Cost of living: How rising energy bills are impacting the mortgage market

Will higher gas and electricity bills make it harder to get a mortgage? We take a look at what impact the rising cost of living is having on mortgage availability.

Energy bills have more than doubled this year as the conflict in Ukraine continues to drive gas and electricity prices higher.

The energy price cap has increased from £1,277 a year at the start of 2022 to £3,549 now. And further price increases are predicted for January 2023.

The rising cost of heating and lighting a home is having a knock-on effect on the mortgage market.

Here’s what you need to know and how you can make yourself more attractive to mortgage lenders.

Why are rising energy bills impacting the mortgage market?

Unfortunately, lenders can’t ignore the impact higher energy bills will have on people’s finances.

Before offering you a mortgage, they need to make sure you can afford the monthly repayments.

Richard Donnell, Director of Research and Insight at Zoopla, explains: “Over the last five-plus years, lenders have focused much more on checking the affordability of mortgage repayments as part of a households’ overall spend.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, adds that most lenders use data from the Office for National Statistics as part of their affordability assessments. This data reflects the recent rise in energy costs.

“As lenders have plugged this new data into their calculations, borrowing potential has been negatively impacted and lower lending limits are being offered,” he says.

Will it be harder to get a mortgage?

Some people are likely to find it harder to get a mortgage due to the rising cost of living.

If a lender feels your budget is too tight to cope with further hikes to energy costs, as well as other price rises, they might offer you a smaller amount to borrow.

But it's not all bad news.

Richard points out that mortgage stress testing has been higher over the last few years.

Most people who have bought a home or remortgaged recently will have needed to show that they would have been able to afford repayments at a much higher mortgage rate of 6% or 7%.

This requirement has since been removed, but it means if you're remortgaging you should have enough flexibility in your budget to meet the cost of higher energy prices.

Who will be impacted most?

First-time buyers and borrowers with low incomes are most likely to be impacted by lenders tightening their affordability criteria.

“Rising energy bills will affect different income groups to a greater or lesser degree. Low income households with less disposable income will be more impacted by energy caps rising,” Mark Harris says.

By contrast, people with high incomes looking to borrow a high multiple of their salary are less likely to be affected, according to Jonathan Harris, of Forensic Property Finance.

“By making the tweaks to their systems, lenders can still confidently lend high loan-to-incomes to people who can afford to cover all the costs comfortably,” he says.

He adds: “The changes are most likely to affect those who are really pushing themselves to borrow as much as possible. This is most likely to be first-time buyers, as it all comes down to the deposit and how much you can raise.”

Will banks be more reluctant to lend?

The good news is that lenders are still very much open for business, even if they are tightening their affordability criteria.

Jonathan Harris says: “Lenders will not become reluctant to lend. They have the systems in place to lend in a responsible fashion due to the constant tweaks they are making to affordability criteria.”

So while banks may be more cautious about the amount they will advance to an individual, it's not expected to be as widespread as it was at the start of the Covid-19 pandemic.

What will happen to mortgage rates?

Mortgage rates are already rising across the board as a result of increases to the Bank of England base rate.

The official cost of borrowing has jumped by 1.65% since December last year, and most of this increase has been passed on to new mortgage customers.

On top of this, Donnell also expects mortgages for people with small deposits to become more expensive. It'll reflect the greater risk these borrowers pose in the face of the rising cost of living.

“When the economic outlook is uncertain and there is greater risk, lenders tend to reduce the availability of loans at higher loan-to-value ratios. They also sometimes increase the cost of mortgages at these levels to cover the risk, which can reduce demand,” he says.

What can I do to help me qualify for a mortgage?

Mark Harris points out that while you can’t directly influence inflation, you can make yourself more attractive to lenders.

Cut back on unnecessary spending and reduce or pay off financial commitments such as loans and store cards.

Jonathan Harris agrees: “Get rid of any committed monthly expenditure such as a Netflix subscription or gym membership, particularly if you rarely use them. Pay off credit cards and loans if you can and conduct your accounts cautiously. Make sure you pay bills and things like parking fines on time.”

Will higher energy bills impact the housing market?

Rising energy costs may encourage some people to move to find a more suitable home that is lower cost to run, according to Donnell.

Buyers are also likely to pay closer attention to the running costs of a property than they have done in the past.

In fact, a recent survey found that the better energy rating and lower running costs of new homes is an increasingly attractive proposition for new buyers.

New-build buyers driving the green home movement – and saving up to 52% on energy costs

But rising energy costs are not expected to trigger anything as dramatic as a house price crash.

This is in part because borrowers who took out mortgages in the past few years will have faced strict affordability tests to ensure they could still afford their repayments even if costs rose.

Will there be a housing crash? Here's what the data says

At the same time, the majority of homeowners with a mortgage are on a fixed rate deal, meaning they will be insulated from interest rises until they need to remortgage.

Instead, house price growth is expected to slow gradually during the rest of the year as buyer demand eases.

Key takeaways

- Lenders will factor higher energy bills into their affordability calculations, which might reduce the amount you can borrow for a mortgage

- You might find it harder to get a mortgage if lenders feel you do not have enough room in your budget to cope with further price hikes

- Try to cut back on unnecessary spending and reduce any outstanding debts to make yourself more attractive to lenders

How can first time buyers handle rising interest rates?

First time buyers are the largest buyer group in the country but they’re about to be hit with higher interest rates. Here’s what’s happening and how you can offset the rising rates.

Interest from first time buyers is up a huge 46% year on year as they drive the market from the bottom up.

They’ve now become the largest buyer group in the country with nearly 177,000 transactions so far this year. That’s one in three sales made to first time buyers.

And they’re going bigger and better, with more than half of their enquiries for three bedroom homes and an average price 10% higher than this time last year (£269,000).

Pandemic changes and new working from norms are continuing to power the first time buyer market.

They’re now able to look further afield in cheaper areas to buy a home, meaning less time spent saving up for a deposit.

Our data shows that 25% of first time buyers outside of London are now searching 10km or more from their home address. That’s compared to just 20% in the summer of 2019.

This search radius has increased even more for first time buyers in London. 30% of first time buyers are enquiring for properties 20km away, up from 21% in summer 2019.

First time buyers will soon need an extra £12,250 on their income to get a mortgage

Despite the current economic situation doing little to deter first time buyers, rising interest rates are likely to impact their levels of activity.

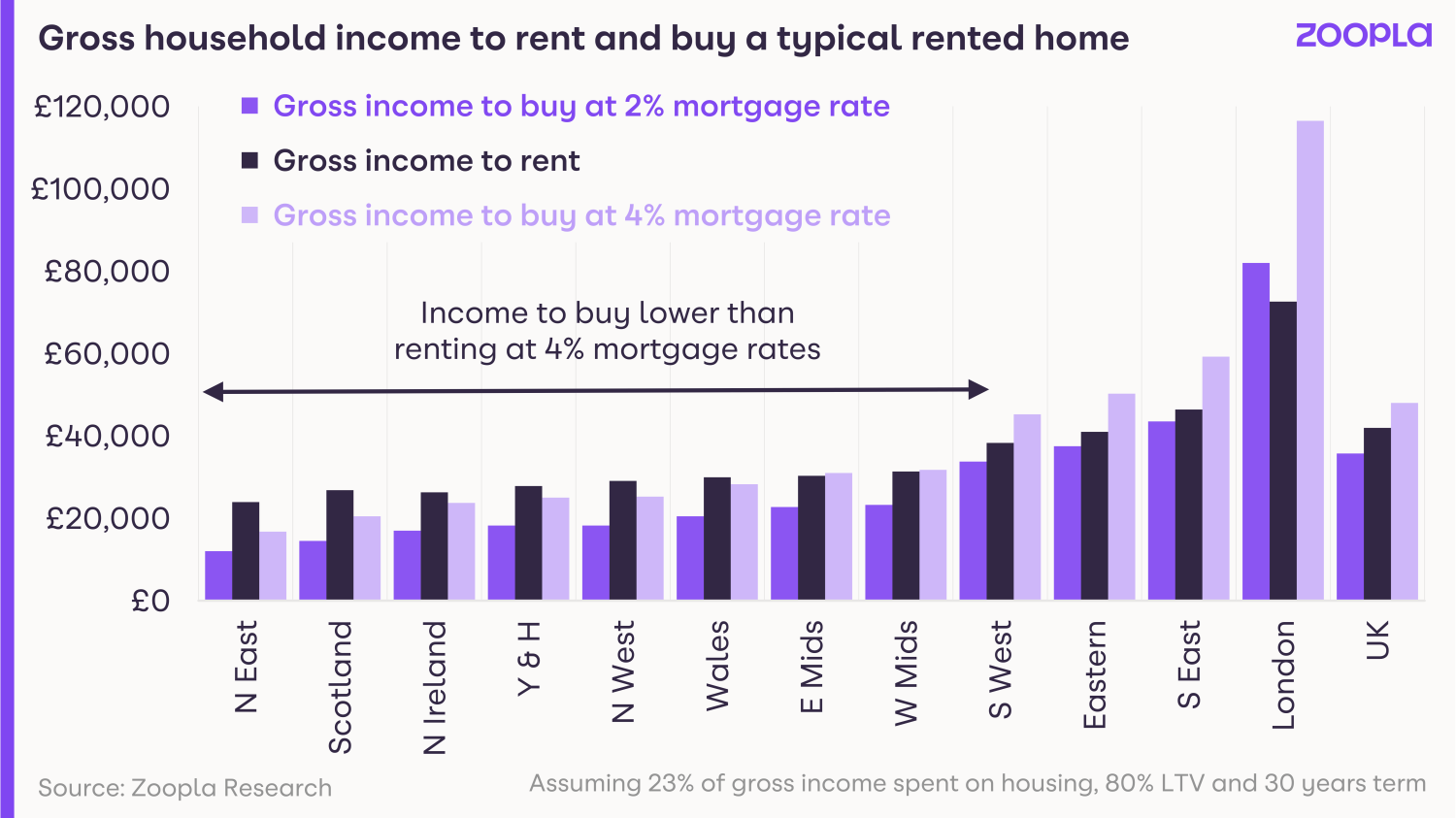

Moving from a 2% mortgage rate to 4% will see the average first time buyer require an extra £12,250 in income.

That means earning £48,000 compared to the previous £37,500.

In London, you’ll need an extra £34,500 on your income.

This impact won’t be felt as much in lower value markets, where first time buyers may only need a few thousand more on their income to secure a mortgage.

It’s still cheaper to buy than rent. Just.

One way to look at the impact of higher mortgage rates on first time buyers is to compare the cost of renting and buying.

We’ve looked at whether a renter can afford to buy the home they live in.

And at the moment, you’re saving an average of £200 by paying a mortgage (with a 2.5% rate) rather than renting.

With a 4% interest rate, it’ll still be slightly cheaper to pay a mortgage than to rent in most places.

But buying will edge into being more expensive than renting in the high value areas of London and the South of England.

What can first time buyers do about rising interest rates?

There’s no one-size-fits-all answer when it comes to how first time buyers can handle higher borrowing costs.

We know how hard it is to get a deposit together and step onto the ladder. And unfortunately, it’s not about to get any easier.

But there are a few things you can do to offset interest rate rises as a first time buyer.

1. Broaden your search area

If you can be flexible on location, look for homes in more regional or rural areas.

In areas outside of major cities, you can find cheaper homes or get more home for your money.

This means smaller monthly repayments, and the amount you pay in interest won’t seem quite as eye-wateringly high.

It’s a tactic that’s already being used by many first time buyers, as we’ve seen them stretch their search area further from their current location.

2. Look into how you can boost your savings

It might seem like it’s all doom and gloom when interest rates go up.

But you could see an increase in the interest rates on your savings account or Cash ISA if you’re on a variable rate.

Shop around to see what interest rates banks and building societies are offering on their savings accounts. It could help you boost your savings and save for a deposit quicker.

3. Use a government buying scheme

The government has launched several first-time buyer schemes to help you get on the property ladder.

The Help to Buy: Equity Loan scheme is a popular choice. You need to put down a 5% deposit, which the government tops up with a 20% equity loan, rising to 40% in London.

However, this scheme is only open until October, and some banks are starting to wind down their Help to Buy mortgage offers.

Meanwhile, the First Homes scheme offers discounts of between 30% and 50% on new build properties to local first-time buyers and key workers.

There are several other schemes that can help you get on the ladder too.

4. Team up with friends or family to get a bigger deposit

Easier said than done, but you can offset rate rises by coming up with a bigger deposit.

This will reduce the size of your mortgage and bring down the amount of interest you owe.

It’s a trend we saw after the first lockdown, when first time buyers started turning up with bigger deposits.

Many are turning to family members or pairing up with partners or friends to get a deposit together.

5. Do your homework on different types of mortgages

It’s vital to understand how different types of mortgages are impacted by base rate changes.

There are still some cheaper deals out there, especially if you have a decent deposit and you can prove your strong financial position.

Keep in mind that there are nine different types of mortgages. They all have their own pros and cons, as well as some restrictions that might mean you’re not eligible.

Although the mortgage with the lowest interest rate might seem tempting, take a close look at what other restrictions will be in place.

This is where it can be worth speaking to a mortgage advisor. Some specialise in first time buyer mortgages, so tap into their knowledge as well as doing your own research.

6. Keep up with your local market

Local housing markets all have their own stories.

You’ll be in the best position to get on the market at a good price if you know what’s happening nearby.

You can uncover pockets of affordability and places where you can get on the market for less.

Speak to local estate agents and see what advice they have for first time buyers. They’ll have a full view of your market and could help you time your step onto the ladder.

Key takeaways

- First time buyers have become the largest buyer group in the UK with nearly 177,000 transactions so far in 2022

- But 4% interest rates mean they’ll need an average of £12,250 more on their income to get a mortgage

- This reaches an additional £34,500 in the higher value London market, but is under £5,000 in more affordable regions

- There’s no one-size-fits-all solution for first time buyers but consider more affordable markets, government schemes and different mortgage options

Economic uncertainty begins to impact demand and house price growth

The housing market remains resilient but price growth begins to lose momentum as demand for homes starts to slow.

UK house prices increased by 8.3% or £19,800 in the past 12 months, however demand for new homes is beginning to weaken as mortgage rates rise and the increasing cost of living begins to bite.

Mortgage rates for new buyers are now at 4%, meaning the average first-time buyer will need an extra £12,250 to buy a home today compared to a year ago - and up to £35,000 more in London.

The average time to sell a home is also lengthening, taking 22 days right now, compared to 19 days back in April.

Why the cost of living isn't hitting the housing market yet

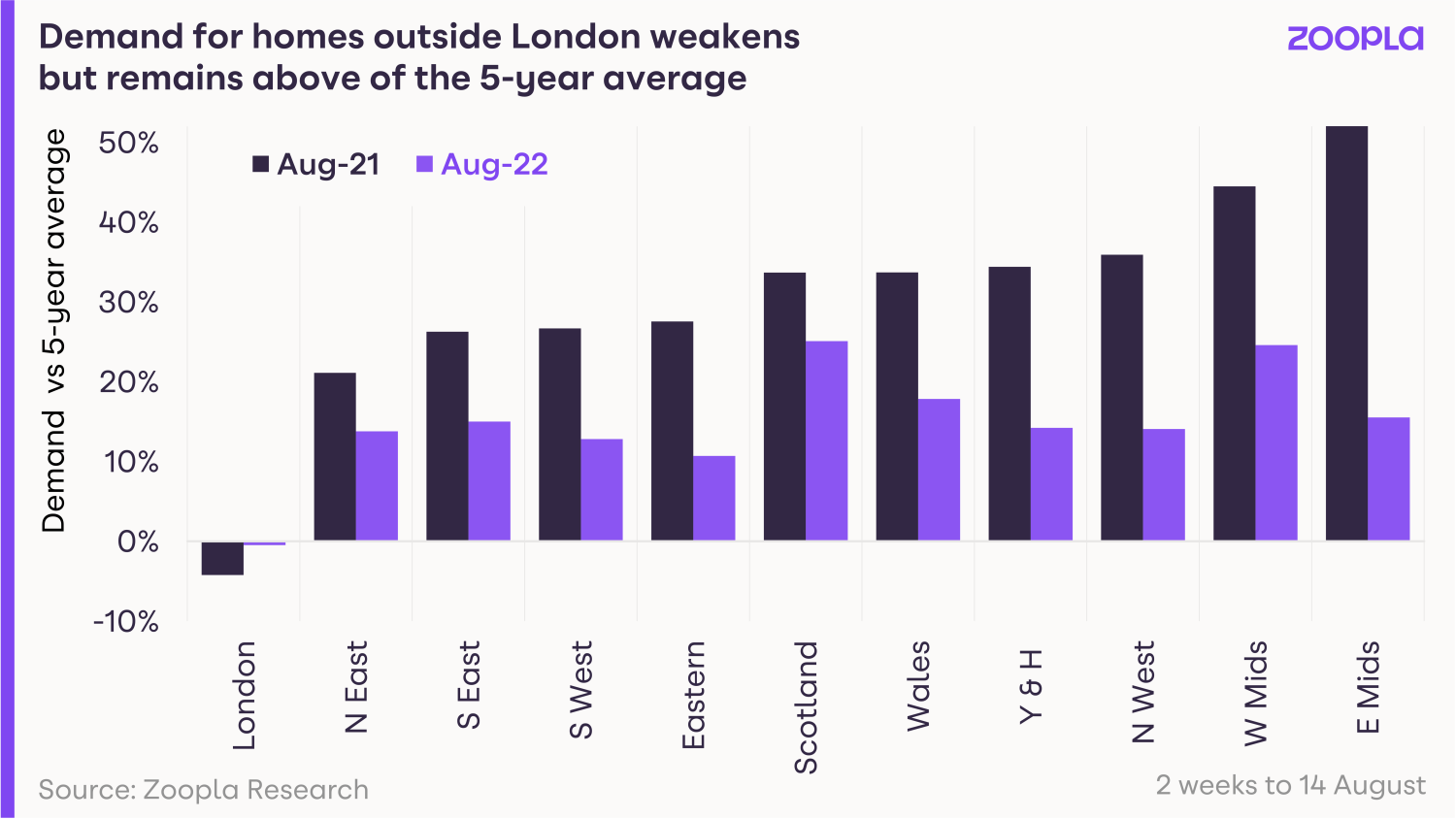

Buyer demand has started to fall but remains well above the five year average, tracking at +17%.

However, that demand has come down from a peak of +54% in May earlier this year and is likely to continue to weaken throughout the rest of 2022.

Demand is now below levels seen this time last year, when the stamp duty holiday was still in place and the nation was on the move in the hunt for more space.

The summer slowdown and increased economic uncertainty are beginning to make an impact.

However, there are a number of reasons why the housing market is remaining resilient, despite concerns over interest rate rises and cost of living increases causing a drop in consumer confidence.

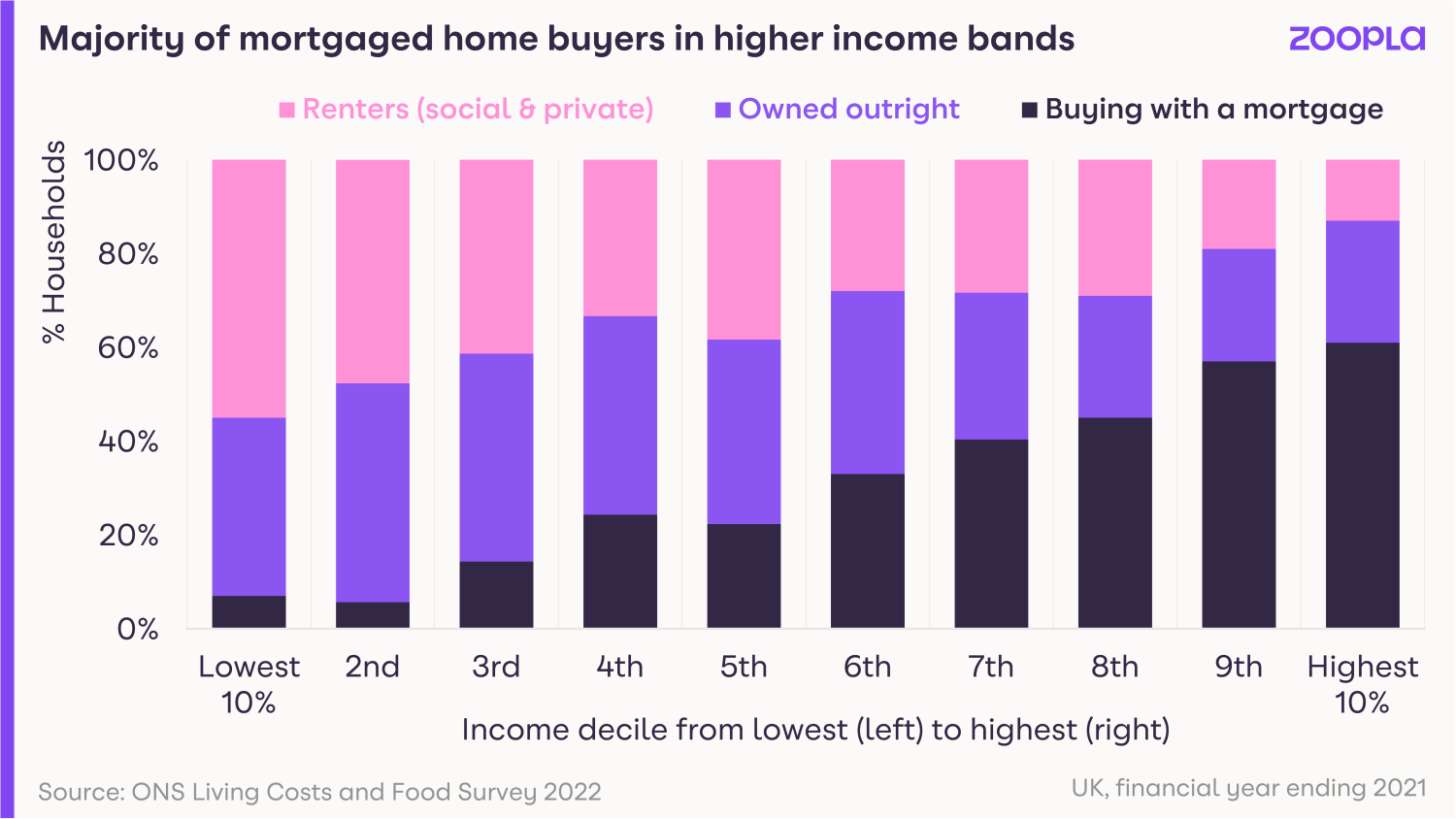

Higher income households and first-time buyers driving the housing market

Homebuyers tend to earn higher incomes and may not yet be feeling the pinch of higher living costs.

In fact, the large majority of those buying with a mortgage, accounting for 7 in 10 of all new sales, sit within the UK’s middle to upper income bands.

The latest spending survey data from the Office for National Statistics shows all households have been adjusting their spending patterns, cutting back on discretionary areas of spend, but those on higher incomes have more room for manoeuvre.

The rising cost of living is hitting those on lower incomes first and will take longer to impact those higher income households.

First-time buyers are currently the biggest driving force in the housing market right now, accounting for 177,000, or 35%, of all transactions.

That’s over a third of all total sales so far this year.

The effects of the pandemic are also continuing to support market activity.

Buyers, no longer chained to an office desk, are able to secure cheaper homes, or bigger homes, in locations further afield.

First-time buyers the driving force in sales right now

The number of first-time buyers purchasing homes is changing the buying landscape this year.

Motivated by a need to step onto the property ladder fast, and with working from home opening up the location landscape, interest from first-time buyers in July 2022 was up 46% year-on-year.

Rising house prices have done little to dent demand among this buying group, despite the average first-time buyer property rising £33,000 to £269,000 year-on-year.

Accounting for one in every three property transactions, first-time buyers are now able to look further afield in cheaper areas to buy a home, meaning less time spent saving up for a deposit.

Our data shows that many are also looking at bigger and more expensive homes, with three bedroom properties accounting for more than half of all first-time buyer enquiries.

How higher mortgage rates will impact first-time buyers

Higher mortgage rates will inevitably mean larger monthly repayments - and the need for a greater household income to meet the increased costs.

The chart below shows the income to rent and buy a typical rented home at 2% and 4% mortgage rates.

Moving from a 2% mortgage rate to 4% means the average FTB will need an extra £12,250 in income, compared to when rates were lower.

In London, the highest value market, this increases to over £34,500.

That said, the increase is less than £6,000 in markets with lower house prices.

First-time buyers can respond to higher borrowing costs by using a bigger deposit to reduce the size of their mortgage, as well as by looking to purchase cheaper homes or stepping back from the market altogether.

In order to fully offset this increase in mortgage rates, first-time buyers would need to almost double the size of the average deposit.

How higher mortgage rates and the cost of living will impact the housing market as a whole

With energy costs set to jump higher in the autumn, the impact of the rising cost of living is likely to be felt across all income bands, exerting a growing impact on household decisions, including home moves.

The key factor - that’s yet to fully impact market activity - is higher mortgage rates, which have more than doubled in the last few months.

In January 2022, new mortgage rates were still very cheap at less than 2%, whereas they have now jumped to 4%.

While those buying homes with a mortgage may be on higher incomes, this jump in mortgage rates for new buyers will compound cost of living increases and is likely to have an impact on sales market activity this autumn and into 2023.

And while this level of mortgage rate is still low by historic standards, homebuyers have become used to very low mortgage rates, meaning any reversal is likely to have some impact on demand, especially when combined with cost of living pressures.

Markets feeling the impact

Our data shows demand for homes is already weakest in higher value areas such as London, a trend that is likely to worsen for those looking to buy their first home as mortgage rates move higher.

Demand for homes in the capital continues to lag behind the rest of the country due to pandemic and affordability factors, with home values rising at a rate of 4.1%, less than half the UK average.

The impact of rising mortgage rates will be felt most acutely here and in high value markets in southern England, where affordability is already a drag on market activity.

The South West and Wales are jointly the best performing regions, with annual house price growth of 10.6%.

Strong demand and healthy volumes of new sales agreed in the first half of the year continue to support the headline rate of growth in these areas.

In terms of cities, Nottingham, where homes remain more affordable, continues to lead the way with house price growth of 10.9%.

It's hotly followed by Bournemouth (+9.3%), Leeds (+9,2%) and Manchester (+9%).

Where’s the market going in the next six months?

The headwinds for the sales market are building but the market is in a much better place to weather these than during the previous economic cycles.

We expect to see a slower rate of price growth in the second half of the year, with economic pressures hitting more households.

But history shows that it is the sudden changes in levels of spending on housing that are most closely linked to changes in house price inflation and sales volumes.

These downsides for prices and sales are most commonly seen during recessions, when consumers need to rapidly adjust what they spend in response to unemployment or higher mortgage rates.

Currently, a high proportion of mortgagees are on fixed rate loans, meaning the impact of rising rates won’t be felt by the majority.

And mortgage affordability testing, where to get a mortgage you need to prove you can afford a 6.5% to 7% mortgage rate - despite paying 2% - has baked in a certain level of resilience that will limit the downside for prices and volumes in our view.

That said, its clear UK households are facing a squeeze on incomes and living standards on multiple fronts, which will filter through into housing market activity and house price growth into 2023.

The higher rates move above 4%, the greater the impact on the market where homeowners already have plenty of equity in their homes.

However, we don’t anticipate any widespread falls in house prices if mortgage rates peak at 4% as expected.

Key takeaways

- Demand for new homes remains above average right now, but is set to weaken as even more households feel the cost of living squeeze in the autumn months

- First-time buyers are currently the biggest group driving transactions in the property market, accounting for 35% of all transactions

- Stock levels are also increasing, giving buyers the biggest choice of homes since May 2021

- And in good news for renters, the number of landlords purchasing buy-to-let homes is on the rise

Renters stay put as competition for homes intensifies

More than 11 would-be renters are chasing each property that is available to let. Here's what's happening and how renters can get ahead.

Rising numbers of renters are choosing to stay in their current home as competition for rental properties intensifies.

Nearly 75% of letting agents have seen an increase in renters renewing their contracts during the past 12 months, according to industry body Propertymark.

Their decisions come against a backdrop of rising demand for rental homes. Each letting agent branch received an average of 127 new rental applications during July.

But supply remains tight, with each branch having an average of just 11 rental homes available. That means would-be tenants are in competition with at least 10 other parties for each home.

Unsurprisingly, the mismatch between supply and demand is continuing to push rents higher. A record 82% of letting agents have reported month-on-month increases in rental rates.

Nathan Emerson, CEO of Propertymark, said: “The private rental market continues to be battered by the perfect storm of high demand, low availability and affordability issues that shows no sign of easing.”

Why is this happening?

Demand for rental homes is growing as rising house prices leave would-be first-time buyers facing a longer wait to get on to the property ladder.

But the number of homes available to rent has been on a steady downward trajectory for a number of years. A series of tax and regulatory changes have led some landlords to sell up their investment homes.

Meanwhile, rising interest rates have led to increased costs for investors.

These factors have combined to put significant upward pressure on rents, with the situation showing little sign of improving.

Who does it affect?

The increase in rents is hitting young people hard. Four out of 10 people aged under 30 now spend more than 30% of their income on rent, according to property consultancy Dataloft.

While rents are highest in London, the research found that the situation had also worsened in previously affordable locations such as Rotherham and Bolton.

What should I do if I rent?

If you currently live in a rental property, you may want to consider staying where you are.

Our research suggests landlords are not raising rents as steeply for existing renters as they are for new ones.

This is likely to be due to the fact that landlords do not want to lose good renters.

They'll also be keen to avoid the costs associated with finding new tenants, as this can offset rises in their rental rate.

If you're looking for a new home to rent, don’t lose heart.

The rental market tends to be highly localised, and there are still locations where rental homes remain affordable, particularly in rural areas.

If you have the flexibility to move anywhere, you could consider relocating to a cheaper area.

But even if you're tied to a certain location, you should still be able to find pockets of affordability.

Search homes for rent to explore cheaper areas near you.

Want to be the first to know about a new rental? We'll ping you an email every time one comes online that matches your criteria.

Key takeaways

- Rising numbers of renters are choosing to stay in their current home as competition for rental properties intensifies

- Letting agents received an average of 127 new applications per branch in July but had only 11 properties available to rent

- Turn on email alerts for your search to be the first to know about new rental homes

Average interest charged on a two-year fixed rate mortgage breaks through 4% barrier

Longer-term fixed rate deals offer better value to homeowners amid rising interest rates.

The average cost of a two-year fixed rate mortgage has broken through the 4% barrier for the first time in nearly a decade.

The typical interest rate charged on one of the deals is now 4.09%, according to financial information group Moneyfacts. That’s the highest level since February 2013.

The interest on fixed rate deals has risen 1.75% since the Bank of England first started increasing interest rates in December 2021. It’s up by 0.14% since the beginning of August 2022 alone.

While mortgage rates are rising across the board, longer-term fixed rate deals for five or even 10 years continue to offer better value for homeowners.

Why are we seeing fixed rate mortgages rise?

The Bank of England’s Monetary Policy Committee has increased the official cost of borrowing in a bid to combat high inflation.

They’ve increased the base rate by 1.65% since December 2021.

But unlike variable rate mortgages, the cost of new fixed rate deals is not based on the Bank of England base rate.

Instead, fixed mortgages are based on swap rates. This is the cost of borrowing money for a set period of time.

Swap rates are based on a number of different factors, including potential future interest rate changes.

With inflation remaining stubbornly high, further interest rate rises are expected in the months ahead.

That’s why the average cost of a fixed rate mortgage has increased by 1.75% since December, when the base rate has only risen by 1.65%.

What should I do if I need to remortgage?

With two-year fixed rate mortgages starting to look expensive, you may want to consider locking into a mortgage deal for a longer period of time.

You’ll be charged an extra 1.75% on a two-year fixed rate loan on average compared to December 2021.

But it’ll only be an extra 1.6% on a five-year loan, which now stand at an average of 4.24%.

This has led to the premium you’ll pay for the security of fixing for a five-year period, rather than a two-year one, narrowing to just 0.15%. That's half the level of 0.3% it stood at in December.

If you can lock in for even longer, ten-year fixed rate mortgages also look good value. You’ll be charged an average interest rate of 4.2%, slightly lower than that for five-year deals.

But before you opt for a longer-term fixed rate mortgage, make sure you won’t need to exit the loan early.

Exit penalties on 10-year fixed rate mortgages can be as high as 8% of the outstanding mortgage debt, so think it through before you jump in.

What about tracker mortgage deals?

Tracker rate mortgages currently look cheap compared with fixed rate ones.

The average interest rate charged on a two-year tracker deal is standing at 3.33%.

But remember that the cost of these mortgages moves up and down in line with the Bank of England base rate.

With some economists predicting the base rate could increase to 3% or more, the rate you pay on a tracker mortgage could rise to more than 4.5% in the next few months.

What else do I need to know?

The mortgage market is currently moving very quickly.

Be prepared to move fast to secure a deal that you like the look of.

Lenders have pulled 269 deals since the beginning of the month, with the typical mortgage product only available for 17 days before it is withdrawn.

Eleanor Williams, finance expert at Moneyfacts, said: “We’ve seen lenders withdraw parts of, or entire product ranges, with a number citing the pause in lending being due to unprecedented demand.

“Providers need to manage their service levels following an influx of applications, as borrowers have rushed to secure deals before rates have a chance to climb even further.”

Remember that you can ‘book’ a mortgage rate up to six months before your current one expires.

So, if you are coming to the end of a mortgage deal, try to lock into a new one now, before interest rates rise again.

Key takeaways

- The average cost of a two-year fixed rate mortgage has broken through the 4% barrier for the first time since February 2013

- Five-year and 10-year fixed rate deals currently offer better value to homeowners

- People remortgaging need to move fast, with lenders pulling deals after an average of just 17 days