People aged 35-44 three times more likely to rent than 20 years ago

Home-ownership rates are falling among all age groups except those aged over 65.

The number of people in their mid-30s and 40s who rent their homes has soared three-fold in the past 20 years.

A third of those aged between 35 and 44 in England were living in the private rental sector in 2017, up from fewer than one in 10 in 1997, according to new figures from the Office for National Statistics.

By contrast, homeownership rates among people aged over 65 have increased, with nearly three-quarters of this age group owning a property outright, compared with 56% in 1993.

The ONS warned that homeownership was becoming increasingly concentrated among older people, with the proportion of people renting in the private sector increasing in all other age groups.

Why is this happening?

A combination of strong house price growth and stagnant earnings over the past decade has led to property affordability becoming increasingly stretched, making it harder for people to buy a home.

The ONS also pointed out that people aged over 65 were the first to benefit from the Right to Buy scheme, under which tenants were able to buy their council homes at a discount, boosting homeownership among this generation.

But many of the properties that were sold to tenants were not replaced, and while a third of people in Great Britain lived in social housing in 1979, the proportion had fallen to just 17.6% by 2017 – the lowest level since records began.

This drop in social housing availability has prevented younger generations from benefiting from the scheme to the same extent.

Who does it affect?

The ONS warned that if the current trend in homeownership continues, people are more likely to still be renting a home in the private sector when they retire than they are today.

It said research suggested someone who owned their home outright would need a pension pot of around £260,000 to maintain their standard of living in retirement, but someone who rented privately would need nearly double this amount at £445,000.

But it added that there were also benefits to renting in latter life, as the landlord would be responsible for maintenance costs.

What’s the background?

While the findings suggest many people are continuing to struggle to get onto the housing ladder, it is worth remembering that the data is from 2017, and the past two years have seen a significant increase in first-time buyers.

The number of people buying their first home soared to a 12-year high in 2019, with more than 350,000 people getting onto the property ladder during the year.

First-time buyers have benefitted from a raft of government initiatives in recent years, including the Help to Buy equity loan, the Help to Buy ISA and stamp duty relief on the first £300,000 of a property’s value, while plans for a new scheme offering local first-time buyers a 30% discount on new homes was recently announced.

These measures have not only helped to increase the number of people buying their first home, but this group accounted for more than half of all property purchases made with a mortgage in 2019.

Top 3 takeaways

- The number of people in their mid-30s and 40s who rent their home has soared three-fold in the past 20 years

- Homeownership rates among people aged over 65 have increased, with nearly three-quarters of this age group owning a property outright, compared with 56% in 1993

- The proportion of people renting in the private sector has risen for all age groups except those aged over 65 in the past 20 years

The best Things to do in February

London events in February

Our guide to the best events, festivals, workshops, exhibitions and things to do throughout February 2020 in London

February 2020 in London is going to be great. We’ve said goodbye to January and now London is beginning to brighten up. Use the – slightly – longer days to enjoy the month’s brilliant batch of events and celebrations. Get loved-up in London or join in the heaps of brilliant events, fun pop-ups and exciting new exhibitions happening. Here are our February 2020 highlights. February in London is also the month of Kew Garden’s Orchid Festival, London Fashion Week Festival, the London Classic Car Show and Brew LDN.

Hey, and while you’ve got your diary out, remember that it’s never too early to start planning for March either.

Pancake Day in London

Have your frying pans at the ready because Pancake Day is just around the corner. In 2020 Shrove Tuesday falls on Tuesday February 25 and London’s best restaurants will be going flipping mad for it.

Make the most of the flipping marvellous Pancake Day in London with our guide to races and celebrations happening around Shrove Tuesday

Have your frying pans at the ready because Pancake Day is just around the corner. In 2020 Shrove Tuesday falls on Tuesday February 25 and London’s best restaurants will be going flipping mad for it. Others will be perfecting their toss at a pancake race and some will be going for the DIY approach and creating crepes at home. Have a blast whatever you get up to, just don’t get too battered in the process. Here’s our guide to Pancake Day in London and our pick of the best races, celebrations and other events across the capital.

What is Pancake Day?

Shrove Tuesday marks the last day before Lent, traditionally a period of abstinence, associated with clearing your cupboards of things like sugar, fat and eggs. It’s known as Pancake Day because it represents a good opportunity to use up such ingredients. Easy peasy lemon squeezy.

When is Pancake Day?

Pancake Day takes place 47 days before Easter Sunday. Because the date of Easter Sunday is dictated by the cycles of the moon, Pancake Day can occur anytime between February 3 and March 9. This year’s batter action takes place on Tuesday February 25 2020.

Imagine Children’s Festival

Southbank Centre, South Bank

Bringing much-needed pizzazz to an otherwise dreary February half term holiday, Imagine is a mix of family-oriented shows and workshops, play experiences and exhibitions, music, art and literature. With events for all ages (from babies to teens) and lots of options which are free and drop-in, Imagine is the perfect way to fire young minds and allow the kids to let off steam when the weather is usually foul and parks are knee-deep in mud.

How cool that one of London’s greatest annual arts festivals is for an audience half of which are scarcely out of training pants

Bringing much-needed pizzazz to an otherwise dreary February half term holiday, Imagine is a mix of family-oriented shows and workshops, play experiences and exhibitions, music, art and literature. With events for all ages (from babies to teens) and lots of options which are free and drop-in, Imagine is the perfect way to fire young minds and allow the kids to let off steam when the weather is usually foul and parks are knee-deep in mud. The festival takes place at Southbank Centre, February 12-23.

On any day during half term you can swing by the Royal Festival Hall and join colourful, weird and wonderful family events. Some of them are free; just turn up and enjoy the eco-inspired games of ‘Earth Activity Trail’, scrawl your designs on the fest’s ‘Giant Chalkboard’, drop into the buzzing line-up kid-friendly music performances in the venue’s Clore Ballroom or, if you’re a worn-out grown-up, get a luxurious hand massage at the ‘Imagine Wellbeing Zone’.

Alternatively, book in advance for special events targeted at kids of all ages. Imagine started life as a literature festival for children and there is still a strong showing of authors and illustrators – this year, Michael Rosen, Dermot O’Leary, Cressida Cowell and Konnie Huq will all be running kid-oriented storytelling and poetry sessions. Many of these sell-out before the festival starts so it’s worth checking the website now.

There’s also a pretty hefty array of theatre shows to pick from. ‘Erth’s Dinosaur Zoo’ (February 15-21) will thrill Jurassic-obsessed kids with its strokable display of puppet lizards. There’s also ‘Slime’, a slug-inspired movement piece for toddlers (February 15-16); hip hop and classical Indian dance storytelling in ‘Same Same… But Different’ (February 23); and a chance to meet a pigtailed literary icon in ‘Meet Astrid Lindgren’s Pippi Longstocking’ (February 23).

You’ll find the full schedule on the Southbank Centre website.

| Event phone: | 0844 847 9910 |

|---|

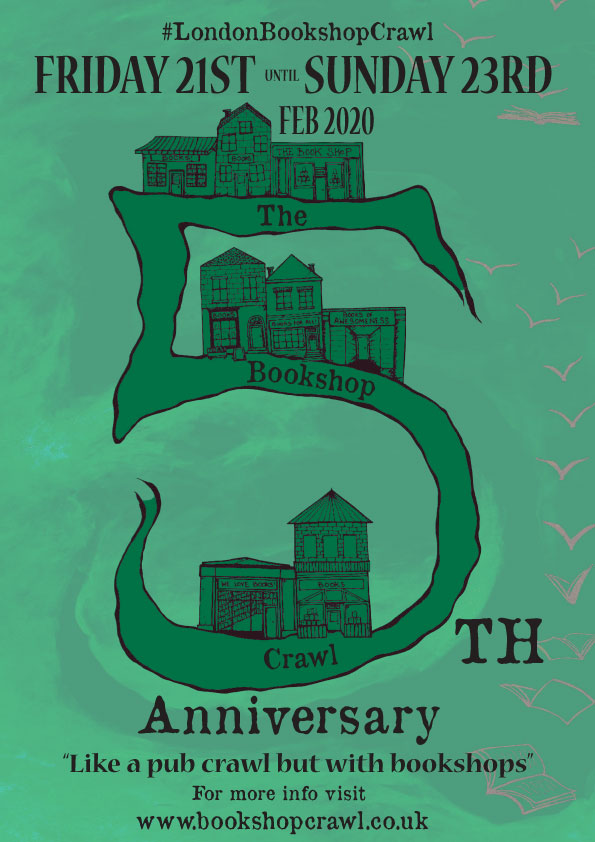

London Bookshop Crawl

Get the rounds in on a crawl of London’ß finest establishments. By ‘rounds’ we mean indulgent flicks through novels, and by ‘establishments’ we mean nice bookshops – but who says you can’t get drunk along the way too?

Dates And Times

-

- Free

-

- Free

-

- Free

Details

| Event website: | http://www.bookshopcrawl.co.uk |

|---|

| Venue name: | Various London locations |

|---|---|

| Address: | |

| Price: | Free |

Orchids Festival at Kew

Kew Gardens’ celebration of the orchid returns for its twenty-fifth year, this time with a focus on the plant life of Indonesia. Kew’s Orchids Festival will see the botanical gardens’ tropical greenhouse bursting with colourful species, and in 2020 they will reflect the country’s diverse landscape – from tropical rainforests to spectacular volcanos.

Kew Gardens’ celebration of the orchid returns for its twenty-fifth year, this time with a focus on the plant life of Indonesia. Kew’s Orchids festival will see the botanical gardens’ tropical greenhouse bursting with colourful species, and in 2020 they will reflect the country’s diverse landscape – from tropical rainforests to spectacular volcanos.

The Prince of Wales Conservatory will be filled with the sights, smells and sounds of Indonesia. Highlights will include a dramatic central pond display filled with bright orange orangutans, life-sized animals and an erupting volcano all made up of hundreds of stunning orchid blossoms. There’ll also be an impressive carnivorous pitcher plant archway.

Don’t miss rare flowers that can only be found on certain islands in the archipelago. Take the infamous Titan Arum aka ‘corpse flower’ from the island of Sumatra, it gets its name from the unbearable smell of rotting flesh it produces when in bloom.

Details

| Event website: | https://www.kew.org/kew-gardens/whats-on/orchids-festival |

|---|

| Venue name: | Kew Gardens |

|---|---|

| Address: | Royal Botanic Gardens London TW9 3AB |

| Transport: | Tube: Kew Gardens/Kew Bridge rail |

| Price: | Free with admission price |

New-build numbers increase but fail to keep pace with housing demand

Home-building levels have risen by more than 80% in the past 10 years but by just 1% between 2018 and 2019.

The number of new homes being built each year has soared by more than 80% during the past decade, but continues to fall short of Government targets.

A total of 1.4 million new homes were registered between 2010 and 2019, according to the National House-Building Council (NHBC), which provides warranties on new-build homes.

In 2019, 161,022 properties were registered with the group, the highest level since 2007 and 81% more than than a decade ago.

But between 2018 and 2019 the number of new homes being built edged ahead by just 1%, while figures continue to be significantly below the estimated 240,000 to 340,000 new homes needed each year to keep pace with demand.

At the same time, all of 2019’s increase was seen in the affordable homes sector, which registered a 13% year-on-year rise, while registrations for properties in the private sector actually fell by 3%.

Why is this happening?

The Government has put a range of measures in place to help boost building numbers after the industry was hit hard during the financial crisis.

Initiatives including streamlining the planning permission procedure, creating an infrastructure fund to support new developments and introducing new sources of funding for small and medium-sized construction firms.

The sector has also benefitted from the Help to Buy equity loan scheme, which enables people to buy a property with just a 5% deposit, as it only applies to new-build properties.

But the industry continues to be dogged by issues, including a shortage of building materials and skilled workers, as well as a lack of suitable sites for homes.

Who does it affect?

London saw the biggest increase in new homes being built in 2019, with registrations in the capital soaring by 37%.

There was a rise in both affordable homes, which were up 42% year-on-year, and private sector properties, which jumped by 33%.

Strong gains were also recorded in the West Midlands, where new-build registrations rose by 17% and Eastern England, which saw an 8% rise.

But the number of new homes being built fell in all other regions of the country apart from Scotland, where levels were broadly unchanged.

The fall in registrations was biggest in Yorkshire and Humberside and Wales, which both saw a 12% drop, while figures were 11% lower in the South West.

Across the UK as a whole, the mix of homes being built was split broadly evenly between detached properties, apartments and semi-detached homes at 29%, 29% and 27% respectively.

This continues the trend seen since 2016, when developers started to prioritise building larger homes over apartments.

What’s the background?

The NHBC also recorded a strong increase in the construction of properties in the so-called build-to-rent sector.

These properties are high quality, professionally managed homes that are built specifically for renters and have corporate landlords and longer tenancies, as well as typically offering a range of extra facilities like in-house gyms.

Registrations for build-to-rent homes soared by 57% during the year to stand at 4,788, 281% more than when the group first began to keep data on the sector in 2015.

Build-to-rent has benefitted from government policy changes, such as the revised National Planning Policy Framework, under which local authorities have been asked to identify how many new rental homes their area needs to help them plan for rising demand.

It has also been helped by Permitted Development Rights, which enable certain buildings, such as offices or factories, to be converted in residential properties without the need for planning permission.

Top 3 takeaways

-

The number of homes being built each year has soared by more than 80% during the past decade

-

A total of 1.4 million new homes were registered between 2010 and 2019, with 161,022 homes registered in 2019

-

But figures continue to be significantly below the estimated 240,000 to 340,000 new homes needed each year to keep pace with demand

First-time buyers save £1 billion through stamp duty exemption

New figures show how stamp duty relief has helped first-time buyers get onto the property ladder.

First-time buyers have saved more than £1 billion collectively since the government first launched stamp duty relief for those getting onto the property ladder.

A total of 464,700 transactions have been exempt from the tax since it was introduced in November 2017, saving buyers in England and Northern Ireland £1.11 billion.

First-time buyer relief was claimed on more than one in five transactions during the final quarter of the year, saving purchasers £154 million – the highest quarterly total since the tax break was first introduced, according to the Office for National Statistics.

But the level of revenue raised through the 3% surcharge for people buying a second home or investment property fell by 3% during the same period, as buy-to-let landlords continued to be cautious about expanding their portfolios.

Why is this happening?

The government introduced the first-time buyer relief on stamp duty in 2017 to help more people get onto the property ladder.

The move means buyers who have never previously owned a property and plan to live in the home they are buying do not pay stamp duty on the first £300,000 of their home’s price.

On house sales valued at up to £500,000, they pay the tax at 5% on the portion of the price between £300,000 and £500,000.

Who does it affect?

Stamp duty relief for first-time buyers has been credited with helping more people get on to the property ladder, alongside other government schemes such as the Help to Buy equity loan and Help to Buy ISA.

By contrast, the 3% surcharge for those buying an investment property, combined with a number of other tax changes, has been blamed for a fall in the number of landlords entering the private rental sector.

The drop in investors buying property has also helped first-time buyers, as the two groups typically chase the same homes at the bottom of the housing ladder.

What’s the background?

Total revenue from stamp duty on residential purchases was slightly down year-on-year reflecting the subdued level of home sales in the property market in 2019.

A total of 752,600 residential transactions were liable for stamp duty in 2019, 3% fewer than in 2018, while receipts were also 3% lower at £8.28 billion.

Within this total there was a slight increase in the number of homebuyers who were liable for stamp duty at a higher rate.

The number of homes bought for between £125,000 and £250,000, which are liable for stamp duty at the 2% rate, fell by 3% during the fourth quarter compared with the same period of the previous year.

At the same time, there was a 5% rise in transactions valued at more than £500,000, on which stamp duty is charged at 5% on the portion of the transaction over £250,000, and as much as 12% on the portion above £1.5 million.

Top 3 takeaways

- First-time buyers have collectively saved more than £1 billion since the government first launched stamp duty relief for those getting on to the property ladder

- More than one in five transactions during the final quarter of the year claimed first-time buyer relief, saving home buyers £154 million – the highest quarterly total since the tax break was first introduced

- The level of revenue raised through the 3% surcharge for people buying a second home or investment property fell by 3% during the final three months of 2019, compared with the same period of 2018

What's happening in the housing market in 2020?

latest State of the Property Nation report reveals what buyers, sellers and estate agents expect to happen to house prices in 2020.

Over a third of buyers actively searching for homes are looking to move within the next year - up 8% since 2017. But sellers are still cautious about putting their homes up for sale, with 31% worried they won't get their asking price.

Buyers become more confident while sellers still wary

While finding properties within budget and in the right location continues to be a challenge for buyers, the good news is there's been a 5% fall in the number of frustrated home-hunters in the past 12 months.

Finding the right location is less of a challenge for first-time buyers. Their main obstacle to becoming a homeowner is affordability: 50% perceive saving for a deposit as a challenge while 43% are concerned about securing a mortgage. But in reality, first-timers make up the largest buying group outside London and the South East, with 40% market share.

More space is the main motivation for moving home

‘Moving to a bigger home’ is the prime motivation for buying a new home, particularly among young families with 39% eager to upsize in the same area.

But over a third, or 36%, of empty-nesters are keen to 'move to a new location', often with the intention of moving closer to family.

Confidence is slowly returning to the housing market

There's been a modest increase in the number of people actively looking to buy, sell or rent a property. Of these active property seekers, 32% say they are more serious about moving than ever before -

Meanwhile, first-time buyers remain the largest buyer demographic outside of London and the South East, with a 40% market share.

Andy Marshall, Chief Commercial Officer at Zoopla, said: "With the property market, it’s easy to focus on the hard data like the number of sales, but it’s also important to scratch under the surface to understand what is motivating people to make a move.

"We are seeing a polarisation of the market. Confidence is slowly returning among buyers, but this is moderated by a feeling of caution among sellers, with ongoing economic uncertainty causing them to doubt whether they will achieve the asking price they believe their property is worth.

"The good news is that increasing numbers of people are active in the property market and that those seeking a new property are serious about making a move."

Mortgage approvals hit highest level in four years

The latest mortgage lending figures show a welcome pick-up in the housing market.

The number of mortgages approved for people buying a home soared by 20% in December to hit a four-year high.

A total of 46,815 loans for home purchases were agreed during the month. This was the highest level since August 2015 on a seasonally adjusted basis, according to UK Finance, the banking and financial industry body.

There was also a strong rise in homeowners switching to a new mortgage deal, with approvals for remortgaging jumping by 25% year-on-year to 33,738.

But there is evidence buyers were already returning even before the election, with mortgage advances in December reaching their highest level since March 2016.

There is typically a two to three month lag between when a mortgage is approved and when the money is advanced.

Why is this happening?

The housing market has been in ‘wait and see’ mode since the UK voted to leave the EU in 2016. But the large majority won by the Conservative Party at the General Election has increased the certainty that Brexit will happen according to the current timetable. This has made people feel more confident about going ahead with a big purchase.

Even before the General Election, estate agents were talking about seeing pent-up demand for homes, with people who had delayed making a decision beginning to return to the market.

Who does it affect?

The rise in activity in the housing market is good news for potential buyers and sellers alike.

Sellers will benefit from the rise in demand as it should enable them to sell their home quicker and achieve an offer that is closer to their asking price.

Increased demand is also likely to benefit buyers, as it should encourage more people to put their home on the market, increasing the amount of choice they have.

What’s the background?

Mortgage advances for the whole of 2019 were £265.8 billion – 1.1% less than in 2018, according to UK Finance.

Alongside Brexit uncertainty causing many people to delay house purchases, stretched affordability in many regions and a shortage of homes for sale have acted as a drag on home-buying levels.

But the property market has remained more buoyant in areas of the country where house prices have remained more affordable, such as the north of England and parts of the Midlands.

01 Winchester

A perfect day in Winchester

Visit leafy Hampshire for history, quirky pubs and rural vibes.

The ever-so-slightly hipster city of Winchester in Hampshire is a fine choice if you want to be surrounded by countryside yet keep those urban comforts. A short drive from the New Forest and the south coast, this pretty city is often voted among the best places to live in the UK. Once the capital of England, the cathedral city has treats for history buffs at every turn. Add cool shops, brilliant pubs, lush rural vistas and trendy bakeries and you'll never want to leave.

The best weekend breaks from London

Need to flee the city? Here’s where to spend the weekend in the UK and still be back in London for work on Monday

A relaxing and inspiring getaway, without the faff of boarding a plane? We’re sold. While we can’t vouch for the weather here in old Blighty, we have every faith in our restaurants, museums, shops, stunning scenery and ace hotels.

Not to mention, we’ve got historical attractions aplenty. When you want to get out of London without any faff, look no further than these gorgeous getaways – from cosy rural retreats to proper city breaks.

That’s right – all of those holiday feels, with no passport (or factor 50) required.

Winchester

It’s always had the looks, but Winchester never used to have that much in the way of personality. Suddenly, though, this handsome cathedral city has become Hampshire’s coolest corner. The food’s fantastic, for starters: you can breakfast on cruffins at Hoxton Bakehouse, settle in for craft brews and tacos at Overdraft, then tuck into a chilli beef burrito pie while flipping through a vintage comic at Piecaramba. Winchester’s the perfect base to explore the rest of Hampshire from, too: nose around Jane Austen’s house in Chawton and join a tour at Hambledon, the UK’s oldest vineyard. Accommodation-wise, you’ll get the VIP treatment at Hotel du Vin – or try gorgeous boutique B&B Hannah’s.

North Norfolk

With its vast skies and meandering waterways, North Norfolk has an eerie beauty all of its own. Start off with a visit to see the seals at Blakeney Point (the pups arrive in the winter), then head to Cromer, where you can tuck into the famous crab at The Jetty, stroll down the pier and stock up on local preserves at the farm shop. Make time to chuff along the North Norfolk Railway from Sheringham to Holt, and see if you can book a tour of Voewood House, an arts-and-crafts masterpiece. After all that fresh air, bed down at The Chequers Inn in Thornham, a gastropub with luxe rooms in a building that dates back to 1499. Or for a splurge, head inland to The Gunton Arms, a plush inn set in a deer park with a magnificently meaty menu.

Get there: three hours 30 minutes by train from London Liverpool Street to Cromer, with changes; around three hours by car.

The Cotswolds

Think of the English countryside and chances are you think of the Cotswolds: 750-odd ridiculously green and pleasant square miles straddling Gloucestershire, Oxfordshire, Somerset, Warwickshire, Wiltshire and Worcestershire. Each county has its own unique charm, but for a textbook weekend stick to Gloucestershire, land of Jilly Cooper, honey-coloured stone cottages and retired rock stars. Immerse yourself in nature: go leaf-peeping at Westonbirt Arboretum, take a clay pigeon-shooting lesson at the Cotswold Clay Club and coo over grazing cattle as you drive into Minchinhampton. Push the boat out with a stay at The Wild Rabbit in Kingham – a Pinterest board come to life – and don’t miss The Wheatsheaf Inn’s superlative Sunday roast.

Get there one hour 30 minutes by train from London Paddington to Moreton-in-Marsh; around two hours 30 minutes by car.

Bristol

The West Country’s undisputed foodie capital, Bristol’s got it all. From cheesecake at Hart’s Bakery to modern British plates in a shipping container at Box-E, you could easily spend 48 hours here doing nothing but eating. And then there are the sourdough toasties with a side of Gallic charm at Bar Buvette and Poco’s internationally influenced tapas (don’t miss the merguez with buttered kale at brunch). Make time to visit the Clifton Suspension Bridge, the gorgeously restored lido and Stokes Croft’s street art – and don’t forget to sip some legendary Exhibition cider in The Coronation Tap (it’s so strong it only comes in halves). Bed down in former merchant’s house Number Thirty Eight, or at the utterly lush Bristol Harbour Hotel.

Get there one hour and 38 minutes by train from London Paddington or if you’re watching your wallet National Express coaches run from Victoria for just £6 one way; around 2 hours 30 minutes by car.

Oxford

Those dreamy spires are just the start of Oxford’s charms. As well as being an ancient university city with history in every brick, it’s a young, thriving cultural hub with plenty of great places to eat and drink (Raoul’s Bar and Liquor Store in Jericho is where it’s at). Tick off the Ashmolean and the Pitt Rivers Museum, then wander through Port Meadow and the University Parks, stopping off for burgers at The Rickety Press. Shop till you drop in the Covered Market, make like Inspector Morse with a pint of Wychwood Hobgoblin at The White Horse on Broad Street (one of the show’s filming locations), then turn in at boutique B&B The Glove House in Woodstock – or bunk up in the Artist Residence, a sweetly chic pub with rooms just outside the city.

Get there one hour by train from London Paddington; one hour 30 minutses by car.

The Yorkshire Dales

It’s probably the UK’s most famous national park, and for good reason – the Dales has staggering good looks and drama in spades. A weekend gives you plenty of time to roam the vast Bolton Abbey Estate near Skipton and be wowed by the Ribblehead viaduct and the natural amphitheatre of Malham Cove (see if you can spot the pair of resident falcons). The Dales are heaven if you live to stuff yourself silly – it’s well worth touring the Wensleydale Creamery, home of the famous cheese, and nosing around Theakston’s brewery. Speaking of pints, The Black Bull near Sedbergh is in a class of its own, with a fantastic, modern kitchen. Stay there, or nearby at The Malabar, an award-winning B&B that started life as a dairy – think Roberts radios in every room, fluffy towels and free afternoon tea when you check in.

Get there: two hours 15 minutes by train from London King’s Cross to Leeds; around three hours 30 minutes by car.

Edinburgh

The Fringe in August is of course when the city comes into its own, but Edinburgh’s brimming with things to do and see during the other 11 months of the year. Climbing Arthur’s Seat is obligatory, as is trekking to Edinburgh Castle – then an evening picnic on the Meadows before hitting the dancefloor at small but legendary venue Sneaky Pete’s. Come bedtime, Rabble has gorgeous mid-century ‘rough-luxe’ rooms in the heart of the New Town, with a top-notch restaurant downstairs. While we’re on the subject of food: pop-up-turned-bricks-and-mortar-venture Ting Thai Caravan is well worth a visit to feast on street food to a soundtrack of, say, The Stooges. Still got itchy feet? Glasgow’s less than an hour away by train.

Get there One hour and 20 minutes by plane; four hours 20 minutes by train from London King’s Cross; around eight hours by car.

Manchester

Whether you’re comparing craft brews in the Port Street Beer House, crate-digging in Piccadilly Records or dancing your socks off on Canal Street, it’s impossible not to get caught up in Manchester’s civic pride. Make former warehouse district the Northern Quarter your base – it’s home to the city’s best coffee (hello, Takk), and both The Cow Hollow Hotel and The Abel Heywood have style in spades. Soak up culture at The Lowry, The Whitworth Art Gallery and the Royal Exchange, refuel on Curry Mile or in the new Mackie Mayor food hall, then party like you never have to go to work again at The Warehouse Project, now back on Store Street underneath Piccadilly Station.

Get there two hours by train from London Euston; around four hours 30 minutes by car.

Frome

There’s a reason Britpop’s top tier (Pearl Lowe and Danny Goffey, Brett Anderson) and Nicolas Cage (yes, really) have swapped London for Somerset. Within a wellies-throw of Glastonbury, it’s gorgeous and peaceful but still has a bit of an edge. Make Frome, a Georgian beauty a with loads of cool stuff on its doorstep, your base: go vintage shopping in Bruton, leaf-peep in Stourhead’s majestic gardens and hike up Cley Hill as the sun sets (it’s a UFO hotspot). Back in the cobbled streets you can tuck into galettes at Bistro Lotte, pair craft beers with an artisan cheese board at Palmer Street Bottle and book a Scandi-inspired Sunday lunch at Fat Radish. Stay at The Merchant’s House, a Grade II*-listed B&B in the centre of town – breakfast by the Aga makes for a delicious start to the day.

Get there: two hours by train from London Paddington; two hours 30 minutes by car.

The Lake District

If you don’t feel like you’ve had a weekend away unless you come home with mucky boots and a sunburned nose, this one’s for you. More than 900 square miles of wilderness dotted with chocolate-box villages, the Lake District is wild and wonderful all year round. If the sun’s out, fuel up on Kendal Mint Cake and climb Scafell Pike – it’s England’s highest peak, but not too tricky if you don’t mind a long walk. Less strenuously, you can take a Steamer across Ullswater, visit The World of Beatrix Potter and stock up on toothsome treats in the Grasmere Gingerbread Shop – its world-famous wares are made to a 160-year-old recipe. Gilpin Hotel & Lake House is the last word in luxury, complete with a back-to-nature spa, or sleep under the stars at one of Buttermere’s picturesque campsites.

Get there two hours and 38 minutes by train from London Euston to Oxenholme; around five hours by car.

Norwich

It may be the home of notable dimwit Alan Partridge, but Norwich is as brainy as they come. There’s the University of East Anglia, whose world-famous Creative Writing MA has turned out the likes of Kazuo Ishiguro, Anne Enright and Ian McEwan, independent booksellers galore and a thriving contemporary arts scene. Of course, a weekend here doesn’t have to be totally cerebral: after a morning making thoughtful noises at the Sainsbury Centre for Visual Arts, hit the shops – don’t miss the super-cool retro furniture at Stubenhocker. The Bicycle Shop does great veggie-friendly plates with a side of live music, and Brick Pizza is the place to carb-load. Accommodation-wise, Gothic House has good-value, Grade II-listed rooms right in the city centre. Back of the net!

Get there one hour and 49 minutes by train from London Liverpool Street; around two hours 30 minutes by car.

Padstow

This pretty-as-a-picture port really is the cream of Cornish. It’s synonymous with everyone’s favourite seafood chef, Rick Stein – get to his fish-and-chip shop early to beat the queue, then mosey around the independent galleries and boutiques, before taking the Black Tor Ferry over the water to Rock for a pint at The Mariners, now co-run by chef Paul Ainsworth. Hire bikes and cycle the 18-mile Camel Trail to Bodmin, sign up for a lesson at Waves Surf School, or just take a kite for a spin on the beach. All that sea air means you’ll sleep like a log – book one of Georgian townhouse St Petroc’s cool, contemporary rooms, or a luxe tipi at Cornish Tipi Holidays if you have a car.

Get there three hours 43 minutes by train from London Paddington to Bodmin Parkway, and a bus; around five hours 30 minutes by car.

House price to earnings link lost in London but strong in other regions

Wondering what drives property values? We take a look at how earnings growth impacts house price rises.

The link between house price growth and earnings in London has become “almost entirely dislocated”, although it remains strong in other regions.

House prices typically rise broadly in line with increases in earnings, with higher wages typically pushing property values up as people can afford to borrow more through a mortgage.

But in London, this link has been broken, with pay growth and house prices often moving in opposite directions, according to estate agent Savills.

Research by the group found that property values in the capital fell by 2% in the two years to September 2019, despite earnings increasing by 7%.

By contrast, while average earnings rose by just 1% in London in 2015, house prices soared by 11%.

The study found that the link between rises in earnings and increases in property values remained strong in other regions, particularly the North West, Yorkshire and the Humber and Wales, with the ratio of house price to earnings remaining in a narrow range of 7.6 times to 8.1 times during the past five years, showing performance was based on what people could afford to borrow.

Lawrence Bowles, residential research analyst at Savills, said: “Our analysis shows that housing affordability in London is far more stretched than in any other region.”

Why is this happening?

While property in regional markets is typically bought by local buyers, overseas investors account for a significant proportion of transactions in London.

As a result, the market is influenced by other factors alongside earnings, such as exchange rates and the global economy.

The London market has also been impacted more than regional markets by stamp duty changes, including an increase in the top rate at which the tax is paid, and the introduction of the 3% stamp duty surcharge for people purchasing a second property.

These factors have diluted the impact earnings growth has on the market.

Who does it affect?

The disconnect between house prices and earnings in London is bad news for people wanting to buy a home there.The fact that earnings growth has only a limited impact on property values has led to affordability becoming increasingly stretched.

Despite this, demand from overseas investors, who typically have deeper pockets, could continue to push London prices higher.

By contrast, in other markets across the UK, house prices tend to stagnate once property becomes unaffordable while earnings catch up.

What’s the background?

Despite the disconnect between London house prices and earnings growth, Savills predicts the market will remain subdued until affordability improves, predicting price rises of just 4% in the capital in the coming five years.

Across the whole of the UK, Savills thinks prices will rise broadly in line with average earnings growth, increasing by just over 15% between now and the end of 2024.

Britain’s best value commuter towns revealed

As this year's average 2.8% annual rail fare hike comes into effect, we take a fresh look at which commuter towns are most affordable.

Grays in Essex is the most affordable place for commuters working in London to buy a home.

The combined cost of a season ticket and mortgage repayments on a property in the town, which takes 41 minutes by train to Fenchurch Station, comes to £15,008 a year, according to our data.

It is followed by Leagrave in Bedfordshire, which has a traveling time of 55 minutes to the capital, with annual costs totalling £15,399, and Crayford in Kent at £15,662.

Basildon and Harlow, both in Essex, complete the top five with commuting times of 37 minutes and 41 minutes respectively.

Laura Howard, consumer expert at Zoopla, says: “As the new season ticket prices come into effect this month – much to the frustration of the millions of commuters across Britain – those looking to relocate to save money should pay close attention to these figures.

“The past decade has seen significant property price growth in prime London commuter belt towns but, despite this, our analysis still identifies pockets across South East England that represent affordable value for commuters.”

What about Bristol?

Potential buyers looking for an affordable home within commuting distance of Bristol should look across the water to Wales.

Newport is the best value commuting town for Bristol, with annual mortgage and season ticket costs adding up £10,166 and a travel time of just 35 minutes to Bristol Temple Meads station.

Highbridge and Burnham in Somerset is the next most affordable location at £11,595 a year, followed by Bridgwater, also in Somerset, at £11,975.

Caldicot in Wales and Weston-Super-Mare in Somerset also represent good value for workers in Bristol.

... and Birmingham?

Wolverhampton not only offers the most affordable homes for people working in Birmingham at a combined cost of £7,484 a year for mortgage payments and a season ticket, but also the shortest commute overall of just 20 minutes.

Cannock in Staffordshire is the next best value for those employed in Birmingham at £7,934 a year, followed by Stoke-on-Trent at £8,273.

Telford and Wilnecote complete the top five of the most affordable towns within easy commuting distance of Birmingham.

Northern commuter cities

Northern cities tend to be more affordable than those in the south, so people are more likely to be able to live close to where they work.

Even so, people working in Manchester who want a cheaper location should consider Hindley, a 58-minute journey away, where combined annual mortgage payments and season ticket costs add up to £6,883.

Homebuyers looking for value within commuting distance of Edinburgh should look at Dunfermline, where mortgage repayments and travelling costs will set them back by £7,530 a year.