Changing Rooms! Nearly 9 million bedrooms lost in the UK

More than four in ten British homeowners transformed their spare bedrooms into offices, gyms, cinemas and more throughout the pandemic. Here's what they did.

Nearly 9 million bedrooms were lost to home offices, gyms, cinemas and even bars during the pandemic, as the UK adapted to the new normal.

How have our homes changed?

We surveyed homeowners across the UK to understand how the nation’s room requirements shifted - and how our homes changed as a result.

Among those who changed their homes, more than half (53%) said they completely repurposed at least one bedroom, while one in five households (22%) said they changed multiple bedrooms.

Nationally, this equates to a whopping 8,856,000 bedrooms that have been ‘lost’ amongst the UK’s 24m privately owned homes during the pandemic.

With remote and hybrid working now set to be a mainstay for many, almost half (46%) of those who have made changes have created a home office.

That means more than 4.5m new home offices have emerged across the UK. And over half of homeowners (58%) say they plan to permanently keep them.

Alongside home offices, there are plenty of other ways Brits have reincarnated rooms in their homes since March 2020. Across the UK:

- 1.3m home gyms have been created

- 984,000 home bars

- 900,000 home cinemas or music rooms

- 688,800 dedicated classrooms

The cost of reincarnation

Repurposing entire rooms doesn’t come cheap.

Our research shows that UK homeowners who adapted their homes spent an average of £3,714, with home offices costing on average £1,735, gyms £1,568 and home cinemas £3,841.

Nationally, this is a total of £36.5 billion.

Home offices: who should pay for them?

Home offices in particular have been one of the more contentious room changes, with many being forced to give up living space in order to simply carry out their jobs.

In fact, 16% of homeowners who created one say they resent giving up space in their home for the benefit of their employer.

Nearly seven in ten (67%) believe that employers should pay all or some of the cost of setting up a home office, with 12% thinking that they should even offer compensation for the space lost.

However, the reality is that just 2% of those who set up home offices say that their employer offered compensation, and only 30% say they made any contributions towards costs at all.

Just 10% covered the full costs.

An unhappy compromise?

For those who have had to repurpose rooms, more than half (55%) say this has meant they have had to compromise on their space at home, leaving homeowners less happy with the space they have.

Amongst those who have, 28% say they now have less space for guests to stay, 21% say they have less or no privacy and 11% state that their children now have to share a bedroom.

However, this feeling of not being completely happy with your home rises significantly amongst younger homeowners, who are likely to have smaller properties.

More than eight in ten (83%) homeowners under 25 say they are currently having to compromise with their living spaces.

For many, having to change their home setup during the pandemic has highlighted the need to find somewhere new and better suited to their changed needs.

Of homeowners who have made changes, nearly a third (32%) say that this has made them consider moving home.

Nick Neill, Managing Director at EweMove Sales & Lettings says: 'Although many believe that their employer should contribute to the cost of setting up a home office, it's important to consider other factors, such as reduced commuter costs and the ability to use the time spent commuting on personal endeavours, such as benefitting from a converted gym.

'The rise of open plan living also means that it can be tricky to find space to set up a home office, but it really does present a more flexible property for buyers to consider purchasing if you do decide to sell in the future.

'It's also worth considering a garden office - which could be anything from a glorified shed to a swanky purpose-built luxury cabin.

'Not only can it enable a better work/life balance and space to work outside of the family home, but it will definitely add value to your property and not take it away, which could be the case if you convert a bedroom.'

Key takeaways

- During the pandemic, 41% of British homeowners adapted their home to suit their changing needs, sacrificing around 8.8m bedrooms in the process

- In their place nearly five million new home offices have been created, alongside over one million home gyms

- The average household spent £3,714 adapting their home during the pandemic - that’s a national total of approximately £36.5 billion

- Nearly 7 in 10 think employers should contribute to the cost of home offices, but only 30% have

Average rents hit nearly £1,000 per month

The rate at which rents are rising is at a 13-year high, while demand soared by 76% in the New Year. Get the latest with our Rental Market Report.

The average cost of renting a home is close to £1,000 a month, as soaring demand pushes prices higher.

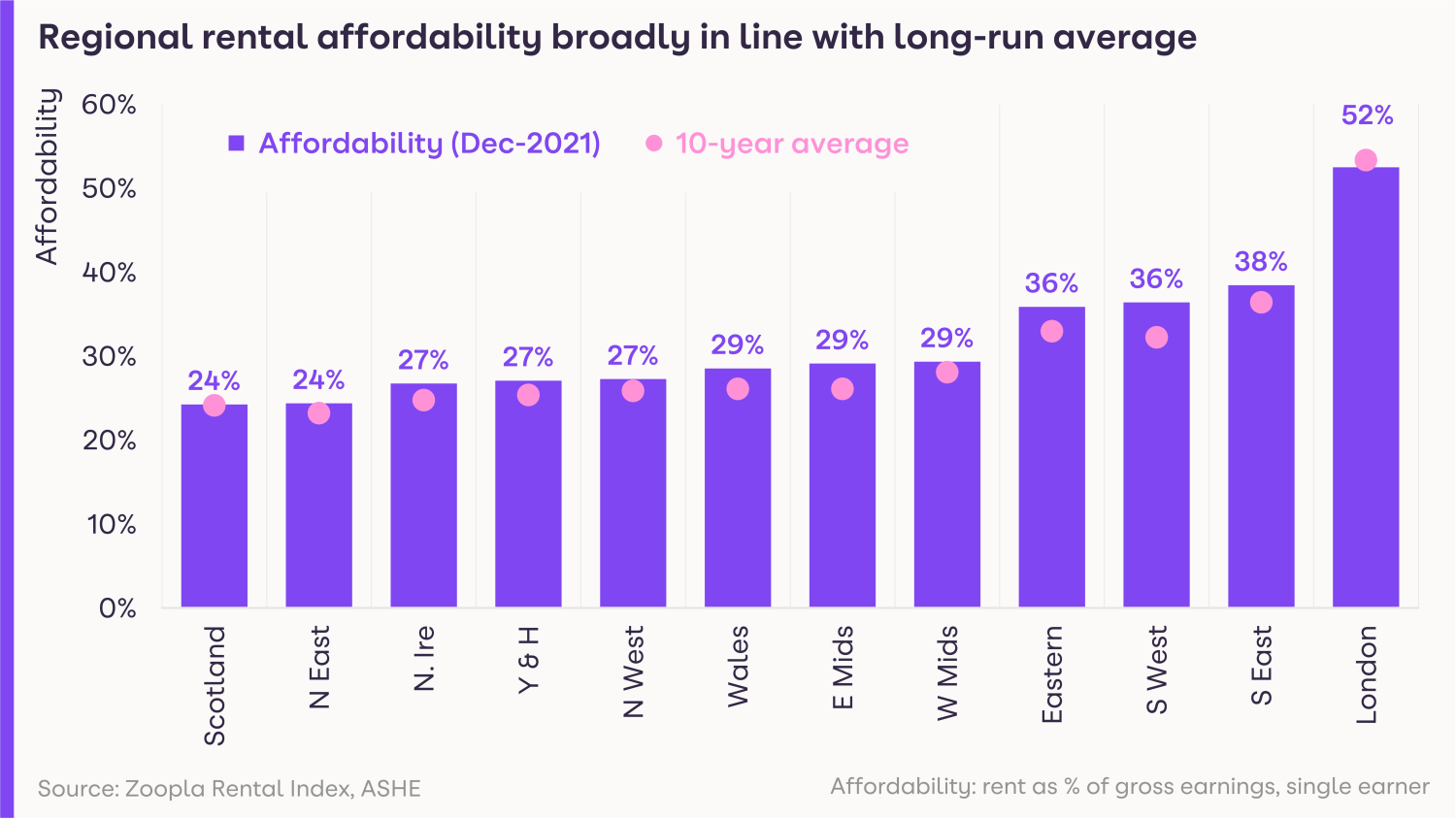

But despite the jump in the cost, rents account for an average of 37% of a single earner’s pay before tax, which is broadly in line with the 10-year average of 36%.

Renters are now paying £969 per month across the UK.

That's £62 a month more than at the beginning of the pandemic, according to our latest Rental Market Report.

What’s happening to rents?

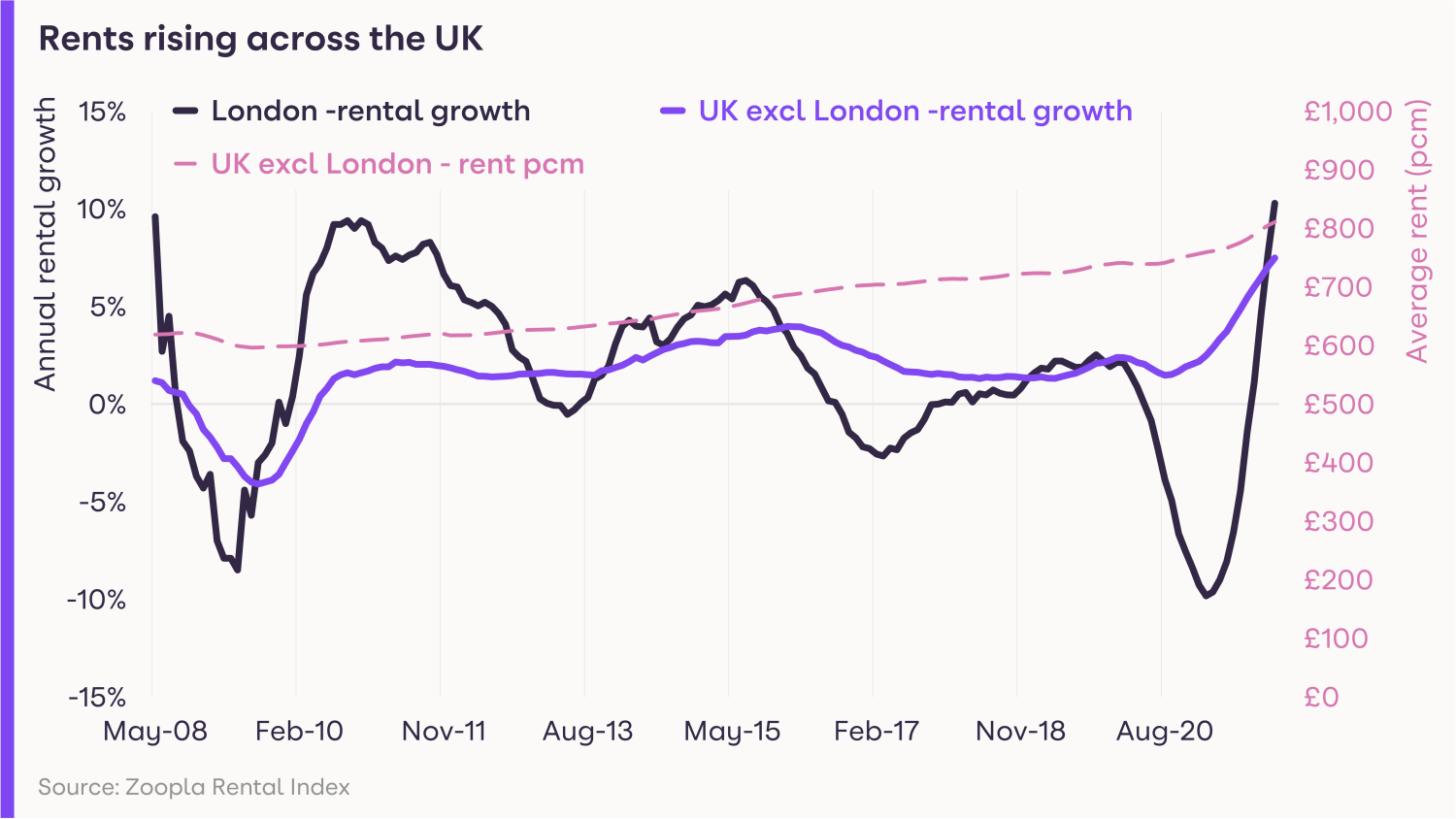

The rate at which rents are rising reached a 13-year high of 8.3% in the final three months of 2021.

The average annual rent for those agreeing a new let is now £744 higher than pre-pandemic levels.

Even so, rents are only 12% higher than they were five years ago, after they fell in some areas during the early stages of the pandemic.

Rents have risen in every region of the UK during the past year, with London seeing the strongest growth of 10.3%, while increases were weakest in Scotland at 4.8%.

However, because rents fell in the capital during the pandemic, they are now only £18 a month more than they were in March 2020.

What’s demand for rental homes like?

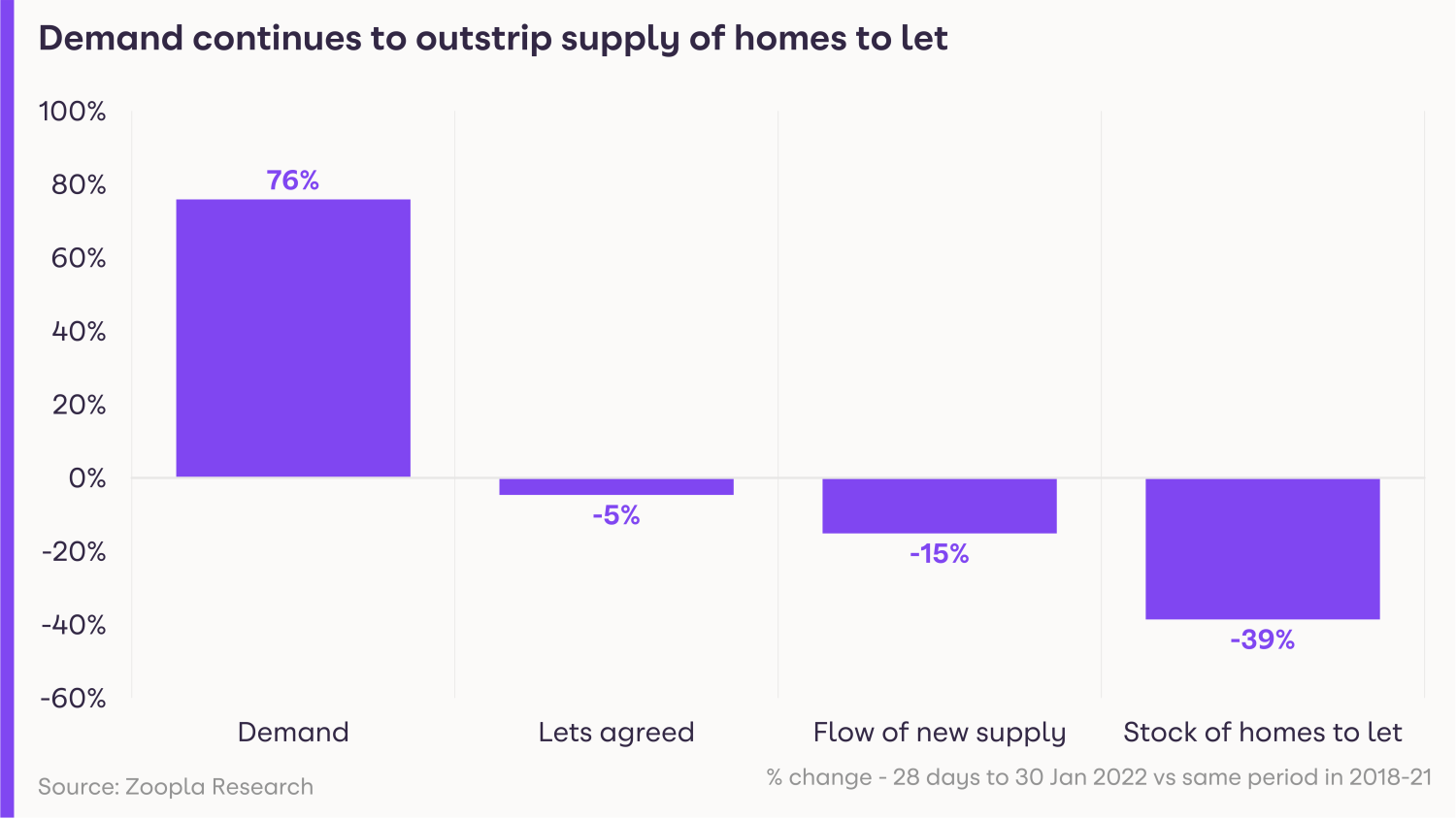

The New Year has seen soaring demand for rental homes, with the number of people looking for a property 76% higher than during the same period between 2018 and 2021.

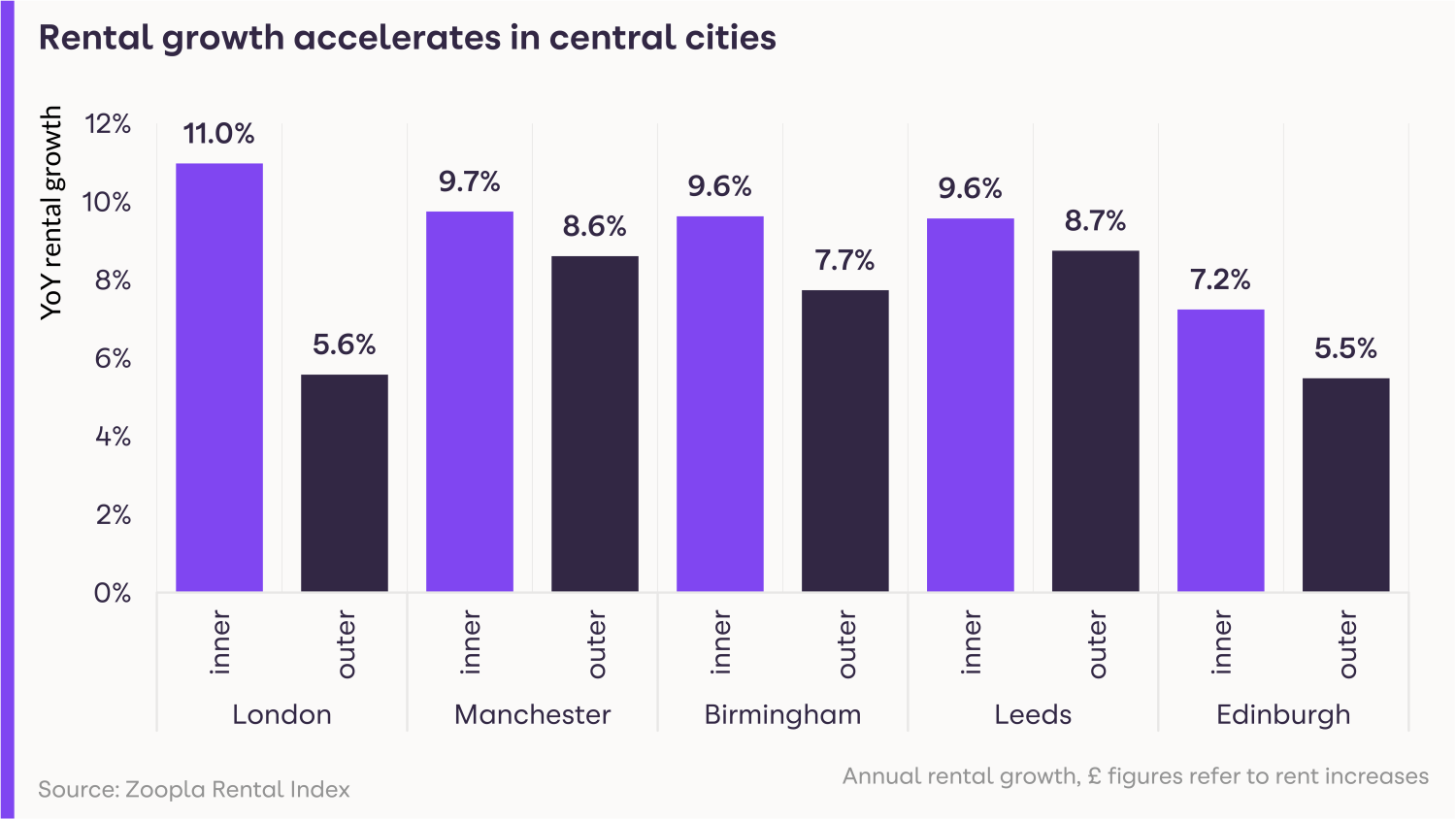

While the pandemic saw increased interest in wider commuter zones as renters also embraced the ‘search for space’, people are now returning to the centres of major cities, such as London, Manchester, Birmingham, Leeds and Edinburgh.

Is there a good supply of homes available to rent?

Unfortunately, the heightened demand in the rental market is not being matched by an increase in supply.

In fact, the number of homes available in January was 39% lower than is typical for the start of the year.

The imbalance between supply and demand is creating a fast-moving rental market with intense competition, pushing the cost of renting higher.

Meanwhile, homes are taking an average of just 14 days to let, compared with three weeks in late 2020.

The shortage of available rental properties is due to a fall in investment in the sector by buy-to-let landlords.

At the same time, rising costs are leading to many renters staying where they are, further limiting the turnover of rental homes available.

What could this mean for you?

Tenants

The rental market is currently moving quickly and there is intense competition from other would-be renters.

As a result, you must be prepared to move fast in order to secure a property, particularly if you are looking in a city centre, where demand has bounced back.

Landlords

The strong demand for rental accommodation, combined with the shortage of availability, means there will be high demand for property and landlords are unlikely to experience many void periods.

For new entrants to the market, average yields are currently at 4.86% across the UK.

What’s the outlook?

The ongoing shortage of rental homes is expected to underpin modest rental growth in the coming months, particularly in city centres, although affordability constraints will act as a brake on larger rises.

Head of research said: “The January peak in rental demand will start to ease in the coming months, putting less severe pressure on supply, which will lead to more local market competition, and more modest rental increases.

“The flooding of rental demand back into city centres, thanks to office workers, students and international demand returning to cities, means the post-pandemic ‘recalibration’ of the rental market is well underway.”

Going forward, rents are expected to rise by 4.5% across the UK excluding London in 2022, and by 3.5% in the capital.

Key takeaways

- Based on new lets agreed, average UK rents are now £969 per month

- The rate at which rents are rising reached a 13-year high of 8.3% in the final three months of 2021

- Demand for rental homes soared by 76% in the New Year, compared with the same period between 2018 and 2021