Sellers are beginning to offer bigger discounts to buyers to get their sales agreed, but we’re not seeing the need for a big double digit reset in UK house prices.

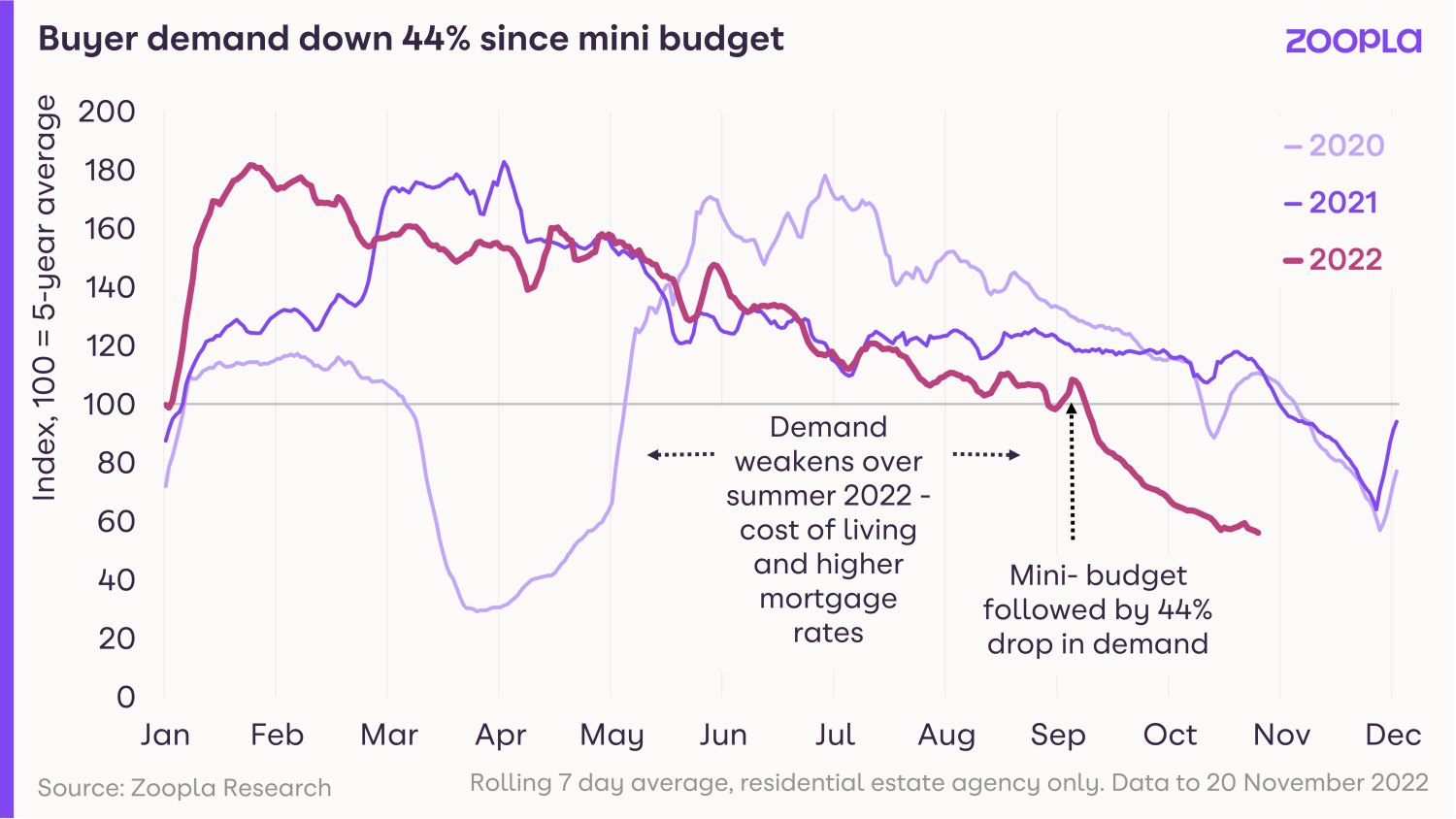

The spike in mortgage rates after the mini-budget in late September undoubtedly hit the housing market.

Demand has now fallen to pre-Christmas levels a lot earlier than usual, as would-be buyers sit on the sidelines, waiting to see what happens with mortgage rates and what the economic outlook holds for jobs and incomes.

In fact, it’s currently at half the level it was at this time last year, when market conditions were stronger, mortgage rates lower and there were fewer cost-of-living pressures on household budgets.

That drop in demand in turn has affected sales volumes, which are down 28% from a year ago and are now on a par with the pre-pandemic period.

More sellers dropping asking prices

Meanwhile, sellers are beginning to offer bigger discounts to buyers to get their sales agreed.

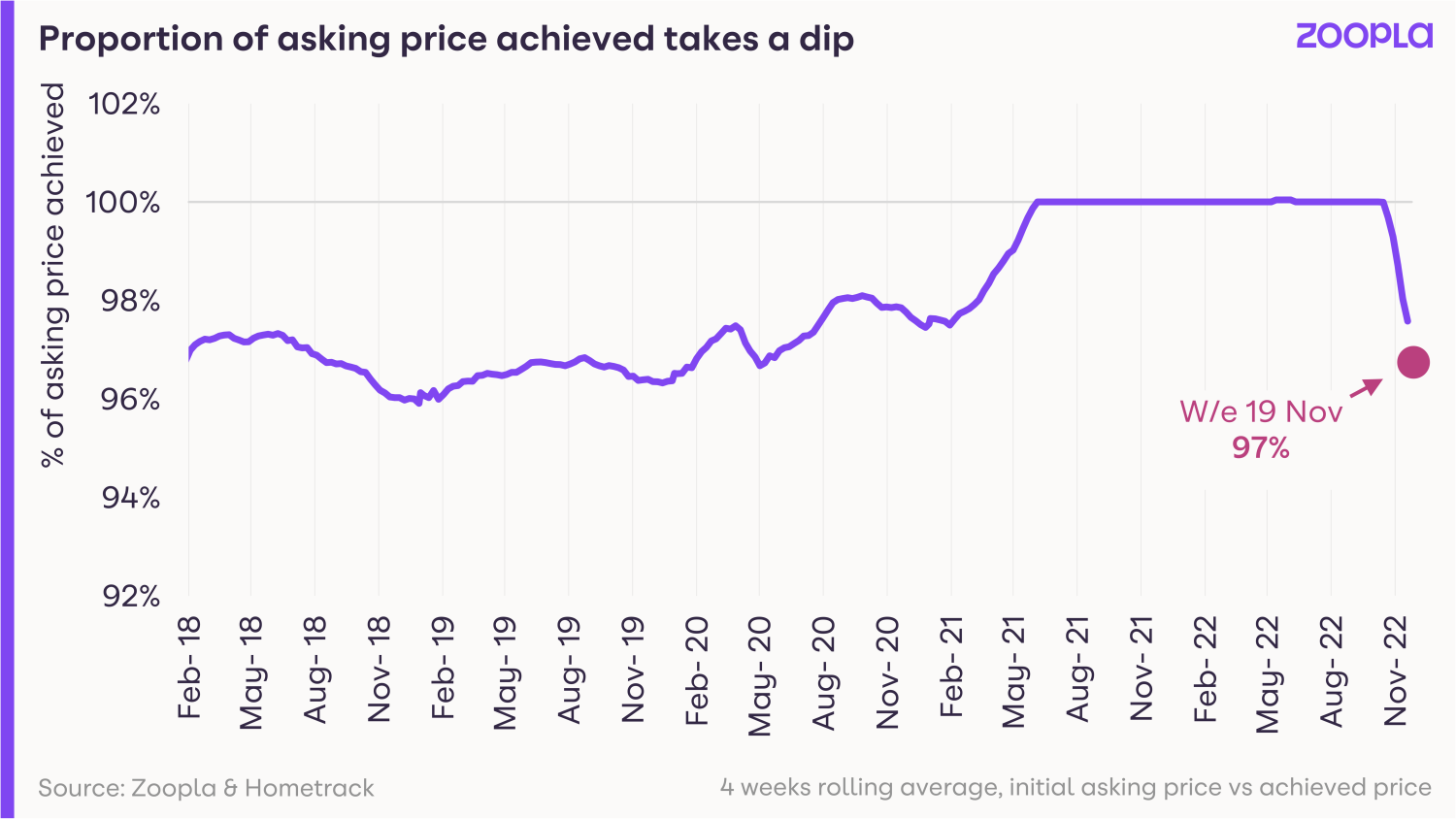

Data from our valuation and property risk business Hometrack, shows that the gap between the first asking price and the agreed selling price has started to widen in recent weeks.

But it’s important to remember that throughout the pandemic, sellers were enjoying the luxury of achieving their full asking price – and in many instances more – as demand surged among buyers.

The pendulum has now started to swing in the opposite direction and the average seller is now offering a 3% discount on their property to achieve a sale.

Why this isn’t a property market crash

Right now, we are simply transitioning from an unsustainably strong market to a more balanced one.

All the leading supply and demand indicators we measure continue to point to a rapid slowdown from very strong market conditions.

Despite higher mortgage rates reducing how much buyers can afford, new sales have been more resilient than some may have expected.

Committed buyers and sellers are continuing to bring homes to the market and agree on deals, although these are fewer in number and harder to negotiate and hold together over the buying cycle.

And while fall-through rates may be higher, they are not unmanageable for agents.

Our data shows that 1 in 15 homes formerly sold is returning to the market after the original sale has fallen through.

Importantly, we are not seeing any evidence of forced sales or the need for a large, double digit reset in UK house prices in 2023.

Historic data shows buyers’ offers need to be in the region of -5% to -7% below what the seller is asking for the property for annual price falls to take place.

We do expect the discount to widen further as we move to more of a buyers’ market, but the positive here is that strong house price growth has given sellers more room to negotiate on their asking price without losing their long-term value gains.

The prospects for 2023 really depend on how willing sellers are to adjust asking prices in line with what buyers are prepared to pay.

Key takeaways

- Buyer demand falls to pre-Christmas levels earlier than normal

- The average seller is accepting offers at 3% below the asking price lately to achieve the sale

- The housing market is now transitioning from an unsustainably strong market to a more balanced one