What happened to the housing market in 2023?

In 2023 one million homes were sold, as mortgage rates soared to over 6% and house prices fell 1.2%. Let’s take a look at the year that was.

2023 was the year we saw five bank rate rises, with mortgage rates peaking at 6.44% for a two-year fixed rate, 75% loan-to-value deal.

In the first half of the year, house prices began to fall in southern regions of the UK, but held their own in the north, where homes remain more affordable.

But by the end of 2023, prices began falling across all price bands in all regions of the UK.

In total on average, house prices fell 1.2% over the course of the year.

Bank rate rises and mortgage rate hikes

The bank rate rose five times in 2023, in three increments of 0.25% in March, May and August, plus two 0.5% rises in January and June, taking it from 3.5% in January to 5.25% today.

The effect on mortgage rates was dramatic.

The average five-year fixed rate mortgage went from 5.05% in January to peak at 6.37% in early August. It now stands at 5.22%

The average two-year fixed rate mortgage went from 5.43% in January to peak at 6.44% in July. It now stands at 5.94%.

The average standard variable rate mortgage is now an eye-watering 8.74%, up from 6.61% at the start of the year.

The volatility of mortgage rates throughout the year meant that Google was inundated with search queries on the topic: with buyers and homeowners searching up mortgage related information every 23 seconds. That’s 3,757 times a day.

In terms of housing sales, the impact to buying power was felt across the market, as buyers found their budgets effectively reduced by 20% in the face of higher mortgage costs.

What happened to house prices in 2023?

House prices fell 1.2% on average across the UK during 2023. Depending on where you live, your home's value could be down 2.6% or up 1%.

The biggest annual falls have been seen in the East of England (-2.6%), the South East (-2.4%) and London (-2.0%).

And in terms of UK cities, Bournemouth (-2.6%), Southampton (-2.3%) and Cambridge (-2.3%) have been the worst hit.

Scotland (+1%) and Northern Ireland (Belfast house prices are up +2.3%) are the only UK regions where house prices are still rising in December 2023.

The average seller discount now stands at 5.5% or £18,000 off the asking price.

That said, property prices remain well above what they were before the pandemic, even in the places with the biggest house price falls.

That meant the detached homes that became so popular during the pandemic ‘race for space’ proved harder to sell in a more expensive financial market.

Meanwhile flats started to regain popularity, being more affordable for first-time buyers.

Homes sold in 2023

|

Terraced houses |

140,000 |

|

Semi-detached homes |

130,000 |

|

Apartments / flats |

120,000 |

|

Detached homes |

89,000 |

|

Maisonettes |

9,000 |

|

Town houses |

7,000 |

|

Cottages |

6,000 |

|

Land |

4,000 |

|

Studios |

2,500 |

|

Barn conversions |

1,000 |

|

Chalets |

1,000 |

|

Mews houses |

850 |

|

Parking spots |

600 |

|

Country houses |

500 |

|

Blocks of flats |

300 |

|

Farm houses |

223 |

|

Farms |

148 |

|

Houseboats |

57 |

How long did it take to sell a house in 2023?

At the start of 2023, it took 36 days to sell a home on average but by April, that figure reduced to just 29 days. Today, it takes 38 days to sell a home.

Why? At the beginning of the year, the housing market remained fairly buoyant as mortgage rates started to come back down from the highs experienced at the end of 2022.

As rates edged closer towards 4%,demand increased alongside the number of sales agreed.

And while the actual number of homes that went under offer was 16% down on the boom years of 2020-2022, sales numbers were 11% up on 2019.

However, as the year went on, inflation remained stubbornly high and mortgage rates started to creep back up over 5% - and this put the breaks on for some buyers.

What happened to the rental market in 2023?

2023 was a difficult year for renters, with rents for new lets consistently rising at 10% or more for at least 20 months in a row.

Scotland recorded the fastest growing rents at 12.7%, where rent controls pushed landlords to maximise their rents for new lets.

Despite this, demand for rental properties remained strong - holding at 51% above the 5-year average for most of the year.

A shortage of rental properties and lack of growth in supply helped to drive up prices.

Meanwhile, rising mortgage costs affected the rental market in two ways:

-

Landlords began exiting the sector as their rental properties proved less financially viable in terms of income

-

Potential first-time buyers remained in rented accommodation for longer, biding their time in the hope that mortgage rates would start to fall again.

Over the last decade, the average rent as a percentage of gross earnings has tracked in a narrow range between 25% and 28%, averaging around 27.2%.

However, double digit rental growth over the last 20 months now means rental affordability is at its worst level for over a decade at 28.4%.

Levels of home building and net new investment by private landlords are falling and set to remain weak into 2024, largely because of higher borrowing costs.

Key takeaways

- One million homes sold in 2023

- House prices fell 1.2% on average across the UK

- The Bank of England hiked the bank rate five times

- Mortgage rates peaked at 6.44% for a two-year fixed rate

- Standard Variable Rate mortgages hit 8.74%

House prices down, mortgage rates to follow

Sellers are offering their biggest discounts in five years, with one in four offering 10% off the asking price right now, putting buyers in a strong negotiating position.

Jeremy Hunt's Autumn Statement last week revealed that inflation has now fallen from a high of 11.1% to 4.6%.

The government anticipates it will fall to 2.8% by the end of 2024 and to 2% by the end of 2025.

‘Financial markets expect the Bank of England to start cutting rates around the summer of 2024,’ says our Director of Research, Richard Donnell.

‘If mortgage rates start to fall further, this will support an improvement in demand, but prices will remain under modest downward pressure.’

The news couldn’t be better for buyers right now, who have been held back by higher mortgage rates in 2023.

Sellers are currently offering the biggest discounts in five years, with one in four offering 10% off the asking price.

The average discount being offered is 5.5%, the equivalent of £18,000.

In London and the South East, that rises to 6.1%, or £25,000, off the asking price.

Across the rest of the UK, the reduction is smaller at 4.8%, or £11,000, but it’s still the highest level of discounting we’ve seen in recent years.

Much more choice of homes, including popular 3-bed properties

The supply of the UK’s most in demand property type: three and four bedroom houses, is increasing.

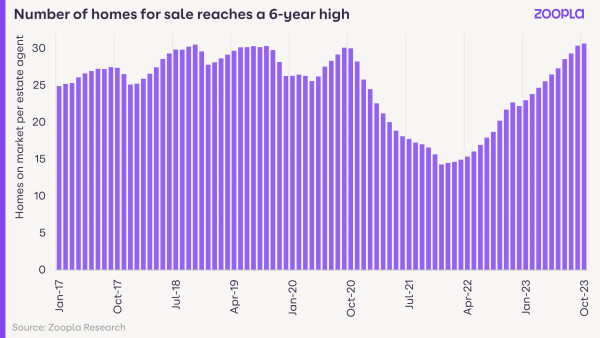

And we’re now seeing record numbers of properties for sale.

During the pandemic years a chronic scarcity of homes on the market pushed up prices.

But this position has now fully reversed, with the highest number of homes for sale per estate agent in six years.

‘The average estate agency branch has 31 homes for sale, compared to a low of just 14 in the middle of the pandemic boom,’ says Donnell.

‘This is boosting choice amongst would-be buyers and providing them with much greater negotiating power with sellers as they agree pricing.’

Buyers have room to negotiate on price

During the pandemic years, buyers had to pay the full asking price to secure a property, but not any more.

‘Over the course of 2023, sellers have been accepting ever larger discounts to the asking price to agree a sale,’ says Donnell.

In the first six months of 2023, those discounts averaged out at 3.4% off the asking price.

This month, the average discount recorded is 5.5%, or £18,000. That’s the largest level of discounting seen since 2018.

And buyers in southern England now have the greatest negotiating power of all. It’s where the biggest discounts are going on, with 6.1% reductions on average asking prices.

‘These discounts reflect the fact that sellers haven't been cutting asking prices very quickly,’ says Donnell. ‘As more sellers adjust asking prices lower, we expect these discounts will start to return to normal levels of 3-4%.’

There couldn’t be a better time to buy in London

London has seen slow price growth over the last seven years of just 8%, while for the rest of the UK, house prices have risen 28%.

Homes in the capital are now seen as better value for money, while a steady return to office working is supporting sales volumes and pricing levels here.

In fact, new sales have rebounded more in London than any other part of the UK over the last 2 months, leading to a slight firming in prices.

What’s going to happen to house prices in 2024?

As we edge towards Christmas, the number of homes for sale will start declining as some sellers take their properties off the market with a view to relaunching in the new year.

But it will remain a buyers’ market in 2024, with no rise in house prices anticipated any time soon.

‘The current repricing of homes has further to run in 2024,’ says Donnell.

‘While 5-year fixed mortgage rates have been falling below 5%, they need to fall further to bring more buyers back into the market.’

Key takeaways

- Sellers are accepting an average discount of £18,000 in November 2023

- In London and the South East, that rises to £25,000

- Buyers are now in a strong negotiation position, particularly in southern England