4 things you might not know about homelessness

Ruth Stone is a Strategic Communications Project Manager at Crisis and her role is all about helping people understand the realities of homelessness. Here, she shares 4 things you might not know about homelessness.

What does home mean to you?

For me, it’s a place I share with my partner and our cats. It’s a space to unwind and be myself. I’ve moved home a lot – and whenever I get to a new place, I unpack my things as quickly as possible so it feels like home. I start with the kitchen because I am never happier than when I’m cooking.

Whatever home means to you, it’s about much more than a roof over your head or somewhere to sleep. And yet sometimes we can forget this when we think about the issue of homelessness.

The views that we have about any topic – including homelessness - are formed in us over a long period of time. They come from our experience, our culture and our media. What we see and hear on the news, in film, on podcasts or just in conversation with family, friends and colleagues all shapes our thinking.

When it comes to homelessness, research has shown there is often a big gap between the realities of what it is, what causes it and how to end it - and how people think and understand the issue.

My role at Crisis is focused on helping to close this gap by working with organisations and individuals to tell a different and more helpful story about homelessness. Which is why I’m sharing four things you might not know about homelessness.

1. Homelessness can be visible or hidden

Homelessness doesn’t look one way. When we think about homelessness, we tend to go straight to the most visible form - rough sleeping. Which makes sense as this is the type of homelessness we see as we travel around our towns and cities.

But homelessness can also be less visible or hidden. For example, many people might be sleeping on a different friend’s sofa every week.

Hidden homelessness also includes unconventional accommodation. This is when people sleep in spaces that are not intended as residential accommodation, like a car, lorry or shed. Some people sleep on public transport because they have nowhere else to go.

None of us should be forced to experience any of these types of homelessness. All of us should have a safe and stable home.

2. Homelessness can be short term or long term

Hostels, shelters and refuges are forms of emergency and temporary accommodation. People may be in this type of accommodation from one night to indefinitely.

The cost of living, rising rents and a sheer lack of truly affordable homes means a record number of us are currently trapped in temporary accommodation.

When we’re forced to live in temporary accommodation that is often unsuitable, insecure and far away from our support networks, it makes it so much harder to do basic things – like register for a doctor, cook a healthy meal, travel to work or do our homework.

3. All forms of homelessness are bad for our health

Whether someone is sleeping on the streets in fear of their safety, facing the constant stress of living with their family in a cramped hotel room or having to move to another sofa week after week, homelessness takes a huge toll on people’s mental health.

Home should be a space where we can thrive. Where we can relax and spend time with our loved ones. It should be a place where we can rest and recover if we are ill.

It’s not ok that the health and wellbeing of hundreds of thousands of us is being harmed by homelessness. But it doesn’t have to be this way!

4. Homelessness can be ended

The final thing I want to share about homelessness is that it can and must be ended. This isn’t me being optimistic or naïve. This is something that is entirely achievable – but it requires political commitment as well as support from people like you.

My Grandma was born in 1924 – four years before women in the UK had the same voting rights as men. As a queer person, I grew up thinking I’d never be able to marry someone that I love. We decided as a society that things could be different.

And we can do the same with homelessness.

We know what needs to be done - just like we did with voting rights, and with equal marriage. We need to build more truly affordable homes and provide more support for those of us at the brink. The more of us who come together to demand this change, the louder our voice will be heard.

Things to do in London this February

Can’t decide what to do with your two delicious days off? This is how to fill them up

1. Fill your eyes with sparkles at the Light Festival at Battersea Power Station

Europe’s largest brick building is no stranger to sparkling spectacles. The Grade II-listed Art Deco masterpiece has appeared in Hitchcock films and is on the cover of one of the most iconic albums of the last generation: Pink Floyd’s ‘Animals’. Now it’s playing backdrop again, and glowing up the gloomy London winter evenings in the process, as seven shining light installations designed by international artists pepper the building for its annual Light Festival. Look out for giant glowing blue butterflies, a series of intriguing-sounding ‘floating geometric matrixes’ and interactive installations like bicycle-powered glowing archways.

2. Think about the Roman Empire at British Museum exhibition ‘Legion: Life in the Roman Army’

This is a rollicking-looking new exhibition for the British Museum, which attempts to put you inside the daily life – both domestic and fighting – of the Roman Legions that controlled much of the world for half a century. It’s about how the elite troops fought: but also about how they lived, and the daily lives of the Empire’s many settled garrisons. Across the course of the exhibit, you’ll meet warriors from Egypt, Italy and England, with over 200 supporting objects, many on display in the UK for the first time, including the world’s oldest intact legionary shield and the world’s oldest set of Roman segmental body armour (which was only unearthed in 2018).

3. See work from British artists of the African, Caribbean and South Asian diasporas at ‘Entangled Pasts, 1768–Now’

Art isn’t always pretty pictures. Sometimes, art is politics; sometimes, art is power. ‘Entangled Pasts’ places work by contemporary British artists of the African, Caribbean and South Asian diasporas alongside paintings and sculptures by Royal Academicians of the past. The aim is to highlight how art has served to perpetuate racism and colonialism, or at the very least profit from it. It opens with depictions of Black figures by Gainsborough and Reynolds, portraits of former slaves, abolitionists, attendants and illegitimate children. And there are contemporary works by the likes of Yinka Shonibare and Sonia Boyce.

4. Get eight dishes, main and dessert at Atul Kochhar's Kanishka

Kanishka has launched a brand-new brunch menu focussing on PanIndian food, with a menu embracing the flavours of India’s various regions, from Punjab to Kerala, Kolkata to Delhi and everywhere in between. Kanishka’s skilled kitchen team, led by chef Atul Kochhar, have curated a symphony of new dishes, including Khari paneer tikka, Palak paneer and Chicken tikka pie. And the best bit? You’ll be greeted with a seasonal welcome Kanishka punch cocktail and two hours of bottomless wine or beer.

5. Have a tropical time at Kew Orchid Festival

The Princess of Wales Conservatory at Kew Gardens is getting a Madagascanmakeover courtesy of the latest annual mind-bending orchid display that takes over the iconic glasshouse each year. The exotic display will celebrate Madagascar’s natural beauty and biodiversity – the place is home to 14,000 plants found nowhere else in the world. Look out for sculptures of native animals carved out of plants, including giraffe weevils and ring-tailed lemurs, installations on extinct species and learn more about the Malagasy orchids that grow at Kew.

6. 51% off bottomless dim sum and a glass of bubbly at Leong’s Legend

Never ending baskets of delicious dim sum. Need we say more? That means tucking into as many dumplings, rolls and buns as you can scoff down, all expertly put together by a Chinatown restaurant celebrating more than ten years of business. Taiwanese pork buns? Check. Pork and prawn soup dumplings? You betcha. ‘Supreme’ crab meat xiao long bao? Of course! And just to make sure you’re all set, Leong’s Legend is further furnishing your palate with a chilled glass of prosecco. Lovely bubbly.

7. Explore Japan’s myths and manga at the Young V&A’s new exhibition

The first temporary exhibition at Young V&A is a real delight, and should appeal to grown-up Nippophiles just as much as school kids. ‘Japan: Myths to Manga’ is a grab bag of the more eye-catching highlights of the past few centuries of Japanese pop culture, taking in everything from Hokusai’s ‘The Great Wave’ to copious Studio Ghibli appearances, to a draw-your-own manga craft corner (complete with arrows to reminds you to draw the cells from right to left). You’ll have gone in thinking Japan was cool; you’ll come out thinking it’s cooler.

8. Get ready to take on the UK’s most daring aerial park

Our Table for Two restaurant box is back, baby. And there really is no better way to go out and explore the city than with 50% off some of its most sought-after destinations. This limited-edition digital box of goodies includes seven, yes seven, vouchers for a handpicked selection of restaurants around the city. Sign up, receive a code and book your spot.

Bank Rate holds at 5.25%, so when will rates drop?

The Bank Rate has remained unchanged for the fourth time in a row since it was raised from 5% to 5.25% in August 2023. Rate cuts aren’t expected until later in the year but mortgage costs have still been falling.

Why has the Bank Rate stayed the same?

The Bank of England monetary policy committee voted by a majority of 6-3 to keep the Bank Rate unchanged this month, with two members voting to increase it by 0.25% and one to cut it by 0.25%.

Although energy prices have fallen, wage growth has eased and the prices of goods and services have been rising more slowly, there’s still a risk that overall inflation will increase again.

The conflict in the Middle East and the attacks on container ships in the Red Sea are two of the factors that could see prices rising faster again.

The committee forecasts that inflation will temporarily fall to its target of 2% in the second quarter of 2024 but that it will increase again over the rest of the year.

It then thinks it will be 2.3% in two years’ time and 1.9% in three. Because of this, there are no rate cuts for now, despite little economic growth.

The Bank of England is giving nothing away about how long it thinks rates should stay the same but experts are predicting that there could be a cut in May or June.

What’s happening to mortgage rates?

While borrowers on variable rates will be disappointed that the cost of their mortgages won’t be going down this month, lenders have been cutting the rates of new mortgage deals over the last six months.

This is good news for first-time buyers but anyone remortgaging is still likely to experience a shock increase in their mortgage repayments.

Mortgage costs – whether you’re taking out a new deal or reverting to your lender’s standard variable rate – remain much higher than they were two or five years ago, when most borrowers would have taken out their current deals.

How have higher mortgage costs affected house prices?

Higher mortgage rates led to fewer property purchases and less mortgage lending in 2023, according to industry body UK Finance. Despite this drop in demand, house prices didn’t follow for the majority of UK homeowners.

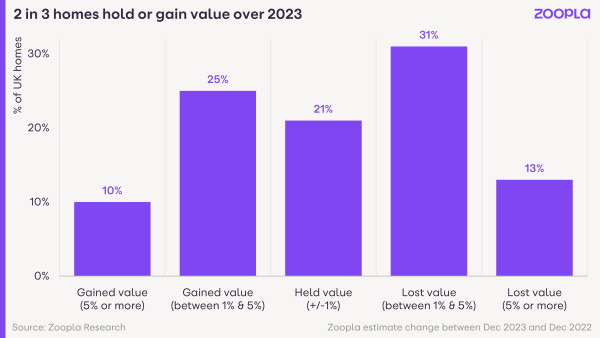

According to our latest data, more than half (56%) of homeowners saw the value of their homes stay the same or increase by at least 1% in 2023.

A quarter of homes increased in value by between 1% and 5% while a 10th increased by a sizeable 5% or more.

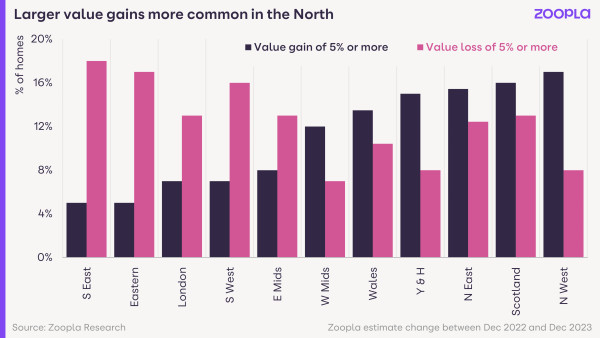

The average value increase was £7,800. Percentage price rises were larger in more affordable areas of the country, with the biggest increases in the North West and Scotland.

This is dramatically different to 2022, though, when 96% of homes saw their value staying the same or going up and the average increase was £19,700 where it did rise.

What’s the outlook for the mortgage market?

While mortgage costs have been going down, mortgage rates will continue to be relatively high compared to two or more years ago. Rate cuts are on the horizon, though, which will be welcome news for first-time buyers and homeowners alike.

Our Executive Director of Research, Richard Donnell, says: 'The debate about the timing and scale of base rate cuts is important for the mortgage rate outlook.

'The peak in base rates last year led financial markets to bet on lower rates in 2024 and into 2025, which have shaved almost 1% off fixed rate mortgages over the last 2 months.

'There is a sense these cuts to rates are close to bottoming out for now and unlikely to move any lower.

'Inflation is down but not out and central banks want to get it under control before cutting base rates.

'It looks likely mortgage rates will remain in the 4.5% to 5% range, which is still cheap by long run standards.

'Those looking to move or refinance should chat to a broker and seek advice about the rates available and the best strategy for them.'

Key takeaways

- The Bank Rate remained at 5.25% today, despite hopes it would come down

- Inflation has fallen significantly over the past year but it's still above the Bank of England’s target of 2%. It stood at 4% in December 2023, unexpectedly rising slightly from November’s figure of 3.9%

- World events are among the factors that could push inflation up again in the second half of this year

- But experts are predicting that there could be a cut in May or June

The home value winners and losers this year

Where did homeowners gain value in the last year? Do you fall into the not-to-lucky group who lost more than 5%? Let’s find out.

Just over a year ago, all the talk was around house prices dropping by up to 10% in 2023.

But things don’t seem quite so bad in hindsight.

And a huge 77% of home values remained within the +/-5% range, highlighting the more stable nature of house prices since stricter mortgage restrictions were introduced in 2015.

Although there are some winners: 1 in 10 UK homeowners gained 5%+ in value, gaining £17,200 on average.

And some losers: just over 13% of homes dropped more than 5% in value, each losing an average of £13,200

| Lost 5% or more in value | Value remained within +/-5% | Gained 5% or more | |

|---|---|---|---|

| Percentage of UK homes | 13% | 77% | 10% |

| Number of UK homes | 3.7 million | 23.1 million | 3.1 million |

January 2024

The winners: where the most homes gained 5%+ in value

| Local authority area, region | Percentage of homes that gained 5%+ in value |

|---|---|

| Rossendale, North West | 44.2% |

| Blackburn with Darwen, North West | 34.5% |

| Telford and Wrekin, West Midlands | 32.6% |

| Merthyr Tydfil, Wales | 32.3% |

| Burnley, North West | 32.3% |

| Bolton, North West | 31.1% |

| Inverclyde, Scotland | 30.0% |

| Glasgow, Scotland | 29.7% |

| Carlisle, North West | 28.9% |

| Knowsley, North West | 27.9% |

Zoopla, January 2024

A lucky 1 in 10 homeowners have seen gains of more than 5% in 2023. That’s 3 million of you across the UK who have gained £17,200 on average.

This year’s winners are largely based in the North West, where half a million homes (17%) gained more than 5% in value. In this region, the average value increase was a tidy £13,200.

An impressive 44% of homeowners in the borough of Rossendale saw a 5% jump in value this year, where reputable schools, stunning scenery and good commuter links are pushing values up.

Elsewhere in the North West, more than 30% of homeowners gained 5% in value in Blackburn, Burnley and Bolton. These up-and-coming commuter towns are affordable and increasingly popular alternatives to Manchester.

Beautiful Inverclyde on Scotland’s west coast and the buzzing city of Glasgow also make our winners list, with 30% of homeowners gaining 5%+ this year - compared to 16% across Scotland as a whole.

The charming Telford and Wrekin area in the West Midlands and Merthyr Tydfil near the Welsh valleys are also top 10 winners this year, with 32% of homeowners gaining 5%+.

The losers: where the most homes lost 5%+ in value

| Local authority area, region | Percentage of homes that lost 5%+ in value |

|---|---|

| Dover, South East | 52.4% |

| Hastings, South East | 50.7% |

| Aberdeen, Scotland | 45.1% |

| Canterbury, South East | 43.4% |

| Thanet, South East | 40.9% |

| Rother, South East | 38.6% |

| Folkestone & Hythe, South East | 35.8% |

| Tendring, East of England | 35.3% |

| Moray, Scotland | 32.1% |

| South Holland, East Midlands | 31.5% |

Zoopla, January 2024

While home values generally fared better than expected last year, there’s no denying that some places lost out - with home values falling by 5%+ over 2023.

The South East was the worst hit, with 18% of homeowners seeing their home’s value drop by 5%+. Of these, the average loss was £13,200 over the year.

These falls are clustered around the Kent and East Sussex coasts: half of all homes in both Dover and Hastings lost 5%+ in value, along with more than 35% of homes in Canterbury, Thanet, Rother, and Folkestone and Hythe.

The East of England saw 18% of properties lose value, although by a lesser average of £11,500. The proportion of homes losing value jumps to 35% in Tendring on the Essex coast, while it was above 27% in both Colchester and Great Yarmouth.

Rural and coastal areas within commuting distance of larger cities saw a large flow of buyers during the Covid-19 pandemic. Home values in these areas are adjusting back now that demand has cooled.

Who will win and lose in 2024?

We think this year will serve up more of the same for homeowners in the UK.

We’re expecting an average fall of around 2% across the country, although - like 2023 - this will differ depending on where you live and what sort of home you own.

How do we work out home values?

We only use data from regulated sources to create our home estimates. These sources include:

-

Data from HM Land Registry and Registers of Scotland

-

Official survey records from accredited surveyors

-

Energy Performance Certificates

We combine this data with live property listings in your area to take the latest local market trends into account.

Once we’ve created estimates for around 30 million homes in the UK, we can analyse the data as a whole and bring you reports like this.

But we don't claim to know everything. We provide confidence ratings to let you know if our data sources haven't updated or we don't have enough info.

And that's why we always recommend you get an estate agent valuation for the most accurate picture of what your home is worth.

Key takeaways

- 1 in 10 UK homeowners gained 5%+ in value in 2023

- The largest proportion of homeowners (77%) saw no significant change to their home’s value in 2023, contradicting predictions of major price falls

- But there are some losers - 13% saw their home’s value fall by 5%+ in the last year

3 in 5 homes rise in value over 2023

At the beginning of 2023, commentators predicted home values would plummet by as much as 10% over the course of the year. Here’s what actually happened.

In 2023, the press was filled with gloom and doom predictions of homes plummeting in value by as much as 10%.

However, our data reveals that in reality, more than half of UK homeowners (56%) saw their home values stay the same or increase by at least 1% over the course of the year.

Senior Property Researcher, Izabella Lubowiecka, says: ‘Where values went up, the average increase seen was £7,800. And 1 in 10 (or 3 million) UK homeowners even registered gains of more than 5% (or £17,200).’

It is a different picture to what happened the year before in 2022, when 96% of homes either held their value or saw an increase. Back then, the average value hike was £19,700.

However, we can clearly see that most homeowners didn’t see the hefty value falls that some initially predicted.

Where did homes rise in value in 2023?

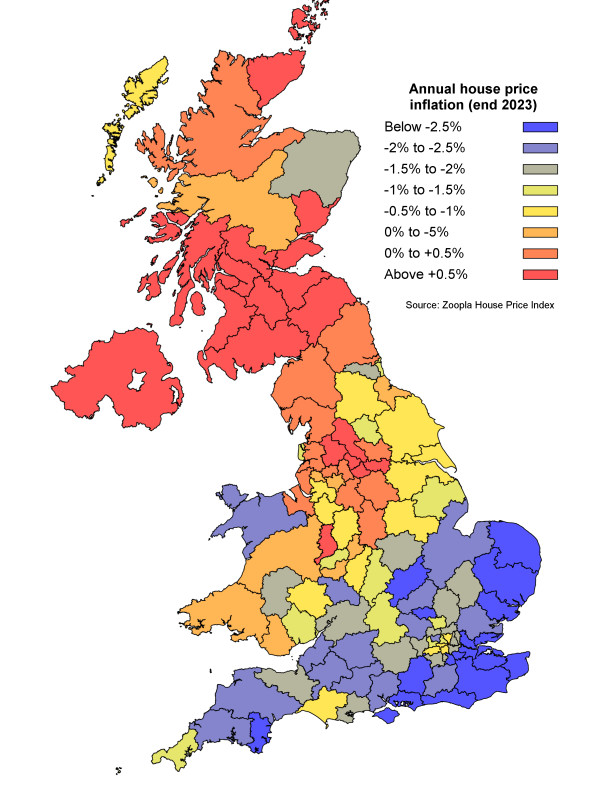

‘There is a clear north-south divide in the fortunes of homeowners during 2023,’ says Lubowiecka.

‘Areas with lower house prices were cushioned from the impact of higher mortgage rates, helping to support activity and sustain house prices in these regions.

‘So in the more affordable parts of the country, such as the north, home values increased.’

In fact, the North West led the way in value gains, with the highest proportion of homes registering value increases of 5% or more (£13,200 on average).

Here, terraced homes proved to be the hottest properties, with 19% of terraces rising by 5%+.

It was hotly followed by Scotland, where 16% of homes (400,000), increased in value by 5%.

Here, apartments proved to be the highest risers, with 19% registering a value increase of 5%+.

The North East and Yorkshire and the Humber take joint third place, with 1 in 7 homes going up in value by 5%+.

Flats were the winners in the North East, with 25% rising by 5%+ in value.

Meanwhile, in Yorkshire and the Humber, terraced homes came up trumps, with 16% rising by 5%+.

Which types of homes held their value in 2023?

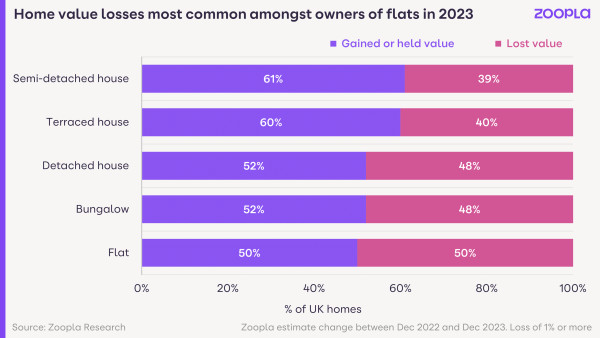

In 2023, the nation’s favourite property types: semi-detached homes and terraces, proved to be the best at holding their value.

‘Homes seen as good value for money continued to attract buyer interest, leading to stronger price performance,’ says Lubowiecka.

‘That said, the larger value gains of 5%+ were equally spread across different property types and enjoyed by 1 in every 10 UK properties.’

Where did home values fall in 2023?

While home values did better than expected, not all homeowners saw their homes increase in value in 2023.

44% of UK homes fell in value by at least 1% over the course of the year. Within that 44%, one third of homes lost 5%+ of their value from 2022.

Homeowners in the South, where house prices are less affordable, were most likely to see the falls.

Some 3 in 5 (or 4 million) homeowners in the East and the South East of England saw a value decrease of 1% or more.

And just over a million of these saw decreases of 5% or more.

‘In the East of England, the average loss was £11,500, while in the South East, it was £13,200,’ says Lubowiecka.

‘The coastal areas of Kent and East Sussex suffered the most in terms of value losses, with half of homeowners in Dover and Hastings experiencing value falls of 5% or more.’

During the pandemic, these rural and coastal areas within commuting distance of larger cities saw a large influx of buyers, boosting house price growth.

But now demand is starting to wane, leading to larger value falls here.

Which types of homes lost the most value in 2023?

Detached houses were most likely to lose value in the East of England (23%), while in the South East, apartments bore the brunt of the losses (25%).

Across the UK as a whole, value drops were more common for detached houses and bungalows, which are less common and often priced at a premium. 48% of these property types lost value in the last year.

Flats also suffered in 2023, despite some pick-up in buyer interest. Our data shows that exactly half of UK flats lost some value last year.

Larger flats fared better than smaller flats, with 52% of 3-bed flats holding or increasing in value. But in contrast, only 46% of 1-bed flats enjoyed the same benefits.

Why we didn’t see house prices plummet in 2023

New mortgage regulations introduced in 2015 helped to prevent homes from being ‘over-valued’, which can lead to property market crashes.

When agreeing to offer mortgages, lenders had to ensure their borrowers could still repay those mortgages at higher interest rates when they took out the loans.

So, if your mortgage rate was say, 2%, you had to prove you could still afford to repay it if it rose to 5%.

That, in turn, meant borrowers wouldn’t be forced to sell their homes if mortgage rates increased, because they had already proven they could meet those higher monthly payments.

Lots of forced sales negatively affect property values, so these regulations helped to protect house prices from a major downturn.

Will home values rise or fall in 2024?

‘Zoopla predicts modest house price falls of 2% in 2024 across the UK,’ says Lubowiecka.

‘This signals a repetition of the last year in terms of pricing as well as key themes influencing the market.

‘How this is going to impact your home value depends on where you are in the country and what property type you own. But we expect those who saw home value growth in 2023 to see similar increases in 2024.’

Higher mortgage rates will continue to limit many peoples’ buying power, and this impact will be most felt in the high-value regions in the South.

‘We anticipate further value drops in the south, especially in areas where values shot up during the pandemic.

‘Flats and detached homes here are most likely to register further value falls, so if you’re planning to sell a home like this in 2024, it’s important to set your price at a realistic level right from the start,’ advises Lubowiecka.

Meanwhile, popular property types such as terraces or 3-bed houses that offer good value for money are likely to hold or increase in value.

Thinking of selling? It’s always a good idea to speak to a local agent to get a valuation for your home.

Estate agents will be on top of all of the local market trends in your area, while taking into account your property’s unique characteristics and all of the improvements you’ve made to it to set the best possible price for a sale.

How we calculate our home values

Monthly estimates for every home in the UK, to show homeowners how much their home is worth.

Our data source, Hometrack's market-leading Automated Valuation Model, is reliably used by mortgage lenders across the UK to assess a home’s value.

And while not as conclusive as an agent valuation, which takes in all of the recent work you might have done to your property, our estimates provide a good initial indication of your home’s worth to help you unlock your next move.

How current estimates differ from sold house price data

Every month, we and many other organisations publish a house price index.

House price indices are a useful guide to the overall direction of travel in national house prices.

But homeowners really want to understand how the value of their own home is moving over time, which could be different to what’s reported in a national index.

In 2023, most house price indices registered modest annual price falls as higher mortgage rates hit buying power.

Many places experienced price falls for the first time since the Global Financial Crisis in 2007.

But while the overall average UK house price moved lower over 2023, the nation’s 30 million homes are spread across thousands of housing markets.

And our data reveals not every home fell in value last year: 3 in every 5 homeowners can testify to that.

Key takeaways

- 3 in 5 homeowners saw their homes hold their value or rise by an average of £7,800 in 2023

- 1 in 10 saw their home’s value increase by 5% or more

- Greater gains were seen in affordable areas like the North West, whereas homes in the South were more likely to see values drop

Two-thirds of first-time buyers team up to step on the property ladder

First-time buyers accounted for more than half of all home loans in 2023 - and more than two-thirds teamed up to secure their own homes.

Almost two thirds of first-time buyers teamed up last year in a bid to get onto the housing ladder.

Against a challenging economic backdrop, 63% of first-time buyer mortgage completions in 2023 were in joint names, with two or more people. Just 37% were sole applications, according to the latest research from Halifax.

First-time buyers accounted for just over half (53%) of all home loans last year, the highest proportion since 1995.

But the overall number of buyers that stepped onto the housing ladder last year stood at 293,339 – a 21% drop compared with 2022.

The number of first-time buyers fell in all regions across the UK in 2023, with the greatest drops in East Anglia and the south east.

What was the average deposit paid by first-time buyers in 2023?

Halifax said it was ‘unsurprising’ that the bulk of first-time buyer mortgage applications were joint, given the increase in deposits over the last decade.

First-time buyers forked out an average deposit of £53,414 last year, around 19% of the purchase price. That’s £9,057 (15%) less than in 2022 but £21,000 (67%) more than 10 years ago.

And even though the typical salary is higher than 10 years ago, first-time buyers have to save more than a year’s average pay for a deposit large enough to buy a first home, according to the lender.

Terraced homes most popular among first-time buyers

In a glimmer of hope for aspiring homeowners, the average price tag of a home for a first-time buyer fell 5% from its peak in 2022 to £288,136.

But house prices for first-time buyers remain over £132,000 (86%) more expensive than a decade ago.

Halifax’s research also revealed that terraced homes were the most sought-after type of property for first-time buyers in 2023, making up 30% of all first-time buyer mortgages.

But their popularity has faded over the last decade, with the number of first-time buyers snapping up a terraced home dropping by 7% compared with 2013.

Flats, on the other hand, have risen in popularity. The number of first-time buyers purchasing a flat over the last 10 years has climbed by 6%, increasing in every region and nation in the UK.

Where are the most affordable places to step onto the housing ladder?

First-time buyers should look to Scotland to boost their chances of homeownership. Many of the most affordable places to buy a first home are in Scotland, said the lender.

Inverclyde was crowned the most affordable area last year, where properties were around 2.6 times the average salary (£41,598).

At the other end of the spectrum, London was home to some of the least affordable places to get onto the housing ladder. Properties in Islington, north London, were a whopping 10.6 times the average salary (£57,548).

To put these figures into wider context, average property values for first-time buyers are around 6.7 times the average UK salary (£43,257), according to Halifax.

Kim Kinnaird, director, Halifax Mortgages said: ‘Following a record year in 2021, unsurprisingly in view of the wider economic environment, the number of first-time buyers joining the property market fell again in 2023 to around 293,000.

‘Despite this drop, new buyers made up over half of all home loans. However, to get a foot on the ladder most people are now buying for the first time in joint names.

‘The overall fall in house prices we saw in 2023 will go some way to helping people get on the ladder for the first time – but these buyers are still dependent on a steady supply of properties in their price range, while they are faced with the continued pressure of saving for a deposit, when rent and living costs are high.'

Key takeaways

- Almost two thirds of first-time buyers teamed up to buy a home last year, with 63% of mortgage completions in joint names, says Halifax

- The average deposit paid was £53,414, around 19% of the purchase price

- Inverclyde in Scotland has been crowned the most affordable place in the UK to step onto the housing ladder, while Islington in London is the least

‘First-time buyers have been hit especially hard by rising mortgage rates. The sub-4% deals we increasingly hear about are typically for those with equity levels of 40% or more,’ explained Tom Bill, head of UK residential research at Knight Frank.

‘The government is likely to offer first-time buyers more financial support ahead of the election this year given that housing is a key political battleground and based on the belief that homeowners are more likely to vote Conservative.’

Will house prices rise in 2024?

If you’re planning to buy or sell a home in 2024, what should you do? Our Executive Director of Research, Richard Donnell, shares his UK house prices forecast.

The first weeks of January have been full of reports about improving conditions in the housing sales market. Some are now projecting that UK house prices might even rise in 2024.

There has been a bounce-back in activity, which has followed the usual seasonal pattern. This is positive news but home buyers and sellers shouldn’t get too carried away with the hype.

Our data shows we are still locked in a buyers market, so it’s unlikely that we will see prices rise in 2024 at a national level. But at the same time, they haven’t fallen much over the last 12 months, despite mortgage rates more than trebling since 2021.

We believe that house prices still need to adjust to higher mortgage rates, even though these are now falling and appear to be on track to get into the 4%-4.5% range later this year.

This means sellers have to remain realistic on what someone will pay for their home and seek advice from an estate agent on how best to get their home ready to sell.

Return of pent-up demand after weak 2023

Demand for homes has certainly jumped out of the blocks in the first weeks of January as pent-up demand from 2023 returns to the market, encouraged by falling mortgage rates.

More than 75% of all homes currently for sale are featured on Zoopla and we can see that buyer demand is 10-15% higher than the pre-pandemic years of 2017-2019 - and also higher than at the start of 2023.

However, demand levels are still more than a third lower than they were at the start of the hotter pandemic years of 2020-2022.

Plenty of choice for buyers will keep price rises in check

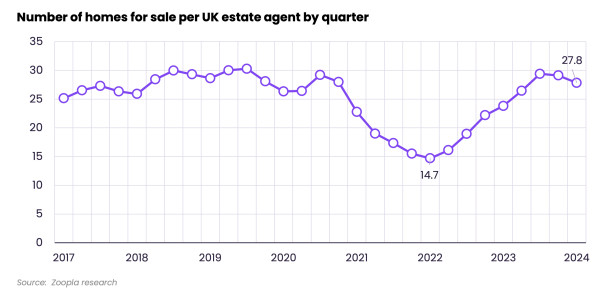

While we have a return of buyers into the housing market, there are also many more homes for sale. This greater choice of homes available is likely to limit the scope for price rises in 2024.

One feature of the pandemic years was a chronic shortage of homes for sale, which drove faster price rises. The low point was just 14 homes per estate agent in late 2022.

Supply is now more than double these lows and back up to an average of 30 homes for sale per agent, closer to the pre-pandemic average.

There are also more larger, 4+ bed family homes for sale, as some sellers re-list homes that might have been on the market in 2023 and struggled to attract interest.

More supply and weaker demand led to a drawn out re-pricing of homes listed for sale over 2023, as sellers adjusted asking prices lower in order to attract demand.

This accelerated in the second half of 2023 as higher mortgage rates hit buying power.

Asking price reductions for homes listed for sale have picked up again in January 2024, which is a sign that house prices are still adjusting to higher borrowing costs.

They aren’t as high as this time last year but are higher than those seen in previous years, as sellers speak to their agents about how to pitch their home at the right price level to attract renewed interest.

Half of owners with a mortgage still need to move onto higher mortgage rates

Buyers remain price sensitive and many with mortgages are still yet to remortgage onto higher rates.

The Bank of England estimates that around 55% of mortgage accounts (around 5 million), have remortgaged since rates started to rise in late 2021.

Higher mortgage rates are expected to affect around a further 5 million households by 2026.

For the typical owner-occupier mortgagor rolling off a fixed rate between 2023 Q2 and the end of 2026, their monthly mortgage repayments are projected to increase by around £240, or around 39%.

The good news is that the more mortgage rates decline, the smaller the jump in repayments.

However, for those looking to buy a home and trade-up for more space or a nicer area, this means spending more and taking on a larger loan, adding to monthly mortgage payments.

With inflation not falling as fast as economists expected, the decline in mortgage rates is set to moderate, despite intense competition between banks.

The cost of mortgages is set to keep buyers focused on value for money, even as mortgage rates fall, keeping prices in check.

It's still a buyers market and sellers need to price carefully

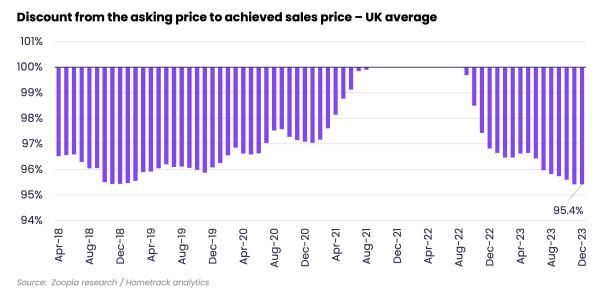

The average UK seller is having to accept offers below the asking price and the typical discount from the asking price to the agreed sale price is around 5%.

This is slightly below the long run average and well down on the hot market conditions seen over the pandemic years.

This proportion is not growing, which means larger price falls are unlikely. But it shows sellers will need to price carefully to ensure they attract demand.

The proportion of sellers achieving their asking prices varies across the UK, with slightly larger discounts happening in southern England.

Here, prices are higher than the national average and for that reason, the impact of higher mortgage rates on pricing levels has been greater than in other regions.

How should sellers and buyers respond to the positive start to 2024?

The positive news at the start of 2024 should boost market confidence and encourage more buyers and sellers into the market.

But it’s important sellers don’t get too carried away and shift expectations on what their home is worth in 2024 versus 2023.

It all depends on what you are looking to sell and how closely this matches to who is in the market looking to buy in your area and price range.

For example, we expect first time buyers to remain a very important group in 2024. However, this group is not focused on buying larger homes, where there is more supply.

Larger homes will mainly appeal to upsizers, who are likely to need bigger borrowings to buy at higher mortgage rates than 2-3 years ago.

We don’t expect house prices to suddenly start rising in 2024, but more demand and sensible pricing of homes for sale is likely to boost housing sales and overall levels of activity.

Key takeaways

- We are still locked in a buyers market, so it’s unlikely we'll see prices rise in 2024 at a national level

- House price falls were modest in 2023, despite mortgage rates more than trebling since 2021

- But buyers remain price sensitive and 45% of those with mortgages are yet to remortgage onto higher rates

- Inflation appears sticky, meaning there is only so far mortgage rates are likely to fall

- The average UK seller is having to accept offers and is getting around 95% of the asking price, so sellers must remain realistic on pricing

Renters paying an extra month's rent per year after latest rises

Rents jumped 9% in the last year, adding £1,200 - a month’s worth of rent - to the average annual bill.

2023 was another tough year for renters, with average rents for new lets reaching £1,200 in November - 9% higher than a year ago.

It means renters have seen an extra £1,200 - or a month’s worth of rent - added to their annual bill.

The table shows how much rents for new lets have increased across the UK in the last year.

| Region | Annual rental increase (%) | Annual rental increase (£) | Average monthly rent |

|---|---|---|---|

| Scotland | 12.1% | £84 | £780 |

| North West | 10.8% | £81 | £831 |

| Wales | 10.1% | £78 | £852 |

| North East | 9.7% | £60 | £672 |

| East Midlands | 9.7% | £75 | £846 |

| East of England | 9.5% | £99 | £1,145 |

| South East | 9.3% | £110 | £1,294 |

| West Midlands | 8.8% | £72 | £883 |

| South West | 8.6% | £83 | £1,061 |

| London | 8.0% | £157 | £2,128 |

| Yorkshire | 7.7% | £56 | £782 |

| Northern Ireland | 4.9% | £35 | £750 |

Zoopla Rental Index, data to November 2023 published in January 2024

Rental inflation in Scotland boosted by rent controls

In September 2022, the Scottish Parliament introduced a rent cap of 3% on annual rises to existing tenancies.

While intended to reduce cost-of-living pressures for renters, it means landlords are now going higher at the start of a tenancy to cover their costs and the limited increases during the contract.

In fact, Scotland has registered the highest level of annual rental inflation in the UK at +12.1%. The average monthly rent in Scotland stands at £780, £84 more than a year ago.

This is a slower rate of growth than the highs of +13.7% back in February 2023, but we still expect Scotland to see faster rental growth than anywhere else in the UK in 2024.

In turn, Scottish cities continue to register some of the largest rent increases in the country. Over the last 12 months, the average monthly rent in Edinburgh increased by £150 and in Glasgow by £100.

Rental inflation is much less dramatic in rural parts of Scotland, with Ayrshire, Moray and the Highlands all recording growth below +7%.

London leads the slowdown in rental growth

Rental inflation has slowed down in southern cities in the last 12 months, giving some relief to renters in the expensive South of England.

The largest moderation is in London, where rental inflation has dropped from +15.9% a year ago to +8.1% today.

Rental growth has slowed the most in Inner London boroughs. A year ago, we were seeing rises of +14.9% in Hammersmith and Fulham and up to +21.1% in Tower Hamlets. Today, no inner borough is seeing growth of more than +9.5%.

However, outer boroughs are a different story, seeing some of the highest rent increases in England right now. Rents have risen by more than +13.5% in boroughs like Hillingdon, Redbridge and Barking and Dagenham.

The second and third largest slowdowns are recorded in Bristol and Newport, where rental inflation has fallen to +7.9% and +8.8% respectively.

These reductions suggest landlords are becoming more realistic in pricing their rentals and may be taking cost-of-living struggles into consideration when setting new rates, which tend to be exacerbated for those in the rental market.

What are renters doing to minimise the impact of higher rents?

Some renters have escaped the steepest rises by staying in their existing homes.

Year-on-year rises for established tenancies rose at the slower rate of 6.2% according to the Index of Rental Prices from the Office for National Statistics.

When renters move and are faced with higher rents and a limited supply of homes on the market, they're more commonly considering renting smaller homes, moving to cheaper areas or house-sharing to reduce costs.

House-sharing reduces the cost of housing per person but it comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We believe that the rental market is now past peak rental growth after starting to cool in the final months of 2023.

We expect a further slowdown in rental growth in 2024 as worsening affordability keeps demand in check and supply improves slowly. There are already signs asking rents have overshot in some markets that are showing resistance to higher rents.

Slower increases will be welcome news to renters who have often faced steep hikes in the last two years.

Key takeaways

- A 9% rise in average monthly rent has added £1,200 to the average annual bill since this time last year

- Renters are now paying £1,200 per month on average, ranging from £672 in the North East to £2,128 in London

- Rental growth slowing to single digits is a sign we're past peak growth after nearly two years of 10%+ increases

- Scotland continues to register the highest rental growth despite rent controls

- London and the South of England are seeing rent growth slow the most as rents hit an affordability ceiling

- We expect a further slowdown in rental growth in 2024 as worsening affordability keeps demand in check

Buyers return amid falling mortgage rates

The first full week back after the new year has seen buyer interest jump out of the blocks faster than last year as mortgage rates drop. Get the latest with Richard Donnell.

The start of 2024 has seen a slew of more positive news on the housing market.

Over the last month, we’ve seen further signs that house price falls are slowing, alongside a further drop in average mortgage rates for new borrowers with some very competitive deals at 60% loan to value.

This reflects what we reported in our most recent house price index: a 17% increase in new sales agreed as buyers sought to lock down new deals at the end of 2023.

This improvement in market activity looks to be rolling over into the start of 2024, driven by improving mortgage rates.

London and South East lead fast start to 2024

The first full week back after the new year has seen buyer interest jump out of the blocks faster than last year and the pre-pandemic period in 2019.

It’s early days but our data shows demand at the end of the first week of January was more than 10% ahead of the same period a year ago.

Demand has jumped most in London and the South East, where house price gains over recent years have been much lower than the rest of the UK, which has helped improve housing affordability.

Modest house price falls over 2023

Our UK house price index shows that prices are 1.1% lower than a year ago, with signs that the scale of price falls is slowing.

Sales volumes are now starting to improve with buyers returning to the market.

While the Zoopla house price index has recorded a modest fall in UK house prices over the last 12 months, the profile of price changes varies widely across the UK.

The largest price falls are up to 4% and concentrated across southern England in markets which saw the greatest demand over the pandemic, including those in the East of England and Kent.

Prices are also falling in areas where there has been strong demand for second homes, such as North Wales and the South West.

In contrast, house price inflation remains positive in many areas across northern England and Scotland. The rate of price gains has slowed quickly from double digit growth at the end of 2022 to close to 0% now but prices aren’t falling everywhere.

The greatest downward pressure on prices has been in southern England, where higher house prices mean a greater impact from higher mortgage rates.

This is where sellers are having to accept larger discounts to the asking price to achieve a sale, averaging around 6%.

While house prices are highest in London, they aren’t leading the fall. That's because the London market has lagged behind the rest of the country in terms of price growth over the last 6 years, making homes slightly less expensive and more accessible to buyers.

Annual house price inflation by postcode area November 2023

Nearly all homeowners are sitting on gains vs the start of the pandemic

House price falls have been modest, despite higher mortgage rates, because of the mortgage regulations introduced in 2015 by the Bank of England.

These regulations stopped the development of a bubble in house prices and are a key reason why price falls have been small over 2023.

The net result is that most areas have house prices still well above the levels they were before the pandemic hit the market, which created a boom in demand for housing.

The average UK home is now worth 18% (or £41,000) more than it was at the start of the pandemic in March 2020.

The map below shows the difference in house prices between March 2020 and November 2023.

It shows that the Northern regions, Wales and the South West are where house prices pushed highest during the pandemic - and that average prices in these regions are still over 24% higher than their pre pandemic levels.

Price gains have been more modest in and around London, where affordability pressures and mortgage regulations have limited the scope for price gains.

So for those looking to sell and move in 2024, the vast majority of homeowners are sitting on price gains compared to the pre-pandemic period.

It’s a much better position than many people predicted we would be in a year ago, although not us however.

House price growth since the start of the pandemic March 2020

What does this mean for buyers and sellers?

We certainly expect news of lower mortgage rates to boost buyer demand and bring more interest into the market over the coming months.

Buyers understand that there is more room to negotiate on pricing with sellers but many will also still need to sell a home to unlock their next move.

Sellers will need to remain realistic over the value they expect to achieve from their property and be prepared to negotiate on price.

We saw a steady reduction in asking prices over 2023, as sellers worked with their estate agents to get the pricing right to attract demand and increase the chances of securing a sale.

Much depends on the type of property you're selling and its location, so it’s essential to speak to your local agent to get a view of demand for a home like yours in the current market.

Key takeaways

- The number of buyers out home hunting has shot up 10% compared to this time last year

- House price falls are starting to slow as sales agreed rise by 17%

- The average UK home is worth 18% (or £41,000) more than it was in March 2020

- Mortgage rates drop further with some very competitive rates for borrowers with a 60% LTV

Brilliant London events to help beat the January 2024 blues

Cheap stuff, secret stuff and heavy-hitting cultural stuff to fill your calendar with for January 2024 in London

Hello, 2024! It is truly great to see you. January is the ideal time to discover London on a budget and without the crowds. Many of city's very best theatre and musicals, restaurants and bars – ranked definitively by Time Out's crew of expert local editors – offer discounted tickets and cheap meal deals.

Spend cold, clear days walking off your post-Christmas malaise in glorious parks and spectacular walking routes. Cosy up with drinks on a beautiful heated winter terrace, or in one of the 100 best pubs in the city. And catch up on magical lights, winter wonderlands and Christmas shows before they disappear.

1. Winter Lights

The bright lights of Canary Wharf's towers are quite the spectacle after dark, but the business district will glow brighter than usual for 11 days in January thanks to the addition of sparkling illuminations created by artists from around the world. All 27 of the artworks are free to visit and a map showing their locations will be available to download before it opens. There’ll also be food and drink stalls along the trail and many of Canary Wharf’s shops, restaurants and bars will be running special offers and discounts.

2. ‘Cute’

From emojis to plushie toys Somerset House is exploring the irresistible force of cuteness in its latest exhibition. Collecting together contemporary artworks and cultural phenomena including music, fashion, toys, video games and social media, the show attempts to find out how cuteness has become so influential.

3. The best mocktails in London

4. Take a bracing winter walk in London

Yes, it's cold out. It's also quite wet. The leaves have fallen from the trees and turned the pavements into a slimy, slippery ice rink. But we're lucky to have some amazing, huge, parks in London, and walking around in them on a crisp winter's day is genuinely one of life’s great joys. Whether you're a Royal Parks stan or a fiend for Hampstead Heath, there are loads of parks to choose from. So, get out there.

5. Just for One Day

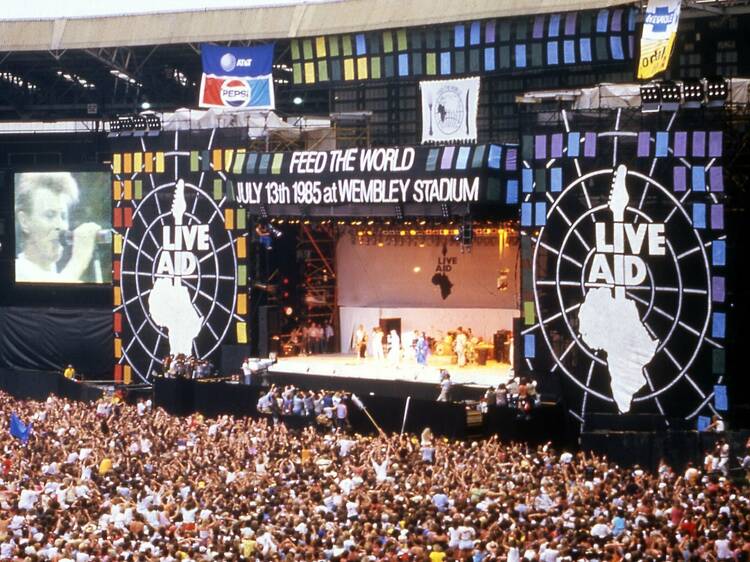

Surely the most famous concert(s) in history and with a ready-made soundtrack of ’80s stadium rock hits, a musical adaptation of Bob Geldof’s 1985 Live Aid concerts does seem like a screechingly logical idea as soon as you think about it.

With a book by satirist and writer of the smash ‘Mrs Doubtfire’ musical John O’Farrell and direction by ‘& Juliet’ man Luke Sheppard, ‘Just for One Day’ sounds like an agreeable jukebox romp that aims to tell the story of the duel London and New York mega-concerts that raised $127m for famine relief back on July 13, 1985.

Supported by the Geldof, performed by the permission of the Band Aid Charitable Trust, and with the rights to perform songs by the likes of Bob Dylan, David Bowie, The Who, U2, Queen, The Police, Elton John, Paul McCartney, The Pretenders, The Cars, Status Quo, Paul Weller, Sade, The Boomtown Rats, Bryan Adams, Diana Ross, Ultravox and more, it feels like a solid crowd-pleaser.

It will, however, be interesting to see if there's any sense of reflection on the project's legacy - while Live Aid has come in for less stick as an endeavour than the Band Aid single 'Do They Know It's Christmas?', there have undeniably been very legitimate questions asked in the years since about the project’s white saviorism and how effectively the money was distributed. Sure, it sounds like a light-hearted musical romp. Bu it would be a shame if ‘Just for One Day’ ducked these questions entirely.

Julie Atherton, Ashley Campbell, Jackie Clune, Craige Els, James Hameed, Naomi Katiyo, Hope Kenna, Freddie Love, Emily Ooi and Rhys Wilkinson star.