5 surprising reasons for the 3-bed home shortage

Feel like three bedroom homes are hard to get your hands on? It’s not just you. An imbalance of supply and demand is making three bedroom homes hot property, and here’s why.

Three bedroom homes for sale are hard to come by at the moment, and it’s because everyone wants one - from first-time buyers to retirees.

There’s an imbalance of supply and demand for three bedroom properties, making them among the quickest selling of any property type in the country.

But what’s causing it? What’s put three bedroom homes at the top of everyone’s list?

We’ve done some digging, and it turns out there’s a few reasons. Let’s take a look.

1. Older homeowners want to host Christmas

Our survey of 2,000 UK homeowners aged over 65 found that 41% live in a home which is ‘larger than they need’.

And a huge 9 in 10 homeowners aged 65+ have at least one spare bedroom. This equates to a massive 10 million spare bedrooms that growing families would love to get their hands on.

These homeowners have lived in their current home for more than a quarter of a century on average. So it’s easy to see why they might find it hard to move on.

22% say emotional ties are a barrier to moving, while more than a quarter (27%) say they’d be concerned about being able to host Christmas if they downsized.

But downsizing can often release capital, cut energy bills, reduce mortgage repayments or even make homeowners mortgage-free. Hosting might be off the cards, but that’s not to say Christmas is ruined.

2. First-time buyers are older than ever

The age Brits buy their first home has been rising, and first-time buyers are now aged 34 on average - compared to 30 a decade ago.

It means many first-time buyers are skipping the one-bedroom flat or two bedroom starter home in favour of a family home.

With first-time buyers making up 34% of buyers in the market, that’s a large proportion joining the hunt for family-sized properties.

Our data shows that 40% of first-time buyer enquiries are for three bedroom houses. That makes them an even bigger buyer group for this type of property than people moving house, who enquire about three bedroom properties 38% of the time.

| Type of buyer | Property | Percentage of enquiries |

|---|---|---|

| Mover | 3 bed house | 38% |

| Mover | 4+ bed house | 22% |

| First-time buyer | 3 bed house | 40% |

| First-time buyer | 4+ bed house | 9% |

Zoopla data, October 2023

3. The stress of moving house in old age

Those who own a home larger than they need reckon it takes them an additional 12.6 hours and £91 per month to maintain, compared to a more suitably-sized property.

But despite this extra work and cost, 25% of older homeowners are put off selling by the stress of moving house ‘at their age’.

No one can deny it’s a stressful process. If you’re in a dreaded chain, everything can feel as delicately balanced as a stack of cards.

What’s more, the housing market is slower than it was over the last three years. Higher mortgage rates make the market a little more uncertain, as people find it harder to be approved for finance.

Not to mention, costs are higher for everything from removals to repairs. This adds financial pressure to the process, no matter your age.

For many, it’ll be about weighing up if the time and money you’ll save in the long-run is worth the short-term stress of moving.

4. Terraces and semis with three bedrooms sell among the quickest of any property type

Speed of sale is an important indicator of buyer demand. The quicker a property type sells, the more buyers are interested in that sort of property.

Three bedroom terraced houses and three bedroom semi-detached houses are 2 of only 3 property types selling faster than the national average of 34 days.

They sell in 31 and 32 days respectively, with only two bedroom terraces selling quicker at 28 days.

However, if your budget can stretch to a three bedroom detached house, you’re likely to have more choice and less competition.

Three bedroom detached houses are taking 43 days to sell, the second longest behind only four bedroom detached houses (47). It’s a symptom of the higher average cost of detached houses - they require larger mortgages which means less demand at the moment.

5. Three bedroom terraces are in highest demand

The table shows the percentage share of buyer enquiries and supply of homes for sale of different property types.

The biggest gap between demand and supply is for three bedroom terraces. They make up almost 20% of enquiries in the market in October 2023, but only represent 12% of homes for sale.

Three bedroom semi-detached houses have the next highest imbalance between demand and supply.

Three bedroom detached houses, on the other hand, have a much lower level of demand. Detached homes are usually more expensive, so this is another reflection of higher mortgage rates limiting buyer demand for this type of property.

Key takeaways

- New research shows there aren’t enough three bedroom homes on the market to satisfy current demand

- They’re a popular choice for all types of buyers - from first-time buyers who are preparing for children to older generations who still want to host Christmas

- Most older homeowners live alone or with their partner, but still have 2 or more spare rooms

- There are an estimated 10 million spare rooms across the UK as 9 out of 10 homeowners aged 65+ have extra bedrooms they don’t use

Rents for new lets rise £1,300 in a year

Rents rise 10% for the 20th month in a row, but in London and the more expensive areas of southern England, the pace of inflation is starting to slow.

Demand for rental properties is currently running at 27% above the 5-year average.

Over the last year, the average rent for a new let increased by 10.1% to stand at £1,166 per month.

That means the average annual rental bill is nearly £1,300 higher than it was a year ago, standing at almost £14,000, compared to £12,700 last September.

This marks the 20th consecutive month of our index reporting rental inflation of over 10%.

However, for renters staying in their existing homes, year-on-year rises are much slower at 5.7%, according to the Index of Rental Prices from the Office for National Statistics.

The table below shows the rates at which rents have increased across different regions of the UK.

Average rent increases by region: November 2023

| Region | Avg rent today | Avg rent 12 months ago | Annual % change | Annual £ change |

|---|---|---|---|---|

| Scotland | £753 | £663 | 12.8% | £90 |

| North West | £799 | £719 | 11.7% | £80 |

| Wales | £817 | £737 | 10.4% | £80 |

| London | £2,057 | £1,867 | 10.3% | £190 |

| East Midlands | £819 | £739 | 10.1% | £80 |

| East | £1,115 | £1,015 | 9.9% | £100 |

| South East | £1,256 | £1,146 | 9.8% | £110 |

| West Midlands | £855 | £785 | 9.6% | £70 |

| North East | £651 | £601 | 9% | £50 |

| South West | £1,020 | £940 | 8.7% | £80 |

| Yorkshire & The Humber | £761 | £701 | 8.6% | £60 |

| Northern Ireland | £744 | £704 | 5% | £40 |

| UK | £1,166 | £1,056 | 10.1% | £110 |

Zoopla

Rental inflation in Scotland boosted by rent controls

Scotland is registering the highest level of rental inflation in the UK at 12.8%.

That’s because landlords are pushing to maximise rents for new tenancies in order to cover increased costs - and to allow for the fact that future rent increases will be limited over the life of the tenancy.

The average rent in Scotland stands at £753, which is £90 higher than a year ago.

Rental inflation in Scotland has now started to moderate down from highs of 13.7% back in February, but we expect it to continue rising at above-average levels.

Rents are growing at the fastest rate in the cities of Edinburgh (16.6%) and Glasgow (13.4%) .

But renters looking for new lets in areas between these two cities will also notice sharp increases: in Falkirk rents are up 14.7% year-on-year, while in North Lanarkshire they’ve risen 13.9%.

In the more sparsely populated areas north and west of Edinburgh and Glasgow, rental inflation is less dramatic, with North Ayrshire, Moray and the Highlands all registering rental growth below 5%.

Rental inflation slows down in England’s southern cities

Over the last 12 months, rental inflation has slowed down in southern England’s most expensive cities.

The largest moderation is happening in London, where rental inflation has decreased from 17% a year ago to 10.4% today.

The inner London boroughs were the first places to see rental inflation fall below 10%.

However, outer London areas such as Harrow, Barking and Dagenham and Redbridge continue to register rental growth above 13.5% - some of the highest increases in the UK.

The second and third largest slowdowns are recorded in Bristol and Brighton, where rental inflation fell to 8.8% and 6.0% respectively.

Rental inflation in the coastal communities of Hastings (6.7%), Newport (8.9%) and Blackpool (5.5%) is also more aligned with earnings growth (8.5%).

Those reductions show us that landlords are becoming more realistic in pricing their rentals, taking into consideration the cost-of-living struggles.

What are renters doing to minimise the impact of higher rents?

Faced with higher rents and a limited supply of homes on the market, renters are more commonly considering renting smaller homes, moving to cheaper areas or sharing properties with other renters to reduce costs.

Renters sharing does reduce the cost per person but it comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We expect rental inflation to remain above 9% for the rest of the year as earnings growth remains strong - and while higher mortgage rates are stopping many renters from moving into home ownership.

We currently anticipate national rental growth of 5-6% in 2024 - but rent increases in cities are likely to be higher.

Key takeaways

- Rents for new lets have risen by more than 10% for the 20th month in a row

- Scotland is seeing the biggest rises, where rent controls are encouraging landlords to secure higher rents upfront

- In more expensive areas, such as London and the south, rental inflation is starting to slow

What's going to happen to the UK housing market in 2024?

Our forecast reveals our housing market predictions for next year. So what will 2024 have in store?

Housing market mortgage rate predictions for 2024

Mortgage rates look set to remain higher for longer into 2024 and we’re not expecting them to fall back to 4.5% until H2 2024.

That means housing affordability will really only improve if people are able to earn more money and their incomes grow.

The ongoing rise in wages will be the main factor that supports sales volumes for the housing market in 2024.

What’s going to happen to house prices in 2024?

UK house prices are expected to fall 2% over 2024.

Homes are currently looking expensive by historic standards amid rising mortgage rates over the last 18 months.

If house prices fall further and incomes increase, or mortgage rates fall back, affordability will improve for home buyers and this in turn will support sales.

The number of homes for sale has now reached a 5-year high, meaning sellers will need to keep pricing competitively if they’re serious about selling. This will keep pricing under pressure.

In 2023, the south of England bore the brunt of house price falls but those falls are now spreading further afield.

Today, 4 in 5 housing markets are registering annual price falls, up from less than 1 in 20 just six months ago.

But crucially, the scale of price falls is modest and limited to very low single digits. No markets are currently registering annual price falls of more than 5%.

However in 2024, we expect to see an increase in markets registering 5% falls, as sellers continue to adjust their asking prices in the face of weaker buying power.

Despite this, the risk of a major collapse in prices is becoming less of a concern, and an improvement in sales hinges more on buyers’ financial ability to move when mortgage rates are in the 4-5% range.

And while the likelihood of a double-digit price drop remains low, housing affordability needs to improve to bring more buyers back into the market and to support sales volumes.

How can housing affordability improve?

Right now, house prices haven’t fallen as much as expected, while mortgage rates remain at 5% or higher, so housing still looks expensive by recent standards.

Faster growth in household incomes over 2024 would improve buyers’ affordability, along with mortgage rates falling over 2024.

Household finances have also been under pressure from rising living costs, with inflation eroding any growth in incomes.

Fortunately, this is now reversing at last and the Bank of England currently projects that inflation will fall to its target of 2% in the first half of 2025.

This, along with a real income growth, will be important in supporting buyer demand.

Housing market could rebound if affordability improves

Our Executive Director of Research, Richard Donnell, says there is scope for a rebound in market activity if affordability improves.

‘The housing market is adjusting to higher borrowing costs through lower sales rather than a big decline in house prices.

‘Asset prices around the world are also adjusting to higher borrowing costs and there is a lively debate in financial circles about the long-run outlook for borrowing costs, which sets the outlook for mortgage rates.

‘Most agree we aren't returning to the years of very cheap borrowing as central banks sunset policies that created cheap money to support economies after the global financial crisis and over the pandemic.

‘Mortgage rates of 4-5% remain low by historic standards, albeit higher than in recent years.

‘Assuming mortgage rates remain in the 4-5% range, we see UK house price growth remaining in the low single digits for the next 1-2 years, below the projections for growth in household incomes.’

This would mean that for the first time in ten years, house prices would start to become more affordable, increasing consumer confidence in making large purchase decisions.

Why haven't house prices fallen more?

There are three reasons why house prices haven’t tumbled, defying predictions for larger falls in 2023:

1: The economy is growing, albeit slowly, while unemployment remains low and incomes are increasing.

2: Lenders are supporting customers to refinance through longer term mortgages, interest-only mortgages and mortgage holidays, limiting the number of forced sellers.

3: Tougher affordability criteria from lenders has meant that while new mortgaged buyers may have been paying just 2% for their mortgages, they’ve still had to prove to their bank they could afford a 7% rate.

That has meant that mortgaged buyers could afford higher rates as they remortgaged.

However, banks are now stress testing new borrowers at 8-9% rates, even though they're actually paying 5%, which is compounding the reduction in buying power and hitting sales.

Homes are currently over-valued and prices likely to fall further

The chart below plots our measure for how much house prices are over- and under-valued over time.

It shows periods of over-valuation in the late 1980s and again in the runup to the global financial crisis in 2007, after which house prices fell over the subsequent recessions.

Will more buyers return to market in 2024?

We expect to see the usual seasonal rebound in demand next spring as pent-up demand returns to the market.

However, the number of sales taking place is set to be lower than spring this year.

General Elections also tend to create a pause in activity, which is why we expect another year with 1m home moves in 2024.

It will be five years since the last general election on December 17 2024. If a general election isn’t called by then, parliament would automatically be dissolved and the election would take place 25 working days later: January 28, 2025.

If mortgage rates fall back to 4% more quickly, the number of sales set to take place would improve.

Buyers are currently hesitant to move amid the uncertainty over house price falls and higher mortgage rates.

This is particularly the case with upsizers looking to secure larger family homes.

Our recent consumer survey reveals parts of the population are still keen to move, but many are hoping and/or waiting for mortgage rates to get lower again before they do.

Cash buyers set to be the biggest buying group in 2024

The biggest group of buyers in 2024 is set to be cash buyers, followed by first-time buyers, as rents continue to rise.

Upsizers are being hit hard by higher mortgage rates, as the larger properties they’re looking to secure require bigger mortgages.

But if they can be encouraged to be more flexible about what they want to buy and where in 2024, this would support overall sales volumes.

Key takeaways

- House prices expected to fall 2% over 2024

- Rising incomes expected to steadily improve housing affordability

- Mortgage rates expected to fall back to 4.5% by the end of 2024

The top locations where you can avoid paying stamp duty

If you're a home mover looking to save money, buying a property under the stamp duty threshold could save you thousands. Here's where to find the most homes under £250,000.

Stamp duty land tax - or SDLT - is the tax you pay when you buy property or land over a certain price in England and Northern Ireland.

Scotland and Wales also have an equivalent tax but different rates apply.

In England and Northern Ireland, no tax is paid if a property is priced below £250,000 and you are an existing homeowner.

Different thresholds apply for first-time buyers, who can buy a property up to £425,000 without paying the tax.

Those buying a home that won’t be their primary residence will pay an additional 3% surcharge on the entire price of the property.

And buyers from overseas will pay an additional 2% surcharge.

Why is it important to know about stamp duty before buying?

A stamp duty bill can be a small or run into tens of thousands of pounds for high value properties. And where you are looking to buy can also affect the amount you pay.

Here's what an existing homeowner would pay in stamp duty for the average-priced UK home (£265,000) cross the UK.

Stamp duty paid on a £265,000 property in the UK

-

£745 in England and Northern Ireland

-

£2,850 in Scotland

-

And £3,200 in Wales

Right now, nearly 1 in 3 (31%) properties listed on Zoopla are priced below the local stamp duty threshold for homeowners. This translates to over 140,000 homes that are available to buy without incurring a tax bill.

Where can homeowners find a home without paying stamp duty?

The percentage of homes under the stamp duty threshold across the UK

| Region/Country | Avg house price | Proportion of homes below stamp duty threshold | No. of homes on Zoopla below threshold |

|---|---|---|---|

| North East | £139,700 | 76% | 9,500 |

| Yorkshire & The Humber | £185,400 | 57% | 17,200 |

| North West | £193,500 | 57% | 23,100 |

| West Midlands | £228,700 | 46% | 15,100 |

| East Midlands | £229,000 | 45% | 14,600 |

| Wales | £204,200 | 43% | 9,300 |

| Scotland | £160,300 | 35% | 6,500 |

| South West | £316,100 | 29% | 13,000 |

| East of England | £340,200 | 23% | 11,800 |

| South East | £388,900 | 20% | 16,700 |

| London | £540,800 | 5% | 4,000 |

| UK | £264,900 | 31% | 140,800 |

Zoopla

Our historical analysis shows that 60% of all stamp duty receipts are paid in the South East and London.

This is down to homes in the south being priced at a higher level than those elsewhere in the country, so finding a home below the tax threshold will be harder here.

Only 1 in 6 homes listed for sale on Zoopla in southern England is priced below the stamp duty threshold of £250,000.

In the Midlands, close to a half of homes listed for sale would be under the threshold.

Meanwhile, in the North of England, where homes are among the most affordable in the UK, we find that 3 in 5 homes could be bought without paying the tax.

This increases to three-quarters in the North East specifically, where the average house price is below £140,000.

In Scotland and Wales, where the stamp duty tax is different to that in England, we find 35% and 43% of homes don’t qualify for tax if bought by an existing homeowner.

This is because the threshold for exemption is lower.

In Scotland the Land and Buildings Transaction Tax threshold kicks in at £175,000.

In Wales, the Land Transaction Tax begins at £225,000.

In contrast to most of England, both of these thresholds are below the average house price for each of the respective regions.

Regional towns have the highest number of homes under the SDLT threshold

The availability of homes exempt from stamp duty varies and is closely linked to the house prices in a given area. This creates differences in the availability of tax-exempt homes within regions too.

We find the largest spread of property values in Yorkshire and the Humber: currently only 21% of homes on the market in York are under the £250,000 threshold - yet 89% of homes up for sale in Hull are priced below £250,000.

We register a similar spread in Wales, where 13% of homes for sale in Monmouthshire sit below the £225,000 LTT threshold, while 78% of homes on the market in Blaenau Gwent are priced below £225,000.

Across the UK as a whole, the largest proportion of homes exempt from stamp duty can be found in the regional towns of northern England.

When it comes to local authorities, Hull has the largest proportion of stamp duty-exempt homes on the market for existing homeowners, with 89% of properties currently priced below the £250,000 threshold.

Hull is closely followed by Blackpool, Middlesbrough and Hartlepool, where 87% of homes would not be subject to any stamp duty land tax.

All of these areas are either the cheapest - or among the cheapest - areas to buy within their respective regions, with average house prices below £125,000.

Looking beyond northern England, where average house prices exceed £200,000, homes that would avoid a stamp duty bill are less common, but not impossible to find.

Nearly 4 in 5 properties are exempt from stamp duty in Stoke-on-Trent, which is the highest proportion anywhere in the Midlands.

Plymouth is the winner in the South, with just over half of homes on the market below the homeowners’ stamp duty threshold.

Where to find homes exempt from stamp duty across the UK

| Region | LA with highest proportion of homes under SDLT threshold | % of homes for sale | Avg house price |

|---|---|---|---|

| Yorkshire & The Humber | Hull | 89% | £113,200 |

| North West | Blackpool | 87% | £122,800 |

| North East | Middlesborough | 87% | £114,100 |

| Wales | Blaenau Gwent | 79% | £127,800 |

| West Midlands | Stoke-on-Trent | 78% | £132,600 |

| East Midlands | Boston | 67% | £178,200 |

| Scotland | West Dunbartonshire | 59% | £109,100 |

| South West | Plymouth | 53% | £201,200 |

| East of England | Norwich | 50% | £228,500 |

| South East | Southampton | 46% | £223,100 |

| London | Barking & Dagenham | 22% | £334,100 |

Zoopla

The areas where it's harder to avoid stamp duty

Most stamp duty payments come from the south of the UK.

With the highest house prices anywhere in the country, it comes as no surprise that London has the fewest homes that could be bought without incurring a stamp duty bill.

Only 1 in 20 homes listed for sale in the capital would qualify for an exemption and in October this year, only 4,000 homes in the capital were marketed below the £250,000 threshold.

Half of them were concentrated in 8 boroughs on the edges of London: Croydon, Hillingdon, Sutton, Barking & Dagenham, Havering, Hounslow, Bromley and Bexley.

Outside of the capital, Edinburgh has the second lowest concentration of homes below the land and buildings transaction tax threshold of £175,000.

Only 1 in 20 homes listed for sale in the Scottish capital is exempt from the tax.

Other high-value areas in the South East and East of England also have a very limited number of homes priced below the homeowner’s stamp duty threshold.

Only 1 in 17 homes in Elmbridge and St Albans and 1 in 14 homes marketed in Hertsmere would be exempt from stamp duty land tax.

How can I find a home that won’t cost me any stamp duty?

Now that you know which areas won’t cost you a stamp duty bill, it’s time to check them out on Zoopla to see if they have the home you’re looking for.

Our price filters will help you find a home that both fits your budget and falls below the stamp duty tax threshold.

You can also use Stamp Duty calculator to find out more about stamp duty, the different rates charged and how it may impact your next home purchase.

Key takeaways

- Most of them can be found in the north east, Yorkshire and the Humber and the north west. In fact in the north as a whole, 3 in 5 make the cut

- In southern England, only 1 in 6 homes for sale is priced below the £250,000 threshold

- London and Edinburgh are where homeowners are least likely to find a home exempt from the tax

How UK homeowners are coping with higher mortgage rates

Marathon mortgages, cutting pensions and raiding savings: how homeowners are coping as mortgage rates hover at their highest levels for 15 years.

Although mortgage rates have started to come down after continuously increasing since the start of 2022, mortgage costs are still sky high.

The average two-year fixed rate now stands at an eye-watering 6.47% while five-year fixes are at 5.97%, according to data from Moneyfacts.

This means that anyone remortgaging after their fixed rate has ended will get a shock as their monthly mortgage payments shoot up.

And first-time buyers are having to budget for higher mortgage costs than they might have originally expected.

To keep the costs at manageable levels, borrowers are doing what they can.

Research from KPMG’s latest Consumer Pulse survey found that:

-

18% of mortgage holders have used their savings to reduce their outstanding mortgage balance

-

16% have switched to an interest-only mortgage

-

12% have increased their mortgage term

-

And 8% have downsized to a cheaper home.

A worrying figure is that another 11% have said they are paying less into their pensions to cope with higher mortgage costs, while a further 20% are considering doing this, which means they could have less money to live on in retirement.

‘The cost of living and rising interest rates has made life all the more difficult for aspiring buyers and existing homeowners alike,’ says David Hollingworth from mortgage broker London & Country Mortgages.

‘The rapid increase in mortgage rates from the historic lows of only a couple of years ago means that borrowers are facing much higher mortgage costs. Affordability is therefore under fire.’

Marathon mortgages

The number of homeowners choosing to take out ‘marathon mortgages’ with repayment terms of 35 years or more – way beyond the standard term of 25 years – to make their monthly payments more affordable has surged.

Data from credit reference agency Experian shows that a quarter of homeowners under 30 have a mortgage with a term of 35 years or more compared to just one in 10 in 2020.

This means they could still be paying back their mortgage when they’re close to retirement.

Emily Summersgill took out a marathon mortgage from Nationwide through London & Country when she bought her first home.

‘As a first-time buyer I wanted to make sure I had absolute certainty that I could pay both my mortgage and all the new bills that came along with being a homeowner,’ she says.

‘Although I knew my monthly outgoings and that I could afford those, I wanted to be sure I always had enough surplus income to pay for the unexpected – like broken down boilers and leaking pipes. I set my mortgage term at 40 years – the maximum possible and within my retirement age.’

While choosing a lengthy mortgage term may be the only way some people can afford to borrow the amount they need, there are downsides to be aware of, warns Hollingworth.

He says: ‘There is a price to pay as the interest payable over the life of the loan will increase substantially. Shifting to a longer term could add tens of thousands of pounds in interest.

‘For example, a £200,000 25-year mortgage at a rate of 5% would cost £1,169 a month and total interest would amount to £150,754.

'Over 35 years the payment would drop to £1,009 but the total interest would be £223,940.’

Fortunately for Summersgill, while she took out the 40-year term to be sure she would always be able to afford her mortgage, she has been able to overpay to keep the overall interest costs down.

‘After completion I changed my direct debit so that I was overpaying each month as if I had taken out a 25-year mortgage,’ she adds. ‘That left me able to drop down to my minimum 40-year payment as and when unexpected costs arose but, for the most part, I’ve actively overpaid to get the balance down quicker.’

Other ways to reduce mortgage costs

Many of the ways borrowers have been making their mortgage more manageable have downsides.

Switching to an interest-only mortgage, for example, will also increase your overall interest costs.

While you're paying the interest, the amount of mortgage debt won’t shrink and you’ll still need to somehow pay off the loan at the end of the mortgage term.

There are other things you can do that have fewer negatives, though. ‘Arguably, the first place to start in managing payments is to consider whether you could be getting a better deal,’ says Hollingworth.

‘As you approach the end of a current deal, it’s a good idea to get ahead and have an option in place to avoid slipping onto a lender’s standard variable rate, which can be well in excess of 8% and even above 9%. It’s possible to secure a deal up to six months in advance.’

If you can afford it and your mortgage deal allows, you could also overpay if you’re currently still on a relatively low fixed rate, so that your mortgage balance is as low as possible by the time you have to remortgage at a higher rate.

This will help you to get used to spending more on your mortgage payments each month too.

Key takeaways

- With mortgage rates still high, borrowers are doing what they can to be able to afford their mortgage

- Options they’re choosing include extending their mortgage term and switching to interest only

- A quarter of young homeowners now have mortgage terms of 35 years or more

- Many of these options have downsides but there are other things you can do to put yourself in a better position

7 ways to help on World Homeless Day

We’re standing with Crisis’ Make History campaign, which calls for a future free from homelessness. Here’s how you can help this World Homeless Day.

Homelessness is rising. Soaring bills, rising rents and a lack of affordable housing are making it harder for us all to have a safe, secure and affordable home.

But it doesn’t have to be this way. We’re standing with Crisis’ Make History campaign, which calls for a national mission to end homelessness.

We need the UK government and all political parties to commit to ending all forms of homelessness.

Join the Make History campaign: add your name to help build a future free from homelessness.

While we’re calling for major change, there are ways we can all help in our communities.

Here are some key ways to help, what to do if someone you know is at risk, and what to do if you see someone sleeping rough.

How to help with homelessness in the UK

1. Donate

We’re all feeling the squeeze, but even a small donation has a big impact on the fight against homelessness.

A few spare quid each month can help fund essential services and train specialist coaches who work closely with people experiencing homelessness.

Your money can help them learn how to manage housing, benefits, wellbeing and work, and set them on a path out of homelessness.

You can donate to Crisis or other homelessness charities.

2. Fundraise

Fundraising is a fun and effective way to join the mission to end homelessness.

There’s a whole world of ways to do it, whether you rally your colleagues at work, fundraise for a race or hold an event.

Or go your own way and get creative. You can fundraise any way you like, from organising a bake-off to hosting a film night.

Charities rely on fundraising to raise most of their income, so you’ll make a difference no matter how much you raise.

3. Volunteer

There’s a local volunteering opportunity for everyone who wants to help fight homelessness.

You could organise donations, look after a shop floor, or give direct coaching in education, employment, housing or health.

After a short application process, you’ll take core training modules on topics like safeguarding, equality and diversity, and data protection.

Volunteering is a great way to build your skills and get stuck in for a fantastic cause.

How to help if someone you know is at risk of homelessness

4. Call Shelter

Shelter is the first port of call if you or someone you know is at risk of homelessness.

It offers a range of support, including one-to-one advice, online chat and lots of resources that could help.

Visit Shelter England or Shelter Scotland, or call its free helpline on 0808 800 4444.

5. Get in touch with other support services

People lose their homes for lots of different reasons. Rising pressure from high rents and low pay, or sudden life events like losing a job or family breakdown, can quickly force people into homelessness.

Whatever someone’s going through, there are some free services that can help – including:

How to help if you see someone sleeping rough

6. Contact StreetLink or Simon Community

Let a specialist charity know if you see someone forced to sleep rough on the street.

Contact Streetlink in England or Wales, or Simon Community in Scotland.

They’ll send someone out to find them, and will connect them with local services to keep them safe.

When you call, give the person’s location, as well as their estimated age, gender, appearance and any belongings they have with them. It can also help to mention if they look unwell or at risk of harm.

7. Stop for a chat

Rough sleeping is both dangerous and isolating, and it often leads to mental and physical health problems.

If you feel comfortable, stop for a chat or say hello to someone who is forced to beg or rough sleep. It might be the only contact they have that day.

Give money or food

When it comes to giving someone change or food, make the decision that feels right for you.

And always consider if it’s the best way to support them. It might be that sharing information or suggesting a service is a better option.

Some people buy gift vouchers from shops to give to people who are having to sleep rough.

If you want to buy them a cup of tea or something to eat, ask them what they’d like first to make sure it’s right for them.

Most importantly, don’t let stereotypes influence your judgement of an individual.

Share information

Giving information can be an excellent way to support someone who is experiencing homelessness.

But bear in mind that some people might find it hard to take in detailed information. Or they might be wary of support services because of past experiences, which can result in frustration or distress.

So before you go ahead, ask if they’d find information useful and make sure you’re both comfortable and safe.

If they’re happy to chat, you could recommend they approach their local authority’s housing team.

Councils have an obligation to advise and assist people who are homeless or about to become homeless. Find your local council.

Another option is calling or visiting their local Crisis Skylight centre, if there’s one nearby.

You can find more local homelessness services – and sometimes make a direct referral – on databases like:

Shelter has advice on getting into a hostel or night shelter in England and emergency accommodation in Scotland.

Or you can search for a night shelter on The Pavement.

London events in October 2023

London comes alive in October, with a host of Halloween celebrations, cultural events, and Black History Month commemorations to enjoy.

October nights bring crisp air, pumpkin spice, and the urge to turn on the central heating. But don't let the cooler temperatures keep you from enjoying all that London has to offer this month.

Halloween fans will be thrilled with the city's many spooky festivities, including family-friendly frights, movie screenings, pumpkin-picking fun, and scary nightlife.

Culture vultures will also be in their element, with the return of the BFI London Film Festival, the London Literature Festival at the Southbank Centre, and the Bloomsbury Festival across Bloomsbury.

And October is also Black History Month in the UK, so many of London's major institutions will be staging special events to mark the occasion.

Art, theater, food, and drink: London has it all in October 2023.

Art lovers can rejoice at Tate Britain's big new exhibition about Young British Artist Sarah Lucas and the long-awaited Marina Abramović retrospective at the Royal Academy of Arts.

Theatergoers will love Penelope Skinner's new play "Lyonesse," starring Lily James and Kristen Scott Thomas, and a big new adaptation of Maggie O'Farrell's bestselling novel "Hamnet."

And those not embarking on Sober October can enjoy Oktoberfest celebrations galore, plus London Cocktail Week.

There's also plenty more to do in London in October, from visiting museums and galleries to exploring the city's many parks and gardens. Check out our list of the best cultural happenings and things to do throughout the month.

1. Let down your synthetic wig at one of these Halloween events in London

When the days are a-darkenin’, London is being over-run with giant arachnids and the supermarkets are filling up with pumpkin-plastered merch, it can only mean one thing: Halloween, Tuesday October 31 2023, is almost upon us. So dust off your cape, comb out your synthetic wig and get searching for a ‘beginner friendly’ face painting tutorial on YouTube. Here are the best Halloween events happening in London this year.

2. Celebrate Black History Month in London

October isn’t just the time of year when the leaves turn brown, the clocks go back, yet another installment of the seemingly unkillable ‘Halloween’ franchise is released and sugary pumpkin syrup suddenly starts appearing in absolutely everything. It’s also Black History Month, and as usual there’s plenty going on around the capital to mark the occasion. Check out our roundup of some of the best stuff going on throughout the month here.

What is Black History Month?

Black History Month is an annual month of observance honouring the history, traditions, arts and culture of Black people both in the UK and across the globe. Founded in the United States in 1970, it was first celebrated in the UK in 1987.

When is Black History Month 2023?

In the UK and Ireland, Black History Month takes place in October, with talks, exhibitions, screenings and plenty more events taking place nationwide throughout the month. Don’t get it mixed up with the US and Canadian version, which is celebrated in February. Yes, it’s another one of those needlessly confusing disparities between our calendars, just like Mother’s Day.

3. Sip on delicious tipples at London Cocktail Week

The biggest cocktail festival in the world, London Cocktail Week, is back this October with a special focus on the city’s reputation as a global capital of cocktail culture. This year you can check out the fancy sounding Connoisseaur’s Collection of unique events with intimate tastings and masterclasses by award-winning bartenders. Plus, there's the return of the Curated Cocktail Tours, where London's top bars are shaking up delectable drinks for just £8 (with the wristband).

4. Check out our roundup of perfect autumnal days out in London

Is that the saccharine scent of pumpkin spice in the air? Surprised to see lots of orange orbs taking over your local supermarket? It can only mean one thing: autumn is upon us in all its crispy-leafed, russet splendour.

From glowing sunsets, to bracing walks and cosy pubs, there are lots of things that make up the ultimate autumnalday trip and London has them in spadefuls. Whether it’s nestling up in an old-school whisky tavern with a wee dram, collecting up armfuls of pumpkins from the city’s premier markets or exploring Gothic cemeteries.

So dig out a jumper and don your most fetching hat: autumn in London is here, and we've got eight autumnal outings in the city guaranteed to get you in the mood for smashing conkers. Summer, we’re so over you.

a. Kew Gardens

They’ve got a tree or two down at Kew Gardens – actually, around 14,000 of them – so if you want to see autumnal colours across the skyline, it’s the place to be. Climb the 118 steps up to the Treetop Walkway to watch nature’s greatest art show.

Get the full autumn effect

Dig out the wellies and go on a rainy day for that primo autumn smell.

b. Richmond Park

More than 600 deer call Richmond Park home, and come autumn they’re feeling amorous. Keep an eye out amid the rust-coloured leaves and long grass, and you might witness stags bark and roar as they clash antlers to impress the ladies. Bit like a night out in Clapham.

Get the full autumn effect

Hire a bike from Roehampton Gate and pedal off into the wilds.

c. Pumpkin picking

Do you have ambitions to cover your mantelpiece in ornate gourds, Martha Stewart style? Or are you just planning an epic pumpkin risotto? Either way, Sainsburys' selection just won't cut it: you've got to go right to the source. Take a day trip to Stanhill farm in Kent or Garson Farm in Surrey and you'll find pumpkins galore that are ready for picking in your very own harvest festival.

Get the full autumn effect

Why stop at pumpkins? Find a nearby hedgerow and go foraging for sloe berries and elderberries for use in homemade gin concotions.

d. Greenwich Park

Kick your way through the fallen leaves from the many horse chestnut trees in Greenwich Park. And once you’ve stocked up on conkers, check out the dreamy views across the river Thames and the amazingly autumnal red deer in the Deer Park.

Get the full autumn effect

Grab a freshly baked treat from the White House Café – time it right and it’ll still be warm.

5. Pay a visit to a free art exhibition

Looking at great art needn't cost the same as buying great art. With a shed-load of free art exhibitions in London, wandering through sculptures, being blinded by neon or admiring some of the best photography in London needn't cost a penny. Here's our pick of the best free art exhibitions this week and beyond.

Rents for new lets rise 10.3% over the last year

The average rent for a new tenancy has increased by 10.3% since September 2022, with renters now paying £1,164 per month on average.

An ongoing supply-demand imbalance continues to push rents higher, despite demand for rental properties peaking earlier than usual this summer.

Over the last year, the average rent for a new tenancy has increased by 10.3% to stand at £1,164 per month.

The average annual rental bill is now £1,320 higher than a year ago at nearly £13,970 a year, compared to £12,670 last September.

This marks the 19th consecutive month of our index reporting a rental inflation of over 10%.

Rental growth for renters staying in their existing home is much lower at 5.5%, according to the Index of Rental Prices from the Office for National Statistics.

Rental inflation in Scotland boosted by rent controls

Scotland is registering the highest level of rental inflation in the UK at 12.8%.

Landlords in Scotland are maximising rents for new tenancies to cover increased costs and allow for the fact that future rent increases will be limited over the life of the tenancy.

The average rent in Scotland is now £750 per month, which is £90 higher than a year ago.

Rental inflation in Scotland has now started to moderate from 13.7% six months ago, but we expect the above-average rental inflation to continue.

Rents are growing at the fastest rate in the cities of Edinburgh (16.3%), Dundee (14.6%) and Glasgow (13.6%). Renters looking for new lets in areas neighbouring Edinburgh and Glasgow are also seeing double-digit increases compared to August 2022.

| Region | Annual rental price change (%) | Annual rental price change (£) | Average rent (per calendar month) |

|---|---|---|---|

| United Kingdom | 10.3% | £110 | £1,164 |

| Scotland | 12.8% | £90 | £750 |

| London | 11.5% | £210 | £2,055 |

| North West | 11.3% | £80 | £796 |

| Wales | 10.2% | £80 | £815 |

| West Midlands | 10.1% | £80 | £853 |

| East of England | 9.8% | £100 | £1,112 |

| East Midlands | 9.8% | £70 | £817 |

| South East | 9.8% | £110 | £1,254 |

| North East | 9.2% | £50 | £649 |

| Yorkshire and the Humber | 8.3% | £60 | £759 |

| South West | 8.1% | £80 | £1,017 |

| Northern Ireland | 4.4% | £30 | £744 |

Zoopla Rental Index, September 2023

Cardiff, Southampton and York are now £1,000 rent cities

The number of cities in which renters pay more than £1,000 per month on average when they start a new tenancy is growing.

In 2023, new additions to this group were Southampton and York, where it now costs £1,057 and £1,045 per month to rent a home.

The latest place to join the club is Cardiff, where average rents increased by 11.2% over last year to reach £1,012.

High rents in London makes renting expensive, pushing demand into more affordable areas. This boost in demand in commuter areas in the South East has led to an increase in the number of commutable towns with average rents exceeding £1,000.

Here are the towns and cities where average rents on new lets have just breached £1,000 per month.

| Town/city | Average rent (per calendar month) | Annual rental price change (%) | Annual rental price change (£) |

|---|---|---|---|

| Worthing | £1,104 | 10.7% | £110 |

| Basingstoke | £1,096 | 11.3% | £110 |

| Luton | £1,096 | 15.3% | £150 |

| Southend-on-Sea | £1,085 | 9.3% | £90 |

| Eastbourne | £1,046 | 7.6% | £70 |

| Colchester | £1,044 | 6.0% | £60 |

Rental Index, September 2023

Manchester next in line to become a city with £1,000 average rent

Manchester is in the top 5 for cities recording the highest rates of rental growth.

Average rents in the city are £996 per month, making it the most expensive city to rent in northern England. We can expect average rent to increase to £1,000 by the end of this year.

Central Manchester, Trafford and Salford already have average rents in excess of £1,000.

Higher rents in these central Manchester areas are likely to turn value-seeking renters towards neighbouring areas such as Bolton, Oldham or Rochdale. This will boost demand and is likely to lead to rental growth in those areas as well.

What are renters doing to minimise the impact of higher rents?

Faced with higher rents and limited supply of homes on the market, renters are more commonly considering renting smaller homes, moving to cheaper areas or sharing a property with other renters to reduce costs.

House sharing reduces the cost per renter but comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We expect rental inflation to remain above 9% for the rest of the year, as earnings growth remains strong while high mortgage rates stop many renters from moving into home ownership.

We anticipate national rental growth of 5% to 6% in 2024. Cities are likely to continue registering rental inflation above this level.

Key takeaways

- Residential rents for new tenancies are 10.3% higher than in September 2022

- Rents have increased the most in Scotland, where new rent controls are encouraging landlords to secure higher rents at the start of a tenancy

- More cities have breached the £1,000 average rent mark - new additions include Cardiff, Southampton and York

- Average rent in Manchester is on track to reach £1,000 by the end of 2023

Southerners searching further for their next home while Northerners stay local

The average buyer looks for their next home 3.9 miles down the road, but people in the south and in cities are much more likely to spread their wings.

As a nation we don't look far for our next home. We tend to think local first, and search in areas that we know and love.

But looking in a wider search area may give you more affordable options or help you buy a bigger property.

Let’s explore the trends in how far people are looking to move and how this varies across the country.

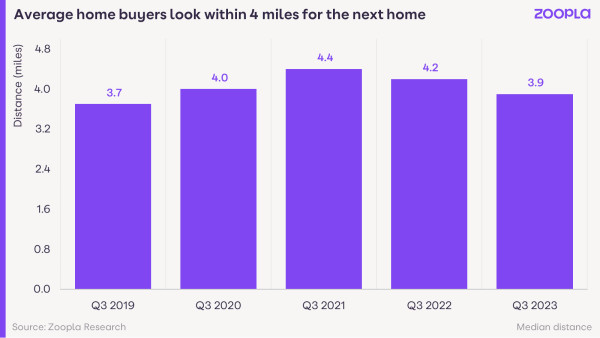

People search for a home 3.9 miles away on average

Our data shows that the average buyer is looking for their next home 3.9 miles down the road, while 3 in 4 people only enquire on homes in one or two neighbourhoods.

In 2021, the distance between someone's home and a home they enquired about was slightly higher at 4.4 miles.

During the pandemic, many households were open to a change in lifestyle and, as markets became more competitive, buying further away was a useful tactic. It helped people find a home that fitted within their budget as house prices soared.

Back in summer 2019, buyers only searched 3.7 miles away on average. The difference now is that there are more properties for sale across the UK, which is creating greater choice locally and supports people to search closer to home.

Southerners look further away while buyers in the North stay local

Our data shows large regional differences in where people are looking for their next property.

Half of buyers in the East of England and 43% of buyers in the South East are looking for a home 10 miles away or further. They're more open to the idea of moving to a town down the road or to the other side of a city.

On the other hand, buyers in the North of England and Midlands are generally enquiring for local properties. 60% of buyers in these regions look for their next home within a 5-mile radius - higher than the national average of 50%.

Importantly, these trends mirror the pre-pandemic moving patterns. They tell us that distance is inherent in moving decisions for many buyers in the south. People may choose to buy further away because of different local economies, the availability of different property types and how expensive properties are in a given area.

In the peak of the Covid-19 home-moving boom, headlines cited a mass exodus from the capital. Our data shows that the proportion of London-based buyers enquiring about properties located 20 miles or further away from their home increased from 18% in summer 2019 to 24% in summer 2021. This is a meaningful change, but not enough to call it a mass exodus.

Londoners are looking closer to home now, but a third of buyer demand from Londoners is for homes at least 10 miles away. Housing unaffordability and lack of houses in inner London create pressure on buyers to move further away.

| Buyer's home region | Median distance to enquiry property (miles) | Proportion of buyers looking for their next home beyond 10 miles |

|---|---|---|

| East of England | 8.9 | 50% |

| South East | 5.7 | 43% |

| Scotland | 4.7 | 35% |

| London | 4.6 | 34% |

| South West | 3.4 | 31% |

| Wales | 3.3 | 25% |

| North West | 3.0 | 25% |

| North East | 2.9 | 22% |

| West Midlands | 2.9 | 21% |

| East Midlands | 2.8 | 26% |

| Yorkshire and the Humber | 2.6 | 20% |

| UK | 3.9 | 32% |

September 2023

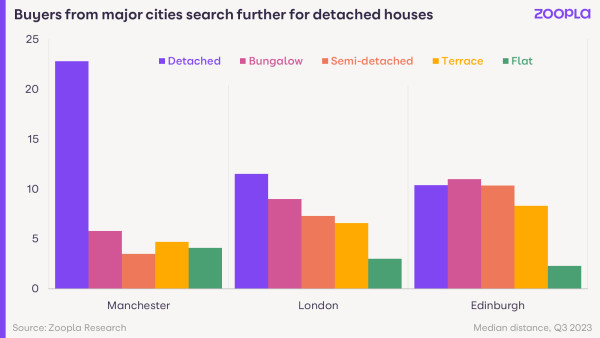

City dwellers search further so they can buy houses over flats

People looking for less common property types, such as bungalows or detached houses, are more likely to look further afield. Certain property types are simply not available to buy in some areas.

For instance, people in Manchester, where only 1 in 27 properties on the market is a detached house, look 23 miles away on average to buy such a home.

Similarly, London-based buyers looking for detached houses enquire for properties typically located 11.5 miles away from their current home.

In Edinburgh, where 64% of homes on the market are flats, those aspiring to buy a house typically look for them 10 miles away from their current location.

What are the benefits of moving further away?

For many, choosing where to move next is a balancing act of selecting areas that have the right type of homes at the right price point and fit well with your lifestyle.

People with jobs in the market services sector, which are concentrated in major UK cities but allow for remote working, have more flexibility to move further afield. For others, moving choices will be more driven by employment opportunities.

It also comes down to what type of home you want to live in. People in cities struggle to find larger houses, while those based in more rural locations have limited options when it comes to flats. As a buyer, you may have to explore more than one or two areas to find your dream property type.

If you're based in a region where it’s more expensive to buy, looking further afield into more affordable areas could mean better value for money and smaller mortgage repayments.

Key takeaways

- Most people search for their next home locally, with the average buyer looking just 3.9 miles away

- Those in the South East and East of England are more likely to move beyond 10 miles to find more space and value

- People in the North of England and the Midlands are more likely to stay local - 60% of buyers in these regions search for their next home within a 5-mile radius

- City dwellers look as far as 23 miles away to find larger properties

- Looking further away for a home can open up your options to different types of properties and more affordable house prices

New legal support service for tenants at risk of losing their home

The new Housing Loss Prevention Advice Service gives free legal support to tenants if their landlord is seeking possession of their home.

The government has today updated its How to Rent Guide with information about how to get free support if you are at risk of losing your rental home in England or Wales.

The new Housing Loss Prevention Advice Service means you can get government-funded legal advice and representation as soon as you receive written notice from your landlord or a creditor.

The update to the How to Rent Guide comes after a string of changes in March 2023, including a mandatory requirement to have smoke and carbon monoxide alarms in rental homes with combustible gas appliances.

What is the Housing Loss Prevention Advice Service?

The Housing Loss Prevention Advice Service offers legal advice and representation if you are at risk of losing your rental home.

The new service replaces the previous Housing Possession Court Duty Schemes (HCPDS).

You can apply for legal help from the moment you receive written notice that your landlord (or a creditor) is seeking possession of the property. It does not matter what your financial situation is and you will not need to pay for the service.

A housing expert will work with you to find a potential solution. They can advise you on:

-

illegal eviction

-

disrepair and other problems with housing conditions

-

rent arrears

-

mortgage arrears

-

welfare benefits payments

-

debt

If you’re asked to attend a court hearing as part of the eviction, the housing expert can give you free legal advice and representation at the court.

How to apply

Find your nearest Housing Loss Prevention Advice Service provider. Type in your postcode and tick the box for the service.

You’ll be shown all the providers nearest to you, along with their websites and contact details.

To apply, you’ll need to:

-

Contact a provider directly

-

Have the written notice from your landlord or creditor ready to show you’re facing losing your home

There’s no government guidance on which provider you should choose, but we recommend contacting the closest ones to you first. Some firms may only support those in their local area, plus it’ll be more practical if you need them to represent you in court.

The service is only available to tenants living in England or Wales. If you live in Scotland, there are other ways to get help with a rent dispute.

What is the How to Rent Guide?

The How to Rent Guide is a government document that outlines the rental process in England.

It details your rights and responsibilities as a tenant, as well as what your landlord is legally responsible for.

When you start a new tenancy, your landlord must provide you with a copy of the latest How to Rent Guide. They’ll normally send you a link to the government website rather than provide a printed version.

If they don’t provide you with the latest How to Rent Guide, they lose the right to evict you using a Section 21 notice.

Key takeaways

- The Housing Loss Prevention Advice Service offers free legal support to tenants at risk of losing their home

- Anyone can use the support service - it doesn’t matter what your financial situation is and you will not have to pay

- You can get help as soon as you receive written notice that your landlord or a creditor wants to possess your home

- Apply by finding a service provider on the government’s website and contacting them directly

- If you end up having to attend a court hearing, a housing expert will represent you in court for free