Rent increases have hit a 13-year high as demand for property doubles in the central zones of major cities. And for the first time in 16 months, London rents are rising.

Rent increases have hit a 13-year high as demand from renters in the central zones of major cities doubles.

The typical cost of renting a home in the UK, excluding London, now stands at £809 per month, according to our latest Rental Market Report.

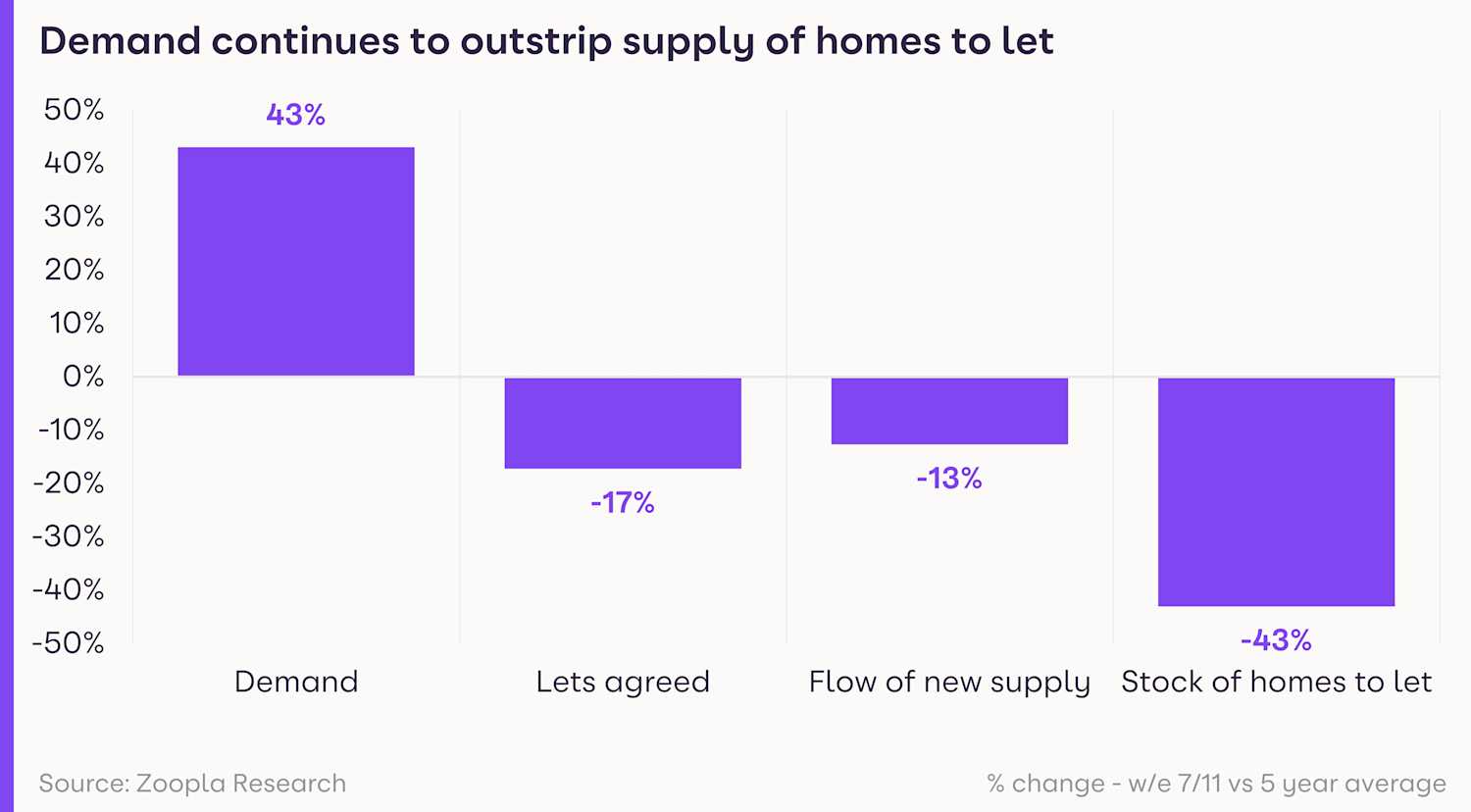

While renters are returning to cities, the rise in demand is not being met by an increase in the number of homes available to rent, forcing rents higher.

The good news is that despite the increase in rents, affordability has remained largely unchanged thanks to rising pay, with rents accounting for an average of 37% of a single tenant’s monthly income.

Gráinne Gilmore, head of research at Zoopla, said: “Households looking for the flexibility of rental accommodation, especially students and city workers, are back in the market after consecutive lockdowns affected demand levels in major cities.”

What’s happening to rents?

Average UK rents, excluding London, have risen by 6% during the year to the end of September, jumping by 3% in the past three months alone.

Strong rental growth is being driven by a return of workers to city centres and students to universities.

It can also be explained in part by renters opting for larger, and by extension more expensive, properties as part of the pandemic-induced search for space.

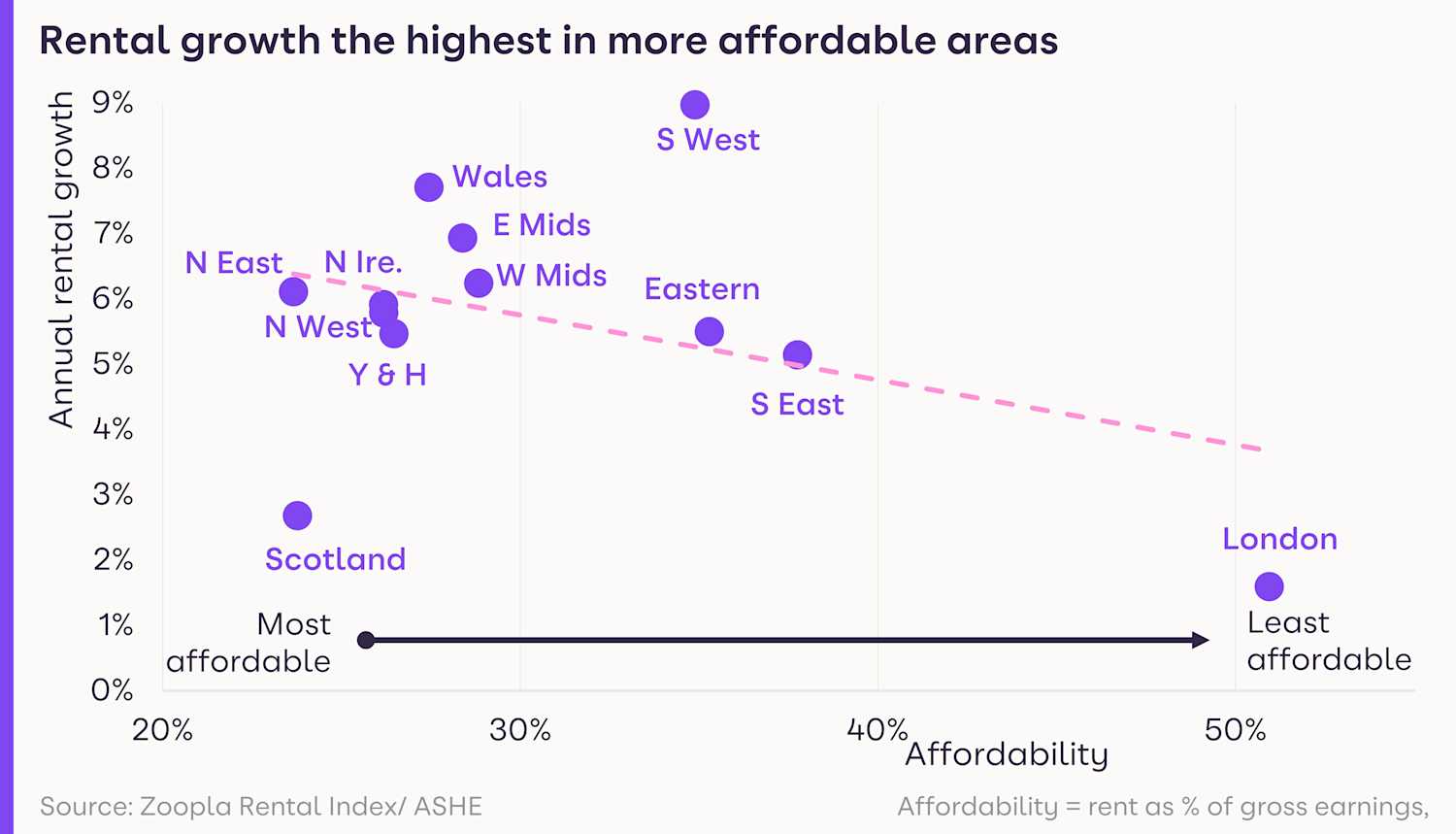

The South West saw the biggest jump in rental growth at 9%, due to its popularity as a place to live, followed by regions where renting remains most affordable, namely Wales, where rents have risen 7.7% year-on-year and the East Midlands at 6.9%.

Rent increases are running well ahead of the five-year average in many of the UK’s largest cities, with Bristol seeing the strongest rise of 8.4%, while Nottingham wasn’t far behind at 8.3%, and Glasgow was in third place at 7.2%.

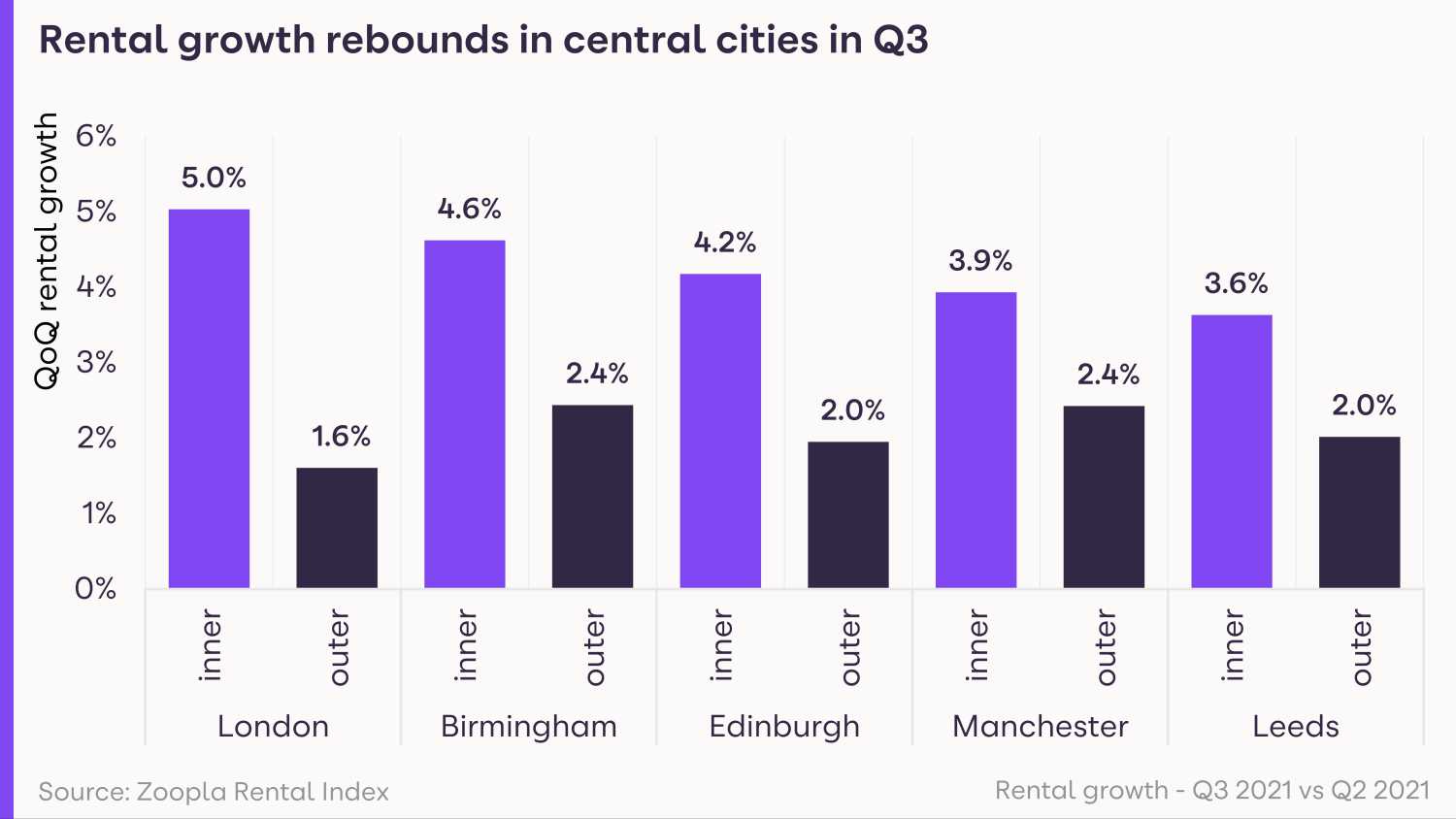

Even in London, rents, which had fallen for 15 months in a row, are rising again, increasing by 1.6% in the year to the end of September as offices reopened and city life resumed.

Despite the bounce back, rents in the capital are still 5% lower than they were at the start of the pandemic, following significant falls during the past 18 months.

What’s demand for rental homes like?

Demand in major cities such as Leeds, Manchester, and Edinburgh doubled in the three months to the end of September, compared with the earlier part of the year, as renters rushed back to city centres following the easing of Covid-19 restrictions.

Meanwhile Birmingham has seen a 60% spike and London has seen a 50% jump in demand.

Across the UK as a whole, demand from renters is 43% higher than the five-year average.

The net result is a fast-paced market with homes taking an average of just 15 days to rent across the UK.

Is there a good supply of homes available to rent?

Unfortunately, this increased demand is not being met a rise in the number of homes available to rent, with properties on the market 43% below the five-year average.

The lack of supply is being driven by a combination of long-term factors which have caused landlords to exit the sector, such as the 3% stamp duty surcharge on additional properties, and the post-lockdown spike in demand.

What could this mean for you?

Tenants

If you’re looking for a new home to rent, you have two issues to contend with, namely intense competition and rising rents.

You can register with us to receive alerts when a property meeting your criteria becomes available, helping you to stay ahead of the competition.

You may find you’re able to get somewhere with a lower rent if you’re prepared to compromise on property type, such as opting for a flat rather than a house, or choosing a less central location.

Landlords

If you’re a landlord with a property to rent, the dual trend of rising demand and higher rents is good news for you.

The current buoyancy of the rental market may mean it’s a good time to think about extending your property portfolio.

But bear in mind that demand patterns have changed compared with during the height of the pandemic, with renters returning to city centre locations.

What’s the outlook?

Looking ahead, the shortage of homes available to rent looks set to continue due to lower levels of investment by landlords.

Meanwhile, demand is also expected to be strong as the employment market remains relatively robust and there is still pent-up demand, particularly for homes in city centres.

This mismatch between supply and demand will continue to push up rents.

Overall, rents across the UK, excluding London, are likely to end 2022 4.5% higher than they started it, while rents in London are likely to rise by 3.5% to exceed their pre-pandemic levels.