Fixed rate mortgage deals up for 1.4 million homeowners in 2023

If you're worried that your fixed deal is up this year, you’re not alone. 57% of people who need to remortgage in 2023 are coming off two-year deals fixed at 2% rates.

If your fixed-rate mortgage deal is due to expire this year, you’re not alone. More than 1.4 million homeowners are in exactly the same boat.

And more than half of that 1.4 million, around 57%, are coming off two-year deals that were fixed at 2% rates, according to the Office for National Statistics.

The report said that with the average cost of new two-year fixed rate deals standing at around 6%, someone with a £100,000 mortgage would face a £220 increase in monthly repayments.

Someone with a £300,000 loan would face a £661-a-month jump.

A total of 353,000 fixed rate mortgages are due to expire in the first three months of the year, followed by a further 371,000 in the three months to the end of June, with the rest coming up for renewal during the second half of the year.

An estimated 86% of homeowners with outstanding mortgages are on fixed rate deals, under which the interest rate charged stays the same for the length of the product term, usually two or five years.

The figure is up from just 51% in 2016.

What will happen to interest rates in 2023?

The official cost of borrowing is known as the Bank of England Bank Rate.

The Office for Budgetary Responsibility, which provides independent analysis on the UK’s public finances, has forecast that the Bank Rate will increase to 4.8% in the second half of 2023, before falling to 4.5% in 2024.

But this is just an estimate, and a number of factors, including the uncertain economic outlook, war in Ukraine and high inflation, make it more difficult to predict the future path of interest rates than usual.

What’s happening in the mortgage market right now?

The good news is that despite the fact the Bank Rate increased in the final part of last year, the cost of fixed rate mortgages has actually fallen for the past two months.

This is because the cost at which lenders borrow money for the deals shot up in the wake of the mini-Budget.

It has since come back down after new Chancellor Jeremy Hunt reversed many of his predecessor’s announcements.

The average interest rate charged on a two-year fixed rate mortgage is now 5.79%, according to financial information group Moneyfacts.

For a five-year deal, it is 5.63%.

If you’re borrowing just 60% of your home’s value, typical rates fall to 5.39% for a two-year fix and 5.33% for a five-year fix.

And some sub-5% deals are now becoming available.

By contrast, the average cost of a standard variable rate mortgage – the rate borrowers are automatically put on when their current deal ends if they do not remortgage – is 6.64%.

Those looking to remortgage will need to move fast, with the average deal available for just 15 days before lenders pull it, down from 28 days in January 2022.

Renters also face higher housing costs

The ONS study found that homeowners are not the only ones facing increased costs, with those renting in the private sector seeing the fastest growth in rents since records began in 2016.

One in four renters said their rent had gone up in the past six months, with rents rising by an average of 4% in the past year.

Rent accounts for an average of 24% of renters’ weekly expenditure, compared with just 16% for those who have a mortgage.

Key takeaways

- More than 1.4 million fixed rate mortgages are due to expire this year

- Around 57% of people who need to renew their mortgage in 2023 are coming off two-year deals fixed at 2% rates

- But mortgage rates have fallen for the last 2 months and sub 5% fixed-rate deals are now available

New rules make property listings more transparent

When it comes to searching for a home, the devil is in the details. Here’s everything you need to know about the new material information rules when you’re buying, renting or selling a home.

If you’re searching for a home, you might’ve noticed that property listings are more detailed than ever before.

It’s no coincidence. In fact, it’s part of an industry-wide process to improve property listings and give you all the important information from the get-go.

The aim is to create a more transparent and less stressful process for everyone involved in buying, selling or renting. It’s all about helping you make informed decisions about a property.

And ultimately, it should help your sale, purchase or rental go through more smoothly, as the facts are clear and everyone knows what they’re getting into from the start.

What is ‘material information’ for a property listing?

The term ‘material information’ covers the nitty-gritty details about a property that might impact your choices around it.

National Trading Standards (NTS) defines it as “information which the average consumer needs, according to the context, to take an informed transactional decision”.

So think of it as the fine print that you really *need* to read about a property, once you’ve stopped admiring the photos or searching for the nearest pub.

It doesn’t cover information like local school ratings or proximity to a train station, as these are seen as preferences rather than essentials.

What information should you see on a property listing?

Since May 2022, estate agents need to include all unavoidable costs associated with a property when they list it for sale or to rent.

This video from NTS explains what’s changed with the material information rules and how they’re benefitting buyers, sellers and renters.

You should see the following information on all listings for properties for sale:

-

Sale price

-

Council tax band (or domestic rate in Northern Ireland)

-

Tenure (freehold, leasehold, share of leasehold, commonhold, feudal)

-

For leasehold properties: length of lease, annual ground rent, ground rent review period, annual service charge amount and service charge review period

-

For Shared Ownership properties: the percentage share being sold plus the rent you’ll pay on the other proportion

And for rental properties, listings should include:

-

Rental rate

-

Deposit amount

-

Length of tenancy (year/month)

-

Council tax band (England, Wales and Scotland)

If you’re wondering about energy efficiency, you’re a step ahead. EPC ratings must be included on property listings under existing laws.

What if a listing is missing this information?

It’s the responsibility of estate agents to submit accurate material information on all their properties.

If they’ve missed something, NTS might get in touch with them to ask them to update or remove it.

If a property you’re interested in is missing some of the details, it’s best to contact the estate agent to ask them for more information.

There are no plans yet to remove property listings that don’t comply, but that might change in the future.

What does it mean if you’re selling your home?

The material information changes mean you’re required to provide certain details about your home and you might be liable if you misrepresent anything.

But it’s nothing to worry about.

Your estate agent will ask you for all the details they need and they’ll be responsible for adding it to the listing.

In fact, giving these details upfront will help encourage genuine enquiries. Potential buyers or tenants will be interested based on accurate information they’ve seen on the listing.

It can also help prevent a sale or rental agreement falling through at a later stage.

What material information will be shown on listings in the future?

When we reach the next steps of the process, you can also expect to see a property’s:

-

Renewable or alternative energy sources

-

Broadband options

-

Parking details

-

Locational information like flood risk

-

Rights and restrictions affecting the property

…and maybe more. The NTS is working on exactly which information will be required in Parts B and C of the process and we’ll update you as soon as they’re good to go - or watch this space for the latest updates.

Key takeaways

- The term ‘material information’ covers the nitty-gritty details about a property that might impact your choices around it

- Estate agents now need to include all unavoidable costs associated with a property when they list it for sale or to rent

- There are plans for property listings to become even more detailed in the future.

Gas and electricity: your common questions answered

Here at Uswitch, we're asked lots of questions about energy suppliers, bills and switching. Here are the answers to some of your most common queries.

Where does UK gas and electricity come from?

According to Ofgem, around half of UK gas supplies come from our own gas fields in the North Sea.

The rest is imported from a variety of sources including Norway, the Continent and across the world using liquefied natural gas (LNG).

The UK's electricity is generated from fossil fuels, nuclear, renewable and imported energy. There are more than 2,000 electricity generating stations in the UK.

Who is my gas and electricity supplier?

Check your latest energy bill to find out who supplies your gas or electricity.

If you don't have a bill to hand, find out the name of your gas or electricity supplier in this handy guide:

Who is my gas or electricity supplier?

What is dual fuel?

With a dual fuel plan you get your gas and electricity from the same energy supplier.

Dual fuel usually works out cheaper than a single fuel plan where you buy your gas and electricity from different suppliers.

This is because energy suppliers often offer discounts and reduced rates for dual fuel plans.

Plus, with a dual fuel plan, you only have to deal with one energy company if you have any queries or problems with your gas and electricity.

What is Economy 7?

Economy 7 refers to both the meter that tracks your electricity usage separately for day and night, and the tariff, which charges different rates for the day and night usage.

I've written in more detail about Economy 7 over on Uswitch:

What is green energy?

Green energy is electricity or gas derived from renewable sources such as hydro energy, wind energy, solar energy and biomass.

How are my gas and electricity bills calculated?

Your energy bills are calculated on the basis of how many units of energy you consume. You may also pay a standing charge.

When your meter is read, the energy company will subtract the amount shown on the previous meter reading from the most recent one to work out your bill.

If your meter isn't read, you will get an estimated bill based on your past use or a standard rate.

Units of electricity are measured in kilowatt hours. This is shown on your electricity meter.

Gas meters measure the volume of gas you used in cubic feet or cubic meters and the gas companies convert this into kilowatt hours. The price charged for each unit of energy varies according to what pricing plan or tariff you are on.

What information should my gas and electricity bills contain?

Your gas and electricity bills should show:

-

Your last meter reading (either estimated or based on your submission)

-

The amount of electricity or gas you've used in the billing period as well as an annual consumption

-

VAT charges

-

The price you're paying per kWh (the unit rate)

-

Your plan name

-

Your meter number(s)

How do I read my gas and electricity meters?

This will depend on the kind of meter you have. Check out our guide to reading your meter, and why it's important to submit regular meter readings:

How to take an energy meter reading

Who should I contact if I have a complaint about my energy supplier?

First, you need to contact your energy supplier and go through their complaints procedure.

If you need to escalate your complaint, you can get in touch with Citizen's Advice and failing all else, contact the Energy Ombudsman.

First-time buyer numbers hit second highest level in 14 years

More than half of all homes bought with a mortgage in 2022 were snapped up by first-time buyers.

The number of first-time buyers hit its second highest level for 14 years in 2022.

An estimated 370,000 people got on to the property ladder last year, according to Yorkshire Building Society.

The total was the highest for more than a decade, with the exception of 2021, when 400,000 people bought their first home.

2021 was an exceptional year for the housing market, as the pandemic-induced search for space and stamp duty holiday led to elevated levels of activity.

Despite the slight year-on-year fall between 2021 and 2022, the number of first-time buyers last year was still 5% higher than in 2019, before the pandemic struck.

First-time buyers accounted for 53% of all people purchasing a property with a mortgage during the year, up from 50% in 2021 and 41% a decade ago.

Why is this happening?

Demand from first-time buyers was fuelled by a combination of high employment levels and low borrowing costs for much of the year.

Low mortgage rates helped to offset the increase in the average price paid for a home, which rose 10% from 2021 to 2022 to stand at £272,500.

The total is also likely to have been boosted by first-time buyers rushing to take advantage of the government’s Help to Buy Equity loan scheme before it closed to new applicants on 31 October 2022.

The initiative enabled people to purchase a property with just a 5% deposit, which the government topped up with a 20% equity loan that was interest-free for the first five years.

New Right to Shared Ownership scheme launched

Who does it affect?

The fact that so many people were able to purchase their first home in 2022 is not just good news for those individuals, but also for the housing market as a whole.

First-time buyers play a vital role in the market by purchasing properties at the bottom of the ladder, enabling existing homeowners to trade up it.

However, first-time buyer numbers are likely to be lower this year due to higher mortgage rates, combined with the cost-of-living squeeze.

What help is available for first-time buyers?

While the government’s Help to Buy equity loan scheme may have closed, there is still plenty of help available to those purchasing their first home.

First Homes helps first-time buyers, key workers and local people to purchase a home at a 30% discount to its market price, while Shared Ownership enables people to buy a share in a property and pay rent on the rest.

Meanwhile, the Mortgage Guarantee Scheme enables both first-time buyers and home-movers to purchase a property with just a 5% deposit.

The scheme, which has been extended by a year to run until 31 December 2023, encourages lenders to offer 95% mortgages by having the government guarantee the portion of the loan over 80%.

First-time buyers saving for a deposit can also use the Lifetime ISA, under which you can save £4,000 a year. The government then adds a 25% bonus - up to a maximum of £1,000 annually. The money must be used to either purchase a first home or for retirement.

The government has also increased the threshold at which stamp duty kicks in for first-time buyers from £300,000 to £425,000 on homes costing up to £625,000 until April 2025.

Key takeaways

- An estimated 370,000 people stepped on to the property ladder in 2022

- The figure was the second highest in the past 14 years, behind only 2021 when the pandemic and stamp duty holiday elevated activity levels

- First-time buyers accounted for 53% of all people purchasing a property with a mortgage during 2022

Latest Housing Census data: number of people renting soars by 28%

More than one in five people now rent in the private sector, while the number of those who own a home has fallen, according to the latest Housing Census.

An estimated 5 million households – more than one in five - rented their home in the private sector in 2021, up from 3.9 million in 2011, according to the government’s latest Housing Census.

Stretched affordability, caused by strong house price growth during the past decade, is likely to be behind the increase, as first-time buyers delay stepping onto the property ladder.

There has also been a fall in the number of households who own their home, with the proportion of owner-occupiers dropping to 62.5%, down from 64.3% in 2011.

The census also found that the number of households in England and Wales has increased by 1.4 million since 2011, to stand at 24.8 million in 2021.

The number of new homes being built has failed to keep pace with this rise, contributing to the increase in house prices seen during the past 10 years.

Here’s what else the census revealed:

How many people own their own home?

Across England and Wales, the percentage of households who own their own home has fallen during the past decade.

However, due to population growth, the actual number of homeowners has increased.

In 2021, around 15.5 million households lived in a property they owned, up from 15 million in 2011.

Overall, a third of people own their property outright, while 29.7% have a mortgage or own a stake in a shared ownership property.

One in five people rent their home in the private sector and 17.1% rent it through a local council or housing association - broadly unchanged from 2011.

A lucky 33,000 households, around 0.1% of the total, live in their home rent free.

This may be because they are property guardians, have a job that comes with a home, are live-in helpers or house-sitters.

Homeownership rates were highest in the South East and South West at 67.1% and 67% respectively, and lowest in London, with the capital having the highest proportion of people who rented from both the private sector at 30% and the social sector at 23.1%.

What type of homes do people live in?

Almost 78% of people lived in houses and bungalows, while almost 22% lived flats, maisonettes or apartments.

The remaining 0.4%, around 104,000 households, lived in a caravan or other temporary structure.

The number of households living in a flat or apartment has seen the biggest increase during the past 10 years, with an additional 500,000 households living in flats in 2021, compared with 2011.

There was also an increase in the proportion of people living in detached and semi-detached houses, while the number of people living in terraced properties fell.

This is likely to be because fewer terraced properties are being built compared with other properties, according to the National House Building Council.

Unsurprisingly, people in London were most likely to live in a flat at 54%, compared with 21.6% in the South East and just 11.4% in the East Midlands.

Do people have enough space?

When recording the Housing Census, the number of 'rooms' a property has doesn't include kitchens, utility rooms, bathrooms, WCs, conservatories, halls or landings.

With that in mind, the study found that three-quarters of people lived in a home that had between three and five rooms, while 13.9% had six to eight rooms.

Just over 1% had nine or more rooms.

At the other end of the scale, one in 10 households are living in properties that have only one or two rooms.

In terms of bedrooms, 40.4% of homes had three bedrooms, with 27.1% having two bedrooms and one in five properties having four or more.

Around 11.4% of properties - the equivalent of 2.8 million households – had just one bedroom.

Despite more than one in 10 properties having just one bedroom, only 4.3% of households said their home was overcrowded and they had fewer bedrooms than they needed, although the proportion rose to 11.1% in London.

Meanwhile, seven out of 10 households reported having more bedrooms than they actually required.

How many homes have central heating?

Nearly all homes in England and Wales had central heating in 2021 at 98.5%, although this still left 367,000 households in properties without central heating.

The majority of homes were heated with mains gas at 73.8%, while 8.5% had electric heating.

Just 99,000 properties were heated using solely renewable energy, but a further 135,000 used at least one renewable energy source, alongside other sources, such as gas or electricity.

People living in the Isles of Scilly, off the coast of Cornwall, were most likely to be using at least some renewable energy at 6.1%.

By contrast, just 0.2% of homes in Blackpool used at least one renewable energy source.

How many cars do people have?

More than three-quarters of households owned a vehicle, with 41.3% households owning at least one car or van, while 26.2% owned two vehicles and 9.2% owned three or more.

But 23.3% of households did not own any cars or vans, down from 25.6% in 2011.

Unsurprisingly, the highest concentration of households that did not own a vehicle was in London at 42.1%, rising to 77.2% in the City of London.

At the other end of the scale, households in the South East and East were most likely to own two or more vehicles at 42.3% and 41.6% respectively.

Key takeaways

- The number of people renting a home in the private sector in England and Wales has jumped by 28% during the past 10 years

- A third of people own their property outright, while 29.7% have a mortgage or own a stake in a shared ownership property

- The majority of people live in a house or bungalow, but the number living in flats has seen the biggest increase since 2011

Mortgage Guarantee Scheme extended to end of 2023

The government-backed scheme to ensure 95% mortgages remain widely available will now run until December 2023.

The Mortgage Guarantee Scheme is being extended by a year to help more people with a 5% deposit to buy a home.

The government-backed scheme had been due to close at the end of 2022, but it will now run until 31 December 2023.

It has already helped more than 24,000 households to purchase a property, 85% of which were first-time buyers.

Chief Secretary to the Treasury, John Glen, said: “Extending this scheme means thousands more have the chance to benefit, and it supports the market as we navigate through these difficult times.”

Before the announcement was made, commentators had expressed concern that the end of the scheme would make it difficult for people with only a small deposit to get a mortgage, particularly as house prices in some areas are falling.

A number of lenders had recently withdrawn their mortgages for people borrowing 95% of their home’s value. But news that the scheme is being extended should boost the supply of these loans.

How does the scheme work?

The scheme encourages lenders to offer 95% mortgages by having the government guarantee the portion of the loan over 80%.

This means that if the borrower defaults on the mortgage, the government will cover up to 15% of the shortfall.

The scheme can be used by both first-time buyers and those trading up the property ladder on homes worth up to £600,000.

It can be used to purchase an existing or a new-build property, but the home must be bought with a repayment mortgage, not an interest-only one.

The Mortgage Guarantee Scheme was launched in April 2021, after lenders withdrew mortgages for people with small deposits in the face of the Covid-19 pandemic, leaving just eight 95% mortgages available on the market.

What other help is available to first-time buyers?

There are a number of government schemes to help people get on to the property ladder.

First Homes helps first-time buyers, key workers and local people to purchase a home at a 30% discount to its market price, while Shared Ownership enables people to buy a share in a property and pay rent on the rest.

First-time buyers saving for a deposit can also use the Lifetime ISA, under which you can save £4,000 a year. The government then adds a 25% bonus - up to a maximum of £1,000 annually - for free. The money must be used to either purchase a first home or for retirement.

The government has also increased the threshold at which stamp duty kicks in for first-time buyers from £300,000 to £425,000 on homes costing up to £625,000 until April 2025.

Lenders to offer mortgages on flats in high-rise buildings

There was also good news for people who own flats in high-rise buildings with cladding.

Six lenders have announced they will start accepting mortgage applications from people who live in buildings in England that are over five storeys high, or 11 metres tall, and have cladding from early next year.

The move follows new guidance from the Royal Institution of Chartered Surveyors to enable valuations on properties impacted by cladding.

But lenders will still want to see evidence that dangerous cladding will be removed, either by the building’s developer or through a government scheme.

The lenders who will consider mortgage applications from people in high-rise buildings with cladding are Barclays Bank, HSBC, Lloyds Banking Group, Nationwide Building Society, NatWest and Santander.

Key takeaways

- The Mortgage Guarantee Scheme is being extended until 31 December 2023

- The scheme helps first-time buyers and home-movers with just a 5% deposit buy a home

- It has already helped more than 24,000 households purchase a property, 85% of which were first-time buyers

Buyers on the hunt for affordable cities and flats in 2023

Apartments and urban areas set for a comeback as buyers prioritise affordability and value for money.

Affordability and value for money will be the big key drivers for the housing market in 2023.

These two factors are going to flip the flight to rural and coastal areas, which has dominated the housing market in recent years, into reverse.

Instead, apartments and urban areas, which lost some of their popularity during the pandemic as the nation began the search for more space in idyllic locations, are making a comeback.

Executive Director for Research, Richard Donnell says “The dynamics that have shaped the housing market over the last 5 years are shifting.

“We expect affordable urban centres to fare better than average in 2023 but the inner London market may require another year before it is ready to rebound.”

Why are urban areas becoming popular again?

Influenced by higher mortgage rates, household incomes and the actual level of house prices, buyers are being priced out of the more expensive markets, preferring to look in areas where homes are more affordable.

Increasingly keen to secure homes in urban settings, where jobs are being created and more services are available, buyers are now showing a stronger preference for towns and cities.

The popularity of family homes in city suburbs and commuter areas is also rising, with demand for homes in these areas climbing to above average levels over the last year.

How rising mortgage rates are affecting where buyers choose to live

Mortgages are currently needed for seven out of every 10 home purchases.

Higher mortgage rates are currently affecting what many people can afford to buy, as they mean more income is needed to secure a sale.

The more expensive a market, the greater the number of households that are priced out.

This in turn weakens demand, leading to fewer sales and possible price reductions to secure those sales in these areas.

In affordable markets with lower average house prices, the opposite is true.

Why affordable markets will fare better in 2023

As demand for more affordable areas increases in 2023, these markets are likely to fare better than their more expensive counterparts in terms of price falls over the coming months.

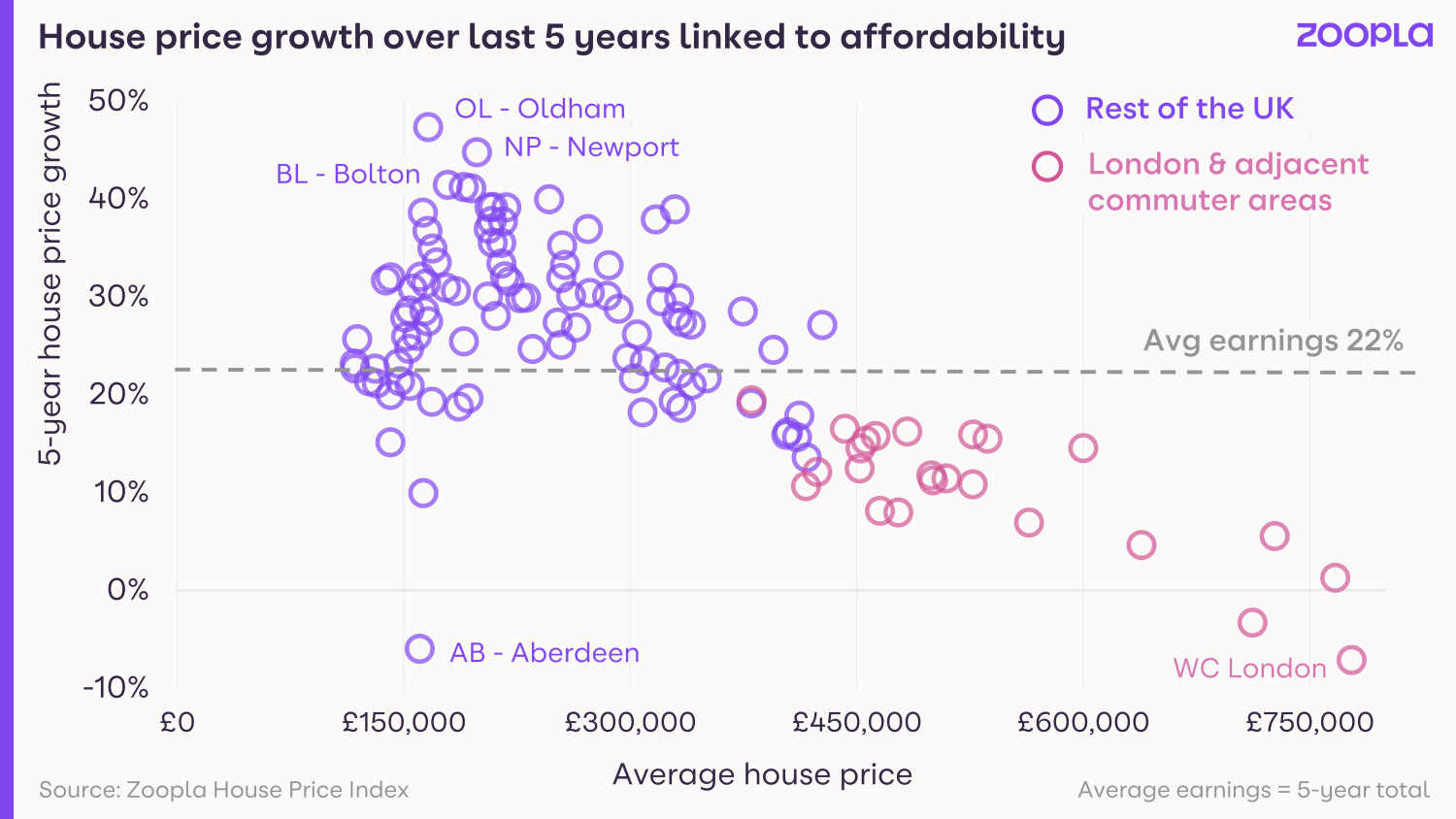

Most housing markets have recorded house price gains of 25.4% over the last 5 years. That's above the level of consumer price inflation (+19%) and average earnings (+22%) over the same time period.

Economic growth, good affordability and low mortgage rates have all enabled above average price gains over this period.

The Oldham postal area recorded the highest price increases since 2017 at +47%, while Newport, Swansea and Bolton also enjoyed high value gains.

However, we expect house price growth to slow in these higher-growth markets in 2023.

UK house prices are predicted to fall by an average of 5% next year.

But in the more affordable markets, the falls are likely to be lower, as the hit to buying power from higher mortgage rates will be felt less keenly.

Which affordable cities are buyers interested in?

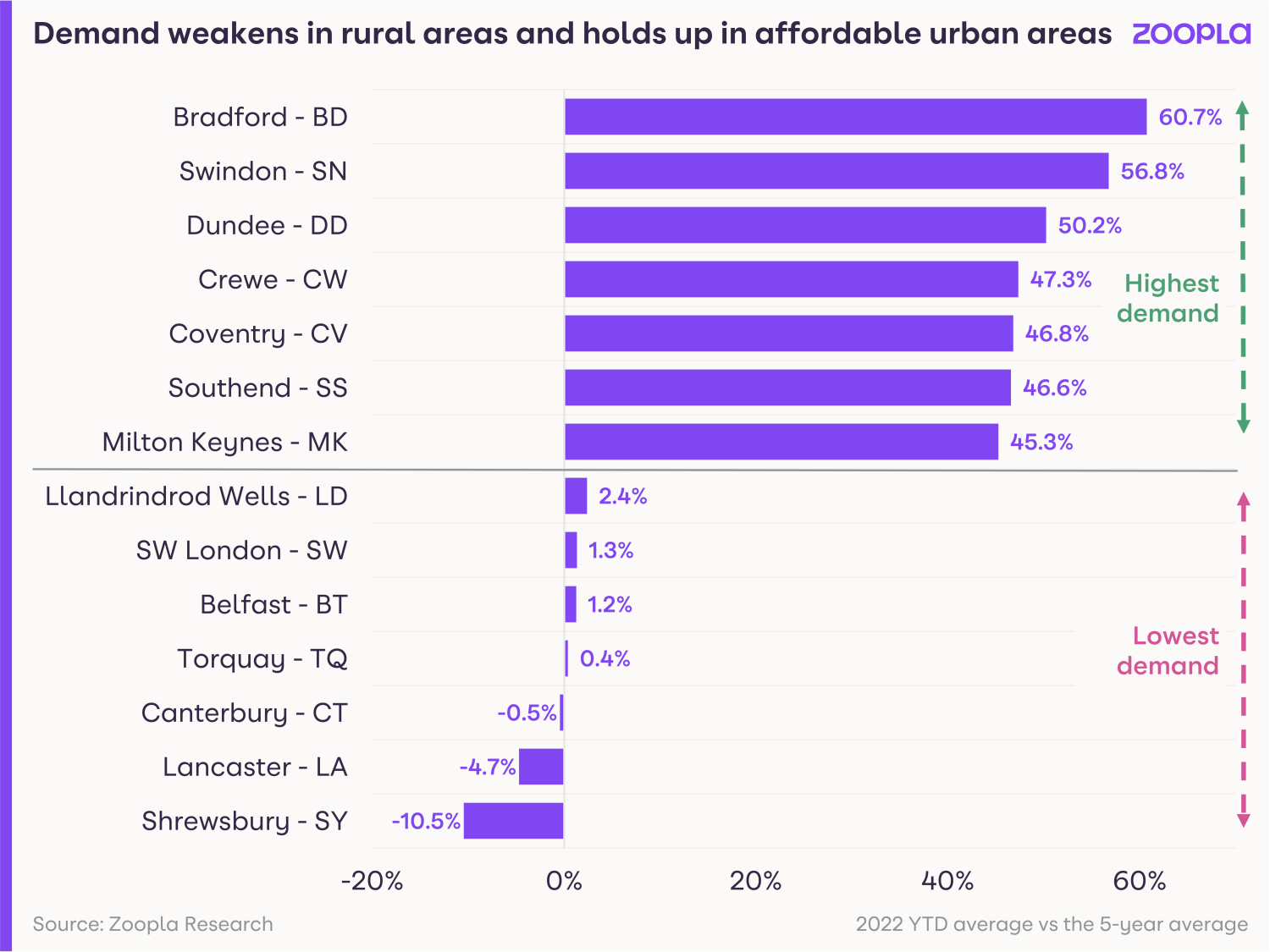

Major towns and cities, including Bradford, Swindon, Coventry, Crewe, Milton Keynes and Southend are all registering above-average demand.

These areas all have their own employment base, but they also enjoy good transport connections into much larger employment centres, such as London, Leeds, Manchester and Birmingham.

We believe employment growth will continue to stimulate housing demand in these affordable city regions throughout 2023.

Why flats are becoming better value for money

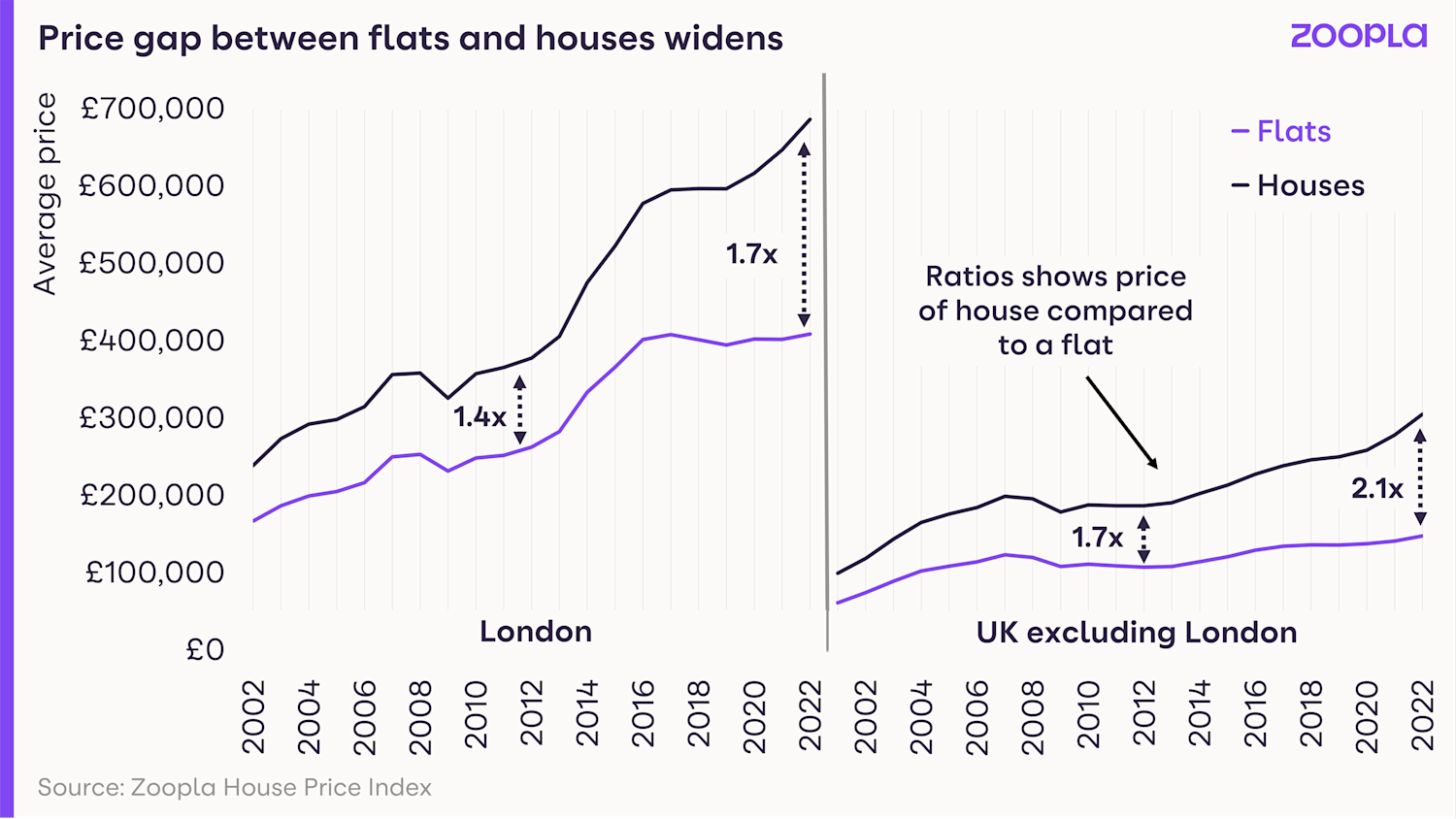

Apartments make up around 1 in 5 homes in the UK, but price inflation for them has lagged behind the growth enjoyed by houses.

Across the UK, houses are currently valued at just over twice the price of flats. That’s the highest price difference seen for 20 years.

In the capital, the average price of a house is 1.7x the price of a flat, up from 1.4x a decade ago.

Flats haven’t experienced those same value gains as houses partly because the search for space made them a less popular option during the pandemic, but also because buyers were experiencing concerns over cladding and leasehold charges.

The chart below tracks the average price of flats and houses since 2002.

However, we expect demand for flats to increase throughout 2023, as buyers seek better value for money.

The government’s moves to ensure cladding problems are remediated in most buildings will also help to boost their popularity further.

What should first time buyers do in 2023?

What will happen with the London housing market in 2023?

London and its commuter areas have under-performed in recent years.

With prices already at the highest end of the market, affordability is already stretched for buyers in the capital.

In central London - and the commuter areas surrounding it - the scope for price increases over the last 5 years has been limited, despite the ultra-low mortgage rates that were available until the middle of this year.

Prices have been falling slightly in central London since 2017 and are now 17% lower in real terms, allowing for inflation.

That said, earnings have been rising at a faster pace than prices since 2017, which is slowly improving affordability.

Still, average prices remain high by national standards and of course, mortgage rates are now higher than last year.

We expect the inner London housing market to rebound soon, but this requires a further improvement in housing affordability.

In the meantime, we expect London house prices to register above-average price falls of 5% to 8% in 2023, which will improve affordability, alongside our expectation of lower mortgage rates.

We also believe that a resurgence in employment growth will be the trigger for a turnaround in this under-performing market in the next 1-2 years.

Key takeaways

- Tide turns on the desire for coastal and rural areas as demand for affordable cities and apartments rises

- Buyers once again attracted to urban settings with plenty of jobs and services

- The dynamics that have shaped the housing market over the last 5 years are shifting

What should first time buyers do in 2023?

From the better value of flats to discounts and price falls, here's how a slower housing market could benefit first time buyers in 2023.

Low mortgage rates have meant first time buyers could often afford a three bedroom semi with a double driveway and a big garden over the past 2 years.

But with mortgages more expensive - plus higher living costs - you might be wondering about your chances of stepping onto the property ladder in 2023.

Our latest House Price Index shows buyers have been stepping back from the market, with demand down 50% against this time last year.

But a slower housing market can bring opportunities for first time buyers. If you know where to look and when to make your move.

Let’s take a look at how you could step onto the property ladder in 2023.

Look to flats for better value for money

Price growth for flats has been much slower than for houses in the last 10 years. This means a flat could give you the chance to buy at a cheaper price for greater value for money.

After the pandemic, there was a rush towards houses as everyone wanted more space. Demand for flats dropped and values rose at a slower rate than house values.

In London, you’ll spend 1.7 times more on a house than you will on a flat. 10 years ago, a London house was only 1.4 times more expensive.

It’s a similar picture across the rest of the UK, where you’ll pay 2.1 times more for a house than a flat - the highest differential in 20 years.

If you want to save money by buying a flat, make sure you’re aware of the extra costs and considerations.

Check if the property is for sale as freehold or leasehold, find out the cost of service charges and ground rent, and make sure it’s clear who will pay for repairs and maintenance to the building.

We expect more buyers to realise the relative value to be found in flats in the coming months, which will increase demand for flats later in 2023. This will also be supported by the government’s commitment to fix cladding issues, which impact a small proportion of flats in the UK.

Put in an offer: sellers will be more open to negotiations in 2023

Sellers are now accepting offers 4% below asking price on average, which works out to a £10,500 discount on the average home right now.

It’s already a big change from a few months ago - in October, buyers were not getting any wriggle room from sellers and we recorded an average discount of 0%.

We think this trend will keep going and you may be able to get an even bigger discount from sellers in 2023.

If you’re looking to buy soon, keep in mind that December is not usually the best month for discounts or reductions to asking prices.

It might be worth making that cheeky offer in the New Year instead, as sellers often wait to see if new buyers will come into the market the first week of January.

Keep an eye out for small drops in house prices

While house prices are up 7.2% over the last year - or £17,500 on average - price growth has stalled since the summer.

In the last 3 months, house prices have only risen 0.3%, compared to 2% in the summer.

And we’re expecting to see house prices fall in the first part of 2023, with annual price falls coming in by mid-year.

If our predictions are right, it’ll be the first time we’ve seen annual price falls for years, meaning a small respite for first time buyers who have faced continually rising prices and strong competition.

Generally speaking, the biggest house price falls will come in the south of England, where house prices are more expensive.

If you’re looking to buy in a high value market, this could give you the chance as competition eases and sellers start to reduce their prices to achieve a sale.

While you might find it harder to get a mortgage, buying remains cheaper than renting an equivalent home everywhere in the UK apart from London.

When you’re looking at homes for sale, check if the price has already been reduced with our ‘listing history’ tab. It can give you an idea if there might be room for the price to be discounted.

Be ready to move quickly in affordable urban areas

In lower-value markets, we’re still seeing high demand as mortgage rate rises have had less of an impact.

Demand is tracking at above average levels in affordable urban areas like Bradford, Swindon, Coventry, Crewe, Milton Keynes and Southend.

But first time buyers have the advantage of flexiblity and the ability to progress quickly, which gains even more favour among sellers in a softening market.

We expect these affordable areas will see above-average house price rises in the next year – but it’ll be at a much slower rate than in the last 2 years.

So if you need to save for a little longer or want to see if mortgage rates drop further, you won’t be seeing the same price rises as recent years and may find you’re in a better position by mid-2023.

Director of Research and Insight, says: "First time buyer demand is expected to hold up in 2023 as the rapid growth in rents makes buying look attractive - even as mortgage rates increase.

"This is particularly the case in regions outside the south of England where mortgage repayments are lower than monthly rental costs, even with 5% mortgage rates.

"Rents are expected to rise further in 2023 adding to the impetus to buy. However, raising a deposit will remain the biggest challenge for first time buyers as the best mortgage rates will be for lower loan-to-value mortgages."

Whatever your situation, we always recommend getting independent financial advice before you go ahead.

Key takeaways

- Flats are offering the best value for money for 20 years across most of the UK

- Sellers are already giving 4% discounts on average and they’ll be even more open to negotiations in 2023

- House prices will start to drop in the new year, with the most expensive areas seeing the biggest price falls

- Many urban areas are still affordable despite high demand, including Bradford, Swindon, Coventry, Crewe, Milton Keynes and Southend.

3 reasons why the housing market might defy expectations in 2023

Mortgage rates hitting 6.5% brought many predictions of sizeable house price falls in 2023. But we're less bearish and believe the housing market will be stronger than many expect next year.

Cost of living pressures and higher mortgage rates have dented interest from new homebuyers in the second half of 2022.

The spike in mortgage rates to 6.5% after the mini budget caused widespread alarm, given mortgage rates were just 2% at the start of 2022. Housing market activity has stalled since October as buyers and sellers stand back and wait to see what the outlook is like in January 2023.

Many forecasters have put out bearish predictions for 2023, anticipating house prices falls of 8% to 12% and a significant fallback in sales numbers. Most of these projections are based on expectations of high mortgage rates over 2023 and an economic recession lasting into 2024.

While the outlook is less certain and more challenging for a growing number of households, we are more positive about the prospects for house prices and sales volumes in 2023 for 3 broad reasons.

1. Banks are keen and ready to lend

Many people are looking back at history to draw parallels, in particular the 2007-09 downturn. The 12% drop in house prices over this period was driven by a lack of credit, in that few banks were willing to lend to anyone but the safest customers. This reduced demand for homes and prices fell.

Price falls were also amplified by banks loosening their lending criteria in the run-up to 2007. A third of borrowers didn't prove their income to their bank in 2007 when applying for a mortgage.

Things are very different today.

UK banks are very well capitalised and their business plans are subjected to regular testing against major downturns in house prices and economic growth. All our high street lenders are mortgage-focused businesses and they will want to make sure credit is available to those that need it in 2023, albeit with higher mortgage rates than at the start of 2022.

Higher interest rates means banks will become more profitable. For existing borrowers, banks are developing a range of options to make sure customers can afford the jump in mortgage rates as they come to the end of fixed term deals.

2. Mortgage rates are dropping

The other big change in recent weeks has been a fall in the cost of money that underpins mortgage rates.

The vast majority of us take fixed rate loans of up to 5 years. After the fallout from the mini budget, the recent fiscal plan from the government has calmed money markets again. This has seen the underlying cost of mortgages fall back to where it was starting to move to earlier in the year.

This means typical mortgage rates for new borrowers taking a 5-year fixed rate will be in the 4.5% to 5% range at the start of 2023.

Higher loan-to-value mortgages will see the higher mortgage rates while those with the biggest deposits, or the most equity in their home, will get the best rates. This factors in further modest increases in the Bank of England base rate in the short term to bring down inflation.

The other important thing to note about mortgage costs is that every homeowner who took out a mortgage over the last 5 years had to prove to their bank they could afford a 6.5% to 7% mortgage rate, even though they may have been paying just 1% or 2%. This so-called affordability stress test was designed to to make sure buyers could afford higher rates.

This is important, and means the housing market has effectively been operating in the background at 6.5% to 7% mortgage rates. It is another key reason we see evidence of underlying resilience in the housing market. If everyone had been buying based on whether they could afford 2% mortgage rates, house price growth would've been much higher and we would now be expecting much bigger price falls as a result.

3. Motivations to move home remain

The impacts of the pandemic continue to shape the desire to move home. People who expect to work more flexibly are 6 times more likely to move than those that don't expect any change in their working style. The proposals from the government to make flexible working more open to employees will support this trend and further loosen the ties between where people live and work.

The pandemic also brought on a jump in the number of people leaving the labour market for health reasons and retirement, which are big triggers for home moves. Those retiring are more likely to have paid off their mortgage or have a small mortgage, so higher mortgage rates are less of a concern - 30% of sales involve no mortgage at all. Many will be looking to move closer to friends and family or to a better area and a smaller home through down-trading.

The jump in energy costs alongside the general increase in living costs are likely to be compounding the drivers to move. This is particularly the case for those concerned about running costs and the suitability of their current home to meet their future needs.

We expect all of these factors to support home moves in 2023, creating demand for homes listed for sale in the new year. We predict there will be 1 million home sales in 2023, which is down 20% on 2022 levels. New buyers will continue to be price sensitive but many sellers have made sizeable gains in their housing equity, giving them some room for movement if they want to move in the year ahead.

Key takeaways

- Banks will be keen to make mortgages available in 2023 and are coming up with options to make sure customers can afford the jump in mortgage rates

- The recent fiscal plan from the government has calmed money markets again and we expect 5-year fixed rate mortgages will be in the 4.5% to 5% range in the new year

- The impacts of the pandemic continue to shape the desire to move home and will help support 1 million home moves in 2023

How to tell if your home is gaining value

Most homeowners have gained a lot of value on their home since the pandemic.

But with small house price falls of up to 5% expected in 2023, you might be wondering what your home’s worth.

Our tools can tell you what your home’s worth right now, how much value you‘ve gained since buying and if its value is still going up.

Not to mention how long it’d take you to sell and how your home stacks up in the local market.

Here are 9 easy ways to find out if you’re gaining value on your home.

1. Get an instant valuation

Be proud. It’s yours and you love it.

And you must be curious about how your bricks and mortar is performing in value.

And how it’s changed over the last few years.

So pop in your postcode. We'll show you the rest.

2. Find out what equity you have

Want to know how much of your home is actually yours?

That’s where equity comes in: it’s the amount of cash you could take away from your sale.

And it’s probably looking pretty healthy after the last couple of years of house price growth.

So head to our equity calculator in My Home. We’ll tell you how much money you could put towards your next place.

3. Keep an eye on your mate's place

It’s not stalking. It’s keeping an eye on the market.

Track your mate’s, neighbour’s or boss’s place to find out what it’s worth.

After all, it’s just a good benchmark for your home, right?

Track as many homes as you like, any time you like, for as long as you like.

And we’ll send you the new price estimate every month.

Job done.

4. See what’s for sale and sold nearby

Who doesn’t love a little nosy on the neighbours?

Well, we can do better than that.

We’ll show you what everyone on your street last sold for in one map, whether it was last week or last decade, in My Home.

Go on. See whose home sold for the most.

5. Get the low-down on your local housing market

Every town and city has a totally different housing market.

And it can be hard to know what’s really happening.

But your local stats in My Home can help with that. From average prices and price growth to how fast homes are selling.

Plus how your local area compares to your region as a whole.

6. Get to grips with the UK house price picture

It’s good to have a feel for what’s right when it comes to property.

The more you get to know the market, the more your instincts will take over when it comes to knowing what a home’s worth.

There’s no secret to it. It’s just about staying in the loop.

7. Check your interior style

Got a new landscaped garden, sparkling bathroom or stylish kitchen extension?

And want to know if it's really added value?

Which home improvements add the most value?

8. Figure out what your asking price should be

An asking price is all about getting the most interest in your home to drive up its value on the market.

But set it too high and you could be left waiting.

Too low and you may later regret it.

9. Get an estate agent’s opinion

If you want to know exactly what your home’s worth, there’s only one way to know for sure: by asking a local estate agent.

And we’ll help you find the best local agent for you, based on customer ratings, asking prices, listing times and more.

So you can compare them and get in touch for an in-person valuation.

And find out what your home’s worth, once and for all.