Expensive ground rents to be banned for new buyers

From 30 June, the government is banning expensive ground rents, meaning leaseholders will no longer have to pay them when purchasing a home on a long lease.

The government is banning the charge of expensive ground rents on leasehold properties for new buyers in England and Wales.

Unlike a freehold property, with a leasehold one, homeowners do not own the property outright. Instead they have the right to live in it for a set length of time, typically between 99 and 125 years.

The land on which the property sits continues to be owned by the freeholder, and the homeowner has to pay annual rent on it – known as ground rent.

But from 30 June, landlords will no longer be allowed to charge ground rent to people purchasing a home on a long lease.

The government said no clear service was provided for the charge, while the regular increases in ground rent imposed on homeowners placed a significant financial burden on them.

Leasehold Minister Lord Stephen Greenhalgh said: “This is an important milestone in our work to fix the leasehold system and to level up home ownership.”

Why is this happening?

In the past, leasehold properties tended to be restricted to flats. But there has been a growing trend in recent years for developers to sell houses on a leasehold basis.

Government research found that people living in leasehold homes were being treated as a steady source of income by the owners of the freehold, with some ground rents doubling every 10 to 15 years.

A study by trade body NAEA Propertymark found that homeowners living in leasehold properties were collectively paying £447 million in ground rent every year.

The average person paid £319 on the rent annually, with a third of homeowners reporting that they would no longer be able to afford to live in their property if it increased further.

Who does it affect?

The ban only applies to new buyers purchasing a leasehold property in England and Wales, and existing homeowners who are renewing their lease from 30 June.

But in preparation for the changes, many landlords have already reduced the ground rent they charge to zero for homeowners starting a new lease.

If you are set to sign a new lease on a home in the next two months, you should speak to your landlord to ensure the ground rent they are charging reflects the changes.

Ground rents for existing leaseholder homeowners will be tackled through future measures, under which homeowners will be given the right to extend their leases to 990 years at zero ground rent.

The government will also launch an online calculator to help homeowners find out how much it would cost them to buy their freehold or extend their lease.

An estimated 4.5 million homeowners in the UK have a leasehold property.

What’s the background?

The move is the first part of a package of reforms to make homeownership cheaper, fairer and more secure.

Thousands of existing leaseholder homeowners have already seen a reduction in their ground rents after the Competition Market Authority secured commitments from major housebuilders to stop doubling ground rent charges every year.

Instead, their ground rent will be reduced to the level it was at when they first purchased their property.

Key takeaways

- The government is banning expensive ground rents on leasehold properties for new buyers in England and Wales

- From 30 June, landlords will no longer be allowed to charge the rents to people purchasing a home on a long lease

- Ground rents for existing leaseholder homeowners will be tackled through future measures

What can I do if I’m struggling to pay my mortgage?

With the cost of living rising, some homeowners may find themselves struggling to meet their monthly mortgage repayments. Here’s what to do if it's happening to you.

If you’re finding you can no longer afford your mortgage repayments, there are options out there that could help you through a difficult time.

Here’s what to do if you think this might be about to happen to you.

What should I do if I think I might miss a mortgage payment?

Contact your lender as soon as possible.

Lenders will always try to work with customers who are experiencing financial difficulties.

But you’re likely to have more options if you contact your lender before you’ve missed a payment.

As soon as you think you might have a problem, get in touch with your bank or building society straight away.

How should I contact my lender?

Check your lender’s website to see how they want you to get in touch if you are experiencing financial difficulties.

Some lenders have a special helpline for people in this situation.

Most lenders will offer a variety of ways in which you can contact them in this scenario, include call hotlines, email, online chats and mobile apps.

Don’t leave contacting your lender until the last minute, as they may be experiencing a high volume of calls.

If you find yourself facing long waiting times on hotlines, try contacting your lender by email or through their website instead.

Will I lose my home?

Losing your home is most people’s worst nightmare. So, it’s good to know that repossessing a property is usually a last resort for lenders.

Instead, they will work with you to try to find a way to make your mortgage repayments affordable.

Charles Roe, Director of Mortgages at UK Finance, says:

“Lenders stand ready to help customers who may be struggling with their payments.

“It is important that anyone experiencing financial difficulty gets in touch with their lender as soon as possible to discuss the best options for them.”

What do I need when I contact my lender?

The most important things you'll need are your mortgage details and account number, so your lender can look you up on their system.

It’s also a good idea to do a budget before you make the call, so you know exactly how much you have coming in and going out each month.

And look for any areas in which you can cut back on your expenses.

Having a clear idea of what you can afford will help you as you discuss a way forward with your lender.

Can I take a mortgage payment holiday?

During the early stages of the Covid-19 pandemic, lenders introduced a mortgage payment holiday scheme.

Under the scheme borrowers could defer their mortgage payments for up to six months.

Unfortunately, the scheme has now ended, and no new official scheme has replaced it.

But lenders are still granting mortgage payment holidays to borrowers on an individual basis.

These payment holidays are typically two to three months long.

Interest that's not paid during this period is added to the outstanding mortgage debt.

What are my options if I can’t pay my mortgage?

There are four main options if you're struggling to pay your mortgage.

The best option for you will depend on your individual circumstances.

1: Extend the length of your mortgage term

The mortgage term is the total period over which you repay your mortgage.

Spreading the debt out over a longer period of time will reduce your monthly payments.

If you’re struggling to afford your mortgage due to higher bills, increasing your mortgage term could be a good option.

Increasing the period over which you repay a £200,000 mortgage from 20 to 30 years would reduce your monthly repayments from £1,019 to £744.

This calculation is based on an interest rate of 2% and a repayment period of 25 years.

The advantage of this option is that you continue to repay your mortgage.

The downside is that by increasing the term, you’ll pay more in interest over the total period of your mortgage.

2: Change to an interest-only mortgage

Changing from a repayment mortgage to an interest-only one dramatically lowers your monthly paymnets.

Since you’ll only be paying the interest on your loan each month, rather than paying down the actual debt, it's a much cheaper option in the short term.

If you’re going through a temporary fall in income, moving to an interest-only mortgage may be a good option as it will significantly reduce your monthly repayments.

For example, if you have a £200,000 mortgage, switching to an interest-only loan will cut your repayments from £854 to just £333 per month.

This calculation is based on an interest rate of 2% and a repayment period of 25 years.

But your lender is only likely to want to do this for a limited period, as you won't be reducing the overall amount you owe.

You’ll also still need to find a way to repay your mortgage over the longer term.

3: Defer your mortgage repayments

You can defer your mortgage and interest payments for a short period of time, typically two to three months.

After this period, the payments you missed will be added to your monthly repayments until you've made them up.

This is often done over the course of one to two years.

4: Request a payment holiday

During a payment holiday, the interest you don’t pay during the holiday will be added to the overall amount that you owe.

A mortgage payment holiday may be a good option if you have seen a sharp drop in your income or been made redundant.

The holiday will give you breathing space of two to three months in which to get back on your feet.

But lenders are unlikely to offer you a holiday for longer than this.

They will also want to be confident that you'll be able to resume repayments once the holiday ends.

The payments you have missed will still need to be made up at a later stage.

If I take out any of these options, will I have to pay any fees or penalties?

No, lenders understand that if you are facing financial difficulties, the last thing you need is extra fees or penalties.

As a result, you won’t face any charges to change to a plan agreed with your lender.

But you may face penalties if you miss a mortgage payment without contacting your lender.

So be sure to keep them up to date with your circumstances.

Are these options open to everyone?

Lenders want to work with you to help you avoid losing your home.

They will try to find an option that works for you even if you've lost your job, or have a poor credit history.

That said, they'll want to feel confident that you can keep up with your repayments over the longer term.

They won't want you to get so far behind with your payments that you can't catch up with them.

Will it impact my credit score?

Unfortunately, taking out a mortgage payment holiday may impact your credit score.

This is nothing to do with mortgage lenders. Instead, credit reference agencies will spot that you have not made a monthly repayment that you were scheduled to make.

This may make it harder to borrow money over the short term. But there are steps you can take to improve your credit score once you get your finances back on track.

Key takeaways

- First things first, if you’re finding it hard to pay your mortgage, contact your lender. Don’t be afraid, lenders will work with you to find a solution

- Options may include a mortgage holiday, changing to an interest-only loan, or increasing your mortgage term

- If you think you might miss a payment, contact your lender as soon as possible before it happens, as they'll be in a better position to help

How does rising inflation impact the housing market?

Rising inflation tends to lead to higher interest rates which can slow house price growth. Here’s how inflation impacts the property market.

Key takeaways

- Rising inflation tends to lead to slower house price growth

- It can also make it slightly harder to get a mortgage

- There is no reason to delay buying a house if you are confident you could afford higher mortgage rates and living costs

- It can be a good time to sell a house before higher inflation leads to lower activity in the property market

What is rising inflation?

Inflation measures the rate at which the price of key goods and services changes over time.

When inflation is rising, it means these things are becoming more expensive.

For example, if inflation is running at 3%, it means something that cost £1 last year will cost £1.03 this year.

There are several different indexes that measure changes to inflation. The key one for the housing market is the Consumer Prices Index (CPI).

This measures the price changes in a basket of 700 goods and services regularly purchased by consumers.

Why is rising inflation happening right now?

A few different things have combined to lead to rising inflation at the moment.

On the one hand, disruption to global supply chains has led to higher shipping costs. This in turn makes the price of certain goods more expensive.

At the same time, the conflict in Ukraine has led to higher oil and energy prices. Energy prices had already increased significantly during the past year.

These price rises not only impact the cost of heating your home and filling up your car. They also push up the prices of goods that need to be transported or manufactured.

Meanwhile, staff shortages mean some companies have had to increase wages to attract employees.

This cost increase is typically passed on to consumers.

Does rising inflation mean house prices go up or down?

You might expect rising inflation to mean that house prices will also rise, but this isn’t necessarily the case.

That's because houses are not included in the basket of goods used to calculate the CPI.

There is a separate index, known as the CPIH, which catchily stands for 'Consumer Prices Index including owner occupiers' housing costs'. This, as you may have guessed, includes housing costs.

As a general rule, rising inflation tends to lead to slower house price growth.

There are two reasons for this. The first reason is that one of the Bank of England’s tasks is to keep CPI inflation as close to 2% as possible.

If inflation rises above this target, the Bank of England may raise interest rates to try to reduce it.

When interest rates rise, so do mortgage rates. This makes buying a home more expensive.

Secondly, when inflation is rising, people have to spend more of their income on the daily necessities such as food, petrol and heating.

Both of these factors reduce the amount people can afford to spend when purchasing a home.

As a result, house price growth tends to slow when inflation is rising.

The impact is not immediate. And it may take a few months before higher inflation is reflected in lower levels of housing market activity.

Does rising inflation make it harder or easier to get a mortgage?

Rising inflation tends to make it slightly harder to get a mortgage.

That's because lenders want to be sure you'll still be able to afford your monthly repayments in the months ahead.

If the cost of living is increasing, they may worry that you'll have to spend more of your income on things like food and energy. And that would leave you with less money for your mortgage repayments.

Lenders will also be wary that higher inflation will lead to interest rate rises. Higher interest rates will increase the cost of your future mortgage repayments.

Lenders will still be wary even if you are applying for a fixed rate mortgage, which doesn’t move up or down in line with changes to interest rates.

That's because they want to be sure you'll still be able to afford the repayments when your current mortgage ends and you go on to their standard variable rate.

That said, it's important not to panic. Future interest rate rises are already built into lenders’ affordability calculations.

Although lenders tend to be more cautious during periods of rising inflation, it doesn’t mean they will automatically reject lots of potential borrowers.

Is it a good idea to buy a property during times of rising inflation?

The answer to this question depends a lot on your individual circumstances.

Do you have a secure job? Is there enough slack in your budget to afford your mortgage repayments if interest rates rise and living costs increase? If so, there is no reason to delay.

But it might not be a good time to make a big jump up the property ladder if your budget is already tight. Mainly because you might struggle to afford higher mortgage repayments if other costs continue to increase.

If you are currently renting, it's worth bearing in mind that your rent could also go up. In some cases, it is actually cheaper to buy a home than to rent one.

The important thing if you are thinking of moving, is to sit down and do a thorough budget. That way you'll ensure you can still afford your new home if your mortgage and other bills increase.

Is it a good idea to sell a property during times of rising inflation?

With inflation rising, house price growth is likely to slow, so selling now would enable you to lock in the gains you have made.

The higher cost of living is also likely to act as a brake on the property market.

As a result, if you wait to sell your home, it may take you longer to find a buyer.

That said, don’t base your decision purely on what's happening to inflation.

You should also ask yourself if now is the right time for you personally to sell.

And if you're planning on trading up the property ladder, make sure you'll still be able to afford your new mortgage repayments.

What can homeowners do to protect themselves during times of rising inflation?

The most important thing you can do is to review your budget. Make sure you know exactly how much you have going in and out each month.

Next look for any areas where you can reduce spending. These may include cancelling subscriptions you don’t really need, or changing your utility provider.

If you are currently on your lender’s standard variable rate, think about remortgaging to a cheaper deal.

The standard variable rate is the mortgage rate you go on to when your fixed-term deal ends.

But standard variable rates are significantly higher than rates for new mortgage deals.

In fact, they are an average of nearly 2% higher. As a result, remortgaging would save someone with a £200,000 mortgage more than £200 a month.

New fund for 1,200 affordable homes unveiled

The homes are designed to benefit people who would otherwise struggle to afford housing locally and communities will be put in charge of deciding how and where the properties will be built.

Key takeaways

- More than 1,200 new affordable homes are set to be built across England

- Communities will decide where and what type of properties will be built

- They will have access to a £4 million Community Housing Fund to cover costs such as searches, planning applications and design fees

More than 1,200 new affordable homes are set to be built across England as part of a government initiative to put communities in the driving seat.

The Department for Levelling Up, Housing and Communities has unveiled a £4 million Community Housing Fund to help community groups design and build properties in their local area.

The fund will cover costs ranging from searches, planning applications and design fees, to renting a town hall for a public meeting.

Once planning permission has been granted, community groups can apply for funding to build the properties through the government’s Affordable Homes Programme, a Housing Association, a developer or a bank loan.

Housing Minister Stuart Andrew said: “Community led housing is a great way to ensure local housing needs are met by putting local people in the driving seat.

“It is about residents playing a leading and lasting role creating genuinely affordable homes which regenerate and restore pride in communities.”

Why is this happening?

The programme is part of the government’s drive to level up the country through regenerating derelict areas and delivering homes that local people can afford.

The new properties will be part of a locally-based organisation, such as a land trust or housing co-operative, meaning they will stay under the control of the community.

The government also believes that community-led housing helps to improve the design and construction quality of homes, as well as creating opportunities for smaller house builders to work on projects, which in turn boosts the local economy.

Who does it affect?

The fund will be used to deliver 52 housing projects in England from Cornwall to Berwick-upon-Tweed.

They will benefit people who would otherwise struggle to afford housing locally, while ensuring the new properties meet the needs of the community and are in keeping with it.

In Bradford, 62 supported homes are being built for people with autism, learning disabilities or dementia, while in Leeds 34 affordable properties are being constructed to help regenerate a deprived area of the city.

Supply of homes for sale on the up as demand remains strong

More properties come onto the market as homeowners look to make their next move and lock in recent house price gains. Demand for family houses remains strong.

Key takeaways

- The number of homes for sale increased in March but buyer demand remained unseasonably strong

- Now is a great time to sell your home, and if you have a family home to sell, it could get snapped up in record time

- House prices rose by 8.1% in the year to the end of February, making the average price for a home £245,200

- Higher mortgage rates and the rising cost of living are expected to slow the housing market in the coming months

The number of homes listed for sale increased in March as buyer demand remains unseasonably strong.

Estate agents reported a 3.5% rise in the level of stock they have on their books during the past month, according to our latest House Price Index.

The improvement in supply is being driven by existing homeowners looking to make their next move and lock in recent house price gains, with demand for family houses currently twice as high as is usual for this time of year.

Buyer activity is also being driven by the bounce back in demand for city and town centres that's been growing since the beginning of 2022.

Thinking of selling your home? Let us put you in touch with an agent for a free valuation

But despite the increase in listings, there continues to be a mismatch between supply and demand, putting further upward pressure on house prices.

What’s happening to house prices?

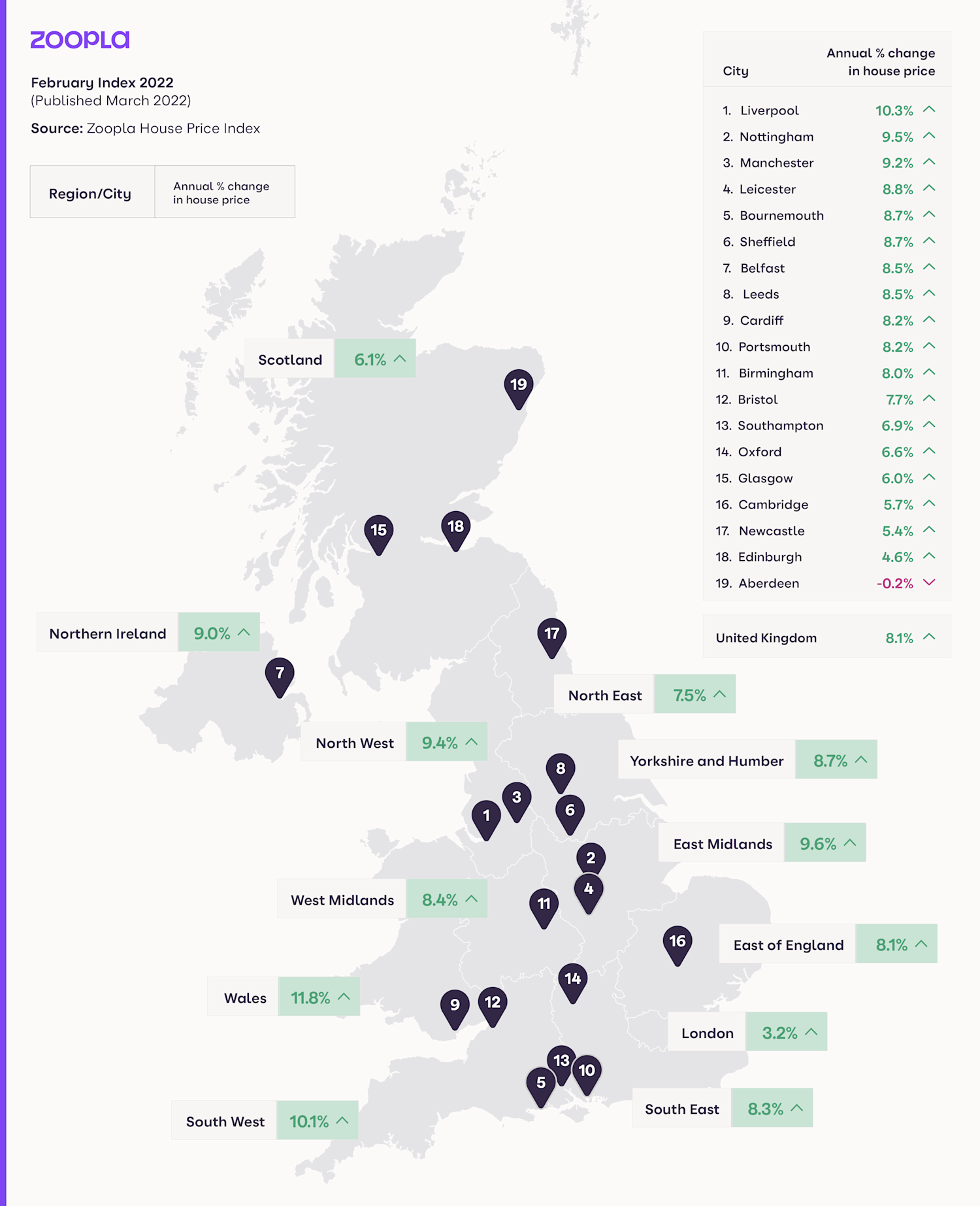

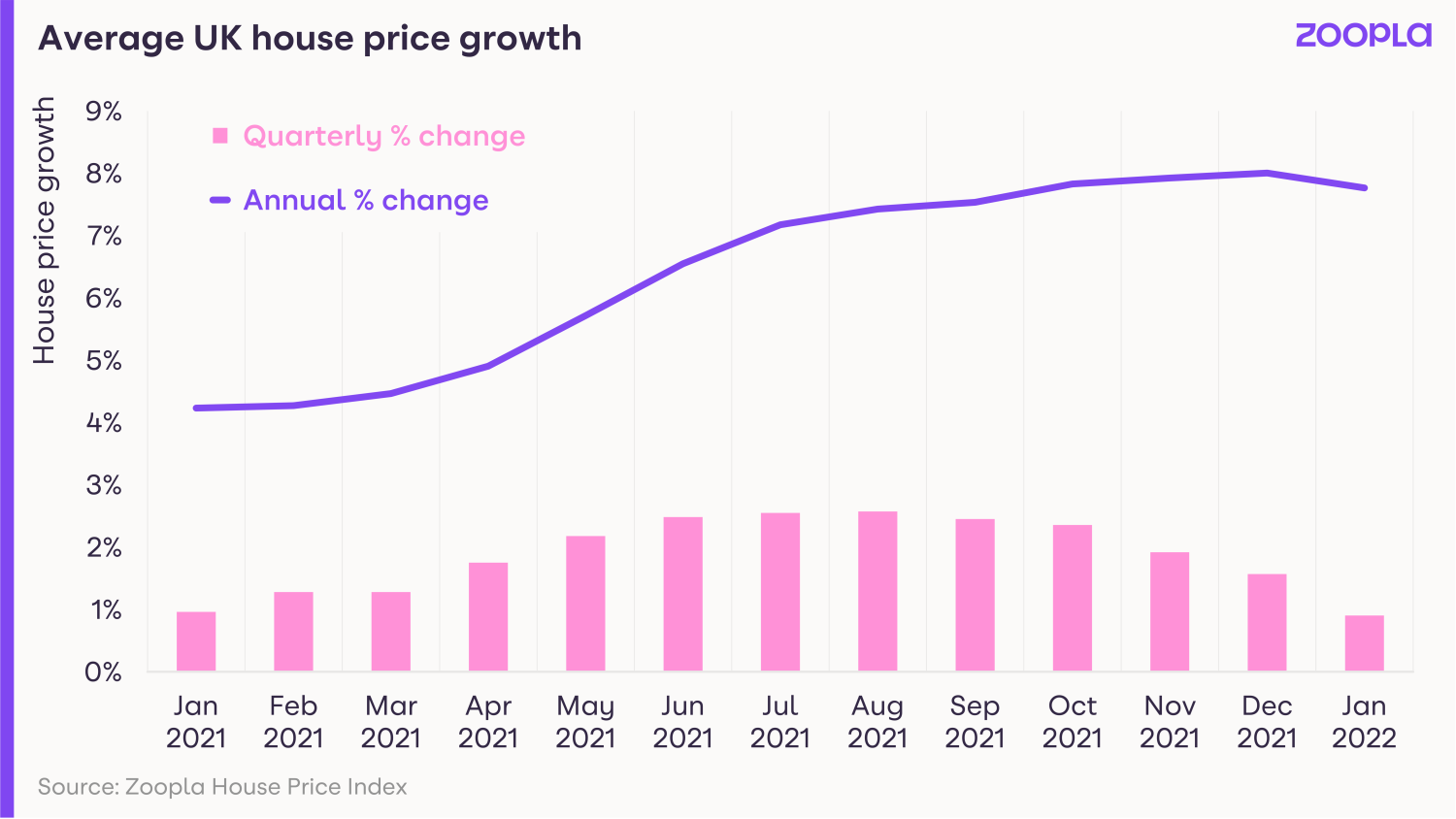

House prices rose by 8.1% in the year to the end of February, nearly double the annual rate of 4.2% recorded in February last year, meaning the average home now costs £245,200.

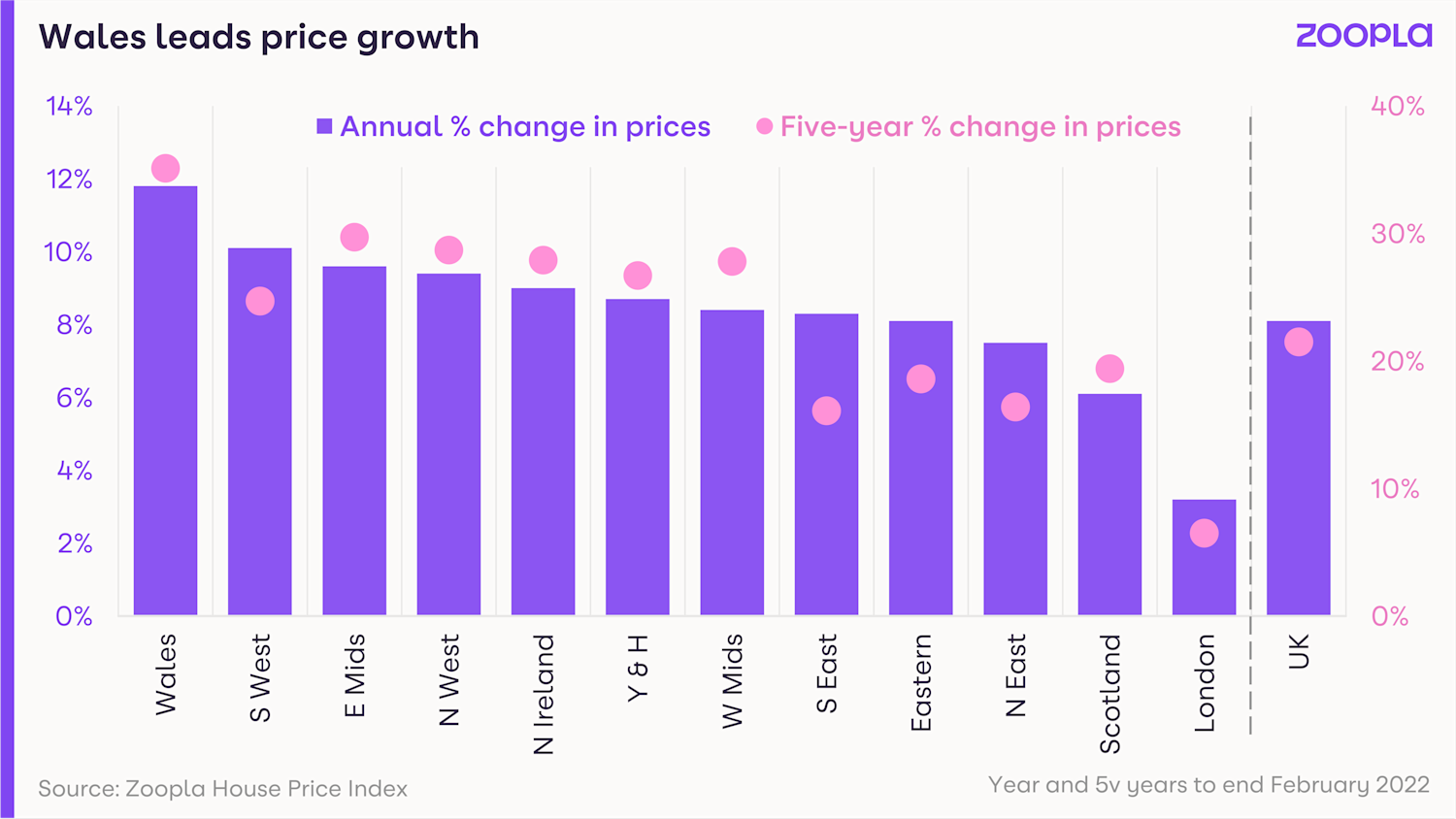

Wales continued to see the highest growth for the 12th consecutive month, with property values rising by 11.8%, followed by the South West at 10.1% and the East Midlands at 9.6%.

London continues to see the slowest growth, with prices rising by 3.2% during the past year, although gains in individual boroughs ranged from 6.8% in Bromley, to no change in the City of London.

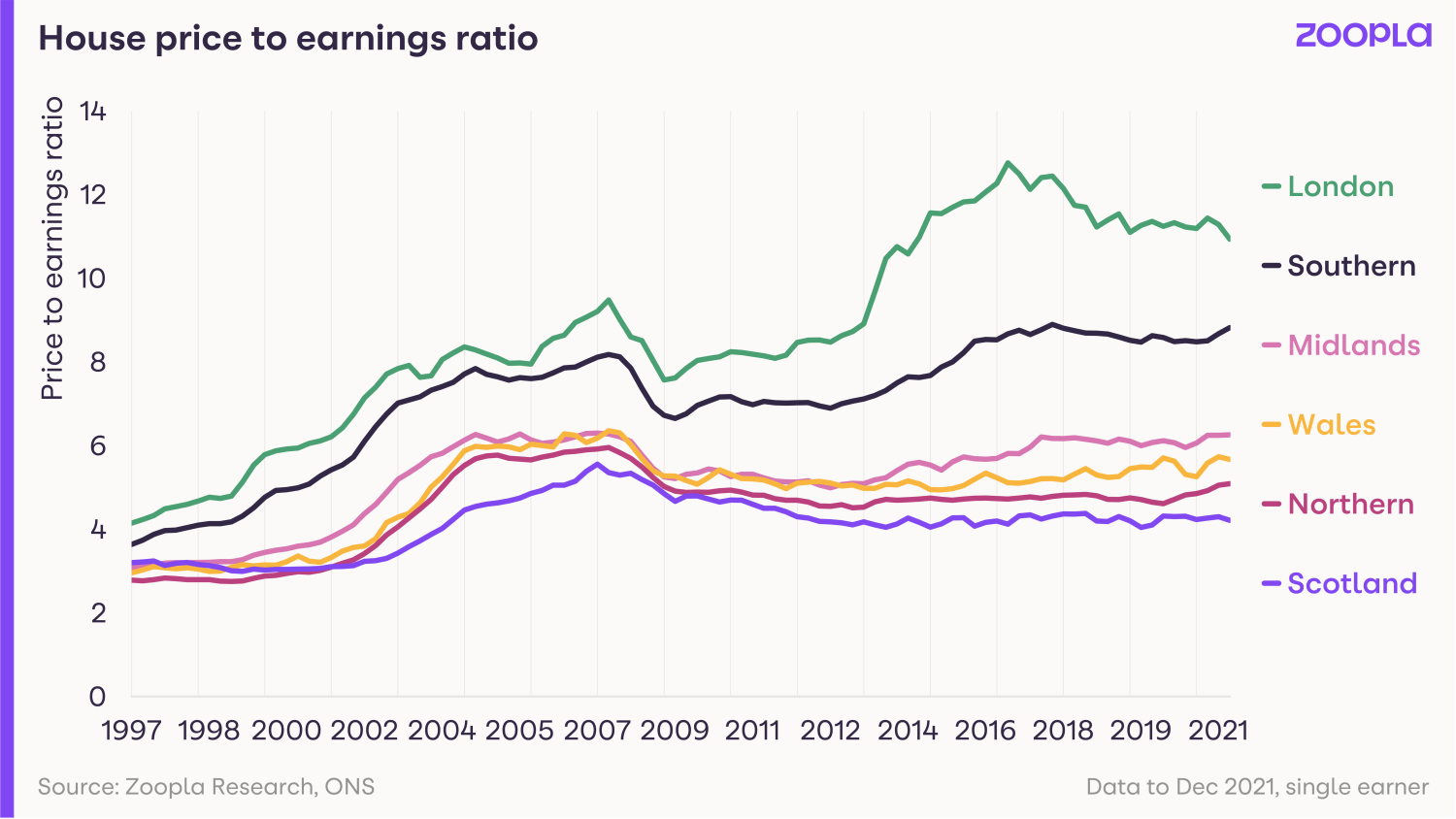

Wales has also seen the strongest price growth during the past five years, with property values rising by 35%, compared with gains of just 6.5% in London.

Affordability has played a big role in house price increases during this period, with growth strongest in areas where homes remain most affordable.

How busy is the market?

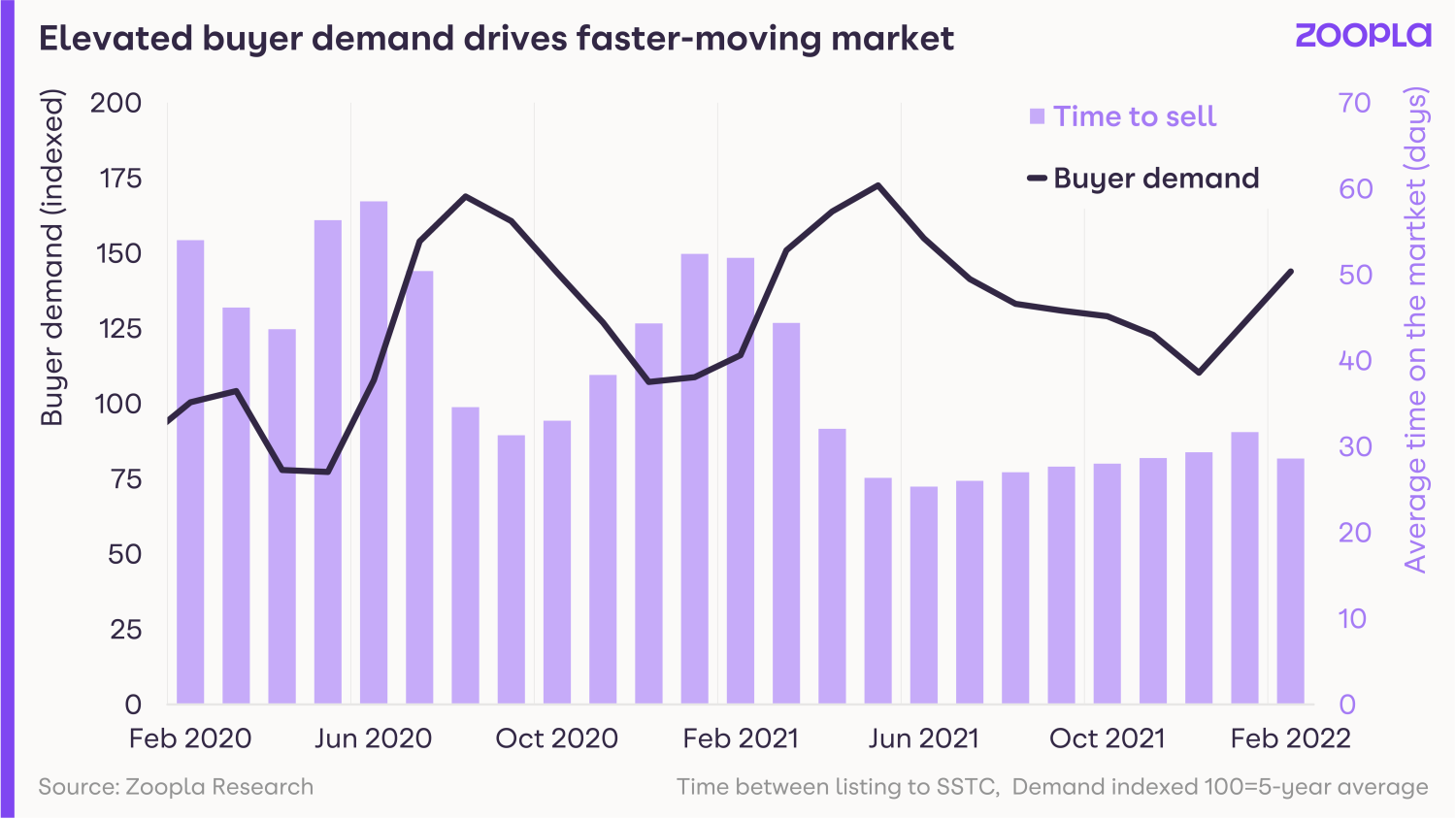

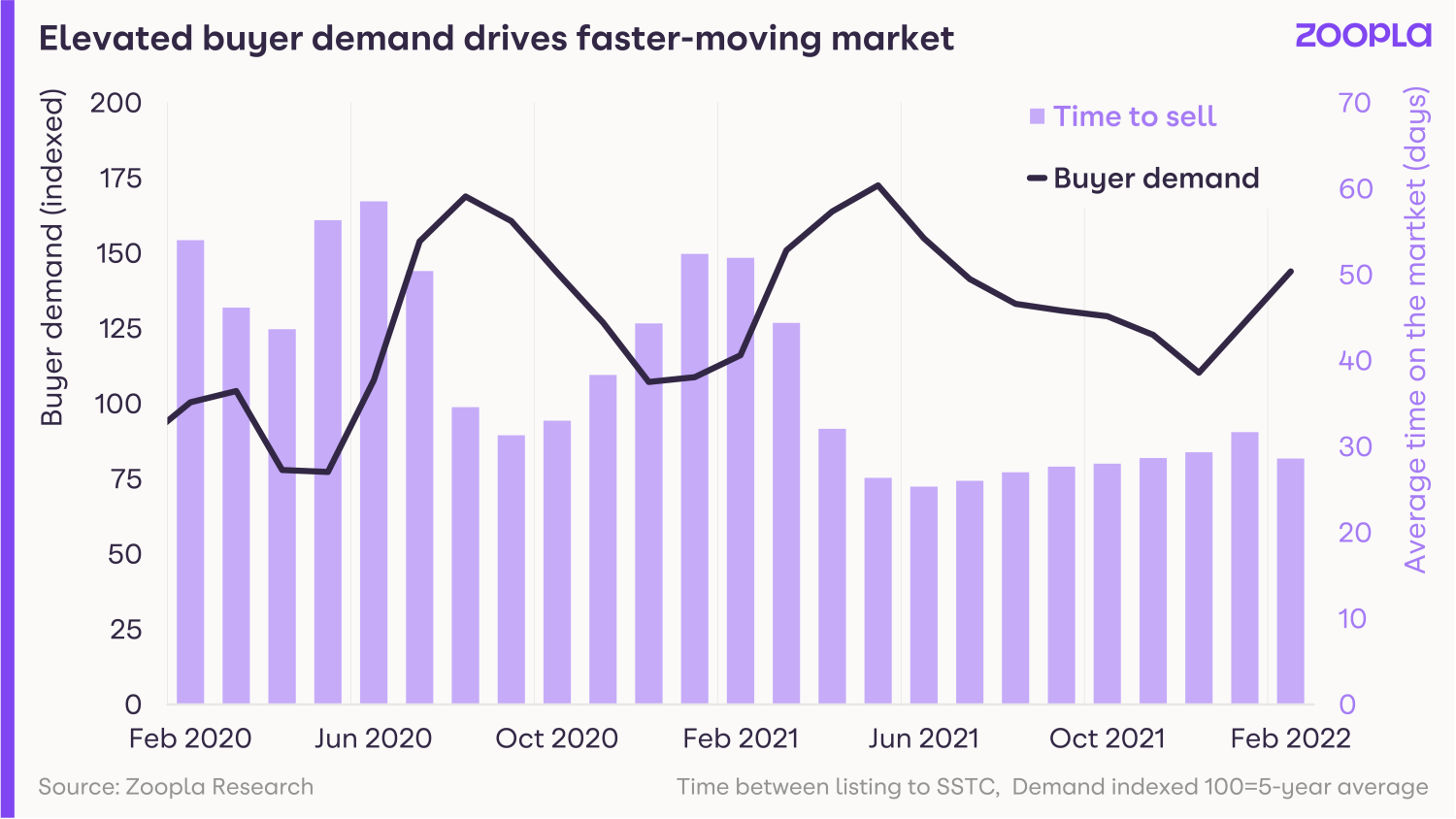

Buyer demand remains unseasonably high across the UK at 65% above the five-year average, but it has eased since January.

Even so, the number of sales agreed during the first three months of the year was 38% higher than in the same period of 2020.

In London, more sales were agreed in the first part of the year than in the same period of 2021, despite the elevated levels of activity in that period due to the stamp duty holiday.

There has also been a rise in buyer interest in other city centres, with demand up 7% in Newcastle in recent weeks, while it is 5% higher in Birmingham.

The increase is even more marked in smaller urban centres, with the number of buyers soaring by 20% in Blackpool, and 19% in Swindon.

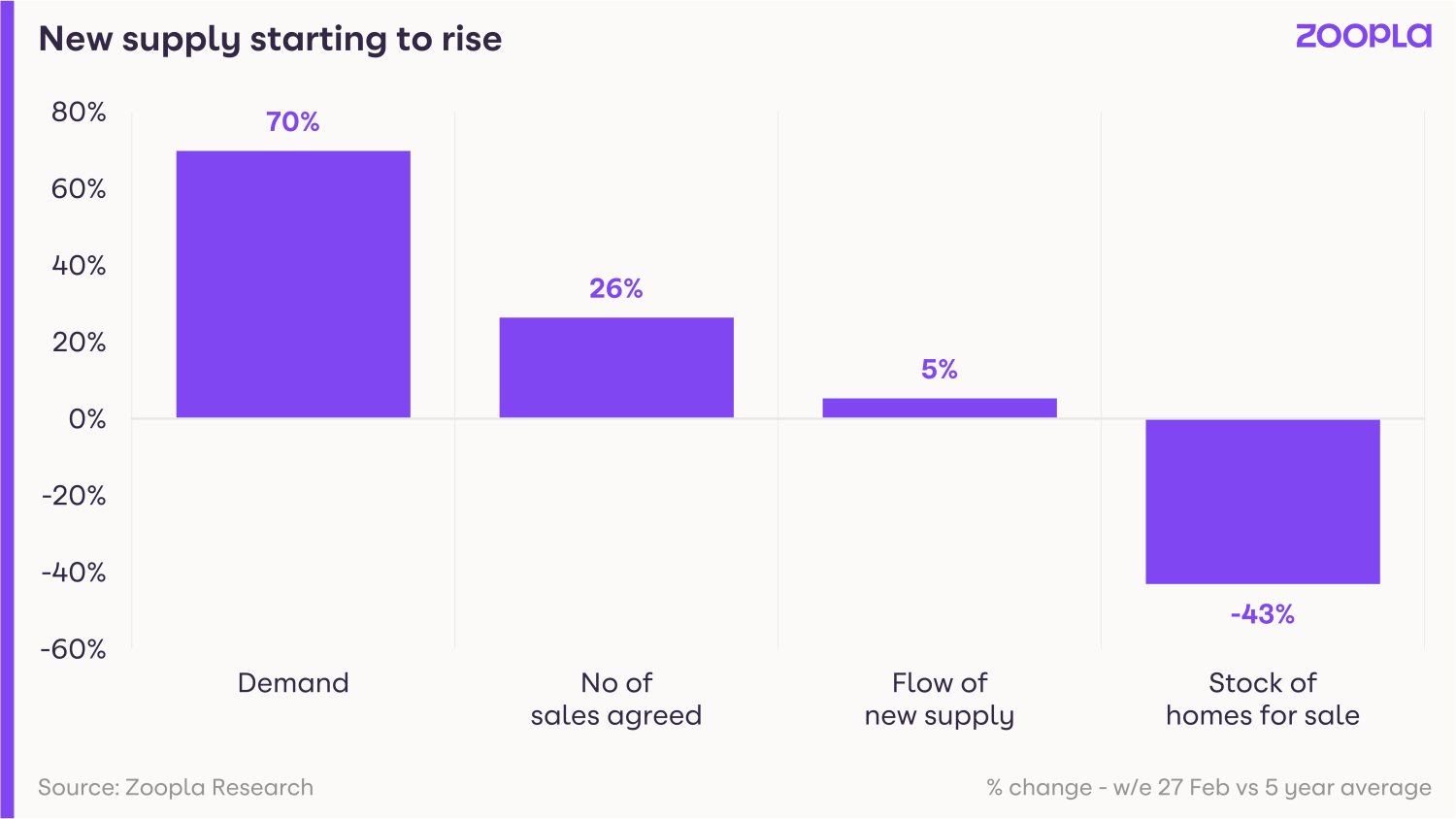

Meanwhile, improvements in supply continued to ease, with the number of properties coming on to the market 5% higher than the five-year average.

This trend is expected to continue in the coming months, as recent strong price growth and high buyer demand triggers more homeowners to make a move.

Despite the improvements, the number of homes listed for sale is still 42% below the five-year average, although this is an improvement on December, when stock levels were 47% down on the five-year norm.

As a result, the market continues to be fast moving, with properties taking an average of just 29 days to sell.

What could this mean for you?

First-time buyers

With more homes coming on to the market as people look to trade up the property ladder, the choice for first-time buyers has improved.

But the market remains fast paced, with homes selling quickly.

As a result, if you see something you like, you need to be prepared to move fast, so try to get a mortgage offer in principle before you start house hunting.

The pace of the market is expected to ease in the months ahead.

Home-movers

If you are an existing homeowner thinking of moving, you have a window of opportunity in which to sell your property.

Demand from potential buyers is currently high across all property types, but particularly family homes, with twice as many people currently looking to purchase a three-bedroom home as this time last year.

As a result, you are in pole position to sell, while the rise in the number of homes coming on to the market means you will have more choice for your next home.

But don’t delay listing your property for too long, as the market is expected to start slowing soon.

What’s the outlook?

The housing market is expected to slow in the coming months as higher mortgage rates and the rising cost of living, as well as the uncertainty caused by the situation in Ukraine, acts as a brake on activity.

But the shortage of homes for sale will prevent prices from falling.

Head of research at said: “Buyer demand remains elevated as the trends that emerged during the pandemic - a reassessment among households about where and how they are living - continue to drive the market.

“High buyer demand and rising supply signal activity levels will remain elevated in the short term.

“As we move into the second half of the year, economic headwinds, including the rising cost of living and rising mortgage rates will act as a brake on price growth, with annual value rises returning to more sustainable levels.”

Is now a good time to remortgage?

With interest rates rising four times in the last three months, and further rises expected later this year, could now be a good time to remortgage?

Key takeaways

- If you're on a standard variable rate or tracker mortgage, now could be a good time to look into a low-interest, fixed-rate mortgage

- 74% of the UK population are currently on fixed-rate mortgages, and if the interest rate is low, you're in a good position and there's no need to remortgage if your deal isn't ending any time soon

- Be aware that if your deal is about to come to an end, you're likely to go onto your lender's standard variable rate - and with interest rates rising, this will be a lot more expensive

- There are still plenty of fixed-rate mortgages available for under 2% interest. We'll show you where to find them

The Bank of England has raised interest rates four times in the last three months.

The latest rise, from 0.5% to 0.75%, means rates are at their highest level since March 2020.

The change will add around £42 a month to repayments for someone with a £200,000 mortgage.

A combination of rising inflation and the war in the Ukraine disrupting global supply chains for food and energy has led to a rise in prices.

The increase in interest rates by the Bank is an attempt to try and reduce that inflation and calm the cost of living.

How do rising interest rates affect the cost of mortgages?

Higher interest rates make borrowing more expensive.

During the pandemic, the Bank of England slashed the Base Rate to an all-time low of 0.1%.

The Base Rate impacts all other interest rates. When it’s low, it costs you less to borrow money, but it also means you make less money in interest on your savings.

When the Base Rate is higher, interest rates on mortgages tend to be higher too.

Higher interest rates on fixed-rate mortgages means that it will cost you more to repay the mortgage in the long term.

That said, if you are already on a fixed-rate mortgage, as 74% of the UK population currently are, your payments will continue to stay the same, despite the rise in the Base Rate.

Variable rate and tracker mortgages tend to follow the Base Rate more closely, so will rise and fall as the Base Rate increases and decreases.

Do you lose money when you remortgage?

Most people remortgage to get a cheaper rate and pay less money on their mortgage as a result.

As long as you are at the end of your mortgage agreement or ‘term’, then you shouldn’t need to pay any exit fees or early redemption penalties.

If you aren’t, be aware that the cost of leaving your current mortgage could run into thousands, so it’s well worth checking first.

In addition, you will often pay fees when securing a new mortgage. They include:

| New mortgage fees | Cost |

|---|---|

| Mortgage arrangement fee | £0 to £2,000 |

| Mortgage booking fee | £99 - £200 |

| Valuation fee | £250 - £1500 |

| Mortgage account fee | £100 - £300 |

moneyhelper.org.uk

However, if you’re moving to a deal with a lower interest rate, you could save yourself hundreds of pounds each month.

And at a time when interest rates are rising, it's best not to go onto your lender's standard variable rate when your mortgage deal ends.

Is it worth remortgaging early?

The best time to start looking at other mortgages is around four to six months before your current mortgage deal ends.

Most lenders will allow you to lock in a deal with them between three to six months in advance.

So if you’re tied into your current mortgage for another three to six months, you can ‘book’ a deal to start in three to six months' time, at the rate it’s currently being offered by the lender.

That said, if you later find a deal with a lower interest rate, you may have to pay a second lot of fees to secure it.

It can be a good idea to use a broker to ensure you get the best deal for you, as they’ll know the mortgage market inside and out and can often get the best deals.

Should you remortgage now?

The Bank of England’s chief economist has warned that further interest rate rises might be needed to curb inflation.

Some experts are predicting that the Bank Rate could increase to 1.25% by the end of 2022.

Should I remortgage if I’m on a fixed-rate deal?

If you’re on a fixed-rate deal set at a low interest rate, you’re in a great position right now and there’s no need to look to remortgage.

However, if your deal is about to come to an end, you're likely to go onto your lender's standard variable rate - and with interest rates getting higher, this will be a lot more expensive.

So it's worth shopping around now for another low-interest fixed-rate deal before interest rates go up again.

Should I remortgage if I’m on a standard variable rate or tracker deal?

If you’re on a standard variable rate or tracker deal, your mortgage payments are likely to continue increasing this year.

Now could be a good time to secure a fixed-rate deal at a lower interest rate to protect yourself against this.

With fixed-rate mortgages, you’ll know what your outgoings are going to be every month, and that’s a good thing in a time of economic uncertainty.

What the Spring Statement means for homeowners and renters

From tax cuts for green home improvements to reduced fuel duty, here’s how the Spring Statement will affect homeowners and renters this year.

Chancellor Rishi Sunak’s Spring Statement 2022 contained few measures that will impact the housing market directly.

But with households feeling the squeeze from the rising cost of living and higher interest rates, the concessions that were announced will be welcomed by homeowners and renters alike.

Even so, there were few big giveaways, and with people’s budgets remaining under pressure, activity in the housing market is likely to slow, while demand for rental homes could increase.

Here’s a rundown of the main announcements from the Spring Statement.

Going green gets cheaper

One of the few measures announced by the Chancellor that has a direct impact on property was the news that VAT will be scrapped on energy-saving technology, such as solar panels, heat pumps, insulation and wind turbines.

The move will reduce the cost of purchasing these devices by 5%. As a result, the Chancellor estimates that someone installing solar panels will save £1,000, while their energy bills will be reduced by £300 a year.

Increase to National Insurance threshold

With households already facing rising energy, food and petrol bills, many had been dreading the rise in National Insurance contributions from 12% to 13.25% in April.

While Sunak has not reversed the increase in the rate, he has offset it for some by increasing the threshold at which contributions start, raising it from £9,880 to £12,570 from July.

The move means 70% of people will pay less National Insurance than they do now, with Sunak estimating the typical employee will be £330 a year better off.

However, those earning more than £40,000 a year will be worse off, with those earning £50,000 annually paying just over £100 a year more than they do now.

In a further sweetener, the Chancellor announced plans to cut the basic rate of income tax from 20% to 19% in 2024, but that is still two years off.

Winners: homeowners and renters earning less than £40,000

Fuel duty cut

The announcement that fuel duty will be cut by 5p was welcome news for struggling motorists reeling from record prices at the pumps.

Even so, the concession only partially offsets the increase to petrol and diesel prices seen since the start of the Ukraine crisis.

The move will save the average motorist just £100 a year, or £8 a month, according to the Chancellor.

While the fuel duty cut will help homeowners and renters, particularly those in rural areas who do not have the option of using public transport, it isn’t much to get excited about.

Winners: homeowners and renters who own vehicles

Changes to student loan repayments

This was not part of the Spring Statement, but documents accompanying it showed that future changes to student loan repayments will save the Treasury a notional £11.2 billion in the coming tax year, due to the way student loans appear in government accounts.

Under the changes, students in England starting university in 2023 will have to begin repaying their student loan when their income reaches £25,000 a year, rather than £27,295 currently.

The term over which they have to repay the debt before it is written off will also increase from 30 years to 40 years, although the rate of interest they have to pay will be reduced.

The move will mean that unlike under the current system where only a quarter of students are expected to repay their student loan in full, 70% are likely to do so under the new one.

The move is expected to save the government an average of £6,200 for every student who has taken out a loan, according to the Institute for Fiscal Studies.

Losers: those with student debts who would not previously have reached the repayment threshold or repaid their loans within 30 years, likely first-time buyers

Rising cost of living

Despite the concessions unveiled, there was no significant help for households with the rising cost of living.

For example, there were no additional increases to the Universal Credit or basic state pension to take account of the high rate of inflation.

Instead figures from the Office of Budgetary Responsibility (OBR), which accompanied the Spring Statement, suggest the situation is likely to get worse.

It predicts inflation – the rate at which the cost of living is rising – will average 7.4% this year and peak at 8.7%. It is currently running at a 30-year high of 6.2%.

The OBR warned that real household disposable income is set to drop by 2.2% per person in the coming year, the biggest fall since records began.

Impact on the housing market

While measures to reduce the impact of a hike in National Insurance contributions and the fuel duty cuts are welcome, in reality, the savings for consumers are small and are likely to do little to offset the rising cost of living people are now facing.

Richard Donnell, executive director at Zoopla, thinks the rising cost of living will impact the rental market by causing people to stay where they are and delay getting on the housing ladder.

He said: “Those most affected by higher energy and household bills may choose to stay put in their existing rental home, as the demand for rental property has led average rents for new lets to rise around 8% on the year.

“At the same time, the rising cost of mortgages could mean that more renters put off their first step onto the housing ladder, staying in the rental sector for longer.

“All of this will increase demand for rental properties, while the supply of homes for rent is constrained, underlining the importance of policies to support the provision of rental homes at every level of affordability.”

Meanwhile, pressure on homeowners’ budgets could also deter people from trading up the property ladder.

While the housing market started the year on a strong footing, demand is expected to cool in the face of economic headwinds, leading to slower price growth.

Interest rates rise again

Nearly two million homeowners will see their mortgage repayments increase after the Bank Rate was hiked for the third time in four months.

Key takeaways

- The Bank of England has increased interest rates for the third time in four months

- The Bank Rate has risen from 0.5% to 0.75%

- The change will add around £42 a month to repayments for someone with a £200,000 mortgage

The Bank of England has increased interest rates for the third time in four months as the cost of living continues to rise.

Its Monetary Policy Committee increased the Bank Rate from 0.5% to 0.75%, the highest level since February 2020.

It was the first time it has increased the official cost of borrowing in three consecutive meetings since 1997.

The move means around two million homeowners with variable rate mortgages will see their monthly repayments rise.

The change will add around £42 a month to repayments for someone with a £200,000 mortgage.

The latest increase heaps further pressure on homeowners, who are already suffering from steep increases in food, petrol and energy prices, while they will also have to pay higher National Insurance contributions from April.

Why is this happening?

Inflation, which measures increases to the cost of living, remains stubbornly high.

Consumer Prices Inflation – the key measure - is currently running at 5.5%, the highest level for 30 years, and the situation looks set to get worse with the war in Ukraine putting further pressure on the price of petrol, food and energy.

The Bank’s Monetary Policy Committee uses changes to interest rates as a way to control inflation.

But with inflation currently running significantly above its 2% target, there are likely to be further interest rate rises to come.

What does it mean for me?

You will only be impacted by the change in interest rates if you are on a variable rate mortgage, such as a tracker deal or your lender’s standard variable rate.

These mortgages move up and down in line with changes to the Bank Rate.

Around 850,000 people currently have a tracker mortgage, with a further 1.1 million on a standard variable rate one.

If you have a £200,000 variable rate mortgage, your monthly repayments will go up by around £42 a month as a result of the latest change, meaning your payments will cost an extra £108 a month as a result of the three interest rate rises seen since December.

Nearly three-quarters of homeowners with a mortgage are on fixed rate deals, and they will not see any change in their payments.

With a fixed rate mortgage, payments stay the same for the length of the deal, which is usually two or five years.

What should I do now?

If you have a fixed rate mortgage, you don’t need to do anything, as you will not be impacted by the change.

If you are currently on your lender’s standard variable rate, you should think about remortgaging on to a more competitive deal.

The average standard variable rate is currently 1.96% higher than the average two-year fixed rate deal. The difference in rates would cost you around £330 a month or nearly £4,000 a year if you have a £200,000 mortgage.

If you are on a tracker deal and want to protect yourself from further interest rate rises, you may want to consider moving to a fixed rate one.

But it is worth noting that the average interest rate charged on a two-year tracker mortgage is currently 2.03%, compared with 2.65% for a two-year fixed rate deal and 2.88% for a five-year fixed rate one.

If you have a tracker mortgage it is also important to check that you would not have to pay any earlier redemption penalties if you switch to a different mortgage before your term is up.

If you do decide to remortgage, you should be prepared to move fast.

Lenders withdrew a total of 518 deals during the past month, the biggest drop in mortgage availability since May 2020, during the early stages of the Covid-19 pandemic.

The average time for which different mortgage deals are available has also dived in the past month, dropping from 42 days to just 28 days, as lenders review and reprice their ranges.

But there is still plenty of choice, with more than 4,800 different deals to choose from.

If you think you may struggle to keep up with your mortgage repayments following the run of interest rate rises, it is important to contact your lender as soon as possible.

There are a number of steps lenders can take to help you, including granting you a temporary payment holiday or putting you on to an interest-only mortgage for a short time.

But options become much more limited if you have already missed a payment.

House price growth shows signs of slowing as supply increases

New home listings were 5% higher in January than the previous five-year average, as the flow of supply starts to increase.

The shortage of homes for sale showed signs of easing during January, while house price growth showed signs of slowing.

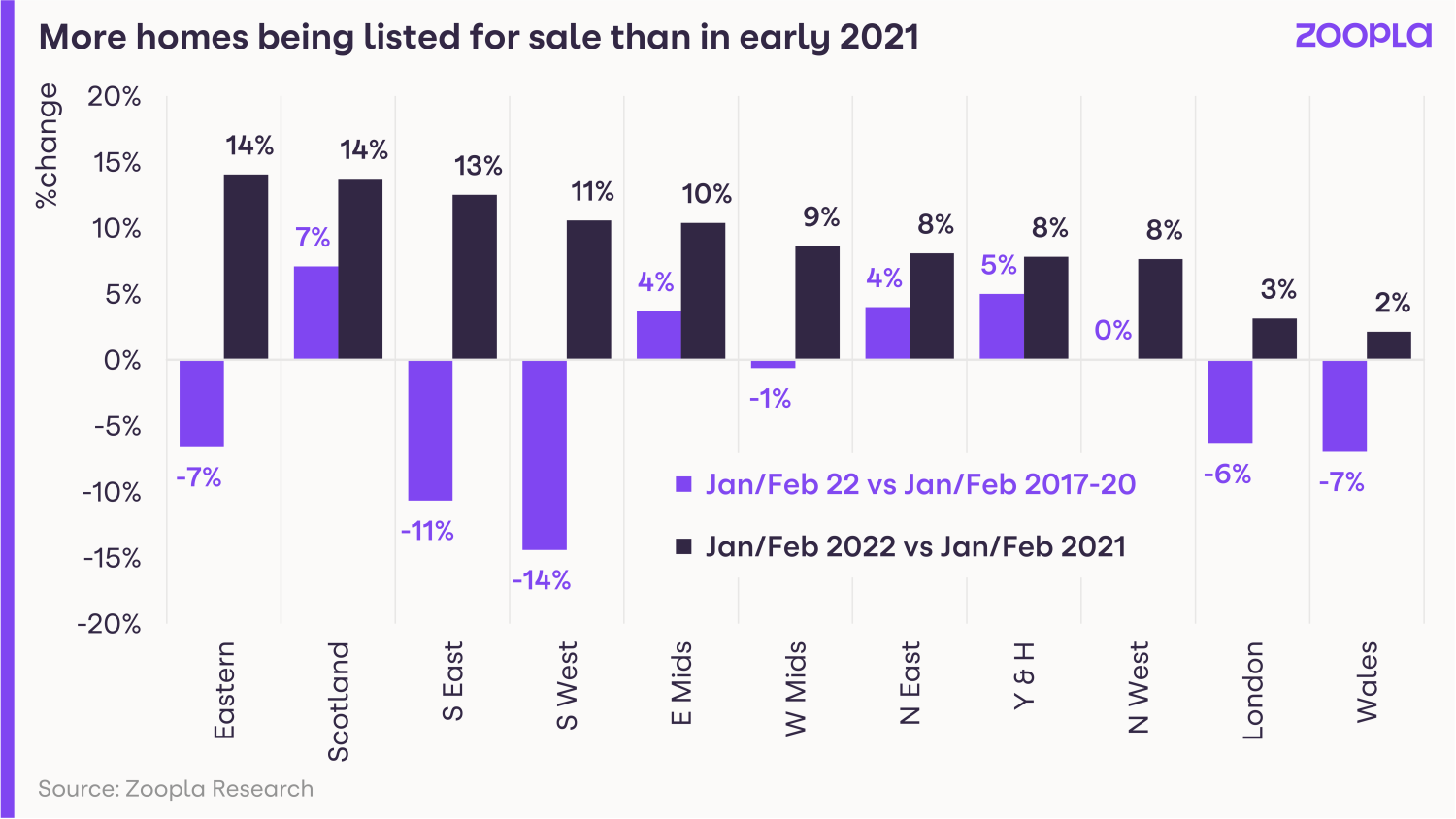

New listings were 5% higher than the five-year average during the month, signalling the start of a recovery in supply.

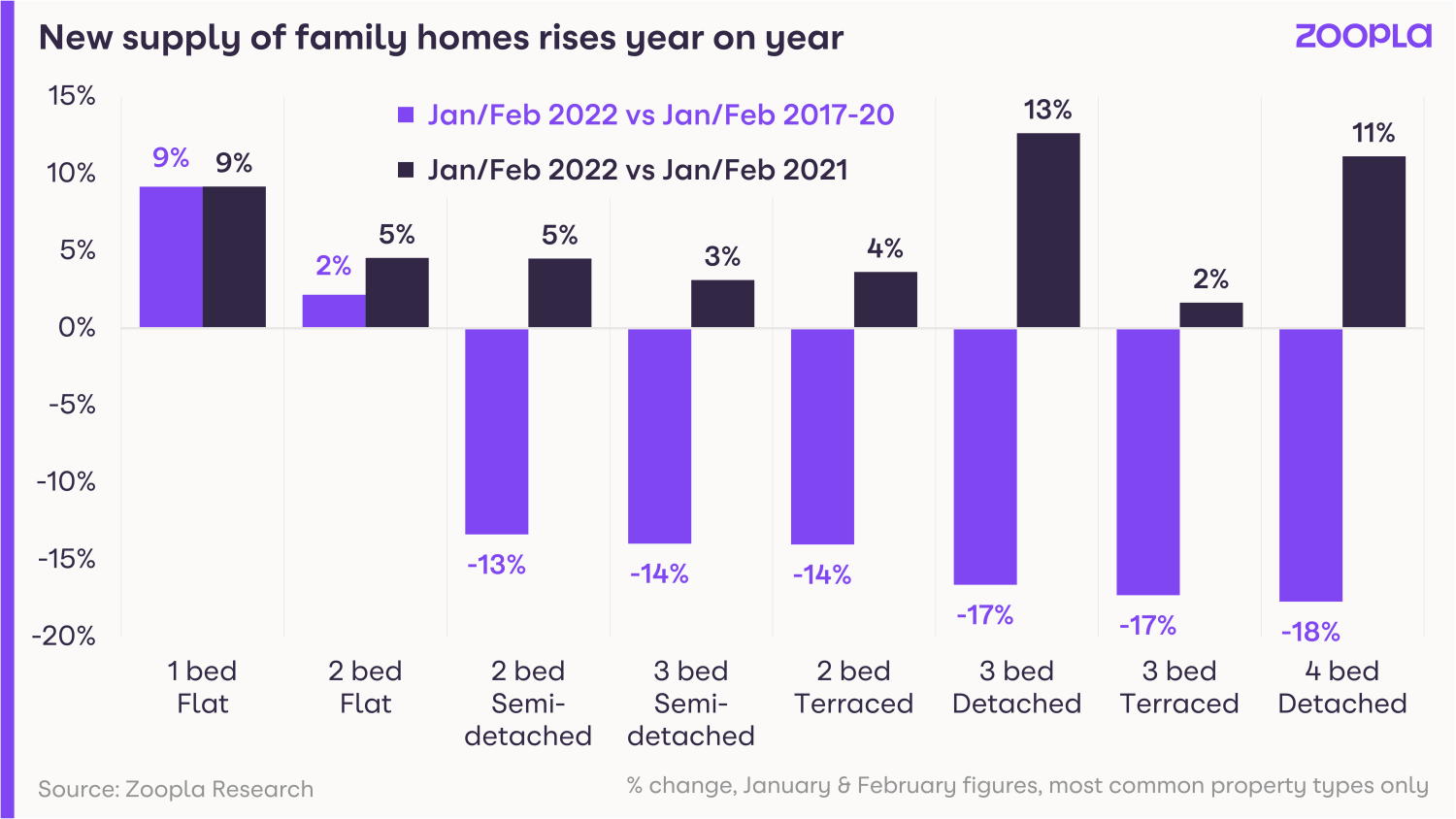

The increase in homes coming on to the market was seen across all property types, including much in demand three and four-bedroom detached family homes, according to our latest House Price Index.

But despite the rise, demand continues to outpace supply, putting further upward pressure on house prices, although that rate of increase is starting to slow.

The average UK home now costs £244,100, after increasing by around £80,000 during the past decade.

What’s happening to house prices?

House prices rose by 7.8% in the year to the end of January.

But there are signs that the rate of growth is slowing, with property values edging ahead by just 0.9% in the past three months, the slowest growth since August 2020.

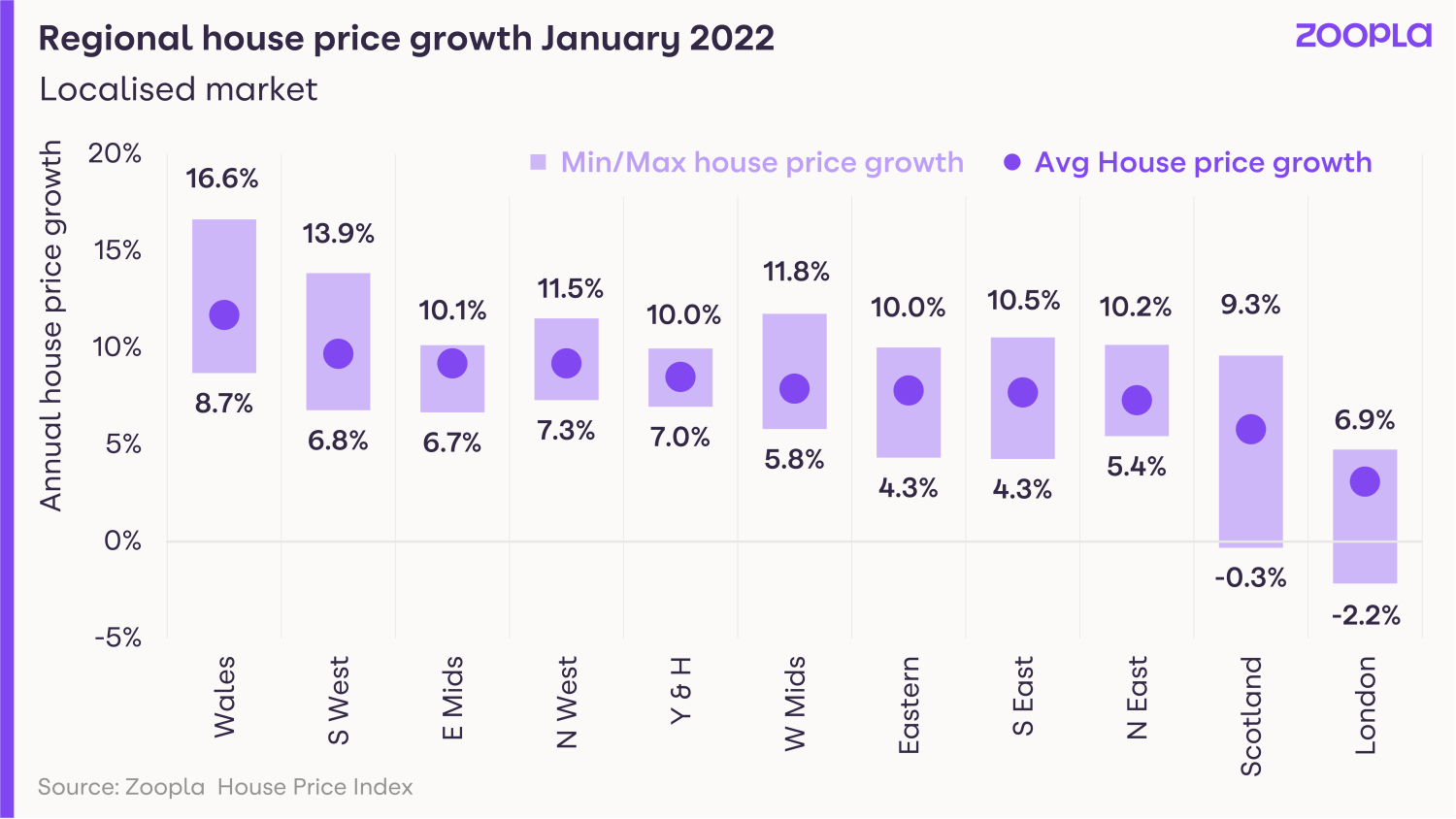

There also continues to be significant variation in price growth by both region and property type.

Wales saw the highest increases for the 11th consecutive month, with property values rising by 11.7% in the past year, followed by the South West at 9.7% and the North West and East Midlands, both at 9.2%.

London continued to lag behind other regions, with the average cost of a property rising by just 3.1% during the same period.

On a more localised level, house price growth ranged from an increase of 16.6% in Powys in Wales, to a fall of 2.2% in the City of London.

Meanwhile, price rises for houses continued to significantly outstrip that of flats, with the average cost of a semi-detached home rising by 9.1% in the year to the end of January, compared with a gain of just 2.6% for flats.

How busy is the market?

Near record demand for properties has continued, with 2022 seeing the busiest January and February since 2016, while the number of sales agreed matched those seen at the start of 2021.

But the increase in supply is suggesting the market is starting to move back towards more normal conditions.

In fact, new supply is now above pre-pandemic levels for this time of year in Scotland, the East Midlands, the North East and Yorkshire, while it matches it in the North West and West Midlands.

Despite this improvement, there continues to be a significant mismatch between supply and demand, with the number of buyers looking to purchase a property in late February 70% above the five-year average, while the total number of homes for sale was 43% below it.

The net result is a very fast-moving market, with half of all homes that were sold snapped up within just three weeks, compared with a third of properties during the same period of 2021.

Family homes are in particularly high demand, with three-bedroom properties outside of London typically taking just 23 days to sell - half the time two-bedroom flats in London take to go under offer.

What could this mean for you?

First-time buyers

If you are a first-time buyer, it may be worth looking to purchase a flat rather than a house.

Flats not only represent better value at the moment, having seen significantly slower price growth during the past year compared with houses, but they are also less in demand, meaning you do not have to move quite as quickly to snap one up.

Going forward, the current increase in supply could mean more first-time buyer properties will be coming on to the market in the coming months.

The reason for this is a lack of choice has previously been holding people back from trading up the housing ladder.

As more homes are listed for sale, this issue will ease, and as people find a property they want to buy, they will in turn list their existing home for sale.

Home-movers

The increase in homes coming on to the market is great news for anyone looking to trade up the property ladder, with the number of three and four-bedroom homes listed for sale now 10% higher than a year ago.

But supply continues to remain tight, and there is still a shortfall in new listings for terraced, semi-detached and detached homes compared with longer-term norms.

As a result, the market for these properties is moving extremely quickly, so you will need to be prepared to move first.

The good news is that with demand continuing to outstrip supply, you are likely to be able to sell your existing home quickly.

What’s the outlook?

The increase in supply is likely to continue going forward, as the improved level of choice encourages more people to put their home on the market.

Grainne Gilmore, head of research at Zoopla, says: “The sheer level of activity in the market in recent years eroded the stock of homes for sale. But the data indicates that more homes are now coming to the market, as movers and other owners list their properties - and this will create more choice for the many buyers active in the market.

“However, the imbalance between high demand and supply will take much longer to unwind, and this imbalance will continue to underpin pricing in the coming year.”

Even so, the rate at which house prices are rising is expected to ease during 2022 due to economic headwinds, including increases to mortgage rates and the rising cost of living.

As a result, property values across the UK are expected to end the year an average of 3.5% higher than they started it.

Key takeaways

- The number of properties put up for sale were 5% higher in January than the five-year average

- House prices rose by 7.8% in the year to the end of January, but the rate of house price growth may be easing

- The mismatch between supply and demand continues

Changing Rooms! Nearly 9 million bedrooms lost in the UK

More than four in ten British homeowners transformed their spare bedrooms into offices, gyms, cinemas and more throughout the pandemic. Here's what they did.

Nearly 9 million bedrooms were lost to home offices, gyms, cinemas and even bars during the pandemic, as the UK adapted to the new normal.

How have our homes changed?

We surveyed homeowners across the UK to understand how the nation’s room requirements shifted - and how our homes changed as a result.

Among those who changed their homes, more than half (53%) said they completely repurposed at least one bedroom, while one in five households (22%) said they changed multiple bedrooms.

Nationally, this equates to a whopping 8,856,000 bedrooms that have been ‘lost’ amongst the UK’s 24m privately owned homes during the pandemic.

With remote and hybrid working now set to be a mainstay for many, almost half (46%) of those who have made changes have created a home office.

That means more than 4.5m new home offices have emerged across the UK. And over half of homeowners (58%) say they plan to permanently keep them.

Alongside home offices, there are plenty of other ways Brits have reincarnated rooms in their homes since March 2020. Across the UK:

- 1.3m home gyms have been created

- 984,000 home bars

- 900,000 home cinemas or music rooms

- 688,800 dedicated classrooms

The cost of reincarnation

Repurposing entire rooms doesn’t come cheap.

Our research shows that UK homeowners who adapted their homes spent an average of £3,714, with home offices costing on average £1,735, gyms £1,568 and home cinemas £3,841.

Nationally, this is a total of £36.5 billion.

Home offices: who should pay for them?

Home offices in particular have been one of the more contentious room changes, with many being forced to give up living space in order to simply carry out their jobs.

In fact, 16% of homeowners who created one say they resent giving up space in their home for the benefit of their employer.

Nearly seven in ten (67%) believe that employers should pay all or some of the cost of setting up a home office, with 12% thinking that they should even offer compensation for the space lost.

However, the reality is that just 2% of those who set up home offices say that their employer offered compensation, and only 30% say they made any contributions towards costs at all.

Just 10% covered the full costs.

An unhappy compromise?

For those who have had to repurpose rooms, more than half (55%) say this has meant they have had to compromise on their space at home, leaving homeowners less happy with the space they have.

Amongst those who have, 28% say they now have less space for guests to stay, 21% say they have less or no privacy and 11% state that their children now have to share a bedroom.

However, this feeling of not being completely happy with your home rises significantly amongst younger homeowners, who are likely to have smaller properties.

More than eight in ten (83%) homeowners under 25 say they are currently having to compromise with their living spaces.

For many, having to change their home setup during the pandemic has highlighted the need to find somewhere new and better suited to their changed needs.

Of homeowners who have made changes, nearly a third (32%) say that this has made them consider moving home.

Nick Neill, Managing Director at EweMove Sales & Lettings says: 'Although many believe that their employer should contribute to the cost of setting up a home office, it's important to consider other factors, such as reduced commuter costs and the ability to use the time spent commuting on personal endeavours, such as benefitting from a converted gym.

'The rise of open plan living also means that it can be tricky to find space to set up a home office, but it really does present a more flexible property for buyers to consider purchasing if you do decide to sell in the future.

'It's also worth considering a garden office - which could be anything from a glorified shed to a swanky purpose-built luxury cabin.

'Not only can it enable a better work/life balance and space to work outside of the family home, but it will definitely add value to your property and not take it away, which could be the case if you convert a bedroom.'

Key takeaways

- During the pandemic, 41% of British homeowners adapted their home to suit their changing needs, sacrificing around 8.8m bedrooms in the process

- In their place nearly five million new home offices have been created, alongside over one million home gyms

- The average household spent £3,714 adapting their home during the pandemic - that’s a national total of approximately £36.5 billion

- Nearly 7 in 10 think employers should contribute to the cost of home offices, but only 30% have