The housing market enjoys its biggest New Year bounce in five years, with demand soaring for all types of property.

Demand for property soared by 49% in January, in the biggest New Year bounce for five years.

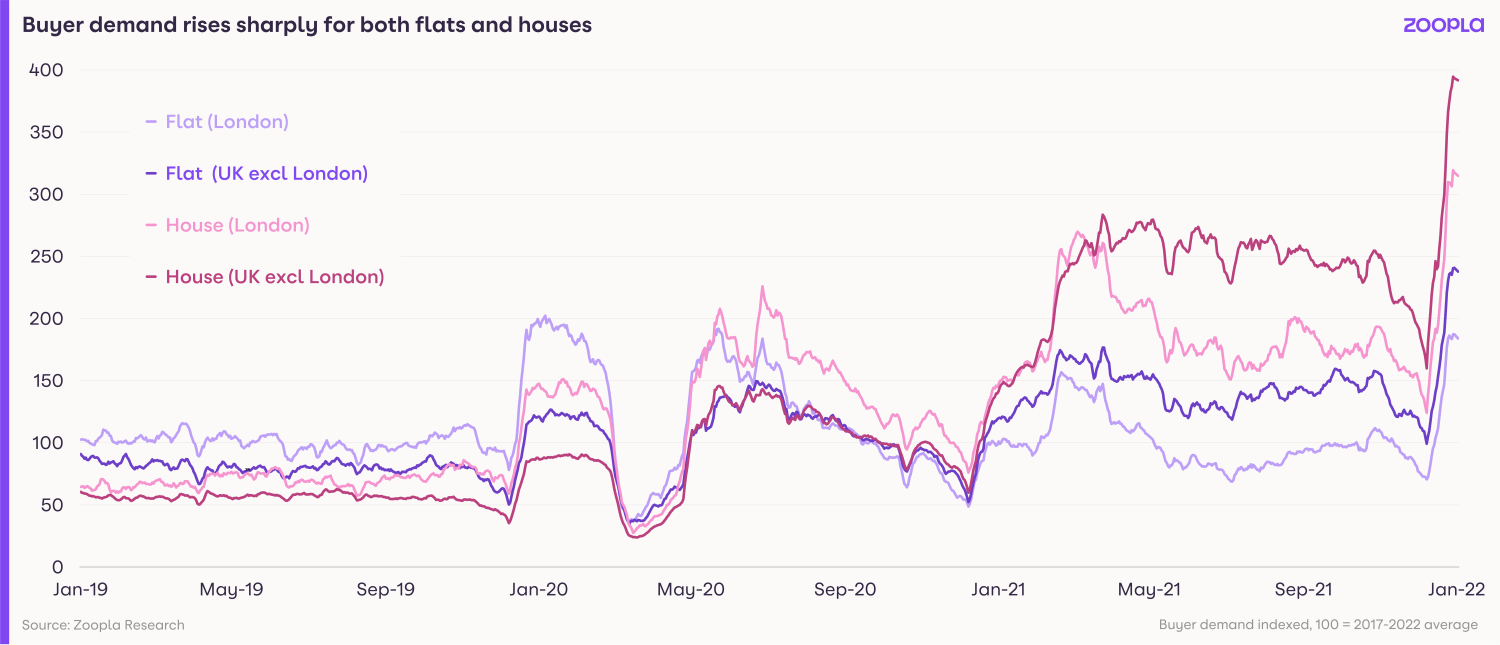

Record demand was recorded for all property types, as buyers searched for both houses and flats.

The increase in buyers was on a par with the record levels of interest seen during the stamp duty holiday, and suggests the search for space still has further to run.

The spike in activity helped push up the average cost of a UK home to £242,000, compared with £216,500 this time last year.

What’s happening to house prices?

Property prices rose by 7.4% in the year to the end of December, with gains for houses continuing to significantly outstrip those of flats.

While the cost of terraced, semi-detached and detached homes soared by 8.8% during the year to stand at £289,500, the price of flats edged ahead by just 2.2% to £175,700.

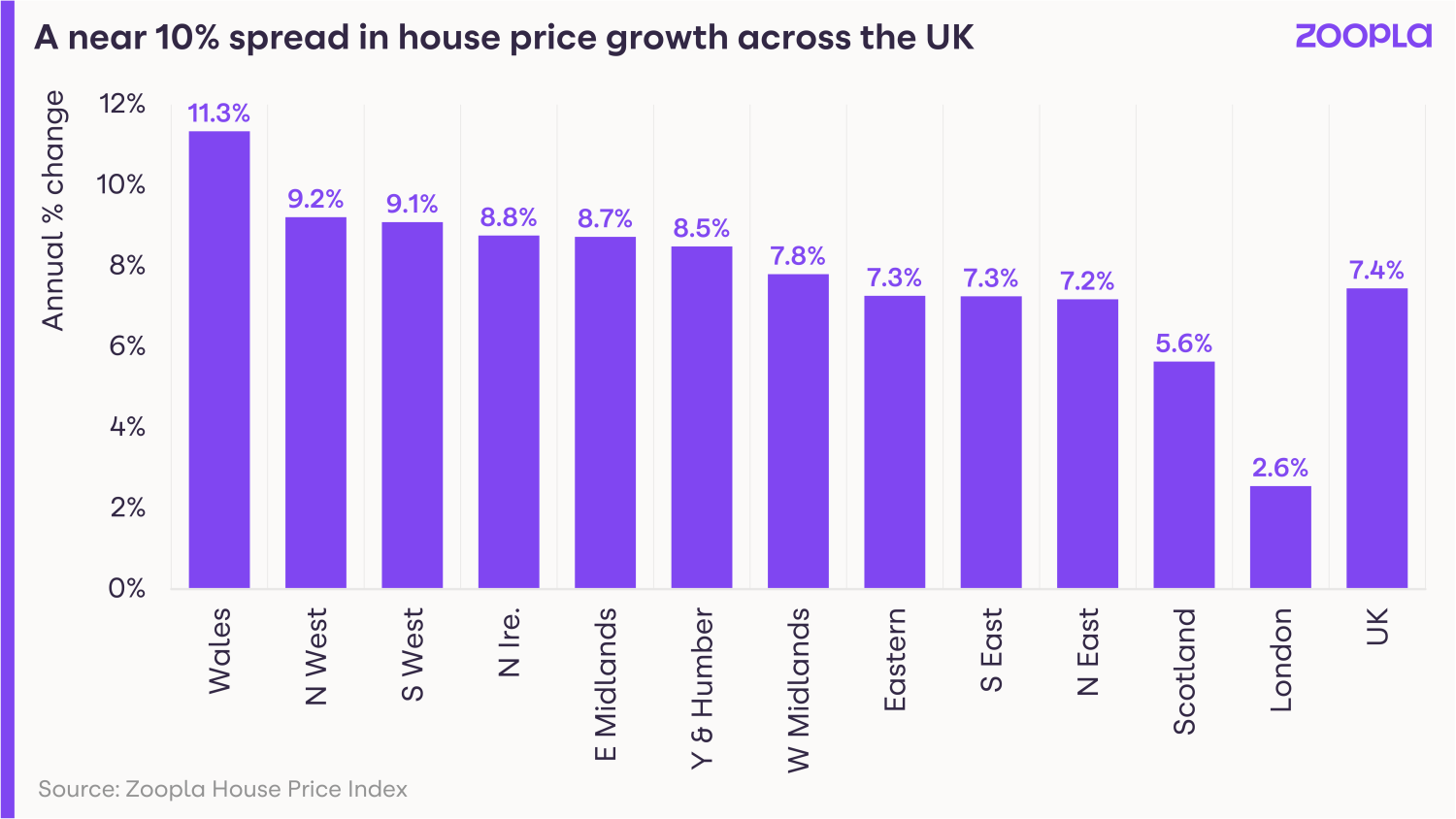

Across the regions, Wales led the way for the 11th consecutive month with property values rising by 11.3%, followed by the North West at 9.2% and the South West at 9.1%.

London continued to lag, posting increases of just 2.6%, although a third of the capital’s boroughs saw price growth of more than 4%.

How busy is the market?

Demand soared across the board at the start of the New Year, with buyers up 49% compared with the average for the past three years.

Three bedroom homes outside of London were the most sought-after property, with demand for these homes four times higher than the five-year average.

Meanwhile, as hybrid working continues to be the norm and city workers start to return to offices, demand for flats was on a sharp upward trajectory, reaching its highest level for five years.

The supply of homes listed for sale also appears to have turned a corner.

Although the number of homes on the market is still 44% below the five-year average, the situation is an improvement from when it was 47% down at the end of 2021, and reverses the trend seen during the past 11 months.

While demand continues to outstrip supply, there is now a growing correlation between the types of home buyers most want and those that are available.

Three-bedroom houses top the list for both supply and demand, although two-bedroom flats are the second most available property, while two-bedroom houses are the second most in demand home.

The increase in supply could be because buyers, keen to make a move before interest rates increase again, are starting to list their current homes for sale now.

Even so, further rate increases are not expected to have a big impact on the property market, as mortgage rates remain low by historical standards and, with three-quarters of homeowners on fixed rate deals, the majority of people will be protected from further base rate rises.

What could this mean for you?

First-time buyers

The increase in the number of homes coming on to the market is good news for first-time buyers as it means they’ll have more choice.

Flats continue to offer better value than houses after seeing more modest price rises during the past year.

And those modest rises are what’s reigniting their popularity among potential buyers.

In London, where demand has reached its highest level for 19 months, first-time buyers are also facing competition from overseas buyers from Hong Kong, who are snapping up flats following the introduction of new British National Overseas (BNO) visa rules.

As a result, you need to be ready to move fast if you see somewhere you like.

Home-movers

If you’re trading up the property ladder, you’re in a strong position to sell your current home, particularly if it’s a three-bedroom house.

The increase in properties being put up for sale also means you should have more choice in finding your next home.

But with buyer demand hitting record high levels, the market remains fast paced and co-ordinating your sale and purchase could be tricky.

Speak to local estate agents to get a sense of how quickly the market is moving where you are and whether you should wait until you’ve found a new home before listing your current one.

What’s the outlook?

While house price growth remains strong, the annual rate at which prices are rising appears to have peaked, dropping to 7.4%, compared with 7.7% in September.

It’s expected to slow further as the market returns to more normal conditions and economic headwinds increase, with house prices likely to end the year 3% higher than they started it.

Meanwhile, the effects of the pandemic are still being felt, with the ongoing search for space contributing to record demand for homes, while city-centre markets are also being boosted by workers returning to the office.

Grainne Gilmore, head of research, Zoopla, says: “Just like much of 2021, the number of homes available for sale is lower than typical levels, but there are signs that the imbalance between demand and supply is starting to ease.

“As more potential sellers are able to find a home to move to, this will spur more supply in the weeks and months to come.”

Key takeaways

- Demand from potential buyers jumped by 49% in January

- House prices rose at an annual rate of 7.4%, taking the average value of a UK home to £242,000

- More homes are coming on to the market, although a significant supply and demand imbalance remains