New-build homeowners save £1,685 a year on energy bills

New data reveals the huge energy savings found with new-build homes, cutting bills by 57% or £1,685 a year on average.

Research from the Home Builders Federation released in May 2024 has shown the significant savings offered by new-build homes compared to older properties.

The average new-build energy bill is 57% cheaper than for older properties, equating to savings of £1,685 a year for those who live in a new-build home.

|

Type of new-build home |

Energy efficiency of new build versus similar older property |

Average monthly saving of a new build |

Average annual saving of a new build |

|

House |

+66% |

£183 |

£2,195 |

|

Flat |

+45% |

£71 |

£850 |

|

Maisonette |

+56% |

£120 |

£1,440 |

|

Bungalow |

+62% |

£124 |

£1,480 |

Homes built to new sustainability regulations from June 2023 onwards are proving to be the most energy efficient options on the market.

The research found that these newest builds save homeowners more than £2,000 on annual energy bills, which rises to £2,575 for houses specifically.

85% of new-build homes achieve an A or B EPC rating

85% of new-build homes achieve an A or B Energy Performance Certificate (EPC) rating compared to less than 5% of older properties.

An EPC rating is an assessment of how much energy your home uses per square metre and how much carbon dioxide it produces.

It takes into account things like the roof, walls, insulation, windows, heating system, lighting and renewable energy solutions. A is the top mark, showing a home has best-in-class energy efficiency.

What makes new-build homes more energy efficient?

New-build homes have energy efficiency built in from the very start of their construction. Everything from the materials to the building techniques are designed to keep heat in and use less energy.

Cavity wall insulation means the gaps between the inner and outer walls of a new-build home are filled with things like mineral wool, polystyrene beads or polyurethane foam. This helps store heat by bouncing it back into the home, rather than letting it escape through draughts.

High-efficiency heating systems also use less energy to generate more heat, while double or triple glazing, low energy lighting and dual flushes all use less energy than conventional equivalents.

New builds also come with brand new A+ appliances, which dramatically reduce the amount of energy used by your dishwasher, washing machine and other white goods.

Key takeaways

- 85% of new-build homes achieve an A or B Energy Performance Certificate (EPC) rating compared to less than 5% of older properties.

- New-build homes are more energy efficient because these considerations are built in from the very start of their construction.

- New-build homes are fitted with cavity wall insulation, double or triple glazing, and brand new A+ appliances which all contribute to a more energy-efficient property.

Bank Rate holds at 5.25%, so when will rates drop?

The Bank Rate has remained unchanged for the sixth time in a row since it was raised from 5% to 5.25% in August 2023. Meanwhile, average mortgage rates on two- and five-year fixed rate deals have increased for the first time in six months.

The Bank of England has kept the Bank Rate at 5.25% for the sixth time in a row.

The Bank’s Monetary Policy Committee (MPC) has voted by a majority of 7-2 to keep the Bank Rate unchanged at 5.25%.

Two members wanted to cut the rate by 0.25%, to 5%. This marks a slight shift from the last vote in March, when only one member voted to reduce the Bank Rate.

The Bank Rate, sometimes known as the 'base rate’ or ‘interest rates’, affects the rates that lenders charge their borrowers. It has remained at a 16-year high of 5.25% since last August.

Why has the Bank Rate been held again?

The Bank has been using interest rates as a way of controlling inflation. It raised interest rates from 0.1% at the end of 2021 to 5.25% last August.

The good news is that the Consumer Prices Index (CPI), a key measure of inflation, has fallen from 11.1% in October 2022 to 3.2% today.

However, 12-month CPI inflation dropped less than expected in March, prompting some people to speculate that interest rate cuts could be pushed back. The Bank has an inflation target of 2%.

The latest decision on interest rates was widely expected. The Bank said that while progress in key economic data is 'encouraging', it needs more evidence that inflation will stay low before it cuts interest rates.

The Bank added that lower oil and gas prices mean that inflation is expected to fall to around 2% before 'increasing slightly' in the second half of the year, to around 2.5%. It’s hoped it will then edge down again.

What does this mean for borrowers?

Borrowers on variable or tracker mortgages will be relieved that their rate is unlikely to go up. Though they’ll be disappointed the Bank Rate wasn’t cut.

According to Moneyfactscompare.co.uk, the average standard variable rate (SVR) is at 8.18%, down from 8.19% last November. The rate has stayed at this level since the start of April.

Meanwhile, borrowers locked into fixed-rate mortgages will not be impacted - yet. But borrowers who come off fixed-rate deals and remortgage soon are likely to see their mortgage repayments jump, squeezing household budgets further.

Annual mortgage repayments for the average buyer are now a staggering 61% higher than they were three years ago, before mortgage rates started climbing.

It means that in pure monetary terms, they have soared from £7,100 to £11,400. Two thirds of that hike is fuelled by higher mortgage rates, while one third is due to higher house prices.

First-time buyers are finding it tricky to afford mortgage repayments in the first place. Because of recent interest rate rises, mortgage affordability is now the biggest challenge for first-time buyers, according to the Building Societies Association (BSA).

But Nick Leeming, chairman of Jackson-Stops, points out that interest rates of around 5% are not high by historical standards.

“It’s important to keep in mind that, while the past 18 months have been a time of economic headwinds, the exceedingly low rates that became the norm in the 2010s were the exception and not the rule,” Leeming explains.

“A pivot towards lower rates in June, even if only minor, would help to ease affordability constraints at the lower end of the housing market and help to ensure chains don’t break down once sales have been agreed.”

What is the forecast for interest rates?

The Bank is generally expected to cut interest rates this year (assuming there’s no surprises in store). But opinions on when exactly this could happen, and by how much, naturally vary.

Mark Harris, chief executive of mortgage broker SPF Private Clients, believes it’s time for rate setters to be bold and start reducing rates: “The Bank was always likely to hold rates this month, and we expect June’s meeting to have a similar outcome.

“That said, by that point there should have been two further lots of improving inflation data, reinforcing the argument for cutting rates by the end of the summer.”

Leeming adds: “While no change was widely assumed, the expectation is that June’s meeting will finally break the base rate deadlock and initiate a rate cut.”

Will mortgage rates go down in 2024?

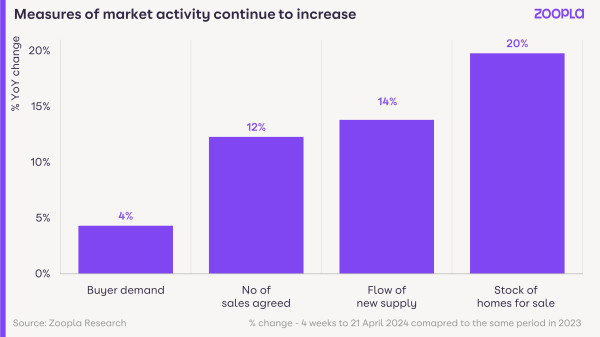

The housing market has been relatively stable in recent months. The number of sales agreed are now 12% higher than this time last year.

This improving picture is echoed in the Bank of England’s recent mortgage approval figures.

The number of mortgages given the green light in March stood at 61,300, edging up from 60,500 the previous month. Monthly mortgage approvals are now close to the 65,000 level seen during the three years leading up to the pandemic, says Hina Bhudia, Partner, Knight Frank Finance.

But in a blow to borrowers, mortgage rates have climbed in recent weeks. Big names including Nationwide, NatWest and Santander have raised rates on fixed-rate mortgages.

According to Moneyfactscompare.co.uk, the average two-year and five-year fixed rate was 5.91% and 5.48% respectively on 1 May, compared with 5.8% and 5.39% at the start of April.

That said, two major lenders provided a glimmer of hope this week, cutting some rates. Harris says: “With Barclays and Lloyds already announcing reductions this week, hopefully it is only a matter of time before other lenders follow suit.”

Our Executive Director of Research, Richard Donnell, believes that even if inflation and interest rates edge down, mortgage rates are unlikely to drop much further this year.

Donnell explains: “Lower interest rates would likely result in further modest declines in mortgage rates but how far depends on how low money markets see base rates falling.

“Economists currently expect base rates to fall to 3.5% by the end of 2025, which would imply mortgage rates remaining in and around the 4%+ range.”

Despite an improved outlook overall, Lucian Cook, head of residential research at Savills, also thinks it’s unlikely there’ll be a further “meaningful” fall in mortgage rates this year.

He adds: “However the highly competitive nature of the mortgage market has meant that mortgage costs have already nudged down this year, and have been much less volatile. Combined with an improved outlook for economic growth, and increased buyer confidence, we can now expect modest house price growth this year.”

Key takeaways

- The Bank of England has voted by a majority of 7-2 to keep the Bank Rate at 5.25%

- It’s the sixth time in a row that the rate has remained unchanged

- The Bank says that while progress in key economic data is “encouraging”, it needs to see more evidence that inflation will stay low before it cuts the Bank Rate.

Will mortgage rates go down in 2024?

Mortgage rates are not expected to fall further this year, but rising wages are likely to improve affordability for buyers as house prices stay flat.

In June last year, the average five-year fixed-rate loan for a 75% loan-to-value mortgage peaked at 5.8%, adding hundreds of pounds to monthly mortgage repayments for buyers and homeowners.

Today, that same mortgage has now fallen to an average rate of 4.4%.

Here’s how that difference pans out in terms of monthly mortgage payments.

Monthly repayments on a five-year fixed-rate 75% LTV over 25 years

|

Mortgage value |

£200,000 property value, 25% deposit |

£300,000 property value, 25% deposit |

£400,000 property value, 25% deposit |

£500,000 property value, 25% deposit |

|

5.8% monthly repayments |

£1,106 |

£1,422 |

£1,896 |

£2,370 |

|

4.4% monthly repayments |

£962 |

£1,237 |

£1,650 |

£2,063 |

Mortgage rates unlikely to drop below 4% in 2024

However, buyers holding out for lower mortgage rates in 2024 may be disappointed, as they are unlikely to decline much further this year, even if inflation and the Base Rate edge lower.

Our Executive Director of Research, Richard Donnell, says: ‘Expectations of lower interest rates are already priced into fixed rate mortgages today.

‘Lower interest rates would likely result in further modest declines in mortgage rates but how far depends on how low money markets see base rates falling.

‘Economists currently expect base rates to fall to 3.5% by the end of 2025, which would imply mortgage rates remaining in and around the 4%+ range.’

Why are mortgage rates going down?

Mortgage rates began to go down in the latter half of 2023, as inflation dropped from 6.3% in September to 4.2% in December. In February this year, inflation dropped to 3.8% and is expected to meet its 2% target in the coming months.

However, the Bank of England has held the base rate at 5.25% since August 2023, as inflation has stayed higher for longer than expected. It is expected to cut the base rate when it meets in June this year - and by the end of 2025, it's expected to lower it to 3%.

The bank rate determines the interest rate the Bank of England pays to commercial banks that hold money with them. It influences the rates those banks charge people to borrow money or pay on their savings.

What factors affect interest rates?

Inflation is the main reason interest rates are high in the UK at the moment. An unexpected rise in demand - or decrease in supply - can cause inflation to rise.

At the end of 2021, the Bank of England began to raise the base rate in order to reduce inflation and help slow down price rises for everyday items including food, petrol, gas and electricity.

It is working - and inflation has fallen a lot, but the Bank of England needs to keep the base rate high enough to ensure inflation comes back to its 2% target.

Global shocks can also have an impact on inflation, such as wars, pandemics or the blockage of major transport routes like the Suez Canal, as they affect the flow of goods around the globe.

How buyer affordability could improve in 2024

All that said, there are other ways in which buyer affordability is likely to improve this year: and that’s wages rising while house prices hold steady.

This trend is happening already, and it’s improving confidence among buyers.

‘Rising household disposable incomes are expected to be the primary driver of improved housing affordability over 2024,’ says Donnell.

‘Disposable incomes are projected to increase by 3.5% over 2024, while house prices look set to remain broadly flat over the year.’

In fact, momentum in the housing market is already ticking up and the number of sales agreed has climbed 9% year-on-year.

This, in turn, is encouraging more sellers to come to market, improving the choice available for buyers.

More choice for buyers in 2024

Currently there are 20% more homes for sale than there were in spring 2023, with the average estate agent having around 30 homes on their books.

And more choice for buyers means more opportunity for wriggle room when it comes to paying the asking price.

‘Our view is that a greater availability of homes for sale will keep price rises in check,’ says Donnell.

‘In Q1 2024, the average estate agent had almost 30 homes for sale, a return to the pre-pandemic average.

‘This means buyers have more choice and room to negotiate, especially where homes are failing to attract buyer interest in a timely manner.’

Affordable areas remain popular with buyers

While momentum is up among buyers and sellers across the UK, in more challenging mortgage rate times, it’s the affordable areas that are proving to be the biggest draw for buyers.

‘Sales activity is up across the board, with the strongest growth in sales taking place in areas with more affordable house prices, such as Yorkshire and the Humber (11%) and the North West (13%),’ says Donnell.

Meanwhile, the strongest growth in new sellers listing homes can be seen in the South West (28%) and North East (26%).

Over in the capital, the supply of homes for sale is just 8% higher, which means house prices are rebounding faster here than other parts of the UK, as more buyers compete for properties.

Asking price discounts narrow as house prices hold steady

While it remains a buyers’ market right now, buyers should know that the discounts being offered by sellers are starting to get smaller.

Towards the end of 2023, nearly half of sellers were offering discounts of 5% or more. That figure has now shrunk to two-fifths.

Similarly, the average discount offered at the end of last year was 4.5%, (£14,250). Today, it’s 3.9% (£10,000).

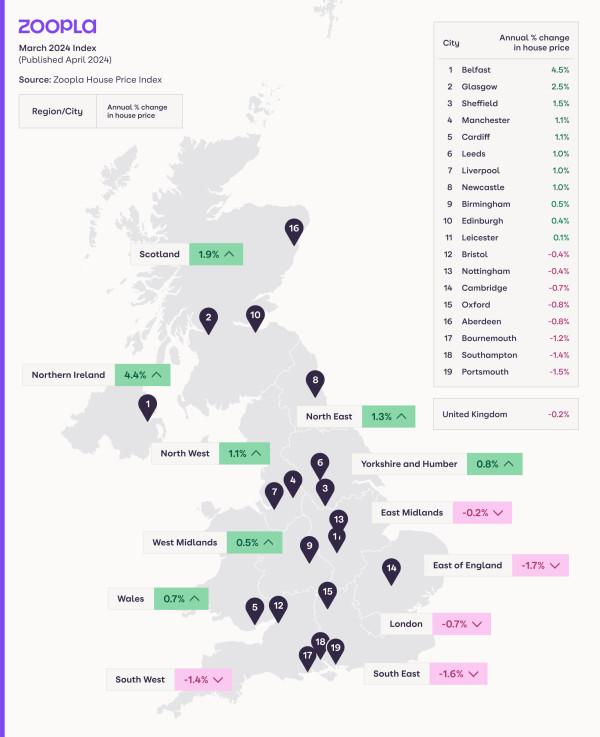

There continues to be a north/south divide in house prices, with homes in the south continuing to register house price falls as homes in the north see house price growth.

But all areas are recording higher annual price inflation than six months ago, as sales volumes recover and pricing levels firm.

So while there’s still room to negotiate, house prices are starting to hold steady in 2024 and we don’t expect to see a further fall in property prices this year.

Key takeaways

- Mortgage rates expected to stay in and around 4+% for the rest of 2024

- House prices will hold steady as rising wages improve affordability

- 20% more homes available for buyers in spring 2024

- Average agent now has 30 homes on their books

Housing affordability more of a challenge in southern England

The challenges facing first time buyers and uspizers right now all boil down to one thing: affordability. And buyers in the south of England are suffering the most on this front. Our Executive Director of Research, Richard Donnell, takes a look at what’s happening in the housing market.

The divide in market activity between the south of England and the rest of the UK is becoming starker on the back of higher mortgage rates.

Why are homes in the south more expensive?

After the global financial crisis in 2007, house prices in southern England rebounded, largely led by London. By 2014, house prices in London were rising at a rate of 20% year-on-year.

In 2015, mortgage regulations were introduced to prevent households taking on unsustainable levels of debt, which can lead to a boom/bust cycle for house prices.

However, those regulations came a little too late for southern England, where prices had already jumped ahead.

Since 2016, we have seen house price inflation under-perform, especially in London, and one key reason for that is the impact of those mortgage regulations.

They’ve meant that buyers have needed to inject more equity into the home they want to buy, in order to make their mortgage repayments more affordable.

The impact of stress testing mortgages and limiting high loan-to-income lending has since led to a decrease in buying power, which in turn has created a cap on demand.

Incomes needed by first-time buyers across the UK

The chart below shows the gross household income needed to rent and buy a typical first-time buyer priced home.

If a buyer is taking out an 80% loan-to-value mortgage (using a 20% deposit) at a rate of 4.5%, the income needed to repay it is broadly the same across most of the UK.

However, because house prices are higher in southern England, for the same type of property, buyers will need to be earning considerably more: well over £100,000.

When that purchase is then stress tested to an 8.5% mortgage rate, the income needed to secure the property jumps even higher, thereby ultimately reducing the number of people who can afford to buy it.

Data from the Office for National Statistics reveals that first-time buyer incomes are generally lower than the income needed for mortgage lenders’ stress-testing rates.

So, first-time buyers are getting around this problem by putting down larger deposits.

This enables them to get their loan-to-value percentage for their mortgage down, so that they can then afford to buy their home at the current stress-testing rates - and their monthly mortgage repayments then become more affordable.

Average first-time buyer deposit in London hits £145,000

In London, this approach means the average first-time buyer needs to have a £145,000 deposit and an annual income of £90,000.

It’s a similar but less extreme position across the rest of the south of England.

However for the rest of the UK, where house prices are lower, the average deposits needed to secure a home and the mortgage repayments for it look more manageable for more would-be buyers.

Calls for higher LTV loans to be made available, alongside the loosening of mortgage regulations, would help FTBs, but they would simply add to buying power, rather than delay the needed reset in affordability.

High LTV lending is very hard to achieve across southern England and consequently 95%+ lending here is a niche lending segment.

What industry solutions might help first-time buyers?

Long-term fixed rate mortgages are an option but this is a market that needs Government support to get off the ground.

Long term mortgages could potentially avoid the need to run a stress test on the borrower at a higher mortgage rate but the ‘loan to income flow’ limit would limit the size of the market: currently lenders are only able to lend 15% of their customers loans of over 4.5x their current income.

It is likely that we will see lenders look to review how they stress test new borrowers, such as applying lower stress rates for 5+ year fixed rate loans.

This flexing of affordability at the margins will help some borrowers. But it wont deliver the reset we need to open up the market to more buyers who don’t currently have access to the levels of equity needed.

With mortgage rates unlikely to get much lower in the short term, incomes growth is going to have to do the hard work in resetting affordability across southern England.

First time buyers adapting to market conditions

Our data shows first-time buyers in southern England are adapting, looking at areas with better value for money for the type of home they need as well as considering smaller homes at lower price points.

We have seen a shift to flats, which have attracted less demand in recent years, as first-time buyers targeted 3 bed homes at lower prices where there was the potential to improve the home.

The average value of a flat in London is just 3% higher than at the start of 2016. This compares to a 13% average increase for flats nationally and 39% for a house in the UK. This underperformance has made flats more affordable relative to incomes and explains the increase in demand.

Buyers should know though, that flats are often sold under the leasehold, which can mean additional running costs such as service charges and ground rents.

Key takeaways

- In 2014, London house prices were rising at a rate of 20% year-on-year

- In 2015, mortgage regulations began to include stress tests, often at rates 3% higher than the mortgage deal being offered

- This has reduced buying power in the south, where homes are more expensive

- In 2024, the average first-time buyer in London needs to have a £145,000 deposit and an annual income of £90,000

Average rent in London: April 2024

The average rent in London is now £2,121 per month after +4.2% growth in the last year. The cheapest average rent is in Bexley (£1,520) and the highest average rent is in Kensington and Chelsea (£3,459), although rental increases are slowing in the most expensive parts of the city.

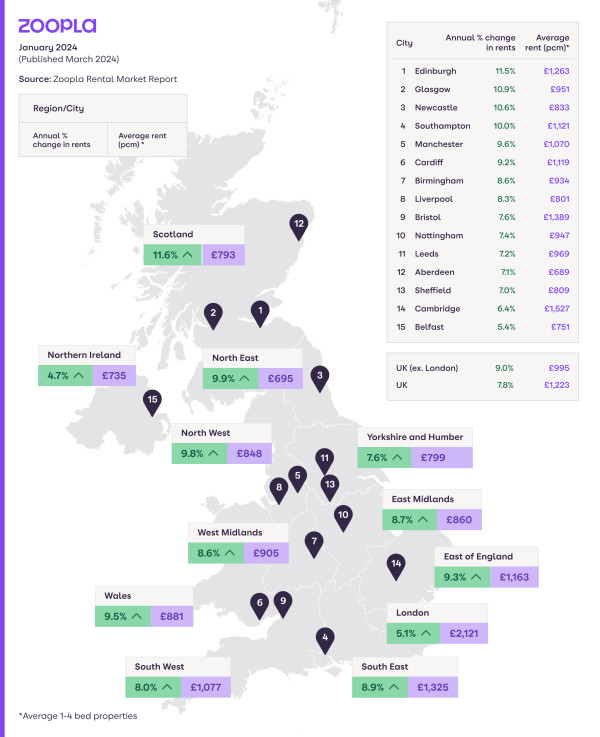

London is by far the most expensive place to rent a home in the UK with an average rent of £2,121 for new lets. Average rents in London are almost double the UK average of £1,220.

However, rental inflation in London has slowed in the last 12 months, now at +4.2% versus +14.8% a year ago. This is lower than UK-wide growth of +7.2% over the last year.

Average rental prices in London

|

Average monthly rent in London in February 2024 |

% change in the last 12 months |

£ change in the last 12 months |

|---|---|---|

|

£2,121 |

+4.2% |

+£90 |

Average rent by borough in London

The table sets out the average rent for every local authority in London, starting with the cheapest. It also shows how much rents for new lets have increased in the last 12 months in each location.

|

Local authority area |

Average monthly rent |

% change in the last 12 months |

£ change in the last 12 months |

|

Bexley |

£1,520 |

10.40% |

£140 |

|

Croydon |

£1,541 |

8.70% |

£120 |

|

Sutton |

£1,547 |

11.80% |

£160 |

|

Havering |

£1,584 |

12.90% |

£180 |

|

Bromley |

£1,609 |

8.10% |

£120 |

|

Enfield |

£1,649 |

9.40% |

£140 |

|

Hillingdon |

£1,656 |

9.50% |

£140 |

|

Barking and Dagenham |

£1,657 |

11.30% |

£170 |

|

Redbridge |

£1,721 |

11.60% |

£180 |

|

Lewisham |

£1,741 |

5.00% |

£80 |

|

Harrow |

£1,775 |

9.10% |

£150 |

|

Waltham Forest |

£1,783 |

11.00% |

£180 |

|

Kingston upon Thames |

£1,801 |

6.80% |

£120 |

|

Hounslow |

£1,845 |

6.10% |

£110 |

|

Greenwich |

£1,866 |

4.80% |

£90 |

|

Barnet |

£1,890 |

7.00% |

£120 |

|

Haringey |

£1,919 |

7.90% |

£140 |

|

Brent |

£1,948 |

4.70% |

£90 |

|

Ealing |

£1,957 |

7.00% |

£130 |

|

Merton |

£1,979 |

5.30% |

£100 |

|

Newham |

£1,984 |

4.00% |

£80 |

|

Richmond upon Thames |

£2,098 |

6.00% |

£120 |

|

Lambeth |

£2,182 |

3.60% |

£80 |

|

Southwark |

£2,219 |

4.60% |

£100 |

|

Hackney |

£2,332 |

4.80% |

£110 |

|

Tower Hamlets |

£2,333 |

2.30% |

£50 |

|

Islington |

£2,384 |

4.50% |

£100 |

|

Wandsworth |

£2,385 |

4.80% |

£110 |

|

Hammersmith and Fulham |

£2,619 |

4.30% |

£110 |

|

City of London |

£2,625 |

1.50% |

£40 |

|

Camden |

£2,672 |

3.80% |

£100 |

|

City of Westminster |

£3,155 |

1.30% |

£40 |

|

Kensington and Chelsea |

£3,459 |

3.10% |

£100 |

Rental growth has slowed the most in Inner London boroughs, which are also commonly the most expensive with average rents sitting well above £2,000 per month. For example, the average rent in Kensington and Chelsea and the City of Westminster exceed £3,000 but growth has stalled to +3.10% and +1.30% respectively.

This slowdown is a response to affordability challenges and lower demand for new lets in the centre of the capital. It suggests landlords are becoming more realistic in pricing their rentals and may be taking cost-of-living struggles into consideration when setting new rates, which tend to be exacerbated for those in the rental market.

However, the experience of renters in Outer London is a different story, with ongoing double-digit rental inflation in several areas. The rises stretch to +12.9% in Havering, where the average annual rental bill is now £2,160 more expensive than a year ago.

Rents have also risen by more than +11% in the last year in more affordable boroughs of Sutton, Redbridge, Barking and Dagenham, and Waltham Forest.

The chart shows how rents have risen in London boroughs over the last year, highlighting the difference between inner and outer boroughs.

What’s next for the London rental market in 2024?

We expect the growth of London rents to slow to around +2% on average in 2024.

It’ll be a reprieve for London renters as they already face the highest rents and lowest affordability of anywhere in the country. The average renting household in London (1.25 people) already spends 40.4% of their earnings on rent compared to a UK average of 28.4%.

Average rent in the UK: February 2024

Demand from London renters will continue to drop as many cannot afford further rent rises amidst other affordability pressures.

London renters will continue to look for lower rental prices in the outer boroughs and nearby commuter towns, which will keep average rents rising more quickly in these places.

Key takeaways

- London’s average rent is currently £2,121 after +4.2% growth in the last year

- Growth has slowed from +6.4% last month and +14.8% a year ago

- The current annual increase is lower than the UK as a whole as London rents have started to reach an affordability ceiling

- The borough of Bexley has the cheapest average rent in London at £1,520 but rents are rising quickly in these comparatively cheap spots on the outskirts

- Rents are much higher in Inner London boroughs like Kensington and Chelsea, the City of Westminster and Camden - but rents are rising more slowly at between +1% and +4%

Sales on the up as house prices hold steady

Buyer confidence is improving and 12% more homes are going under offer compared to this time last year. Mortgage approvals for home purchases are also up 32%.

The housing market is now more balanced than it was before the pandemic, which is good news for sellers, as it means more people have a chance of moving home in 2024.

The number of homes available for sale is continuing to grow but house price inflation remains broadly static.

And static house prices are good for buyers, who are already struggling to cope with a 60% increase in mortgage payments in 2024.

Meanwhile, more homes for sale and renewed buyer confidence means more sales are being agreed: in fact sales agreed are up 12% compared to this time last year.

And for the first four months of 2024, the number of homes going under offer has also been higher than in the first 4 months of 2023.

Our Executive Director of Research, Richard Donnell, says: ‘The housing sales pipeline is now rebuilding after a period of lower sales, when mortgage rates spiked higher in 2022 and 2023.

‘Our data shows that the housing market remains on track for 1.1m sales completions in 2024, up 10% on 2023.’

Mortgage approvals up more than 30%

Mortgage approvals for home purchases went up 32% year-on-year in February 2024, marking another return towards pre-pandemic levels.

‘The 4 to 6+ month time lag between agreeing a sale ‘subject to contract’ and moving in, means sales completion data is yet to register an upturn but this will emerge in the coming months,’ says Donnell.

House prices firming as market activity improves

House prices are continuing to hold steady right now, and annual house price inflation is largely unchanged since last month. It currently stands at -0.2% at the end of March 2024.

‘House prices continue to fall, at a slowing rate, across five English regions covering southern England and the East Midlands, with prices down the most in the East of England (-1.7%),’ says Donnell.

‘However, in the north of England, West Midlands, Wales, Scotland and Northern Ireland, house price inflation has moved into positive territory, with prices in Belfast rising by 4.5%.’

Higher mortgage rates continue to affect buyer affordability

In southern England, where homes are more expensive, buyers are being hit harder by higher mortgage rates, low income growth and rising living costs.

This, in turn, is affecting house prices, as sellers set lower asking prices in order to attract a sale. Our data shows that 95-100% of homes in southern England are in markets where prices are currently falling.

However, at a national level, only 64% of homes are in markets registering annual price falls. Back in October last year, that number was much higher: 82%.

‘The scale of these price falls is relatively modest, in most cases between 0% and -3%,’ says Donnell.

‘We expect house prices to continue to firm over 2024 but we don’t expect house price inflation to start accelerating. The current trends in price inflation, and the divergence between the south and the rest of the UK, are expected to continue over the coming months.

‘Much depends on the outlook for interest rates and how this influences mortgage rates. Fixed rate mortgages today already reflect expectations for interest rate reductions in the future and we don’t expect any major changes in average mortgage rates over the rest of the year.

‘What the housing market needs most is continued price stability, which will create the right environment for continued growth in sales.’

Key takeaways

- Sales agreed volumes up 12% year-on-year as house prices stay static

- Homes in the south are currently seeing negative price inflation in the UK

- 64% of homes are in markets with price falls, but this is down from 82% last October

Mortgage repayments up 60% since 2021

Home buyers are currently facing an annual increase of £4,300 on their mortgage repayments, rising to £7,500 in London.

How much have mortgages risen since 2021?

Across the whole of the UK, the average buyer is having to find an extra £4,320-a-year to pay their mortgage in 2024, when buying an average priced home with a 30% deposit.

Back in 2021, the average annual mortgage payment was £7,000. Today, it’s £11,400.

And higher mortgage rates are hitting southern England the hardest.

In London, the average buyer will need to find an extra £7,500-a-year to cover the cost of their mortgage, which is now amounting to £23,000-a-year. In 2021, that figure was closer to £15,000.

In the South East, annual repayments on mortgages have risen by £6,000, while in the South West, they’ve gone up by £5,300 a year.

Across the rest of the UK, the picture is less bleak, with buyers in the Midlands needing to find an extra £3,900, while buyers in the North East are paying an extra £2,350.

Our Executive Director of Research, Richard Donnell, says: ‘At a region and country level there has been a 50% to 70% increase in mortgage repayments for a typical buyer between 2021 and 2024.

‘The largest monetary impact is in southern England, where house prices are higher. The annual cost of mortgage repayments for an average priced home is more than £5,000 higher per annum in 2024 than 2021 across the South West, South East, East of England.

‘Two thirds of this increase is a result of higher mortgage rates. However, one third is also down to the fact that average house prices are still 13% higher than they were in March 2021.’

Annual mortgage payments across the UK: 2021 vs 2024

We’re all missing the ultra-low lending rates enjoyed in 2021

Since 2022, mortgage rates have spiked twice: at the end of that fateful autumn budget year and again in the summer of 2023, as interest rates increased to combat rising inflation.

Aside from massively reducing purchasing power for buyers and spare income for homeowners, higher mortgage rates have also affected the housing market in two major ways:

-

A 23% drop in sales over 2023

-

Modest house price falls

And while the average mortgage rate for a 5-year fix at 75% loan-to-value has fallen back to 4.5% in recent months, rates are starting to drift higher again amid shifting expectations for interest rate cuts later this year.

Our view is that mortgage rates will average out at 4.5% over 2024. However, affordability remains a challenge for buyers and first-time buyers, as mortgages are now costing an average of 60% more than they did three years ago.

Mortgage rates set to plateau at 4.5% this year

While, in good news, the Bank of England’s base rate looks to have reached a plateau, the reality is that the annual mortgage repayments for a typical buyer using a 70% LTV loan for an average priced home are still much higher than 3 years ago.

‘This continues to act as a drag on buying power and levels of house price inflation,’ says Donnell.

‘When mortgage rates started to rise, we reported that the shift from 2% mortgage rates to 5% would deliver a 30% reduction in buying power for mortgaged home buyers, assuming the borrower kept their repayments and deposits the same,’ says Donnell.

‘Buyers withdrew from the market in the face of higher borrowing costs and general uncertainty over the economic outlook and this drove transactions lower over 2023.’

Then there’s stamp duty to think about

Stamp duty is a tax that’s mainly paid by homebuyers in the south of England, since it only kicks in on properties over £425,000 for first-time buyers, or £250,000 for home movers in England.

What are buyers doing in the face of higher mortgage rates?

Buyers are open to widening their searches in the hunt for better value homes.

And while they aren’t looking to compromise on the size of the home they need or the number of bedrooms they require, some are looking further afield to secure the right home for them and their families.

Our latest consumer research shows that a third of households who want to move are now looking beyond their local area to secure the home they require.

In fact, despite higher mortgage rates, confidence among buyers is high, and the number of sales agreed is now 12% higher than this time last year.

And for the first 4 months of 2024, the number of sales agreed has been higher than the first 4 months of 2023.

More choice in the number of homes available is enticing more buyers back to market.

‘The housing sales pipeline is now rebuilding after a period of lower sales when mortgage rates spiked higher in 2022 and 2023,' says Donnell.

‘Our data shows that the housing market remains on track for 1.1m sales completions in 2024, up 10% on 2023.’

Key takeaways

- The annual mortgage repayments for the average buyer in 2024 have now reached £11,400

- In London, that figure rises to more than £23,000-a-year

- Buyers in the south east are paying £16,600-a-year, while in the east of England, annual repayments average out at £14,530

The highest yielding areas for buy-to-let property in the UK

Considering becoming a landlord? One strategy for investment is to focus on higher yielding markets. Here are the top investor hotspots in the UK.

Ready to become a landlord and want the biggest return on your investment?

It’s worth getting to grips with rental yield if you’re purchasing a buy-to-let property.

Gross rental yield is the annual rental income expressed as a percentage of the property price. Net rental yield also factors in the cost of maintaining and renting out the rental property. Both can help you decide if a property is a good investment.

The average gross rental yield in the UK is currently 5.60%. This is based on the average buy-to-let property costing £261,897 and the UK’s average rent being £1,223, according to our latest data.

Gross yields have improved across all regions in the last year as house prices have started to fall or remained the same while rents have continued to rise.

Keep in mind that tenant demand and the potential for house price growth - among other factors - should also be considered with property investment.

Top cities for rental yields in the UK

Sunderland, Aberdeen and Burnley top the chart for the highest rental yields in the UK, with average gross yields over 8%.

The top 17 cities for rental yields in the UK are all in the North of England and Scotland. In contrast, southern cities tend to have much higher house prices, bringing the gross yield down for buy-to-let properties.

Here’s how every city in the UK compares for gross rental yield.

|

City |

Average gross rental yield |

Average monthly rent |

Average price of a buy-to-let property |

|

Sunderland |

8.96% |

£626 |

£83,842 |

|

Aberdeen |

8.03% |

£689 |

£102,920 |

|

Burnley |

8.00% |

£566 |

£84,869 |

|

Dundee |

7.96% |

£774 |

£116,690 |

|

Glasgow |

7.95% |

£951 |

£143,617 |

|

Middlesbrough |

7.92% |

£613 |

£92,862 |

|

Blackburn |

7.52% |

£661 |

£105,460 |

|

Hull |

7.45% |

£612 |

£98,617 |

|

Newcastle |

7.45% |

£833 |

£134,245 |

|

Liverpool |

7.44% |

£801 |

£129,172 |

|

Stoke |

7.38% |

£735 |

£119,562 |

|

Grimsby |

7.16% |

£608 |

£101,883 |

|

Barnsley |

7.15% |

£684 |

£114,805 |

|

Bradford |

7.02% |

£692 |

£118,267 |

|

Blackpool |

6.98% |

£692 |

£119,049 |

|

Wigan |

6.96% |

£752 |

£129,656 |

|

Swansea |

6.92% |

£867 |

£150,377 |

|

Preston |

6.91% |

£784 |

£136,148 |

|

Rochdale |

6.85% |

£815 |

£142,781 |

|

Bolton |

6.80% |

£790 |

£139,483 |

|

Doncaster |

6.79% |

£678 |

£119,911 |

|

Leeds |

6.67% |

£969 |

£174,269 |

|

Coventry |

6.66% |

£1,015 |

£182,782 |

|

Nottingham |

6.64% |

£947 |

£171,146 |

|

Cardiff |

6.59% |

£1,119 |

£203,663 |

|

Wakefield |

6.56% |

£737 |

£134,826 |

|

Birkenhead |

6.54% |

£713 |

£130,914 |

|

Manchester |

6.53% |

£1,070 |

£196,603 |

|

Huddersfield |

6.42% |

£704 |

£131,596 |

|

Mansfield |

6.41% |

£732 |

£137,105 |

|

Plymouth |

6.39% |

£878 |

£164,771 |

|

Sheffield |

6.38% |

£809 |

£152,051 |

|

Southampton |

6.34% |

£1,121 |

£212,118 |

|

Newport |

6.32% |

£879 |

£166,835 |

|

Warrington |

6.30% |

£863 |

£164,258 |

|

Derby |

6.28% |

£798 |

£152,479 |

|

Gloucester |

6.28% |

£945 |

£180,449 |

|

Peterborough |

6.24% |

£907 |

£174,548 |

|

Belfast |

6.16% |

£751 |

£146,190 |

|

Ipswich |

6.16% |

£879 |

£171,273 |

|

Portsmouth |

6.14% |

£1,161 |

£226,802 |

|

Birmingham |

6.10% |

£934 |

£183,628 |

|

Medway |

6.09% |

£1,176 |

£231,635 |

|

Luton |

6.08% |

£1,145 |

£226,150 |

|

Northampton |

6.08% |

£977 |

£192,858 |

|

Edinburgh |

6.03% |

£1,263 |

£251,423 |

|

Swindon |

6.03% |

£969 |

£192,908 |

|

Telford |

5.92% |

£809 |

£164,075 |

|

Norwich |

5.83% |

£1,065 |

£219,141 |

|

Leicester |

5.77% |

£924 |

£192,229 |

|

Bournemouth |

5.68% |

£1,243 |

£262,577 |

|

Bristol |

5.66% |

£1,389 |

£294,503 |

|

Hastings |

5.58% |

£1,016 |

£218,348 |

|

Worthing |

5.52% |

£1,171 |

£254,618 |

|

Reading |

5.48% |

£1,412 |

£309,293 |

|

Aldershot |

5.47% |

£1,325 |

£290,646 |

|

Crawley |

5.46% |

£1,376 |

£302,547 |

|

MiltonKeynes |

5.41% |

£1,202 |

£266,589 |

|

Brighton |

5.39% |

£1,616 |

£360,102 |

|

York |

5.22% |

£1,111 |

£255,222 |

|

Southend |

5.15% |

£1,152 |

£268,305 |

|

London |

4.95% |

£2,047 |

£496,124 |

|

Oxford |

4.79% |

£1,667 |

£417,737 |

|

Cambridge |

4.50% |

£1,527 |

£407,603 |

Top regions for rental yields in the UK

Rents in the North East are cheaper than anywhere else in the country (£695) - and so are buy-to-let properties, at £109,072 on average. This gives the region the highest average yield in the UK of 7.65%.

It’s followed by Scotland (7.48%), the North West (6.66%), Wales (6.43%) and Yorkshire and the Humber (6.38%). Gross yields in these regions have risen over the last 3 months as rents have risen faster than house prices.

London offers the lowest gross yields in the UK of 4.93% on average, only 0.1 percentage point higher than 3 months ago. With higher mortgage rates, new regulations and low house price growth in recent years, rents appear to have reached an affordability ceiling and tenant demand is starting to moderate.

The East of England and South East also offer lower gross yields of 5.28% and 5.34% respectively. However, their rental yield has improved on last year as they are the two regions where house prices have fallen the most.

|

Region |

Average gross rental yield |

Average monthly rent |

Average price of a buy-to-let property |

|

North East |

7.65% |

£695 |

£109,072 |

|

Scotland |

7.48% |

£793 |

£127,284 |

|

North West |

6.66% |

£848 |

£152,719 |

|

Wales |

6.43% |

£881 |

£164,388 |

|

Yorkshire and the Humber |

6.38% |

£799 |

£150,261 |

|

Northern Ireland |

6.11% |

£735 |

£144,423 |

|

West Midlands |

5.95% |

£905 |

£182,531 |

|

East Midlands |

5.84% |

£860 |

£176,730 |

|

South West |

5.37% |

£1,077 |

£240,472 |

|

South East |

5.34% |

£1,325 |

£297,971 |

|

East of England |

5.28% |

£1,163 |

£264,539 |

|

London |

4.93% |

£2,121 |

£516,295 |

The highest yielding areas in each part of the UK

Looking for a buy-to-let property near where you live can be useful. You know the area, understand local influences on the market and can work closely with a nearby letting agent.

So it helps to know which parts of your region offer the greatest rental yield. Here are the top 3 local authorities for average yields in each UK region.

North East: 7.65% average gross yield

-

County Durham: 7.81% gross rental yield

-

Darlington: 7.52% gross rental yield

-

Gateshead: 7.75% gross rental yield

Scotland: 7.48% average gross yield

-

Renfrewshire: 9.56% gross rental yield

-

East Ayrshire: 9.50% gross rental yield

-

West Dunbartonshire: 9.09% gross rental yield

North West: 6.66% average gross yield

-

Burnley: 8.40% gross rental yield

-

Blackpool: 7.80% gross rental yield

-

Preston: 7.55% gross rental yield

Wales: 6.43% average gross yield

-

Blaenau Gwent: 7.58% gross rental yield

-

Neath Port Talbot: 7.44% gross rental yield

-

Merthyr Tydfil: 7.40% gross rental yield

Yorkshire and the Humber: 6.38% average gross yield

-

Hull: 7.45% gross rental yield

-

North East Lincolnshire: 7.16% gross rental yield

-

Barnsley: 7.15% gross rental yield

West Midlands: 5.95% average gross yield

-

Stoke-on-Trent: 7.72% gross rental yield

-

Coventry: 6.66% gross rental yield

-

Newcastle-under-Lyme: 6.65% gross rental yield

East Midlands: 5.84% average gross yield

-

Nottingham: 7.27% gross rental yield

-

Mansfield: 6.57% gross rental yield

-

Boston: 6.50% gross rental yield

South West: 5.37% average gross yield

-

Plymouth: 6.39% gross rental yield

-

Gloucester: 6.28% gross rental yield

-

Swindon: 6.03% gross rental yield

South East: 5.34% average gross yield

-

Southampton: 6.62% gross rental yield

-

Gosport: 6.46% gross rental yield

-

Portsmouth: 6.45% gross rental yield

East of England: 5.28% average gross yield

-

Great Yarmouth: 6.42% gross rental yield

-

Peterborough: 6.24% gross rental yield

-

Fenland: 6.17% gross rental yield

London: 4.93% average gross yield

-

Barking and Dagenham: 6.22% gross rental yield

-

Newham: 5.89% gross rental yield

-

Bexley: 5.68% gross rental yield

What’s the outlook for buy-to-let property investment in the UK?

The heat is coming out of UK rent rises. Annual growth is now at the lowest rate for two years, down to +7.8% from +11% a year ago as demand has dropped by a fifth in that time.

However, there are still more than 15 enquiries for every home to rent - double the rate of before the pandemic. And new investment from private landlords remains low, with the average letting agent currently listing 12 homes for rent. This is a fifth higher than last year but 28% below the pre-pandemic average (16 homes).

While the supply and demand imbalance has started to narrow, it is far from closed, so we project that UK rental inflation will be around +5% over 2024.

The outlook for buy-to-let investment also hinges on house prices, which we expect to remain broadly the same this year. With rents generally rising faster than house prices, we can expect gross rental yields to increase in 2024.

What is rental yield?

Rental yield is the amount of money you make from a rental property each year against the cost of purchasing and running it. It’s always expressed as a percentage.

The gross yield only takes the cost of the property and the rental income into account.

The net rental yield, on the other hand, considers the extra costs of running the property, like maintenance and property management.

To figure out the best investment property for you, it’s worth looking at both of these yields as well as other factors.

Why is rental yield important?

Before you jump into buying a property to rent out, you've got to figure out if it’s a worthwhile venture.

If your rental income doesn't cover your costs, or you're just breaking even, unexpected expenses like fixing a broken boiler or a leaky roof can impact your finances.

So looking at the potential rental yield will help you do the maths and make sure it’s a good investment.

What else to think about with a buy-to-let property

There’s more to choosing a good buy-to-let property than just the rental yield.

You could buy a property with a strong yield, but if house prices aren’t rising or you can’t find tenants, it might not be the best investment.

House price trends

Get a feel for house price growth to see if the property is likely to rise in value. Look at historic sale prices for individual properties as well as value increases for the postcode and local area.

The cost of a buy-to-let mortgage

At the same time, you need to think about the costs of taking out a buy-to-let mortgage and all the other associated costs of running a rental property.

Tenant demand

It also helps to understand what tenant demand is like in the area and what sort of properties they’re looking for.

Speak to a letting agent to find out what’s happening in the local rental market. They’ll be able to share what tenants are looking for and which properties could be a strong buy-to-let investment.

How to work out your gross rental yield

Let’s say you want to buy a property worth £200,000. You plan to charge £1,000 per month in rent, which works out to £12,000 per year. Divide 12,000 by 200,000, then multiply by 100. That equals a gross yield of 6%.

(Annual rent / property value) x 100 = gross rental yield

How to work out your net rental yield

To work out your net rental yield, you need to take your extra costs off your annual rental income.

So add up the amount of money you think you’ll spend over the year. This will include paying the mortgage, agency fees, property maintenance, and any costs you might incur to keep up with regulations.

Then deduct these costs from your annual rental income, and do the same sum from there.

[(Annual rent - annual costs) / property value] x 100 = net rental yield

Let’s say you’re buying the same £200,000 property and charging the same £12,000 per year in rent.

But you’re spending £300 on maintenance and agency fees, which comes to £3,600 over the year.

That means your net rental yield for this property is 4.2%.

Key takeaways

- If you’re looking for a buy-to-let property, rental yield can help you decide if the cost of the property is worth the potential rental income

- Gross rental yields have increased in the last year as rents have risen at a faster rate than house prices

- The highest yielding cities in the UK are Sunderland, Aberdeen and Burnley, which offer average gross yields of 8%+

- The North East is the best region for investors looking for strong yields, offering an average of 7.65%

- We reveal the three highest yielding areas in every region of the UK

- Take other factors into account before you invest, like tenant demand and the potential for future house price growth

The UK’s cheapest places to rent a home in 2024

Looking for a rental home that doesn’t cost an arm and a leg? Here’s your complete guide to the cheapest places to rent in the UK in 2024.

The UK’s average rent is now £1,223, a rise of +7.8% in the last year.

That’s the lowest level of rent rises for 2 years as the heat finally comes out of the rental market. Demand has dropped a fifth in a year and supply has risen by a fifth in the same period.

However, we still expect rents to rise in 2024, although a little more slowly. This is because rental demand is double the rate of before the pandemic, with 15 enquiries for every home to rent. At the same time, supply of rental homes remains 28% below the pre-pandemic average.

So with rents still rising and the cost-of-living squeeze pushing all our purses to the limit, you might be looking for a cheaper home to rent.

The good news is there are places where it’s much cheaper to rent a home than others. Let’s take a look at the regions, cities and local areas with the cheapest rents in the UK.

The cheapest places to rent in 2024: Regions

For the cheapest rents in the country, set your sights on the North East - you could expect to spend an average of £695 per month on rent here. It’s also the only region with no rental markets averaging more than £1,000 per month.

Northern Ireland, Scotland, Yorkshire and the Humber, and the North West all sit at the cheaper end of the scale too, with rents averaging less than £800 per month at the start of 2024.

As you may expect, rents across the South of England are much more expensive.

London’s average rent of £2,121 per month makes it almost twice as pricey as anywhere else. However, London renters will be glad to hear it has recorded the sharpest slowdown in rent rises, now at +5.1% compared to +15.3% a year ago.

The capital’s high rents are followed by the South East (£1,325), where nearly all private rental homes are now in areas with average rents higher than £1,000 per month. In 2020, that figure was less than 50%.

Then you’ve got the East of England (£1,163), where 70% of homes sit in £1,000-rent markets, and the South West (£1,077), with more than half now over that benchmark.

|

Region |

Average rent in 2024 |

Annual change in average rent (%) |

Annual change in average rent (£) |

|

North East |

£695 |

9.9% |

£60 |

|

Northern Ireland |

£735 |

4.7% |

£30 |

|

Scotland |

£793 |

11.6% |

£80 |

|

Yorkshire and the Humber |

£799 |

7.6% |

£60 |

|

North West |

£848 |

9.8% |

£80 |

|

East Midlands |

£860 |

8.7% |

£70 |

|

Wales |

£881 |

9.5% |

£80 |

|

West Midlands |

£905 |

8.6% |

£70 |

|

South West |

£1,077 |

8.0% |

£80 |

|

East of England |

£1,163 |

9.3% |

£100 |

|

South East |

£1,325 |

8.9% |

£110 |

|

London |

£2,121 |

5.1% |

£100 |

The cheapest places to rent in 2024: Cities

We’ve got rental data for every city in the UK, and you might be surprised when it comes to the cheapest (and most expensive) places.

The cost of rent varies a huge amount across UK cities, with the lowest in Burnley (£566), Grimsby (£608) and Hull (£612) and the highest in Brighton (£1,616), Oxford (£1,667) and London (£2,047).

Some of the UK’s most popular cities for students and young professionals are cheaper than you might think, too. Liverpool’s average rent comes in at £801 per month, closely followed by Sheffield (£809), Newcastle (£833), Swansea (£867) and Plymouth (£878).

When it comes to Scotland, you’ll find cheap city rents in Glasgow, where rents average £951 per month. Edinburgh is much pricier with an average rent of £1,263 per month.

|

City |

Average rent in 2024 |

Annual change in average rent (%) |

Annual change in average rent (£) |

|

Burnley |

£566 |

10.8% |

£60 |

|

Grimsby |

£608 |

7.8% |

£40 |

|

Hull |

£612 |

11.1% |

£60 |

|

Middlesbrough |

£613 |

8.0% |

£50 |

|

Sunderland |

£626 |

8.2% |

£50 |

|

Blackburn |

£661 |

9.8% |

£60 |

|

Doncaster |

£678 |

7.0% |

£40 |

|

Barnsley |

£684 |

11.3% |

£70 |

|

Aberdeen |

£689 |

7.1% |

£50 |

|

Blackpool |

£692 |

6.0% |

£40 |

|

Bradford |

£692 |

9.4% |

£60 |

|

Huddersfield |

£704 |

7.9% |

£50 |

|

Birkenhead |

£713 |

9.3% |

£60 |

|

Mansfield |

£732 |

9.3% |

£60 |

|

Stoke |

£735 |

11.1% |

£70 |

|

Wakefield |

£737 |

8.3% |

£60 |

|

Belfast |

£751 |

5.4% |

£40 |

|

Wigan |

£752 |

8.8% |

£60 |

|

Dundee |

£774 |

8.2% |

£60 |

|

Preston |

£784 |

7.7% |

£60 |

|

Bolton |

£790 |

13.7% |

£100 |

|

Derby |

£798 |

11.4% |

£80 |

|

Liverpool |

£801 |

8.3% |

£60 |

|

Sheffield |

£809 |

7.0% |

£50 |

|

Telford |

£809 |

7.8% |

£60 |

|

Rochdale |

£815 |

11.0% |

£80 |

|

Newcastle |

£833 |

10.6% |

£80 |

|

Warrington |

£863 |

12.3% |

£90 |

|

Swansea |

£867 |

9.1% |

£70 |

|

Plymouth |

£878 |

7.7% |

£60 |

|

Ipswich |

£879 |

9.7% |

£80 |

|

Newport |

£879 |

9.2% |

£70 |

|

Peterborough |

£907 |

8.0% |

£70 |

|

Leicester |

£924 |

10.2% |

£90 |

|

Birmingham |

£934 |

8.6% |

£70 |

|

Gloucester |

£945 |

10.9% |

£90 |

|

Nottingham |

£947 |

7.4% |

£60 |

|

Glasgow |

£951 |

10.9% |

£90 |

|

Leeds |

£969 |

7.2% |

£70 |

|

Swindon |

£969 |

11.0% |

£100 |

|

Northampton |

£977 |

7.1% |

£60 |

|

Coventry |

£1,015 |

9.3% |

£90 |

|

Hastings |

£1,016 |

7.6% |

£70 |

|

Norwich |

£1,065 |

7.4% |

£70 |

|

Manchester |

£1,070 |

9.6% |

£90 |

|

York |

£1,111 |

10.1% |

£100 |

|

Cardiff |

£1,119 |

9.2% |

£90 |

|

Southampton |

£1,121 |

10.0% |

£100 |

|

Luton |

£1,145 |

11.4% |

£120 |

|

Southend |

£1,152 |

9.9% |

£100 |

|

Portsmouth |

£1,161 |

7.1% |

£80 |

|

Worthing |

£1,171 |

7.3% |

£80 |

|

Medway |

£1,176 |

12.0% |

£130 |

|

Milton Keynes |

£1,202 |

8.5% |

£90 |

|

Bournemouth |

£1,243 |

6.7% |

£80 |

|

Edinburgh |

£1,263 |

11.5% |

£130 |

|

Aldershot |

£1,325 |

11.5% |

£140 |

|

Crawley |

£1,376 |

10.6% |

£130 |

|

Bristol |

£1,389 |

7.6% |

£100 |

|

Reading |

£1,412 |

7.7% |

£100 |

|

Cambridge |

£1,527 |

6.4% |

£90 |

|

Brighton |

£1,616 |

7.0% |

£110 |

|

Oxford |

£1,667 |

8.2% |

£130 |

|

London |

£2,047 |

5.4% |

£100 |

The cheapest places to rent in 2024: Local authority areas

Let’s go one step further and dive into the local authority areas with the cheapest rent in the UK.

At the top of the table we’ve got Hartlepool, with an average rent of £527 in 2024, along with East Ayrshire (£548), Burnley (£556) and Dumfries and Galloway (£557).

The North East dominates the list, with Country Durham (£575), Redcar and Cleveland (£588), North East Lincolnshire (£608) and Darlington (£611) all featuring.

The North West is also well-represented when it comes to cheap rental spots - including Pendle (£583), Allerdale (£591), Hyndburn (£594), Copeland (£598) and Carlisle (£602).

The rest of the spots are filled by Scottish areas, with North Ayrshire (£602) and Angus (£604) recording some of the lowest average rents in 2024.

|

Area Name |

Average rent in 2024 |

Annual change in average rent (%) |

Annual change in average rent (£) |

|

Hartlepool (B) |

£527 |

11.6% |

£50 |

|

East Ayrshire |

£548 |

8.4% |

£40 |

|

Burnley District (B) |

£556 |

12.0% |

£60 |

|

Dumfries and Galloway |

£557 |

11.9% |

£60 |

|

County Durham |

£575 |

8.5% |

£50 |

|

Pendle District (B) |

£583 |

8.8% |

£50 |

|

Redcar and Cleveland (B) |

£588 |

8.1% |

£40 |

|

Allerdale District (B) |

£591 |

6.8% |

£40 |

|

Hyndburn District (B) |

£594 |

12.4% |

£70 |

|

Copeland District (B) |

£598 |

7.3% |

£40 |

|

Carlisle District (B) |

£602 |

10.6% |

£60 |

|

North Ayrshire |

£602 |

7.4% |

£40 |

|

Angus |

£604 |

10.9% |

£60 |

|

North East Lincolnshire (B) |

£608 |

7.8% |

£40 |

|

Darlington (B) |

£611 |

10.5% |

£60 |

|

City of Kingston upon Hull (B) |

£612 |

11.1% |

£60 |

|

Stockton-on-Tees (B) |

£616 |

8.7% |

£50 |

|

Middlesbrough (B) |

£619 |

8.0% |

£50 |

|

South Tyneside District (B) |

£626 |

7.9% |

£50 |

|

Sunderland District (B) |

£626 |

8.2% |

£50 |

Bank Rate holds at 5.25%, so when will rates drop?

The Bank Rate has remained unchanged for the fourth time in a row since it was raised from 5% to 5.25% in August 2023. Rate cuts aren’t expected until later in the year but mortgage costs have still been falling.

Why has the Bank Rate stayed the same?

The Bank of England monetary policy committee voted by a majority of 6-3 to keep the Bank Rate unchanged this month, with two members voting to increase it by 0.25% and one to cut it by 0.25%.

Although energy prices have fallen, wage growth has eased and the prices of goods and services have been rising more slowly, there’s still a risk that overall inflation will increase again.

The conflict in the Middle East and the attacks on container ships in the Red Sea are two of the factors that could see prices rising faster again.

The committee forecasts that inflation will temporarily fall to its target of 2% in the second quarter of 2024 but that it will increase again over the rest of the year.

It then thinks it will be 2.3% in two years’ time and 1.9% in three. Because of this, there are no rate cuts for now, despite little economic growth.

The Bank of England is giving nothing away about how long it thinks rates should stay the same but experts are predicting that there could be a cut in May or June.

What’s happening to mortgage rates?

While borrowers on variable rates will be disappointed that the cost of their mortgages won’t be going down this month, lenders have been cutting the rates of new mortgage deals over the last six months.

This is good news for first-time buyers but anyone remortgaging is still likely to experience a shock increase in their mortgage repayments.

Mortgage costs – whether you’re taking out a new deal or reverting to your lender’s standard variable rate – remain much higher than they were two or five years ago, when most borrowers would have taken out their current deals.

How have higher mortgage costs affected house prices?

Higher mortgage rates led to fewer property purchases and less mortgage lending in 2023, according to industry body UK Finance. Despite this drop in demand, house prices didn’t follow for the majority of UK homeowners.

According to our latest data, more than half (56%) of homeowners saw the value of their homes stay the same or increase by at least 1% in 2023.

A quarter of homes increased in value by between 1% and 5% while a 10th increased by a sizeable 5% or more.

The average value increase was £7,800. Percentage price rises were larger in more affordable areas of the country, with the biggest increases in the North West and Scotland.

This is dramatically different to 2022, though, when 96% of homes saw their value staying the same or going up and the average increase was £19,700 where it did rise.

What’s the outlook for the mortgage market?

While mortgage costs have been going down, mortgage rates will continue to be relatively high compared to two or more years ago. Rate cuts are on the horizon, though, which will be welcome news for first-time buyers and homeowners alike.

Our Executive Director of Research, Richard Donnell, says: 'The debate about the timing and scale of base rate cuts is important for the mortgage rate outlook.

'The peak in base rates last year led financial markets to bet on lower rates in 2024 and into 2025, which have shaved almost 1% off fixed rate mortgages over the last 2 months.

'There is a sense these cuts to rates are close to bottoming out for now and unlikely to move any lower.

'Inflation is down but not out and central banks want to get it under control before cutting base rates.

'It looks likely mortgage rates will remain in the 4.5% to 5% range, which is still cheap by long run standards.

'Those looking to move or refinance should chat to a broker and seek advice about the rates available and the best strategy for them.'

Key takeaways

- The Bank Rate remained at 5.25% today, despite hopes it would come down

- Inflation has fallen significantly over the past year but it's still above the Bank of England’s target of 2%. It stood at 4% in December 2023, unexpectedly rising slightly from November’s figure of 3.9%

- World events are among the factors that could push inflation up again in the second half of this year

- But experts are predicting that there could be a cut in May or June