UK house prices hit record high

The value of the average home has increased by £44 per day in the last 6 months alone.

UK house prices have hit a record high of £235,000 as sales are agreed at their fastest pace for 5 years.

The average home in the UK has increased in value by £44 per day in the past 6 months alone.

This is up from £30 per day between July 2020 and January 2021.

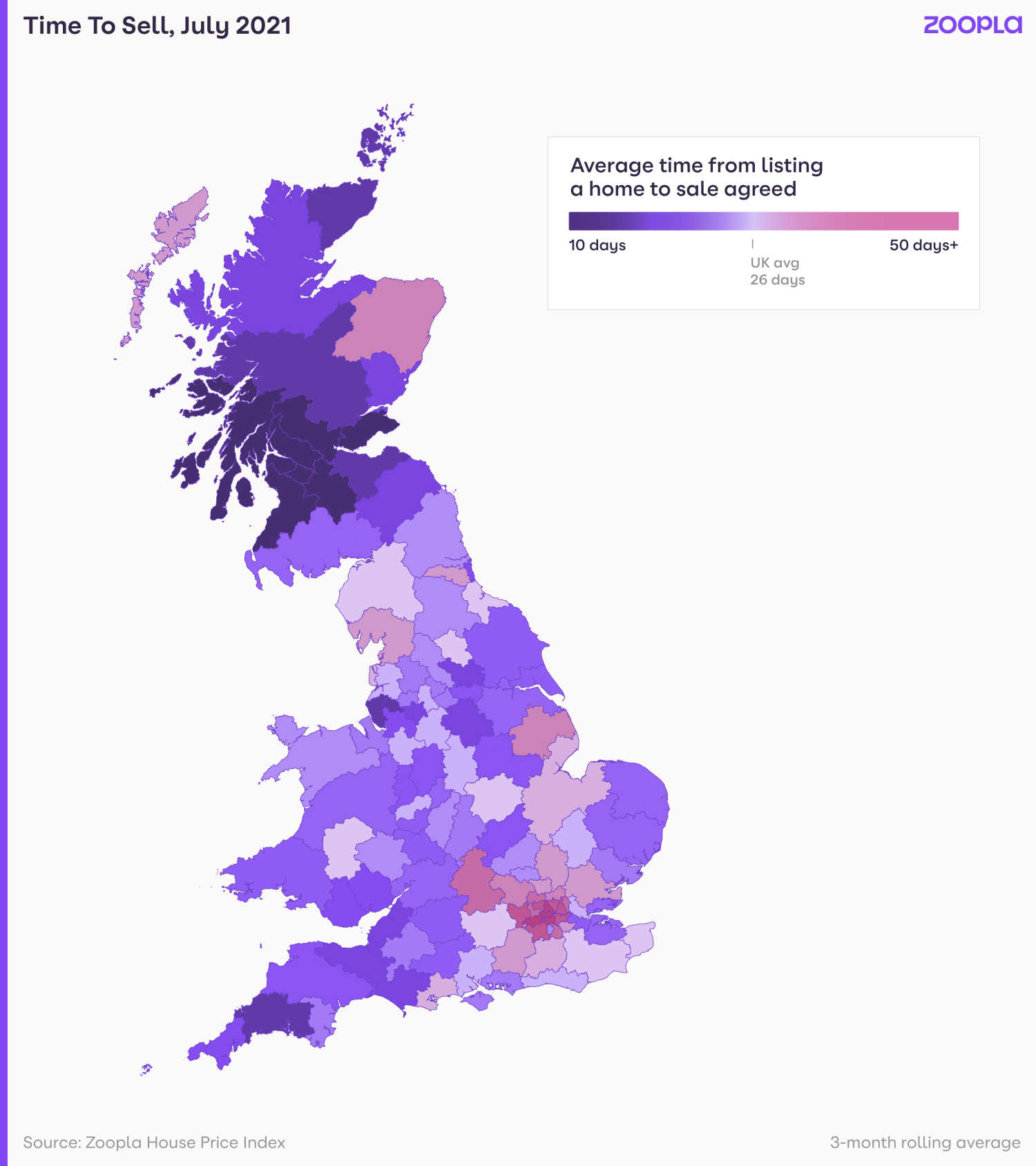

Meanwhile, the time it takes to agree a sale on a home is now less than 30 days, according to our latest House Price Index report.

House prices climbed by 6.1% in the last year – more than double the rate of annual house price growth seen in August 2020.

At a regional level, house prices rose the most in Wales at 9.8%, followed by Northern Ireland at 8.4% and north west England at 8%.

And in terms of cities, Liverpool continued to lead the way. House prices in the city jumped by 9.8%, followed by Manchester and Sheffield at 8.1% and 7.6% respectively.

At the other end of the scale, house price growth continued to lag the national average in London, with property prices edging ahead by just 2.2% in the last year.

The gap between house price growth in Wales and London was one of the widest seen in the past 3 years.

The pandemic-induced search for space continued to fuel house hunting, with buyer demand still 35% higher than the average for the past 5 years.

There was a noticeable uptick in the number of buyers in London, with demand rising by 14% during the past month as many return to office life.

Houses continue to be more popular than flats, with buyer interest in houses up 25% in the capital compared with 6% for flats.

Meanwhile, the fast-approaching deadline for the stamp duty holiday in England and Northern Ireland at the end of this month does not appear to have dampened buyers’ enthusiasm.

The housing market is moving at its fastest pace for 5 years.

The time between listing a property and agreeing a sale has consistently averaged less than 30 days each month since May. Normally, it takes 40 days at this time of year.

And the acute shortage of homes for sale continues, with levels 28% lower so far this year compared with the average for 2020.

What could this mean for you?

First-time buyers

Despite the shortage of homes for sale, there is some good news for people taking their first step onto the property ladder.

There’s evidence that some landlords are selling up. Some 8% of homes that are currently listed for sale have been previously rented, rising to 13% in London. That’s up from a UK-wide average of just 3% 2 years ago.

And this in turn could boost choice for first-time buyers, who are typically interested in buying the same types of homes as landlords.

Also, if you are happy to purchase a flat, you are not only likely to face less competition, but you could also be in a stronger position to negotiate on the price.

Even so, the market remains fast-moving. It pays to get all your ducks in a row before you start your property search, so that you will be in a position to move quickly when you see something you like.

Home-movers

People moving up the property ladder continue to face the challenge of being both a seller and a buyer.

The good news is that if you have a family home to put on the market, you are likely to be able to secure both a top price and a quick sale.

The downside is that you are also likely to face stiff competition from other potential buyers for your next home. Meanwhile, the shortage of homes for sale may mean you have limited choice.

If you need to coordinate the sale of your current home and buy your next one, speak to a local estate agent. They’ll give you a good sense of the pace of your local housing market and whether there are currently many properties up for sale that meet your criteria.

Depending on how quickly the market is moving, you may want to have an offer accepted on a home you like before listing your current one for sale.

What is the best value home?

Wondering how far your budget could stretch? Find out which types of property and locations come up trumps when it comes to getting more bang for your buck.

Want to know where you can get more bang for your buck? It’s worth doing your homework, with the same amount of space costing up to 12 times as much in some areas compared with others.

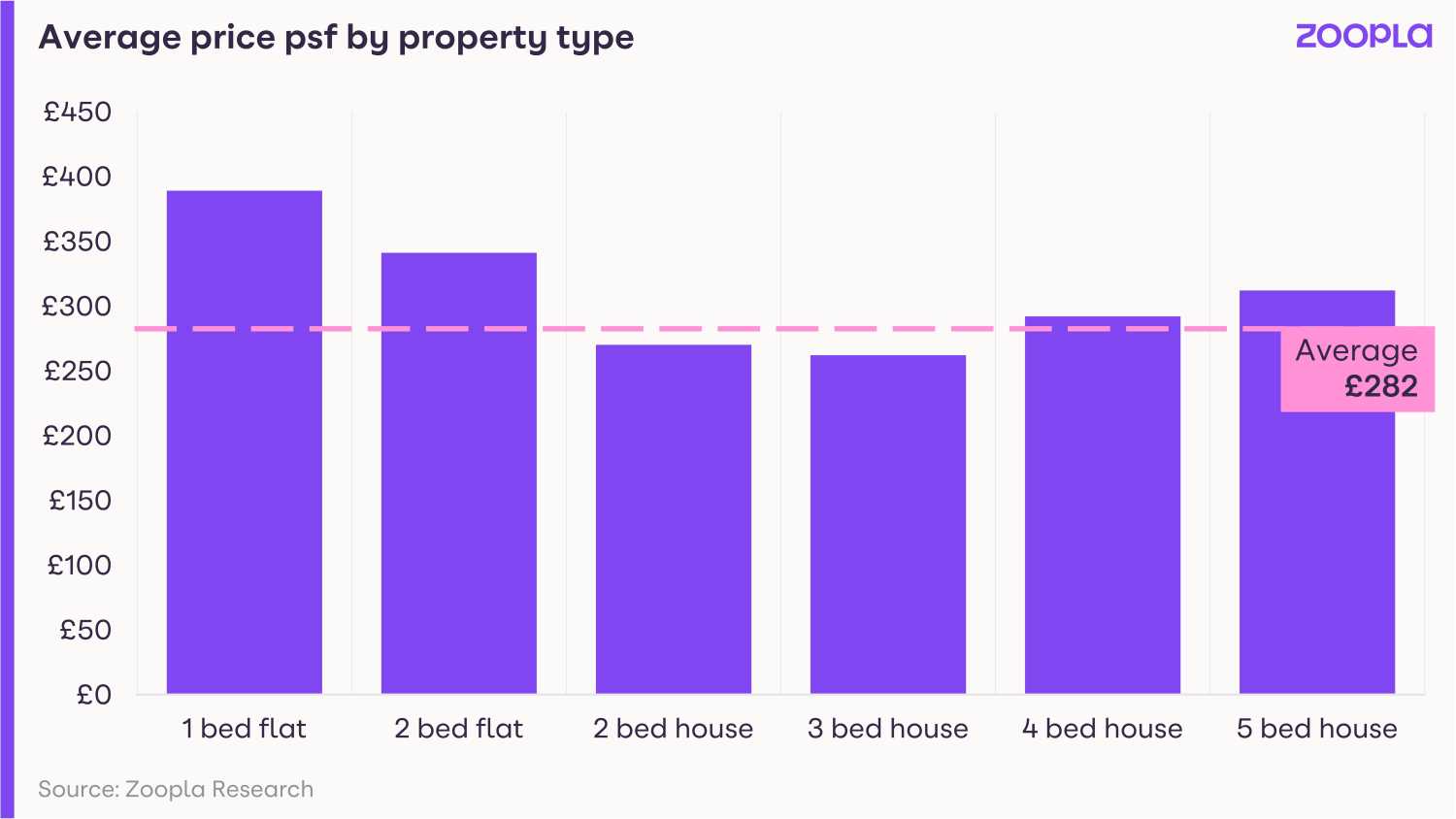

The average property in the UK costs £282 per square foot, according to our latest report, How home values compare by floorspace.

But the sum rises to an eye-watering £1,491 per square foot in London’s chic enclave of Kensington and Chelsea and drops to just £104 per square foot in Burnley, Lancashire.

In case you’re wondering, we’ve measured property on a price per square foot basis because it’s a useful way of comparing prices. It strips out variations to give a like-for-like benchmark.

Which type of property offers the best value?

Three-bedroom homes offer the most bang for your buck, costing an average of £262 per square foot.

And at the other end of the spectrum, smaller flats and larger family homes offer the least value for money on a price per square foot basis.

Yes, one-bedroom flats, typically popular among first-time buyers, cost an average £389 per square foot.

This falls to £270 per square foot for two-bedroom houses, and drops again for three-bedroom ones.

But the cost per square foot then rises to £292 for four-bedroom houses and stands at £312 for five-bedroom properties.

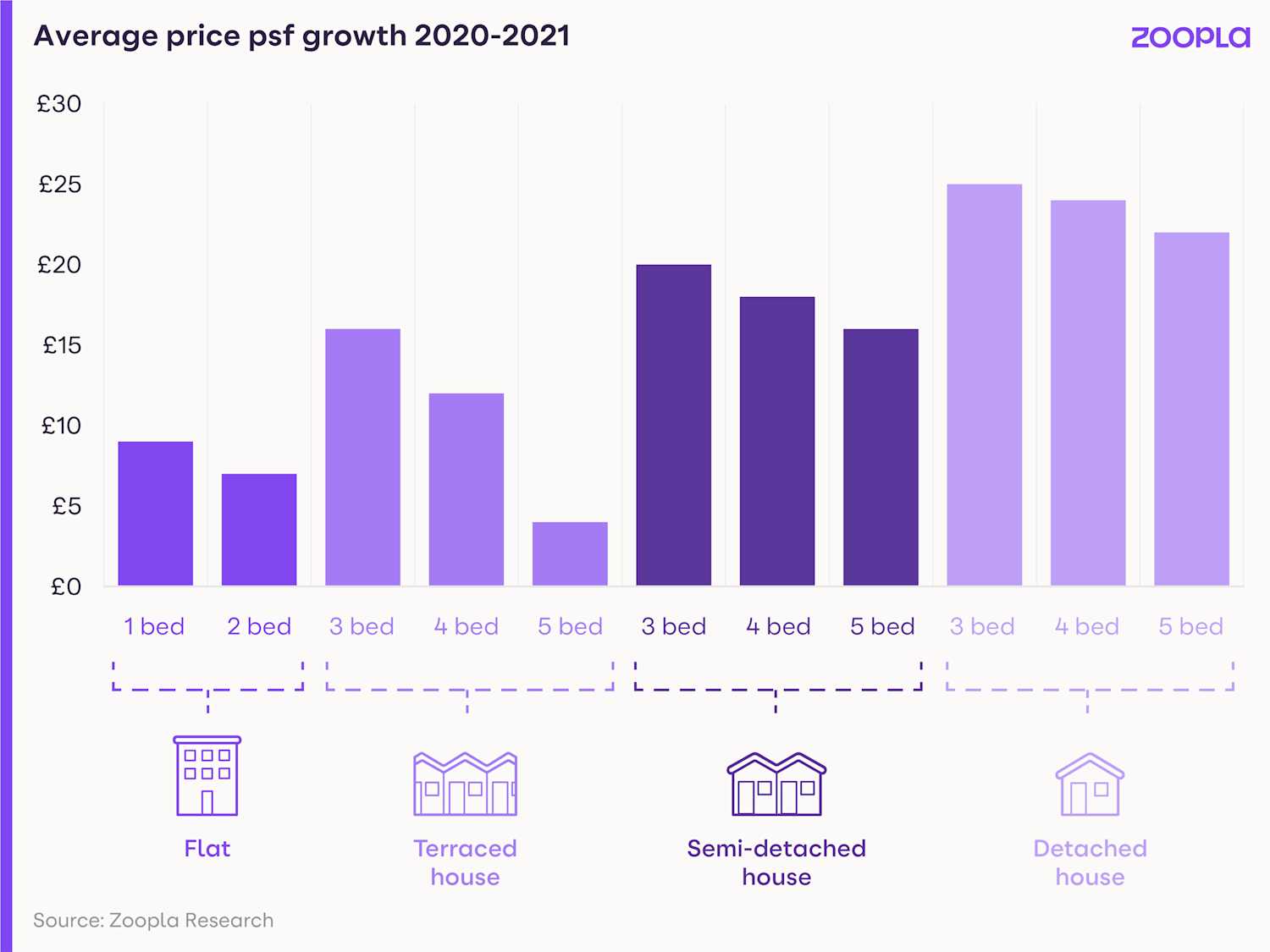

The ‘search for space’ has made three and four-bedroom houses the most sought-after types of property during the pandemic.

It means that the typical cost of a three-bedroom detached house has risen by £25 per square foot, compared with an increase of just £7 per square foot for a two-bedroom flat.

Nicky Stevenson, managing director of Fine & Country UK, said:

"Certain types of properties will command a higher price. This is down to demand. The more buyers interested in a certain type of property, the higher the price they would need to pay to secure it.

"Since the pandemic, space has been the name of the game with buyers wanting homes that offer gardens and an extra bedroom or home office, especially now with so many people working remotely."

Where can you get the most for your money?

It is not only the type of property that determines the cost of bricks and mortar, but the location too.

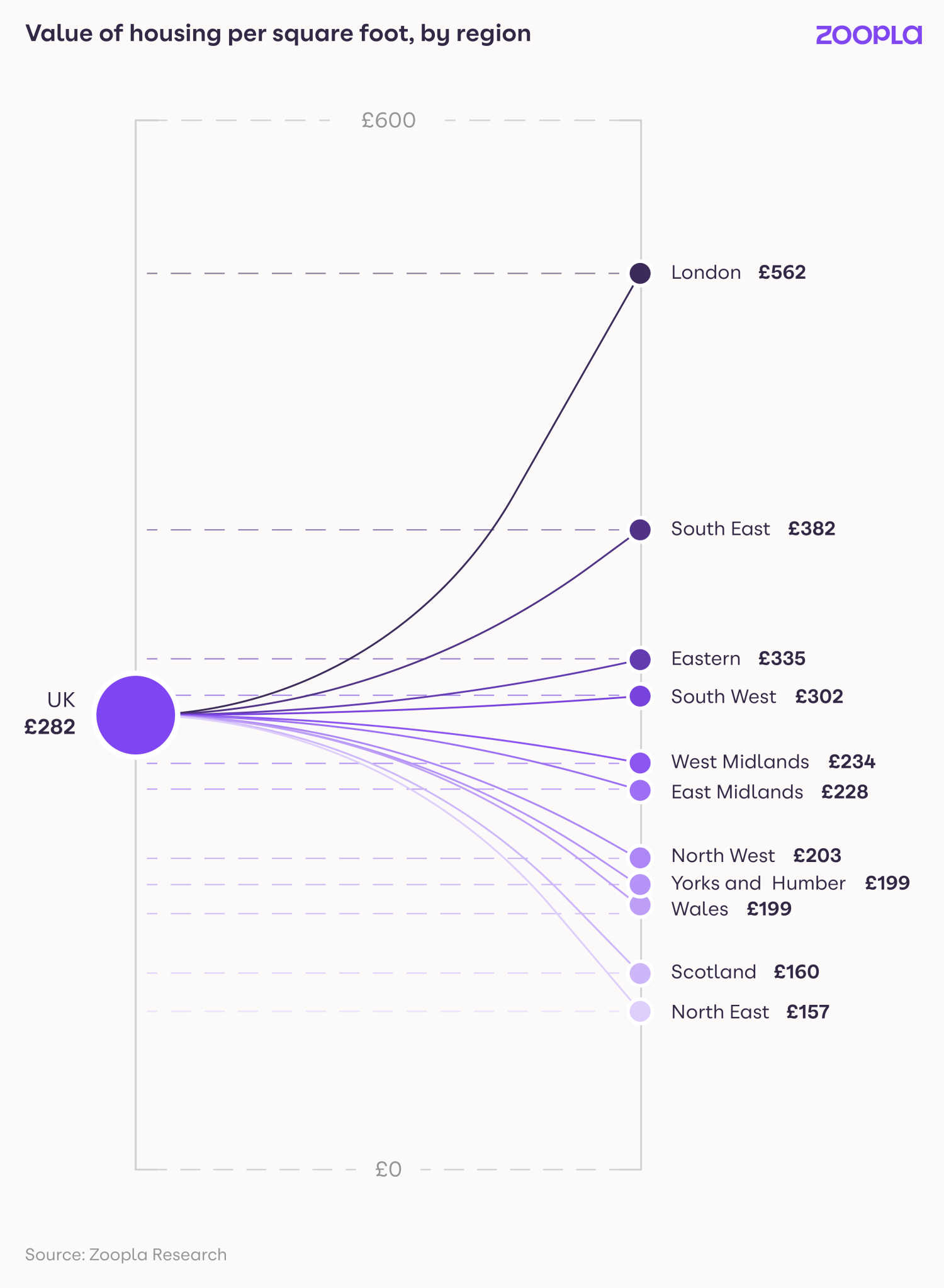

The north-east offers the best value for money, with homes costing an average of £157 per square foot.

It’s followed by Scotland at £160 per square foot, and Wales and Yorkshire and the Humber, both at £199 per square foot.

Homes in Burnley are the cheapest in the UK on a price per square foot basis, with the cost coming in at an average of just £123.

Other towns that offer good value are Sunderland, Dundee and Hull.

Head of research said: "The research reveals the scale of difference when it comes to how much space you can get for your money in different parts of the country. It shows that location really is a key driving force behind what a home is worth."

Where are the most expensive areas to buy a home?

Unsurprisingly, the most expensive place in which to buy a home is London, where prices average £562 per square foot – double the national average.

London is significantly pricier than the next most expensive region, the south-east, where homes cost an average of £382 per square foot.

London’s Kensington and Chelsea takes the overall crown, with homes costing a massive £1,491 per square foot.

To put this into perspective, it means the floorspace required for a double bed would cost an eye-watering £46,550.

Cambridge is the second most expensive city after London, where buying space for a double bed would set you back by an average of £15,994.

It's followed by Brighton and Oxford at £14,520 and £14,168 respectively.

Stevenson explained:

"As the old adage says, location, location, location. Properties that are located in sought-after areas will command a higher price. The price per square foot in a location is synonymous with buyer demand, which is driven by factors such as lifestyle offering and proximity to amenities.

"Buyers will pay more for homes in areas with excellent schools, easy access to commuter routes and shopping facilities, as well as lifestyle elements such as green spaces, restaurants and entertainment venues."

So what can £5,000 get you?

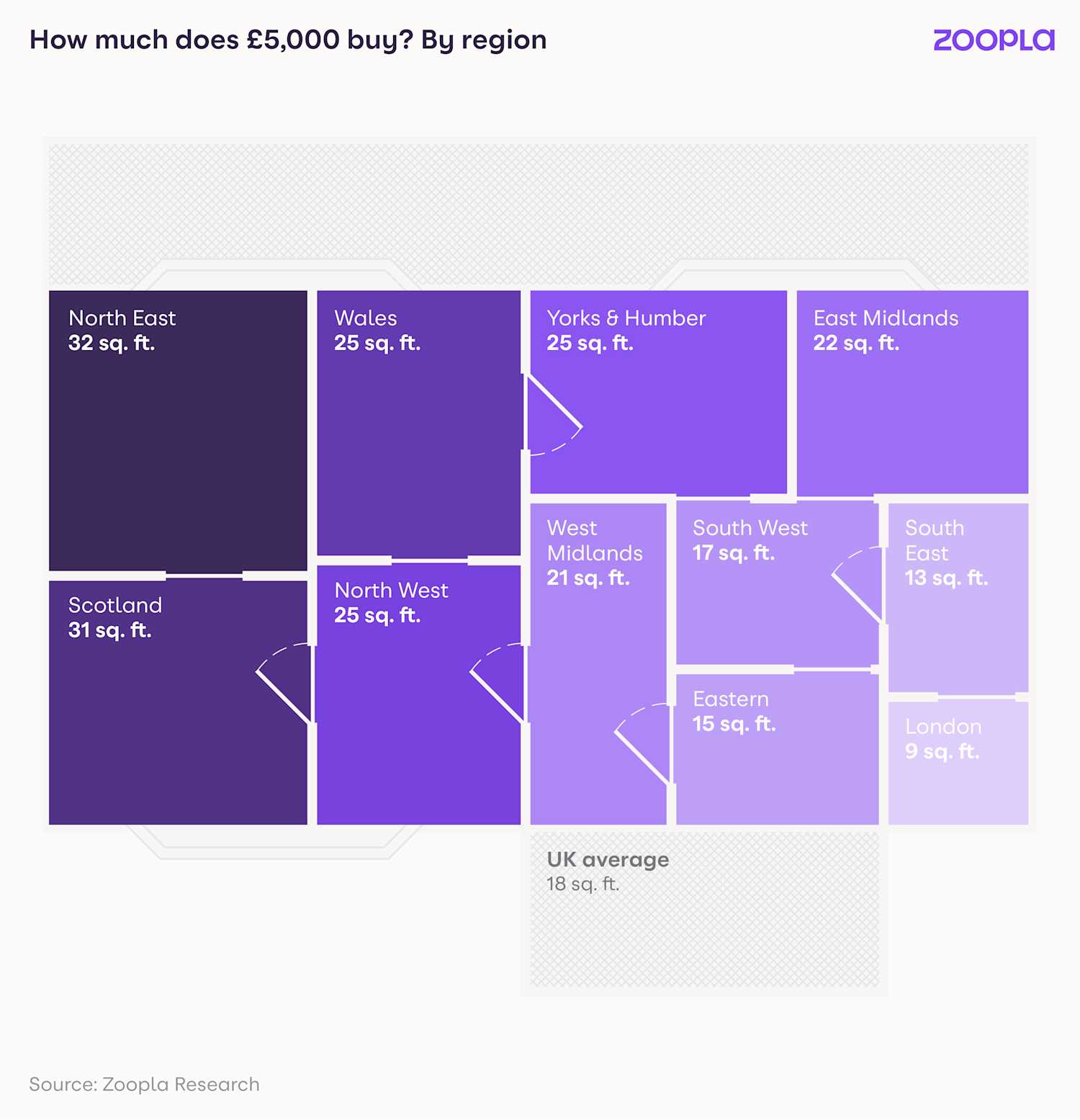

The amount of space you can buy with £5k varies significantly.

On average, £5k will buy you 18 square feet. But the amount nearly doubles to 32 square feet in the north-east, while it will buy you 31 square feet in Scotland.

At the other end of the scale, you would only get 9 square feet for £5k in London and 13 square feet in the south-east.

What does it all mean for you?

It could be good news if you're looking to sell a family house, with values rising the most for three-bedroom detached houses over the last year.

"Given the market conditions since the start of the pandemic, and the ‘search for space’ among many buyers making a move, the value of houses has risen more than the value of flats," Gilmore added.

"As a result, these types of homes are commanding higher values per square foot. Those currently looking to sell a family house could be in pole position."

If you’re looking to move onto or up the housing ladder, knowing how much property costs on a price per square foot basis helps you understand where you can get the most space for your budget.

- The same amount of space in some parts of the UK can cost a whopping 12 times more than in others.

- The floorspace needed for a double bed alone in London's Kensington and Chelsea stands at £43,951.

- Three-bedroom homes offer the best value for buyers seeking more space for their money. But watch out! Prices for this type of property are on the rise.

Rents outside London rise at fastest rate for 13 years

The UK rental market is roaring ahead, with properties letting almost a week faster than in 2020, our research shows.

Rents outside London are rising at their fastest rate since 2008 as people return to city centres.

The typical price of renting a home in the UK, excluding the capital, now stands at £790 a month, costing tenants an additional £456 a year, according to our latest Rental Market Report.

The steep increase has been driven by renters returning to cities. But the surge in tenant demand has not been met by an increase in the number of homes to rent, forcing rents higher.

Our head of research, said: "There has been a sharp rise in demand for rental properties in recent months, especially in central city markets, signalling the return of city life as offices and other leisure and cultural venues continue to open up more fully."

What’s happening to rents?

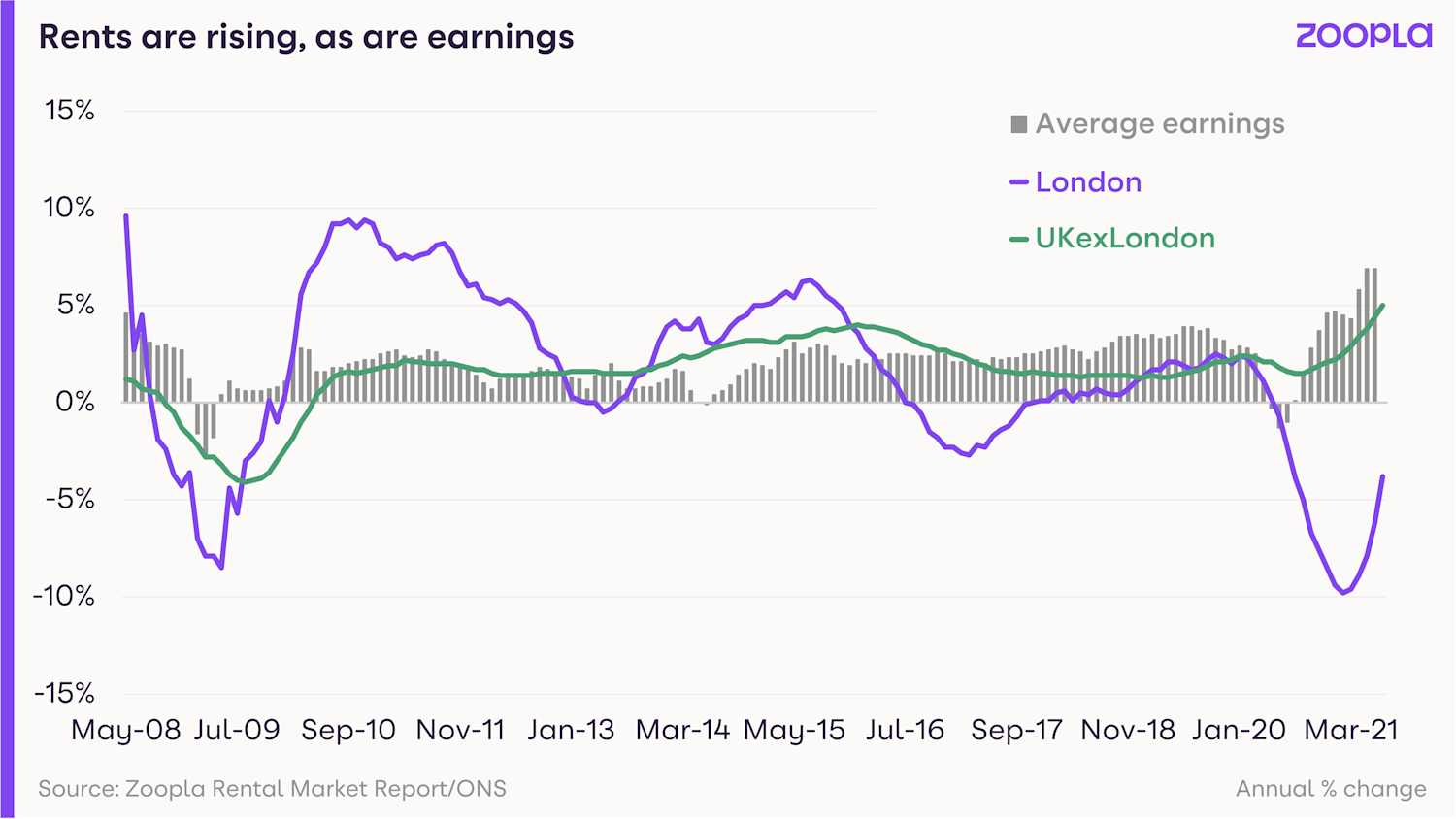

Rents across the UK, excluding London, have risen by 5% in the last year, the highest level since our index began in 2008 and more than double the 2.2% rise recorded in January.

The south-west saw the biggest hike, with the cost of being a tenant jumping by 7.6% year-on-year. It was followed closely by the East Midlands at 6.8% and the north-east at 6.5%.

Rent increases were particularly strong in some towns and cities, with Wigan and Mansfield seeing hikes of 10.5% and 10% respectively.

Meanwhile, rents in Hastings, Blackburn, Barnsley and Norwich all grew by 9.4% or more.

Despite the rise, these places remain some of the most affordable in which to be a tenant. A single earner has to spend an average of 21% of their income on rent, compared with a UK average of 32%.

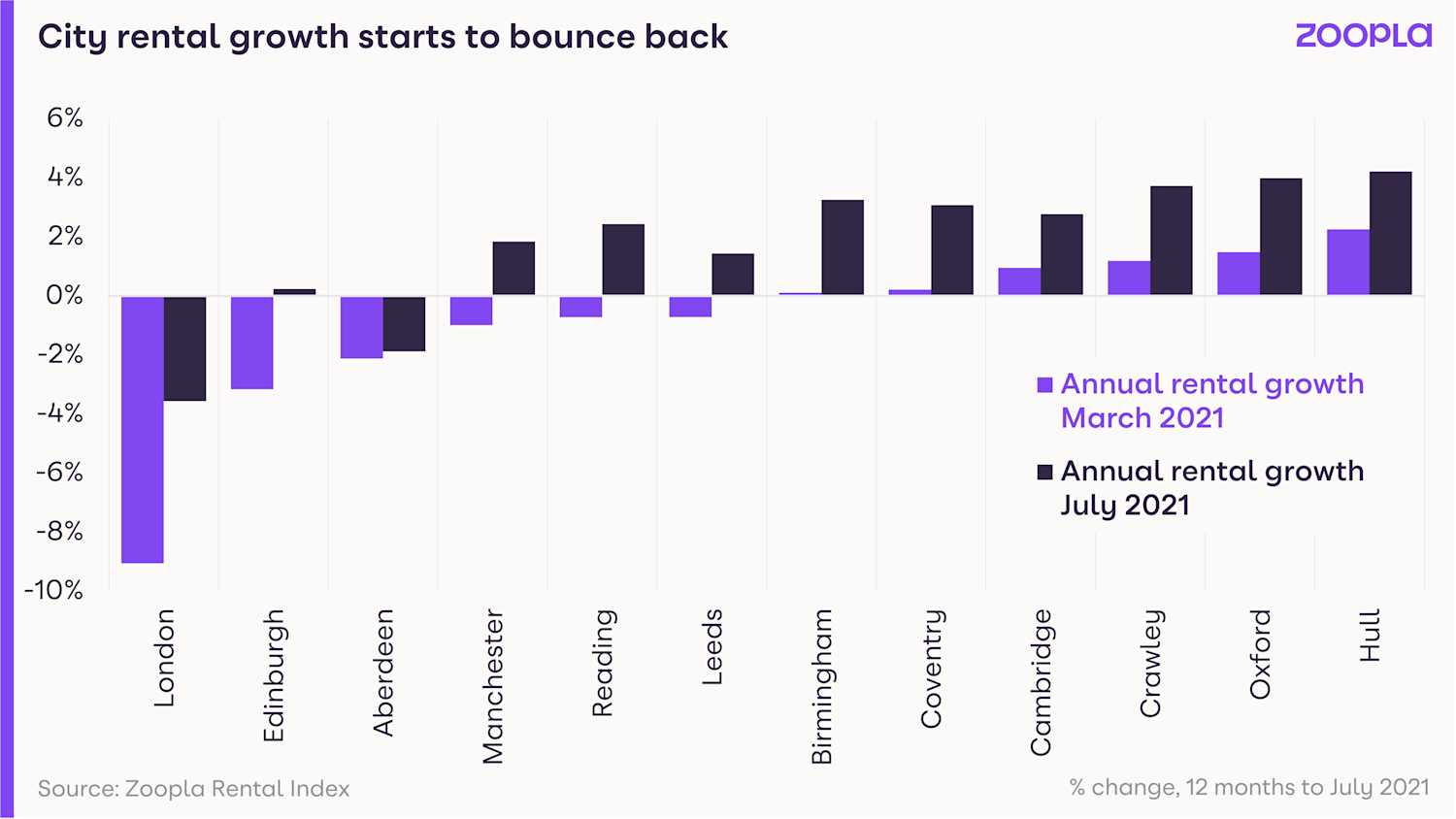

At the other end of the scale, rents in London have dropped by 3.8% year-on-year.

Even so, the rate at which rents in the capital are falling is showing signs of bottoming out, as tenants return to the city.

Across the whole of the UK, including the capital, the average rent stands at £943 a month, 2.1% more than a year earlier.

But with average earnings rising faster than rents, rental affordability is holding steady for tenants who are employed.

Kate Eales, head of regional residential agency at Strutt & Parker, said:

"Rents are recording healthy growth in cities, but in the most desirable areas, there’s evidence of growth up to 25%. We recently let a home in the Cotswolds for £3,750 a month when it was previously let out at £2,200 and another was let for £5,500, up from £4,100."

What’s demand for rental homes like?

Tenant demand is soaring. It was nearly 80% higher in August than average levels between 2017 and 2019.

It’s being driven by a resurgence in city centre life, with people being drawn back as offices, bars, restaurants and other leisure facilities reopen.

There are also seasonal factors at play, such as university students looking for accommodation ahead of the new academic year, graduates starting jobs and families moving before the school term starts.

The bounce back has been particularly marked in London, leading to rents in the 12 inner boroughs rising by an average of 2.3% between May and July.

Similar spikes have been seen in Birmingham, Edinburgh, Leeds and Manchester.

It’s reversing the decline seen during the earlier stages of the pandemic, when renters moved back in with families or relocated to more rural areas.

Is there a good supply of homes available to rent?

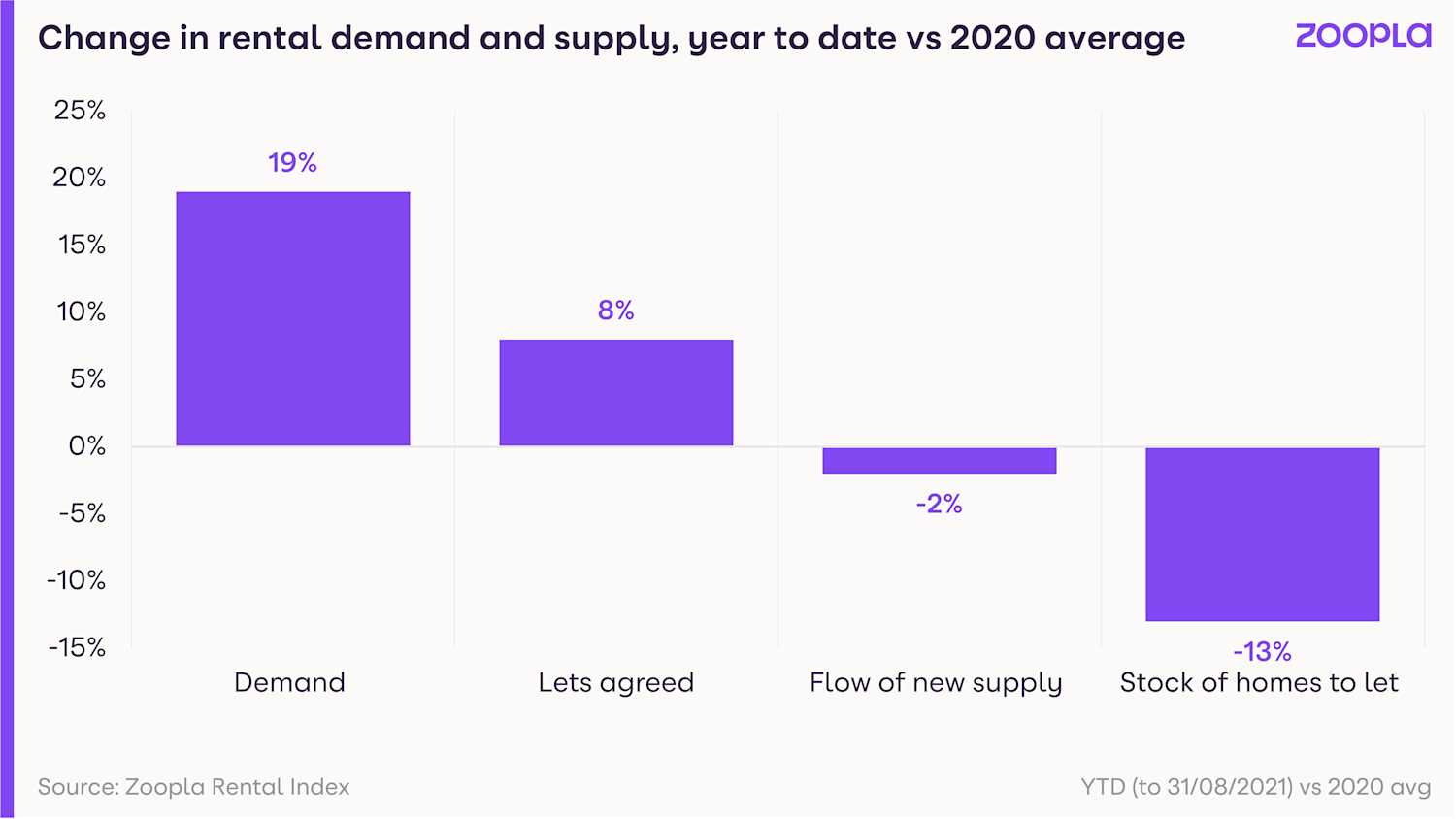

While demand so far this year has increased by 19%, the level of rental homes available has fallen by 13%.

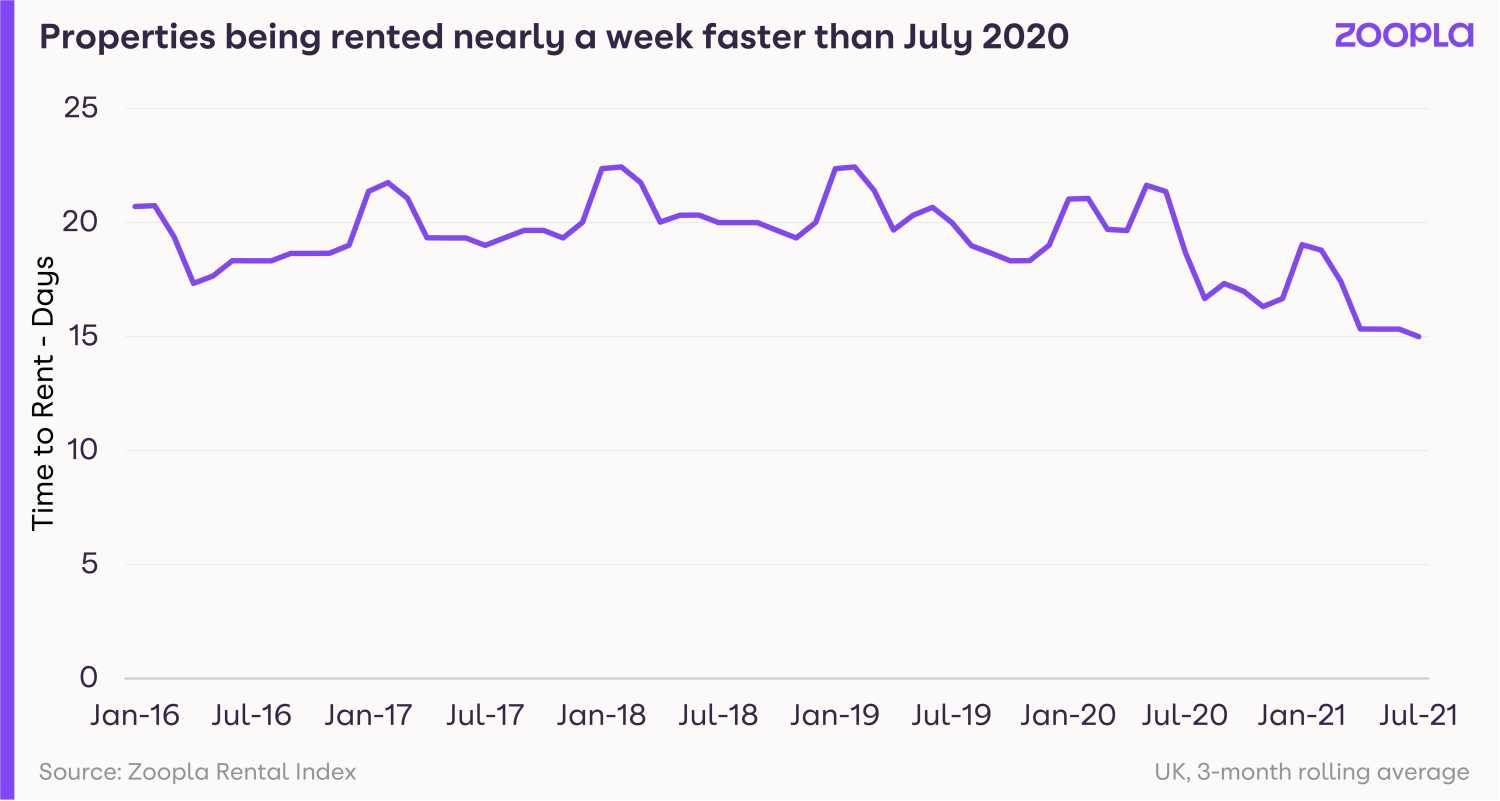

This mismatch is not only forcing rents up, it is also leading to the rental market moving at its fastest pace since 2016.

The average time between marketing a property for rent and agreeing a tenancy is now just 15 days, compared with 20 in July last year.

Coastal locations, such as Hastings, Worthing, Bournemouth and Plymouth, have the fastest-moving markets, with properties taking just over a week to let.

Rental homes in many large cities, including Liverpool, Cardiff, York, Bristol and Newcastle, are also coming off the market quickly, with the time to rent averaging just under two weeks.

Eales added:

"The recovery in the rental market has, in many ways, mirrored the boom in the sales market, with people looking for homes that accommodate a different set of needs shaped by their lockdown experience.

"Lack of stock and high demand are inevitably driving price growth. This stock depletion is a result in part of many accidental landlords having now sold their properties - benefiting from the soaring demand in the sales market."

What could this mean for you?

Landlords

If you are a landlord with a property to rent, the current surge in tenant demand is good news.

It not only means you are likely to be able to find a tenant quickly, but you are also likely to be able to achieve the rent you want.

It is worth noting the swing back to city life, compared with the earlier stages of the pandemic when people were looking for homes in rural locations and ones with outdoor space.

Tenants

With demand rising and the level of homes to rent falling, you can expect to face significant competition from other tenants to secure a home.

The imbalance is also pushing rents higher, so you may have to pay more than you did a year ago.

If you are finding it hard to find somewhere, consider looking outside of town and city centres.

What’s the outlook?

The high number of people looking for a home to rent during August will ease off in line with seasonal trends.

But demand is expected to remain high in the coming months as the return to city life continues.

Gilmore explained: "As ever, much will be dependent on the extent to which the current rules around Covid-19 continue as they are.

"But given no deviation from the current landscape, the demand for rental property, coupled with lower levels of supply, will continue to put upward pressure on rents.

"In London, this will translate into rental growth returning to positive territory late 2021 or early 2022."

Government to spend £8.6bn on 119,000 affordable homes

The money will deliver nearly 120,000 new properties across England, some of which will be available to buy and others will be for rent.

The government has allocated £8.6bn to help thousands of people across the country get onto the property ladder.

The money will be used to deliver around 119,000 affordable homes, 57,000 of which will be for people to buy.

A further 29,600 of the properties will be delivered for social rent, while 6,250 will be affordable rural homes.

Housing Secretary Robert Jenrick said: “This huge funding package will make the ambition of owning a home a reality for families by making it realistic and affordable.

“We are also ensuring tens of thousands of new homes for rent are built in the years ahead.”

The funding is part of the Affordable Housing Programme, which aims to deliver up to 180,000 new affordable properties.

Why is this happening?

The supply of new homes has been hit by the shutdown of the construction industry during the first lockdown, leading to an 11% fall in completions in the year to the end of March. The sector is also facing a shortage of workers as a result of Brexit.

Meanwhile, the pandemic has increased demand for property, particularly houses, as people reassess their housing needs.

The number of properties for sale has fallen to its lowest level for more than 6 years and is forecast to remain low well into next year.

The net result is a significant mismatch between supply and demand, which is putting upward pressure on prices, making it harder for many people to purchase a home without assistance.

What does it mean for you?

The announcement is good news for people struggling to get on to the housing ladder who want to take advantage of the affordable homes scheme.

The main scheme is shared ownership, under which you can buy a stake of as little as 10% in a property and pay rent on the portion you do not own, with the option to increase your share when you can afford to.

To qualify for a shared ownership home, you must have a household income of £80,000 a year or less, rising to £90,000 in London, and not be able to afford a deposit and mortgage payments for a property that meets your needs on the open market.

Nearly £5.2bn of the latest funding will be used to build properties outside of London, giving a boost to people in the regions who want to get on to the property ladder.

What’s the background?

Affordable homes is just one of a number of government initiatives to help people purchase a property.

The flagship scheme is the Help to Buy equity loan, under which first-time buyers can purchase a new-build property with a 5% deposit, which the government tops up with a 20% equity loan that is interest-free for 5 years.

Other initiatives include First Homes, under which first-time buyers, key workers and local people, can purchase a home at a 30% discount to its market price, while the 95% mortgage guarantee scheme helps buyers get a mortgage with just a 5% deposit.

Those saving for a deposit can also take advantage of the Lifetime ISA, under which they can save £4,000 a year towards purchasing their first home or their retirement, which the Government tops up with a 25% bonus, up to a maximum of £1,000 annually.

Low supply and high demand create a sellers' market

The number of properties for sale has fallen to its lowest level for more than 6 years and is forecast to remain low well into next year.

The housing market faces an acute shortage of homes for sale as the supply of properties fails to keep pace with the current buying frenzy.

One in 20 homes changed hands during the past year driven by the stamp duty holiday and the pandemic-induced search for space.

The number of homes being put up for sale is failing to replenish those that are sold, however, leading to the most acute shortage of stock since 2015 when we first began tracking this measure.

The mismatch between supply and demand has created a sellers’ market, particularly for 3 and 4-bedroom family homes, which is pushing up house prices because homeowners can command the top price for their properties.

The pace of the market is also accelerating, with homes taking an average of just 26 days to sell, nearly half the 49 days they took in 2019, as a growing number of buyers compete for limited properties.

Scroll down to get more insight from our latest House Price Index report and find out what it could mean for you.

What’s happening to house prices?

Strong demand from buyers is continuing to put upward pressure on prices, with the average UK home seeing its value increase by 6% in the year to the end of July.

The increase, which has left the typical property costing £234,000, is more than double the 2.3% rate of growth recorded in the same month of 2020.

Regions in which affordability is less stretched continue to see the strongest house price gains, with Wales leading the way with growth of 9.4%, followed by Northern Ireland at 9% and the North West at 7.9%.

A similar pattern is evident at a city level, with Liverpool, where the average home costs £136,721, going up in price by 9.4% during the past year, while house prices in Manchester and Belfast have increased 7.7% and 7.5% respectively over the same 12 month period.

By contrast, property values in London have edged ahead by just 2.5%, although the rate of growth has increased from 1.9% in March.

How busy is the housing market?

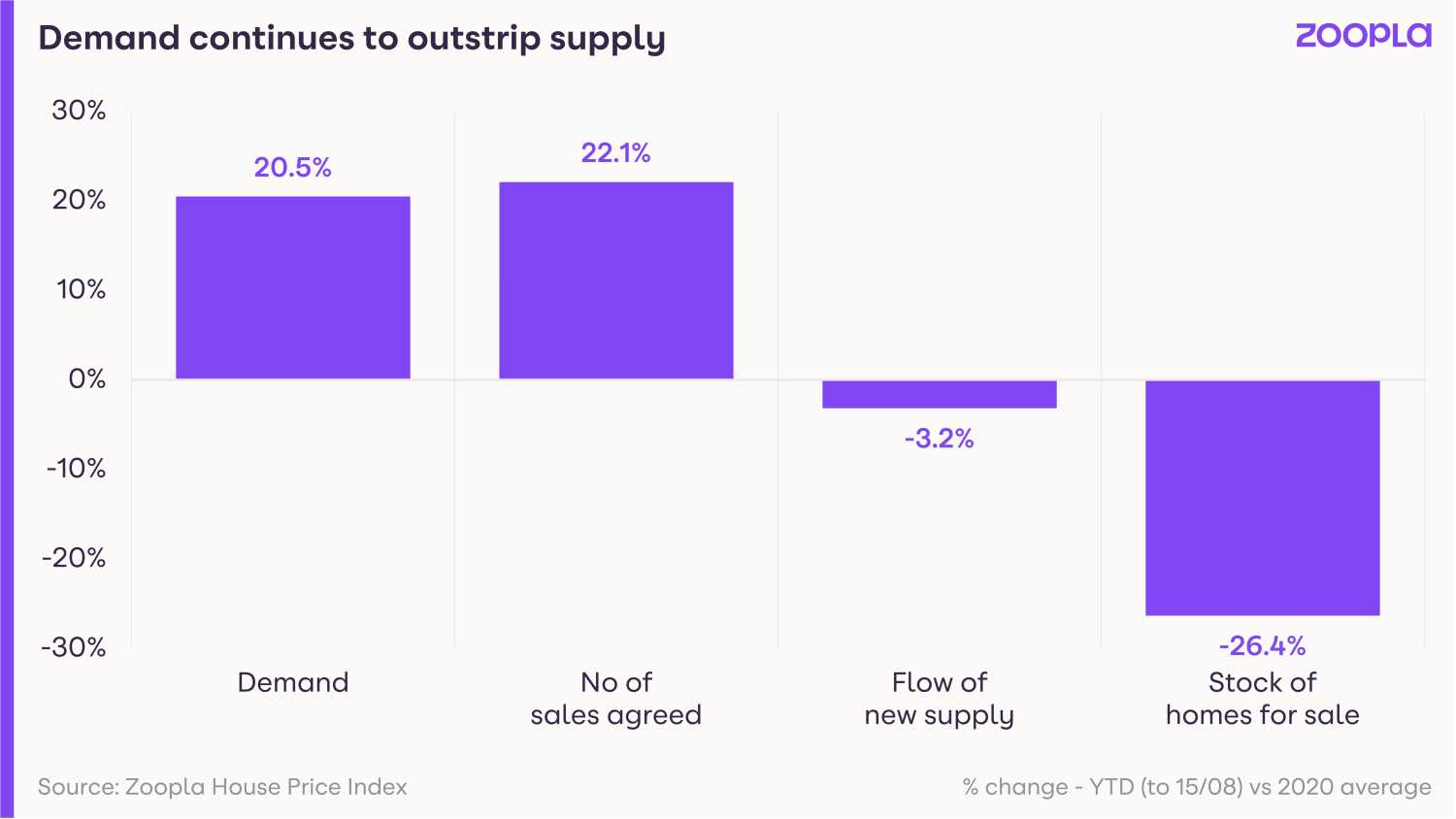

Demand from potential buyers remains elevated, with the number of people looking to purchase a home 20.5% higher than the average for 2020.

Competition among buyers has been intensifying during the second half of last year and the first half of 2021, spurred on by the stamp duty holiday.

These high levels of demand have led to a 40% increase in sales in the 12 months to the end of June.

The high level of buyers in the market is not being matched by sellers, however, with the number of homes for sale down 26.4% than the average for 2020, and 33% lower than levels seen in 2018 and 2019.

What do buyers want?

The supply constraints are most evident for houses, in particular family houses of 3 or 4-bedrooms, and properties priced up to £350,000.

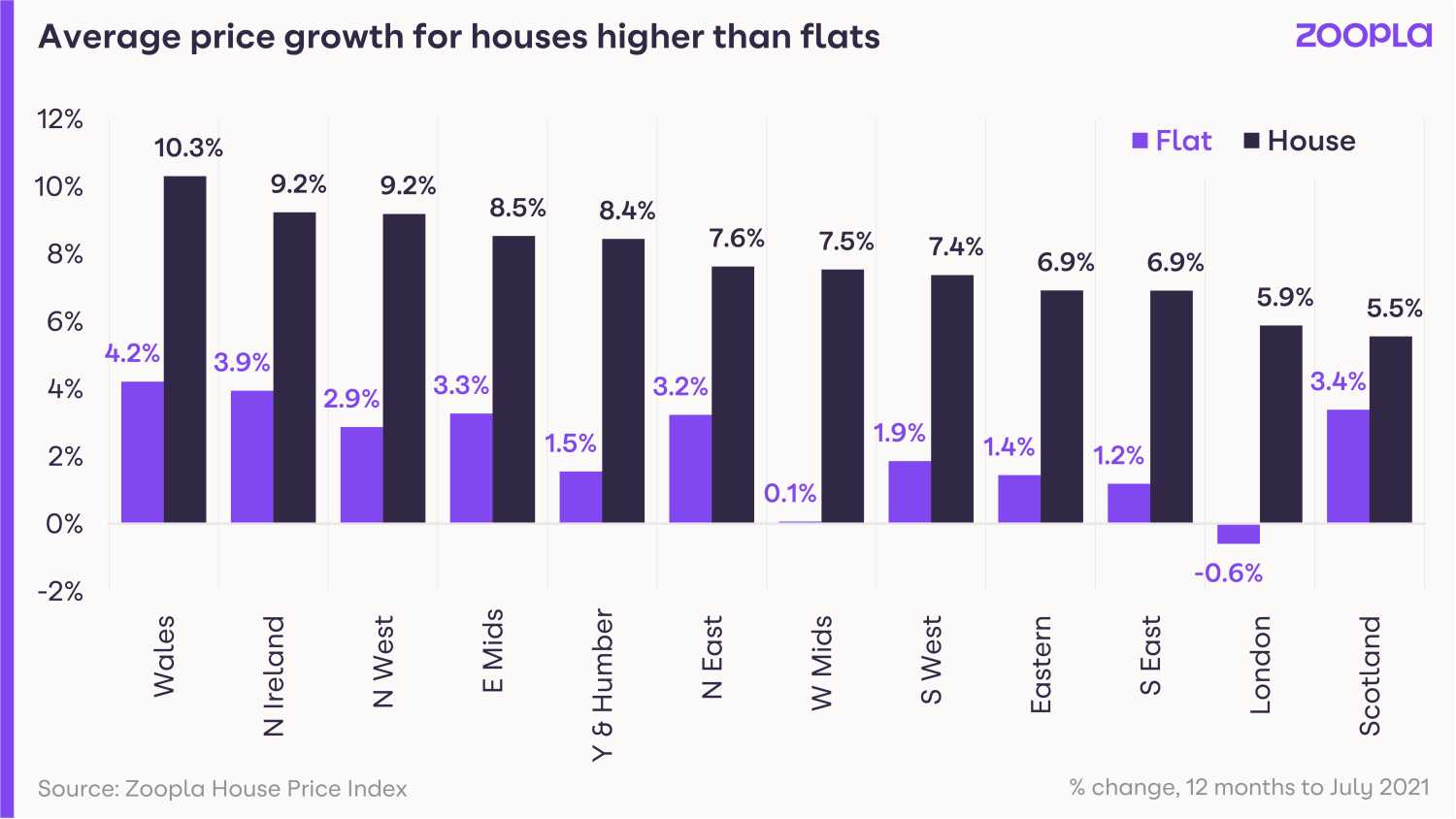

This shortage is reflected in the price of houses which jumped by 7.6% during the past year, compared with a gain of just 1.2% for flats.

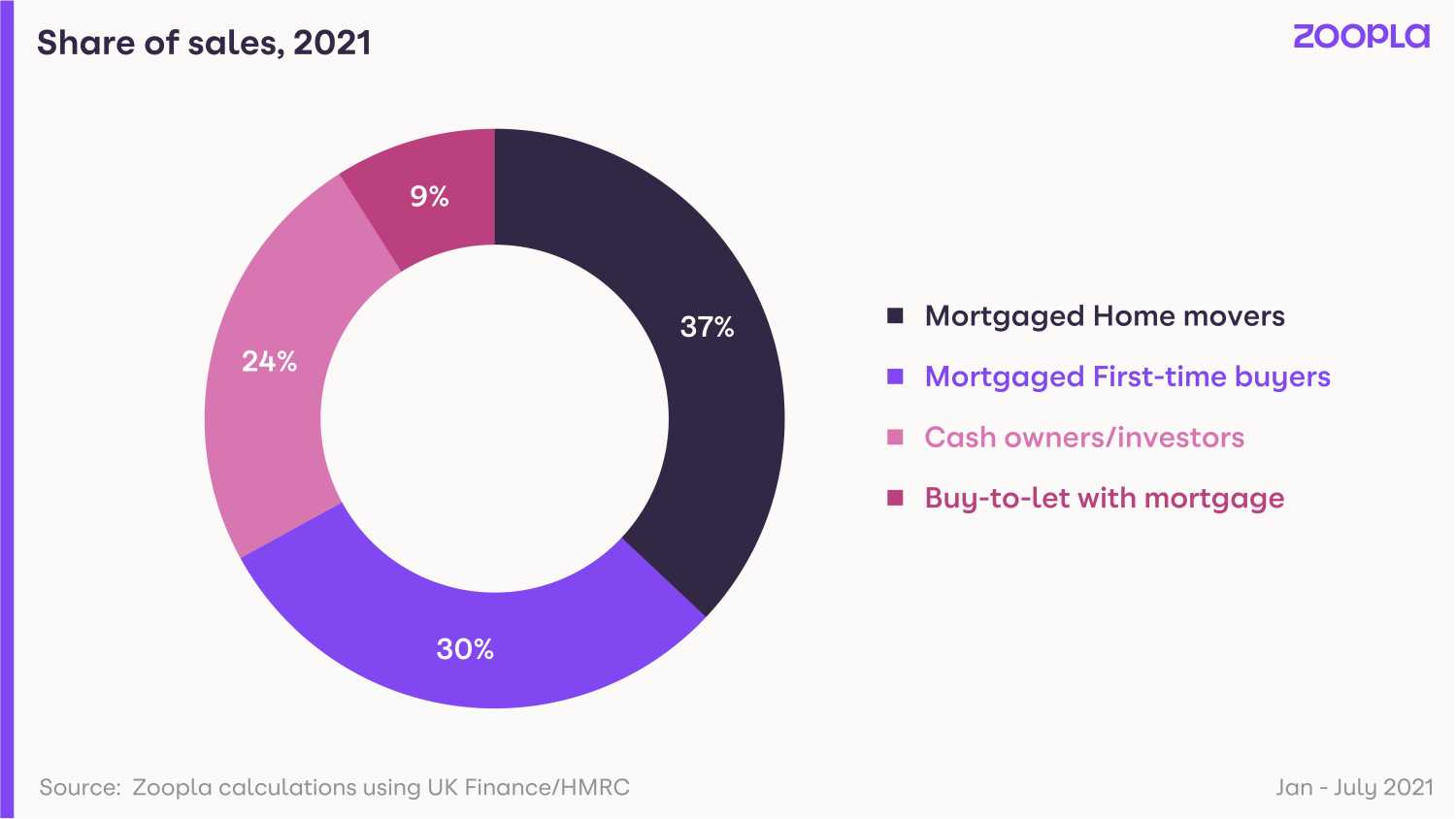

Typically a homemover both buys and sells, creating demand and supply. But the current shortage is not being helped by increased activity among first-time buyers and property investors, who do not have a home to sell.

What could a sellers' market mean for you?

First-time buyers

Buying activity in this group has increased as lenders have become more willing to offer mortgages to people with smaller deposits.

As a result, if you are looking to purchase your first home, you can expect strong competition from others trying to get on to the property ladder, with first-time buyers accounting for 30% of all sales so far this year.

The good news is that first-time buyers will continue to be exempt from stamp duty on the first £300,000 of a property purchase costing up to £500,000, even once the tapered stamp duty holiday ends.

As a result, you are not under the same pressure to find a home and complete a purchase as other buyers looking to take advantage of the tax break before the end of September, so you can afford to wait until the market cools down a bit.

Home-movers

If you have a family home that you are looking to sell you are in prime position to take advantage of the current sellers’ market and get the top price for your property.

With the market currently operating at an accelerated speed, you can also expect a quick sale.

Finding your next home is likely to be trickier, however, due to the shortage of homes for sale and intense competition from other buyers.

If you are in a position to sell your current home and delay purchasing your next one, it may be worth doing so.

Otherwise, you may want to find your next home before listing your current one.

What will happen in the market next?

The shortage of homes for sale is expected to continue well into 2022, as the impact of the stamp duty holiday continues to work its way through the market.

Once this has waned and other government stimulus measures related to the pandemic, such as the furlough scheme, have been withdrawn, levels of housing stock should begin to gradually recover.

In the meantime, low levels of available homes is likely to lead to a slowdown in the market towards the end of this year and into early next year.

As a result, house price growth is expected to ease back from its current rate of 6%, to between 4% and 5%.

Head of research, said: “The post-pandemic ‘reassessment of home’, with households deciding to change how and where they live, has further to run, especially as office-based workers receive confirmation about flexible working, allowing more leeway to live further from the office.

“However, the lack of supply, especially for family houses, means the market will start to naturally slow during the rest of this year and into next year, as buyers hold on for more stock to become available before making a move.

“As we move into 2022, there will be a strong start to the year in line with seasonal trends, but after that, a return to more usual levels of activity among first-time buyers, the effect of the ending of the stamp duty holiday, and some buyers waiting for more stock to become available will result in a slow repairing of stock levels through the first half.”

Record numbers use government's Help to Buy scheme

More than 55,000 households used the government initiative to purchase a home in the past year.

A record 55,649 households used the government’s Help to Buy equity loan scheme to purchase a property in the year to the end of March.

The initiative enables people in England to purchase a new-build home with just a 5% deposit, which the government tops up with a 5-year interest-free equity loan worth 20% of the property’s value, rising to 40% in London.

A total of 328,506 households have benefitted from the scheme since it was first launched in April 2013, with the government providing a £20.1bn-worth of equity loans, according to the Ministry of Housing, Communities and Local Government.

The scheme was changed in April this year and is now only available to first-time buyers, while regional price caps on the value of homes that can be purchased through it have also been introduced.

Why is this happening?

Help to Buy has been hugely popular among people trying to buy their first home and those trading up the property ladder. The number of properties purchased through it have been on a steady upward trajectory since it was launched.

The increase in purchases during the past year is likely to reflect the buoyancy in the wider housing market, as people reassessed their housing needs following the Covid-19 pandemic.

At the same time, the fact the initiative in its original form was due to close to new buyers on 31 March, is likely to have further increased the number of people taking advantage of the scheme.

Who does it benefit?

Although Help to Buy in its original form was open to both first-time buyers and existing homeowners, 82% of people who used the scheme in the year to the end of March were taking their first step on the property ladder.

Half of the properties purchased cost £250,000 or less, while 49% of those using the scheme had a household income of between £20,000 and £50,000, suggesting the initiative was reaching those who would have struggled to buy somewhere without help.

To qualify for the new version of the scheme, you and anyone you are purchasing a property with must never have previously owned a home in either the UK or abroad.

You will also have to ensure the property you are buying is below the new region price caps that have been introduced, which range from £186,100 in the northeast to £437,600 in the southeast. The price cap in London remains unchanged at £600,000.

What other help is available?

Help to Buy is one of a number of government initiatives to help people get on to the property ladder.

The recently launched First Homes scheme enables local first-time buyers and key workers to purchase a property at a discount of between 30% and 50% of its market price, while Shared Ownership enables first-time buyers to purchase a stake in a property and pay rent on the portion they do not own.

Earlier this year, the government launched the 95% mortgage guarantee scheme to increase the availability of mortgages for people with only a 5% deposit.

Meanwhile, first-time buyers saving for a deposit can use the Lifetime ISA into which they can save £4,000 each tax year, with the government contributing 25p for every £1 they save, giving a maximum tax-free bonus of £1,000 a year.

Even though the transition phase of the stamp duty holiday is coming to an end on 30 September for the wider housing market, first-time buyers will not have to pay the tax on the first £300,000 of a property costing up to £500,000 from 1 October 2021 onwards.

Stamp duty payments soar 90% despite tax holiday

The amount of tax paid by people buying a new home has nearly doubled compared to last year, despite more than half of buyers benefitting from the stamp duty holiday.

People buying a home in England and Northern Ireland paid a total of £2.06bn in stamp duty in the 3 months to the end of June, up 90% on the same period of 2020.

The jump in payments came despite the impact of the stamp duty holiday, which ended on 30 June 2021, during which the tax was not charged on homes costing up to £500,000.

Only 37% of buyers in the 3 months to the end of June 2021 were liable for stamp duty, according to HM Revenue & Customs.

By contrast, 64% of buyers were liable for the tax in the same period of 2020 (before the holiday was introduced), resulting in a payment of £1.9bn in tax duty - almost half what was paid by a smaller percentage of buyers in 2021.

Why is this happening?

The steep increase in the amount of stamp duty being paid has been driven by soaring property transactions, as people took advantage of the threshold at which stamp duty kicked in being raised to £500,000.

There was a 175% jump in the number of homes changing hands during the 3 months to the end of June, as people rushed to complete their purchase before the full stamp duty holiday ended, according to HMRC.

It also led to a significant rise in the number of people buying homes costing more than £500,000, as they were still able to make significant stamp duty savings, despite being charged the tax at a rate of 5% on the portion of their purchase costing between £500,001 and £925,000,10% on the portion between £925,001 and £1.5m, and 12% on the portion above £1.5m.

A total of 59,600 properties were bought for more than £500,000 in the 3 months to June 2021, compared with just 13,000 a year earlier, with these higher rates of stamp duty making a significant contribution to the total amount of the tax paid.

A further £485m was paid by people purchasing a second home or buy-to-let property, as the 3% surcharge on these homes was not covered by the stamp duty holiday.

At the same time, a new 2% stamp duty surcharge was introduced for overseas buyers purchasing a property in England or Northern Ireland on 1 April, which raised £19m.

What could this mean for you?

While the full stamp duty holiday on homes up to £500,000 has ended, you still have time to take advantage of the tapered stamp duty holiday.

If you can complete the purchase of your property by 30 September 2021, you will not have to pay stamp duty on the first £250,000 of the purchase.

Once the conveyancing process starts, be sure to respond to any questions or requests for documents from your solicitor as soon as possible to give yourself the best chance of completing on time.

And remember, if you are a first-time buyer, you do not have to pay stamp duty on the first £300,000 of your purchase, as long as your home costs less than £500,000.

What’s the background?

Not only did the stamp duty holiday lead to a sharp increase in the number of homes being sold, but the mismatch between supply and demand also led to strong house price growth.

As a result, an estimated 1.8m properties have been pushed into a higher stamp duty band, according to our research.

An estimated 940,000 properties have moved into the 5% stamp duty band, while 130,000 have moved into the 10% band.

The change will cost buyers purchasing a home in the 5% band an additional £725 on average once the tapered stamp duty holiday ends, while those purchasing a home in the 10% band can expect to pay £6,100 more.

Whose house price have you snooped on?

From family and friends, to colleagues and even ex-partners, we reveal whose house prices Brits secretly look up – and how you can track down yours.

Keen to find out what your boss forked out for their sprawling house? Or fancy checking out the price tag of your ex-partner’s shiny new pad?

If so, you’re in good company. Nearly 6 out of 10 Brits admit to secretly looking up how much someone they know has paid for their home.

Yes, a whopping 59% of people we surveyed have snooped on the property price of a friend, relative, colleague or even potential partner.

But only 19% of people think it is acceptable to ask someone what they paid for their home. And 65% say they would never admit to the owner that they had looked up the value of their property.

How did people react after checking out someone else's house price?

A third of Brits admitted they had continued dating someone they otherwise would not have after finding out how much their home was worth.

And a further 50% said it 'encouraged' them to keep seeing someone.

But 24% of people dumped someone after viewing their home online.

Putting romance aside, 11% of Brits confessed they felt jealous after finding out how much someone they knew paid for their home.

But 10% said they respected someone more and 9% said they liked them better after looking up their house price online.

Why are Brits nosy about house prices?

The main reason people looked up someone else’s house price was to get a better idea of what their own property was worth, with 23% of the 2,000 people we surveyed citing this.

Fancy finding out what your home could be worth? Use My Home to get an instant estimated value of your property and discover how much you could have made on it.

Around 18% of people who checked out the sale price of someone else’s property said they did so to find out what their home looked like on the inside, while 12% were motivated by nostalgia and wanted to see pictures of their previous home.

Some people were motivated by improving their own property, with 10% wanting to see what different layouts or extensions would be feasible for their home, and 9% claim they were looking for interior design inspiration.

Meanwhile, 8% of those who had looked up sale prices said they wanted to gauge if it was a good time to put their home on the market.

What could it mean for you?

Tom Parker, consumer spokesperson, said: “Buttoned up Britons love talking about house prices – but for most, asking someone straight-up what they paid for their home is still considered a taboo.

“But how much a house sold for is publicly available information and is easy to source online. Whether it’s your boss, a friend or even a potential partner, it’s clear we want to know more about the homes they live in and will often treat them differently as a result.”

Key takeaways

- A whopping 59% of Brits admit to checking out how much someone they know has paid for their home.

- People are most likely to find out what their neighbours, friends and family have forked out for their home. But 3% have looked up the price of their boss’ pad.

- Nearly a third have continued to date someone they wouldn’t have otherwise after viewing their home online, while a quarter have dumped someone as a result of it.

- The main reason people found out the value of someone else’s home was to get a better idea of what their own property was worth.

Demand for houses doubles as buyers search for more space

Whether you’re a first-time buyer or a homeowner looking to move up the housing ladder, here’s how the surge in popularity for houses could impact you.

In search of a spacious new home? You’re not the only one. Demand for houses has more than doubled as buyers search for more space in the wake of successive lockdowns.

Family houses are the most sought-after type of property, with the number of buyers looking to snap one up soaring by a whopping 114% compared with levels typically seen at this time of year between 2017 and 2019.

But while demand for all types of houses, from terraced to detached, has more than doubled, the number of buyers looking to purchase a flat has risen by only 34%, according to our latest House Price Index report.

This has led to the average cost of a house jumping by 7.3% during the past year, while the typical price of a flat has edged ahead by just 1.4%.

In fact, price growth for houses has outstripped flats across all regions of the country

But the greatest disparity has been seen in Wales, where the cost of a house has risen by 10.2% year-on-year, while the price of a flat has edged up by just 0.9%.

Why is this happening?

On the one hand, demand for houses has been stoked by the stamp duty holiday, with bigger savings on offer for larger properties (typically houses).

But it also reflects a surge in buyer interest for more space, with successive lockdowns driving people to reassess their homes and lifestyles.

At the same time, the trend for working from home has prompted people to leave city centres in favour of more rural locations, which are more likely to consist of houses rather than flats.

What could it mean for you?

First-time buyers

It could be good news if you’re a first-time buyer purchasing a flat rather than a house. The cost of flats has risen much more slowly than property values across the wider housing market during the past year.

It's worth remembering that there's significant variation across the regions though. Price growth for flats is down 0.5% in London during the past 12 months, while it's up 5.2% in Scotland.

If you're a first-time buyer eyeing a house, be prepared to face stiff competition. However, with no property to sell, you have an advantage over buyers in a property chain.

And remember that there are schemes available to help make buying your first home more affordable, such as first-time buyer stamp duty relief and Help to Buy.

Home-movers

Soaring demand for houses means that if you are planning to sell a house, you could be in a good position to secure a quick sale.

You are likely to have seen it’s value rise during the past year too. Price growth for houses has been particularly strong in Wales and the north west, where it has jumped by 10.2% and 8.8% year-on-year respectively. It’s been weakest in London, where it has increased by 5.6%.

But if you are selling a flat, you may find the gap between the value of your current home and the house you want to purchase has widened in recent months.

Head of research, explained: “There is a continued drumbeat of demand for more space among buyers, both inside and outside, funnelling demand towards houses, resulting in stronger price growth for these properties. Sellers will need to consider this when it comes to pricing expectations.”

Regardless of the type of property you are selling, if you are looking to purchase a house, you are likely to face stiff competition from other buyers.

So it's important to do your homework and be prepared to move quickly when you find something you like.

Key takeaways

- Interest in houses for sale has more than doubled as the pandemic drives buyers to search for more space.

- The number of people looking to snap up a family house has soared by 114% compared with levels typically seen at this time of year between 2017 and 2019.

- The average cost of a house has jumped by 7.3% during the past year, while the typical price of a flat has edged ahead by just 1.4%.

What’s the outlook?

While buyer demand for all property types has eased slightly, it remains up 80% compared with typical levels for this time of year.

But these high levels of demand are not being matched by the volume of homes on the market. And this means that buyer competition for houses is set to remain intense.

According to our research, house price growth for all property types is expected to hit 6% in the coming months.

But as the stamp duty holiday ends and economic conditions become more challenging, it’s set to fall back to between 4% and 5% by the end of the year.

Property hotspots: top areas for long-term house price growth

With UK house prices nearly tripling over the last two decades, how much could you have made on your home?

UK house prices have nearly tripled since 2001, with the value of the average home soaring by a massive £163,700.

Homeowners who purchased a home before the global financial crisis saw a dip in its value between 2008 and 2012.

But these losses have been offset by strong house price growth since 2013, according to our latest research.

Where have house prices increased the most?

Kensington & Chelsea in west London has been crowned the number one property hotspot for long-term house price growth.

Homes in the exclusive London borough have soared by nearly £740,000 in the past 20 years, making it the top-performing area for house price growth of any region since 2001.

It means that the average cost of a property in Kensington & Chelsea now stands at £1.1m, after prices rose by £380,200 since 2011 and £739,800 since 2001.

The commuter hotspots of St Albans and Elmbridge saw the strongest growth in the east of England and south east respectively, with property values climbing by more than £402,000 in both locations over the past two decades.

Trafford, an easy drive from Manchester, boasted the biggest house price rises in the north west. Meanwhile, rural areas took the top spot in other regions, such as Monmouthshire in Wales.

| Area | Region | Average house price (May 2021) | Average house price growth over 10 years (since May 2011) | Average house price growth over 20 years (since May 2011) |

|---|---|---|---|---|

| Kensington & Chelsea | London | £1.1m | £380,200 | £739,800 |

| St Albans | East of England | £624,000 | £221,900 | £402,300 |

| Elmbridge | South east | £639,500 | £220,300 | £402,200 |

| East Dorset | South west | £433,600 | £141,500 | £273,500 |

| Trafford | North west | £341,000 | £112,700 | £224,700 |

| Stratford-on-Avon | West Midlands | £338,300 | £102,500 | £206,500 |

| South Northamptonshire | East Midlands | £329,300 | £116,800 | £205,900 |

| York | Yorkshire & the Humber | £292,000 | £67,700 | £188,500 |

| Monmouthshire | Wales | £283,400 | £79,400 | £183,500 |

| Newcastle upon Tyne | North east | £164,400 | £20,300 | £99,900 |

| Scottish Borders | Scotland | £162,500 | £15,000 | £97,900 |

Research

What's happened to house prices in your area?

House prices in the south have risen the most during both the past 10 and 20 years, with southern regions occupying all of the top four spots.

Perhaps unsurprisingly, London led the way, with homes in the capital increasing in value by an average of £201,300 since 2011 and £337,400 since 2001.

To find out how house prices have changed in different areas of London over the last two decades, scroll further down our article.

At the other end of the scale, homes in Northern Ireland have seen the smallest price increases during the past 20 years, with gains of only £69,600.

And homes in the north east have increased in value the least since 2011, at an average of just £13,300.

| Region | Average house price (May 2021) | Average house price growth over 10 years (since May 2011) | Average house price growth over 20 years (since May 2001) |

|---|---|---|---|

| London | £495,400 | £201,300 | £337,400 |

| South east | £363,100 | £123,400 | £227,100 |

| East of England | £321,000 | £114,900 | £210,900 |

| South west | £284,500 | £82,800 | £180,100 |

| East Midlands | £211,500 | £65,600 | £138,500 |

| West Midlands | £207,100 | £60,700 | £130,600 |

| North west | £183,300 | £41,600 | £117,100 |

| Wales | £178,600 | £44,200 | £116,900 |

| Yorkshire & the Humber | £174,800 | £38,500 | £113,800 |

| Scotland | £158,400 | £22,200 | £93,400 |

| North east | £135,200 | £13,300 | £81,300 |

| Northern Ireland | £153,500 | £19,000 | £69,600 |

| United Kingdom | £256,100 | £73,900 | £163,700 |

Research

Why is this happening?

Since the late nineties, price growth has been fuelled by falling credit costs, which has kept mortgage payments low as prices have risen, according to Howard Bettridge, Hampton's regional director in the south east.

He explained: "Many households are also now making lower monthly mortgage payments than they were in real terms a couple of decades ago.

"This has been coupled with a house building hangover from the aftermath of the 2007 crash which has created a lack of supply, pushing prices up, while house building is only just getting back to pre-2007 levels."

On top of these longer-term trends, the last 18 months have seen price growth fuelled by white collar workers’ lockdown savings, a stamp duty holiday, and homeowners reassessing how and where they live, Bettridge added.

"Prices in London and the south east spent much of the last decade surging away from the rest of the country. But this changed around three years ago, with value growth in the north outpacing the south."

What could this mean for you?

With UK house prices nearly tripling since 2001, many homeowners have seen significant rises in the value of their property since their purchase, according to research.

You can also use My Home to track your home and other properties you're interested in. It means that you can list your home for sale when the time is right for you.

However, long-term house price growth also means that buyers face forking out larger deposits to step onto, or move up the housing ladder.

If you're in need of a helping hand, you could consider one of the government schemes aimed at assisting buyers, such as Help to Buy and Shared Ownership. And, for first-time buyers, there's stamp duty relief available beyond the current stamp duty holiday.

Which areas of London have seen the biggest house price rises?

London boroughs with the most expensive homes have seen the highest levels of house price growth.

Kensington & Chelsea took the top spot, followed by the City of London and Westminster, where property values have risen by £739,800, £570,200 and £512,200 respectively in the past 20 years.

Barking & Dagenham, which has the most affordable homes in the capital, came bottom of the table, but even here house prices have increased by an average of £242,600 since 2001.

Overall, the typical home in all but seven London boroughs has seen its price rise by at least £300,000 in the past 20 years.

| London borough | Average house price (May 2021) | Average house price growth over 10 years (since May 2011) | Average house price growth over 20 years (since May 2001) |

|---|---|---|---|

| Kensington & Chelsea | £1.1m | £380,200 | £739,800 |

| City of London | £831,300 | £294,000 | £570,200 |

| Westminster | £780,900 | £257,000 | £512,200 |

| Hammersmith & Fulham | £755,400 | £261,200 | £501,000 |

| Richmond upon Thames | £759,200 | £274,500 | £477,900 |

| Wandsworth | £646,500 | £244,600 | £435,400 |

| Camden | £636,100 | £221,900 | £424,700 |

| Barnet | £619,400 | £217,300 | £416,900 |

| Waltham Forest | £545,700 | £255,900 | £394,700 |

| Haringey | £558,700 | £224,200 | £389,400 |

| Islington | £552,500 | £214,500 | £379,500 |

| Harrow | £573,800 | £213,000 | £377,400 |

| Hackney | £527,600 | £228,000 | £368,700 |

| Brent | £541,100 | £192,100 | £365,500 |

| Lambeth | £543,400 | £205,200 | £365,400 |

| Kingston upon Thames | £563,600 | £193,100 | £353,700 |

| Southwark | £493,200 | £214,400 | £347,700 |

| Redbridge | £502,300 | £202,100 | £345,800 |

| Bromley | £523,900 | £204,500 | £337,800 |

| Ealing | £512,800 | £201,200 | £337,500 |

| Merton | £495,800 | £191,900 | £336,900 |

| Lewisham | £458,500 | £204,600 | £326,500 |

| Newham | £437,000 | £203,900 | £315,800 |

| Hillingdon | £477,700 | £182,500 | £310,500 |

| Tower Hamlets | £451,000 | £185,000 | £308,300 |

| Sutton | £471,700 | £180,700 | £304,000 |

| Hounslow | £473,800 | £170,400 | £297,300 |

| Greenwich | £415,200 | £184,800 | £295,800 |

| Enfield | £441,200 | £166,600 | £285,400 |

| Havering | £414,800 | £168,300 | £281,000 |

| Bexley | £426,000 | £167,300 | £273,800 |

| Croydon | £412,300 | £161,600 | £265,900 |

| Barking & Dagenham | £345,300 | £149,500 | £242,600 |

Research