Queen's speech: no fault evictions to be banned

Landlords will no longer be able to evict renters for no reason as part of a package of measures included in the Queen’s Speech to make the rental market fairer.

Landlords are set to be banned from evicting renters without a reason as part of a package of measures to make the private rental sector fairer.

The Renters Reform Bill, which was included in the Queen’s Speech, will abolish so-called ‘no fault’ section 21 evictions in England, under which landlords can force renters to leave their properties even if they have done nothing wrong.

Local councils are also set to be given more effective tools to enable them to crack down on rogue landlords, as part of a campaign to halve the number of non-decent rental homes by 2030.

In addition, a new property portal will be introduced to give renters performance information on their landlord to help hold landlords to account.

The government is also pressing ahead with moves to improve living conditions for people who live in social housing.

The Social Housing Regeneration Bill will introduce new Tenant Satisfaction Measures to help people see how their landlord is performing.

It will also ensure the Regulator of Social Housing is able to inspect properties and act as a watchdog on standards.

Why is this happening?

The government made a manifesto commitment to abolish no fault evictions.

It is now acting on this pledge by including the Renters Reform Bill in the Queen’s Speech, which means it will be part of the government’s legislative programme for the new session of Parliament.

Alongside greater protection for renters, the bill also introduces a stronger legal framework for landlords to help them regain their properties if renters are repeatedly in rent arrears, while notice periods will also be reduced for cases of anti-social behaviour.

Who will it affect?

The bill is good news for the 4.4 million households in England who currently rent their home in the private sector.

Not only will renters have greater security once no fault evictions are banned, but the bill will also empower them to challenge unfair rent increases and other poor practices by landlords without the fear of being kicked out of their home in retaliation.

Research in 2019/20 found that 22% of renters had not ended their last tenancy by choice, forcing them to spend an average of £1,400 in moving costs.

Meanwhile, applying the legally binding ‘Decent Homes Standard’ to the private rented sector for the first time will ensure renters have access to safer, better quality homes, as one in five private rented homes currently falls short of this standard.

Measures to provide a more effective legal framework and stable market for landlords should also benefit renters, as it should encourage existing landlords to remain in the sector and new ones to enter it.

As a result, the supply of private rental homes should increase, offering more choice to renters and helping to relieve some of the upward pressure on rents.

The introduction of a new Ombudsman for private landlords will also enable disputes to be resolved without having to go to court, which is both expensive and slow.

Residents to be more involved in local developments

A third bill included in the Queen’s Speech that will impact the housing market is the Levelling Up and Regeneration Bill, which includes measures to reform the planning system to give residents more involvement in local development.

The bill aims to simplify and standardise the planning process, so that local plans can be produced more quickly and will be easier for communities to influence.

The move is expected to help ensure new developments are attractive and environmentally friendly, as well as including affordable housing.

It will also see the introduction of a new levy on developments, which will be set locally and used to pay for the infrastructure that communities need, such as housing, schools, GPs and new roads.

Key takeaways

- Landlords are set to be banned from evicting renters without a reason as part of a package of measures to make the private rental sector fairer

- Local councils are being given more effective tools to enable them to crack down on rogue landlords

- A new property portal will be introduced to give renters performance information on their landlord, making landlords more accountable

Lenders reluctant to pass on full interest rate rises to borrowers

Intense competition in the mortgage market means lenders haven't been passing on full interest rate rises to borrowers since December.

The Bank of England has increased interest rates for the fourth consecutive time in a bid to tackle soaring inflation.

Its Monetary Policy Committee has raised the official cost of borrowing – known as the Bank Rate – from 0.75% to 1%.

The move will lead to around two million homeowners with variable rate mortgages facing higher monthly repayments, adding around £26 a month for someone with a £200,000 mortgage.

But there is some good news for homeowners looking to remortgage.

The rate rise had been widely anticipated and much of the increase has already been priced into new fixed rate deals by lenders.

At the same time, intense competition in the mortgage market has prevented the full increase to the Bank Rate since December from being passed on to new borrowers.

Why is this happening?

Inflation, which measures increases to the cost of living, is continuing to rise as the conflict in Ukraine puts further pressure on prices.

Consumer Prices Inflation – the key measure used by the Bank of England – has soared to 7% during the past year.

This is well above the 2% target at which the Monetary Policy Committee is expected to keep inflation and even higher than its own predictions for inflation.

The Monetary Policy Committee also expects the situation to get worse, with inflation expected to hit 10% by the end of the year, due in a large part to further increases in energy costs anticipated in October.

The Monetary Policy Committee uses changes to interest rates as a way of controlling inflation.

The theory is that by making it more expensive to borrow money, people and companies will spend less, which will help to reduce pressure on prices.

With inflation expected to continue to increase, there are likely to be further increases to the Bank Rate in the months ahead, with economists predicting they could rise to 1.5% or even higher.

What does it mean for me?

The vast majority of homeowners, around three-quarters, will not be impacted by the change as they are on fixed rate mortgages.

The increase to the Bank Rate will only affect you if you have a variable rate mortgage, such as a tracker deal, or if you are on your lender’s standard variable rate.

Only around 850,000 homeowners currently have a tracker mortgage, while a further 1.1 million are on a standard variable rate one.

With a fixed rate mortgage, monthly payments stay the same for the length of the deal, which is usually two or five years.

For homeowners on a variable rate deal, their repayments will increase by around £26 a month if they have a £200,000 mortgage.

As a result, repayments will have risen by a total of £92 per month since interest rates first started to rise in December.

But it is worth remembering that people on standard variable rates typically have much lower outstanding mortgages than average.

If they only owe £50,000 through their mortgage, their monthly repayments will have risen by just £23 a month since December.

What’s happening in the mortgage market?

It is still too early to say how much of the latest increase will be passed on to borrowers by lenders.

But the previous increases have not been passed on in full due to intense competition in the mortgage market.

For example, although the Bank Rate increased by 0.65% between December and March, standard variable rate mortgages rose by only 0.37% on average during the same period.

The increase in interest rates has also been widely anticipated, so much of the rise has already been priced into fixed rate deals.

As a result, rates on these products are not expected to rise significantly following the latest change to the Bank Rate.

The average two-year fixed rate mortgage currently stands at 3.03%, up from 2.29% in November last year before rates started to rise.

What should I do now?

If you have a fixed rate mortgage, you do not need to take any action, as you will not be impacted by the change.

If you are on your lender’s standard variable rate, you should think about remortgaging to a more competitive deal.

The difference between the average interest rate charged on an SVR and the typical one for a fixed rate mortgage is currently 1.75%.

As a result, someone with a £200,000 mortgage being repaid over 25 years could save £192 a month, or a massive £4,611 over two years by switching.

Their savings would increase by a further £695 over two years if standard variable rates rise by a further 0.25%.

Meanwhile, an estimated 1.5 million homeowners will come to the end of fixed rate mortgage deals this year.

Unfortunately, if you are coming off a two-year fixed rate mortgage, you are likely to find that rates for new deals are higher than when you last remortgaged.

The average cost of a two-year fixed rate mortgage was 2.09% in May 2020, nearly 1% less than the 3.03% it stands at today.

As a result, if you have a £200,000 mortgage you could see your repayments rise by £98 a month.

But remember, this calculation is based on average rates and there are better deals available, with best buy rates starting at around 2.3%.

Your home is also likely to have increased in value since you last remortgaged, while you will have repaid some of your loan. As a result, you are also likely to qualify for a competitive mortgage rate.

If you are worried about higher repayments when you remortgage, you could consider increasing your mortgage term.

Extending your mortgage term from 20 years to 30 years would reduce your monthly payments from £1,120 to £850, based on a £200,000 mortgage and an interest rate of 3%.

But remember, if you do this, you will end up paying more interest over the life of your mortgage.

The news is better if you are coming to the end of a five-year fixed rate mortgage, as average rates on these are only 0.28% higher than five years ago, a difference of £28 a month for someone with a £200,000 mortgage.

If you are looking to take out a new fixed rate mortgage, you will need to decide whether you want to remortgage on to a two-year or a five-year deal.

The difference between these two rates has continued to narrow, with the average premium for fixing for five years, rather than two years, now just 0.14%.

If you think you may struggle to keep up with your mortgage repayments following the run of interest rate rises, it is important to contact your lender as soon as possible.

There are a number of steps lenders can take to help you, including granting you a temporary payment holiday or putting you on to an interest-only mortgage for a short time.

Key takeaways

- The Bank of England has increased interest rates to 1%

- However, the rate rise had been widely anticipated and much of the increase has already been priced into new fixed rate deals by lenders

- And in good news for borrowers, intense competition in the mortgage market means lenders have been reluctant to pass on the recent rises in full to customers

Property hotspots: where house prices have gone up the most in the last 10 years

Discover the top regions and towns across the UK that are on the up - and which hotspots in the capital have seen house prices rise the most in the last 10 years.

Waltham Forest in London leads the way for house price growth in the UK over the past 10 years.

Named London’s first ever ‘Borough of Culture’, Waltham Forest has been attracting plenty of young professionals in recent years, thanks to its affordable house prices and rising market.

At the heart of the borough, Walthamstow has a vibrant restaurant and bar scene and lots of independent shops, while the recently restored Lloyd Park, complete with William Morris Museum, attracts families aplenty at the weekends.

Back in 2012, you could snap up a home here for around £250K. Today, the average home costs 87% more than that, at £472,144.

Outside of London, Dover is the next hot property destination right now, with prices currently 81% higher than they were 10 years ago, when a home could be yours for around £160K.

Today, owning a slice of the housing market near those famous white cliffs costs £295K on average.

Loved for its views of France, medieval castle and wartime tunnels, Dover also benefits from having lovely neighbours.

Nearby Deal, with its multi-coloured Georgian seafront and pebble beach, has just been voted the South East’s best place to live by The Times.

While neighbouring Folkestone is also currently undergoing a major regeneration, with the Lower Leas Coastal Park, harbour and railway viaduct already complete.

Thurrock comes in at number seven on the list, followed by Canterbury, Basildon and Thanet, home to the seaside towns of Margate, Ramsgate and Broadstairs.

Head of Research, says: "The strong desire among buyers for coastal and rural living during the pandemic, coupled with a shortage of homes for sale, has resulted in strong price growth, especially in areas where homes are relatively more affordable."

On the up: the UK's top 10 boroughs for house price growth since 2012

| Area | Current avg price | % increase | Value added | |

|---|---|---|---|---|

| 1 | Waltham Forest | £472,144 | 87% | £220,068 |

| 2 | Barking & Dagenham | £319,597 | 87% | £148,659 |

| 3 | Newham | £391,889 | 87% | £85,062 |

| 4 | Dover | £294,846 | 81% | £132,250 |

| 5 | Greenwich | £401,401 | 80% | £178,750 |

| 6 | Lewisham | £433,444 | 80% | £192,902 |

| 7 | Thurrock | £306,454 | 79% | £135,570 |

| 8 | Canterbury | £351,977 | 79% | £155,716 |

| 9 | Basildon | £331,456 | 79% | £145,845 |

| 10 | Thanet | £288,057 | 78% | £126,437 |

What's happening with house prices in London?

After Waltham Forest, London's next top hotspots are Barking and Dagenham, Newham, Greenwich and Lewisham.

Currently undergoing a huge regeneration project, Barking & Dagenham remains one of the cheapest places in the capital to buy a home, with the average house price coming in at just under £320K.

Barking & Dagenham's excellent transport links, it's on the District and Hammersmith & City Tube lines, while the Overground runs from Barking station, offer easy access to London and the surrounding suburbs.

A planned multi-million pound redevelopment of the local shopping centre, Vicarage Field, is set to add high street stores, a cinema and music venue, alongside bars and restaurants.

Over in Newham, you can find one of the most popular secondary schools in the country. Brampton Manor sends more students to Oxford and Cambridge Universities than Eton.

Transformed by the Winter Olympics of 2012, Newham is rapidly becoming popular with young professionals on the lookout for slick city apartments.

Now home to the Queen Elizabeth Park, the London Olympic Stadium and London Aquatics Centre, Newham's proximity to Stratford's Westfield adds further allure for buyers on the lookout for a place in this property hotspot.

Yet Newham remains one of the cheapest areas in the capital to buy a home, with the average property costing £391K.

Greenwich and neighbouring borough Lewisham also make the top five.

One of the most attractive places in the capital to live, Greenwich has a wonderful park with views spanning the London skyline, a bustling market and plenty of beautiful housing stock to choose from.

Next door in Lewisham, it's still possible to buy a beautiful home for better-than-average prices, as gentrification is happening at a much slower pace here than in other parts of London.

Well-connected transport-wise, Lewisham is seen as one of the best value areas in Zone 2.

It has the Docklands Light Railway, with access to Canary Wharf, and enjoys good train links to London Bridge.

Then, when the much anticipated Bakerloo Line extension reaches town, it will also join the Tube network.

The top 10 London boroughs where house prices have increased the most

| Borough | Current avg price | % increase | Value added | |

|---|---|---|---|---|

| 1 | Waltham Forest | £472,144 | 87% | £220,068 |

| 2 | Barking & Dagenham | £319,597 | 87% | £148,959 |

| 3 | Newham | £319,889 | 87% | £182,119 |

| 4 | Greenwich | £401,401 | 80% | £178,750 |

| 5 | Lewisham | £433,444 | 80% | £192,902 |

| 6 | Havering | £399,668 | 78% | £175,237 |

| 7 | Southwark | £503,586 | 75% | £216,240 |

| 8 | Hackney | £548,475 | 74% | £233,816 |

| 9 | Redbridge | £455,758 | 74% | £193,917 |

| 10 | Bromley | £501,399 | 73% | £205,320 |

UK regions: average house price growth since 2012

Unsurprisingly, London tops the regions for the biggest house price growth in the last 10 years, despite property prices rising at a slower pace since the start of the pandemic.

Home values in the capital have risen by 71% since 2012, taking the average property price to £508K, up from £298K ten years ago.

The East of England makes number two in the regional charts with prices up 68% to an average of £324K.

In third place is the South East, where prices are up 68% to an average of £373K, while the East Midlands comes in fourth place, where prices grew 60% to an average of £213K.

UK house price rises by region over the last 10 years

| Region | Current avg price | % increase | Value added | |

|---|---|---|---|---|

| 1 | London | £508,225 | 71% | £210,164 |

| 2 | East | £324,168 | 68% | £130,930 |

| 3 | South-East | £372,998 | 63% | £143,722 |

| 4 | East Midlands | £212,617 | 60% | £79,657 |

| 5 | South West | £294,660 | 56% | £105,759 |

| 6 | West Midlands | £209,347 | 54% | £73,298 |

| 7 | Wales | £186,058 | 50% | £61,779 |

| 8 | North West | £177,312 | 44% | £54,103 |

| 9 | Yorkshire & the Humber | £171,918 | 42% | £50,870 |

| 10 | Scotland | £149,636 | 27% | £32,258 |

| 11 | North East | £130,743 | 21% | £23,032 |

Key takeaways

- Waltham Forest in London is top of the UK charts when it comes to house price growth since 2012. Homes here have risen by more than £220K in the last 10 years

- Outside of the capital, Dover is leading the way in value gains. Homes here are up £132K compared with 10 years ago

- Thurrock, Canterbury, Basildon and Thanet also make the top 10 rising areas in the UK

First-time buyer deposits soar more than 50% in a decade

The average person taking their first step on to the property ladder now puts down more than £45,000 as a deposit.

Key takeaways

- The average deposit put down by a first-time buyer has soared by 54% during the past decade

- The typical person taking their first step on to the property ladder now puts down an average of £45,569, compared with £23,625 10 years ago

- The size of the deposit put down has also increased from 17% to 20% of the home’s value

The average deposit put down by a first-time buyer has soared by more than 50% during the past decade.

The typical person taking their first step on to the property ladder now puts down an average of £45,569, according to professional services platform Stipendium.

The sum represents a 54% jump compared with first-time buyer deposits 10 years ago, and a 40% increase in the past five years alone.

Not only have house prices risen during the period, but the typical deposit first-time buyers need to have saved in order to secure a mortgage has also increased from 17% of their home’s value to 20%.

While the combination of soaring house prices and larger deposits makes it harder for first-time buyers to get on to the property ladder, the government has launched a number of schemes during the past 10 years to help people purchase their first home.

Why is this happening?

The huge jump in the size of deposits first-time buyers are putting down has been largely driven by increases to house prices.

The research found that while 10 years ago the typical person put down a 17% deposit, the average first-time buyer property cost just £138,973, giving a deposit of £23,625, or £29,684 in today’s money after being adjusted for inflation.

But fast-forward 10 years, and the typical first-time buyer property now costs £227,846.

At the same time, the proportion of a home’s value that first-time buyers need to put down in order to qualify for a mortgage has increased from 17% to 20%.

As a result, first-time buyers now need to save an average of £45,569 – a massive £21,944 more than 10 years ago.

Who does it affect?

The strong house price growth seen during the past decade makes it particularly challenging for first-time buyers to get on to the property ladder in areas where house prices are higher.

This is particularly the case for first-time buyers in London, where the average property costs £508,500 according to latest House Price Index, as well as other towns and cities in the South East, where property prices are generally higher.

But there are still pockets of affordability for first-time buyers, particularly in northern cities, such as Glasgow, Newcastle, Aberdeen and Sheffield.

The average home in Glasgow costs just £135,200, meaning a first time buyer putting down a 20% deposit would need to save £27,040 – broadly in line with the typical deposit put down 10 years ago.

What’s the background?

The good news for first-time buyers is that the government has introduced a number of schemes to help them get on to the property ladder.

People saving for a deposit can benefit from the Lifetime ISA, under which they can save £4,000 a year to which the government adds a 25% bonus, up to a maximum of £1,000 annually.

The money must be used to either purchase a first home or for retirement.

To help buyers purchase a property with a smaller deposit, there is the 95% mortgage guarantee scheme.

The Help to Buy equity loan scheme also enables first-time buyers to purchase a new-build property with a 5% deposit, which the government tops up with a 20% equity loan that's interest-free for five years.

Other schemes include First Homes, under which first-time buyers, key workers and local people can purchase a home at a 30% discount to its market price, and Shared Ownership, which enables people to buy a share in a property and pay rent on the portion they don’t own.

First-time buyers are also exempt from stamp duty on the first £300,000 of a home purchase on properties costing up to £500,000.

Expensive ground rents to be banned for new buyers

From 30 June, the government is banning expensive ground rents, meaning leaseholders will no longer have to pay them when purchasing a home on a long lease.

The government is banning the charge of expensive ground rents on leasehold properties for new buyers in England and Wales.

Unlike a freehold property, with a leasehold one, homeowners do not own the property outright. Instead they have the right to live in it for a set length of time, typically between 99 and 125 years.

The land on which the property sits continues to be owned by the freeholder, and the homeowner has to pay annual rent on it – known as ground rent.

But from 30 June, landlords will no longer be allowed to charge ground rent to people purchasing a home on a long lease.

The government said no clear service was provided for the charge, while the regular increases in ground rent imposed on homeowners placed a significant financial burden on them.

Leasehold Minister Lord Stephen Greenhalgh said: “This is an important milestone in our work to fix the leasehold system and to level up home ownership.”

Why is this happening?

In the past, leasehold properties tended to be restricted to flats. But there has been a growing trend in recent years for developers to sell houses on a leasehold basis.

Government research found that people living in leasehold homes were being treated as a steady source of income by the owners of the freehold, with some ground rents doubling every 10 to 15 years.

A study by trade body NAEA Propertymark found that homeowners living in leasehold properties were collectively paying £447 million in ground rent every year.

The average person paid £319 on the rent annually, with a third of homeowners reporting that they would no longer be able to afford to live in their property if it increased further.

Who does it affect?

The ban only applies to new buyers purchasing a leasehold property in England and Wales, and existing homeowners who are renewing their lease from 30 June.

But in preparation for the changes, many landlords have already reduced the ground rent they charge to zero for homeowners starting a new lease.

If you are set to sign a new lease on a home in the next two months, you should speak to your landlord to ensure the ground rent they are charging reflects the changes.

Ground rents for existing leaseholder homeowners will be tackled through future measures, under which homeowners will be given the right to extend their leases to 990 years at zero ground rent.

The government will also launch an online calculator to help homeowners find out how much it would cost them to buy their freehold or extend their lease.

An estimated 4.5 million homeowners in the UK have a leasehold property.

What’s the background?

The move is the first part of a package of reforms to make homeownership cheaper, fairer and more secure.

Thousands of existing leaseholder homeowners have already seen a reduction in their ground rents after the Competition Market Authority secured commitments from major housebuilders to stop doubling ground rent charges every year.

Instead, their ground rent will be reduced to the level it was at when they first purchased their property.

Key takeaways

- The government is banning expensive ground rents on leasehold properties for new buyers in England and Wales

- From 30 June, landlords will no longer be allowed to charge the rents to people purchasing a home on a long lease

- Ground rents for existing leaseholder homeowners will be tackled through future measures

What can I do if I’m struggling to pay my mortgage?

With the cost of living rising, some homeowners may find themselves struggling to meet their monthly mortgage repayments. Here’s what to do if it's happening to you.

If you’re finding you can no longer afford your mortgage repayments, there are options out there that could help you through a difficult time.

Here’s what to do if you think this might be about to happen to you.

What should I do if I think I might miss a mortgage payment?

Contact your lender as soon as possible.

Lenders will always try to work with customers who are experiencing financial difficulties.

But you’re likely to have more options if you contact your lender before you’ve missed a payment.

As soon as you think you might have a problem, get in touch with your bank or building society straight away.

How should I contact my lender?

Check your lender’s website to see how they want you to get in touch if you are experiencing financial difficulties.

Some lenders have a special helpline for people in this situation.

Most lenders will offer a variety of ways in which you can contact them in this scenario, include call hotlines, email, online chats and mobile apps.

Don’t leave contacting your lender until the last minute, as they may be experiencing a high volume of calls.

If you find yourself facing long waiting times on hotlines, try contacting your lender by email or through their website instead.

Will I lose my home?

Losing your home is most people’s worst nightmare. So, it’s good to know that repossessing a property is usually a last resort for lenders.

Instead, they will work with you to try to find a way to make your mortgage repayments affordable.

Charles Roe, Director of Mortgages at UK Finance, says:

“Lenders stand ready to help customers who may be struggling with their payments.

“It is important that anyone experiencing financial difficulty gets in touch with their lender as soon as possible to discuss the best options for them.”

What do I need when I contact my lender?

The most important things you'll need are your mortgage details and account number, so your lender can look you up on their system.

It’s also a good idea to do a budget before you make the call, so you know exactly how much you have coming in and going out each month.

And look for any areas in which you can cut back on your expenses.

Having a clear idea of what you can afford will help you as you discuss a way forward with your lender.

Can I take a mortgage payment holiday?

During the early stages of the Covid-19 pandemic, lenders introduced a mortgage payment holiday scheme.

Under the scheme borrowers could defer their mortgage payments for up to six months.

Unfortunately, the scheme has now ended, and no new official scheme has replaced it.

But lenders are still granting mortgage payment holidays to borrowers on an individual basis.

These payment holidays are typically two to three months long.

Interest that's not paid during this period is added to the outstanding mortgage debt.

What are my options if I can’t pay my mortgage?

There are four main options if you're struggling to pay your mortgage.

The best option for you will depend on your individual circumstances.

1: Extend the length of your mortgage term

The mortgage term is the total period over which you repay your mortgage.

Spreading the debt out over a longer period of time will reduce your monthly payments.

If you’re struggling to afford your mortgage due to higher bills, increasing your mortgage term could be a good option.

Increasing the period over which you repay a £200,000 mortgage from 20 to 30 years would reduce your monthly repayments from £1,019 to £744.

This calculation is based on an interest rate of 2% and a repayment period of 25 years.

The advantage of this option is that you continue to repay your mortgage.

The downside is that by increasing the term, you’ll pay more in interest over the total period of your mortgage.

2: Change to an interest-only mortgage

Changing from a repayment mortgage to an interest-only one dramatically lowers your monthly paymnets.

Since you’ll only be paying the interest on your loan each month, rather than paying down the actual debt, it's a much cheaper option in the short term.

If you’re going through a temporary fall in income, moving to an interest-only mortgage may be a good option as it will significantly reduce your monthly repayments.

For example, if you have a £200,000 mortgage, switching to an interest-only loan will cut your repayments from £854 to just £333 per month.

This calculation is based on an interest rate of 2% and a repayment period of 25 years.

But your lender is only likely to want to do this for a limited period, as you won't be reducing the overall amount you owe.

You’ll also still need to find a way to repay your mortgage over the longer term.

3: Defer your mortgage repayments

You can defer your mortgage and interest payments for a short period of time, typically two to three months.

After this period, the payments you missed will be added to your monthly repayments until you've made them up.

This is often done over the course of one to two years.

4: Request a payment holiday

During a payment holiday, the interest you don’t pay during the holiday will be added to the overall amount that you owe.

A mortgage payment holiday may be a good option if you have seen a sharp drop in your income or been made redundant.

The holiday will give you breathing space of two to three months in which to get back on your feet.

But lenders are unlikely to offer you a holiday for longer than this.

They will also want to be confident that you'll be able to resume repayments once the holiday ends.

The payments you have missed will still need to be made up at a later stage.

If I take out any of these options, will I have to pay any fees or penalties?

No, lenders understand that if you are facing financial difficulties, the last thing you need is extra fees or penalties.

As a result, you won’t face any charges to change to a plan agreed with your lender.

But you may face penalties if you miss a mortgage payment without contacting your lender.

So be sure to keep them up to date with your circumstances.

Are these options open to everyone?

Lenders want to work with you to help you avoid losing your home.

They will try to find an option that works for you even if you've lost your job, or have a poor credit history.

That said, they'll want to feel confident that you can keep up with your repayments over the longer term.

They won't want you to get so far behind with your payments that you can't catch up with them.

Will it impact my credit score?

Unfortunately, taking out a mortgage payment holiday may impact your credit score.

This is nothing to do with mortgage lenders. Instead, credit reference agencies will spot that you have not made a monthly repayment that you were scheduled to make.

This may make it harder to borrow money over the short term. But there are steps you can take to improve your credit score once you get your finances back on track.

Key takeaways

- First things first, if you’re finding it hard to pay your mortgage, contact your lender. Don’t be afraid, lenders will work with you to find a solution

- Options may include a mortgage holiday, changing to an interest-only loan, or increasing your mortgage term

- If you think you might miss a payment, contact your lender as soon as possible before it happens, as they'll be in a better position to help

How does rising inflation impact the housing market?

Rising inflation tends to lead to higher interest rates which can slow house price growth. Here’s how inflation impacts the property market.

Key takeaways

- Rising inflation tends to lead to slower house price growth

- It can also make it slightly harder to get a mortgage

- There is no reason to delay buying a house if you are confident you could afford higher mortgage rates and living costs

- It can be a good time to sell a house before higher inflation leads to lower activity in the property market

What is rising inflation?

Inflation measures the rate at which the price of key goods and services changes over time.

When inflation is rising, it means these things are becoming more expensive.

For example, if inflation is running at 3%, it means something that cost £1 last year will cost £1.03 this year.

There are several different indexes that measure changes to inflation. The key one for the housing market is the Consumer Prices Index (CPI).

This measures the price changes in a basket of 700 goods and services regularly purchased by consumers.

Why is rising inflation happening right now?

A few different things have combined to lead to rising inflation at the moment.

On the one hand, disruption to global supply chains has led to higher shipping costs. This in turn makes the price of certain goods more expensive.

At the same time, the conflict in Ukraine has led to higher oil and energy prices. Energy prices had already increased significantly during the past year.

These price rises not only impact the cost of heating your home and filling up your car. They also push up the prices of goods that need to be transported or manufactured.

Meanwhile, staff shortages mean some companies have had to increase wages to attract employees.

This cost increase is typically passed on to consumers.

Does rising inflation mean house prices go up or down?

You might expect rising inflation to mean that house prices will also rise, but this isn’t necessarily the case.

That's because houses are not included in the basket of goods used to calculate the CPI.

There is a separate index, known as the CPIH, which catchily stands for 'Consumer Prices Index including owner occupiers' housing costs'. This, as you may have guessed, includes housing costs.

As a general rule, rising inflation tends to lead to slower house price growth.

There are two reasons for this. The first reason is that one of the Bank of England’s tasks is to keep CPI inflation as close to 2% as possible.

If inflation rises above this target, the Bank of England may raise interest rates to try to reduce it.

When interest rates rise, so do mortgage rates. This makes buying a home more expensive.

Secondly, when inflation is rising, people have to spend more of their income on the daily necessities such as food, petrol and heating.

Both of these factors reduce the amount people can afford to spend when purchasing a home.

As a result, house price growth tends to slow when inflation is rising.

The impact is not immediate. And it may take a few months before higher inflation is reflected in lower levels of housing market activity.

Does rising inflation make it harder or easier to get a mortgage?

Rising inflation tends to make it slightly harder to get a mortgage.

That's because lenders want to be sure you'll still be able to afford your monthly repayments in the months ahead.

If the cost of living is increasing, they may worry that you'll have to spend more of your income on things like food and energy. And that would leave you with less money for your mortgage repayments.

Lenders will also be wary that higher inflation will lead to interest rate rises. Higher interest rates will increase the cost of your future mortgage repayments.

Lenders will still be wary even if you are applying for a fixed rate mortgage, which doesn’t move up or down in line with changes to interest rates.

That's because they want to be sure you'll still be able to afford the repayments when your current mortgage ends and you go on to their standard variable rate.

That said, it's important not to panic. Future interest rate rises are already built into lenders’ affordability calculations.

Although lenders tend to be more cautious during periods of rising inflation, it doesn’t mean they will automatically reject lots of potential borrowers.

Is it a good idea to buy a property during times of rising inflation?

The answer to this question depends a lot on your individual circumstances.

Do you have a secure job? Is there enough slack in your budget to afford your mortgage repayments if interest rates rise and living costs increase? If so, there is no reason to delay.

But it might not be a good time to make a big jump up the property ladder if your budget is already tight. Mainly because you might struggle to afford higher mortgage repayments if other costs continue to increase.

If you are currently renting, it's worth bearing in mind that your rent could also go up. In some cases, it is actually cheaper to buy a home than to rent one.

The important thing if you are thinking of moving, is to sit down and do a thorough budget. That way you'll ensure you can still afford your new home if your mortgage and other bills increase.

Is it a good idea to sell a property during times of rising inflation?

With inflation rising, house price growth is likely to slow, so selling now would enable you to lock in the gains you have made.

The higher cost of living is also likely to act as a brake on the property market.

As a result, if you wait to sell your home, it may take you longer to find a buyer.

That said, don’t base your decision purely on what's happening to inflation.

You should also ask yourself if now is the right time for you personally to sell.

And if you're planning on trading up the property ladder, make sure you'll still be able to afford your new mortgage repayments.

What can homeowners do to protect themselves during times of rising inflation?

The most important thing you can do is to review your budget. Make sure you know exactly how much you have going in and out each month.

Next look for any areas where you can reduce spending. These may include cancelling subscriptions you don’t really need, or changing your utility provider.

If you are currently on your lender’s standard variable rate, think about remortgaging to a cheaper deal.

The standard variable rate is the mortgage rate you go on to when your fixed-term deal ends.

But standard variable rates are significantly higher than rates for new mortgage deals.

In fact, they are an average of nearly 2% higher. As a result, remortgaging would save someone with a £200,000 mortgage more than £200 a month.

New fund for 1,200 affordable homes unveiled

The homes are designed to benefit people who would otherwise struggle to afford housing locally and communities will be put in charge of deciding how and where the properties will be built.

Key takeaways

- More than 1,200 new affordable homes are set to be built across England

- Communities will decide where and what type of properties will be built

- They will have access to a £4 million Community Housing Fund to cover costs such as searches, planning applications and design fees

More than 1,200 new affordable homes are set to be built across England as part of a government initiative to put communities in the driving seat.

The Department for Levelling Up, Housing and Communities has unveiled a £4 million Community Housing Fund to help community groups design and build properties in their local area.

The fund will cover costs ranging from searches, planning applications and design fees, to renting a town hall for a public meeting.

Once planning permission has been granted, community groups can apply for funding to build the properties through the government’s Affordable Homes Programme, a Housing Association, a developer or a bank loan.

Housing Minister Stuart Andrew said: “Community led housing is a great way to ensure local housing needs are met by putting local people in the driving seat.

“It is about residents playing a leading and lasting role creating genuinely affordable homes which regenerate and restore pride in communities.”

Why is this happening?

The programme is part of the government’s drive to level up the country through regenerating derelict areas and delivering homes that local people can afford.

The new properties will be part of a locally-based organisation, such as a land trust or housing co-operative, meaning they will stay under the control of the community.

The government also believes that community-led housing helps to improve the design and construction quality of homes, as well as creating opportunities for smaller house builders to work on projects, which in turn boosts the local economy.

Who does it affect?

The fund will be used to deliver 52 housing projects in England from Cornwall to Berwick-upon-Tweed.

They will benefit people who would otherwise struggle to afford housing locally, while ensuring the new properties meet the needs of the community and are in keeping with it.

In Bradford, 62 supported homes are being built for people with autism, learning disabilities or dementia, while in Leeds 34 affordable properties are being constructed to help regenerate a deprived area of the city.

Supply of homes for sale on the up as demand remains strong

More properties come onto the market as homeowners look to make their next move and lock in recent house price gains. Demand for family houses remains strong.

Key takeaways

- The number of homes for sale increased in March but buyer demand remained unseasonably strong

- Now is a great time to sell your home, and if you have a family home to sell, it could get snapped up in record time

- House prices rose by 8.1% in the year to the end of February, making the average price for a home £245,200

- Higher mortgage rates and the rising cost of living are expected to slow the housing market in the coming months

The number of homes listed for sale increased in March as buyer demand remains unseasonably strong.

Estate agents reported a 3.5% rise in the level of stock they have on their books during the past month, according to our latest House Price Index.

The improvement in supply is being driven by existing homeowners looking to make their next move and lock in recent house price gains, with demand for family houses currently twice as high as is usual for this time of year.

Buyer activity is also being driven by the bounce back in demand for city and town centres that's been growing since the beginning of 2022.

Thinking of selling your home? Let us put you in touch with an agent for a free valuation

But despite the increase in listings, there continues to be a mismatch between supply and demand, putting further upward pressure on house prices.

What’s happening to house prices?

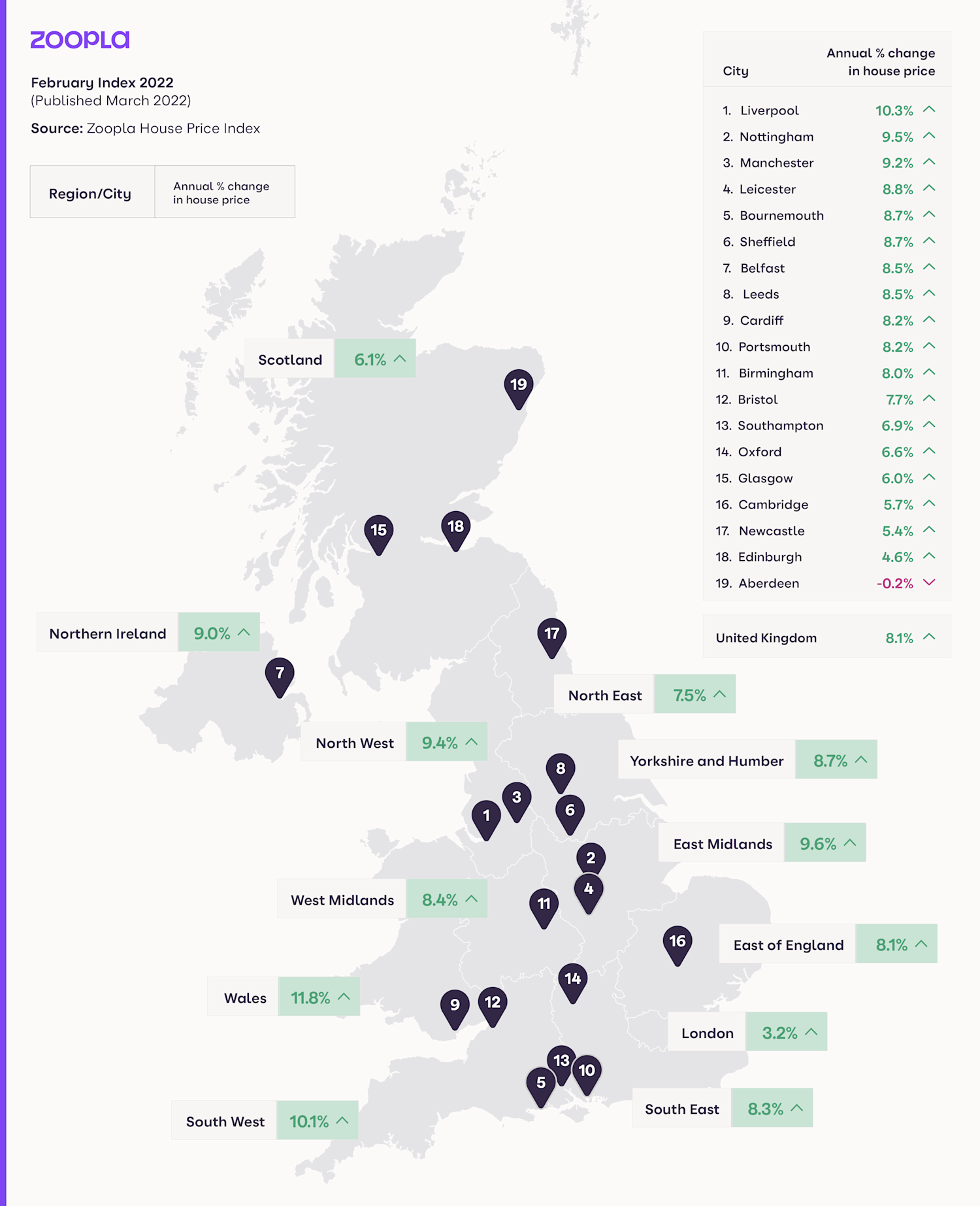

House prices rose by 8.1% in the year to the end of February, nearly double the annual rate of 4.2% recorded in February last year, meaning the average home now costs £245,200.

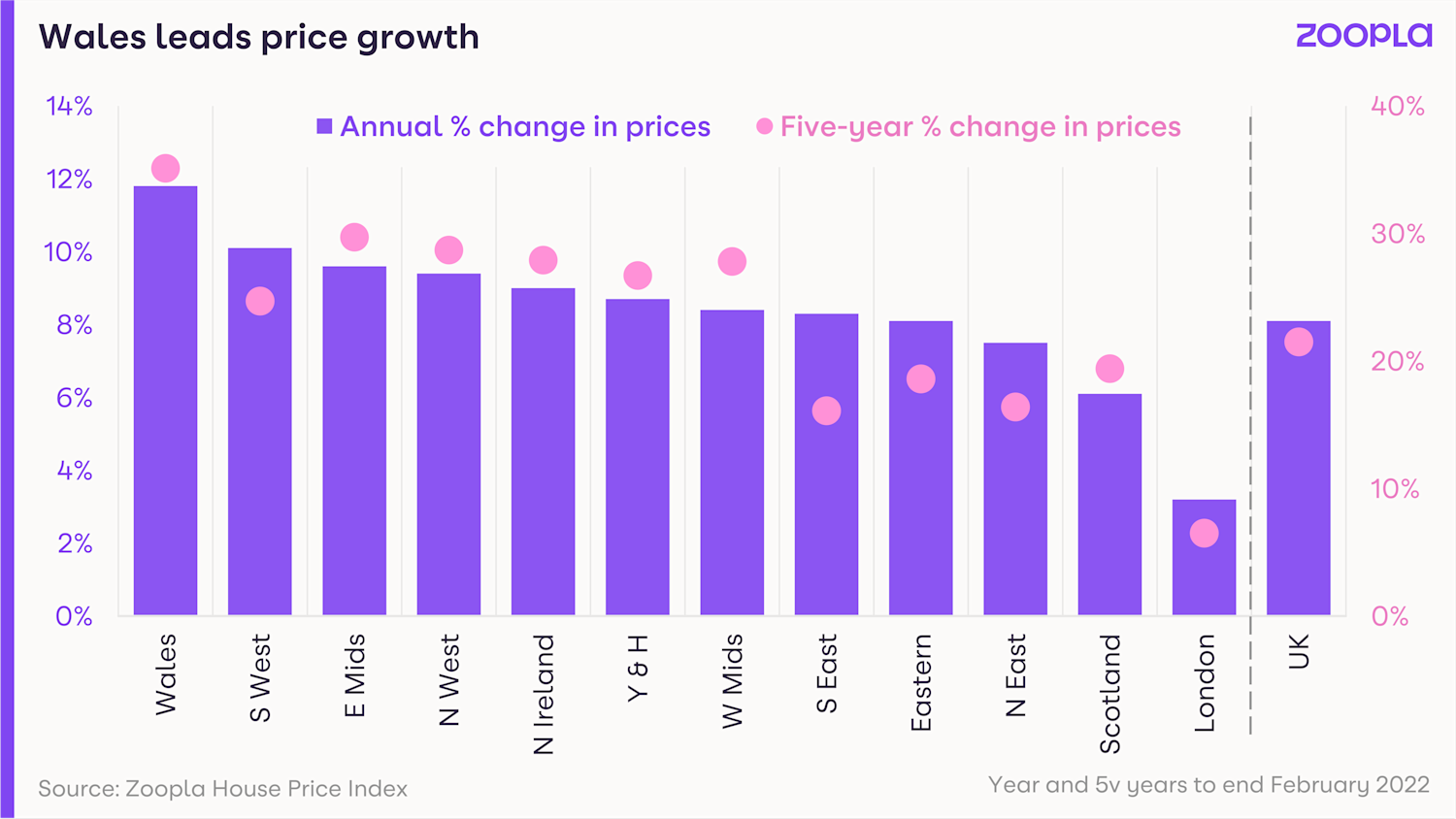

Wales continued to see the highest growth for the 12th consecutive month, with property values rising by 11.8%, followed by the South West at 10.1% and the East Midlands at 9.6%.

London continues to see the slowest growth, with prices rising by 3.2% during the past year, although gains in individual boroughs ranged from 6.8% in Bromley, to no change in the City of London.

Wales has also seen the strongest price growth during the past five years, with property values rising by 35%, compared with gains of just 6.5% in London.

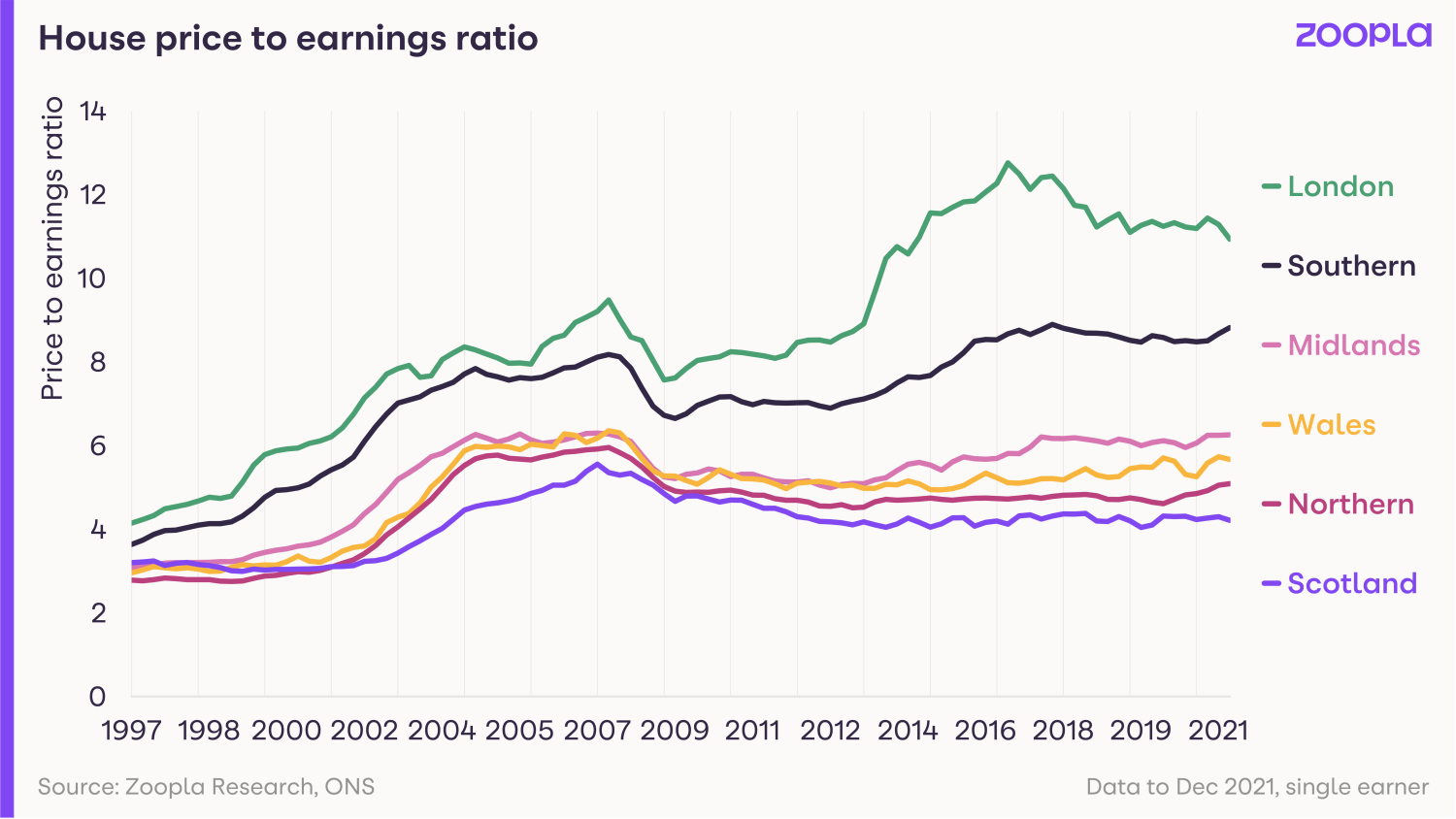

Affordability has played a big role in house price increases during this period, with growth strongest in areas where homes remain most affordable.

How busy is the market?

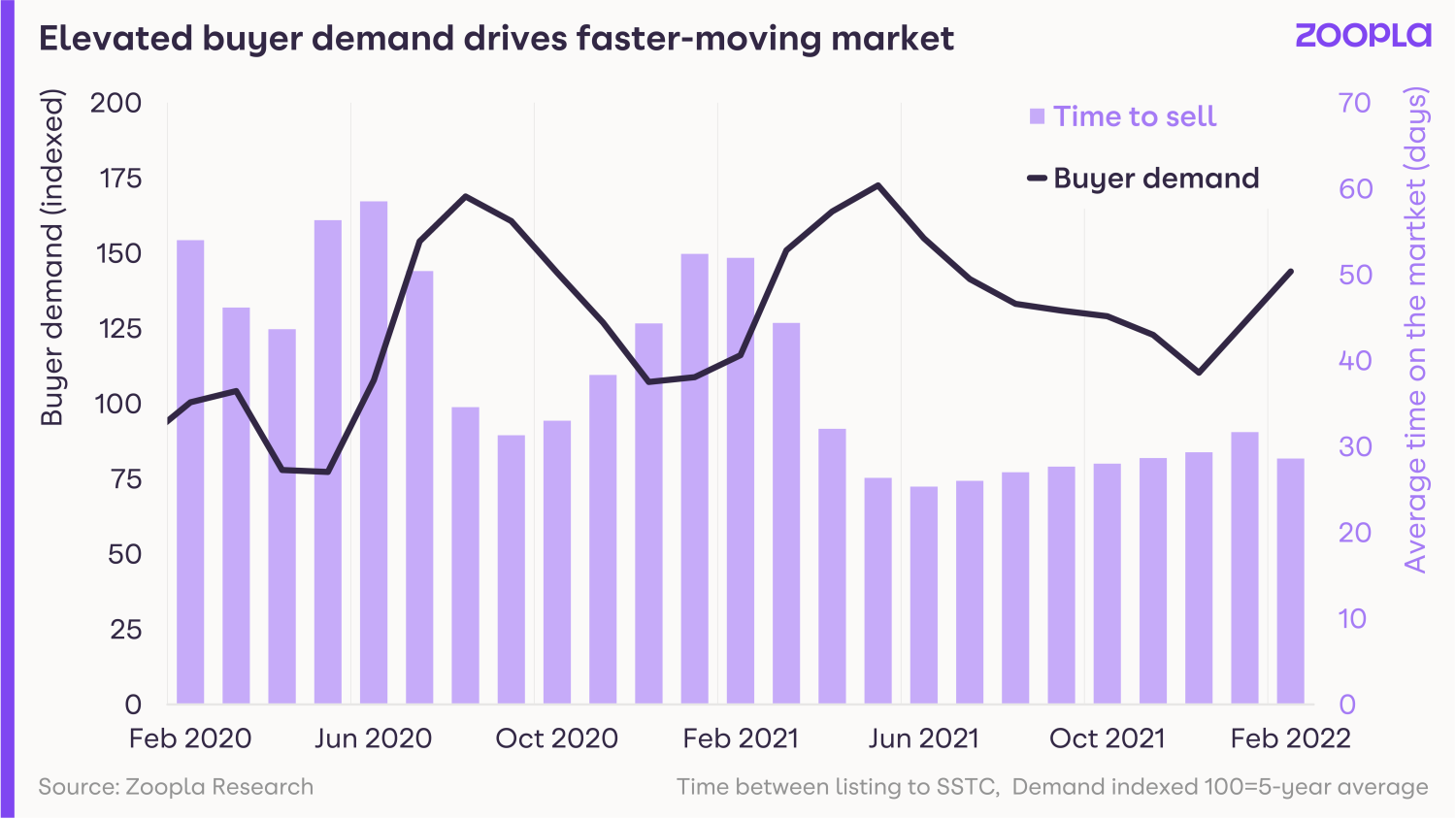

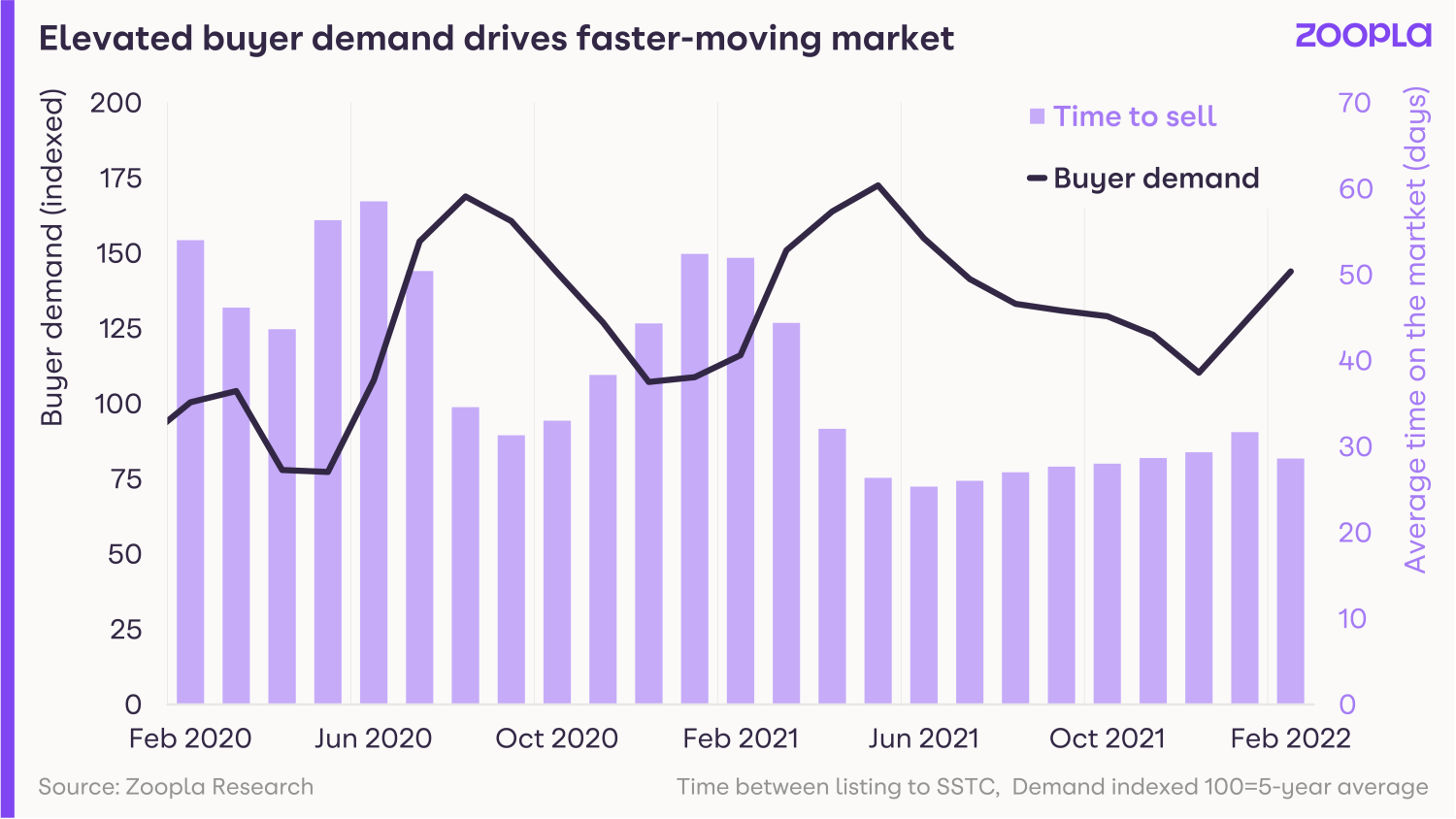

Buyer demand remains unseasonably high across the UK at 65% above the five-year average, but it has eased since January.

Even so, the number of sales agreed during the first three months of the year was 38% higher than in the same period of 2020.

In London, more sales were agreed in the first part of the year than in the same period of 2021, despite the elevated levels of activity in that period due to the stamp duty holiday.

There has also been a rise in buyer interest in other city centres, with demand up 7% in Newcastle in recent weeks, while it is 5% higher in Birmingham.

The increase is even more marked in smaller urban centres, with the number of buyers soaring by 20% in Blackpool, and 19% in Swindon.

Meanwhile, improvements in supply continued to ease, with the number of properties coming on to the market 5% higher than the five-year average.

This trend is expected to continue in the coming months, as recent strong price growth and high buyer demand triggers more homeowners to make a move.

Despite the improvements, the number of homes listed for sale is still 42% below the five-year average, although this is an improvement on December, when stock levels were 47% down on the five-year norm.

As a result, the market continues to be fast moving, with properties taking an average of just 29 days to sell.

What could this mean for you?

First-time buyers

With more homes coming on to the market as people look to trade up the property ladder, the choice for first-time buyers has improved.

But the market remains fast paced, with homes selling quickly.

As a result, if you see something you like, you need to be prepared to move fast, so try to get a mortgage offer in principle before you start house hunting.

The pace of the market is expected to ease in the months ahead.

Home-movers

If you are an existing homeowner thinking of moving, you have a window of opportunity in which to sell your property.

Demand from potential buyers is currently high across all property types, but particularly family homes, with twice as many people currently looking to purchase a three-bedroom home as this time last year.

As a result, you are in pole position to sell, while the rise in the number of homes coming on to the market means you will have more choice for your next home.

But don’t delay listing your property for too long, as the market is expected to start slowing soon.

What’s the outlook?

The housing market is expected to slow in the coming months as higher mortgage rates and the rising cost of living, as well as the uncertainty caused by the situation in Ukraine, acts as a brake on activity.

But the shortage of homes for sale will prevent prices from falling.

Head of research at said: “Buyer demand remains elevated as the trends that emerged during the pandemic - a reassessment among households about where and how they are living - continue to drive the market.

“High buyer demand and rising supply signal activity levels will remain elevated in the short term.

“As we move into the second half of the year, economic headwinds, including the rising cost of living and rising mortgage rates will act as a brake on price growth, with annual value rises returning to more sustainable levels.”

Is now a good time to remortgage?

With interest rates rising four times in the last three months, and further rises expected later this year, could now be a good time to remortgage?

Key takeaways

- If you're on a standard variable rate or tracker mortgage, now could be a good time to look into a low-interest, fixed-rate mortgage

- 74% of the UK population are currently on fixed-rate mortgages, and if the interest rate is low, you're in a good position and there's no need to remortgage if your deal isn't ending any time soon

- Be aware that if your deal is about to come to an end, you're likely to go onto your lender's standard variable rate - and with interest rates rising, this will be a lot more expensive

- There are still plenty of fixed-rate mortgages available for under 2% interest. We'll show you where to find them

The Bank of England has raised interest rates four times in the last three months.

The latest rise, from 0.5% to 0.75%, means rates are at their highest level since March 2020.

The change will add around £42 a month to repayments for someone with a £200,000 mortgage.

A combination of rising inflation and the war in the Ukraine disrupting global supply chains for food and energy has led to a rise in prices.

The increase in interest rates by the Bank is an attempt to try and reduce that inflation and calm the cost of living.

How do rising interest rates affect the cost of mortgages?

Higher interest rates make borrowing more expensive.

During the pandemic, the Bank of England slashed the Base Rate to an all-time low of 0.1%.

The Base Rate impacts all other interest rates. When it’s low, it costs you less to borrow money, but it also means you make less money in interest on your savings.

When the Base Rate is higher, interest rates on mortgages tend to be higher too.

Higher interest rates on fixed-rate mortgages means that it will cost you more to repay the mortgage in the long term.

That said, if you are already on a fixed-rate mortgage, as 74% of the UK population currently are, your payments will continue to stay the same, despite the rise in the Base Rate.

Variable rate and tracker mortgages tend to follow the Base Rate more closely, so will rise and fall as the Base Rate increases and decreases.

Do you lose money when you remortgage?

Most people remortgage to get a cheaper rate and pay less money on their mortgage as a result.

As long as you are at the end of your mortgage agreement or ‘term’, then you shouldn’t need to pay any exit fees or early redemption penalties.

If you aren’t, be aware that the cost of leaving your current mortgage could run into thousands, so it’s well worth checking first.

In addition, you will often pay fees when securing a new mortgage. They include:

| New mortgage fees | Cost |

|---|---|

| Mortgage arrangement fee | £0 to £2,000 |

| Mortgage booking fee | £99 - £200 |

| Valuation fee | £250 - £1500 |

| Mortgage account fee | £100 - £300 |

moneyhelper.org.uk

However, if you’re moving to a deal with a lower interest rate, you could save yourself hundreds of pounds each month.

And at a time when interest rates are rising, it's best not to go onto your lender's standard variable rate when your mortgage deal ends.

Is it worth remortgaging early?

The best time to start looking at other mortgages is around four to six months before your current mortgage deal ends.

Most lenders will allow you to lock in a deal with them between three to six months in advance.

So if you’re tied into your current mortgage for another three to six months, you can ‘book’ a deal to start in three to six months' time, at the rate it’s currently being offered by the lender.

That said, if you later find a deal with a lower interest rate, you may have to pay a second lot of fees to secure it.

It can be a good idea to use a broker to ensure you get the best deal for you, as they’ll know the mortgage market inside and out and can often get the best deals.

Should you remortgage now?

The Bank of England’s chief economist has warned that further interest rate rises might be needed to curb inflation.

Some experts are predicting that the Bank Rate could increase to 1.25% by the end of 2022.

Should I remortgage if I’m on a fixed-rate deal?

If you’re on a fixed-rate deal set at a low interest rate, you’re in a great position right now and there’s no need to look to remortgage.

However, if your deal is about to come to an end, you're likely to go onto your lender's standard variable rate - and with interest rates getting higher, this will be a lot more expensive.

So it's worth shopping around now for another low-interest fixed-rate deal before interest rates go up again.

Should I remortgage if I’m on a standard variable rate or tracker deal?

If you’re on a standard variable rate or tracker deal, your mortgage payments are likely to continue increasing this year.

Now could be a good time to secure a fixed-rate deal at a lower interest rate to protect yourself against this.

With fixed-rate mortgages, you’ll know what your outgoings are going to be every month, and that’s a good thing in a time of economic uncertainty.