House prices down, mortgage rates to follow

Sellers are offering their biggest discounts in five years, with one in four offering 10% off the asking price right now, putting buyers in a strong negotiating position.

Jeremy Hunt's Autumn Statement last week revealed that inflation has now fallen from a high of 11.1% to 4.6%.

The government anticipates it will fall to 2.8% by the end of 2024 and to 2% by the end of 2025.

‘Financial markets expect the Bank of England to start cutting rates around the summer of 2024,’ says our Director of Research, Richard Donnell.

‘If mortgage rates start to fall further, this will support an improvement in demand, but prices will remain under modest downward pressure.’

The news couldn’t be better for buyers right now, who have been held back by higher mortgage rates in 2023.

Sellers are currently offering the biggest discounts in five years, with one in four offering 10% off the asking price.

The average discount being offered is 5.5%, the equivalent of £18,000.

In London and the South East, that rises to 6.1%, or £25,000, off the asking price.

Across the rest of the UK, the reduction is smaller at 4.8%, or £11,000, but it’s still the highest level of discounting we’ve seen in recent years.

Much more choice of homes, including popular 3-bed properties

The supply of the UK’s most in demand property type: three and four bedroom houses, is increasing.

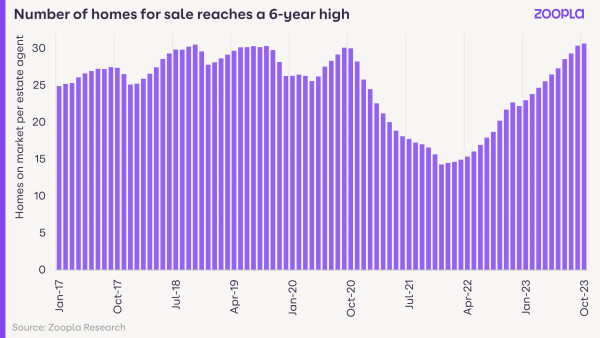

And we’re now seeing record numbers of properties for sale.

During the pandemic years a chronic scarcity of homes on the market pushed up prices.

But this position has now fully reversed, with the highest number of homes for sale per estate agent in six years.

‘The average estate agency branch has 31 homes for sale, compared to a low of just 14 in the middle of the pandemic boom,’ says Donnell.

‘This is boosting choice amongst would-be buyers and providing them with much greater negotiating power with sellers as they agree pricing.’

Buyers have room to negotiate on price

During the pandemic years, buyers had to pay the full asking price to secure a property, but not any more.

‘Over the course of 2023, sellers have been accepting ever larger discounts to the asking price to agree a sale,’ says Donnell.

In the first six months of 2023, those discounts averaged out at 3.4% off the asking price.

This month, the average discount recorded is 5.5%, or £18,000. That’s the largest level of discounting seen since 2018.

And buyers in southern England now have the greatest negotiating power of all. It’s where the biggest discounts are going on, with 6.1% reductions on average asking prices.

‘These discounts reflect the fact that sellers haven't been cutting asking prices very quickly,’ says Donnell. ‘As more sellers adjust asking prices lower, we expect these discounts will start to return to normal levels of 3-4%.’

There couldn’t be a better time to buy in London

London has seen slow price growth over the last seven years of just 8%, while for the rest of the UK, house prices have risen 28%.

Homes in the capital are now seen as better value for money, while a steady return to office working is supporting sales volumes and pricing levels here.

In fact, new sales have rebounded more in London than any other part of the UK over the last 2 months, leading to a slight firming in prices.

What’s going to happen to house prices in 2024?

As we edge towards Christmas, the number of homes for sale will start declining as some sellers take their properties off the market with a view to relaunching in the new year.

But it will remain a buyers’ market in 2024, with no rise in house prices anticipated any time soon.

‘The current repricing of homes has further to run in 2024,’ says Donnell.

‘While 5-year fixed mortgage rates have been falling below 5%, they need to fall further to bring more buyers back into the market.’

Key takeaways

- Sellers are accepting an average discount of £18,000 in November 2023

- In London and the South East, that rises to £25,000

- Buyers are now in a strong negotiation position, particularly in southern England

London events in December

Your guide to the best activities, events and fun stuff happening in London throughout December 2023

Can you hear those sleigh bells jingling? Yes, it’s December, and Christmas in London has begun in earnest. See the city skies sparkling with glimmering Christmas lights, fill your ears with Christmas songs, scoff down an indulgent Christmas sandwich, get luxurious festive treats from London restaurants and liven up a winter walk with a trip to a heated pub garden.

Read our guide for the lowdown on the events, parties, cultural happenings, and things to do taking place in London in December 2023.

1. Wander around Southbank Centre Winter Market

2. Childhood fave ‘The Witches’ hits the stage

It’s been years since the National Theatre produced a truly great new musical, but this certainly looks promising. Top Brit playwright Lucy Kirkwood and cult US composer Dave Malloy have joined forces to tackle Roald Dahl’s classic kids’ novel about a young boy and his grandma who uncover a terrifying conspiracy of witches at a seaside hotel. Lyndsey Turner directs her first ever musical, with a cast headed by Katherin Kingsley as the Grand High Witch and Daniel Rigby as Mr Stringer.

3. Hit up Hyde Park Winter Wonderland

The Grinch would have a real job stealing all the Christmas from Hyde Park’s huge tribute to festive fun. The annual favourite is back for its sixteenth year in 2023. Head along for cheerily lit fairground rides, a child-friendly Santa Land (including Santa’s grotto) and quaint Christmas markets. It’s a real treat for anyone wanting to get into the festive spirit – as long as you’re ready to hear all those songs as you potter around.

3. Try your luck getting tickets to Christmas at Kew

The mother of all light trails, Christmas at Kew has become a key date in London’s festive calendar as the 300-acre botanic garden is lit up with glistening lights and illuminations. This year’s route will take you past glass houses emblazoned with kaleidoscopic projections, through shimmering tunnels of light and trees drenched in jewel-bright colours. As usual, there’ll also be warming winter snacks and a grotto where you can say hello to Father C himself. Be warned, Christmas at Kew tends to sell out quickly, so look sharp to secure your place.

3. Eat up at the Maltby Street Christmas Night Market

Maltby Street Market’s Festive Fridays are back. Guzzle Christmas dishes from around the globe as the iconic food market’s finest traders set up their stalls after dark beneath Bermondsey’s fairy-light-festooned Victorian railway arches. There’ll be carolling, hot mulled wine, mince pies, wreath-making and responsibly sourced Christmas trees to buy. You’ll feel like you’ve wandered into a cosmopolitan Dickens’ ‘A Christmas Carol’.

4. Try your hand at Christmas curling

The sport of curling – the one you watch on telly during the Winter Olympics and find curiously engaging – has arrived in King’s Cross, with a pop-up outdoor arena set among the restaurants and bars of Coal Drops Yard. Curl the night away on one of six synthetic curling lanes in groups of up to six, and then once you’ve finished your 45-minute session, warm up with a toasty cocktail at the Curling Club bar. This year it's back with a '90s twist, so the fun and games will be soundtracked by a programme of DJs curated thanks to Voices Radio.

5. Hitch up on a cheery winter horse carriage ride

Live out all your dark Dickensian dreams on a winter outing that sleighs the competition. Explore Richmond Park or Bushy Park on a traditional carriage ride drawn by a pair of majestic Shire horses from the last working herd in London. Snuggle up in a blanket and clip-clop your way around the park while sipping on sloe gin, eating mince pies and learning about your surroundings from guides and carriage riders that look straight out of ‘Great Expectations’, dressed in smock coats and bowler hats. The private rides in Richmond Park aren’t cheap, but all the money raised supports the equine therapy services of Operation Centaur, who manage the horses. If you want a more wallet-friendly option, book one of the group rides in Bushy Park.

6. Dine at a cosy winter terrace

It is cold, so cold. Head to the nearest cosy outdoor space in London immediately. Luckily, some of our favourite bars and restaurants have been thinking on their frozen feet. So wrap up warm and check out these new outdoor terraces for drinking and dining decked out in wintry decor and adorned with roaring fire pits, patio heaters and enough faux fur to make you think you got stuck in the wardrobe on your way into Narnia.

7. Skaters gonna skate

Ice skating season is back baby, and we can’t wait to whizz around one of London’s many excellent slabs of ice. Winter Wonderland’s rink is the biggest, Canary Wharf’s is open for the longest period (18 sweet weeks!) and Somerset House’s is the most fabulous. Take your pick, lace up your boots and get swishing.

8. Grab last minute presents at London’s best Christmas markets

Markets, eh? They’re pretty nice to wander around at nearly every time of year. But, at Christmas? Well, that’s when London’s markets really come into their own. Every year the capital fills with the kind of markets that host fairy-light-lined stalls, festive street-food sellers and community tombolas, with a playlist of Christmas songs on loop in the background. In fact, whether you’re looking for tasty treats, traditional decorations and cutting-edge arts and crafts or are just shopping for a last-minute present, the capital’s selection of Yuletide stalls are here to help.

9. Don’t miss out on any NYE events

New Year’s Eve in London means you’re faced with some choices. Sometimes there’s so much choice, in fact, that you end up spending the night indoors with a few loved ones and plenty of booze. We’ve all been there, but London boasts loads of great New Year’s Eve events that should coax even the most reluctant NYE fan out of the house this year.

Autumn Statement 2023: what it means for the housing market

95% mortgage guarantee scheme extended, 40,000 new homes to be built and Local Housing Allowance unfrozen to help renters on the lowest incomes.

There were no huge surprises for the housing market in today’s Autumn Statement.

Rumours of a stamp duty cut to kickstart the market did not come to fruition. But buried in the detail was news that the existing mortgage guarantee scheme would be extended.

The scheme was first introduced in 2021, with the aim of encouraging lenders to offer 95% loan-to-value (LTV) mortgages for buyers with a 5% deposit.

Mortgages issued under the scheme are backed by the Government, meaning if the buyer defaults, the Government will step in to cover some of the shortfall.

The scheme was due to end in December, but will now run until the end of June 2025, in a bid to continue to help prospective borrowers with smaller deposits buy a home.

Our expert's view

Richard Donnell, Executive Director comments: 'First-time buyers continue to be a key engine for the housing market - however they have to rely on the Bank of Mum and Dad.

'Although first-time buyers get a lot of support through stamp duty relief, the big hurdles remain having the income needed to afford a mortgage alongside raising a deposit.

'Extending the mortgage guarantee will help some buyers struggling to borrow for their first property.'

In the last two years since the scheme started in April 2021, it has been used to help 37,800 households, 86% of whom are first-time buyers.

This equates to around 5% of first-time buyers using a mortgage to buy a home between April 2021 and May 2023.

However, in comparison, the Help to Buy equity loan scheme was more generous - helping 387,200 buyers since it started a decade ago, 85% of which were first-time buyers. This scheme helped around 1 in 10 first-time buyers using a mortgage.

'With this in mind, the key to the extension of the Mortgage Guarantee Scheme will be improving its affordability and appeal,' said Donnell.

National living wage increased and National Insurance cut

The Chancellor also focused on boosting incomes for households, which in turn, could help to improve housing affordability.

An increase in the National Living Wage was unveiled, alongside a cut in National Insurance for both employees and self-employed individuals, helping to put more money back into the nation’s pockets.

This news will be welcomed by many as household budgets continue to be squeezed thanks to the ongoing cost-of-living crisis.

This, alongside high mortgage rates, have added further pressure for first-time buyers and home movers, causing property transaction levels and house prices to slump.

Inflation set to hit 2% target in 2025

Improving affordability is one way to help combat this, but with the Bank of England projecting inflation to fall to its target in the first half of 2025, mortgage rates could also fall faster than expected in 2024. If this happens, we could also start to see a rise in house sales.

'The most important focus for the Government should be deploying policies that help support the reduction in borrowing costs for all buyer groups,' says Donnell.

'This needs to be supported by boosting housing supply through new house building and more support for affordable housing schemes to help those on all incomes.'

£110m to boost new homes supply

On house building planning applications, the Chancellor promised to invest more than £110 million this year and next to build 40,000 new homes and boost supply.

He also promised to invest £32 million to 'bust the planning backlog' and develop new housing in cities such as Cambridge, London and Leeds.

An additional £450 million will be allocated to the Local Authority Housing Fund to build around 2,400 new homes.

The Chancellor also announced plans to consult on a new permitted development right, enabling any home to be converted into two flats, so long as the exterior remains unaffected.

Local Housing Allowance rate unfrozen for lowest income renters

Finally, in rental news, the Local Housing Allowance rate, which affects how much help you get when renting from a private landlord, will be increased, having been frozen since 2020.

The increase should help families struggling to afford rising rents and will give 1.6 million households an average of £800 of support next year.

Key takeaways

- Mortgage Guarantee Scheme extended until end of June 2025

- £110 million to be invested in new home developments this year and next to build 40,000 new properties

- Freeze on Local Housing Allowance Funds removed, giving 1.6 million households an average of £800 of support for their rental costs next year

What does Jeremy Hunt’s Autumn Statement 2023 mean for household budgets?

Living wage and pensions rise as National Insurance comes down. What does Jeremy Hunt’s Autumn Statement mean for household budgets?

Chancellor Jeremy Hunt unveiled his Autumn Statement this afternoon, announcing a rise in the living wage and pensions.

National Insurance will be cut from January and inflation is on track to reach 2% by the end of 2025.

Here’s what happened:

Wages

The national living wage will rise from £10.42 an hour to £11.44 an hour, working out as an average increase of £1800 a year for a full-time worker.

Pensions

The state pension is set to rise 8.5% or £900 a year.

The chancellor also announced plans for employees to ask a new employer to pay contributions into existing pension pot, if they so choose, rather than being asked to adopt a company’s specific pension scheme.

National insurance contributions

National Insurance will be cut from 12% to 10% from January 6th, saving a worker earning £35,000 a year £450.

Nurses will save an average of £520 a year, police officers £630 a year.

National Insurance relief will also continue to be provided for businesses supporting veterans until April 2025.

Self employed

In recognition of the plumbers, delivery drivers and farmers who kept the country running throughout the pandemic, self-employed taxes will be simplified and reformed.

Class 2 National Insurance contributions, which are a flat rate of £3.45 a week for those earning up to £12,500 a year, will be abolished, saving the self-employed £192 a year.

Class 4 NI contributions of up to 9% for those earning between £12,300 and £50,270 a year will be cut to 8% from April, saving two million people an average of £350 a year.

Inflation

Following the worst global inflation shock for a generation, inflation fell last week to 4.6%

The government anticipates it will fall to 2.8% by the end of 2024 and to 2% by the end of 2025.

The Chancellor thanked the Bank of England for its role in helping to bring it down and pledged to support families in financial difficulty.

Universal credit increased and housing benefit freeze ended

‘Cost of living pressures remain at their most acute for the poorest families,’ said Hunt.

Universal credit is now set to rise 6.7% in line with September’s inflation rate, the equivalent of £470 for 5.5 million households next year.

And because the cost of rent can take up to half of the living costs for those that rent on the lowest incomes, the Local Housing Allowance will also no longer be frozen, as it has been since 2020.

Housing benefit will now cover the bottom 30% of local rents from April 2024, providing an extra £800 of support for 1.6m households.

Welfare reforms

The Chancellor announced a ‘Back to work’ plan for the 100,000 new people who claim benefits every year because of sickness or disability, ‘where treatment, rather than time-off becomes the default’.

If a Universal Credit claimant in England and Wales has failed to find a job after 6 months, they will be referred to an expanded and improved Restart scheme, providing 12 months of intensive, tailored support including coaching, CV and interview skills, plus training sessions.

Claimants who are still unemployed after 12 months on Restart will be required to accept a time-limited mandatory work placement.

If a claimant refuses to accept without good reason, their Universal Credit claim will be closed. This model will be rolled out gradually from 2024.

Cigarettes & booze

Aside from the government’s plans for a smoke-free generation (prohibiting the sale of tobacco products to anyone born after January 1, 2009), from today, duty rates on all tobacco products will increase in line with inflation +2% .

For hand-rolling tobacco, an extra 10% tax increase will be added, meaning it will increase in line with inflation + 12% this year.

Confirming the Brexit pubs guarantee, the chancellor confirmed that all duty on alcohol will be frozen until 1st August 2024, meaning there will be no increase on beer, cider, wine or spirits.

Clean energy

The UK is currently a world leader in the deployment of offshore wind - and plans to create new offshore wind farms are underway, including floating wind farms in the Celtic Sea.

A further £2 billion is being set aside for a target of zero emissions in the automotive sector.

Overall growth

Last autumn, the Office for Budgetary Responsibility forecast that the economy would shrink 1.4%.

But it has grown and is now 1.8% larger than it was pre-pandemic, meaning the UK economy has grown faster than those of Spain, Portugal, France, Italy, the Netherlands, Germany and Japan.

It’s predicted to grow 0.6% this year and 0.7% next year.

Key takeaways

- National living wage rises from £10.42 to £11.44 an hour

- Pensions up 8.5% or £900 a year

- National Insurance cut from 12% to 10% from January 6, 2024, meaning a worker earning £35,000 a year will be £450 better off

5 surprising reasons for the 3-bed home shortage

Feel like three bedroom homes are hard to get your hands on? It’s not just you. An imbalance of supply and demand is making three bedroom homes hot property, and here’s why.

Three bedroom homes for sale are hard to come by at the moment, and it’s because everyone wants one - from first-time buyers to retirees.

There’s an imbalance of supply and demand for three bedroom properties, making them among the quickest selling of any property type in the country.

But what’s causing it? What’s put three bedroom homes at the top of everyone’s list?

We’ve done some digging, and it turns out there’s a few reasons. Let’s take a look.

1. Older homeowners want to host Christmas

Our survey of 2,000 UK homeowners aged over 65 found that 41% live in a home which is ‘larger than they need’.

And a huge 9 in 10 homeowners aged 65+ have at least one spare bedroom. This equates to a massive 10 million spare bedrooms that growing families would love to get their hands on.

These homeowners have lived in their current home for more than a quarter of a century on average. So it’s easy to see why they might find it hard to move on.

22% say emotional ties are a barrier to moving, while more than a quarter (27%) say they’d be concerned about being able to host Christmas if they downsized.

But downsizing can often release capital, cut energy bills, reduce mortgage repayments or even make homeowners mortgage-free. Hosting might be off the cards, but that’s not to say Christmas is ruined.

2. First-time buyers are older than ever

The age Brits buy their first home has been rising, and first-time buyers are now aged 34 on average - compared to 30 a decade ago.

It means many first-time buyers are skipping the one-bedroom flat or two bedroom starter home in favour of a family home.

With first-time buyers making up 34% of buyers in the market, that’s a large proportion joining the hunt for family-sized properties.

Our data shows that 40% of first-time buyer enquiries are for three bedroom houses. That makes them an even bigger buyer group for this type of property than people moving house, who enquire about three bedroom properties 38% of the time.

| Type of buyer | Property | Percentage of enquiries |

|---|---|---|

| Mover | 3 bed house | 38% |

| Mover | 4+ bed house | 22% |

| First-time buyer | 3 bed house | 40% |

| First-time buyer | 4+ bed house | 9% |

Zoopla data, October 2023

3. The stress of moving house in old age

Those who own a home larger than they need reckon it takes them an additional 12.6 hours and £91 per month to maintain, compared to a more suitably-sized property.

But despite this extra work and cost, 25% of older homeowners are put off selling by the stress of moving house ‘at their age’.

No one can deny it’s a stressful process. If you’re in a dreaded chain, everything can feel as delicately balanced as a stack of cards.

What’s more, the housing market is slower than it was over the last three years. Higher mortgage rates make the market a little more uncertain, as people find it harder to be approved for finance.

Not to mention, costs are higher for everything from removals to repairs. This adds financial pressure to the process, no matter your age.

For many, it’ll be about weighing up if the time and money you’ll save in the long-run is worth the short-term stress of moving.

4. Terraces and semis with three bedrooms sell among the quickest of any property type

Speed of sale is an important indicator of buyer demand. The quicker a property type sells, the more buyers are interested in that sort of property.

Three bedroom terraced houses and three bedroom semi-detached houses are 2 of only 3 property types selling faster than the national average of 34 days.

They sell in 31 and 32 days respectively, with only two bedroom terraces selling quicker at 28 days.

However, if your budget can stretch to a three bedroom detached house, you’re likely to have more choice and less competition.

Three bedroom detached houses are taking 43 days to sell, the second longest behind only four bedroom detached houses (47). It’s a symptom of the higher average cost of detached houses - they require larger mortgages which means less demand at the moment.

5. Three bedroom terraces are in highest demand

The table shows the percentage share of buyer enquiries and supply of homes for sale of different property types.

The biggest gap between demand and supply is for three bedroom terraces. They make up almost 20% of enquiries in the market in October 2023, but only represent 12% of homes for sale.

Three bedroom semi-detached houses have the next highest imbalance between demand and supply.

Three bedroom detached houses, on the other hand, have a much lower level of demand. Detached homes are usually more expensive, so this is another reflection of higher mortgage rates limiting buyer demand for this type of property.

Key takeaways

- New research shows there aren’t enough three bedroom homes on the market to satisfy current demand

- They’re a popular choice for all types of buyers - from first-time buyers who are preparing for children to older generations who still want to host Christmas

- Most older homeowners live alone or with their partner, but still have 2 or more spare rooms

- There are an estimated 10 million spare rooms across the UK as 9 out of 10 homeowners aged 65+ have extra bedrooms they don’t use

Rents for new lets rise £1,300 in a year

Rents rise 10% for the 20th month in a row, but in London and the more expensive areas of southern England, the pace of inflation is starting to slow.

Demand for rental properties is currently running at 27% above the 5-year average.

Over the last year, the average rent for a new let increased by 10.1% to stand at £1,166 per month.

That means the average annual rental bill is nearly £1,300 higher than it was a year ago, standing at almost £14,000, compared to £12,700 last September.

This marks the 20th consecutive month of our index reporting rental inflation of over 10%.

However, for renters staying in their existing homes, year-on-year rises are much slower at 5.7%, according to the Index of Rental Prices from the Office for National Statistics.

The table below shows the rates at which rents have increased across different regions of the UK.

Average rent increases by region: November 2023

| Region | Avg rent today | Avg rent 12 months ago | Annual % change | Annual £ change |

|---|---|---|---|---|

| Scotland | £753 | £663 | 12.8% | £90 |

| North West | £799 | £719 | 11.7% | £80 |

| Wales | £817 | £737 | 10.4% | £80 |

| London | £2,057 | £1,867 | 10.3% | £190 |

| East Midlands | £819 | £739 | 10.1% | £80 |

| East | £1,115 | £1,015 | 9.9% | £100 |

| South East | £1,256 | £1,146 | 9.8% | £110 |

| West Midlands | £855 | £785 | 9.6% | £70 |

| North East | £651 | £601 | 9% | £50 |

| South West | £1,020 | £940 | 8.7% | £80 |

| Yorkshire & The Humber | £761 | £701 | 8.6% | £60 |

| Northern Ireland | £744 | £704 | 5% | £40 |

| UK | £1,166 | £1,056 | 10.1% | £110 |

Zoopla

Rental inflation in Scotland boosted by rent controls

Scotland is registering the highest level of rental inflation in the UK at 12.8%.

That’s because landlords are pushing to maximise rents for new tenancies in order to cover increased costs - and to allow for the fact that future rent increases will be limited over the life of the tenancy.

The average rent in Scotland stands at £753, which is £90 higher than a year ago.

Rental inflation in Scotland has now started to moderate down from highs of 13.7% back in February, but we expect it to continue rising at above-average levels.

Rents are growing at the fastest rate in the cities of Edinburgh (16.6%) and Glasgow (13.4%) .

But renters looking for new lets in areas between these two cities will also notice sharp increases: in Falkirk rents are up 14.7% year-on-year, while in North Lanarkshire they’ve risen 13.9%.

In the more sparsely populated areas north and west of Edinburgh and Glasgow, rental inflation is less dramatic, with North Ayrshire, Moray and the Highlands all registering rental growth below 5%.

Rental inflation slows down in England’s southern cities

Over the last 12 months, rental inflation has slowed down in southern England’s most expensive cities.

The largest moderation is happening in London, where rental inflation has decreased from 17% a year ago to 10.4% today.

The inner London boroughs were the first places to see rental inflation fall below 10%.

However, outer London areas such as Harrow, Barking and Dagenham and Redbridge continue to register rental growth above 13.5% - some of the highest increases in the UK.

The second and third largest slowdowns are recorded in Bristol and Brighton, where rental inflation fell to 8.8% and 6.0% respectively.

Rental inflation in the coastal communities of Hastings (6.7%), Newport (8.9%) and Blackpool (5.5%) is also more aligned with earnings growth (8.5%).

Those reductions show us that landlords are becoming more realistic in pricing their rentals, taking into consideration the cost-of-living struggles.

What are renters doing to minimise the impact of higher rents?

Faced with higher rents and a limited supply of homes on the market, renters are more commonly considering renting smaller homes, moving to cheaper areas or sharing properties with other renters to reduce costs.

Renters sharing does reduce the cost per person but it comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We expect rental inflation to remain above 9% for the rest of the year as earnings growth remains strong - and while higher mortgage rates are stopping many renters from moving into home ownership.

We currently anticipate national rental growth of 5-6% in 2024 - but rent increases in cities are likely to be higher.

Key takeaways

- Rents for new lets have risen by more than 10% for the 20th month in a row

- Scotland is seeing the biggest rises, where rent controls are encouraging landlords to secure higher rents upfront

- In more expensive areas, such as London and the south, rental inflation is starting to slow

What's going to happen to the UK housing market in 2024?

Our forecast reveals our housing market predictions for next year. So what will 2024 have in store?

Housing market mortgage rate predictions for 2024

Mortgage rates look set to remain higher for longer into 2024 and we’re not expecting them to fall back to 4.5% until H2 2024.

That means housing affordability will really only improve if people are able to earn more money and their incomes grow.

The ongoing rise in wages will be the main factor that supports sales volumes for the housing market in 2024.

What’s going to happen to house prices in 2024?

UK house prices are expected to fall 2% over 2024.

Homes are currently looking expensive by historic standards amid rising mortgage rates over the last 18 months.

If house prices fall further and incomes increase, or mortgage rates fall back, affordability will improve for home buyers and this in turn will support sales.

The number of homes for sale has now reached a 5-year high, meaning sellers will need to keep pricing competitively if they’re serious about selling. This will keep pricing under pressure.

In 2023, the south of England bore the brunt of house price falls but those falls are now spreading further afield.

Today, 4 in 5 housing markets are registering annual price falls, up from less than 1 in 20 just six months ago.

But crucially, the scale of price falls is modest and limited to very low single digits. No markets are currently registering annual price falls of more than 5%.

However in 2024, we expect to see an increase in markets registering 5% falls, as sellers continue to adjust their asking prices in the face of weaker buying power.

Despite this, the risk of a major collapse in prices is becoming less of a concern, and an improvement in sales hinges more on buyers’ financial ability to move when mortgage rates are in the 4-5% range.

And while the likelihood of a double-digit price drop remains low, housing affordability needs to improve to bring more buyers back into the market and to support sales volumes.

How can housing affordability improve?

Right now, house prices haven’t fallen as much as expected, while mortgage rates remain at 5% or higher, so housing still looks expensive by recent standards.

Faster growth in household incomes over 2024 would improve buyers’ affordability, along with mortgage rates falling over 2024.

Household finances have also been under pressure from rising living costs, with inflation eroding any growth in incomes.

Fortunately, this is now reversing at last and the Bank of England currently projects that inflation will fall to its target of 2% in the first half of 2025.

This, along with a real income growth, will be important in supporting buyer demand.

Housing market could rebound if affordability improves

Our Executive Director of Research, Richard Donnell, says there is scope for a rebound in market activity if affordability improves.

‘The housing market is adjusting to higher borrowing costs through lower sales rather than a big decline in house prices.

‘Asset prices around the world are also adjusting to higher borrowing costs and there is a lively debate in financial circles about the long-run outlook for borrowing costs, which sets the outlook for mortgage rates.

‘Most agree we aren't returning to the years of very cheap borrowing as central banks sunset policies that created cheap money to support economies after the global financial crisis and over the pandemic.

‘Mortgage rates of 4-5% remain low by historic standards, albeit higher than in recent years.

‘Assuming mortgage rates remain in the 4-5% range, we see UK house price growth remaining in the low single digits for the next 1-2 years, below the projections for growth in household incomes.’

This would mean that for the first time in ten years, house prices would start to become more affordable, increasing consumer confidence in making large purchase decisions.

Why haven't house prices fallen more?

There are three reasons why house prices haven’t tumbled, defying predictions for larger falls in 2023:

1: The economy is growing, albeit slowly, while unemployment remains low and incomes are increasing.

2: Lenders are supporting customers to refinance through longer term mortgages, interest-only mortgages and mortgage holidays, limiting the number of forced sellers.

3: Tougher affordability criteria from lenders has meant that while new mortgaged buyers may have been paying just 2% for their mortgages, they’ve still had to prove to their bank they could afford a 7% rate.

That has meant that mortgaged buyers could afford higher rates as they remortgaged.

However, banks are now stress testing new borrowers at 8-9% rates, even though they're actually paying 5%, which is compounding the reduction in buying power and hitting sales.

Homes are currently over-valued and prices likely to fall further

The chart below plots our measure for how much house prices are over- and under-valued over time.

It shows periods of over-valuation in the late 1980s and again in the runup to the global financial crisis in 2007, after which house prices fell over the subsequent recessions.

Will more buyers return to market in 2024?

We expect to see the usual seasonal rebound in demand next spring as pent-up demand returns to the market.

However, the number of sales taking place is set to be lower than spring this year.

General Elections also tend to create a pause in activity, which is why we expect another year with 1m home moves in 2024.

It will be five years since the last general election on December 17 2024. If a general election isn’t called by then, parliament would automatically be dissolved and the election would take place 25 working days later: January 28, 2025.

If mortgage rates fall back to 4% more quickly, the number of sales set to take place would improve.

Buyers are currently hesitant to move amid the uncertainty over house price falls and higher mortgage rates.

This is particularly the case with upsizers looking to secure larger family homes.

Our recent consumer survey reveals parts of the population are still keen to move, but many are hoping and/or waiting for mortgage rates to get lower again before they do.

Cash buyers set to be the biggest buying group in 2024

The biggest group of buyers in 2024 is set to be cash buyers, followed by first-time buyers, as rents continue to rise.

Upsizers are being hit hard by higher mortgage rates, as the larger properties they’re looking to secure require bigger mortgages.

But if they can be encouraged to be more flexible about what they want to buy and where in 2024, this would support overall sales volumes.

Key takeaways

- House prices expected to fall 2% over 2024

- Rising incomes expected to steadily improve housing affordability

- Mortgage rates expected to fall back to 4.5% by the end of 2024

The top locations where you can avoid paying stamp duty

If you're a home mover looking to save money, buying a property under the stamp duty threshold could save you thousands. Here's where to find the most homes under £250,000.

Stamp duty land tax - or SDLT - is the tax you pay when you buy property or land over a certain price in England and Northern Ireland.

Scotland and Wales also have an equivalent tax but different rates apply.

In England and Northern Ireland, no tax is paid if a property is priced below £250,000 and you are an existing homeowner.

Different thresholds apply for first-time buyers, who can buy a property up to £425,000 without paying the tax.

Those buying a home that won’t be their primary residence will pay an additional 3% surcharge on the entire price of the property.

And buyers from overseas will pay an additional 2% surcharge.

Why is it important to know about stamp duty before buying?

A stamp duty bill can be a small or run into tens of thousands of pounds for high value properties. And where you are looking to buy can also affect the amount you pay.

Here's what an existing homeowner would pay in stamp duty for the average-priced UK home (£265,000) cross the UK.

Stamp duty paid on a £265,000 property in the UK

-

£745 in England and Northern Ireland

-

£2,850 in Scotland

-

And £3,200 in Wales

Right now, nearly 1 in 3 (31%) properties listed on Zoopla are priced below the local stamp duty threshold for homeowners. This translates to over 140,000 homes that are available to buy without incurring a tax bill.

Where can homeowners find a home without paying stamp duty?

The percentage of homes under the stamp duty threshold across the UK

| Region/Country | Avg house price | Proportion of homes below stamp duty threshold | No. of homes on Zoopla below threshold |

|---|---|---|---|

| North East | £139,700 | 76% | 9,500 |

| Yorkshire & The Humber | £185,400 | 57% | 17,200 |

| North West | £193,500 | 57% | 23,100 |

| West Midlands | £228,700 | 46% | 15,100 |

| East Midlands | £229,000 | 45% | 14,600 |

| Wales | £204,200 | 43% | 9,300 |

| Scotland | £160,300 | 35% | 6,500 |

| South West | £316,100 | 29% | 13,000 |

| East of England | £340,200 | 23% | 11,800 |

| South East | £388,900 | 20% | 16,700 |

| London | £540,800 | 5% | 4,000 |

| UK | £264,900 | 31% | 140,800 |

Zoopla

Our historical analysis shows that 60% of all stamp duty receipts are paid in the South East and London.

This is down to homes in the south being priced at a higher level than those elsewhere in the country, so finding a home below the tax threshold will be harder here.

Only 1 in 6 homes listed for sale on Zoopla in southern England is priced below the stamp duty threshold of £250,000.

In the Midlands, close to a half of homes listed for sale would be under the threshold.

Meanwhile, in the North of England, where homes are among the most affordable in the UK, we find that 3 in 5 homes could be bought without paying the tax.

This increases to three-quarters in the North East specifically, where the average house price is below £140,000.

In Scotland and Wales, where the stamp duty tax is different to that in England, we find 35% and 43% of homes don’t qualify for tax if bought by an existing homeowner.

This is because the threshold for exemption is lower.

In Scotland the Land and Buildings Transaction Tax threshold kicks in at £175,000.

In Wales, the Land Transaction Tax begins at £225,000.

In contrast to most of England, both of these thresholds are below the average house price for each of the respective regions.

Regional towns have the highest number of homes under the SDLT threshold

The availability of homes exempt from stamp duty varies and is closely linked to the house prices in a given area. This creates differences in the availability of tax-exempt homes within regions too.

We find the largest spread of property values in Yorkshire and the Humber: currently only 21% of homes on the market in York are under the £250,000 threshold - yet 89% of homes up for sale in Hull are priced below £250,000.

We register a similar spread in Wales, where 13% of homes for sale in Monmouthshire sit below the £225,000 LTT threshold, while 78% of homes on the market in Blaenau Gwent are priced below £225,000.

Across the UK as a whole, the largest proportion of homes exempt from stamp duty can be found in the regional towns of northern England.

When it comes to local authorities, Hull has the largest proportion of stamp duty-exempt homes on the market for existing homeowners, with 89% of properties currently priced below the £250,000 threshold.

Hull is closely followed by Blackpool, Middlesbrough and Hartlepool, where 87% of homes would not be subject to any stamp duty land tax.

All of these areas are either the cheapest - or among the cheapest - areas to buy within their respective regions, with average house prices below £125,000.

Looking beyond northern England, where average house prices exceed £200,000, homes that would avoid a stamp duty bill are less common, but not impossible to find.

Nearly 4 in 5 properties are exempt from stamp duty in Stoke-on-Trent, which is the highest proportion anywhere in the Midlands.

Plymouth is the winner in the South, with just over half of homes on the market below the homeowners’ stamp duty threshold.

Where to find homes exempt from stamp duty across the UK

| Region | LA with highest proportion of homes under SDLT threshold | % of homes for sale | Avg house price |

|---|---|---|---|

| Yorkshire & The Humber | Hull | 89% | £113,200 |

| North West | Blackpool | 87% | £122,800 |

| North East | Middlesborough | 87% | £114,100 |

| Wales | Blaenau Gwent | 79% | £127,800 |

| West Midlands | Stoke-on-Trent | 78% | £132,600 |

| East Midlands | Boston | 67% | £178,200 |

| Scotland | West Dunbartonshire | 59% | £109,100 |

| South West | Plymouth | 53% | £201,200 |

| East of England | Norwich | 50% | £228,500 |

| South East | Southampton | 46% | £223,100 |

| London | Barking & Dagenham | 22% | £334,100 |

Zoopla

The areas where it's harder to avoid stamp duty

Most stamp duty payments come from the south of the UK.

With the highest house prices anywhere in the country, it comes as no surprise that London has the fewest homes that could be bought without incurring a stamp duty bill.

Only 1 in 20 homes listed for sale in the capital would qualify for an exemption and in October this year, only 4,000 homes in the capital were marketed below the £250,000 threshold.

Half of them were concentrated in 8 boroughs on the edges of London: Croydon, Hillingdon, Sutton, Barking & Dagenham, Havering, Hounslow, Bromley and Bexley.

Outside of the capital, Edinburgh has the second lowest concentration of homes below the land and buildings transaction tax threshold of £175,000.

Only 1 in 20 homes listed for sale in the Scottish capital is exempt from the tax.

Other high-value areas in the South East and East of England also have a very limited number of homes priced below the homeowner’s stamp duty threshold.

Only 1 in 17 homes in Elmbridge and St Albans and 1 in 14 homes marketed in Hertsmere would be exempt from stamp duty land tax.

How can I find a home that won’t cost me any stamp duty?

Now that you know which areas won’t cost you a stamp duty bill, it’s time to check them out on Zoopla to see if they have the home you’re looking for.

Our price filters will help you find a home that both fits your budget and falls below the stamp duty tax threshold.

You can also use Stamp Duty calculator to find out more about stamp duty, the different rates charged and how it may impact your next home purchase.

Key takeaways

- Most of them can be found in the north east, Yorkshire and the Humber and the north west. In fact in the north as a whole, 3 in 5 make the cut

- In southern England, only 1 in 6 homes for sale is priced below the £250,000 threshold

- London and Edinburgh are where homeowners are least likely to find a home exempt from the tax

How UK homeowners are coping with higher mortgage rates

Marathon mortgages, cutting pensions and raiding savings: how homeowners are coping as mortgage rates hover at their highest levels for 15 years.

Although mortgage rates have started to come down after continuously increasing since the start of 2022, mortgage costs are still sky high.

The average two-year fixed rate now stands at an eye-watering 6.47% while five-year fixes are at 5.97%, according to data from Moneyfacts.

This means that anyone remortgaging after their fixed rate has ended will get a shock as their monthly mortgage payments shoot up.

And first-time buyers are having to budget for higher mortgage costs than they might have originally expected.

To keep the costs at manageable levels, borrowers are doing what they can.

Research from KPMG’s latest Consumer Pulse survey found that:

-

18% of mortgage holders have used their savings to reduce their outstanding mortgage balance

-

16% have switched to an interest-only mortgage

-

12% have increased their mortgage term

-

And 8% have downsized to a cheaper home.

A worrying figure is that another 11% have said they are paying less into their pensions to cope with higher mortgage costs, while a further 20% are considering doing this, which means they could have less money to live on in retirement.

‘The cost of living and rising interest rates has made life all the more difficult for aspiring buyers and existing homeowners alike,’ says David Hollingworth from mortgage broker London & Country Mortgages.

‘The rapid increase in mortgage rates from the historic lows of only a couple of years ago means that borrowers are facing much higher mortgage costs. Affordability is therefore under fire.’

Marathon mortgages

The number of homeowners choosing to take out ‘marathon mortgages’ with repayment terms of 35 years or more – way beyond the standard term of 25 years – to make their monthly payments more affordable has surged.

Data from credit reference agency Experian shows that a quarter of homeowners under 30 have a mortgage with a term of 35 years or more compared to just one in 10 in 2020.

This means they could still be paying back their mortgage when they’re close to retirement.

Emily Summersgill took out a marathon mortgage from Nationwide through London & Country when she bought her first home.

‘As a first-time buyer I wanted to make sure I had absolute certainty that I could pay both my mortgage and all the new bills that came along with being a homeowner,’ she says.

‘Although I knew my monthly outgoings and that I could afford those, I wanted to be sure I always had enough surplus income to pay for the unexpected – like broken down boilers and leaking pipes. I set my mortgage term at 40 years – the maximum possible and within my retirement age.’

While choosing a lengthy mortgage term may be the only way some people can afford to borrow the amount they need, there are downsides to be aware of, warns Hollingworth.

He says: ‘There is a price to pay as the interest payable over the life of the loan will increase substantially. Shifting to a longer term could add tens of thousands of pounds in interest.

‘For example, a £200,000 25-year mortgage at a rate of 5% would cost £1,169 a month and total interest would amount to £150,754.

'Over 35 years the payment would drop to £1,009 but the total interest would be £223,940.’

Fortunately for Summersgill, while she took out the 40-year term to be sure she would always be able to afford her mortgage, she has been able to overpay to keep the overall interest costs down.

‘After completion I changed my direct debit so that I was overpaying each month as if I had taken out a 25-year mortgage,’ she adds. ‘That left me able to drop down to my minimum 40-year payment as and when unexpected costs arose but, for the most part, I’ve actively overpaid to get the balance down quicker.’

Other ways to reduce mortgage costs

Many of the ways borrowers have been making their mortgage more manageable have downsides.

Switching to an interest-only mortgage, for example, will also increase your overall interest costs.

While you're paying the interest, the amount of mortgage debt won’t shrink and you’ll still need to somehow pay off the loan at the end of the mortgage term.

There are other things you can do that have fewer negatives, though. ‘Arguably, the first place to start in managing payments is to consider whether you could be getting a better deal,’ says Hollingworth.

‘As you approach the end of a current deal, it’s a good idea to get ahead and have an option in place to avoid slipping onto a lender’s standard variable rate, which can be well in excess of 8% and even above 9%. It’s possible to secure a deal up to six months in advance.’

If you can afford it and your mortgage deal allows, you could also overpay if you’re currently still on a relatively low fixed rate, so that your mortgage balance is as low as possible by the time you have to remortgage at a higher rate.

This will help you to get used to spending more on your mortgage payments each month too.

Key takeaways

- With mortgage rates still high, borrowers are doing what they can to be able to afford their mortgage

- Options they’re choosing include extending their mortgage term and switching to interest only

- A quarter of young homeowners now have mortgage terms of 35 years or more

- Many of these options have downsides but there are other things you can do to put yourself in a better position

7 ways to help on World Homeless Day

We’re standing with Crisis’ Make History campaign, which calls for a future free from homelessness. Here’s how you can help this World Homeless Day.

Homelessness is rising. Soaring bills, rising rents and a lack of affordable housing are making it harder for us all to have a safe, secure and affordable home.

But it doesn’t have to be this way. We’re standing with Crisis’ Make History campaign, which calls for a national mission to end homelessness.

We need the UK government and all political parties to commit to ending all forms of homelessness.

Join the Make History campaign: add your name to help build a future free from homelessness.

While we’re calling for major change, there are ways we can all help in our communities.

Here are some key ways to help, what to do if someone you know is at risk, and what to do if you see someone sleeping rough.

How to help with homelessness in the UK

1. Donate

We’re all feeling the squeeze, but even a small donation has a big impact on the fight against homelessness.

A few spare quid each month can help fund essential services and train specialist coaches who work closely with people experiencing homelessness.

Your money can help them learn how to manage housing, benefits, wellbeing and work, and set them on a path out of homelessness.

You can donate to Crisis or other homelessness charities.

2. Fundraise

Fundraising is a fun and effective way to join the mission to end homelessness.

There’s a whole world of ways to do it, whether you rally your colleagues at work, fundraise for a race or hold an event.

Or go your own way and get creative. You can fundraise any way you like, from organising a bake-off to hosting a film night.

Charities rely on fundraising to raise most of their income, so you’ll make a difference no matter how much you raise.

3. Volunteer

There’s a local volunteering opportunity for everyone who wants to help fight homelessness.

You could organise donations, look after a shop floor, or give direct coaching in education, employment, housing or health.

After a short application process, you’ll take core training modules on topics like safeguarding, equality and diversity, and data protection.

Volunteering is a great way to build your skills and get stuck in for a fantastic cause.

How to help if someone you know is at risk of homelessness

4. Call Shelter

Shelter is the first port of call if you or someone you know is at risk of homelessness.

It offers a range of support, including one-to-one advice, online chat and lots of resources that could help.

Visit Shelter England or Shelter Scotland, or call its free helpline on 0808 800 4444.

5. Get in touch with other support services

People lose their homes for lots of different reasons. Rising pressure from high rents and low pay, or sudden life events like losing a job or family breakdown, can quickly force people into homelessness.

Whatever someone’s going through, there are some free services that can help – including:

How to help if you see someone sleeping rough

6. Contact StreetLink or Simon Community

Let a specialist charity know if you see someone forced to sleep rough on the street.

Contact Streetlink in England or Wales, or Simon Community in Scotland.

They’ll send someone out to find them, and will connect them with local services to keep them safe.

When you call, give the person’s location, as well as their estimated age, gender, appearance and any belongings they have with them. It can also help to mention if they look unwell or at risk of harm.

7. Stop for a chat

Rough sleeping is both dangerous and isolating, and it often leads to mental and physical health problems.

If you feel comfortable, stop for a chat or say hello to someone who is forced to beg or rough sleep. It might be the only contact they have that day.

Give money or food

When it comes to giving someone change or food, make the decision that feels right for you.

And always consider if it’s the best way to support them. It might be that sharing information or suggesting a service is a better option.

Some people buy gift vouchers from shops to give to people who are having to sleep rough.

If you want to buy them a cup of tea or something to eat, ask them what they’d like first to make sure it’s right for them.

Most importantly, don’t let stereotypes influence your judgement of an individual.

Share information

Giving information can be an excellent way to support someone who is experiencing homelessness.

But bear in mind that some people might find it hard to take in detailed information. Or they might be wary of support services because of past experiences, which can result in frustration or distress.

So before you go ahead, ask if they’d find information useful and make sure you’re both comfortable and safe.

If they’re happy to chat, you could recommend they approach their local authority’s housing team.

Councils have an obligation to advise and assist people who are homeless or about to become homeless. Find your local council.

Another option is calling or visiting their local Crisis Skylight centre, if there’s one nearby.

You can find more local homelessness services – and sometimes make a direct referral – on databases like:

Shelter has advice on getting into a hostel or night shelter in England and emergency accommodation in Scotland.

Or you can search for a night shelter on The Pavement.