First-time buyers have just two months left to use the Help to Buy equity loan scheme

The government’s flagship initiative to help people get on to the property ladder will close to new applications on 31 October.

First-time buyers have just two months left to use the Help to Buy equity loan scheme before it closes to new applicants.

The flagship initiative to help people get on to the property ladder will stop accepting new applications at 6pm on 31 October, before closing completely on 31 March 2023.

The scheme enables people to purchase a new build property with just a 5% deposit. The government then tops this up with a 20% equity loan, rising to 40% in London, that is interest free for the first five years.

Since it was first launched in 2013, more than 350,000 people have used the Help to Buy equity loan to purchase a home.

What does the deadline mean?

Because the Help to Buy equity loan only applies to new build properties, the scheme effectively has two deadlines.

This is because new build properties are typically sold off plan and then have to be built.

As a result, the first deadline of 6pm on 31 October is the date by which you must apply to the Help to Buy equity loan scheme, having agreed to purchase a home off plan.

In practice, this means submitting your Property Information Form to your Help to Buy agent by this date.

The second deadline of 6pm on 31 March 2023 is the date by which you must have legally completed on your home, meaning you must have the keys and be able to move in.

If you don’t complete by this date, you will not be eligible for the equity loan.

There is also a third deadline you need to know about.

The builder must have finished building your home so that it is ready to live in by 31 December 2022. This is known as the practical completion.

If you plan to use the scheme, it is important to check with your housebuilder and solicitor that you will be able to meet all of these deadlines.

Why is this happening?

Help to Buy equity loan was only ever intended to be temporary scheme.

When the government announced plans for the second phase of the initiative, which included limiting it to first-time buyers and introducing regional price caps, it made it clear it would run from 1 April 2021 to 31 March 2023.

There are currently no plans to extend or replace it.

What other help is available?

The good news is that while Help to Buy equity loan may be ending, there are still a number of government schemes available to help both first-time buyers and those trading up the housing ladder.

- Both first-time buyers and home-movers who have only a 5% deposit can use the mortgage guarantee scheme to borrow 95% of their home’s value.

- Meanwhile, First Homes, helps first-time buyers, key workers and local people to purchase a home at a 30% discount to its market price.

- And Shared Ownership enables people to buy a share in a property and pay rent on the rest.

- First-time buyers saving for a deposit can also use the Lifetime ISA, under which you can save £4,000 a year. The government then adds a 25% bonus - up to a maximum of £1,000 annually - for free. The money must be used to either purchase a first home or for retirement.

Key takeaways

- The Help to Buy equity loan scheme will stop accepting new applications at 6pm on 31 October, before closing completely on 31 March 2023

- The initiative enables first-time buyers to purchase a new build property with just a 5% deposit

- There are still a number of government schemes available to help both first-time buyers and those trading up the housing ladder

Cost of living: How rising energy bills are impacting the mortgage market

Will higher gas and electricity bills make it harder to get a mortgage? We take a look at what impact the rising cost of living is having on mortgage availability.

Energy bills have more than doubled this year as the conflict in Ukraine continues to drive gas and electricity prices higher.

The energy price cap has increased from £1,277 a year at the start of 2022 to £3,549 now. And further price increases are predicted for January 2023.

The rising cost of heating and lighting a home is having a knock-on effect on the mortgage market.

Here’s what you need to know and how you can make yourself more attractive to mortgage lenders.

Why are rising energy bills impacting the mortgage market?

Unfortunately, lenders can’t ignore the impact higher energy bills will have on people’s finances.

Before offering you a mortgage, they need to make sure you can afford the monthly repayments.

Richard Donnell, Director of Research and Insight at Zoopla, explains: “Over the last five-plus years, lenders have focused much more on checking the affordability of mortgage repayments as part of a households’ overall spend.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, adds that most lenders use data from the Office for National Statistics as part of their affordability assessments. This data reflects the recent rise in energy costs.

“As lenders have plugged this new data into their calculations, borrowing potential has been negatively impacted and lower lending limits are being offered,” he says.

Will it be harder to get a mortgage?

Some people are likely to find it harder to get a mortgage due to the rising cost of living.

If a lender feels your budget is too tight to cope with further hikes to energy costs, as well as other price rises, they might offer you a smaller amount to borrow.

But it's not all bad news.

Richard points out that mortgage stress testing has been higher over the last few years.

Most people who have bought a home or remortgaged recently will have needed to show that they would have been able to afford repayments at a much higher mortgage rate of 6% or 7%.

This requirement has since been removed, but it means if you're remortgaging you should have enough flexibility in your budget to meet the cost of higher energy prices.

Who will be impacted most?

First-time buyers and borrowers with low incomes are most likely to be impacted by lenders tightening their affordability criteria.

“Rising energy bills will affect different income groups to a greater or lesser degree. Low income households with less disposable income will be more impacted by energy caps rising,” Mark Harris says.

By contrast, people with high incomes looking to borrow a high multiple of their salary are less likely to be affected, according to Jonathan Harris, of Forensic Property Finance.

“By making the tweaks to their systems, lenders can still confidently lend high loan-to-incomes to people who can afford to cover all the costs comfortably,” he says.

He adds: “The changes are most likely to affect those who are really pushing themselves to borrow as much as possible. This is most likely to be first-time buyers, as it all comes down to the deposit and how much you can raise.”

Will banks be more reluctant to lend?

The good news is that lenders are still very much open for business, even if they are tightening their affordability criteria.

Jonathan Harris says: “Lenders will not become reluctant to lend. They have the systems in place to lend in a responsible fashion due to the constant tweaks they are making to affordability criteria.”

So while banks may be more cautious about the amount they will advance to an individual, it's not expected to be as widespread as it was at the start of the Covid-19 pandemic.

What will happen to mortgage rates?

Mortgage rates are already rising across the board as a result of increases to the Bank of England base rate.

The official cost of borrowing has jumped by 1.65% since December last year, and most of this increase has been passed on to new mortgage customers.

On top of this, Donnell also expects mortgages for people with small deposits to become more expensive. It'll reflect the greater risk these borrowers pose in the face of the rising cost of living.

“When the economic outlook is uncertain and there is greater risk, lenders tend to reduce the availability of loans at higher loan-to-value ratios. They also sometimes increase the cost of mortgages at these levels to cover the risk, which can reduce demand,” he says.

What can I do to help me qualify for a mortgage?

Mark Harris points out that while you can’t directly influence inflation, you can make yourself more attractive to lenders.

Cut back on unnecessary spending and reduce or pay off financial commitments such as loans and store cards.

Jonathan Harris agrees: “Get rid of any committed monthly expenditure such as a Netflix subscription or gym membership, particularly if you rarely use them. Pay off credit cards and loans if you can and conduct your accounts cautiously. Make sure you pay bills and things like parking fines on time.”

Will higher energy bills impact the housing market?

Rising energy costs may encourage some people to move to find a more suitable home that is lower cost to run, according to Donnell.

Buyers are also likely to pay closer attention to the running costs of a property than they have done in the past.

In fact, a recent survey found that the better energy rating and lower running costs of new homes is an increasingly attractive proposition for new buyers.

New-build buyers driving the green home movement – and saving up to 52% on energy costs

But rising energy costs are not expected to trigger anything as dramatic as a house price crash.

This is in part because borrowers who took out mortgages in the past few years will have faced strict affordability tests to ensure they could still afford their repayments even if costs rose.

Will there be a housing crash? Here's what the data says

At the same time, the majority of homeowners with a mortgage are on a fixed rate deal, meaning they will be insulated from interest rises until they need to remortgage.

Instead, house price growth is expected to slow gradually during the rest of the year as buyer demand eases.

Key takeaways

- Lenders will factor higher energy bills into their affordability calculations, which might reduce the amount you can borrow for a mortgage

- You might find it harder to get a mortgage if lenders feel you do not have enough room in your budget to cope with further price hikes

- Try to cut back on unnecessary spending and reduce any outstanding debts to make yourself more attractive to lenders

How can first time buyers handle rising interest rates?

First time buyers are the largest buyer group in the country but they’re about to be hit with higher interest rates. Here’s what’s happening and how you can offset the rising rates.

Interest from first time buyers is up a huge 46% year on year as they drive the market from the bottom up.

They’ve now become the largest buyer group in the country with nearly 177,000 transactions so far this year. That’s one in three sales made to first time buyers.

And they’re going bigger and better, with more than half of their enquiries for three bedroom homes and an average price 10% higher than this time last year (£269,000).

Pandemic changes and new working from norms are continuing to power the first time buyer market.

They’re now able to look further afield in cheaper areas to buy a home, meaning less time spent saving up for a deposit.

Our data shows that 25% of first time buyers outside of London are now searching 10km or more from their home address. That’s compared to just 20% in the summer of 2019.

This search radius has increased even more for first time buyers in London. 30% of first time buyers are enquiring for properties 20km away, up from 21% in summer 2019.

First time buyers will soon need an extra £12,250 on their income to get a mortgage

Despite the current economic situation doing little to deter first time buyers, rising interest rates are likely to impact their levels of activity.

Moving from a 2% mortgage rate to 4% will see the average first time buyer require an extra £12,250 in income.

That means earning £48,000 compared to the previous £37,500.

In London, you’ll need an extra £34,500 on your income.

This impact won’t be felt as much in lower value markets, where first time buyers may only need a few thousand more on their income to secure a mortgage.

It’s still cheaper to buy than rent. Just.

One way to look at the impact of higher mortgage rates on first time buyers is to compare the cost of renting and buying.

We’ve looked at whether a renter can afford to buy the home they live in.

And at the moment, you’re saving an average of £200 by paying a mortgage (with a 2.5% rate) rather than renting.

With a 4% interest rate, it’ll still be slightly cheaper to pay a mortgage than to rent in most places.

But buying will edge into being more expensive than renting in the high value areas of London and the South of England.

What can first time buyers do about rising interest rates?

There’s no one-size-fits-all answer when it comes to how first time buyers can handle higher borrowing costs.

We know how hard it is to get a deposit together and step onto the ladder. And unfortunately, it’s not about to get any easier.

But there are a few things you can do to offset interest rate rises as a first time buyer.

1. Broaden your search area

If you can be flexible on location, look for homes in more regional or rural areas.

In areas outside of major cities, you can find cheaper homes or get more home for your money.

This means smaller monthly repayments, and the amount you pay in interest won’t seem quite as eye-wateringly high.

It’s a tactic that’s already being used by many first time buyers, as we’ve seen them stretch their search area further from their current location.

2. Look into how you can boost your savings

It might seem like it’s all doom and gloom when interest rates go up.

But you could see an increase in the interest rates on your savings account or Cash ISA if you’re on a variable rate.

Shop around to see what interest rates banks and building societies are offering on their savings accounts. It could help you boost your savings and save for a deposit quicker.

3. Use a government buying scheme

The government has launched several first-time buyer schemes to help you get on the property ladder.

The Help to Buy: Equity Loan scheme is a popular choice. You need to put down a 5% deposit, which the government tops up with a 20% equity loan, rising to 40% in London.

However, this scheme is only open until October, and some banks are starting to wind down their Help to Buy mortgage offers.

Meanwhile, the First Homes scheme offers discounts of between 30% and 50% on new build properties to local first-time buyers and key workers.

There are several other schemes that can help you get on the ladder too.

4. Team up with friends or family to get a bigger deposit

Easier said than done, but you can offset rate rises by coming up with a bigger deposit.

This will reduce the size of your mortgage and bring down the amount of interest you owe.

It’s a trend we saw after the first lockdown, when first time buyers started turning up with bigger deposits.

Many are turning to family members or pairing up with partners or friends to get a deposit together.

5. Do your homework on different types of mortgages

It’s vital to understand how different types of mortgages are impacted by base rate changes.

There are still some cheaper deals out there, especially if you have a decent deposit and you can prove your strong financial position.

Keep in mind that there are nine different types of mortgages. They all have their own pros and cons, as well as some restrictions that might mean you’re not eligible.

Although the mortgage with the lowest interest rate might seem tempting, take a close look at what other restrictions will be in place.

This is where it can be worth speaking to a mortgage advisor. Some specialise in first time buyer mortgages, so tap into their knowledge as well as doing your own research.

6. Keep up with your local market

Local housing markets all have their own stories.

You’ll be in the best position to get on the market at a good price if you know what’s happening nearby.

You can uncover pockets of affordability and places where you can get on the market for less.

Speak to local estate agents and see what advice they have for first time buyers. They’ll have a full view of your market and could help you time your step onto the ladder.

Key takeaways

- First time buyers have become the largest buyer group in the UK with nearly 177,000 transactions so far in 2022

- But 4% interest rates mean they’ll need an average of £12,250 more on their income to get a mortgage

- This reaches an additional £34,500 in the higher value London market, but is under £5,000 in more affordable regions

- There’s no one-size-fits-all solution for first time buyers but consider more affordable markets, government schemes and different mortgage options

Economic uncertainty begins to impact demand and house price growth

The housing market remains resilient but price growth begins to lose momentum as demand for homes starts to slow.

UK house prices increased by 8.3% or £19,800 in the past 12 months, however demand for new homes is beginning to weaken as mortgage rates rise and the increasing cost of living begins to bite.

Mortgage rates for new buyers are now at 4%, meaning the average first-time buyer will need an extra £12,250 to buy a home today compared to a year ago - and up to £35,000 more in London.

The average time to sell a home is also lengthening, taking 22 days right now, compared to 19 days back in April.

Why the cost of living isn't hitting the housing market yet

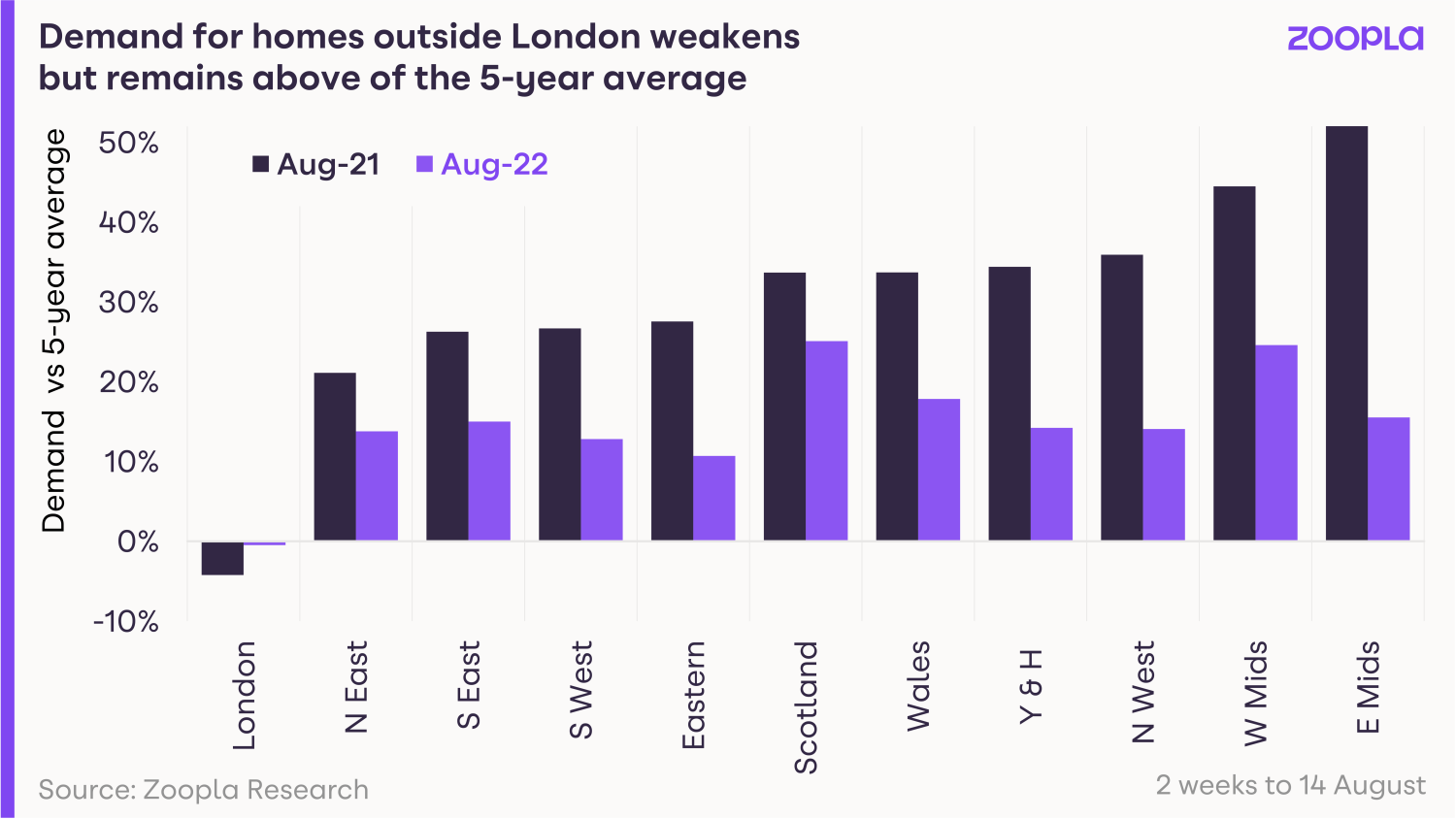

Buyer demand has started to fall but remains well above the five year average, tracking at +17%.

However, that demand has come down from a peak of +54% in May earlier this year and is likely to continue to weaken throughout the rest of 2022.

Demand is now below levels seen this time last year, when the stamp duty holiday was still in place and the nation was on the move in the hunt for more space.

The summer slowdown and increased economic uncertainty are beginning to make an impact.

However, there are a number of reasons why the housing market is remaining resilient, despite concerns over interest rate rises and cost of living increases causing a drop in consumer confidence.

Higher income households and first-time buyers driving the housing market

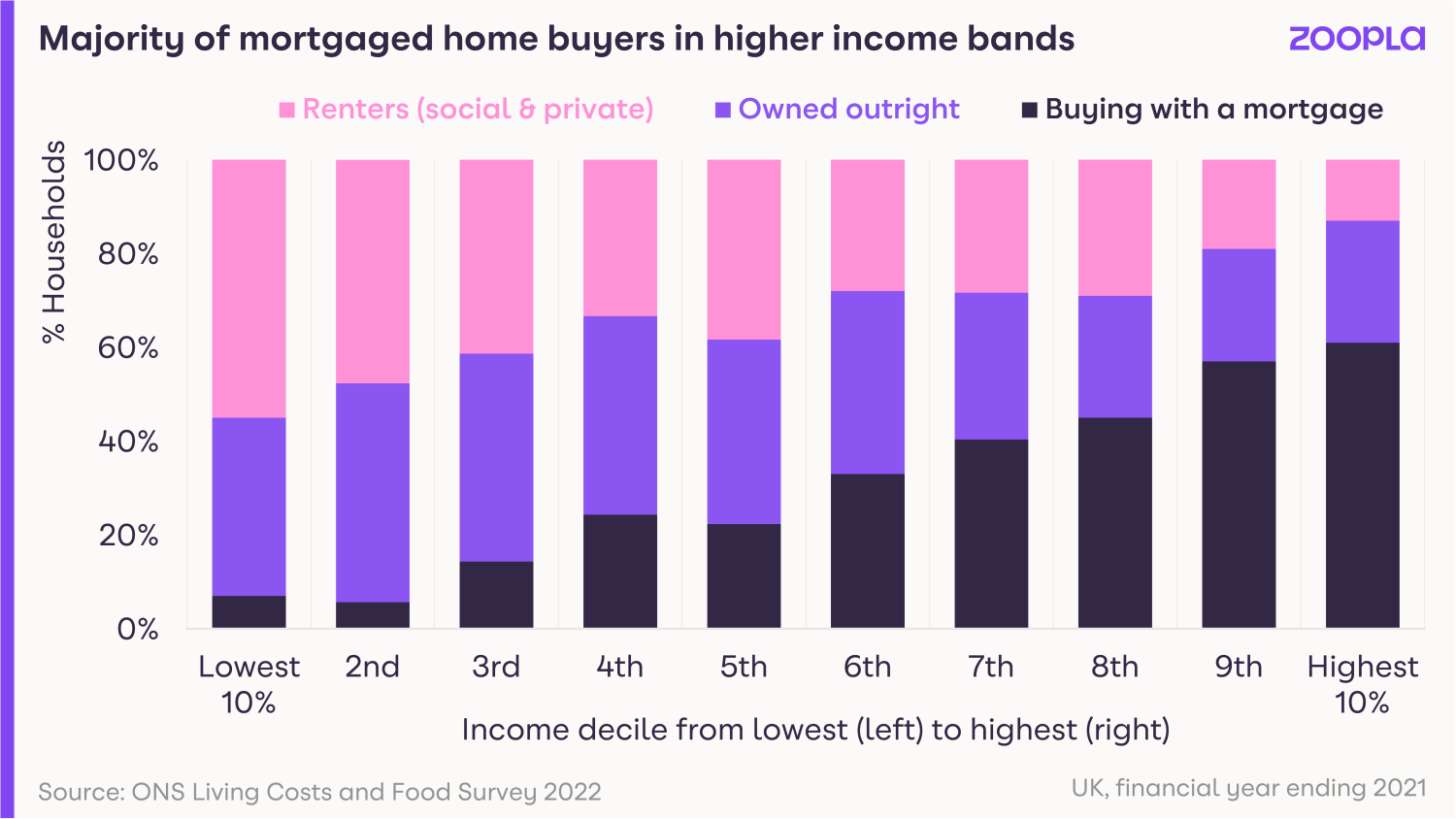

Homebuyers tend to earn higher incomes and may not yet be feeling the pinch of higher living costs.

In fact, the large majority of those buying with a mortgage, accounting for 7 in 10 of all new sales, sit within the UK’s middle to upper income bands.

The latest spending survey data from the Office for National Statistics shows all households have been adjusting their spending patterns, cutting back on discretionary areas of spend, but those on higher incomes have more room for manoeuvre.

The rising cost of living is hitting those on lower incomes first and will take longer to impact those higher income households.

First-time buyers are currently the biggest driving force in the housing market right now, accounting for 177,000, or 35%, of all transactions.

That’s over a third of all total sales so far this year.

The effects of the pandemic are also continuing to support market activity.

Buyers, no longer chained to an office desk, are able to secure cheaper homes, or bigger homes, in locations further afield.

First-time buyers the driving force in sales right now

The number of first-time buyers purchasing homes is changing the buying landscape this year.

Motivated by a need to step onto the property ladder fast, and with working from home opening up the location landscape, interest from first-time buyers in July 2022 was up 46% year-on-year.

Rising house prices have done little to dent demand among this buying group, despite the average first-time buyer property rising £33,000 to £269,000 year-on-year.

Accounting for one in every three property transactions, first-time buyers are now able to look further afield in cheaper areas to buy a home, meaning less time spent saving up for a deposit.

Our data shows that many are also looking at bigger and more expensive homes, with three bedroom properties accounting for more than half of all first-time buyer enquiries.

How higher mortgage rates will impact first-time buyers

Higher mortgage rates will inevitably mean larger monthly repayments - and the need for a greater household income to meet the increased costs.

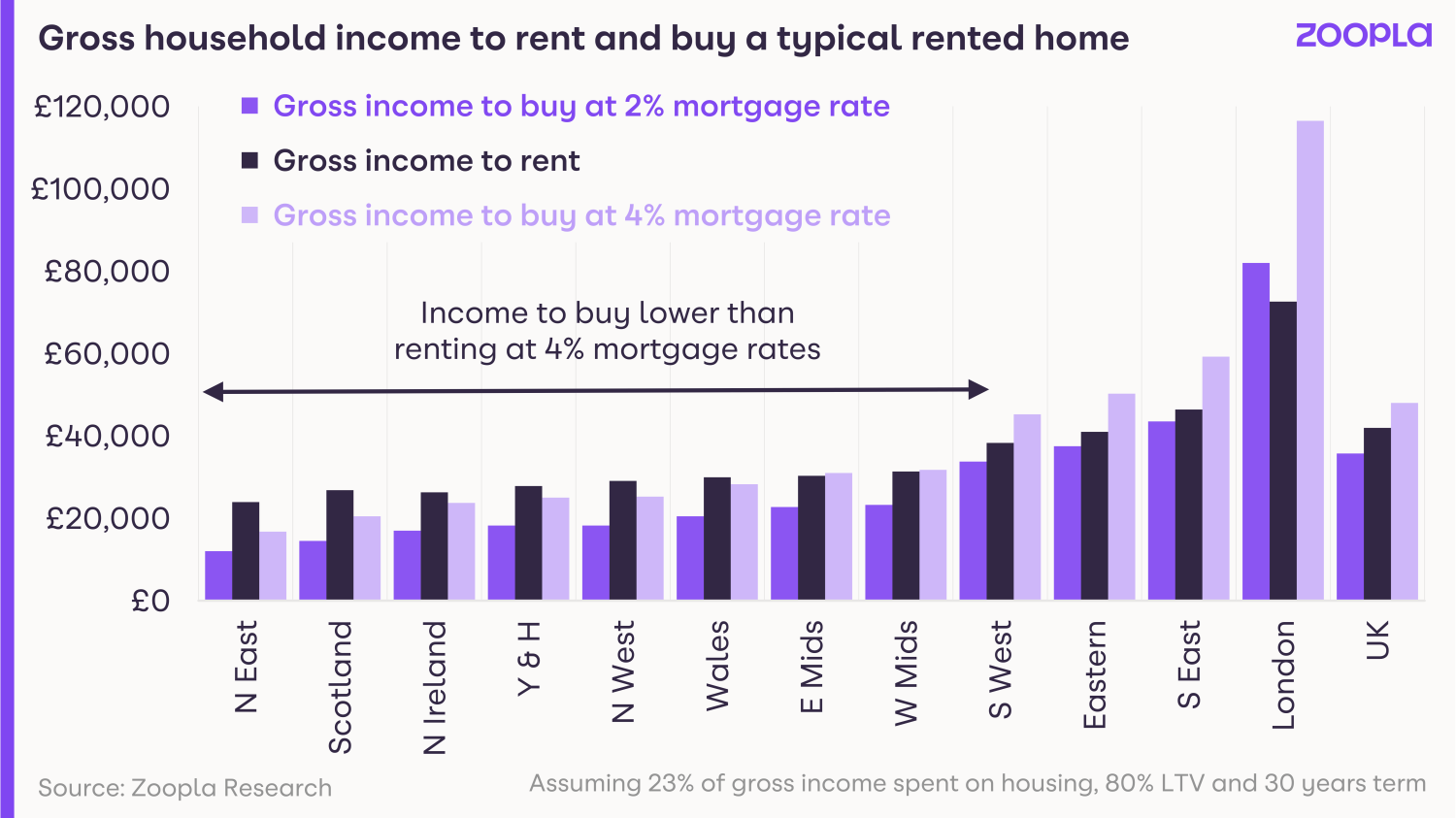

The chart below shows the income to rent and buy a typical rented home at 2% and 4% mortgage rates.

Moving from a 2% mortgage rate to 4% means the average FTB will need an extra £12,250 in income, compared to when rates were lower.

In London, the highest value market, this increases to over £34,500.

That said, the increase is less than £6,000 in markets with lower house prices.

First-time buyers can respond to higher borrowing costs by using a bigger deposit to reduce the size of their mortgage, as well as by looking to purchase cheaper homes or stepping back from the market altogether.

In order to fully offset this increase in mortgage rates, first-time buyers would need to almost double the size of the average deposit.

How higher mortgage rates and the cost of living will impact the housing market as a whole

With energy costs set to jump higher in the autumn, the impact of the rising cost of living is likely to be felt across all income bands, exerting a growing impact on household decisions, including home moves.

The key factor - that’s yet to fully impact market activity - is higher mortgage rates, which have more than doubled in the last few months.

In January 2022, new mortgage rates were still very cheap at less than 2%, whereas they have now jumped to 4%.

While those buying homes with a mortgage may be on higher incomes, this jump in mortgage rates for new buyers will compound cost of living increases and is likely to have an impact on sales market activity this autumn and into 2023.

And while this level of mortgage rate is still low by historic standards, homebuyers have become used to very low mortgage rates, meaning any reversal is likely to have some impact on demand, especially when combined with cost of living pressures.

Markets feeling the impact

Our data shows demand for homes is already weakest in higher value areas such as London, a trend that is likely to worsen for those looking to buy their first home as mortgage rates move higher.

Demand for homes in the capital continues to lag behind the rest of the country due to pandemic and affordability factors, with home values rising at a rate of 4.1%, less than half the UK average.

The impact of rising mortgage rates will be felt most acutely here and in high value markets in southern England, where affordability is already a drag on market activity.

The South West and Wales are jointly the best performing regions, with annual house price growth of 10.6%.

Strong demand and healthy volumes of new sales agreed in the first half of the year continue to support the headline rate of growth in these areas.

In terms of cities, Nottingham, where homes remain more affordable, continues to lead the way with house price growth of 10.9%.

It's hotly followed by Bournemouth (+9.3%), Leeds (+9,2%) and Manchester (+9%).

Where’s the market going in the next six months?

The headwinds for the sales market are building but the market is in a much better place to weather these than during the previous economic cycles.

We expect to see a slower rate of price growth in the second half of the year, with economic pressures hitting more households.

But history shows that it is the sudden changes in levels of spending on housing that are most closely linked to changes in house price inflation and sales volumes.

These downsides for prices and sales are most commonly seen during recessions, when consumers need to rapidly adjust what they spend in response to unemployment or higher mortgage rates.

Currently, a high proportion of mortgagees are on fixed rate loans, meaning the impact of rising rates won’t be felt by the majority.

And mortgage affordability testing, where to get a mortgage you need to prove you can afford a 6.5% to 7% mortgage rate - despite paying 2% - has baked in a certain level of resilience that will limit the downside for prices and volumes in our view.

That said, its clear UK households are facing a squeeze on incomes and living standards on multiple fronts, which will filter through into housing market activity and house price growth into 2023.

The higher rates move above 4%, the greater the impact on the market where homeowners already have plenty of equity in their homes.

However, we don’t anticipate any widespread falls in house prices if mortgage rates peak at 4% as expected.

Key takeaways

- Demand for new homes remains above average right now, but is set to weaken as even more households feel the cost of living squeeze in the autumn months

- First-time buyers are currently the biggest group driving transactions in the property market, accounting for 35% of all transactions

- Stock levels are also increasing, giving buyers the biggest choice of homes since May 2021

- And in good news for renters, the number of landlords purchasing buy-to-let homes is on the rise

Renters stay put as competition for homes intensifies

More than 11 would-be renters are chasing each property that is available to let. Here's what's happening and how renters can get ahead.

Rising numbers of renters are choosing to stay in their current home as competition for rental properties intensifies.

Nearly 75% of letting agents have seen an increase in renters renewing their contracts during the past 12 months, according to industry body Propertymark.

Their decisions come against a backdrop of rising demand for rental homes. Each letting agent branch received an average of 127 new rental applications during July.

But supply remains tight, with each branch having an average of just 11 rental homes available. That means would-be tenants are in competition with at least 10 other parties for each home.

Unsurprisingly, the mismatch between supply and demand is continuing to push rents higher. A record 82% of letting agents have reported month-on-month increases in rental rates.

Nathan Emerson, CEO of Propertymark, said: “The private rental market continues to be battered by the perfect storm of high demand, low availability and affordability issues that shows no sign of easing.”

Why is this happening?

Demand for rental homes is growing as rising house prices leave would-be first-time buyers facing a longer wait to get on to the property ladder.

But the number of homes available to rent has been on a steady downward trajectory for a number of years. A series of tax and regulatory changes have led some landlords to sell up their investment homes.

Meanwhile, rising interest rates have led to increased costs for investors.

These factors have combined to put significant upward pressure on rents, with the situation showing little sign of improving.

Who does it affect?

The increase in rents is hitting young people hard. Four out of 10 people aged under 30 now spend more than 30% of their income on rent, according to property consultancy Dataloft.

While rents are highest in London, the research found that the situation had also worsened in previously affordable locations such as Rotherham and Bolton.

What should I do if I rent?

If you currently live in a rental property, you may want to consider staying where you are.

Our research suggests landlords are not raising rents as steeply for existing renters as they are for new ones.

This is likely to be due to the fact that landlords do not want to lose good renters.

They'll also be keen to avoid the costs associated with finding new tenants, as this can offset rises in their rental rate.

If you're looking for a new home to rent, don’t lose heart.

The rental market tends to be highly localised, and there are still locations where rental homes remain affordable, particularly in rural areas.

If you have the flexibility to move anywhere, you could consider relocating to a cheaper area.

But even if you're tied to a certain location, you should still be able to find pockets of affordability.

Search homes for rent to explore cheaper areas near you.

Want to be the first to know about a new rental? We'll ping you an email every time one comes online that matches your criteria.

Key takeaways

- Rising numbers of renters are choosing to stay in their current home as competition for rental properties intensifies

- Letting agents received an average of 127 new applications per branch in July but had only 11 properties available to rent

- Turn on email alerts for your search to be the first to know about new rental homes

Average interest charged on a two-year fixed rate mortgage breaks through 4% barrier

Longer-term fixed rate deals offer better value to homeowners amid rising interest rates.

The average cost of a two-year fixed rate mortgage has broken through the 4% barrier for the first time in nearly a decade.

The typical interest rate charged on one of the deals is now 4.09%, according to financial information group Moneyfacts. That’s the highest level since February 2013.

The interest on fixed rate deals has risen 1.75% since the Bank of England first started increasing interest rates in December 2021. It’s up by 0.14% since the beginning of August 2022 alone.

While mortgage rates are rising across the board, longer-term fixed rate deals for five or even 10 years continue to offer better value for homeowners.

Why are we seeing fixed rate mortgages rise?

The Bank of England’s Monetary Policy Committee has increased the official cost of borrowing in a bid to combat high inflation.

They’ve increased the base rate by 1.65% since December 2021.

But unlike variable rate mortgages, the cost of new fixed rate deals is not based on the Bank of England base rate.

Instead, fixed mortgages are based on swap rates. This is the cost of borrowing money for a set period of time.

Swap rates are based on a number of different factors, including potential future interest rate changes.

With inflation remaining stubbornly high, further interest rate rises are expected in the months ahead.

That’s why the average cost of a fixed rate mortgage has increased by 1.75% since December, when the base rate has only risen by 1.65%.

What should I do if I need to remortgage?

With two-year fixed rate mortgages starting to look expensive, you may want to consider locking into a mortgage deal for a longer period of time.

You’ll be charged an extra 1.75% on a two-year fixed rate loan on average compared to December 2021.

But it’ll only be an extra 1.6% on a five-year loan, which now stand at an average of 4.24%.

This has led to the premium you’ll pay for the security of fixing for a five-year period, rather than a two-year one, narrowing to just 0.15%. That's half the level of 0.3% it stood at in December.

If you can lock in for even longer, ten-year fixed rate mortgages also look good value. You’ll be charged an average interest rate of 4.2%, slightly lower than that for five-year deals.

But before you opt for a longer-term fixed rate mortgage, make sure you won’t need to exit the loan early.

Exit penalties on 10-year fixed rate mortgages can be as high as 8% of the outstanding mortgage debt, so think it through before you jump in.

What about tracker mortgage deals?

Tracker rate mortgages currently look cheap compared with fixed rate ones.

The average interest rate charged on a two-year tracker deal is standing at 3.33%.

But remember that the cost of these mortgages moves up and down in line with the Bank of England base rate.

With some economists predicting the base rate could increase to 3% or more, the rate you pay on a tracker mortgage could rise to more than 4.5% in the next few months.

What else do I need to know?

The mortgage market is currently moving very quickly.

Be prepared to move fast to secure a deal that you like the look of.

Lenders have pulled 269 deals since the beginning of the month, with the typical mortgage product only available for 17 days before it is withdrawn.

Eleanor Williams, finance expert at Moneyfacts, said: “We’ve seen lenders withdraw parts of, or entire product ranges, with a number citing the pause in lending being due to unprecedented demand.

“Providers need to manage their service levels following an influx of applications, as borrowers have rushed to secure deals before rates have a chance to climb even further.”

Remember that you can ‘book’ a mortgage rate up to six months before your current one expires.

So, if you are coming to the end of a mortgage deal, try to lock into a new one now, before interest rates rise again.

Key takeaways

- The average cost of a two-year fixed rate mortgage has broken through the 4% barrier for the first time since February 2013

- Five-year and 10-year fixed rate deals currently offer better value to homeowners

- People remortgaging need to move fast, with lenders pulling deals after an average of just 17 days

Mortgage rates expected to rise again as inflation soars above 10%

Homeowners have a month in which to remortgage before the Bank of England’s next interest rate setting meeting.

Inflation soared into double-digit territory in July to stand at a new 40-year high of 10.1%.

The jump in the rate at which the cost of living is increasing was bigger than both the Bank of England and economists had predicted.

Commentators are warning the rise makes it likely the Bank’s Monetary Policy Committee will increase interest rates again when it meets on 15 September.

The situation also increases the likelihood that the committee will hike the official cost of borrowing by 0.5%, rather than 0.25%.

Homeowners who are coming to the end of their mortgage deal have just under a month to secure a new one before the interest rate setting meeting takes place.

Compare the best mortgage deals at Money.co.uk

Why is this happening?

The Bank of England has been increasing interest rates since the end of last year in a bid to control inflation.

But inflation as measured by the Consumer Prices Index remains stubbornly high due to a combination of the conflict in Ukraine impacting energy and fuel prices, and disruption to the supply chain following the Covid-19 pandemic.

The Bank is supposed to keep inflation at around 2%. With inflation currently running at more than five-times this level, it is widely expected to make further interest rate rises in the coming months.

What should I do?

The good news is that homeowners have nearly a month before the Bank of England’s next interest rate setting meeting in which to take action.

If you are currently on a fixed rate mortgage that is not close to the end of its term, you do not need to do anything. This is because the interest rate you are charged will not change until your deal ends.

But if you are close to the end of your current term, it's a good idea to start looking for a new deal now.

Most lenders will allow you to secure a new mortgage up to six months before your current one ends.

If you are in this situation, you may want to put in a new application as soon as possible, as lenders may start repricing their mortgages ahead of the next Bank of England meeting following the latest inflation news.

If you are currently on your lender’s standard variable rate – the rate you are automatically moved to when a deal ends - you should also consider remortgaging.

The average standard variable rate is currently 5.17% - significantly higher than interest of 3.95% charged on a typical two-year fixed rate mortgage.

The course of action you should take is harder to judge if you have a tracker rate or variable rate mortgage.

These types of mortgage move up and down in line with changes to the Bank of England base rate.

As a result, if interest rates increase again in September, your mortgage rate will rise by the same amount.

If you want the security of knowing how much your mortgage will be each month, you may want to switch to a fixed rate deal.

But before doing so, it is important to check that you will not incur any penalties for exiting your tracker mortgage before the term is up.

You should also weigh up whether the cost of any mortgage arrangement fees you will have to pay to take out a new deal still make it worth switching.

If you want to remortgage, you need to be prepared to move fast, as the typical mortgage deal is currently only available for 17 days before it is pulled by lenders.

Which mortgage deals offer the best value?

Unfortunately, mortgage rates have increased across the board since the Bank of England first started raising the base rate in December last year.

But five-year fixed rate deals continue to offer better value than their two-year counterparts.

While the Bank of England base rate has increased by 1.65% since December, and the average rate charged on a two-year fixed rate mortgage is 1.61% higher, the cost of a five-year deal has risen by a more moderate 1.44%.

The premium borrowers pay for the security of fixing for five years has also continued to shrink, with interest on the typical five-year fixed rate deal currently standing at 4.08%, compared with 3.95% for a two-year one – a difference of just 0.13%.

But before opting for a five-year fixed rate mortgage, it is important to be sure you won’t need to exit the deal early, as you are likely to incur penalties if you do.

Key takeaways

- Inflation soared to a new 40-year high of 10.1% in July

- The rise makes it likely the Bank’s Monetary Policy Committee will increase interest rates again when it meets on 15 September, possibly by as much as 0.5%

- Homeowners who are coming to the end of their mortgage deal have a month to secure a new one before the interest rate setting meeting takes place

Will there be a housing crash in 2022? Here’s what the data says

Spoiler alert: no, we don’t think there’ll be a housing crash in 2022. Let’s take a look at why the UK market is on track to avoid any major falls in house prices.

The housing market’s set to slow down later this year. There’ll be fewer sales and house price growth is easing.

But buyer demand is still tracking in line with last year, as we explain in our latest House Price Index.

The market’s proving more resilient than anyone expected, even in the face of economic headwinds.

And we don’t see a housing crash on the horizon.

Why not?

Well, a huge amount of change since the Covid-19 pandemic has opened up the housing landscape in the UK.

It’s given us greater choice over where we live, highlighted our relationships with our homes, and altered our reasons for moving.

And the housing market’s in a very different position to the last time we saw house prices fall, after the global financial crisis of 2008.

Let’s take a look at what’s changed in the last few years, and why it means there won’t be a housing crash.

House prices aren’t as overvalued as they were in previous economic cycles

“House prices tend to fall when they get too high and out of kilter with incomes,” says Richard Donnell, Executive Director of Research and Insight at Zoopla.

“In the past, this has gone hand in hand with more relaxed mortgage lending.

“In 2007, more than a third of buyers taking out a mortgage didn’t prove their income to the bank. And almost a fifth were getting mortgages when they had small deposits of less than 10%.

“This led to house prices shooting up. Then, when mortgages dried up and the economy went into recession, prices fell back.

“The difference now is that there are much tougher rules to get a mortgage.

“You must prove a lot more about your income and outgoings. People usually have much more than 10% deposits so they are less vulnerable to possible negative equity.

“In short, we don’t have the scale of over-valuation of housing that we’ve seen before.

“This puts the market in a much better position to weather high mortgage rates and the increased cost of living.

“The housing market is not immune from these pressures and some will already be feeling the squeeze. But the likelihood of big price falls is much lower than in the past.”

House price growth has spread across the country

House price growth has spread around the country.

It’s no longer London and the South East that are tracking the biggest house price gains.

Instead, we’ve got the South West, Wales and the Midlands seeing double-digit house price growth.

With higher demand in new areas, the value of housing has started evening up across the country.

In fact, the average UK home has risen by £48 a day since February 2020. That's the equivalent of £38,000.

And when you’ve seen your house price rise, it’s another incentive to sell. Many people want to release equity or take the chance to upgrade their home.

More people want to move because of the pandemic

In a recent survey, we found that 22% of people were more keen to move house since the pandemic. Only 6% were more keen to stay put.

Of existing homeowners, 19% were eager to move because of the pandemic.

Those figures might not sound very high.

But when only 4% to 6% of owner-occupiers move house each year, it’s a massive proportion.

Was this just a short-lived, post-lockdown thing?

Nope.

We asked consumers the same question in 2022. And for those who want to move home, they’re even more certain it’s the right choice.

“The data suggests that attitudinal changes have matured,” says Richard. “They’re both more considered and more embedded within households.

“And when you have buyers with their mind set on a move, the market will keep moving too.”

Thinking all these committed buyers have already made a move?

Only 1 in 17 privately-owned homes changed hands in 2021. That means plenty of people who want to move and haven’t yet taken the plunge.

Hybrid working is here to stay

In February 2022, 42% of people plan to work mostly from home, according to the Office for National Statistics. That’s an increase from 30% in April 2021.

That’s around five million more workers who are now able to work from home when they want, and a total of 9.7 million people.

“We’ve seen a strong trend between home working and the desire to move home,” says Richard.

“Our consumer survey found that home workers are five times more eager to move than those with more traditional working patterns.”

54% of those who expected to work from home more said they were more eager to move, compared with 13% who expected to do less working from home in future.

Working from home patterns have been a major contributor to the demand to move home in the last two years. We expect this influence to continue in the years ahead.

First time buyers are more motivated to get on the ladder

The working from home trend has granted a huge amount of opportunity for first time buyers.

“In our survey, renters were the most keen to move house out of anyone” says Richard.

“25% of renters said they were more eager to move because of the pandemic.

“With less of a need to live close to the office, first time buyers can look further afield for their home.”

We’ve seen a marked increase in the radius that first time buyers are searching in since the pandemic.

“A first time buyer in London now considers homes in an area 33% bigger than pre-pandemic,” says Richard.

“And first time buyers outside of London stretch their search by a further 20% since the pandemic.”

“This shows that many first time buyers would rather get on the ladder now in a cheaper area using their current savings, than wait until they can afford a more expensive area.”

We’re still keen to swap city life for country living

It’s been one of the biggest talking points about the housing market since the pandemic.

That we all want to switch the city for a slower pace and more space.

And our research shows this trend is even more pronounced a couple of years on.

“Back in July 2021, people living in major cities were far more likely to want to move house (36%) than those in rural areas (3%),” says Richard.

“Fast forward to spring 2022, and 44% of city dwellers want to move to a more rural location.”

“Interestingly, more rural homeowners fancy a move this year, too (8%).”

“This is typically older homeowners looking to downsize. The influx of demand to rural areas has created more opportunities to relocate closer to family or take equity from their current home.”

More people are retiring

Almost half a million older workers have left the labour market since the pandemic.

A huge 63% of adults aged 50 to 70 left their job sooner than expected, according to the Office for National Statistics.

Leaving work to retire was the most commonly reported reason (47%). But 15% of retirees said they left because of the Covid-19 pandemic, and 13% cited illness or disability.

Retirement is a common trigger for selling your home.

You might want to be closer to family and friends. Some are looking to embrace a new lifestyle or indulge in a passion, while others want to downsize and release some equity.

There may be other practical reasons for a move in retirement, like the need for good public transport or healthcare nearby.

With 75% of older households (65+) owning their home outright (GOV.UK), this group has the means to make a move that suits their lifestyle. They’re keeping momentum in the market by offering homes for sale while also buying a new place.

Rising mortgage rates won’t hit existing homeowners too hard - but it will prompt some to move

Half of all homeowners have a mortgage, and the rest own their homes outright.

Of homeowners with mortgages, 90% are on fixed rate deals for up to 5 years. Many are on low rates of sub 2%.

So most homeowners with mortgages will be unaffected by interest rate increases due to their fixed rate.

And if they got their mortgage post-2015, they will have had to prove they can afford a mortgage rate of up to 7%. This means many homeowners will be able to absorb additional cost pressures on their budget.

Rising interest rates can also prompt some savvy homeowners to make a move. If they’re coming to the end of their fixed term, a move could help them lock in a rate they might not see again for several years.

With most mortgage offers lasting just six months, this impact will dissipate soon. But we expect it to be one factor that keeps the market buoyant in late 2022.

Key takeaways

- House prices aren’t as overvalued as they were in previous economic cycles

- Value has spread across the country, giving more people the ability and motivation to move

- More people are working from home, retiring and reevaluating their lifestyle, which all prompt sales and purchases

- Nearly a quarter of people said they want to move house since the pandemic, but only 1 in 17 privately-owned homes changed hands in 2021

What does the latest house price data mean for you?

Will your home keep rising in value? Should you hold off from moving? And will there be a housing crash? Here’s what the latest data from our House Price Index means for you.

There’s a lot of noise around the UK housing market. And it can be hard to know when to stick, twist or make your dream move.

Richard Donnell, Director of Research and Insight, answers some of the most common questions about the UK housing market and how it will affect your home or move.

Will my home continue to rise in value this year?

“The vast majority of UK homes have risen in value over 2022 and most will continue to do so over the rest of the year, albeit at a slower pace.

“The outlook for home values really depends where you live and how affordable homes in your area are, compared to the wider market and nationally."

“Price growth is much lower in the more expensive parts of the UK where prices are high and many times the average salary. If you live in London or the South East, you’ll see a slower rate of growth.

“But if you live in a more affordable area, there’s much more room for prices to increase. Even if mortgage rates keep rising.

"So if you live in Wales, the South West or the East Midlands, you’ll continue to see strong growth in the value of your home in the second half of the year."

Is now a good time to put my home up for sale?

“The average homeowner moves once every 20 years. It’s a big decision and is likely to be linked to what’s happening in your life, whether it’s finding a partner, starting a family or retiring.

“Lots of people worry about timing their move with market trends but this is rarely a successful approach.

“It's all about whether it’s the right time for you and your family.”

“Beyond that, it’s about getting the best advice to make your move successful.”

“The most valuable thing you can do is speak to an estate agent long before you want to make your move.

“Agents are always willing to give would-be sellers advice on the market. They can also recommend what you can do to make your home as attractive as possible to buyers.”

“Don’t wait until you’re ready to put your home on the market or have found your next home.”

If I put my home on the market now, how long will it take me to sell?

“The average time to sell a home across the UK is currently 21 days. This compares to 22 days a year ago.

That’s 21 days from listing your home to accepting an offer. It could be a further 1 to 3 months for the legal side of things to go through.

“But keep in mind that the average sales period varies market to market and by price level."

“Ultimately, the time to sell a home will depend on each home and its asking price – and how closely this is linked to what buyers in the area want to pay.

“While the market has been hotter than normal recently, more expensive homes tend to take a little longer to sell. It’s the same for homes that are little out of the ordinary from the typical three bedroom semi-detached house."

Which types of properties are most in demand at the moment?

“Three bedroom houses have been the most in-demand properties in the last three months.

“44% of all enquiries on Zoopla are for three bedroom houses. The pandemic has driven a ‘search for space’ which has boosted interest in these family homes.

“But cities tend to have a greater supply of smaller homes and apartments, and this is matched by greater demand for them. This is particularly the case in London and Scotland, where apartments are most in demand.”

Will there be a housing crash?

“We can never say never, but no – we don’t think there will be a housing crash.

“Double digit falls in average prices are highly unlikely, even as we face higher mortgage rates and increases in the cost of living.

“House prices only tend to fall when there are forced sellers. That’s people who can’t afford their mortgage and have no option but to sell.

“But in the UK, less than half of homeowners have mortgages. 85% of those who do have mortgages are on fixed rates for 3 to 5 years. This insulates the market from short-term changes in mortgage rates.

“We already have tough affordability checks for buyers, too. History shows that falling house prices tend to be preceded by looser lending standards.

“For these reasons, we expect slower rates of growth or flat prices rather than big price falls.

“It would take interest rates rising much higher or for the strong labour market to turn on its head before we saw a housing crash.”

I’m a first time buyer. Should I buy now or hold off?

“At a time of increased uncertainty, like now, some first time buyers are waiting as they think homes may become cheaper.

“But the reality is that there have only been 31 months with house price falls in the last 20 years. Those months were all between 2008 and 2012.

“So I wouldn’t wait and hope for homes to become cheaper. Prices are set to keep rising slowly in most places.”

“If you think your household income will be steady or rise over the next 2 to 3 years, there’s limited point in delaying.

“Just spend plenty of time doing your research. Find a home that meets your needs and for which you feel you’re paying a fair price. Get advice about mortgage finance to help with this.”

I’m looking to downsize. Will I be better off moving now or later?

“In my opinion, worrying about the housing market and what will happen to prices should come second to your personal motivations for moving.

“You might’ve realised you have too much space or are facing high running costs.

“You might want to move closer to friends and family. Or look to take some equity out of your current home to fund your retirement or specific purchases.

“Whatever the market’s doing, there are ways to maximise the value of your home when you sell.

“It starts with talking to a local estate agent. They can tell you what buyers are looking for and what you can do in the current market to get the best sale result.”

I’m a homeowner. What do rising interest rates mean for my mortgage?

“85% of people have opted for a fixed rate mortgage in the last few years, often up to five year terms.

“If you still have several years left on your fixed term, interest rate rises won’t impact you until then.

“But higher mortgage rates will be an issue if you are coming to the end of your initial term for your fixed rate.

What changing interest rates could mean for you

“It pays to shop around and look for the best mortgage from different lenders. But keep in mind that lenders always look to offer their current customers some of the best deals.

“It’s probably unrealistic to expect a fall back to the low mortgage rates we’ve seen in the last few years.

“But even with the recent increases, borrowing costs are low by historic standards.”

Key takeaways

- Your home will probably continue to rise in value during 2022, albeit at a slower pace

- You’re likely to sell in 21 days if you put your home on the market now

- The most valuable thing you can do? Get personal advice from a local estate agent long before you’re thinking of selling

The 20 locations where homes sell the fastest

Where do homes sell the fastest, and what factors impact the speed of sales? Our research reveals the top 20 locations where homes are selling the fastest in 2022.

Dartford, Redditch, Test Valley and Gloucester are the fastest moving property markets in the UK.

Homes listed for sale in these areas take just 14 days to sell.

If we look at regions, the South West and the West Midlands have the fastest moving housing markets in 2022.

But the stories behind the fast sales are different across the country.

Where you live, the type of property and the price of your home will all impact how quickly it sells.

The top 20 places where homes sell the fastest

| Local authority | Region | Time on the market (full days) |

|---|---|---|

| Dartford | South East | 14 |

| Redditch | West Midlands | 14 |

| Test Valley | South East | 14 |

| Gloucester | South West | 14 |

| Bristol | South West | 15 |

| Wigan | North West | 15 |

| Rugby | West Midlands | 15 |

| South Gloucestershire | South West | 15 |

| Stoke-on-Trent | West Midlands | 15 |

| Trafford | North West | 16 |

| Basingstoke and Deane | South East | 16 |

| Bexley | London | 16 |

| Knowsley | North West | 16 |

| Wellingborough | East Midlands | 16 |

| Nuneaton and Bedworth | West Midlands | 16 |

| Worcester | West Midlands | 17 |

| Neath Port Talbot | Wales | 17 |

| Swindon | South West | 17 |

| Stafford | West Midlands | 17 |

| Plymouth | South West | 17 |

Zoopla, July 2022

What's happening in the hottest housing markets?

Dartford, Kent

While several other commuter markets have slowed down since last year, Dartford’s kept its place as one of the fastest selling areas.

With house prices still affordable and good commutes into London, buyers in Dartford are having to move quickly to land the home they want.

Two bedroom terraced homes are selling the fastest in Dartford. In terms of price bracket, you’ll sell the fastest if your Dartford home is priced between £250k and £300k.

This is the cheaper end of the market, with average house prices in Dartford at £344,500 in May 2022. This size and price signals that first time buyers are driving the fast-paced market in Dartford.

Redditch, Worcestershire

Homeowners in this West Midlands area have seen a dramatic improvement in how quick they’ll sell this year.

It’s dropped to 14 days, putting it at the top of the list.

In 2021, Redditch was the second fastest moving market. But it took much longer to sell your home, at an average of 27 days.

In terms of property type and pricing, owners of three bedroom terraced properties in Redditch are getting the fastest sales.

And you’ll sell your Redditch home the fastest if it’s priced between £200k and £250k.

Test Valley, Hampshire

Test Valley in Hampshire is another place where it takes only 14 days to sell your home.

But the fastest selling homes here are more expensive than other hot markets. Homes between £350k and £400k sell the quickest in this part of Hampshire.

Although this range is more expensive than other areas on the list, it aligns with the average local property price of £365,000 in May 2022.

There’s high demand for family homes and space in Test Valley. That’s shown in three bedroom semi-detached homes selling the fastest.

Gloucester

Like several areas in the South West, Gloucester is seeing very fast sales this year.

In particular, three bedroom semi detached homes are flying off the shelf. In terms of price, those between £250k and £300k are the fastest to sell.

This price range is lower than the average house price in the area, which was £222,400 in May 2022.

If you live in Bristol, Plymouth, Exeter, or Swindon, you’re seeing sales go through almost as quickly. They all make it into the top 20 fastest moving markets.

How has the UK market changed in the last year?

What’s really noticeable this year is the fast pace of urban markets in the South West. They feature much more prominently than last year.

If you live in or around Bristol, Plymouth, Exeter, Gloucester or Swindon, you’re likely to sell within 14 to 17 days.

Two and three bedroom terraced homes are selling the fastest in South West cities.

The only exception is Bristol, where you’ll sell fastest if you have a three bedroom semi-detached house.

It's a similar picture in the West Midlands, too. Redditch, Rugby, Stoke-on-Trent, Nuneaton and Bedworth, Worcester and Stafford are all in the top 20 hottest markets.

There’s still a fast pace within city markets, which is a trend we saw last year and previously. Around 12 of the 29 fastest markets featured before the pandemic.

But we’re seeing a shift away from the pandemic-led choices of buyers in 2021. Back then, lots of us were looking for coastal areas and commuter towns. But they no longer feature as much in the fastest markets.

Which areas have seen the most improvement in the time it takes to sell?

House sales in West Oxfordshire have sped up the most in the last year.

It now takes 24 days for an offer to be accepted, compared to 37 in June 2021.

Lancaster and Ealing are in joint second place. If you live in these places, it’ll now take you 21 or 31 days respectively to sell. That’s 12 days faster than this time last year.

As interest in the London property market picks up again, London and the South East have also seen big improvements in the time it takes to sell.

Kensington and Chelsea, Richmond Upon Thames and Wandsworth are all in the top 10 most improved.

Cherwell and Windsor and Maidenhead also make the list. Homes in these areas are selling 9 to 11 days faster than last year.

Carlisle and the Vale of Glamorgan make the top 10 too, having seen a dramatic change in time to sell. They’re now at 18 and 19 days respectively, both a drop of 9 days since last year.

What are the fastest moving housing markets in London?

Bexley is the fastest-moving housing market in the capital.

It takes homes in Bexley just 16 days to sell, with two bedroom terraced properties selling like hot cakes.

The fastest selling properties in Bexley are priced between £400k and £450k.

Waltham Forest is the second hottest housing market in London, with homes selling in 17 days.

It’s four bedroom terraced homes and those priced between £550k and £600k that are being snapped up the fastest.

These areas are outperforming the rest of London. On average, it takes 35 days to sell your home in the capital. That makes it one of the slowest regions in the country.

Is now the time to sell?

If the average sell time is low in your area, it’s a sign of strong demand.

It usually means there’s more buyers looking for a new home than there are sellers. And that there aren’t enough suitable homes on the market for them all.

That can lead to buyers competing for the house they want. When this happens, it’s quicker for the seller to get an offer they like the look of.

Key takeaways

- It takes just 14 days to sell your home in the UK's fastest markets: Dartford, Redditch, Test Valley and Gloucester

- Urban housing markets in the South West and West Midlands have picked up pace, with homes selling in 14 to 17 days

- There are areas all over the country where you can expect to sell your home in less than 3 weeks