Mortgage lenders pledge to help struggling borrowers

Lenders have agreed to adopt a more flexible approach for those hit by the rising cost of living, offering tailored support for homeowners who run into difficulties.

Mortgage lenders have promised to do more to help homeowners who are struggling with their repayments.

The sector has agreed to be more flexible in the way it approaches borrowers who have been impacted by the cost-of-living squeeze.

Alongside offering tailored support to those who run into difficulties, lenders will also enable customers who are up to date with their payments to switch to a new mortgage deal without having to do another affordability test.

In addition, they will ensure highly trained and experienced staff are on hand to help customers when needed.

The pledge was made following a meeting between mortgage lenders, Chancellor Jeremy Hunt, the chair of regulator the Financial Conduct Authority (FCA) and MoneySavingExpert’s Martin Lewis.

Sheldon Mills, executive director of consumers and competition at the FCA, said: “If you’re struggling to pay your mortgage, or are worried you might, you don’t need to struggle alone.

"Your lender has a range of tools available to help, so you should contact them as soon as possible.”

Why is this happening?

Britons were already coming under pressure as a result of high inflation, with steep increases to the cost of food, energy and petrol.

But they are also now facing higher mortgage rates due to a combination of increases to the Bank of England Bank Rate, which has been raised in a bid to tackle inflation, and the fallout from former Chancellor Kwasi Kwarteng’s mini-Budget.

The government called the meeting with lenders as it recognised that many borrowers were concerned about being able to afford increases to their mortgage payments, which for most people are their single largest monthly outgoing.

What help is available?

Lenders

To help those who are concerned about increases to their monthly repayments, lenders have agreed that borrowers who are up to date with payments can switch to a new competitive mortgage deal without having to do an affordability test.

Concerns had been expressed that homeowners may be able to afford a new rate, but they would not be able to remortgage on to it, as they would not pass lenders’ strict affordability tests.

Affordability tests measure a homeowner's ability to repay their loan if interest rates were to rise to levels that are significantly higher than they are today.

Lenders have also agreed to provide well-timed information to enable customers to plan ahead before their current mortgage rate expires.

For those who are struggling, they have agreed to offer tailored support, such as extending the mortgage term to make monthly payments lower, offering a short-term reduction in repayments, or switching borrowers to an interest-only mortgage for a set period of time.

Finally, they will ensure highly trained staff are available to talk to people who have run into difficulties.

The government

For its part, the government has confirmed it will take action to make Support for Mortgage Interest easier to access.

The support offers people on certain benefits, such as Universal Credit, Pension Credit and Income Support, help with mortgage interest payments.

It is also putting record levels of funding into the Money and Pension Service to provide debt advice in England.

The regulator

The FCA has announced that it is launching a consultation on draft guidance clarifying how lenders can support borrowers who have been impacted by the rising cost of living.

It will also provide information for borrowers on the options and support that is available if they are struggling with their mortgage payments.

What should I do if I’m struggling to pay my mortgage?

If you are struggling to pay your mortgage, it is important that you contact your lender as soon as possible.

Banks and building societies work with people who run into difficulties and only repossess their home as a last resort. As detailed above, there are a lot of options available to you.

But you are likely to have more options if you start talking to your lender before you have already missed a payment.

Key takeaways

- Mortgage lenders have promised to do more to help homeowners who are struggling with their repayments because of the cost-of-living squeeze

- They will offer tailored support to those who run into difficulties, including short-term reductions in repayments and mortgage term extensions

- Customers who are up to date with their payments will be able to switch to a new mortgage deal without having to do another affordability test

Buy-to-let mortgage market shows signs of recovering

The number of different mortgages landlords have to choose from has risen by more than 700 products since the beginning of October.

The buy-to-let mortgage market is showing signs of recovery as lenders relaunch products following the chaos caused by the mini-Budget.

The number of different deals landlords have to choose from has increased by more than 700 since the beginning of October, with 1,769 mortgages now available in the sector.

Within the total, the biggest rise has been for two-year fixed rate buy-to-let mortgages for people borrowing 25% of their property’s value, with 139 new deals launched, according to financial information group Moneyfacts.

At the same time, 130 new five-year fixed rate mortgages for landlords with a 25% deposit have come onto the market since early October.

Rachel Springall, finance expert at Moneyfacts.co.uk, said: “The buy-to-let sector has faced notable market turmoil, so it’s positive to see product choice gradually returning since the start of last month.

“A rise in choice could indicate an encouraging sentiment across lenders that appear to be adjusting their ranges to cater to landlords searching for a new deal.”

Why is this happening?

The buy-to-let mortgage sector suffered the same loss of choice as the wider mortgage market in the wake of the mini-Budget, with lenders pulling their ranges to reprice them.

The big increase in choice seen during the past couple of months is good news for those who need to remortgage, as it suggests lenders are very much open for business to this part of the market.

What’s happening to mortgage rates?

Unfortunately, the average cost of a buy-to-let mortgage has continued to increase and now stands at more than 6%.

The typical interest rate charged on a two-year fixed rate deal currently stands at 6.5%, a rise of 0.93% since the beginning of October.

Five-year fixed rate mortgages for buy-to-let landlords have seen a slightly less dramatic rise, increasing to 6.42%, up from 6.05% two months earlier.

Surprisingly, rates for landlords borrowing 60% of their property’s value have seen the biggest increases, with the cost of two-year deals jumping by an average of 1.75%, while five-year ones have risen by 1.68%.

What should I do if I need to remortgage?

Buy-to-let mortgage rates are expected to come down in the weeks ahead, so if you can afford to wait before taking out a new deal, it might be worth doing so.

That said, with house prices currently falling, you may be better off remortgaging sooner rather than later if you are very close to a loan-to-value (LTV) boundary.

For example, if you would currently only need to borrow 60% of your property’s value, but a small drop in house prices would push you above this level into the next tier, it would mean you could be charged a higher interest rate.

If you need to remortgage now, five-year fixed rates for people borrowing 60% of their property’s value currently look the best value, at an average of 5.94%.

But remember, if you take out one of these deals, you will be locking into the current high level of interest rates for five years.

Although the Bank of England base rate is expected to rise further from its current level of 3%, the official cost of borrowing is expected to start falling again within the next two years.

As a result, you may be better off opting for a two-year fixed rate deal, with these currently averaging 6.27%.

For landlords looking to borrow 75% of their property’s value, the difference is much smaller, with five-year deals averaging 6.55% and two-year ones averaging 6.53%.

Anything else I need to be aware of?

To qualify for a buy-to-let mortgage, lenders use a particular affordability test, known as the Interest Cover Ratio.

Under this test, rental income from the property has to be the equivalent of between 125% and 145% of the monthly mortgage interest payment.

So, if your mortgage rate is 6.5% and you are borrowing £200,000, your rental income would need to be between £1,354 and £1,571 a month.

There are some ways around the test. For example, you can ask your lender for ‘top slicing’ under which they will include some of your income in their affordability calculations.

But not all lenders will do this, so if you want to use top slicing, it might be worth getting help from a mortgage broker.

Key takeaways

- The number of buy-to-let mortgage deals available has increased by more than 700 since the beginning of October to 1,769 different products

- The average cost of the mortgages has continued to increase and stands at 6.5% for two-year deals and 6.42% for five-year ones

- Buy-to-let mortgage rates are expected to fall in the weeks ahead

What’s going to happen to the rental market in 2023?

Will rents keep rising at the rate they are now and will more homes become available for renters next year? Get the latest with our Rental Market Report.

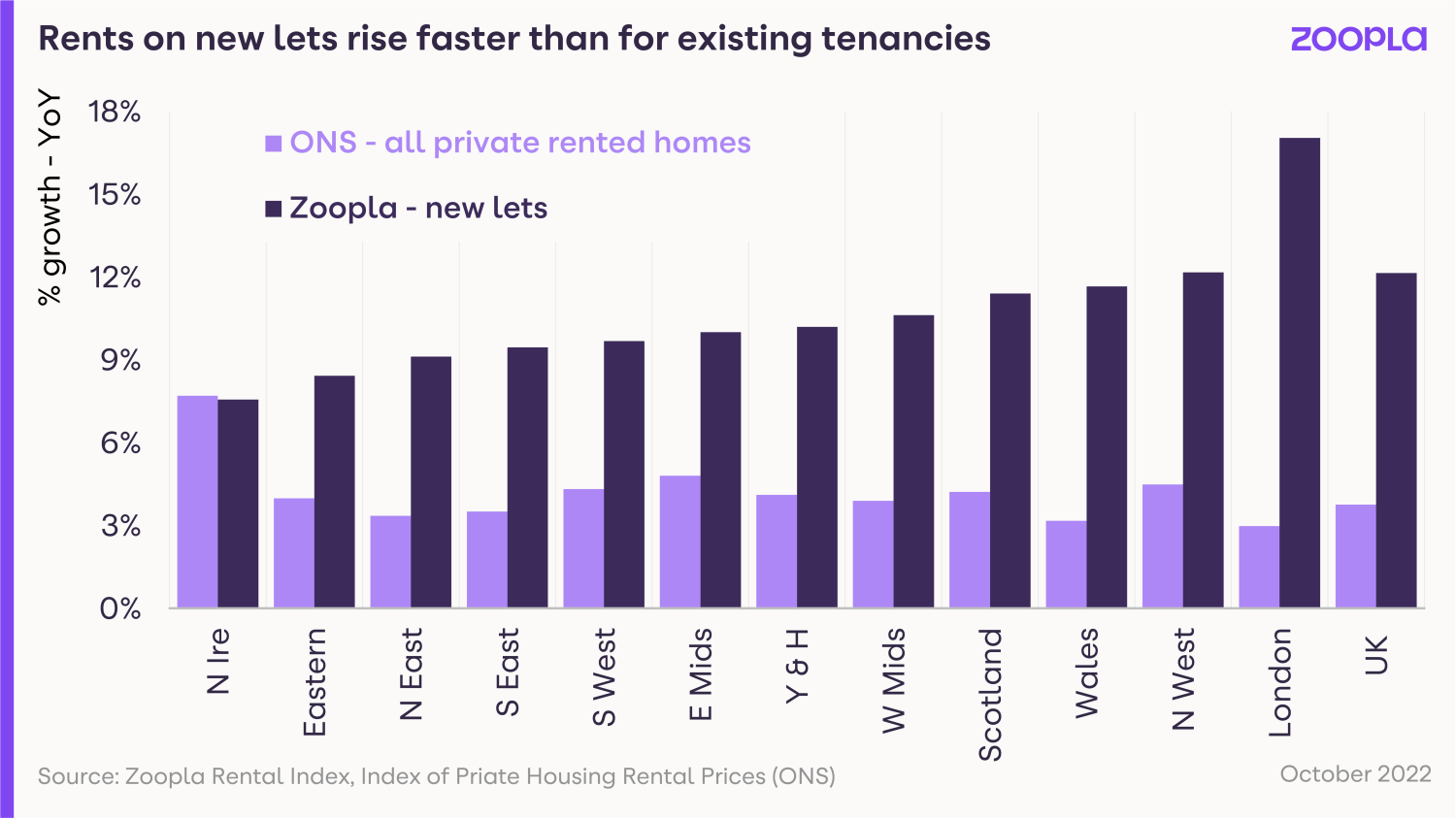

Rents have risen 12.1% in the last year on new lettings. That’s around £117 a month, or £1,400 a year.

The rise is way ahead of the rate at which wages have increased, up 6% on average in the last 12 months.

Rental affordability, measured as the percentage of income a single renter pays on rent, is now at its highest level for a decade at 35%.

New lettings account for a quarter of the rental market, as one in four renters move home each year.

For the 75% of renters who stay put, the picture is less bleak, as rents have risen by an average of 3.8% for this group, according to the Office for National Statistics.

However, the fact that renters are choosing not to move rather than face higher rents is compounding the supply issue for the market.

When will rentals get cheaper?

With demand up 46% and supply down 38%, rent prices are being pushed up fast.

That demand is being further exacerbated by rising mortgage rates, meaning more potential first-time buyers are continuing to rent for the time being.

But there’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents are rising in 2023.

The current momentum in rental levels is a growing concern for all private renters, especially those on low incomes, as it only exacerbates cost-of-living pressures.

If rental growth were to continue to run at 12% over 2023, the proportion of earnings needed to pay rent would be stretched even further to 37%.

This is not likely or feasible and we expect the growing unaffordability of renting to hit spending power.

This trend, supported by a modest improvement in available supply, could lead to rental growth slowing to 5% over 2023.

What will make renting less expensive?

The quickest way to slow rental inflation is to boost rental supply.

Executive Director Richard Donnell says: “Increasing investment in new rental supply from multiple sources is the main route to reducing rental growth and making for a more sustainable private rented sector.”

Unfortunately however, we’re not expecting to see any major improvement in this area over the next 12 months.

The private rented sector has a structural supply problem stemming from economic and policy factors.

The stock of homes available for rent has not grown in size since 2016, holding steady at around 5.5m homes.

Over the last 7 years, we’ve seen private landlords selling up and taking advantage of the strong sales market in the face of higher taxes and greater regulation.

That said, the reduction in privately available rented homes has been offset somewhat by corporate investors delivering ‘build-to-rent’ schemes, keeping overall supply static since 2016.

It is important that policymakers encourage good landlords of all types and sizes to stay in the market and deliver much-needed supply.

Only by increasing investment in the private rented sector can we ease the affordability pressures on renters in the medium term and make for a more sustainable rental market.

Rental supply is beginning to improve

We do expect to see a modest improvement in rental supply in the coming months.

In fact, the number of homes available for rent has increased in recent weeks as the sales market weakens.

Landlords looking to sell homes may now continue to rent them out while uncertainty in the wider sales market persists.

The average estate agency branch now has 10 homes available for rent, up from a low of 7 at the end of September.

Unfortunately though, this increase in rental supply is unlikely to provide a material slowdown to rental inflation in isolation.

Increasing demand is pushing rents higher and adding to affordability pressures for renters.

This means more renters are having to consider a greater set of compromises when looking to secure a home.

More renters likely to share homes to spread costs

Recent research from the Resolution Foundation 2 found that there has been a steady increase in sharing, measured by the space per private renter, which has decreased by 16% over the last two decades.

More renters likely to continue living with parents

ONS data 3 shows a continued increase in the number of young adults aged 20-34 years staying at home (3.6m in 2021) rather than incurring rental payments to live independently.

This trend is already helping to ease some of the current demand-side pressures.

More renters trading down to smaller homes

Our last report highlighted how renters are seeking smaller homes with an increase in demand for 1- and 2-bed flats and a reduction in the demand for houses.

Our latest data shows this trend is continuing with an acceleration in demand for 1-bed flats, which now account for 32% of rental enquiries across the UK.

The affordability dynamics for a couple renting a 1-bed flat are much better than a 2-bed home and keeping a spare room or sub-letting.

What’s the outlook for renting in 2023?

Proposed regulations and new rules on renting homes that aren’t at an Energy Efficiency rating of C or above from 2025 are likely to result in more private landlords selling up, especially if they own homes that are expensive to manage and retrofit.

Sadly this further loss of privately rented homes is likely to offset the impact of new investment in the build-to-rent sector.

Policymakers need to better understand the rental market as well as the forces and factors shaping the overall availability of supply.

The demand for rented homes is only going to rise in the medium term, so it's important we encourage more supply from all forms of landlords, whether private individuals or large corporates.

Key takeaways

- Rental growth is likely to slow from 12% in 2022 to 5% over 2023

- Single renters are currently spending 35% of their income on rent. If rental inflation continued at the rate it is now, that would increase to 37% in 2023, which we think is unlikely

- There’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents increase next year

Rents rising fastest in major regional cities

UK rents are 12.1% higher than last year but major cities have seen even more rental inflation. Find out the average rent for your area and how quickly rents are rising across the country.

The average UK rent is now £1,078 per month, a rise of 12.1% in the last year.

Rents are rising the fastest in large cities where shortages of available rental homes cannot meet demand created by strong employment markets and large student populations.

London has seen the highest rental growth in the last year at 17%. That works out to a rise of £273 per month for renters in the capital, compared to a UK-wide jump of £117 per month.

There’s also been high rental growth in Manchester (+15.6%), Glasgow (+14.1%), Bristol (+12.9%), Sheffield (+12.4%) and Birmingham (+12.3%).

Rental growth is slower in smaller cities like Hull, York, Oxford and Leicester, where rents rose less than 8% in the last year.

But that’s still higher than the average 6% rise in earnings in the same period. The average renter now puts 35% of their income towards rent, making renting in the UK the most unaffordable it’s been this decade.

Southern cities record highest average rents

Average rental rates are highest in southern UK cities - London (£1,879), Cambridge (£1,431), Bristol (£1,254) and Southampton (£1,006).

The only city outside of the south to match these levels is Edinburgh, where renters are paying £1,060 per month for new tenancies - an above-average rise of 12.4% in the last 12 months.

Looking at regions rather than cities, the most expensive places to rent a home in the UK are the South East (£1,189) and East of England (£1,051), both higher than the UK average of £1,028 per month.

While rents have risen at 9.4% and 8.4% in these regions respectively, those are some of the slower regional growth rates in the country.

The South West - with an average rent of £983 - is also tracking slower regional growth (9.7%) than regions further north.

Rents are cheapest in northern regions and cities

As a general rule, rents get cheaper the further away you move from London.

Wales, East and West Midlands, Yorkshire and the Humber, and the North West are all recording average rents of between £700 and £800, offering greater value for money for renters.

But the cheapest regions to rent in the UK are the North East (£612), Northern Ireland (£679) and Scotland (£688).

If we look at major UK cities, the cheapest rental rates are currently in Newcastle (£712), Liverpool (£717) and Sheffield (£735).

Sheffield, however, has seen some of the highest rental growth in the last year with rents jumping 12.4%.

Will rents keep rising in 2023?

There’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents increase next year.

We expect annual rental growth to be between 4% and 5% by the end of 2023, as affordability limits of renters combine with a modest uplift in rental supply due to the weaker sales market.

Executive Director Richard Donnell says: “Increasing investment in new rental supply from multiple sources is the main route to reducing rental growth and making for a more sustainable private rented sector.”

Key takeaways

- Rents are rising the fastest in large UK cities with strong employment and large student populations

- London, Manchester and Glasgow recorded the highest rental growth in the last 12 months

- The South East and East of England are the most expensive regions to rent in December 2022, while rents get cheaper as you move further north