At the beginning of 2023, commentators predicted home values would plummet by as much as 10% over the course of the year. Here’s what actually happened.

In 2023, the press was filled with gloom and doom predictions of homes plummeting in value by as much as 10%.

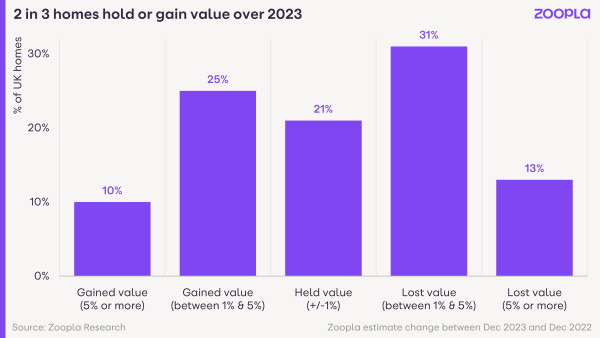

However, our data reveals that in reality, more than half of UK homeowners (56%) saw their home values stay the same or increase by at least 1% over the course of the year.

Senior Property Researcher, Izabella Lubowiecka, says: ‘Where values went up, the average increase seen was £7,800. And 1 in 10 (or 3 million) UK homeowners even registered gains of more than 5% (or £17,200).’

It is a different picture to what happened the year before in 2022, when 96% of homes either held their value or saw an increase. Back then, the average value hike was £19,700.

However, we can clearly see that most homeowners didn’t see the hefty value falls that some initially predicted.

Where did homes rise in value in 2023?

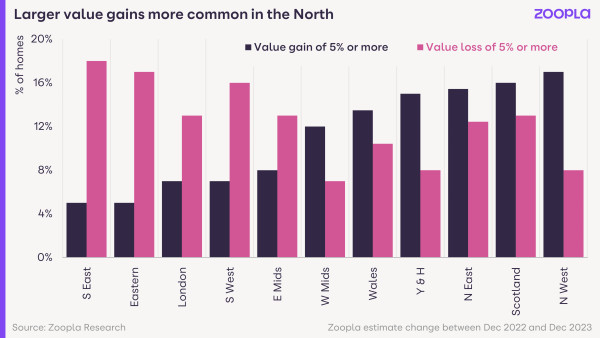

‘There is a clear north-south divide in the fortunes of homeowners during 2023,’ says Lubowiecka.

‘Areas with lower house prices were cushioned from the impact of higher mortgage rates, helping to support activity and sustain house prices in these regions.

‘So in the more affordable parts of the country, such as the north, home values increased.’

In fact, the North West led the way in value gains, with the highest proportion of homes registering value increases of 5% or more (£13,200 on average).

Here, terraced homes proved to be the hottest properties, with 19% of terraces rising by 5%+.

It was hotly followed by Scotland, where 16% of homes (400,000), increased in value by 5%.

Here, apartments proved to be the highest risers, with 19% registering a value increase of 5%+.

The North East and Yorkshire and the Humber take joint third place, with 1 in 7 homes going up in value by 5%+.

Flats were the winners in the North East, with 25% rising by 5%+ in value.

Meanwhile, in Yorkshire and the Humber, terraced homes came up trumps, with 16% rising by 5%+.

Which types of homes held their value in 2023?

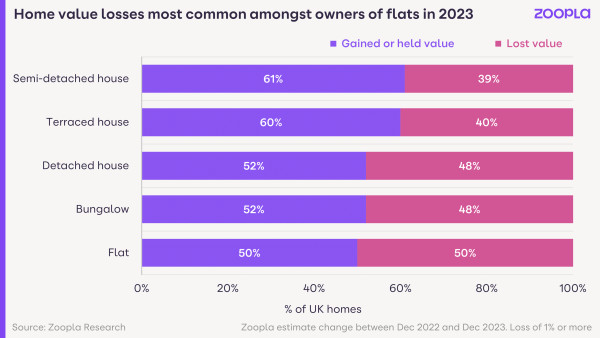

In 2023, the nation’s favourite property types: semi-detached homes and terraces, proved to be the best at holding their value.

‘Homes seen as good value for money continued to attract buyer interest, leading to stronger price performance,’ says Lubowiecka.

‘That said, the larger value gains of 5%+ were equally spread across different property types and enjoyed by 1 in every 10 UK properties.’

Where did home values fall in 2023?

While home values did better than expected, not all homeowners saw their homes increase in value in 2023.

44% of UK homes fell in value by at least 1% over the course of the year. Within that 44%, one third of homes lost 5%+ of their value from 2022.

Homeowners in the South, where house prices are less affordable, were most likely to see the falls.

Some 3 in 5 (or 4 million) homeowners in the East and the South East of England saw a value decrease of 1% or more.

And just over a million of these saw decreases of 5% or more.

‘In the East of England, the average loss was £11,500, while in the South East, it was £13,200,’ says Lubowiecka.

‘The coastal areas of Kent and East Sussex suffered the most in terms of value losses, with half of homeowners in Dover and Hastings experiencing value falls of 5% or more.’

During the pandemic, these rural and coastal areas within commuting distance of larger cities saw a large influx of buyers, boosting house price growth.

But now demand is starting to wane, leading to larger value falls here.

Which types of homes lost the most value in 2023?

Detached houses were most likely to lose value in the East of England (23%), while in the South East, apartments bore the brunt of the losses (25%).

Across the UK as a whole, value drops were more common for detached houses and bungalows, which are less common and often priced at a premium. 48% of these property types lost value in the last year.

Flats also suffered in 2023, despite some pick-up in buyer interest. Our data shows that exactly half of UK flats lost some value last year.

Larger flats fared better than smaller flats, with 52% of 3-bed flats holding or increasing in value. But in contrast, only 46% of 1-bed flats enjoyed the same benefits.

Why we didn’t see house prices plummet in 2023

New mortgage regulations introduced in 2015 helped to prevent homes from being ‘over-valued’, which can lead to property market crashes.

When agreeing to offer mortgages, lenders had to ensure their borrowers could still repay those mortgages at higher interest rates when they took out the loans.

So, if your mortgage rate was say, 2%, you had to prove you could still afford to repay it if it rose to 5%.

That, in turn, meant borrowers wouldn’t be forced to sell their homes if mortgage rates increased, because they had already proven they could meet those higher monthly payments.

Lots of forced sales negatively affect property values, so these regulations helped to protect house prices from a major downturn.

Will home values rise or fall in 2024?

‘Zoopla predicts modest house price falls of 2% in 2024 across the UK,’ says Lubowiecka.

‘This signals a repetition of the last year in terms of pricing as well as key themes influencing the market.

‘How this is going to impact your home value depends on where you are in the country and what property type you own. But we expect those who saw home value growth in 2023 to see similar increases in 2024.’

Higher mortgage rates will continue to limit many peoples’ buying power, and this impact will be most felt in the high-value regions in the South.

‘We anticipate further value drops in the south, especially in areas where values shot up during the pandemic.

‘Flats and detached homes here are most likely to register further value falls, so if you’re planning to sell a home like this in 2024, it’s important to set your price at a realistic level right from the start,’ advises Lubowiecka.

Meanwhile, popular property types such as terraces or 3-bed houses that offer good value for money are likely to hold or increase in value.

Thinking of selling? It’s always a good idea to speak to a local agent to get a valuation for your home.

Estate agents will be on top of all of the local market trends in your area, while taking into account your property’s unique characteristics and all of the improvements you’ve made to it to set the best possible price for a sale.

How we calculate our home values

Monthly estimates for every home in the UK, to show homeowners how much their home is worth.

Our data source, Hometrack’s market-leading Automated Valuation Model, is reliably used by mortgage lenders across the UK to assess a home’s value.

And while not as conclusive as an agent valuation, which takes in all of the recent work you might have done to your property, our estimates provide a good initial indication of your home’s worth to help you unlock your next move.

How current estimates differ from sold house price data

Every month, we and many other organisations publish a house price index.

House price indices are a useful guide to the overall direction of travel in national house prices.

But homeowners really want to understand how the value of their own home is moving over time, which could be different to what’s reported in a national index.

In 2023, most house price indices registered modest annual price falls as higher mortgage rates hit buying power.

Many places experienced price falls for the first time since the Global Financial Crisis in 2007.

But while the overall average UK house price moved lower over 2023, the nation’s 30 million homes are spread across thousands of housing markets.

And our data reveals not every home fell in value last year: 3 in every 5 homeowners can testify to that.

Key takeaways

- 3 in 5 homeowners saw their homes hold their value or rise by an average of £7,800 in 2023

- 1 in 10 saw their home’s value increase by 5% or more

- Greater gains were seen in affordable areas like the North West, whereas homes in the South were more likely to see values drop