What the Spring Statement means for homeowners and renters

From tax cuts for green home improvements to reduced fuel duty, here’s how the Spring Statement will affect homeowners and renters this year.

Chancellor Rishi Sunak’s Spring Statement 2022 contained few measures that will impact the housing market directly.

But with households feeling the squeeze from the rising cost of living and higher interest rates, the concessions that were announced will be welcomed by homeowners and renters alike.

Even so, there were few big giveaways, and with people’s budgets remaining under pressure, activity in the housing market is likely to slow, while demand for rental homes could increase.

Here’s a rundown of the main announcements from the Spring Statement.

Going green gets cheaper

One of the few measures announced by the Chancellor that has a direct impact on property was the news that VAT will be scrapped on energy-saving technology, such as solar panels, heat pumps, insulation and wind turbines.

The move will reduce the cost of purchasing these devices by 5%. As a result, the Chancellor estimates that someone installing solar panels will save £1,000, while their energy bills will be reduced by £300 a year.

Increase to National Insurance threshold

With households already facing rising energy, food and petrol bills, many had been dreading the rise in National Insurance contributions from 12% to 13.25% in April.

While Sunak has not reversed the increase in the rate, he has offset it for some by increasing the threshold at which contributions start, raising it from £9,880 to £12,570 from July.

The move means 70% of people will pay less National Insurance than they do now, with Sunak estimating the typical employee will be £330 a year better off.

However, those earning more than £40,000 a year will be worse off, with those earning £50,000 annually paying just over £100 a year more than they do now.

In a further sweetener, the Chancellor announced plans to cut the basic rate of income tax from 20% to 19% in 2024, but that is still two years off.

Winners: homeowners and renters earning less than £40,000

Fuel duty cut

The announcement that fuel duty will be cut by 5p was welcome news for struggling motorists reeling from record prices at the pumps.

Even so, the concession only partially offsets the increase to petrol and diesel prices seen since the start of the Ukraine crisis.

The move will save the average motorist just £100 a year, or £8 a month, according to the Chancellor.

While the fuel duty cut will help homeowners and renters, particularly those in rural areas who do not have the option of using public transport, it isn’t much to get excited about.

Winners: homeowners and renters who own vehicles

Changes to student loan repayments

This was not part of the Spring Statement, but documents accompanying it showed that future changes to student loan repayments will save the Treasury a notional £11.2 billion in the coming tax year, due to the way student loans appear in government accounts.

Under the changes, students in England starting university in 2023 will have to begin repaying their student loan when their income reaches £25,000 a year, rather than £27,295 currently.

The term over which they have to repay the debt before it is written off will also increase from 30 years to 40 years, although the rate of interest they have to pay will be reduced.

The move will mean that unlike under the current system where only a quarter of students are expected to repay their student loan in full, 70% are likely to do so under the new one.

The move is expected to save the government an average of £6,200 for every student who has taken out a loan, according to the Institute for Fiscal Studies.

Losers: those with student debts who would not previously have reached the repayment threshold or repaid their loans within 30 years, likely first-time buyers

Rising cost of living

Despite the concessions unveiled, there was no significant help for households with the rising cost of living.

For example, there were no additional increases to the Universal Credit or basic state pension to take account of the high rate of inflation.

Instead figures from the Office of Budgetary Responsibility (OBR), which accompanied the Spring Statement, suggest the situation is likely to get worse.

It predicts inflation – the rate at which the cost of living is rising – will average 7.4% this year and peak at 8.7%. It is currently running at a 30-year high of 6.2%.

The OBR warned that real household disposable income is set to drop by 2.2% per person in the coming year, the biggest fall since records began.

Impact on the housing market

While measures to reduce the impact of a hike in National Insurance contributions and the fuel duty cuts are welcome, in reality, the savings for consumers are small and are likely to do little to offset the rising cost of living people are now facing.

Richard Donnell, executive director at Zoopla, thinks the rising cost of living will impact the rental market by causing people to stay where they are and delay getting on the housing ladder.

He said: “Those most affected by higher energy and household bills may choose to stay put in their existing rental home, as the demand for rental property has led average rents for new lets to rise around 8% on the year.

“At the same time, the rising cost of mortgages could mean that more renters put off their first step onto the housing ladder, staying in the rental sector for longer.

“All of this will increase demand for rental properties, while the supply of homes for rent is constrained, underlining the importance of policies to support the provision of rental homes at every level of affordability.”

Meanwhile, pressure on homeowners’ budgets could also deter people from trading up the property ladder.

While the housing market started the year on a strong footing, demand is expected to cool in the face of economic headwinds, leading to slower price growth.

Interest rates rise again

Nearly two million homeowners will see their mortgage repayments increase after the Bank Rate was hiked for the third time in four months.

Key takeaways

- The Bank of England has increased interest rates for the third time in four months

- The Bank Rate has risen from 0.5% to 0.75%

- The change will add around £42 a month to repayments for someone with a £200,000 mortgage

The Bank of England has increased interest rates for the third time in four months as the cost of living continues to rise.

Its Monetary Policy Committee increased the Bank Rate from 0.5% to 0.75%, the highest level since February 2020.

It was the first time it has increased the official cost of borrowing in three consecutive meetings since 1997.

The move means around two million homeowners with variable rate mortgages will see their monthly repayments rise.

The change will add around £42 a month to repayments for someone with a £200,000 mortgage.

The latest increase heaps further pressure on homeowners, who are already suffering from steep increases in food, petrol and energy prices, while they will also have to pay higher National Insurance contributions from April.

Why is this happening?

Inflation, which measures increases to the cost of living, remains stubbornly high.

Consumer Prices Inflation – the key measure - is currently running at 5.5%, the highest level for 30 years, and the situation looks set to get worse with the war in Ukraine putting further pressure on the price of petrol, food and energy.

The Bank’s Monetary Policy Committee uses changes to interest rates as a way to control inflation.

But with inflation currently running significantly above its 2% target, there are likely to be further interest rate rises to come.

What does it mean for me?

You will only be impacted by the change in interest rates if you are on a variable rate mortgage, such as a tracker deal or your lender’s standard variable rate.

These mortgages move up and down in line with changes to the Bank Rate.

Around 850,000 people currently have a tracker mortgage, with a further 1.1 million on a standard variable rate one.

If you have a £200,000 variable rate mortgage, your monthly repayments will go up by around £42 a month as a result of the latest change, meaning your payments will cost an extra £108 a month as a result of the three interest rate rises seen since December.

Nearly three-quarters of homeowners with a mortgage are on fixed rate deals, and they will not see any change in their payments.

With a fixed rate mortgage, payments stay the same for the length of the deal, which is usually two or five years.

What should I do now?

If you have a fixed rate mortgage, you don’t need to do anything, as you will not be impacted by the change.

If you are currently on your lender’s standard variable rate, you should think about remortgaging on to a more competitive deal.

The average standard variable rate is currently 1.96% higher than the average two-year fixed rate deal. The difference in rates would cost you around £330 a month or nearly £4,000 a year if you have a £200,000 mortgage.

If you are on a tracker deal and want to protect yourself from further interest rate rises, you may want to consider moving to a fixed rate one.

But it is worth noting that the average interest rate charged on a two-year tracker mortgage is currently 2.03%, compared with 2.65% for a two-year fixed rate deal and 2.88% for a five-year fixed rate one.

If you have a tracker mortgage it is also important to check that you would not have to pay any earlier redemption penalties if you switch to a different mortgage before your term is up.

If you do decide to remortgage, you should be prepared to move fast.

Lenders withdrew a total of 518 deals during the past month, the biggest drop in mortgage availability since May 2020, during the early stages of the Covid-19 pandemic.

The average time for which different mortgage deals are available has also dived in the past month, dropping from 42 days to just 28 days, as lenders review and reprice their ranges.

But there is still plenty of choice, with more than 4,800 different deals to choose from.

If you think you may struggle to keep up with your mortgage repayments following the run of interest rate rises, it is important to contact your lender as soon as possible.

There are a number of steps lenders can take to help you, including granting you a temporary payment holiday or putting you on to an interest-only mortgage for a short time.

But options become much more limited if you have already missed a payment.

House price growth shows signs of slowing as supply increases

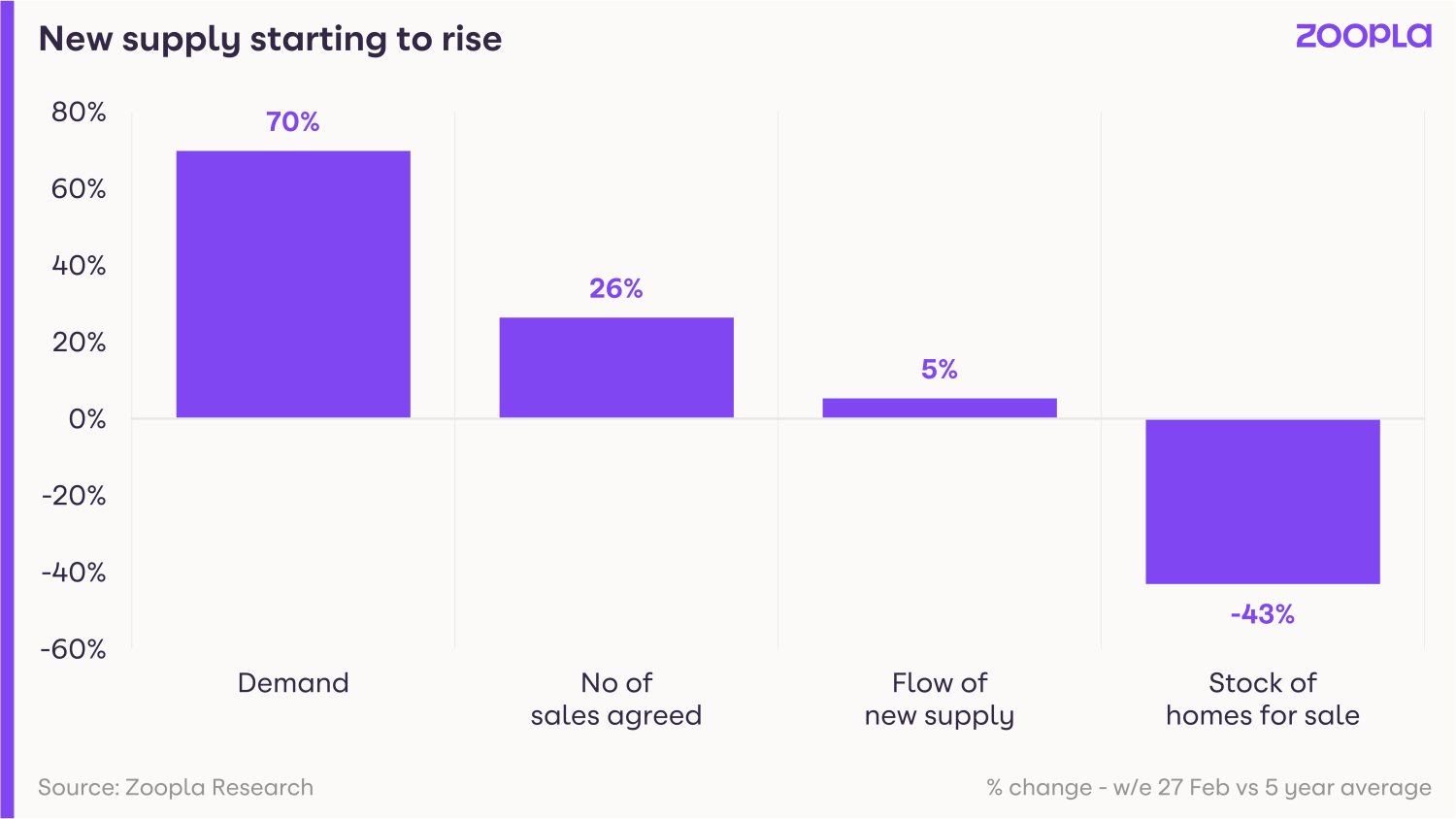

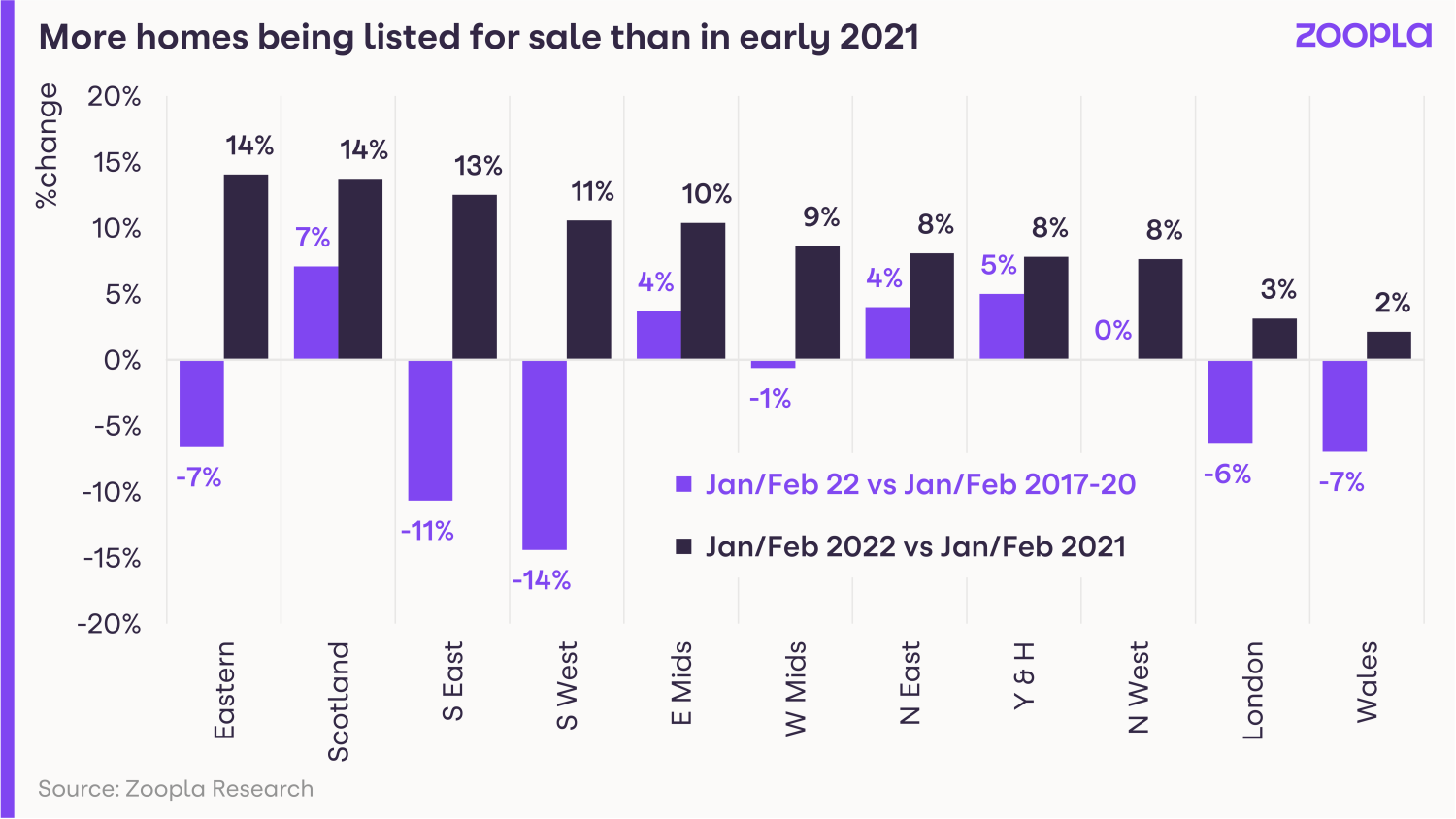

New home listings were 5% higher in January than the previous five-year average, as the flow of supply starts to increase.

The shortage of homes for sale showed signs of easing during January, while house price growth showed signs of slowing.

New listings were 5% higher than the five-year average during the month, signalling the start of a recovery in supply.

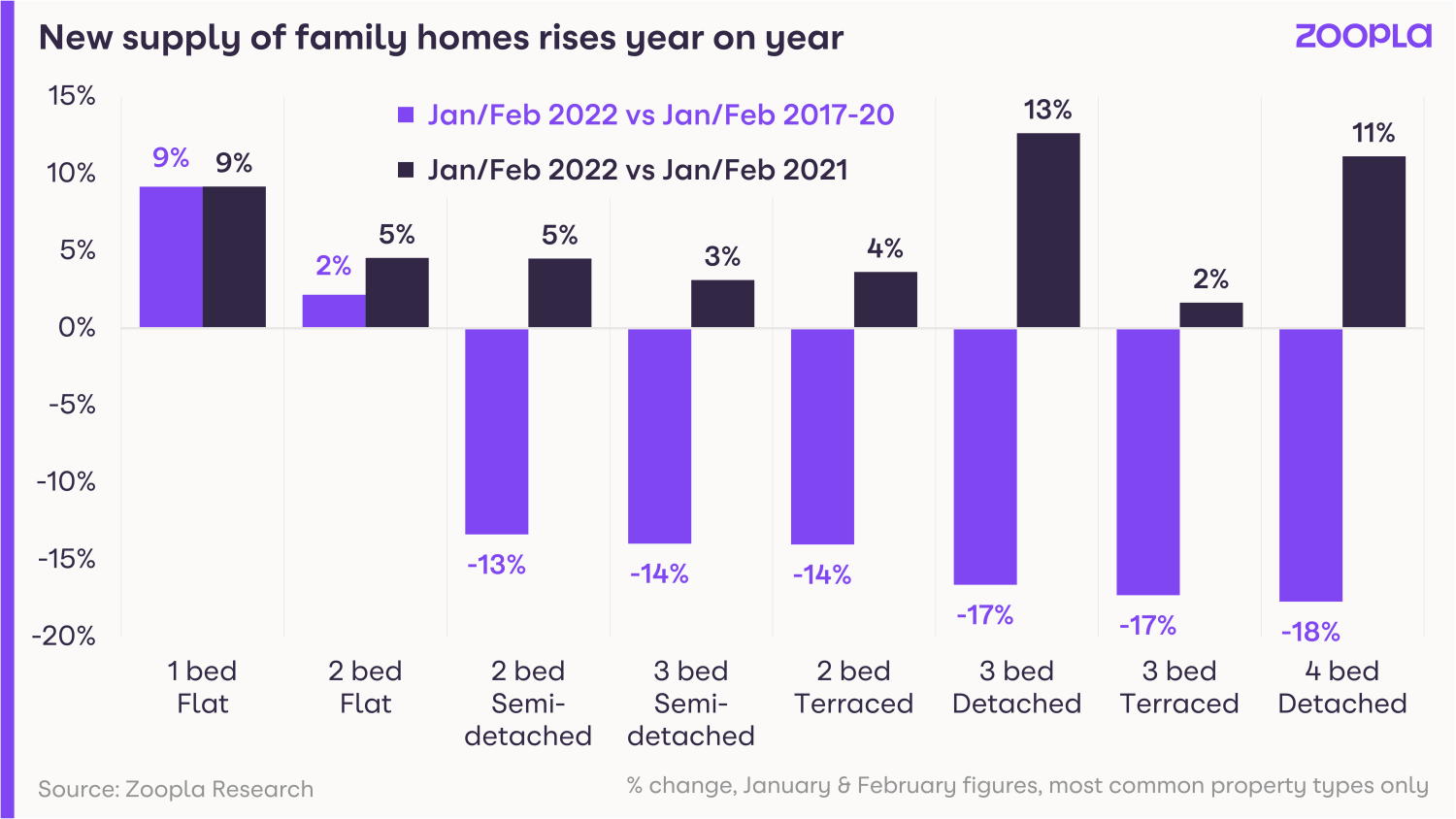

The increase in homes coming on to the market was seen across all property types, including much in demand three and four-bedroom detached family homes, according to our latest House Price Index.

But despite the rise, demand continues to outpace supply, putting further upward pressure on house prices, although that rate of increase is starting to slow.

The average UK home now costs £244,100, after increasing by around £80,000 during the past decade.

What’s happening to house prices?

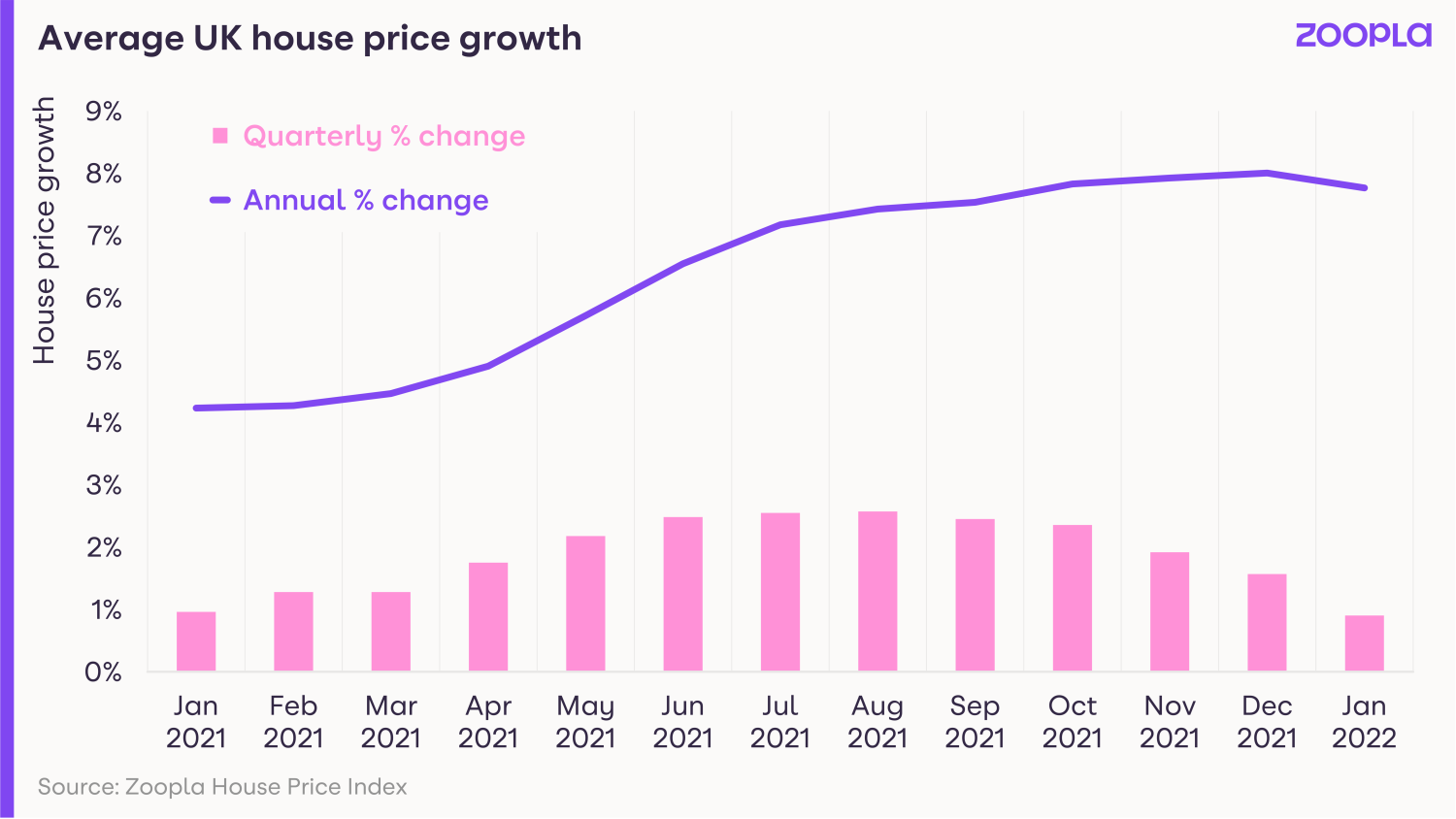

House prices rose by 7.8% in the year to the end of January.

But there are signs that the rate of growth is slowing, with property values edging ahead by just 0.9% in the past three months, the slowest growth since August 2020.

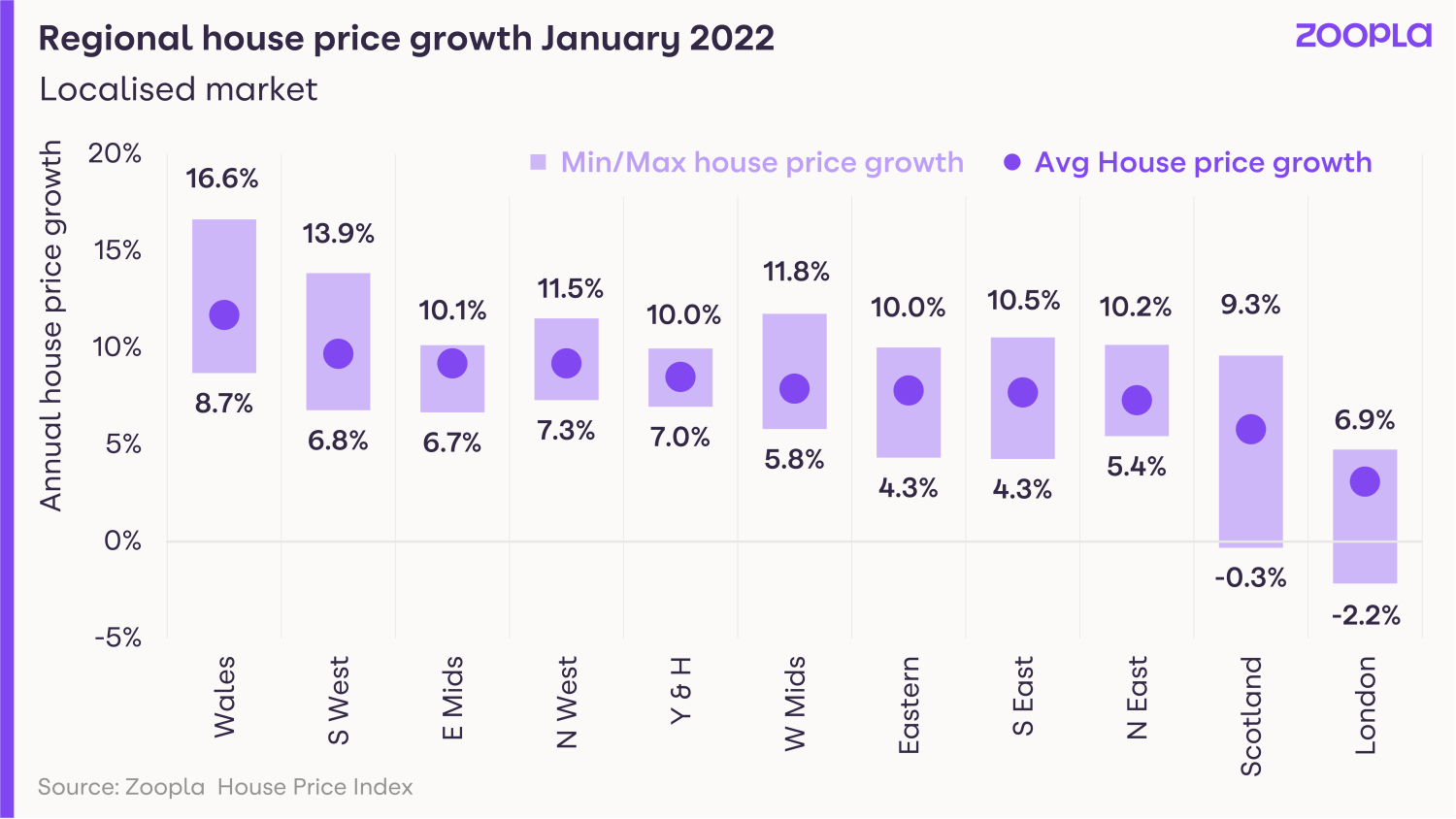

There also continues to be significant variation in price growth by both region and property type.

Wales saw the highest increases for the 11th consecutive month, with property values rising by 11.7% in the past year, followed by the South West at 9.7% and the North West and East Midlands, both at 9.2%.

London continued to lag behind other regions, with the average cost of a property rising by just 3.1% during the same period.

On a more localised level, house price growth ranged from an increase of 16.6% in Powys in Wales, to a fall of 2.2% in the City of London.

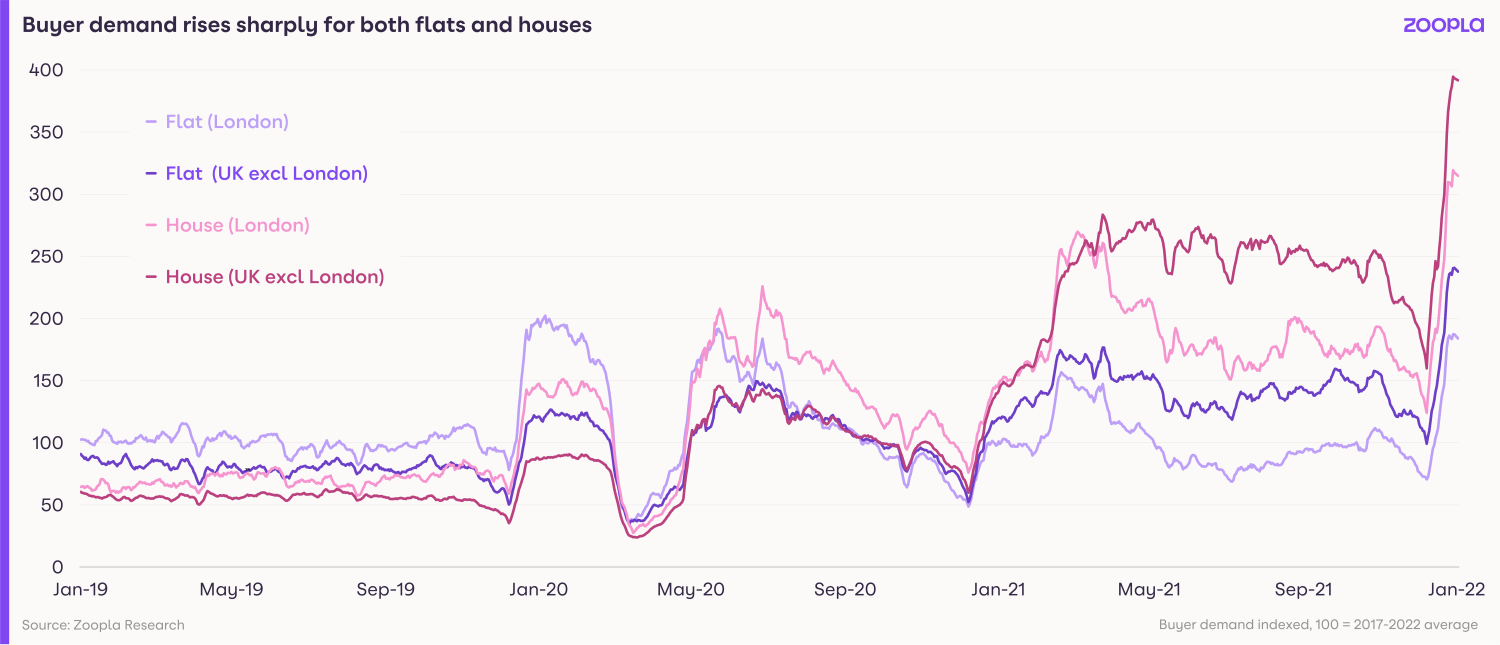

Meanwhile, price rises for houses continued to significantly outstrip that of flats, with the average cost of a semi-detached home rising by 9.1% in the year to the end of January, compared with a gain of just 2.6% for flats.

How busy is the market?

Near record demand for properties has continued, with 2022 seeing the busiest January and February since 2016, while the number of sales agreed matched those seen at the start of 2021.

But the increase in supply is suggesting the market is starting to move back towards more normal conditions.

In fact, new supply is now above pre-pandemic levels for this time of year in Scotland, the East Midlands, the North East and Yorkshire, while it matches it in the North West and West Midlands.

Despite this improvement, there continues to be a significant mismatch between supply and demand, with the number of buyers looking to purchase a property in late February 70% above the five-year average, while the total number of homes for sale was 43% below it.

The net result is a very fast-moving market, with half of all homes that were sold snapped up within just three weeks, compared with a third of properties during the same period of 2021.

Family homes are in particularly high demand, with three-bedroom properties outside of London typically taking just 23 days to sell - half the time two-bedroom flats in London take to go under offer.

What could this mean for you?

First-time buyers

If you are a first-time buyer, it may be worth looking to purchase a flat rather than a house.

Flats not only represent better value at the moment, having seen significantly slower price growth during the past year compared with houses, but they are also less in demand, meaning you do not have to move quite as quickly to snap one up.

Going forward, the current increase in supply could mean more first-time buyer properties will be coming on to the market in the coming months.

The reason for this is a lack of choice has previously been holding people back from trading up the housing ladder.

As more homes are listed for sale, this issue will ease, and as people find a property they want to buy, they will in turn list their existing home for sale.

Home-movers

The increase in homes coming on to the market is great news for anyone looking to trade up the property ladder, with the number of three and four-bedroom homes listed for sale now 10% higher than a year ago.

But supply continues to remain tight, and there is still a shortfall in new listings for terraced, semi-detached and detached homes compared with longer-term norms.

As a result, the market for these properties is moving extremely quickly, so you will need to be prepared to move first.

The good news is that with demand continuing to outstrip supply, you are likely to be able to sell your existing home quickly.

What’s the outlook?

The increase in supply is likely to continue going forward, as the improved level of choice encourages more people to put their home on the market.

Grainne Gilmore, head of research at Zoopla, says: “The sheer level of activity in the market in recent years eroded the stock of homes for sale. But the data indicates that more homes are now coming to the market, as movers and other owners list their properties - and this will create more choice for the many buyers active in the market.

“However, the imbalance between high demand and supply will take much longer to unwind, and this imbalance will continue to underpin pricing in the coming year.”

Even so, the rate at which house prices are rising is expected to ease during 2022 due to economic headwinds, including increases to mortgage rates and the rising cost of living.

As a result, property values across the UK are expected to end the year an average of 3.5% higher than they started it.

Key takeaways

- The number of properties put up for sale were 5% higher in January than the five-year average

- House prices rose by 7.8% in the year to the end of January, but the rate of house price growth may be easing

- The mismatch between supply and demand continues

Changing Rooms! Nearly 9 million bedrooms lost in the UK

More than four in ten British homeowners transformed their spare bedrooms into offices, gyms, cinemas and more throughout the pandemic. Here's what they did.

Nearly 9 million bedrooms were lost to home offices, gyms, cinemas and even bars during the pandemic, as the UK adapted to the new normal.

How have our homes changed?

We surveyed homeowners across the UK to understand how the nation’s room requirements shifted - and how our homes changed as a result.

Among those who changed their homes, more than half (53%) said they completely repurposed at least one bedroom, while one in five households (22%) said they changed multiple bedrooms.

Nationally, this equates to a whopping 8,856,000 bedrooms that have been ‘lost’ amongst the UK’s 24m privately owned homes during the pandemic.

With remote and hybrid working now set to be a mainstay for many, almost half (46%) of those who have made changes have created a home office.

That means more than 4.5m new home offices have emerged across the UK. And over half of homeowners (58%) say they plan to permanently keep them.

Alongside home offices, there are plenty of other ways Brits have reincarnated rooms in their homes since March 2020. Across the UK:

- 1.3m home gyms have been created

- 984,000 home bars

- 900,000 home cinemas or music rooms

- 688,800 dedicated classrooms

The cost of reincarnation

Repurposing entire rooms doesn’t come cheap.

Our research shows that UK homeowners who adapted their homes spent an average of £3,714, with home offices costing on average £1,735, gyms £1,568 and home cinemas £3,841.

Nationally, this is a total of £36.5 billion.

Home offices: who should pay for them?

Home offices in particular have been one of the more contentious room changes, with many being forced to give up living space in order to simply carry out their jobs.

In fact, 16% of homeowners who created one say they resent giving up space in their home for the benefit of their employer.

Nearly seven in ten (67%) believe that employers should pay all or some of the cost of setting up a home office, with 12% thinking that they should even offer compensation for the space lost.

However, the reality is that just 2% of those who set up home offices say that their employer offered compensation, and only 30% say they made any contributions towards costs at all.

Just 10% covered the full costs.

An unhappy compromise?

For those who have had to repurpose rooms, more than half (55%) say this has meant they have had to compromise on their space at home, leaving homeowners less happy with the space they have.

Amongst those who have, 28% say they now have less space for guests to stay, 21% say they have less or no privacy and 11% state that their children now have to share a bedroom.

However, this feeling of not being completely happy with your home rises significantly amongst younger homeowners, who are likely to have smaller properties.

More than eight in ten (83%) homeowners under 25 say they are currently having to compromise with their living spaces.

For many, having to change their home setup during the pandemic has highlighted the need to find somewhere new and better suited to their changed needs.

Of homeowners who have made changes, nearly a third (32%) say that this has made them consider moving home.

Nick Neill, Managing Director at EweMove Sales & Lettings says: 'Although many believe that their employer should contribute to the cost of setting up a home office, it's important to consider other factors, such as reduced commuter costs and the ability to use the time spent commuting on personal endeavours, such as benefitting from a converted gym.

'The rise of open plan living also means that it can be tricky to find space to set up a home office, but it really does present a more flexible property for buyers to consider purchasing if you do decide to sell in the future.

'It's also worth considering a garden office - which could be anything from a glorified shed to a swanky purpose-built luxury cabin.

'Not only can it enable a better work/life balance and space to work outside of the family home, but it will definitely add value to your property and not take it away, which could be the case if you convert a bedroom.'

Key takeaways

- During the pandemic, 41% of British homeowners adapted their home to suit their changing needs, sacrificing around 8.8m bedrooms in the process

- In their place nearly five million new home offices have been created, alongside over one million home gyms

- The average household spent £3,714 adapting their home during the pandemic - that’s a national total of approximately £36.5 billion

- Nearly 7 in 10 think employers should contribute to the cost of home offices, but only 30% have

Average rents hit nearly £1,000 per month

The rate at which rents are rising is at a 13-year high, while demand soared by 76% in the New Year. Get the latest with our Rental Market Report.

The average cost of renting a home is close to £1,000 a month, as soaring demand pushes prices higher.

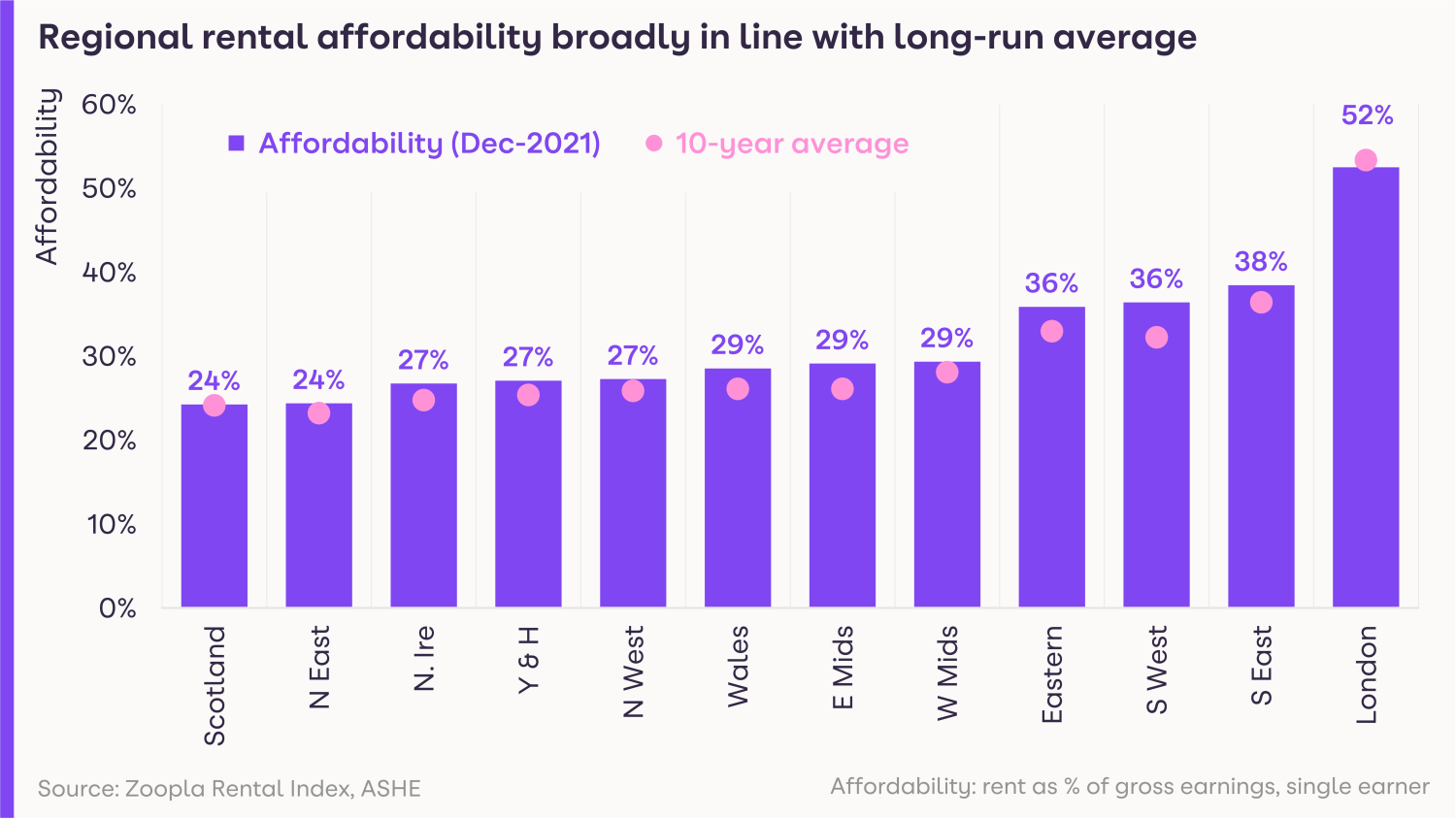

But despite the jump in the cost, rents account for an average of 37% of a single earner’s pay before tax, which is broadly in line with the 10-year average of 36%.

Renters are now paying £969 per month across the UK.

That's £62 a month more than at the beginning of the pandemic, according to our latest Rental Market Report.

What’s happening to rents?

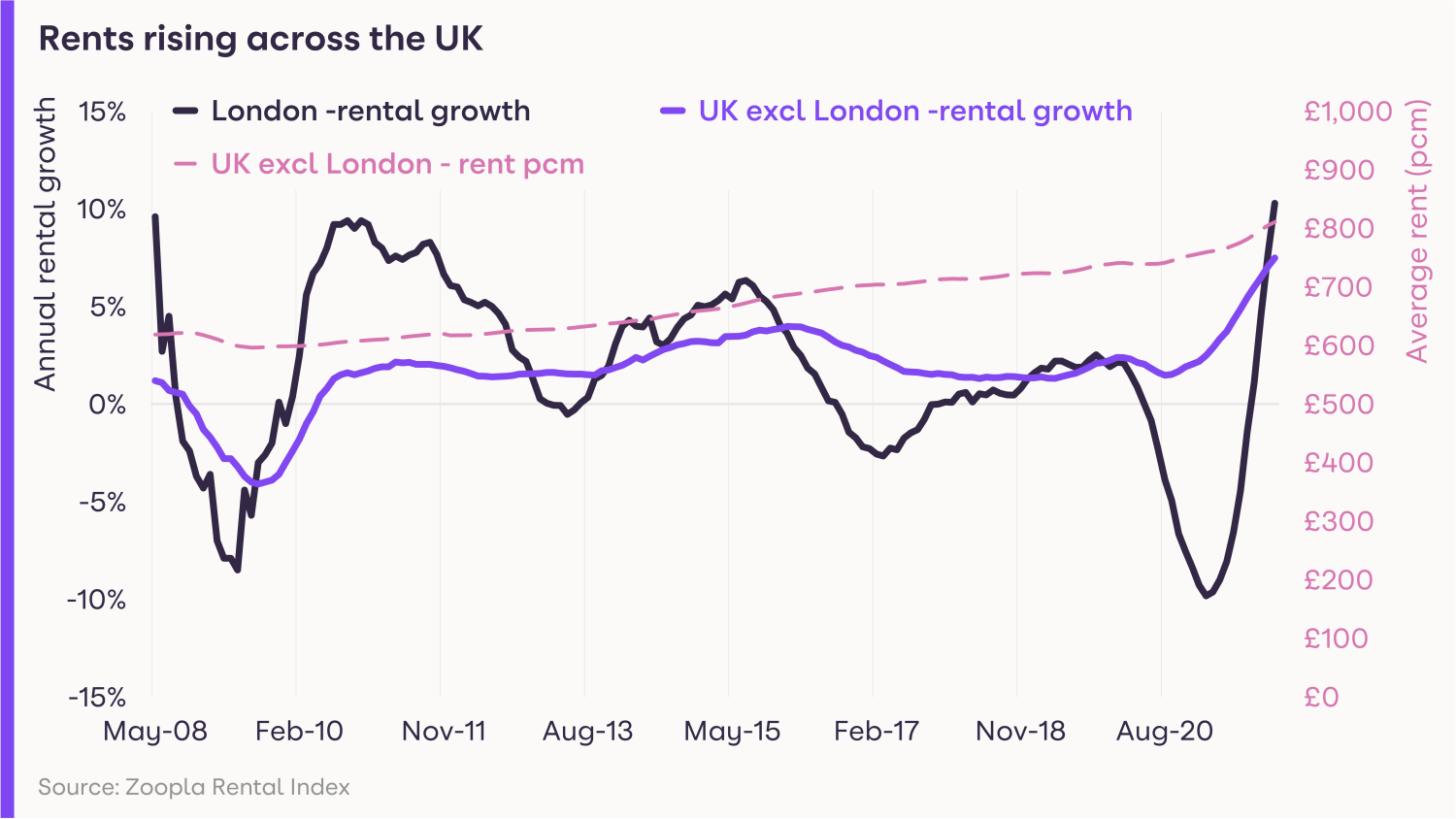

The rate at which rents are rising reached a 13-year high of 8.3% in the final three months of 2021.

The average annual rent for those agreeing a new let is now £744 higher than pre-pandemic levels.

Even so, rents are only 12% higher than they were five years ago, after they fell in some areas during the early stages of the pandemic.

Rents have risen in every region of the UK during the past year, with London seeing the strongest growth of 10.3%, while increases were weakest in Scotland at 4.8%.

However, because rents fell in the capital during the pandemic, they are now only £18 a month more than they were in March 2020.

What’s demand for rental homes like?

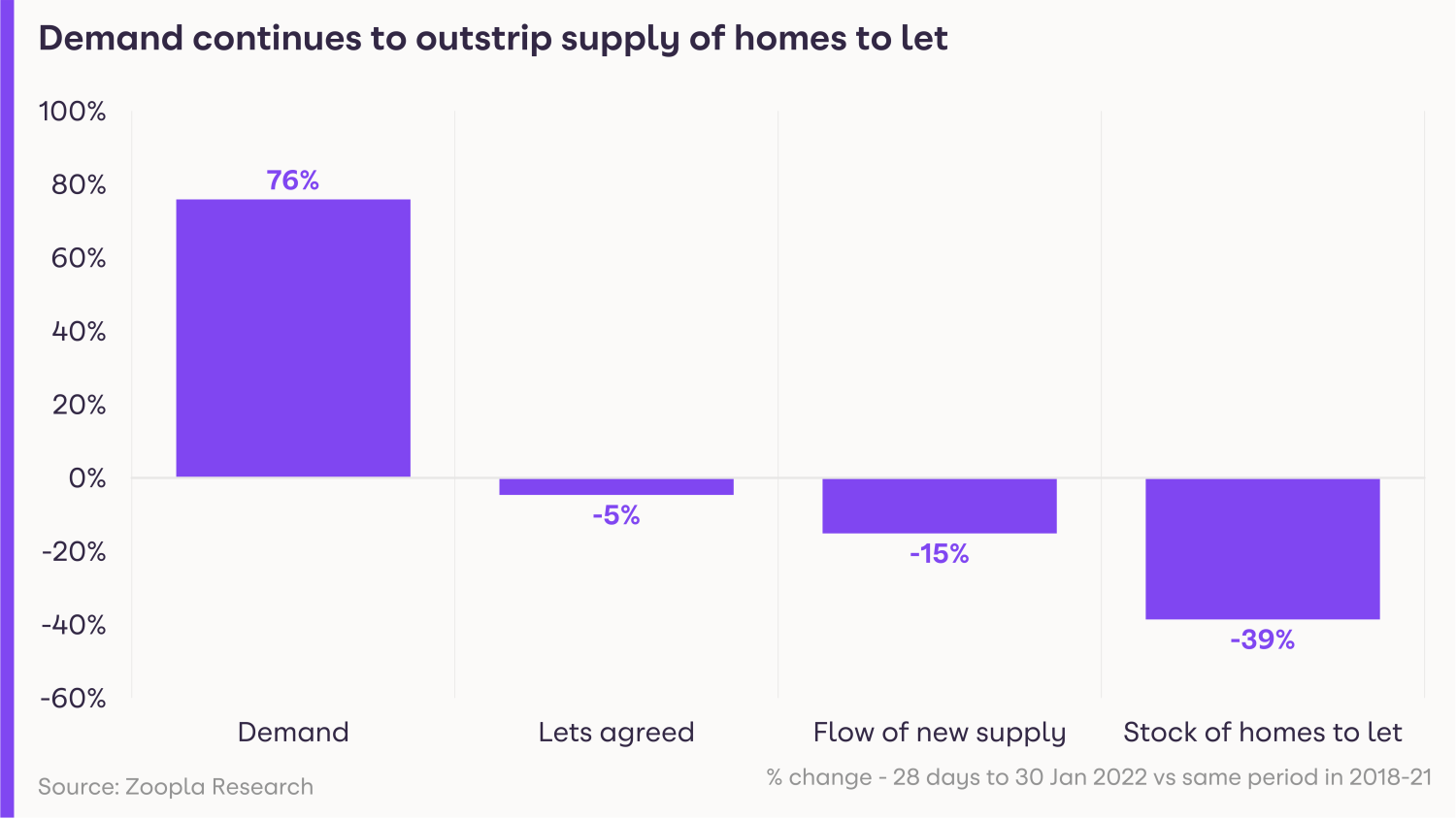

The New Year has seen soaring demand for rental homes, with the number of people looking for a property 76% higher than during the same period between 2018 and 2021.

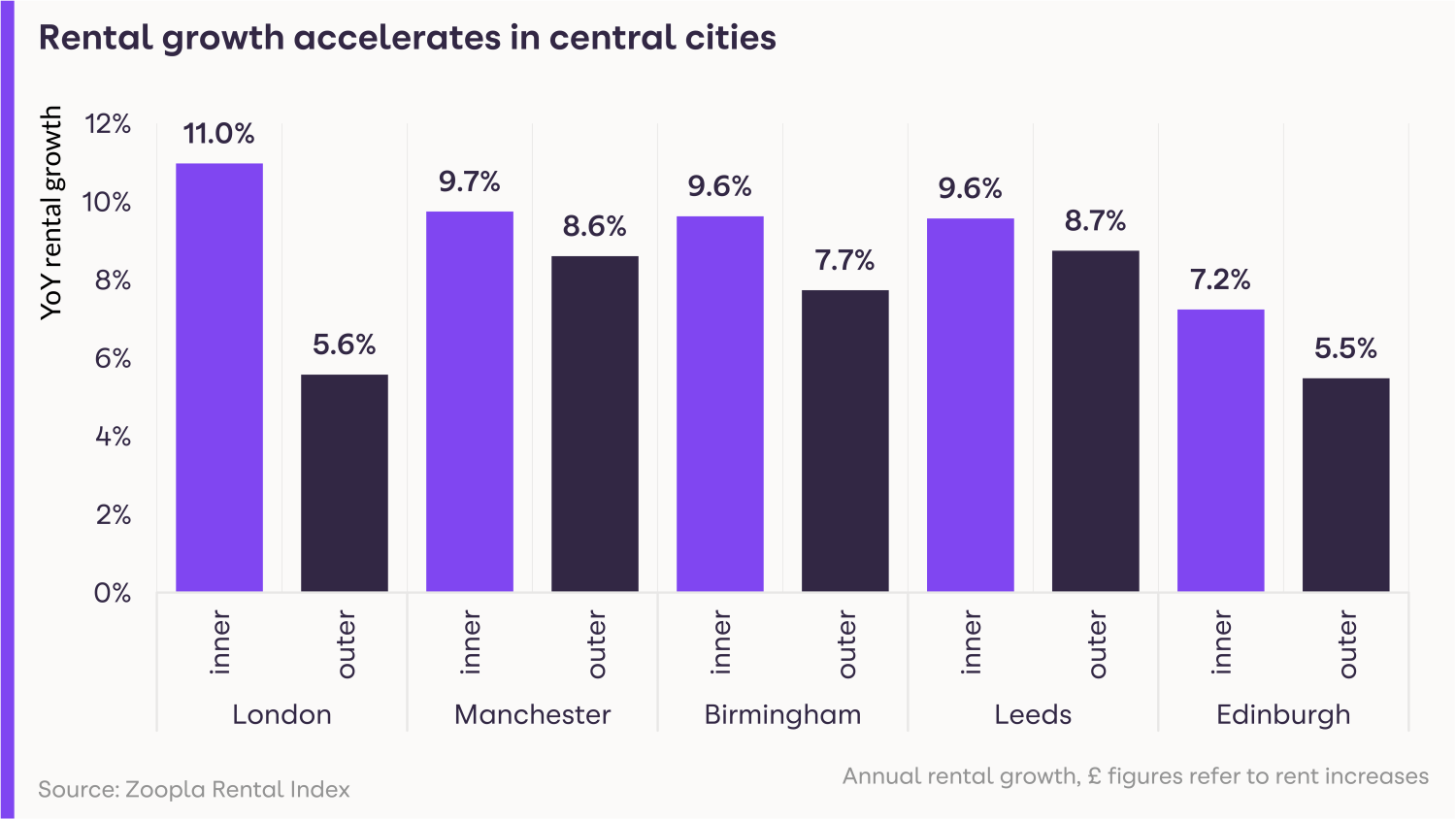

While the pandemic saw increased interest in wider commuter zones as renters also embraced the ‘search for space’, people are now returning to the centres of major cities, such as London, Manchester, Birmingham, Leeds and Edinburgh.

Is there a good supply of homes available to rent?

Unfortunately, the heightened demand in the rental market is not being matched by an increase in supply.

In fact, the number of homes available in January was 39% lower than is typical for the start of the year.

The imbalance between supply and demand is creating a fast-moving rental market with intense competition, pushing the cost of renting higher.

Meanwhile, homes are taking an average of just 14 days to let, compared with three weeks in late 2020.

The shortage of available rental properties is due to a fall in investment in the sector by buy-to-let landlords.

At the same time, rising costs are leading to many renters staying where they are, further limiting the turnover of rental homes available.

What could this mean for you?

Tenants

The rental market is currently moving quickly and there is intense competition from other would-be renters.

As a result, you must be prepared to move fast in order to secure a property, particularly if you are looking in a city centre, where demand has bounced back.

Landlords

The strong demand for rental accommodation, combined with the shortage of availability, means there will be high demand for property and landlords are unlikely to experience many void periods.

For new entrants to the market, average yields are currently at 4.86% across the UK.

What’s the outlook?

The ongoing shortage of rental homes is expected to underpin modest rental growth in the coming months, particularly in city centres, although affordability constraints will act as a brake on larger rises.

Head of research said: “The January peak in rental demand will start to ease in the coming months, putting less severe pressure on supply, which will lead to more local market competition, and more modest rental increases.

“The flooding of rental demand back into city centres, thanks to office workers, students and international demand returning to cities, means the post-pandemic ‘recalibration’ of the rental market is well underway.”

Going forward, rents are expected to rise by 4.5% across the UK excluding London in 2022, and by 3.5% in the capital.

Key takeaways

- Based on new lets agreed, average UK rents are now £969 per month

- The rate at which rents are rising reached a 13-year high of 8.3% in the final three months of 2021

- Demand for rental homes soared by 76% in the New Year, compared with the same period between 2018 and 2021

Interest rates hiked again as cost of living rises

Nearly two million homeowners will face higher mortgage repayments after the Bank Rate was increased for the second time in three months.

The Bank of England has increased interest rates for the second time in three months.

The Bank Rate – the official cost of borrowing – has gone up from 0.25% to 0.5%.

The move means around two million homeowners with variable rate mortgages will see their monthly repayments rise.

The change will add around £24 a month to repayments on a £200,000 mortgage.

The increase comes as consumers are already facing pressure on their budgets as a result of higher food prices and rising energy costs, while National Insurance contributions are due to be increased in April.

Energy bills are set to rise by 54% this year to an average of £1,971, after energy regulator Ofgem increased the cap on the prices that energy companies can charge.

The Bank of England warned that families faced the biggest fall in disposable income since records began three decades ago.

Why are interest rates going up?

Inflation hit a 30-year high in December of 5.4%.

The Bank’s Monetary Policy Committee (MPC) uses changes to interest rates as a way of controlling inflation.

It is supposed to keep inflation – which measures the rate at which things we buy get more expensive – at 2%, as measured by the Consumer Prices Index.

But inflation is currently more than double this level and it is expected to rise further to peak at more than 7% in April.

The MPC is made up of 12 members who all vote on whether or not interest rates should be changed.

At the latest meeting, four members voted to raise the Bank Rate to 0.75%, suggesting there are further interest rate hikes to come.

What does it mean for me?

You will only be impacted by the interest rate change if you are on a mortgage that moves up and down in line with changes to the Bank Rate.

These are mortgages such as tracker deals or standard variable rates, which you revert to when a fixed term deal comes to an end.

Around 850,000 homeowners are currently on tracker mortgages, while 1.1 million are on standard variable rate ones, according to mortgage trade body UK Finance.

People with a £200,000 mortgage will see their repayments increase by around £24 per month following the latest hike, increasing their monthly payments by just under £40 once the previous increase is factored in.

Around 74% of mortgage holders are on fixed rate deals, and they will not see any change to their monthly repayments.

This is because under fixed rate mortgages the interest rate you pay remains the same for the length of the deal, which is usually two to five years.

What should I do now?

If you are currently on a fixed rate mortgage, you don’t need to worry about higher interested rates until your deal ends.

If you are on a tracker mortgage and want to protect yourself from further interest rate rises, you may want to switch to a fixed rate deal.

But before you do this, check to make sure you will not incur any penalties for ending your deal early.

If you are on a standard variable rate you can switch to a new mortgage at any time.

The good news is that although mortgage rates have risen during the past month as lenders anticipated the latest rate hike, competitive deals are still available.

The average cost of a two-year fixed rate mortgage is now 2.44%, while a five-year fixed rate deal is 2.71%, and a 10-year fixed rate mortgage is only slightly more expensive at an average of 2.85%.

This compares with an average rate of 4.46% for people on standard variable rates.

If you think you may struggle to keep up with your mortgage repayments after the latest interest rate rise, it is important to contact your lender as soon as possible.

There are a number of steps lenders can take to help you, including granting you a temporary payment holiday or putting you on to an interest-only mortgage for a short time.

But options become much more limited if you have already missed a payment.

Key takeaways

- The Bank of England has increased interest rates for the second time in three months, raising them by 0.25% to 0.5%

- The move means around two million homeowners with variable rate mortgages will see their monthly repayments rise

- The increase will add around £24 a month to repayments for someone with a £200,000 mortgage

Levelling Up: no fault evictions for renters to end

The Government has unveiled plans for a dramatic shake up of the private rented sector with its Levelling Up white paper. Find out what's in store for renters and more.

Landlords will no longer be able to kick renters out of their homes for no reason under new plans announced by the Government.

Section 21 ‘no fault’ evictions, under which renters have to vacate a property after a notice period even if they’ve done nothing wrong, will be abolished as part of a number of reforms included in the Government’s Levelling Up White Paper.

Other improvements include ensuring all homes in the private rented sector meet a minimum standard for the first time ever, and halving the number of poor-quality rental homes across the country.

The Government also plans to explore introducing a landlords register, pledging to crack down on rogue landlords.

Using fines and bans, it wants to stop repeat offenders leaving renters living in unacceptable conditions.

Why is this happening?

The measures are part of the government’s Levelling Up White Paper, which aims to shift government focus and resources to communities that have lagged behind the rest of the country in terms of prosperity.

The paper sets out 12 Missions to Level Up the UK by 2030, ranging from increasing employment and productivity, to improving public transport and 5G access while offering skills training.

One of these missions is to ensure renters have a secure path to homeownership, and to improve their accommodation in the meantime.

Who does it affect?

The white paper is good news for renters in both the private and social housing sectors.

Under the Decent Homes Standard, which currently only applies to social housing, private rented homes will have to be in a reasonable state of repair, have reasonably modern kitchens and bathrooms, and have effective insulation and heating.

Meanwhile, the government has also committed to building more genuinely affordable social homes.

In addition, it will deliver on the commitments it made following the Grenfell fire tragedy in 2017, such as ensuring homes are safe, complaints are dealt with promptly and that renters’ voices are heard, through a new Social Housing Regulation Bill.

But it is important to note that beyond setting the broad target to meet the 12 missions by 2030, no timeline has been announced for the individual measures included in the white paper.

What else is happening?

The white paper also included other measures that will impact housing.

A new £1.5 billion Levelling Up Home Building Fund will be launched to provide loans to small and medium-sized developers.

The Government also said much of its £1.8 billion brownfield funding will be diverted away from building homes in London and the South East to transforming brownfield sites in the North and Midlands.

Homes England will also spearhead efforts to regenerate 20 town and city centres into 'beautiful communities'.

Key takeaways

- Section 21 ‘no fault’ evictions will be abolished as part of a number of reforms included in the Government’s Levelling Up White Paper

- All homes in the private rented sector will have to meet a minimum standard for the first time

- The Government will crack down on rogue landlords through fines and bans

New Year demand for property hits record levels, up 50%

The housing market enjoys its biggest New Year bounce in five years, with demand soaring for all types of property.

Demand for property soared by 49% in January, in the biggest New Year bounce for five years.

Record demand was recorded for all property types, as buyers searched for both houses and flats.

The increase in buyers was on a par with the record levels of interest seen during the stamp duty holiday, and suggests the search for space still has further to run.

The spike in activity helped push up the average cost of a UK home to £242,000, compared with £216,500 this time last year.

What’s happening to house prices?

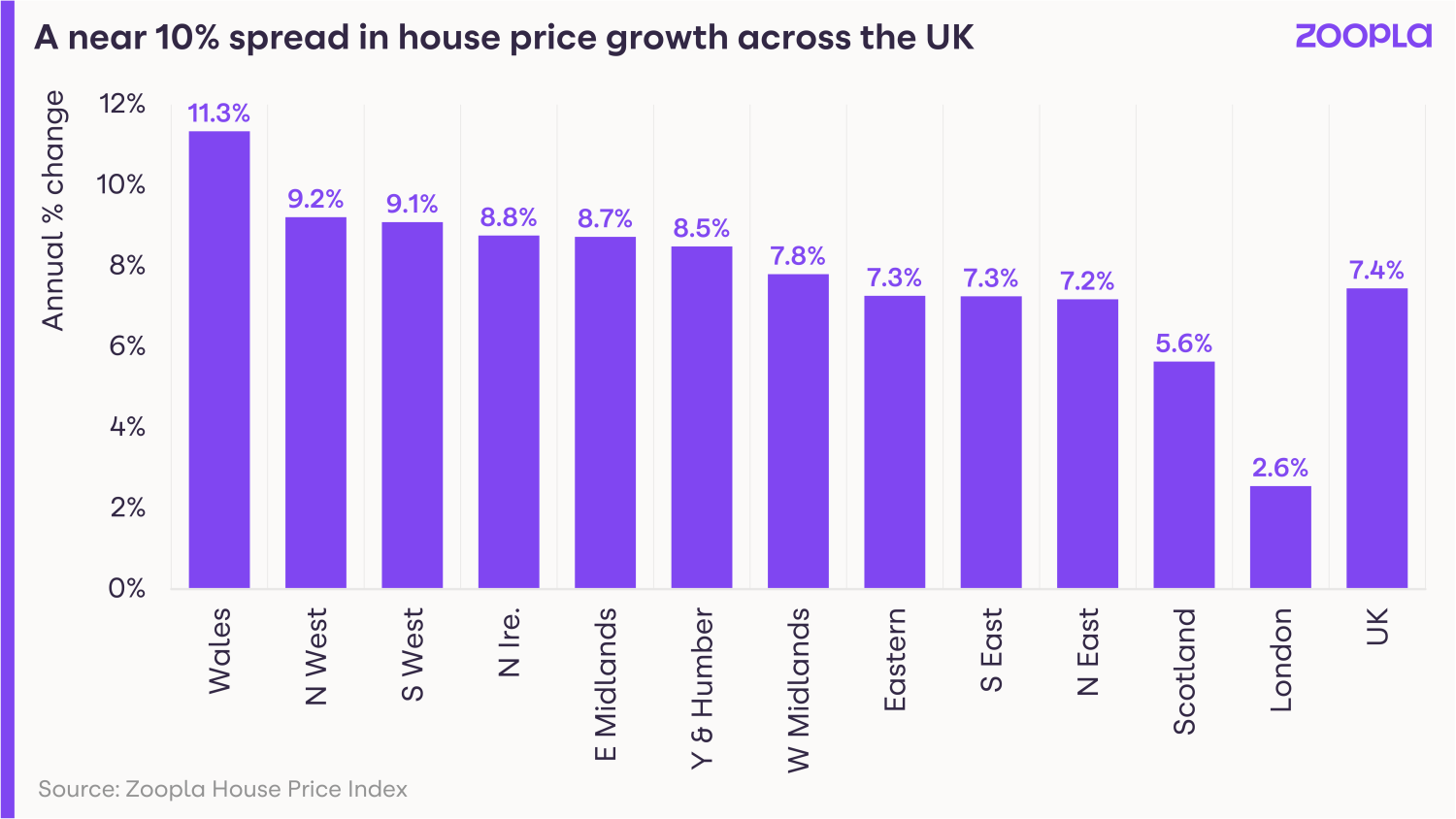

Property prices rose by 7.4% in the year to the end of December, with gains for houses continuing to significantly outstrip those of flats.

While the cost of terraced, semi-detached and detached homes soared by 8.8% during the year to stand at £289,500, the price of flats edged ahead by just 2.2% to £175,700.

Across the regions, Wales led the way for the 11th consecutive month with property values rising by 11.3%, followed by the North West at 9.2% and the South West at 9.1%.

London continued to lag, posting increases of just 2.6%, although a third of the capital’s boroughs saw price growth of more than 4%.

How busy is the market?

Demand soared across the board at the start of the New Year, with buyers up 49% compared with the average for the past three years.

Three bedroom homes outside of London were the most sought-after property, with demand for these homes four times higher than the five-year average.

Meanwhile, as hybrid working continues to be the norm and city workers start to return to offices, demand for flats was on a sharp upward trajectory, reaching its highest level for five years.

The supply of homes listed for sale also appears to have turned a corner.

Although the number of homes on the market is still 44% below the five-year average, the situation is an improvement from when it was 47% down at the end of 2021, and reverses the trend seen during the past 11 months.

While demand continues to outstrip supply, there is now a growing correlation between the types of home buyers most want and those that are available.

Three-bedroom houses top the list for both supply and demand, although two-bedroom flats are the second most available property, while two-bedroom houses are the second most in demand home.

The increase in supply could be because buyers, keen to make a move before interest rates increase again, are starting to list their current homes for sale now.

Even so, further rate increases are not expected to have a big impact on the property market, as mortgage rates remain low by historical standards and, with three-quarters of homeowners on fixed rate deals, the majority of people will be protected from further base rate rises.

What could this mean for you?

First-time buyers

The increase in the number of homes coming on to the market is good news for first-time buyers as it means they'll have more choice.

Flats continue to offer better value than houses after seeing more modest price rises during the past year.

And those modest rises are what's reigniting their popularity among potential buyers.

In London, where demand has reached its highest level for 19 months, first-time buyers are also facing competition from overseas buyers from Hong Kong, who are snapping up flats following the introduction of new British National Overseas (BNO) visa rules.

As a result, you need to be ready to move fast if you see somewhere you like.

Home-movers

If you're trading up the property ladder, you're in a strong position to sell your current home, particularly if it's a three-bedroom house.

The increase in properties being put up for sale also means you should have more choice in finding your next home.

But with buyer demand hitting record high levels, the market remains fast paced and co-ordinating your sale and purchase could be tricky.

Speak to local estate agents to get a sense of how quickly the market is moving where you are and whether you should wait until you've found a new home before listing your current one.

What’s the outlook?

While house price growth remains strong, the annual rate at which prices are rising appears to have peaked, dropping to 7.4%, compared with 7.7% in September.

It's expected to slow further as the market returns to more normal conditions and economic headwinds increase, with house prices likely to end the year 3% higher than they started it.

Meanwhile, the effects of the pandemic are still being felt, with the ongoing search for space contributing to record demand for homes, while city-centre markets are also being boosted by workers returning to the office.

Grainne Gilmore, head of research, Zoopla, says: “Just like much of 2021, the number of homes available for sale is lower than typical levels, but there are signs that the imbalance between demand and supply is starting to ease.

“As more potential sellers are able to find a home to move to, this will spur more supply in the weeks and months to come.”

Key takeaways

- Demand from potential buyers jumped by 49% in January

- House prices rose at an annual rate of 7.4%, taking the average value of a UK home to £242,000

- More homes are coming on to the market, although a significant supply and demand imbalance remains

New government guidelines for unvaccinated buyers and renters

People who are not vaccinated against Covid-19 will have to isolate if they are exposed to the virus, even if it means missing their moving day.

The government has announced new guidelines for people buying a home or moving into a rental property who are not vaccinated.

Under the rules, those who are not fully vaccinated against Covid-19 are legally required to stay at home and self-isolate for seven days if someone in their household tests positive for the virus.

The guidance issued by the Department for Levelling Up, Housing and Communities applies even if the isolation period coincides with the day on which they were scheduled to move home.

But those who are fully vaccinated do not have to follow these rules.

Instead, they can move home according to their original schedule, even if someone in their household has tested positive.

They are, however, “strongly advised” to take a lateral flow test every day for seven days, and to self-isolate if any of their tests are positive.

Why is this happening?

The rules are the latest in a series of guidance issued by the Government during the pandemic relating to the homebuying and moving process.

They have been introduced following the emergence of the Omicron variant, which is more contagious.

But this is the first time that the government has differentiated between those who are vaccinated and those who are not.

They reflect the fact that people who are vaccinated are less likely to become severely ill if they catch Covid-19, and are also less likely to spread it to other people.

Who does it affect?

The new guidance applies to both buyers and renters who are aged over 18 years and six months.

The rules affect those who are not fully vaccinated, which is defined as having both doses of a two dose vaccine.

Those who are fully vaccinated, or who are aged under 18 years and six months do not have to follow them.

The guidance also impacts those working in the homebuying and moving industry, including letting and estate agents, valuers and removers.

The rules only apply to people moving in England.

Scotland, Wales and Northern Ireland have their own anti-pandemic measures.

What’s the background?

The housing market in England remains open if you are looking for a new home to buy or rent.

As a result, you can continue to view potential properties and move home, as long as you have not been exposed to Covid-19.

But the government is urging everyone involved to continue to follow good hygiene practices, such as regular handwashing and cleaning, and to be as flexible as possible if a move needs to be delayed as a result of someone needing to self-isolate.

Key takeaways

- For the first time, the government has differentiated between those who are vaccinated and those who are not when it comes to buying a home or moving into a rental property

- Under the new rules, those who are not fully vaccinated against Covid-19 are legally required to stay at home and self-isolate if someone in their household tests positive for the virus

- Those who are fully vaccinated do not have to follow these rules and can move home according to their original schedule, even if someone in their household has tested positive

How parents bend the rules if their home isn't in a school catchment area

What lengths would you go to, to get your child into a good school? Our latest research reveals a quarter of parents have bent the rules. Here's what they did.

With the primary school application deadline upon us (15 January), almost a quarter of parents (24%) admit to flouting school admissions criteria to get their child into their preferred local school, according to our latest research.

We surveyed parents of school age children to understand the lengths they go to in order to secure a place at the best schools.

And we found that parents pay on average £82,960 more for a property in the catchment area of a high-performing school.

In London, that figure rises to more than £200,000.

Nearly a fifth of parents lie to get their kids into a good or outstanding school

In total, 17% of parents of school aged children admit they lied, bent or broke school application rules to get their children into their preferred school.

A further seven per cent say they ‘played the system’.

That means one in four (24%) parents are going to extreme lengths to secure preferred school places for their kids.

But bending the rules can take many forms.

Among the parents who have, 27% fessed up to exaggerating their religious beliefs to get into a faith school.

Property porkies are also prevalent.

Among those who broke the rules, over a fifth (21%) say they registered their child at a family member’s address that was closer to their preferred school.

One in ten confessed they simply lied about their address, and eight per cent admitted they temporarily rented a second home (that the child never lived in) within the catchment area.

One in six parents confessed to outright bribery of their preferred school

Money and school donations also play a key role.

One in six parents (16%) who admit they bent the rules say they made a ‘voluntary donation’ to a particular school ahead of applying, while eight per cent confessed to offering a bribe.

Others offered their time, with 20% saying they volunteered at or became involved with a school ahead of applying for their child’s place.

A further 14% said they became ‘friendly’ with senior figures at the school in order to curry favour.

What's the cost of a home in the right catchment area?

Of course, many parents do not bend the rules – some are simply able to move into the catchment area of the school they want their children to go to.

In total, 28% of parents who currently have school aged children say they did this.

However, the research found that there’s a huge premium attached to doing so - which might be prohibitive to some.

Among those who bought a home in a good catchment area, the average premium they paid was a huge £82,960 with the figure rising to £209,599 in London.

How do parents feel about bending the rules?

The majority of parents in the UK are against bending or breaking rules to get children into a good or outstanding school.

Over half (55%) say they feel it is an ‘unfair practice which should be stopped’ and the 56% who have done so, admit they feel guilty about it.

A further 6% of parents admit they are so fed up with the practice that they have ‘grassed up’ another parent and reported them to the school.

However, more than one in ten (11%) believe it is acceptable and a further 19% admit it isn’t fair but ‘everyone does it’.

Key takeaways

- Parents are breaking school admissions criteria to avoid paying an average £82,960 premium on homes in a good or outstanding school catchment area

- 17% of parents say they lied, bent or broke admissions rules, while a further 7% say they ‘played the system’ in order to get their child into a good local school; this totals 24% flouting the rules

- Pretending to be religious or lying about home addresses are the most common mistruths told in order to secure in-demand school places

- 16% of those who admit to breaking rules say they made a ‘voluntary donation’ to the school while 8% admit they offered a bribe

- Despite the prevalence of rule breaking, over half of parents (56%) who’ve done so feel guilty about it