Rental Market Report: March 2024

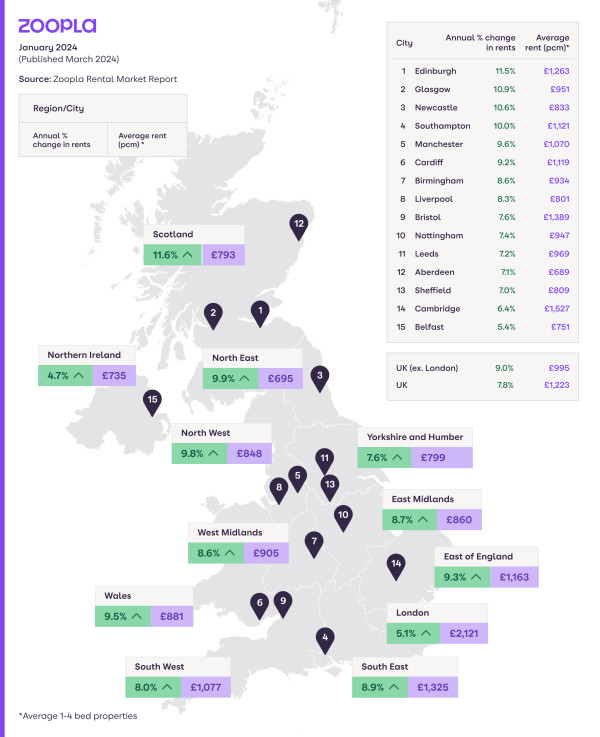

The average UK rent is now £1,223 after a +7.8% rise in the last year. Rents for new lets will rise more slowly this year, but only a major supply boost will help with rental affordability.

The average rent for new lets in the UK is £1,223 as of January 2024 (published in March 2024).

Rents have risen +7.8% in the last year, the slowest rate of growth in two years.

Key figures

|

January 2024 |

December 2024 |

November 2023 |

|

|

Average rent (new lets only) |

£1,223 |

£1,219 |

£1,213 |

|

Annual rental growth |

+7.8% |

+8.2% |

+8.7% |

UK rental inflation lowest for 2 years

The heat is finally coming out of UK rent rises. Annual growth is now at the lowest rate for two years, down to +7.8% from +11% a year ago.

This is down to weakening demand and growing affordability pressures on renters, rather than a big boost in rental supply.

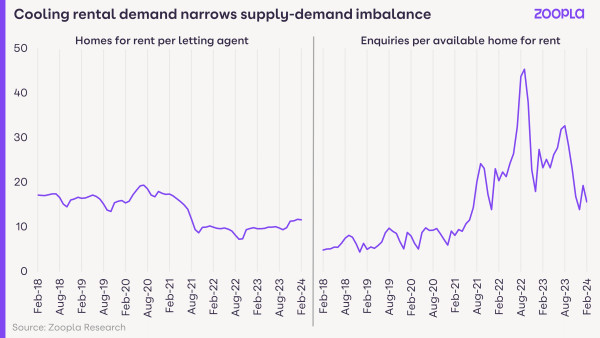

No major expansion in rental supply

New investment from private landlords remains low, with the average letting agent currently listing 12 homes for rent. This is a fifth higher than last year but 28% below the pre-pandemic average (16 homes).

Demand cools but still outweighs supply

Demand for rented homes has fallen by a fifth over the last year. One-off pandemic factors have receded, the labour market has cooled and settling mortgage rates have supported first-time buyers.

However, there are more than 15 enquiries for every home to rent. This is double the rate of before the pandemic, despite dropping from over 40 enquiries per property in 2021.

The supply and demand imbalance is narrowing but is far from closed. I expect rents to continue to rise in 2024, just at a slowing rate.

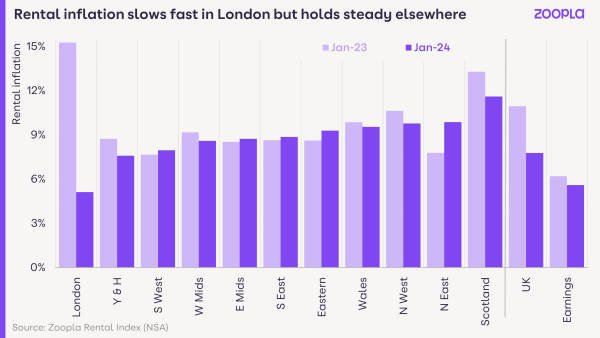

Rental inflation in line with a year ago across most of UK

Across most of the country, rental growth is broadly in line with a year ago despite weaker demand.

Rental inflation is starting to slow across all major cities, with London seeing the biggest slowdown.

Rents continue to rise the fastest in Scotland (+11.6%). In fact, it’s the only UK region or country with double-digit rental growth, although it’s seen a slight slowdown compared to a year ago.

Rental growth slows the most in London

London has recorded a sharp slowdown in annual rental inflation, with rents now rising at a rate of +5.1% compared to +15.3% a year ago.

The balance between supply and demand has narrowed the most in London, with demand -30% lower than a year ago while available supply has increased by the same amount.

This is down to London’s high rents combining with other cost-of-living pressures to hit the pockets of renters, making rising rents ever-less affordable.

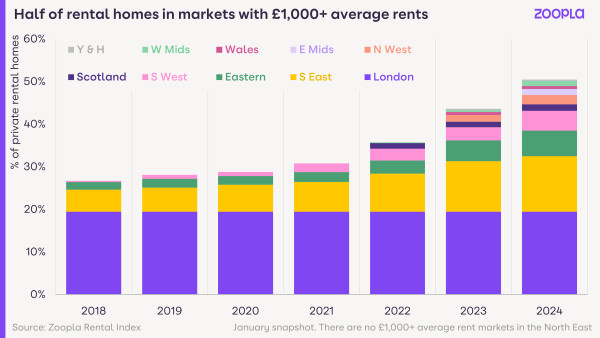

Pandemic price growth pushes half of rented homes into £1,000+ per month markets

Rents are 29% higher than pre-pandemic on average

The pandemic years have driven a step-change in rental growth, with the average UK rent jumping 29% since January 2020.

This has pushed many more properties into higher price brackets. Over half of rented homes in the UK (51%) are now in markets with average rents of more than £1,000 per month. This is almost double the number of rental homes in these pricey markets compared to five years ago.

More high-rent areas across Southern England

Rents in southern England have been close to, or above, £1,000 per calendar month for some time. The fast pandemic-fuelled rental growth has pushed many more over this threshold.

Nearly all private rental homes in the South East are now in areas with average rents higher than £1,000 per month compared to less than half in 2020.

In the East of England, it’s 70% today compared to only 24% in 2020. Over half of rented homes in the South West have also breached the £1,000 per month mark.

Rise in £1,000+ rents in affordable regions

A fifth of rented homes in Scotland, the North West, East Midlands and West Midlands are now in areas with average rents above £1,000 per month.

Just 3 years ago, nowhere outside of the South of England had an average rent higher than £1,000.

The North East remains the only region with no £1,000+ rental markets, while 4% of areas in Yorkshire and the Humber are over this price threshold.

Build-to-rent creates new city centre rental markets

There are now more of these £1,000 per month markets in regional markets, as new city centre rental markets emerge at the same time.

The rise of corporate and institutional investment in rented homes has led to the delivery of more than 90,000 new built-to-rent homes across the UK in recent years - with more to come. House builders are also starting to sell new-build homes to corporate landlords.

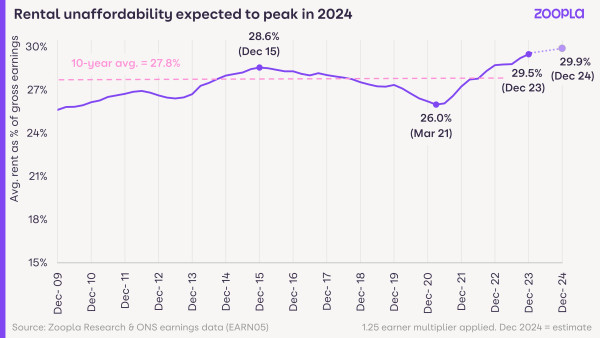

Rents to remain ‘unaffordable’ in 2024

We measure ‘rental affordability’ by looking at average rent as a percentage of average gross earnings, adjusted to reflect the estimated total income of renting households.

At the end of 2023, this measure of rental affordability reached a high of 29.5%. It came after rents for new lets rose faster than average earnings for more than 2 years (since October 2021).

Rental affordability improved between 2016 and 2021 as rents rose by only 4% in that time. This was a result of weaker demand post-Brexit, growth in rental supply, and easier access to home ownership thanks to low mortgage rates.

In contrast, recent years have been marked by strong demand, no increase in supply and high mortgage rates making it harder for first-time buyers to access home ownership.

This widened the supply and demand imbalance and pushed rents for new lets up faster than earnings. Ultimately, this has led to the deterioration in rental affordability.

The graph shows how rental affordability has tracked since December 2009 to today, with our projection for the rest of this year.

It highlights the difficulties faced by renters in the current climate, even with rents no longer rising as quickly.

Rent predictions for 2024: Rental supply must grow to improve rental affordability

We project that UK rental inflation will halve to +5% in 2024. Meanwhile, the consensus among economic forecasters is that average earnings growth will also slow, to just below +4%.

This means no immediate prospect that rental affordability will improve in 2024.

There must be a sustained expansion in rental supply to see a faster slowdown in rental inflation. It would even result in rents falling in some city centres.

However, any boost in supply this year is unlikely to be at a scale that impacts overall rental growth.

Continually low levels of net-new investment in rental properties means supply will remain below average, supporting further rent rises.

The clear conclusion is that the best way to improve affordability is to boost rental supply. This will continue to come from the new-build sector, but the big needle-mover would be more investment by private landlords.

This looks unlikely - and further rationalisation of landlord portfolios in the face of higher mortgage rates, alongside growing regulation, will offset any rise in new investment in rental supply.

Sellers make £74k average profit in 2023

9 in 10 homeowners who sold up in 2023 made 25% in profit, with the average seller of a £275,000 property earning £74,000. How much money did your home make?

House prices fell for the first time in 1 1 years during 2023. But that doesn’t mean it’s all doom and gloom for sellers.

We analysed a sample of over 100,000 Land Registry entries from the past 12 months to see how much profit sellers made last year - and the results might surprise.

The average gross gains from a home sale in 2023 was £74,000.

Meanwhile, 93% of sellers made a profit, despite house prices falling.

Sellers’ profits in different areas of the UK

|

Region |

Average gains at sale |

Average gains per year |

Average sold price |

|

London |

£137,000 |

£15,100 |

£517,000 |

|

South East |

£103,000 |

£13,300 |

£370,000 |

|

East of England |

£92,500 |

£12,500 |

£327,000 |

|

South West |

£90,000 |

£12,500 |

£305,000 |

|

East Midlands |

£70,000 |

£10,000 |

£235,000 |

|

West Midlands |

£69,000 |

£9,500 |

£235,000 |

|

Wales |

£61,000 |

£8,800 |

£195,000 |

|

North West |

£56,500 |

£8,000 |

£195,000 |

|

Yorkshire & The Humber |

£52,000 |

£7,500 |

£192,500 |

|

North East |

£30,000 |

£4,250 |

£151,000 |

|

UK |

£74,000 |

£10,500 |

£275,000 |

What affects the profit you make when selling your home?

It’s all in the timing

And by that we mean the length of time you’ve lived there.

Our Senior Property Researcher, Izabella Lubowiecka, says: ‘Generally, the longer someone lives in a property, the more money they stand to make,’ (that’s called capital gains).

‘However, those who bought when property prices last peaked, just before the 2007 financial crisis, saw more modest gains compared to those who bought after, when house prices dipped.’

Sellers who’ve lived in their homes for 10 to 15 years made between £63,000 in Northern England to £115,000 in the South.

And it’s all about location

The average value of homes in your neighbourhood also impacts how much you’ll make from a sale.

Sellers in London, who’ve lived in their properties for more than 15 years, typically made more than £250,000 between sales.

Outside of London, sellers who bought their homes after the 2007 financial crisis (which triggered a house price correction) made the largest gains.

And the type of property you’re selling is important

‘While demand for large family homes and bungalows fell towards the end of last year, successful sellers of these property types stood to make the most money in 2023.’ says Lubowiecka.

‘The average seller of a detached home made £137,000. That means their property earned £18,000-a-year for them while they lived there.

‘Bungalows were also profitable in 2023: the average gross profit made from a bungalow sale was £102,000, the equivalent of earning £13,100-a-year.’

The margins are larger in part because owners of detached homes and bungalows sell less often, living in their homes for 10 and 11 years respectively (longer than the national average of 9 years).

For owners of terraced homes and semis, the average gains were more modest: the typical gain from a terraced home sale was £65,000, while for a semi it was £81,000.

If you sold a flat, you’re likely to have made around £30,000 - or a 19% gain, as these types of properties have seen lower price growth in recent years.

Which properties gained the most value in 2023?

Perhaps unsurprisingly, detached homes made the most value when sold last year, earning their owners £137,000 over a total period of 10 years on average.

They were hotly followed by bungalows, which earned around £102,000 during that time, then semis (£81,000), terraces (£65,000) and finally flats (£30,000).

|

Property type |

Average gains at sale |

Average gain per year |

Years between moves |

|

Detached |

£137,000 |

£18,000 |

10 |

|

Bungalow |

£102,000 |

£13,000 |

11 |

|

Semi |

£81,000 |

£12,000 |

9 |

|

Terrace |

£65,000 |

£9,400 |

9 |

|

Flat |

£30,000 |

£4,500 |

9 |

So what does this all mean for mover-uppers?

So what does this all mean for flat-owners looking to buy a house, and house owners looking to buy a bigger house?

‘In the capital, if you sold a 2-bed flat last year, you’d have made £78,000 on average,’ says Lubowiecka. ‘This could contribute 14% towards the purchase of an average-priced 3-bed home in London.

‘In contrast, those making the same move in northern England made £17,000 on average, which would work out as a 9% contribution towards the average 3-bed house.’

If you’re upsizing from a 3-bed house to a 4-bed house it becomes easier, as the profits made from selling a 3-bed house tend to make a more meaningful contribution towards the purchase of a larger 4-bed house.

‘In London, the gross gains from a 3-bed house sale could contribute 25% towards your next property, while in northern England, it’s around 16%,’ says Lubowiecka.

‘Those who sold a 2-bed house with the intention of upsizing to a 3-bed house could count on the profits making the largest contribution towards their next home purchase.’

Those profits ranged between 30% in London to 21% in Northern England.

Profits earned towards you next house move from a sale

|

Property location |

Gains made |

% towards next move |

|

London |

2 bed flat - £78,000 |

3 bed house - 14% |

|

London |

2 bed house - £165,000 |

3 bed house - 21% |

|

London |

3 bed house - £231,000 |

4 bed house - 25% |

|

South England |

2 bed flat - £39,000 |

3 bed house - 11% |

|

South England |

2 bed house - £82,500 |

3 bed house - 23% |

|

South England |

3 bed house - £115,000 |

4 bed house - 19% |

|

North England |

2 bed flat - £17,000 |

3 bed house - 9% |

|

North England |

2 bed house - £40,000 |

3 bed house - 21% |

|

North England |

3 bed house - £57,000 |

4 bed house - 16% |

|

Midlands |

2 bed flat - £21,000 |

3 bed house - 9% |

|

Midlands |

2 bed house - £55,500 |

3 bed house - 23% |

|

Midlands |

3 bed house - £77,500 |

4 bed house - 19% |

|

Wales |

2 bed flat - £27,000 |

3 bed house - 14% |

|

Wales |

2 bed house - £48,000 |

3 bed house - 24% |

|

Wales |

3 bed house - £67,000 |

4 bed house - 19% |

Average gains in 2023 (Land Registry) vs average asking price 2023

Key takeaways

- The average seller in 2023 put their property on the market after 9 years. In that time, their homes earned them between £30,000 to £137,000, depending on where they lived

- In London, the average seller made £137,000, which works out at just over £15,000 for each year of ownership

- In the North East, the average seller made £30,000, which works out at just over £4,000 for each year of ownership

- Homeowners selling bungalows and detached homes made over £100,000 on average

- However, 1 in 14 sellers (or 7%) sold at a loss of £17,000 on average

What does the Spring Budget 2024 mean for the housing market?

It was a disappointing Budget for anyone hoping for measures to help home buyers and mortgage borrowers but tax changes announced could have a small impact.

Today’s Spring Budget was a chance for the Government to boost its popularity ahead of this year’s general election but there will be many younger and less wealthy voters left disappointed by the lack of measures to address the shortage of affordable housing in the UK and the challenges of getting a mortgage.

It was thought that a new 99% mortgage scheme could be announced but this idea has now been ditched.

It would have helped aspiring first-time buyers with small deposits get onto the property ladder, although critics pointed out that it would also expose them to greater risk of getting into negative equity if house prices were to fall.

There were also hopes that the early withdrawal penalty on Lifetime ISAs, which help people save for their first home or retirement, would be reduced and the limit on the value of home you can buy using the money you save in them would be increased.

However, there were some tax tweaks that could result in a modest boost to the housing market.

Capital gains tax cut

Currently, if you sell a residential property that isn’t your main home and you’re a higher rate tax payer, you pay 28% tax on the profits you make.

From April this will be cut to 24%, which could encourage more people to sell property and increase the supply of homes available.

On the other hand, wealthy property owners will get to keep more of the money they make when they sell it.

Holiday lettings tax breaks abolished

Owners of furnished holiday lets currently get more tax breaks than owners of buy-to-let properties but these will be scrapped from April, making holiday letting a less attractive option.

This could result in more longer-term rental property becoming available or more homes available to buy for local people.

Our Executive Director of Research, Richard Donnell, says: 'The furnished holiday let changes will see a mix of impacts split between more homes returning into the long let market or some of these homes being sold, benefitting from a reduction in capital gains tax.

'The impact will be felt in tourist hotspots, where most of these homes are to be found. But it's unlikely to have a big impact on the wider market in these areas. It is a further attempt to ensure investors can't outbid first time buyers.'

Stamp duty relief on multiple dwellings scrapped

There was one change to stamp duty announced, however.

From June, anyone buying more than one residential property at once will no longer pay less stamp duty than if they were buying them individually.

The Government says this is because there was no evidence that this relief was encouraging more people to invest in the private rented sector.

Our expert's view

'The Budget marks another missed opportunity to take action on boosting supply and mortgage availability in the housing market,' says Donnell.

'The consensus is that the country needs more new homes. Supply has increased but this has now stalled.

'There is a need for a widespread reform of the planning system to encourage more supply. More funding is needed for social and affordable homes, as well as investment in housing infrastructure to unlock more homes.

'The Government should also look to support the emergence of a long-term fixed rate mortgage market as a matter of urgency.

'This will help more young people with smaller deposits access home ownership – particularly in southern England, where deposit size is the biggest barrier to getting on the housing ladder.

'Another missed opportunity is the decision not to make the £625,000 threshold for first-time buyer relief permanent. This means 30% more first-time buyers will be liable to pay full stamp duty from March next year.'

Key takeaways

- The Chancellor has announced a cut in the rate of capital gains tax paid on property sales

- Tax breaks for those letting holiday homes are to be scrapped

- There are no plans to make the temporary higher stamp duty threshold permanent

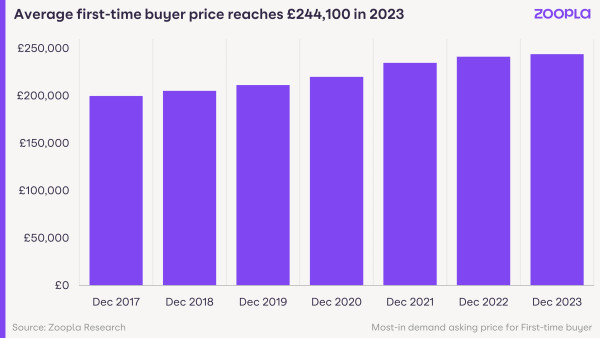

Should I buy my first home in 2024?

How are first-time buyers coping with higher mortgage rates? We take a look out how buyers are stepping onto the property ladder as borrowing gets more expensive.

First-time buyers wait in the wings and save larger deposits

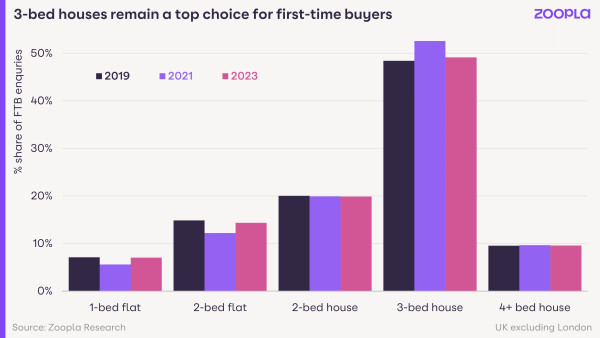

Despite higher borrowing costs, first-time buyers (FTBs) haven't changed what they’re looking for in a home.

Three-bed houses, below the average price for their local area, remain the most popular choice.

And most buyers are looking within a five-mile radius from where they’re already based.

First-time buyers were expected to adjust what they want from their first home in the face of higher mortgage costs, but many remain resolute in the criteria they want and need from their first home.

Those who have bought have managed to secure their first homes by putting more equity into their deposits and taking advantage of it being a buyers’ market where possible.

That said, many have parked the idea of buying until their financial situation improves or mortgage rates fall.

UK Finance data show that almost 80,000 (-20%) fewer first-time buyers bought their first home in 2023 compared to 2022.

First-time buyer deposits increase alongside mortgage payments

| Q4 2022 | Q4 2023 | % change | |

|---|---|---|---|

| Average FTB price paid | £241,300 | £244,100 | 1.2% |

| Average FTB deposit | £56,000 | £59,300 | 5.9% |

| Average FTB mortgage size | £185,300 | £184,800 | -0.3% |

| Average monthly mortgage payment | £777 | £990 | 27.4% |

Zoopla

The average price of what first-time buyers are looking to buy on Zoopla increased by 1.2% over the course of 2023.

Most are now looking at properties costing an average of £244,100, that’s £2,800 higher than a year ago.

However, this small increase in first-time buyer prices does not necessarily mean paying larger mortgages.

UK Finance data shows that the average loan-to-value has declined slightly to just under 76%, meaning FTBs are using slightly larger deposits.

Based on the average price of a first-time buyer home on Zoopla, we estimate the average deposit size paid has increased by £3,300 (5.9%) over 2023.

This means that the typical first-time buyer mortgage is almost the same compared to a year ago (+£500).

Using slightly larger deposits did not, however, fully offset higher borrowing costs.

Higher mortgage rates mean that first-time buyers now need to pay mortgage bills that are 27% higher than they would be if they’d purchased their first home in the second half of 2022.

We estimate the monthly mortgage payment for a first-time buyer purchasing an average-priced home of £244,100 is now £990. That’s over £200 more than a year ago.

First-time buyers look for homes priced below market average

|

Region |

FTB house price (£) |

Price of all homes (£) |

Price difference (£) |

% discount |

|

London |

399,000 |

536,800 |

137,800 |

-26% |

|

South East |

321,400 |

386,400 |

65,000 |

-17% |

|

East of England |

316,700 |

337,700 |

21,000 |

-6% |

|

South West |

241,500 |

313,700 |

72,200 |

-23% |

|

East Midlands |

211,300 |

228,400 |

17,100 |

-7% |

|

West Midlands |

196,800 |

229,300 |

32,500 |

-14% |

|

Wales |

174,700 |

203,300 |

28,600 |

-14% |

|

North West |

164,100 |

194,800 |

30,700 |

-16% |

|

Scotland |

161,400 |

162,100 |

700 |

0% |

|

Yorkshire & the Humber |

153,800 |

185,900 |

32,100 |

-17% |

|

North East |

117,900 |

140,800 |

22,900 |

-16% |

|

UK |

244,100 |

264,400 |

20,300 |

-8% |

First-time buyers are looking for family homes at value-for-money prices.

Nationally, the average first-time buyer price is 8% below that of the UK average sold price. This translates to a saving of £20,300 on average.

First-time buyers in London, the South West and Yorkshire and the Humber are looking for the largest savings of 23% or more.

In the capital, first-time buyers typically look for homes that are £137,800 below the average price of £536,800, going up to £184,00 in West London (W).

This level of discounting is possible if first-time buyers choose apartments, which now attract nearly 70% of first-time buyer enquiries in London.

The South West is where first-time buyers are looking for some of the largest percentage discounts off the average local house price.

This is most evident in the areas that saw the largest value boosts during the pandemic. The typical discount being sought by a first-time buyer in Truro (TR), Cornwall and Dorchester (DO) in Dorset is 39%, the UK's largest discount for first-time buyers.

On the other hand, buyers in the East of England and Scotland are looking for homes that are closest to the regional average, with up to a 6% gap between market price and what first-time buyers are willing to pay.

In areas such as Glasgow, Motherwell and Paisley, first-time buyers are even looking for homes priced slightly above the average market price.

First-time buyers aren’t changing what they want from a home

Looking for a smaller home, to upsize further down the line, is one of the tactics that first-time buyers can use to get on the ladder in this higher mortgage rates environment.

Today’s first-time home buyer prefers 3-bed houses, attracting close to half of FTB enquiries in 2023. This shows us that first-time buyers are taking a long-term view.

Terraced homes are one of the most affordable options for those looking to buy a family-sized home. And this is what first-time buyers are turning to in both expensive and cheaper markets.

In 2023, terraced homes were the most sought-after property type among those looking to buy for the first time in southern England.

This mirrors historical trends, despite the serious hit to the buying power that was amplified by higher prices in this part of the UK.

However, in 2023, first-time buyers in southern regions were looking to spend £3,400 less (-1.2%) on average on a terraced house compared to late 2022.

This tells us that first-time buyers may not be changing their preferences, but are definitely trying to make the most of cooling market conditions.

Terraced homes are also the most popular choice among first-time buyers in the North East, North West, Wales and Yorkshire and the Humber, where 4 in 10 first-time buyer enquiries relate to this property type.

The average price of terraced homes attracting first-time buyer interest in these areas has also cooled down. Yorkshire and the Humber is an exception, where prices increased 4.3% in 2023.

In the Midlands, classic 3-bed semi-detached homes are the most popular choice for first-time buyers. Here, the price of semis that first-time buyers are interested in remain in line with the later part of 2022.

In contrast, FTBs in London and Scotland prefer flats, which are both very common and historically popular amongst those looking to step on the property ladder in these areas.

Little appetite to relocate to boost buying chances

In the face of higher borrowing costs, first-time buyers have an option to move further afield to access more affordable markets.

But in reality today, fewer buyers are deciding to make a big move, compared to previous years.

Only 27% of first-time buyers are looking for their first home 10 miles or more from where they’re currently living, down from 29% a year ago.

This decrease goes hand-in-hand with an increase in the stock of homes for sale: more homes on the market means FTBs don’t have to look so far to find the home they want and need.

Over half (55%) of first-time buyers enquire about homes within a 5-mile radius from where they are based, which is a bigger proportion than other buyer groups (48%).

Having said that, FTBs in the less affordable markets of southern England are more likely to look for a home more than 10 miles away.

41% of enquiries in the East of England, 34% in the South East and 31% in London fall into this category. In northern England and Midlands, only half this number of first-time buyers look beyond 10 miles.

This highlights how affordability challenges in the South are a bigger trigger for first-time buyers to look further afield than in the North.

Why aren’t first-time buyers changing their requirements?

The average age of a first-time buyer in the UK today is currently 33, which means many will be buying with family needs in mind.

Nearly twice as many first-time buyers now have dependent children, compared to during the pre-2007 financial crisis period.

This, as well as more modest equity and wage growth than a few decades ago, is encouraging first-time buyers to look for more long-term homes, rather than traditional starter homes or flats.

This means that 3-bed houses attract nearly half (48%) of first-time buyer enquiries outside London in 2023. This is down from a 52% peak in 2021, but signals that first-time buyer needs remain the same as during pandemic.

What can first-time buyers expect in 2024?

We have seen some positive signals from mortgage markets last month, with lenders offering more deals to attract first-time buyers. This will lead to a small increase in buying power, which was a problem for many first-time buyers in 2023.

Meanwhile, earnings growth, alongside falls in house prices, is improving affordability. This, combined with lower borrowing costs, should encourage more first-time buyers to come to market in 2024, particularly in the second half of the year

Key takeaways

- Most first-time buyers are now looking at properties costing an average of £244,100, that’s £2,800 higher than a year ago

- However across the UK, the average first-time buyer price is 8% below that of the UK average sold price, a saving of £20,300

- The monthly mortgage payment for a first-time buyer purchasing an average-priced home of £244,100 is now £990. That’s over £200 more than a year ago

- 3-bed houses remain the top property choice on Zoopla for first-time buyers

- Recent falls in mortgage rates will support first-time buyers looking to buy in 2024

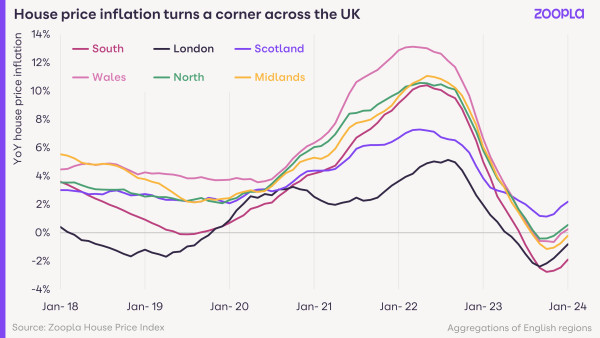

More homes come to market as house prices hold steady

Buyers have a lot more choice when it comes to securing a home in 2024. More sellers are coming to market as mortgage rates are expected to plateau at 4% to 5%.

The number of homes available for sale is up 20% on this time last year, meaning much more choice for home hunters.

Meanwhile, house price reductions are lower than a year ago but remain above average, as house price falls continue to slow.

Annual house price inflation is currently at -0.5% year-on-year, up from the recent low of -1.4% recorded in October 2023.

Where can buyers find the biggest price reductions right now?

The biggest cuts to house prices (5% or more) are currently underway in the UK’s more expensive regions: the South East and East of England.

Five English regions are registering annual price falls of up to -2.1%, led by the East.

However, house prices have moved into positive territory in the remaining 4 regions of England, alongside Wales, Scotland and Northern Ireland - where prices have risen 4.3% in the last year.

Will mortgage rates come down in 2024?

Mortgage rates have fallen back to where they were a year ago, but they remain above 4% and are likely to plateau at this point for the foreseeable.

Our Executive Director of Research, Richard Donnell, says: ‘Mortgage rates could move a little lower over the year, but this hinges on the timing of future base rate cuts, which may come later in the year.’

Falling mortgage rates are important when it comes to boosting housing market activity, but lenders have recently been pulling mortgage deals below 4%.

‘The cost of finance used to fund mortgages has increased modestly in recent weeks,’ says Donnell. ‘Rising incomes are helping to offset the impact of higher borrowing costs, but at a slow pace.

‘Buyers should anticipate 4-5% mortgage rates over much of 2024.’

A three-speed housing market

Across the UK over the last 18 months, there has been a rapid slowdown of house price inflation, largely due to higher mortgage rates and cost of living pressures.

These factors have mainly hit prices in the more expensive areas of the UK, such as London and the South, while areas with more affordable housing, such as the North, have been less impacted.

The housing market has now become divided into three groups:

1) Southern England is registering the largest price falls

The East, South East and South West regions have been hit hardest by rising mortgage rates and reduced household buying power. Largely because the average home price here is £344,000, which is 30% above the UK average.

2) London is seeing the lowest price inflation

‘While it is the most expensive housing market with an average price of £534,000, London is a market that has registered much lower levels of house price inflation over the last seven years,’ says Donnell.

‘Affordability has been improving slowly over this time, opening the market up to more potential buyers than before.’

London is now in hot demand as a location, yet fewer sellers are coming to market in the capital (+7% year on year), compared to the rest of the UK (+21% year on year).

This means demand is outstripping supply, so house prices are holding steady in the capital, rather than falling as they are in the rest of Southern England.

3) The rest of the UK is seeing firmer pricing

‘Over the last 12 months, annual price falls have been very limited across the rest of the UK, where house prices are at or below the UK average,’ says Donnell, ‘because the impact on buying power from higher mortgage rates has been less pronounced.’

In fact, Scottish house prices have been rising in the last 12 months, while Northern England, the West Midlands and Wales are registering firmer pricing because they are more affordable. Consequently more sales are being agreed here.

Will the Budget have anything in store for buyers?

‘We don’t expect the Budget to have any specific measures that will boost market activity in the very short term,’ says Donnell.

‘There is a case to make permanent stamp duty changes for first-time buyers from the 2022 autumn budget.

‘But any longer-term measures such as the Mortgage Guarantee Scheme or small deposit mortgages will take longer to impact market activity, with much depending on the scale of the proposals.’

Key takeaways

- 20% more homes available for sale as sellers return to market

- House prices not expected to rise quickly in 2024

- 15% more sales are being agreed, boosted by falling mortgage rates, which are now plateauing

- There is a 3-tier housing market split between southern England, London and the rest of the UK

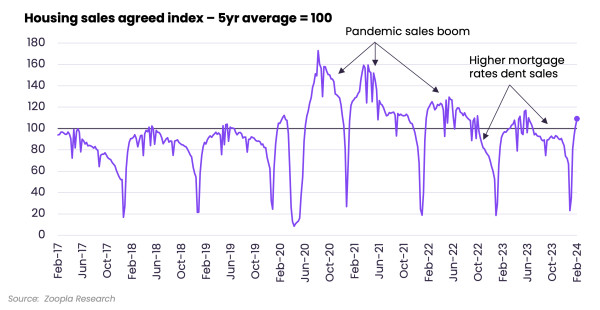

Sales agreed up 15% as buyers return to market

Buyers are back in market and demand is now 11% up on this time last year. This is good news for sellers, as the number of sales agreed climbs 15%.

Sales market activity continues to improve

Pent up demand is returning to the housing market as mortgage rates return to 4-5%, which is good news for sellers.

More buyers are looking to secure homes, with demand up 11% compared to this time last year.

But even more importantly, the number of sales agreed is also up 15% compared to early 2023.

This shows both greater buyer confidence and more realism on pricing by sellers.

North East and London lead the way in sales

In the North East, the number of homes going under offer is up +17% on this time last year, while in London 16% more homes have sales agreed.

Across the UK as a whole, more properties are now coming to market, with 21% more sellers putting up their For Sale signs than this time last year.

This, in turn, is increasing the choice of homes available for buyers and supporting sales for sellers.

Our Executive Director of Research, Richard Donnell, says: ‘The housing market has proved very resilient to higher mortgage rates and cost of living pressures.

‘More sales and more sellers shows growing confidence among households and evidence that 4-5% mortgage rates are not a barrier to improving market conditions.’

Are sellers still reducing their prices?

‘While increased activity levels are welcome news, it’s important to note that a small proportion of sellers continue to reduce asking prices to attract buyer interest,’ says Donnell.

However, sellers will be pleased to learn that fewer price reductions are now taking place, compared with this time last year.

Reductions are still above average right now, as higher mortgage rates continue to make buyers price sensitive, but discounts of 5% or more are mainly taking place in the South East and East of England.

What will happen to house prices in 2024?

‘There is clear demand from homeowners and first-time buyers looking to move and buy their first home in 2024,’ says Donnell.

‘This is going to support higher sales volumes, but we don’t expect higher house price growth.

‘The reality is that the housing market is still adjusting to higher mortgage rates and the impact of reduced buying power, which has varied across the country.’

This means that sellers will need to remain realistic on pricing, but the fact that their home is likely to attract more interest is good news, as it increases the chances of agreeing a sale.

‘The average estate agent is agreeing 6 new sales a month, up from 5.2 a year ago, which proves that house prices don’t need to fall to support sales,’ says Donnell.

This is feeding through into our UK house price index, which continues to record a slowdown in the rate of price falls.

Annual house price inflation is currently -0.5%, up from the recent low of -1.4% recorded in October 2023. And house prices are now 1.5% below their peak of £268,000 in October 2022.

What’s going to happen to mortgage rates in 2024?

Mortgage rates have fallen back to where they were a year ago, but they remain above 4% and are likely to plateau at this point for the foreseeable.

‘Mortgage rates could move a little lower over the year, but this hinges on the timing of future base rate cuts, which may come later in the year,’ says Donnell.

Falling mortgage rates are important when it comes to boosting housing market activity, but lenders have recently been pulling mortgage deals below 4%.

‘The cost of finance used to fund mortgages has increased modestly in recent weeks,’ says Donnell. ‘Rising incomes are helping to offset the impact of higher borrowing cost, but at a slow pace.

‘Buyers should anticipate 4-5% mortgage rates over much of 2024. But our consistently held view is that 5% mortgage rates are the tipping point for annual house price falls.

‘Mortgage rates over 6% for a sustained period would lead to larger double-digit price falls. Mortgage rates in the 4-5% range are consistent with flat to low single digit price rises.’

Will the Budget have anything in store for sellers?

‘We don’t expect the Budget to have any specific measures that will boost market activity in the very short term,’ says Donnell.

‘There is a case to make permanent stamp duty changes for first-time buyers from the 2022 autumn budget.

‘But any longer-term measures such as the Mortgage Guarantee Scheme or small deposit mortgages will take longer to impact market activity, with much depending on the scale of the proposals.’

Key takeaways

- Demand rises 11% and sales agreed are 15% higher than a year ago

- Sellers make a return with 20% more homes for sale than this time last year

- Activity is being boosted by falling mortgage rates, which are now plateauing

- We expect to see more sales in 2024, rather than faster price growth

Things to do in London March 2024 edition

Our guide to the best events, festivals, workshops, exhibitions and things to do throughout March 2024 in London

Say hello to March. Finally, the days are getting lighter and spring is here brightening up London with colourful flowers and plenty of opportunities for sunny park walks. The month also packs in a whole host of big events from St Paddy’s to Mother’s Day.

This means it’s time to finally come out of winter hibernation and set about exploring the city’s fantastic parks and gardens, world-class museums and galleries, and unbeatable restaurant offerings. Watch Oxford and Cambridge take each other on in the historic Boat Race; settle down and watch great LGBTQ+ cinema at BFI Flare and the UK’s biggest queer film event.

1. BFI Flare Film Festival 2024

The UK’s largest queer film event, BFI Flare returns to the BFI Southbank (and to the BFI Player online) over ten days this March to showcase the best new LGBTQ+ cinema from around the world. Watch this space for full details of this year’s programme.

2. St Patrick’s Day Parade and Festival

The Irish are experts when it comes to partying. They’re so good, in fact, they even have a special untranslatable term – the craic – to describe their unique brand of conviviality. With Trafalgar Square as the setting for London’s official bash in celebration of their patron saint, a blast is pretty much guaranteed. This year, the London extravaganza takes place on Sunday March 17 and is set to see more than 50,000 turning out for Irish food, dancing and a huge parade featuring pageantry, floats and music that will wend its way from Hyde Park Corner along Piccadilly, St James’s Street, Pall Mall, Cockspur Street and Whitehall.

3. Enzo Mari at the Design Museum

Italian artist and furniture designer Enzo Mari’s simple but ingenious creations have inspired generations of creative types. This retrospective at the Design Museum is a comprehensive showcase of his resonant and timeless projects. Debuting at the Triennale Milano in 2020, just days after the designer’s death, the exhibition spans his 60-year career, bringing together furniture, product design, children's books and conceptual installations curated by influential art critic and Serpentine Galleries art director Hans-Ulrich Obrist, with Francesca Giacomelli.

4. Zheng Bo: ‘Bamboo as Method’

Fancy eating your sad office sarnies in a cacoon of bamboo? Somerset House is turning its bombastic neoclassical courtyard into a garden full of the panda food which you can frolic about in for free to enjoy a quick picnic, a moment of calm in your busy work day, or an inevitable photo-op. The immersive installation is a new large-scale commission from Hong-Kong based artist Zheng Bo that ‘invites visitors to temporarily disconnect from their fast-paced, hyper-connected everyday lives by immersing themselves in the biosphere’.

5. The Boat Race

The famous and historic London rowing contest between the UK’s oldest two universities returns for its 169th edition on Saturday March 30, when crews from Oxford and Cambridge go head-to-head in eight-oared rowing boats across the Thames.

Beginning in 1829 for chaps and 1927 for ladies, the annual fixture now attracts around 250,000 spectators to south-west London every year. The four-and-a-quarter mile course runs along the Thames from Putney Bridge to Mortlake and takes around 16 to 18 minutes (Cambridge’s men hold the course record of 16 minutes 19 seconds, set in 1998).

Spectators can watch the BBC’s coverage of the race large screens at two riverside Fan Zones in Hammersmith and Fulham, where they’ll also find covered seating, street food vendors, bars and toilet facilities.

6. British Science Week at the Royal Observatory

With 2024’s theme of ‘time’, this year’s British Science Week is promising a fascinating roster of workshops, events and behind-the-scenes adventures suitable for a range of ages. What better place to get stuck in than the home of Greenwich Mean Time, anyway? There’ll be an evening on ‘Astrophotography’ on International Women’s Day, showcasing the dazzling work of women in the industry. Astronomy & Islam, a planetarium show on how Arab navigators used stars to found thier way around the earth, will take place March 9. For more information on the brilliant events happening throughout March, have a look at the Observatory’s website.

7. Horniman Spring Fair

The Horniman Museum and Gardens’ Spring Fair is maybe the most efficient way to cram as much Easter fun into a single day as possible. The gardens will be taken over by a ridiculously busy programme, with everything from a Spring Time Disco (11.30 am - 1.30 pm) to an Easter Bonnet Parade (1 pm). But there’s plenty more: think circus skills, singalongs, fete games and seed planting, all fuelled by some cracking cuisine from the roster of food stalls. Maame T’s African inspired food, Lapecoraso Churros and Picks Organic Farm are just some of the kitchens that’ll be rustling up food – you better grab your ticket!

8. Kricket’s Fried Chicken Challenge

Got a thing for finger lickin’ chicken? Some of London’s best spots in the fried thigh biz are going head to head to battle it out for the title of the best fried chicken in the city. Hosted by top notch Indian restaurant Kircket Brixton, chefs from the likes of Coqfighter, Smoking Goat, Thunderbird Fried Chicken, Chicken Shop, Kanada-Ya, Studio Kitchen, Soho Hotel, Daffodil Mulligan, Tonkotsu and Black Bear will be trying their luck with judges including Top Jaw’s Jesse Burgess, Professor Green and Zena Kamgaing deciding who cooks up the best dish. Will Rogers, of sister bar Soma, will be on hosting duties, while guests will be able to chomp on an abundance of Keralan Fried Chicken and drink two complimentary beers courtesy of Harbour Brewing Company for the price of the £20 ticket.

Home buyers and sellers are back in market

Demand for homes up 11% as buyers and sellers return to market in growing numbers, boosting sales. Our Executive Director of Research, Richard Donnell, has the latest.

Buyer demand now 11% higher than last year

The first weeks of January got off to a strong start with activity spurred on by falling mortgage rates and pent-up demand from the second half of 2023.

Our latest data shows this momentum has been carried into the first half of February.

At a headline level, buyer demand is running 11% higher than this time last year. Buyer numbers are up across all parts of the UK but London is firmly out in front, followed by the North East and North West regions.

London’s housing market has lagged behind the rest of the UK for seven years since 2016 with low levels of house price growth due to stretched housing affordability.

The average value of a flat is just 13% higher than in 2016, compared to the UK average house price being 33% higher and up to 50% higher in Wales.

Better value for money is improving the prospects for London but it remains an expensive housing market.

A healthier market with more sales agreed

One of the best ways to assess the overall health of the housing market is to look at the trends in the number of sales being agreed.

If buyers and sellers are agreeing more sales then that shows a healthier market, with people able to fulfil their home moving ambitions.

The fact we have almost a fifth more homes for sale than a year ago is helping, providing buyers with more choice and boosting the chances of sales being agreed.

Our latest data shows sales agreed are up across all regions and countries of the UK and more than 10% higher in six regions led by London, the South East and Yorkshire and Humber.

Increasing demand and sales bring more sellers into the market

Improving market confidence is bringing more sellers into the market. We have seen an increase in the number of new homes being listed for sale.

The flow of new homes for sale is 10% higher than a year ago and the highest it’s been since 2020. New sellers are listing their homes at the fastest pace in the East of England, the South West and North East.

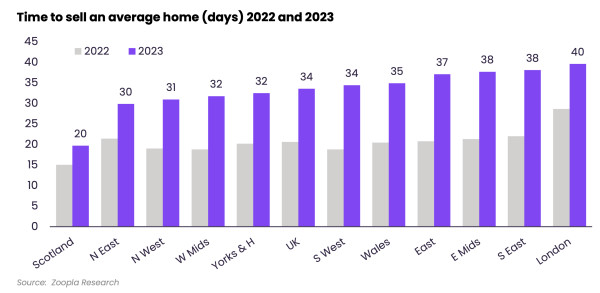

33 days to agree the sale of a home

In 2023 the average sale took 34 days - from the property first being launched to the market to a sale being agreed, subject to contract.

This is 2 weeks longer than the hotter pandemic fuelled market of 2022 - when homes went under offer in 20 days.

Pitching the asking price at the right level is key to attracting demand and getting a sale agreed. This can be harder for unique or unusual homes. Sellers need to speak to local agents to understand the market and the demand for their type of home.

The longest sales periods in 2023 were up to 40 days in London and the South East with the fastest sales periods in Scotland (20 days) and the North East (30 days).

This difference primarily reflects housing affordability and the impact of higher mortgage rates on buying power in markets with high house prices. It’s why falling mortgage rates are boosting activity more in southern England, especially London.

It’s important to note that once a sales has been agreed, it can take another 3-6 months for the legal and mortgage process to get to an exchange of contracts - and then legal completion, when you can get the keys to your new home.

A need for realism on pricing remains

We expect rising activity to continue over the coming months. The market is better balanced between sellers and buyers than it has been for 3 years.

Despite reports that house prices are rising once again, it’s important sellers keep their feet on the ground.

The positive news is that finding a buyer is going to be easier for most sellers but more choice of homes for sale will mean greater room for negotiation.

Key takeaways

- Buyers and sellers are returning to the housing market in growing numbers, boosting sales across the UK

- London is leading the way in terms of buyer demand, followed by the North East and North West regions

- Meanwhile, the flow of new homes for sale is 10% higher than a year ago and the highest it’s been since 2020

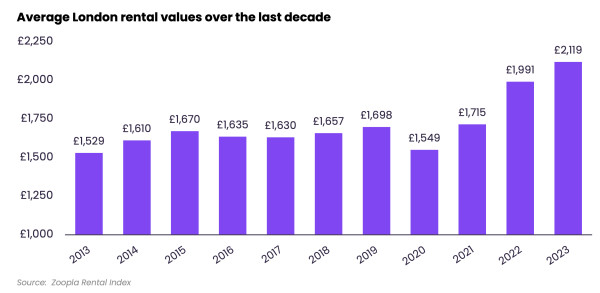

Average rent in London: February 2024

The average rent in London is now £2,119 per month after +6.4% growth in the last year. The cheapest average rent is in Bexley (£1,520) and the highest average rent is in Kensington and Chelsea (£3,460) although rental increases are slowing in the most expensive parts of the city.

London is by far the most expensive place to rent a home in the UK with an average rent of £2,119 for new lets. Average rents in London are almost double the UK average of £1,220.

However, rental inflation in London has slowed in the last 12 months, now at +6.4% versus +16.1% a year ago. This is currently lower than UK-wide growth of +8.3% over the last year.

Average rental prices in London

| Average monthly rent in London (December 2023) | Average monthly rent in London (December 2022) | % change in the last 12 months | £ change in the last 12 months |

|---|---|---|---|

| £2,119 | £1,989 | +6.4% | £130 |

Zoopla Rental Index. Data to December 2023, published February 2024

Average rent by local authority in London

The table sets out the average rent for every local authority in London, starting with the cheapest. It also shows how much rents for new lets have increased in the last 12 months in each location.

| London borough | Average monthly rent (December 2023) | % change in the last 12 months | £ change in the last 12 months |

|---|---|---|---|

| Bexley | £1,520 | +11.7% | +£160 |

| Croydon | £1,540 | +9.2% | +£130 |

| Sutton | £1,544 | +11.9% | +£160 |

| Havering | £1,583 | +13.6% | +£190 |

| Bromley | £1,609 | +9.6% | +£140 |

| Enfield | £1,649 | +11.3% | +£170 |

| Hillingdon | £1,656 | +11.9% | +£180 |

| Barking and Dagenham | £1,657 | +13.3% | +£190 |

| Redbridge | £1,720 | +13.0% | +£200 |

| Lewisham | £1,740 | +8.4% | +£130 |

| Harrow | £1,774 | +10.3% | +£170 |

| Waltham Forest | £1,782 | +11.4% | +£180 |

| Kingston upon Thames | £1,801 | +10.1% | +£160 |

| Hounslow | £1,844 | +9.2% | +£160 |

| Greenwich | £1,865 | +9.1% | +£160 |

| Barnet | £1,890 | +9.3% | +£160 |

| Haringey | £1,917 | +9.9% | +£170 |

| Brent | £1,949 | +7.4% | +£130 |

| Ealing | £1,956 | +9.0% | +£160 |

| Merton | £1,976 | +7.7% | +£140 |

| Newham | £1,983 | +7.2% | +£130 |

| Richmond upon Thames | £2,095 | +7.2% | +£140 |

| Lambeth | £2,181 | +5.2% | +£110 |

| Southwark | £2,217 | +5.7% | +£120 |

| Hackney | £2,330 | +6.1% | +£130 |

| Tower Hamlets | £2,331 | +5.% | +£110 |

| Islington | £2,380 | +6.4% | +£140 |

| Wandsworth | £2,383 | +6.7% | +£150 |

| Hammersmith and Fulham | £2,616 | +7.3% | +£180 |

| City of London | £2,629 | +3.4% | +£90 |

| Camden | £2,669 | +6.2% | +£160 |

| City of Westminster | £3,153 | +4.8% | +£140 |

| Kensington and Chelsea | £3,460 | +5.1% | +£170 |

Zoopla Rental Index. Data to December 2023, published 2024

Rental growth has slowed the most in Inner London boroughs, which are also commonly the most expensive with average rents sitting well above £2,000 per month. For example, we were seeing rent rises of up to +20.9% in Tower Hamlets a year ago where the average rent is £2,331, but these increases have now steadied to +5.0%.

However, the experience of renters in Outer London is a different story, with double-digit rental inflation in many areas. Rents have risen by more than +13% in the last year in more affordable eastern boroughs of Havering, Redbridge and Barking and Dagenham.

These reductions suggest landlords are becoming more realistic in pricing their rentals and may be taking cost-of-living struggles into consideration when setting new rates, which tend to be exacerbated for those in the rental market.

What’s next for the London rental market in 2024?

We expect the growth of London rents to slow to around +2% on average in 2024.

It’ll be a reprieve for London renters as they already face the highest rents and lowest affordability of anywhere in the country. The average renting household in London (1.25 people) already spends 40.4% of their earnings on rent compared to a UK average of 28.4%.

Demand from London renters will continue to drop as many cannot afford further rent rises amidst other affordability pressures.

London renters will continue to look for lower rental prices in the outer boroughs and nearby commuter towns, which will keep average rents rising in these places.

Key takeaways

- London’s average rent is currently £2,119 after +6.4% growth in the last year

- This annual increase is lower than the UK as a whole as London rents have started to reach an affordability ceiling

- The borough of Bexley has the cheapest average rent in London at £1,520 but rents are still rising quickly in these comparatively cheap spots on the outskirts

- Rents are much higher in Inner London boroughs like Kensington and Chelsea, the City of Westminster and Camden but annual increases are lower at around +5%

Average rent in the UK: February 2024

The average rent in the UK is now £1,220 per month after 8.3% growth in the last year. The highest average rent in the UK is in London (£2,119) while the North East has the lowest monthly rent (£695).

The average UK rent for new lets has now reached £1,220, an +8.3% rise in the average UK rent over the last year.

This equates to UK renters paying an extra £1,100 per year (or £90 per month) compared to a year ago.

However, this rate of inflation is lower than we’ve seen at any time during the last two years. In 2023 alone, rental growth dropped from +11.4% to +8.2%.

Average rental prices in the UK: last 3 months

| December 2023 | November 2023 | October 2023 | |

|---|---|---|---|

| Average monthly rent in the UK | £1,220 | £1,200 | £1,166 |

data to December 2023, published in February 2024

Average rent by region

Average rents vary across the country, from a high of £2,119 per month in London to £695 per month in the North East.

Rent growth has now slowed in all regions except the North East. Average rents for new lets in the region increased by +9.3% in the last year, compared to +8.1% the year before.

The table shows current average rents for new lets across UK regions and how much they have changed in the last year.

| Region | Average monthly rent | Change on a year ago (%) | Change on a year ago (£) |

|---|---|---|---|

| London | £2,119 | +6.4% | +£130 |

| South East | £1,325 | +9.3% | +£110 |

| East of England | £1,162 | +9.3% | +£100 |

| South West | £1,076 | +8.1% | +£80 |

| West Midlands | £905 | +8.7% | +£70 |

| Wales | £880 | +9.4% | +£80 |

| East Midlands | £860 | +9.2% | +£70 |

| North West | £847 | +10.2% | +£80 |

| Yorkshire and the Humber | £799 | +7.7% | +£60 |

| Scotland | £791 | +11.6% | +£80 |

| Northern Ireland | £733 | +3.7% | +£30 |

| North East | £695 | +9.3% | +£60 |

December 2023, published in February 2024

Rental inflation in Scotland boosted by rent controls

In September 2022, the Scottish Parliament introduced a rent cap of 3% on annual rises to existing tenancies.

While intended to reduce cost-of-living pressures for renters, it means landlords are now going higher at the start of a tenancy to cover their costs and the limited increases during the contract.

This leads to Scotland having the highest level of annual rental inflation in the UK at +11.1%. The average monthly rent in Scotland stands at £790, £82 more than a year ago.

However, this is already a slower rate of growth than the highs of +13.7% back in February 2023, but we still expect Scotland to see faster rental growth than anywhere else in the UK in 2024.

Fast-increasing rents in Glasgow (+11.4%) and Edinburgh (+12.5%) are encouraging renters to look into neighbouring areas, leading to large rent increases beyond main cities. Average rents in three local authorities adjacent to Glasgow and Edinburgh breached the £1,000 mark in 2023 (East Dunbartonshire, East Renfrewshire and East Lothian).

Rental inflation is much less dramatic in rural parts of Scotland, with Aberdeenshire, Moray and the Highlands all recording growth below +6%.

Rental inflation slows down in inner London

Rental inflation has slowed down in London and some southern cities in the last 12 months, giving some relief to renters in the expensive South of England.

The largest moderation is in London, where rental inflation has dropped from +16.1% a year ago to +6.4% today.

Rental growth has slowed the most in Inner London boroughs. A year ago, we were seeing rises of up to +20.9% in Tower Hamlets, which has now dropped to +5%.

However, the experience of renters in outer London will be different, as there is still double-digit rental inflation in many areas. Rents have risen by more than +13% in more affordable eastern boroughs of Havering, Redbridge and Barking and Dagenham.

These reductions suggest landlords are becoming more realistic in pricing their rentals and may be taking cost-of-living struggles into consideration when setting new rates, which tend to be exacerbated for those in the rental market.

What factors influence rental prices?

One of the most important factors that influences rental prices is the level of demand from renters versus supply of rental properties.

A chronic mismatch between supply and demand has been the defining feature of the UK rental market for three years. It’s the main reason rental inflation has been so sharp during that time.

Rental growth is also impacted by earnings growth - a strong jobs market and subsequent wage rises keeps demand high and means tenants can weather rent increases.

In the last year, higher mortgage rates have also impacted rents as they’ve prevented more would-be first-time buyers from owning a home and boosted demand for rental homes.

What are renters doing to minimise the impact of higher rents?

Some renters have escaped the steepest rises by staying in their existing homes.

Year-on-year rises for established tenancies rose at the slower rate of 6.2% according to the Index of Rental Prices from the Office for National Statistics.

When renters move and are faced with higher rents and a limited supply of homes on the market, they're more commonly considering renting smaller homes, moving to cheaper areas or house-sharing to reduce costs.

House-sharing reduces the cost of housing per person but it comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We believe that the rental market is now past peak rental growth after starting to cool in the final months of 2023.

We expect a further slowdown in rental growth in 2024 as worsening affordability keeps demand in check and supply improves slowly. There are already signs asking rents have overshot in some of the most expensive markets that are showing resistance to higher rents.

Slower increases will be welcome news to renters who have often faced steep hikes in the last two years.

Key takeaways

- The average UK rent has risen 8.3% on average in the last year, adding £1,100 to the average annual bill

- UK renters are now paying £1,220 per month on average, ranging from £695 in the North East to £2,119 in London

- Rental growth slowing to single digits is a sign we're past peak growth after nearly two years of 10%+ increases

- Scotland continues to register the highest rental growth for new lets despite rent controls

- London is seeing growth slow the most as rents hit an affordability ceiling

- We expect a further slowdown in rental growth in 2024 as worsening affordability keeps demand in check