Moderate house price falls set to continue

Homeowners who sold at the end of 2022 saw small price falls but it’s doing little to dent the equity most gained during the pandemic.

Most sold homes saw their prices fall in the last quarter of 2022 after a turbulent final few months of 2022.

This meant the average house price rose 6.5% in the year to December 2022, which is the lowest rate of annual growth since May 2021.

It’s a marked slowdown compared to the 8.3% rise in the previous year when moves and prices were still fuelled by the pandemic boost to the market.

And we expect further single-digit price falls in the first half of 2023.

But thanks to a big jump in home values from 2020 to mid-2022, these modest price falls will do little to dent the equity most homeowners have gained over the long-term.

What’s causing house prices to fall?

The number of enquiries sent to estate agents fell by 50% in the last quarter of 2022 compared to the previous quarter.

With fewer buyers in the market and sellers less certain about achieving a sale, buyers have gained the ability to drive some bargains.

They’re now getting an average of 3% to 4% off asking prices originally set by sellers.

But discounts now look to be staying at this level and we don’t see any reason for bigger discounts in the coming months.

What does 2023 hold for the housing market?

Our monthly House Price Index uses more data than any other, so we can get the most accurate picture of house prices across the UK.

However, it's early days to get a clear read on the market outlook for 2023.

Many households thinking about a home move this year are likely to be waiting to see if mortgage rates and house prices fall further.

The economic outlook has improved a little in recent weeks, with mortgage rates settling in the 4% to 5% range.

Buyers and sellers alike will gain confidence from this but the outlook for the housing market in 2023 will become clearer after Easter.

So far, we know that the number of buyers in the market has already rebounded to pre-pandemic levels, in line with 2018 and 10% higher than in 2019.

But priorities are changing as buyers become more value-conscious, with flats and towns near big cities moving up the wish list.

The squeeze on disposable incomes may prompt home moves too, with some seeing it as the time to release equity or find a cheaper-to-run home.

Meanwhile, demand from first-time buyers will remain as they look to escape the rapid growth in rents.

What are buyers looking for in 2023?

92% of homeowners enjoyed value gains on their homes in 2022

While house price falls are never welcome news for homeowners, our latest Value of Housing report might go some way to reassure you.

It found that 92% of homeowners enjoyed value gains on their homes in 2022 despite an uncertain end to the year.

The average capital gain was £19,000 while nearly 3 million homeowners made more than £50,000.

How much value did your home gain in 2022?

The report showed that the total value of homes in the UK is over £10.5 trillion.

With around £1.6 trillion of mortgage value, that leaves homeowners with almost £8 trillion in equity.

What are buyers looking for in 2023?

Looking to sell this year? Find out what buyers are on the hunt for right now and which locations they’re looking in.

For early buyers in 2023, it’s all about apartments.

The first few weeks of the year have revealed home buyers are becoming more value-conscious.

The hit to buying power, caused by higher mortgage rates, inflation and the cost-of-living squeeze is causing property-seekers to hunt for smaller homes.

We’ve seen a clear shift in demand towards flats across the UK, with a notable decline in the desire for 3-bed houses.

Our data reveals:

-

27% of new buyers are looking for 1- and 2-bed flats, up from 22% a year ago

-

49% of buyers in London are looking for 1- and 2-bed flats, up from 42% a year ago

-

Share of demand for 3-bed houses has fallen 5 percentage points to 39%

That said, 3-bed homes are still the most in-demand property type among UK buyers.

What areas are becoming more popular with flat-hunting buyers right now?

Share of interest in apartments is growing in the markets that are near the big cities.

Some of the largest increases in share of demand for flats have been seen in towns next to London such as Slough, Watford, Chelmsford, Guildford and Dartford.

The relative price differential is attractive for those who work locally, or who commute to London and are able to work more flexibly.

The same is true in other regional cities such as Huddersfield, Stockport and Wakefield, though to a lesser degree.

What’s going to happen to house prices in 2023?

In the short term we expect further small single-digit price falls in the first few months of the year, but the housing market is in better shape to deal with the headwinds than in previous economic cycles.

Will demand for homes increase in 2023?

2023 is off to a slower start than more recent years.

The economic outlook has improved slightly in recent weeks but the squeeze on household disposable incomes is very real and is having a direct impact on sales activity.

Some buyers will be waiting to see if house prices - and mortgage rates - start to fall in the first few months of the year.

Mortgage rates are now generally below 5% and look set to remain in the 4 to 5% range for 2023.

While this is a much better prospect than the 6% to 6.5% levels at the end of last year, buyers are likely to remain cautious in the next few weeks.

The pressure on incomes, combined with the costs of running homes, is also likely to drive a certain amount of movement in the market.

Sizeable amounts of embedded equity in many millions of homes may encourage downtrading to release equity and cut the energy bills.

As the outlook becomes clearer after Easter, we believe that demand is likely to pick up further.

How much depends on the economic outlook, the strength of the labour market, the level of inflation and how this impacts interest rates.

Key takeaways

- It's all about apartments for home buyers right now

- And towns near big cities are proving to be the hottest locations

- 2023 has kicked off to a slow start, but our research team believe demand for homes is set to rise as mortgage rates continue to fall

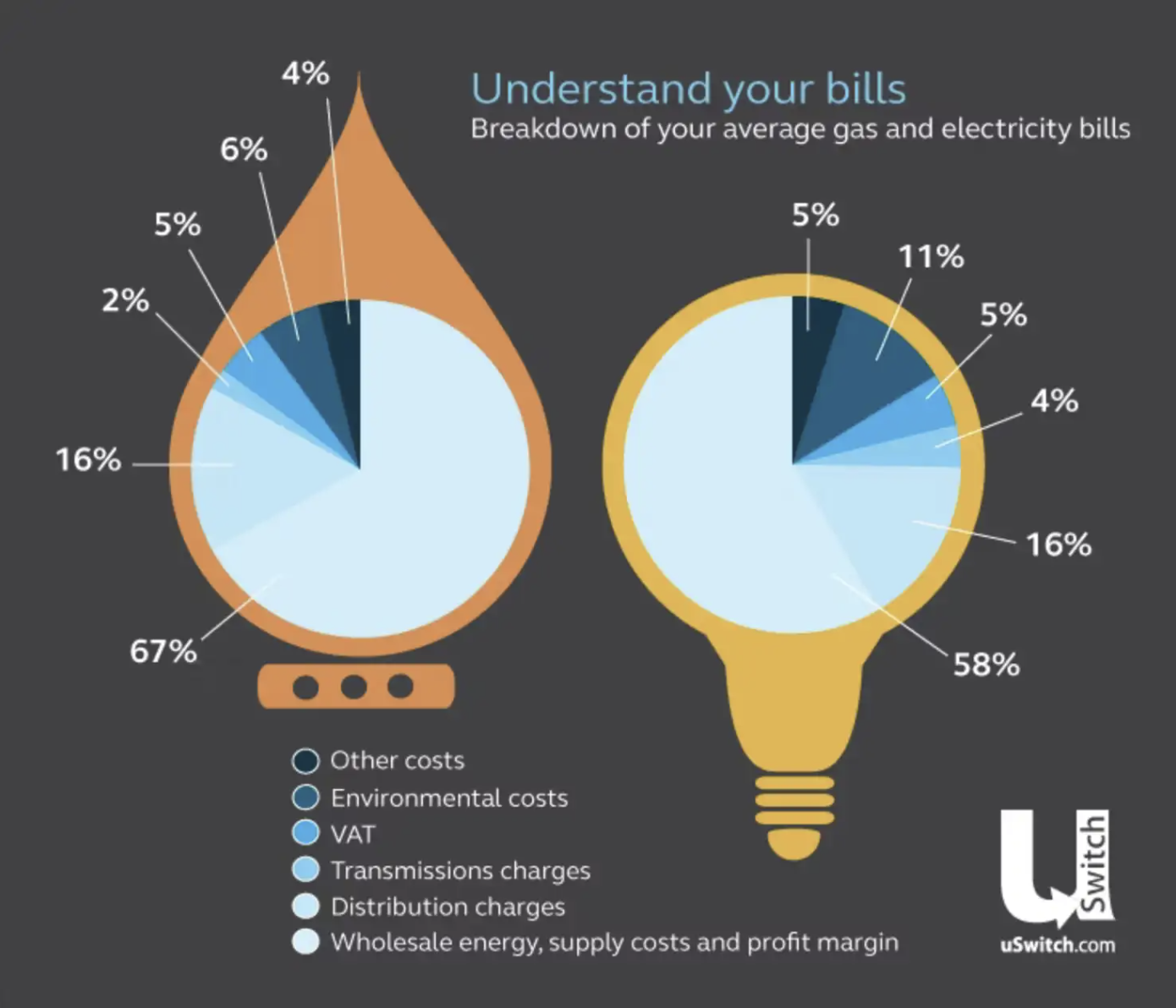

Gas and electricity bills breakdown

Here's a breakdown of the average energy bill to give you a better idea of where your money is going.

Here's a breakdown of the average energy bill to give you a better idea of where your money is going.

Your gas and electricity utility bill sets out the charges you've incurred as a gas and electricity customer.

Your energy supplier sends you your utility bills on a monthly or quarterly basis so that you can understand how much you owe.

The average utility bill is made up of several different components, with the majority of your payment going on the energy you use.

But there are other costs factored in, like distribution charges, environmental costs and VAT.

Here's how the average energy bill breaks down to give you a better idea of where your money is going.

Breakdown of the average energy bill

Where your gas payment goes

-

67% on wholesale energy, supply costs and profit margin

-

16% on distribution charges

-

6% on environmental costs

-

5% on VAT

-

4% on other costs

-

2% on transmission charges

Where your electricity payment goes

-

58% on wholesale energy, supply costs and profit margin

-

16% on distribution charges

-

11% on environmental costs

-

5% on VAT

-

5% on other costs

-

4% on transmission charges

Environmental costs

A proportion of your gas and electricity bill is used to subsidise the government's environmental initiatives.

Environmental costs comprise approximately 6% of your gas bill and 11% of your electricity bill.

Environmental schemes which are subsidised by your gas and electricity bill include:

-

Feed-in Tariff scheme (FITs)

-

Carbon Emissions Reduction Target (CERT)

-

Community Energy Saving Programme (CESP)

-

The Renewables Obligation (RO)

-

EU Emissions Trading Scheme (ETS)

Find out more about the Feed-in Tariff scheme on Uswitch.

VAT charges

Contrary to popular belief, you do not pay full VAT on gas and electricity, but you do pay some.

Currently, VAT payments are capped at 5% of your total bill.

Transmission charges

Transmission networks are what actually deliver electricity and gas to your home, and some of the cost of building and maintaining transmission chargers is passed on to customers.

Currently, 2% of your gas bill and 4% of your electricity bill make up these costs.

Distribution charges

16% of your gas bill and 16% of your electricity bill go towards distribution costs.

This covers some of the cost of building, maintaining and operating the local gas pipes and electricity wires which deliver energy to the home.

Wholesale energy and supply costs

The bulk of your bill, unsurprisingly, is comprised of charges for the gas and electricity you actually use.

This comes to roughly 67% and 58% of your respective bills.

Wholesale cost is the price that the energy supplier has to pay for the gas and electricity they buy.

Supply costs are the costs the energy supplier incurs for the general administration associated with a retail business, like running a call centre and sending out bills. These vary according to which tariff you're on.

Compare gas and electricity deals on Uswitch

Other costs

Other costs cover things like meter installation and gas storage, which comprise about 4% of your gas bill and 5% of your electricity bill.

How can you bring your energy bill down?

These energy-saving tips will help bring your energy bills down and reduce your carbon footprint.

Heating

The biggest portion of your energy bill is taken up with heating your home and water.

Follow these tips and you could save a fortune on your heating bills:

-

Turn your thermostat down by a single degree. This could save you as much as £60 on your energy bills over the space of a year.

-

Make sure your home is adequately insulated. Loft and cavity wall insulation may require an initial investment, but could easily save you hundreds a year in heating costs.

-

If you're on a low income, you may be eligible for an energy efficiency grant to make improvements to your home.

-

Try to block any draughts that are coming into your house and make sure you close your curtains to keep the heat in.

In the kitchen

The next largest portion goes towards powering your washing machines, fridges, freezers and cooking appliances.

Keep kitchen costs down with these tips:

-

Do your washing less frequently. It may sound obvious but make sure the machine is full every time for maximum efficiency.

-

Use the economy setting on your washing machine. Many washing powders will now work at temperatures as low as 30 degrees, which is enough to effectively wash clothes while also helping your machine run more efficiently.

-

Dry your clothes outside or on a clothes horse. Tumble dryers use a lot of energy, so if you can dry your clothes for free, that will help keep costs down.

-

Replace your current fridge and/or freezer with an energy-efficient model. Look out for the energy efficiency stickers on modern appliances. You should also make sure they're kept as full as possible and that the area around them is clean so they don't have to work as hard.

Computers, gadgets and electronics

Next up is the amount of energy used by consumer electronics such as DVDs, TVs and computers every year.

Bring these costs down by:

-

Turning electronics off instead of leaving them on standby. If you're forgetful, invest in a standby saver - it will automatically cut the power to any electronics left on standby.

-

Only charging devices when you need to. Don't leave laptops and mobile phones charging overnight as this is a big waste of energy.

Lighting

Finally, there is the portion of bills going towards lighting your home.

The quickest and easiest ways to save on your lighting costs are to:

-

Buy energy-efficient LED lightbulbs. They last up to 24 times more than incandescent lightbulbs and each one you swap could save you at least £4 per year.

-

Turn the lights off behind you when you leave a room and get into the habit of switching the lights off as you move through the house.