The pandemic-led property boom leads to affordability problems, as some parts of the UK experience 10 years’ price growth in the space of just two years.

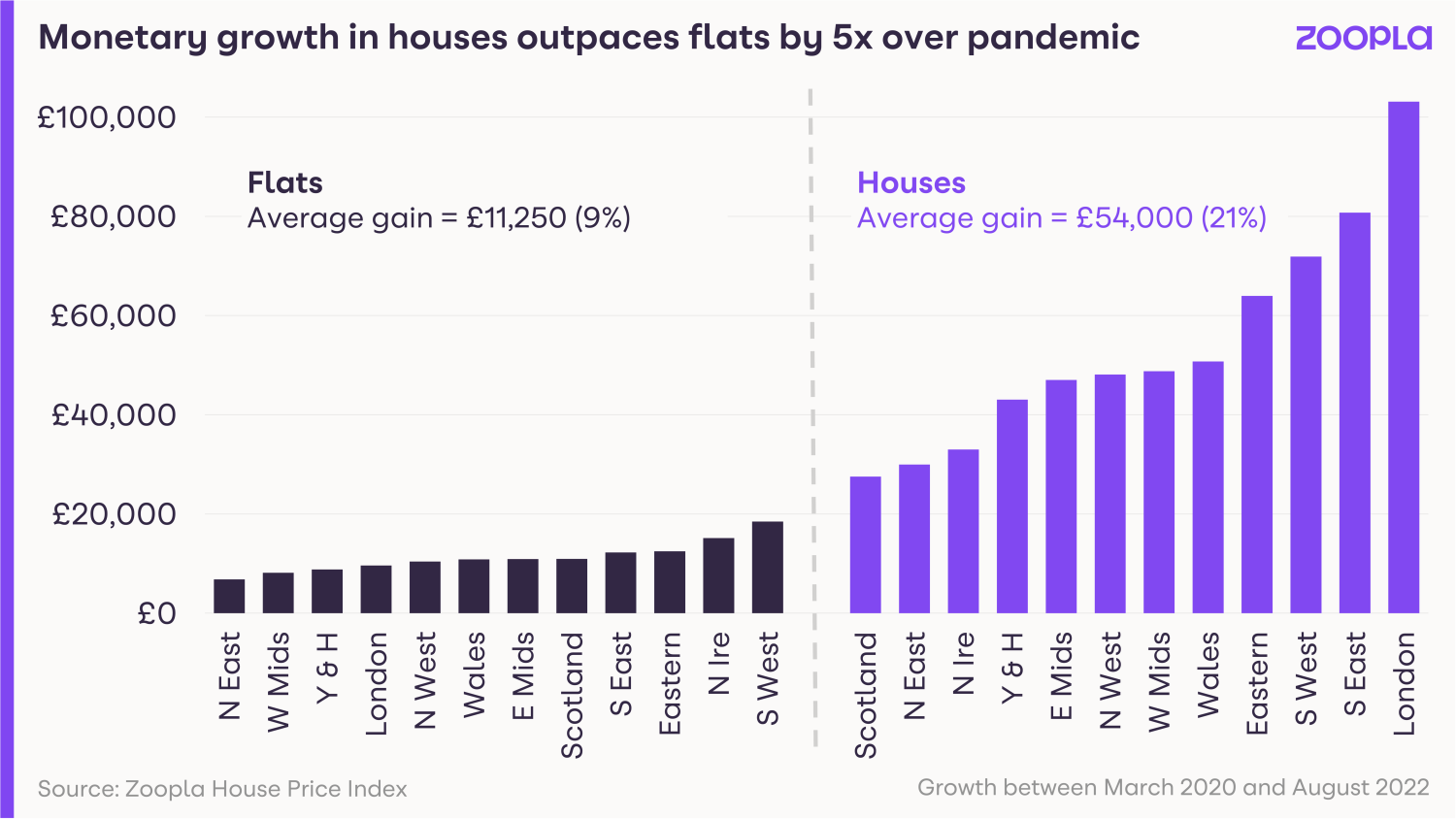

The effect of the pandemic on home moves and consequent house price rises has meant the average house price has increased five times more than the average price of flats since 2020.

In the last two years, the search for space and record low mortgage rates led to a surge in demand for new homes – and that demand pushed up house prices as buyers competed to secure their dream properties.

Some parts of the country have seen 10-years’ worth of price growth in just two years, such as Wales, which recorded a 27% increase in house prices.

Similarly, the North East and Scotland, which had experienced below average growth since 2009, has seen four-to-five years’ growth in the space of just two years.

In the South, the capital lagged behind the rest of the country in terms of house price growth.

Yet despite this, the average home in London has risen by £100,000 in value since the pandemic began.

Are we shifting to a buyers’ market as more homes are reduced in price?

Conversely, the average flat in the capital has risen by just 2.4%, the weakest growth across the country, as buyers prioritised their needs for more space and a place to work from home.

These sizeable increases in house prices over the pandemic are set to be compounded by the impact of higher mortgage rates on market activity as we move towards the end of 2022 and into 2023.

Key takeaways

- The average house price has risen five times faster than the average flat since the pandemic

- Some parts of the country have seen 10 years’ price growth in just two years

- The average home in London has risen by £100,000 since the pandemic began