How are first-time buyers coping with higher mortgage rates? We take a look out how buyers are stepping onto the property ladder as borrowing gets more expensive.

First-time buyers wait in the wings and save larger deposits

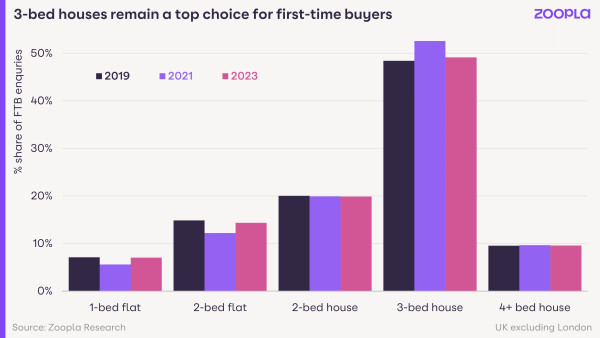

Despite higher borrowing costs, first-time buyers (FTBs) haven’t changed what they’re looking for in a home.

Three-bed houses, below the average price for their local area, remain the most popular choice.

And most buyers are looking within a five-mile radius from where they’re already based.

First-time buyers were expected to adjust what they want from their first home in the face of higher mortgage costs, but many remain resolute in the criteria they want and need from their first home.

Those who have bought have managed to secure their first homes by putting more equity into their deposits and taking advantage of it being a buyers’ market where possible.

That said, many have parked the idea of buying until their financial situation improves or mortgage rates fall.

UK Finance data show that almost 80,000 (-20%) fewer first-time buyers bought their first home in 2023 compared to 2022.

First-time buyer deposits increase alongside mortgage payments

| Q4 2022 | Q4 2023 | % change | |

|---|---|---|---|

| Average FTB price paid | £241,300 | £244,100 | 1.2% |

| Average FTB deposit | £56,000 | £59,300 | 5.9% |

| Average FTB mortgage size | £185,300 | £184,800 | -0.3% |

| Average monthly mortgage payment | £777 | £990 | 27.4% |

Zoopla

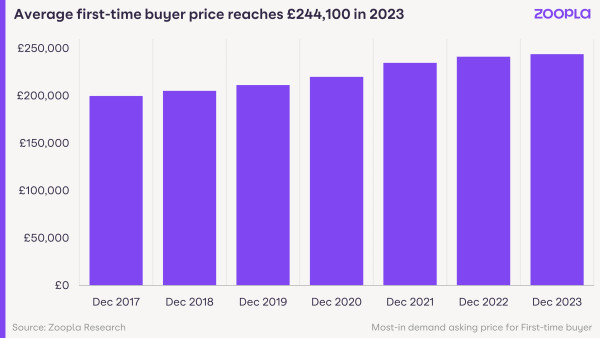

The average price of what first-time buyers are looking to buy on Zoopla increased by 1.2% over the course of 2023.

Most are now looking at properties costing an average of £244,100, that’s £2,800 higher than a year ago.

However, this small increase in first-time buyer prices does not necessarily mean paying larger mortgages.

UK Finance data shows that the average loan-to-value has declined slightly to just under 76%, meaning FTBs are using slightly larger deposits.

Based on the average price of a first-time buyer home on Zoopla, we estimate the average deposit size paid has increased by £3,300 (5.9%) over 2023.

This means that the typical first-time buyer mortgage is almost the same compared to a year ago (+£500).

Using slightly larger deposits did not, however, fully offset higher borrowing costs.

Higher mortgage rates mean that first-time buyers now need to pay mortgage bills that are 27% higher than they would be if they’d purchased their first home in the second half of 2022.

We estimate the monthly mortgage payment for a first-time buyer purchasing an average-priced home of £244,100 is now £990. That’s over £200 more than a year ago.

First-time buyers look for homes priced below market average

|

Region |

FTB house price (£) |

Price of all homes (£) |

Price difference (£) |

% discount |

|

London |

399,000 |

536,800 |

137,800 |

-26% |

|

South East |

321,400 |

386,400 |

65,000 |

-17% |

|

East of England |

316,700 |

337,700 |

21,000 |

-6% |

|

South West |

241,500 |

313,700 |

72,200 |

-23% |

|

East Midlands |

211,300 |

228,400 |

17,100 |

-7% |

|

West Midlands |

196,800 |

229,300 |

32,500 |

-14% |

|

Wales |

174,700 |

203,300 |

28,600 |

-14% |

|

North West |

164,100 |

194,800 |

30,700 |

-16% |

|

Scotland |

161,400 |

162,100 |

700 |

0% |

|

Yorkshire & the Humber |

153,800 |

185,900 |

32,100 |

-17% |

|

North East |

117,900 |

140,800 |

22,900 |

-16% |

|

UK |

244,100 |

264,400 |

20,300 |

-8% |

First-time buyers are looking for family homes at value-for-money prices.

Nationally, the average first-time buyer price is 8% below that of the UK average sold price. This translates to a saving of £20,300 on average.

First-time buyers in London, the South West and Yorkshire and the Humber are looking for the largest savings of 23% or more.

In the capital, first-time buyers typically look for homes that are £137,800 below the average price of £536,800, going up to £184,00 in West London (W).

This level of discounting is possible if first-time buyers choose apartments, which now attract nearly 70% of first-time buyer enquiries in London.

The South West is where first-time buyers are looking for some of the largest percentage discounts off the average local house price.

This is most evident in the areas that saw the largest value boosts during the pandemic. The typical discount being sought by a first-time buyer in Truro (TR), Cornwall and Dorchester (DO) in Dorset is 39%, the UK’s largest discount for first-time buyers.

On the other hand, buyers in the East of England and Scotland are looking for homes that are closest to the regional average, with up to a 6% gap between market price and what first-time buyers are willing to pay.

In areas such as Glasgow, Motherwell and Paisley, first-time buyers are even looking for homes priced slightly above the average market price.

First-time buyers aren’t changing what they want from a home

Looking for a smaller home, to upsize further down the line, is one of the tactics that first-time buyers can use to get on the ladder in this higher mortgage rates environment.

Today’s first-time home buyer prefers 3-bed houses, attracting close to half of FTB enquiries in 2023. This shows us that first-time buyers are taking a long-term view.

Terraced homes are one of the most affordable options for those looking to buy a family-sized home. And this is what first-time buyers are turning to in both expensive and cheaper markets.

In 2023, terraced homes were the most sought-after property type among those looking to buy for the first time in southern England.

This mirrors historical trends, despite the serious hit to the buying power that was amplified by higher prices in this part of the UK.

However, in 2023, first-time buyers in southern regions were looking to spend £3,400 less (-1.2%) on average on a terraced house compared to late 2022.

This tells us that first-time buyers may not be changing their preferences, but are definitely trying to make the most of cooling market conditions.

Terraced homes are also the most popular choice among first-time buyers in the North East, North West, Wales and Yorkshire and the Humber, where 4 in 10 first-time buyer enquiries relate to this property type.

The average price of terraced homes attracting first-time buyer interest in these areas has also cooled down. Yorkshire and the Humber is an exception, where prices increased 4.3% in 2023.

In the Midlands, classic 3-bed semi-detached homes are the most popular choice for first-time buyers. Here, the price of semis that first-time buyers are interested in remain in line with the later part of 2022.

In contrast, FTBs in London and Scotland prefer flats, which are both very common and historically popular amongst those looking to step on the property ladder in these areas.

Little appetite to relocate to boost buying chances

In the face of higher borrowing costs, first-time buyers have an option to move further afield to access more affordable markets.

But in reality today, fewer buyers are deciding to make a big move, compared to previous years.

Only 27% of first-time buyers are looking for their first home 10 miles or more from where they’re currently living, down from 29% a year ago.

This decrease goes hand-in-hand with an increase in the stock of homes for sale: more homes on the market means FTBs don’t have to look so far to find the home they want and need.

Over half (55%) of first-time buyers enquire about homes within a 5-mile radius from where they are based, which is a bigger proportion than other buyer groups (48%).

Having said that, FTBs in the less affordable markets of southern England are more likely to look for a home more than 10 miles away.

41% of enquiries in the East of England, 34% in the South East and 31% in London fall into this category. In northern England and Midlands, only half this number of first-time buyers look beyond 10 miles.

This highlights how affordability challenges in the South are a bigger trigger for first-time buyers to look further afield than in the North.

Why aren’t first-time buyers changing their requirements?

The average age of a first-time buyer in the UK today is currently 33, which means many will be buying with family needs in mind.

Nearly twice as many first-time buyers now have dependent children, compared to during the pre-2007 financial crisis period.

This, as well as more modest equity and wage growth than a few decades ago, is encouraging first-time buyers to look for more long-term homes, rather than traditional starter homes or flats.

This means that 3-bed houses attract nearly half (48%) of first-time buyer enquiries outside London in 2023. This is down from a 52% peak in 2021, but signals that first-time buyer needs remain the same as during pandemic.

What can first-time buyers expect in 2024?

We have seen some positive signals from mortgage markets last month, with lenders offering more deals to attract first-time buyers. This will lead to a small increase in buying power, which was a problem for many first-time buyers in 2023.

Meanwhile, earnings growth, alongside falls in house prices, is improving affordability. This, combined with lower borrowing costs, should encourage more first-time buyers to come to market in 2024, particularly in the second half of the year

Key takeaways

- Most first-time buyers are now looking at properties costing an average of £244,100, that’s £2,800 higher than a year ago

- However across the UK, the average first-time buyer price is 8% below that of the UK average sold price, a saving of £20,300

- The monthly mortgage payment for a first-time buyer purchasing an average-priced home of £244,100 is now £990. That’s over £200 more than a year ago

- 3-bed houses remain the top property choice on Zoopla for first-time buyers

- Recent falls in mortgage rates will support first-time buyers looking to buy in 2024