Mortgage rates expected to go down this autumn

Mortgage rates are on track to drop below 5% this autumn, boosting buyer confidence as more return to market.

What's happening with mortgage rates right now?

Mortgage rates are on track to fall below 5% this year.

The latest pause in the Bank of England’s base rate rises, amid better than expected inflation news, is good news for buyers, mortgagees and sellers.

The amount banks need to pay for borrowing money has now fallen, giving them wiggle room to reduce mortgage rates - and they are starting to creep downwards.

What 4% mortgage rates mean for the housing market

The closer mortgage rates get to 4%, the more buyers will come back to market.

That’s good news for sellers, as it will support both house sales and house prices.

Our Executive Director of Research, Richard Donnell, says: ‘Our consistently held view is that mortgage rates over 5% mean lower sales and year-on-year price falls.

‘We expect mortgage rates to start falling slowly in the coming weeks into the high 4% range.’

Right now, across the UK’s biggest lenders, the average cost of a 5-year 75% LTV fixed-rate mortgage is 5.1%.

Back in spring 2023 it fell to 4.2%, which boosted buyer demand and the number of sales agreed.

There is still some uncertainty over the outlook for inflation and how quickly it will fall back to the Bank of England’s 2% target, but it is ultimately lower mortgage rates that will increase buying power over the next 12-18 months.

More buyers will come to market once mortgage rates get below 4.5%

House prices have fallen at a modest rate this year, despite the 20% hit to buying power triggered by mortgage rates increasing since early 2022.

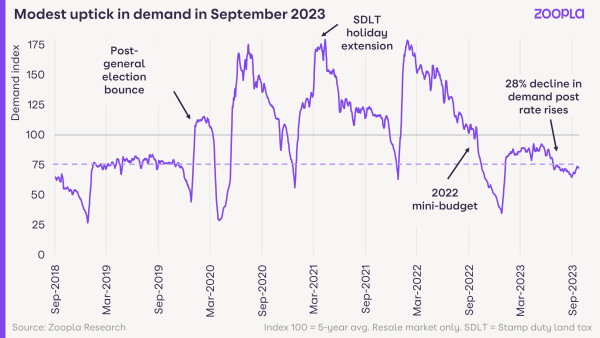

However, a silver lining is beginning to emerge in the housing market: this September saw more buyers coming back to the market.

And enquiries to estate agents are up 12% since the August bank-holiday weekend.

While this improvement comes from a low base (demand remains 33% down on what it was a year ago), it means the housing market is now tracking more closely to where it was in 2019.

And while this uptick is partly seasonal, it also reflects improving consumer confidence, which is now at a two-year high, amid expectations of lower mortgage rates.

Donnell adds: ‘It’s clear that some buyers are returning to the market this autumn, having delayed home moving decisions as base rates moved ever higher.

‘Many others are waiting on the outlook for mortgage rates and holding their requirements for their next purchase.

‘The quicker average mortgage rates (for 5-year 75% LTV fixed-rates) move towards 4.5% or lower, the sooner we will see buyers return to the market.

‘This doesn't mean prices will start to rise but it will support sales volumes.’

Why house prices aren’t tumbling in 2023

Stricter lending regulations, where mortgagees are stress-tested to prove they can still pay their mortgages at up to 8% rates, have prevented larger house price falls this year.

That’s because we’re not seeing high numbers of forced sales, where mortgagees can no longer afford their repayments.

Instead, homeowners are using alternative routes, like extending their mortgages over a longer period of time, to lower their monthly repayments amid higher borrowing costs.

A buoyant jobs market is also helping mortgagees to keep up with those repayments.

But it remains a buyers’ market right now, with the average seller offering a £12,125 discount to sell their home.

Key takeaways

- Lenders reduce mortgage rates as bank rate holds

- Buyer confidence increases as borrowing rates edge closer to sub 5%

- Estate agents report 12% increase in enquiries

Bank Rate unchanged: what does it mean for mortgage rates?

The Bank of England has kept its base rate at 5.25%, despite a surprise drop in inflation. This is the highest level in 15 years, but borrowers can expect to see mortgage rates fall further in the coming weeks.

Why has the Bank of England kept the Bank Rate the same?

The Bank had been increasing the Bank Rate to get inflation under control but the latest figures showed that inflation had fallen unexpectedly.

Previous rate increases have begun to hurt the economy, with economic growth weaker than expected and unemployment rising. The Monetary Policy Committee, which decides the Bank Rate, voted by a majority of 5 to 4 to keep the Bank Rate at 5.25% today.

“Better than expected inflation figures have put an end to successive Bank Rate increases,” comments Richard Donnell, Executive Director of Research at Zoopla.

“This will be welcome news to homebuyers who have already felt the impact of mortgage rates rising higher over the summer and remaining well over 5%. This has led to demand for homes falling by 25% since the spring as buyers wait to see whether mortgage rates start to fall.”

How does the Bank Rate decision impact the housing market?

“There has been some softening in mortgage rates but as long as rates stay over 5% then house prices will continue to fall,” Richard continues.

“The concern is that money markets expect the Bank Rate to stay higher for longer in the face of higher inflation, which will keep two- and five-year fixed mortgage rates higher as well.”

“As we saw this spring, mortgage rates in the low 4% range would bring buyers back into the market. This would require money markets to expect cuts to the Bank Rate, rather than just an end to the increases.”

Housing demand and sale numbers depend on how far mortgage rates fall and the expectations of home buyers about what rate will get them back into the market. The trajectory of mortgage rates is largely down to the view of financial markets on how stubborn inflation is and how the Bank Rate is set in the future.

What will happen to mortgage rates?

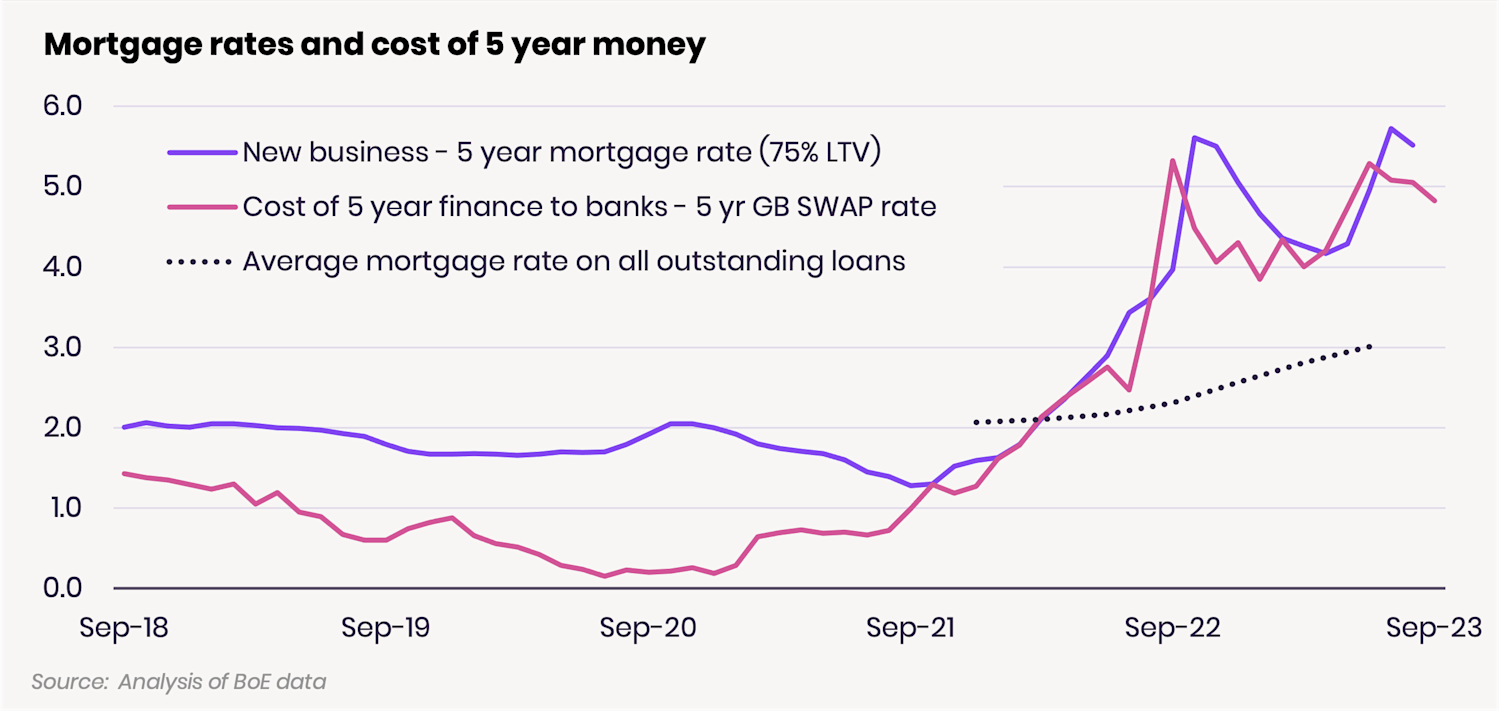

The chart below compares the mortgage rate for new five-year 75% loan-to-value mortgages against the five-year swap rate – the cost of five-year fixed-rate finance to banks – and the average mortgage rate for all 9.5m outstanding mortgages.

The swap rate has fallen back below 5% so rates for new mortgages are expected to follow.

The vast majority (82%) of outstanding mortgages are fixed-rate deals according to industry body UK Finance, so most borrowers haven’t been affected by the recent rate rises.

However, 800,000 homeowners are on fixed rates that are due to end in the second half of 2023, so they are likely to face a jump in their mortgage costs at this point.

More households fixing for five years in recent times means the average mortgage rate for all outstanding loans is now 3.0%, up from its low of 2.1% at the end of 2021.

But as households remortgage onto higher rates, this average will continue to increase, putting more pressure on the household finances of existing borrowers.

“Today’s homebuyers and remortgagers are taking what they will hope is short-term pain to get a better, lower rate in two years' time - 40% of new mortgages are being taken at the higher 2-year fixed rate,” says Richard.

“The chart also raises some questions over the margin on new mortgage business for banks. They don't fund solely from the money markets - they also use money from savings, current accounts and other sources to get a blended cost of funds.

“Margins looked much better for banks pre-2021 and this will be supporting their profits. Banks are fully capitalised and ready and willing to lend but they can only price against the underlying cost of finance.”

When will mortgage rates fall below 5%?

“Our view is that we will get to sub-5% rates in the second half of 2023," Richard adds.

“Demand for homes is lower since rates started to rise in June but we are still seeing new sales being agreed. It shows there are committed buyers in the market, who are benefiting from many more homes for sale than we have seen in recent years.”

Key takeaways

- The Bank of England has today kept the Bank Rate at 5.25% after it was previously expected to increase it to 5.5%

- It’s thought that the Bank Rate may have peaked but is likely to remain high in an attempt to bring inflation closer to the target of 2%

- Experts were split as to whether the Bank would increase the rate as previously anticipated following a surprise drop in inflation from 6.8% in July to 6.7% in August

- Swap rates – the cost to banks of fixed-rate borrowing – have already fallen so fixed-rate mortgage rates are expected to follow

The highest yielding areas for buy-to-let property in the UK

Thinking of buying a rental property? One strategy for investment is to focus on higher yielding markets. Here are the top investor hotspots in the UK.

Ready to become a landlord and want the biggest return on your investment?

It’s worth getting to grips with rental yield if you’re purchasing a buy-to-let property.

Gross rental yield is the amount of money you make from a rental property each year, after you take away the cost of buying it. Net rental yield also factors in the cost of maintaining the rental property.

Both are usually expressed as a percentage and can help you decide if a property is a good investment.

But it’s not just yield that you need to think about with a buy-to-let property. A high-yielding market might not deliver much house price growth or tenant demand, which can be a key consideration as to whether you’ll get a return down the line.

The highest-yielding rental regions in the UK

The average rental yield in the UK is currently 5.03%, as the average buy-to-let property costs £263,000 and the average rental rate is £1,163.

Yields are running higher than this time last year, when the average gross yield was 4.8%. The average investment property cost the same but average rents were lower at £1,053.

The region with the highest rental yields is currently the North East, where the average gross yield is 7.2%.

Locations with cheaper house prices tend to offer the greatest yields, even though rent is also usually cheaper.

The average buy-to-let property costs only £109,000 in the North East, so an average rent of £649 offers a greater return in comparison to the cost of the property.

The North East’s yield appeal is largely thanks to the investment triangle of Sunderland, Middlesbrough and Hartlepool, where gross yields sit between 8.01% and 8.39%.

On the other hand, London has the lowest gross yield in the UK as it’s so expensive to buy a rental property there - despite average rents reaching £2,053 this month. However, this is higher than the average gross yield in London this time last year of 4.16%.

| Region | Average gross yield | Average monthly rent | Average price of a buy-to-let property |

|---|---|---|---|

| North East | 7.2% | £649 | £109,000 |

| Scotland | 7.1% | £748 | £127,000 |

| North West | 6.3% | £795 | £151,000 |

| Northern Ireland | 6.2% | £744 | £143,500 |

| Yorkshire and the Humber | 6.1% | £758 | £150,000 |

| Wales | 6.0% | £814 | £163,500 |

| West Midlands | 5.6% | £852 | £182,500 |

| East Midlands | 5.5% | £816 | £178,000 |

| South West | 5.0% | £1,016 | £242,500 |

| East of England | 5.0% | £1,111 | £266,500 |

| South East | 5.0% | £1,254 | £301,000 |

| London | 4.7% | £2,053 | £522,000 |

Rental Market Report for September 2023 (data to July 2023)

The 10 highest yielding rental cities in the UK

When it comes to cities, you’re generally better off focusing your search in the North of England if you’re after a high yield.

In Sunderland, the average rental property costs a little over £80,000, meaning a high 8.39% gross yield with a £582 rental rate.

Burnley, Liverpool and Blackburn are top investor cities in the North East while Dundee and Glasgow are buy-to-let hotspots in Scotland.

| City | Average gross yield yield | Average monthly rent | Average price of a buy-to-let property |

|---|---|---|---|

| Sunderland | 8.39% | £582 | £83,000 |

| Dundee | 7.85% | £768 | £117,500 |

| Burnley | 7.73% | £530 | £82,000 |

| Glasgow | 7.73% | £898 | £139,500 |

| Middlesbrough | 7.53% | £578 | £92,000 |

| Liverpool | 7.21% | £764 | £127,000 |

| Blackburn | 7.12% | £622 | £105,000 |

| Hull | 7.03% | £578 | £98,500 |

| Grimsby | 6.92% | £579 | £100,500 |

| Newcastle | 6.89% | £763 | £133,000 |

Rental Market Report, September 2023 (data to July 2023)

The highest yielding areas in each region of the UK

Looking for a buy-to-let property near where you live? It can be useful as you know the local area and can work closely with a local letting agent.

So you might want to consider which parts of your region offer the greatest rental yield. Here are the top 3 local authorities for yields in each UK region.

East Midlands

-

Nottingham - 6.8% gross rental yield

-

Boston - 6.34% gross rental yield

-

Mansfield - 6.36% gross rental yield

East of England

-

Great Yarmouth - 5.93% gross rental yield

-

Peterborough - 5.93% gross rental yield

-

Fenland - 5.92% gross rental yield

London

-

Barking and Dagenham - 5.81% gross rental yield

-

Newham - 5.56% gross rental yield

-

Bexley - 5.38% gross rental yield

North East

-

Sunderland - 8.39% gross rental yield

-

Middlesbrough - 8.16% gross rental yield

-

Hartlepool - 8.01% gross rental yield

North West

-

Burnley - 8.11% gross rental yield

-

Barrow-in-Furness - 7.43% gross rental yield

-

Liverpool - 7.32% gross rental yield

Scotland

-

West Dunbartonshire - 9.05% gross rental yield

-

Renfrewshire - 8.96% gross rental yield

-

East Ayrshire - 8.58% gross rental yield

South East

-

Southampton - 6.16% gross rental yield

-

Portsmouth - 6.05% gross rental yield

-

Gosport - 5.93% gross rental yield

South West

-

Gloucester - 6.01% gross rental yield

-

Plymouth - 5.98% gross rental yield

-

Swindon - 5.80% gross rental yield

Wales

-

Blaenau Gwent - 7.25% gross rental yield

-

Merthyr Tydfil - 6.94% gross rental yield

-

Neath Port Talbot - 6.89% gross rental yield

West Midlands

-

Stoke-on-Trent - 6.90% gross rental yield

-

Coventry - 6.28% gross rental yield

-

Newcastle-under-Lyme - 6.22% gross rental yield

Yorkshire and the Humber

-

Hull - 7.03% gross rental yield

-

North East Lincolnshire - 6.92% gross rental yield

-

Bradford - 6.86% gross rental yield

What is rental yield?

Rental yield is the amount of money you make from a rental property each year against the cost of purchasing and running it. It’s always expressed as a percentage.

The gross yield only takes the cost of the property and the rental income into account.

The net rental yield, on the other hand, considers the extra costs of running the property, like maintenance and property management.

To figure out the best investment property for you, it’s worth looking at both of these yields as well as other factors.

Why is rental yield important?

Before you jump into buying a property to rent out, you've got to figure out if it’s a worthwhile venture.

If your rental income doesn't cover your costs, or you're just breaking even, unexpected expenses like fixing a broken boiler or a leaky roof can impact your finances.

So looking at the potential rental yield will help you do the maths and make sure it’s a good investment.

What else to think about with a buy-to-let property

There’s more to choosing a good buy-to-let property than just the rental yield.

You could buy a property with a strong yield, but if house prices aren’t rising or you can’t find tenants, it might not be the best investment.

House price trends

Get a feel for house price growth to see if the property is likely to rise in value. Look at historic sale prices for individual properties as well as value increases for the postcode and local area.

The cost of a buy-to-let mortgage

At the same time, you need to think about the costs of taking out a buy-to-let mortgage and all the other associated costs of running a rental property.

Tenant demand

It also helps to understand what tenant demand is like in the area and what sort of properties they’re looking for.

Speak to a letting agent to find out what’s happening in the local rental market. They’ll be able to share what tenants are looking for and which properties could be a strong buy-to-let investment.

How to work out your gross rental yield

Let’s say you want to buy a property worth £200,000. You plan to charge £1,000 per month in rent, which works out to £12,000 per year. Divide 12,000 by 200,000, then multiply by 100. That equals a gross yield of 6%.

(Annual rent / property value) x 100 = gross rental yield

How to work out your net rental yield

To work out your net rental yield, you need to take your extra costs off your annual rental income.

So add up the amount of money you think you’ll spend over the year. This will include paying the mortgage, agency fees, property maintenance, and any costs you might incur to keep up with regulations.

Then deduct these costs from your annual rental income, and do the same sum from there.

[(Annual rent - annual costs) / property value] x 100 = net rental yield

Let’s say you’re buying the same £200,000 property and charging the same £12,000 per year in rent.

But you’re spending £300 on maintenance and agency fees, which comes to £3,600 over the year.

That means your net rental yield for this property is 4.2%.

Key takeaways

- If you’re looking for a buy-to-let property, rental yield can help you decide if the cost of the property is worth the potential rental income

- Take other factors into account, like the potential for house price growth and tenant demand in the area

- The North East is top of the yield charts right now – investors here make an average gross yield of 7.2%

- The highest yielding cities in the UK are Sunderland, Dundee and Burnley, which offer a gross yield of between 7.7% and 8.4%

- We reveal the three highest yielding areas in every region of the UK

The cheapest places to rent a home in 2023

Looking for a rental home that doesn’t cost an arm and a leg? Here’s your complete guide to the cheapest places to rent in the UK.

Rents for new lets have risen by an average of £1,320 over the last year. It’s driven by rental demand sitting 51% above the five-year average, while the availability of rental homes is down 30% compared to normal for this time of year.

This supply and demand mismatch has pushed rents 10.5% higher over the last 12 months - although this is a little slower than the 12.1% growth we saw a year ago.

With rents still rising and the cost-of-living squeeze pushing all our purses to the limit, you might be looking for a cheaper home to rent.

The good news is there are some places where it’s much cheaper to rent a home than others.

Let’s take a look at the regions, cities and local areas with the cheapest rents in the UK.

The cheapest places to rent in the UK - regions

For the cheapest rents in the country, set your sights on the North East - tenants spend an average of £649 per month on rent here.

Northern Ireland, Scotland, Yorkshire and the Humber, and the North West all sit at the cheaper end of the scale too, with rents averaging less than £800 per month.

Rents in the South of England are much more expensive than anywhere else in the country.

London is by far the most expensive region to rent in the UK (£2,053 per month), followed by the South East (£1,254), East of England (£1,111) and South West (£1,016).

| Region | Average rent | Annual % change |

|---|---|---|

| North East | £649 | +9.5% |

| Northern Ireland | £744 | +4.2% |

| Scotland | £748 | +12.7% |

| Yorkshire and the Humber | £758 | +8.4% |

| North West | £795 | +11.0% |

| Wales | £814 | +9.9% |

| East Midlands | £816 | +9.5% |

| West Midlands | £852 | +10.0% |

| South West | £1,016 | +7.8% |

| East of England | £1,111 | +9.8% |

| South East | £1,254 | +9.5% |

| London | £2,053 | +12.4% |

Rental Market Report, September 2023 (data to July 2023)

The cheapest UK cities to rent a home in 2023

Just because you want cheaper rent, it doesn’t mean you have to move out to the sticks.

The cost of rent varies a huge amount across UK cities, with Belfast, Liverpool and Sheffield offering the cheapest average rents.

In Belfast, rents are currently averaging £759 per month - plus it has affordable living costs compared to mainland Britain.

Renters in Liverpool are paying £764 per month to live in the UK’s friendliest city, where rents have risen 8.7% in the last year.

The only other major city where rents are below £800 per month is Sheffield, the vibrant Yorkshire city that’s home to a lively student scene.

Cities in the Midlands tend to be fairly cheap to rent, with Birmingham and Nottingham both posting average rents of below £900 per month.

When it comes to Scotland, you’ll find a dynamic city lifestyle and cheap rents in Glasgow, where rents average £898 per month. Edinburgh is much pricier with an average rent of £1,199 per month.

In southern cities, you can expect to pay higher rent than anywhere else in the country. London and Bristol have the highest monthly rents of any UK city, with Southampton also posting an expensive average rate of £1,057.

| City | Average monthly rent | Annual % change |

|---|---|---|

| Belfast | £759 | +4.7% |

| Liverpool | £764 | +8.7% |

| Sheffield | £772 | +7.9% |

| Birmingham | £880 | +10.6% |

| Nottingham | £896 | +10.1% |

| Glasgow | £898 | +13.7% |

| Leeds | £908 | +8.6% |

| Manchester | £994 | +13.1% |

| Cardiff | £1,011 | +10.7% |

| Southampton | £1,057 | +10.6% |

| Edinburgh | £1,199 | +15.6% |

| Bristol | £1,315 | +9.1% |

| London | £2,053 | +12.4% |

Rental Market Report, September 2023 (data to July 2023)

The cheapest places to rent in every region

Getting cheaper rent doesn’t mean you have to move to a whole new part of the country, either.

Here’s a breakdown of the cheapest districts to rent in each UK region. It might be that you could get a cheaper rent just by moving a few miles.

| Region | Cheapest local authority to rent | Average monthly rent |

|---|---|---|

| East Midlands | East Lindsey | £626 |

| East of England | Waveny | £724 |

| London | Bexley | £1,455 |

| North East | Hartlepool | £497 |

| North West | Burnley | £521 |

| Scotland | East Ayrshire | £502 |

| South East | Isle of Wight | £862 |

| South West | North Devon | £753 |

| Wales | Powys | £594 |

| West Midlands | Stoke-on-Trent | £632 |

| Yorkshire and the Humber | Hull | £578 |

Rental Market Report, September 2023 (data to July 2023)

Key takeaways

- UK rents have risen by 10.5% in the last year, bringing the average monthly rent to £1,163

- The North East is the cheapest region to rent a home in the UK with an average rent of £649 per month

- The cheapest major cities to rent are Belfast, Liverpool, Sheffield and Birmingham, where average rents are below £900 per month

- London rents have hit £2,053, making it twice as expensive to rent a home in London than in the South West (£1,016)

Why is the cost of renting so expensive right now?

A supply and demand problem in the rental market is pushing rents to sky high levels. When will renting prices come down?

The number of homes currently available for rent is nearly a third below the five year average.

This, coupled with demand for rental properties running at 51% above the five year average, is creating a major housing supply problem for renters - and has been doing so for quite some time.

However, a silver lining is beginning to emerge: demand for new rental properties is starting to come down - and is now 20% lower than this time last year.

Equally, the number of homes now available for rent is 20% higher than this time last year.

When will the cost of renting come down?

The cost of renting has been rising at such a rate that it’s outpaced the rate at which wages are rising for the last 22 months - and rents have now hit their worst affordability level in over a decade.

Rental inflation has been running in double digits for 18 months, meaning the average rent has increased by £110 per month over the last year – an annual increase of £1,320.

Over the last 3 years, rents for new lets are up by an average of £2,772 per year, compounding the cost of living for renters.

However, again, there is a glimmer of hope on the horizon, as rental inflation is now starting to come down.

This time last year, rental inflation was running at just over 12%. Today, it is running at 10% and by the end of the year, we believe it will begin to track at 9%.

In 2024, we expect rental inflation to slow to 5-6%.

What’s happening with rents across the UK?

What’s going on with rents in Scotland?

In Scotland, where a rent cap was introduced to prevent landlords from raising rents by more than 3% for tenants in situ, rents are rising fast.

A system designed to be fairer for tenants is creating issues when the property becomes vacant.

Landlords, unsure of how long a new tenancy might last, are charging the full market price for new lets, meaning rents in Scotland are now rising faster than the rest of the UK.

Our Executive Director - Research, Richard Donnell, says: ‘The introduction of rent controls in September 2022 is a key factor here.

‘Landlords are seeking to maximise the rent for new tenancies to cover increased costs and allow for the fact that future rent increases will be capped over the life of the tenancy.’

This means Scotland has now overtaken London in terms of rental inflation.

In Edinburgh and Dundee, rents are up 15.6%, while in Glasgow they are up 13.7%. In London, rents are up 12.4%.

What’s going on with rents across the UK?

Across the UK as a whole, the rental market is stuck in a state of low supply and high demand.

While growing the supply of rented homes available is a clear solution, higher borrowing costs are causing the number of new investments from landlords to fall - alongside the level of new homes being built.

'New investment from corporate landlords via 'build to rent' is a bright spot, boosting supply in many city centres,' says Donnell.

'However, rental levels set by corporate landlords are above-average and not at a scale to impact the wider market.'

Renters in existing tenancies are also reluctant to move in a rising costs market, meaning fewer rental properties are becoming available.

This has led to the average letting agent now having just 10 rental properties on their books, compared to 16-17 before the pandemic.

Why is rental demand so high right now?

Rental demand is rising for three main reasons:

-

Higher mortgage rates, preventing would-be first-time buyers from entering the housing market

-

The strength of the labour market and job creation

-

Record levels of immigration, particularly apparent a year ago as international borders re-opened with an influx of overseas students returning to study in the UK.

When mortgage rates hit 5.5%, repayments for a first-time buyer become more expensive than rental costs.

Unfortunately, the supply/demand imbalance doesn’t look set to ease in 2024. But the cost of renting cannot keep rising beyond what renters can afford - and it is this that will have the greatest impact on rental costs going forward.

‘Increasingly unaffordable rental costs should temper demand and lead to a reduction in the rate of growth, says Donnell.

‘However, the scale of the mis-match between supply and demand means that rental growth will reduce more slowly than might be expected.

‘If supply remains low then a weaker labour market, lower immigration and falling mortgage rates would all be needed to reduce demand to a level that would reduce rental growth back towards 5% per annum.’

How can I spend less on my rent each month?

To help cope with the increased cost of renting, renters are:

-

Renting smaller properties

-

Sharing homes

-

Moving to more affordable areas

'More renters sharing does reduce the cost per renter, but this comes at the personal expense of less private space,’ says Donnell.

'It also supports headline rental values. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

'In our view, sharing is supporting high rents in inner London where the reduction in floorspace per renter has been greatest.’

In fact, increased levels of sharing could be a key factor in rents continuing to rise above earnings across regional cities in the next 12-24 months.

Elsewhere, the rates at which rents are rising varies across the UK - and renters are now choosing more affordable areas to live in.

In London particularly, renters are heading to the suburbs to seek better value for money, causing rental prices in inner London to slow.

Will the cost of renting come down in 2024?

Rents for new lettings are expected to keep rising ahead of earnings growth in 2024.

Wages are projected to rise by 3.6% next year, while we expect rents to increase by 5-6%, due to the lack of supply and sustained higher mortgage rates.

Regional cities across the UK are likely to see the highest rental increases, apart from inner London, where affordability constraints are likely to slow rental inflation.

This inner London slowdown is significant, as it will act as a drag on UK rental inflation as a whole and may potentially halve it to more sustainable levels.

Amazing Things To Do in London in September 2023

September in London may be ‘back to school’ time, but it’s also when the city comes alive. A lot of London’s cultural scene goes into semi-hibernation mode over the summer, but come autumn it kicks back into gear with landmark museum exhibitions, new theatre and art shows and brand new food and drink openings.

There’s also a whole host of city-wide fests taking over the capital, including Open House London – giving us a chance to get a sneak peek inside usually private buildings – London Design Festival and Totally Thames – the brilliant celebration of London’s watery main artery complete with an illuminated flotilla installation.

1. Celebrate London’s watery main artery at Totally Thames Festival

🌟 Festivals 📍 Bloomsbury 📅

This month-long annual celebration of the Thames makes a splash with its mix of art festivals, community events, regattas, river races and environmental activities. This year look out for an immersive exhibition about the planet’s simultaneous beauty and fragility with satellite views and a live performer, plus free walking tours, a kayak taster session, creative workshops and a climate cabaret.

2. Step into beautiful immersive installations at London Design Festival

🌟 Festivals 📍 South Kensington 📅

Once again the world’s best designers interrogating the boundaries of what can be constructed are taking over London with a bunch of inventive events, exhibitions and installations. 2023 marks 300 years since the death of Sir Christopher Wren (aka the bloke who designed St Paul’s Cathedral), so expect plenty of projects celebrating his contribution to the capital’s cityscape, plus the usual events at the V&A and across designated Design Districts all over London. With new destinations in Dalston, Fitzrovia, Chelsea and Battersea, it’s likely some fantastic contemporary exhibitions will be cropping up near you.

3. Regent’s Park becomes an huge outdoor gallery for Frieze Sculpture 2023

🌟 Art ✪ Sculpture 📍Regent’s Park 📅 20 Sept to 29 Oct 2023

Frieze Sculpture is transforming Regent’s Park into a massive outdoor gallery again. Fatoş Üstek takes the curation reins for the first time, and visitors can appreciate the new works by leading international artists, including Ayşe Erkmen, Ghada Amer and Hank Willis Thomas. Look out for performances and talks enhancing the art which will also be free to the public. Slap on the sun cream (or a raincoat) and go soak up some sculpture.

4. Go to a gig inside a big, colourful and inflatable tunnel

🌟 Quirky events 📍Clapham 📅Until 17 Sept 2023

Colourscape’s labyrinth of polychromatic tunnels is returning to Clapham Common. Never been? Just wander around its big inflatable labyrinth to see what musicians you can find inside. You might happen upon a flautist, a classical guitarist or maybe some bloke playing a conch. Who knows!? Those kaleidoscopic innards are designed to surprise. One of the few upsides of the post-covid era is that you have to pre-book, doing away with the long Colourscape queues of yore. Check their website for more info on opening times and ticket releases.

5. Music and politics meet at boutique fest HowTheLightGetsIn

🌟 Festivals 📍 Hampstead Heath 📅 23 Sept to 24 Sept 2023

You don't see many festivals billing themselves as a blend of ’philosophy and music’ but that’s exactly what you get at this weekend of ideas, with over 100 events planned at Kenwood House in Hampstead Heath. Dine with some of the world's leading thinkers, listen to debates, including discussions on ‘the Danger of Safety’, and ‘Peace for Our Time’. Once you’re ready to take your thinking cap off, there are the comedy and music sets.

6. Two-step to electronic tunes at Waterworks Festival

🌟 Music ✪ Music festivals 📍 Acton 📅16 Sept 2023

It's not time to hang up your dancing shoes just yet, as there is one final day festival coming to the capital, and it's going to be a corker. Created by the gang behind Percolate and Croatian festival Love International, Waterworks returns to Gunnersbury Park this autumn and the line-up is banging. Make sure to catch Saoirse, Peach, Moxie and Shanti Celeste, AKA SASS, doing their only UK show this year, taking over the Orbit stage for 4.5 hours. Then there are sets from dance music heavyweights like Call Super, Palms Trax, SHERELLE and Francesco Del Garda. Plus a whole load of other top DJs including Josey Rebelle, Yung Singh, salute, Lukas Wigflex, Angel D'Lite, Eliza Rose, HAAi, the list goes on. See you in the dance.

Generation Guppie: A growing number of young adults are giving up on owning a home.

42% of adults aged 18-39 who don’t own a home say they’ve given up on the idea of buying one in the next ten years, including 38% of those earning £60,000+.

More than four in ten (42%) British adults under the age of 40 who do not currently own a home are now ‘Guppies’ – young people, many of whom have professional careers and big salaries, who have ‘Given Up on Property’.

The Guppies of today are in stark contrast to the ‘Yuppies’ of the Eighties and Nineties – young urban professionals with a good salary and no issues buying a home.

Our latest survey of 2,000 adults under the age of 40 reveals that even among those earning over £60,000 per year, 38% have given up on affording a home in the next decade.

Overall, just one in five (21%) say that they will ‘definitely’ be able to afford a home in the next decade, while 14% are currently planning to buy one, or are in the process of doing so.

The vast majority of Brits under the age of 40 in the UK do not already own a home – just 22.5% of those aged 25-34 and 1.4% of those aged 24 or under do.

In fact, non-home-owning under 40s in the UK are now more likely to be living with their parents, than be planning to, or be in the process of, buying a home (14.4% vs 14.1%).

Those who have given up on a home in the next decade cite 3 main reasons:

-

the cost of living crisis (64%)

-

increasing house prices (51%)

-

higher mortgage rates (49%)

Of those who are planning to buy, or who are in the process of buying their first home, 85% say they have made financial sacrifices to do so.

Over a third 34% have given up holidays, and 30% have had to give up socialising.

A quarter (25%) have stopped saving for their future and one in ten (10%) have even given up dating or being in a relationship in order to afford a home.

Younger people adjusting expectations to get on the ladder

Younger people can get on the housing ladder but many need to make compromises in order to do so.

Among those under 40 who are currently planning to buy, or who are in the process of buying their first home, seven in ten (69%) say they made compromises on the property.

Most common were ‘not being able to buy in the area they’d ideally like to (31%), not being able to buy a home in as good condition as I’d like (18%) and being unable to afford any spare rooms’ (17%).

Many also look to alternative locations. Just 33% of all under 40s who don’t currently own a home say they’d be able to afford to buy a property where they currently live - but 23% say they might if they were to move further away.

Location is the key

Among those who say they might be able to afford a home if they moved to a different location, they’d on average have to move around 37 miles. As such, investigating new areas may be the key to homeownership for many.

In adulthood, many move away from where they grew up. But for some, moving back could help.

Overall, 37% say that they’d be able to afford to buy a home in the place where they grew up. However, this rises to nearly half (49%) in Scotland and 45% in Yorkshire and the Humber.

Those in the South of England are less likely to be able to. Just 27% in the South West and 33% in the South East say they could afford a home where they grew up.

The ‘alternative’ ways Brits are considering to get a home

Many young adults today are open to less conventional ways of getting on the ladder.

Nearly a third of under 40s who don’t currently own a home (31%) would be open to a part ownership or help to buy type scheme, and 18% would be open to buying with a friend, colleague or sibling.

Many are also up for getting their hands dirty - a fifth (20%) would be open to buying a near-derelict home and doing it up whilst 19% would even consider building a home themselves.

Seventeen percent say they would be open to moving to a cheaper area and working remotely.

What can I do to get onto the property ladder?

1. Find out what you can afford

Use our mortgage calculator to find out what you could afford based on your income to get a starting point for your search.

2. Be area-agnostic

Most people in the survey say they can’t afford to buy a home where they live or where they grew up, so the reality for many is that they’ll need to look at alternative locations.

3. Look at the help available

There are many schemes out there designed to help people get on the ladder. Shared Ownership schemes (where you own part of the home and pay rent on the rest) can be a great way to get a foot on the ladder.

Meanwhile 95%, mortgages can help make saving the deposit less of a barrier.

4. Don’t go it alone

Buying with a friend or a partner is one way to slash costs significantly and pool your salaries together.

It may feel risky, but it’s actually very straightforward to get a legal document drawn up to enshrine what your share of the property is.

5. Get the right mortgage

Many people will have seen worrying news reports about huge increases in monthly mortgage costs - in fact 18% in the study said they’d be too worried to take out a mortgage.

However, there are a number of options so it’s vital to choose what’s right for you.

For example, a fixed mortgage reassures you of what your monthly mortgage payments will be for a set period.

Free online mortgage brokers such as Mojo can help here, by looking for the best options for you.

Key takeaways

- The cost of living crisis is now the key barrier to purchasing a property for young people - with higher mortgage rates also having a strong impact

- Non-home owning under 40s are more likely to be living with their parents, than planning to buy a property

- But many are looking to ‘alternative’ ways to get on the ladder - from moving away from where they currently live to buying with friends, getting a ‘doer upper’ or even building their own home

Is it cheaper to rent a home in the countryside?

Generally, it is cheaper to rent a home in the countryside than in the city. This is because there is less demand for rental properties in rural areas, which means that landlords can charge lower rents. Additionally, the cost of living in rural areas is also lower, which can further offset the cost of rent.

However, the trend of renting in the countryside has been changing in recent years. During the COVID-19 pandemic, many people moved out of cities to the countryside in search of more space and a better quality of life. This increased demand for rental properties in rural areas led to higher rents. However, as the pandemic has subsided, some people have started to move back to the cities. This has led to a decrease in demand for rental properties in rural areas, and rents have started to become more affordable again.

Summer is one of the busiest times of year in the rental market.

And demand for new rentals this year is now even higher than the same time last year.

Meanwhile, the supply of homes to rent is only slightly ahead of last year’s levels.

That means the supply-demand gap for the rental market is continuing to put pressure on rents.

And as demand increases, so do the prices.

Our rental index of new lets shows that the average UK rent increased by 0.9% over June - the highest monthly increase since October 2022.

The average UK rent has now reached £1,163, which is £110 higher than a year ago.

Rents in urban areas rise faster than rural areas

A new trend is emerging in the rental market: rural areas are becoming more affordable than cities when it comes to new lets.

Rural areas are built out of Census output areas defined as those with a population of less than 10,000. They can include isolated dwellings, hamlets, villages and small hub towns.

Urban areas are built out of Census output areas that tend to have a population of 10,000 or more and include cities, towns and suburbs.

In England, the average city rent in major cities reached £1,300 in June, while in the countryside it remained £220 lower at £1,080.

The lettings market in UK cities is prone to seasonal summer spikes in rental inflation as demand from students, graduates and relocating families grows over the summer.

In recent months, some of the largest UK cities have experienced above national average inflation of more than 10%.

However, rural rents are now growing at a slower pace.

Over the last 12 months, rents in the English countryside increased by an average of 6.6% or £67 a year.

This new trend marks a reversal of what happened during the pandemic years of 2020-21, when rural rental properties were in hot demand.

The reopening of cities in 2021 has seen renters returning to urban areas. And by June 2022, their regained popularity led rental inflation in cities to exceed that of their rural counterparts.

Rental affordability in cities has become increasingly challenging.

Conversely, the average proportion of household earnings needed to rent in the countryside has stayed broadly the same over the last 12 months.

Having said that, this won’t be a universal experience of all renters in rural locations.

Some 2 out of 5 rural areas saw rental inflation rise above the national average wage growth (6.9%).

And renters in some rural areas are now having to put a higher proportion of their income towards housing costs.

8 UK cities where rents are rising fastest

| City | Average rent | % increase | annual increase pcm |

|---|---|---|---|

| Edinburgh | £1,136 | 14.2% | £140 |

| London | £2,005 | 13% | £230 |

| Manchester | £983 | 13% | £110 |

| Glasgow | £871 | 12.9% | £100 |

| Southampton | £1,052 | 10.9% | £100 |

| Cardiff | £1,031 | 10.9% | £100 |

| Birmingham | £865 | 10.2% | £80 |

| Nottingham | £899 | 10.1% | £80 |

Rental Market Index

In June, we identified 8 major UK cities where the prices of new rents increased by at least 10% in one year.

In Edinburgh, London, Manchester, Glasgow, Southampton and Cardiff, the cost of a new let rose by £80 pcm or more.

Top of the list was Edinburgh, where the average monthly rent for a new let in the city rose by £150 pcm, pushing the average rent close to £1,200 per month.

Manchester and Glasgow were next, with rents increasing by £120 and £100 pcm respectively.

Meanwhile, renters in Liverpool, Sheffield and Belfast saw the lowest rental growth among the largest UK cities.

In these locations, average monthly rents increased by less than £60 in the last year.

Cheaper urban areas to rent

While most renters across the UK saw steep rental increases in the last 12 months, there are a few exceptions.

When considering the UK’s largest urban areas, there are three towns where rental inflation was below 5%.

Annual rental increases in Blackpool were the lowest among all UK cities and large towns, with average rents increasing by £20 on average.

Blackpool is followed by Doncaster and Grimsby, both in Yorkshire and the Humber, where rent increases over the last 12 months were £30 and £20 respectively.

All three areas are among the least expensive large towns to rent in the UK.

|

Town |

Average Rent (PCM) |

Annual rental price change (%) |

Annual rental price change (£) |

|

Grimsby |

£579 |

4.7% |

£30 |

|

Doncaster |

£644 |

3.8% |

£20 |

|

Blackpool |

£651 |

3.2% |

£20 |

Rents rise fastest in London and Scotland

Scotland and London - the two largest rental markets in the UK - are experiencing the steepest growth.

In Scotland, rents increased by £80 per calendar month (or 13.1%) on average in the last 12 months.

In the Scottish Borders area of Tweeddale, the monthly cost of a new let increased by 17.1% - or £80 pcm.

In London, rents have risen £230 (or 12.7%) in the last year. That’s actually down from an annual rise of £273 (or 17.6%) in the 12 months leading up to June 2022.

The fact that rental inflation is coming down in the capital now suggests affordability is stretched in London, with less headroom for rents to grow further.

In reality, there is a lot of variation in how fast rents are going up in different London boroughs.

For the fifth month in a row, rents in Newham are growing faster than anywhere else in the capital (16.5%), whereas the lowest rental inflation is currently being seen in Kensington and Chelsea (11.0%).

Slower rental growth in Northern Ireland and South West England

Our data shows the lowest rental inflation is happening in Northern Ireland (4.3%) and the South West (7.7%).

Northern Ireland is currently among the regions with the lowest earnings growth in the UK, which limits how much rents can increase.

Meanwhile, demand for rentals in the South West has slowed down from the pandemic peak of 2021 and it has been lagging behind other UK regions since October 2022.

This has eased the pressure on rental inflation in the region, particularly in the more rural areas.

Key takeaways

- Rents in cities are now rising faster than in rural areas

- In 8 UK cities, rents have increased by more than 10%. In Edinburgh, rents are up 14%

- However in rural locations, rents have increased by 6.6% - or £67 on average

- The average monthly UK rent reached £1,163 in June, which is £110 higher than a year ago, with London and Scotland seeing the greatest increases

Things to do in London in August 2023

It’s the height of summer, but the weather is anything but balmy. Raincoats and jumpers are the order of the day, but that doesn’t mean we can’t have a good time in London this weekend. The city is always buzzing with energy, no matter what the weather, and there are plenty of things to do to keep you entertained.

1. Dance in the W11 streets at Notting Hill Carnival

Dancing, music and masquerade – make the most of the Notting Hill Carnival with our full guide to all the info, dates, timings details and tips.

For a lot of Londoners, Notting Hill Carnival on the August Bank Holiday Weekend flashes by in a blaze of feathers, Red Stripe and tinnitus. To those who make it happen, it’s a year-round operation to create one of the biggest and oldest street parties in the world. This Carnival weekend, it’s expected that more than two million people will flock to west London to dance in the streets of W11. It’s free to join family day on the Sunday and the Monday which is for the hard partiers. It’s a celebration of freedom and Caribbean culture, with an iconic parade showcasing the best of mas, soca, calypso, steel bands and soundsystems. What are you waiting for?

When is Notting Hill Carnival 2023?

West London is getting taken over again with dazzling floats, kaleidoscopically dressed performers, rib-shaking soundsystems, the sweet, smoky smell of jerk chicken and steel bands over the August Bank Holiday weekend from Sunday August 27 to Monday August 28.

When is family day for Notting Hill Carnival?

Family day is on Carnival Sunday August 27 2023. The official opening ceremony will take place from 10am to 10.30am on Great Western road, before the children’s day parade and Carnival Parade kicks off and runs until 5pm.

Which is the better day at Carnival?

If you’re after a more chilled NHC experience, go for family day on Sunday, or if you like the sound of a hard-partying parade, make sure to go on Carnival Monday. The festivities kick off with an opening ceremony on Sunday morning, with the parade starting at 10am. Monday’s adult’s day parade starts at 10.30am and afterparties run until after dark. There’s nothing stopping you from going both days, of course.

Do I need a ticket for Notting Hill Carnival?

The NHC parade is free for anyone to attend and everyone is welcome. But, if you want to join in with the parade, you need to be part of a group authorised to do so, or pay to join the procession. If you want to continue the festivities into the night, you will need to buy a ticket for one of the countless afterparties across the city.

Travel by tube:

As Notting Hill’s roads will be closed off throughout the Bank Holiday weekend, you won’t be able to get an Uber or catch a bus into the heart of the action. But there are plenty of nearby tube stations are within walking distance of the main event including Notting Hill Gate, which will be ‘exit only’ from 11am to 7pm each day, to accommodate the hundreds of thousands of people using the station that day. FYI: there will be no interchange between the Circle and District line and Central Line on both days.

Royal Oak and Westbourne Park will be ‘exit only’ from 11am to 6pm, with Royal Oak closing thereafter and Westbourne Park closing after 11.30pm. Also don’t forget: Latimer road will be closed from 11.30pm on both days. Avoid Ladbroke Grove and Holland Park as they’re both closed on Sunday and Monday.

Want a Carnival hack? Don’t forget to pick a meeting point in advance for when you inevitably lose your mates in the crowd.

2. Glowing animatronic swans will fill the Thames at this year’s Greenwich + Docklands Festival

London’s spectacular free outdoor Greenwich + Docklands International Festival is back for 2023. The free line-up once again features the sort of spectacular installations that have become its hallmark since the pandemic moved the focus away from street theatre. Look out for ‘Cygnus’ by Denis Bivour and Florian Giefer, which will see illuminated animatronic swans fill the Thames at the Royal Docks (Aug 31-Sep 3), the festival opener ‘Open Lines’ (Aug 25) and the return of GDIF regulars Greenwich Fair (a big Greenwich-wide family fun day on Aug 26).

3. Dance to Stormzy, The Strokes, Yeah Yeah Yeahs, HAIM, Erykah Badu and more at All Points East

Since its inception in 2018, All Points East has earned a reputation for a varied blend of musical styles and genres. Back in Vicky Park for another instalment, it’s confirmed big-hitting headliners Stormzy, HAIM, The Strokes, Jungle and Dermot Kennedy. The support acts are just as enticing, with the likes of Erykah Badu, Amyl and the Sniffers, Confidence Man, Angel Olsen, Tove Lo and more warming up the stage. This all comes bookended with free activities around the local area from In The NBHD.

Line-up: Stormzy, The Strokes, Yeah Yeah Yeahs, HAIM, Erykah Badu, Dermot Kennedy, Jungle.

This year’s headliners are Stormzy (August 18), Field Day (August 19), The Strokes (August 25), Jungle (August 26), Dermot Kennedy (August 27) and Haim (August 28).

The rest of the line-up features a huge range of artists, from the Yeah Yeah Yeahs and Erykah Badu to Angel Olsen, Confidence Man, Sampha and Kehlani.

How to get tickets

You can get tickets for each day on the official website here.

Ticket prices differ depending on the tier and entry time you choose. Some dates still have primary entry available, and ticket prices can start from £57.05. However, it looks like it’s selling out, so be sure to book now to avoid disappointment.

4. Tuck into six-course tasting menu inspired by fantastical tales at Six by Nico

Get a nostalgic captivating dining experience, inspired by fantastical tales

Word about Six by Nico has spread across the country thanks to its novel concept: its ever-evolving six-course tasting menu changes every six weeks each time with a different theme inviting you on a journey of discovery to experience new flavours. Whether you are a food novice or connoisseur, enjoy a carefully curated experience with everything from an amuse-bouche to an indulging dessert. Right now you can tuck into the ‘Once Upon A Time: Chapter II’ menu inspired by fantastical tales.

Highlights

- A carefully curated six-course tasting menu inspired by nostalgic memories

- Offer also includes a glass of Prosecco

- Vegetarian menu also available

- Over 30% off

Time Out says

Famed for its ever-evolving restaurant concept, where the menu changes every six weeks, Six By Nico invites you on a journey of discovery to experience new flavours. Whether you are a food novice or connoisseur, enjoy a carefully curated experience with a six-course tasting menu with everything from an amuse bouche that pleases the palate to an indulging dessert. Enjoy the ‘Once Upon A Time: Chapter II’ menu, a captivating dining experience, inspired by fantastical tales that are sure to delight with every bite.

What’s on the menu?

Once Upon A Time: Chapter II

Course One

Bird Pie – The Twits; Chicken & Duck Leg Ragu, Pickled Celeriac, Prune & Caramelised Puff Pastry

Course Two

Just Right Porridge – Goldilocks; Spaetzle, Barbecue Maitake, White Turnip, Black Garlic Dressing

Course Three

I Like Them, Sam-I-Am! – Dr. Seuss; Smoked Ham Hough Sandwich, Garden Pea Pesto, Egg Yolk Jam

Course Four

Dip Face, Have A Carrot – Matilda; Sole Ballotine, Tandoori Baked Carrot, Carrot Top Pesto, Lobster Jus

Course Five

I’ll Huff, And I’ll Puff! – Three Little Pigs; Pork Roulade, Pumpkin, Sweet & Sour Choucroute, Smoked Ash Emulsion, Bourguignon Jus

Course Six

Brucey! Brucey! – Matilda; 54% Chocolate Cremeux, Miso Caramel, Mango & Passion Fruit

Need to know

- This voucher is valid for six courses and a glass of Prosecco at Six By Nico.

- To redeem, please book here, with your preferred date and time. Please include your voucher, and security code in the comments section.

- The Once Upon A Time: Chapter II menu will be available to book during the valid dates of this voucher. Please visit Six by Nico to view all menu options at both Fitzrovia and Canary Wharf locations.

- The six-course tasting menu is priced at £48 per person with the option to enjoy an expertly selected wine. Specialist drinks pairing for an additional £35 at each restaurant.

- All Six by Nico menus can cater to dietary requirements and can be made vegan upon request and if enough notice is given to our team of chefs.

- Voucher valid until September 24, 2023.

- Please present your voucher upon arrival.

- Offer not valid on Saturdays.

- Maximum booking of six people.

- One voucher per person.

- Menu subject to change.

- The restaurant must be informed of any changes/cancellations – if the booking is cancelled within 24 hours of your booking, the voucher will be deemed to have been redeemed for the current booking and cannot be used towards a new booking.

- Location(s): Six by Nico Fitzrovia, 41 Charlotte Street, London W1T 1RR and Six by Nico Canary Wharf, Chancellor Passage, London E14 5EA.

- This voucher cannot be cancelled, amended, exchanged, refunded or used in conjunction with any other offer. For full terms and conditions.

What do higher interest rates mean for the housing market?

The UK base rate continues to increase but mortgage rates are close to peaking.

Base rate up 0.25% - fewer increases expected

The Bank of England has raised rates again to 5.25% in an effort to cool inflation. City expectations of how much higher interest rates need to rise have moderated in recent weeks. Most expect only one more increase. This is an improvement on a few weeks ago when market expectations were for base rates to rise above 6%.

Mortgage rates for fixed rate deals are close to peaking

Changing market expectations for base rates has led to a fall in the underlying cost of finance for fixed rate mortgages. Some banks have already started to reduce mortgage rates as a result. These are modest reductions so far, but a sign mortgage rates are peaking.

We expect mortgage rates to fall further in the months ahead but how much depends on the outlook for inflation and what this means for City expectations for base rates. We could well see sub 5% mortgage rates return this autumn.

9 in 10 mortgage holders on fixed rates

The vast majority of people buying homes in recent years have taken mortgages with fixed rates. Almost 9 in 10 outstanding mortgages (87%) are on fixed rates meaning today’s rate rise will not have an impact on their monthly repayments.

However, 15% of mortgage holders will see their fixed deal come to an end in 2023, meaning the need to refinance onto higher rates and pay an extra £200-£250 per month on average. In some areas with higher property prices this increase will be much greater.

The remaining 13% of mortgagees are on variable rates which means higher mortgage repayments almost straight away. The fact over 1 in 10 loans are on variable rates probably reflects those with smaller loans where changes in rates have a much smaller impact on their monthly repayments.

Jump in borrowers paying down mortgages

Households with access to savings are paying down mortgage debt at a much faster rate as they look to reduce the impact of higher rates. This trend is being exacerbated by lower savings rates which makes paying down debt more attractive, especially for those who are higher rate taxpayers.

Bank of England data shows households paying off an extra £2.2 billion a month over and above regular debt repayments - this is 66% higher than the 10 year average.

Higher mortgage rates have a variable market impact

The rise in mortgage rates has hit demand from new buyers by 18% over the last 2 months. Sales have also slowed but Zoopla has not seen a drop in activity as severe as over the period immediately after 2022’s mini budget.

Home buyers are steadily accepting that we are returning to a period of more normal mortgage rates in the 4-5% range rather than the ultra low, sub 2% mortgage rates of recent years.

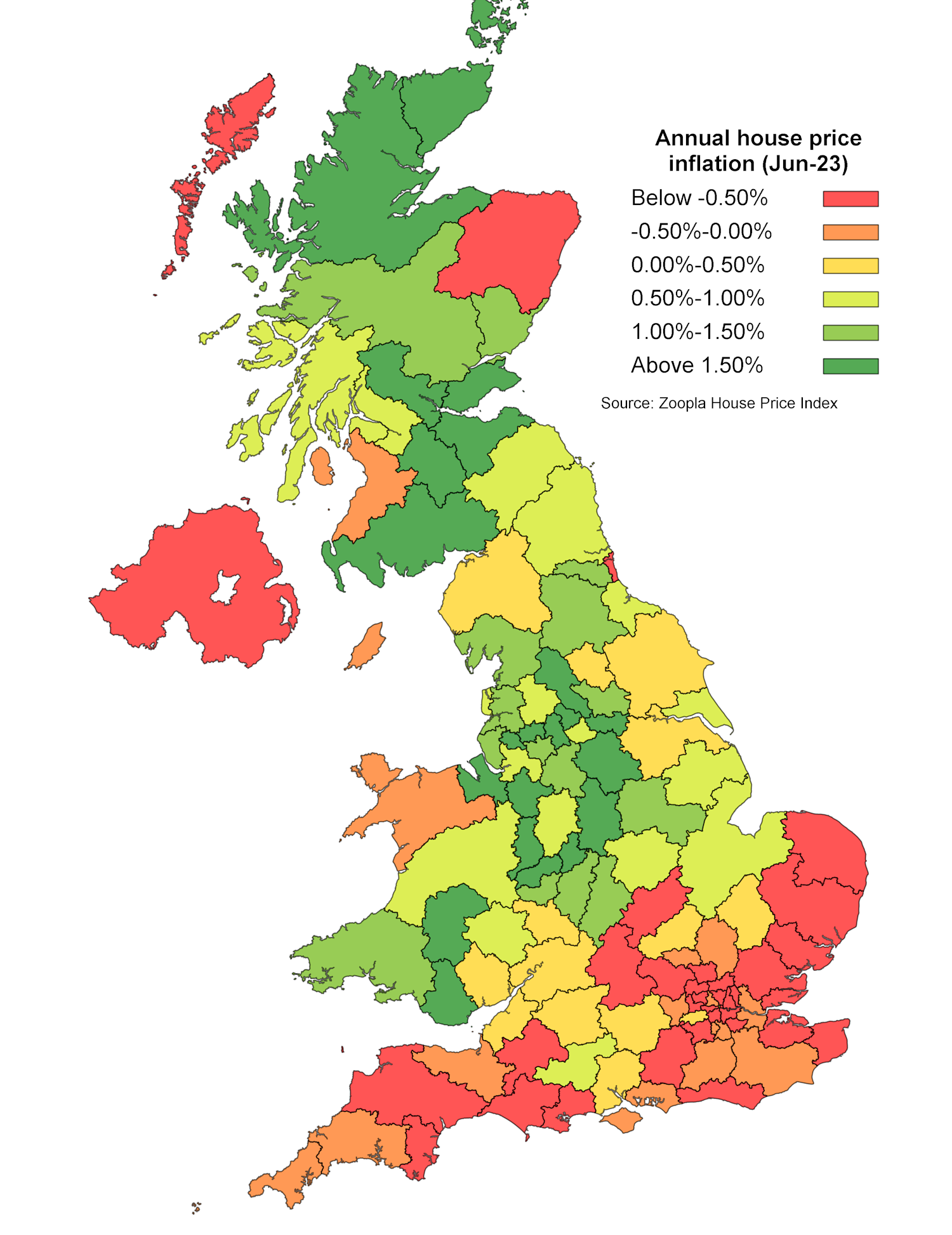

Higher mortgage rates hit buyers hardest in higher value housing markets where the size of the mortgage is larger and buyers need a larger income to buy. House Price Index shows prices falling across southern England as the hit to buying power pushes prices lower.

However, in the north of England and Scotland house prices are still rising as the impact of higher mortgage rates is less pronounced. These trends are explained by the income needed to buy and how accessible the market is for first-time buyers.

It’s cheaper to buy than rent at 5.5% mortgage rates across lower value housing markets in the north of England and Scotland. In contrast, in southern England, would-be first-time buyers face much greater challenges which weakens demand and keeps house prices under downward pressure.

UK house prices to fall 5% over 2023

Higher mortgage rates have reduced the buying power of households and this will need to be reflected in house prices which fell at the end of 2022 but started to increase this spring as mortgage rates reduced to 4%.

Now mortgage rates are rising again we expect further modest price falls in the second half of 2023. Overall we expect the average UK house price to fall 5% over 2023 but they will still remain 15% higher than the start of the pandemic.

The longer term outlook depends on the strength of the economy and labour market and how long mortgage rates remain over 5%. We expect house price growth to remain very low over 2024 and into 2025 as the market adjusts to higher borrowing costs.

There is no quick rebound in prospect as mortgage rates start to fall and anyone serious about moving needs to set their price carefully if they want to move home.

Key takeaways

- The Bank of England base rate has risen but the underlying cost of a fixed rate mortgage has been falling in recent weeks

- Mortgage rates are close to peaking

- 15% of households with a mortgage will need to refinance this year

- The impact of higher mortgage rates on demand and house prices is not uniform across the country