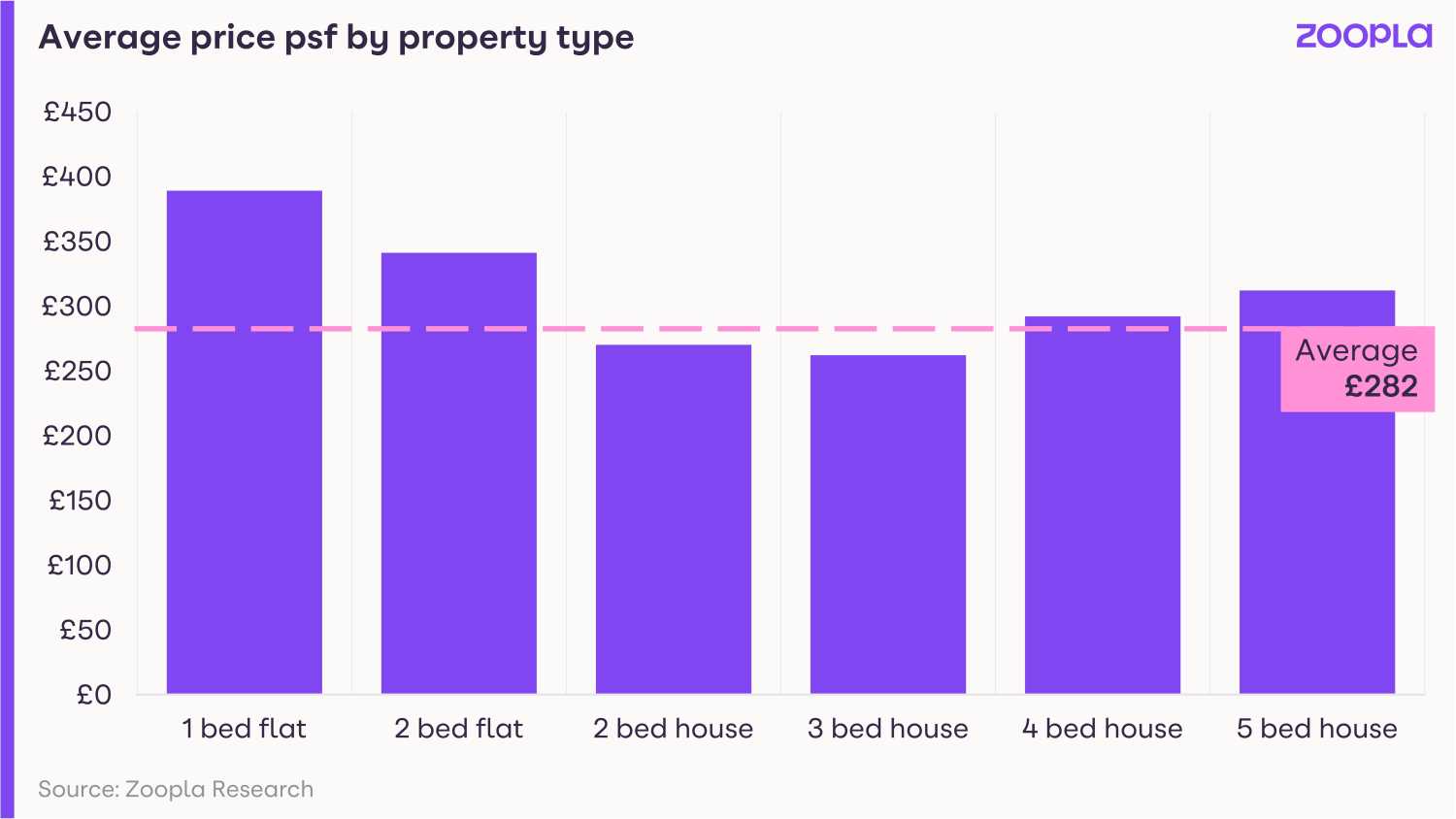

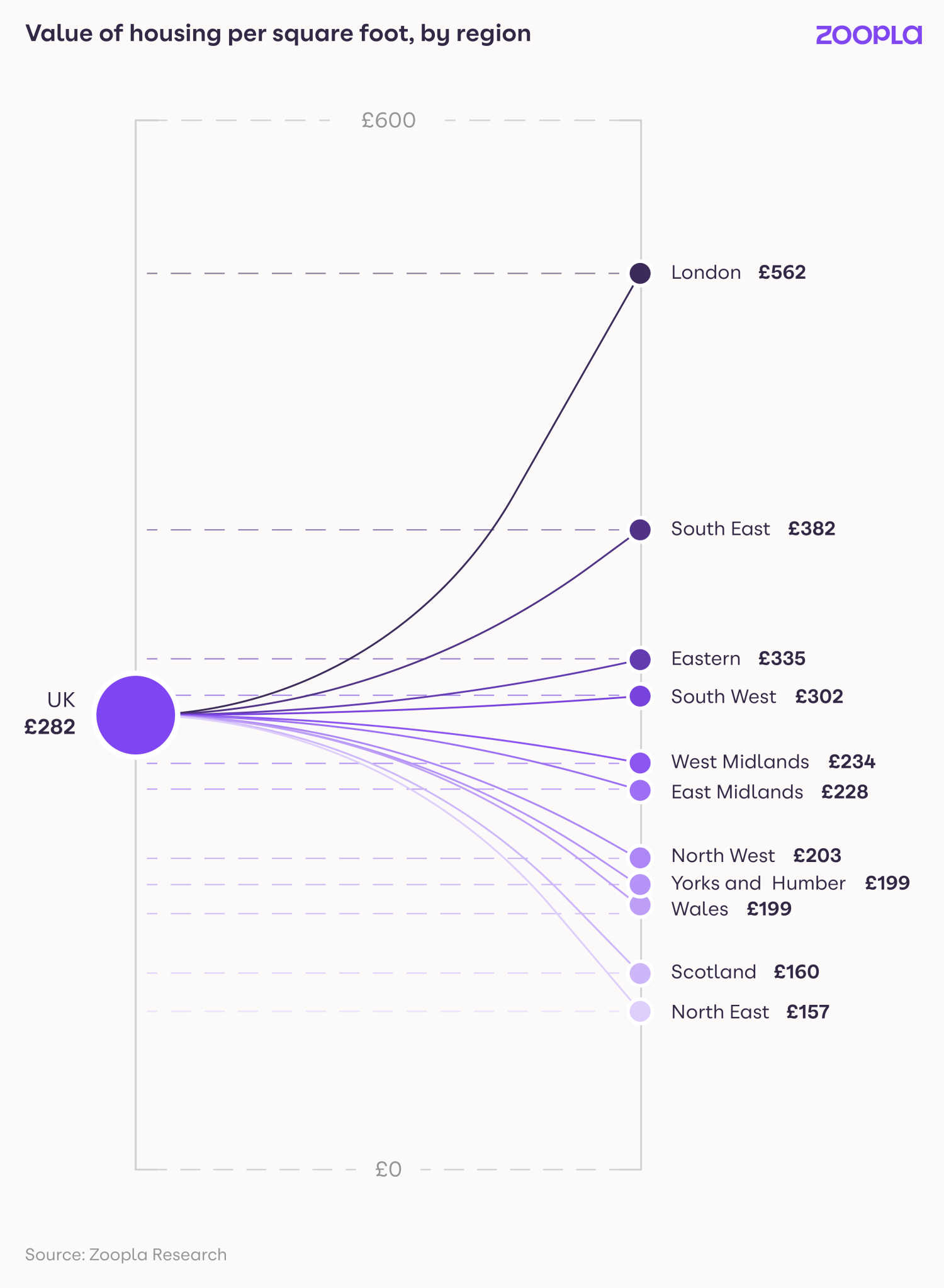

The average property in the UK costs £282 per square foot, according to our latest report, How home values compare by floorspace.

But the sum rises to an eye-watering £1,491 per square foot in London’s chic enclave of Kensington and Chelsea and drops to just £104 per square foot in Burnley, Lancashire.

In case you’re wondering, we’ve measured property on a price per square foot basis because it’s a useful way of comparing prices. It strips out variations to give a like-for-like benchmark.

Which type of property offers the best value?

Three-bedroom homes offer the most bang for your buck, costing an average of £262 per square foot.

And at the other end of the spectrum, smaller flats and larger family homes offer the least value for money on a price per square foot basis.

Yes, one-bedroom flats, typically popular among first-time buyers, cost an average £389 per square foot.

This falls to £270 per square foot for two-bedroom houses, and drops again for three-bedroom ones.

But the cost per square foot then rises to £292 for four-bedroom houses and stands at £312 for five-bedroom properties.

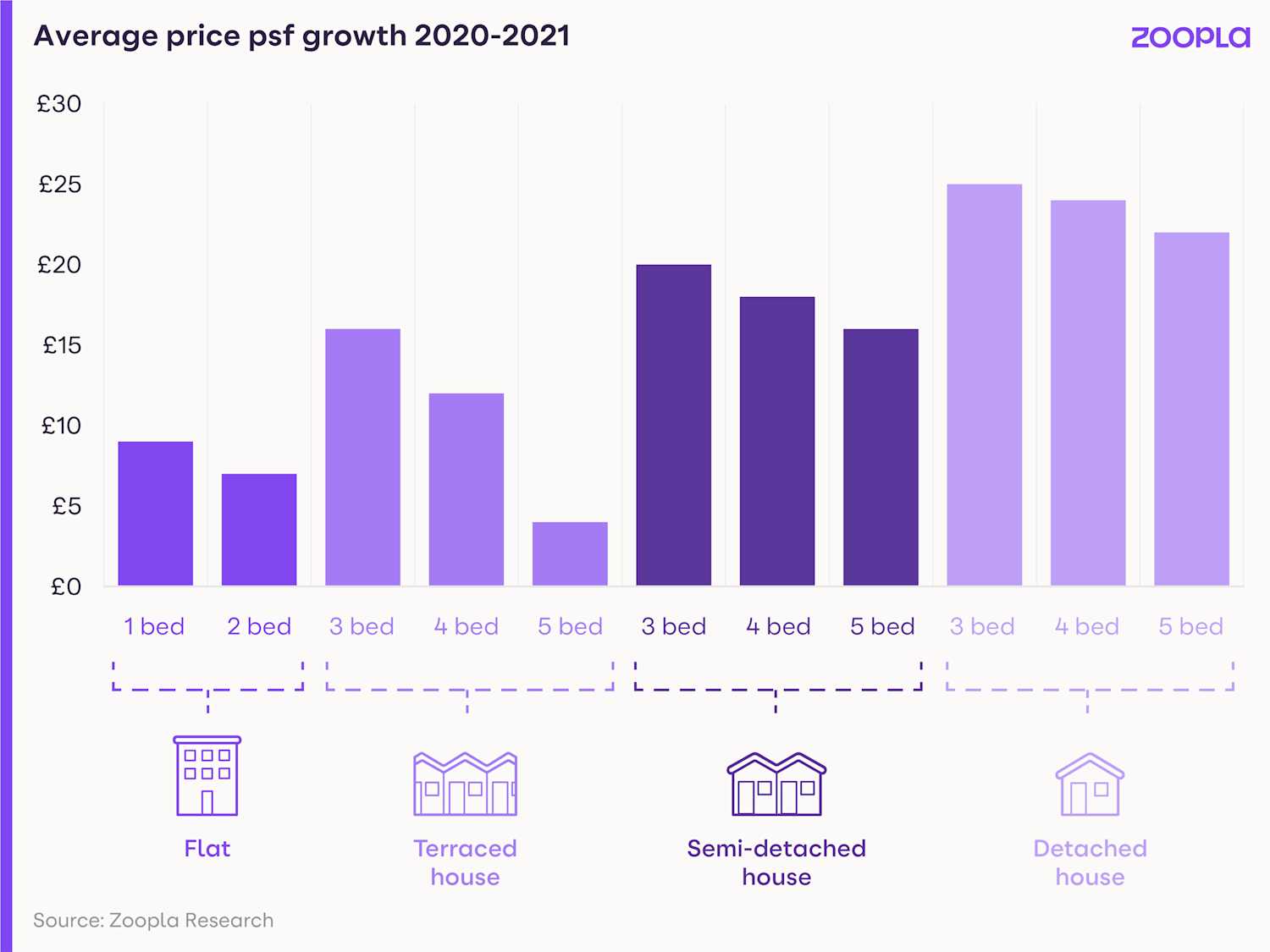

The ‘search for space’ has made three and four-bedroom houses the most sought-after types of property during the pandemic.

It means that the typical cost of a three-bedroom detached house has risen by £25 per square foot, compared with an increase of just £7 per square foot for a two-bedroom flat.

Nicky Stevenson, managing director of Fine & Country UK, said:

“Certain types of properties will command a higher price. This is down to demand. The more buyers interested in a certain type of property, the higher the price they would need to pay to secure it.

“Since the pandemic, space has been the name of the game with buyers wanting homes that offer gardens and an extra bedroom or home office, especially now with so many people working remotely.”

Where can you get the most for your money?

It is not only the type of property that determines the cost of bricks and mortar, but the location too.

The north-east offers the best value for money, with homes costing an average of £157 per square foot.

It’s followed by Scotland at £160 per square foot, and Wales and Yorkshire and the Humber, both at £199 per square foot.

Homes in Burnley are the cheapest in the UK on a price per square foot basis, with the cost coming in at an average of just £123.

Other towns that offer good value are Sunderland, Dundee and Hull.

Head of research said: “The research reveals the scale of difference when it comes to how much space you can get for your money in different parts of the country. It shows that location really is a key driving force behind what a home is worth.”

Where are the most expensive areas to buy a home?

Unsurprisingly, the most expensive place in which to buy a home is London, where prices average £562 per square foot – double the national average.

London is significantly pricier than the next most expensive region, the south-east, where homes cost an average of £382 per square foot.

London’s Kensington and Chelsea takes the overall crown, with homes costing a massive £1,491 per square foot.

To put this into perspective, it means the floorspace required for a double bed would cost an eye-watering £46,550.

Cambridge is the second most expensive city after London, where buying space for a double bed would set you back by an average of £15,994.

It’s followed by Brighton and Oxford at £14,520 and £14,168 respectively.

Stevenson explained:

“As the old adage says, location, location, location. Properties that are located in sought-after areas will command a higher price. The price per square foot in a location is synonymous with buyer demand, which is driven by factors such as lifestyle offering and proximity to amenities.

“Buyers will pay more for homes in areas with excellent schools, easy access to commuter routes and shopping facilities, as well as lifestyle elements such as green spaces, restaurants and entertainment venues.”

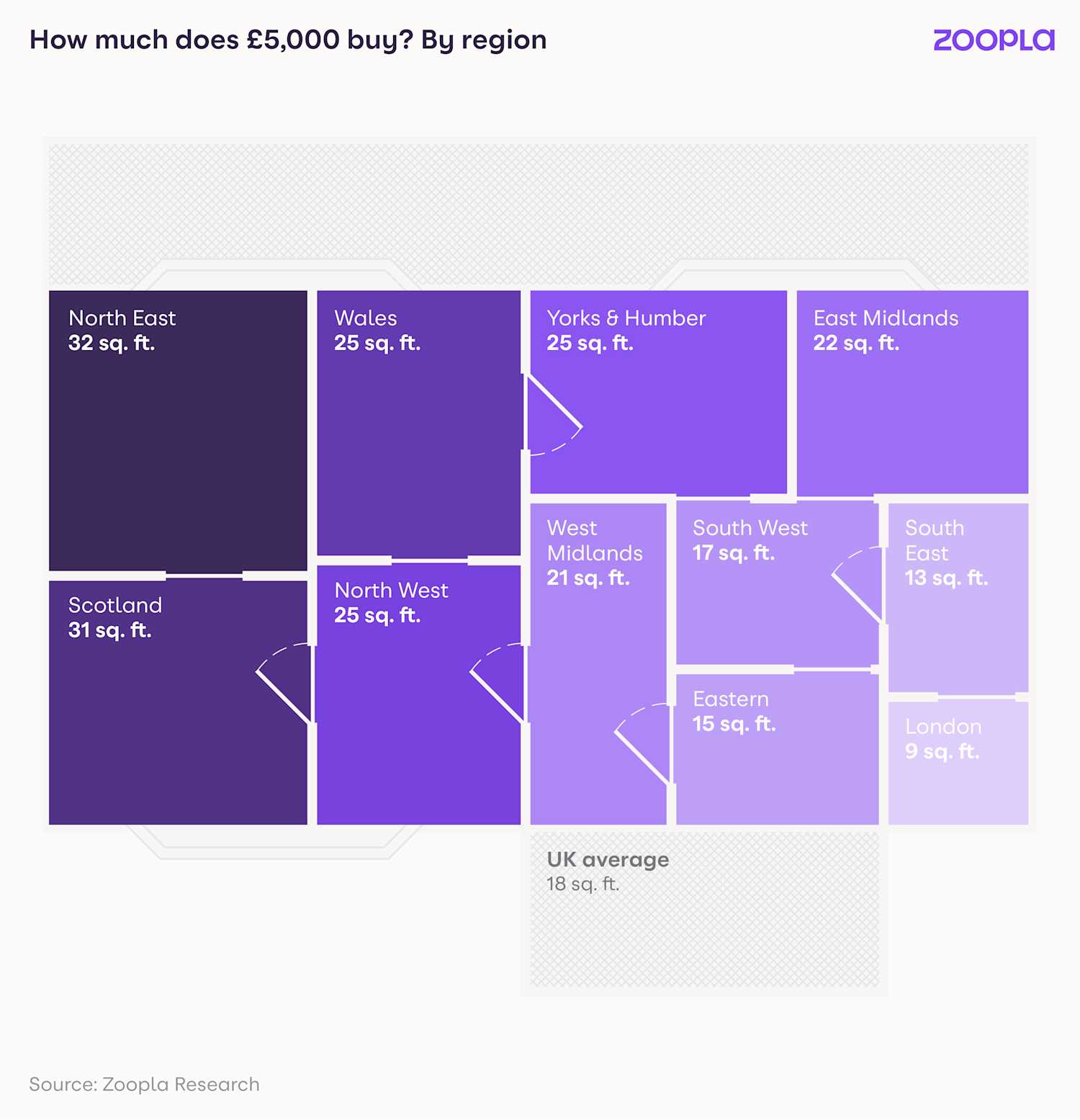

So what can £5,000 get you?

The amount of space you can buy with £5k varies significantly.

On average, £5k will buy you 18 square feet. But the amount nearly doubles to 32 square feet in the north-east, while it will buy you 31 square feet in Scotland.

At the other end of the scale, you would only get 9 square feet for £5k in London and 13 square feet in the south-east.

What does it all mean for you?

It could be good news if you’re looking to sell a family house, with values rising the most for three-bedroom detached houses over the last year.

“Given the market conditions since the start of the pandemic, and the ‘search for space’ among many buyers making a move, the value of houses has risen more than the value of flats,” Gilmore added.

“As a result, these types of homes are commanding higher values per square foot. Those currently looking to sell a family house could be in pole position.”

If you’re looking to move onto or up the housing ladder, knowing how much property costs on a price per square foot basis helps you understand where you can get the most space for your budget.

- The same amount of space in some parts of the UK can cost a whopping 12 times more than in others.

- The floorspace needed for a double bed alone in London’s Kensington and Chelsea stands at £43,951.

- Three-bedroom homes offer the best value for buyers seeking more space for their money. But watch out! Prices for this type of property are on the rise.