Rents rising fastest in major regional cities

UK rents are 12.1% higher than last year but major cities have seen even more rental inflation. Find out the average rent for your area and how quickly rents are rising across the country.

The average UK rent is now £1,078 per month, a rise of 12.1% in the last year.

Rents are rising the fastest in large cities where shortages of available rental homes cannot meet demand created by strong employment markets and large student populations.

London has seen the highest rental growth in the last year at 17%. That works out to a rise of £273 per month for renters in the capital, compared to a UK-wide jump of £117 per month.

There’s also been high rental growth in Manchester (+15.6%), Glasgow (+14.1%), Bristol (+12.9%), Sheffield (+12.4%) and Birmingham (+12.3%).

Rental growth is slower in smaller cities like Hull, York, Oxford and Leicester, where rents rose less than 8% in the last year.

But that’s still higher than the average 6% rise in earnings in the same period. The average renter now puts 35% of their income towards rent, making renting in the UK the most unaffordable it’s been this decade.

Southern cities record highest average rents

Average rental rates are highest in southern UK cities - London (£1,879), Cambridge (£1,431), Bristol (£1,254) and Southampton (£1,006).

The only city outside of the south to match these levels is Edinburgh, where renters are paying £1,060 per month for new tenancies - an above-average rise of 12.4% in the last 12 months.

Looking at regions rather than cities, the most expensive places to rent a home in the UK are the South East (£1,189) and East of England (£1,051), both higher than the UK average of £1,028 per month.

While rents have risen at 9.4% and 8.4% in these regions respectively, those are some of the slower regional growth rates in the country.

The South West - with an average rent of £983 - is also tracking slower regional growth (9.7%) than regions further north.

Rents are cheapest in northern regions and cities

As a general rule, rents get cheaper the further away you move from London.

Wales, East and West Midlands, Yorkshire and the Humber, and the North West are all recording average rents of between £700 and £800, offering greater value for money for renters.

But the cheapest regions to rent in the UK are the North East (£612), Northern Ireland (£679) and Scotland (£688).

If we look at major UK cities, the cheapest rental rates are currently in Newcastle (£712), Liverpool (£717) and Sheffield (£735).

Sheffield, however, has seen some of the highest rental growth in the last year with rents jumping 12.4%.

Will rents keep rising in 2023?

There’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents increase next year.

We expect annual rental growth to be between 4% and 5% by the end of 2023, as affordability limits of renters combine with a modest uplift in rental supply due to the weaker sales market.

Executive Director Richard Donnell says: “Increasing investment in new rental supply from multiple sources is the main route to reducing rental growth and making for a more sustainable private rented sector.”

Key takeaways

- Rents are rising the fastest in large UK cities with strong employment and large student populations

- London, Manchester and Glasgow recorded the highest rental growth in the last 12 months

- The South East and East of England are the most expensive regions to rent in December 2022, while rents get cheaper as you move further north

Top five urban regeneration hotspots

Buying in an area that's being regenerated is a smart move. Find out which major cities are being transformed with mulit-million pound investment projects right now.

As activity in the housing market slows, areas undergoing regeneration can be a good bet for property investors and home buyers.

Urban regeneration often triggers rising demand for housing as locations become more desirable places in which to live, which in turn attracts new businesses, according to Seven Capital.

“Developments such as new train stations, shopping centres, leisure facilities and mixed-use commercial spaces directly provide a better lifestyle, which in turn attracts new residents.

“This effect can then ripple outwards, attracting new businesses which support a higher-paid workforce and thus, increase demand for residential living nearby,” the group said.

Seven Capital has identified five locations that are seeing above-average regeneration, which will not only transform them into desirable places to live and work, but could also boost property values.

Derby

The Derby City Centre Masterplan is an ambitious regeneration scheme to deliver new retail, leisure and residential developments across the city.

Scheduled for competition in 2030, it aims to leverage £3.5 billion of investment to create 1,900 new homes and 4,000 jobs, as well as a hi-tech business park.

Meanwhile, the city’s Local Plan will see 11,000 new homes and more than 100,000sqm of office space built by 2028 in a bid to attract new employers to the city.

Derby is also poised to benefit from improved transport links through High Speed 2 (HS2), with the rail project putting it less than an hour away from London and within around 30 minutes of Birmingham.

These new amenities, employment opportunities and transport links are expected to lead to significant population growth in the city, leading to higher property demand, with Seven Capital predicting house prices could rise by 24% by 2025.

Birmingham

The UK’s second city has already benefited from a number of regeneration schemes in the past two decades, including the Bullring, New Street Station and Grand Central.

Birmingham is now focusing on the West Midlands Metro tram extension, which will create new transport links across the city.

Seven Capital expects the project to lead to a 6% increase in house prices in areas that will benefit from the increased connectivity.

Meanwhile the Paradise and Snowhill developments bring new office space and homes, while Digbeth is continuing to undergo regeneration, including the £1.5 billion Birmingham Smithfield development to create a mix of commercial space, offices, homes and public areas.

Birmingham is also set to be a significant beneficiary of HS2, which will cut the journey time to London to just 52 minutes.

Leeds

Leeds is already one of the fastest growing cities in the UK, and its appeal looks set to continue thanks to a number of regeneration projects.

Following on from the revamp of Leeds City Station, a £270 million development project is set to see the city’s Lisbon Square area transformed into a 2.8 hectare site that includes apartments, hotels and mixed-use office space.

Not only will it double the size of the city centre, but it is also expected to help boost the local economy.

At the same time, £8.6 million is set to be spent transforming road space into green space under the City Park scheme, while £7.4 billion will go towards expanding Temple Green Park and Ride, and £2.6 billion will be spent renovating older properties in the Holbeck area of the city.

Slough

Already a popular destination for London commuters, Slough is set to benefit from £3 billion of redevelopment cash.

The Heart of Slough project will see the former Thames Valley University land transformed into new homes, commercial space, retail and leisure facilities.

The town already boasts The Curve, a new theatre and library, as well as several new sports and leisure facilities, including an ice rink.

Meanwhile, plans are in place to transform the old Queensmere Shopping Centre into 1,600 new homes, as well as 12,000sqm of retail space and 40,000sqm of office space.

At the same time, the newly completed development The Metalworks offers homes less than 200 metres from a Crossrail station.

Bracknell

Bracknell has seen a number of regeneration projects during the past 10 years as the popularity of the town increases.

The £770 million Bracknell Town Centre Vision 2032 has already seen the creation of retail and leisure complex The Lexicon.

Future redevelopment projects include The Grand Exchange, a new residential complex designed to capitalise on growing demand for homes from people leaving London.

Other up-and-coming projects include Princess Square and The Deck which will provide new retails offerings and public space.

Key takeaways

- Regeneration in urban areas can help to boost house prices

- Good transport links, alongside improved shopping, restaurants, cafes and sports facilities generate employment and create more desirable places to live

- Derby, Birmingham, Leeds, Slough and Bracknell are the places to watch right now, as they're all seeing high levels of regeneration

It's a property market 'shake out' not a property market crash

Sellers are beginning to offer bigger discounts to buyers to get their sales agreed, but we’re not seeing the need for a big double digit reset in UK house prices.

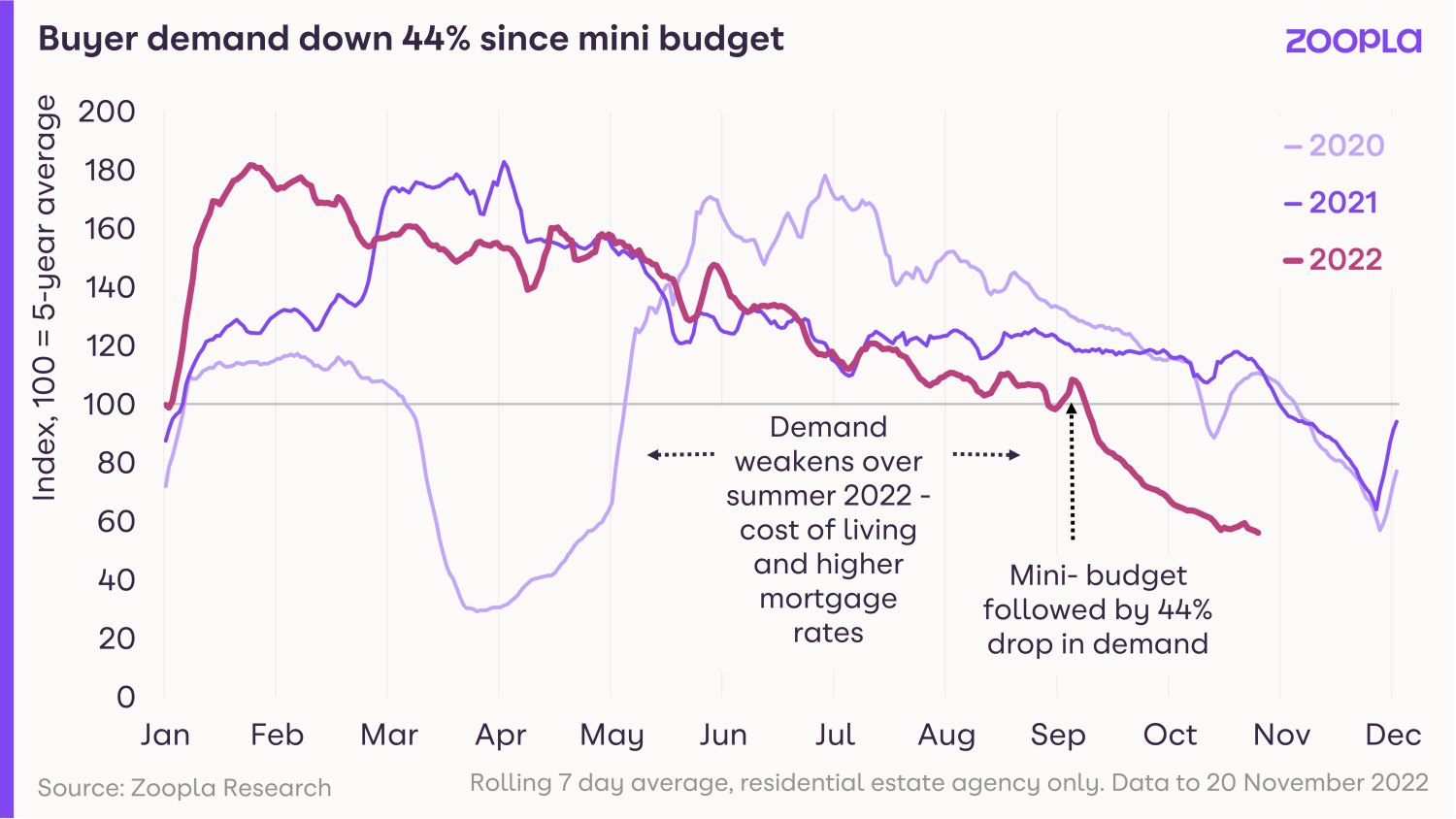

The spike in mortgage rates after the mini-budget in late September undoubtedly hit the housing market.

Demand has now fallen to pre-Christmas levels a lot earlier than usual, as would-be buyers sit on the sidelines, waiting to see what happens with mortgage rates and what the economic outlook holds for jobs and incomes.

In fact, it’s currently at half the level it was at this time last year, when market conditions were stronger, mortgage rates lower and there were fewer cost-of-living pressures on household budgets.

That drop in demand in turn has affected sales volumes, which are down 28% from a year ago and are now on a par with the pre-pandemic period.

More sellers dropping asking prices

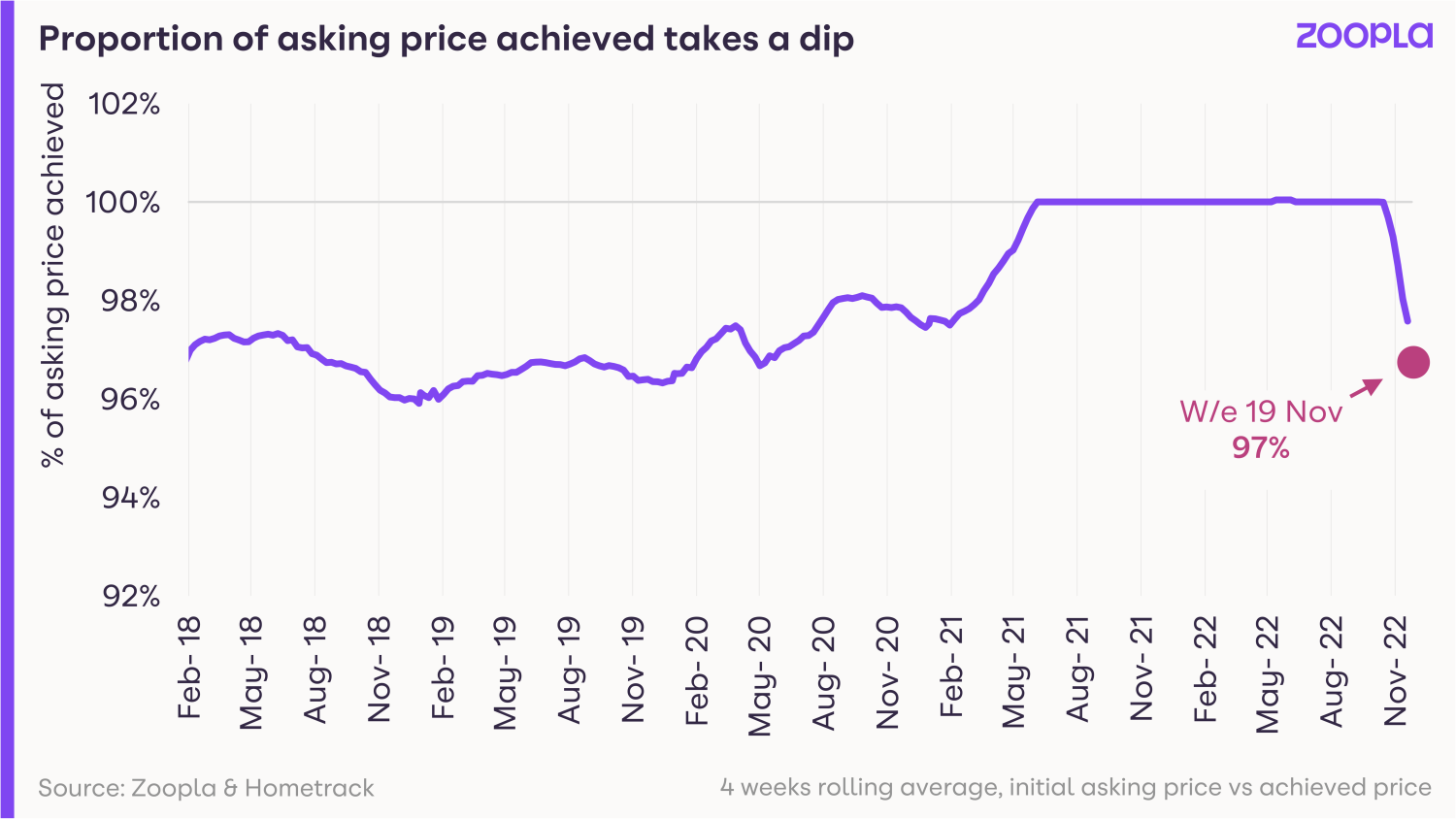

Meanwhile, sellers are beginning to offer bigger discounts to buyers to get their sales agreed.

Data from our valuation and property risk business Hometrack, shows that the gap between the first asking price and the agreed selling price has started to widen in recent weeks.

But it’s important to remember that throughout the pandemic, sellers were enjoying the luxury of achieving their full asking price - and in many instances more - as demand surged among buyers.

The pendulum has now started to swing in the opposite direction and the average seller is now offering a 3% discount on their property to achieve a sale.

Why this isn’t a property market crash

Right now, we are simply transitioning from an unsustainably strong market to a more balanced one.

All the leading supply and demand indicators we measure continue to point to a rapid slowdown from very strong market conditions.

Despite higher mortgage rates reducing how much buyers can afford, new sales have been more resilient than some may have expected.

Committed buyers and sellers are continuing to bring homes to the market and agree on deals, although these are fewer in number and harder to negotiate and hold together over the buying cycle.

And while fall-through rates may be higher, they are not unmanageable for agents.

Our data shows that 1 in 15 homes formerly sold is returning to the market after the original sale has fallen through.

Importantly, we are not seeing any evidence of forced sales or the need for a large, double digit reset in UK house prices in 2023.

Historic data shows buyers’ offers need to be in the region of -5% to -7% below what the seller is asking for the property for annual price falls to take place.

We do expect the discount to widen further as we move to more of a buyers’ market, but the positive here is that strong house price growth has given sellers more room to negotiate on their asking price without losing their long-term value gains.

The prospects for 2023 really depend on how willing sellers are to adjust asking prices in line with what buyers are prepared to pay.

Key takeaways

- Buyer demand falls to pre-Christmas levels earlier than normal

- The average seller is accepting offers at 3% below the asking price lately to achieve the sale

- The housing market is now transitioning from an unsustainably strong market to a more balanced one

Greater choice returns to the housing market

More homes are now coming up for sale across the UK. And because they’re no longer selling like hotcakes as they did in the pandemic, stocks are starting to rebuild.

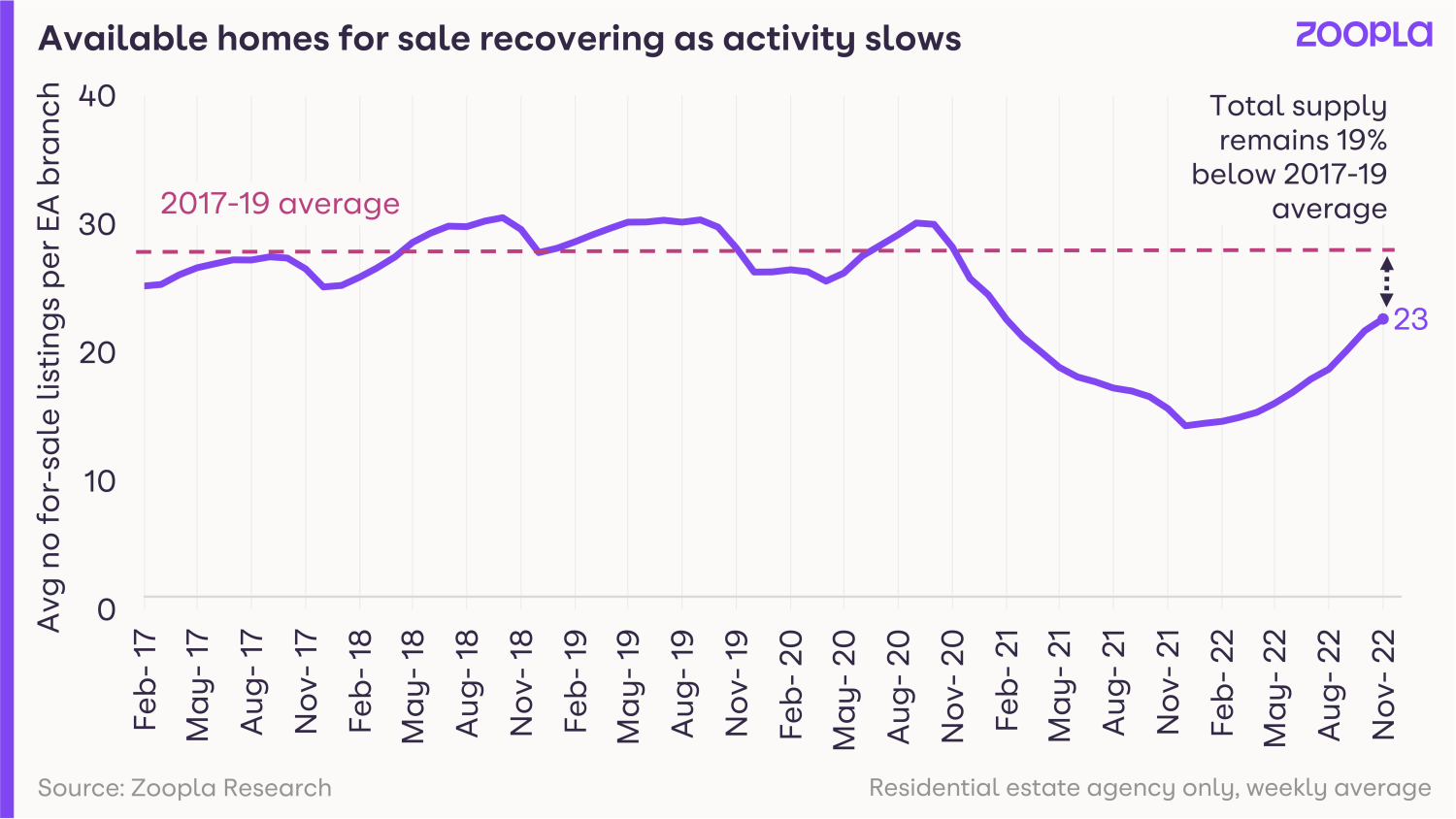

In good news for buyers, there’s now more choice available when it comes to finding a new home.

The average estate agent office now has 23 homes for sale, the highest level of stock seen since January 2021.

We’re still not quite back up to pre-pandemic levels yet, when the average agent had 29 homes on their books.

But the growth in homes available for sale is being seen across all areas of the UK.

Greater availability of homes for sale reduces upward pressure on prices

Rebuilding sales inventory, which boosts buyer choice, is part of the move to a more balanced housing market.

However, it’s important that sellers price their homes in line with what buyers are prepared to pay, given the current hit to buying power caused by higher mortgage rates.

More homes for sale will help to reduce the scale of the upward pressure on house prices and bring us back to a more normalised housing market for buyers.

House prices are not expected to tumble in 2023

Our expectation is that we won’t get an over-supply of homes for sale in 2023.

We expect some element of scarcity to remain a feature of the market, meaning house prices are not expected to fall dramatically next year.

The drivers and motivations to move home have shifted, and will continue to in our view.

Pandemic-related forces, including greater labour market flexibility, the rise in the number of people reaching retirement age and the desire for more space, means people will continue to look for new homes next year.

Some of these factors though, are now being compounded by rising living costs.

In particular, high levels of rental inflation are adding to the cost of living pressures for renters.

We expect this to support first-time buyer demand in 2023, even with the oncoming headwinds and the hit to buying power from higher mortgage rates.

Key takeaways

- Across the UK, the number of homes for sale is growing, meaning greater choice for buyers

- The average agent now has 23 homes on their books, the highest level of stock in nearly two years

- More homes for sale will reduce the upward pressure on house prices and bring us back to a more normalised housing market for buyers

How far will mortgage rates fall in 2023?

Mortgage rates look set to return to more affordable levels next year, but how low can they go? Here are our predictions for mortgage rates in 2023.

The rise in mortgage rates in the last 2 months has been the main reason for the recent slowdown in the housing market.

But things are looking a little more positive for borrowers as we head towards the New Year, and we expect mortgage rates to settle between 4.5% and 5% by mid-2023.

Along with a widespread fall in house prices by up to 5%, more affordable mortgage rates will encourage some people to move next year and we’re anticipating 1 million completed sales in 2023.

Underlying cost of fixed rate mortgages for lenders falls to 4.1%

The underlying cost for banks to borrow for a 5-year fix - the most popular initial term - has fallen from 5.5% to 4.1% since early October.

Lenders add a margin for risk and profit on top of this underlying cost. This is why mortgage rates soared to 6.5% after the mini budget.

We expect the recent fall in the cost of finance for banks to translate into more affordable fixed mortgage deals on the high street, with mortgage rates at or below 5% in January then settling at between 4.5% and 5% by the middle of the year.

Compared to the 6.25% rates of recent months, it will put the 6 in 10 mortgaged buyers who use a 5-year fixed mortgage in a stronger buying position in 6 months’ time.

Greater choice returns to the housing market

More buyers will reduce reliance on mortgage finance in 2023

A 4.5% or 5% mortgage rate is still a material increase in costs for the 7 in 10 buyers who use a mortgage, compared to the sub-2% rates of recent years.

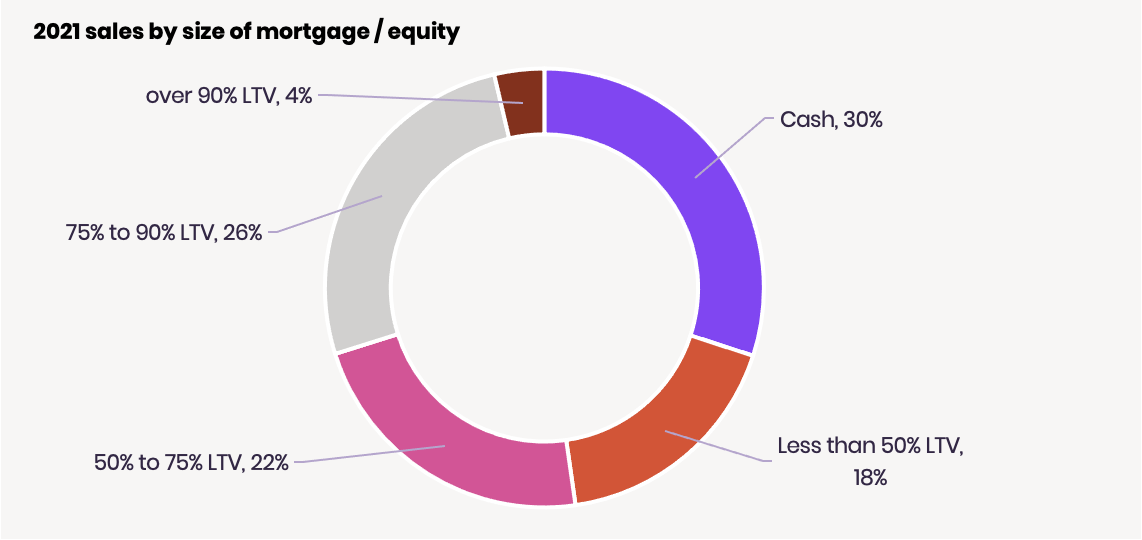

As a result, we expect more home buyers to look for ways to reduce their reliance on mortgage finance.

They’ll look to borrow less by changing what they need in their next home, coming up with more equity or waiting to see if further falls to house prices or mortgage rates come later in 2023.

Together, this will further reduce the housing market’s reliance on high loan-to-value mortgages, a trend we’ve seen grow over the last decade.

As lenders tightened their criteria after the global financial crisis, buyers needed greater equity and income to take out a mortgage.

So, over time, homeowners have gained greater stakes in their homes and the ability to absorb small price fluctuations, which is key in preventing a housing crash and keeping sales volumes healthy in 2023.

This is an important and underreported shift in enabling home moves, and one of the main reasons we continue to feel relatively optimistic in our housing market predictions for 2023.

It's a property market 'shakeout', not a property market crash

Lower mortgage rates and house price falls will support sales volume

Current market measures - such as asking price reductions and buyer demand decreases - are pointing towards modest but widespread house prices falls of up to 5% in 2023.

Quarterly house price growth at lowest level since February 2020

However, price corrections combined with steadying fixed mortgage rates will support the number of sales completed in 2023, which we estimate will reach 1 million over the year.

It signals a return to more normal housing market conditions after 2 years of frenzied pandemic-driven activity.

Key takeaways

- Underlying cost of fixed rate mortgages for lenders has fallen from 5.5% to 4.1% since early October - actual mortgage rates are higher than this

- Average 5-year fixed mortgage rates likely to settle between 4.5% and 5% by mid-2023

- The housing market’s reduced reliance on high loan-to-value mortgage finance will continue to encourage home moves next year

Thousands of new homes to be built with £175 million government scheme

Government launches fund to transform derelict land into sites with brand new homes - including affordable homes - across the UK.

Thousands of new homes are set to be built on derelict land under a new £175 million government scheme.

The funding will be used to turn council-owned land, including redundant industrial sites, disused car parks and derelict buildings, into new communities, according to the Department for Levelling Up, Housing and Communities.

A total of 59 regeneration projects, from Exeter to Sunderland, have been approved to receive the first £35 million under the scheme.

The fund will lead to 2,200 new properties being built, including 800 affordable homes.

The remaining £140 million will be allocated over the next two years, leading to a further 17,600 new homes.

Minister for Housing Lucy Frazer said: “We are helping local communities transform unwanted, urban eyesores into thriving places that people are proud to call home.

“Regeneration is at the heart of our levelling up mission and this new brownfield first fund will help communities across the country unlock disused, council-owned sites to build more of the right homes in the right places.”

Why is this happening?

The scheme is part of the government’s drive to help more people get on to the housing ladder, while levelling up the country.

Funding for the scheme will come from the £180 million Brownfield Land Release Fund 2, which has been allocated to 41 councils to help kickstart regeneration in towns and cities.

It builds on the first Brownfield Land Release Fund, under which councils received £77 million to assist with the construction of 7,750 new homes.

Who does it affect?

The move is good news for people wanting to purchase a new-build home, as it will help to boost supply.

Developments will also take into account the types of property local communities need.

Meanwhile, turning derelict land and buildings into new properties will have a positive impact on the surrounding area, making neighbourhoods more desirable and helping to support local house prices.

What’s the background?

The government has pledged to deliver 300,000 new homes each year in a bid to tackle the UK’s housing shortage.

The National House Building Council (NHBC) recently announced that the number of new properties being built had soared to a 15-year high during the three months to the end of September, with a total of 44,729 homes started during the period.

The level of properties under construction increased in 10 of the UK’s 12 regions.

New-build homes offer a number of advantages to buyers. Not only are they more energy efficient and have lower maintenance costs, but they typically come with a 10-year warranty from the NHBC.

In addition, purchasing a new-build property is chain-free if you are a first-time buyer or do not have a home that you need to sell.

Key takeaways

- Thousands of new homes are set to be built on derelict land under a new £175 million government scheme

- The funding will turn council-owned land, including redundant industrial sites, disused car parks and derelict buildings, into new communities

- 59 regeneration projects for 2,200 new properties have already been approved under the scheme

What can I do if my home is repossessed?

We take a look at what you should do if you are struggling to pay your mortgage, or if your rental home is repossessed.

Home repossessions are used as a very last resort by lenders.

However, the number of repossessions is starting to increase as people struggle with the cost-of-living squeeze.

A total of 700 properties were taken back by lenders during the three months to the end of September, 15% more than during the previous three-month period, according to mortgage trade body UK Finance.

There was also an 11% jump in the number of buy-to-let homes that were repossessed, with 390 landlords losing properties after falling behind with mortgage payments.

However, the number of properties being repossessed represents less than 1% of cases where homeowners have fallen into arrears with their mortgage repayments.

The proportion was slightly higher for landlords, with just under 7% of mortgage arrears cases leading to repossessions.

Right now, 74,440 homeowners and 5, 760 landlords are currently in arrears of more than 2.5%.

A separate report by the Ministry of Justice shows that while repossession figures have increased significantly compared with the previous year, they are still around a third lower than the level seen before the Covid-19 pandemic.

Why is this happening?

There are two factors driving the increase in repossessions.

1: Higher food, petrol and energy prices, combined with rising interest rates, has made it harder for some people to keep up with their mortgage repayments.

2: Measures that were put in place to stop people losing their home during the pandemic have now come to an end.

What should I do if I’m struggling with my mortgage?

If you are struggling to pay your mortgage, it is important that you contact your lender as soon as possible.

Regulators require banks and building societies to work with people who run into difficulties and only repossess their home as a last resort.

Contacting your lender sooner, especially before you miss a mortgage payment, will open up more options to you.

There are a number of steps lenders can take to help you if you are struggling.

These include increasing your mortgage term, for example allowing you to repay your mortgage over 30 years rather than 20 years, or changing you to an interest only mortgage for a period of time.

Both of these options will significantly reduce your monthly mortgage payments.

They may also grant you a mortgage payment holiday for a period of two to three months to help you get back on your feet if, for example, you have been made redundant.

During this period, the interest that you don’t pay will be added to the outstanding amount that you owe. The payments you have missed will also have to be made up at a later stage.

Another option is to defer mortgage payments for a set period of time, after which the payments you have missed will be added to your monthly repayments and made up over the course of a year or two.

What are my rights if my rental home is repossessed?

If you rent your home, the prospect of your landlord having the property repossessed can be very stressful.

The good news is that in some cases you have the right to stay on in the property, for example if your tenancy is binding on your landlord’s mortgage lender.

It may be binding if the lender agreed to the tenancy, if you were already living in the property when the mortgage was granted, or if the lender has recognised your tenancy in some way, such as by asking you to pay rent to them.

If your tenancy is not recognised by your landlord’s lender and you do not have the right to stay in your home, you can still delay having to leave by up to two months.

You can do this through making an application to the court during the possession hearing, at which point the judge can agree to delay the date on which you must leave.

Unfortunately, you will have to pay a fee to make an application to the court.

If you miss the hearing when the possession order is made, you have another opportunity to ask for a delay when the mortgage lender applies for a warrant of possession.

Before the lender is allowed to evict you, they have to send a notice to your home saying they have applied for a possession order.

At this stage you can apply to the lender to delay repossessing the property for up to two months.

If the lender refuses or does not reply to you, you can apply to the court instead, but you will need to move quickly, as the court can issue a warrant of possession within 14 days of notice being sent to your home. You will also have to pay a fee.

The process can be a bit complicated, but charities such as Citizens Advice are able to help you establish whether you have a right to stay in the property.

They can also help you to apply for a delay in leaving it.

Key takeaways

- Home repossessions rose by 15% to 700 properties in the three months to the end of September

- There was also an 11% jump in the number of buy-to-let homes that were repossessed

- If you're struggling with your mortgage contact your lender as soon as possible, if you rent your home you may be able to stay in it, even if it is repossessed

What Jeremy Hunt's autumn statement means for the housing market

Stamp duty cuts reversed and rising council tax rates on the way - but the energy price cap remains in place. And what does it all mean for mortgage rates?

Chancellor Jeremy Hunt today set out plans to fill a £55 billion hole in the government’s finances through a combination of tax rises and spending cuts.

The deficit was created by former Chancellor Kwasi Kwarteng’s now infamous mini-Budget, which sparked chaos in the financial markets and led to a steep increase in government borrowing costs.

Just under half of the £55 billion will come from tax rises, with just over half coming from cuts to government spending, Hunt said.

He added that once the UK’s economy had recovered, the pace of fiscal consolidation would be increased, to reduce pressure on the Bank of England to raise interest rates.

What’s the big picture?

The Office for Budgetary Responsibility (OBR), which provides independent analysis on the government’s finances, confirmed that the UK is already in recession.

But Hunt said the OBR expects the downturn to be shallower as a result of the measures in the Autumn Statement.

The OBR forecast the economy will grow by 4.2% this year, before contracting by 1.4% in 2023, with growth recovering to 1.3% in 2024.

Meanwhile, inflation will average 9.1% this year, before starting to fall steeply from the middle of next year.

Unemployment is expected to rise from its current rate of 3.6% to reach 4.9% in 2024, before falling back to 4.1%.

Which taxes are going up?

Income tax

The Chancellor announced that the thresholds at which the different rates of income tax kick in will be frozen at their current level for six years.

This means the basic rate of 20% will be charged on all earnings over £12,570 until April 2028, while the 40% rate will be charged on earnings over £50,270 until the same date.

Meanwhile, more high earners will be pulled into the top rate of income tax, with the level of income on which the 45% rate is charged being reduced to £125,410 from £150,000 now.

The move will cost those earning more than £150,000 around £1,200 a year.

The thresholds for National Insurance for individuals will also be frozen.

Stamp duty

Kwarteng’s increase to the threshold at which stamp duty is paid to £250,000 was one of the few mini-Budget measures that were not reversed by Hunt when he took office.

But he announced today that the increase will be temporary, with the threshold falling back to its previous level of £125,000 after 31 March 2025.

The threshold for first-time buyers will also be cut to £300,000 from £425,000, on properties costing up to £500,000, rather than £625,000.

He justified the measure by saying that activity in the housing market was expected to slow down over the next two years, and reverting back to the former stamp duty threshold in 2025 would encourage people to bring forward purchases.

The move will cost people purchasing a home for more than £250,000 an extra £2,500 in higher stamp duty payments.

Executive Director of research and insight, Richard Donnell, says: "The government's announcement of a reversal of the recently announced stamp duty changes in 2025 signifies a real need to reform stamp duty - a tax that is now starting to resemble income tax where it's the top tax bands generating the greatest receipts.

"This reversal will make it increasingly difficult for prospective first-time buyers to get on the housing ladder in the coming years, particularly in London and the South East which accounts for the majority of stamp duty receipts."

Council tax

Hunt has lifted the cap on council tax increases to give local authorities more freedom to raise cash.

Local authorities will now be able to raise council tax by up to 5% without having to hold a referendum on their plans.

The impact of the move will vary from council to council, as well as according to individual property bands, but it could see the average amount charged on a band D property rise from £1,966 to as much as £2,064.

Capital gains tax

Capital gains tax is charged at a rate of 18% on residential property and 10% on other assets for basic rate tax payers, and 28% and 20% respectively for higher rate taxpayers. But the first £12,300 of gains are tax free.

However, Hunt announced today that he was reducing the tax-free threshold to £6,000 from April 2023, and to £3,000 from April 2024.

The move will impact investors who sell buy-to-let properties, but the tax is not charged on the sale of people’s main home.

Inheritance tax

The threshold at which inheritance tax starts has also been frozen at its current level of £325,000, although couples can still combine their allowances and assets left to a spouse or civil partner will not be liable for the tax.

In another blow for people planning to leave their family home to their children, the Chancellor also announce the introduction of a cap on social care costs would be delayed by two years.

The cap had been due to come in to force in October 2023, and would limit the total amount individuals had to spend on social care as they aged to £86,000, after which the state would step in to foot the bill.

The cap would have reduced the number of elderly people who had to sell their family home to pay for care.

What support is available?

Hunt had previously warned that the Energy Price Guarantee, which limited average household energy bills to £2,500 a year would be reviewed at the end of March, sparking concerns that it could be scrapped altogether.

But there was good news for struggling households, with Hunt saying it would remain in place but be increased to £3,000 a year for a further 12 months.

Although the move will cost the typical household an additional £500 a year, the sum is significantly less than they would have to pay if the guarantee was abolished altogether.

He also announced that people on means tested benefits would receive a one-off £900 cost-of-living payment, while pensioners would get £300, and those on disability benefits would receive £150.

In addition, the state pension and means tested benefits will be increased by 10.1%, in line with the level of inflation as measured by the Consumer Prices Index in September.

People who rent their home from a social landlord will have rent increases capped at 7% for 2023/24.

What does this mean for the mortgage market?

It’s too early to say how financial markets will react, but the statement is expected to reassurance them after the chaos caused by the mini-Budget.

Not only does Hunt set out exactly how he plans to fill the government’s budget deficit, but he has also published the OBR’s response to his plans.

The interest rates charged on fixed rate mortgages had already fallen before today’s statement, and they are likely to continue their downward trend following it.

Hunt’s announcement that the rate at which fiscal consolidation would take place would increase once the economy returned to growth also means the Bank of England will be under less pressure to raise interest rates, which is further good news for mortgage rates.

Director of estate agency Anderson Harris, Adrian Anderson, says: “In today’s Autumn Statement, Chancellor Jeremy Hunt highlighted the importance of getting inflation and mortgage rates under control before announcing a raft of measures, both tax rises and spending cuts, in an attempt achieve that goal.

“Whilst the medicine will be painful for many, for mortgage borrowers spiralling inflation combined with consequential higher interest rates is punishing and I am hopeful that these steps will result in the Bank of England base rate peaking around 4% as now predicted."

What does it all mean for the housing market?

The statement is a mixed bag for the housing market.

Activity has already slowed in the face of higher living costs, rising interest rates and economic uncertainty.

The freezing of the income tax thresholds, combined with higher council tax and energy bills will do little to change this.

That said, the continuation of the Energy Price Guarantee from April, albeit at a slightly higher level, will reassure consumers that they will not face a steep increase in their gas and electricity bills come the spring, and could go some way towards increasing confidence.

Meanwhile, news that the threshold at which stamp duty is charged will fall back to £125,000 in April 2025, may cause some people to bring forward their purchase.

The fact that unemployment should not increase significantly should also help to prevent a high level of forced sales, while the overall stability the statement brings is also good news for the housing market.

The one area of bad news is the decrease in the capital gains tax allowance in 2023 and 2024.

Some commentators have warned that the move could prompt small-scale buy-to-let landlords to sell their properties ahead of the decrease, further intensifying the shortage of homes in the private rented sector.

Key takeaways

- Stamp duty cuts to be reversed in April 2025

- Energy price cap, raised to £3,000, to stay in place for a further 12 months

- Councils given the power to increase council tax

- Capital gains tax threshold reduced to £6,000

- Inheritance tax threshold frozen at £325,000

Inflation expected to fall sharply next year

The Bank of England predicts inflation will be below its 2% target in two years time, and close to zero in three years, leading to lower mortgage rates.

Minutes from the Bank of England’s latest interest rate setting meeting triggered some alarming headlines.

But while some outlets warned that the UK was heading for its longest recession since records began, there was actually good news buried in the minutes of its meeting - including suggestions that interest rates may not need to rise by as much as previously expected.

We take a look at some of the positives from the report and how they will impact the housing market.

The recession will be long but may not be too deep

The most eye-catching prediction from the Bank’s Monetary Policy Committee’s (MPC) minutes was that the UK is likely already in a recession, which is expected to last for two years.

If this prediction is correct, it would be the longest recession for the country since records began in 1920.

But what received less attention is the fact that economic growth is expected to contract by 1.9% in 2023 and 0.1% in 2024.

This means that while the MPC is expecting the recession to be long, it does not think it will be too deep.

To put these figures in context, the current recession would be significantly less bad than the one in the wake of the global financial crisis, when GDP growth contracted by 2.6% in a single quarter, and by 7.1% across five quarters in 2008 and 2009.

During the Covid-19 pandemic, GDP dived by a record 19.4%.

Economists have also pointed out that the MPC’s forecast is based on current market predictions for interest rates.

But the MPC suggested interest rates will not need to rise by as much as markets think, suggesting the recession could be less severe than its forecast suggests.

Unemployment will remain reasonably low

The MPC also forecast a rise in unemployment in its minutes, predicting the proportion of people who are out of work would increase from 3.5% now to 4.9% by the end of 2023.

While the increase may sound alarming, it is important to see it in context.

Unemployment is currently at its lowest level since 1974. A rise to 4.9%, would put the number of people out of work broadly on the same level as in early 2021 during the pandemic.

Looking further ahead, the MPC expects unemployment to continue rising in 2024 and 2025 to reach 6.4% by the end of that year. That's still well below the peak of 10.7% seen in the 1992 recession.

The fact that the number of people likely to lose their job is expected to remain relatively low compared with previous recessions, is good news for the housing market.

In the past, steep rises in unemployment led to a high level of forced sales, as people were no longer able to keep up with their mortgage repayments, triggering house price falls.

But that looks unlikely to happen this time around. Not only are job losses expected to be limited, but lenders are also now required by regulators to work with people who run into difficulties repaying their mortgage, and only repossess their home as a last resort.

Inflation should peak soon, then fall sharply

A major factor contributing to the current slowdown in activity in the housing market is the cost-of-living squeeze.

Steep increases in the cost of food, petrol and energy have made consumers more cautious, and caused them to delay making big purchases, such as a buying a new home.

It also makes it harder for them to pass mortgage affordability tests, as more of their money is being spent on essentials.

But the MPC expects inflation to peak at 11% in the final three months of this year, before falling sharply from the middle of next year.

In fact, it predicts inflation will be below its 2% target two years from now, and be close to zero in three years’ time.

Getting inflation back under control will not only boost consumer confidence, but it will also enable the MPC to reduce the Bank Rate – the official cost of borrowing – which should lead to lower mortgage rates.

Interest rates may not rise by as much as expected

This one is a bit more speculative, as the MPC does not make predictions on interest rates.

But it did appear to signal that the Bank Rate may not need to increase by as much as markets currently expect.

When the MPC held its November meeting, money markets had priced in further increases to the Bank Rate to 5.25%.

As is customary, the MPC based its economic forecasts on interest rates peaking at this level.

Although it continued with its previous rhetoric that it will “respond forcefully, as necessary” to get inflation back down to its 2% target, it also said the impact of previous interest rate rises had not yet been fully felt.

In a press conference following the meeting, Bank Governor Andrew Bailey also said the Bank Rate would have to go up by less than currently expected by financial markets.

He said: “Our best view of where the rate should be … is nearer the constant rate curve [3.00%] than the market rate curve [5.25%].”

Economists have interpreted his comments as suggesting the Bank Rate could peak at between 3% to 4%, meaning it may not rise much further from its current level of 3%.

This is obviously good news for mortgage rates.

Variable rate mortgages, such as tracker products and standard variable rates, move up and down in line with changes to the Bank Rate.

Fixed rate mortgages are based on so-called swap rates, which are themselves based on what the money markets think will happen with interest rates in the future.

In both cases, if interest rates do not need to rise by as much as previously expected, mortgage rates will also be lower.

What does this mean for the housing market?

Activity in the housing market has been hit by a combination of the cost-of-living squeeze, economic uncertainty, and the recent increase in mortgage rates.

If inflation peaks soon and mortgage rates do not rise any higher, it could help to restore consumer confidence.

In fact, the cost of fixed rate mortgages, which has already come down since the mini-Budget, is expected to continue to fall during the final part of the year.

At the same time, a sharp spike in unemployment in 2023 is not expected, meaning there are unlikely to be a high level of forced sales.

Even so, mortgage rates still remain significantly higher than they were at the start of the year, which, combined with higher house prices, will impact affordability.

This is likely to lead to lower buyer demand, and house prices are likely to drop from their current record level in some areas.

Key takeaways

- Getting inflation back under control will enable the MPC to reduce the Bank Rate – the official cost of borrowing – which should lead to lower mortgage rates

- Economists are suggesting the Bank Rate could peak at between 3% to 4%, meaning it may not rise much further from its current level of 3%

- While the recession that the UK is already in will be long, it will not be too deep

What does the latest interest rate rise mean for home buyers?

The Bank Rate is up by 0.75% but the outlook for mortgage rates is unchanged, with the likelihood borrowing costs will be lower by the year end.

Bank Rate up, outlook for mortgage rate improves

The Bank Rate moved 0.75% higher this week. This does not mean the average mortgage rate of 6.25% will rise to 7%, making life even harder for new home buyers.

In fact, the outlook for fixed rate mortgages has improved off the back of the Bank of England's increase. This is great news but home buyers using a mortgage should still expect to pay higher mortgage rates than in the recent past.

The cost of fixed rate mortgages, used by 9 in 10 borrowers, is based on the how money markets expect the cost of Government borrowing to change over time. The Bank of England is acting more aggressively now to control inflation and hoping that they can reduce interest rates more quickly later in 2023. The Governor has also suggest financial markets are over-estimating the outlook for borrowing costs.

The all-important money market benchmark that underpins 5 year mortgage rates continues to fall from its high, just after the mini budget when lenders pulled mortgages products and pushed mortgage rates much higher. It has fallen over 1.25% in recent weeks and currently points towards mortgage rates of just over 5% later this year.

Home buyers adopt wait-and-see approach

These are uncertain times for everyone in the UK. Higher interest rates and talk of a drawn-out recession are not the backdrop to build confidence in making big home move decisions.

We have seen new buyer demand continue to fall - down almost 40% since the mini budget - as those without cheap mortgages or in the process of buying a home step back from the market. It is a uniform picture across the country. It mirrors what we tend to see at the end of November as the market slows in the run up to Christmas and the New Year.

How might buyers adapt in 2023?

5% mortgage rates are still much more than borrowers were paying a year ago and will dent home buyer demand in 2023. However, the impact of higher borrowing cost is far from equal and we expect some would-be home buyers to shift strategies.

30% of home buyers use cash and a further 18% use smaller sized loans, groups that will be less affected by higher borrowing costs.

The pandemic and working from home means more buyers might look to move further, seeking out better value for money using a smaller mortgage. Others may look to move and transfer or 'port' their current mortgage to their new home without taking on any more debt.

First time buyers and those looking to take out big mortgages to trade up to a bigger homes will be more affected. First time buyers often sit at the bottom of many chains of housing sales which could have a wider impact.

Outside South East England, many first time buyers have been taking advantage of lower borrowing costs and buying larger 3 bedroom homes. There is scope for them look at smaller homes and we will have to see whether they are willing to compromise on space in the face of higher mortgage rates.

Don't stop your planning if you want to move

For those serious about moving in 2023, it's important not to stop all activities. Buying a home is a 3 to 9 month process and the wider economic backdrop can move fast.

With the pressure on budgets for what you can afford, we would encourage buyers to consider other markets and areas that might offer what they need at a lower price point. Do your research using Zoopla's tools and go and visit and speak to local agents who may be able to give you the inside story into local areas.

The cost of mortgages will be in flux over the coming months and lenders will be changing the product range and pricing, so stay in touch with your broker and lender to keep on top of the options available.

It's going to be a bumpy ride for the next few months but with improved planning and preparation there are still options to find that next home.

Key takeaways

- Bank of England pushes Bank Rate to 3% but outlook for mortgages improves (slightly)

- Would-be movers adopt a wait-and-see approach amid talk of a drawn-out recession

- A high proportion of buyers using cash or smaller mortgages are less exposed to higher mortgage rates

- Other buyers will adopt new strategies to buy in 2023

- Don't get caught out waiting too long: buying a home is a 3 to 9 month process and the wider economic backdrop can move fast