Average rents hit nearly £1,000 per month

The rate at which rents are rising is at a 13-year high, while demand soared by 76% in the New Year. Get the latest with our Rental Market Report.

The average cost of renting a home is close to £1,000 a month, as soaring demand pushes prices higher.

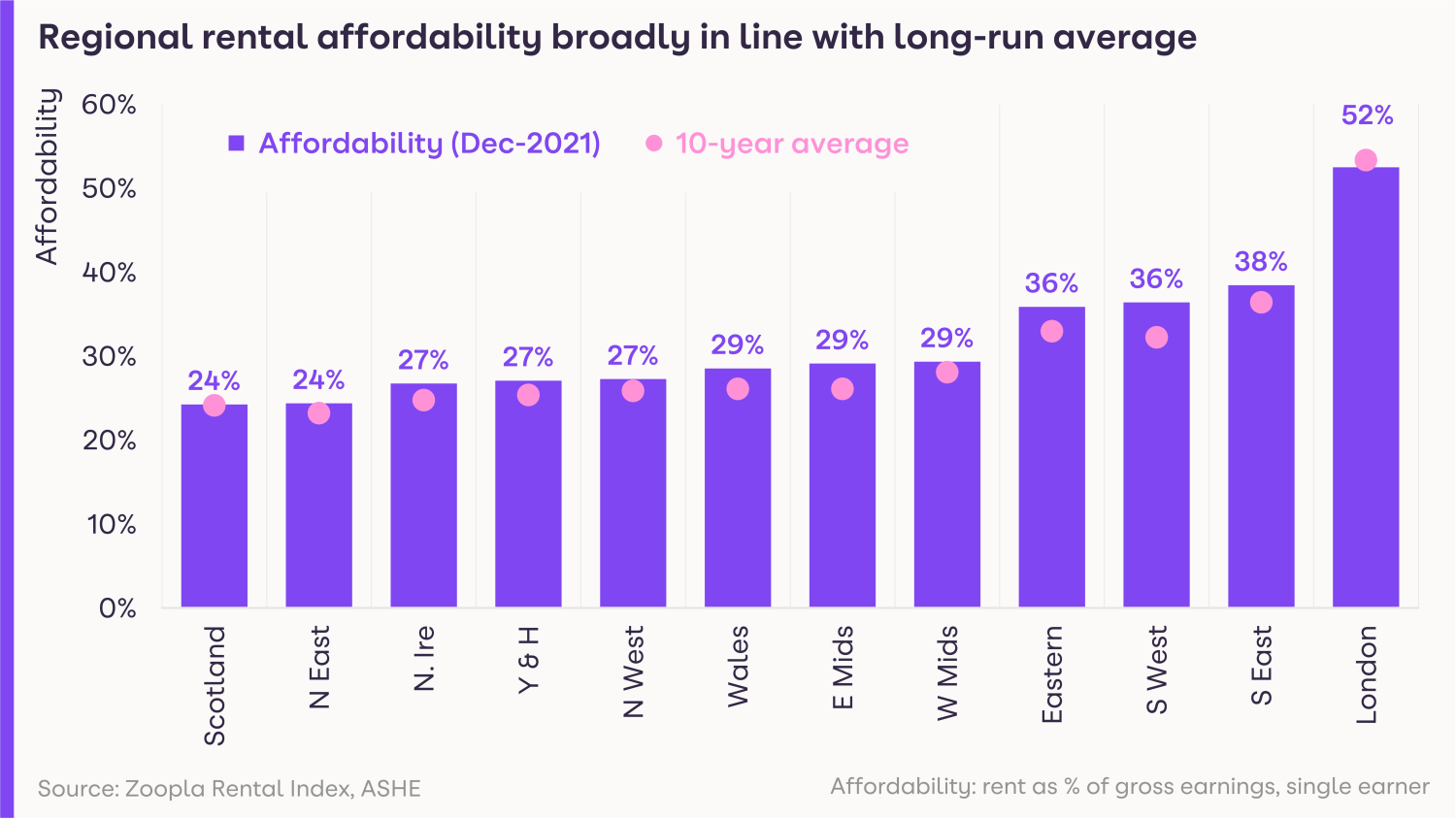

But despite the jump in the cost, rents account for an average of 37% of a single earner’s pay before tax, which is broadly in line with the 10-year average of 36%.

Renters are now paying £969 per month across the UK.

That's £62 a month more than at the beginning of the pandemic, according to our latest Rental Market Report.

What’s happening to rents?

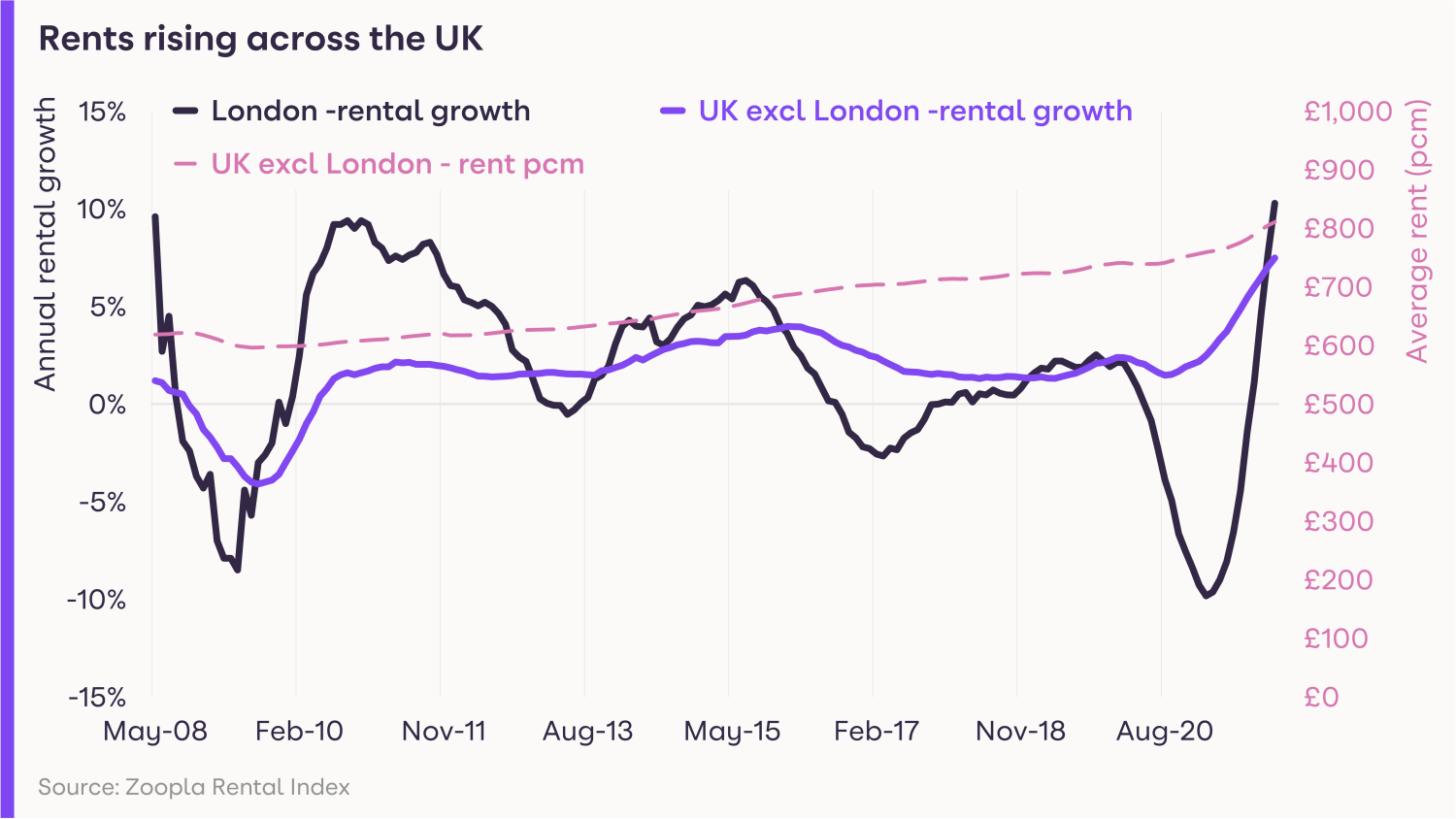

The rate at which rents are rising reached a 13-year high of 8.3% in the final three months of 2021.

The average annual rent for those agreeing a new let is now £744 higher than pre-pandemic levels.

Even so, rents are only 12% higher than they were five years ago, after they fell in some areas during the early stages of the pandemic.

Rents have risen in every region of the UK during the past year, with London seeing the strongest growth of 10.3%, while increases were weakest in Scotland at 4.8%.

However, because rents fell in the capital during the pandemic, they are now only £18 a month more than they were in March 2020.

What’s demand for rental homes like?

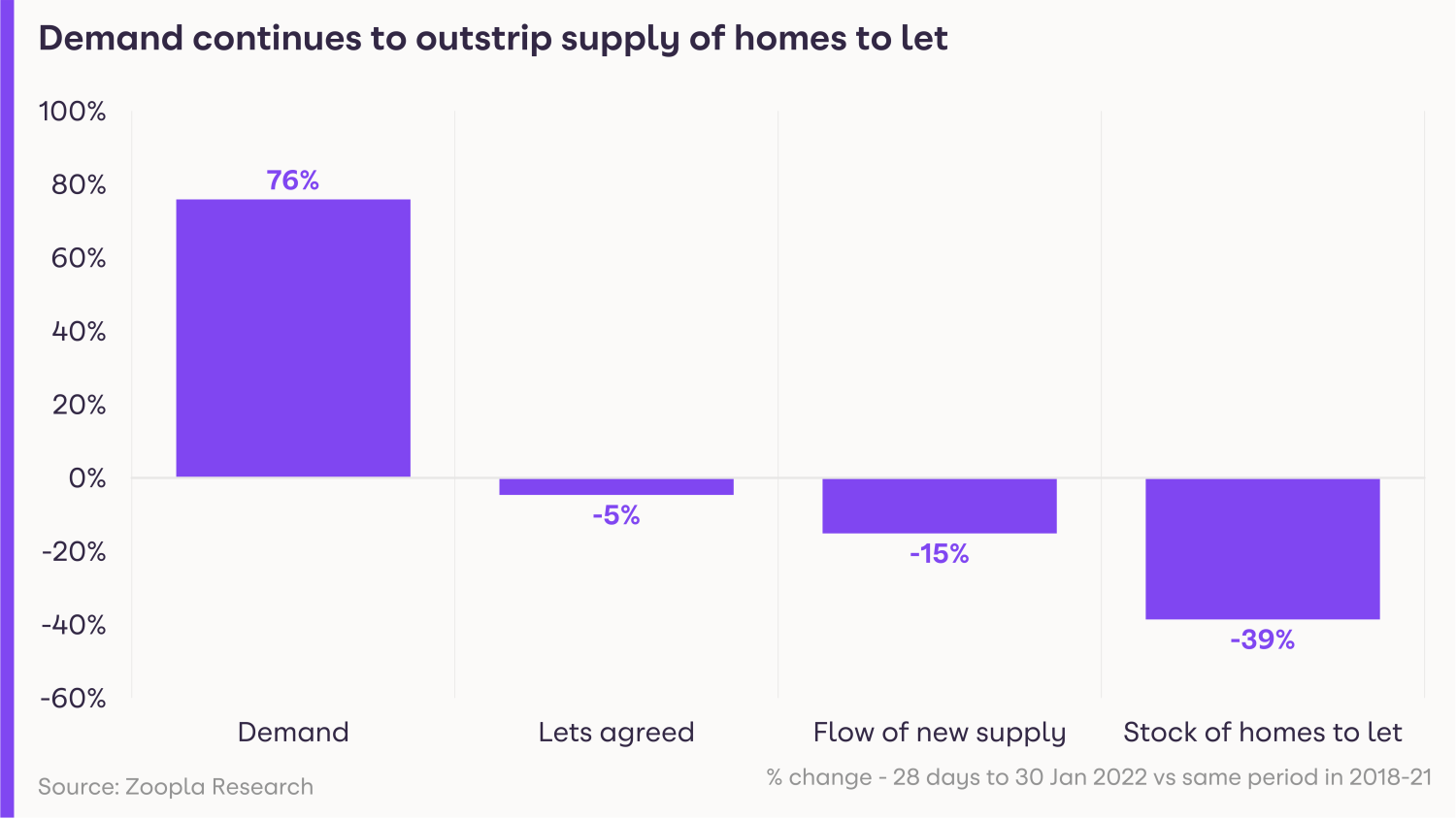

The New Year has seen soaring demand for rental homes, with the number of people looking for a property 76% higher than during the same period between 2018 and 2021.

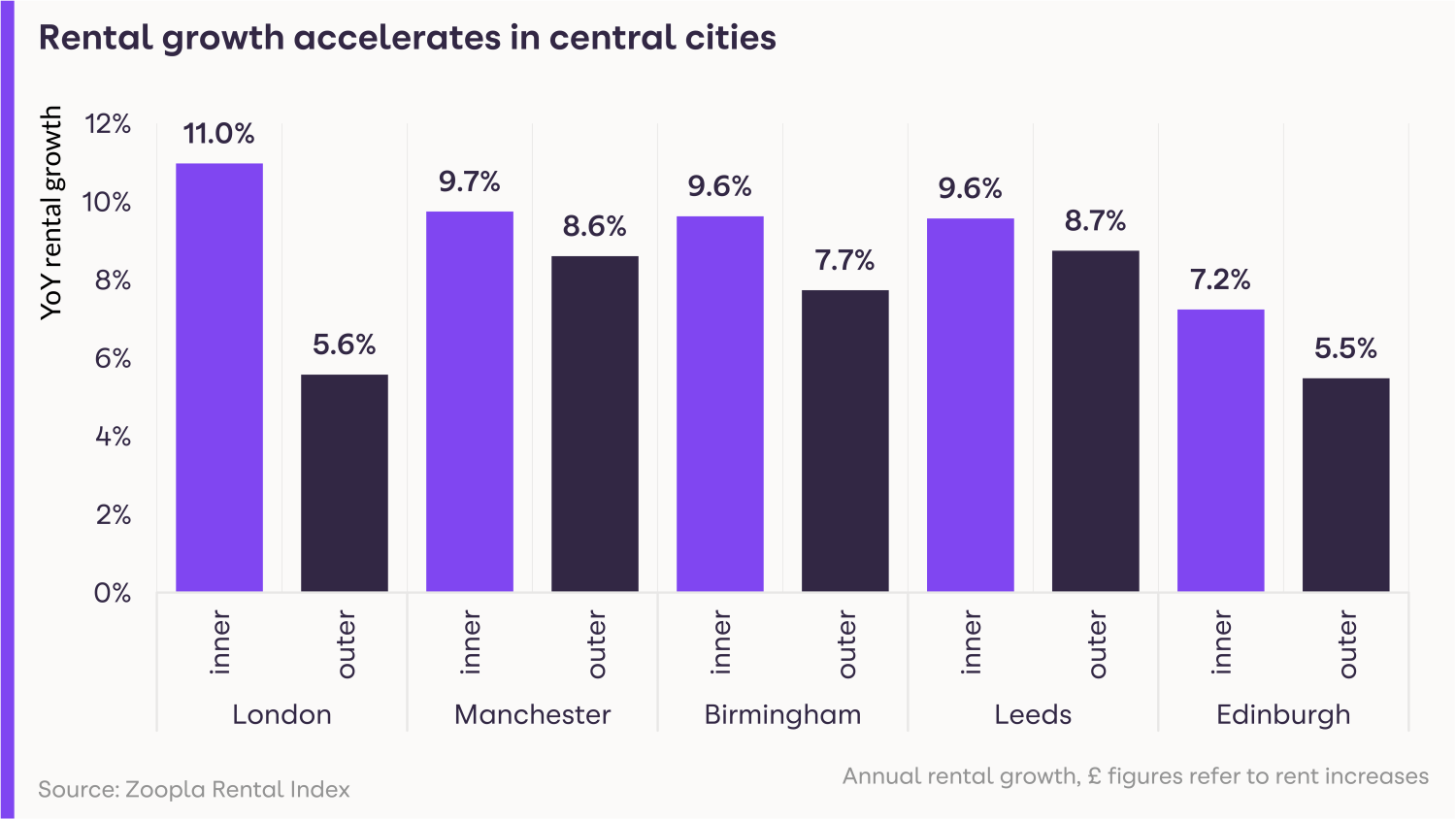

While the pandemic saw increased interest in wider commuter zones as renters also embraced the ‘search for space’, people are now returning to the centres of major cities, such as London, Manchester, Birmingham, Leeds and Edinburgh.

Is there a good supply of homes available to rent?

Unfortunately, the heightened demand in the rental market is not being matched by an increase in supply.

In fact, the number of homes available in January was 39% lower than is typical for the start of the year.

The imbalance between supply and demand is creating a fast-moving rental market with intense competition, pushing the cost of renting higher.

Meanwhile, homes are taking an average of just 14 days to let, compared with three weeks in late 2020.

The shortage of available rental properties is due to a fall in investment in the sector by buy-to-let landlords.

At the same time, rising costs are leading to many renters staying where they are, further limiting the turnover of rental homes available.

What could this mean for you?

Tenants

The rental market is currently moving quickly and there is intense competition from other would-be renters.

As a result, you must be prepared to move fast in order to secure a property, particularly if you are looking in a city centre, where demand has bounced back.

Landlords

The strong demand for rental accommodation, combined with the shortage of availability, means there will be high demand for property and landlords are unlikely to experience many void periods.

For new entrants to the market, average yields are currently at 4.86% across the UK.

What’s the outlook?

The ongoing shortage of rental homes is expected to underpin modest rental growth in the coming months, particularly in city centres, although affordability constraints will act as a brake on larger rises.

Head of research said: “The January peak in rental demand will start to ease in the coming months, putting less severe pressure on supply, which will lead to more local market competition, and more modest rental increases.

“The flooding of rental demand back into city centres, thanks to office workers, students and international demand returning to cities, means the post-pandemic ‘recalibration’ of the rental market is well underway.”

Going forward, rents are expected to rise by 4.5% across the UK excluding London in 2022, and by 3.5% in the capital.

Key takeaways

- Based on new lets agreed, average UK rents are now £969 per month

- The rate at which rents are rising reached a 13-year high of 8.3% in the final three months of 2021

- Demand for rental homes soared by 76% in the New Year, compared with the same period between 2018 and 2021

Interest rates hiked again as cost of living rises

Nearly two million homeowners will face higher mortgage repayments after the Bank Rate was increased for the second time in three months.

The Bank of England has increased interest rates for the second time in three months.

The Bank Rate – the official cost of borrowing – has gone up from 0.25% to 0.5%.

The move means around two million homeowners with variable rate mortgages will see their monthly repayments rise.

The change will add around £24 a month to repayments on a £200,000 mortgage.

The increase comes as consumers are already facing pressure on their budgets as a result of higher food prices and rising energy costs, while National Insurance contributions are due to be increased in April.

Energy bills are set to rise by 54% this year to an average of £1,971, after energy regulator Ofgem increased the cap on the prices that energy companies can charge.

The Bank of England warned that families faced the biggest fall in disposable income since records began three decades ago.

Why are interest rates going up?

Inflation hit a 30-year high in December of 5.4%.

The Bank’s Monetary Policy Committee (MPC) uses changes to interest rates as a way of controlling inflation.

It is supposed to keep inflation – which measures the rate at which things we buy get more expensive – at 2%, as measured by the Consumer Prices Index.

But inflation is currently more than double this level and it is expected to rise further to peak at more than 7% in April.

The MPC is made up of 12 members who all vote on whether or not interest rates should be changed.

At the latest meeting, four members voted to raise the Bank Rate to 0.75%, suggesting there are further interest rate hikes to come.

What does it mean for me?

You will only be impacted by the interest rate change if you are on a mortgage that moves up and down in line with changes to the Bank Rate.

These are mortgages such as tracker deals or standard variable rates, which you revert to when a fixed term deal comes to an end.

Around 850,000 homeowners are currently on tracker mortgages, while 1.1 million are on standard variable rate ones, according to mortgage trade body UK Finance.

People with a £200,000 mortgage will see their repayments increase by around £24 per month following the latest hike, increasing their monthly payments by just under £40 once the previous increase is factored in.

Around 74% of mortgage holders are on fixed rate deals, and they will not see any change to their monthly repayments.

This is because under fixed rate mortgages the interest rate you pay remains the same for the length of the deal, which is usually two to five years.

What should I do now?

If you are currently on a fixed rate mortgage, you don’t need to worry about higher interested rates until your deal ends.

If you are on a tracker mortgage and want to protect yourself from further interest rate rises, you may want to switch to a fixed rate deal.

But before you do this, check to make sure you will not incur any penalties for ending your deal early.

If you are on a standard variable rate you can switch to a new mortgage at any time.

The good news is that although mortgage rates have risen during the past month as lenders anticipated the latest rate hike, competitive deals are still available.

The average cost of a two-year fixed rate mortgage is now 2.44%, while a five-year fixed rate deal is 2.71%, and a 10-year fixed rate mortgage is only slightly more expensive at an average of 2.85%.

This compares with an average rate of 4.46% for people on standard variable rates.

If you think you may struggle to keep up with your mortgage repayments after the latest interest rate rise, it is important to contact your lender as soon as possible.

There are a number of steps lenders can take to help you, including granting you a temporary payment holiday or putting you on to an interest-only mortgage for a short time.

But options become much more limited if you have already missed a payment.

Key takeaways

- The Bank of England has increased interest rates for the second time in three months, raising them by 0.25% to 0.5%

- The move means around two million homeowners with variable rate mortgages will see their monthly repayments rise

- The increase will add around £24 a month to repayments for someone with a £200,000 mortgage

Levelling Up: no fault evictions for renters to end

The Government has unveiled plans for a dramatic shake up of the private rented sector with its Levelling Up white paper. Find out what's in store for renters and more.

Landlords will no longer be able to kick renters out of their homes for no reason under new plans announced by the Government.

Section 21 ‘no fault’ evictions, under which renters have to vacate a property after a notice period even if they’ve done nothing wrong, will be abolished as part of a number of reforms included in the Government’s Levelling Up White Paper.

Other improvements include ensuring all homes in the private rented sector meet a minimum standard for the first time ever, and halving the number of poor-quality rental homes across the country.

The Government also plans to explore introducing a landlords register, pledging to crack down on rogue landlords.

Using fines and bans, it wants to stop repeat offenders leaving renters living in unacceptable conditions.

Why is this happening?

The measures are part of the government’s Levelling Up White Paper, which aims to shift government focus and resources to communities that have lagged behind the rest of the country in terms of prosperity.

The paper sets out 12 Missions to Level Up the UK by 2030, ranging from increasing employment and productivity, to improving public transport and 5G access while offering skills training.

One of these missions is to ensure renters have a secure path to homeownership, and to improve their accommodation in the meantime.

Who does it affect?

The white paper is good news for renters in both the private and social housing sectors.

Under the Decent Homes Standard, which currently only applies to social housing, private rented homes will have to be in a reasonable state of repair, have reasonably modern kitchens and bathrooms, and have effective insulation and heating.

Meanwhile, the government has also committed to building more genuinely affordable social homes.

In addition, it will deliver on the commitments it made following the Grenfell fire tragedy in 2017, such as ensuring homes are safe, complaints are dealt with promptly and that renters’ voices are heard, through a new Social Housing Regulation Bill.

But it is important to note that beyond setting the broad target to meet the 12 missions by 2030, no timeline has been announced for the individual measures included in the white paper.

What else is happening?

The white paper also included other measures that will impact housing.

A new £1.5 billion Levelling Up Home Building Fund will be launched to provide loans to small and medium-sized developers.

The Government also said much of its £1.8 billion brownfield funding will be diverted away from building homes in London and the South East to transforming brownfield sites in the North and Midlands.

Homes England will also spearhead efforts to regenerate 20 town and city centres into 'beautiful communities'.

Key takeaways

- Section 21 ‘no fault’ evictions will be abolished as part of a number of reforms included in the Government’s Levelling Up White Paper

- All homes in the private rented sector will have to meet a minimum standard for the first time

- The Government will crack down on rogue landlords through fines and bans

New Year demand for property hits record levels, up 50%

The housing market enjoys its biggest New Year bounce in five years, with demand soaring for all types of property.

Demand for property soared by 49% in January, in the biggest New Year bounce for five years.

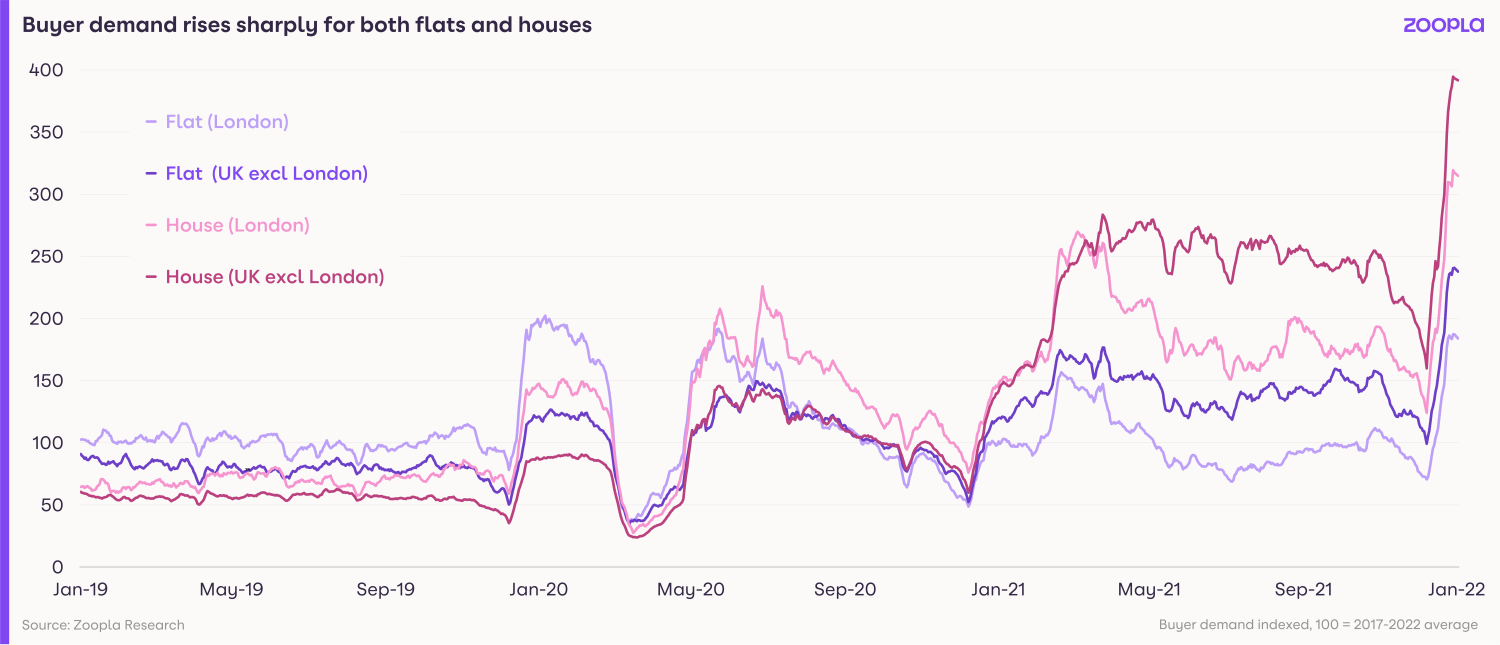

Record demand was recorded for all property types, as buyers searched for both houses and flats.

The increase in buyers was on a par with the record levels of interest seen during the stamp duty holiday, and suggests the search for space still has further to run.

The spike in activity helped push up the average cost of a UK home to £242,000, compared with £216,500 this time last year.

What’s happening to house prices?

Property prices rose by 7.4% in the year to the end of December, with gains for houses continuing to significantly outstrip those of flats.

While the cost of terraced, semi-detached and detached homes soared by 8.8% during the year to stand at £289,500, the price of flats edged ahead by just 2.2% to £175,700.

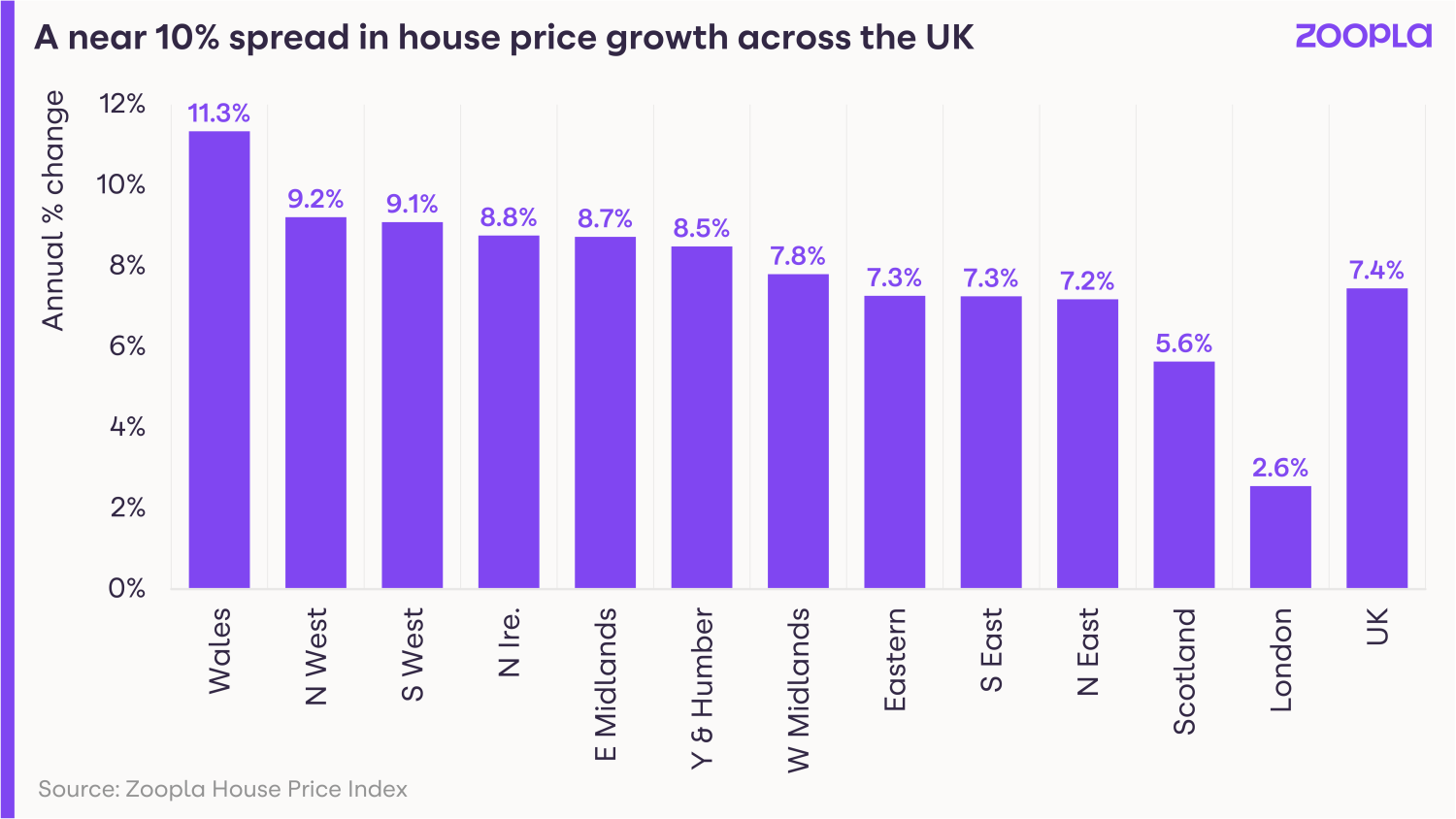

Across the regions, Wales led the way for the 11th consecutive month with property values rising by 11.3%, followed by the North West at 9.2% and the South West at 9.1%.

London continued to lag, posting increases of just 2.6%, although a third of the capital’s boroughs saw price growth of more than 4%.

How busy is the market?

Demand soared across the board at the start of the New Year, with buyers up 49% compared with the average for the past three years.

Three bedroom homes outside of London were the most sought-after property, with demand for these homes four times higher than the five-year average.

Meanwhile, as hybrid working continues to be the norm and city workers start to return to offices, demand for flats was on a sharp upward trajectory, reaching its highest level for five years.

The supply of homes listed for sale also appears to have turned a corner.

Although the number of homes on the market is still 44% below the five-year average, the situation is an improvement from when it was 47% down at the end of 2021, and reverses the trend seen during the past 11 months.

While demand continues to outstrip supply, there is now a growing correlation between the types of home buyers most want and those that are available.

Three-bedroom houses top the list for both supply and demand, although two-bedroom flats are the second most available property, while two-bedroom houses are the second most in demand home.

The increase in supply could be because buyers, keen to make a move before interest rates increase again, are starting to list their current homes for sale now.

Even so, further rate increases are not expected to have a big impact on the property market, as mortgage rates remain low by historical standards and, with three-quarters of homeowners on fixed rate deals, the majority of people will be protected from further base rate rises.

What could this mean for you?

First-time buyers

The increase in the number of homes coming on to the market is good news for first-time buyers as it means they'll have more choice.

Flats continue to offer better value than houses after seeing more modest price rises during the past year.

And those modest rises are what's reigniting their popularity among potential buyers.

In London, where demand has reached its highest level for 19 months, first-time buyers are also facing competition from overseas buyers from Hong Kong, who are snapping up flats following the introduction of new British National Overseas (BNO) visa rules.

As a result, you need to be ready to move fast if you see somewhere you like.

Home-movers

If you're trading up the property ladder, you're in a strong position to sell your current home, particularly if it's a three-bedroom house.

The increase in properties being put up for sale also means you should have more choice in finding your next home.

But with buyer demand hitting record high levels, the market remains fast paced and co-ordinating your sale and purchase could be tricky.

Speak to local estate agents to get a sense of how quickly the market is moving where you are and whether you should wait until you've found a new home before listing your current one.

What’s the outlook?

While house price growth remains strong, the annual rate at which prices are rising appears to have peaked, dropping to 7.4%, compared with 7.7% in September.

It's expected to slow further as the market returns to more normal conditions and economic headwinds increase, with house prices likely to end the year 3% higher than they started it.

Meanwhile, the effects of the pandemic are still being felt, with the ongoing search for space contributing to record demand for homes, while city-centre markets are also being boosted by workers returning to the office.

Grainne Gilmore, head of research, Zoopla, says: “Just like much of 2021, the number of homes available for sale is lower than typical levels, but there are signs that the imbalance between demand and supply is starting to ease.

“As more potential sellers are able to find a home to move to, this will spur more supply in the weeks and months to come.”

Key takeaways

- Demand from potential buyers jumped by 49% in January

- House prices rose at an annual rate of 7.4%, taking the average value of a UK home to £242,000

- More homes are coming on to the market, although a significant supply and demand imbalance remains

New government guidelines for unvaccinated buyers and renters

People who are not vaccinated against Covid-19 will have to isolate if they are exposed to the virus, even if it means missing their moving day.

The government has announced new guidelines for people buying a home or moving into a rental property who are not vaccinated.

Under the rules, those who are not fully vaccinated against Covid-19 are legally required to stay at home and self-isolate for seven days if someone in their household tests positive for the virus.

The guidance issued by the Department for Levelling Up, Housing and Communities applies even if the isolation period coincides with the day on which they were scheduled to move home.

But those who are fully vaccinated do not have to follow these rules.

Instead, they can move home according to their original schedule, even if someone in their household has tested positive.

They are, however, “strongly advised” to take a lateral flow test every day for seven days, and to self-isolate if any of their tests are positive.

Why is this happening?

The rules are the latest in a series of guidance issued by the Government during the pandemic relating to the homebuying and moving process.

They have been introduced following the emergence of the Omicron variant, which is more contagious.

But this is the first time that the government has differentiated between those who are vaccinated and those who are not.

They reflect the fact that people who are vaccinated are less likely to become severely ill if they catch Covid-19, and are also less likely to spread it to other people.

Who does it affect?

The new guidance applies to both buyers and renters who are aged over 18 years and six months.

The rules affect those who are not fully vaccinated, which is defined as having both doses of a two dose vaccine.

Those who are fully vaccinated, or who are aged under 18 years and six months do not have to follow them.

The guidance also impacts those working in the homebuying and moving industry, including letting and estate agents, valuers and removers.

The rules only apply to people moving in England.

Scotland, Wales and Northern Ireland have their own anti-pandemic measures.

What’s the background?

The housing market in England remains open if you are looking for a new home to buy or rent.

As a result, you can continue to view potential properties and move home, as long as you have not been exposed to Covid-19.

But the government is urging everyone involved to continue to follow good hygiene practices, such as regular handwashing and cleaning, and to be as flexible as possible if a move needs to be delayed as a result of someone needing to self-isolate.

Key takeaways

- For the first time, the government has differentiated between those who are vaccinated and those who are not when it comes to buying a home or moving into a rental property

- Under the new rules, those who are not fully vaccinated against Covid-19 are legally required to stay at home and self-isolate if someone in their household tests positive for the virus

- Those who are fully vaccinated do not have to follow these rules and can move home according to their original schedule, even if someone in their household has tested positive

How parents bend the rules if their home isn't in a school catchment area

What lengths would you go to, to get your child into a good school? Our latest research reveals a quarter of parents have bent the rules. Here's what they did.

With the primary school application deadline upon us (15 January), almost a quarter of parents (24%) admit to flouting school admissions criteria to get their child into their preferred local school, according to our latest research.

We surveyed parents of school age children to understand the lengths they go to in order to secure a place at the best schools.

And we found that parents pay on average £82,960 more for a property in the catchment area of a high-performing school.

In London, that figure rises to more than £200,000.

Nearly a fifth of parents lie to get their kids into a good or outstanding school

In total, 17% of parents of school aged children admit they lied, bent or broke school application rules to get their children into their preferred school.

A further seven per cent say they ‘played the system’.

That means one in four (24%) parents are going to extreme lengths to secure preferred school places for their kids.

But bending the rules can take many forms.

Among the parents who have, 27% fessed up to exaggerating their religious beliefs to get into a faith school.

Property porkies are also prevalent.

Among those who broke the rules, over a fifth (21%) say they registered their child at a family member’s address that was closer to their preferred school.

One in ten confessed they simply lied about their address, and eight per cent admitted they temporarily rented a second home (that the child never lived in) within the catchment area.

One in six parents confessed to outright bribery of their preferred school

Money and school donations also play a key role.

One in six parents (16%) who admit they bent the rules say they made a ‘voluntary donation’ to a particular school ahead of applying, while eight per cent confessed to offering a bribe.

Others offered their time, with 20% saying they volunteered at or became involved with a school ahead of applying for their child’s place.

A further 14% said they became ‘friendly’ with senior figures at the school in order to curry favour.

What's the cost of a home in the right catchment area?

Of course, many parents do not bend the rules – some are simply able to move into the catchment area of the school they want their children to go to.

In total, 28% of parents who currently have school aged children say they did this.

However, the research found that there’s a huge premium attached to doing so - which might be prohibitive to some.

Among those who bought a home in a good catchment area, the average premium they paid was a huge £82,960 with the figure rising to £209,599 in London.

How do parents feel about bending the rules?

The majority of parents in the UK are against bending or breaking rules to get children into a good or outstanding school.

Over half (55%) say they feel it is an ‘unfair practice which should be stopped’ and the 56% who have done so, admit they feel guilty about it.

A further 6% of parents admit they are so fed up with the practice that they have ‘grassed up’ another parent and reported them to the school.

However, more than one in ten (11%) believe it is acceptable and a further 19% admit it isn’t fair but ‘everyone does it’.

Key takeaways

- Parents are breaking school admissions criteria to avoid paying an average £82,960 premium on homes in a good or outstanding school catchment area

- 17% of parents say they lied, bent or broke admissions rules, while a further 7% say they ‘played the system’ in order to get their child into a good local school; this totals 24% flouting the rules

- Pretending to be religious or lying about home addresses are the most common mistruths told in order to secure in-demand school places

- 16% of those who admit to breaking rules say they made a ‘voluntary donation’ to the school while 8% admit they offered a bribe

- Despite the prevalence of rule breaking, over half of parents (56%) who’ve done so feel guilty about it

7 things renters need to know in 2022

From new Covid-19 measures to rising demand, here’s what you need to be aware of if you’re renting this year.

Are you renting in 2022? Here’s all the news and information you’ll need to know your rights and make the right decisions.

1. New anti-Covid-19 measures

The government has released new guidance to help limit the spread of Covid-19 in rented homes.

It advises renters to make sure your homes are well ventilated if people from outside of your household visit.

This includes landlords, letting agents and workmen.

The guidance suggested keeping windows or doors on opposite sides of a room open during a visit.

Renters should also ensure small vents or grilles at the top of windows are open and unblocked.

You cannot have repairs or safety inspections carried out if someone in your household has Covid-19 symptoms.

The only exception is if the repairs are to fix something that is a direct safety risk to you or the public.

2. Six-month eviction notice rule extended in Wales

In Wales, laws meaning your landlord has to give you six months’ warning if they want to evict you have been extended.

The rule, which was introduced in July 2020 as a result of the Covid-19 pandemic, had been due to expire on 31 December 2021.

But the Welsh Government has now extended it until 24 March 2022.

It applies to all types of evictions, except those involving domestic violence or anti-social behaviour.

3. New energy efficiency rules are on the cards

Renters in England and Wales can look forward to having more energy efficient homes.

The government is expected to press ahead with new energy efficiency rules this year.

The rules state that all rental properties must have an energy performance rating of C or above.

This might mean installing double-glazed windows, a more efficient boiler and additional insulation.

As a result of which, you’ll likely need to spend less on gas and electricity bills.

The only snag is, you might not see much change fast.

The government is expected to give landlords an extra year until 2026 for new rental agreements, and until 2028 for existing ones.

4. It’s easier to have a pet in your home

The government has changed its model tenancy agreement so that landlords can no longer issue blanket bans on pets.

This is good news for all pet-lovers in rental homes.

The change means landlords can only refuse to let you have well-behaved pets if there is a valid reason, such as a lack of space.

The model tenancy agreement is widely used by landlords in England.

It’s important to note that you still need to ask your landlord if you can have a pet.

5. Carbon monoxide safety rules are getting stricter

The government has introduced new carbon monoxide safety rules for rented homes with gas boilers or gas fires.

Landlords must install carbon monoxide detectors. This applies to existing appliances and when new ones are installed.

The detectors must also be fixed or replaced if they are faulty.

The aim is to end accidental carbon monoxide poisoning. Hopefully it will also renters to feel safer in your homes.

6. Renters are getting older

The proportion of people aged between 55 and 64 years old who are renting in the private sector has doubled during the past decade.

There has also been a significant increase in the number of renters aged between 45 and 54, according to the latest English Housing Survey.

The rise in older renters is likely to be due to high property prices making it harder to buy homes, and people divorcing later in life.

7. Increased competition for rental homes in cities

The number of people looking for rental homes in cities is increasing.

But there has been a fall in new properties coming on to the market.

Our latest research found demand is currently 43% higher than the five-year average, but the number of homes available is 43% lower.

The mismatch has led to rent increases hitting a 13-year high.

The typical cost of renting a home across the UK, excluding London, now stands at £809 per month.

Rents outside of London are expected to continue to rise during 2022, to end the year 4.5% higher than they started it.

Key takeaways

- The government has issued new guidance to help stop the spread of Covid-19 in rented homes, as well as new rules making it easier to keep pets in rental homes

- Other laws coming into force this year include changes to energy efficiency standards and tighter carbon monoxide safety rules

- Renters are getting older with the proportion in their mid-50s to 60s having doubled, while high demand and dwindling supply means rents have hit a 13-year high.

Number of first-time buyers hits 20-year high

Record year for first-time buyers stepping onto the ladder, as more than 400,000 buy their first home. The highest number in 20 years.

The number of people taking their first step on the property ladder soared to a 20-year high in 2021.

An estimated 408,379 people bought their first home during the year, 35% more than in 2020, according to Yorkshire Building Society.

It was the first time that first-time buyer numbers have broken through the 400,000 threshold since 2006, while the figure was also more than double the 200,000 people who purchased their first home each year between 2008 and 2012.

First-time buyers accounted for 50% of all people purchasing a property with a mortgage in 2021, up from a low of 36% in 2007 during the global financial crisis.

But numbers still have some way to recover to reach the previous first-time buyer peak seen in 2002, when 531,800 people bought their first home.

Why is this happening?

A combination of high levels of employment and low interest rates have helped to drive the increase in first-time buyer numbers.

There has also been a significant rise in the number of mortgages available for people with only small deposits, after lenders began offering 95% mortgages again.

Many banks and building society pulled the deals in 2020 during the early stages of the Covid-19 pandemic. But the government-backed mortgage guarantee scheme has increased confidence once more.

There are now more than 350 mortgages available to buyers borrowing 95% of their home’s value, while interest rates on these products have fallen to a record low.

At the same time, people purchasing their first home have also benefitted from a raft of government schemes.

Anecdotal evidence also suggests many first-time buyers were able to save more towards a deposit during the pandemic due to decreased expenditure during successive lockdowns.

Who does it affect?

The figures are great news for aspiring first-time buyers as they show mortgage lenders are once again happy to lend to this sector of the market.

They are also good news for people who want to trade up the property ladder.

First-time buyers play a vital role in the market through buying entry-level properties, enabling the owners of these homes to trade up to bigger properties.

What help is available to first-time buyers?

The government’s flagship scheme to help first-time buyers is the Help to Buy equity loan scheme.

It enables people to purchase a new-build property with a 5% deposit, which the government tops up with a 20% equity loan that's interest-free for five years.

Other initiatives include First Homes, under which first-time buyers, key workers and local people, can purchase a home at a 30% discount to its market price, while the 95% mortgage guarantee scheme helps buyers get a mortgage with just a 5% deposit.

There is also help for people saving for a deposit. First-time buyers can take out a Lifetime ISA, into which they can save £4,000 a year, which the government tops up with a 25% bonus, up to a maximum of £1,000 annually.

The money must be used to either purchase a first home or for retirement.

Meanwhile, first-time buyers continue to be exempt from stamp duty on the on the first £300,000 of a purchase on homes costing up to £500,000.

| Property price | Percentage of stamp duty paid |

|---|---|

| £0 - £300,000 | 0% |

| £300,000 - £500,000 | 5% |

| £500,000+ | Normal stamp duty rates apply |

UK homes went up £16,000 in 2021

Homeowners saw thousands added to the value of their homes this year with the entire UK housing stock now estimated to be worth £9.5trn, our latest House Price Index reveals.

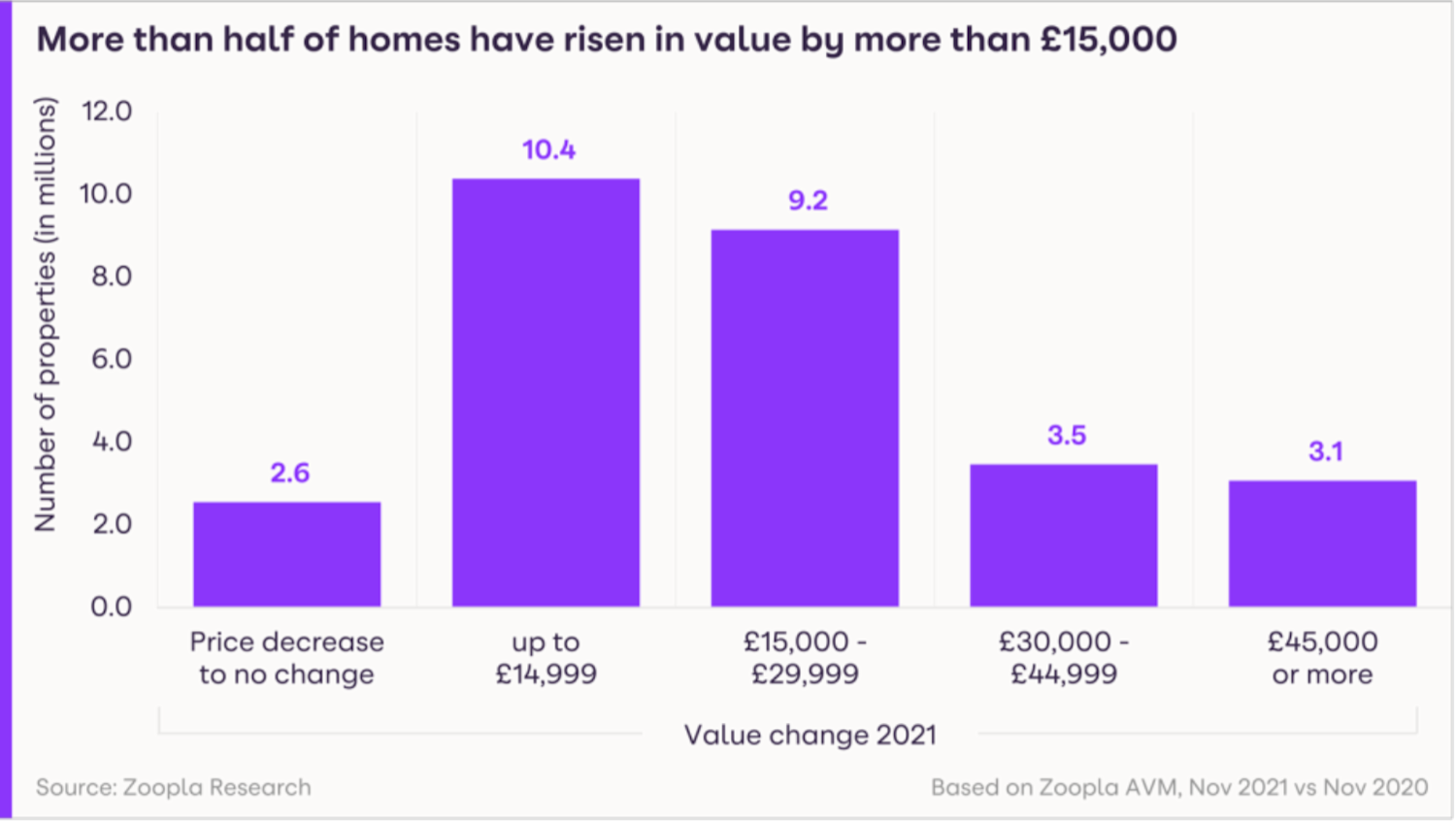

UK house prices hit an all-time high in 2021 with the average home rising in value by £16,000.

The increase has left the typical property costing £240,800.

More than half of UK homes have risen in value by more than £15,000.

A whopping 3.5m homeowners will have seen a £30,000 to £44,999 increase in their property’s value.

And, 3.1m homes have soared by more than £45,000.

A surge in home sales in 2021 has resulted in the market value of homes soaring by £670bn collectively.

The entire UK housing stock is now estimated to be worth £9.5trn.

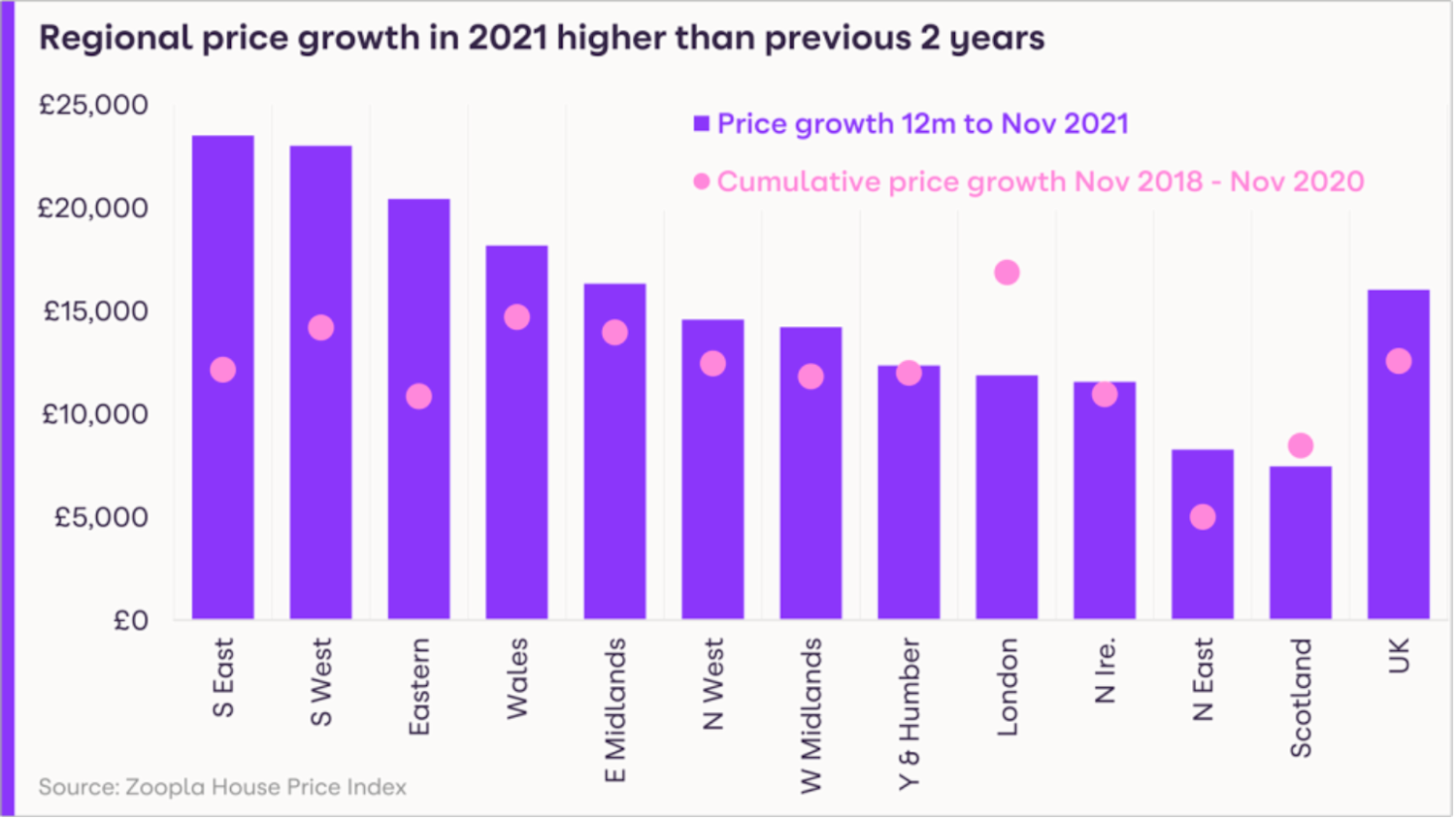

House prices in nearly every region of the country have risen by more this year than in 2019 and 2020 combined.

But, the rate at which property values are increasing is expected to slow next year amid economic headwinds, and a rise in the number of homes being put up for sale - from record low levels

What’s happening to house prices?

House prices rose at an annual rate of 7.1% in November.

The strongest growth was in Wales, where house prices went up 11.1%.

This was followed by the North West at 9.1% and the South West at 8.7%.

By contrast, prices in London edged ahead by just 2.4%.

Northern cities continued to see the highest growth.

Liverpool led the way with growth of 10.7%, followed by Manchester at 8.5% and Nottingham at 8.1%.

In monetary rather than percentage terms, homeowners in the South East saw the biggest gains.

Homes in the South East went up by an average of £23,500.

While those in the South West typically gained £23,000 and the East of England gained £20,400.

How busy is the housing market?

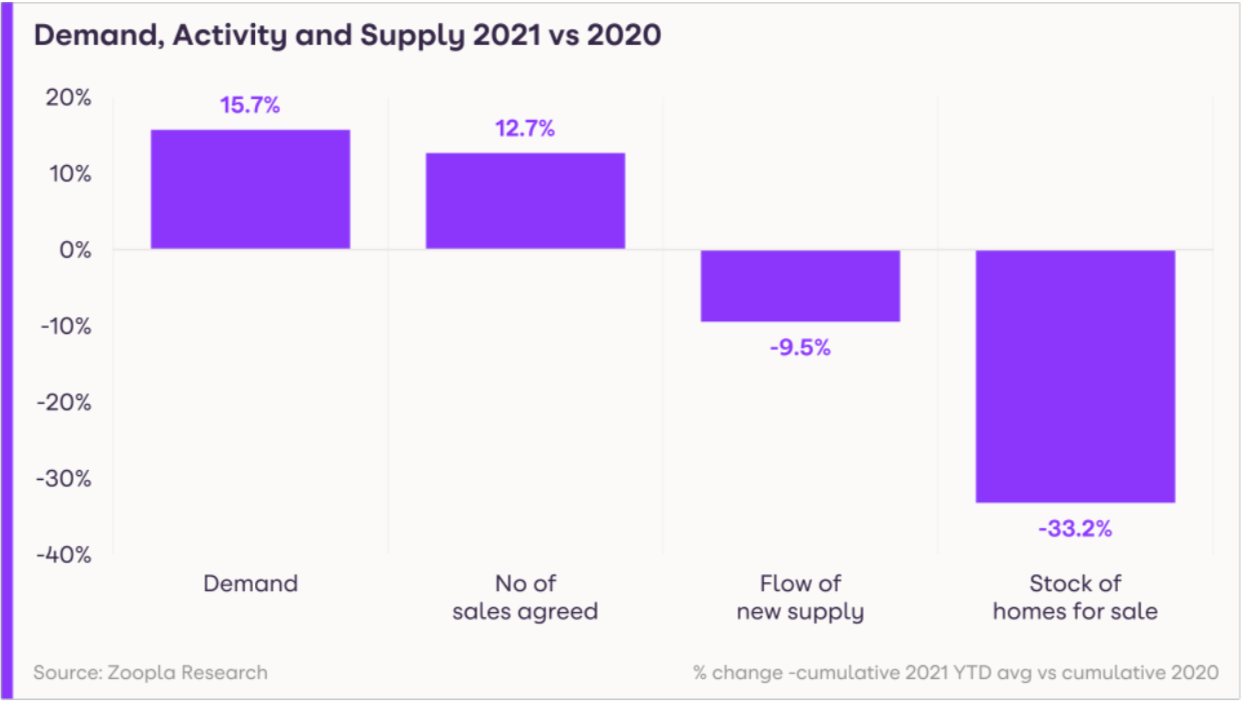

Buyer demand has remained strong throughout the year, running at an average of 15.7% higher than in 2020.

The number of people looking to move is currently highest in the East Midlands at 42% above last year’s level.

The West Midlands and Yorkshire and the Humber are not far behind at 35% and 28% respectively.

Buyer activity peaked in June 2021, when more people moved home than in any month since our records began in 2005.

But, the number of homes for sale has failed to keep pace with soaring demand.

The number of properties on the market is around a third lower than it was in 2020.

Strong demand and limited supply has accelerated house price growth in 2021.

What could this mean for you?

First-time buyers

Big jumps in property prices are bad news if you are a first-time buyer, as it makes getting a first home harder.

The good news is that the increase is only an average and the price of houses has increased significantly more than flats.

In fact, the typical price of a flat in London is broadly unchanged since last year.

As a result, if you are struggling to afford your first home, it may be worth looking at flats.

Home-movers

Strong house price gains mean that if you’re an existing homeowner wanting you could be sitting on significant equity.

The shortage of homes on the market also means you are likely to be able to sell your current home quickly, putting you in a strong position to buy.

On the downside, you can expect to face significant competition from other buyers. But this should ease somewhat next year.

What will happen in the housing market in 2022?

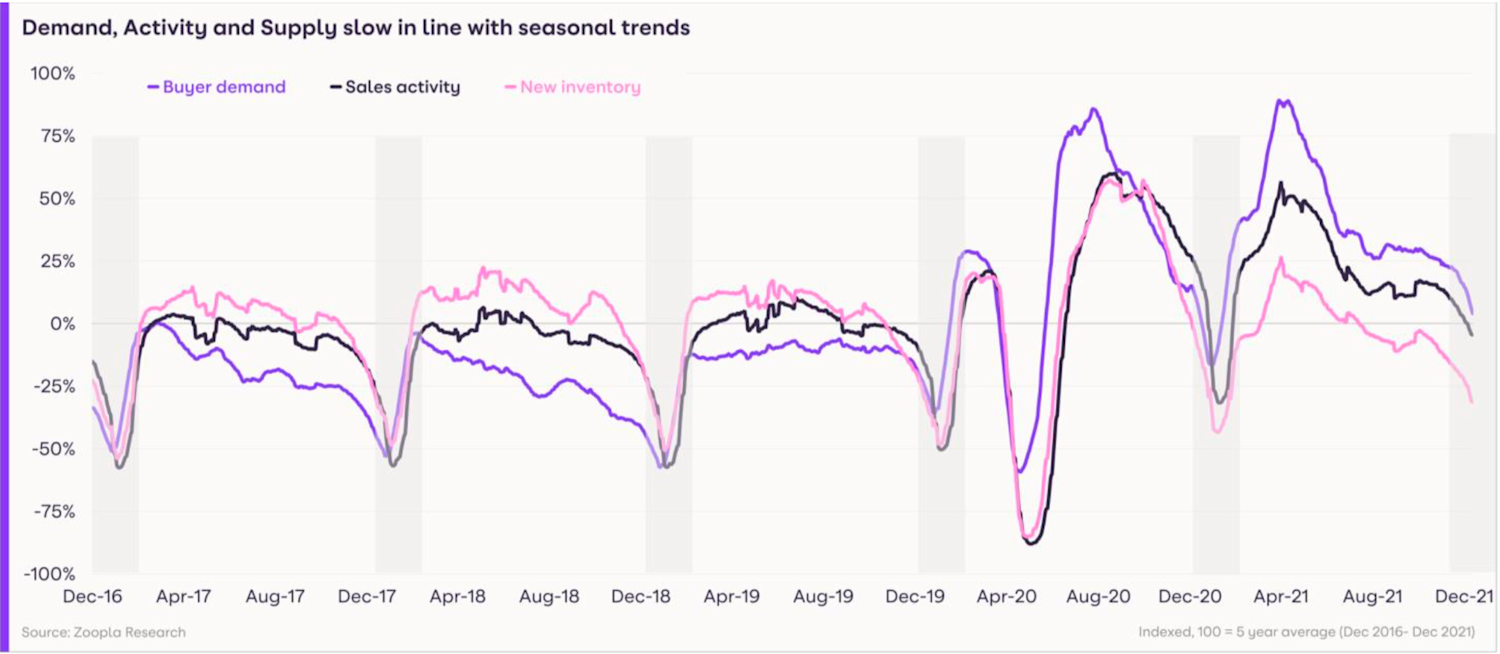

The property market is currently in a seasonal dip, as people put buying plans on hold while they celebrate Christmas.

But, we expect a massive bounce back in activity after the festive season as the pandemic-induced search for space continues.

Our Head of research, said: “This year has been a record year for the market.

“The stamp duty holiday and the pandemic-led ‘search for space’ has resulted in the highest number of sales since before the financial crisis, with 1.5m transactions.”

She expects the strong price growth seen during the past year to prompt some homeowners to cash in and move in the new year.

As a result, more properties are expected to come on to the market in the first quarter of 2021.

As more homes come onto the market, the imbalance between supply and demand should begin to ease.

It currently takes fewer than 30 days on average from a property being listed to a sale being agreed subject to contract.

Sales times are expected to fall back to a pre-pandemic level of 50 days during 2022.

Even so, demand is likely to continue to outpace supply, leading to predicted house price growth of 3% during 2022.

In 2022, we estimate 1.2m homes will be sold, compared with 1.5m in 2021.

Renters spend more on housing costs each month than homeowners

Renters fork out considerably more of their monthly income on their home each month than mortgage-holders, according to the latest English Housing Survey.

Renters face significantly higher housing costs than owner occupiers, according to the latest English Housing Survey.

Private renters spend 31% of their household income on rent each month, while those buying a home with a mortgage spend just 18%.

The English Housing Survey findings for 2020/21 come as our own research shows that rent increases hit a 13-year high.

The cost of renting a UK home outside London, now stands at £809 per month, according to our latest Rental Market Report.

The good news for potential buyers is that there has been a steep increase in the number of people getting on to the property ladder.

The number of first-time buyers in 2020/2021 reached 957,000. That’s over 130,000 more than the previous year.

A total of 61% of people in the private rented sector expect to be able to buy their own home at some point, according to the survey.

Of those, 35% expect to be able to step onto the property ladder within the next two years.

Why are renters paying more?

People in the private rented sector paid an average of £198 a week for their home. While people with a mortgage paid £174 a week.

Part of the discrepancy is caused by the fact that homeowners are currently benefiting from record low mortgage rates.

At the same time, private landlords are facing increased costs due to tax changes and new regulatory requirements. Some of these costs are being passed on to tenants.

Also, private sector rents reflect the current market rate, because rents are typically adjusted when tenants’ contracts are renewed.

Homeowners typically take around 25 years to fully own a property outright if they are buying it with a mortgage.

The owner-occupier figures include people who bought years ago when house prices were lower. This means their mortgage payments are lower than if they were buying today.

How many people are in private rented homes?

One in five people in England rent a home in the private sector, rising to 27% in London.

Younger people are more likely to rent, with 65% of people in the private rented sector aged under 45.

There has been an increase in older age groups who rent.

There are 11% of people aged between 55 to 64 letting in the private sector, double the proportion a decade earlier.

While, the number of people aged between 45 and 54 renting stands at 16%, up from 11% 10 years ago.

How did so many people buy homes this year?

The number of first-time buyers in 2020/2021 reached 957,000. That’s 131,000 more than in 2019/2020.

Many of these buyers will have taken advantage of the stamp duty holiday which ended in June.

The average first-time buyer was 32 when they got on the property ladder, rising to 34 in London, according to the survey.

First-time buyers put down a typical deposit of £44,294, while 62% opted for a mortgage term of 30 years.

The steep increase in first-time buyers is likely to reflect the amount of government support available for those getting on to the property ladder.

What government help is available to first-time buyers?

The Help to Buy equity loan is the flagship scheme which enables first-time buyers to purchase a property with just a 5% deposit.

The government then tops this up with a 20% equity loan, which is interest-free for five years.

In September, the government announced plans to deliver 57,000 affordable homes for first-time buyers to purchase through schemes such as shared ownership.

First-time buyers are also exempt from paying stamp duty on the first £300,000 of a property purchase on a home costing up to £500,000.

Other schemes include First Homes, under which first-time buyers, key workers and local people, can purchase a home at a 30% discount to its market price.

While the 95% mortgage guarantee scheme helps buyers get a mortgage with just a 5% deposit.

First-time buyers can also save for a deposit using the Lifetime ISA, which the government tops up with a 25% bonus of up to £1,000 annually.