Is Your Childhood Town Still Affordable? A Look at UK House Price Shifts

Two decades of rising house prices may be pricing Brits out of the places they once called home.

Ever dreamt of moving back to your childhood hometown, perhaps to walk the same streets, pop into the corner shop that sold your favourite sweets, or raise a family where you grew up?

You’re not alone. Over half of Brits (52%), say they’d consider returning to the area they grew up in. But for many, that heart-warming vision clashes with a hard-hitting reality: they simply can’t afford it anymore.

Our latest research reveals that average UK house prices have jumped by 74% over the past two decades, rising from £113,900 in 2005 to £268,200 in 2025. For millions, this growth has transformed childhood stomping grounds into financially unreachable dreamlands.

The South price surge: dreams delayed

Some of the steepest climbs in property prices have occurred in London, the South East and the East of England, where returning home now often comes with a hefty price tag.

Londoners have witnessed a jaw-dropping 119% rise in average house prices since 2005, now sitting at an average of £534,400. Meanwhile, Elmbridge in Surrey takes the title for the largest average house price increase in the South East, up 110% to a wallet-wincing £712,700.

Over in the East of England, St Albans leads the charge with house prices more than doubling from £289,600 to £622,100. That’s a 110% increase, largely driven by the region’s commuter convenience and historical charm. Not quite the budget-friendly return home many may have imagined.

However, like the South East, there are more affordable pockets in the East of England.The popular coastal town Great Yarmouth has seen the lowest growth in average house price increases in the region over the last 20 years, up 77% from £105.900 to £187,700.

|

Region |

Avg house price in 2025 |

Avg house price in 2005 |

Percentage increase |

|---|---|---|---|

|

London |

£534,400 |

£244,200 |

119% |

|

South East |

£385,400 |

£206,100 |

87% |

|

East of England |

£337,500 |

£180,600 |

87% |

|

South West |

£312,000 |

£179,300 |

74% |

|

East Midlands |

£231,000 |

£136,100 |

70% |

North-South divide: nostalgia comes cheaper up north

But it’s not all doom and skyrocketing property ladders. Those born and raised in Northern regions may be pleasantly surprised to find affordability still within reach.

The North East has seen the smallest increase in house prices, just 39% over twenty years. In Sunderland, homes have only nudged up by 22%, from £101,600 to £124,000. In Blackpool, the rise is similarly modest, up just 26%, with homes costing £124.300, up from £98,400 in 2005, making it one of the most affordable seaside towns for returnees.

Affordability has improved in real terms in the North West and Yorkshire, too, with house price to earnings ratios falling: From 6 to 5.1 in the North West and 5.7 to 5 in Yorkshire - a rare bit of good news in the housing market saga.

|

Region |

Avg house price in 2025 |

Avg house price in 2005 |

Percentage increase |

|---|---|---|---|

|

Wales |

£206,500 |

£125,600 |

64% |

|

North West |

£200,800 |

£126,300 |

59% |

|

Yorkshire and the Humber |

£190,400 |

£121,200 |

57% |

|

North East |

£146,400 |

£115,800 |

26% |

|

Scotland |

£168,000 |

£103,100 |

63% |

A tale of two towns

To paint the picture clearly: if you’re heading home to Elmbridge, expect to fork out over £370,000 more than in 2005. But a move to Hull, where prices have risen a more modest 49%, might only cost you around £38,000 more than it would’ve twenty years ago.

The local authority with the lowest increase in house prices is Sunderland, where prices have crept up by just £22,400 over the past two decades.

Planning your next move

Daniel Copley, consumer expert at Zoopla, sums it up: "Our latest analysis brings to light the profound impact two decades of house price growth has had on the dream of 'returning home'. UK house prices have soared by 74% since 2005, making that nostalgic return financially unattainable for many, especially in hotspots in the South East and the East of England."

"However, the picture is far from uniform across the UK. Our data shows that while some areas have seen dramatic increases, house prices have risen slowly, in line with incomes in northern regions. This means that for some, the dream of returning to their roots might be much more attainable than they think.”

Key takeaways

- 52% of Brits say they would consider a move back to the area where they grew up

- But it may not be that easy - house price rises across the UK are pricing people out of their hometowns

- House prices across the UK have increased by an average of 74% over the last 20 years, from £113,900 to £268,200

- South East and Eastern England have registered a significant jump in house prices, increasing by 87% in both regions, with Elmbridge in Surrey seeing the biggest increase in house prices, up from £338,800 to £712,700

- Affordability has improved significantly in northern regions, particularly in the North East where average house prices have increased by 39%, the smallest increase across the UK over the last 20 years

- In Blackpool, average house prices have increased by just 26%, with homes costing £124.300, up from £98,400 in 2005

Everything You Need to Know About Gen H’s New Build Boost – A New Alternative to Help to Buy

What Is New Build Boost?

New Build Boost is a home financing scheme introduced by Gen H designed to help people purchase new-build properties with a lower deposit. It combines a standard mortgage with an interest-free equity loan to lower upfront costs and improve affordability.

Key Features:

-

Buy with just a 5% deposit

-

Get a 15% interest-free equity loan from Gen H

-

Take out an 80% LTV mortgage

-

The equity loan remains interest-free for the full mortgage term

-

You own 100% of the property

For the first five years, the equity loan is locked at its original value. After that, repayments adjust with the market value of the home but are capped at twice the original loan amount.

Who Can Apply?

The scheme is open to:

-

First-time buyers and existing homeowners

-

Buyers purchasing a new-build home from Persimmon or Charles Church

-

Those with a deposit of 5–15% (from savings or a gift)

📍 Not available in Scotland or Wales

How Does It Compare to Help to Buy?

While inspired by the Help to Buy model, New Build Boost introduces several differences:

| Feature | Help to Buy | New Build Boost |

|---|---|---|

| Buyer eligibility | First-time buyers only | Includes homeowners |

| Interest-free period | 5 years | Entire mortgage term |

| Loan-to-value | 75% mortgage + 20% loan + 5% deposit | 80% mortgage + 15% loan + 5% deposit |

| Equity loan value adjustment | Based on market value from year 6 | Fixed for 5 years, then adjusts (capped) |

| Application process | Separate mortgage and loan steps | Integrated application through Gen H |

In short, New Build Boost offers greater long-term predictability and simpler access, even for those who’ve owned before.

Why It Matters

With the end of Help to Buy, many buyers were left without viable support. Gen H’s New Build Boost could provide a lifeline for those struggling with deposits or affordability—especially in today’s challenging housing market.

Is It the Right Choice for You?

While schemes like this can open doors to homeownership, they aren’t for everyone. Monthly repayments may be higher than a standard mortgage, and if your new build is leasehold, you’ll need to budget for service charges or ground rent.

✅ Speak to a mortgage broker or financial advisor to evaluate whether this fits your budget and long-term goals.

Next Steps

If you’re interested in buying a new-build home and are worried about saving a large deposit, consider exploring New Build Boost.

📞 Talk to a mortgage adviser

🌐 Visit Gen H’s official site for more information

Key takeaways

- Bigger Borrowing Power: Gen H is offering the potential to borrow more, with borrowers being assessed against 80% Loan to Value (LTV) criteria. For some eligible borrowers, they might be able to borrow up to 5.5 times their income. And what's better, buyers will own the entire home from day one.

- Potentially Smaller Deposits: New Build Boost unlocks 80% LTV mortgages on new-build homes with just a 5% deposit. It aims to help first-time buyers, and those looking to buy a new build, get on the ladder with less savings required.

- Thinking Outside the Box: Gen H aren't your typical mortgage lender, and this new product seems to reflect that. They're talking about how they can be more flexible and "reimagine the new build buying journey."

Unmissable Events and Things To Do In London In June 2025

Summer has officially landed in London, and June is bursting with energy, creativity, and sunshine. Whether you're a culture vulture, festivalgoer, or just here for the vibes, this month is shaping up to be one for the books.

From headline-grabbing exhibitions to world-class theatre and unforgettable music festivals, there’s no shortage of standout events to fill your calendar. June kicks off with the much-anticipated debut of Lido Festival, boasting a killer lineup that includes Charli XCX, Massive Attack, and Jamie xx. Over at the National Theatre, the acclaimed production London Road returns to the stage. And if that wasn’t enough, the city welcomes the first-ever SXSW London, bringing cutting-edge music, tech, and film together in one exhilarating week.

But June in London isn’t just about big events — it’s about atmosphere. Parks are glowing in their summer best, pub gardens are buzzing, and rooftops and terraces become the place to be. Open-air theatre is back, alfresco dining is in full swing, and the scent of suncream and barbecue floats through the air. Over in south west London, crowds gather for another British summer tradition: Wimbledon — where strawberries, sunhats, and Centre Court drama await.

So whether you're here for the art, the entertainment, or simply the long, lazy evenings, London in June is not to be missed. Dive in — it’s going to be glorious.

1. Get stuck in at the inaugural SXSW London

⭐ Music ✨ Music festivals 📌 London ⏰ Until 7 Jun 2025

Known worldwide as the launchpad for tomorrow’s icons, Austin’s legendary SXSW festival has long been the place where stars are born — with past early sets from the likes of Billie Eilish, Dua Lipa, and Chappell Roan. Now, after a successful expansion to Sydney, the global phenomenon is heading to London for the very first time.

SXSW London will make its debut this June, transforming Shoreditch into a hub of creativity and discovery. Expect more than 70 live music performances across top venues including Shoreditch Town Hall and Village Underground, featuring emerging talent from all over the world.

But it’s not just about the music. The festival's influential conference series will also be making the trip, bringing over 400 talks and panels on innovation, tech, business, and cultural trends. And for film lovers, there's a packed programme of 250 screenings, with a strong showing of international premieres.

While the full line-up is still under wraps, anticipation is already building — and if past editions are anything to go by, this is one event you won’t want to miss.

2. Enter a Gender-Fluid Fantasy in A Midsummer Night’s Dream

Step into a dazzling, gender-fluid reimagining of Shakespeare’s most magical comedy as Nicholas Hytner’s wildly inventive A Midsummer Night’s Dream makes its triumphant return to the Bridge Theatre in 2025. This exuberant production bends tradition with flair, swapping roles and expectations in a riot of colour, chaos, and queer joy.

The starry cast includes JJ Feild in the dual roles of Oberon/Theseus, Susannah Fielding as a commanding Titania/Hippolyta, and Emmanuel Akwafo bringing fresh energy to Bottom. David Moorst reprises his celebrated turn as the mischievous Puck/Philostrate, adding to the enchantment of this bold and boundary-pushing take on the Bard.

Expect immersive staging, surreal visuals, and a party-like atmosphere that brings new life—and new love stories—to the forest of Athens.

3. Dance Through History at a Silent Disco in the London Transport Museum

All aboard for one of London’s most unique parties. For one night only, the London Transport Museum transforms into a neon-lit dance floor as the Iconic Silent Disco rolls into town. Don your headphones, choose your soundtrack—from ’80s throwbacks to indie bangers—and shimmy your way through vintage buses and historic carriages in Covent Garden's most unexpected party setting.

With drinks flowing, a strictly 18+ crowd, and two time slots to suit your night owl status (or early bird energy), this is one museum night out you’ll actually want to remember.

Tickets are £36 exclusively via Time Out Offers—grab yours before they’re gone.

4. Sing Your Heart Out at West End Live – For Free!

Calling all musical theatre lovers: West End Live is back, bringing the magic of London’s top shows to the great outdoors — and it won’t cost you a penny. For one glorious weekend, Trafalgar Square transforms into a giant open-air stage, as the casts of the West End’s biggest musicals step into the spotlight for a series of free performances.

Expect show-stopping numbers, surprise guest appearances, and the chance to belt out your favourites alongside thousands of fellow fans. With photo ops, merch stalls, and all the glittery theatre energy you could ask for, this is one of the most joyful (and budget-friendly) events of the summer.

No ticket, no problem — just show up and sing along.

5. Feast Your Way Through Regent’s Park at Taste of London

Get ready to indulge: Taste of London returns to Regent’s Park, turning the heart of the city into a paradise for food lovers. This open-air culinary festival gathers the crème de la crème of London’s dining scene, offering a chance to sample signature dishes from top restaurants—all in one glorious, sun-dappled spot.

Newcomers to this year’s lineup include Guy Ritchie’s gastropub Lore of the Land, the buzzworthy Akira Back (serving up inventive Japanese-Korean fusion), Pan-Pacific masters Los Mochis, and trendy Hackney wine bar Bambi. But the food is just the beginning. You’ll also find live cooking demos, chef talks, tastings, and more.

Come hungry, leave happy — and maybe bring some antacids just in case.

6. Explore the Wonders of Science at The Great Exhibition Road Festival

Step into the future—and the past—at The Great Exhibition Road Festival, a modern-day celebration inspired by the legendary 1851 Great Exhibition that once drew millions to Hyde Park. Returning for its second edition in 2025, this vibrant weekend transforms Exhibition Road in South Kensington into a pedestrian-only playground of innovation, creativity, and discovery.

Some of London’s most prestigious museums and institutions come together to host hands-on experiments, cutting-edge tech demos, live science shows, interactive art, and dynamic performances of music and dance. There’s something for all ages, whether you’re a curious kid or a grown-up science geek.

Best of all? It’s completely free—just bring your sense of wonder.

7. Discover Hidden Green Gems at London Square Open Gardens

Think you’ve seen all of London? Think again. The London Square Open Gardens Weekend offers a rare opportunity to peek behind the city’s private gates and explore over 100 secret green spaces usually off-limits to the public.

For two days only, the capital's most exclusive gardens — from historic Georgian squares to tucked-away rooftop terraces, community allotments, and urban wildlife havens — open their doors. It’s a celebration of the city’s lush, often overlooked corners, spanning grand old estates to contemporary eco-spaces.

Whether you're a garden enthusiast, an architecture buff, or just curious to see what’s hidden behind London’s locked gates, this is your chance to explore a more tranquil, leafy side of the city.

8. Soak Up Summer Vibes at the Kew Midsummer Fete

Looking for a feel-good way to spend a sunny Saturday? Head to the Kew Midsummer Fete, where village green charm meets full-on summer celebration. With over 100 stalls, a traditional Victorian fairground, a lively dog show, and classic competitions like tug of war, it’s the kind of wholesome fun that never goes out of style.

Grab a pint at the Fuller’s beer tent, browse handmade crafts, groove to live music from local bands, and try your luck in the charity raffle—all while supporting great causes in the local community.

Entry is free, but your spending goes to help local charities, so every ice cream, pint, or raffle ticket does a little good.

9. See Pop Royalty Live at Capital FM’s Summertime Ball

Get ready for one of the biggest pop parties of the year: the Capital FM Summertime Ball is back, packing Wembley Stadium with a blockbuster line-up of 2025’s chart-topping stars.

Mariah Carey headlines this year’s show, bringing her legendary vocals to the stage alongside a glittering roster that includes Benson Boone, KSI, Lola Young, Busted vs McFly, and Zara Larsson. Also on the bill? Rising stars Dasha, Reneé Rapp, and powerhouse performer Jessie J.

With back-to-back hits, tens of thousands of fans, and an atmosphere that screams summer, this is a one-day pop spectacular you won’t want to miss. Be warned: tickets vanish fast, so snap them up while you can.

What to Expect for Mortgage Rates in 2025

Rates are projected to hold steady between 4% and 5%, while relaxed lending criteria may improve affordability for homebuyers.

Following the recent base rate reduction—from 4.5% to 4.25% in May 2025—analysts anticipate that mortgage rates will remain relatively stable, hovering between 4% and 5% throughout the remainder of the year.

Since reaching a high in mid-2023, mortgage costs have steadily eased. Back in June 2023, the average rate for a five-year fixed mortgage at 75% loan-to-value climbed to 5.8%, significantly increasing monthly repayments for many borrowers.

Now, that same loan product has seen a notable decline, with the average rate down to approximately 5.04%, offering some relief to prospective buyers and existing homeowners alike.

Average mortgage rates in May 2025

|

Deal length and type |

Current average rate across all lenders |

Current average rate across 'big six' lenders |

|---|---|---|

|

2 year fixed-rate (75% LTV) |

4.79% |

4.27% |

|

5 year fixed-rate (75% LTV) |

5.04% |

4.19% |

|

2 year variable rate (75% LTV) |

4.75% |

4.7% |

|

Standard variable rate (SVR) |

7.74% |

6.75% |

All average rates are provided by Mojo Mortgages. The above are the average mortgage rates for various products across the market. These won't necessarily be available to you, and are not the only product types available.

Most forecasters are expecting mortgage rates to remain in the 4-5% range this year, even if inflation and the base rate edge lower.

Our Executive Director of Research, Richard Donnell, says: ‘Expectations of lower interest rates are already priced into fixed rate mortgages today.

‘Lower interest rates would likely result in further modest declines in mortgage rates but how far depends on how low money markets see base rates falling.

‘Economists currently expect base rates to fall to 3.5% by the end of 2025, which would imply mortgage rates remaining in and around the 4%+ range.’

Why are mortgage rates going down?

Mortgage rates began to go down in the latter half of 2023, as inflation dropped from 6.3% in September to 4.2% in December.

In June 2024, inflation hit its 2% target, but it has risen slightly since then and is currently sitting at 2.6%.

The Bank of England cut the base rate twice last year, first in August and again in November - and then again in February 2025.

At the most recent Bank of England meeting in May 2025, the Bank dropped the base rate to 4.25%. Some forecasters are predicting it will fall further by the end of the year.

The bank rate determines the interest rate the Bank of England pays to commercial banks that hold money with them. It influences the rates those banks charge people to borrow money or pay on their savings.

What factors affect interest rates?

Inflation is the main reason interest rates have been high in the UK over the last 3 years. An unexpected rise in demand - or decrease in supply - can cause inflation to rise.

At the end of 2021, the Bank of England began to raise the base rate in order to reduce inflation and help slow down price rises for everyday items including food, petrol, gas and electricity.

Inflation is currently hovering over its 2% target at 2.6%, so the Bank of England needs to keep the base rate high enough to ensure inflation doesn't rise again.

Global shocks can also have an impact on inflation, such as wars, pandemics and tariffs as they affect the flow of goods around the world.

Easing Affordability Tests Could Strengthen Buyer Confidence in 2025

A shift in how lenders assess mortgage applications may soon improve access to home financing. One significant change on the horizon is the easing of affordability checks, which could help boost borrowing power and reinvigorate housing market activity this year.

Although borrowers typically focus on their actual mortgage rate—currently averaging around 4.5% for a 5-year fixed term—lenders also assess whether they could afford repayments at a much higher hypothetical “stress” rate. At present, many lenders use stress rates of 8–9%, making it harder for buyers with smaller deposits to qualify.

If lenders return to pre-2022 stress levels of 6.5–7%, buyers could see their borrowing capacity increase by up to 20%. For example, a first-time buyer currently needing to show they can cover £1,550 in monthly payments at an 8.5% stress rate would only need to demonstrate affordability at £1,275 under a 6.5% rate—freeing up their budget and increasing buying options. While the exact impact varies by lender and borrower type, the effect would likely support housing demand and sales.

However, it's important to note that other mortgage regulations and criteria will continue to influence access to credit.

Housing Market Sees More Listings—and More Buyer Choice

As of early 2025, the number of homes on the market is up 12% compared to last year. With more sellers entering the market—many of whom are also planning to buy—there's greater choice for prospective buyers.

This increased inventory may limit upward pressure on prices. “We believe the wider availability of homes will help keep house price growth moderate,” explains Donnell. Buyers may find more room to negotiate, especially on properties that aren’t drawing much interest.

Affordable Regions Lead the Way in Sales Growth

Despite cost pressures from higher mortgage rates, demand remains strong in lower-priced areas. Recent data shows that regions with more accessible housing continue to outperform others.

“Sales volumes are climbing across the UK, but we’re seeing the most robust growth in places with more affordable homes,” says Donnell. Wales, the North West, and the North East are currently leading the way, each with a 10–14% annual increase in sales activity.

These trends highlight the resilience of the market and point to a potential shift in buyer behavior as affordability remains a key driver in 2025.

Key takeaways

- Mortgage rates are expected to hold steady around 4-5% throughout 2025

- A two-year variable rate with a 75% loan-to-value ratio currently averages 4.75% while the average five-year fixed term sits at 5.04%

- The base rate dropped to 4.25% in May 2025 in positive news for households

- Changes to affordability testing by mortgage lenders could make it easier for buyers to borrow

- The Base Rate could fall further by the end of 2025

Top 10 Budget-Friendly Towns Families Are Flocking To

Explore the trending towns where affordability meets family-friendly living—these spots are gaining serious attention.

Our experts have uncovered the most popular affordable towns for families, crowning Glenrothes in East-Central Scotland number one across the whole of the UK.

In Glenrothes, in the heart of Fife and just an hour from Edinburgh, you can expect to pay an average of £136,900 for a three-bed home – that’s £540 in monthly mortgage payments.

We examined the most affordable towns and then worked out which areas were getting the most interest from property-searchers on Zoopla.

We also calculated an income-to-affordability to ratio to help you work out if one of these places would meet your budget.

Most popular affordable towns for families by region

We looked at the most popular affordable towns by region, discovering that there are affordable places for families to live even in the most expensive UK regions.

Sutton-in-Ashfield in the East Midlands takes the top spot by region, with a three-bed home expected to cost £189,400 or £750 in monthly mortgage payments.

Barking and Dagenham is the most popular affordable area in London. For a three-bed home you’ll pay £1,750 in monthly mortgage payments, based on an average value of £440,300.

Bootle is the most popular affordable town in the North West, with three-bed homes valued at half the national average at £142,900.

Plymouth offers the best affordability for families in the South West of England, with three-bed homes averaging £261,000, or £1,040 per month in mortgage payments.

Here are the best places to live in each region of the UK for families, based on the average price of a three-bed home and the popularity of homes for sale there.

|

Town |

Region |

Avg 3-bed £ |

Estimated earnings* |

Monthly mortgage £** |

Price to earnings ratio*** |

|---|---|---|---|---|---|

|

Sutton-in Ashfield |

East Midlands |

£189,400 |

£67,100 |

£750 |

2.8 |

|

Tilbury |

East of England |

£347,800 |

£84,900 |

£1,380 |

4.1 |

|

Bedlington |

North East |

£154,800 |

£75,100 |

£610 |

2.1 |

|

Bootle |

North West |

£142,900 |

£76,400 |

£570 |

1.9 |

|

Glenrothes |

Scotland |

£136,900 |

£78,200 |

£540 |

1.8 |

|

Dartford |

South East |

£423,600 |

£90,800 |

£1,680 |

4.7 |

|

Plymouth |

South West |

£261,000 |

£70,100 |

£1,040 |

3.7 |

|

Llanelli |

Wales |

£170,600 |

£75,800 |

£680 |

2.3 |

|

Willenhall |

West Midlands |

£225,100 |

£68,100 |

£890 |

3.3 |

|

Dewsbury |

Yorks&Humber |

£192,000 |

£71,300 |

£760 |

2.7 |

|

Barking & Dagenham |

London |

£440,300 |

£79,400 |

£1,750 |

5.5 |

10 most popular affordable towns for families in the UK

We've also identified the top 10 towns for families to live across the whole of the UK by looking at the most affordable places along with how many people are searching for homes there.

|

Rank |

Town |

Region |

Avg 3-bed £ |

Estimated earnings* |

Monthly mortgage £** |

Price to earnings ratio*** |

|---|---|---|---|---|---|---|

|

1 |

Scotland |

£136,900 |

£78,200 |

£540 |

1.8 |

|

|

2 |

Wales |

£170,600 |

£75,800 |

£680 |

2.3 |

|

|

3 |

Wales |

£176,400 |

£74,800 |

£700 |

2.4 |

|

|

4 |

Wales |

£160,300 |

£74,800 |

£640 |

2.1 |

|

|

5 |

Scotland |

£168,600 |

£80,500 |

£670 |

2.1 |

|

|

6 |

Wales |

£142,200 |

£71,400 |

£560 |

2.0 |

|

|

7 |

South East |

£423,600 |

£90,800 |

£1,680 |

4.7 |

|

|

8 |

Scotland |

£164,600 |

£78,200 |

£650 |

2.1 |

|

|

9 |

Scotland |

£177,600 |

£82,300 |

£700 |

2.2 |

|

|

10 |

South East |

£444,900 |

£95,100 |

£1,770 |

4.7 |

(Source: Zoopla research 2025; *Two full-time earners/ **Estimated earnings required/***Q1 2025)

You’d need an estimated household income of £72,200 to afford a three-bed home in Glenrothes.

We discovered that it’s possible to buy a three-bed home for well under the national UK average house price of £268,000 in all but two of the towns on our list.

Four out of 10 of the most popular towns are in Scotland, including Wishaw (£168,600; £670 a month), Leven (£164,600; £650 a month) and Larkhall (£177,600; £700 a month).

Welsh towns take the second, third and fourth spots in our UK-wide list, with Llanelli (£170,600 on average; £680 monthly mortgage), followed by Neath ( £176,400; £700 a month) and Port Talbot (£160,300; £640 monthly).

Two places in the South East make an appearance - the Kent towns of Dartford and Swanley, whose relative affordability compared to other parts of the region make them popular places for families to live.

Perhaps unsurprisingly though, they are the priciest of the affordable towns on our list of family-friendly hotspots.

Families looking for a three-bed home in Dartford will need to pay an average of £1,680 in monthly mortgage payments, based on an average value of £423,600.

While anyone wanting a three-bed home in Swanley will need to pay £444,900 or £1,770 in monthly mortgage payments on average.

Affordability ‘remains critical’ for families

“This latest analysis paints a clear picture of a market where affordability remains a critical factor for families planning their next home move,” said Richard Donnell, Executive Director at Zoopla.

“What's particularly telling is the level of buyer interest these towns are attracting; three-bedroom homes in the most popular affordable locations are seeing twice the amount of listing views compared to the regional average,” he adds.

“This heightened popularity, coupled with the significant portion of would-be buyers expressing concerns about being priced out of housing, underscores the ongoing challenges facing movers and the clear appetite for value.”

How we crunched the numbers

To hit upon our top 10 of affordable places for families to live, we looked at the most affordable areas nationally and then looked at the popularity of listings of three-bed homes in those areas.

We found that property listing views were twice as high for three-bed homes in the most popular affordable towns compared to the regional average for similar properties.

In order to work out affordability, we measured the ratio of average three-bed house prices in an area to average earnings in the local area.

In each region, 30% of towns with the lowest price-to-earnings ratios were selected, resulting in a final list of 248 towns, plus 10 London boroughs (used in place of postal towns for the capital).

Popularity was ranked based on the average listing views for a three-bed home in each area.

To estimate monthly mortgage repayments for a typical three-bed house in the town, we calculated the cost of a 20% deposit, a 30 year repayment period, with a mortgage rate of 4.3%

A third of buyers fear being priced out

Meanwhile, separate research reveals that a third of buyers are worried they can’t afford to buy in their ideal family home location.

According to a survey of 2,000 UK adults conducted in April, 34 per cent of buyers fear being priced out of their preferred area.

Of those surveyed, 37 per cent said they would be happy to move to an entirely new region in the UK in order to buy a more affordable family home.

The average monthly mortgage payment for a £304,600 three-bed home is currently £1,210. Those surveyed, however, said they felt £870 was a reasonable mortgage payment.

Two in five respondents said they were unwilling to move from their ideal location.

Those willing to move said they would only be willing to move an average of 41 minutes away.

Key takeaways

- We've identified the top towns for families to live in every region of the UK

- We looked at the most affordable places to buy a three-bed home along with how many people are searching for homes there

- Sutton-in-Ashfield in the East Midlands takes the top spot by region, while Barking and Dagenham wins for London, Bootle takes the crown in the North West and Plymouth tops the list in the South West

- We crowned Glenrothes in Scotland the most popular town for families seeking affordability across the whole of the UK

- A three-bedroom home in Glenrothes is listed at £136,900 on average – around half the national average house price of £268,000

- We calculated affordability based on a regional price-to-earnings ratio so you can find out how much you need to earn to buy a three-bed home there

- Separate research shows a third of buyers are anxious about being priced out

Base rate lowered to 4.25% by the Bank of England

The Bank of England has lowered its key interest rate to 4.25%. This is how the change could affect borrowing costs and the housing loan sector and what it could mean if you're planning to relocate or buy a new home.

Ahead of today’s meeting of the Bank of England’s Monetary Policy Committee (MPC), experts were divided on whether another base rate cut was likely — some anticipated a pause in rate adjustments, while others expected a more aggressive move.

However, it has now been confirmed that the Bank of England has reduced the base rate by 0.25 percentage points, lowering it to 4.25% — the lowest it's been in two years.

The decision was not unanimous, with the MPC voting 5-2-2. Two members pushed for an even larger rate cut, and two favoured holding rates steady.

The base rate — sometimes referred to as the 'bank rate' or simply the 'interest rate' — plays a crucial role in determining the cost of borrowing across the economy, including mortgage rates offered by lenders.

The Bank has been using the base rate as a way of taming inflation, which hit a recent peak of 11.1% in October 2022.

The Bank increased the base rate from 0.1% in late 2021, to 5.25% in August 2023. It then cut the rate twice last year, first in August, again in November and then again in February this year.

The good news is that inflation has recently dropped. The Consumer Prices Index (CPI), a key measure of inflation, stood at 2.6% in the year to March. While that’s still above the Bank’s 2% target, it’s edged down from 2.8% in the year to February.

In its Monetary Policy Report today, the Bank said that inflation is “following a bumpy path”.

It explained: “Inflation will increase temporarily this year before falling back to the 2% target. This is partly because of increases in energy prices, and increases in some regulated prices such as water bills.

"Inflation could stay higher than expected if the prices of some services continue to rise quite quickly. On the other hand, demand in the economy could be weaker than expected, which would lower prices."

How does this impact interest rate predictions for 2025?

The report took a positive yet cautious approach to future base rate changes, stating "If things evolve as expected, we expect to reduce interest rates further."

"We will judge carefully how far and how fast to cut interest rates. The best contribution we can make to support economic growth and people’s prosperity is to make sure we have low and stable inflation."

What does the base rate cut mean for mortgage rates?

If you’re planning to get a new mortgage soon, you’re likely to see the lower base rate factored into new deals. This could make moving more affordable for you.

Whether you’re moving, buying your first home or your fixed rate is ending, it’s worth seeing if any lower rates are now available to you.

Key takeaways

- The Bank of England has cut the base rate from 4.5% to 4.25%, its lowest level in around 2 years

- The decision is likely to improve mortgage affordability, paving the way for more people to move house this year

- The base rate, also known as the 'bank rate’ or the ‘interest rate’, influences the rates that mortgage lenders charge their borrowers

- Today’s decision comes after UK inflation dropped by more than expected to 2.6% in March.

London events in May

As London gears up for summer in May 2025, the city transforms into a hub of excitement with plenty to offer. Whether you're into music festivals, rooftop bars, or thought-provoking exhibitions, May is undoubtedly one of the best months to experience everything London has to offer. The weather is just right—pleasantly warm with vibrant spring flowers blooming everywhere—and the buzz of an approaching summer fills the air.

With two bank holidays in May, there's no shortage of opportunities to kick off your summer adventures. You can start by visiting a rooftop bar for panoramic views of the city, catch some live music at one of the year's first outdoor festivals, unwind in a serene park, explore captivating exhibitions, or even plan a quick escape from the city for a refreshing day trip or mini-break.

If these options don't satisfy your thirst for adventure, we've put together a comprehensive guide highlighting the top events, lively parties, unique pop-ups, and other exciting activities happening across London in May 2025. Get ready for a month filled with unforgettable experiences!

1. Catch Kneecap, Cmat and Peaches at Wide Awake festival

Wide Awake bills itself as a ‘musical melting pot’, and it’s easy to see why given the hugely eclectic headliners it has had in recent years, ranging from veteran alt-rockers Primal Scream in 2022 to ethereal indie pop singer Caroline Polachek in 2023 to psychedelic Aussie rockers King Gizzard and the Lizard Wizard in 2024. You can expect the usual mixture of leftfield indie, post-punk, electronica and techno at the 2025 edition, which sees ascendent Irish hip hop trio Kneecap headline, with Irish singer-songwriter Cmat, Mercury Prize-winning indie outfit English Teacher, and Canadian electroclash legend Peaches also on the bill. Further down the line-up, you’ll find DJ and producer Daniel Avery, experimental dance music maven Cobrah, NYC indie duo Fcukers, Philadelphia punk band Mannequin Pussy and many, many more. Tier three tickets are on sale now here.

2. Be one of the first visitors to the V&A East Storehouse

Two years on from the reopening of the Young V&A comes the next phase of the iconic museum’s building projects. Opening its doors in May 2025, the V&A East Storehouse is a brand new venue in the Queen Elizabeth Olympic Park. Purpose-built to house more than 1,000 archives from the museum’s collection, comprising more than 250,000 objects and 350,000 books, the storehouse promises to offer a peek behind the scenes to show how a working museum goes about cataloguing artefacts, from vintage footie kits and Glastonbury festival ephemera to a collection of samurai swords. It’s set to open on Saturday May 31.

3. See the most Tony-nominated play of all time on the West End

Although most news coming out of America this year is hysterically awful, we are, at least, getting Stereophonic. The most Tony-nominated play of all time, the drama by David Adjmi with songs by Arcade Fire’s Will Butler is a fictionalised account of the legendarily tense sessions that led to the birth of Fleetwood Mac’s all conquering Rumours album, written and recorded while the various couples in the band were in the process of splittling from each other with degrees of prejudice. Hugely acclaimed Stateside, it’ll go straight into the West End for its London transfer.

4. Watch dozens of hot air balloons take to the skies for the Lord Mayor’s Regatta

It’s been six years since the Lord Mayor’s Hot Air Balloon Regatta was able to take place, thanks to the Covid-19 pandemic and, in 2022, 2023 and 2024, bad weather. Fingers crossed, then, the 2025 edition can take off without a hitch. The troupe will be hoping to take off on May 11, but will instead attempt to soar high in July 20 and, if necessary, July 27, should May be unfeasible. Should they be able to take off, you’ll be able to spot them soaring past some of the city’s most iconic landmarks, from Buckingham Palace and the London Eye to the Tower of London and Tower Bridge. The regatta isn’t just an excuse to brighten up London’s skyline, but part of a charity initiative that has raised more than £250,000 since 2015.

5. See the British Museum’s new exhibition on sacred art in Ancient India

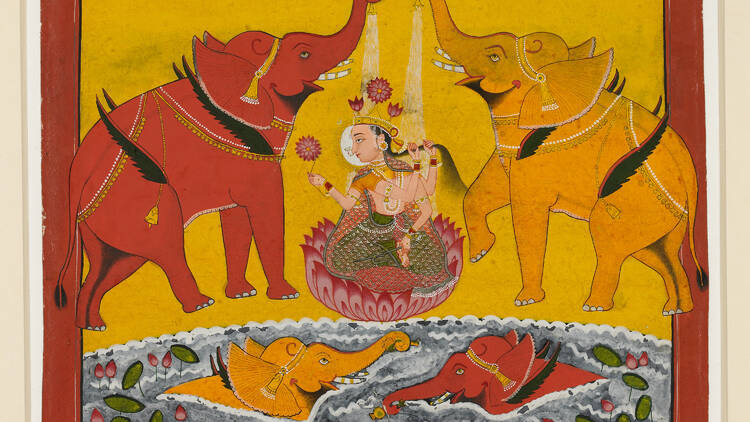

A world-first is on its way to the British Museum in ‘Ancient India: Living Traditions’. The new exhibition is the first ever to consider early Indian sacred art through a global, pluralistic lens. It takes visitors on a journey to the roots of three major world religions – Hinduism, Buddhism and Jainism – through the emergence of the country’s sacred art, and looks at how ancient religious practice has shaped living traditions today, plus the daily lives of around 2 billion people across the globe. In the exhibition, you’ll find over 180 objects, including 2,000-year-old sculptures, paintings, drawings and manuscripts. The whole thing was pulled together in close collaboration with an advisory panel of practising Buddhists, Hindus and Jains, who helped shape the exhibition into what promises to be an intriguing triumph.

6. Celebrate the tenth anniversary of southeast London festival GALA

All of London’s hippest and hottest people will once again be making the pilgrimage to Peckham for the tenth edition of electronic music bonanza GALA. Returning in its usual slot over the late May bank holiday, the festival is celebrating reaching double digits with a stellar three-day line-up curated in partnership with NTS radio, plus some of the city’s most acclaimed music and nightlife brands. Friday’s slightly mellowed line-up features headline sets from Floating Points, Moodymann and Theo Parrish, while Avalon Emerson, Ben UFO and KiNK get top billing on a Saturday line-up that leans towards the heavier end of the dance music spectrum, with curation from Chapter Ten and The Cause. Headlined by Caribou, Floorplan and Hunee & Antal, the festival’s closing day features artists from Rhythm Section, plus several stalwarts from London’s queer party scene.Also on the line-up across the three days are: Anz, Batu, Bradley Zero, Gideön, Heléna Star, Horse Meat Disco, Hudson Mohawke, Michelle Manetti, Surusinghe, Tash LC and many, many more.

Four in five homeowners in England and Northern Ireland to pay more stamp duty from 1st April

Four in five existing homeowners (83%) will pay stamp duty from April, up from 49% today as the 2% band returns between £125k and £250k, adding up to £2,500 per purchase

Analysis from Zoopla, one of the UK’s leading property websites, has revealed that the cost of buying a home will increase for the majority of home buyers in England and Northern Ireland from April, when the stamp duty land tax (SDLT) relief introduced in the 2022 mini budget ends and reverts to previous rates.

The impact and extra cost will vary across the country and between existing homeowners and first-time buyers as different rates apply. Overall Zoopla estimates that these changes will raise an extra £1.1bn a year in stamp duty for the government.

| Buyer type | Percentage of sales paying stamp duty today | Percentage of sales paying stamp duty from April 2025 | Extra sales caught by stamp duty from April 2025 | Stamp duty free sales from April 2025 |

|---|---|---|---|---|

| First-time buyer | 21% | 42% | +21% | 58% |

| Homeowner | 49% | 83% | +34% | 17% |

Majority of homeowners to pay more stamp duty

From the 1st April of 2025, four in every five (83%) homeowners will pay stamp duty on buying a main residence, up from 49% today, as the two percent rate between £125,000 and £250,000 returns. Less than a fifth of homeowners (17%) will pay no stamp duty on purchases below £125,000.

This means that the 49% of homeowner purchases over £250,000 will pay an extra £2,500 in stamp duty from April. The 33% of buyers purchasing between £125,000 and £250,000 will pay two percent on the purchase price up to a maximum of £2,500. Zoopla estimates this will generate an additional £900m in stamp duty.

The biggest jump in buyers paying stamp duty will be in the West Midlands where 66% more sales will pay from April, followed by 55% in the East Midlands and 50% in the North West.

The proportion of first-time buyers paying stamp duty doubles

First-time buyers will pay stamp duty on purchases over £300,000 from April, meaning three in five (58%) will avoid this extra cost of buying. This helps those buying in areas with lower house prices. The number of first-time buyers liable to pay stamp duty will be the lowest in the North East (two percent), Yorkshire and the Humber (three percent), Northern Ireland (five percent) and the North West (five percent).

However, the proportion of first-time buyers liable to pay stamp duty will double to 42% from April, hitting London and South East buyers in the £300,000 and £625,000 range the hardest, with costs of up to £15,000 per purchase. Buying at £350,000 will cost £2,500 per purchase, up from £0 today. Buying a £500,000 home will cost £10,000 in stamp duty, up from £3,750 today and buying at £550,000 will jump from £6,250 to £15,000.

Zoopla estimates this will generate an additional £200m in stamp duty.

Richard Donnell, Executive Director at Zoopla comments

Existing homeowners will pay up to £2,500 more for each purchase across a large number of sales. The average seller has made £60,000 in capital gains so there is flexibility to absorb this cost but buyers will expect to factor this extra cost into what they offer.

It’s positive that most first-time buyers will still pay no stamp duty from April, but these changes hit those buying over £300,000 in southern England the most where buying costs are already high. This will reduce buying power and market activity at a local level.

Stamp duty is a big tax on home movers in southern England where affordability problems are already a major challenge. The case for reforming stamp duty remains but the question is where to replace the multi billion in annual tax revenues.

Key takeaways

- Four in five existing homeowners (83%) will pay stamp duty from April, up from 49% today as the 2% band returns between £125k and £250k, adding up to £2,500 per purchase

- Less than a fifth of existing homeowners (17%) will pay no stamp duty

- The biggest jump in home buyers paying stamp duty will be in the West Midlands where 66% more sales will pay stamp duty from April

- The proportion of first-time buyers liable to pay stamp duty will double to 42% from April, hitting those buying in London and the South East the hardest

- However, 58% of first-time buyer purchases will still pay no stamp duty under property purchases of £300,000 with buyers in the north benefitting the most

- Overall these changes are estimated to raise an extra £1.1bn a year in stamp duty for the government

The best things to do in London in April 2025

Plan an amazing April 2025 with our selection of the best events, exhibitions and things to do in London

April bursts onto the scene, a kaleidoscope of reawakening. The city stretches, yawns, and sheds its winter cloak, revealing a vibrant tapestry of blossoming parks and sun-drenched streets. A symphony of birdsong replaces the hushed stillness, and the air hums with a newfound energy. Think: picnics in fragrant gardens, the thrill of the first open-air theatre performance under a pastel sky, and the electric buzz of the London Marathon. Easter's double dose of holiday magic ignites the city with festivals, art, and the rhythmic pulse of music. It's a month where every sense is heightened, a prelude to summer's crescendo. Dive into this explosion of life – London in April is pure, unadulterated vitality.

1. Have a cracking Easter in London

London has an amazing energy on bank holidays and Easter weekend is particularly blessed, because it’s a rare double bank holiday, meaning we get four whole days of work-free fun from Good Friday on April 18 to Easter Monday on April 21. The capital has plenty to keep you occupied over your extra-long weekend. From egg hunts to bumper club nights, check out our top picks for Easter weekend 2025 below.

2. See Sondheim’s final musical ‘Here We Are’

He may have been the greatest composer of musicals in history, but Stephen Sondheim’s final musical was, appropriately enough, too arty for Broadway: the posthumously produced Here We Are debuted in NYC to warm if not uncritical notices. Now the new Sondheim is arriving in London – and it’s a coup for Rufus Norris to score it as the centrepiece of his final season running the NT. Directed by Joe Mantello in what has been billed as a new production, different from his original NYC one, it has a formidable cast headed by Tracie Bennett, Rory Kinnear and Denis O’Hare. The plot follows Leo and Marianne Brink, who think they’ve discovered the perfect new brunch spot – but things start to get very weird.

3. See three of George Balanchine’s quintessential works in a Royal Ballet triple bill

Balanchine’s greatest hits are back on at the ROH this Spring as the Royal Ballet will peform three works from the father of American ballet: Serenade (1935), Prodigal Son (1929), and Symphony in C (1947). There’s a reason why Balanchine’s classics are still bangers today: oozing elegance and grace, these plotless, minimal works set to scores by Tschaikovsky, Prokofiev and Bizet are not to be missed.

4. Cheer on the 50,000 brave souls tackling The London Marathon

Running a marathon is a truly gruelling feat requiring countless hours of training, so the 50,000 brave souls who are taking part London Marathon on Sunday April 27 very much deserve our support. Check out our route guide to find the best spectating spots and track down nearby pubs and bars for when all that whooping and clapping leaves you feeling nearly as thirsty as the runners. Remember: your presence at this monumental sporting occasion makes it absolutely fine to drink lager or rosé in the street at 10am on a Sunday.

5. Indulge your sweet tooth at The Chocolate Station Market

Battersea Power Station plays host to its first-ever chocolate market this Easter. The Chocolate Station will boast stalls from some of the UK and Europe’s finest chocolatiers, including the oldest chocolate manufacturer in Belgium, Meurisse. Vegans with a sweet tooth can stock up at Diana’s Chocolates, while there’ll be cakes, cookies and more available from the likes of Ritual Cacao and Midnight Pantry, plus bars, eggs and truffles from Cornwall’s Chocolarder, and many more.

6. Learn some circus skills at the Horniman Spring Fair

The Horniman Museum and Gardens’ Spring Fair is maybe the most efficient way to cram as much Easter fun into a single day as possible. The gardens will be taken over by a ridiculously busy programme, with everything from an Animal Walk to an Easter Bonnet Parade. But there’s plenty more: think circus skills, singalongs, fete games and seed planting, all fuelled by some cracking cuisine from the roster of food stalls.

7. Watch The Oxford vs Cambridge Boat Race from the banks of the Thames

The famous and historic London rowing contest between the UK’s oldest two universities returns for its 170th edition on Sunday April 13, when crews from Oxford and Cambridge go head-to-head in eight-oared rowing boats across the Thames. The women’s race is usually up first, followed by the men’s race an hour later. Spectators can watch the BBC’s coverage of the race on large screens at two riverside Fan Zones in Hammersmith and Fulham, or check out our guide for the best places to see all the rive-side action.

8. Pick up some new houseplants at the Garden Museum’s Spring Plant Fair

Once again the Garden Museum is throwing open its doors to exhibitors and plant perusers. The fair takes place both outside and inside the museum and this year has been curated by Susanna Grant, garden designer and founder of Hackney’s Hello There Linda. Nab plants and garden ephemera for your urban space, balcony or allotment, pick the brains of pro growers and attend talks and workshops covering everything from the city’s fruit trees to setting up your own micro-nursery.

London events in March 2025

Uncover London's vibrant March 2025 with our curated list of must-see events, from lively festivals to insightful workshops and captivating exhibitions.

Spring's whisper arrives in London. Light returns, flowers bloom, and the city pulses with life. March is here! Step out of winter's shadows. Explore parks, savor flavors, and immerse yourself in culture. Celebrations mark the month: festive holidays and cultural events. Film buffs find paradise in numerous film festivals. Art, literature, and music thrive. Your guide to London's vibrant March awaits.

1. See spring flowers blooming around the capital

Spring in London is always a knockout. We might live in a sprawling capital city, but that doesn’t mean there aren’t tons of amazing green spaces to enjoy the season’s pops of colour. From London's bright pink cherry blossoms to seas of daffodils, take a look at our list of the best places to see flowers in London

2. Celebrate the matriarchs in your life on Mother’s Day in London

Mums deserve high praise all year round, but Mothering Sunday is the ultimate excuse to treat your darling ma and any other matriarchs in your life to a lovely time. Here’s our guide to help you get organised and plan a proper celebration of mumsy on Sunday March 10, whether you want to take her for a cheeky Mumtini, treat her to a relaxing trip to one of London’s exquisite spas, or send her a stunning bunch of flowers.

3. Explore Ancient Egypt at ‘Tutankhamun: The Immersive Exhibition’

Promising ‘cutting-edge technology with rich historical narratives’, this Ancient Egypt-themed show is the latest experience to arrive at the ImmerseLDN, the ExCeL’s sprawling, 26,909 sq ft space for staging all things ‘immersive’. Tutankhamun: The Immersive Exhibition has apparently been viewed by 1.8 million visitors on a global tour, and arrives in London for 14 weeks this spring. Using splashy technology and 8-metre-tall projections, the exhibit will be divided into six galleries, each bringing the maximum amount of razzle dazzle to bear on the time of the Pharaohs. You’ll be able to experience such thrills as an immersive movie about the discovery of the tomb, a VR experience taking you ‘into the Egyptian afterlife’ and an AR walk through the Valley of Kings. Gimmicky it might sound, but it’s been endorsed by both the History Channel and the Grand Egyptian Museum in Cairo, so we’d imagine it will at the very least nail the historical accuracy. Got a kid that’s going through an Ancient Egypt phase? They’ll probably love it.

4. See the prettiest looking cats around at the London Catstravaganza

Ever looked at Crufts and thought, ‘this would be so much better with cats’? Well, taking place over two days, Catstravaganza is a celebration of fluffy and fabulous pussycats, with prizes given for the prettiest cats and kittens, as well as a razzle-dazzle ‘best in show’ presentation on the Copperbox Arena catwalk, and the chance to look at (and maybe stroke) some seriously stunning mogs.

5. Pick up some bargain pieces for your boring walls at The Other Art Fair

Your landlord might disagree, but there really is no excuse for boring white walls. Pick up original work from local artists to brighten up your bedroom for as little as £100 at this accessible alternative to (the many) stuffier and more expensive fairs on the London art circuit. Over 150 independent artists will be exhibiting work at the annual event presented by Saatchi Art, and there’ll also be immersive installations, performances, DJs, a fully stocked bar to entertain you. Think of it as art served with a side of party.