What does the latest interest rate rise mean for home buyers?

The Bank Rate is up by 0.75% but the outlook for mortgage rates is unchanged, with the likelihood borrowing costs will be lower by the year end.

Bank Rate up, outlook for mortgage rate improves

The Bank Rate moved 0.75% higher this week. This does not mean the average mortgage rate of 6.25% will rise to 7%, making life even harder for new home buyers.

In fact, the outlook for fixed rate mortgages has improved off the back of the Bank of England's increase. This is great news but home buyers using a mortgage should still expect to pay higher mortgage rates than in the recent past.

The cost of fixed rate mortgages, used by 9 in 10 borrowers, is based on the how money markets expect the cost of Government borrowing to change over time. The Bank of England is acting more aggressively now to control inflation and hoping that they can reduce interest rates more quickly later in 2023. The Governor has also suggest financial markets are over-estimating the outlook for borrowing costs.

The all-important money market benchmark that underpins 5 year mortgage rates continues to fall from its high, just after the mini budget when lenders pulled mortgages products and pushed mortgage rates much higher. It has fallen over 1.25% in recent weeks and currently points towards mortgage rates of just over 5% later this year.

Home buyers adopt wait-and-see approach

These are uncertain times for everyone in the UK. Higher interest rates and talk of a drawn-out recession are not the backdrop to build confidence in making big home move decisions.

We have seen new buyer demand continue to fall - down almost 40% since the mini budget - as those without cheap mortgages or in the process of buying a home step back from the market. It is a uniform picture across the country. It mirrors what we tend to see at the end of November as the market slows in the run up to Christmas and the New Year.

How might buyers adapt in 2023?

5% mortgage rates are still much more than borrowers were paying a year ago and will dent home buyer demand in 2023. However, the impact of higher borrowing cost is far from equal and we expect some would-be home buyers to shift strategies.

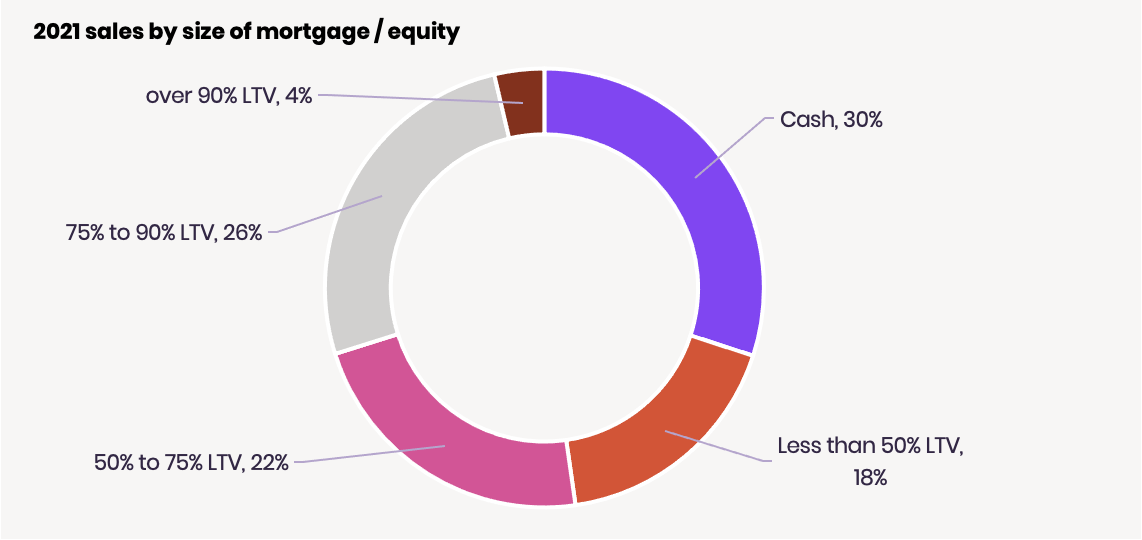

30% of home buyers use cash and a further 18% use smaller sized loans, groups that will be less affected by higher borrowing costs.

The pandemic and working from home means more buyers might look to move further, seeking out better value for money using a smaller mortgage. Others may look to move and transfer or 'port' their current mortgage to their new home without taking on any more debt.

First time buyers and those looking to take out big mortgages to trade up to a bigger homes will be more affected. First time buyers often sit at the bottom of many chains of housing sales which could have a wider impact.

Outside South East England, many first time buyers have been taking advantage of lower borrowing costs and buying larger 3 bedroom homes. There is scope for them look at smaller homes and we will have to see whether they are willing to compromise on space in the face of higher mortgage rates.

Don't stop your planning if you want to move

For those serious about moving in 2023, it's important not to stop all activities. Buying a home is a 3 to 9 month process and the wider economic backdrop can move fast.

With the pressure on budgets for what you can afford, we would encourage buyers to consider other markets and areas that might offer what they need at a lower price point. Do your research using Zoopla's tools and go and visit and speak to local agents who may be able to give you the inside story into local areas.

The cost of mortgages will be in flux over the coming months and lenders will be changing the product range and pricing, so stay in touch with your broker and lender to keep on top of the options available.

It's going to be a bumpy ride for the next few months but with improved planning and preparation there are still options to find that next home.

Key takeaways

- Bank of England pushes Bank Rate to 3% but outlook for mortgages improves (slightly)

- Would-be movers adopt a wait-and-see approach amid talk of a drawn-out recession

- A high proportion of buyers using cash or smaller mortgages are less exposed to higher mortgage rates

- Other buyers will adopt new strategies to buy in 2023

- Don't get caught out waiting too long: buying a home is a 3 to 9 month process and the wider economic backdrop can move fast

What’s the outlook for buy-to-let in 2023?

With many landlords weighing up their position, we take a look at what’s happening in the buy-to-let market.

With mortgage rates high and house prices expected to fall by up to 5% in some areas, many buy-to-let landlords are wondering if they should stay in the market.

But despite the uncertain economic outlook, demand for rental homes is growing, and a shortage of properties is pushing rents higher.

We take a look at what’s happening right now in the buy-to-let market, and what the future is likely to hold.

What’s happening to buy-to-let mortgages?

Like the rest of the mortgage market, buy-to-let loans were hit by former Chancellor Kwasi Kwarteng’s mini budget.

The number of products available dropped steeply to just 988 different deals in the wake of Kwarteng announcing his fiscal plans, compared with 1,942 before the mini budget.

But the good news is that lenders are returning to the market, with just over 1,400 different products currently available to choose from.

Are buy-to-let mortgage rates rising?

The less good news is that interest rates on buy-to-let mortgages have increased significantly since the beginning of the year.

The average cost of a two-year fixed rate mortgage for an investment property has jumped from 2.94% in January to 6.76% now.

Around 2% of this increase is the result of hikes to the Bank of England Bank Rate - the official cost of borrowing - the rest has been driven by the market’s response to the mini budget.

The cost of five-year fixed rate mortgages has followed a similar pattern, rising from an average of 3.18% at the beginning of the year to 6.73% now.

To put these increases into context, a landlord borrowing £200,000 on a two-year fixed rate mortgage would see their monthly payments on an interest-only mortgage jump from £490 in January to £1,127 now, if they borrowed at the average rate.

Tracker mortgages currently look better value than their fixed rate counterparts, with 2 year buy-to-let deals averaging 4.42%.

But it is important to remember that these mortgages move up and down with changes to the Bank Rate.

If the Bank Rate increases from its current level of 2.25% to 5%, as some economists are predicting, a tracker mortgage rate that is currently 4.42% would rise to 7.17%.

What should I do if I need to remortgage my rental property?

The mortgage market is currently in a state of flux.

Rates have fallen slightly after some market confidence was restored by the appointment of Jeremy Hunt as Chancellor, and they may fall further as the cost of government borrowing continues to drop.

But at the same time, the Bank Rate has risen to 3% in a bid to bring inflation down from its current level of 10.1%.

5 year fixed rate mortgages are currently slightly cheaper than two-year ones at 6.73%, compared with 6.76%.

Although economists expect interest rates to rise further, with the UK expected to go into recession, they are not expected to remain high for long.

If you are due to remortgage on more than one buy-to-let property in the near future, you may wish to hedge your bets by opting for different mortgage terms on the properties.

It is also important to note that the rates quoted are average rates, and more competitive deals are available on the market, particularly if you have a large equity stake in your property.

If you can afford to do so, it may be worth using savings to reduce the amount you need to borrow through a mortgage, if this enables you to qualify for a lower loan-to-value tier.

For example, if you are looking to borrow 70% of the property’s value, but can reduce this to just 60% by using savings, you are more likely to qualify for the most competitive rates a lender has.

Will higher interest rates make it harder to get a mortgage?

Lenders use specific affordability tests when assessing people for buy-to-let mortgages.

Known as the Interest Cover Ratio, lenders typically want rental income from the property to be equivalent to between 125% and 145% of the monthly mortgage interest payment.

So, if your mortgage rate is 6.76% and you are borrowing £200,000, your rental income would need to be between £1,408 and £1,634 a month.

If you are worried about passing this stress test, you can ask your lender for ‘top slicing’ which means they will include some of your income in their affordability calculations.

Not all lenders will do this, and if you want to go down this route, it might be worth using the services of a mortgage broker to help you.

What’s happening with rents?

Mortgage rates are rising, but so are rental rates.

New rental rates have increased by £115 during the past year to average £1,051, according to our latest Rental Market Report.

Rents are rising so sharply because there is a significant mismatch between supply and demand in the sector.

A combination of tax rises and increased regulation during the past few years have led to many investment landlords selling up and exiting the sector.

This has resulted in there being too few properties in the private rental sector to meet demand.

The number of homes on the market to rent are currently around half the level seen during the past five years.

Meanwhile, the number of people looking to rent a home is 142% higher than five years ago.

We expect this trend to continue in 2023, putting further upward pressure on rents.

Are house prices likely to fall?

Unlike in the rental market, demand has fallen recently among people looking to buy a home.

In fact, demand from potential buyers dropped by a third since the mini budget, according to our latest figures.

This fall in demand, combined with higher mortgage rates, which will impact affordability, is expected to lead to some localised house price falls next year.

But we are not anticipating steep drops. Instead, we think the average cost of a UK home may dip by around 5%.

It's important to see this in the context of the strong increase in property values since the start of the pandemic, with a 5% fall only taking house prices back to where they were in the first part of this year.

Over the longer-term, house prices are likely to resume their upward trend, as the UK continues to fail to build enough new homes each year to keep pace with rising population growth.

What new regulations are being introduced?

The government has pledged to introduce the Renters Reform Bill during this Parliament.

The Bill includes measures to protect renters from unfair rent increases, while no fault evictions will be banned, homes will have to meet minimum standards and it will be easier for renters to have pets.

The changes are largely focused on improving the quality of homes in the private rented sector, with the government estimating that 21% of properties are currently unfit.

But for landlords who already maintain high standards, the new bill is not expected to lead to significant extra costs.

Nor is the government reported to be considering any new tax changes for landlords, such as the previous changes to mortgage interest tax relief and the end of the ‘wear and tear’ allowance that caused many landlords to exit the sector a few years ago.

Should I purchase a buy-to-let property?

The answer to this question will very much depend on your individual circumstances.

But with buyer demand generally falling, first-time buyers delaying getting on to the property ladder, and house prices expected to dip, you are likely to be in a strong position to negotiate a discount on the asking price.

Meanwhile, demand from renters is strong, and rents are continuing to rise.

That said, with average mortgage rates currently high, it is important to make sure you do your sums to ensure a buy-to-let property is affordable.

With many households struggling with cost-of-living increases, you should also think about whether you would be able to afford monthly mortgage interest payments on a buy-to-let property if your tenant fell behind with their rent, or you had a period when the property was not rented out.

What’s the outlook for the buy-to-let market?

The buy-to-let property market is likely to encounter some ‘bumps’ in the coming year as a result of higher mortgage rates and the impact of the cost-of-living squeeze on renters.

House prices could also dip, reducing the value of investment properties.

But with demand for rental homes massively outstripping supply, and strong rent increases expected over the medium term, buy-to-let properties could still be a good bet over the long term for those who can afford to ride out short-term issues in the market.

Key takeaways

- Lenders are returning to the buy-to-let mortgage market following the chaos caused by the mini budget, with more than 1,400 different products currently available

- The average interest rate is 6.76% on a 2 year fixed rate buy-to-let mortgage and 6.73% on a 5 year one

- Rents have increased by £115 during the past year to average £1,051

- Demand from renters significantly exceeds supply, which will continue to push rents higher

Bank Rate rises to 3% to reach highest level since 2008

The UK Bank Rate has risen to 3% from 2.25% in the biggest single increase for 33 years. Here's what it means for you and your home.

The Bank of England has increased interest rates by 0.75% - the biggest single increase since 1989, apart from the almost immediately reversed rise on Black Wednesday in 1992.

The Bank Rate is now at 3%, its highest level since 2008.

It was the eighth meeting in a row at which the Monetary Policy Committee (MPC) has increased the official cost of borrowing, as it continues to battle high inflation.

The move adds around £86 a month to repayments for someone with a £200,000 variable rate mortgage.

The increase will impact the estimated 850,000 people who have a tracker mortgage, and the 1.1 million who are on their lender’s standard variable rate, both of which move up and down in line with the Bank Rate.

Homeowners with variable rate mortgages have now seen their mortgage payments rise by more than £300 a month since December, at a time when they are also grappling with steep increases to the cost of living.

"Money markets were expecting a hefty jump in the Bank Rate"

Director of Research and Insight at Zoopla, said: "Money markets were expecting a hefty jump in the Bank Rate today. Most borrowers used fixed rate loans so it's the cost of 2 and 5 year fixed rate money for banks that underpins mortgage rates more than the base rate.

"Today's jump does not worsen the outlook for mortgage borrowers but home buyers need to realise that 4% to 5% mortgages are set to be the norm in future, not the 1% to 2% of recent years."

What's going to happen to the housing market in 2023?

Why has the Bank Rate been increased?

The MPC has increased the Bank Rate by 2.9% since it first started to raise the official cost of borrowing in December last year, in a bid to bring inflation down.

Despite these increases, inflation – which measures the rate at which the cost of goods and services is rising – has remained stubbornly high at 10.1%.

The MPC’s job has been made significantly harder by former Chancellor Kwasi Kwarteng’s mini budget.

The markets were spooked by his plans to cut taxes and increase spending, leading to a steep drop in the value of the pound. This in turn made imports more expensive, and was expected to push inflation higher.

It also impacted the housing market, with the number of people looking to buy a home dropping by a third in the wake of the mini budget.

In the minutes on its latest meeting, the MPC warned that “further increases in Bank Rate may be required” in order to get inflation back down to its 2% target.

But there was some good news for homeowners, with the MPC adding that interest rates were likely to peak at a lower level than was being predicted by the financial markets.

Economists had previously expected interest rates to have to increase to around 5% by the middle of next year, but they have since trimmed their forecasts to 4.25%.

What should I do about my mortgage?

If you are on a fixed rate mortgage

If you are on a fixed rate mortgage you don’t need to do anything right away. The interest rate you are paying will stay the same until the end of your product term, usually two or five years.

If you are coming to the end of your deal, you should start thinking about your next one.

Most lenders will allow you to ‘book’ a new rate between three and six months before your current one ends.

But you need to be prepared for a significant increase in your monthly repayments, as interest rates are now likely to be much higher than they were when you took out your mortgage or last remortgaged.

Mortgage rates could fall slightly towards the end of this year and early next year as markets stabilise, so you may want to wait to see if this happens before committing to a new rate.

Mortgage rates expected to fall in 2023

But there is no guarantee that rates will fall, and the MPC could increase the Base Rate further at its December meeting.

If you are on a standard variable rate (SVR) mortgage

If you are on your lender’s standard variable rate (SVR), the rate you are automatically put on when your mortgage deal ends, you may want to remortgage soon.

The average interest rate charged on SVR mortgages was already 5.86% before the latest interest rate hike, its highest level for more than a decade, and it is likely to increase by a further 0.75% following today’s Bank Rate increase.

That said, if you are comfortable sitting on a higher rate for a couple of months, you may want to delay remortgaging to see whether rates do come down.

If you are on a tracker mortgage

If you are on a tracker mortgage, which moves up and down in line with changes to the Bank Rate, you may want to stay put.

Although the Bank Rate is widely expected to rise further, interest rates charged on fixed rate mortgages have already factored in some of these anticipated increases.

As a result, the average cost of a two year fixed rate mortgage is currently 6.47%, while interest charged on a five-year deal is only slightly lower at 6.32%.

It is important to remember that if you take out a fixed rate deal, you will be locking into the current high interest rates for two or five years, depending on which product term you opt for.

How can I reduce my mortgage repayments?

If you are worried about the increase in your monthly repayments that you might face when you come to remortgage, there are steps you can take to reduce them.

One way to lower your repayments is to borrow less. While this may be easier said than done, if you have a good level of savings, you may want to think about using some of the money you have set aside to make a lump sum overpayment to reduce the size of your mortgage.

You can also reduce your monthly repayments by increasing your mortgage term.

For example, monthly repayments on a £200,000 mortgage on a fixed rate of 6% would be £1,450 if the mortgage was being repaid over 20 years.

But monthly repayments would fall to £1,210 if the term was increased to 30 years, and to £1,150 if it was being repaid over 35 years.

But it is important to bear in mind that increasing your mortgage term will mean you pay more in interest over the entire life of your mortgage.

It is also worth remembering that although interest rates have increased, the value of your home is also likely to have gone up since you last remortgaged.

As a result, you will be borrowing a lower proportion of your property’s value than previously, known as the loan-to-value (LTV) ratio.

Lenders offer their most competitive rates to people with lower LTVs, so you may now qualify for a better rate than previously.

What should I do if I’m struggling to pay my mortgage?

If you are struggling to keep up with your mortgage repayments, or think you may do so in the near future, it is important to contact your lender as soon as possible.

There are a number of steps lenders can take to help you, including granting you a temporary payment holiday or putting you on to an interest-only mortgage for a short time.

But options become much more limited if you have already missed a payment.

Lenders are obliged by the regulator to work with customers who are struggling with mortgage repayments to find a solution, and they can only repossess a home as a last resort.

Key takeaways

- The Bank of England has increased interest rates by 0.75% - the biggest single increase in 3 decades

- The hike leaves the Bank Rate at 3%, its highest level since 2008

- It does not significantly worsen the outlook for mortgage borrowers, but home buyers need to realise that 4% to 5% mortgages are set to be the norm in future