The highest yielding areas for buy-to-let property in the UK

Considering becoming a landlord? One strategy for investment is to focus on higher yielding markets. Here are the top investor hotspots in the UK.

Ready to become a landlord and want the biggest return on your investment?

It’s worth getting to grips with rental yield if you’re purchasing a buy-to-let property.

Gross rental yield is the annual rental income expressed as a percentage of the property price. Net rental yield also factors in the cost of maintaining and renting out the rental property. Both can help you decide if a property is a good investment.

Keep in mind that tenant demand and the potential for house price growth - among other factors - should also be considered with property investment.

The average gross rental yield in the UK is currently 5.49%. The average buy-to-let property costs £262,288 and the UK’s average rent is £1,201.

Yields have improved across all regions in the last year as house prices have started to fall and rents have continued to rise.

10 top cities for rental yields in the UK

Sunderland, Dundee and Burnley top the chart for the highest rental yields in the UK, with average gross yields of close to or higher than 8%.

Cities in the North of England and Scotland are generally better for yields than the South of England and London. This is because house prices are disproportionately higher than rents in these southern locations.

Glasgow and Liverpool also make our list with gross yields of 7.90% and 7.43% respectively. These cities provide attractive opportunities for property investors due to their relatively low average house prices, excellent employment prospects and large student populations.

Here are the top 10 cities for rental yields right now.

| City | Average gross rental yield | Average monthly rent | Average price of a buy-to-let property |

|---|---|---|---|

| Sunderland | 8.50% | £598 | £84,432 |

| Dundee | 8.07% | £783 | £116,498 |

| Burnley | 7.96% | £561 | £84,575 |

| Glasgow | 7.90% | £930 | £141,180 |

| Middlesbrough | 7.85% | £604 | £92,292 |

| Aberdeen | 7.45% | £673 | £108,436 |

| Liverpool | 7.43% | £798 | £128,905 |

| Blackburn | 7.41% | £656 | £106,209 |

| Hull | 7.30% | £594 | £97,602 |

| Grimsby | 7.07% | £602 | £102,208 |

Rental Index, December 2023

Top regions for rental yields in the UK

When it comes to regions, the top places for rental yields are all northern.

Rents in the North East are cheaper than anywhere else in the country (£671) - but so are buy-to-let properties, at £109,715 on average. This gives the region the highest average yield in the UK of 7.34%.

It’s followed by Scotland (7.32%), the North West (6.52%), Northern Ireland (6.24%) and Wales (6.23%).

London offers the lowest gross yields in the UK of 4.92% on average. With higher mortgage rates, new regulations and low house price growth in recent years, landlord investment in the city has been limited. Particularly as rents appear to have reached an affordability ceiling and tenant demand is starting to moderate.

The South East and East of England also offer lower gross yields of 5.17%. These are the two regions where house prices have fallen the most, which has improved their rental yield from between 4.50% and 5.0% a year ago.

| Region | Average gross rental yield | Average monthly rent | Average price of a buy-to-let property |

|---|---|---|---|

| North East | 7.34% | £671 | £109,715 |

| Scotland | 7.32% | £777 | £127,326 |

| North West | 6.52% | £828 | £152,369 |

| Northern Ireland | 6.24% | £746 | £143,462 |

| Wales | 6.23% | £848 | £163,283 |

| Yorkshire and the Humber | 6.23% | £781 | £150,504 |

| West Midlands | 5.78% | £881 | £182,947 |

| East Midlands | 5.70% | £845 | £177,816 |

| South West | 5.23% | £1,058 | £242,532 |

| East of England | 5.17% | £1,143 | £265,351 |

| South East | 5.17% | £1,291 | £299,890 |

| London | 4.92% | £2,125 | £518,056 |

Zoopla Rental Index, December 2023

The highest yielding areas in each part of the UK

Looking for a buy-to-let property near where you live can be useful. You know the local area, understand local influences on the market and can work closely with a local letting agent.

And it helps to know which parts of your region offer the greatest rental yield. Here are the top 3 local authorities for average yields in each UK region.

North East

-

Middlesbrough - 8.52% gross rental yield

-

Sunderland - 8.50% gross rental yield

-

Hartlepool - 8.31% gross rental yield

Scotland

-

East Ayrshire - 9.57% gross rental yield

-

West Dunbartonshire - 9.15% gross rental yield

-

Renfrewshire - 9.13% gross rental yield

North West

-

Burnley - 8.41% gross rental yield

-

Liverpool - 7.57% gross rental yield

-

Hyndburn - 7.47% gross rental yield

Wales

-

Blaenau Gwent - 7.38% gross rental yield

-

Neath Port Talbot - 7.23% gross rental yield

-

Merthyr Tydfil - 7.22% gross rental yield

Yorkshire and the Humber

-

Hull - 7.30% gross rental yield

-

North East Lincolnshire - 7.07% gross rental yield

-

Barnsley - 7.02% gross rental yield

West Midlands

-

Stoke-on-Trent - 7.09% gross rental yield

-

Newcastle-under-Lyme - 6.52% gross rental yield

-

Coventry - 6.46% gross rental yield

East Midlands

-

Nottingham - 7.06% gross rental yield

-

Mansfield - 6.40% gross rental yield

-

Boston - 6.39% gross rental yield

South West

-

Plymouth - 6.32% gross rental yield

-

Gloucester - 6.20% gross rental yield

-

Swindon - 6.06% gross rental yield

East of England

-

Great Yarmouth - 6.13%

-

Fenland - 6.05%

-

Peterborough - 6.04%

South East

-

Southampton - 6.42% gross rental yield

-

Gosport - 6.10% gross rental yield

-

Portsmouth - 6.09% gross rental yield

London

-

Barking and Dagenham - 6.24%

-

Newham - 5.78%

-

Bexley - 5.62%

What’s the outlook for buy-to-let property investment in the UK?

Tenant demand is a third higher than the 5-year average while supply is limited by low new investment. We expect rents to rise between 5% and 8% next year as there is still affordability headroom across most of the country.

There is also further for house prices to fall. If house prices are falling and rents are rising, gross yields will continue to improve.

However, there are signs that the rental market is about to turn and we have already passed the peak of rental growth. We expect annual UK rental growth to halve to 5% to 8% during 2024, the lowest growth since 2021.

There are already signs that rental demand is weakening. Influencing factors include the ending of one-off pandemic after-effects, slower jobs and wage growth, and mortgage rates dropping since a year ago.

Key takeaways

- If you’re looking for a buy-to-let property, rental yield can help you decide if the cost of the property is worth the potential rental income

- Rental yields have improved in the last year due to falling house prices and increasing rents

- The highest yielding cities in the UK are Sunderland, Dundee and Glasgow, which offer a gross rental yield of between 7.7% and 8.4%

- The North East is the best best for investors looking for strong yields, offering an average of 7.15%

- We reveal the three highest yielding areas in every region of the UK

- Take other factors into account before you invest, like tenant demand and the potential for future house price growth

The cheapest places to rent a home in 2023

Renters will be pleased to learn the UK rental market has now passed its peak rate of growth. So where are the cheapest places to rent right now?

The cost of renting a home has risen rapidly over the last three years due to a chronic shortage of supply.

Rental prices have increased by a third in that time, adding £3,360 to the average renter’s bill.

But in good news for renters, we’re anticipating a major deceleration in prices for new lets during 2024.

The cost of new lets has now reached the ceiling of what renters are able to afford.

This will lead to a slowdown in demand and a gradual increase in the availability of homes to rent.

Our Executive Director of Research, Richard Donnell, says: ‘There are already signs asking rents have overshot in some markets showing resistance to higher rents.

‘Our data shows that rental demand has been steadily losing momentum over second half of 2023.

'This is illustrated by the number of enquiries per home for rent. This measure peaked at over 35 enquiries per property in the summer of 2022.

'There was a seasonal peak this summer, but to a lesser degree. We are now in the usual seasonal slowdown that will extend into Q1 2024.’

London to lead the way in reducing rents

One third of the UK’s rental homes are based in London and it's set to lead the way in reducing the price of new lets next year.

The capital is the most expensive place to rent a home in the UK and prices for new lets here have already hit the ceiling for renters.

A year ago, rents here were rising at a rate of 17%. Today, that rate has dropped to 9.7%.

Across the rest of the UK, rents were rising at 11.9% a year ago. Today they are also rising at 9.7%.

In 2024, average UK rents are expected to rise by 5%, the lowest growth rate since in 2021.

Scotland bucks this trend however. Here, rental growth is continuing to gain momentum with rents up 12.9%, compared to 11.4% a year ago.

That's largely because rents have been capped here, meaning landlords may only increase rents by 3% during a tenancy. That has led landlords and letting agents to push up prices for new lets in advance of them being rented out.

The cheapest places to rent in the UK - regions

For the cheapest rents in the country, the North East is where it’s at. Tenants spend an average of £671 per month on rent here.

Northern Ireland, Scotland and Yorkshire and the Humber all sit at the cheaper end of the scale too, with rents averaging less than £800 per month.

Rents in the South of England are much more expensive than anywhere else in the country.

London is by far the most expensive region to rent in the UK (£2,125 per month), followed by the South East (£1,291), East of England (£1,143) and South West (£1,058).

| Region | Average rent | Annual rental price change | Annual % change |

|---|---|---|---|

| North East | £671 | £60 | 10.5% |

| Northern Ireland | £746 | £20 | 3.2% |

| Scotland | £777 | £90 | 12.9% |

| Yorkshire & The Humber | £781 | £60 | 7.8% |

| North West | £828 | £80 | 11.3% |

| East Midlands | £845 | £80 | 10.5% |

| Wales | £848 | £80 | 10.7% |

| West Midlands | £881 | £80 | 10.1% |

| South West | £1,058 | £90 | 8.8% |

| East of England | £1,143 | £100 | 10% |

| South East | £1,291 | £120 | 10% |

| London | £2,125 | £170 | 9% |

| UK average | £1,201 | £110 | 9.7% |

Rental Market Report, December 2023 (data to October 2023)

The cheapest UK cities to rent a home in 2023

Just because you want cheaper rent, it doesn’t mean you have to move out to the sticks.

The cost of rent varies a huge amount across UK cities, with Aberdeen, Belfast, and Newcastle offering the cheapest average rents.

The only major city where rents are below £700 per month is Aberdeen, where the architecture is gorgeous and the cost of living low.

In Belfast, rents are currently averaging £762 per month - plus it has affordable living costs compared to mainland Britain.

Renters in Liverpool are paying £798 per month to live in the UK’s friendliest city, where rents have risen 9.5% in the last year.

Cities in the Midlands tend to be more affordable, with Birmingham and Nottingham both posting average rents of below £950 per month.

Elsewhere in Scotland, you’ll find a dynamic city lifestyle and cheap rents in Glasgow, where rents average £930 per month. But Edinburgh is much pricier with an average rent of £1,259 per month.

In southern cities, you can expect to pay higher rent than anywhere else in the country. London and Cambridge have the highest monthly rents of any UK city, with Bristol also posting an expensive average rate of £1,374.

| City | Average monthly rent | Annual % change |

|---|---|---|

| Aberdeen | £673 | 9% |

| Belfast | £762 | 3.2% |

| Newcastle | £793 | 11.7% |

| Sheffield | £796 | 7.6% |

| Liverpool | £798 | 9.5% |

| Birmingham | £912 | 10.3% |

| Leeds | £923 | 7.8% |

| Glasgow | £930 | 13.2% |

| Nottingham | £932 | 11.3% |

| Manchester | £1,037 | 12.2% |

| Cardiff | £1,065 | 11.8% |

| Southampton | £1,098 | 11.3% |

| Edinburgh | £1,259 | 15.2% |

| Bristol | £1,374 | 8.8% |

| Cambridge | £1,549 | 8.6% |

| London | £2,125 | 9% |

Rental Market Report, December 2023 (data to October 2023)

The cheapest places to rent in every region

Getting cheaper rent doesn’t mean you have to move to a whole new part of the country, either.

Here’s a breakdown of the cheapest areas to rent in each UK region. It might be that you could get a cheaper rent just by moving a few miles.

| Region | Cheapest area to rent | Average monthly rent |

|---|---|---|

| North East | Hartlepool | £516 |

| Scotland | Dumfries & Galloway | £541 |

| Yorkshire & The Humber | Hull | £594 |

| North West | Burnley | £552 |

| East Midlands | East Lindsey | £643 |

| Wales | Powys | £601 |

| West Midlands | Stoke-on-Trent | £656 |

| South West | Torridge | £754 |

| East of England | Waveney | £740 |

| South East | Isle of Wight | £869 |

| London | Bexley | £1,513 |

Rental Market Report, December 2023 (data to October 2023)

Key takeaways

- Rental inflation for new lets has now dropped below 10% for the first time in 20 months

- The UK rental market is now passed peak growth and we expect rents in 2024 to halve to a growth rate of 5%. That’s the lowest growth since 2021

- London will lead the slowdown with rents expected to increase by just 2% over 2024 as affordability pressures impact demand

What happened to the housing market in 2023?

In 2023 one million homes were sold, as mortgage rates soared to over 6% and house prices fell 1.2%. Let’s take a look at the year that was.

2023 was the year we saw five bank rate rises, with mortgage rates peaking at 6.44% for a two-year fixed rate, 75% loan-to-value deal.

In the first half of the year, house prices began to fall in southern regions of the UK, but held their own in the north, where homes remain more affordable.

But by the end of 2023, prices began falling across all price bands in all regions of the UK.

In total on average, house prices fell 1.2% over the course of the year.

Bank rate rises and mortgage rate hikes

The bank rate rose five times in 2023, in three increments of 0.25% in March, May and August, plus two 0.5% rises in January and June, taking it from 3.5% in January to 5.25% today.

The effect on mortgage rates was dramatic.

The average five-year fixed rate mortgage went from 5.05% in January to peak at 6.37% in early August. It now stands at 5.22%

The average two-year fixed rate mortgage went from 5.43% in January to peak at 6.44% in July. It now stands at 5.94%.

The average standard variable rate mortgage is now an eye-watering 8.74%, up from 6.61% at the start of the year.

The volatility of mortgage rates throughout the year meant that Google was inundated with search queries on the topic: with buyers and homeowners searching up mortgage related information every 23 seconds. That’s 3,757 times a day.

In terms of housing sales, the impact to buying power was felt across the market, as buyers found their budgets effectively reduced by 20% in the face of higher mortgage costs.

What happened to house prices in 2023?

House prices fell 1.2% on average across the UK during 2023. Depending on where you live, your home's value could be down 2.6% or up 1%.

The biggest annual falls have been seen in the East of England (-2.6%), the South East (-2.4%) and London (-2.0%).

And in terms of UK cities, Bournemouth (-2.6%), Southampton (-2.3%) and Cambridge (-2.3%) have been the worst hit.

Scotland (+1%) and Northern Ireland (Belfast house prices are up +2.3%) are the only UK regions where house prices are still rising in December 2023.

The average seller discount now stands at 5.5% or £18,000 off the asking price.

That said, property prices remain well above what they were before the pandemic, even in the places with the biggest house price falls.

That meant the detached homes that became so popular during the pandemic ‘race for space’ proved harder to sell in a more expensive financial market.

Meanwhile flats started to regain popularity, being more affordable for first-time buyers.

Homes sold in 2023

|

Terraced houses |

140,000 |

|

Semi-detached homes |

130,000 |

|

Apartments / flats |

120,000 |

|

Detached homes |

89,000 |

|

Maisonettes |

9,000 |

|

Town houses |

7,000 |

|

Cottages |

6,000 |

|

Land |

4,000 |

|

Studios |

2,500 |

|

Barn conversions |

1,000 |

|

Chalets |

1,000 |

|

Mews houses |

850 |

|

Parking spots |

600 |

|

Country houses |

500 |

|

Blocks of flats |

300 |

|

Farm houses |

223 |

|

Farms |

148 |

|

Houseboats |

57 |

How long did it take to sell a house in 2023?

At the start of 2023, it took 36 days to sell a home on average but by April, that figure reduced to just 29 days. Today, it takes 38 days to sell a home.

Why? At the beginning of the year, the housing market remained fairly buoyant as mortgage rates started to come back down from the highs experienced at the end of 2022.

As rates edged closer towards 4%,demand increased alongside the number of sales agreed.

And while the actual number of homes that went under offer was 16% down on the boom years of 2020-2022, sales numbers were 11% up on 2019.

However, as the year went on, inflation remained stubbornly high and mortgage rates started to creep back up over 5% - and this put the breaks on for some buyers.

What happened to the rental market in 2023?

2023 was a difficult year for renters, with rents for new lets consistently rising at 10% or more for at least 20 months in a row.

Scotland recorded the fastest growing rents at 12.7%, where rent controls pushed landlords to maximise their rents for new lets.

Despite this, demand for rental properties remained strong - holding at 51% above the 5-year average for most of the year.

A shortage of rental properties and lack of growth in supply helped to drive up prices.

Meanwhile, rising mortgage costs affected the rental market in two ways:

-

Landlords began exiting the sector as their rental properties proved less financially viable in terms of income

-

Potential first-time buyers remained in rented accommodation for longer, biding their time in the hope that mortgage rates would start to fall again.

Over the last decade, the average rent as a percentage of gross earnings has tracked in a narrow range between 25% and 28%, averaging around 27.2%.

However, double digit rental growth over the last 20 months now means rental affordability is at its worst level for over a decade at 28.4%.

Levels of home building and net new investment by private landlords are falling and set to remain weak into 2024, largely because of higher borrowing costs.

Key takeaways

- One million homes sold in 2023

- House prices fell 1.2% on average across the UK

- The Bank of England hiked the bank rate five times

- Mortgage rates peaked at 6.44% for a two-year fixed rate

- Standard Variable Rate mortgages hit 8.74%

House prices down, mortgage rates to follow

Sellers are offering their biggest discounts in five years, with one in four offering 10% off the asking price right now, putting buyers in a strong negotiating position.

Jeremy Hunt's Autumn Statement last week revealed that inflation has now fallen from a high of 11.1% to 4.6%.

The government anticipates it will fall to 2.8% by the end of 2024 and to 2% by the end of 2025.

‘Financial markets expect the Bank of England to start cutting rates around the summer of 2024,’ says our Director of Research, Richard Donnell.

‘If mortgage rates start to fall further, this will support an improvement in demand, but prices will remain under modest downward pressure.’

The news couldn’t be better for buyers right now, who have been held back by higher mortgage rates in 2023.

Sellers are currently offering the biggest discounts in five years, with one in four offering 10% off the asking price.

The average discount being offered is 5.5%, the equivalent of £18,000.

In London and the South East, that rises to 6.1%, or £25,000, off the asking price.

Across the rest of the UK, the reduction is smaller at 4.8%, or £11,000, but it’s still the highest level of discounting we’ve seen in recent years.

Much more choice of homes, including popular 3-bed properties

The supply of the UK’s most in demand property type: three and four bedroom houses, is increasing.

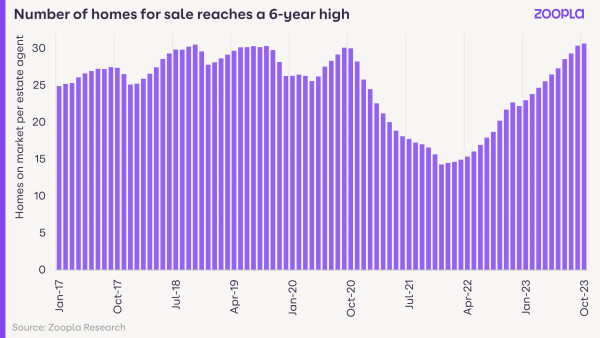

And we’re now seeing record numbers of properties for sale.

During the pandemic years a chronic scarcity of homes on the market pushed up prices.

But this position has now fully reversed, with the highest number of homes for sale per estate agent in six years.

‘The average estate agency branch has 31 homes for sale, compared to a low of just 14 in the middle of the pandemic boom,’ says Donnell.

‘This is boosting choice amongst would-be buyers and providing them with much greater negotiating power with sellers as they agree pricing.’

Buyers have room to negotiate on price

During the pandemic years, buyers had to pay the full asking price to secure a property, but not any more.

‘Over the course of 2023, sellers have been accepting ever larger discounts to the asking price to agree a sale,’ says Donnell.

In the first six months of 2023, those discounts averaged out at 3.4% off the asking price.

This month, the average discount recorded is 5.5%, or £18,000. That’s the largest level of discounting seen since 2018.

And buyers in southern England now have the greatest negotiating power of all. It’s where the biggest discounts are going on, with 6.1% reductions on average asking prices.

‘These discounts reflect the fact that sellers haven't been cutting asking prices very quickly,’ says Donnell. ‘As more sellers adjust asking prices lower, we expect these discounts will start to return to normal levels of 3-4%.’

There couldn’t be a better time to buy in London

London has seen slow price growth over the last seven years of just 8%, while for the rest of the UK, house prices have risen 28%.

Homes in the capital are now seen as better value for money, while a steady return to office working is supporting sales volumes and pricing levels here.

In fact, new sales have rebounded more in London than any other part of the UK over the last 2 months, leading to a slight firming in prices.

What’s going to happen to house prices in 2024?

As we edge towards Christmas, the number of homes for sale will start declining as some sellers take their properties off the market with a view to relaunching in the new year.

But it will remain a buyers’ market in 2024, with no rise in house prices anticipated any time soon.

‘The current repricing of homes has further to run in 2024,’ says Donnell.

‘While 5-year fixed mortgage rates have been falling below 5%, they need to fall further to bring more buyers back into the market.’

Key takeaways

- Sellers are accepting an average discount of £18,000 in November 2023

- In London and the South East, that rises to £25,000

- Buyers are now in a strong negotiation position, particularly in southern England

Autumn Statement 2023: what it means for the housing market

95% mortgage guarantee scheme extended, 40,000 new homes to be built and Local Housing Allowance unfrozen to help renters on the lowest incomes.

There were no huge surprises for the housing market in today’s Autumn Statement.

Rumours of a stamp duty cut to kickstart the market did not come to fruition. But buried in the detail was news that the existing mortgage guarantee scheme would be extended.

The scheme was first introduced in 2021, with the aim of encouraging lenders to offer 95% loan-to-value (LTV) mortgages for buyers with a 5% deposit.

Mortgages issued under the scheme are backed by the Government, meaning if the buyer defaults, the Government will step in to cover some of the shortfall.

The scheme was due to end in December, but will now run until the end of June 2025, in a bid to continue to help prospective borrowers with smaller deposits buy a home.

Our expert's view

Richard Donnell, Executive Director comments: 'First-time buyers continue to be a key engine for the housing market - however they have to rely on the Bank of Mum and Dad.

'Although first-time buyers get a lot of support through stamp duty relief, the big hurdles remain having the income needed to afford a mortgage alongside raising a deposit.

'Extending the mortgage guarantee will help some buyers struggling to borrow for their first property.'

In the last two years since the scheme started in April 2021, it has been used to help 37,800 households, 86% of whom are first-time buyers.

This equates to around 5% of first-time buyers using a mortgage to buy a home between April 2021 and May 2023.

However, in comparison, the Help to Buy equity loan scheme was more generous - helping 387,200 buyers since it started a decade ago, 85% of which were first-time buyers. This scheme helped around 1 in 10 first-time buyers using a mortgage.

'With this in mind, the key to the extension of the Mortgage Guarantee Scheme will be improving its affordability and appeal,' said Donnell.

National living wage increased and National Insurance cut

The Chancellor also focused on boosting incomes for households, which in turn, could help to improve housing affordability.

An increase in the National Living Wage was unveiled, alongside a cut in National Insurance for both employees and self-employed individuals, helping to put more money back into the nation’s pockets.

This news will be welcomed by many as household budgets continue to be squeezed thanks to the ongoing cost-of-living crisis.

This, alongside high mortgage rates, have added further pressure for first-time buyers and home movers, causing property transaction levels and house prices to slump.

Inflation set to hit 2% target in 2025

Improving affordability is one way to help combat this, but with the Bank of England projecting inflation to fall to its target in the first half of 2025, mortgage rates could also fall faster than expected in 2024. If this happens, we could also start to see a rise in house sales.

'The most important focus for the Government should be deploying policies that help support the reduction in borrowing costs for all buyer groups,' says Donnell.

'This needs to be supported by boosting housing supply through new house building and more support for affordable housing schemes to help those on all incomes.'

£110m to boost new homes supply

On house building planning applications, the Chancellor promised to invest more than £110 million this year and next to build 40,000 new homes and boost supply.

He also promised to invest £32 million to 'bust the planning backlog' and develop new housing in cities such as Cambridge, London and Leeds.

An additional £450 million will be allocated to the Local Authority Housing Fund to build around 2,400 new homes.

The Chancellor also announced plans to consult on a new permitted development right, enabling any home to be converted into two flats, so long as the exterior remains unaffected.

Local Housing Allowance rate unfrozen for lowest income renters

Finally, in rental news, the Local Housing Allowance rate, which affects how much help you get when renting from a private landlord, will be increased, having been frozen since 2020.

The increase should help families struggling to afford rising rents and will give 1.6 million households an average of £800 of support next year.

Key takeaways

- Mortgage Guarantee Scheme extended until end of June 2025

- £110 million to be invested in new home developments this year and next to build 40,000 new properties

- Freeze on Local Housing Allowance Funds removed, giving 1.6 million households an average of £800 of support for their rental costs next year

What does Jeremy Hunt’s Autumn Statement 2023 mean for household budgets?

Living wage and pensions rise as National Insurance comes down. What does Jeremy Hunt’s Autumn Statement mean for household budgets?

Chancellor Jeremy Hunt unveiled his Autumn Statement this afternoon, announcing a rise in the living wage and pensions.

National Insurance will be cut from January and inflation is on track to reach 2% by the end of 2025.

Here’s what happened:

Wages

The national living wage will rise from £10.42 an hour to £11.44 an hour, working out as an average increase of £1800 a year for a full-time worker.

Pensions

The state pension is set to rise 8.5% or £900 a year.

The chancellor also announced plans for employees to ask a new employer to pay contributions into existing pension pot, if they so choose, rather than being asked to adopt a company’s specific pension scheme.

National insurance contributions

National Insurance will be cut from 12% to 10% from January 6th, saving a worker earning £35,000 a year £450.

Nurses will save an average of £520 a year, police officers £630 a year.

National Insurance relief will also continue to be provided for businesses supporting veterans until April 2025.

Self employed

In recognition of the plumbers, delivery drivers and farmers who kept the country running throughout the pandemic, self-employed taxes will be simplified and reformed.

Class 2 National Insurance contributions, which are a flat rate of £3.45 a week for those earning up to £12,500 a year, will be abolished, saving the self-employed £192 a year.

Class 4 NI contributions of up to 9% for those earning between £12,300 and £50,270 a year will be cut to 8% from April, saving two million people an average of £350 a year.

Inflation

Following the worst global inflation shock for a generation, inflation fell last week to 4.6%

The government anticipates it will fall to 2.8% by the end of 2024 and to 2% by the end of 2025.

The Chancellor thanked the Bank of England for its role in helping to bring it down and pledged to support families in financial difficulty.

Universal credit increased and housing benefit freeze ended

‘Cost of living pressures remain at their most acute for the poorest families,’ said Hunt.

Universal credit is now set to rise 6.7% in line with September’s inflation rate, the equivalent of £470 for 5.5 million households next year.

And because the cost of rent can take up to half of the living costs for those that rent on the lowest incomes, the Local Housing Allowance will also no longer be frozen, as it has been since 2020.

Housing benefit will now cover the bottom 30% of local rents from April 2024, providing an extra £800 of support for 1.6m households.

Welfare reforms

The Chancellor announced a ‘Back to work’ plan for the 100,000 new people who claim benefits every year because of sickness or disability, ‘where treatment, rather than time-off becomes the default’.

If a Universal Credit claimant in England and Wales has failed to find a job after 6 months, they will be referred to an expanded and improved Restart scheme, providing 12 months of intensive, tailored support including coaching, CV and interview skills, plus training sessions.

Claimants who are still unemployed after 12 months on Restart will be required to accept a time-limited mandatory work placement.

If a claimant refuses to accept without good reason, their Universal Credit claim will be closed. This model will be rolled out gradually from 2024.

Cigarettes & booze

Aside from the government’s plans for a smoke-free generation (prohibiting the sale of tobacco products to anyone born after January 1, 2009), from today, duty rates on all tobacco products will increase in line with inflation +2% .

For hand-rolling tobacco, an extra 10% tax increase will be added, meaning it will increase in line with inflation + 12% this year.

Confirming the Brexit pubs guarantee, the chancellor confirmed that all duty on alcohol will be frozen until 1st August 2024, meaning there will be no increase on beer, cider, wine or spirits.

Clean energy

The UK is currently a world leader in the deployment of offshore wind - and plans to create new offshore wind farms are underway, including floating wind farms in the Celtic Sea.

A further £2 billion is being set aside for a target of zero emissions in the automotive sector.

Overall growth

Last autumn, the Office for Budgetary Responsibility forecast that the economy would shrink 1.4%.

But it has grown and is now 1.8% larger than it was pre-pandemic, meaning the UK economy has grown faster than those of Spain, Portugal, France, Italy, the Netherlands, Germany and Japan.

It’s predicted to grow 0.6% this year and 0.7% next year.

Key takeaways

- National living wage rises from £10.42 to £11.44 an hour

- Pensions up 8.5% or £900 a year

- National Insurance cut from 12% to 10% from January 6, 2024, meaning a worker earning £35,000 a year will be £450 better off

5 surprising reasons for the 3-bed home shortage

Feel like three bedroom homes are hard to get your hands on? It’s not just you. An imbalance of supply and demand is making three bedroom homes hot property, and here’s why.

Three bedroom homes for sale are hard to come by at the moment, and it’s because everyone wants one - from first-time buyers to retirees.

There’s an imbalance of supply and demand for three bedroom properties, making them among the quickest selling of any property type in the country.

But what’s causing it? What’s put three bedroom homes at the top of everyone’s list?

We’ve done some digging, and it turns out there’s a few reasons. Let’s take a look.

1. Older homeowners want to host Christmas

Our survey of 2,000 UK homeowners aged over 65 found that 41% live in a home which is ‘larger than they need’.

And a huge 9 in 10 homeowners aged 65+ have at least one spare bedroom. This equates to a massive 10 million spare bedrooms that growing families would love to get their hands on.

These homeowners have lived in their current home for more than a quarter of a century on average. So it’s easy to see why they might find it hard to move on.

22% say emotional ties are a barrier to moving, while more than a quarter (27%) say they’d be concerned about being able to host Christmas if they downsized.

But downsizing can often release capital, cut energy bills, reduce mortgage repayments or even make homeowners mortgage-free. Hosting might be off the cards, but that’s not to say Christmas is ruined.

2. First-time buyers are older than ever

The age Brits buy their first home has been rising, and first-time buyers are now aged 34 on average - compared to 30 a decade ago.

It means many first-time buyers are skipping the one-bedroom flat or two bedroom starter home in favour of a family home.

With first-time buyers making up 34% of buyers in the market, that’s a large proportion joining the hunt for family-sized properties.

Our data shows that 40% of first-time buyer enquiries are for three bedroom houses. That makes them an even bigger buyer group for this type of property than people moving house, who enquire about three bedroom properties 38% of the time.

| Type of buyer | Property | Percentage of enquiries |

|---|---|---|

| Mover | 3 bed house | 38% |

| Mover | 4+ bed house | 22% |

| First-time buyer | 3 bed house | 40% |

| First-time buyer | 4+ bed house | 9% |

Zoopla data, October 2023

3. The stress of moving house in old age

Those who own a home larger than they need reckon it takes them an additional 12.6 hours and £91 per month to maintain, compared to a more suitably-sized property.

But despite this extra work and cost, 25% of older homeowners are put off selling by the stress of moving house ‘at their age’.

No one can deny it’s a stressful process. If you’re in a dreaded chain, everything can feel as delicately balanced as a stack of cards.

What’s more, the housing market is slower than it was over the last three years. Higher mortgage rates make the market a little more uncertain, as people find it harder to be approved for finance.

Not to mention, costs are higher for everything from removals to repairs. This adds financial pressure to the process, no matter your age.

For many, it’ll be about weighing up if the time and money you’ll save in the long-run is worth the short-term stress of moving.

4. Terraces and semis with three bedrooms sell among the quickest of any property type

Speed of sale is an important indicator of buyer demand. The quicker a property type sells, the more buyers are interested in that sort of property.

Three bedroom terraced houses and three bedroom semi-detached houses are 2 of only 3 property types selling faster than the national average of 34 days.

They sell in 31 and 32 days respectively, with only two bedroom terraces selling quicker at 28 days.

However, if your budget can stretch to a three bedroom detached house, you’re likely to have more choice and less competition.

Three bedroom detached houses are taking 43 days to sell, the second longest behind only four bedroom detached houses (47). It’s a symptom of the higher average cost of detached houses - they require larger mortgages which means less demand at the moment.

5. Three bedroom terraces are in highest demand

The table shows the percentage share of buyer enquiries and supply of homes for sale of different property types.

The biggest gap between demand and supply is for three bedroom terraces. They make up almost 20% of enquiries in the market in October 2023, but only represent 12% of homes for sale.

Three bedroom semi-detached houses have the next highest imbalance between demand and supply.

Three bedroom detached houses, on the other hand, have a much lower level of demand. Detached homes are usually more expensive, so this is another reflection of higher mortgage rates limiting buyer demand for this type of property.

Key takeaways

- New research shows there aren’t enough three bedroom homes on the market to satisfy current demand

- They’re a popular choice for all types of buyers - from first-time buyers who are preparing for children to older generations who still want to host Christmas

- Most older homeowners live alone or with their partner, but still have 2 or more spare rooms

- There are an estimated 10 million spare rooms across the UK as 9 out of 10 homeowners aged 65+ have extra bedrooms they don’t use

Rents for new lets rise £1,300 in a year

Rents rise 10% for the 20th month in a row, but in London and the more expensive areas of southern England, the pace of inflation is starting to slow.

Demand for rental properties is currently running at 27% above the 5-year average.

Over the last year, the average rent for a new let increased by 10.1% to stand at £1,166 per month.

That means the average annual rental bill is nearly £1,300 higher than it was a year ago, standing at almost £14,000, compared to £12,700 last September.

This marks the 20th consecutive month of our index reporting rental inflation of over 10%.

However, for renters staying in their existing homes, year-on-year rises are much slower at 5.7%, according to the Index of Rental Prices from the Office for National Statistics.

The table below shows the rates at which rents have increased across different regions of the UK.

Average rent increases by region: November 2023

| Region | Avg rent today | Avg rent 12 months ago | Annual % change | Annual £ change |

|---|---|---|---|---|

| Scotland | £753 | £663 | 12.8% | £90 |

| North West | £799 | £719 | 11.7% | £80 |

| Wales | £817 | £737 | 10.4% | £80 |

| London | £2,057 | £1,867 | 10.3% | £190 |

| East Midlands | £819 | £739 | 10.1% | £80 |

| East | £1,115 | £1,015 | 9.9% | £100 |

| South East | £1,256 | £1,146 | 9.8% | £110 |

| West Midlands | £855 | £785 | 9.6% | £70 |

| North East | £651 | £601 | 9% | £50 |

| South West | £1,020 | £940 | 8.7% | £80 |

| Yorkshire & The Humber | £761 | £701 | 8.6% | £60 |

| Northern Ireland | £744 | £704 | 5% | £40 |

| UK | £1,166 | £1,056 | 10.1% | £110 |

Zoopla

Rental inflation in Scotland boosted by rent controls

Scotland is registering the highest level of rental inflation in the UK at 12.8%.

That’s because landlords are pushing to maximise rents for new tenancies in order to cover increased costs - and to allow for the fact that future rent increases will be limited over the life of the tenancy.

The average rent in Scotland stands at £753, which is £90 higher than a year ago.

Rental inflation in Scotland has now started to moderate down from highs of 13.7% back in February, but we expect it to continue rising at above-average levels.

Rents are growing at the fastest rate in the cities of Edinburgh (16.6%) and Glasgow (13.4%) .

But renters looking for new lets in areas between these two cities will also notice sharp increases: in Falkirk rents are up 14.7% year-on-year, while in North Lanarkshire they’ve risen 13.9%.

In the more sparsely populated areas north and west of Edinburgh and Glasgow, rental inflation is less dramatic, with North Ayrshire, Moray and the Highlands all registering rental growth below 5%.

Rental inflation slows down in England’s southern cities

Over the last 12 months, rental inflation has slowed down in southern England’s most expensive cities.

The largest moderation is happening in London, where rental inflation has decreased from 17% a year ago to 10.4% today.

The inner London boroughs were the first places to see rental inflation fall below 10%.

However, outer London areas such as Harrow, Barking and Dagenham and Redbridge continue to register rental growth above 13.5% - some of the highest increases in the UK.

The second and third largest slowdowns are recorded in Bristol and Brighton, where rental inflation fell to 8.8% and 6.0% respectively.

Rental inflation in the coastal communities of Hastings (6.7%), Newport (8.9%) and Blackpool (5.5%) is also more aligned with earnings growth (8.5%).

Those reductions show us that landlords are becoming more realistic in pricing their rentals, taking into consideration the cost-of-living struggles.

What are renters doing to minimise the impact of higher rents?

Faced with higher rents and a limited supply of homes on the market, renters are more commonly considering renting smaller homes, moving to cheaper areas or sharing properties with other renters to reduce costs.

Renters sharing does reduce the cost per person but it comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We expect rental inflation to remain above 9% for the rest of the year as earnings growth remains strong - and while higher mortgage rates are stopping many renters from moving into home ownership.

We currently anticipate national rental growth of 5-6% in 2024 - but rent increases in cities are likely to be higher.

Key takeaways

- Rents for new lets have risen by more than 10% for the 20th month in a row

- Scotland is seeing the biggest rises, where rent controls are encouraging landlords to secure higher rents upfront

- In more expensive areas, such as London and the south, rental inflation is starting to slow

What's going to happen to the UK housing market in 2024?

Our forecast reveals our housing market predictions for next year. So what will 2024 have in store?

Housing market mortgage rate predictions for 2024

Mortgage rates look set to remain higher for longer into 2024 and we’re not expecting them to fall back to 4.5% until H2 2024.

That means housing affordability will really only improve if people are able to earn more money and their incomes grow.

The ongoing rise in wages will be the main factor that supports sales volumes for the housing market in 2024.

What’s going to happen to house prices in 2024?

UK house prices are expected to fall 2% over 2024.

Homes are currently looking expensive by historic standards amid rising mortgage rates over the last 18 months.

If house prices fall further and incomes increase, or mortgage rates fall back, affordability will improve for home buyers and this in turn will support sales.

The number of homes for sale has now reached a 5-year high, meaning sellers will need to keep pricing competitively if they’re serious about selling. This will keep pricing under pressure.

In 2023, the south of England bore the brunt of house price falls but those falls are now spreading further afield.

Today, 4 in 5 housing markets are registering annual price falls, up from less than 1 in 20 just six months ago.

But crucially, the scale of price falls is modest and limited to very low single digits. No markets are currently registering annual price falls of more than 5%.

However in 2024, we expect to see an increase in markets registering 5% falls, as sellers continue to adjust their asking prices in the face of weaker buying power.

Despite this, the risk of a major collapse in prices is becoming less of a concern, and an improvement in sales hinges more on buyers’ financial ability to move when mortgage rates are in the 4-5% range.

And while the likelihood of a double-digit price drop remains low, housing affordability needs to improve to bring more buyers back into the market and to support sales volumes.

How can housing affordability improve?

Right now, house prices haven’t fallen as much as expected, while mortgage rates remain at 5% or higher, so housing still looks expensive by recent standards.

Faster growth in household incomes over 2024 would improve buyers’ affordability, along with mortgage rates falling over 2024.

Household finances have also been under pressure from rising living costs, with inflation eroding any growth in incomes.

Fortunately, this is now reversing at last and the Bank of England currently projects that inflation will fall to its target of 2% in the first half of 2025.

This, along with a real income growth, will be important in supporting buyer demand.

Housing market could rebound if affordability improves

Our Executive Director of Research, Richard Donnell, says there is scope for a rebound in market activity if affordability improves.

‘The housing market is adjusting to higher borrowing costs through lower sales rather than a big decline in house prices.

‘Asset prices around the world are also adjusting to higher borrowing costs and there is a lively debate in financial circles about the long-run outlook for borrowing costs, which sets the outlook for mortgage rates.

‘Most agree we aren't returning to the years of very cheap borrowing as central banks sunset policies that created cheap money to support economies after the global financial crisis and over the pandemic.

‘Mortgage rates of 4-5% remain low by historic standards, albeit higher than in recent years.

‘Assuming mortgage rates remain in the 4-5% range, we see UK house price growth remaining in the low single digits for the next 1-2 years, below the projections for growth in household incomes.’

This would mean that for the first time in ten years, house prices would start to become more affordable, increasing consumer confidence in making large purchase decisions.

Why haven't house prices fallen more?

There are three reasons why house prices haven’t tumbled, defying predictions for larger falls in 2023:

1: The economy is growing, albeit slowly, while unemployment remains low and incomes are increasing.

2: Lenders are supporting customers to refinance through longer term mortgages, interest-only mortgages and mortgage holidays, limiting the number of forced sellers.

3: Tougher affordability criteria from lenders has meant that while new mortgaged buyers may have been paying just 2% for their mortgages, they’ve still had to prove to their bank they could afford a 7% rate.

That has meant that mortgaged buyers could afford higher rates as they remortgaged.

However, banks are now stress testing new borrowers at 8-9% rates, even though they're actually paying 5%, which is compounding the reduction in buying power and hitting sales.

Homes are currently over-valued and prices likely to fall further

The chart below plots our measure for how much house prices are over- and under-valued over time.

It shows periods of over-valuation in the late 1980s and again in the runup to the global financial crisis in 2007, after which house prices fell over the subsequent recessions.

Will more buyers return to market in 2024?

We expect to see the usual seasonal rebound in demand next spring as pent-up demand returns to the market.

However, the number of sales taking place is set to be lower than spring this year.

General Elections also tend to create a pause in activity, which is why we expect another year with 1m home moves in 2024.

It will be five years since the last general election on December 17 2024. If a general election isn’t called by then, parliament would automatically be dissolved and the election would take place 25 working days later: January 28, 2025.

If mortgage rates fall back to 4% more quickly, the number of sales set to take place would improve.

Buyers are currently hesitant to move amid the uncertainty over house price falls and higher mortgage rates.

This is particularly the case with upsizers looking to secure larger family homes.

Our recent consumer survey reveals parts of the population are still keen to move, but many are hoping and/or waiting for mortgage rates to get lower again before they do.

Cash buyers set to be the biggest buying group in 2024

The biggest group of buyers in 2024 is set to be cash buyers, followed by first-time buyers, as rents continue to rise.

Upsizers are being hit hard by higher mortgage rates, as the larger properties they’re looking to secure require bigger mortgages.

But if they can be encouraged to be more flexible about what they want to buy and where in 2024, this would support overall sales volumes.

Key takeaways

- House prices expected to fall 2% over 2024

- Rising incomes expected to steadily improve housing affordability

- Mortgage rates expected to fall back to 4.5% by the end of 2024

The top locations where you can avoid paying stamp duty

If you're a home mover looking to save money, buying a property under the stamp duty threshold could save you thousands. Here's where to find the most homes under £250,000.

Stamp duty land tax - or SDLT - is the tax you pay when you buy property or land over a certain price in England and Northern Ireland.

Scotland and Wales also have an equivalent tax but different rates apply.

In England and Northern Ireland, no tax is paid if a property is priced below £250,000 and you are an existing homeowner.

Different thresholds apply for first-time buyers, who can buy a property up to £425,000 without paying the tax.

Those buying a home that won’t be their primary residence will pay an additional 3% surcharge on the entire price of the property.

And buyers from overseas will pay an additional 2% surcharge.

Why is it important to know about stamp duty before buying?

A stamp duty bill can be a small or run into tens of thousands of pounds for high value properties. And where you are looking to buy can also affect the amount you pay.

Here's what an existing homeowner would pay in stamp duty for the average-priced UK home (£265,000) cross the UK.

Stamp duty paid on a £265,000 property in the UK

-

£745 in England and Northern Ireland

-

£2,850 in Scotland

-

And £3,200 in Wales

Right now, nearly 1 in 3 (31%) properties listed on Zoopla are priced below the local stamp duty threshold for homeowners. This translates to over 140,000 homes that are available to buy without incurring a tax bill.

Where can homeowners find a home without paying stamp duty?

The percentage of homes under the stamp duty threshold across the UK

| Region/Country | Avg house price | Proportion of homes below stamp duty threshold | No. of homes on Zoopla below threshold |

|---|---|---|---|

| North East | £139,700 | 76% | 9,500 |

| Yorkshire & The Humber | £185,400 | 57% | 17,200 |

| North West | £193,500 | 57% | 23,100 |

| West Midlands | £228,700 | 46% | 15,100 |

| East Midlands | £229,000 | 45% | 14,600 |

| Wales | £204,200 | 43% | 9,300 |

| Scotland | £160,300 | 35% | 6,500 |

| South West | £316,100 | 29% | 13,000 |

| East of England | £340,200 | 23% | 11,800 |

| South East | £388,900 | 20% | 16,700 |

| London | £540,800 | 5% | 4,000 |

| UK | £264,900 | 31% | 140,800 |

Zoopla

Our historical analysis shows that 60% of all stamp duty receipts are paid in the South East and London.

This is down to homes in the south being priced at a higher level than those elsewhere in the country, so finding a home below the tax threshold will be harder here.

Only 1 in 6 homes listed for sale on Zoopla in southern England is priced below the stamp duty threshold of £250,000.

In the Midlands, close to a half of homes listed for sale would be under the threshold.

Meanwhile, in the North of England, where homes are among the most affordable in the UK, we find that 3 in 5 homes could be bought without paying the tax.

This increases to three-quarters in the North East specifically, where the average house price is below £140,000.

In Scotland and Wales, where the stamp duty tax is different to that in England, we find 35% and 43% of homes don’t qualify for tax if bought by an existing homeowner.

This is because the threshold for exemption is lower.

In Scotland the Land and Buildings Transaction Tax threshold kicks in at £175,000.

In Wales, the Land Transaction Tax begins at £225,000.

In contrast to most of England, both of these thresholds are below the average house price for each of the respective regions.

Regional towns have the highest number of homes under the SDLT threshold

The availability of homes exempt from stamp duty varies and is closely linked to the house prices in a given area. This creates differences in the availability of tax-exempt homes within regions too.

We find the largest spread of property values in Yorkshire and the Humber: currently only 21% of homes on the market in York are under the £250,000 threshold - yet 89% of homes up for sale in Hull are priced below £250,000.

We register a similar spread in Wales, where 13% of homes for sale in Monmouthshire sit below the £225,000 LTT threshold, while 78% of homes on the market in Blaenau Gwent are priced below £225,000.

Across the UK as a whole, the largest proportion of homes exempt from stamp duty can be found in the regional towns of northern England.

When it comes to local authorities, Hull has the largest proportion of stamp duty-exempt homes on the market for existing homeowners, with 89% of properties currently priced below the £250,000 threshold.

Hull is closely followed by Blackpool, Middlesbrough and Hartlepool, where 87% of homes would not be subject to any stamp duty land tax.

All of these areas are either the cheapest - or among the cheapest - areas to buy within their respective regions, with average house prices below £125,000.

Looking beyond northern England, where average house prices exceed £200,000, homes that would avoid a stamp duty bill are less common, but not impossible to find.

Nearly 4 in 5 properties are exempt from stamp duty in Stoke-on-Trent, which is the highest proportion anywhere in the Midlands.

Plymouth is the winner in the South, with just over half of homes on the market below the homeowners’ stamp duty threshold.

Where to find homes exempt from stamp duty across the UK

| Region | LA with highest proportion of homes under SDLT threshold | % of homes for sale | Avg house price |

|---|---|---|---|

| Yorkshire & The Humber | Hull | 89% | £113,200 |

| North West | Blackpool | 87% | £122,800 |

| North East | Middlesborough | 87% | £114,100 |

| Wales | Blaenau Gwent | 79% | £127,800 |

| West Midlands | Stoke-on-Trent | 78% | £132,600 |

| East Midlands | Boston | 67% | £178,200 |

| Scotland | West Dunbartonshire | 59% | £109,100 |

| South West | Plymouth | 53% | £201,200 |

| East of England | Norwich | 50% | £228,500 |

| South East | Southampton | 46% | £223,100 |

| London | Barking & Dagenham | 22% | £334,100 |

Zoopla

The areas where it's harder to avoid stamp duty

Most stamp duty payments come from the south of the UK.

With the highest house prices anywhere in the country, it comes as no surprise that London has the fewest homes that could be bought without incurring a stamp duty bill.

Only 1 in 20 homes listed for sale in the capital would qualify for an exemption and in October this year, only 4,000 homes in the capital were marketed below the £250,000 threshold.

Half of them were concentrated in 8 boroughs on the edges of London: Croydon, Hillingdon, Sutton, Barking & Dagenham, Havering, Hounslow, Bromley and Bexley.

Outside of the capital, Edinburgh has the second lowest concentration of homes below the land and buildings transaction tax threshold of £175,000.

Only 1 in 20 homes listed for sale in the Scottish capital is exempt from the tax.

Other high-value areas in the South East and East of England also have a very limited number of homes priced below the homeowner’s stamp duty threshold.

Only 1 in 17 homes in Elmbridge and St Albans and 1 in 14 homes marketed in Hertsmere would be exempt from stamp duty land tax.

How can I find a home that won’t cost me any stamp duty?

Now that you know which areas won’t cost you a stamp duty bill, it’s time to check them out on Zoopla to see if they have the home you’re looking for.

Our price filters will help you find a home that both fits your budget and falls below the stamp duty tax threshold.

You can also use Stamp Duty calculator to find out more about stamp duty, the different rates charged and how it may impact your next home purchase.

Key takeaways

- Most of them can be found in the north east, Yorkshire and the Humber and the north west. In fact in the north as a whole, 3 in 5 make the cut

- In southern England, only 1 in 6 homes for sale is priced below the £250,000 threshold

- London and Edinburgh are where homeowners are least likely to find a home exempt from the tax