Buy-to-let mortgage market shows signs of recovering

The number of different mortgages landlords have to choose from has risen by more than 700 products since the beginning of October.

The buy-to-let mortgage market is showing signs of recovery as lenders relaunch products following the chaos caused by the mini-Budget.

The number of different deals landlords have to choose from has increased by more than 700 since the beginning of October, with 1,769 mortgages now available in the sector.

Within the total, the biggest rise has been for two-year fixed rate buy-to-let mortgages for people borrowing 25% of their property’s value, with 139 new deals launched, according to financial information group Moneyfacts.

At the same time, 130 new five-year fixed rate mortgages for landlords with a 25% deposit have come onto the market since early October.

Rachel Springall, finance expert at Moneyfacts.co.uk, said: “The buy-to-let sector has faced notable market turmoil, so it’s positive to see product choice gradually returning since the start of last month.

“A rise in choice could indicate an encouraging sentiment across lenders that appear to be adjusting their ranges to cater to landlords searching for a new deal.”

Why is this happening?

The buy-to-let mortgage sector suffered the same loss of choice as the wider mortgage market in the wake of the mini-Budget, with lenders pulling their ranges to reprice them.

The big increase in choice seen during the past couple of months is good news for those who need to remortgage, as it suggests lenders are very much open for business to this part of the market.

What’s happening to mortgage rates?

Unfortunately, the average cost of a buy-to-let mortgage has continued to increase and now stands at more than 6%.

The typical interest rate charged on a two-year fixed rate deal currently stands at 6.5%, a rise of 0.93% since the beginning of October.

Five-year fixed rate mortgages for buy-to-let landlords have seen a slightly less dramatic rise, increasing to 6.42%, up from 6.05% two months earlier.

Surprisingly, rates for landlords borrowing 60% of their property’s value have seen the biggest increases, with the cost of two-year deals jumping by an average of 1.75%, while five-year ones have risen by 1.68%.

What should I do if I need to remortgage?

Buy-to-let mortgage rates are expected to come down in the weeks ahead, so if you can afford to wait before taking out a new deal, it might be worth doing so.

That said, with house prices currently falling, you may be better off remortgaging sooner rather than later if you are very close to a loan-to-value (LTV) boundary.

For example, if you would currently only need to borrow 60% of your property’s value, but a small drop in house prices would push you above this level into the next tier, it would mean you could be charged a higher interest rate.

If you need to remortgage now, five-year fixed rates for people borrowing 60% of their property’s value currently look the best value, at an average of 5.94%.

But remember, if you take out one of these deals, you will be locking into the current high level of interest rates for five years.

Although the Bank of England base rate is expected to rise further from its current level of 3%, the official cost of borrowing is expected to start falling again within the next two years.

As a result, you may be better off opting for a two-year fixed rate deal, with these currently averaging 6.27%.

For landlords looking to borrow 75% of their property’s value, the difference is much smaller, with five-year deals averaging 6.55% and two-year ones averaging 6.53%.

Anything else I need to be aware of?

To qualify for a buy-to-let mortgage, lenders use a particular affordability test, known as the Interest Cover Ratio.

Under this test, rental income from the property has to be the equivalent of between 125% and 145% of the monthly mortgage interest payment.

So, if your mortgage rate is 6.5% and you are borrowing £200,000, your rental income would need to be between £1,354 and £1,571 a month.

There are some ways around the test. For example, you can ask your lender for ‘top slicing’ under which they will include some of your income in their affordability calculations.

But not all lenders will do this, so if you want to use top slicing, it might be worth getting help from a mortgage broker.

Key takeaways

- The number of buy-to-let mortgage deals available has increased by more than 700 since the beginning of October to 1,769 different products

- The average cost of the mortgages has continued to increase and stands at 6.5% for two-year deals and 6.42% for five-year ones

- Buy-to-let mortgage rates are expected to fall in the weeks ahead

What’s going to happen to the rental market in 2023?

Will rents keep rising at the rate they are now and will more homes become available for renters next year? Get the latest with our Rental Market Report.

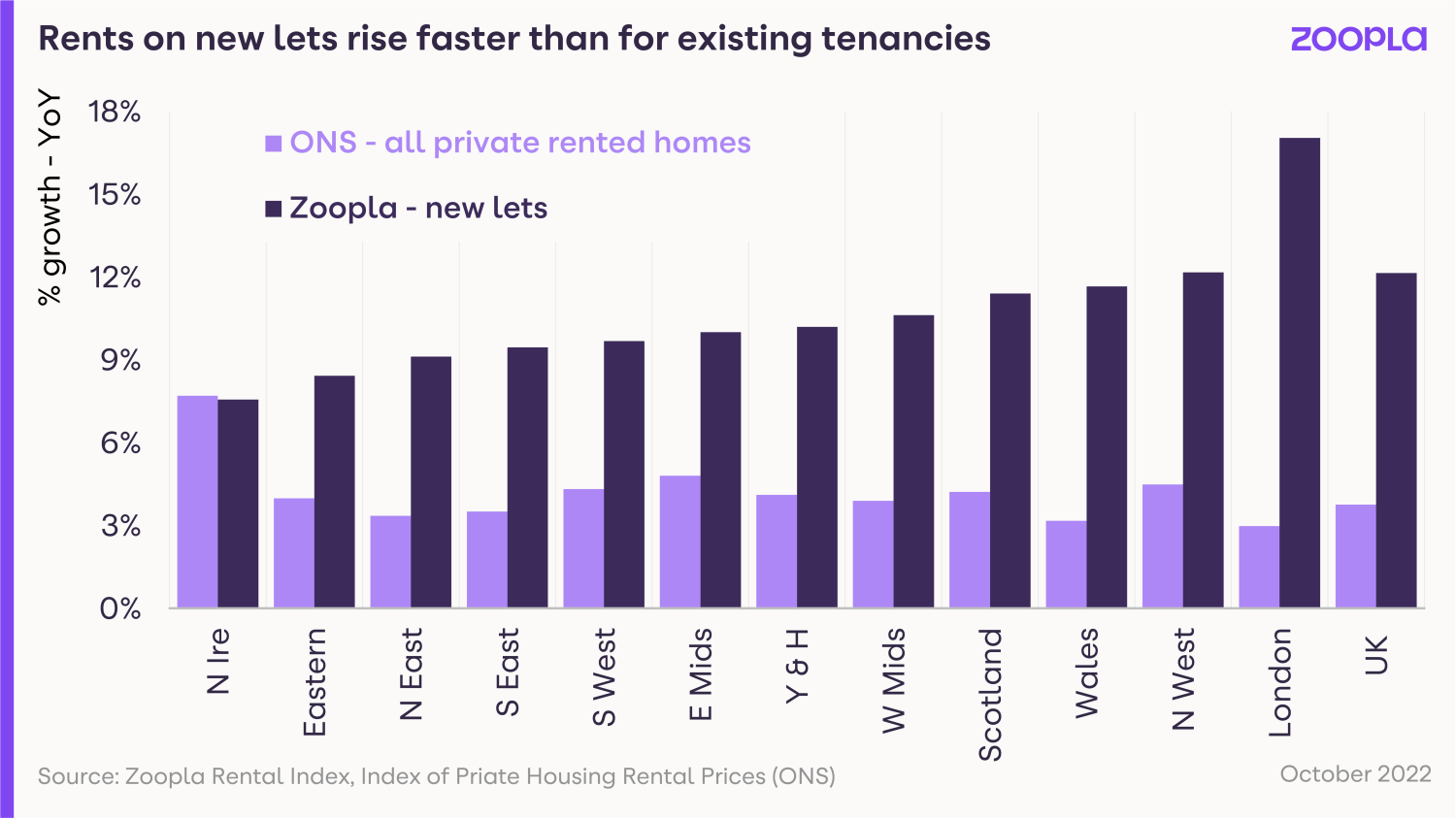

Rents have risen 12.1% in the last year on new lettings. That’s around £117 a month, or £1,400 a year.

The rise is way ahead of the rate at which wages have increased, up 6% on average in the last 12 months.

Rental affordability, measured as the percentage of income a single renter pays on rent, is now at its highest level for a decade at 35%.

New lettings account for a quarter of the rental market, as one in four renters move home each year.

For the 75% of renters who stay put, the picture is less bleak, as rents have risen by an average of 3.8% for this group, according to the Office for National Statistics.

However, the fact that renters are choosing not to move rather than face higher rents is compounding the supply issue for the market.

When will rentals get cheaper?

With demand up 46% and supply down 38%, rent prices are being pushed up fast.

That demand is being further exacerbated by rising mortgage rates, meaning more potential first-time buyers are continuing to rent for the time being.

But there’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents are rising in 2023.

The current momentum in rental levels is a growing concern for all private renters, especially those on low incomes, as it only exacerbates cost-of-living pressures.

If rental growth were to continue to run at 12% over 2023, the proportion of earnings needed to pay rent would be stretched even further to 37%.

This is not likely or feasible and we expect the growing unaffordability of renting to hit spending power.

This trend, supported by a modest improvement in available supply, could lead to rental growth slowing to 5% over 2023.

What will make renting less expensive?

The quickest way to slow rental inflation is to boost rental supply.

Executive Director Richard Donnell says: “Increasing investment in new rental supply from multiple sources is the main route to reducing rental growth and making for a more sustainable private rented sector.”

Unfortunately however, we’re not expecting to see any major improvement in this area over the next 12 months.

The private rented sector has a structural supply problem stemming from economic and policy factors.

The stock of homes available for rent has not grown in size since 2016, holding steady at around 5.5m homes.

Over the last 7 years, we’ve seen private landlords selling up and taking advantage of the strong sales market in the face of higher taxes and greater regulation.

That said, the reduction in privately available rented homes has been offset somewhat by corporate investors delivering ‘build-to-rent’ schemes, keeping overall supply static since 2016.

It is important that policymakers encourage good landlords of all types and sizes to stay in the market and deliver much-needed supply.

Only by increasing investment in the private rented sector can we ease the affordability pressures on renters in the medium term and make for a more sustainable rental market.

Rental supply is beginning to improve

We do expect to see a modest improvement in rental supply in the coming months.

In fact, the number of homes available for rent has increased in recent weeks as the sales market weakens.

Landlords looking to sell homes may now continue to rent them out while uncertainty in the wider sales market persists.

The average estate agency branch now has 10 homes available for rent, up from a low of 7 at the end of September.

Unfortunately though, this increase in rental supply is unlikely to provide a material slowdown to rental inflation in isolation.

Increasing demand is pushing rents higher and adding to affordability pressures for renters.

This means more renters are having to consider a greater set of compromises when looking to secure a home.

More renters likely to share homes to spread costs

Recent research from the Resolution Foundation 2 found that there has been a steady increase in sharing, measured by the space per private renter, which has decreased by 16% over the last two decades.

More renters likely to continue living with parents

ONS data 3 shows a continued increase in the number of young adults aged 20-34 years staying at home (3.6m in 2021) rather than incurring rental payments to live independently.

This trend is already helping to ease some of the current demand-side pressures.

More renters trading down to smaller homes

Our last report highlighted how renters are seeking smaller homes with an increase in demand for 1- and 2-bed flats and a reduction in the demand for houses.

Our latest data shows this trend is continuing with an acceleration in demand for 1-bed flats, which now account for 32% of rental enquiries across the UK.

The affordability dynamics for a couple renting a 1-bed flat are much better than a 2-bed home and keeping a spare room or sub-letting.

What’s the outlook for renting in 2023?

Proposed regulations and new rules on renting homes that aren’t at an Energy Efficiency rating of C or above from 2025 are likely to result in more private landlords selling up, especially if they own homes that are expensive to manage and retrofit.

Sadly this further loss of privately rented homes is likely to offset the impact of new investment in the build-to-rent sector.

Policymakers need to better understand the rental market as well as the forces and factors shaping the overall availability of supply.

The demand for rented homes is only going to rise in the medium term, so it's important we encourage more supply from all forms of landlords, whether private individuals or large corporates.

Key takeaways

- Rental growth is likely to slow from 12% in 2022 to 5% over 2023

- Single renters are currently spending 35% of their income on rent. If rental inflation continued at the rate it is now, that would increase to 37% in 2023, which we think is unlikely

- There’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents increase next year

Rents rising fastest in major regional cities

UK rents are 12.1% higher than last year but major cities have seen even more rental inflation. Find out the average rent for your area and how quickly rents are rising across the country.

The average UK rent is now £1,078 per month, a rise of 12.1% in the last year.

Rents are rising the fastest in large cities where shortages of available rental homes cannot meet demand created by strong employment markets and large student populations.

London has seen the highest rental growth in the last year at 17%. That works out to a rise of £273 per month for renters in the capital, compared to a UK-wide jump of £117 per month.

There’s also been high rental growth in Manchester (+15.6%), Glasgow (+14.1%), Bristol (+12.9%), Sheffield (+12.4%) and Birmingham (+12.3%).

Rental growth is slower in smaller cities like Hull, York, Oxford and Leicester, where rents rose less than 8% in the last year.

But that’s still higher than the average 6% rise in earnings in the same period. The average renter now puts 35% of their income towards rent, making renting in the UK the most unaffordable it’s been this decade.

Southern cities record highest average rents

Average rental rates are highest in southern UK cities - London (£1,879), Cambridge (£1,431), Bristol (£1,254) and Southampton (£1,006).

The only city outside of the south to match these levels is Edinburgh, where renters are paying £1,060 per month for new tenancies - an above-average rise of 12.4% in the last 12 months.

Looking at regions rather than cities, the most expensive places to rent a home in the UK are the South East (£1,189) and East of England (£1,051), both higher than the UK average of £1,028 per month.

While rents have risen at 9.4% and 8.4% in these regions respectively, those are some of the slower regional growth rates in the country.

The South West - with an average rent of £983 - is also tracking slower regional growth (9.7%) than regions further north.

Rents are cheapest in northern regions and cities

As a general rule, rents get cheaper the further away you move from London.

Wales, East and West Midlands, Yorkshire and the Humber, and the North West are all recording average rents of between £700 and £800, offering greater value for money for renters.

But the cheapest regions to rent in the UK are the North East (£612), Northern Ireland (£679) and Scotland (£688).

If we look at major UK cities, the cheapest rental rates are currently in Newcastle (£712), Liverpool (£717) and Sheffield (£735).

Sheffield, however, has seen some of the highest rental growth in the last year with rents jumping 12.4%.

Will rents keep rising in 2023?

There’s only so much renters can afford to pay - and this is likely to have an impact on demand and the pace at which rents increase next year.

We expect annual rental growth to be between 4% and 5% by the end of 2023, as affordability limits of renters combine with a modest uplift in rental supply due to the weaker sales market.

Executive Director Richard Donnell says: “Increasing investment in new rental supply from multiple sources is the main route to reducing rental growth and making for a more sustainable private rented sector.”

Key takeaways

- Rents are rising the fastest in large UK cities with strong employment and large student populations

- London, Manchester and Glasgow recorded the highest rental growth in the last 12 months

- The South East and East of England are the most expensive regions to rent in December 2022, while rents get cheaper as you move further north

Top five urban regeneration hotspots

Buying in an area that's being regenerated is a smart move. Find out which major cities are being transformed with mulit-million pound investment projects right now.

As activity in the housing market slows, areas undergoing regeneration can be a good bet for property investors and home buyers.

Urban regeneration often triggers rising demand for housing as locations become more desirable places in which to live, which in turn attracts new businesses, according to Seven Capital.

“Developments such as new train stations, shopping centres, leisure facilities and mixed-use commercial spaces directly provide a better lifestyle, which in turn attracts new residents.

“This effect can then ripple outwards, attracting new businesses which support a higher-paid workforce and thus, increase demand for residential living nearby,” the group said.

Seven Capital has identified five locations that are seeing above-average regeneration, which will not only transform them into desirable places to live and work, but could also boost property values.

Derby

The Derby City Centre Masterplan is an ambitious regeneration scheme to deliver new retail, leisure and residential developments across the city.

Scheduled for competition in 2030, it aims to leverage £3.5 billion of investment to create 1,900 new homes and 4,000 jobs, as well as a hi-tech business park.

Meanwhile, the city’s Local Plan will see 11,000 new homes and more than 100,000sqm of office space built by 2028 in a bid to attract new employers to the city.

Derby is also poised to benefit from improved transport links through High Speed 2 (HS2), with the rail project putting it less than an hour away from London and within around 30 minutes of Birmingham.

These new amenities, employment opportunities and transport links are expected to lead to significant population growth in the city, leading to higher property demand, with Seven Capital predicting house prices could rise by 24% by 2025.

Birmingham

The UK’s second city has already benefited from a number of regeneration schemes in the past two decades, including the Bullring, New Street Station and Grand Central.

Birmingham is now focusing on the West Midlands Metro tram extension, which will create new transport links across the city.

Seven Capital expects the project to lead to a 6% increase in house prices in areas that will benefit from the increased connectivity.

Meanwhile the Paradise and Snowhill developments bring new office space and homes, while Digbeth is continuing to undergo regeneration, including the £1.5 billion Birmingham Smithfield development to create a mix of commercial space, offices, homes and public areas.

Birmingham is also set to be a significant beneficiary of HS2, which will cut the journey time to London to just 52 minutes.

Leeds

Leeds is already one of the fastest growing cities in the UK, and its appeal looks set to continue thanks to a number of regeneration projects.

Following on from the revamp of Leeds City Station, a £270 million development project is set to see the city’s Lisbon Square area transformed into a 2.8 hectare site that includes apartments, hotels and mixed-use office space.

Not only will it double the size of the city centre, but it is also expected to help boost the local economy.

At the same time, £8.6 million is set to be spent transforming road space into green space under the City Park scheme, while £7.4 billion will go towards expanding Temple Green Park and Ride, and £2.6 billion will be spent renovating older properties in the Holbeck area of the city.

Slough

Already a popular destination for London commuters, Slough is set to benefit from £3 billion of redevelopment cash.

The Heart of Slough project will see the former Thames Valley University land transformed into new homes, commercial space, retail and leisure facilities.

The town already boasts The Curve, a new theatre and library, as well as several new sports and leisure facilities, including an ice rink.

Meanwhile, plans are in place to transform the old Queensmere Shopping Centre into 1,600 new homes, as well as 12,000sqm of retail space and 40,000sqm of office space.

At the same time, the newly completed development The Metalworks offers homes less than 200 metres from a Crossrail station.

Bracknell

Bracknell has seen a number of regeneration projects during the past 10 years as the popularity of the town increases.

The £770 million Bracknell Town Centre Vision 2032 has already seen the creation of retail and leisure complex The Lexicon.

Future redevelopment projects include The Grand Exchange, a new residential complex designed to capitalise on growing demand for homes from people leaving London.

Other up-and-coming projects include Princess Square and The Deck which will provide new retails offerings and public space.

Key takeaways

- Regeneration in urban areas can help to boost house prices

- Good transport links, alongside improved shopping, restaurants, cafes and sports facilities generate employment and create more desirable places to live

- Derby, Birmingham, Leeds, Slough and Bracknell are the places to watch right now, as they're all seeing high levels of regeneration

It's a property market 'shake out' not a property market crash

Sellers are beginning to offer bigger discounts to buyers to get their sales agreed, but we’re not seeing the need for a big double digit reset in UK house prices.

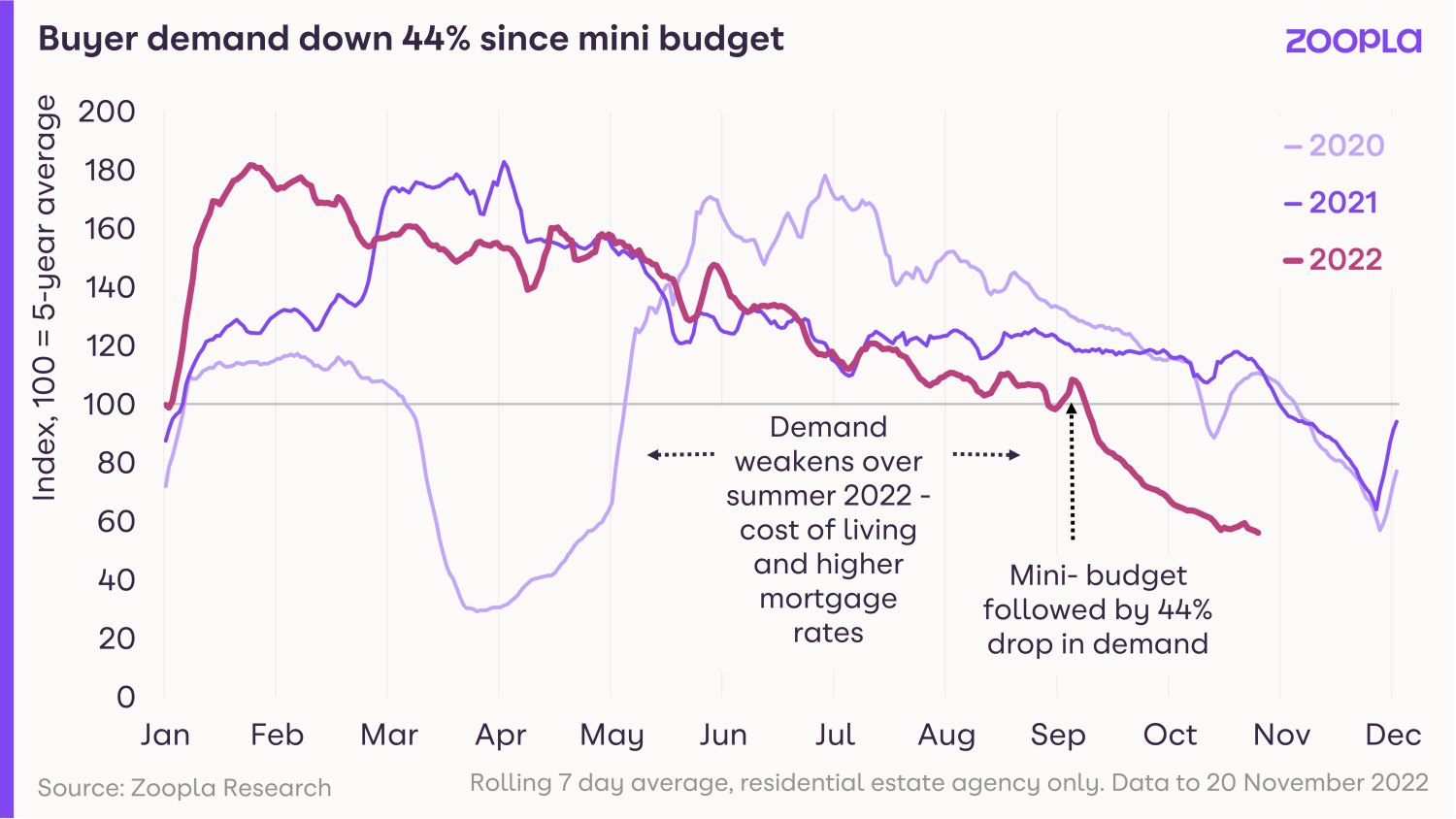

The spike in mortgage rates after the mini-budget in late September undoubtedly hit the housing market.

Demand has now fallen to pre-Christmas levels a lot earlier than usual, as would-be buyers sit on the sidelines, waiting to see what happens with mortgage rates and what the economic outlook holds for jobs and incomes.

In fact, it’s currently at half the level it was at this time last year, when market conditions were stronger, mortgage rates lower and there were fewer cost-of-living pressures on household budgets.

That drop in demand in turn has affected sales volumes, which are down 28% from a year ago and are now on a par with the pre-pandemic period.

More sellers dropping asking prices

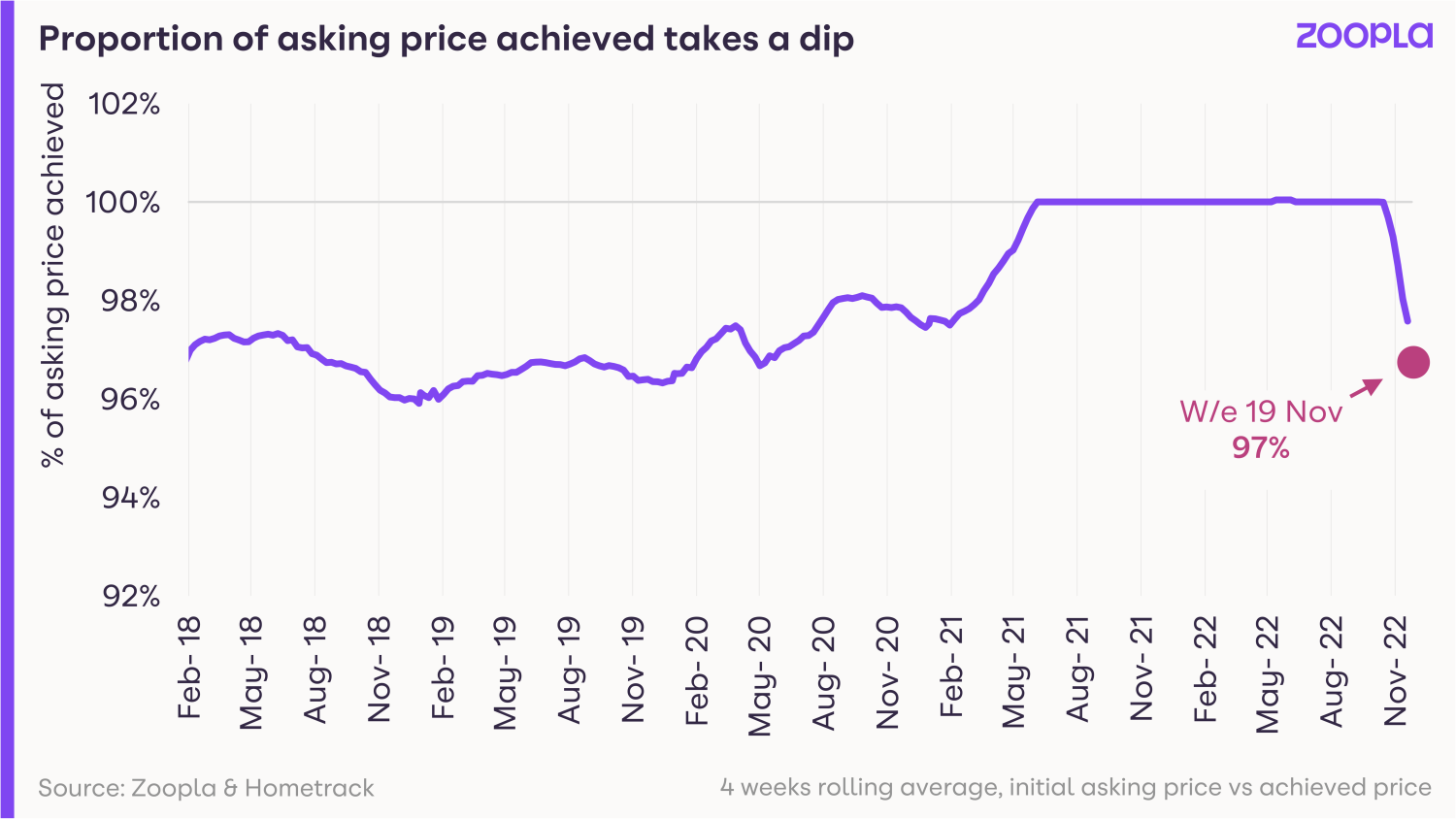

Meanwhile, sellers are beginning to offer bigger discounts to buyers to get their sales agreed.

Data from our valuation and property risk business Hometrack, shows that the gap between the first asking price and the agreed selling price has started to widen in recent weeks.

But it’s important to remember that throughout the pandemic, sellers were enjoying the luxury of achieving their full asking price - and in many instances more - as demand surged among buyers.

The pendulum has now started to swing in the opposite direction and the average seller is now offering a 3% discount on their property to achieve a sale.

Why this isn’t a property market crash

Right now, we are simply transitioning from an unsustainably strong market to a more balanced one.

All the leading supply and demand indicators we measure continue to point to a rapid slowdown from very strong market conditions.

Despite higher mortgage rates reducing how much buyers can afford, new sales have been more resilient than some may have expected.

Committed buyers and sellers are continuing to bring homes to the market and agree on deals, although these are fewer in number and harder to negotiate and hold together over the buying cycle.

And while fall-through rates may be higher, they are not unmanageable for agents.

Our data shows that 1 in 15 homes formerly sold is returning to the market after the original sale has fallen through.

Importantly, we are not seeing any evidence of forced sales or the need for a large, double digit reset in UK house prices in 2023.

Historic data shows buyers’ offers need to be in the region of -5% to -7% below what the seller is asking for the property for annual price falls to take place.

We do expect the discount to widen further as we move to more of a buyers’ market, but the positive here is that strong house price growth has given sellers more room to negotiate on their asking price without losing their long-term value gains.

The prospects for 2023 really depend on how willing sellers are to adjust asking prices in line with what buyers are prepared to pay.

Key takeaways

- Buyer demand falls to pre-Christmas levels earlier than normal

- The average seller is accepting offers at 3% below the asking price lately to achieve the sale

- The housing market is now transitioning from an unsustainably strong market to a more balanced one

Greater choice returns to the housing market

More homes are now coming up for sale across the UK. And because they’re no longer selling like hotcakes as they did in the pandemic, stocks are starting to rebuild.

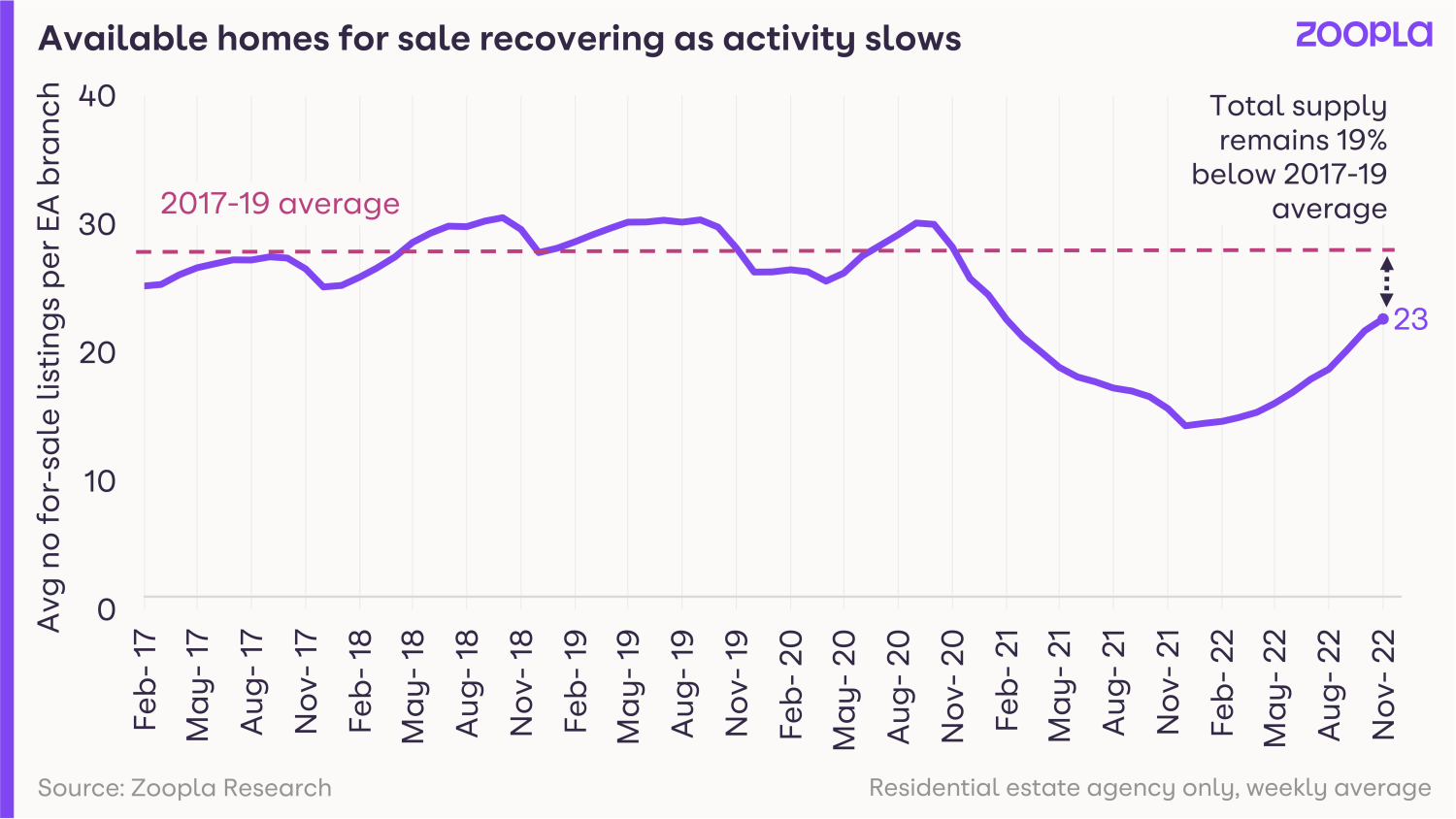

In good news for buyers, there’s now more choice available when it comes to finding a new home.

The average estate agent office now has 23 homes for sale, the highest level of stock seen since January 2021.

We’re still not quite back up to pre-pandemic levels yet, when the average agent had 29 homes on their books.

But the growth in homes available for sale is being seen across all areas of the UK.

Greater availability of homes for sale reduces upward pressure on prices

Rebuilding sales inventory, which boosts buyer choice, is part of the move to a more balanced housing market.

However, it’s important that sellers price their homes in line with what buyers are prepared to pay, given the current hit to buying power caused by higher mortgage rates.

More homes for sale will help to reduce the scale of the upward pressure on house prices and bring us back to a more normalised housing market for buyers.

House prices are not expected to tumble in 2023

Our expectation is that we won’t get an over-supply of homes for sale in 2023.

We expect some element of scarcity to remain a feature of the market, meaning house prices are not expected to fall dramatically next year.

The drivers and motivations to move home have shifted, and will continue to in our view.

Pandemic-related forces, including greater labour market flexibility, the rise in the number of people reaching retirement age and the desire for more space, means people will continue to look for new homes next year.

Some of these factors though, are now being compounded by rising living costs.

In particular, high levels of rental inflation are adding to the cost of living pressures for renters.

We expect this to support first-time buyer demand in 2023, even with the oncoming headwinds and the hit to buying power from higher mortgage rates.

Key takeaways

- Across the UK, the number of homes for sale is growing, meaning greater choice for buyers

- The average agent now has 23 homes on their books, the highest level of stock in nearly two years

- More homes for sale will reduce the upward pressure on house prices and bring us back to a more normalised housing market for buyers

How far will mortgage rates fall in 2023?

Mortgage rates look set to return to more affordable levels next year, but how low can they go? Here are our predictions for mortgage rates in 2023.

The rise in mortgage rates in the last 2 months has been the main reason for the recent slowdown in the housing market.

But things are looking a little more positive for borrowers as we head towards the New Year, and we expect mortgage rates to settle between 4.5% and 5% by mid-2023.

Along with a widespread fall in house prices by up to 5%, more affordable mortgage rates will encourage some people to move next year and we’re anticipating 1 million completed sales in 2023.

Underlying cost of fixed rate mortgages for lenders falls to 4.1%

The underlying cost for banks to borrow for a 5-year fix - the most popular initial term - has fallen from 5.5% to 4.1% since early October.

Lenders add a margin for risk and profit on top of this underlying cost. This is why mortgage rates soared to 6.5% after the mini budget.

We expect the recent fall in the cost of finance for banks to translate into more affordable fixed mortgage deals on the high street, with mortgage rates at or below 5% in January then settling at between 4.5% and 5% by the middle of the year.

Compared to the 6.25% rates of recent months, it will put the 6 in 10 mortgaged buyers who use a 5-year fixed mortgage in a stronger buying position in 6 months’ time.

Greater choice returns to the housing market

More buyers will reduce reliance on mortgage finance in 2023

A 4.5% or 5% mortgage rate is still a material increase in costs for the 7 in 10 buyers who use a mortgage, compared to the sub-2% rates of recent years.

As a result, we expect more home buyers to look for ways to reduce their reliance on mortgage finance.

They’ll look to borrow less by changing what they need in their next home, coming up with more equity or waiting to see if further falls to house prices or mortgage rates come later in 2023.

Together, this will further reduce the housing market’s reliance on high loan-to-value mortgages, a trend we’ve seen grow over the last decade.

As lenders tightened their criteria after the global financial crisis, buyers needed greater equity and income to take out a mortgage.

So, over time, homeowners have gained greater stakes in their homes and the ability to absorb small price fluctuations, which is key in preventing a housing crash and keeping sales volumes healthy in 2023.

This is an important and underreported shift in enabling home moves, and one of the main reasons we continue to feel relatively optimistic in our housing market predictions for 2023.

It's a property market 'shakeout', not a property market crash

Lower mortgage rates and house price falls will support sales volume

Current market measures - such as asking price reductions and buyer demand decreases - are pointing towards modest but widespread house prices falls of up to 5% in 2023.

Quarterly house price growth at lowest level since February 2020

However, price corrections combined with steadying fixed mortgage rates will support the number of sales completed in 2023, which we estimate will reach 1 million over the year.

It signals a return to more normal housing market conditions after 2 years of frenzied pandemic-driven activity.

Key takeaways

- Underlying cost of fixed rate mortgages for lenders has fallen from 5.5% to 4.1% since early October - actual mortgage rates are higher than this

- Average 5-year fixed mortgage rates likely to settle between 4.5% and 5% by mid-2023

- The housing market’s reduced reliance on high loan-to-value mortgage finance will continue to encourage home moves next year

Thousands of new homes to be built with £175 million government scheme

Government launches fund to transform derelict land into sites with brand new homes - including affordable homes - across the UK.

Thousands of new homes are set to be built on derelict land under a new £175 million government scheme.

The funding will be used to turn council-owned land, including redundant industrial sites, disused car parks and derelict buildings, into new communities, according to the Department for Levelling Up, Housing and Communities.

A total of 59 regeneration projects, from Exeter to Sunderland, have been approved to receive the first £35 million under the scheme.

The fund will lead to 2,200 new properties being built, including 800 affordable homes.

The remaining £140 million will be allocated over the next two years, leading to a further 17,600 new homes.

Minister for Housing Lucy Frazer said: “We are helping local communities transform unwanted, urban eyesores into thriving places that people are proud to call home.

“Regeneration is at the heart of our levelling up mission and this new brownfield first fund will help communities across the country unlock disused, council-owned sites to build more of the right homes in the right places.”

Why is this happening?

The scheme is part of the government’s drive to help more people get on to the housing ladder, while levelling up the country.

Funding for the scheme will come from the £180 million Brownfield Land Release Fund 2, which has been allocated to 41 councils to help kickstart regeneration in towns and cities.

It builds on the first Brownfield Land Release Fund, under which councils received £77 million to assist with the construction of 7,750 new homes.

Who does it affect?

The move is good news for people wanting to purchase a new-build home, as it will help to boost supply.

Developments will also take into account the types of property local communities need.

Meanwhile, turning derelict land and buildings into new properties will have a positive impact on the surrounding area, making neighbourhoods more desirable and helping to support local house prices.

What’s the background?

The government has pledged to deliver 300,000 new homes each year in a bid to tackle the UK’s housing shortage.

The National House Building Council (NHBC) recently announced that the number of new properties being built had soared to a 15-year high during the three months to the end of September, with a total of 44,729 homes started during the period.

The level of properties under construction increased in 10 of the UK’s 12 regions.

New-build homes offer a number of advantages to buyers. Not only are they more energy efficient and have lower maintenance costs, but they typically come with a 10-year warranty from the NHBC.

In addition, purchasing a new-build property is chain-free if you are a first-time buyer or do not have a home that you need to sell.

Key takeaways

- Thousands of new homes are set to be built on derelict land under a new £175 million government scheme

- The funding will turn council-owned land, including redundant industrial sites, disused car parks and derelict buildings, into new communities

- 59 regeneration projects for 2,200 new properties have already been approved under the scheme

What can I do if my home is repossessed?

We take a look at what you should do if you are struggling to pay your mortgage, or if your rental home is repossessed.

Home repossessions are used as a very last resort by lenders.

However, the number of repossessions is starting to increase as people struggle with the cost-of-living squeeze.

A total of 700 properties were taken back by lenders during the three months to the end of September, 15% more than during the previous three-month period, according to mortgage trade body UK Finance.

There was also an 11% jump in the number of buy-to-let homes that were repossessed, with 390 landlords losing properties after falling behind with mortgage payments.

However, the number of properties being repossessed represents less than 1% of cases where homeowners have fallen into arrears with their mortgage repayments.

The proportion was slightly higher for landlords, with just under 7% of mortgage arrears cases leading to repossessions.

Right now, 74,440 homeowners and 5, 760 landlords are currently in arrears of more than 2.5%.

A separate report by the Ministry of Justice shows that while repossession figures have increased significantly compared with the previous year, they are still around a third lower than the level seen before the Covid-19 pandemic.

Why is this happening?

There are two factors driving the increase in repossessions.

1: Higher food, petrol and energy prices, combined with rising interest rates, has made it harder for some people to keep up with their mortgage repayments.

2: Measures that were put in place to stop people losing their home during the pandemic have now come to an end.

What should I do if I’m struggling with my mortgage?

If you are struggling to pay your mortgage, it is important that you contact your lender as soon as possible.

Regulators require banks and building societies to work with people who run into difficulties and only repossess their home as a last resort.

Contacting your lender sooner, especially before you miss a mortgage payment, will open up more options to you.

There are a number of steps lenders can take to help you if you are struggling.

These include increasing your mortgage term, for example allowing you to repay your mortgage over 30 years rather than 20 years, or changing you to an interest only mortgage for a period of time.

Both of these options will significantly reduce your monthly mortgage payments.

They may also grant you a mortgage payment holiday for a period of two to three months to help you get back on your feet if, for example, you have been made redundant.

During this period, the interest that you don’t pay will be added to the outstanding amount that you owe. The payments you have missed will also have to be made up at a later stage.

Another option is to defer mortgage payments for a set period of time, after which the payments you have missed will be added to your monthly repayments and made up over the course of a year or two.

What are my rights if my rental home is repossessed?

If you rent your home, the prospect of your landlord having the property repossessed can be very stressful.

The good news is that in some cases you have the right to stay on in the property, for example if your tenancy is binding on your landlord’s mortgage lender.

It may be binding if the lender agreed to the tenancy, if you were already living in the property when the mortgage was granted, or if the lender has recognised your tenancy in some way, such as by asking you to pay rent to them.

If your tenancy is not recognised by your landlord’s lender and you do not have the right to stay in your home, you can still delay having to leave by up to two months.

You can do this through making an application to the court during the possession hearing, at which point the judge can agree to delay the date on which you must leave.

Unfortunately, you will have to pay a fee to make an application to the court.

If you miss the hearing when the possession order is made, you have another opportunity to ask for a delay when the mortgage lender applies for a warrant of possession.

Before the lender is allowed to evict you, they have to send a notice to your home saying they have applied for a possession order.

At this stage you can apply to the lender to delay repossessing the property for up to two months.

If the lender refuses or does not reply to you, you can apply to the court instead, but you will need to move quickly, as the court can issue a warrant of possession within 14 days of notice being sent to your home. You will also have to pay a fee.

The process can be a bit complicated, but charities such as Citizens Advice are able to help you establish whether you have a right to stay in the property.

They can also help you to apply for a delay in leaving it.

Key takeaways

- Home repossessions rose by 15% to 700 properties in the three months to the end of September

- There was also an 11% jump in the number of buy-to-let homes that were repossessed

- If you're struggling with your mortgage contact your lender as soon as possible, if you rent your home you may be able to stay in it, even if it is repossessed

What Jeremy Hunt's autumn statement means for the housing market

Stamp duty cuts reversed and rising council tax rates on the way - but the energy price cap remains in place. And what does it all mean for mortgage rates?

Chancellor Jeremy Hunt today set out plans to fill a £55 billion hole in the government’s finances through a combination of tax rises and spending cuts.

The deficit was created by former Chancellor Kwasi Kwarteng’s now infamous mini-Budget, which sparked chaos in the financial markets and led to a steep increase in government borrowing costs.

Just under half of the £55 billion will come from tax rises, with just over half coming from cuts to government spending, Hunt said.

He added that once the UK’s economy had recovered, the pace of fiscal consolidation would be increased, to reduce pressure on the Bank of England to raise interest rates.

What’s the big picture?

The Office for Budgetary Responsibility (OBR), which provides independent analysis on the government’s finances, confirmed that the UK is already in recession.

But Hunt said the OBR expects the downturn to be shallower as a result of the measures in the Autumn Statement.

The OBR forecast the economy will grow by 4.2% this year, before contracting by 1.4% in 2023, with growth recovering to 1.3% in 2024.

Meanwhile, inflation will average 9.1% this year, before starting to fall steeply from the middle of next year.

Unemployment is expected to rise from its current rate of 3.6% to reach 4.9% in 2024, before falling back to 4.1%.

Which taxes are going up?

Income tax

The Chancellor announced that the thresholds at which the different rates of income tax kick in will be frozen at their current level for six years.

This means the basic rate of 20% will be charged on all earnings over £12,570 until April 2028, while the 40% rate will be charged on earnings over £50,270 until the same date.

Meanwhile, more high earners will be pulled into the top rate of income tax, with the level of income on which the 45% rate is charged being reduced to £125,410 from £150,000 now.

The move will cost those earning more than £150,000 around £1,200 a year.

The thresholds for National Insurance for individuals will also be frozen.

Stamp duty

Kwarteng’s increase to the threshold at which stamp duty is paid to £250,000 was one of the few mini-Budget measures that were not reversed by Hunt when he took office.

But he announced today that the increase will be temporary, with the threshold falling back to its previous level of £125,000 after 31 March 2025.

The threshold for first-time buyers will also be cut to £300,000 from £425,000, on properties costing up to £500,000, rather than £625,000.

He justified the measure by saying that activity in the housing market was expected to slow down over the next two years, and reverting back to the former stamp duty threshold in 2025 would encourage people to bring forward purchases.

The move will cost people purchasing a home for more than £250,000 an extra £2,500 in higher stamp duty payments.

Executive Director of research and insight, Richard Donnell, says: "The government's announcement of a reversal of the recently announced stamp duty changes in 2025 signifies a real need to reform stamp duty - a tax that is now starting to resemble income tax where it's the top tax bands generating the greatest receipts.

"This reversal will make it increasingly difficult for prospective first-time buyers to get on the housing ladder in the coming years, particularly in London and the South East which accounts for the majority of stamp duty receipts."

Council tax

Hunt has lifted the cap on council tax increases to give local authorities more freedom to raise cash.

Local authorities will now be able to raise council tax by up to 5% without having to hold a referendum on their plans.

The impact of the move will vary from council to council, as well as according to individual property bands, but it could see the average amount charged on a band D property rise from £1,966 to as much as £2,064.

Capital gains tax

Capital gains tax is charged at a rate of 18% on residential property and 10% on other assets for basic rate tax payers, and 28% and 20% respectively for higher rate taxpayers. But the first £12,300 of gains are tax free.

However, Hunt announced today that he was reducing the tax-free threshold to £6,000 from April 2023, and to £3,000 from April 2024.

The move will impact investors who sell buy-to-let properties, but the tax is not charged on the sale of people’s main home.

Inheritance tax

The threshold at which inheritance tax starts has also been frozen at its current level of £325,000, although couples can still combine their allowances and assets left to a spouse or civil partner will not be liable for the tax.

In another blow for people planning to leave their family home to their children, the Chancellor also announce the introduction of a cap on social care costs would be delayed by two years.

The cap had been due to come in to force in October 2023, and would limit the total amount individuals had to spend on social care as they aged to £86,000, after which the state would step in to foot the bill.

The cap would have reduced the number of elderly people who had to sell their family home to pay for care.

What support is available?

Hunt had previously warned that the Energy Price Guarantee, which limited average household energy bills to £2,500 a year would be reviewed at the end of March, sparking concerns that it could be scrapped altogether.

But there was good news for struggling households, with Hunt saying it would remain in place but be increased to £3,000 a year for a further 12 months.

Although the move will cost the typical household an additional £500 a year, the sum is significantly less than they would have to pay if the guarantee was abolished altogether.

He also announced that people on means tested benefits would receive a one-off £900 cost-of-living payment, while pensioners would get £300, and those on disability benefits would receive £150.

In addition, the state pension and means tested benefits will be increased by 10.1%, in line with the level of inflation as measured by the Consumer Prices Index in September.

People who rent their home from a social landlord will have rent increases capped at 7% for 2023/24.

What does this mean for the mortgage market?

It’s too early to say how financial markets will react, but the statement is expected to reassurance them after the chaos caused by the mini-Budget.

Not only does Hunt set out exactly how he plans to fill the government’s budget deficit, but he has also published the OBR’s response to his plans.

The interest rates charged on fixed rate mortgages had already fallen before today’s statement, and they are likely to continue their downward trend following it.

Hunt’s announcement that the rate at which fiscal consolidation would take place would increase once the economy returned to growth also means the Bank of England will be under less pressure to raise interest rates, which is further good news for mortgage rates.

Director of estate agency Anderson Harris, Adrian Anderson, says: “In today’s Autumn Statement, Chancellor Jeremy Hunt highlighted the importance of getting inflation and mortgage rates under control before announcing a raft of measures, both tax rises and spending cuts, in an attempt achieve that goal.

“Whilst the medicine will be painful for many, for mortgage borrowers spiralling inflation combined with consequential higher interest rates is punishing and I am hopeful that these steps will result in the Bank of England base rate peaking around 4% as now predicted."

What does it all mean for the housing market?

The statement is a mixed bag for the housing market.

Activity has already slowed in the face of higher living costs, rising interest rates and economic uncertainty.

The freezing of the income tax thresholds, combined with higher council tax and energy bills will do little to change this.

That said, the continuation of the Energy Price Guarantee from April, albeit at a slightly higher level, will reassure consumers that they will not face a steep increase in their gas and electricity bills come the spring, and could go some way towards increasing confidence.

Meanwhile, news that the threshold at which stamp duty is charged will fall back to £125,000 in April 2025, may cause some people to bring forward their purchase.

The fact that unemployment should not increase significantly should also help to prevent a high level of forced sales, while the overall stability the statement brings is also good news for the housing market.

The one area of bad news is the decrease in the capital gains tax allowance in 2023 and 2024.

Some commentators have warned that the move could prompt small-scale buy-to-let landlords to sell their properties ahead of the decrease, further intensifying the shortage of homes in the private rented sector.

Key takeaways

- Stamp duty cuts to be reversed in April 2025

- Energy price cap, raised to £3,000, to stay in place for a further 12 months

- Councils given the power to increase council tax

- Capital gains tax threshold reduced to £6,000

- Inheritance tax threshold frozen at £325,000