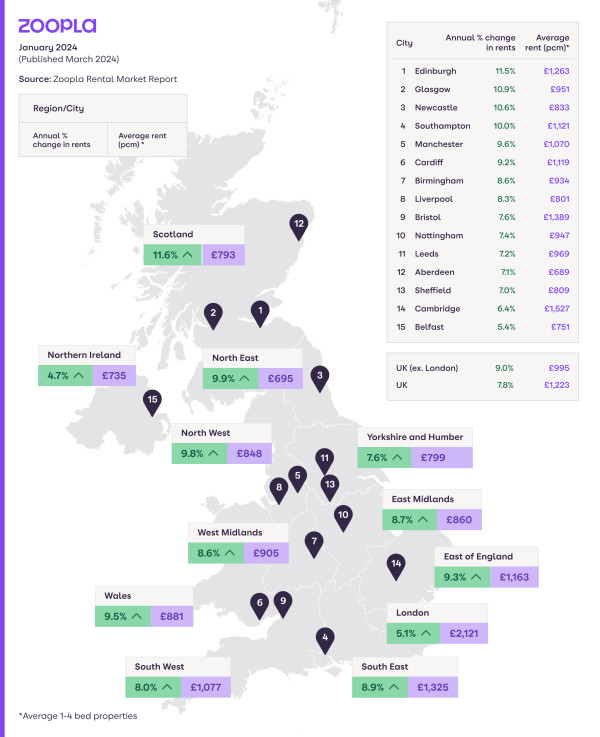

The average UK rent is now £1,223 after a +7.8% rise in the last year. Rents for new lets will rise more slowly this year, but only a major supply boost will help with rental affordability.

The average rent for new lets in the UK is £1,223 as of January 2024 (published in March 2024).

Rents have risen +7.8% in the last year, the slowest rate of growth in two years.

Key figures

|

January 2024 |

December 2024 |

November 2023 |

|

|

Average rent (new lets only) |

£1,223 |

£1,219 |

£1,213 |

|

Annual rental growth |

+7.8% |

+8.2% |

+8.7% |

UK rental inflation lowest for 2 years

The heat is finally coming out of UK rent rises. Annual growth is now at the lowest rate for two years, down to +7.8% from +11% a year ago.

This is down to weakening demand and growing affordability pressures on renters, rather than a big boost in rental supply.

No major expansion in rental supply

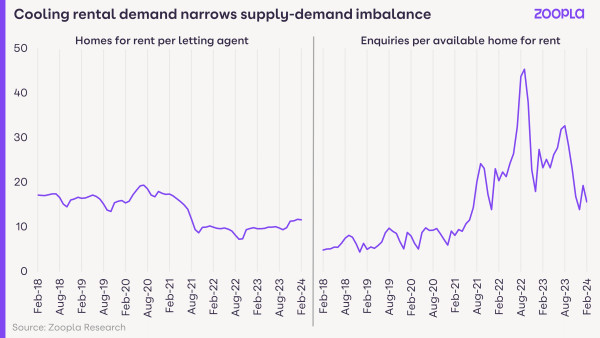

New investment from private landlords remains low, with the average letting agent currently listing 12 homes for rent. This is a fifth higher than last year but 28% below the pre-pandemic average (16 homes).

Demand cools but still outweighs supply

Demand for rented homes has fallen by a fifth over the last year. One-off pandemic factors have receded, the labour market has cooled and settling mortgage rates have supported first-time buyers.

However, there are more than 15 enquiries for every home to rent. This is double the rate of before the pandemic, despite dropping from over 40 enquiries per property in 2021.

The supply and demand imbalance is narrowing but is far from closed. I expect rents to continue to rise in 2024, just at a slowing rate.

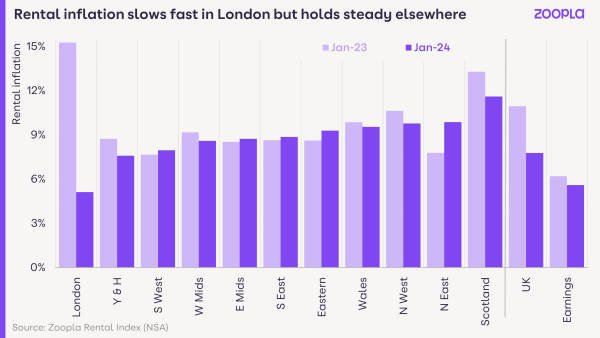

Rental inflation in line with a year ago across most of UK

Across most of the country, rental growth is broadly in line with a year ago despite weaker demand.

Rental inflation is starting to slow across all major cities, with London seeing the biggest slowdown.

Rents continue to rise the fastest in Scotland (+11.6%). In fact, it’s the only UK region or country with double-digit rental growth, although it’s seen a slight slowdown compared to a year ago.

Rental growth slows the most in London

London has recorded a sharp slowdown in annual rental inflation, with rents now rising at a rate of +5.1% compared to +15.3% a year ago.

The balance between supply and demand has narrowed the most in London, with demand -30% lower than a year ago while available supply has increased by the same amount.

This is down to London’s high rents combining with other cost-of-living pressures to hit the pockets of renters, making rising rents ever-less affordable.

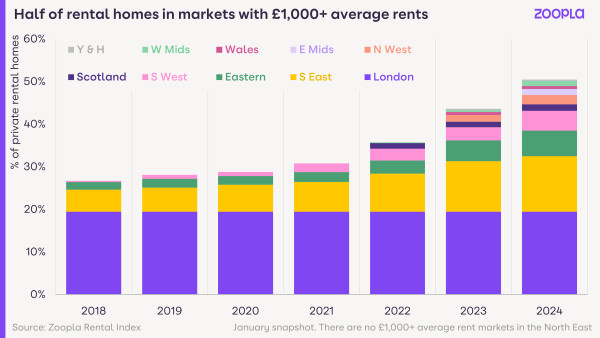

Pandemic price growth pushes half of rented homes into £1,000+ per month markets

Rents are 29% higher than pre-pandemic on average

The pandemic years have driven a step-change in rental growth, with the average UK rent jumping 29% since January 2020.

This has pushed many more properties into higher price brackets. Over half of rented homes in the UK (51%) are now in markets with average rents of more than £1,000 per month. This is almost double the number of rental homes in these pricey markets compared to five years ago.

More high-rent areas across Southern England

Rents in southern England have been close to, or above, £1,000 per calendar month for some time. The fast pandemic-fuelled rental growth has pushed many more over this threshold.

Nearly all private rental homes in the South East are now in areas with average rents higher than £1,000 per month compared to less than half in 2020.

In the East of England, it’s 70% today compared to only 24% in 2020. Over half of rented homes in the South West have also breached the £1,000 per month mark.

Rise in £1,000+ rents in affordable regions

A fifth of rented homes in Scotland, the North West, East Midlands and West Midlands are now in areas with average rents above £1,000 per month.

Just 3 years ago, nowhere outside of the South of England had an average rent higher than £1,000.

The North East remains the only region with no £1,000+ rental markets, while 4% of areas in Yorkshire and the Humber are over this price threshold.

Build-to-rent creates new city centre rental markets

There are now more of these £1,000 per month markets in regional markets, as new city centre rental markets emerge at the same time.

The rise of corporate and institutional investment in rented homes has led to the delivery of more than 90,000 new built-to-rent homes across the UK in recent years – with more to come. House builders are also starting to sell new-build homes to corporate landlords.

Rents to remain ‘unaffordable’ in 2024

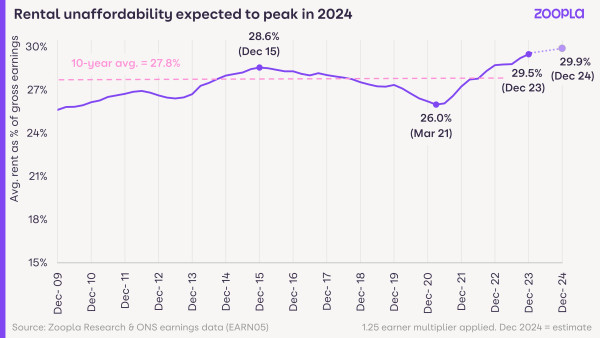

We measure ‘rental affordability’ by looking at average rent as a percentage of average gross earnings, adjusted to reflect the estimated total income of renting households.

At the end of 2023, this measure of rental affordability reached a high of 29.5%. It came after rents for new lets rose faster than average earnings for more than 2 years (since October 2021).

Rental affordability improved between 2016 and 2021 as rents rose by only 4% in that time. This was a result of weaker demand post-Brexit, growth in rental supply, and easier access to home ownership thanks to low mortgage rates.

In contrast, recent years have been marked by strong demand, no increase in supply and high mortgage rates making it harder for first-time buyers to access home ownership.

This widened the supply and demand imbalance and pushed rents for new lets up faster than earnings. Ultimately, this has led to the deterioration in rental affordability.

The graph shows how rental affordability has tracked since December 2009 to today, with our projection for the rest of this year.

It highlights the difficulties faced by renters in the current climate, even with rents no longer rising as quickly.

Rent predictions for 2024: Rental supply must grow to improve rental affordability

We project that UK rental inflation will halve to +5% in 2024. Meanwhile, the consensus among economic forecasters is that average earnings growth will also slow, to just below +4%.

This means no immediate prospect that rental affordability will improve in 2024.

There must be a sustained expansion in rental supply to see a faster slowdown in rental inflation. It would even result in rents falling in some city centres.

However, any boost in supply this year is unlikely to be at a scale that impacts overall rental growth.

Continually low levels of net-new investment in rental properties means supply will remain below average, supporting further rent rises.

The clear conclusion is that the best way to improve affordability is to boost rental supply. This will continue to come from the new-build sector, but the big needle-mover would be more investment by private landlords.

This looks unlikely – and further rationalisation of landlord portfolios in the face of higher mortgage rates, alongside growing regulation, will offset any rise in new investment in rental supply.