If you’re planning to buy or sell a home in 2024, what should you do? Our Executive Director of Research, Richard Donnell, shares his UK house prices forecast.

The first weeks of January have been full of reports about improving conditions in the housing sales market. Some are now projecting that UK house prices might even rise in 2024.

There has been a bounce-back in activity, which has followed the usual seasonal pattern. This is positive news but home buyers and sellers shouldn’t get too carried away with the hype.

Our data shows we are still locked in a buyers market, so it’s unlikely that we will see prices rise in 2024 at a national level. But at the same time, they haven’t fallen much over the last 12 months, despite mortgage rates more than trebling since 2021.

We believe that house prices still need to adjust to higher mortgage rates, even though these are now falling and appear to be on track to get into the 4%-4.5% range later this year.

This means sellers have to remain realistic on what someone will pay for their home and seek advice from an estate agent on how best to get their home ready to sell.

Return of pent-up demand after weak 2023

Demand for homes has certainly jumped out of the blocks in the first weeks of January as pent-up demand from 2023 returns to the market, encouraged by falling mortgage rates.

More than 75% of all homes currently for sale are featured on Zoopla and we can see that buyer demand is 10-15% higher than the pre-pandemic years of 2017-2019 – and also higher than at the start of 2023.

However, demand levels are still more than a third lower than they were at the start of the hotter pandemic years of 2020-2022.

Plenty of choice for buyers will keep price rises in check

While we have a return of buyers into the housing market, there are also many more homes for sale. This greater choice of homes available is likely to limit the scope for price rises in 2024.

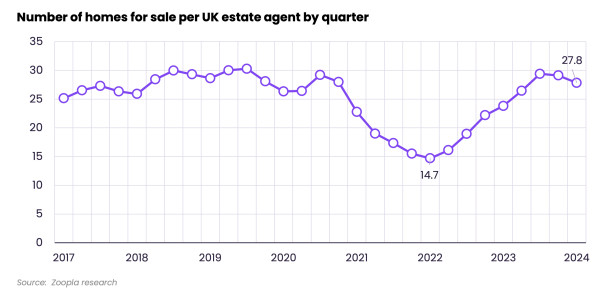

One feature of the pandemic years was a chronic shortage of homes for sale, which drove faster price rises. The low point was just 14 homes per estate agent in late 2022.

Supply is now more than double these lows and back up to an average of 30 homes for sale per agent, closer to the pre-pandemic average.

There are also more larger, 4+ bed family homes for sale, as some sellers re-list homes that might have been on the market in 2023 and struggled to attract interest.

More supply and weaker demand led to a drawn out re-pricing of homes listed for sale over 2023, as sellers adjusted asking prices lower in order to attract demand.

This accelerated in the second half of 2023 as higher mortgage rates hit buying power.

Asking price reductions for homes listed for sale have picked up again in January 2024, which is a sign that house prices are still adjusting to higher borrowing costs.

They aren’t as high as this time last year but are higher than those seen in previous years, as sellers speak to their agents about how to pitch their home at the right price level to attract renewed interest.

Half of owners with a mortgage still need to move onto higher mortgage rates

Buyers remain price sensitive and many with mortgages are still yet to remortgage onto higher rates.

The Bank of England estimates that around 55% of mortgage accounts (around 5 million), have remortgaged since rates started to rise in late 2021.

Higher mortgage rates are expected to affect around a further 5 million households by 2026.

For the typical owner-occupier mortgagor rolling off a fixed rate between 2023 Q2 and the end of 2026, their monthly mortgage repayments are projected to increase by around £240, or around 39%.

The good news is that the more mortgage rates decline, the smaller the jump in repayments.

However, for those looking to buy a home and trade-up for more space or a nicer area, this means spending more and taking on a larger loan, adding to monthly mortgage payments.

With inflation not falling as fast as economists expected, the decline in mortgage rates is set to moderate, despite intense competition between banks.

The cost of mortgages is set to keep buyers focused on value for money, even as mortgage rates fall, keeping prices in check.

It’s still a buyers market and sellers need to price carefully

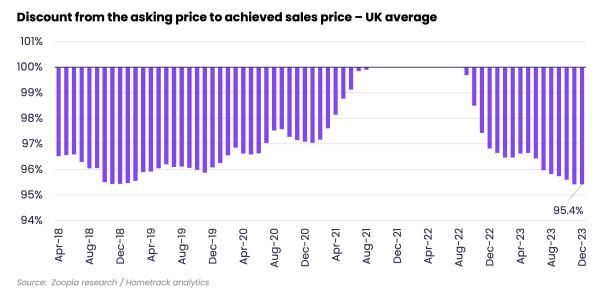

The average UK seller is having to accept offers below the asking price and the typical discount from the asking price to the agreed sale price is around 5%.

This is slightly below the long run average and well down on the hot market conditions seen over the pandemic years.

This proportion is not growing, which means larger price falls are unlikely. But it shows sellers will need to price carefully to ensure they attract demand.

The proportion of sellers achieving their asking prices varies across the UK, with slightly larger discounts happening in southern England.

Here, prices are higher than the national average and for that reason, the impact of higher mortgage rates on pricing levels has been greater than in other regions.

How should sellers and buyers respond to the positive start to 2024?

The positive news at the start of 2024 should boost market confidence and encourage more buyers and sellers into the market.

But it’s important sellers don’t get too carried away and shift expectations on what their home is worth in 2024 versus 2023.

It all depends on what you are looking to sell and how closely this matches to who is in the market looking to buy in your area and price range.

For example, we expect first time buyers to remain a very important group in 2024. However, this group is not focused on buying larger homes, where there is more supply.

Larger homes will mainly appeal to upsizers, who are likely to need bigger borrowings to buy at higher mortgage rates than 2-3 years ago.

We don’t expect house prices to suddenly start rising in 2024, but more demand and sensible pricing of homes for sale is likely to boost housing sales and overall levels of activity.

Key takeaways

- We are still locked in a buyers market, so it’s unlikely we’ll see prices rise in 2024 at a national level

- House price falls were modest in 2023, despite mortgage rates more than trebling since 2021

- But buyers remain price sensitive and 45% of those with mortgages are yet to remortgage onto higher rates

- Inflation appears sticky, meaning there is only so far mortgage rates are likely to fall

- The average UK seller is having to accept offers and is getting around 95% of the asking price, so sellers must remain realistic on pricing