With steadying mortgage rates and 65% more homes for sale than this time last year, buyers are back in the market and agreeing 11% more sales than in 2019.

Increasing sales volumes indicate recovering market health

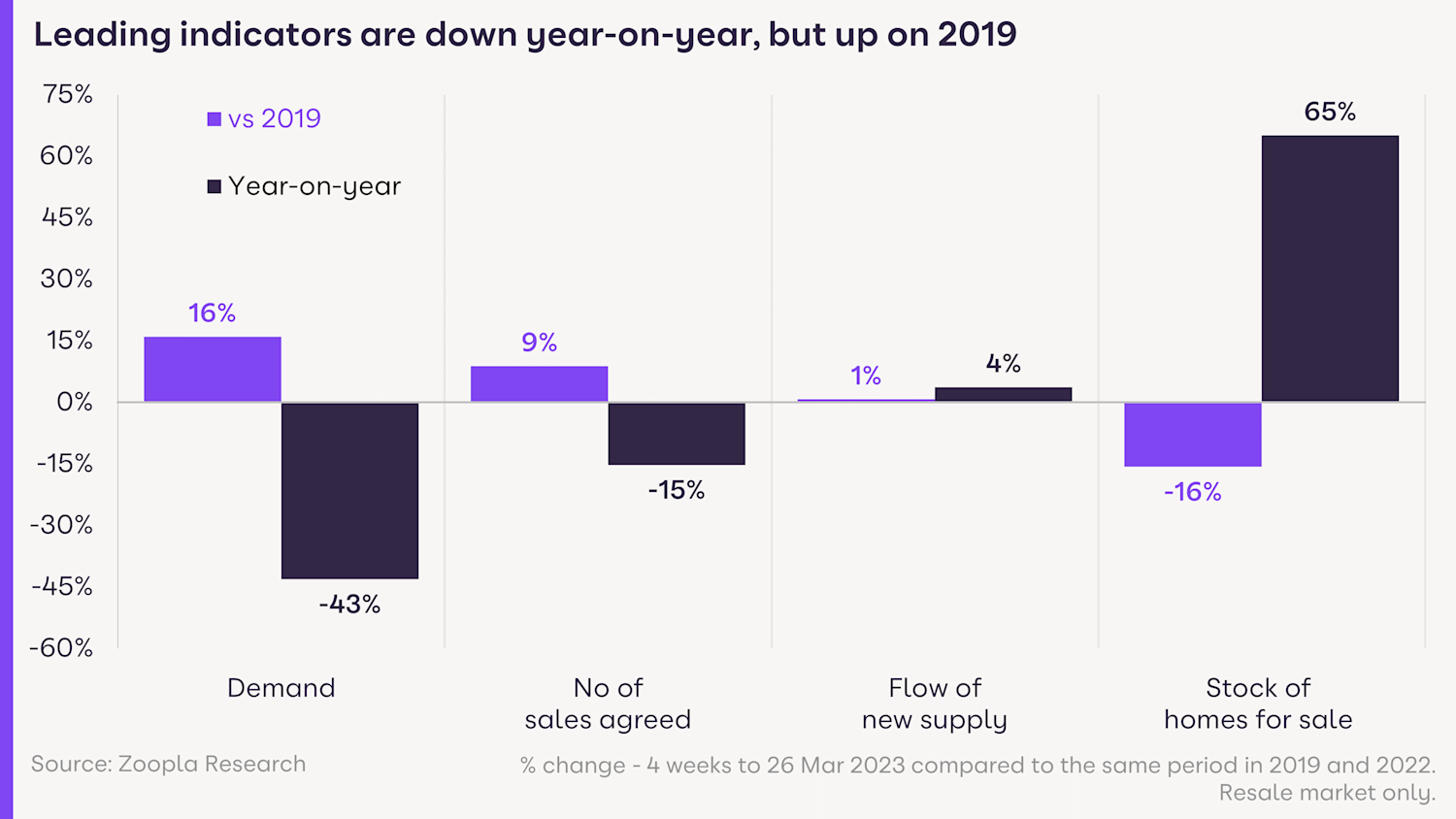

The housing market is continuing to see cautious improvements in conditions since the mini budget in October 2022.

Sales volumes are on an upward trajectory while the demand for homes has reached the highest level since last October in recent weeks.

The number of agreed sales is now 11% higher than in 2019, while demand from buyers sits 16% and homes are selling more quickly across most regions of the UK.

While these measures are tracking lower than this time last year, the return of more ‘normal’ market conditions in recent months makes 2019 a more relevant benchmark of activity than the pandemic housing boom of 2020 to mid-2022.

Second-steppers in favourable position to upsize

Homeowners looking to upsize are enjoying a favourable position thanks to greater demand at the lower end of the market along with more choice of their next property and repricing at the upper end of the market.

There’s been a clear shift in the proportion of homes selling across the UK, with properties in the cheapest 40% of the market agreeing 5% more sales. Meanwhile, houses in the most expensive 40% have seen a 4% drop in agreed sales.

There are 65% more homes for sale than a year ago with the average estate agent listing 25 available homes for sale compared to the low of 14 last year.

This is seeing sales agreed at 4% lower than asking price – or £14,000 on average – which equates to the greatest savings on higher-priced properties.

What’s more, the rapid 11% rise in rental rates in the last year is continuing to support demand from first time buyers, who accounted for 1 in 3 sales last year.

These trends are coming together to give homeowners at the lower end of the market confidence in the sale of their current home, along with more choice, time and bargaining power in their next purchase.

However, upsizing will come with the consideration of higher mortgage costs. We expect more people to proceed with their move as the economic outlook becomes clearer and UK-wide house prices start to register small annual falls this summer.

First time buyers look to escape rising rents

The rapid pace of rental inflation – up 11% in the last year – is encouraging an increasing number of renters to become owners, despite the challenge of getting a deposit together.

We expect this to hold up this year as rental growth shows no sign of slowing and mortgage rates remain below rental costs in many regions – even with current 4% mortgage rates limiting buyer power by up to 20% compared to last year.

Buyers finding value in affordable regions and some pockets of London

More affordable areas are seeing the highest demand as the market adjusts to higher mortgage rates.

The highest levels of demand are from buyers in Scotland, Wales, the North East of England and London.

Buyers are generally less keen to move in regions where prices increased the most during the pandemic and where higher mortgage rates therefore have the biggest impact – across the South of England and the Midlands.

Rebalancing of house prices set to support activity across the housing market in 2023

Rising house prices are often associated with market health but we believe the current repricing will support activity from all segments of the housing market as we look to the end of 2023 and into 2024.

The highest prices we saw in mid-2022 simply aren’t sustainable with the mortgage rates now available, so the natural tip back towards what buyers can realistically afford with a 4% mortgage rate will encourage more back into the market.

We expect 1 million sales in 2023 with 5% house price falls in localised areas, but sellers’ concerns will be somewhat alleviated by an average gain of £19,000 to their home’s value in 2022.

Key takeaways

- Increasing sales volumes indicate recovering market health with 11% more agreed sales than in 2019

- Second-steppers in favourable position with highest demand at cheaper end of the market plus more choice, time and bargaining power with their next purchase

- Widespread repricing of homes set to tempt more buyers this summer while sellers’ concerns are alleviated by an average £19,000 gain in home values in 2022