Mortgage rates are falling and choice is increasing

More than 4,000 different deals are now available as the mortgage market continues to stabilise.

Mortgage rates are falling and product choice is increasing as the market continues to stabilise.

A total of 4,341 different deals are currently available, up from 3,643 in January, marking the first time product choice has risen above 4,000 since August last year.

The average interest rate charged on both two-year and five-year deals has also fallen for the third month in a row, according to financial information group Moneyfacts.

Mortgage rates fall to below 4% for lower loan-to-value mortgages

The typical cost of a two-year deal is now 5.44%, down from 5.79% in January, while interest on five-year fixed rate mortgages has dropped to 5.20%, from 5.63%.

The latest fall puts the cost of both products back where they were in October 2022, despite the Bank of England Bank Rate rising by 1.75% during the same period.

In further good news, the average amount of time a mortgage is available before it is withdrawn has increased to 28 days, the highest level since March 2022, and up from just 15 days in January.

Why is this happening?

Mortgage lenders withdrew products and hiked their rates in the wake of former Chancellor Kwasi Kwarteng’s mini-Budget in September last year.

The turmoil caused by the mini-Budget led to a steep rise in government borrowing costs, which in turn impacted the rate at which lenders borrow money for fixed rate deals.

As a result, banks and building societies pulled products for repricing, with the number of different mortgages available dropping to just 2,258 at the beginning of October.

But the market has been recovering steadily since Jeremy Hunt took over as Chancellor and reversed nearly all of the measures in the mini-Budget.

As a result, mortgage rates have been on a downward trend, despite the Bank Rate moving in the opposite direction.

What does it mean for me?

Mortgage availability has increased across all deposit levels. The biggest rebound has been for people with a 40% stake in their home, with 606 products now available, the highest level for three years and up from 484 in January.

There is also good news for first-time buyers, with 149 mortgages on the market for people with only a 5% deposit and 539 for those with a 10% one.

Rates are also falling across the board, with the average cost of a five-year fixed rate product for those with 40% to put down back below 5%, while two-year fixed rate deals for people borrowing 95% of their home’s value are averaging 5.99% and five-year ones are 5.53%.

What should I do now?

If you are sitting on your lender’s standard variable rate – the rate you are automatically put on when your existing deal comes to an end – you may want to think about remortgaging.

The average standard variable rate is currently 6.84% - its highest level since October 2008.

Remortgaging from this rate to an average five-year fixed rate deal of 5.2% would save someone with a £200,000 mortgage £200 a month.

Competition among lenders is currently more focused towards five-year fixed rate deals than two-year ones, with the gap between the interest charged on five-year and two-year products standing at 0.24%, the biggest margin for 15 years.

If you have enough flexibility in your budget to cope with future interest rate rises, you may want to consider a tracker mortgage.

Two-year tracker deals currently average 4.39%, although it is important to note that, unlike fixed rate mortgages under which the interest rate stays the same for the product term, tracker mortgages move up and down in line with changes to the Bank Rate.

Key takeaways

- Mortgage rates are falling and product choice is increasing as the market continues to stabilise

- A total of 4,341 different deals are currently available, the first time product choice has risen above 4,000 since August last year

- The average cost of a five-year fixed rate product for those with 40% to put down is now back below 5%

Mortgage rates fall below 4% for lower loan-to-value mortgages

The best new mortgage deals are now at below 4% for lower loan-to-value remortgages, a major improvement on the average rate of 6% in November 2022. Here's how much further I think they will fall.

The last 12 months have been a rollercoaster for mortgage rates. While mortgage rates have been falling steadily over the last decade, they spiked last year as a result of central banks increasing borrowing costs to curb demand and stop inflation getting out of control.

In the UK, the cost of mortgages shot up even higher as a result of the fallout from the Liz Truss mini budget in the autumn of 2022. Average mortgage rates peaked at over 6% having started 2022 at less than 2%.

The increase in mortgage rates is now reversing.

Average rates for new mortgages are starting to fall back quickly. Bank of England data for January 2023 shows the average rate for a new 75% loan-to-value 5-year fix is 4.8% and on a clear downward trend.

Mortgage rates vary according to the size of the mortgage and the value of the home it's borrowed against. And smaller loans get the best prices.

The cheapest rates are starting to emerge at below 4% for people staying in their homes and remortgaging with smaller loans. This is a major improvement to the 6% average last November.

The pricing of mortgages for buyers and those looking to remortgage is a complex process and much depends upon the path of interest rates and inflation in the UK and overseas.

We expect competition among banks to win new mortgage business to be strong in 2023 and this will mean some better deals for borrowers this year.

While it is welcome news that mortgage rates are falling, there is a risk that if inflation doesn't slow as fast as the Bank of England expects it to, interest rates may stay higher for longer.

Average UK mortgage rates are likely to settle in the 4% to 5% range in the coming months. This is certainly higher than recent years but still relatively cheap compared to historic levels for mortgage rates.

House prices and mortgage rates are key for would-be home sellers

Homeowners who want to move in 2023 are keeping a close eye on mortgage rates and the outlook for house prices.

The value a seller can achieve from their home today unlocks their next move, so the risk of a lower sale price - as well as higher borrowing costs - will impact what they can get with their next home in terms of location and size.

The start of the year has seen demand for homes tracking inline with the pre-pandemic years of 2018 and 2019. There is evidence that some would-be movers are holding back and waiting to see if the projections for big price falls and a year-long economic recession will materialise.

Major house price correction highly unlikely

The UK avoided recession in 2022 and the outlook is improving for 2023, although economic growth in the UK is set to lag behind other major western economies.

House price growth stalled in in the final quarter of 2022 and while sellers are taking bigger discounts of up to 4% to achieve sales, it looks very unlikely that homeowners are facing a major house price re-correction in the year ahead.

Sellers will need to accept that they might have to give up some of those record pandemic price gains to achieve a sale.

Every home is different, so it’s really important to speak to an estate agent to get an accurate view on who is in the market to buy a home like yours.

Affordable homes in high demand areas will still attract strong interest. Meanwhile, higher value homes that have seen prices surge ahead over the pandemic will need to be priced more carefully if the seller is serious about attracting interest and moving.

Lower mortgage rates will reduce the hit to buying power

The good news is that lower mortgage rates will reduce the hit to buying power for households looking to move home. In turn, this will limit the downward pressure on home prices in 2023.

The impact will vary across the UK, with the higher value housing markets likely to see the greatest pressure on sellers to be realistic about pricing expectations.

In the more affordable, lower-value housing markets, there will be less downward pressure on prices and some of these markets may avoid any year-on-year reductions in prices altogether.

Key takeaways

- Mortgage rates for the best products have fallen sharply

- Outlook for mortgage rates and house prices are key for home sellers

- Demand for homes is in reasonably good shape at the start of 2023

- Sizeable house price correction is highly unlikely

UK cities see record-high rent increases

The average UK rent has increased £120 in the past year with London, Manchester and Glasgow seeing the biggest hikes.

Rents charged ahead in 2022

The rate of rent increases in 2022 were at the highest level for the last decade. In December, the UK average rent was £1,118 which is 11.5% or £120 higher than a year ago.

Yet, the pace at which rents are increasing has slowed since peaking in July 2022 when rents were growing by 12.1%.

This growth in rents for new lets reflects the experience of a quarter of all renters who move each year.

For those staying put, the pace of rental increases is slower. Data from the Office for National Statistics on all private rented homes shows an average increase of 4.2%.

| Region | Average monthly rent | Annual rental growth (%) | Annual rental growth (£) |

|---|---|---|---|

| London | £1,976 | 16.1% | £270 |

| Scotland | £711 | 12.5% | £80 |

| North West | £777 | 11.3% | £80 |

| Wales | £811 | 11.2% | £80 |

| West Midlands | £830 | 10.1% | £80 |

| East Midlands | £803 | 9.8% | £70 |

| Yorkshire and the Humber | £743 | 9.1% | £60 |

| South East | £1,229 | 8.8% | £100 |

| Eastern | £1,069 | 8.7% | £90 |

| North East | £632 | 8.4% | £50 |

| South West | £1,007 | 8.2% | £80 |

| Northern Ireland | £688 | 5.9% | £40 |

| United Kingdom | £1,118 | 11.5% | £120 |

What’s causing rents to increase?

There isn’t a single answer to this question as the pace at which rental values rise depends on a combination of different national and local factors.

In 2022 we saw a chronic imbalance between the supply of homes to rent and the level of demand from renters. This encouraged competition between renters and gave rise to sizeable rent hikes.

High inflation, high employment and strong wage growth in recent years are additional drivers of rental growth, especially in urban centres.

Rents in inner London grew faster than anywhere else in the country

As London continues to recover from the pandemic slowdown, the capital is the region with the highest annual rental growth in the UK. In the last 12 months, the average rent for a new let increased by 16.1%, adding £270 to the average monthly rent.

High levels of demand in inner London are behind record-high rental growth, where rents went up by 17.4% on average in contrast to 13.3% in outer London.

The London Borough of Newham had the highest rate of rental increase anywhere in the country. In 2022, the average rent there increased by 21.2% or £320.

Popularity amongst professionals and students, regeneration projects delivering more newly-built stock of homes to rent and new connections with central London drive rental growth in this area.

In contrast, Havering - a leafier borough further east - saw the lowest level of rental growth in London as renters' preferences changed in favour of inner cities. Rents in this area increased by ‘only’ 9.2% last year, adding £120 to the average monthly rent.

Renters in cities saw the highest price increases

| City | Average monthly rent | Annual rental growth (%) | Annual rental growth (£) |

|---|---|---|---|

| London | £1,976 | 16.1% | £274 |

| Manchester | £977 | 14.8% | £126 |

| Glasgow | £844 | 13.1% | £98 |

| Edinburgh | £1,130 | 12.7% | £127 |

| Cardiff | £1,043 | 11.7% | £109 |

| Birmingham | £849 | 11.6% | £88 |

| Nottingham | £902 | 11.4% | £92 |

| Sheffield | £747 | 11.3% | £76 |

| Bristol | £1,297 | 11.0% | £129 |

| Cambridge | £1,439 | 10.4% | £136 |

| Aberdeen | £635 | 9.8% | £57 |

| Southampton | £1,036 | 9.6% | £91 |

| Newcastle | £745 | 9.2% | £63 |

| Leeds | £917 | 9.0% | £76 |

| Liverpool | £758 | 8.9% | £62 |

| Belfast | £701 | 6.7% | £44 |

Zoopla Rental Index, December 2022

High levels of rental inflation are not exclusive to the capital.

Manchester and some Scottish cities have also been affected by the record-high increases in prices of new lets.

In Manchester, the average rent is now £977 per month, up from £847 in December 2021. Rents in inner Manchester, Trafford and Salford are growing at the fastest rate in the North of England. In all three areas, the average new rent is now £140 higher than a year ago.

Our data also shows very high rental growth in the Scottish cities of Glasgow (13.7%), Edinburgh (+12.7%) and Dundee (12.6%). This above-average level of price increases for new lets is driven by a growing gap between demand from renters and the supply of homes to let in these cities.

What’s the outlook for the rental market in 2023?

We expect rents to continue to increase albeit at a slower rate in 2023. Supply will remain tight due to lower levels of new investment by landlords. A strong labour market and higher borrowing costs for home buyers will continue to stimulate demand for rented homes.

Fixing supply issues will take a long time and a larger renting budget is not an answer for everyone. Renters in the market for rental homes need to prepare for a greater set of compromises. Searching for smaller properties, an alternative location or modest features are common tactics.

However, steep rental growth is not sustainable in the longer term. Affordability pressures will start to limit the upward pressure on rents and so we expect rental growth to slow down in 2023 towards a national average of 5%.

Key takeaways

- Average UK rent increases by £120 over 2022 to reach the highest level in a decade

- Renters in London see the highest rent increases in the UK with annual growth of 16.1%

- Rents are also increasing at a record pace in other cities such as Manchester, Glasgow and Edinburgh

Interest rates rise again but mortgage rates keep falling

Despite increases to the cost of borrowing, fixed rate mortgages are continuing to come down, falling by 0.35% for two-year deals and by 0.43% for five-year ones.

The Bank of England has increased interest rates by 0.5% to 4%, the highest level since October 2008.

It was the 10th consecutive meeting at which the Monetary Policy Committee (MPC) has hiked the official cost of borrowing, as it continues to try to bring down high inflation.

The latest increase adds a further £60 a month to repayments for homeowners with a £200,000 mortgage.

People with variable rate mortgages have now seen their monthly mortgage costs jump by £440 since the MPC first started to raise interest rates from 0.1% in December 2021.

An estimated 850,000 homeowners have a tracker mortgage, and 1.1 million are on their lender’s standard variable rate – both of which move up and down in line with changes made to the Bank Rate.

But despite increases to the cost of borrowing, the average rate charged on new fixed rate mortgages has continued to come down, falling by 0.35% for two-year deals and by 0.43% for five-year ones, offering hope to those who need to remortgage in the near future.

There was further good news for borrowers, with the tone of the minutes that accompany the MPC’s interest rate announcement suggesting the Bank Rate could be close to peaking.

There was a notable shift in language, with the MPC saying there “would” be further increases to interest rates “if” there was evidence of persistent inflationary pressures.

This contrasts with its previous statements that it would continue to “respond forcefully” and “take the actions necessary” to get inflation back down to its target.

Two members of the nine-strong MPC also again voted to leave rates unchanged.

Why has the Bank Rate been increased?

The MPC began increasing interest rates from their record low in December 2021 in a bid to bring down inflation.

Despite increasing the Bank Rate by 3.9%, inflation, which measures the rate at which the cost of goods and services increases, has remained stubbornly high.

The latest figures show it stood at 10.5% in December, down only slightly from November’s figure of 10.7%, and still well above the MPC’s target of 2%.

Part of the problem for the MPC is that inflation is being stoked by external factors, such as the conflict in Ukraine which has pushed energy prices higher.

But inflation does now appear to be on a downward trend, and is expected to fall to around 4% by the end of this year.

In further good news, the MPC also said it expects the UK’s recession to be less severe than previously thought.

It is now predicting that it will last for only one year, rather than two, with economic growth contracting by just 1%, rather than the 2.9% previously predicted.

Economists now expect the Bank Rate to peak at 4.25% later this year, following the MPC’s latest announcement.

What should I do about my mortgage?

Despite interest rates increasing by 1% since the end of October, the cost of fixed rate mortgages has been moving in the opposite direction, falling by just over 0.9% during the same period.

Interest charged on fixed rate mortgages shot up at the end of September last year in the wake of then Chancellor Kwasi Kwarteng’s mini-Budget.

It triggered a sharp rise in government borrowing costs - which influences the rate at which lenders borrow money for fixed rate mortgages.

But they have been easing downwards since Jeremy Hunt took over as Chancellor, and this trend is expected to continue in the coming months.

After hitting highs of around 6%, mortgage rates for new business are now generally below 5%, and they are expected to remain in the 4% to 5% range for most of 2023.

There is also good news if you are planning to remortgage but are worried about passing your lender’s affordability test due to the rising cost of living.

Following a meeting with the government and the regulator, lenders have agreed to allow customers who are up to date with their payments to switch to a new mortgage deal without having to do another affordability test.

If you are on a fixed rate mortgage

More than 1.4 million homeowners are on fixed rate mortgages that are due to expire this year.

If your deal is due to end soon, you should start looking around for a new rate now, as lenders will allow you to book on to a new rate up to six months before your existing one ends.

But if you see a deal that you like the look of, you need to be prepared to move fast, as the average mortgage is currently only available for 15 days before lenders withdraw it.

The average interest rate charged on a two-year fixed rate deal is currently 5.44%, while on a five-year one it is 5.2%.

But it is important to remember that these rates are just averages, and best buy deals for people with large equity stakes in their property are available for below 4%.

If your current mortgage deal is not due to end soon, you don’t have to do anything, as the rate you are paying now will stay the same until the end of your product term, even if interest rates increase further.

If you are on a standard variable rate (SVR) mortgage

The interest charged on SVRs has been steadily increasing since December 2021, as rates on these automatically move up and down in line with changes to the Bank Rate.

The average interest rate charged on an SVR was already 6.84% before today’s announcement, and it is likely to rise above 7% following the latest hike.

As a result, you are likely to want to look into remortgaging on to a more competitive rate.

Remortgaging from an SVR of 6.84% to an average two-year fixed rate deal of 5.44% would save you nearly £175 per month, based on a £200,000 mortgage.

If you are on a tracker mortgage

If you are on a tracker mortgage, your rate will automatically increase following today’s interest rate rise.

Remortgaging to a fixed rate deal would protect you from any further interest rate increases, but economists are now predicting that the Bank Rate is close to peaking.

If you stay on your current deal, the cost of fixed rate mortgages may have fallen further by the time you need to remortgage.

When making a decision, it is important to think about how much slack you have in your budget to afford your mortgage repayments if the Bank Rate rises by more than is currently expected.

What can I do if I’m struggling with my mortgage?

If you are struggling with your mortgage payments, there are two main ways you can make them more affordable.

The first is to increase your mortgage term.

For example, monthly repayments on a £200,000 mortgage on a fixed rate of 6% would be £1,450 if you are repaying it over 20 years.

But monthly repayments fall to £1,210 if you increase the term to 30 years. They fall even further to £1,150 if you repay the mortgage over 35 years.

If you do decide to go down this route, it is important to understand that although it will reduce your monthly repayments in the short term, you will end up paying a lot more interest over the entire life of your mortgage.

The second option is to talk to your lender about being put on to an interest-only mortgage for a period of time.

Only paying interest significantly reduces your monthly payments, although it does mean that the amount you owe is not being reduced, so you will need to resume full repayments at some point.

If you are really struggling, you can ask your lender for a short-term payment holiday. This enables you to take a break from making repayments, with the interest portion of your monthly payment added to your outstanding mortgage debt.

If you think you may run into difficulties, it is important to contact your lender as soon as possible.

Lenders are obliged by the regulator to work with customers who are struggling with mortgage repayments to find a solution, and they can only repossess a home as a last resort.

But options become much more limited if you have already missed a payment.

Key takeaways

- The Bank of England has increased interest rates by 0.5% to 4%, the highest level since October 2008

- Yet mortgage rates are continuing to fall, and economists believe the Bank Rate is now close to peaking

- Nearly 2 million homeowners with variable rate mortgages will see their monthly repayments rise by a further £60 a month, based on a £200,000 loan

Energy efficient homes holding their value in market slowdown

Potential buyers are showing a greater interest in homes with high energy efficiency ratings.

Energy efficient homes are outperforming other properties in the current housing market.

Six out of 10 estate agents say homes with high energy efficiency ratings are holding their value despite the overall market slowdown, according to the Royal Institution of Chartered Surveyors.

At the same time, 40% said they are seeing more interest from potential buyers in energy efficient homes.

And 41% said sellers are attaching a price premium to their home if it has a high energy efficiency rating.

Mairead Carroll, senior specialist in land and property standards at RICS, said:

“It will be fascinating to see how important energy efficiency becomes to buyers over the next 12 months.”

The survey reflects our own findings that buyers are becoming more value-conscious due to higher mortgage rates, inflation and the cost-of-living squeeze.

Buyers are factoring energy costs into moving decisions

The average household has seen its gas and electricity bill double from £1,277 per year at the start of 2022 to £2,500 now.

The government’s Energy Price Guarantee has kept bills lower than they might otherwise be. It limits the amount suppliers can charge per unit of gas or electricity.

But the guarantee will change in April and the average annual bill for gas and electricity is expected jump to around £3,000.

These rising costs have led to home buyers increasingly factoring in the cost of heating a home to their moving decisions.

Mortgage lenders are looking at potential energy costs too

The growing appeal of energy efficient homes isn’t just because buyers want to save money on their bills.

Banks and building societies are also factoring in energy costs when assessing whether people can afford a mortgage.

If a lender thinks your budget is too tight to cope with further increases to energy costs, they may only be prepared to lend you a lower amount.

First-time buyers and those on lower incomes are most likely to be impacted.

On the other hand, if you can show lenders that your home has a high energy efficiency rating - and so it costs less to run and heat - they’re less likely to be concerned about your impact to manage future gas and electricity price rises.

Properties are given an Energy Performance Certificate (EPC) which rates their energy efficiency on a scale from A to G.

Find out your EPC rating - GOV.UK

A is the most efficient EPC rating and G is the least efficient. If you’re selling or renting a property, it’s a legal requirement to have an up-to-date EPC rating.

While 80% of new-build homes have an EPC rating of A or B, only 3% of older properties have a rating this high.

How can I make my home more energy efficient?

There are a number of steps you can take to make your property more energy efficient.

Insulating your loft will prevent up to 25% of heating being lost through the roof, while installing cavity wall insulation will help to stop 35% of heat being lost.

Installing double or triple glazed windows or replacing an old boiler with a new energy efficient one will also make your home cheaper to run.

On a smaller scale, using energy efficient light bulbs and sealing any gaps letting in draughts in your home will also have an impact.

Financial support to make your home more energy efficient

There are a number of schemes to help you carry out energy efficiency home improvements.

If you’re claiming certain benefits, energy companies have an obligation to help you under the Energy Company Obligation scheme.

The scheme will pay for loft or cavity wall insulation (as long as it’s suitable for your home), double glazing, and even a new boiler if your current one has broken.

Energy Company Obligation scheme - Ofgem

If you own a home in England or Wales, the Boiler Upgrade Scheme can give you £5,000 towards the cost of an air source heat pump or biomass boiler.

Or you can get £6,000 towards the cost of a ground source heat pump.

Boiler Upgrade Scheme - GOV.UK

Another option is the Green Homes Grant Local Authority Delivery Scheme.

Grants averaging £10,000 are available to homeowners to install solar PVs, air source heat pumps, and loft, underfloor, external wall and cavity wall insulation.

To qualify, you must have a household income of less than £30,000 a year and your home must have an EPC rating of D, E, F or G.

You can apply through your local council.

The government also recently launched the Green Home Finance Accelerator scheme.

Under this scheme, £20 million is being made available to lenders to fund affordable loans for homeowners carrying out energy efficient improvements.

Green Home Finance Accelerator scheme - GOV.UK

Key takeaways

- Energy efficient homes are outperforming other properties during the current challenging market conditions

- Six out of 10 estate agents said homes with high energy-efficiency ratings were holding their value

- Four out of 10 said they were seeing more interest in energy efficient homes from potential buyers

Moderate house price falls set to continue

Homeowners who sold at the end of 2022 saw small price falls but it’s doing little to dent the equity most gained during the pandemic.

Most sold homes saw their prices fall in the last quarter of 2022 after a turbulent final few months of 2022.

This meant the average house price rose 6.5% in the year to December 2022, which is the lowest rate of annual growth since May 2021.

It’s a marked slowdown compared to the 8.3% rise in the previous year when moves and prices were still fuelled by the pandemic boost to the market.

And we expect further single-digit price falls in the first half of 2023.

But thanks to a big jump in home values from 2020 to mid-2022, these modest price falls will do little to dent the equity most homeowners have gained over the long-term.

What’s causing house prices to fall?

The number of enquiries sent to estate agents fell by 50% in the last quarter of 2022 compared to the previous quarter.

With fewer buyers in the market and sellers less certain about achieving a sale, buyers have gained the ability to drive some bargains.

They’re now getting an average of 3% to 4% off asking prices originally set by sellers.

But discounts now look to be staying at this level and we don’t see any reason for bigger discounts in the coming months.

What does 2023 hold for the housing market?

Our monthly House Price Index uses more data than any other, so we can get the most accurate picture of house prices across the UK.

However, it's early days to get a clear read on the market outlook for 2023.

Many households thinking about a home move this year are likely to be waiting to see if mortgage rates and house prices fall further.

The economic outlook has improved a little in recent weeks, with mortgage rates settling in the 4% to 5% range.

Buyers and sellers alike will gain confidence from this but the outlook for the housing market in 2023 will become clearer after Easter.

So far, we know that the number of buyers in the market has already rebounded to pre-pandemic levels, in line with 2018 and 10% higher than in 2019.

But priorities are changing as buyers become more value-conscious, with flats and towns near big cities moving up the wish list.

The squeeze on disposable incomes may prompt home moves too, with some seeing it as the time to release equity or find a cheaper-to-run home.

Meanwhile, demand from first-time buyers will remain as they look to escape the rapid growth in rents.

What are buyers looking for in 2023?

92% of homeowners enjoyed value gains on their homes in 2022

While house price falls are never welcome news for homeowners, our latest Value of Housing report might go some way to reassure you.

It found that 92% of homeowners enjoyed value gains on their homes in 2022 despite an uncertain end to the year.

The average capital gain was £19,000 while nearly 3 million homeowners made more than £50,000.

How much value did your home gain in 2022?

The report showed that the total value of homes in the UK is over £10.5 trillion.

With around £1.6 trillion of mortgage value, that leaves homeowners with almost £8 trillion in equity.

What are buyers looking for in 2023?

Looking to sell this year? Find out what buyers are on the hunt for right now and which locations they’re looking in.

For early buyers in 2023, it’s all about apartments.

The first few weeks of the year have revealed home buyers are becoming more value-conscious.

The hit to buying power, caused by higher mortgage rates, inflation and the cost-of-living squeeze is causing property-seekers to hunt for smaller homes.

We’ve seen a clear shift in demand towards flats across the UK, with a notable decline in the desire for 3-bed houses.

Our data reveals:

-

27% of new buyers are looking for 1- and 2-bed flats, up from 22% a year ago

-

49% of buyers in London are looking for 1- and 2-bed flats, up from 42% a year ago

-

Share of demand for 3-bed houses has fallen 5 percentage points to 39%

That said, 3-bed homes are still the most in-demand property type among UK buyers.

What areas are becoming more popular with flat-hunting buyers right now?

Share of interest in apartments is growing in the markets that are near the big cities.

Some of the largest increases in share of demand for flats have been seen in towns next to London such as Slough, Watford, Chelmsford, Guildford and Dartford.

The relative price differential is attractive for those who work locally, or who commute to London and are able to work more flexibly.

The same is true in other regional cities such as Huddersfield, Stockport and Wakefield, though to a lesser degree.

What’s going to happen to house prices in 2023?

In the short term we expect further small single-digit price falls in the first few months of the year, but the housing market is in better shape to deal with the headwinds than in previous economic cycles.

Will demand for homes increase in 2023?

2023 is off to a slower start than more recent years.

The economic outlook has improved slightly in recent weeks but the squeeze on household disposable incomes is very real and is having a direct impact on sales activity.

Some buyers will be waiting to see if house prices - and mortgage rates - start to fall in the first few months of the year.

Mortgage rates are now generally below 5% and look set to remain in the 4 to 5% range for 2023.

While this is a much better prospect than the 6% to 6.5% levels at the end of last year, buyers are likely to remain cautious in the next few weeks.

The pressure on incomes, combined with the costs of running homes, is also likely to drive a certain amount of movement in the market.

Sizeable amounts of embedded equity in many millions of homes may encourage downtrading to release equity and cut the energy bills.

As the outlook becomes clearer after Easter, we believe that demand is likely to pick up further.

How much depends on the economic outlook, the strength of the labour market, the level of inflation and how this impacts interest rates.

Key takeaways

- It's all about apartments for home buyers right now

- And towns near big cities are proving to be the hottest locations

- 2023 has kicked off to a slow start, but our research team believe demand for homes is set to rise as mortgage rates continue to fall

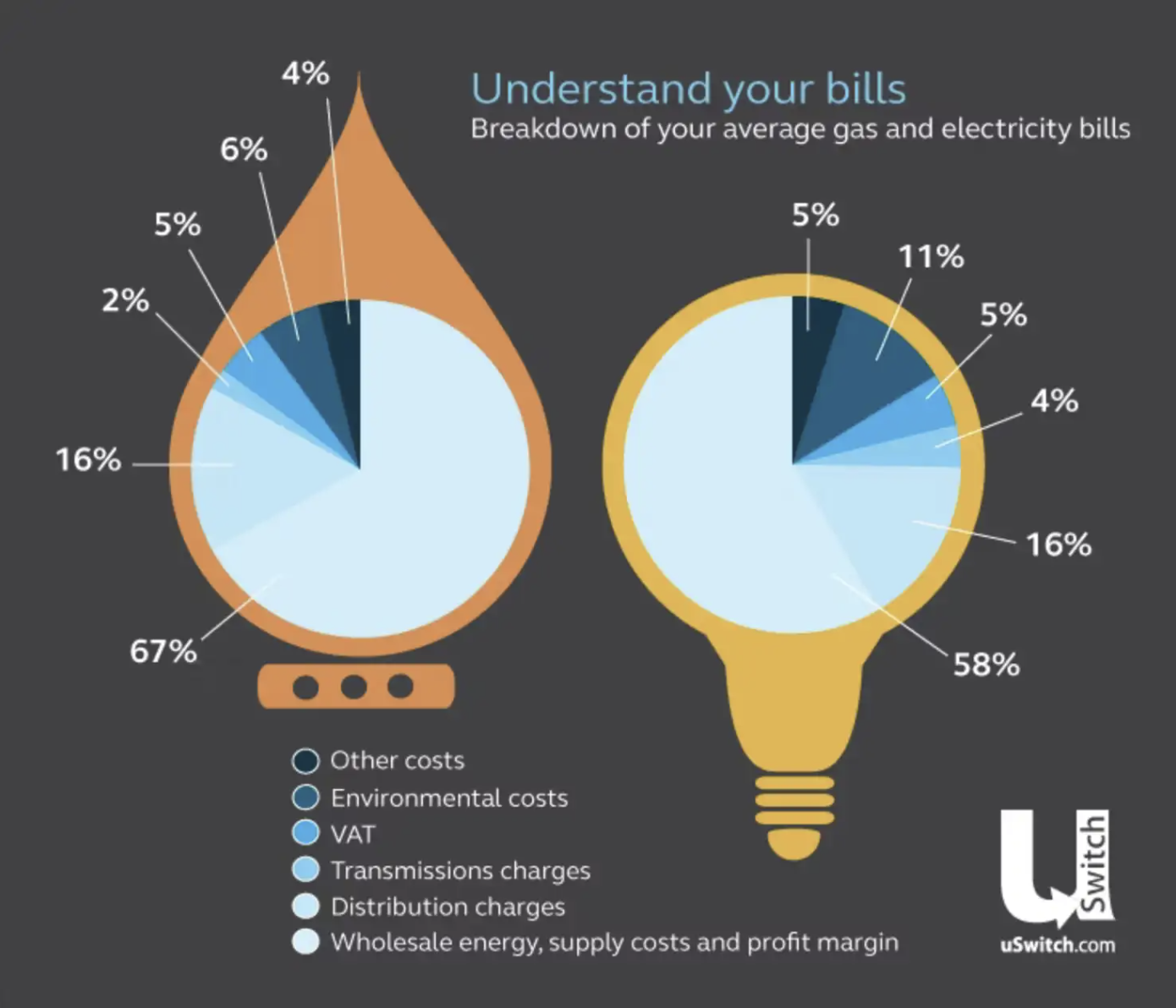

Gas and electricity bills breakdown

Here's a breakdown of the average energy bill to give you a better idea of where your money is going.

Here's a breakdown of the average energy bill to give you a better idea of where your money is going.

Your gas and electricity utility bill sets out the charges you've incurred as a gas and electricity customer.

Your energy supplier sends you your utility bills on a monthly or quarterly basis so that you can understand how much you owe.

The average utility bill is made up of several different components, with the majority of your payment going on the energy you use.

But there are other costs factored in, like distribution charges, environmental costs and VAT.

Here's how the average energy bill breaks down to give you a better idea of where your money is going.

Breakdown of the average energy bill

Where your gas payment goes

-

67% on wholesale energy, supply costs and profit margin

-

16% on distribution charges

-

6% on environmental costs

-

5% on VAT

-

4% on other costs

-

2% on transmission charges

Where your electricity payment goes

-

58% on wholesale energy, supply costs and profit margin

-

16% on distribution charges

-

11% on environmental costs

-

5% on VAT

-

5% on other costs

-

4% on transmission charges

Environmental costs

A proportion of your gas and electricity bill is used to subsidise the government's environmental initiatives.

Environmental costs comprise approximately 6% of your gas bill and 11% of your electricity bill.

Environmental schemes which are subsidised by your gas and electricity bill include:

-

Feed-in Tariff scheme (FITs)

-

Carbon Emissions Reduction Target (CERT)

-

Community Energy Saving Programme (CESP)

-

The Renewables Obligation (RO)

-

EU Emissions Trading Scheme (ETS)

Find out more about the Feed-in Tariff scheme on Uswitch.

VAT charges

Contrary to popular belief, you do not pay full VAT on gas and electricity, but you do pay some.

Currently, VAT payments are capped at 5% of your total bill.

Transmission charges

Transmission networks are what actually deliver electricity and gas to your home, and some of the cost of building and maintaining transmission chargers is passed on to customers.

Currently, 2% of your gas bill and 4% of your electricity bill make up these costs.

Distribution charges

16% of your gas bill and 16% of your electricity bill go towards distribution costs.

This covers some of the cost of building, maintaining and operating the local gas pipes and electricity wires which deliver energy to the home.

Wholesale energy and supply costs

The bulk of your bill, unsurprisingly, is comprised of charges for the gas and electricity you actually use.

This comes to roughly 67% and 58% of your respective bills.

Wholesale cost is the price that the energy supplier has to pay for the gas and electricity they buy.

Supply costs are the costs the energy supplier incurs for the general administration associated with a retail business, like running a call centre and sending out bills. These vary according to which tariff you're on.

Compare gas and electricity deals on Uswitch

Other costs

Other costs cover things like meter installation and gas storage, which comprise about 4% of your gas bill and 5% of your electricity bill.

How can you bring your energy bill down?

These energy-saving tips will help bring your energy bills down and reduce your carbon footprint.

Heating

The biggest portion of your energy bill is taken up with heating your home and water.

Follow these tips and you could save a fortune on your heating bills:

-

Turn your thermostat down by a single degree. This could save you as much as £60 on your energy bills over the space of a year.

-

Make sure your home is adequately insulated. Loft and cavity wall insulation may require an initial investment, but could easily save you hundreds a year in heating costs.

-

If you're on a low income, you may be eligible for an energy efficiency grant to make improvements to your home.

-

Try to block any draughts that are coming into your house and make sure you close your curtains to keep the heat in.

In the kitchen

The next largest portion goes towards powering your washing machines, fridges, freezers and cooking appliances.

Keep kitchen costs down with these tips:

-

Do your washing less frequently. It may sound obvious but make sure the machine is full every time for maximum efficiency.

-

Use the economy setting on your washing machine. Many washing powders will now work at temperatures as low as 30 degrees, which is enough to effectively wash clothes while also helping your machine run more efficiently.

-

Dry your clothes outside or on a clothes horse. Tumble dryers use a lot of energy, so if you can dry your clothes for free, that will help keep costs down.

-

Replace your current fridge and/or freezer with an energy-efficient model. Look out for the energy efficiency stickers on modern appliances. You should also make sure they're kept as full as possible and that the area around them is clean so they don't have to work as hard.

Computers, gadgets and electronics

Next up is the amount of energy used by consumer electronics such as DVDs, TVs and computers every year.

Bring these costs down by:

-

Turning electronics off instead of leaving them on standby. If you're forgetful, invest in a standby saver - it will automatically cut the power to any electronics left on standby.

-

Only charging devices when you need to. Don't leave laptops and mobile phones charging overnight as this is a big waste of energy.

Lighting

Finally, there is the portion of bills going towards lighting your home.

The quickest and easiest ways to save on your lighting costs are to:

-

Buy energy-efficient LED lightbulbs. They last up to 24 times more than incandescent lightbulbs and each one you swap could save you at least £4 per year.

-

Turn the lights off behind you when you leave a room and get into the habit of switching the lights off as you move through the house.

How much value did your home gain in 2022?

12 in 13 homeowners enjoyed value gains in 2022, could you be one of them?

2022 started well…

2022 was a year of two halves for UK housing.

It kicked off with a strong start thanks to record-low mortgage rates and a continuation of the pandemic-driven desire to move.

These factors, combined with a chronic lack of homes for sale, meant house price growth remained strong up until the summer.

And looking across the year as a whole, 12 out of 13 homeowners saw the value of their home increase by an average of £19,000.

Among them, nearly 3 million homeowners made more than £50,000.

How much value did your home gain?

But then things started to change…

In the second half of the year, the picture became less rosy.

Rising living costs and a jump in mortgage rates halved the demand for homes, causing the rate of house price growth to start slowing rapidly.

In some areas of the UK the value of individual homes is now falling, writing off some of the recent pandemic gains.

How much value are homes losing?

Of the UK’s 30 million homes, 16 million experienced value losses by the end of 2022.

But for the majority of these homeowners, the drop is small. The average value reduction in the final 3 months of 2022 was £3,900.

When compared to the average value gain of £19,000 over the course of the whole year, this leaves most homeowners comfortably in the black for 2022.

And that figure becomes even smaller when noting the average home gained £32,400 during the first two years of the pandemic.

Within the group of 16 million homeowners experiencing value losses in the last 3 months of 2022, only 2.3 million (or 8%) registered a loss over the year.

For these homeowners, that average loss was £7,300.

And more than 26% of those homes were in London.

We estimate that 1 million homes lost all of the value their properties gained in the two years leading up to February 2022.

But these homes were found in areas where prices didn’t increase much during the pandemic in the first place, such as the capital, the South East and Scotland.

A further 7.3 million homeowners lost part of their pandemic paper gains in the last 6 months of the year.

However, while home values are starting to decline in some areas, in contrast to the national headlines, our price estimates for the UK’s homes reveal that 14 million properties saw their values increase in the final 3 months of 2022.

Where are homes losing value?

The reduction in home values over the second half of 2022 was concentrated in markets where price gains have been slower over the last year.

Homeowners in London have seen the largest number of reductions, followed by the South East.

The average reduction between June and December was £8,400 in London and £5,200 in the South East.

However in both these areas, more homes increased in value than fell, showing how the pressure on values is highly localised.

Outside of London and the South East, we found that three-quarters of homeowners saw the value of their home increase by an average of £6,600.

And price falls in these areas were modest, averaging £3,800.

Which areas are in demand right now?

In the latter half of 2022, some markets were faring better than others.

Our latest House Price Index found that affordable cities and suburbs continue to see strong demand for homes, while the outlook is weaker for the more expensive markets and rural locations.

Why are homes losing value?

Home values are starting to fall back because of weaker demand in the final 6 months of 2022.

Rising mortgage rates and cost-of-living pressures are causing some potential home movers to press pause for now. And a reduction in demand leads to a reduction in upwards pressure on house prices.

But while the number of homes losing value is growing: rising from 8 million in between July and December 2022 to 16 million in the 3 months to December 2022, it’s crucial to remember that these price reductions are fairly modest compared to the gains made in recent years.

What’s going to happen to home values in 2023?

The scale of value reductions has been relatively small so far but is likely to grow further in the first part of 2023.

We’re expecting to see national house price falls of around 5% for this year.

Homeowners who lose value may be put off moving or need to look at alternatives like cheaper homes or lower-value markets for their next move.

That said, we’re still expecting 1 million property transactions to take place this year as the pandemic-driven search for space continues. The ability to work from home remains for many office workers, which has opened up the location landscape for many.

Those in retirement, who may be cash buyers or looking to downsize, will also continue to look for new homes and cost-of-living adjustments are likely to motivate people to find new properties that are cheaper to run.

How can I find out what’s happening to house prices in my area?

The outlook for home values depends very much on the individual home and the market it sits within.

It's important that homeowners don’t focus too much on national trends in prices, but rather what’s happening in their area locally.

Key takeaways

- Despite a turbulent second half to the year, 92% of homeowners enjoyed value gains on their homes in 2022

- The average capital gain was £19,000

- However, weaker demand from July onwards meant that nearly 1 in 3 saw the value of their home decline by an average of £4,400 from July to December

New Save to Buy scheme launched for first-time buyers

What if the rent you paid could be saved towards your deposit instead? New homes developer Fairview has launched a scheme that does exactly that.

A new scheme has been launched for first-time buyers under which all money they pay in rent is put towards a deposit for their home.

The Save to Buy initiative enables first-time buyers to move into their home and pay ‘rent’ at a fixed cost for between six months and two years.

But instead of the money going into the pocket of a landlord, it is set aside until they have saved a big enough deposit to qualify for a mortgage on the property.

The scheme, offered by housebuilder Fairview New Homes, is currently running at two of its developments: New Hayes in West London, and Epping Gate in Loughton, Essex.

However, homes at other developments are expected to be added to the scheme later this year.

Christopher Hood, sales and marketing director at Fairview, said: “We’re bringing forward the opportunity to own a home for our customers.

"Those who thought home ownership was out of reach, because of the rental trap they found themselves in, can finally have the breathing space to save.”

How does Save to Buy work?

People who want to buy one of the Save to Buy homes must have already saved a deposit equivalent to 1% of the property’s value.

They hand this over to Fairview when they first exchange contracts and move into their home.

They then pay ‘rent’ at a fixed monthly cost, based on their own finances and average local rents, with 100% of the money going towards their deposit.

Buyers typically have between six to 12 months to save their deposit, but the scheme can run for up to two years if they need longer.

They can also top up their monthly payments to reach their goal sooner.

When they are within one month of having saved the required deposit, they submit a mortgage application to a lender to buy the property.

Once they have legally completed, they own the property, just as they would if they had bought it on the open market.

Who can use Save to Buy?

The scheme is designed to help people who would not otherwise be able to buy a home immediately.

To use it, you must also be a first-time buyer, be employed and the property must be your only residence.

If you think this applies to you, Fairview suggests talking to one of its sales representatives.

Those wanting to take part in the scheme will need to be assessed by a financial advisor, who will set out the income and deposit they require. They will also conduct a credit check to make sure you are eligible.

Homes available through the scheme are offered on a first come, first served basis, with the initiative due to close to new applicants in December 2023.

What other help is available to first-time buyers?

While Save to Buy is offered by a housebuilder, there are a number of government schemes available to help people get on to the property ladder.

Shared Ownership enables people to buy a share in a property and pay rent on the rest.

First Homes enables first-time buyers, key workers and local people to purchase a home at a 30% discount to its market price.

The Mortgage Guarantee Scheme, recently extended until 31 December 2023, enables both first-time buyers and home-movers to purchase a property with just a 5% deposit, with the government guaranteeing the portion of the loan over 80%.

First-time buyers saving for a deposit can also use the Lifetime ISA, under which they can save £4,000 a year. The government then adds a 25% bonus - up to a maximum of £1,000 annually. The money must be used to either purchase a first home or for retirement.

The government has also increased the threshold at which stamp duty kicks in for first-time buyers from £300,000 to £425,000 on homes costing up to £625,000 until April 2025.

Key takeaways

- A new Save to Buy scheme has launched, enabling first-time buyers to move into the home they plan to buy before they have completed on the purchase

- They then pay ‘rent’ at a fixed cost, with all of the money going towards their deposit

- The scheme, launched by Fairview New Homes, is currently available in London and Essex, but is set to be rolled out to other developments later this year