Coronavirus: how you can still buy and sell your home

Lawyers, developers and estate agents are working hard to keep the cogs turning as efficiently and safely as possible during the coronavirus lockdown.

We may all be following social distancing rules under the coronavirus lockdown but that does not mean your property search or home sale is completely on hold.

"There is a slight silver lining in that cloud that we are starting to see," says Charlie Bryant, CEO of Zoopla. "Number one: people have kept their properties on the market.” The number of homes for sale is currently only one per cent lower today than on March 7.

"Having that stock will be really, really important to enable a bounce back once the market reopens. I wouldn’t go as far as saying it’s a green shoot, but it’s a seed in the ground."

The number of new property sales agreed in the UK has fallen by 70% since the start of the coronavirus restrictions and the government's guidelines to moving home.

But in the second week of lockdown there was a rise in people browsing properties.

When you're stuck in a home you've outgrown, trying to work remotely while entertaining energetic children, that's exactly the time you decide you really need to make plans to move.

"We have in fact seen a slight single digit increase week on week," says Charlie. "And in the lettings space we have seen a 16 per cent week on week increase in lettings browsing levels.

"We tend to find with the lettings market that it is counter cyclical - when people feel it’s not the right time to buy, they turn to lettings.”

Unprecedented times - but temporary

"The property market has not been forced to an immediate halt – we must remember Covid-19 is temporary and we will recover," says Amy Hazelton, senior paralegal at law firm Blake Morgan.

"We may even see the market recover with first-time buyers who realise they need their own space after being locked down with family or flatmates.

"People have extra time to sit and trawl through agents' sites and Zoopla. They may think about a move they have not had the time to consider before and some may even spend the time considering investment opportunities in the market."

Should I keep my home on the market?

It's really not such a bad time to be selling your home. With the majority of people stuck at home without much to do, many would-be house hunters are spending their time browsing for a new home online. So, if your home is already on the market there is no reason to withdraw it.

It's also worth noting that the government has not banned property transactions from going through. Instead, it has said that if the property being bought is empty, the sale can continue as normal.

It is only if the property is currently occupied that it is encouraging people involved in the transaction to agree an alternative date on which to move.

Can estate agents take on new listings?

Their physical offices may be shut but estate agents are still open for business, albeit working remotely from home.

That said, it is difficult for them to take on new properties at the moment, as the current social distancing rules mean they cannot visit your home to take photographs and measurements for the listing details.

But don’t let that put you off if you're thinking of selling your home.

Estate agents will still be able to talk to you by telephone to advise you on how much they may list your property for, subject to a physical viewing once restrictions are lifted, and to give you an idea of the market in your area.

They are also likely to be having similar conversations with potential buyers, so they may be able to line up some interested parties to view your home once the lockdown is over.

What is happening to mortgage rates?

The good news is that mortgage rates are falling in response to cheaper borrowing costs for banks and building societies themselves.

The average cost of a two-year fixed rate mortgage has fallen from 2.36% on 1 April to 2.13% now, while the cost of a five-year fixed rate deal has dropped from 2.66% to 2.37%.

Rates have fallen across the board, not just for borrowers with large equity stakes in their properties.

In fact, one of the biggest reductions is to the cost of an average five-year fixed rate loan for someone with just a 10% deposit, with this dropping by 0.61% since the beginning of the month.

Is it a good time to remortgage?

Although there are fewer mortgages than before the market was impacted by coronavirus, there continues to be a good choice for borrowers.

It is also expensive for homeowners to sit on their lender’s standard variable rate (SVR), the rate people typically revert to when their existing deal comes to an end.

The average interest rate charged on an SVR is currently 4.61%, compared with an average of 2.13% on a two-year fixed rate deal.

As a result, someone with a £200,000 mortgage would save nearly £3,240 a year by switching from their lender’s SVR to a new deal.

Is it a good time to remortgage?

Although there are fewer mortgages than before the market was impacted by coronavirus, there continues to be a good choice for borrowers.

It is also expensive for homeowners to sit on their lender’s standard variable rate (SVR), the rate people typically revert to when their existing deal comes to an end.

The average interest rate charged on an SVR is currently 4.61%, compared with an average of 2.13% on a two-year fixed rate deal.

As a result, someone with a £200,000 mortgage would save nearly £3,240 a year by switching from their lender’s SVR to a new deal.

Can people still view my home?

Assuming your home is already listed with an estate agency, they can continue to market it, but potential buyers won’t be able to view it in person until the current social distancing measures are lifted.

That said, people can still get an excellent sense of what your home is like through doing a virtual tour.

Some estate agents created these tours using 3D cameras to offer a high-definition, 360 degree walk-throughs of their clients’ properties before the lockdown came into force.

Andy Marshall, our chief commercial officer at Zoopla, says: "We have seen an upsurge of 215 per cent in virtual viewings of new-builds.

"While this is partly in response to coronavirus, we anticipate that online and virtual tours are quickly becoming the new normal. Online viewings afford convenience and flexibility."

If your agent was not able to create one for you before social distancing was introduced, you could have a go at creating your own using the video on your mobile phone.

While it may not have the same professional touch as one created by an estate agent, it should still give potential buyers a good sense of how your home looks.

What if someone makes an offer?

If you receive an offer, there is nothing to stop you negotiating and accepting it.

But you do need to be mindful that the selling process is likely to take longer than usual.

The government has advised people to delay exchanging contracts while the current lockdown measures are in place.

Your buyer may also face delays in having a survey done on the property, as surveyors have been told not to carry out non-urgent work.

"Our move will happen - just at a later date"

Katie Beardsworth, 34, from Hull, is in the process of buying a new home in North Tyneside. Katie, who runs a classical music artist and project management company, was hoping to move in late April with her husband Robert and three-year-old son Sam.

"I was looking forward to walks on the beach. It would have been more sustaining than the local park for the 100th time. But the benefit of not moving yet is living in a network of neighbours we've known for eight years.

"We've been on quite a journey buying. At first we wanted to stay in the area but move to a bigger house, but after quite a few houses fell through, we realised we wanted to totally change and live by a beach.

"We have everything ready for exchange, but we won't move forward further until we know we can actually move in. We're in a small chain - a first-time buyer is buying our three-bed terraced and the owner of the four-bed we're buying will be moving to an empty house.

"We've had reassurances that everyone is happy to wait and the estate agents and solicitors, all working remotely, have been great throughout the process. Our survey was done the day before lockdown and we'd signed all the paperwork by post. I've had to answer a few queries by email rather than post, but that's a welcome change. Our mortgage provider has been very helpful, calling to tell us when the mortgage offer will end and that there will be flexibility to extend if we need to.

"Now I'm quite philosophical - it will happen when it happens. But when lockdown first happened, I was upset. I'm a big planner and I'd been planning how I was going to organise new childcare and make new friends so moving home was less disruptive for my son Sam. Now that doesn't feel as important - he's already had a massive transition from nursery to being at home with me all day and I know we'll all be fine.

"I'd say there's no point in stressing about things that you can't control."

The lawyer's view on the timeline of buying and selling during lockdown

Amy Hazelton is senior paralegal in the new homes team at law firm Blake Morgan.

"Depending on the stage in your transaction, going ahead with a purchase may now mean you have to travel along a slightly different route than initially planned.

"In cases where contracts have not yet been exchanged, buyer and seller should try and agree delay clauses to allow for Covid-19 provisions to protect them both.

"You may encounter other blockers along the way towards exchange as a result of local authority closures, search provider delays and getting physical signature and witnessing of documents, due to social distancing and travel restriction guidelines.

"Some of these problems (especially with searches) can be overcome by specialist insurance. Others (such as signature) may need alternative arrangements to be agreed between the buyer and seller.

"If a buyer is between exchange and completion, all parties are still legally bound to proceed to avoid being in breach of contract and having financial penalties imposed.

"Where possible, completions should be delayed in accordance with the UK government guidelines to 'stay indoors' but, for some, completion may be unavoidable. Matters are likely to become more complicated where there is a chain and there are more parties to juggle.

"Lawyers throughout the country are working together in drafting solutions to help the market keep moving and this includes the certainty of exchanges taking place whilst keeping the flexibility to ensure no one is forced to complete against their will.

"Buyers and sellers should stay in regular contact with all parties involved."

What if I want to buy a new home?

If you want to buy a new home, there are still plenty of things you can do to kick-start your search while in lockdown.

You can use the time to browse homes online that estate agents already have on their books, to give you a sense of what is out there, while many properties also have virtual tours you can take.

You can also do research on the areas you're interested in. For example, our site offers a number of tools enabling you to check out the local area, even journey times if you'll be commuting.

Check out mortgage lenders websites too, to get a sense of how much you may be able to borrow, giving you an idea of the price range for your new home.

Estate agents are still working, so even though you can’t visit them in their offices, it is still worth ringing them for a chat about the type of property you're looking for, as they may have someone waiting to list as soon as the restrictions are listed.

If you do find a property that seems perfect, you can put in an offer for it, although as explained above, the conveyancing process is likely to be slower than usual.

What can I do to get my home ready to sell?

One of the key things to do when preparing your home for sale is to have a good tidy up.

Rooms that contain a lot of clutter generally look smaller and darker than ones that are tidy and have clear surfaces, and this can put off potential buyers.

So, spend some of your time while in lockdown going through each room, having a good clear-out and packing away some of the ornaments and personal effects on display.

Also think about whether there is any furniture you could remove from rooms and store in the loft or garage to help make the space look bigger or more appealing.

Can I carry out home improvements during lockdown?

Many DIY stores remain open, although some are asking customers to order what they need online and then pick up their purchases at the store while still complying with the two-metre social distancing guidelines.

As a result, there is nothing stopping you from cracking on with those small DIY jobs you may have been putting off for a while.

Touching up paintwork or regrouting tiles can have a big impact on the overall look of your home.

Bear in mind that you cannot employ professional decorators and builders in your home during lockdown when you are living there, so a it's a great time to try your hand at DIY.

So-called kerb appeal is incredibly important when trying to sell your home, as the outside is the first thing potential buyers will see.

Under the current circumstances some potential buyers may drive by and have a look at your property before they are able to view the inside, and first impressions count.

As a result, put some effort into sprucing up the outside of your home. Whether this involves repainting the front door or tidying up the garden, it is likely to be time well spent.

Mega Events To Make The Most of March 2020 In London

London events in March

Our guide to the best events, festivals, workshops, exhibitions and things to do throughout March 2020 in London

A bright, blossom-filled March 2020 in London is definitely our bag. As spring arrives and the days start to get sunnier and longer, there’s plenty going on in London to embrace the new season. Why not take a stroll around London’s best parks and gardens as they start to burst with colour, check out the city’s best restaurants or sink a drink in one of London’s neon-filled bars. St Patrick’s Day and Mother’s Day. It also holds WoW: Women of the World Festival, Earth Hour, London Book and Screen Week and the big St Patrick’s Day Parade and Festival in Trafalgar Square. For more fun in the city, check out our guide to the best events, free stuff, art and music. This lot should keep you busy in London for the whole of March 2020. You’re welcome!

St Patrick’s Day in London

You don’t have to go to Ireland to enjoy the party atmosphere of St Patrick’s Day 2020, there’s plenty going on right here in London

The Irish really know how to celebrate, so when it comes to St Patrick’s Day in London, the city’s Irish community have no problem showing us how it’s done. A day to celebrate the patron saint of Ireland, the occasion is always one big welcoming bash. Expect lots of dancing, hearty traditional dishes, a huge parade and as many pints as you can handle.

The official holiday lands annually on March 17 (a Tuesday in 2020), but this year the main London celebrations take place in Trafalgar Square March 13-17.

At this year’s three-day shindig, more than 50,000 revellers are expected to descend on Trafalgar Square for a lively parade of music and ceilidh dancing, plus plenty of things to do with the kids, from an Irish folk show and film festival to Irish walking tours. Feeling peckish? Fill up on traditional grub from the Irish Street Food Market.

If you can’t face the crowds, we’ve rounded up the best St Patrick’s Day happenings below. Or if you want more cultural inspiration, check our pick of the best London events in March. Get ready for a very green weekend.

When is St Patrick’s Day?

It’s always March 17, but in true Irish fashion, St Patrick’s Day sessions usually run throughout Paddy’s weekend.

What is St Patrick’s Day?

The date supposedly marks the death of this guy called (yep, you guessed it!) St Patrick, who travelled to Ireland in the fifth century to convince Irish pagans that Christianity is where it’s at. Do you associate Ireland with shamrocks? That’s down to him too: the story goes that St Patrick used the three-leaved clover to describe the Holy Trinity to non-believers. Oh, and legend says he banished snakes from the country by chasing them into the sea. Best mull that last part over with a Guinness.

Where is the London St Patrick’s Day Parade?

London’s St Patrick’s Day parade lines the streets from Piccadilly to Trafalgar Square and cheers on a stream of leprechaun floats, traditional musicians and squads of Irish dancers. The main stage at Trafalgar Square will be surrounded by a street food market and a ‘tea tent’, with a line-up of Irish bands. Basically, it’s a big, rip-roaring one-day festival, only the pints are a shade of Gaelic green.

Rare Birds Bohemian Market

The festival-themed market at 93 Feet East has everything you want in a market and more. Head along to Brick Lane to gobble down street food, sip on cocktails, pick up wavey garms from independent designers and vintage stalls and join denim customising workshops, all to a soundtrack from banging DJs and live acts.

Details

| Event website: | https://www.rarebirdsmarket.com |

|---|

| Venue name: | 93 Feet East |

|---|---|

| Address: | 150 Brick Lane London E1 6QL |

| Transport: | Tube: Liverpool St |

| Price: | Free entry |

Dates And Times

- 93 Feet East Free Entry

Rare Birds Bohemian Market

The Oxford v Cambridge Goat Race

Polish your horns and belt out those bleats, because London’s favourite farmyard fracas is back for an eleventh year in 2020. The Goat Race is fast becoming as popular as its Thames-based rival (at least around the Time Out office), and sees two goats – one representing ‘Oxford’, the other ‘Cambridge’ – take part in a dash around the farm.

The gates open at noon with lots to enjoy on the farm, including bands, booze and other fun, goat-related nonsense. The race takes place at some point between 4.30pm, although the exact time depends on the mood of the athletes. There’s an official bookie and sweepstake if you or your nanny fancy a flutter. Young bucks at heart can join the Goat-e-oke, take part in the Coat Race or the Goatry Slam. By the end of it, you might just pass out from goat-pun fatigue. Book tickets well in advance – the animals mustn’t get overcrowded and places sell out fast.

This year you can upgrade your goat race ticket to a VIP experience. For out £50 and as well as a front-row seat at the goat race, you’ll also get close up and personal with the farm’s goats. Help groom, feed and walk them and bring along up four people with you to help you do it. All proceeds go to the upkeep of Spitalfields City Farm.

Details

| Event website: | https://www.thegoatrace.com/ |

|---|

| Venue name: | Spitalfields City Farm |

|---|---|

| Address: | Buxton Street London E1 5AR |

| Transport: | Tube: Whitechapel |

| Price: | £17.50, kids £5 |

Dates And Times

-

- Spitalfields City Farm £17.50, kids £5 Book online

- Spitalfields City Farm £17.50, kids £5 Book online

The Mikvah Project

Achingly intimate remounting of Josh Azouz’s drama about two men drawn to each other at a Jewish bath

Two men exist awkwardly, nakedly together in a single Jewish ritual bath (the title’s ‘mikvah’). Josh Azouz’s tender story is soaked in healing water and other, harder-to-shift substances: tradition, self-doubt, hypocrisy.

‘The Mikvah Project’ was first staged at The Yard; translated to the more intimate Orange Tree, Georgia Green’s production is an example of the alchemy that happens when you get the perfect combination of play and theatre. In Cory Shipp’s set, a mosaic-tiled pool is recessed into the stage, its water reflecting Eitan and Avi’s limbs as they meet, first by accident, then more deliberately. The Orange Tree’s in-the-round set-up means that the audience becomes the walls of the mikvah. Sometimes the two performers are showmen, acknowledging us and explaining snippets of Jewish tradition from their warm, if sometimes claustrophobic, community. Sometimes they act like they’re alone.

Josh Zaré plays 17-year-old Eitan. He’s still a kid, really, and Zaré has this incredible energy that makes him visibly fizz with excitement as he mimes driving his first car, or drifts into confused monologues about the girls he’s meant to fancy. Avi doesn’t have time to help him work things out, because he’s married and trying for a kid. In theory. Alex Waldmann captures the contradictions of this man who always knows the right thing to say, the right thing to do, but can’t make himself stay within those lines he’s drawn out so neatly.

Religious tradition. Forbidden lust. We’ve seen it all before. Except we haven’t, because Azouz’s play takes what could be a familiar clash between religion and homosexuality and makes it strange. His writing dances, torturing unspoken truths into weird metaphors, like when Avi tries to use football to codedly explain why Eitan should choose a heteronormative life. It doesn’t work. But Azouz’s play doesn’t soar into queer wish fulfilment fantasies either: there’s an incredibly tense pattern of release, denial, release which makes it impossible to look away.

The mikvah is an acceptable place for men to be naked, together, and this play is an often-hilarious interrogation of all the intimacies that makes room for. This production doesn’t always find the more mystical side of the mikvah’s symbolism: Avi’s meant to be a talented singer but his voice lacks the strength to bring a spine-tingling spirituality into this small space. But it has the power to transport you from tiny room to bustling synagogue to snatched moment in the sun, with a still, cold pool of water at its heart.

Details

| Venue name: | Orange Tree Theatre |

|---|---|

| Address: | 1 Clarence Street Richmond TW9 2SA |

| Transport: | Rail/Tube: Richmond |

| Price: | £15-£32, £15 concs. Runs 1hr 5min |

Dates And Times

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

-

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

- Orange Tree Theatre £15-£32, £15 concs. Runs 1hr 5min

Homeowners opt to unlock equity when remortgaging

People taking out a new mortgage increased their loan by an average of more than £50,000.

Thousands of homeowners tapped into their housing equity in December, unlocking an average of £50,702 each.

A total of 16,820 people who remortgaged during the month increased their borrowing, nearly 6% more than in the same month of the previous year, according to UK Finance.

More than half of people remortgaging in December opted to take on more debt, marking the seventh month in 2019 in which those unlocking equity outnumbered those who did not.

But there was no sign that homeowners were overstretching themselves, with the average loan-to-value ratio of people remortgaging increasing only slightly to 58.8%.

Why is this happening?

On the one hand, the number of people unlocking equity suggests homeowners are feeling confident about the outlook for the property market and are not concerned that house prices may fall in the near future.

At the same time, it is also likely to reflect a growing trend for existing homeowners to use equity in their property to fund extensions or other home improvements as an alternative to buying a new home and incurring all the move costs, including stamp duty.

Finally, the high levels of competition in the mortgage market, particularly during the final quarter of the year when banks and building societies are looking to meet their end of year lending targets, is likely to have tempted homeowners to take on more borrowing.

Who does it affect?

The fact that people feel optimistic about the property market is good news, as it suggests those who had been delaying making a purchase until the economic and political outlook was clearer will now go ahead with one.

But it is less positive that homeowners appear to be opting to stay put and improve their current property rather than trade up the housing ladder.

One of the factors that has been holding back transaction levels in recent years has been the shortage of homes for sale.

The property market needs existing homeowners to trade up the ladder and sell their current home to make properties available for those lower down.

What’s the background?

The UK Finance figures also showed a jump in people buying a home, as well as those remortgaging.

A total of 29,400 existing homemover mortgages were approved during the month, 3% more than a year earlier.

At the same time, mortgages were also advanced to 29,490 first-time buyers.

Top 3 takeaways

-

Thousands of homeowners tapped into their housing equity in December, unlocking an average of £50,702 each

-

A total of 16,820 people who remortgaged during the month increased their borrowing, nearly 6% more than in the same month of the previous year

-

More than half of people remortgaging in December opted to take on more debt, marking the seventh month in 2019 in which those unlocking equity outnumbered those who did not

Buyers and sellers return to housing market

The pick-up seen after the General Election continued into January.

Confidence in the housing market continued to build in January with activity increasing for the second month in a row.

Estate agents recorded a rise in enquiries from potential buyers and new sellers listing their homes, while there was also an increase in the number of sales agreed. More estate agents are reporting an increase in property values for the first time since July 2018.

The rebound is expected to continue, with estate agents predicting an increase in sales in all areas of the country in both the near term and a year from now, according to the Royal Institution of Chartered Surveyors (RICS).

Simon Rubinsohn, RICS chief economist, said: "The latest survey results point to a continued improvement in market sentiment over the month, building on a noticeable pick-up in the immediate aftermath of the General Election."

Why is this happening?

The housing market has lacked direction for the past three and a half years, following the vote to leave the EU.

The political and economic uncertainty the referendum result created led potential buyers and sellers to adopt a ‘wait and see’ approach.

But December’s General Election, with Prime Minister Boris Johnson’s hard line on leaving the EU, backed by a significant majority in the House of Commons, brought some certainty to the market.

As a result, people who had previously sat on their hands for months are beginning to return to the market.

Who does it affect?

The increase in homes being put up for sale is good news for potential buyers, as the market has been dogged by a lack of stock, and therefore limited buyer choice, for the past few years.

But RICS cautioned that, despite the improvement, the average number of properties estate agents had on their books still remained very low at just 43 per branch.

This shortage of homes for sale is expected to put rising pressure on prices, with estate agents expecting property values to increase over both the coming three months and the next year; bad news for first-time buyers and those looking to trade up the property ladder.

What’s the background?

While the latest RICS survey offers good news for the housing market, it is less upbeat about the rental one.

Letting agents reported a fall in the number of new homes available to let for the 15th consecutive quarter.

At the same time, demand from potential tenants continued to increase.

The ongoing mismatch between supply and demand is expected to push rents higher, with letting agents predicting they will rise by just over 2% in the year ahead.

Top 3 takeaways

-

Confidence in the housing market continued to build in January with activity increasing for the second month in a row

-

Estate agents recorded a rise in inquiries from potential buyers and new sellers listing their homes, while there was also an increase in the number of sales agreed

-

Estate agents predict an increase in sales in all areas of the country in both the next three months and a year from now

People aged 35-44 three times more likely to rent than 20 years ago

Home-ownership rates are falling among all age groups except those aged over 65.

The number of people in their mid-30s and 40s who rent their homes has soared three-fold in the past 20 years.

A third of those aged between 35 and 44 in England were living in the private rental sector in 2017, up from fewer than one in 10 in 1997, according to new figures from the Office for National Statistics.

By contrast, homeownership rates among people aged over 65 have increased, with nearly three-quarters of this age group owning a property outright, compared with 56% in 1993.

The ONS warned that homeownership was becoming increasingly concentrated among older people, with the proportion of people renting in the private sector increasing in all other age groups.

Why is this happening?

A combination of strong house price growth and stagnant earnings over the past decade has led to property affordability becoming increasingly stretched, making it harder for people to buy a home.

The ONS also pointed out that people aged over 65 were the first to benefit from the Right to Buy scheme, under which tenants were able to buy their council homes at a discount, boosting homeownership among this generation.

But many of the properties that were sold to tenants were not replaced, and while a third of people in Great Britain lived in social housing in 1979, the proportion had fallen to just 17.6% by 2017 – the lowest level since records began.

This drop in social housing availability has prevented younger generations from benefiting from the scheme to the same extent.

Who does it affect?

The ONS warned that if the current trend in homeownership continues, people are more likely to still be renting a home in the private sector when they retire than they are today.

It said research suggested someone who owned their home outright would need a pension pot of around £260,000 to maintain their standard of living in retirement, but someone who rented privately would need nearly double this amount at £445,000.

But it added that there were also benefits to renting in latter life, as the landlord would be responsible for maintenance costs.

What’s the background?

While the findings suggest many people are continuing to struggle to get onto the housing ladder, it is worth remembering that the data is from 2017, and the past two years have seen a significant increase in first-time buyers.

The number of people buying their first home soared to a 12-year high in 2019, with more than 350,000 people getting onto the property ladder during the year.

First-time buyers have benefitted from a raft of government initiatives in recent years, including the Help to Buy equity loan, the Help to Buy ISA and stamp duty relief on the first £300,000 of a property’s value, while plans for a new scheme offering local first-time buyers a 30% discount on new homes was recently announced.

These measures have not only helped to increase the number of people buying their first home, but this group accounted for more than half of all property purchases made with a mortgage in 2019.

Top 3 takeaways

- The number of people in their mid-30s and 40s who rent their home has soared three-fold in the past 20 years

- Homeownership rates among people aged over 65 have increased, with nearly three-quarters of this age group owning a property outright, compared with 56% in 1993

- The proportion of people renting in the private sector has risen for all age groups except those aged over 65 in the past 20 years

The best Things to do in February

London events in February

Our guide to the best events, festivals, workshops, exhibitions and things to do throughout February 2020 in London

February 2020 in London is going to be great. We’ve said goodbye to January and now London is beginning to brighten up. Use the – slightly – longer days to enjoy the month’s brilliant batch of events and celebrations. Get loved-up in London or join in the heaps of brilliant events, fun pop-ups and exciting new exhibitions happening. Here are our February 2020 highlights. February in London is also the month of Kew Garden’s Orchid Festival, London Fashion Week Festival, the London Classic Car Show and Brew LDN.

Hey, and while you’ve got your diary out, remember that it’s never too early to start planning for March either.

Pancake Day in London

Have your frying pans at the ready because Pancake Day is just around the corner. In 2020 Shrove Tuesday falls on Tuesday February 25 and London’s best restaurants will be going flipping mad for it.

Make the most of the flipping marvellous Pancake Day in London with our guide to races and celebrations happening around Shrove Tuesday

Have your frying pans at the ready because Pancake Day is just around the corner. In 2020 Shrove Tuesday falls on Tuesday February 25 and London’s best restaurants will be going flipping mad for it. Others will be perfecting their toss at a pancake race and some will be going for the DIY approach and creating crepes at home. Have a blast whatever you get up to, just don’t get too battered in the process. Here’s our guide to Pancake Day in London and our pick of the best races, celebrations and other events across the capital.

What is Pancake Day?

Shrove Tuesday marks the last day before Lent, traditionally a period of abstinence, associated with clearing your cupboards of things like sugar, fat and eggs. It’s known as Pancake Day because it represents a good opportunity to use up such ingredients. Easy peasy lemon squeezy.

When is Pancake Day?

Pancake Day takes place 47 days before Easter Sunday. Because the date of Easter Sunday is dictated by the cycles of the moon, Pancake Day can occur anytime between February 3 and March 9. This year’s batter action takes place on Tuesday February 25 2020.

Imagine Children’s Festival

Southbank Centre, South Bank

Bringing much-needed pizzazz to an otherwise dreary February half term holiday, Imagine is a mix of family-oriented shows and workshops, play experiences and exhibitions, music, art and literature. With events for all ages (from babies to teens) and lots of options which are free and drop-in, Imagine is the perfect way to fire young minds and allow the kids to let off steam when the weather is usually foul and parks are knee-deep in mud.

How cool that one of London’s greatest annual arts festivals is for an audience half of which are scarcely out of training pants

Bringing much-needed pizzazz to an otherwise dreary February half term holiday, Imagine is a mix of family-oriented shows and workshops, play experiences and exhibitions, music, art and literature. With events for all ages (from babies to teens) and lots of options which are free and drop-in, Imagine is the perfect way to fire young minds and allow the kids to let off steam when the weather is usually foul and parks are knee-deep in mud. The festival takes place at Southbank Centre, February 12-23.

On any day during half term you can swing by the Royal Festival Hall and join colourful, weird and wonderful family events. Some of them are free; just turn up and enjoy the eco-inspired games of ‘Earth Activity Trail’, scrawl your designs on the fest’s ‘Giant Chalkboard’, drop into the buzzing line-up kid-friendly music performances in the venue’s Clore Ballroom or, if you’re a worn-out grown-up, get a luxurious hand massage at the ‘Imagine Wellbeing Zone’.

Alternatively, book in advance for special events targeted at kids of all ages. Imagine started life as a literature festival for children and there is still a strong showing of authors and illustrators – this year, Michael Rosen, Dermot O’Leary, Cressida Cowell and Konnie Huq will all be running kid-oriented storytelling and poetry sessions. Many of these sell-out before the festival starts so it’s worth checking the website now.

There’s also a pretty hefty array of theatre shows to pick from. ‘Erth’s Dinosaur Zoo’ (February 15-21) will thrill Jurassic-obsessed kids with its strokable display of puppet lizards. There’s also ‘Slime’, a slug-inspired movement piece for toddlers (February 15-16); hip hop and classical Indian dance storytelling in ‘Same Same… But Different’ (February 23); and a chance to meet a pigtailed literary icon in ‘Meet Astrid Lindgren’s Pippi Longstocking’ (February 23).

You’ll find the full schedule on the Southbank Centre website.

| Event phone: | 0844 847 9910 |

|---|

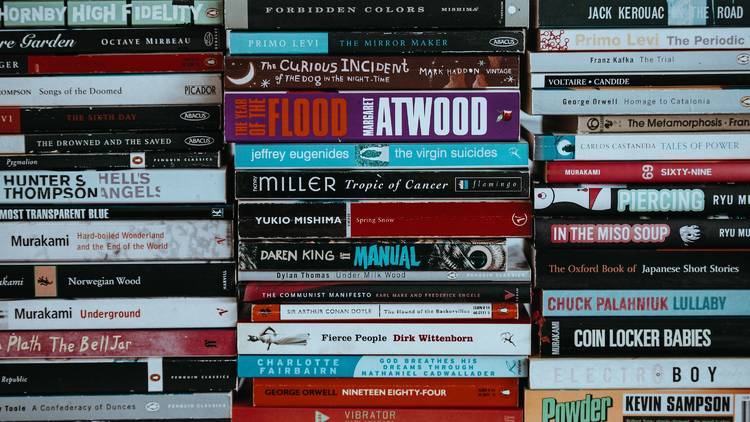

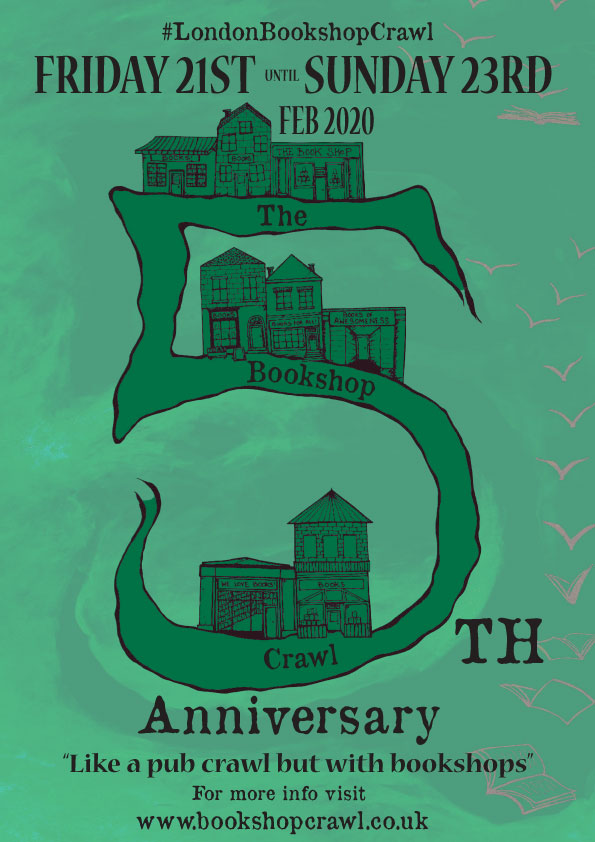

London Bookshop Crawl

Get the rounds in on a crawl of London’ß finest establishments. By ‘rounds’ we mean indulgent flicks through novels, and by ‘establishments’ we mean nice bookshops – but who says you can’t get drunk along the way too?

Dates And Times

-

- Free

-

- Free

-

- Free

Details

| Event website: | http://www.bookshopcrawl.co.uk |

|---|

| Venue name: | Various London locations |

|---|---|

| Address: | |

| Price: | Free |

Orchids Festival at Kew

Kew Gardens’ celebration of the orchid returns for its twenty-fifth year, this time with a focus on the plant life of Indonesia. Kew’s Orchids Festival will see the botanical gardens’ tropical greenhouse bursting with colourful species, and in 2020 they will reflect the country’s diverse landscape – from tropical rainforests to spectacular volcanos.

Kew Gardens’ celebration of the orchid returns for its twenty-fifth year, this time with a focus on the plant life of Indonesia. Kew’s Orchids festival will see the botanical gardens’ tropical greenhouse bursting with colourful species, and in 2020 they will reflect the country’s diverse landscape – from tropical rainforests to spectacular volcanos.

The Prince of Wales Conservatory will be filled with the sights, smells and sounds of Indonesia. Highlights will include a dramatic central pond display filled with bright orange orangutans, life-sized animals and an erupting volcano all made up of hundreds of stunning orchid blossoms. There’ll also be an impressive carnivorous pitcher plant archway.

Don’t miss rare flowers that can only be found on certain islands in the archipelago. Take the infamous Titan Arum aka ‘corpse flower’ from the island of Sumatra, it gets its name from the unbearable smell of rotting flesh it produces when in bloom.

Details

| Event website: | https://www.kew.org/kew-gardens/whats-on/orchids-festival |

|---|

| Venue name: | Kew Gardens |

|---|---|

| Address: | Royal Botanic Gardens London TW9 3AB |

| Transport: | Tube: Kew Gardens/Kew Bridge rail |

| Price: | Free with admission price |

New-build numbers increase but fail to keep pace with housing demand

Home-building levels have risen by more than 80% in the past 10 years but by just 1% between 2018 and 2019.

The number of new homes being built each year has soared by more than 80% during the past decade, but continues to fall short of Government targets.

A total of 1.4 million new homes were registered between 2010 and 2019, according to the National House-Building Council (NHBC), which provides warranties on new-build homes.

In 2019, 161,022 properties were registered with the group, the highest level since 2007 and 81% more than than a decade ago.

But between 2018 and 2019 the number of new homes being built edged ahead by just 1%, while figures continue to be significantly below the estimated 240,000 to 340,000 new homes needed each year to keep pace with demand.

At the same time, all of 2019’s increase was seen in the affordable homes sector, which registered a 13% year-on-year rise, while registrations for properties in the private sector actually fell by 3%.

Why is this happening?

The Government has put a range of measures in place to help boost building numbers after the industry was hit hard during the financial crisis.

Initiatives including streamlining the planning permission procedure, creating an infrastructure fund to support new developments and introducing new sources of funding for small and medium-sized construction firms.

The sector has also benefitted from the Help to Buy equity loan scheme, which enables people to buy a property with just a 5% deposit, as it only applies to new-build properties.

But the industry continues to be dogged by issues, including a shortage of building materials and skilled workers, as well as a lack of suitable sites for homes.

Who does it affect?

London saw the biggest increase in new homes being built in 2019, with registrations in the capital soaring by 37%.

There was a rise in both affordable homes, which were up 42% year-on-year, and private sector properties, which jumped by 33%.

Strong gains were also recorded in the West Midlands, where new-build registrations rose by 17% and Eastern England, which saw an 8% rise.

But the number of new homes being built fell in all other regions of the country apart from Scotland, where levels were broadly unchanged.

The fall in registrations was biggest in Yorkshire and Humberside and Wales, which both saw a 12% drop, while figures were 11% lower in the South West.

Across the UK as a whole, the mix of homes being built was split broadly evenly between detached properties, apartments and semi-detached homes at 29%, 29% and 27% respectively.

This continues the trend seen since 2016, when developers started to prioritise building larger homes over apartments.

What’s the background?

The NHBC also recorded a strong increase in the construction of properties in the so-called build-to-rent sector.

These properties are high quality, professionally managed homes that are built specifically for renters and have corporate landlords and longer tenancies, as well as typically offering a range of extra facilities like in-house gyms.

Registrations for build-to-rent homes soared by 57% during the year to stand at 4,788, 281% more than when the group first began to keep data on the sector in 2015.

Build-to-rent has benefitted from government policy changes, such as the revised National Planning Policy Framework, under which local authorities have been asked to identify how many new rental homes their area needs to help them plan for rising demand.

It has also been helped by Permitted Development Rights, which enable certain buildings, such as offices or factories, to be converted in residential properties without the need for planning permission.

Top 3 takeaways

-

The number of homes being built each year has soared by more than 80% during the past decade

-

A total of 1.4 million new homes were registered between 2010 and 2019, with 161,022 homes registered in 2019

-

But figures continue to be significantly below the estimated 240,000 to 340,000 new homes needed each year to keep pace with demand

First-time buyers save £1 billion through stamp duty exemption

New figures show how stamp duty relief has helped first-time buyers get onto the property ladder.

First-time buyers have saved more than £1 billion collectively since the government first launched stamp duty relief for those getting onto the property ladder.

A total of 464,700 transactions have been exempt from the tax since it was introduced in November 2017, saving buyers in England and Northern Ireland £1.11 billion.

First-time buyer relief was claimed on more than one in five transactions during the final quarter of the year, saving purchasers £154 million – the highest quarterly total since the tax break was first introduced, according to the Office for National Statistics.

But the level of revenue raised through the 3% surcharge for people buying a second home or investment property fell by 3% during the same period, as buy-to-let landlords continued to be cautious about expanding their portfolios.

Why is this happening?

The government introduced the first-time buyer relief on stamp duty in 2017 to help more people get onto the property ladder.

The move means buyers who have never previously owned a property and plan to live in the home they are buying do not pay stamp duty on the first £300,000 of their home’s price.

On house sales valued at up to £500,000, they pay the tax at 5% on the portion of the price between £300,000 and £500,000.

Who does it affect?

Stamp duty relief for first-time buyers has been credited with helping more people get on to the property ladder, alongside other government schemes such as the Help to Buy equity loan and Help to Buy ISA.

By contrast, the 3% surcharge for those buying an investment property, combined with a number of other tax changes, has been blamed for a fall in the number of landlords entering the private rental sector.

The drop in investors buying property has also helped first-time buyers, as the two groups typically chase the same homes at the bottom of the housing ladder.

What’s the background?

Total revenue from stamp duty on residential purchases was slightly down year-on-year reflecting the subdued level of home sales in the property market in 2019.

A total of 752,600 residential transactions were liable for stamp duty in 2019, 3% fewer than in 2018, while receipts were also 3% lower at £8.28 billion.

Within this total there was a slight increase in the number of homebuyers who were liable for stamp duty at a higher rate.

The number of homes bought for between £125,000 and £250,000, which are liable for stamp duty at the 2% rate, fell by 3% during the fourth quarter compared with the same period of the previous year.

At the same time, there was a 5% rise in transactions valued at more than £500,000, on which stamp duty is charged at 5% on the portion of the transaction over £250,000, and as much as 12% on the portion above £1.5 million.

Top 3 takeaways

- First-time buyers have collectively saved more than £1 billion since the government first launched stamp duty relief for those getting on to the property ladder

- More than one in five transactions during the final quarter of the year claimed first-time buyer relief, saving home buyers £154 million – the highest quarterly total since the tax break was first introduced

- The level of revenue raised through the 3% surcharge for people buying a second home or investment property fell by 3% during the final three months of 2019, compared with the same period of 2018

What's happening in the housing market in 2020?

latest State of the Property Nation report reveals what buyers, sellers and estate agents expect to happen to house prices in 2020.

Over a third of buyers actively searching for homes are looking to move within the next year - up 8% since 2017. But sellers are still cautious about putting their homes up for sale, with 31% worried they won't get their asking price.

Buyers become more confident while sellers still wary

While finding properties within budget and in the right location continues to be a challenge for buyers, the good news is there's been a 5% fall in the number of frustrated home-hunters in the past 12 months.

Finding the right location is less of a challenge for first-time buyers. Their main obstacle to becoming a homeowner is affordability: 50% perceive saving for a deposit as a challenge while 43% are concerned about securing a mortgage. But in reality, first-timers make up the largest buying group outside London and the South East, with 40% market share.

More space is the main motivation for moving home

‘Moving to a bigger home’ is the prime motivation for buying a new home, particularly among young families with 39% eager to upsize in the same area.

But over a third, or 36%, of empty-nesters are keen to 'move to a new location', often with the intention of moving closer to family.

Confidence is slowly returning to the housing market

There's been a modest increase in the number of people actively looking to buy, sell or rent a property. Of these active property seekers, 32% say they are more serious about moving than ever before -

Meanwhile, first-time buyers remain the largest buyer demographic outside of London and the South East, with a 40% market share.

Andy Marshall, Chief Commercial Officer at Zoopla, said: "With the property market, it’s easy to focus on the hard data like the number of sales, but it’s also important to scratch under the surface to understand what is motivating people to make a move.

"We are seeing a polarisation of the market. Confidence is slowly returning among buyers, but this is moderated by a feeling of caution among sellers, with ongoing economic uncertainty causing them to doubt whether they will achieve the asking price they believe their property is worth.

"The good news is that increasing numbers of people are active in the property market and that those seeking a new property are serious about making a move."

Mortgage approvals hit highest level in four years

The latest mortgage lending figures show a welcome pick-up in the housing market.

The number of mortgages approved for people buying a home soared by 20% in December to hit a four-year high.

A total of 46,815 loans for home purchases were agreed during the month. This was the highest level since August 2015 on a seasonally adjusted basis, according to UK Finance, the banking and financial industry body.

There was also a strong rise in homeowners switching to a new mortgage deal, with approvals for remortgaging jumping by 25% year-on-year to 33,738.

But there is evidence buyers were already returning even before the election, with mortgage advances in December reaching their highest level since March 2016.

There is typically a two to three month lag between when a mortgage is approved and when the money is advanced.

Why is this happening?

The housing market has been in ‘wait and see’ mode since the UK voted to leave the EU in 2016. But the large majority won by the Conservative Party at the General Election has increased the certainty that Brexit will happen according to the current timetable. This has made people feel more confident about going ahead with a big purchase.

Even before the General Election, estate agents were talking about seeing pent-up demand for homes, with people who had delayed making a decision beginning to return to the market.

Who does it affect?

The rise in activity in the housing market is good news for potential buyers and sellers alike.

Sellers will benefit from the rise in demand as it should enable them to sell their home quicker and achieve an offer that is closer to their asking price.

Increased demand is also likely to benefit buyers, as it should encourage more people to put their home on the market, increasing the amount of choice they have.

What’s the background?

Mortgage advances for the whole of 2019 were £265.8 billion – 1.1% less than in 2018, according to UK Finance.

Alongside Brexit uncertainty causing many people to delay house purchases, stretched affordability in many regions and a shortage of homes for sale have acted as a drag on home-buying levels.

But the property market has remained more buoyant in areas of the country where house prices have remained more affordable, such as the north of England and parts of the Midlands.