Renters look for smaller homes in cost of living squeeze

Demand for two-bed apartments on the up as renters try to combat rising rent and energy costs.

As the cost of living squeeze looms large, rising rents and energy bills are pushing renters to look for smaller homes in a bid to reduce outgoings.

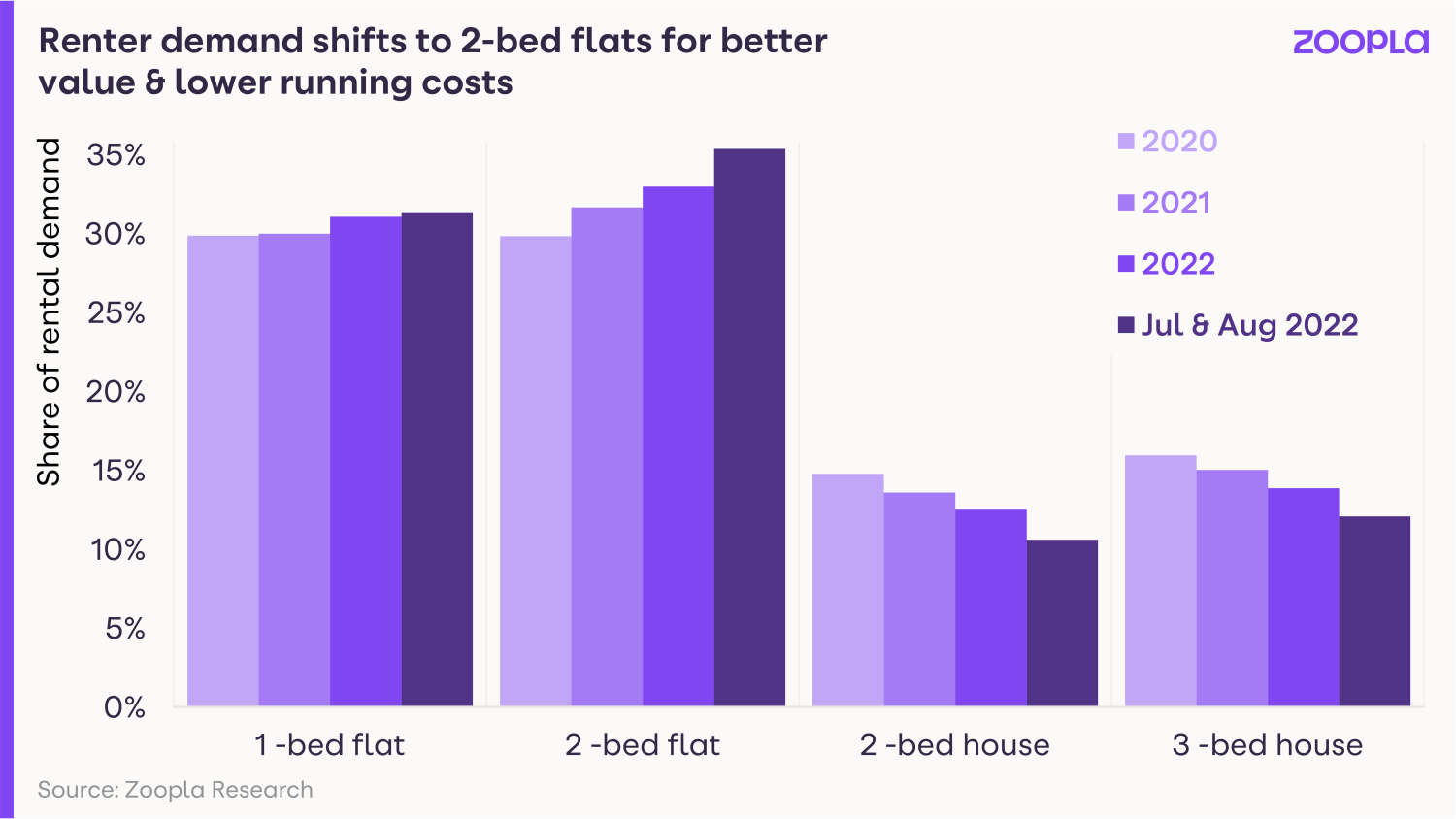

Our latest data on rental demand shows that renters are shifting their focus from three-bed houses to two-bed flats. And that trend is growing.

With the gas needed to warm a purpose-built flat working out around 40% less than that needed to warm a three-bed family terraced home, or 25% less with a flat conversion, the savings are set to be substantial.

A one-bed home requires less than half the gas that’s needed for a three-bed home.

And D and E rated homes need 25% and 48% more gas to run compared to a C rated home.

The decline in the number of renters looking for two- and three-bed houses in the last year has been significant, as the pendulum of demand swings towards one- and two-bed flats.

And our data suggests the appeal of apartments and energy-efficient homes will only grow as we head into 2023.

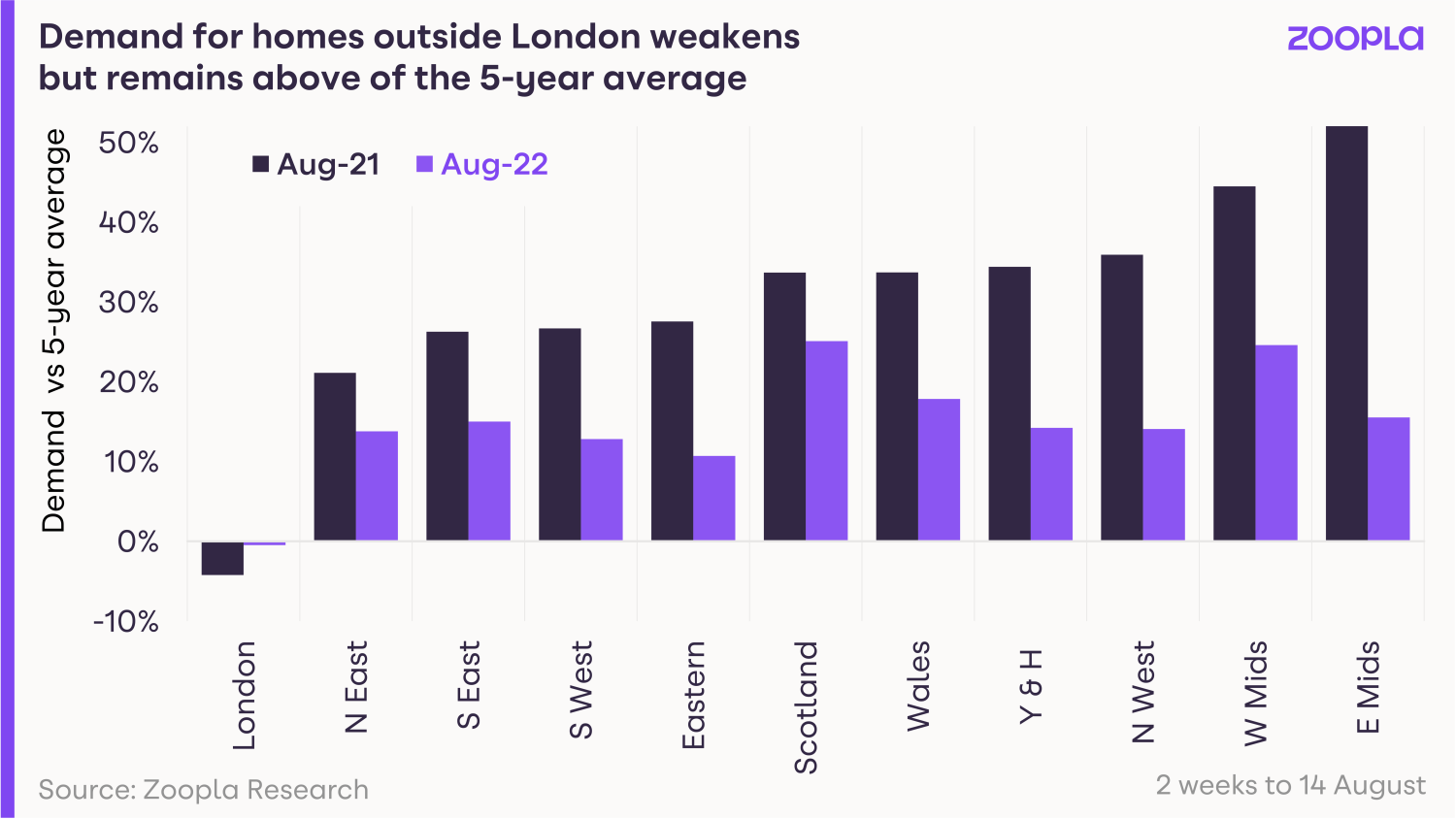

The cost of renting is also having an impact on where renters are choosing to live.

Outside of London, the current difference in rents charged for a two-bed flat and a three-bed house is £105 per month.

This translates into £1260 per year in rent, so big savings can be made by moving into smaller apartments.

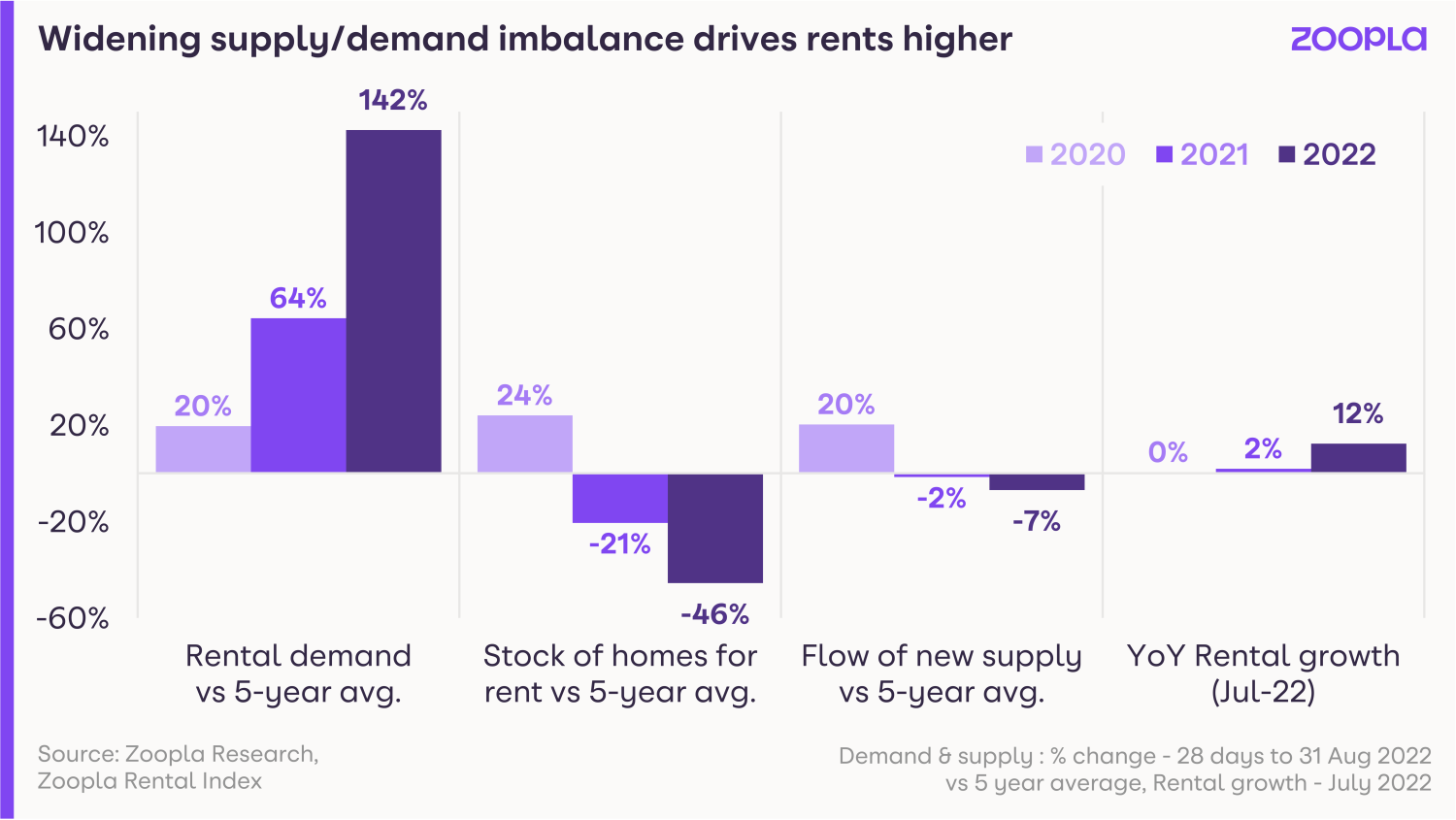

Yet conversely, despite all of these cost of living headwinds, a chronic undersupply of rental properties available on the market means rents will continue to grow at above average rates into 2023.

Massive supply shortage drives up rents

The average rent has gone up by £115 per month since September last year to £1,051 a month.

The rise is outpacing earnings growth across the country and basically boils down to a major shortage of available homes.

Right now, rental home stock levels are sitting at around half the numbers seen on the market in the past five years, so there’s a lot less choice out there for renters.

Many renters are also deciding to stay put with their current landlords to avoid future rent increases.

And from the landlords’ side, increasing taxes and regulations are causing many to sell up as letting a home becomes less affordable.

Hannah Gretton, Lettings Director at LSL’s Your Move and Reeds Rains brands says: “We are experiencing high levels of demand for rental properties with homes being snapped up within hours of hitting the market.

“With over 270 lettings branches nationwide, it's a picture that is reflected up and down the country with particular demand in urban areas.

“On average, we are seeing double figures of enquiries per property with a one-bedroom property in Manchester last week receiving over 100 requests to view, highlighting just how busy our branches are and the challenges renters face when it comes to finding an appropriate property."

Where are rents rising fastest?

The capital has long been the most expensive place to rent a home and rents here have gone up by 18% on average in the last year.

However, rents did fall by 10% in London during lockdown, so these rent rises are coming up from a low base.

When compared directly with pre-pandemic levels, rents are actually up 7.8% in London. But in the rest of the UK, they’ve risen by 13% on average.

Renters make a return to the cities

Strong employment growth in cities - and the growth in high quality, purpose built build-to-rent homes around the UK - is attracting renters into urban areas.

Energy efficient new-build homes are currently proving to be a big pull, and most new developments tend to be around city centres.

In fact, build-to-rent developments, featuring stylish apartments with luxury on-site facilities, are currently driving the growth of rental housing stock in the UK.

More cost-effective to heat, thanks to brand new energy-efficient boilers, double or triple glazing and low energy lighting, the appeal of new-build homes is growing fast.

However, fierce competition for homes is also leading rents to increase by 10.5% in urban areas, compared with 8.5% in the countryside.

How much higher can rents go?

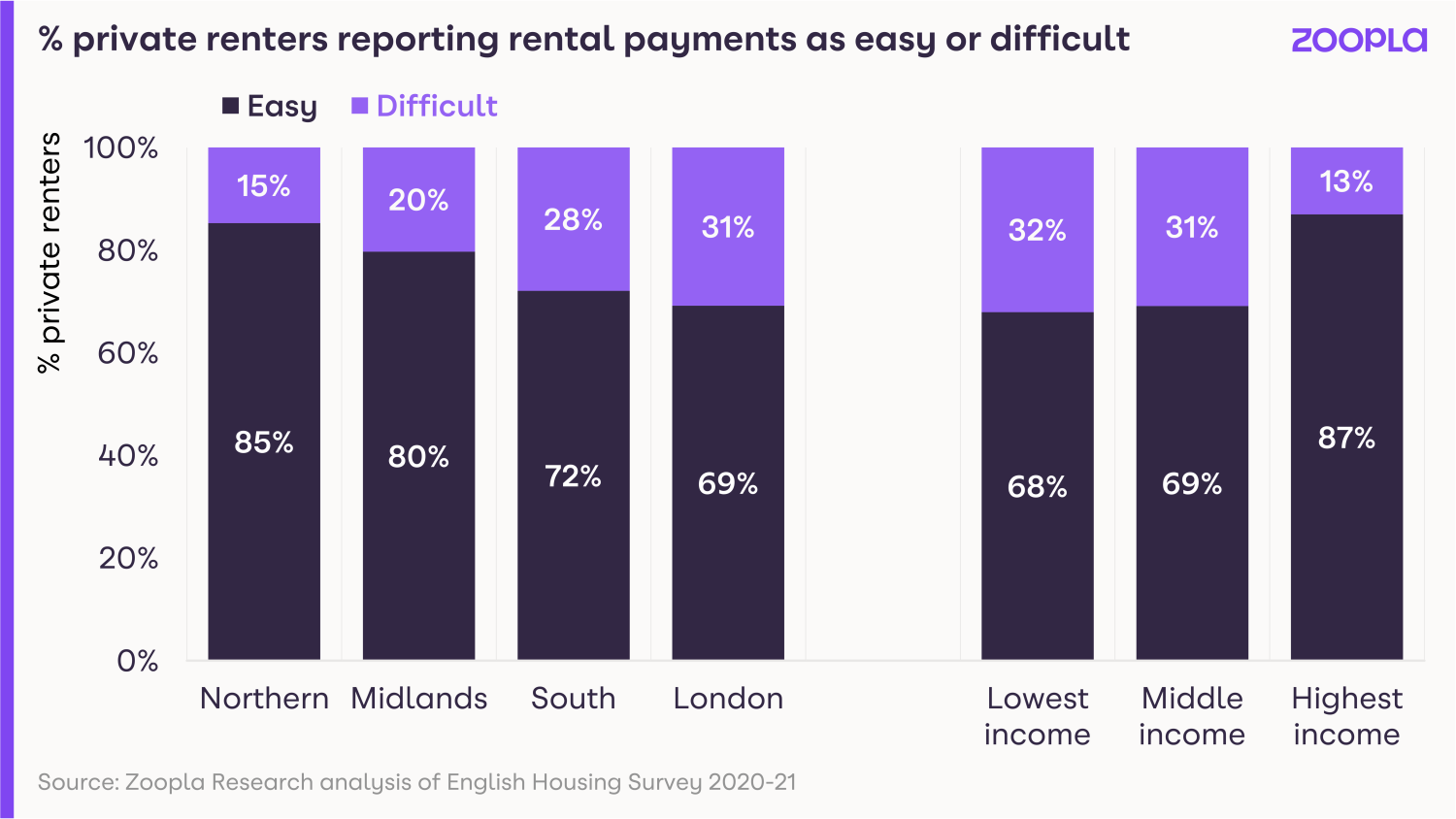

The private rental market caters for a range of households on low and high incomes, with a quarter of tenants receiving housing benefit.

And while rental affordability varies according to location and income, in the latest English Housing Survey from 2020 to 2021, three-quarters of private renters said they found rental payments very or fairly easy to meet.

Conversely 25% found them fairly or very difficult to pay.

In the North and the Midlands, where rents tend to be cheaper, more tenants found their rent easy to pay. However in the south, more tenants reported that their rent was difficult to pay.

The question of how much higher rents can go will depend on how much headroom renters have to pay more rent.

And while the pace of rent increases is beginning to plateau, our data on rental affordability suggests there is still further headroom for above-average growth in the less expensive areas of the UK.

Apartment rents rising faster at the top end of the market

Asking rents for two-bed flats are rising faster in the top 25% of the market, with growth lagging across the bottom 25% of the market (where demand is more price sensitive).

For three-bed houses, there is less of a difference, but in many regions, the asking rents in the more affordable segments are rising faster.

However, as rented family homes become less attainable, demand for two-bedroom apartments is climbing as renters seek homes that are better value for money.

Rents for non-movers rising at a much slower pace

The average renter moves every four years, so our data reflects rent prices on new lets for around 25% of the market.

However, the Office for National Statistics’ rental index shows rental increases across the board, for movers and non-movers.

It shows current rents across all rented homes are 3.7% higher than they were in July 2021.

However, those moving to a new rented property will find the cost of renting 12.3% higher - as rents for new lets are reflecting the current lack of supply amid high demand across the country.

What’s going to happen to rents in the rest of 2022 and into 2023?

There is no real prospect of a significantly improved rental supply in the near term, as private landlords continue to sell off homes and renters stay put for longer.

The imbalance in supply and demand is here to stay, and rents will continue to rise at above-average levels into 2023 across the more affordable markets.

There is headroom for some renters to pay more - especially outside London and the South East - where rents are already high.

We expect the headline rental growth to slow over the rest of 2022 and into 2023 - but it won’t happen quickly.

Executive Director says: “Rents have surged ahead over the last year but there are signs that the pace of growth is peaking and set to slow into 2023.

“Renters are responding and looking for smaller, better value for money homes to rent with an eye on energy costs as much as rental levels.

“What the rental market needs to combat these challenges is more new homes for rent.

“Greater regulation has discouraged some landlords from investing and more are exiting, meaning the rental market has stopped growing since 2016.

“There is a risk that more regulation to improve standards or potential new measures to dampen rental growth, as proposed in Scotland, may compound the supply problem which is pushing rents up in the first place.

Key takeaways

- Renters are choosing two-bed apartments over three-bed family homes to reduce outgoings as the cost of living rises

- Rents on new lets have gone up £115 per calendar month compared with this time last year, rising faster than wages

- In a market where demand is massively outstripping supply, rents are likely to keep going up into 2023

Energy price freeze announced

The average household will see their energy bills frozen at £2,500 a year until October 2024.

Energy prices for households will be frozen until October 2024, the government announced today.

The move, under which the combined gas and electricity bill for the typical household will be held at £2,500 a year, will protect people from further spiralling energy costs.

The average household is currently paying £1,971 in energy bills, but that figure was set to soar to £3,459 from October 1, while analysts had warned it could rise to more than £5,000 from January.

Today’s announcement will save the typical household just under £1,000 a year, but energy bills will still be double the level they were at the beginning of 2022.

Those who heat their home using oil, as well as people living in Park Homes or on heat networks, will receive equivalent support.

The energy price freeze was welcomed by consumer groups, but some warned that many people were already facing fuel poverty when average annual bills were at a lower rate of £1,971.

What are the details?

Under the terms of the energy price freeze, the maximum amount power companies can charge customers per unit of energy used will be capped until October 2024.

As companies are currently paying significantly more than this level for power on the wholesale markets, the difference in price will be covered by the government.

While the average household will see their bill frozen at £2,500, the actual level of bills will vary from household to household depending on how much power they use, with some paying more than this amount and some paying less.

Consumers do not have to do anything to benefit from the price freeze, as it will be automatically passed on by their supplier.

It is estimated that the scheme will cost the government around £150 billion over the two years.

How will the price freeze impact the housing market?

Soaring energy prices as a result of the conflict in Ukraine have been a major factor in pushing inflation higher.

Inflation as measured by the Consumer Prices Index – which tracks the rate at which the cost of goods and services frequently bought by consumers are increasing – hit a new 40-year high of 10.1% in July.

The Bank of England has been aggressively hiking interest rates since the end of last year in a bid to bring down inflation, which it is supposed to keep at around 2%.

Before today, there had been warnings that inflation was set to rise to 13% by October, with some economists predicting it could hit 18% or even 22% next year if the government did not take steps to tackle the energy crisis.

Today’s news means inflation is likely to peak sooner than previously expected at around 11.5% in November.

It is also good news for the housing market.

Our latest House Price Index showed that demand was beginning to cool in the face of rising mortgage rates, the cost-of-living crisis and general economic uncertainty.

The energy price freeze will provide some relief to those worried about facing a sharp rise in their bills from October, helping to support demand.

But it is unlikely to be enough to reverse the current slowdown.

What should I do if I am struggling to pay my bills?

If you are already struggling to pay your energy bills or are worried you might run into difficulties, make sure you are claiming any support that is available to you.

A number of the major energy companies offer grants to help people falling behind with their fuel bills, including British Gas, which offers up to £1,500 for individuals and families who are in energy debt regardless of who their supplier is.

In March this year, the government announced that every household would have £400 cut from their energy bills, with low-income households, pensioners and people with disabilities receiving up to £800 off.

In addition, pensioners will receive an additional £300 Cost of Living Payment, while people with disabilities will receive £150.

Support is also available through the Household Support Fund and the Warm Home Discount Scheme.

If you do fall behind, it is important to contact your supplier as soon as possible. Ofgem has rules that they must help you if you can’t afford your energy bill, and they should work with you to create an affordable payment plan.

There are also a number of steps you can take to reduce your gas and electricity consumption, such as turning your thermostat down, taking shorter showers, draft-proofing your windows and doors, not using a tumble drier and turning off appliances left on standby mode.

Key takeaways

- Energy bills will be frozen at an average of £2,500 a year until October 2024

- The move will save the typical household just under £1,000 a year, but bills will still be double the level they were at the beginning of 2022

- Those who heat their home using oil, as well as people living in Park Homes or on heat networks, will receive equivalent support

As Scotland announces a freeze on rents, will the rest of the UK follow suit?

Renters in both the public and private sectors in Scotland will be protected from eviction as part of measures designed to help with the cost of living crisis.

Rents in Scotland are set to be frozen until March 2023 as part of a package of measures to help people cope with the cost of living crisis.

The emergency legislation will apply to renters in both the public and private sectors, the Scottish Government has announced.

It is also introducing a moratorium on evictions, meaning landlords will not be able to force renters to leave their homes, even if they fall behind with their rent.

The rent freeze will be accompanied by a new tenants’ rights campaign, as well as a one-stop website that will give people information on the benefits and support that is available if they are struggling to keep up with their bills.

Campaigners are calling for a similar rent freeze and eviction ban to be introduced for renters in other parts of the UK.

Generation Rent said: “Every renter deserves certainty that they won’t be hit with further costs.”

However, there are fears that introducing a cap on private rents could force more landlords out of the rental sector, worsening the situation for renters in a market where the supply of rental homes is already strained.

UK government proposes rent cap for social housing

The UK government recently launched a consultation on introducing a cap on rent increases for people living in social housing.

However, the proposals don't include the private sector.

It is proposing limiting any rent increases on council and housing association homes to 3%, 5% or 7% from 1 April 2023 to 31 March 2024.

It estimates the move would save social housing renters around £300 a year each.

The government regulates how much social housing rents can increase by each year.

But rises are set at the rate of inflation as measured by the Consumer Prices Index plus 1%, meaning social housing renters could face increases of 11% next year without intervention.

Government plans for the private rental sector

A separate consultation has also been launched on setting a minimum standard for homes in the private rented sector for the first time.

The Decent Homes Standard would require homes in the private rented sector to be kept in a good state of repair with efficient heating and suitable facilities, while being free from serious hazards, such as major damp or fire risks.

Executive Director of Research, Richard Donnell, says: "The UK has seen a greater focus on the taxation of landlords and regulations to improve standards of housing rather than controlling rents.

"UK landlords have some of the toughest tax treatments and the Rental Reform Bill in England will improve standards of homes but also increase costs further.

"Against this regulatory backdrop, talk of possible rent controls will simply push more to exit the sector worsening the supply problem pushing rents up in the first place.

"It is important policy makers focus on the supply side problems in the rented sector in addition to the level of rents as the two are inextricably linked.

"We need to ensure policies and regulations encourage as many decent landlords as possible to remain in the market, otherwise the market will not grow and will start to decline in size, pushing rents up further."

Why is this happening?

Inflation, which measures the rate at which the cost of things increases, is currently running at a 40-year high of 10.1%.

One of the biggest increases people face is soaring gas and electricity bills.

The average household will see their combined energy bill rise from £1,277 at the beginning of the year to £3,549 from October after the energy price cap was increased, with some forecasts suggesting it could hit £5,300 in January.

Announcing the measures, First Minister Nicola Sturgeon said the magnitude of action needed to help people cope with the rising cost of living was on a scale similar to the initial response to the Covid-19 pandemic.

Who does it affect?

The rent freeze and eviction ban apply to renters in both the public and private sector until at least 31 March 2023.

The emergency legislation will take effect immediately.

But it will only help people who rent a home in Scotland. Renters in England, Wales and Northern Ireland will need to wait to see if similar legislation is introduced.

Key takeaways

- Rents in Scotland are set to be frozen until at least March 2023 as part of a package of measures to help people cope with the cost of living crisis

- The freeze will apply to renters in both the public and private sector with immediate effect

- Campaigners are calling for the rest of the UK to follow suit

What can I do if I’m struggling to pay my mortgage?

With the cost of living rising, some homeowners may find themselves struggling to meet their monthly mortgage repayments. Here’s what to do if it's happening to you.

If you’re finding you can no longer afford your mortgage repayments, there are options out there that could help you through a difficult time.

Here’s what to do if you think this might be about to happen to you.

What should I do if I think I might miss a mortgage payment?

Contact your lender as soon as possible.

Lenders will always try to work with customers who are experiencing financial difficulties.

But you’re likely to have more options if you contact your lender before you’ve missed a payment.

As soon as you think you might have a problem, get in touch with your bank or building society straight away.

How should I contact my lender?

Check your lender’s website to see how they want you to get in touch if you are experiencing financial difficulties.

Some lenders have a special helpline for people in this situation.

Most lenders will offer a variety of ways in which you can contact them in this scenario, include call hotlines, email, online chats and mobile apps.

Don’t leave contacting your lender until the last minute, as they may be experiencing a high volume of calls.

If you find yourself facing long waiting times on hotlines, try contacting your lender by email or through their website instead.

Will I lose my home?

Losing your home is most people’s worst nightmare. So, it’s good to know that repossessing a property is usually a last resort for lenders.

Instead, they will work with you to try to find a way to make your mortgage repayments affordable.

Charles Roe, Director of Mortgages at UK Finance, says:

“Lenders stand ready to help customers who may be struggling with their payments.

“It is important that anyone experiencing financial difficulty gets in touch with their lender as soon as possible to discuss the best options for them.”

What do I need when I contact my lender?

The most important things you'll need are your mortgage details and account number, so your lender can look you up on their system.

It’s also a good idea to do a budget before you make the call, so you know exactly how much you have coming in and going out each month.

And look for any areas in which you can cut back on your expenses.

Having a clear idea of what you can afford will help you as you discuss a way forward with your lender.

Can I take a mortgage payment holiday?

During the early stages of the Covid-19 pandemic, lenders introduced a mortgage payment holiday scheme.

Under the scheme borrowers could defer their mortgage payments for up to six months.

Unfortunately, the scheme has now ended, and no new official scheme has replaced it.

But lenders are still granting mortgage payment holidays to borrowers on an individual basis.

These payment holidays are typically two to three months long.

Interest that's not paid during this period is added to the outstanding mortgage debt.

What are my options if I can’t pay my mortgage?

There are four main options if you're struggling to pay your mortgage.

The best option for you will depend on your individual circumstances.

1: Extend the length of your mortgage term

The mortgage term is the total period over which you repay your mortgage.

Spreading the debt out over a longer period of time will reduce your monthly payments.

If you’re struggling to afford your mortgage due to higher bills, increasing your mortgage term could be a good option.

Increasing the period over which you repay a £200,000 mortgage from 20 to 30 years would reduce your monthly repayments from £1,019 to £744.

This calculation is based on an interest rate of 2% and a repayment period of 25 years.

The advantage of this option is that you continue to repay your mortgage.

The downside is that by increasing the term, you’ll pay more in interest over the total period of your mortgage.

2: Change to an interest-only mortgage

Changing from a repayment mortgage to an interest-only one dramatically lowers your monthly payments.

Since you’ll only be paying the interest on your loan each month, rather than paying down the actual debt, it's a much cheaper option in the short term.

If you’re going through a temporary fall in income, moving to an interest-only mortgage may be a good option as it will significantly reduce your monthly repayments.

For example, if you have a £200,000 mortgage, switching to an interest-only loan will cut your repayments from £854 to just £333 per month.

This calculation is based on an interest rate of 2% and a repayment period of 25 years.

But your lender is only likely to want to do this for a limited period, as you won't be reducing the overall amount you owe.

You’ll also still need to find a way to repay your mortgage over the longer term.

3: Defer your mortgage repayments

You can defer your mortgage and interest payments for a short period of time, typically two to three months.

After this period, the payments you missed will be added to your monthly repayments until you've made them up.

This is often done over the course of one to two years.

4: Request a payment holiday

During a payment holiday, the interest you don’t pay during the holiday will be added to the overall amount that you owe.

A mortgage payment holiday may be a good option if you have seen a sharp drop in your income or been made redundant.

The holiday will give you breathing space of two to three months in which to get back on your feet.

But lenders are unlikely to offer you a holiday for longer than this.

They will also want to be confident that you'll be able to resume repayments once the holiday ends.

The payments you have missed will still need to be made up at a later stage.

If I take out any of these options, will I have to pay any fees or penalties?

No, lenders understand that if you are facing financial difficulties, the last thing you need is extra fees or penalties.

As a result, you won’t face any charges to change to a plan agreed with your lender.

But you may face penalties if you miss a mortgage payment without contacting your lender.

So be sure to keep them up to date with your circumstances.

Are these options open to everyone?

Lenders want to work with you to help you avoid losing your home.

They will try to find an option that works for you even if you've lost your job, or have a poor credit history.

That said, they'll want to feel confident that you can keep up with your repayments over the longer term.

They won't want you to get so far behind with your payments that you can't catch up with them.

Will it impact my credit score?

Unfortunately, taking out a mortgage payment holiday may impact your credit score.

This is nothing to do with mortgage lenders. Instead, credit reference agencies will spot that you have not made a monthly repayment that you were scheduled to make.

This may make it harder to borrow money over the short term. But there are steps you can take to improve your credit score once you get your finances back on track.

Key takeaways

- First things first, if you’re finding it hard to pay your mortgage, contact your lender. Don’t be afraid, lenders will work with you to find a solution

- Options may include a mortgage holiday, changing to an interest-only loan, or increasing your mortgage term

- If you think you might miss a payment, contact your lender as soon as possible before it happens, as they'll be in a better position to help

First-time buyers have just two months left to use the Help to Buy equity loan scheme

The government’s flagship initiative to help people get on to the property ladder will close to new applications on 31 October.

First-time buyers have just two months left to use the Help to Buy equity loan scheme before it closes to new applicants.

The flagship initiative to help people get on to the property ladder will stop accepting new applications at 6pm on 31 October, before closing completely on 31 March 2023.

The scheme enables people to purchase a new build property with just a 5% deposit. The government then tops this up with a 20% equity loan, rising to 40% in London, that is interest free for the first five years.

Since it was first launched in 2013, more than 350,000 people have used the Help to Buy equity loan to purchase a home.

What does the deadline mean?

Because the Help to Buy equity loan only applies to new build properties, the scheme effectively has two deadlines.

This is because new build properties are typically sold off plan and then have to be built.

As a result, the first deadline of 6pm on 31 October is the date by which you must apply to the Help to Buy equity loan scheme, having agreed to purchase a home off plan.

In practice, this means submitting your Property Information Form to your Help to Buy agent by this date.

The second deadline of 6pm on 31 March 2023 is the date by which you must have legally completed on your home, meaning you must have the keys and be able to move in.

If you don’t complete by this date, you will not be eligible for the equity loan.

There is also a third deadline you need to know about.

The builder must have finished building your home so that it is ready to live in by 31 December 2022. This is known as the practical completion.

If you plan to use the scheme, it is important to check with your housebuilder and solicitor that you will be able to meet all of these deadlines.

Why is this happening?

Help to Buy equity loan was only ever intended to be temporary scheme.

When the government announced plans for the second phase of the initiative, which included limiting it to first-time buyers and introducing regional price caps, it made it clear it would run from 1 April 2021 to 31 March 2023.

There are currently no plans to extend or replace it.

What other help is available?

The good news is that while Help to Buy equity loan may be ending, there are still a number of government schemes available to help both first-time buyers and those trading up the housing ladder.

- Both first-time buyers and home-movers who have only a 5% deposit can use the mortgage guarantee scheme to borrow 95% of their home’s value.

- Meanwhile, First Homes, helps first-time buyers, key workers and local people to purchase a home at a 30% discount to its market price.

- And Shared Ownership enables people to buy a share in a property and pay rent on the rest.

- First-time buyers saving for a deposit can also use the Lifetime ISA, under which you can save £4,000 a year. The government then adds a 25% bonus - up to a maximum of £1,000 annually - for free. The money must be used to either purchase a first home or for retirement.

Key takeaways

- The Help to Buy equity loan scheme will stop accepting new applications at 6pm on 31 October, before closing completely on 31 March 2023

- The initiative enables first-time buyers to purchase a new build property with just a 5% deposit

- There are still a number of government schemes available to help both first-time buyers and those trading up the housing ladder

Cost of living: How rising energy bills are impacting the mortgage market

Will higher gas and electricity bills make it harder to get a mortgage? We take a look at what impact the rising cost of living is having on mortgage availability.

Energy bills have more than doubled this year as the conflict in Ukraine continues to drive gas and electricity prices higher.

The energy price cap has increased from £1,277 a year at the start of 2022 to £3,549 now. And further price increases are predicted for January 2023.

The rising cost of heating and lighting a home is having a knock-on effect on the mortgage market.

Here’s what you need to know and how you can make yourself more attractive to mortgage lenders.

Why are rising energy bills impacting the mortgage market?

Unfortunately, lenders can’t ignore the impact higher energy bills will have on people’s finances.

Before offering you a mortgage, they need to make sure you can afford the monthly repayments.

Richard Donnell, Director of Research and Insight at Zoopla, explains: “Over the last five-plus years, lenders have focused much more on checking the affordability of mortgage repayments as part of a households’ overall spend.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, adds that most lenders use data from the Office for National Statistics as part of their affordability assessments. This data reflects the recent rise in energy costs.

“As lenders have plugged this new data into their calculations, borrowing potential has been negatively impacted and lower lending limits are being offered,” he says.

Will it be harder to get a mortgage?

Some people are likely to find it harder to get a mortgage due to the rising cost of living.

If a lender feels your budget is too tight to cope with further hikes to energy costs, as well as other price rises, they might offer you a smaller amount to borrow.

But it's not all bad news.

Richard points out that mortgage stress testing has been higher over the last few years.

Most people who have bought a home or remortgaged recently will have needed to show that they would have been able to afford repayments at a much higher mortgage rate of 6% or 7%.

This requirement has since been removed, but it means if you're remortgaging you should have enough flexibility in your budget to meet the cost of higher energy prices.

Who will be impacted most?

First-time buyers and borrowers with low incomes are most likely to be impacted by lenders tightening their affordability criteria.

“Rising energy bills will affect different income groups to a greater or lesser degree. Low income households with less disposable income will be more impacted by energy caps rising,” Mark Harris says.

By contrast, people with high incomes looking to borrow a high multiple of their salary are less likely to be affected, according to Jonathan Harris, of Forensic Property Finance.

“By making the tweaks to their systems, lenders can still confidently lend high loan-to-incomes to people who can afford to cover all the costs comfortably,” he says.

He adds: “The changes are most likely to affect those who are really pushing themselves to borrow as much as possible. This is most likely to be first-time buyers, as it all comes down to the deposit and how much you can raise.”

Will banks be more reluctant to lend?

The good news is that lenders are still very much open for business, even if they are tightening their affordability criteria.

Jonathan Harris says: “Lenders will not become reluctant to lend. They have the systems in place to lend in a responsible fashion due to the constant tweaks they are making to affordability criteria.”

So while banks may be more cautious about the amount they will advance to an individual, it's not expected to be as widespread as it was at the start of the Covid-19 pandemic.

What will happen to mortgage rates?

Mortgage rates are already rising across the board as a result of increases to the Bank of England base rate.

The official cost of borrowing has jumped by 1.65% since December last year, and most of this increase has been passed on to new mortgage customers.

On top of this, Donnell also expects mortgages for people with small deposits to become more expensive. It'll reflect the greater risk these borrowers pose in the face of the rising cost of living.

“When the economic outlook is uncertain and there is greater risk, lenders tend to reduce the availability of loans at higher loan-to-value ratios. They also sometimes increase the cost of mortgages at these levels to cover the risk, which can reduce demand,” he says.

What can I do to help me qualify for a mortgage?

Mark Harris points out that while you can’t directly influence inflation, you can make yourself more attractive to lenders.

Cut back on unnecessary spending and reduce or pay off financial commitments such as loans and store cards.

Jonathan Harris agrees: “Get rid of any committed monthly expenditure such as a Netflix subscription or gym membership, particularly if you rarely use them. Pay off credit cards and loans if you can and conduct your accounts cautiously. Make sure you pay bills and things like parking fines on time.”

Will higher energy bills impact the housing market?

Rising energy costs may encourage some people to move to find a more suitable home that is lower cost to run, according to Donnell.

Buyers are also likely to pay closer attention to the running costs of a property than they have done in the past.

In fact, a recent survey found that the better energy rating and lower running costs of new homes is an increasingly attractive proposition for new buyers.

New-build buyers driving the green home movement – and saving up to 52% on energy costs

But rising energy costs are not expected to trigger anything as dramatic as a house price crash.

This is in part because borrowers who took out mortgages in the past few years will have faced strict affordability tests to ensure they could still afford their repayments even if costs rose.

Will there be a housing crash? Here's what the data says

At the same time, the majority of homeowners with a mortgage are on a fixed rate deal, meaning they will be insulated from interest rises until they need to remortgage.

Instead, house price growth is expected to slow gradually during the rest of the year as buyer demand eases.

Key takeaways

- Lenders will factor higher energy bills into their affordability calculations, which might reduce the amount you can borrow for a mortgage

- You might find it harder to get a mortgage if lenders feel you do not have enough room in your budget to cope with further price hikes

- Try to cut back on unnecessary spending and reduce any outstanding debts to make yourself more attractive to lenders

How can first time buyers handle rising interest rates?

First time buyers are the largest buyer group in the country but they’re about to be hit with higher interest rates. Here’s what’s happening and how you can offset the rising rates.

Interest from first time buyers is up a huge 46% year on year as they drive the market from the bottom up.

They’ve now become the largest buyer group in the country with nearly 177,000 transactions so far this year. That’s one in three sales made to first time buyers.

And they’re going bigger and better, with more than half of their enquiries for three bedroom homes and an average price 10% higher than this time last year (£269,000).

Pandemic changes and new working from norms are continuing to power the first time buyer market.

They’re now able to look further afield in cheaper areas to buy a home, meaning less time spent saving up for a deposit.

Our data shows that 25% of first time buyers outside of London are now searching 10km or more from their home address. That’s compared to just 20% in the summer of 2019.

This search radius has increased even more for first time buyers in London. 30% of first time buyers are enquiring for properties 20km away, up from 21% in summer 2019.

First time buyers will soon need an extra £12,250 on their income to get a mortgage

Despite the current economic situation doing little to deter first time buyers, rising interest rates are likely to impact their levels of activity.

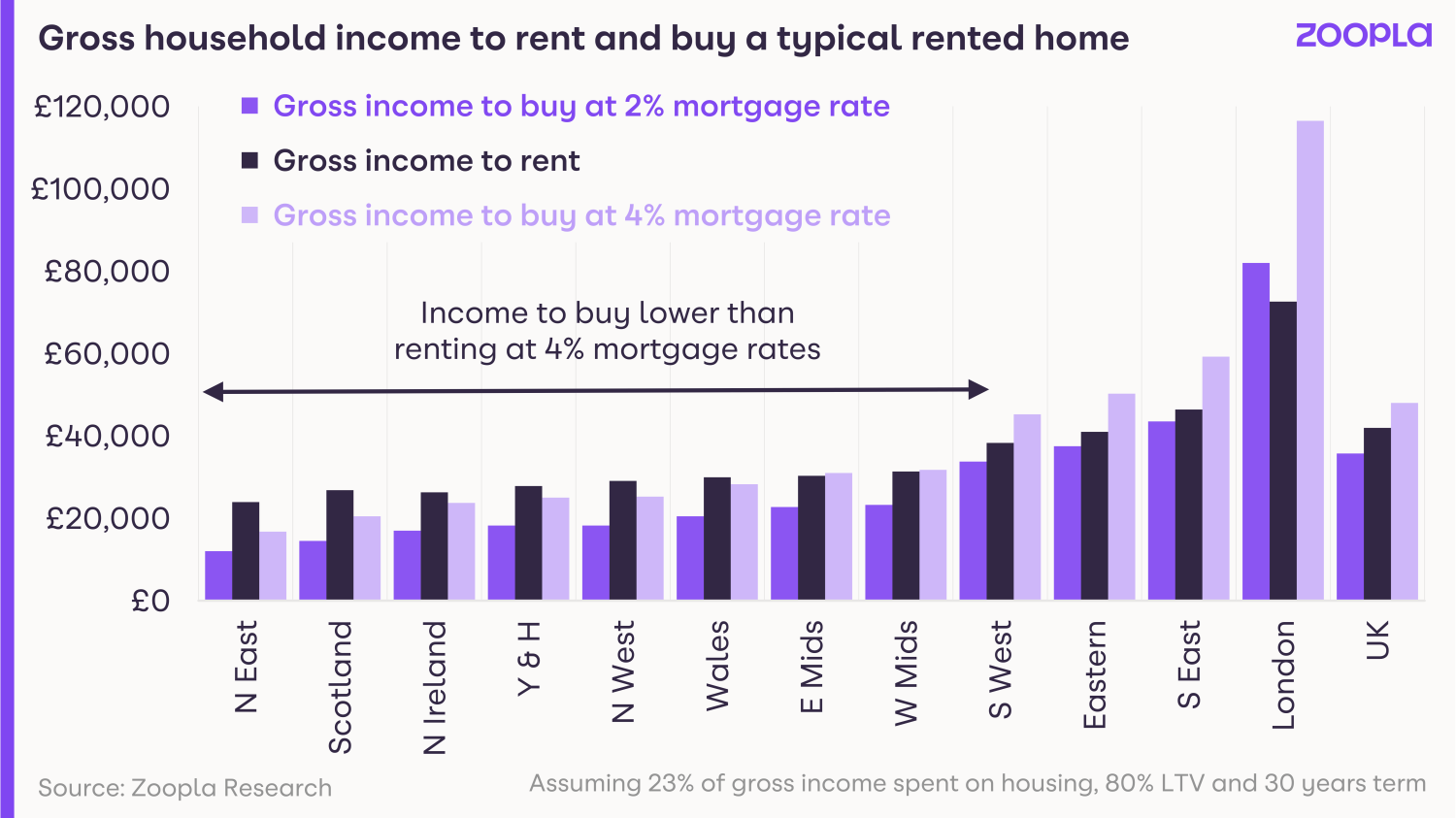

Moving from a 2% mortgage rate to 4% will see the average first time buyer require an extra £12,250 in income.

That means earning £48,000 compared to the previous £37,500.

In London, you’ll need an extra £34,500 on your income.

This impact won’t be felt as much in lower value markets, where first time buyers may only need a few thousand more on their income to secure a mortgage.

It’s still cheaper to buy than rent. Just.

One way to look at the impact of higher mortgage rates on first time buyers is to compare the cost of renting and buying.

We’ve looked at whether a renter can afford to buy the home they live in.

And at the moment, you’re saving an average of £200 by paying a mortgage (with a 2.5% rate) rather than renting.

With a 4% interest rate, it’ll still be slightly cheaper to pay a mortgage than to rent in most places.

But buying will edge into being more expensive than renting in the high value areas of London and the South of England.

What can first time buyers do about rising interest rates?

There’s no one-size-fits-all answer when it comes to how first time buyers can handle higher borrowing costs.

We know how hard it is to get a deposit together and step onto the ladder. And unfortunately, it’s not about to get any easier.

But there are a few things you can do to offset interest rate rises as a first time buyer.

1. Broaden your search area

If you can be flexible on location, look for homes in more regional or rural areas.

In areas outside of major cities, you can find cheaper homes or get more home for your money.

This means smaller monthly repayments, and the amount you pay in interest won’t seem quite as eye-wateringly high.

It’s a tactic that’s already being used by many first time buyers, as we’ve seen them stretch their search area further from their current location.

2. Look into how you can boost your savings

It might seem like it’s all doom and gloom when interest rates go up.

But you could see an increase in the interest rates on your savings account or Cash ISA if you’re on a variable rate.

Shop around to see what interest rates banks and building societies are offering on their savings accounts. It could help you boost your savings and save for a deposit quicker.

3. Use a government buying scheme

The government has launched several first-time buyer schemes to help you get on the property ladder.

The Help to Buy: Equity Loan scheme is a popular choice. You need to put down a 5% deposit, which the government tops up with a 20% equity loan, rising to 40% in London.

However, this scheme is only open until October, and some banks are starting to wind down their Help to Buy mortgage offers.

Meanwhile, the First Homes scheme offers discounts of between 30% and 50% on new build properties to local first-time buyers and key workers.

There are several other schemes that can help you get on the ladder too.

4. Team up with friends or family to get a bigger deposit

Easier said than done, but you can offset rate rises by coming up with a bigger deposit.

This will reduce the size of your mortgage and bring down the amount of interest you owe.

It’s a trend we saw after the first lockdown, when first time buyers started turning up with bigger deposits.

Many are turning to family members or pairing up with partners or friends to get a deposit together.

5. Do your homework on different types of mortgages

It’s vital to understand how different types of mortgages are impacted by base rate changes.

There are still some cheaper deals out there, especially if you have a decent deposit and you can prove your strong financial position.

Keep in mind that there are nine different types of mortgages. They all have their own pros and cons, as well as some restrictions that might mean you’re not eligible.

Although the mortgage with the lowest interest rate might seem tempting, take a close look at what other restrictions will be in place.

This is where it can be worth speaking to a mortgage advisor. Some specialise in first time buyer mortgages, so tap into their knowledge as well as doing your own research.

6. Keep up with your local market

Local housing markets all have their own stories.

You’ll be in the best position to get on the market at a good price if you know what’s happening nearby.

You can uncover pockets of affordability and places where you can get on the market for less.

Speak to local estate agents and see what advice they have for first time buyers. They’ll have a full view of your market and could help you time your step onto the ladder.

Key takeaways

- First time buyers have become the largest buyer group in the UK with nearly 177,000 transactions so far in 2022

- But 4% interest rates mean they’ll need an average of £12,250 more on their income to get a mortgage

- This reaches an additional £34,500 in the higher value London market, but is under £5,000 in more affordable regions

- There’s no one-size-fits-all solution for first time buyers but consider more affordable markets, government schemes and different mortgage options

Economic uncertainty begins to impact demand and house price growth

The housing market remains resilient but price growth begins to lose momentum as demand for homes starts to slow.

UK house prices increased by 8.3% or £19,800 in the past 12 months, however demand for new homes is beginning to weaken as mortgage rates rise and the increasing cost of living begins to bite.

Mortgage rates for new buyers are now at 4%, meaning the average first-time buyer will need an extra £12,250 to buy a home today compared to a year ago - and up to £35,000 more in London.

The average time to sell a home is also lengthening, taking 22 days right now, compared to 19 days back in April.

Why the cost of living isn't hitting the housing market yet

Buyer demand has started to fall but remains well above the five year average, tracking at +17%.

However, that demand has come down from a peak of +54% in May earlier this year and is likely to continue to weaken throughout the rest of 2022.

Demand is now below levels seen this time last year, when the stamp duty holiday was still in place and the nation was on the move in the hunt for more space.

The summer slowdown and increased economic uncertainty are beginning to make an impact.

However, there are a number of reasons why the housing market is remaining resilient, despite concerns over interest rate rises and cost of living increases causing a drop in consumer confidence.

Higher income households and first-time buyers driving the housing market

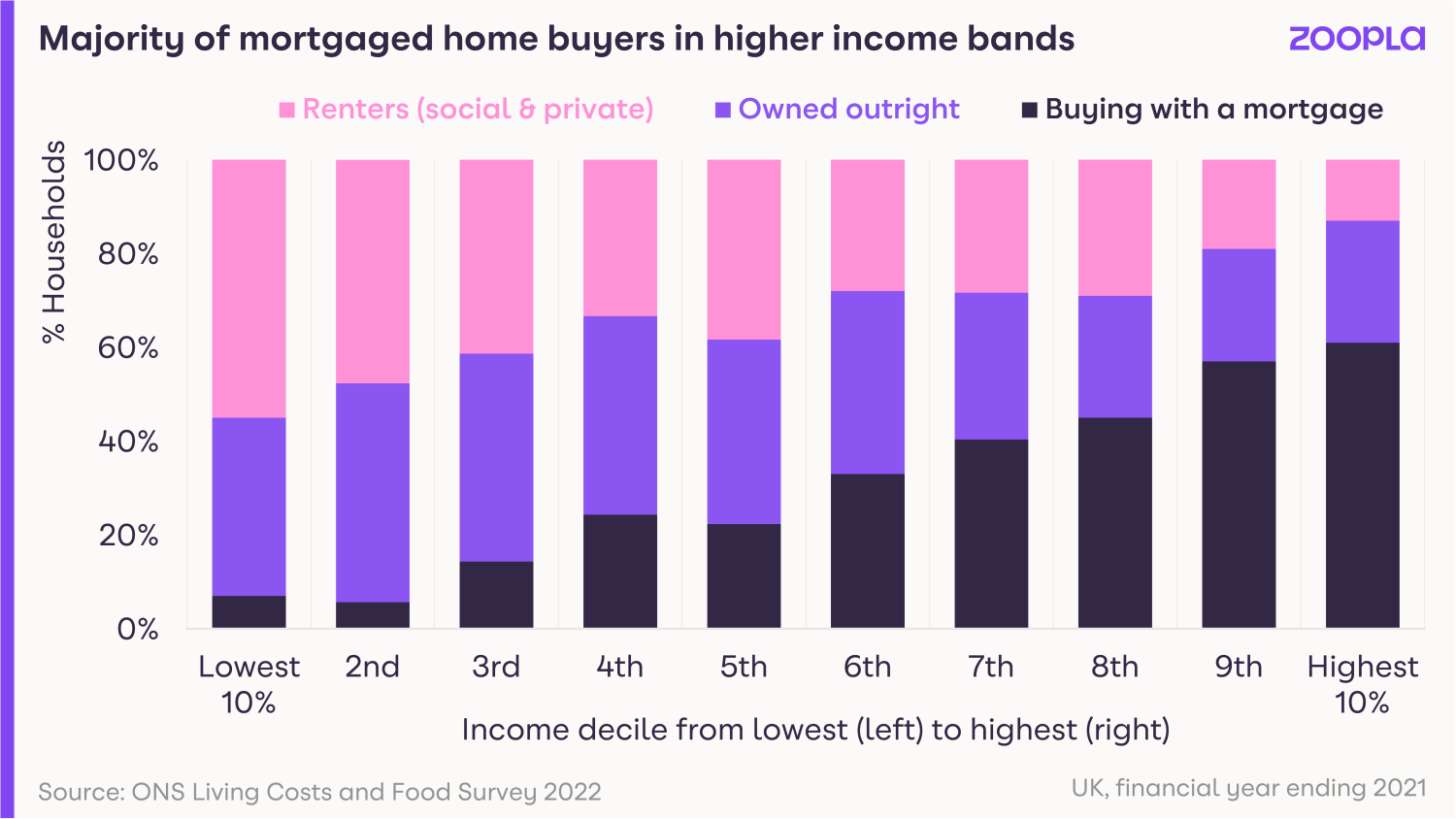

Homebuyers tend to earn higher incomes and may not yet be feeling the pinch of higher living costs.

In fact, the large majority of those buying with a mortgage, accounting for 7 in 10 of all new sales, sit within the UK’s middle to upper income bands.

The latest spending survey data from the Office for National Statistics shows all households have been adjusting their spending patterns, cutting back on discretionary areas of spend, but those on higher incomes have more room for manoeuvre.

The rising cost of living is hitting those on lower incomes first and will take longer to impact those higher income households.

First-time buyers are currently the biggest driving force in the housing market right now, accounting for 177,000, or 35%, of all transactions.

That’s over a third of all total sales so far this year.

The effects of the pandemic are also continuing to support market activity.

Buyers, no longer chained to an office desk, are able to secure cheaper homes, or bigger homes, in locations further afield.

First-time buyers the driving force in sales right now

The number of first-time buyers purchasing homes is changing the buying landscape this year.

Motivated by a need to step onto the property ladder fast, and with working from home opening up the location landscape, interest from first-time buyers in July 2022 was up 46% year-on-year.

Rising house prices have done little to dent demand among this buying group, despite the average first-time buyer property rising £33,000 to £269,000 year-on-year.

Accounting for one in every three property transactions, first-time buyers are now able to look further afield in cheaper areas to buy a home, meaning less time spent saving up for a deposit.

Our data shows that many are also looking at bigger and more expensive homes, with three bedroom properties accounting for more than half of all first-time buyer enquiries.

How higher mortgage rates will impact first-time buyers

Higher mortgage rates will inevitably mean larger monthly repayments - and the need for a greater household income to meet the increased costs.

The chart below shows the income to rent and buy a typical rented home at 2% and 4% mortgage rates.

Moving from a 2% mortgage rate to 4% means the average FTB will need an extra £12,250 in income, compared to when rates were lower.

In London, the highest value market, this increases to over £34,500.

That said, the increase is less than £6,000 in markets with lower house prices.

First-time buyers can respond to higher borrowing costs by using a bigger deposit to reduce the size of their mortgage, as well as by looking to purchase cheaper homes or stepping back from the market altogether.

In order to fully offset this increase in mortgage rates, first-time buyers would need to almost double the size of the average deposit.

How higher mortgage rates and the cost of living will impact the housing market as a whole

With energy costs set to jump higher in the autumn, the impact of the rising cost of living is likely to be felt across all income bands, exerting a growing impact on household decisions, including home moves.

The key factor - that’s yet to fully impact market activity - is higher mortgage rates, which have more than doubled in the last few months.

In January 2022, new mortgage rates were still very cheap at less than 2%, whereas they have now jumped to 4%.

While those buying homes with a mortgage may be on higher incomes, this jump in mortgage rates for new buyers will compound cost of living increases and is likely to have an impact on sales market activity this autumn and into 2023.

And while this level of mortgage rate is still low by historic standards, homebuyers have become used to very low mortgage rates, meaning any reversal is likely to have some impact on demand, especially when combined with cost of living pressures.

Markets feeling the impact

Our data shows demand for homes is already weakest in higher value areas such as London, a trend that is likely to worsen for those looking to buy their first home as mortgage rates move higher.

Demand for homes in the capital continues to lag behind the rest of the country due to pandemic and affordability factors, with home values rising at a rate of 4.1%, less than half the UK average.

The impact of rising mortgage rates will be felt most acutely here and in high value markets in southern England, where affordability is already a drag on market activity.

The South West and Wales are jointly the best performing regions, with annual house price growth of 10.6%.

Strong demand and healthy volumes of new sales agreed in the first half of the year continue to support the headline rate of growth in these areas.

In terms of cities, Nottingham, where homes remain more affordable, continues to lead the way with house price growth of 10.9%.

It's hotly followed by Bournemouth (+9.3%), Leeds (+9,2%) and Manchester (+9%).

Where’s the market going in the next six months?

The headwinds for the sales market are building but the market is in a much better place to weather these than during the previous economic cycles.

We expect to see a slower rate of price growth in the second half of the year, with economic pressures hitting more households.

But history shows that it is the sudden changes in levels of spending on housing that are most closely linked to changes in house price inflation and sales volumes.

These downsides for prices and sales are most commonly seen during recessions, when consumers need to rapidly adjust what they spend in response to unemployment or higher mortgage rates.

Currently, a high proportion of mortgagees are on fixed rate loans, meaning the impact of rising rates won’t be felt by the majority.

And mortgage affordability testing, where to get a mortgage you need to prove you can afford a 6.5% to 7% mortgage rate - despite paying 2% - has baked in a certain level of resilience that will limit the downside for prices and volumes in our view.

That said, its clear UK households are facing a squeeze on incomes and living standards on multiple fronts, which will filter through into housing market activity and house price growth into 2023.

The higher rates move above 4%, the greater the impact on the market where homeowners already have plenty of equity in their homes.

However, we don’t anticipate any widespread falls in house prices if mortgage rates peak at 4% as expected.

Key takeaways

- Demand for new homes remains above average right now, but is set to weaken as even more households feel the cost of living squeeze in the autumn months

- First-time buyers are currently the biggest group driving transactions in the property market, accounting for 35% of all transactions

- Stock levels are also increasing, giving buyers the biggest choice of homes since May 2021

- And in good news for renters, the number of landlords purchasing buy-to-let homes is on the rise

Renters stay put as competition for homes intensifies

More than 11 would-be renters are chasing each property that is available to let. Here's what's happening and how renters can get ahead.

Rising numbers of renters are choosing to stay in their current home as competition for rental properties intensifies.

Nearly 75% of letting agents have seen an increase in renters renewing their contracts during the past 12 months, according to industry body Propertymark.

Their decisions come against a backdrop of rising demand for rental homes. Each letting agent branch received an average of 127 new rental applications during July.

But supply remains tight, with each branch having an average of just 11 rental homes available. That means would-be tenants are in competition with at least 10 other parties for each home.

Unsurprisingly, the mismatch between supply and demand is continuing to push rents higher. A record 82% of letting agents have reported month-on-month increases in rental rates.

Nathan Emerson, CEO of Propertymark, said: “The private rental market continues to be battered by the perfect storm of high demand, low availability and affordability issues that shows no sign of easing.”

Why is this happening?

Demand for rental homes is growing as rising house prices leave would-be first-time buyers facing a longer wait to get on to the property ladder.

But the number of homes available to rent has been on a steady downward trajectory for a number of years. A series of tax and regulatory changes have led some landlords to sell up their investment homes.

Meanwhile, rising interest rates have led to increased costs for investors.

These factors have combined to put significant upward pressure on rents, with the situation showing little sign of improving.

Who does it affect?

The increase in rents is hitting young people hard. Four out of 10 people aged under 30 now spend more than 30% of their income on rent, according to property consultancy Dataloft.

While rents are highest in London, the research found that the situation had also worsened in previously affordable locations such as Rotherham and Bolton.

What should I do if I rent?

If you currently live in a rental property, you may want to consider staying where you are.

Our research suggests landlords are not raising rents as steeply for existing renters as they are for new ones.

This is likely to be due to the fact that landlords do not want to lose good renters.

They'll also be keen to avoid the costs associated with finding new tenants, as this can offset rises in their rental rate.

If you're looking for a new home to rent, don’t lose heart.

The rental market tends to be highly localised, and there are still locations where rental homes remain affordable, particularly in rural areas.

If you have the flexibility to move anywhere, you could consider relocating to a cheaper area.

But even if you're tied to a certain location, you should still be able to find pockets of affordability.

Search homes for rent to explore cheaper areas near you.

Want to be the first to know about a new rental? We'll ping you an email every time one comes online that matches your criteria.

Key takeaways

- Rising numbers of renters are choosing to stay in their current home as competition for rental properties intensifies

- Letting agents received an average of 127 new applications per branch in July but had only 11 properties available to rent

- Turn on email alerts for your search to be the first to know about new rental homes

Average interest charged on a two-year fixed rate mortgage breaks through 4% barrier

Longer-term fixed rate deals offer better value to homeowners amid rising interest rates.

The average cost of a two-year fixed rate mortgage has broken through the 4% barrier for the first time in nearly a decade.

The typical interest rate charged on one of the deals is now 4.09%, according to financial information group Moneyfacts. That’s the highest level since February 2013.

The interest on fixed rate deals has risen 1.75% since the Bank of England first started increasing interest rates in December 2021. It’s up by 0.14% since the beginning of August 2022 alone.

While mortgage rates are rising across the board, longer-term fixed rate deals for five or even 10 years continue to offer better value for homeowners.

Why are we seeing fixed rate mortgages rise?

The Bank of England’s Monetary Policy Committee has increased the official cost of borrowing in a bid to combat high inflation.

They’ve increased the base rate by 1.65% since December 2021.

But unlike variable rate mortgages, the cost of new fixed rate deals is not based on the Bank of England base rate.

Instead, fixed mortgages are based on swap rates. This is the cost of borrowing money for a set period of time.

Swap rates are based on a number of different factors, including potential future interest rate changes.

With inflation remaining stubbornly high, further interest rate rises are expected in the months ahead.

That’s why the average cost of a fixed rate mortgage has increased by 1.75% since December, when the base rate has only risen by 1.65%.

What should I do if I need to remortgage?

With two-year fixed rate mortgages starting to look expensive, you may want to consider locking into a mortgage deal for a longer period of time.

You’ll be charged an extra 1.75% on a two-year fixed rate loan on average compared to December 2021.

But it’ll only be an extra 1.6% on a five-year loan, which now stand at an average of 4.24%.

This has led to the premium you’ll pay for the security of fixing for a five-year period, rather than a two-year one, narrowing to just 0.15%. That's half the level of 0.3% it stood at in December.

If you can lock in for even longer, ten-year fixed rate mortgages also look good value. You’ll be charged an average interest rate of 4.2%, slightly lower than that for five-year deals.

But before you opt for a longer-term fixed rate mortgage, make sure you won’t need to exit the loan early.

Exit penalties on 10-year fixed rate mortgages can be as high as 8% of the outstanding mortgage debt, so think it through before you jump in.

What about tracker mortgage deals?

Tracker rate mortgages currently look cheap compared with fixed rate ones.

The average interest rate charged on a two-year tracker deal is standing at 3.33%.

But remember that the cost of these mortgages moves up and down in line with the Bank of England base rate.

With some economists predicting the base rate could increase to 3% or more, the rate you pay on a tracker mortgage could rise to more than 4.5% in the next few months.

What else do I need to know?

The mortgage market is currently moving very quickly.

Be prepared to move fast to secure a deal that you like the look of.

Lenders have pulled 269 deals since the beginning of the month, with the typical mortgage product only available for 17 days before it is withdrawn.

Eleanor Williams, finance expert at Moneyfacts, said: “We’ve seen lenders withdraw parts of, or entire product ranges, with a number citing the pause in lending being due to unprecedented demand.

“Providers need to manage their service levels following an influx of applications, as borrowers have rushed to secure deals before rates have a chance to climb even further.”

Remember that you can ‘book’ a mortgage rate up to six months before your current one expires.

So, if you are coming to the end of a mortgage deal, try to lock into a new one now, before interest rates rise again.

Key takeaways

- The average cost of a two-year fixed rate mortgage has broken through the 4% barrier for the first time since February 2013

- Five-year and 10-year fixed rate deals currently offer better value to homeowners

- People remortgaging need to move fast, with lenders pulling deals after an average of just 17 days