The housing market remains resilient but price growth begins to lose momentum as demand for homes starts to slow.

UK house prices increased by 8.3% or £19,800 in the past 12 months, however demand for new homes is beginning to weaken as mortgage rates rise and the increasing cost of living begins to bite.

Mortgage rates for new buyers are now at 4%, meaning the average first-time buyer will need an extra £12,250 to buy a home today compared to a year ago – and up to £35,000 more in London.

The average time to sell a home is also lengthening, taking 22 days right now, compared to 19 days back in April.

Why the cost of living isn’t hitting the housing market yet

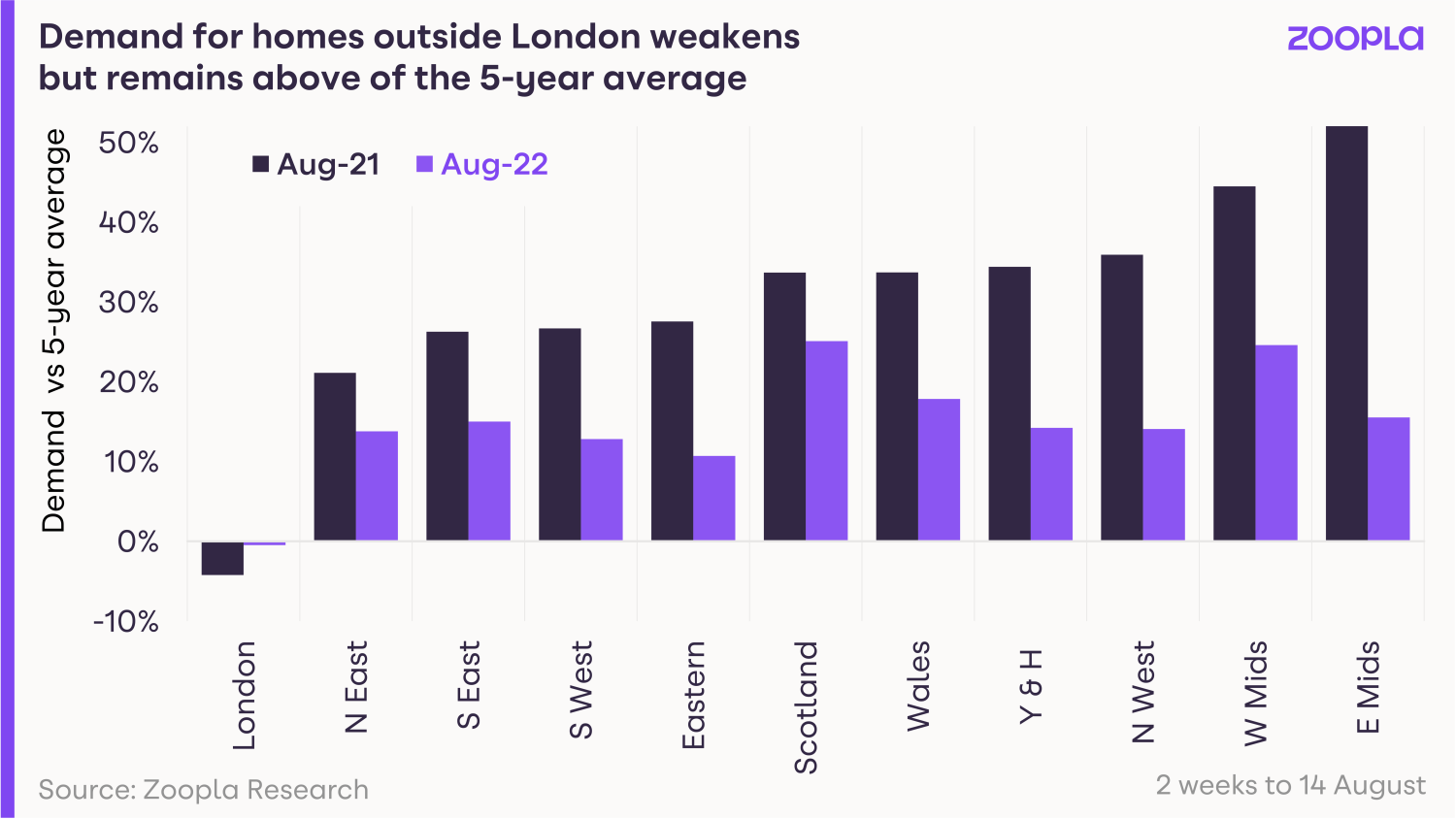

Buyer demand has started to fall but remains well above the five year average, tracking at +17%.

However, that demand has come down from a peak of +54% in May earlier this year and is likely to continue to weaken throughout the rest of 2022.

Demand is now below levels seen this time last year, when the stamp duty holiday was still in place and the nation was on the move in the hunt for more space.

The summer slowdown and increased economic uncertainty are beginning to make an impact.

However, there are a number of reasons why the housing market is remaining resilient, despite concerns over interest rate rises and cost of living increases causing a drop in consumer confidence.

Higher income households and first-time buyers driving the housing market

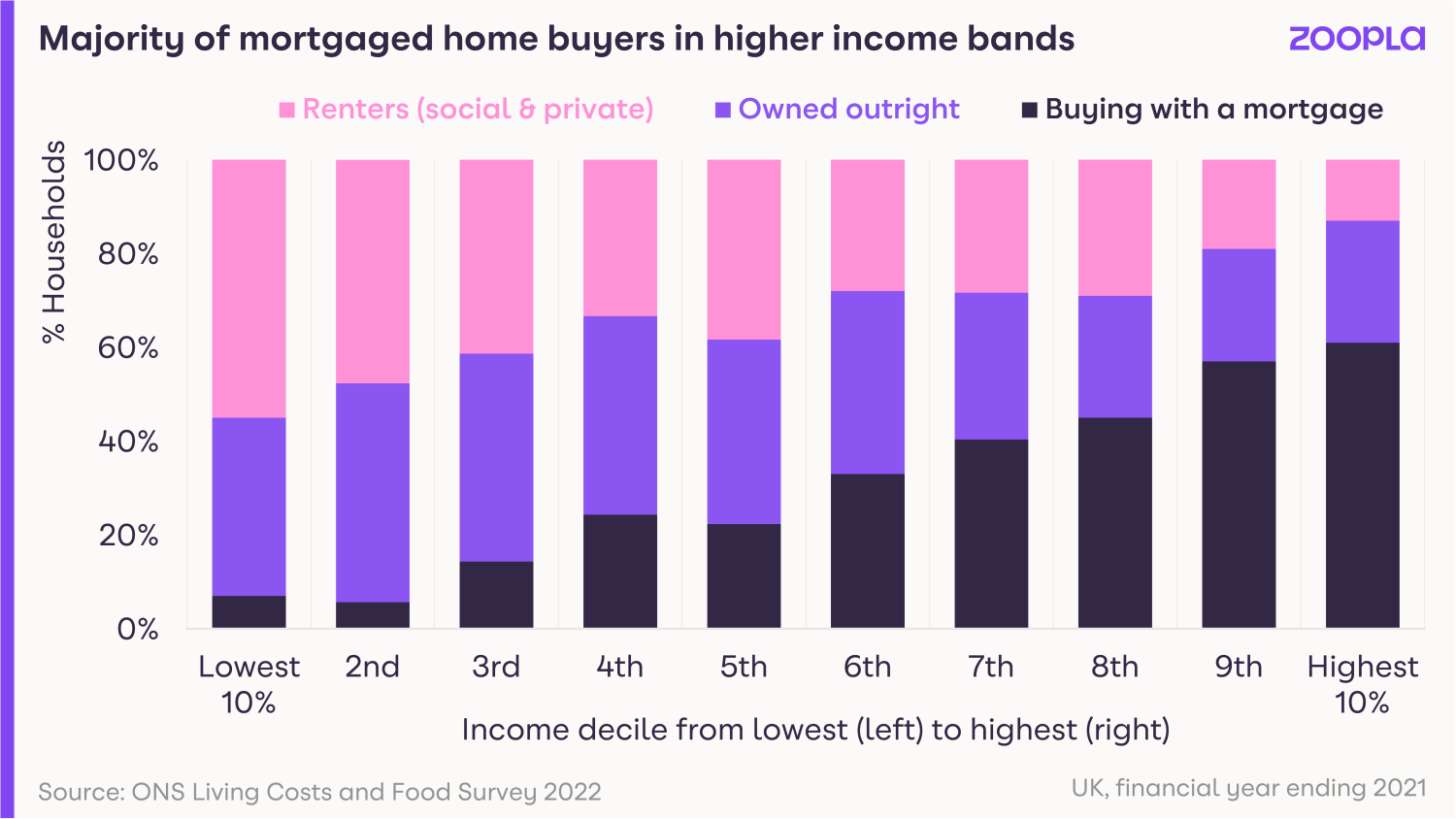

Homebuyers tend to earn higher incomes and may not yet be feeling the pinch of higher living costs.

In fact, the large majority of those buying with a mortgage, accounting for 7 in 10 of all new sales, sit within the UK’s middle to upper income bands.

The latest spending survey data from the Office for National Statistics shows all households have been adjusting their spending patterns, cutting back on discretionary areas of spend, but those on higher incomes have more room for manoeuvre.

The rising cost of living is hitting those on lower incomes first and will take longer to impact those higher income households.

First-time buyers are currently the biggest driving force in the housing market right now, accounting for 177,000, or 35%, of all transactions.

That’s over a third of all total sales so far this year.

The effects of the pandemic are also continuing to support market activity.

Buyers, no longer chained to an office desk, are able to secure cheaper homes, or bigger homes, in locations further afield.

First-time buyers the driving force in sales right now

The number of first-time buyers purchasing homes is changing the buying landscape this year.

Motivated by a need to step onto the property ladder fast, and with working from home opening up the location landscape, interest from first-time buyers in July 2022 was up 46% year-on-year.

Rising house prices have done little to dent demand among this buying group, despite the average first-time buyer property rising £33,000 to £269,000 year-on-year.

Accounting for one in every three property transactions, first-time buyers are now able to look further afield in cheaper areas to buy a home, meaning less time spent saving up for a deposit.

Our data shows that many are also looking at bigger and more expensive homes, with three bedroom properties accounting for more than half of all first-time buyer enquiries.

How higher mortgage rates will impact first-time buyers

Higher mortgage rates will inevitably mean larger monthly repayments – and the need for a greater household income to meet the increased costs.

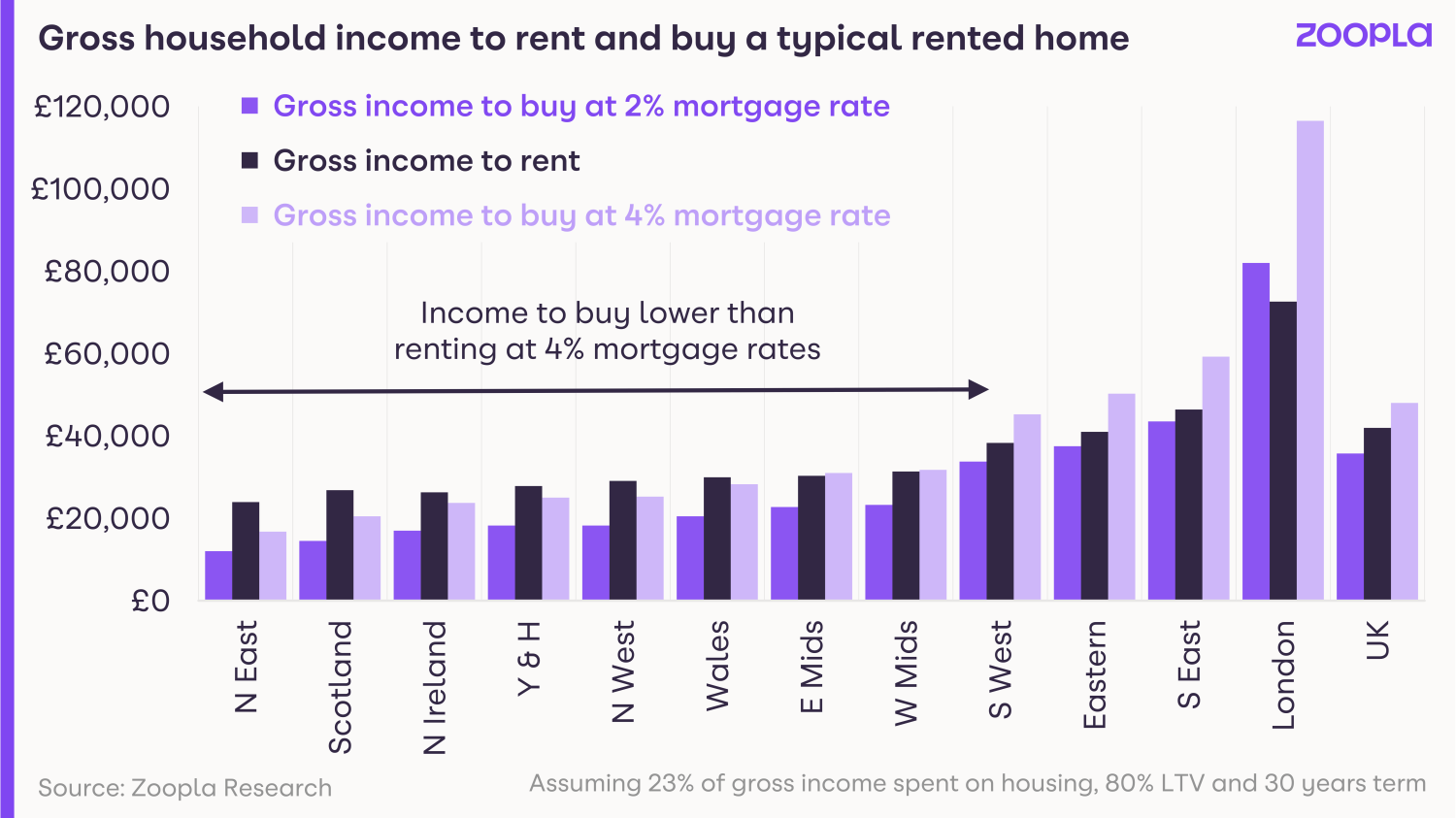

The chart below shows the income to rent and buy a typical rented home at 2% and 4% mortgage rates.

Moving from a 2% mortgage rate to 4% means the average FTB will need an extra £12,250 in income, compared to when rates were lower.

In London, the highest value market, this increases to over £34,500.

That said, the increase is less than £6,000 in markets with lower house prices.

First-time buyers can respond to higher borrowing costs by using a bigger deposit to reduce the size of their mortgage, as well as by looking to purchase cheaper homes or stepping back from the market altogether.

In order to fully offset this increase in mortgage rates, first-time buyers would need to almost double the size of the average deposit.

How higher mortgage rates and the cost of living will impact the housing market as a whole

With energy costs set to jump higher in the autumn, the impact of the rising cost of living is likely to be felt across all income bands, exerting a growing impact on household decisions, including home moves.

The key factor – that’s yet to fully impact market activity – is higher mortgage rates, which have more than doubled in the last few months.

In January 2022, new mortgage rates were still very cheap at less than 2%, whereas they have now jumped to 4%.

While those buying homes with a mortgage may be on higher incomes, this jump in mortgage rates for new buyers will compound cost of living increases and is likely to have an impact on sales market activity this autumn and into 2023.

And while this level of mortgage rate is still low by historic standards, homebuyers have become used to very low mortgage rates, meaning any reversal is likely to have some impact on demand, especially when combined with cost of living pressures.

Markets feeling the impact

Our data shows demand for homes is already weakest in higher value areas such as London, a trend that is likely to worsen for those looking to buy their first home as mortgage rates move higher.

Demand for homes in the capital continues to lag behind the rest of the country due to pandemic and affordability factors, with home values rising at a rate of 4.1%, less than half the UK average.

The impact of rising mortgage rates will be felt most acutely here and in high value markets in southern England, where affordability is already a drag on market activity.

The South West and Wales are jointly the best performing regions, with annual house price growth of 10.6%.

Strong demand and healthy volumes of new sales agreed in the first half of the year continue to support the headline rate of growth in these areas.

In terms of cities, Nottingham, where homes remain more affordable, continues to lead the way with house price growth of 10.9%.

It’s hotly followed by Bournemouth (+9.3%), Leeds (+9,2%) and Manchester (+9%).

Where’s the market going in the next six months?

The headwinds for the sales market are building but the market is in a much better place to weather these than during the previous economic cycles.

We expect to see a slower rate of price growth in the second half of the year, with economic pressures hitting more households.

But history shows that it is the sudden changes in levels of spending on housing that are most closely linked to changes in house price inflation and sales volumes.

These downsides for prices and sales are most commonly seen during recessions, when consumers need to rapidly adjust what they spend in response to unemployment or higher mortgage rates.

Currently, a high proportion of mortgagees are on fixed rate loans, meaning the impact of rising rates won’t be felt by the majority.

And mortgage affordability testing, where to get a mortgage you need to prove you can afford a 6.5% to 7% mortgage rate – despite paying 2% – has baked in a certain level of resilience that will limit the downside for prices and volumes in our view.

That said, its clear UK households are facing a squeeze on incomes and living standards on multiple fronts, which will filter through into housing market activity and house price growth into 2023.

The higher rates move above 4%, the greater the impact on the market where homeowners already have plenty of equity in their homes.

However, we don’t anticipate any widespread falls in house prices if mortgage rates peak at 4% as expected.

Key takeaways

- Demand for new homes remains above average right now, but is set to weaken as even more households feel the cost of living squeeze in the autumn months

- First-time buyers are currently the biggest group driving transactions in the property market, accounting for 35% of all transactions

- Stock levels are also increasing, giving buyers the biggest choice of homes since May 2021

- And in good news for renters, the number of landlords purchasing buy-to-let homes is on the rise