Banks reduce lending: will mortgage rates go down?

Mortgage lenders are becoming more risk averse as a rising number of homeowners struggle to keep up with their mortgage repayments - but will mortgage rates go down?

Banks are becoming more strict with mortgage lending criteria as the number of people falling behind with their mortgage rose during the first three months of 2023.

Mortgage lenders expect this trend to continue going forward and, as a result, they plan to tighten their credit scoring criteria.

They will also reduce lending to people with smaller deposits, according to the latest Bank of England Credit Conditions Survey.

Mortgage lenders cited the changing economic outlook and a reduced appetite for risk for their increased caution, as well as the slowdown in the UK housing market.

The tightening comes at a time when demand for mortgages is expected to rise to a near-two-year high, particularly among people remortgaging.

But there is still good news if you're wondering whether mortgage rates will go down.

The interest charged on fixed-rate mortgages has recently fallen to a six-month low and there is a wide range of mortgage products to choose from.

Why are mortgage lenders tightening their criteria?

Household budgets have been impacted by the combination of the cost-of-living squeeze and rising interest rates.

The Bank’s Monetary Policy Committee (MPC) has increased the Bank Rate by 4.15% since December 2021, adding around £446 a month to mortgage repayments for someone with a £200,000 mortgage.

The cost-of-living crisis and these higher mortgage rates have impacted some people’s ability to afford their monthly mortgage payments.

And in turn, it's making lenders more cautious about lending.

But despite some problems in the US and European banking sectors, lenders are not anticipating a wider credit crunch such as that seen during the global financial crisis.

Buyers with smaller deposits to be most impacted by tighter mortgage criteria

Mortgage lenders have indicated that the drop in mortgage availability will have the biggest impact on home buyers with smaller deposits and homeowners with smaller equity in their properties.

There will be the biggest decline in mortgage lending to those with house deposits or equity of 25% or less, while there may be a slight reduction in lending to people with higher stakes in their home.

Understanding your loan-to-value ratio

Despite this, the availability of mortgages for people with a 10% deposit will only reduce slightly.

Mortgage lenders also expect no change in the number of mortgage applications they approve.

This is a significant turnaround from the final three months of 2022 when lenders were much more picky about who they lent to.

Number of available mortgage products recovers to pre-mini budget levels

While banks are tightening their lending criteria, there’s no need to be alarmed if you're buying or remortgaging.

The number of mortgage deals available has recovered to the same level as before the mini budget in October 2022. This includes more than 500 mortgages on offer for people with a 10% deposit.

Average mortgage rates have also continued to come down, despite increases to the Base Rate, with the typical cost of fixed rate deals recently falling to a six-month low.

The biggest decision will be whether to opt for a fixed rate mortgage, for which the interest rate stays the same for the term, or a tracker one, where the interest you pay moves up and down in line with the Bank Rate.

Will mortgage rates go down?

Average mortgage rates in the UK are currently:

-

4.48% for a tracker mortgage

-

5.32% for a two-year fixed rate mortgage

-

5.00% for a five-year fixed rate mortgage, although sub-4% mortgage rates are available if you shop around.

Back in February, the cost of a two-year fixed rate mortgage was 5.44% while the cost of a five-year fixed rate mortgage was 5.20%.

And in January these mortgage rates sat at 5.79% and 5.63% respectively, showing that mortgage rates have gone down over the first few months of the year.

Our Director of Research Richard Donnell thinks that fixed mortgage rates will be at 4-4.75% throughout 2023.

"We expect fixed rate mortgage rates for new business to sit between 4% and 4.75% for much of 2023. This is low by historic standards but means the average buyer will face an increase of £200 to £500-a-month more in mortgage repayments than at the start of 2022, when mortgage rates were much lower."

Which type of mortgage is right for you?

If you take out a tracker mortgage, your monthly repayments will increase if the MPC increases interest rates again. But you could also see them fall if the MPC starts to cut the official cost of borrowing.

If you prefer the certainty offered by a fixed rate mortgage, you will need to decide whether to fix for two years or five.

Mortgage calculator: work out your mortgage repayments

Five year deals are currently cheaper than two year ones, but interest rates are thought to be close to peaking. If mortgage rates start to come down, you’ll be locked into the rate for longer.

Whatever you decide to do, it’s a good idea not to stay on your lender’s standard variable rate for too long as these currently average a mortgage rate of 7.12%. This is the rate you automatically revert to when your current deal ends.

Key takeaways

- Banks are tightening their mortgage lending criteria as more homeowners struggle to keep up with their mortgage repayments

- Mortgage lenders plan to tighten their credit scoring criteria and reduce lending to people with smaller house deposits

- But interest rates for fixed mortgages are going down and have reached a six-month low, while there is a wide choice of available mortgage products

- The average cost of a five-year fixed rate mortgage is now 5.00%, down from 5.63% in January 2023

- The average cost of a two-year fixed rate mortgage is now 5.32%, down from 5.79% in January 2023

Selling this year? Then we’ve got some good news

If you're looking to sell a home that represents good value, then you're in demand. Homes that offer more bang for their buck are just what buyers are looking for right now.

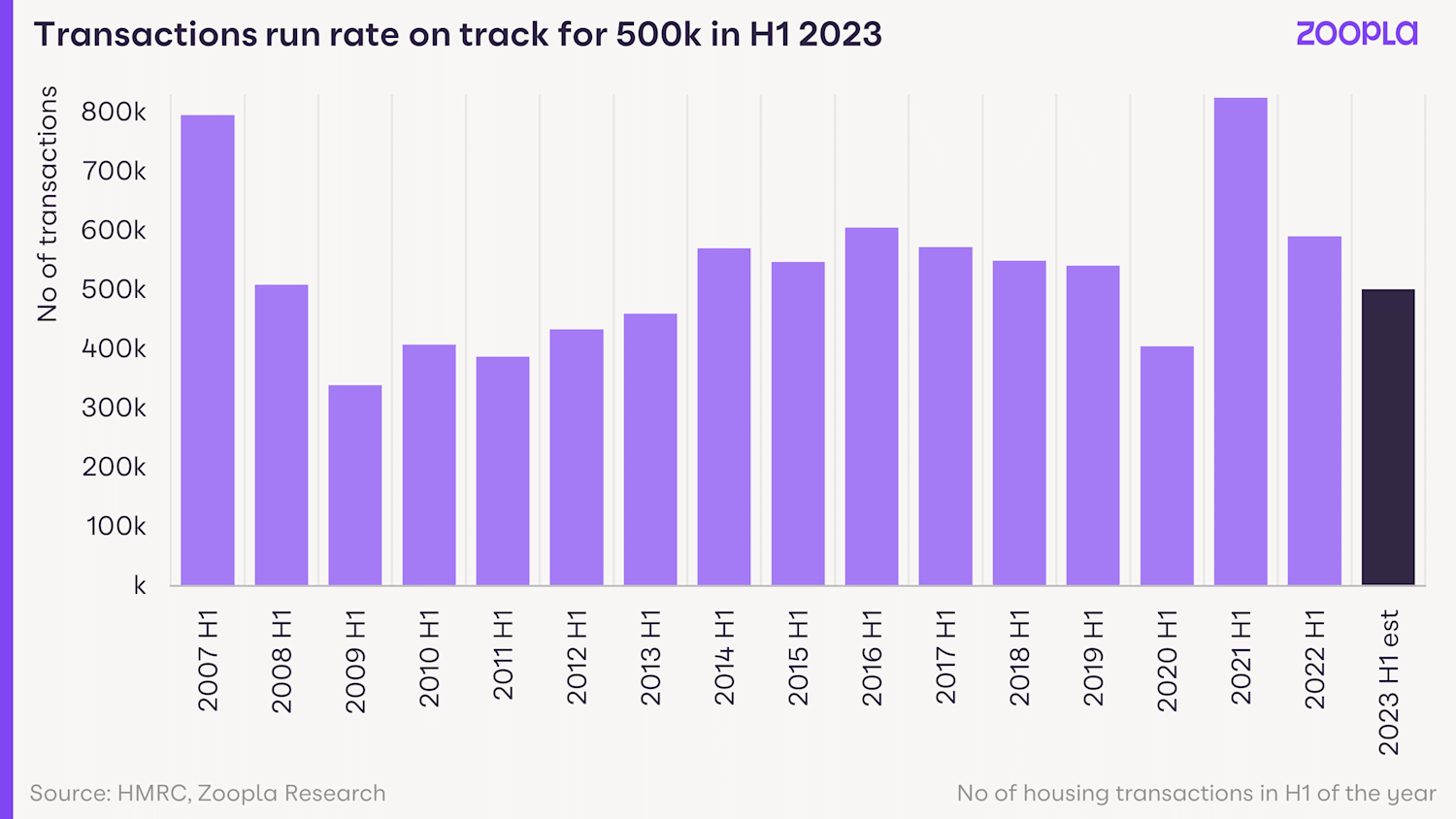

House prices are still up 4% year on year and we’re expecting 500,000 home sales to go through in the first half of 2023.

The number of sales agreed is 11% higher than the number agreed in spring 2019 - and sales are on an upward trajectory.

Prices are down 1% from what they were in October 2022, but the housing market is faring much better than many predicted and the number of sales going through is starting to pick up.

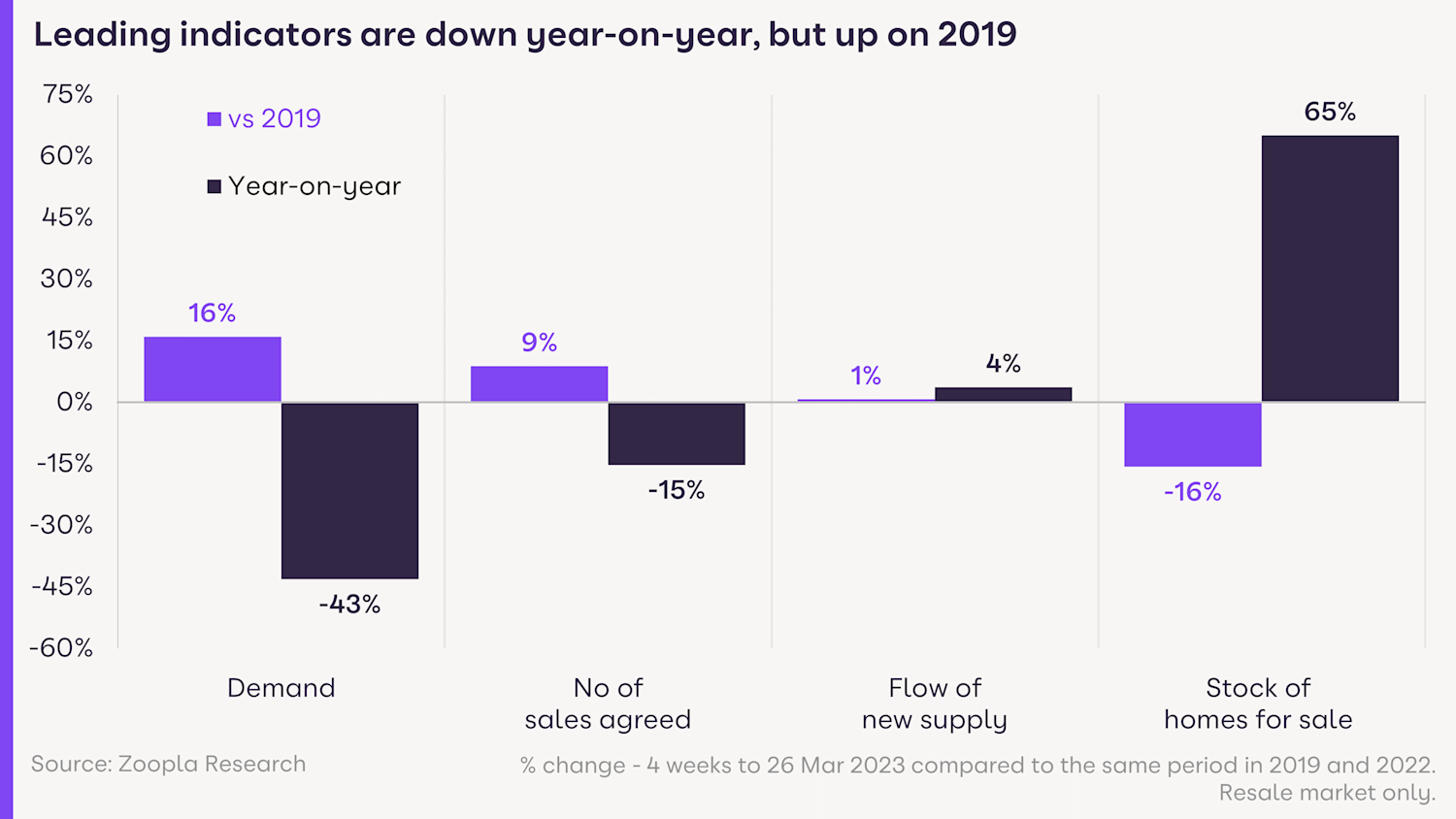

There are now 65% more homes available for sale than there were this time last year. The average estate agent now has 25 homes available, compared to a low of 14 homes in spring 2022.

This means there’s much more choice for buyers - and we’re expecting at least a million home sales to go through in 2023.

If your home represents good value for money, then you’re in demand

Buyers with less spending power are looking for homes that offer more bang for their buck.

That means homes in the more affordable areas like Scotland, Wales, the North East of England and London are seeing plenty of demand.

And we’re expecting the popularity of inner London flats to see a resurgence this year - because of price stagnation since 2016 - they’re now representing good value for money.

Across all regions and countries of the UK, we’re seeing a 5% increase in the share of sales at the lower end of the market and a 4% decrease at the top end, clearly showing that buyers are currently more interested in homes at the more affordable end of the spectrum.

The top end of the London market is the only area bucking this national trend, with an increase in the share of sales in the top 20%.

If you live in an area that saw big gains during the pandemic (we’re talking the South West, South East and Midlands) then you may find it takes longer to sell, as these homes now need bigger mortgages from would-be buyers.

And 4% mortgage rates are currently reducing buying power by 20%, hence buyers are looking for cheaper properties.

How much are sellers cutting their asking prices by?

Sellers are making modest downward adjustments to their asking prices to ensure their pricing matches what buyers are prepared to pay.

The average seller discount at the moment is 4% or £14,000.

That said, the scale of price gains over the pandemic (where the average home value increased by £42,000) is giving sellers room for manoeuvre to make these adjustments so that they can continue with their moving plans.

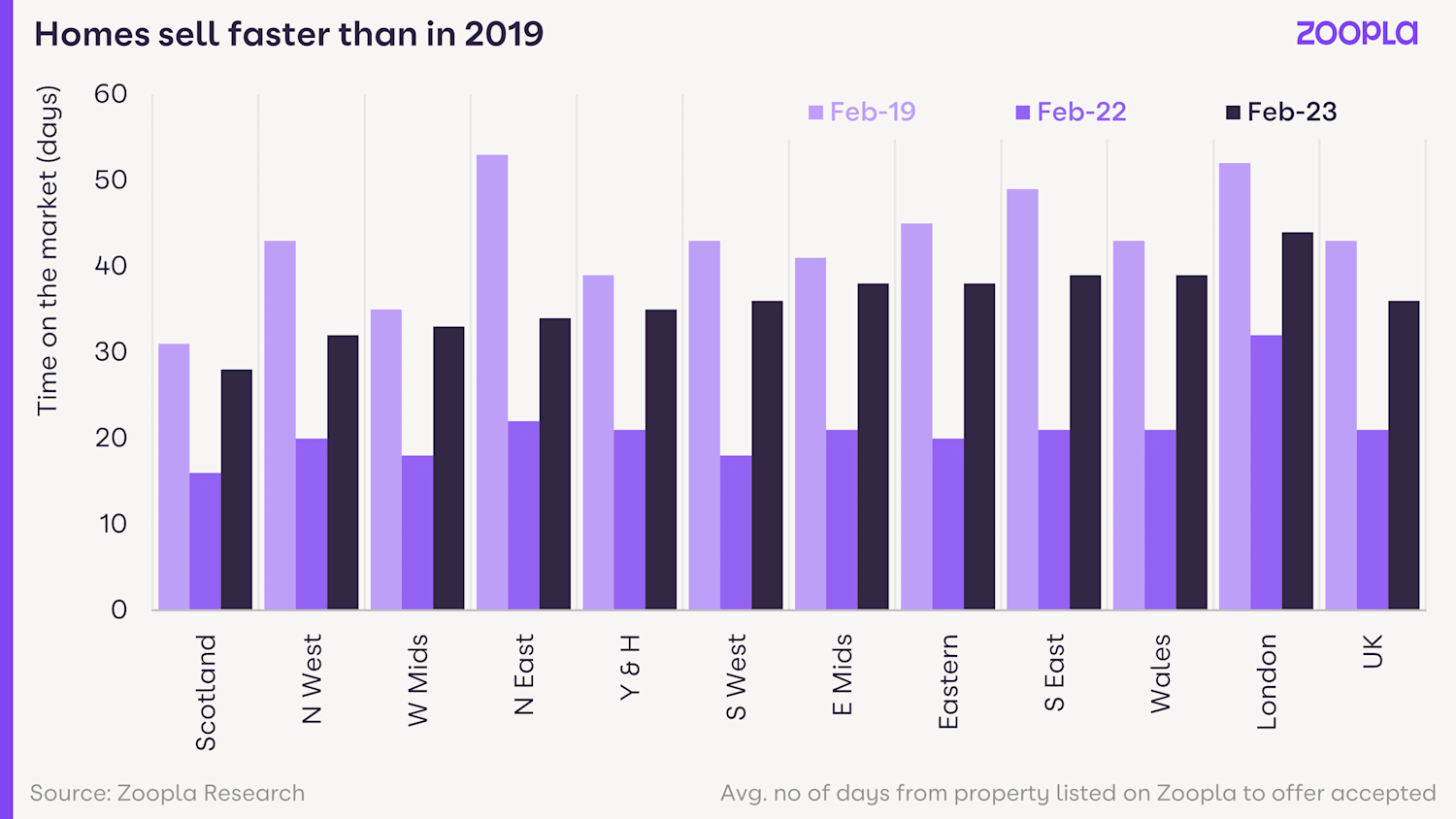

How long does it take to sell a home in March 2023?

The average home is now taking 15 days longer to sell than in spring 2022, when we were in a red hot housing market.

However, homes in most areas are still selling faster right now than they did in spring 2019.

Scotland has the shortest sales period at 28 days (where homes are marketed with a survey and valuation in place), and London has the longest time to sell at 44 days.

Why buyers are still motivated to move in 2023

Hybrid working between the home and office is becoming the norm for many office workers.

And that freedom is still opening up the buying landscape for many, allowing them to look further afield for a home that’s better value for money.

A spike in retirement caused by the pandemic is also continuing to be a trigger for home moves.

Meanwhile, increasingly high rents are pushing some renters to become first-time buyers.

And finally, cost-of-living pressures will encourage some movers to down-trade from larger homes that are expensive to run to more affordable properties.

How is the rest of 2023 looking for the housing market?

The market is going through a soft repricing process with modest quarter-on-quarter price falls across all regions and countries of the UK.

But the good news is that buyers and sellers are continuing to agree deals and there’s little evidence to suggest house prices and transaction volumes are going to suddenly drop lower.

The most affordable markets will continue to attract demand and see above-average levels of sales.

The onus on all sellers is to make sure pricing aligns with buyers' expectations. If you are serious about moving, you simply cannot afford to over-price your home.

Mortgage rates are set to remain around 4% over much of 2023 and could move lower towards the end of the year.

Key takeaways

- Demand for homes has reached its highest level since October 2022 and is 16% higher than spring 2019

- Demand from buyers is also above average in the most affordable areas, led by Scotland, Wales, the North East of England and London

- Mortgage rates are set to remain at around 4% for most of 2023 - and could move lower towards the end of the year

- Prices are adjusting lower but most homeowners looking to sell will still be making more from their home than 1-2 years ago

Where are house prices falling in the UK?

Seven local authority areas in the UK have seen an annual fall in house prices.

Houses across the UK are now selling at an average price of £259,700, 1% less than in October 2022.

UK-wide annual house price growth has dropped to 4.1%, but a few locations are already seeing annual price falls: expensive London boroughs and the east coast of Scotland.

We’ll reveal the locations in the UK where house prices are falling and rising, plus the cheapest and most expensive places to buy a home on average right now.

Having said that, we know averages aren’t going to cut it when it comes to your home.

The UK locations where house prices are falling

Four parts of London have registered a fall in average house prices since this time last year.

Homes in Westminster are selling for £12,170 less than a year ago on average (-1.2%), while properties in Kensington and Chelsea have lost an average of £6,220 (-0.5%).

House prices have fallen slightly in Hammersmith and Fulham (-0.1%) and Tower Hamlets (-0.1%), taking £550 and £350 off the average sale price respectively.

Meanwhile, Islington, Camden and Wandsworth have seen house prices rise less than 1% in the last year.

London is feeling the impact of increased mortgage rates due to its higher house prices, which is impacting buyer demand and causing price growth to stagnate or fall into reverse.

The only other places in the country where house prices are already falling year-on-year are on the east coast of Scotland: Aberdeen (-1.1%), Aberdeenshire (-0.2%) and Moray (-0.2%).

A lack of investment in the North Sea’s oil industry in recent years is having a knock-on effect on local employment and reducing demand for property on the Scottish east coast.

Here are the sevens places where house prices are falling, along with the locations seeing the lowest annual house price growth.

| Local authority area | Average house price | Annual price change (%) | Annual price change (£) |

|---|---|---|---|

| City of Westminster | £962,600 | -1.2% | -£12,170 |

| Aberdeen | £140,000 | -1.1% | -£1,590 |

| Kensington and Chelsea | £1,189,400 | -0.5% | -£6,220 |

| Moray | £168,700 | -0.3% | -£560 |

| Aberdeenshire | £186,600 | -0.2% | -£350 |

| Hammersmith and Fulham | £731,100 | -0.1% | -£550 |

| Tower Hamlets | £482,100 | -0.1% | -£350 |

| Islington | £628,000 | 0.4% | £2,260 |

| Camden | £750,900 | 0.6% | £4,560 |

| Wandsworth | £655,500 | 0.7% | £4,660 |

Zoopla House Price Index, March 2023

The UK locations where house prices are rising the most

Areas in the North West and Wales are recording the strongest house price growth in the UK, with homeowners gaining more than 6% in sale prices year-on-year.

House prices have risen the most in four towns near Manchester - Oldham (+7.4%), Rochdale (+7.3%), Wigan (+7.1%) and Calderdale (+6.9%) - as buyers seek value for money and connections to large employment centres.

Homeowners in these areas can expect to see at least £10,000 added to their home’s sale price since February 2022.

Areas in South and West Wales have also enjoyed strong house price growth in the last year, with the biggest gains seen in Carmarthenshire (+6.8%), Neath Port Talbot (+6.7%) and Bridgend (+6.6%).

The Vale of Glamorgan has seen the biggest monetary gains with homeowners adding £17,360 (+6.3%) to their home’s sale price, while those in Pembrokeshire have seen a £13,920 rise (+6.5%) since February 2022.

| Local authority area | Average house price | Annual price change (%) | Annual price change (£) |

|---|---|---|---|

| Oldham | £171,900 | 7.4% | £11,820 |

| Rochdale | £163,700 | 7.3% | £11,070 |

| Wigan | £163,900 | 7.1% | £10,860 |

| Calderdale | £169,200 | 6.9% | £10,900 |

| Carmarthenshire | £199,000 | 6.8% | £12,650 |

| Neath Port Talbot | £151,000 | 6.7% | £9,480 |

| Bridgend | £192,100 | 6.6% | £11,870 |

| Pembrokeshire | £228,300 | 6.5% | £13,920 |

| Caerphilly | £174,100 | 6.4% | £10,410 |

| Vale of Glamorgan | £293,300 | 6.3% | £17,360 |

House Price Index, March 2023

The UK locations with the cheapest house prices

The cheapest areas to buy a home in the UK right now are all located in Scotland and the North of England.

The cheapest houses for sale in the UK are in rural areas to the east of Glasgow - Inverclyde, East Ayrshire and West Dunbartonshire - where house prices average less than £110,000.

In the North East, you can find cheap houses for less than £120,000 in Hartlepool, Hull, Middlesbrough and Sunderland.

And in the North West, the cheapest properties for sale are in Burnley, where the average home costs £116,600.

The prominence of Scottish regions is down to a greater balance between property and wage growth than the rest of the UK.

"Scotland dominates the most affordable areas list, with modest pricing and stronger relative earnings making a home move more accessible for many,” says Izabella Lubowiecka, Researcher at Zoopla.

"For home movers on average salaries, mortgages are more affordable in these lower-value locations, especially if they have built up some equity in their current property.”

| Local authority area | Average house price | Annual price change (%) | Annual price change (£) |

|---|---|---|---|

| Inverclyde | £101,200 | 3.3% | £3,190 |

| East Ayrshire | £102,600 | 3.3% | £3,300 |

| West Dunbartonshire | £108,700 | 2.7% | £2,810 |

| Hartlepool | £110,500 | 3.7% | £3,930 |

| North Ayrshire | £111,200 | 3.0% | £3,220 |

| Hull | £112,000 | 2.5% | £2,750 |

| Middlesbrough | £113,900 | 3.7% | £4,110 |

| Burnley | £116,600 | 3.3% | £3,720 |

| North Lanarkshire | £117,600 | 3.9% | £4,380 |

| Sunderland | £117,700 | 2.4% | £2,810 |

House Price Index, March 2023

Where are the most expensive house prices in the UK?

When it comes to the most expensive places to buy a home, it’s all about London and the South East.

Kensington and Chelsea is the only place where the average house price pips the £1 million mark, but houses are selling for £6,220 less than a year ago on average.

The City of Westminster is a clear second place at £962,600 despite a £12,170 annual drop in sold prices.

House prices in Richmond, Camden, Hammersmith and Fulham, and Elmbridge all sit above £700,000 but price growth is low or negative.

Stretched affordability in London is limiting the scope for price growth and we’re expecting price falls of around 5% to 8% by the end of 2023. This will improve affordability and support a future rebound in inner London markets.

| Local authority area | Average house price | Annual price change (%) | Annual price change (£) |

|---|---|---|---|

| Kensington and Chelsea | £1,189,400 | -0.5% | -£6,220 |

| City of Westminster | £962,600 | -1.2% | -£12,170 |

| Richmond upon Thames | £764,600 | 1.2% | £9,430 |

| Camden | £750,900 | 0.6% | £4,560 |

| Hammersmith and Fulham | £731,100 | -0.1% | -£550 |

| Elmbridge | £720,200 | 1.8% | £12,710 |

| South Buckinghamshire | £680,100 | 2.4% | £15,620 |

| Wandsworth | £655,500 | 0.7% | £4,660 |

| Chiltern | £654,300 | 2.3% | £14,640 |

| Islington | £628,000 | 0.4% | £2,260 |

House Price Index, March 2023

Key takeaways

- The UK’s average house price is now £259,700 as house prices fall 1% since October and annual price growth drops to 4.1%

- There are seven local authority areas in the country where house prices are already falling year-on-year - four London boroughs and three areas on the east coast of Scotland

- All other areas in the UK continue to see low annual house price growth, with towns on the outskirts of Manchester and areas in Wales faring the best

Property sales rise as buyers regain confidence

With steadying mortgage rates and 65% more homes for sale than this time last year, buyers are back in the market and agreeing 11% more sales than in 2019.

Increasing sales volumes indicate recovering market health

The housing market is continuing to see cautious improvements in conditions since the mini budget in October 2022.

Sales volumes are on an upward trajectory while the demand for homes has reached the highest level since last October in recent weeks.

The number of agreed sales is now 11% higher than in 2019, while demand from buyers sits 16% and homes are selling more quickly across most regions of the UK.

While these measures are tracking lower than this time last year, the return of more ‘normal’ market conditions in recent months makes 2019 a more relevant benchmark of activity than the pandemic housing boom of 2020 to mid-2022.

Second-steppers in favourable position to upsize

Homeowners looking to upsize are enjoying a favourable position thanks to greater demand at the lower end of the market along with more choice of their next property and repricing at the upper end of the market.

There’s been a clear shift in the proportion of homes selling across the UK, with properties in the cheapest 40% of the market agreeing 5% more sales. Meanwhile, houses in the most expensive 40% have seen a 4% drop in agreed sales.

There are 65% more homes for sale than a year ago with the average estate agent listing 25 available homes for sale compared to the low of 14 last year.

This is seeing sales agreed at 4% lower than asking price - or £14,000 on average - which equates to the greatest savings on higher-priced properties.

What’s more, the rapid 11% rise in rental rates in the last year is continuing to support demand from first time buyers, who accounted for 1 in 3 sales last year.

These trends are coming together to give homeowners at the lower end of the market confidence in the sale of their current home, along with more choice, time and bargaining power in their next purchase.

However, upsizing will come with the consideration of higher mortgage costs. We expect more people to proceed with their move as the economic outlook becomes clearer and UK-wide house prices start to register small annual falls this summer.

First time buyers look to escape rising rents

The rapid pace of rental inflation - up 11% in the last year - is encouraging an increasing number of renters to become owners, despite the challenge of getting a deposit together.

We expect this to hold up this year as rental growth shows no sign of slowing and mortgage rates remain below rental costs in many regions - even with current 4% mortgage rates limiting buyer power by up to 20% compared to last year.

Buyers finding value in affordable regions and some pockets of London

More affordable areas are seeing the highest demand as the market adjusts to higher mortgage rates.

The highest levels of demand are from buyers in Scotland, Wales, the North East of England and London.

Buyers are generally less keen to move in regions where prices increased the most during the pandemic and where higher mortgage rates therefore have the biggest impact - across the South of England and the Midlands.

Rebalancing of house prices set to support activity across the housing market in 2023

Rising house prices are often associated with market health but we believe the current repricing will support activity from all segments of the housing market as we look to the end of 2023 and into 2024.

The highest prices we saw in mid-2022 simply aren’t sustainable with the mortgage rates now available, so the natural tip back towards what buyers can realistically afford with a 4% mortgage rate will encourage more back into the market.

We expect 1 million sales in 2023 with 5% house price falls in localised areas, but sellers’ concerns will be somewhat alleviated by an average gain of £19,000 to their home’s value in 2022.

Key takeaways

- Increasing sales volumes indicate recovering market health with 11% more agreed sales than in 2019

- Second-steppers in favourable position with highest demand at cheaper end of the market plus more choice, time and bargaining power with their next purchase

- Widespread repricing of homes set to tempt more buyers this summer while sellers’ concerns are alleviated by an average £19,000 gain in home values in 2022

The best Easter events and activities in London

The first bank holiday of the year is also a double one – here are our top ten things to do over the Easter weekend in London.

Easter weekend isn’t just a time to scoff loads of chocolate and have a big roast dinner: it’s also a double bank holiday. We get four whole days off between Good Friday on April 7 and Easter Monday on April 10, so the world – or at least London – is our oyster.

Worried about filling up all your extra time off? Time Out has your back. There’s plenty to do in the capital over the Easter weekend: from checking out spring flowers and other kid-friendly Easter activities to swinging by one of London’s top rooftop bars and coffee shops. Hopefully, the weather will be glorious and hanging out in the park for four days straight won’t involve dashing away from freak rain storms.

But if not, you can still spend your time checking out a free art exhibition, seeing some top theatre or treating yourself to a proper pub roast on Easter Sunday. If you’re looking for something truly special to do over the extra-long April break, read on for our top ten things to do in London this Easter. From a resurrection-themed pub crawl to Good Friday club nights, there’s absolutely no way you’ll be bored.

How to spend your Easter weekend in London

1. Kick off your four-day weekend with a ‘very, very good Friday’ party at The Cause

Dance your way through the Easter bank hol at one of The Cause's famed day parties. Chicago-based Hiroko Yamamura will make her UK debut behind the decks at the 60 Dock Road venue. Cause fave and Berghain stalwart Ryan Elliott will also be going B2B with Evan Baggs and there’ll even be a slap-up brunch and £5 bloody marys for sustenance. This one finishes at 10pm, so you’ll be in ship shape for your fam on Easter Saturday.

2. Sup the hops of life on a crucifixion-themed pub crawl

Worship at the altar of the pint on this Easter crucifixion-themed charity pub crawl, which is being resurrected after a three-year hiatus following that biblical-scale situation we all lived through recently. Participants on the Easter Sunday sesh dress like Jesus and visit biblically-named pubs to raise money for charity – you will be asked for a small donation – starting at The Trinity in Borough and finishing at Whitehall’s Silver Cross. Prepare to make a holy show of yourself.

3. Enter an immersive David Attenborough documentary

The Attenborough supremacy continues with this immersive experience that thrusts you into the heart of the BBC’s recent opus ‘Seven Worlds, One Planet’. The general vibe is that enormous 360-degree screens give you the sense that you’re stepping into the programme’s awesome vistas – and while the footage is all from that particular show, you’ll be treated to extended scenes, alternative camera angles, and the obviously seismic difference between this and your puny telly. Plus we’re promised ‘bespoke’ commentary from David Attenborough himself.

4. Craft an eco-friendly Easter wreath

Wreaths aren’t just for Christmas. Craft your own Easter-themed donut of foliage at this hands-on workshop from the green-fingered gurus at Petersham Nurseries. Director of horticulture Thomas Broom-Hughes will be on hand to school you on how to make an environmentally friendly willow-based wreath using woodland materials, seasonal British foliage and flowering bulbs, meaning the design you take home won’t just be beautiful but also compostable. A win for your front room and for nature.

5. Rent a boat and go for a float along London’s canals

With GoBoat in Paddington, you can hire and self-drive your own boat make your way across London’s canals. Depending on how good your steering skills are, you’ll be travelling past London Zoo, through Regent’s Park and Camden Lock. Prices start at £95 for one hour. Sound good? Each GoBoat can have a micro crew of up to six people. Your days as a lonely sea captain are over.

6. Play new, experimental games at Now Play This

Sunday lunch. There’s nothing quite like it. An elemental meal that Londoners take incredibly seriously, debates about what constitutes the ‘perfect’ Sunday roast have been known to last for hours. There is no shortage of top roasts in London. We’ve rounded up the city’s best Sunday meals from a host of homely pubs and restaurants all around town. From snug neighbourhood staples to more bijou gastropubs. A lot of these places get quite busy, by the way. So you’re always advised to book ahead to avoid disappointment.

8. Witness Trafalgar Square’s enormous reenactment of the crucifixion

Wintershall Players return with their huge (for which read horses, donkeys, doves and a cast of more than 100) open-air re-enactment of ‘The Passion of Jesus’ on Good Friday, featuring volunteers from in and around London. Huge crowds are expected but big screens will ensure nobody misses any crucial plot twists.

9. Embrace the season at the Horniman Museum’s spring fair

This gem of a museum and gardens in south-east London has a lovely spring fair on the Saturday of the Easter bank holiday weekend. Wow your wee’uns with towering stilt walkers and enchanting bubble performances, or battle it out on the green with UrbanCrazy minigolf. Or take your pick from the rest of the array of family-friendly fun including face painting, garden trails, arts and crafts and live music.

10. Frolic among the flowers at Kew Gardens

London’s botany HQ should be booming with blooms in April, making it the perfect spot for an Easter weekend walk. From its Cherry Walk lined with pink-blossomed Japanese cherry trees to its primrose and crocus-filled woodland garden, there’s plenty of pretty petals to spot here.

How to celebrate Easter in London this April

Easter in London 2023

A double bank holiday, chocolate for days and plenty of springtime activities – maximise Easter weekend 2023 in London

Ask any Londoner what the vibe is on bank holidays and they’ll no doubt agree that it’s absolutely bloomin’ marvellous. From blissful drinks in the park to glorious day parties and some of the year’s biggest and best club nights, this city sure knows how to make the most of an extra day or two off. Even the weather somehow always seems to pull through with dazzling sunshine.

London’s bank holiday energy is off the charts – and Easter weekend is a particularly sweet deal. Not only is it a religious holiday that demands you eat as much chocolate and hot cross buns as humanly possible, but it’s also a rare double bank holiday. Meaning, yes, you get four whole days of work-free folly.

Easter weekend this year runs from Good Friday on April 7 to Easter Monday on April 10. And, as always, those four days are packed full of stuff to keep you busy. Whether you’re after afternoons dazing in sun-glazed parks, extended Sunday pub lunches, evenings at the theatre – London this Easter bank holiday weekend has you covered. Here are our top picks below.

Plan a cracking Easter weekend in London

Top ten Easter activities in London

Concerned about rents rising and want to buy a home - is now the right time?

It's cheaper to buy the home you rent in many regions outside of southern England. If you're a renter looking to become a first-time buyer, is now the time to make a move?

Hundreds of thousands of renters make the jump to owning each year

The English Housing Survey shows that around 166,000 private renter households exit the rental market to buy their first home each year. There are another 87,000 who jump to home ownership directly, often from living with friends and family.

The decision to buy your first home is fraught with challenges and complexities, not least the outlook for the housing market and hoping that prices don't fall, having made your first step into home ownership.

This is compounded by the fact that mortgage rates for new borrowers are more than double the level they were a year ago and the fact that selling schemes like the Help to Buy equity loan have now ended.

Many who would like to buy are feeling under growing pressure to move from the pace of rental growth. Annual rental costs for a renter moving home are up £2,200 since the pandemic, adding to financial pressures at a time when disposable incomes aren’t rising and other living costs are also on the up.

It is important to say that not all renters have a desire to buy and renting is a great flexible option for those that want to remain less tied to a home long term.

Soft landing for house prices and more negotiation and choice

Recent house price index reports cover the detailed trends in the sales market and the outlook. They show that house price growth is slowing, but sales are still being agreed and buyers continue to enter the market. More importantly, we have 65% more homes available for sale than we did this time last year, boosting choice for would-be buyers of all types.

Sellers have been reducing asking prices steadily over the last 6 months as they try to make sure the price is in line with what buyers want to pay. This has been a generally uniform trend across the market. At the same time, sellers are also accepting average discounts of 4-5% off the asking price to help agree a sale. This varies around the country and reflects a return to more normal market conditions.

It’s important to note that in Scotland homes are typically marketed as ‘offers over’ with an accompanying valuation, so this notion of bidding less than the asking price is more of a trend in England, Wales and Northern Ireland.

Overall it looks like prices might fall by up to 5% over 2023 and in some areas we may not see any price reductions. This may not be what first-time buyers want to hear but it's the outlook as things stand today. It's fair to say housing market conditions are the most balanced between sellers and buyers for 4 years and slightly more in favour of the buyer.

Renting vs buying and mortgage availability

Another big consideration is the cost of renting versus buying a home with a mortgage. If a first time buyer is comfortable with monthly rental costs, then this often becomes a benchmark for mortgage repayments and what is affordable.

The biggest hurdle for many first-time buyers is saving for the deposit - and many get support from friends and family to help with this. In recent years we have seen more first-time buyers using larger deposits than was the case before 2007. This is because mortgage rates are cheaper below 90% loan to value loans and there are more regulations that make it harder to access high loan to value mortgages from lenders.

Data from the Financial Conduct Authority up to mid 2021 shows almost two thirds (63%) of first-time buyers take mortgages below or equal to 85% loan to value (LTV). Just over 1 in ten (12%) borrowed at or above 90% LTV, meaning a 10% deposit or less.

In 2017 almost 20% of first-time buyers used a 10% deposit or less, the result of higher house prices, which has more recently been compounded by higher mortgage rates.

It is cheaper to buy the home you rent in many regions outside southern England

We have compared the cost of renting versus buying across different areas of the UK. We assume a renter buys the home they rent in terms of size and price to make it a like-for-like comparison.

This table shows monthly mortgage repayments compared to monthly rents, assuming the borrower uses an 85% mortgage and takes a 30 year loan at a 4.5% mortgage rate. It shows that in markets with lower house prices the monthly mortgage payments are lower than the monthly rental payments by up to 23%.

| Region | Rent pcm | 4.5% mortgage repayments pcm | Difference to rental costs | Mortgage repayments as % of rental costs |

|---|---|---|---|---|

| North East | £598 | £461 | -£137 | -23% |

| Scotland | £671 | £535 | -£136 | -20% |

| Northern Ireland | £658 | £603 | -£55 | -8% |

| Yorkshire & The Humber | £696 | £632 | -£64 | -9% |

| North West | £727 | £636 | -£91 | -13% |

| Wales | £749 | £696 | -£53 | -7% |

| East Midlands | £758 | £756 | -£2 | 0% |

| West Midlands | £784 | £769 | -£15 | -2% |

| South West | £957 | £1,048 | £91 | 10% |

| Eastern | £1,025 | £1,153 | £128 | 13% |

| South East | £1,160 | £1,314 | £154 | 13% |

| London | £1,815 | £2,225 | £410 | 23% |

| UK | £1,049 | £1,108 | £59 | 6% |

Zoopla

In London and the South East mortgage payments are higher than rents as house prices are higher. The reality is that first-time buyers in these regions typically need to put down more equity to afford to buy a home and reduce the monthly repayments to a more manageable level.

Low mortgage rates have enabled some first-time buyers to buy bigger homes than the ones they rent, especially in markets where house prices are at or below the national average.

Many have targeted buying a 3 bed home at a discount to the local market that needs some improvement work. This doesn’t work everywhere and really depends on where you are looking to live and the price of homes.

Mortgage stress testing makes life a little harder

It’s important to acknowledge an extra complication for first-time buyers when looking at mortgage costs. While many will see that mortgage payments are lower than their rent, lending rules can lead to you not being able to get a mortgage.

As part of the lending decision, banks need to make sure a new borrower can afford a higher mortgage rate than they will actually pay. This is called 'mortgage affordability stress testing' and it has been around since 2015.

It means the bank will check to see if you can afford to pay the mortgage at a rate that is closer to 6% or higher, even though you are seeking a loan for 4.5% as in the example above. This is all about ensuring borrowers don’t overextend themselves and have room to manage an increase in borrowing costs.

It's an important regulatory tool for banks that has stopped an over-valuation of house prices in the last few years and means we are not facing a collapse in house prices today. It does, however, make it that bit harder to buy your first home, especially in locations where house prices are higher than average.

Chat to your bank or mortgage broker

While mortgage rates have moved higher, our analysis shows that it is still cheaper to buy with an 85% LTV mortgage than to rent in many areas of the country, assuming you buy the home you rent. Buying a bigger home will shift this dynamic and first-time buyers also need to allow for the impact of affordability testing.

The first thing for a would-be first-time buyer to do is speak to a bank or mortgage broker to see what you can afford by way of a mortgage. Using this with your deposit will help you understand what price of home you can afford, allowing for the fact that there may be some wriggle room to negotiate on price.

Plan for a longer stay in your first home

The final general piece of advice to first-time buyers is don't expect house prices to rise quickly in the coming years. Prices will rise but slowly, more in line with incomes. If you plan to buy your first home, ask yourself if it's the right size and location for you to be there for 5-10+ years, rather than 2-4 years, unless you expect to inherit or gain access to equity to help fund that next move.

Key takeaways

- 75% of first-time buyers come from the rental market each year

- Across much of the country it's cheaper to buy at 4.5% mortgage rates than to rent

- It pays to understand what you can afford as borrowing is more complex

- First time buyers should typically plan to buy a home that will work for the next 5-10 years

When will the pressure on renters start to ease?

With rents up £2,200-a-year since the start of the pandemic and supply 33% down on the five-year average, Executive Director of Research takes a look at what's happening in the rental market.

A tale of two housing markets

The housing market has two narratives. The main question on the mind of buyers and sellers in the sales market is: ‘Will house prices fall and by how much?’. But it’s the total opposite if you are a renter. The cost of renting is rising, and securing a home to rent is the hardest it’s been in the last 5 years.

The latest Zoopla rental index reveals average residential rents have risen by 11% in the last year. That’s over 20% higher since the start of the pandemic.

Rents are rising fastest in the UK’s biggest cities. Manchester and London lead the way with rents here rising by almost 15%. That's more than twice the growth in average earnings.

Even at the bottom end of the rental-growth league table, average rents are up 5-7% in the last year.

Immigration, students and jobs boost competition for rented homes

When the economy reopened mid-2021, the competition for rented homes bounced back too. People were returning to work in the cities.

At the same time, the Government relaxed visa rules for students and postgraduates to attract them to study and work in the UK.

In 2022, we saw a record net inflow of people coming to live in the UK - a sizeable proportion being overseas students.

Most university towns have purpose-built student housing. But, there isn’t enough to go round. The inflow of students is spilling over into the wider rental market.

Each year, on average, we see over 350,000 renters become first-time buyers. But higher mortgage rates have hit first-time buyers hard, preventing some of them from getting onto the property ladder.

Instead of freeing up rental homes, would-be first-time buyers are staying put. This has restricted supply and increased demand for rental properties.

Rental market grows just 1% since 2016

While the demand for rented homes is running high (50% above the 5-year average), the average estate agent has 33% fewer homes for rent than before the pandemic.

This is down to renters staying put for longer (over 4 years on average) but also very slow growth in the overall stock of private rented homes.

Great Britain has 5.6 million rented homes (up from 5.5 million in 2016) with private landlords owning 85% of all rented homes. Tax changes and regulations have stalled new investment by private landlords while some have decided to sell.

The net result is that those selling rented homes are offsetting the impact of new investment coming into the market. This marks a big change from the period 2000 to 2016, when the rental market doubled in size.

There's little evidence that supply will grow quickly

Only by increasing the supply of rented homes can we start to ease the pressure on renters and boost choice. Unfortunately, it’s hard to see rental supply increasing rapidly in the near term.

More regulations are coming down the track to improve standards of rented housing and shift the balance between renters and landlords. At the same time, higher mortgage rates are impacting the costs for landlords entering the market and those remortgaging. Instead, some have decided to sell and pay down mortgage debt.

The next big challenge for landlords are proposals that rental properties need to have an energy efficiency rating of C or higher from 2025. This means a sizeable number of rented homes will need material investment to upgrade to a C rating. Some landlords may prefer to sell rather than make this investment, which will further erode available supply.

One bright spot for supply is the build-to-rent market, where corporate landlords and pension funds are investing in the development of homes for rent. The flow of capital is sizeable but this sector still accounts for less than 5% of all rented homes.

Rental growth to slow as affordability pressures mount

Looking ahead, we expect rental growth to slow to 4-5% over 2023. We expect demand levels to cool and fewer landlords to sell up, boosting supply.

Affordability will become a growing constraint - it’s not possible for rents to grow much faster than earnings for a sustained period. Our data shows rents as a percentage of average earnings (for a single person) are at or above the maximum levels seen over the last ten years. They are lower in London than the maximum seen in 2015 but high by national standards.

So, we expect growing affordability pressures to act as a brake on rental growth. This will be a small comfort for renters, but there needs to be a sustained increase in supply to improve rental market conditions.

The Government’s focus on improving standards is important. But so is encouraging all types of landlords to continue to invest. It will boost an important housing tenure that is key for the UK’s economic growth.

Key takeaways

- Conditions in the rental market are the total opposite of the UK sales market

- Demand has risen alongside jobs growth and record net immigration

- Higher borrowing costs make it harder for first-time buyers to get out of the rental cycle

- The annual cost of renting is £2,200 higher since the start of pandemic

- The number of rental homes has increased by just 1% since 2016

- Affordability pressures will slow rental growth

Base rate rises to 4.25% but new fixed rate mortgages to stay at 4-4.75% for 2023

The latest rise in the base rate to 4.25% is unlikely to have an impact on new fixed rate mortgages in 2023.

Interest rates rise again

The Bank of England increased interest rates one more notch, from 4% to 4.25% today. Inflation isn’t falling as fast as some had hoped, opening the door for more monetary tightening to reduce demand and cool the pace of price increases.

In the US, the Federal Reserve has raised interest rates again this week, despite some problems in the banking system. However, it has signalled that the need for more rate increases is probably over now.

UK mortgage rates have been dropping back

It’s not clear whether a further small increase in UK interest rates will push mortgage rates much higher. In the UK too there is a sense that base rate increases are coming to an end.

Average fixed rate mortgages have dropped back over the last 3 months from the highs seen at the end of 2022. Bank of England data shows the average 5-year fixed rate mortgage for a 75% loan to value (LTV) mortgage has dropped to 4.38% from a high of 5.6% last October.

What many borrowers will remember is the ultra-low 1.2% mortgage rates reached in September 2021. This was the low point, before rates started to increase over 2022 as inflationary pressures built up, which were then boosted by the impact of the mini budget late last year.

Mortgage pricing is complex

How banks set mortgage rates is complex and there is not a fixed relationship between mortgage rates and the interest rates set by the Bank of England.

It all depends on where banks get their funding from in order to lend money out as mortgages - and what this funding costs. They then add a margin onto this cost to reflect risk and a profit margin, which makes the mortgage rate.

This is why higher loan to value mortgages attract slightly higher mortgage rates, as there is more risk lending at 90% LTV than say, a 50% LTV mortgage.

Banks use savings from depositors such as households and companies to turn into loans. Current accounts also add to the funding pool.

Banks also secure funding for mortgages from the money markets. They can access fixed rate money for 2 or 5 years or longer. The cost of this money is called the SWAP rate - the cost of swapping variable rate money to fixed money for a defined period.

The price of this fixed rate finance will be influenced by where markets believe interest rates will go over the period the money is secured for.

While base rates might go up in the short term, if the view is that inflation will slow quickly and interest rates will fall then this may result in SWAP rates being lower than base rates. The 5 year UK SWAP rate is currently 4% and has fallen back from a high of 5.3% last year.

Banks will use a blend of sources as they price mortgages and this means an increase in interest rates doesn't necessarily flow into the cost of new mortgages. Borrowers on variable rate mortgages, where the cost is linked to the base rate, will see mortgage rates increase as the Bank of England raises rates. But for the majority on fixed rate loans there will be no change.

Mortgage rates likely to hold where they are for much of 2023

We expect fixed rate mortgage rates for new business to sit between 4% and 4.75% for much of 2023. This is low by historic standards but means the average buyer will face an increase of £200 to £500-a-month more in mortgage repayments than at the start of 2022, when mortgage rates were much lower.

We don't expect the increase in the base rate to make much difference to the outlook for the housing market. Demand for homes is down on last year but sales are still being agreed, albeit at a slower rate (20% lower).

People still want to move and households are resetting their plans in an environment of higher borrowing costs. Talk of a big price correction in home values has been overplayed and if you price your home sensibly, it’s likely to attract interest subject to some negotiation on the final price.

Key takeaways

- The Bank of England has increased the base rate by 0.25% to 4.25%

- However, fixed rate mortgages for new borrowers are likely to remain between 4% and 4.75% for much of 2023

- Mortgage rates are set by multiple factors, including the different costs of money for banks

- And they have dropped back to an average of 4.5% over the first 3 months of this year