Pandemic house price boost adds to affordability troubles

The pandemic-led property boom leads to affordability problems, as some parts of the UK experience 10 years' price growth in the space of just two years.

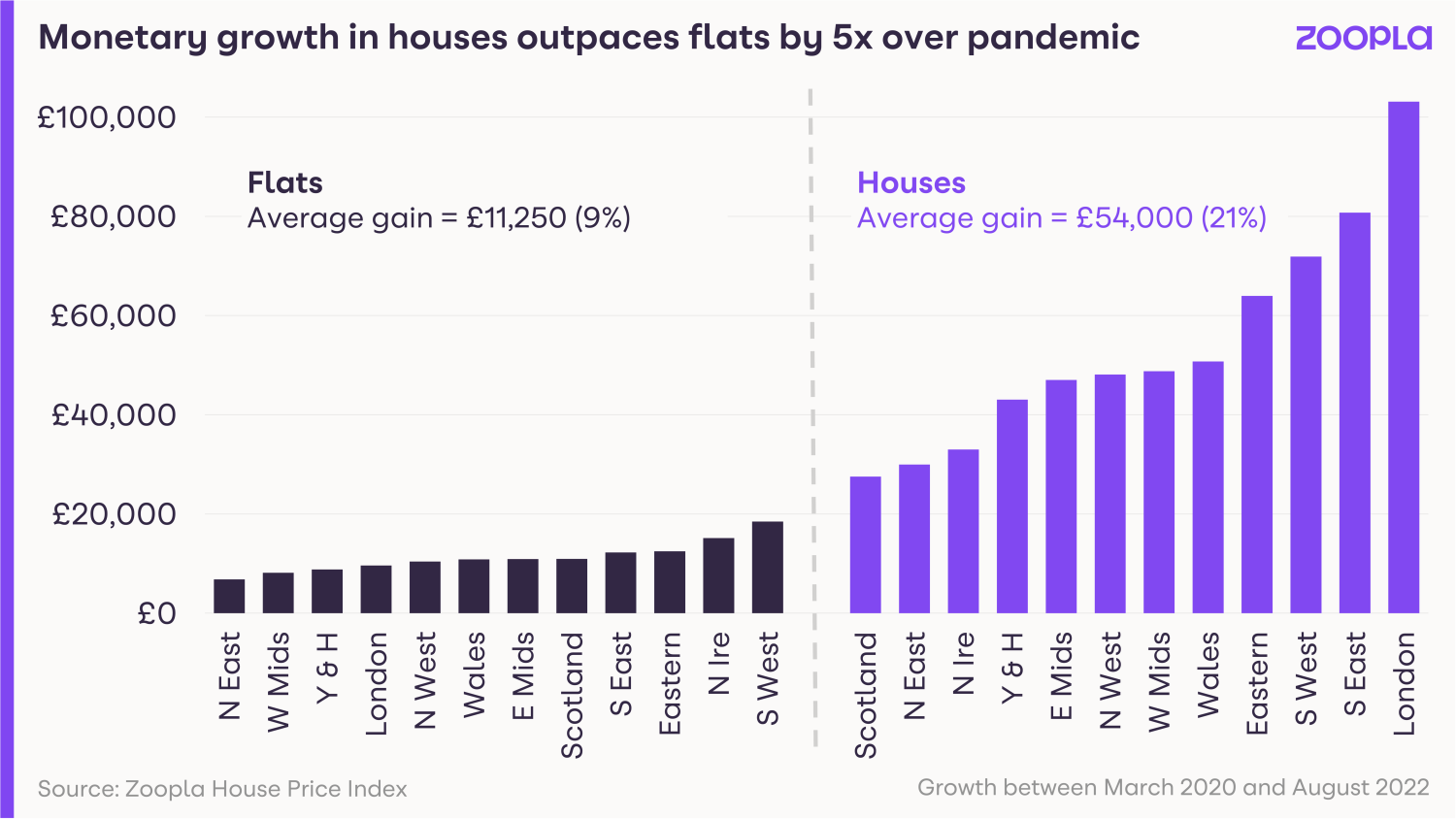

The effect of the pandemic on home moves and consequent house price rises has meant the average house price has increased five times more than the average price of flats since 2020.

In the last two years, the search for space and record low mortgage rates led to a surge in demand for new homes - and that demand pushed up house prices as buyers competed to secure their dream properties.

Some parts of the country have seen 10-years’ worth of price growth in just two years, such as Wales, which recorded a 27% increase in house prices.

Similarly, the North East and Scotland, which had experienced below average growth since 2009, has seen four-to-five years’ growth in the space of just two years.

In the South, the capital lagged behind the rest of the country in terms of house price growth.

Yet despite this, the average home in London has risen by £100,000 in value since the pandemic began.

Are we shifting to a buyers' market as more homes are reduced in price?

Conversely, the average flat in the capital has risen by just 2.4%, the weakest growth across the country, as buyers prioritised their needs for more space and a place to work from home.

These sizeable increases in house prices over the pandemic are set to be compounded by the impact of higher mortgage rates on market activity as we move towards the end of 2022 and into 2023.

Key takeaways

- The average house price has risen five times faster than the average flat since the pandemic

- Some parts of the country have seen 10 years' price growth in just two years

- The average home in London has risen by £100,000 since the pandemic began

Rising mortgage rates set to reduce buying power by 28%

With mortgage rates set to hit 5% by the end of this year, which areas are going to be hit hardest and what can buyers do to combat rising rates?

The macro backdrop for the housing market has evolved rapidly over the summer

Central banks have increased interest rates to bring down inflation.

Rising energy prices are adding to the cost-of-living squeeze and UK consumer confidence has hit an all-time low.

The UK government has responded with tax cuts and an energy price cap to support housing demand.

But while changes to stamp duty will boost some segments, the recent spike in borrowing costs are set to push mortgage rates higher.

Most new loans are on fixed rates and the costs to secure financing for these mortgages does not directly follow base rates.

That said, costs for new mortgages have surged recently, and mortgage rates are on track to reach 5% by the end of this year and even higher.

That’s more than double the rates at the start of 2022.

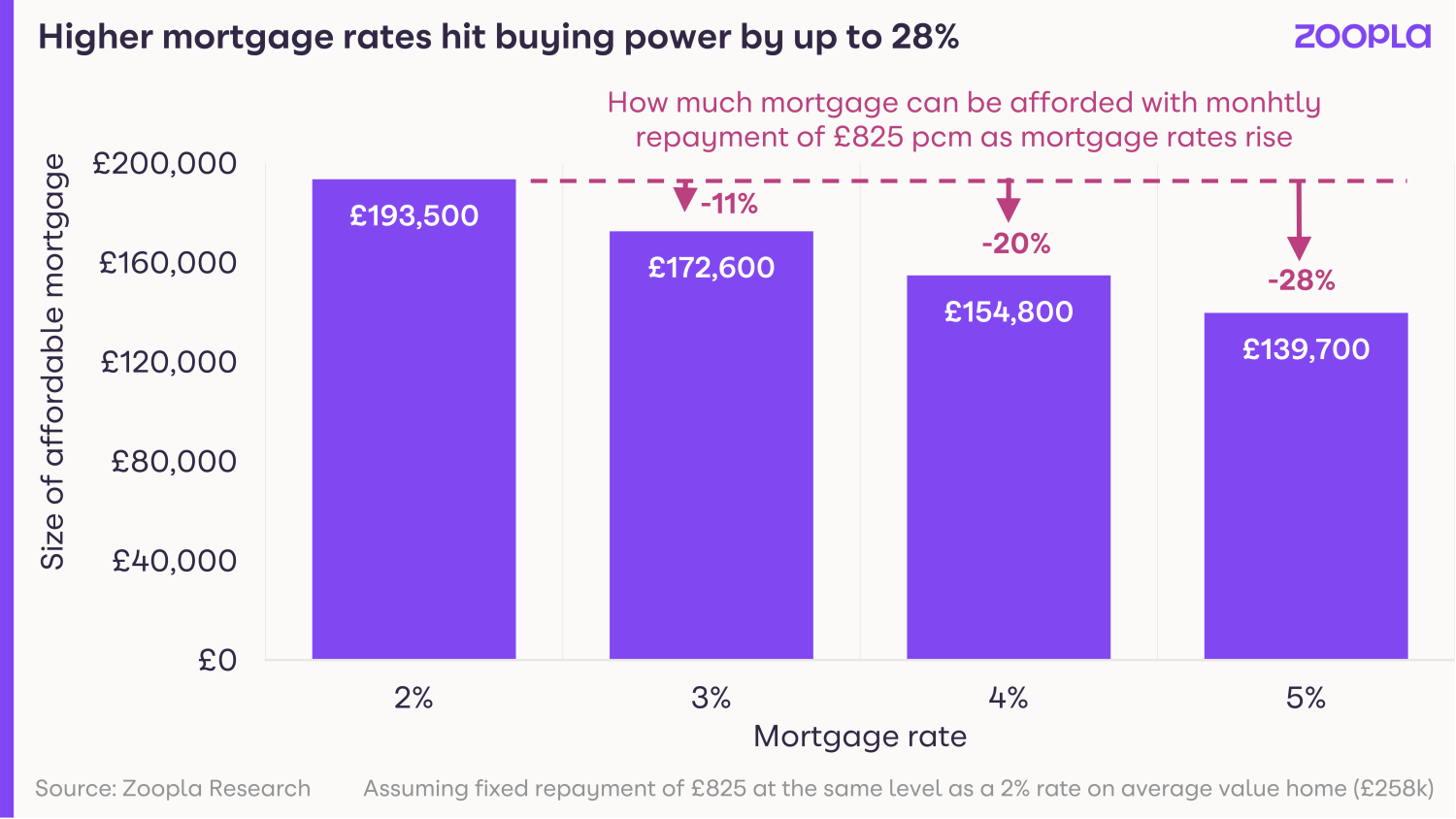

Our research shows that higher mortgage rates will reduce buying power by as much as 28% as rates rise from 2% to 5%.

That’s if buyers want to keep their monthly mortgage payments the same.

And the impact of this is likely to last into 2023.

Buyers now have four options to help combat rising mortgage rates

1: Put down larger deposits

2: Allocate more income to mortgage costs

3: Adjust their budgets by looking into smaller properties or cheaper areas

4: Wait on the sidelines until the outlook for borrowing costs becomes clearer.

Are we shifting to a buyers' market as more homes are reduced in price?

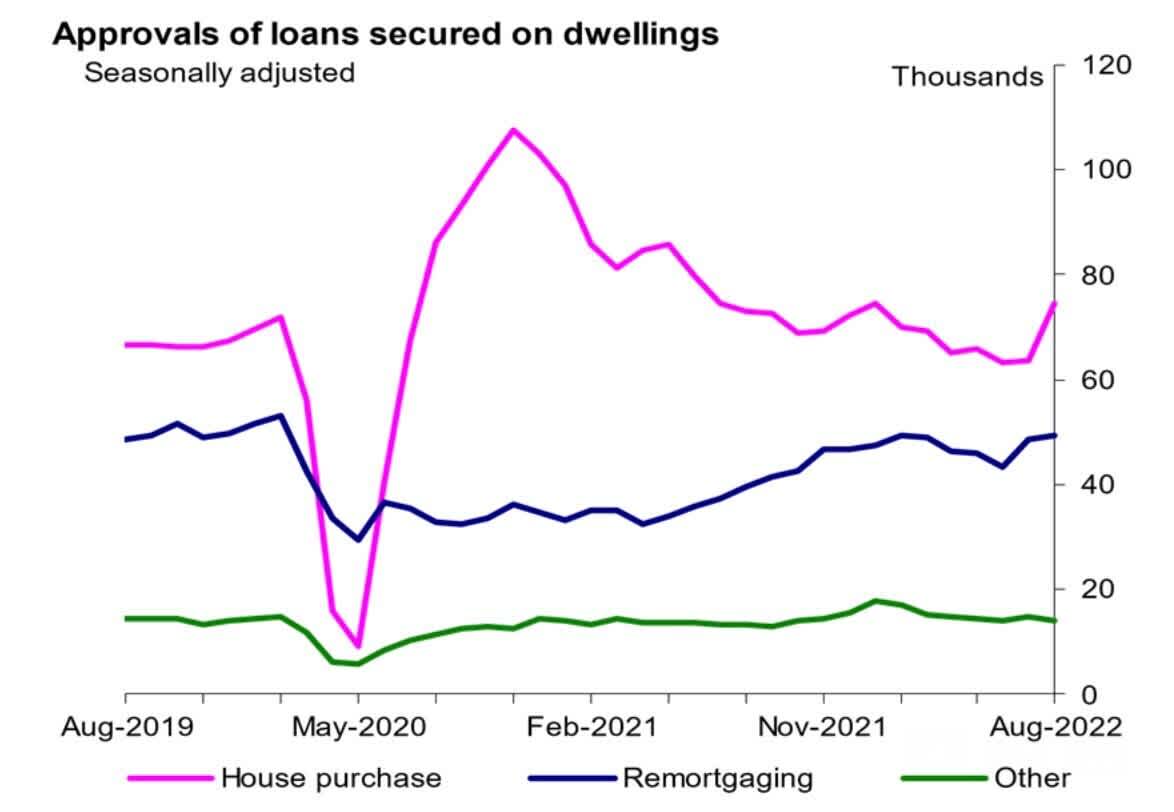

Mortgage approvals up 17% in August

Mortgage approvals for house purchases increased by 17% M/M, seasonally adjusted, to 74,300 in August, according to the Bank of England, showing the resilience of demand.

This is the highest level since January this year, where mortgage approvals hit 74,500, and above the 12-month pre-pandemic average up to February 2020 of 66,800.

The rise follows a downward trend over the previous several months, but suggests buyers and homeowners were getting ahead, ensuring they secured finance before rates rose.

On a non-seasonally adjusted basis, the Y/Y increase was 0.9%.

Areas with expensive homes and highest growth hit hardest

Rising mortgage rates are set to have the biggest impact on areas where homes are already at the higher end of the market, or where house prices have surged over the pandemic.

Pandemic house price boost adds to affordability troubles

The average UK home has risen by 8.2% - or £19,650 - in the last 12 months and although the quarterly growth rate is slowing, there are no immediate signs of a major slowdown in price inflation.

Looking ahead, higher mortgage rates will have the greatest impact on activity in these higher value markets and areas which have registered the greatest surge in prices over the the last two years.

Key takeaways

- Mortgage costs have surged recently, and mortgage rates are on track to reach 5% by the end of this year

- Buyers now have four options to combat rising mortgage rates:

- put down larger deposits

- allocate more income to mortgage costs

- adjust budgets by looking into smaller homes or cheaper areas

- wait until the outlook for borrowing costs becomes clearer

- Areas with more expensive homes are set to be hit hardest by the rising rates

Are we shifting to a buyers’ market as more homes are reduced in price?

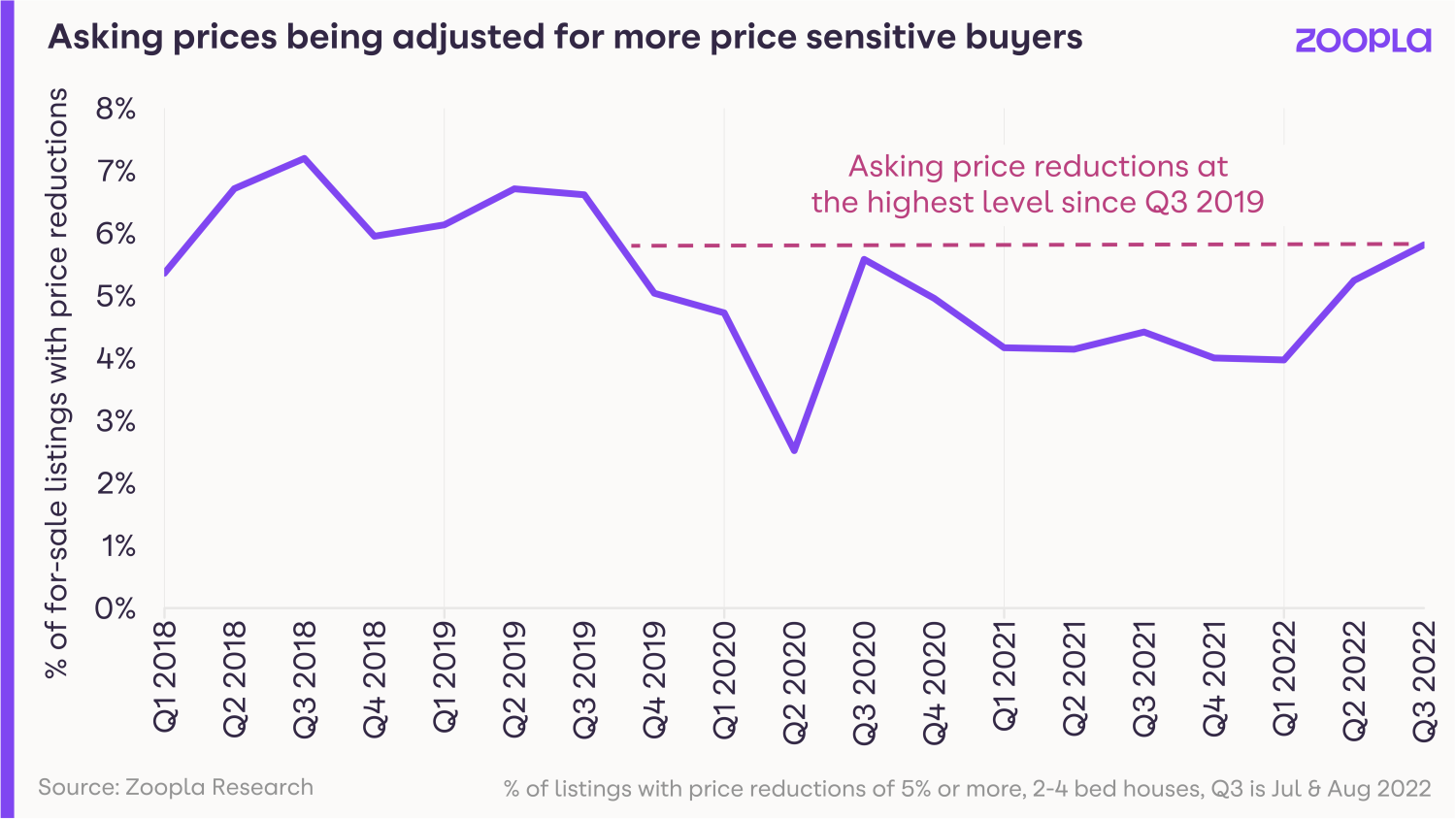

After two years of being a red-hot sellers’ market, it looks like the UK housing market is shifting back to becoming a buyers’ market.

Over the spring and summer this year, an increasing number of homes for sale underwent price reductions.

And there has been a clear upward trend in the proportion of listings which have had asking prices reduced by 5% or more.

Pandemic house price boost adds to affordability troubles

Our latest data shows 6.1% of homes for sale have been reduced in price this year, the highest level since before the pandemic, although re-pricing is a common seasonal trend as we enter the autumn market.

After two years of being a red-hot sellers’ market, it looks like the UK housing market is shifting back to becoming a buyers’ market.

Rising mortgage rates set to reduce buying power by 28%

However, these price adjustments are to be expected as the market transitions from one where demand greatly exceeded supply to one where buyer demand is reducing.

The reductions don't mean we're about to see big price falls, but they do suggest house price growth will start to slow at the end of this year and into next.

That means anyone looking to sell their home this autumn and winter - or next year - will need to make sure their house is priced at the right level to ensure a sale.

And while demand for homes will weaken, we still expect ongoing pandemic and cost-of-living pressures to stimulate homeowners to want to move, while being more cautious on pricing.

Key takeaways

- Over the spring and summer this year, an increasing number of homes for sale underwent price reductions

- However, this is to be expected as the market transitions from one where demand greatly exceeded supply to one where buyer demand is reducing

- The reductions don't mean we're about to see big price falls, but they do suggest house price growth will start to slow at the end of this year and into next

Record number of mortgages pulled by lenders

More than 900 deals were withdrawn in one day as lenders looked to reprice their loans. But the move is set to be temporary as lenders reassess their rates.

Mortgage lenders have withdrawn deals at a record rate in response to the current market volatility.

More than 900 products – representing one third of the mortgage market – were pulled overnight between 27 and 28 September, the highest level since financial information group Moneyfacts started keeping records.

More than a dozen lenders either withdrew or repriced their mortgages, including big names such as Halifax, Santander and Nationwide Building Society.

Their actions left 2,661 different products available, less than half the 5,315 deals that were on offer in December last year, before the Bank of England started to increase interest rates.

But homeowners were reassured that the situation is likely to be temporary, while lenders reassess the interest rates they charge in response to the current market volatility.

Rachel Springall, finance expert at Moneyfacts, said: “Borrowers would be wise to keep calm over the current volatility in the mortgage market and seek the advice from an independent broker.

“Various lenders have been very vocal that their decision to withdraw products is a temporary measure, amid the uncertainty over interest rates."

Why is this happening?

Chancellor Kwasi Kwarteng mini-Budget triggered a steep fall in the value of the pound, with investors worried his plans to cut taxes would boost inflation.

The Bank of England has already increased interest rates from 0.1% to 2.25% in a bid to bring inflation down from its current 40-year high.

But economists have warned that it may now have to hike the cost of borrowing even higher than previously thought, with some predicting they could peak at 5% next year, while money markets have priced in a rise to 6% by May 2023.

Speculation that interest rates will have to rise faster and further than previously thought has led to lenders’ own borrowing costs increasing from 3.6% in early September to 5% now.

This rise means lenders can no longer afford to offer mortgages at their previous rates, so they have withdrawn their products while they reprice them.

What does it mean for homeowners?

The good news for homeowners is that lenders are expected to relaunch their ranges once they have repriced them.

It is worth noting that, unlike at the start of the Covid-19 pandemic when lenders withdrew products for people with small deposits, mortgages have been pulled across nearly all areas of the market, with people looking to borrow 75% of their home’s value seeing the biggest fall in choice.

This suggests that the lenders do simply want to reassess the rates they charge and not that they have lost their appetite to lend to certain types of borrower.

The bad news is that when they do relaunch their ranges, interest rates will definitely be higher.

The average cost of a two-year fixed rate mortgage has already increased from 4.24% at the beginning of September to 4.81% now, while interest rate charged on a typical five-year fixed rate deal has risen from 4.33% to 4.76% during the same period.

Economists are predicting the Bank of England will make a significant increase to interest rates when it next meets in early November, possibly raising the Bank Rate by as much as 1% in one go.

As a result, mortgage rates are likely to get significantly more expensive in the months ahead.

What should I do?

If you are on your lender’s standard variable rate – the rate you revert to when your mortgage deal comes to an end – you should remortgage as soon as possible.

Although mortgage rates have risen, at 4.81%, the average two-year fixed rate loan is still cheaper than the average standard variable rate at 5.4%. As a result, switching would save someone with a £200,000 mortgage around £70 a month.

If you have six months or less left on your current mortgage deal, you should also move quickly to secure your next one.

Lenders will let people ‘book’ a new rate between three to six months before their current one ends.

The situation is harder to call if you have more than six months left on a fixed rate or tracker product, as you may incur penalties if you exit the mortgage early.

Even so, in some cases, it may be worth doing this to enable you to secure a new deal before mortgage rates rise further.

As each case will be different, you may want to consider consulting a mortgage broker to help you decide what the best course of action is for you.

It is worth noting that five-year fixed rate deals are now cheaper than two-year ones – reversing the normal situation in which homeowners have to pay a premium for the security of having their rate fixed for a longer period of time.

This suggests that while markets anticipate steep rises in interest rates in the short-term, they expect rates to be back on their way down again after a couple of years.

Key takeaways

- More than 900 products, representing one third of the mortgage market, were pulled overnight between 27 and 28 September

- The situation is likely to be temporary while lenders reassess the rates they charge following predictions interest rates could hit 6%

- The average cost of a two-year fixed rate mortgage has risen from 4.24% at the beginning of September to 4.81% now

What the weak pound means for the mortgage market

The value of the pound has tumbled following Chancellor Kwasi Kwarteng’s mini-Budget. We take a look at what it’s likely to mean for mortgage rates.

The value of the pound has fallen steeply since Chancellor Kwasi Kwarteng delivered his mini-Budget.

The pound briefly hit a record low against the US dollar on Monday, as markets digested the implications of tax cuts and higher government borrowing for the UK economy.

Many economists have predicted the giveaways will stoke inflation and lead to higher interest rates.

We take a look at why the pound has dived and what this means for homeowners.

Why has the pound fallen so much?

The pound has been weakening for some time against the dollar in line with other global currencies as the US central bank, the Federal Reserve, increases interest rates in the USA, drawing in international investors.

The pound has weakened further due to market uncertainty over the funding costs for the spending changes announced in the mini budget.

Kwarteng announced tax cuts and other support measures worth an estimated £45 billion in his mini-Budget.

He believes putting more money in people’s pockets and reducing the amount of tax businesses have to pay will increase demand and help to drive economic growth.

In fact, he has set a target for GDP to reach 2.5% a year over the medium term, arguing that growing the UK economy will reduce the UK’s debt-to-GDP ratio in a fiscally sustainable way.

Unfortunately, the markets don’t agree.

Investors are worried that the Chancellor’s giveaways will lead to higher inflation, which will mean higher interest rates that will reduce economic growth.

The Bank of England has already had to raise interest rates aggressively in a bid to tackle inflation, which is currently at a 40-year high.

It has increased the Bank Rate from 0.1% in December to 2.25% now.

Investors are concerned that the Bank of England will now have to raise rates even higher than previously thought to get inflation back under control.

At the same time, they think the tax cuts will lead to higher government borrowing.

This has made them lose confidence in the pound, leading to them selling the currency, causing its value to drop.

What does the fall in the pound mean?

The value of currencies fluctuates all the time. But the recent drop in the pound is of a different order of magnitude, with the currency at one point losing nearly 5% of its value against the US dollar.

This is important because global commodities – everything from oil to grain – are priced in US dollars.

As a result, the drop in the pound means the cost of everything the UK imports has become more expensive, which will drive inflation higher.

In order to control inflation, the Bank of England may have to hike interest rates even more aggressively than previously thought.

How high could interest rates go?

Before the mini-Budget, economists were predicting interest rates would peak at between 3% and 4% in the middle of next year.

The money markets now expect them to reach 6% by May. If this happened, it would represent a 3.75% increase from the current level of 2.25%.

But it is important to stress that this is just a prediction - markets can be volatile and fluctuate in times of greater uncertainty..

Markets are less confident in the UK government’s plans, especially given the fact that the proposals were not accompanied by an independent forecast from the Office for Budget Responsibility.

Hopefully If the government can regain their confidence, the pound should strengthen again, and interest rates may not have to rise so steeply.

What happens next?

There is speculation that the Bank of England will have to step in to help restore confidence in the pound, either by holding an emergency meeting to increase interest rates, or raising them steeply at its scheduled meeting in early November.

Unfortunately, the increase would need to be dramatic to make a difference, with traders betting rates could be increased to just below 4% by November.

What does this mean for mortgages?

Mortgage rates reached record lows in early 2022 but higher inflation and rising interest rates means higher borrowing costs for new buyers using a mortgage and those looking to refinance.

Since December last year, average mortgage rates have risen across the board as the cost of money for banks has risen.

If interest rates do rise to 6% by May, and mortgage rates increase by the same amount, it would add £465 a month to a £200,000 mortgage.

That is a pretty sizable increase for new borrowers.

Existing borrowers will have had to prove to their bank they could afford a 6 or 7% mortgage rate to get a mortgage in the last 5 years, so there is some insulation to higher rates but perhaps less so at a time of rising living costs.

There are steps homeowners can take to protect themselves.

What should I do?

If you are currently on a fixed rate mortgage, you don’t need to do anything, as the mortgage rate you are charged will stay the same for your product term, usually two or five years.

If you are on your lender’s standard variable rate – the rate you are automatically put on when your mortgage deal ends – you should try to remortgage as soon as possible.

The average cost of a two-year fixed rate mortgage is currently 4.24%, while a five-year one is 4.33%.

If you take out one of these deals now, your interest rate will stay the same for two or five years – depending on the term you opt for – by which time inflation should be back under control and interest rates could be heading down again.

If you are currently on a tracker mortgage, under which the interest rate charged moves up and down in line with changes to the Bank Rate, you may want to consider exiting your deal early in order to take out a fixed rate one.

But before you do so, be sure to check whether you will incur any exit penalties, as these may wipe out the savings you would make.

Equally, if you only have a few months left on a fixed rate deal, you may want to consider exiting it to take out a new one before interest rates rise further.

Again, it is important to weigh up the penalties you would pay against the potential savings you would make.

It is also worth remembering that many lenders will let you ‘book’ a new mortgage deal up to three to six months before your current one ends, which may enable you to secure a new rate without having to pay an early redemption penalty.

What does this mean for the housing market?

The surge in mortgage rates means buying power in the housing market will be hit, compounding the rising cost of living and economic uncertainty. House price growth will slow and we are set to move to more of a buyers market.

However, 25% of sales involve no mortgage and a large proportion of other sales have small to mid sized loans which will reduce the impact on borrowers. The greatest impact will be felt by those wanting to move, taking on more debt to buy a larger home or buying their first home.

The Chancellor announced in the mini-Budget that the threshold at which stamp duty is paid had been doubled to £250,000, in a bid to kick-start activity.

But rapidly rising interest rates, which will reduce the amount people can afford to borrow, is likely to more than offset any boost provided by the stamp duty cut.

Key takeaways

- The value of the pound has fallen steeply since Chancellor Kwasi Kwarteng delivered his mini-Budget, briefly hitting a record low against the US dollar

- The situation is expected to lead to higher interest rates, which could hit 6% by May

- Mortgage rates are also expected to rise, which would hit the buying power of households and lead to a sharp slowdown in the housing market