Mortgage Guarantee Scheme extended to end of 2023

The government-backed scheme to ensure 95% mortgages remain widely available will now run until December 2023.

The Mortgage Guarantee Scheme is being extended by a year to help more people with a 5% deposit to buy a home.

The government-backed scheme had been due to close at the end of 2022, but it will now run until 31 December 2023.

It has already helped more than 24,000 households to purchase a property, 85% of which were first-time buyers.

Chief Secretary to the Treasury, John Glen, said: “Extending this scheme means thousands more have the chance to benefit, and it supports the market as we navigate through these difficult times.”

Before the announcement was made, commentators had expressed concern that the end of the scheme would make it difficult for people with only a small deposit to get a mortgage, particularly as house prices in some areas are falling.

A number of lenders had recently withdrawn their mortgages for people borrowing 95% of their home’s value. But news that the scheme is being extended should boost the supply of these loans.

How does the scheme work?

The scheme encourages lenders to offer 95% mortgages by having the government guarantee the portion of the loan over 80%.

This means that if the borrower defaults on the mortgage, the government will cover up to 15% of the shortfall.

The scheme can be used by both first-time buyers and those trading up the property ladder on homes worth up to £600,000.

It can be used to purchase an existing or a new-build property, but the home must be bought with a repayment mortgage, not an interest-only one.

The Mortgage Guarantee Scheme was launched in April 2021, after lenders withdrew mortgages for people with small deposits in the face of the Covid-19 pandemic, leaving just eight 95% mortgages available on the market.

What other help is available to first-time buyers?

There are a number of government schemes to help people get on to the property ladder.

First Homes helps first-time buyers, key workers and local people to purchase a home at a 30% discount to its market price, while Shared Ownership enables people to buy a share in a property and pay rent on the rest.

First-time buyers saving for a deposit can also use the Lifetime ISA, under which you can save £4,000 a year. The government then adds a 25% bonus - up to a maximum of £1,000 annually - for free. The money must be used to either purchase a first home or for retirement.

The government has also increased the threshold at which stamp duty kicks in for first-time buyers from £300,000 to £425,000 on homes costing up to £625,000 until April 2025.

Lenders to offer mortgages on flats in high-rise buildings

There was also good news for people who own flats in high-rise buildings with cladding.

Six lenders have announced they will start accepting mortgage applications from people who live in buildings in England that are over five storeys high, or 11 metres tall, and have cladding from early next year.

The move follows new guidance from the Royal Institution of Chartered Surveyors to enable valuations on properties impacted by cladding.

But lenders will still want to see evidence that dangerous cladding will be removed, either by the building’s developer or through a government scheme.

The lenders who will consider mortgage applications from people in high-rise buildings with cladding are Barclays Bank, HSBC, Lloyds Banking Group, Nationwide Building Society, NatWest and Santander.

Key takeaways

- The Mortgage Guarantee Scheme is being extended until 31 December 2023

- The scheme helps first-time buyers and home-movers with just a 5% deposit buy a home

- It has already helped more than 24,000 households purchase a property, 85% of which were first-time buyers

Buyers on the hunt for affordable cities and flats in 2023

Apartments and urban areas set for a comeback as buyers prioritise affordability and value for money.

Affordability and value for money will be the big key drivers for the housing market in 2023.

These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse.

Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

Executive Director for Research, Richard Donnell says “The dynamics that have shaped the housing market over the last 5 years are shifting.

“We expect affordable urban centres to fare better than average in 2023 but the inner London market may require another year before it is ready to rebound.”

Why are urban areas becoming popular again?

Influenced by higher mortgage rates, household incomes and the actual level of house prices, buyers are being priced out of the more expensive markets, preferring to look in areas where homes are more affordable.

Increasingly keen to secure homes in urban settings, where jobs are being created and more services are available, buyers are now showing a stronger preference for towns and cities.

The popularity of family homes in city suburbs and commuter areas is also rising, with demand for homes in these areas climbing to above average levels over the last year.

How rising mortgage rates are affecting where buyers choose to live

Mortgages are currently needed for seven out of every 10 home purchases.

Higher mortgage rates are currently affecting what many people can afford to buy, as they mean more income is needed to secure a sale.

The more expensive a market, the greater the number of households that are priced out.

This in turn weakens demand, leading to fewer sales and possible price reductions to secure those sales in these areas.

In affordable markets with lower average house prices, the opposite is true.

Why affordable markets will fare better in 2023

As demand for more affordable areas increases in 2023, these markets are likely to fare better than their more expensive counterparts in terms of price falls over the coming months.

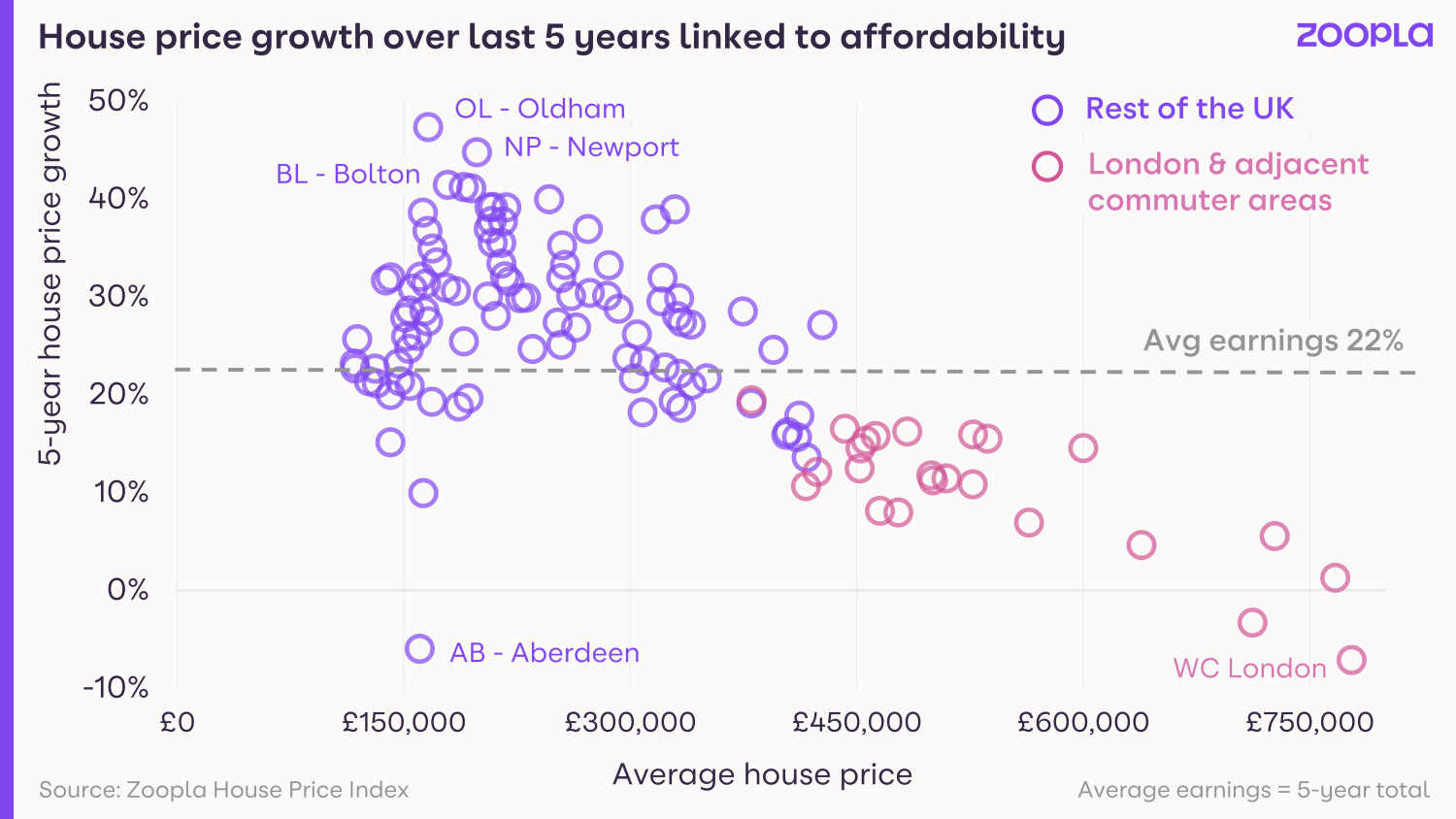

Most housing markets have recorded house price gains of 25.4% over the last 5 years. That's above the level of consumer price inflation (+19%) and average earnings (+22%) over the same time period.

Economic growth, good affordability and low mortgage rates have all enabled above average price gains over this period.

The Oldham postal area recorded the highest price increases since 2017 at +47%, while Newport, Swansea and Bolton also enjoyed high value gains.

However, we expect house price growth to slow in these higher-growth markets in 2023.

UK house prices are predicted to fall by an average of 5% next year.

But in the more affordable markets, the falls are likely to be lower, as the hit to buying power from higher mortgage rates will be felt less keenly.

Which affordable cities are buyers interested in?

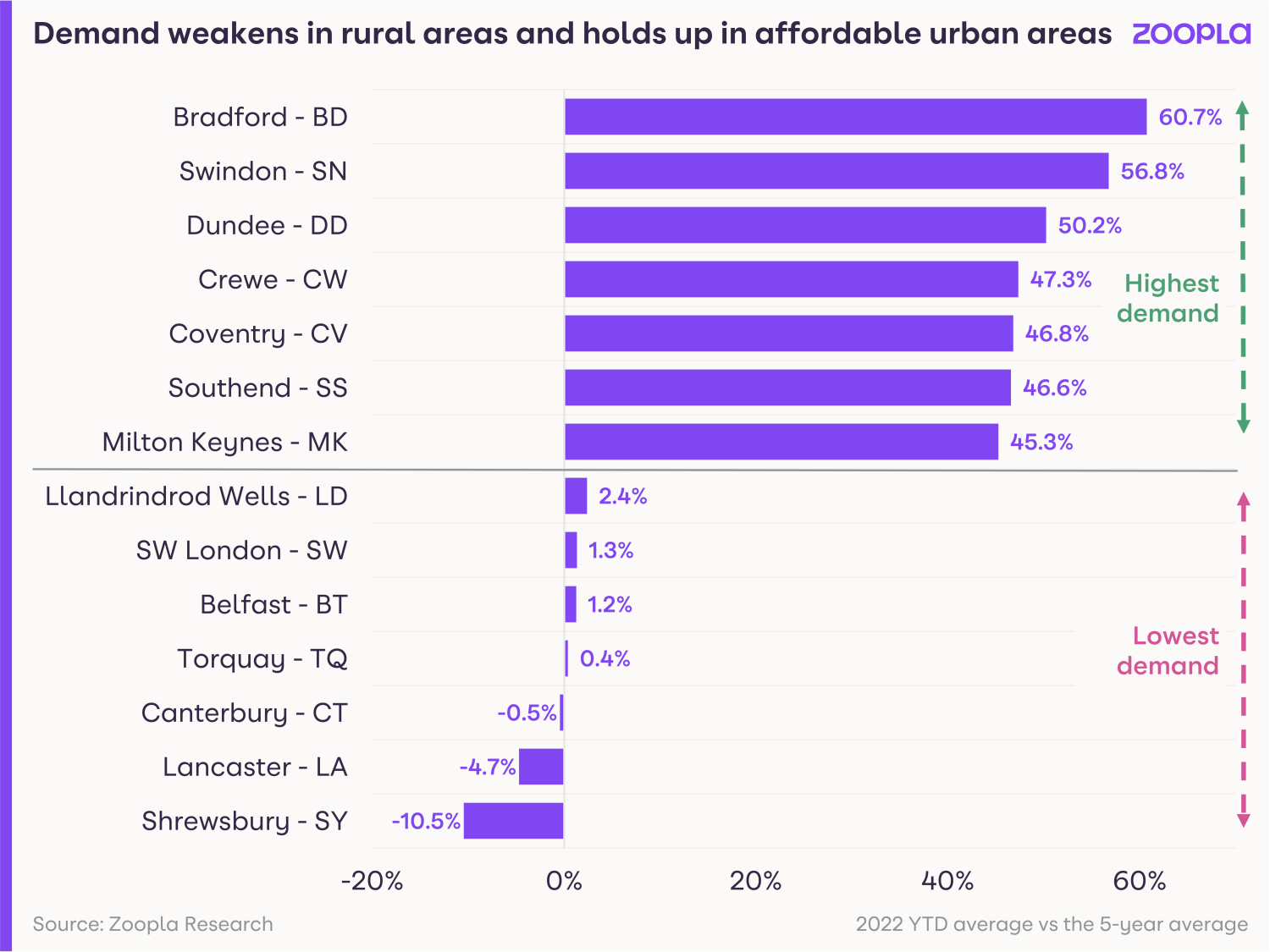

Major towns and cities, including Bradford, Swindon, Coventry, Crewe, Milton Keynes and Southend are all registering above-average demand.

These areas all have their own employment base, but they also enjoy good transport connections into much larger employment centres, such as London, Leeds, Manchester and Birmingham.

We believe employment growth will continue to stimulate housing demand in these affordable city regions throughout 2023.

Why flats are becoming better value for money

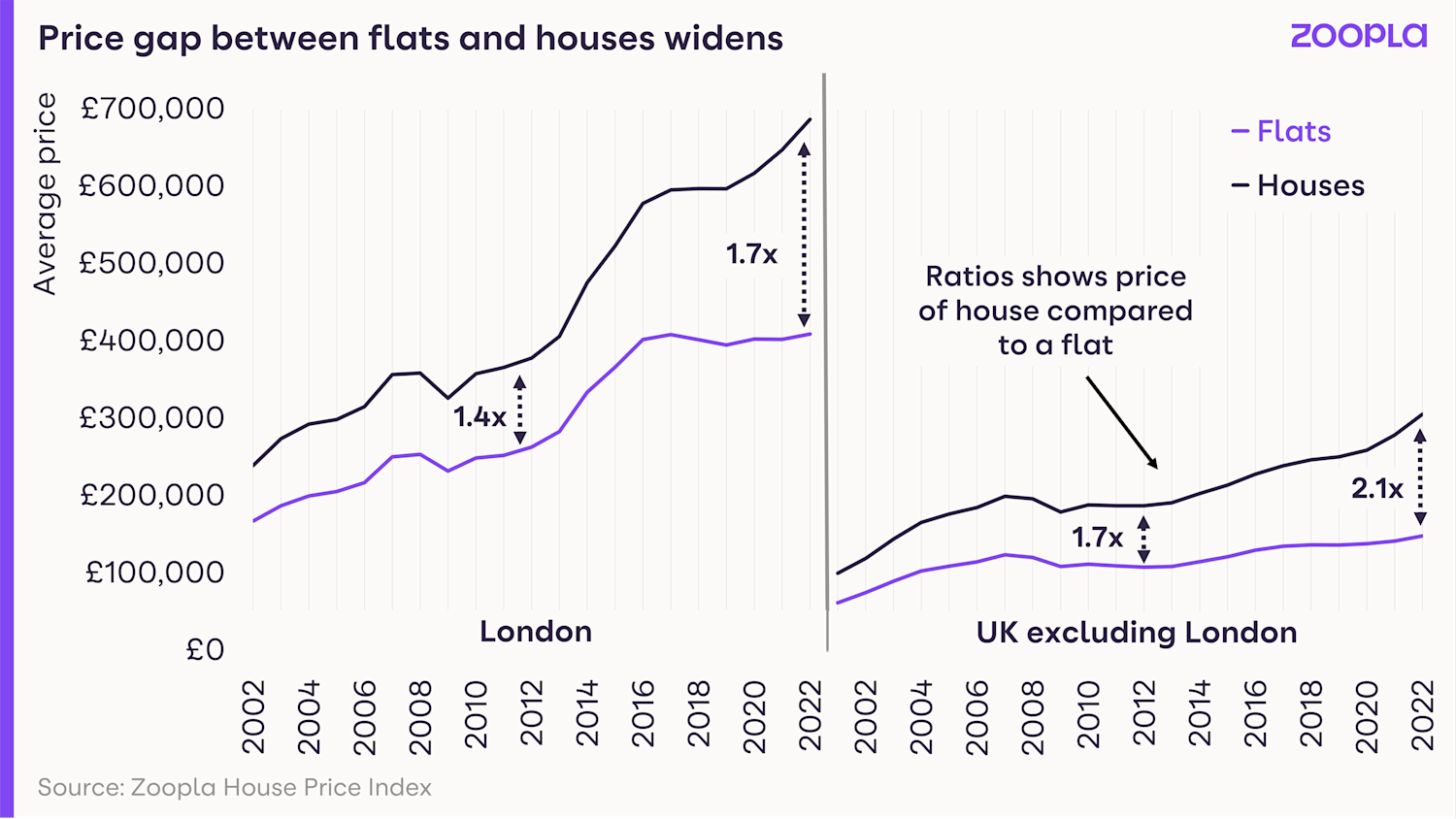

Apartments make up around 1 in 5 homes in the UK, but price inflation for them has lagged behind the growth enjoyed by houses.

Across the UK, houses are currently valued at just over twice the price of flats. That’s the highest price difference seen for 20 years.

In the capital, the average price of a house is 1.7x the price of a flat, up from 1.4x a decade ago.

Flats haven’t experienced those same value gains as houses partly because the search for space made them a less popular option during the pandemic, but also because buyers were experiencing concerns over cladding and leasehold charges.

The chart below tracks the average price of flats and houses since 2002.

However, we expect demand for flats to increase throughout 2023, as buyers seek better value for money.

The government’s moves to ensure cladding problems are remediated in most buildings will also help to boost their popularity further.

What should first time buyers do in 2023?

What will happen with the London housing market in 2023?

London and its commuter areas have under-performed in recent years.

With prices already at the highest end of the market, affordability is already stretched for buyers in the capital.

In central London - and the commuter areas surrounding it - the scope for price increases over the last 5 years has been limited, despite the ultra-low mortgage rates that were available until the middle of this year.

Prices have been falling slightly in central London since 2017 and are now 17% lower in real terms, allowing for inflation.

That said, earnings have been rising at a faster pace than prices since 2017, which is slowly improving affordability.

Still, average prices remain high by national standards and of course, mortgage rates are now higher than last year.

We expect the inner London housing market to rebound soon, but this requires a further improvement in housing affordability.

In the meantime, we expect London house prices to register above-average price falls of 5% to 8% in 2023, which will improve affordability, alongside our expectation of lower mortgage rates.

We also believe that a resurgence in employment growth will be the trigger for a turnaround in this under-performing market in the next 1-2 years.

Key takeaways

- Tide turns on the desire for coastal and rural areas as demand for affordable cities and apartments rises

- Buyers once again attracted to urban settings with plenty of jobs and services

- The dynamics that have shaped the housing market over the last 5 years are shifting

What should first time buyers do in 2023?

From the better value of flats to discounts and price falls, here's how a slower housing market could benefit first time buyers in 2023.

Low mortgage rates have meant first time buyers could often afford a three bedroom semi with a double driveway and a big garden over the past 2 years.

But with mortgages more expensive - plus higher living costs - you might be wondering about your chances of stepping onto the property ladder in 2023.

Our latest House Price Index shows buyers have been stepping back from the market, with demand down 50% against this time last year.

But a slower housing market can bring opportunities for first time buyers. If you know where to look and when to make your move.

Let’s take a look at how you could step onto the property ladder in 2023.

Look to flats for better value for money

Price growth for flats has been much slower than for houses in the last 10 years. This means a flat could give you the chance to buy at a cheaper price for greater value for money.

After the pandemic, there was a rush towards houses as everyone wanted more space. Demand for flats dropped and values rose at a slower rate than house values.

In London, you’ll spend 1.7 times more on a house than you will on a flat. 10 years ago, a London house was only 1.4 times more expensive.

It’s a similar picture across the rest of the UK, where you’ll pay 2.1 times more for a house than a flat - the highest differential in 20 years.

If you want to save money by buying a flat, make sure you’re aware of the extra costs and considerations.

Check if the property is for sale as freehold or leasehold, find out the cost of service charges and ground rent, and make sure it’s clear who will pay for repairs and maintenance to the building.

We expect more buyers to realise the relative value to be found in flats in the coming months, which will increase demand for flats later in 2023. This will also be supported by the government’s commitment to fix cladding issues, which impact a small proportion of flats in the UK.

Put in an offer: sellers will be more open to negotiations in 2023

Sellers are now accepting offers 4% below asking price on average, which works out to a £10,500 discount on the average home right now.

It’s already a big change from a few months ago - in October, buyers were not getting any wriggle room from sellers and we recorded an average discount of 0%.

We think this trend will keep going and you may be able to get an even bigger discount from sellers in 2023.

If you’re looking to buy soon, keep in mind that December is not usually the best month for discounts or reductions to asking prices.

It might be worth making that cheeky offer in the New Year instead, as sellers often wait to see if new buyers will come into the market the first week of January.

Keep an eye out for small drops in house prices

While house prices are up 7.2% over the last year - or £17,500 on average - price growth has stalled since the summer.

In the last 3 months, house prices have only risen 0.3%, compared to 2% in the summer.

And we’re expecting to see house prices fall in the first part of 2023, with annual price falls coming in by mid-year.

If our predictions are right, it’ll be the first time we’ve seen annual price falls for years, meaning a small respite for first time buyers who have faced continually rising prices and strong competition.

Generally speaking, the biggest house price falls will come in the south of England, where house prices are more expensive.

If you’re looking to buy in a high value market, this could give you the chance as competition eases and sellers start to reduce their prices to achieve a sale.

While you might find it harder to get a mortgage, buying remains cheaper than renting an equivalent home everywhere in the UK apart from London.

When you’re looking at homes for sale, check if the price has already been reduced with our ‘listing history’ tab. It can give you an idea if there might be room for the price to be discounted.

Be ready to move quickly in affordable urban areas

In lower-value markets, we’re still seeing high demand as mortgage rate rises have had less of an impact.

Demand is tracking at above average levels in affordable urban areas like Bradford, Swindon, Coventry, Crewe, Milton Keynes and Southend.

But first time buyers have the advantage of flexiblity and the ability to progress quickly, which gains even more favour among sellers in a softening market.

We expect these affordable areas will see above-average house price rises in the next year – but it’ll be at a much slower rate than in the last 2 years.

So if you need to save for a little longer or want to see if mortgage rates drop further, you won’t be seeing the same price rises as recent years and may find you’re in a better position by mid-2023.

Director of Research and Insight, says: "First time buyer demand is expected to hold up in 2023 as the rapid growth in rents makes buying look attractive - even as mortgage rates increase.

"This is particularly the case in regions outside the south of England where mortgage repayments are lower than monthly rental costs, even with 5% mortgage rates.

"Rents are expected to rise further in 2023 adding to the impetus to buy. However, raising a deposit will remain the biggest challenge for first time buyers as the best mortgage rates will be for lower loan-to-value mortgages."

Whatever your situation, we always recommend getting independent financial advice before you go ahead.

Key takeaways

- Flats are offering the best value for money for 20 years across most of the UK

- Sellers are already giving 4% discounts on average and they’ll be even more open to negotiations in 2023

- House prices will start to drop in the new year, with the most expensive areas seeing the biggest price falls

- Many urban areas are still affordable despite high demand, including Bradford, Swindon, Coventry, Crewe, Milton Keynes and Southend.

3 reasons why the housing market might defy expectations in 2023

Mortgage rates hitting 6.5% brought many predictions of sizeable house price falls in 2023. But we're less bearish and believe the housing market will be stronger than many expect next year.

Cost of living pressures and higher mortgage rates have dented interest from new homebuyers in the second half of 2022.

The spike in mortgage rates to 6.5% after the mini budget caused widespread alarm, given mortgage rates were just 2% at the start of 2022. Housing market activity has stalled since October as buyers and sellers stand back and wait to see what the outlook is like in January 2023.

Many forecasters have put out bearish predictions for 2023, anticipating house prices falls of 8% to 12% and a significant fallback in sales numbers. Most of these projections are based on expectations of high mortgage rates over 2023 and an economic recession lasting into 2024.

While the outlook is less certain and more challenging for a growing number of households, we are more positive about the prospects for house prices and sales volumes in 2023 for 3 broad reasons.

1. Banks are keen and ready to lend

Many people are looking back at history to draw parallels, in particular the 2007-09 downturn. The 12% drop in house prices over this period was driven by a lack of credit, in that few banks were willing to lend to anyone but the safest customers. This reduced demand for homes and prices fell.

Price falls were also amplified by banks loosening their lending criteria in the run-up to 2007. A third of borrowers didn't prove their income to their bank in 2007 when applying for a mortgage.

Things are very different today.

UK banks are very well capitalised and their business plans are subjected to regular testing against major downturns in house prices and economic growth. All our high street lenders are mortgage-focused businesses and they will want to make sure credit is available to those that need it in 2023, albeit with higher mortgage rates than at the start of 2022.

Higher interest rates means banks will become more profitable. For existing borrowers, banks are developing a range of options to make sure customers can afford the jump in mortgage rates as they come to the end of fixed term deals.

2. Mortgage rates are dropping

The other big change in recent weeks has been a fall in the cost of money that underpins mortgage rates.

The vast majority of us take fixed rate loans of up to 5 years. After the fallout from the mini budget, the recent fiscal plan from the government has calmed money markets again. This has seen the underlying cost of mortgages fall back to where it was starting to move to earlier in the year.

This means typical mortgage rates for new borrowers taking a 5-year fixed rate will be in the 4.5% to 5% range at the start of 2023.

Higher loan-to-value mortgages will see the higher mortgage rates while those with the biggest deposits, or the most equity in their home, will get the best rates. This factors in further modest increases in the Bank of England base rate in the short term to bring down inflation.

The other important thing to note about mortgage costs is that every homeowner who took out a mortgage over the last 5 years had to prove to their bank they could afford a 6.5% to 7% mortgage rate, even though they may have been paying just 1% or 2%. This so-called affordability stress test was designed to to make sure buyers could afford higher rates.

This is important, and means the housing market has effectively been operating in the background at 6.5% to 7% mortgage rates. It is another key reason we see evidence of underlying resilience in the housing market. If everyone had been buying based on whether they could afford 2% mortgage rates, house price growth would've been much higher and we would now be expecting much bigger price falls as a result.

3. Motivations to move home remain

The impacts of the pandemic continue to shape the desire to move home. People who expect to work more flexibly are 6 times more likely to move than those that don't expect any change in their working style. The proposals from the government to make flexible working more open to employees will support this trend and further loosen the ties between where people live and work.

The pandemic also brought on a jump in the number of people leaving the labour market for health reasons and retirement, which are big triggers for home moves. Those retiring are more likely to have paid off their mortgage or have a small mortgage, so higher mortgage rates are less of a concern - 30% of sales involve no mortgage at all. Many will be looking to move closer to friends and family or to a better area and a smaller home through down-trading.

The jump in energy costs alongside the general increase in living costs are likely to be compounding the drivers to move. This is particularly the case for those concerned about running costs and the suitability of their current home to meet their future needs.

We expect all of these factors to support home moves in 2023, creating demand for homes listed for sale in the new year. We predict there will be 1 million home sales in 2023, which is down 20% on 2022 levels. New buyers will continue to be price sensitive but many sellers have made sizeable gains in their housing equity, giving them some room for movement if they want to move in the year ahead.

Key takeaways

- Banks will be keen to make mortgages available in 2023 and are coming up with options to make sure customers can afford the jump in mortgage rates

- The recent fiscal plan from the government has calmed money markets again and we expect 5-year fixed rate mortgages will be in the 4.5% to 5% range in the new year

- The impacts of the pandemic continue to shape the desire to move home and will help support 1 million home moves in 2023

How to tell if your home is gaining value

Most homeowners have gained a lot of value on their home since the pandemic.

But with small house price falls of up to 5% expected in 2023, you might be wondering what your home’s worth.

Our tools can tell you what your home’s worth right now, how much value you‘ve gained since buying and if its value is still going up.

Not to mention how long it’d take you to sell and how your home stacks up in the local market.

Here are 9 easy ways to find out if you’re gaining value on your home.

1. Get an instant valuation

Be proud. It’s yours and you love it.

And you must be curious about how your bricks and mortar is performing in value.

And how it’s changed over the last few years.

So pop in your postcode. We'll show you the rest.

2. Find out what equity you have

Want to know how much of your home is actually yours?

That’s where equity comes in: it’s the amount of cash you could take away from your sale.

And it’s probably looking pretty healthy after the last couple of years of house price growth.

So head to our equity calculator in My Home. We’ll tell you how much money you could put towards your next place.

3. Keep an eye on your mate's place

It’s not stalking. It’s keeping an eye on the market.

Track your mate’s, neighbour’s or boss’s place to find out what it’s worth.

After all, it’s just a good benchmark for your home, right?

Track as many homes as you like, any time you like, for as long as you like.

And we’ll send you the new price estimate every month.

Job done.

4. See what’s for sale and sold nearby

Who doesn’t love a little nosy on the neighbours?

Well, we can do better than that.

We’ll show you what everyone on your street last sold for in one map, whether it was last week or last decade, in My Home.

Go on. See whose home sold for the most.

5. Get the low-down on your local housing market

Every town and city has a totally different housing market.

And it can be hard to know what’s really happening.

But your local stats in My Home can help with that. From average prices and price growth to how fast homes are selling.

Plus how your local area compares to your region as a whole.

6. Get to grips with the UK house price picture

It’s good to have a feel for what’s right when it comes to property.

The more you get to know the market, the more your instincts will take over when it comes to knowing what a home’s worth.

There’s no secret to it. It’s just about staying in the loop.

7. Check your interior style

Got a new landscaped garden, sparkling bathroom or stylish kitchen extension?

And want to know if it's really added value?

Which home improvements add the most value?

8. Figure out what your asking price should be

An asking price is all about getting the most interest in your home to drive up its value on the market.

But set it too high and you could be left waiting.

Too low and you may later regret it.

9. Get an estate agent’s opinion

If you want to know exactly what your home’s worth, there’s only one way to know for sure: by asking a local estate agent.

And we’ll help you find the best local agent for you, based on customer ratings, asking prices, listing times and more.

So you can compare them and get in touch for an in-person valuation.

And find out what your home’s worth, once and for all.

Mortgage lenders pledge to help struggling borrowers

Lenders have agreed to adopt a more flexible approach for those hit by the rising cost of living, offering tailored support for homeowners who run into difficulties.

Mortgage lenders have promised to do more to help homeowners who are struggling with their repayments.

The sector has agreed to be more flexible in the way it approaches borrowers who have been impacted by the cost-of-living squeeze.

Alongside offering tailored support to those who run into difficulties, lenders will also enable customers who are up to date with their payments to switch to a new mortgage deal without having to do another affordability test.

In addition, they will ensure highly trained and experienced staff are on hand to help customers when needed.

The pledge was made following a meeting between mortgage lenders, Chancellor Jeremy Hunt, the chair of regulator the Financial Conduct Authority (FCA) and MoneySavingExpert’s Martin Lewis.

Sheldon Mills, executive director of consumers and competition at the FCA, said: “If you’re struggling to pay your mortgage, or are worried you might, you don’t need to struggle alone.

"Your lender has a range of tools available to help, so you should contact them as soon as possible.”

Why is this happening?

Britons were already coming under pressure as a result of high inflation, with steep increases to the cost of food, energy and petrol.

But they are also now facing higher mortgage rates due to a combination of increases to the Bank of England Bank Rate, which has been raised in a bid to tackle inflation, and the fallout from former Chancellor Kwasi Kwarteng’s mini-Budget.

The government called the meeting with lenders as it recognised that many borrowers were concerned about being able to afford increases to their mortgage payments, which for most people are their single largest monthly outgoing.

What help is available?

Lenders

To help those who are concerned about increases to their monthly repayments, lenders have agreed that borrowers who are up to date with payments can switch to a new competitive mortgage deal without having to do an affordability test.

Concerns had been expressed that homeowners may be able to afford a new rate, but they would not be able to remortgage on to it, as they would not pass lenders’ strict affordability tests.

Affordability tests measure a homeowner's ability to repay their loan if interest rates were to rise to levels that are significantly higher than they are today.

Lenders have also agreed to provide well-timed information to enable customers to plan ahead before their current mortgage rate expires.

For those who are struggling, they have agreed to offer tailored support, such as extending the mortgage term to make monthly payments lower, offering a short-term reduction in repayments, or switching borrowers to an interest-only mortgage for a set period of time.

Finally, they will ensure highly trained staff are available to talk to people who have run into difficulties.

The government

For its part, the government has confirmed it will take action to make Support for Mortgage Interest easier to access.

The support offers people on certain benefits, such as Universal Credit, Pension Credit and Income Support, help with mortgage interest payments.

It is also putting record levels of funding into the Money and Pension Service to provide debt advice in England.

The regulator

The FCA has announced that it is launching a consultation on draft guidance clarifying how lenders can support borrowers who have been impacted by the rising cost of living.

It will also provide information for borrowers on the options and support that is available if they are struggling with their mortgage payments.

What should I do if I’m struggling to pay my mortgage?

If you are struggling to pay your mortgage, it is important that you contact your lender as soon as possible.

Banks and building societies work with people who run into difficulties and only repossess their home as a last resort. As detailed above, there are a lot of options available to you.

But you are likely to have more options if you start talking to your lender before you have already missed a payment.

Key takeaways

- Mortgage lenders have promised to do more to help homeowners who are struggling with their repayments because of the cost-of-living squeeze

- They will offer tailored support to those who run into difficulties, including short-term reductions in repayments and mortgage term extensions

- Customers who are up to date with their payments will be able to switch to a new mortgage deal without having to do another affordability test

Buy-to-let mortgage market shows signs of recovering

The number of different mortgages landlords have to choose from has risen by more than 700 products since the beginning of October.

The buy-to-let mortgage market is showing signs of recovery as lenders relaunch products following the chaos caused by the mini-Budget.

The number of different deals landlords have to choose from has increased by more than 700 since the beginning of October, with 1,769 mortgages now available in the sector.

Within the total, the biggest rise has been for two-year fixed rate buy-to-let mortgages for people borrowing 25% of their property’s value, with 139 new deals launched, according to financial information group Moneyfacts.

At the same time, 130 new five-year fixed rate mortgages for landlords with a 25% deposit have come onto the market since early October.

Rachel Springall, finance expert at Moneyfacts.co.uk, said: “The buy-to-let sector has faced notable market turmoil, so it’s positive to see product choice gradually returning since the start of last month.

“A rise in choice could indicate an encouraging sentiment across lenders that appear to be adjusting their ranges to cater to landlords searching for a new deal.”

Why is this happening?

The buy-to-let mortgage sector suffered the same loss of choice as the wider mortgage market in the wake of the mini-Budget, with lenders pulling their ranges to reprice them.

The big increase in choice seen during the past couple of months is good news for those who need to remortgage, as it suggests lenders are very much open for business to this part of the market.

What’s happening to mortgage rates?

Unfortunately, the average cost of a buy-to-let mortgage has continued to increase and now stands at more than 6%.

The typical interest rate charged on a two-year fixed rate deal currently stands at 6.5%, a rise of 0.93% since the beginning of October.

Five-year fixed rate mortgages for buy-to-let landlords have seen a slightly less dramatic rise, increasing to 6.42%, up from 6.05% two months earlier.

Surprisingly, rates for landlords borrowing 60% of their property’s value have seen the biggest increases, with the cost of two-year deals jumping by an average of 1.75%, while five-year ones have risen by 1.68%.

What should I do if I need to remortgage?

Buy-to-let mortgage rates are expected to come down in the weeks ahead, so if you can afford to wait before taking out a new deal, it might be worth doing so.

That said, with house prices currently falling, you may be better off remortgaging sooner rather than later if you are very close to a loan-to-value (LTV) boundary.

For example, if you would currently only need to borrow 60% of your property’s value, but a small drop in house prices would push you above this level into the next tier, it would mean you could be charged a higher interest rate.

If you need to remortgage now, five-year fixed rates for people borrowing 60% of their property’s value currently look the best value, at an average of 5.94%.

But remember, if you take out one of these deals, you will be locking into the current high level of interest rates for five years.

Although the Bank of England base rate is expected to rise further from its current level of 3%, the official cost of borrowing is expected to start falling again within the next two years.

As a result, you may be better off opting for a two-year fixed rate deal, with these currently averaging 6.27%.

For landlords looking to borrow 75% of their property’s value, the difference is much smaller, with five-year deals averaging 6.55% and two-year ones averaging 6.53%.

Anything else I need to be aware of?

To qualify for a buy-to-let mortgage, lenders use a particular affordability test, known as the Interest Cover Ratio.

Under this test, rental income from the property has to be the equivalent of between 125% and 145% of the monthly mortgage interest payment.

So, if your mortgage rate is 6.5% and you are borrowing £200,000, your rental income would need to be between £1,354 and £1,571 a month.

There are some ways around the test. For example, you can ask your lender for ‘top slicing’ under which they will include some of your income in their affordability calculations.

But not all lenders will do this, so if you want to use top slicing, it might be worth getting help from a mortgage broker.

Key takeaways

- The number of buy-to-let mortgage deals available has increased by more than 700 since the beginning of October to 1,769 different products

- The average cost of the mortgages has continued to increase and stands at 6.5% for two-year deals and 6.42% for five-year ones

- Buy-to-let mortgage rates are expected to fall in the weeks ahead

What’s going to happen to the rental market in 2023?

Will rents keep rising at the rate they are now and will more homes become available for renters next year? Get the latest with our Rental Market Report.

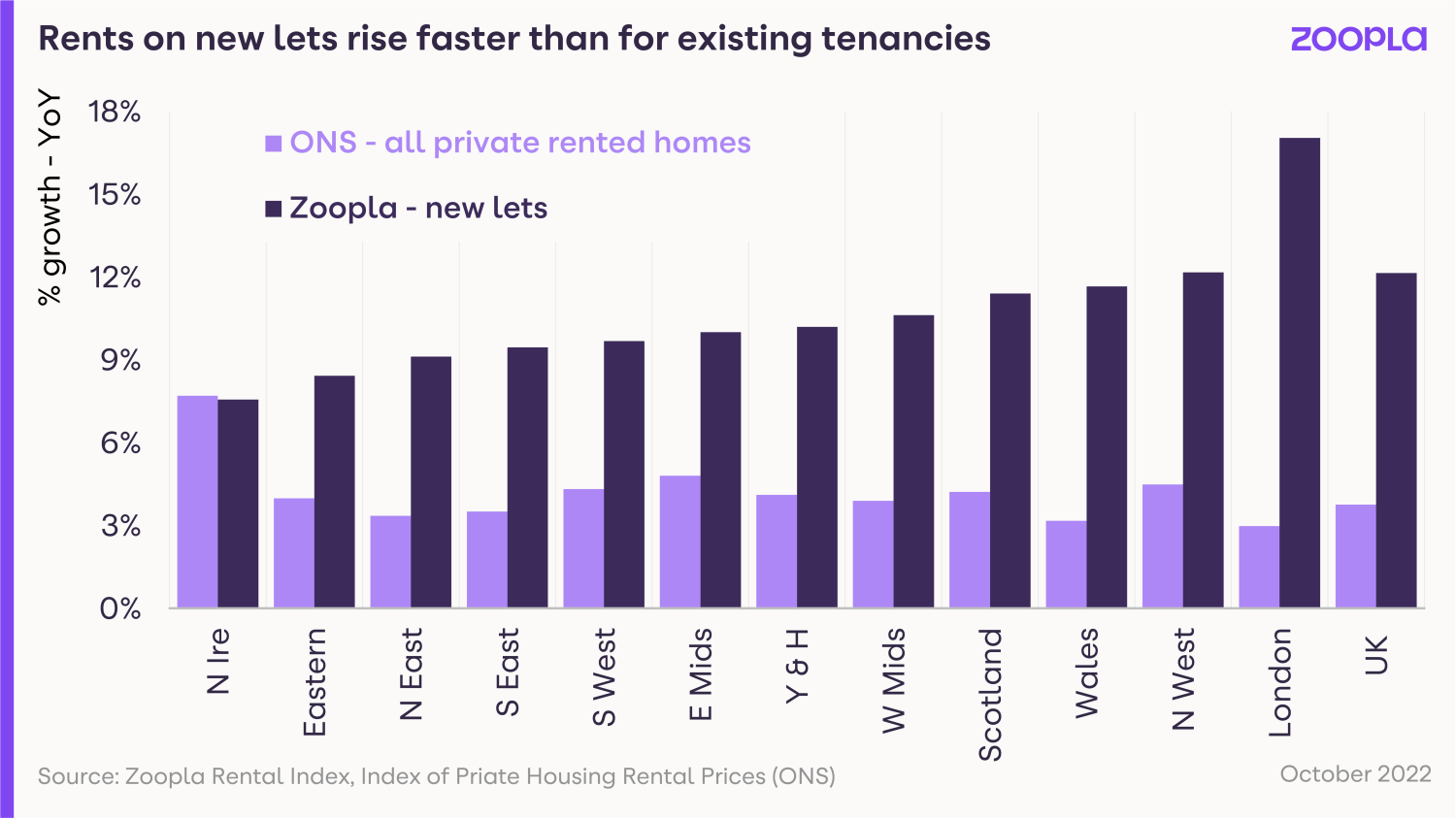

Rents have risen 12.1% in the last year on new lettings. That’s around £117 a month, or £1,400 a year.

The rise is way ahead of the rate at which wages have increased, up 6% on average in the last 12 months.

Rental affordability, measured as the percentage of income a single renter pays on rent, is now at its highest level for a decade at 35%.

New lettings account for a quarter of the rental market, as one in four renters move home each year.

For the 75% of renters who stay put, the picture is less bleak, as rents have risen by an average of 3.8% for this group, according to the Office for National Statistics.

However, the fact that renters are choosing not to move rather than face higher rents is compounding the supply issue for the market.

When will rentals get cheaper?

With demand up 46% and supply down 38%, rent prices are being pushed up fast.

That demand is being further exacerbated by rising mortgage rates, meaning more potential first-time buyers are continuing to rent for the time being.

But there’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents are rising in 2023.

The current momentum in rental levels is a growing concern for all private renters, especially those on low incomes, as it only exacerbates cost-of-living pressures.

If rental growth were to continue to run at 12% over 2023, the proportion of earnings needed to pay rent would be stretched even further to 37%.

This is not likely or feasible and we expect the growing unaffordability of renting to hit spending power.

This trend, supported by a modest improvement in available supply, could lead to rental growth slowing to 5% over 2023.

What will make renting less expensive?

The quickest way to slow rental inflation is to boost rental supply.

Executive Director Richard Donnell says: “Increasing investment in new rental supply from multiple sources is the main route to reducing rental growth and making for a more sustainable private rented sector.”

Unfortunately however, we’re not expecting to see any major improvement in this area over the next 12 months.

The private rented sector has a structural supply problem stemming from economic and policy factors.

The stock of homes available for rent has not grown in size since 2016, holding steady at around 5.5m homes.

Over the last 7 years, we’ve seen private landlords selling up and taking advantage of the strong sales market in the face of higher taxes and greater regulation.

That said, the reduction in privately available rented homes has been offset somewhat by corporate investors delivering ‘build-to-rent’ schemes, keeping overall supply static since 2016.

It is important that policymakers encourage good landlords of all types and sizes to stay in the market and deliver much-needed supply.

Only by increasing investment in the private rented sector can we ease the affordability pressures on renters in the medium term and make for a more sustainable rental market.

Rental supply is beginning to improve

We do expect to see a modest improvement in rental supply in the coming months.

In fact, the number of homes available for rent has increased in recent weeks as the sales market weakens.

Landlords looking to sell homes may now continue to rent them out while uncertainty in the wider sales market persists.

The average estate agency branch now has 10 homes available for rent, up from a low of 7 at the end of September.

Unfortunately though, this increase in rental supply is unlikely to provide a material slowdown to rental inflation in isolation.

Increasing demand is pushing rents higher and adding to affordability pressures for renters.

This means more renters are having to consider a greater set of compromises when looking to secure a home.

More renters likely to share homes to spread costs

Recent research from the Resolution Foundation 2 found that there has been a steady increase in sharing, measured by the space per private renter, which has decreased by 16% over the last two decades.

More renters likely to continue living with parents

ONS data 3 shows a continued increase in the number of young adults aged 20-34 years staying at home (3.6m in 2021) rather than incurring rental payments to live independently.

This trend is already helping to ease some of the current demand-side pressures.

More renters trading down to smaller homes

Our last report highlighted how renters are seeking smaller homes with an increase in demand for 1- and 2-bed flats and a reduction in the demand for houses.

Our latest data shows this trend is continuing with an acceleration in demand for 1-bed flats, which now account for 32% of rental enquiries across the UK.

The affordability dynamics for a couple renting a 1-bed flat are much better than a 2-bed home and keeping a spare room or sub-letting.

What’s the outlook for renting in 2023?

Proposed regulations and new rules on renting homes that aren’t at an Energy Efficiency rating of C or above from 2025 are likely to result in more private landlords selling up, especially if they own homes that are expensive to manage and retrofit.

Sadly this further loss of privately rented homes is likely to offset the impact of new investment in the build-to-rent sector.

Policymakers need to better understand the rental market as well as the forces and factors shaping the overall availability of supply.

The demand for rented homes is only going to rise in the medium term, so it's important we encourage more supply from all forms of landlords, whether private individuals or large corporates.

Key takeaways

- Rental growth is likely to slow from 12% in 2022 to 5% over 2023

- Single renters are currently spending 35% of their income on rent. If rental inflation continued at the rate it is now, that would increase to 37% in 2023, which we think is unlikely

- There’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents increase next year

Rents rising fastest in major regional cities

UK rents are 12.1% higher than last year but major cities have seen even more rental inflation. Find out the average rent for your area and how quickly rents are rising across the country.

The average UK rent is now £1,078 per month, a rise of 12.1% in the last year.

Rents are rising the fastest in large cities where shortages of available rental homes cannot meet demand created by strong employment markets and large student populations.

London has seen the highest rental growth in the last year at 17%. That works out to a rise of £273 per month for renters in the capital, compared to a UK-wide jump of £117 per month.

There’s also been high rental growth in Manchester (+15.6%), Glasgow (+14.1%), Bristol (+12.9%), Sheffield (+12.4%) and Birmingham (+12.3%).

Rental growth is slower in smaller cities like Hull, York, Oxford and Leicester, where rents rose less than 8% in the last year.

But that’s still higher than the average 6% rise in earnings in the same period. The average renter now puts 35% of their income towards rent, making renting in the UK the most unaffordable it’s been this decade.

Southern cities record highest average rents

Average rental rates are highest in southern UK cities - London (£1,879), Cambridge (£1,431), Bristol (£1,254) and Southampton (£1,006).

The only city outside of the south to match these levels is Edinburgh, where renters are paying £1,060 per month for new tenancies - an above-average rise of 12.4% in the last 12 months.

Looking at regions rather than cities, the most expensive places to rent a home in the UK are the South East (£1,189) and East of England (£1,051), both higher than the UK average of £1,028 per month.

While rents have risen at 9.4% and 8.4% in these regions respectively, those are some of the slower regional growth rates in the country.

The South West - with an average rent of £983 - is also tracking slower regional growth (9.7%) than regions further north.

Rents are cheapest in northern regions and cities

As a general rule, rents get cheaper the further away you move from London.

Wales, East and West Midlands, Yorkshire and the Humber, and the North West are all recording average rents of between £700 and £800, offering greater value for money for renters.

But the cheapest regions to rent in the UK are the North East (£612), Northern Ireland (£679) and Scotland (£688).

If we look at major UK cities, the cheapest rental rates are currently in Newcastle (£712), Liverpool (£717) and Sheffield (£735).

Sheffield, however, has seen some of the highest rental growth in the last year with rents jumping 12.4%.

Will rents keep rising in 2023?

There’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents increase next year.

We expect annual rental growth to be between 4% and 5% by the end of 2023, as affordability limits of renters combine with a modest uplift in rental supply due to the weaker sales market.

Executive Director Richard Donnell says: “Increasing investment in new rental supply from multiple sources is the main route to reducing rental growth and making for a more sustainable private rented sector.”

Key takeaways

- Rents are rising the fastest in large UK cities with strong employment and large student populations

- London, Manchester and Glasgow recorded the highest rental growth in the last 12 months

- The South East and East of England are the most expensive regions to rent in December 2022, while rents get cheaper as you move further north

Top five urban regeneration hotspots

Buying in an area that's being regenerated is a smart move. Find out which major cities are being transformed with mulit-million pound investment projects right now.

As activity in the housing market slows, areas undergoing regeneration can be a good bet for property investors and home buyers.

Urban regeneration often triggers rising demand for housing as locations become more desirable places in which to live, which in turn attracts new businesses, according to Seven Capital.

“Developments such as new train stations, shopping centres, leisure facilities and mixed-use commercial spaces directly provide a better lifestyle, which in turn attracts new residents.

“This effect can then ripple outwards, attracting new businesses which support a higher-paid workforce and thus, increase demand for residential living nearby,” the group said.

Seven Capital has identified five locations that are seeing above-average regeneration, which will not only transform them into desirable places to live and work, but could also boost property values.

Derby

The Derby City Centre Masterplan is an ambitious regeneration scheme to deliver new retail, leisure and residential developments across the city.

Scheduled for competition in 2030, it aims to leverage £3.5 billion of investment to create 1,900 new homes and 4,000 jobs, as well as a hi-tech business park.

Meanwhile, the city’s Local Plan will see 11,000 new homes and more than 100,000sqm of office space built by 2028 in a bid to attract new employers to the city.

Derby is also poised to benefit from improved transport links through High Speed 2 (HS2), with the rail project putting it less than an hour away from London and within around 30 minutes of Birmingham.

These new amenities, employment opportunities and transport links are expected to lead to significant population growth in the city, leading to higher property demand, with Seven Capital predicting house prices could rise by 24% by 2025.

Birmingham

The UK’s second city has already benefited from a number of regeneration schemes in the past two decades, including the Bullring, New Street Station and Grand Central.

Birmingham is now focusing on the West Midlands Metro tram extension, which will create new transport links across the city.

Seven Capital expects the project to lead to a 6% increase in house prices in areas that will benefit from the increased connectivity.

Meanwhile the Paradise and Snowhill developments bring new office space and homes, while Digbeth is continuing to undergo regeneration, including the £1.5 billion Birmingham Smithfield development to create a mix of commercial space, offices, homes and public areas.

Birmingham is also set to be a significant beneficiary of HS2, which will cut the journey time to London to just 52 minutes.

Leeds

Leeds is already one of the fastest growing cities in the UK, and its appeal looks set to continue thanks to a number of regeneration projects.

Following on from the revamp of Leeds City Station, a £270 million development project is set to see the city’s Lisbon Square area transformed into a 2.8 hectare site that includes apartments, hotels and mixed-use office space.

Not only will it double the size of the city centre, but it is also expected to help boost the local economy.

At the same time, £8.6 million is set to be spent transforming road space into green space under the City Park scheme, while £7.4 billion will go towards expanding Temple Green Park and Ride, and £2.6 billion will be spent renovating older properties in the Holbeck area of the city.

Slough

Already a popular destination for London commuters, Slough is set to benefit from £3 billion of redevelopment cash.

The Heart of Slough project will see the former Thames Valley University land transformed into new homes, commercial space, retail and leisure facilities.

The town already boasts The Curve, a new theatre and library, as well as several new sports and leisure facilities, including an ice rink.

Meanwhile, plans are in place to transform the old Queensmere Shopping Centre into 1,600 new homes, as well as 12,000sqm of retail space and 40,000sqm of office space.

At the same time, the newly completed development The Metalworks offers homes less than 200 metres from a Crossrail station.

Bracknell

Bracknell has seen a number of regeneration projects during the past 10 years as the popularity of the town increases.

The £770 million Bracknell Town Centre Vision 2032 has already seen the creation of retail and leisure complex The Lexicon.

Future redevelopment projects include The Grand Exchange, a new residential complex designed to capitalise on growing demand for homes from people leaving London.

Other up-and-coming projects include Princess Square and The Deck which will provide new retails offerings and public space.

Key takeaways

- Regeneration in urban areas can help to boost house prices

- Good transport links, alongside improved shopping, restaurants, cafes and sports facilities generate employment and create more desirable places to live

- Derby, Birmingham, Leeds, Slough and Bracknell are the places to watch right now, as they're all seeing high levels of regeneration