Will rents keep rising at the rate they are now and will more homes become available for renters next year? Get the latest with our Rental Market Report.

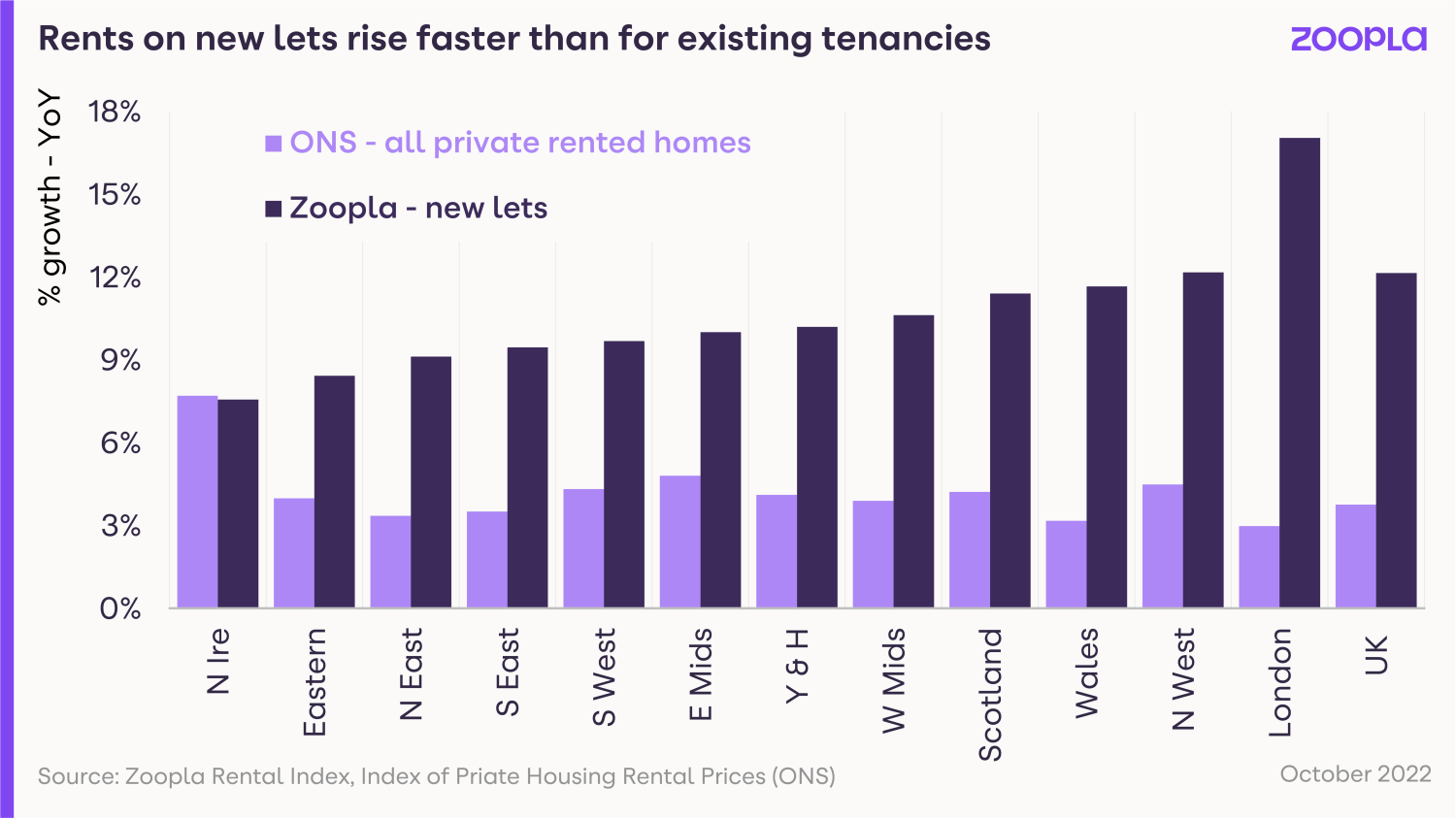

Rents have risen 12.1% in the last year on new lettings. That’s around £117 a month, or £1,400 a year.

The rise is way ahead of the rate at which wages have increased, up 6% on average in the last 12 months.

Rental affordability, measured as the percentage of income a single renter pays on rent, is now at its highest level for a decade at 35%.

New lettings account for a quarter of the rental market, as one in four renters move home each year.

For the 75% of renters who stay put, the picture is less bleak, as rents have risen by an average of 3.8% for this group, according to the Office for National Statistics.

However, the fact that renters are choosing not to move rather than face higher rents is compounding the supply issue for the market.

When will rentals get cheaper?

With demand up 46% and supply down 38%, rent prices are being pushed up fast.

That demand is being further exacerbated by rising mortgage rates, meaning more potential first-time buyers are continuing to rent for the time being.

But there’s only so much renters can afford to pay – and this is likely to have an impact on demand and the pace at which rents are rising in 2023.

The current momentum in rental levels is a growing concern for all private renters, especially those on low incomes, as it only exacerbates cost-of-living pressures.

If rental growth were to continue to run at 12% over 2023, the proportion of earnings needed to pay rent would be stretched even further to 37%.

This is not likely or feasible and we expect the growing unaffordability of renting to hit spending power.

This trend, supported by a modest improvement in available supply, could lead to rental growth slowing to 5% over 2023.

What will make renting less expensive?

The quickest way to slow rental inflation is to boost rental supply.

Executive Director Richard Donnell says: “Increasing investment in new rental supply from multiple sources is the main route to reducing rental growth and making for a more sustainable private rented sector.”

Unfortunately however, we’re not expecting to see any major improvement in this area over the next 12 months.

The private rented sector has a structural supply problem stemming from economic and policy factors.

The stock of homes available for rent has not grown in size since 2016, holding steady at around 5.5m homes.

Over the last 7 years, we’ve seen private landlords selling up and taking advantage of the strong sales market in the face of higher taxes and greater regulation.

That said, the reduction in privately available rented homes has been offset somewhat by corporate investors delivering ‘build-to-rent’ schemes, keeping overall supply static since 2016.

It is important that policymakers encourage good landlords of all types and sizes to stay in the market and deliver much-needed supply.

Only by increasing investment in the private rented sector can we ease the affordability pressures on renters in the medium term and make for a more sustainable rental market.

Rental supply is beginning to improve

We do expect to see a modest improvement in rental supply in the coming months.

In fact, the number of homes available for rent has increased in recent weeks as the sales market weakens.

Landlords looking to sell homes may now continue to rent them out while uncertainty in the wider sales market persists.

The average estate agency branch now has 10 homes available for rent, up from a low of 7 at the end of September.

Unfortunately though, this increase in rental supply is unlikely to provide a material slowdown to rental inflation in isolation.

Increasing demand is pushing rents higher and adding to affordability pressures for renters.

This means more renters are having to consider a greater set of compromises when looking to secure a home.

More renters likely to share homes to spread costs

Recent research from the Resolution Foundation 2 found that there has been a steady increase in sharing, measured by the space per private renter, which has decreased by 16% over the last two decades.

More renters likely to continue living with parents

ONS data 3 shows a continued increase in the number of young adults aged 20-34 years staying at home (3.6m in 2021) rather than incurring rental payments to live independently.

This trend is already helping to ease some of the current demand-side pressures.

More renters trading down to smaller homes

Our last report highlighted how renters are seeking smaller homes with an increase in demand for 1- and 2-bed flats and a reduction in the demand for houses.

Our latest data shows this trend is continuing with an acceleration in demand for 1-bed flats, which now account for 32% of rental enquiries across the UK.

The affordability dynamics for a couple renting a 1-bed flat are much better than a 2-bed home and keeping a spare room or sub-letting.

What’s the outlook for renting in 2023?

Proposed regulations and new rules on renting homes that aren’t at an Energy Efficiency rating of C or above from 2025 are likely to result in more private landlords selling up, especially if they own homes that are expensive to manage and retrofit.

Sadly this further loss of privately rented homes is likely to offset the impact of new investment in the build-to-rent sector.

Policymakers need to better understand the rental market as well as the forces and factors shaping the overall availability of supply.

The demand for rented homes is only going to rise in the medium term, so it’s important we encourage more supply from all forms of landlords, whether private individuals or large corporates.

Key takeaways

- Rental growth is likely to slow from 12% in 2022 to 5% over 2023

- Single renters are currently spending 35% of their income on rent. If rental inflation continued at the rate it is now, that would increase to 37% in 2023, which we think is unlikely

- There’s only so much renters can afford to pay – and this is likely to have an impact on demand and the pace at which rents increase next year