Top five urban regeneration hotspots

Buying in an area that's being regenerated is a smart move. Find out which major cities are being transformed with mulit-million pound investment projects right now.

As activity in the housing market slows, areas undergoing regeneration can be a good bet for property investors and home buyers.

Urban regeneration often triggers rising demand for housing as locations become more desirable places in which to live, which in turn attracts new businesses, according to Seven Capital.

“Developments such as new train stations, shopping centres, leisure facilities and mixed-use commercial spaces directly provide a better lifestyle, which in turn attracts new residents.

“This effect can then ripple outwards, attracting new businesses which support a higher-paid workforce and thus, increase demand for residential living nearby,” the group said.

Seven Capital has identified five locations that are seeing above-average regeneration, which will not only transform them into desirable places to live and work, but could also boost property values.

Derby

The Derby City Centre Masterplan is an ambitious regeneration scheme to deliver new retail, leisure and residential developments across the city.

Scheduled for competition in 2030, it aims to leverage £3.5 billion of investment to create 1,900 new homes and 4,000 jobs, as well as a hi-tech business park.

Meanwhile, the city’s Local Plan will see 11,000 new homes and more than 100,000sqm of office space built by 2028 in a bid to attract new employers to the city.

Derby is also poised to benefit from improved transport links through High Speed 2 (HS2), with the rail project putting it less than an hour away from London and within around 30 minutes of Birmingham.

These new amenities, employment opportunities and transport links are expected to lead to significant population growth in the city, leading to higher property demand, with Seven Capital predicting house prices could rise by 24% by 2025.

Birmingham

The UK’s second city has already benefited from a number of regeneration schemes in the past two decades, including the Bullring, New Street Station and Grand Central.

Birmingham is now focusing on the West Midlands Metro tram extension, which will create new transport links across the city.

Seven Capital expects the project to lead to a 6% increase in house prices in areas that will benefit from the increased connectivity.

Meanwhile the Paradise and Snowhill developments bring new office space and homes, while Digbeth is continuing to undergo regeneration, including the £1.5 billion Birmingham Smithfield development to create a mix of commercial space, offices, homes and public areas.

Birmingham is also set to be a significant beneficiary of HS2, which will cut the journey time to London to just 52 minutes.

Leeds

Leeds is already one of the fastest growing cities in the UK, and its appeal looks set to continue thanks to a number of regeneration projects.

Following on from the revamp of Leeds City Station, a £270 million development project is set to see the city’s Lisbon Square area transformed into a 2.8 hectare site that includes apartments, hotels and mixed-use office space.

Not only will it double the size of the city centre, but it is also expected to help boost the local economy.

At the same time, £8.6 million is set to be spent transforming road space into green space under the City Park scheme, while £7.4 billion will go towards expanding Temple Green Park and Ride, and £2.6 billion will be spent renovating older properties in the Holbeck area of the city.

Slough

Already a popular destination for London commuters, Slough is set to benefit from £3 billion of redevelopment cash.

The Heart of Slough project will see the former Thames Valley University land transformed into new homes, commercial space, retail and leisure facilities.

The town already boasts The Curve, a new theatre and library, as well as several new sports and leisure facilities, including an ice rink.

Meanwhile, plans are in place to transform the old Queensmere Shopping Centre into 1,600 new homes, as well as 12,000sqm of retail space and 40,000sqm of office space.

At the same time, the newly completed development The Metalworks offers homes less than 200 metres from a Crossrail station.

Bracknell

Bracknell has seen a number of regeneration projects during the past 10 years as the popularity of the town increases.

The £770 million Bracknell Town Centre Vision 2032 has already seen the creation of retail and leisure complex The Lexicon.

Future redevelopment projects include The Grand Exchange, a new residential complex designed to capitalise on growing demand for homes from people leaving London.

Other up-and-coming projects include Princess Square and The Deck which will provide new retails offerings and public space.

Key takeaways

- Regeneration in urban areas can help to boost house prices

- Good transport links, alongside improved shopping, restaurants, cafes and sports facilities generate employment and create more desirable places to live

- Derby, Birmingham, Leeds, Slough and Bracknell are the places to watch right now, as they're all seeing high levels of regeneration

It's a property market 'shake out' not a property market crash

Sellers are beginning to offer bigger discounts to buyers to get their sales agreed, but we’re not seeing the need for a big double digit reset in UK house prices.

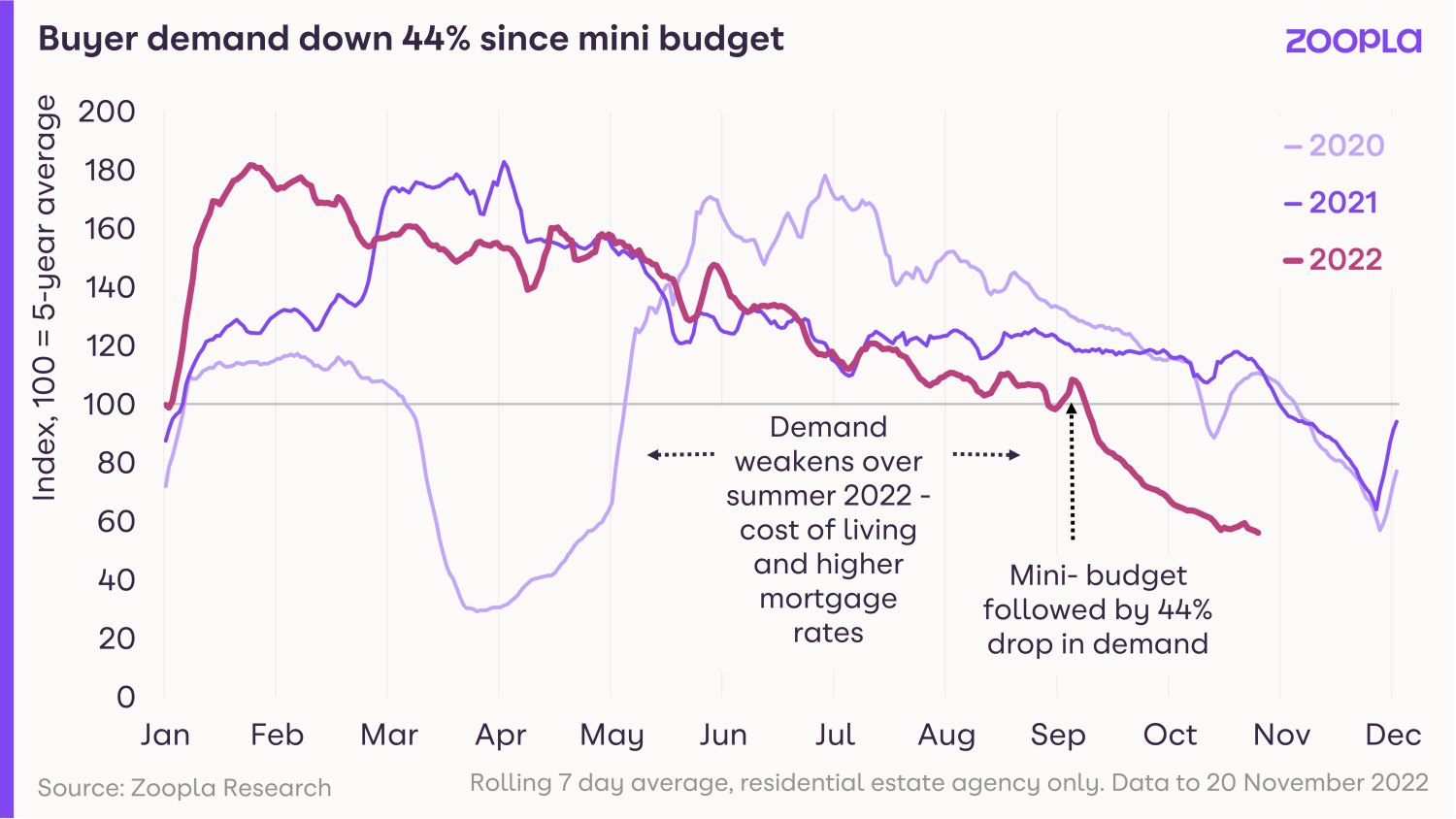

The spike in mortgage rates after the mini-budget in late September undoubtedly hit the housing market.

Demand has now fallen to pre-Christmas levels a lot earlier than usual, as would-be buyers sit on the sidelines, waiting to see what happens with mortgage rates and what the economic outlook holds for jobs and incomes.

In fact, it’s currently at half the level it was at this time last year, when market conditions were stronger, mortgage rates lower and there were fewer cost-of-living pressures on household budgets.

That drop in demand in turn has affected sales volumes, which are down 28% from a year ago and are now on a par with the pre-pandemic period.

More sellers dropping asking prices

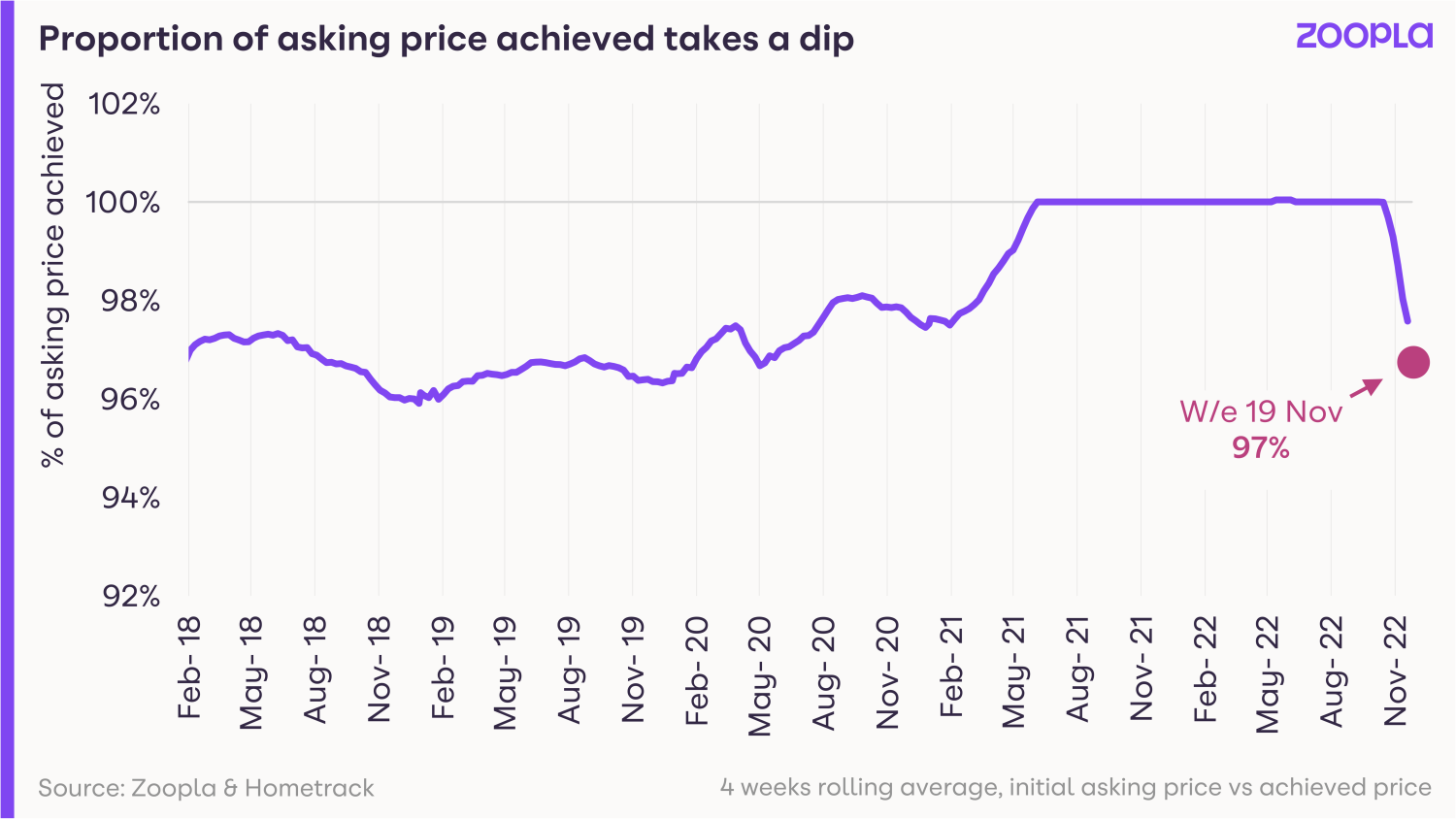

Meanwhile, sellers are beginning to offer bigger discounts to buyers to get their sales agreed.

Data from our valuation and property risk business Hometrack, shows that the gap between the first asking price and the agreed selling price has started to widen in recent weeks.

But it’s important to remember that throughout the pandemic, sellers were enjoying the luxury of achieving their full asking price - and in many instances more - as demand surged among buyers.

The pendulum has now started to swing in the opposite direction and the average seller is now offering a 3% discount on their property to achieve a sale.

Why this isn’t a property market crash

Right now, we are simply transitioning from an unsustainably strong market to a more balanced one.

All the leading supply and demand indicators we measure continue to point to a rapid slowdown from very strong market conditions.

Despite higher mortgage rates reducing how much buyers can afford, new sales have been more resilient than some may have expected.

Committed buyers and sellers are continuing to bring homes to the market and agree on deals, although these are fewer in number and harder to negotiate and hold together over the buying cycle.

And while fall-through rates may be higher, they are not unmanageable for agents.

Our data shows that 1 in 15 homes formerly sold is returning to the market after the original sale has fallen through.

Importantly, we are not seeing any evidence of forced sales or the need for a large, double digit reset in UK house prices in 2023.

Historic data shows buyers’ offers need to be in the region of -5% to -7% below what the seller is asking for the property for annual price falls to take place.

We do expect the discount to widen further as we move to more of a buyers’ market, but the positive here is that strong house price growth has given sellers more room to negotiate on their asking price without losing their long-term value gains.

The prospects for 2023 really depend on how willing sellers are to adjust asking prices in line with what buyers are prepared to pay.

Key takeaways

- Buyer demand falls to pre-Christmas levels earlier than normal

- The average seller is accepting offers at 3% below the asking price lately to achieve the sale

- The housing market is now transitioning from an unsustainably strong market to a more balanced one

Greater choice returns to the housing market

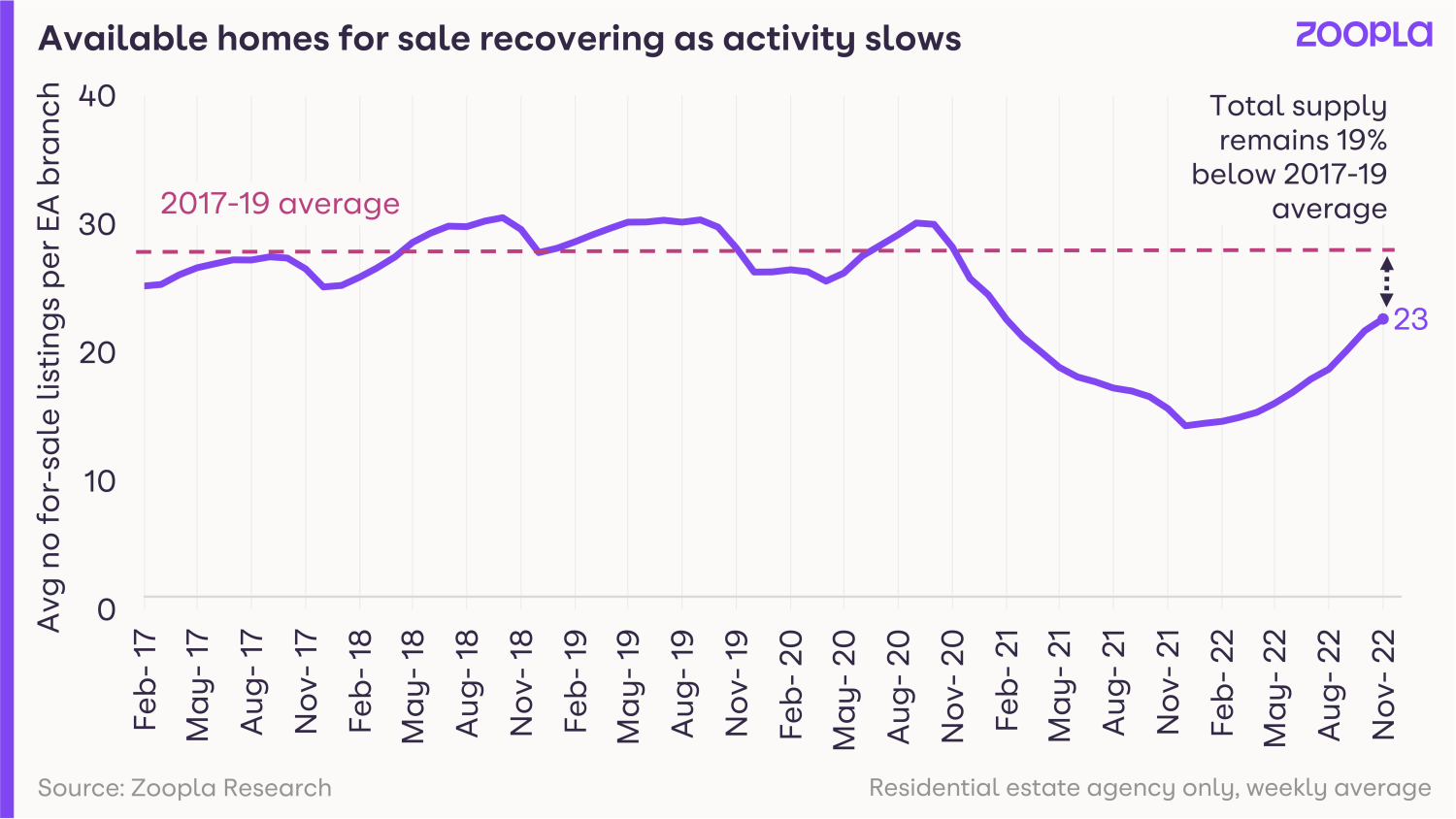

More homes are now coming up for sale across the UK. And because they’re no longer selling like hotcakes as they did in the pandemic, stocks are starting to rebuild.

In good news for buyers, there’s now more choice available when it comes to finding a new home.

The average estate agent office now has 23 homes for sale, the highest level of stock seen since January 2021.

We’re still not quite back up to pre-pandemic levels yet, when the average agent had 29 homes on their books.

But the growth in homes available for sale is being seen across all areas of the UK.

Greater availability of homes for sale reduces upward pressure on prices

Rebuilding sales inventory, which boosts buyer choice, is part of the move to a more balanced housing market.

However, it’s important that sellers price their homes in line with what buyers are prepared to pay, given the current hit to buying power caused by higher mortgage rates.

More homes for sale will help to reduce the scale of the upward pressure on house prices and bring us back to a more normalised housing market for buyers.

House prices are not expected to tumble in 2023

Our expectation is that we won’t get an over-supply of homes for sale in 2023.

We expect some element of scarcity to remain a feature of the market, meaning house prices are not expected to fall dramatically next year.

The drivers and motivations to move home have shifted, and will continue to in our view.

Pandemic-related forces, including greater labour market flexibility, the rise in the number of people reaching retirement age and the desire for more space, means people will continue to look for new homes next year.

Some of these factors though, are now being compounded by rising living costs.

In particular, high levels of rental inflation are adding to the cost of living pressures for renters.

We expect this to support first-time buyer demand in 2023, even with the oncoming headwinds and the hit to buying power from higher mortgage rates.

Key takeaways

- Across the UK, the number of homes for sale is growing, meaning greater choice for buyers

- The average agent now has 23 homes on their books, the highest level of stock in nearly two years

- More homes for sale will reduce the upward pressure on house prices and bring us back to a more normalised housing market for buyers

How far will mortgage rates fall in 2023?

Mortgage rates look set to return to more affordable levels next year, but how low can they go? Here are our predictions for mortgage rates in 2023.

The rise in mortgage rates in the last 2 months has been the main reason for the recent slowdown in the housing market.

But things are looking a little more positive for borrowers as we head towards the New Year, and we expect mortgage rates to settle between 4.5% and 5% by mid-2023.

Along with a widespread fall in house prices by up to 5%, more affordable mortgage rates will encourage some people to move next year and we’re anticipating 1 million completed sales in 2023.

Underlying cost of fixed rate mortgages for lenders falls to 4.1%

The underlying cost for banks to borrow for a 5-year fix - the most popular initial term - has fallen from 5.5% to 4.1% since early October.

Lenders add a margin for risk and profit on top of this underlying cost. This is why mortgage rates soared to 6.5% after the mini budget.

We expect the recent fall in the cost of finance for banks to translate into more affordable fixed mortgage deals on the high street, with mortgage rates at or below 5% in January then settling at between 4.5% and 5% by the middle of the year.

Compared to the 6.25% rates of recent months, it will put the 6 in 10 mortgaged buyers who use a 5-year fixed mortgage in a stronger buying position in 6 months’ time.

Greater choice returns to the housing market

More buyers will reduce reliance on mortgage finance in 2023

A 4.5% or 5% mortgage rate is still a material increase in costs for the 7 in 10 buyers who use a mortgage, compared to the sub-2% rates of recent years.

As a result, we expect more home buyers to look for ways to reduce their reliance on mortgage finance.

They’ll look to borrow less by changing what they need in their next home, coming up with more equity or waiting to see if further falls to house prices or mortgage rates come later in 2023.

Together, this will further reduce the housing market’s reliance on high loan-to-value mortgages, a trend we’ve seen grow over the last decade.

As lenders tightened their criteria after the global financial crisis, buyers needed greater equity and income to take out a mortgage.

So, over time, homeowners have gained greater stakes in their homes and the ability to absorb small price fluctuations, which is key in preventing a housing crash and keeping sales volumes healthy in 2023.

This is an important and underreported shift in enabling home moves, and one of the main reasons we continue to feel relatively optimistic in our housing market predictions for 2023.

It's a property market 'shakeout', not a property market crash

Lower mortgage rates and house price falls will support sales volume

Current market measures - such as asking price reductions and buyer demand decreases - are pointing towards modest but widespread house prices falls of up to 5% in 2023.

Quarterly house price growth at lowest level since February 2020

However, price corrections combined with steadying fixed mortgage rates will support the number of sales completed in 2023, which we estimate will reach 1 million over the year.

It signals a return to more normal housing market conditions after 2 years of frenzied pandemic-driven activity.

Key takeaways

- Underlying cost of fixed rate mortgages for lenders has fallen from 5.5% to 4.1% since early October - actual mortgage rates are higher than this

- Average 5-year fixed mortgage rates likely to settle between 4.5% and 5% by mid-2023

- The housing market’s reduced reliance on high loan-to-value mortgage finance will continue to encourage home moves next year