Generation Guppie: A growing number of young adults are giving up on owning a home.

42% of adults aged 18-39 who don’t own a home say they’ve given up on the idea of buying one in the next ten years, including 38% of those earning £60,000+.

More than four in ten (42%) British adults under the age of 40 who do not currently own a home are now ‘Guppies’ – young people, many of whom have professional careers and big salaries, who have ‘Given Up on Property’.

The Guppies of today are in stark contrast to the ‘Yuppies’ of the Eighties and Nineties – young urban professionals with a good salary and no issues buying a home.

Our latest survey of 2,000 adults under the age of 40 reveals that even among those earning over £60,000 per year, 38% have given up on affording a home in the next decade.

Overall, just one in five (21%) say that they will ‘definitely’ be able to afford a home in the next decade, while 14% are currently planning to buy one, or are in the process of doing so.

The vast majority of Brits under the age of 40 in the UK do not already own a home – just 22.5% of those aged 25-34 and 1.4% of those aged 24 or under do.

In fact, non-home-owning under 40s in the UK are now more likely to be living with their parents, than be planning to, or be in the process of, buying a home (14.4% vs 14.1%).

Those who have given up on a home in the next decade cite 3 main reasons:

-

the cost of living crisis (64%)

-

increasing house prices (51%)

-

higher mortgage rates (49%)

Of those who are planning to buy, or who are in the process of buying their first home, 85% say they have made financial sacrifices to do so.

Over a third 34% have given up holidays, and 30% have had to give up socialising.

A quarter (25%) have stopped saving for their future and one in ten (10%) have even given up dating or being in a relationship in order to afford a home.

Younger people adjusting expectations to get on the ladder

Younger people can get on the housing ladder but many need to make compromises in order to do so.

Among those under 40 who are currently planning to buy, or who are in the process of buying their first home, seven in ten (69%) say they made compromises on the property.

Most common were ‘not being able to buy in the area they’d ideally like to (31%), not being able to buy a home in as good condition as I’d like (18%) and being unable to afford any spare rooms’ (17%).

Many also look to alternative locations. Just 33% of all under 40s who don’t currently own a home say they’d be able to afford to buy a property where they currently live - but 23% say they might if they were to move further away.

Location is the key

Among those who say they might be able to afford a home if they moved to a different location, they’d on average have to move around 37 miles. As such, investigating new areas may be the key to homeownership for many.

In adulthood, many move away from where they grew up. But for some, moving back could help.

Overall, 37% say that they’d be able to afford to buy a home in the place where they grew up. However, this rises to nearly half (49%) in Scotland and 45% in Yorkshire and the Humber.

Those in the South of England are less likely to be able to. Just 27% in the South West and 33% in the South East say they could afford a home where they grew up.

The ‘alternative’ ways Brits are considering to get a home

Many young adults today are open to less conventional ways of getting on the ladder.

Nearly a third of under 40s who don’t currently own a home (31%) would be open to a part ownership or help to buy type scheme, and 18% would be open to buying with a friend, colleague or sibling.

Many are also up for getting their hands dirty - a fifth (20%) would be open to buying a near-derelict home and doing it up whilst 19% would even consider building a home themselves.

Seventeen percent say they would be open to moving to a cheaper area and working remotely.

What can I do to get onto the property ladder?

1. Find out what you can afford

Use our mortgage calculator to find out what you could afford based on your income to get a starting point for your search.

2. Be area-agnostic

Most people in the survey say they can’t afford to buy a home where they live or where they grew up, so the reality for many is that they’ll need to look at alternative locations.

3. Look at the help available

There are many schemes out there designed to help people get on the ladder. Shared Ownership schemes (where you own part of the home and pay rent on the rest) can be a great way to get a foot on the ladder.

Meanwhile 95%, mortgages can help make saving the deposit less of a barrier.

4. Don’t go it alone

Buying with a friend or a partner is one way to slash costs significantly and pool your salaries together.

It may feel risky, but it’s actually very straightforward to get a legal document drawn up to enshrine what your share of the property is.

5. Get the right mortgage

Many people will have seen worrying news reports about huge increases in monthly mortgage costs - in fact 18% in the study said they’d be too worried to take out a mortgage.

However, there are a number of options so it’s vital to choose what’s right for you.

For example, a fixed mortgage reassures you of what your monthly mortgage payments will be for a set period.

Free online mortgage brokers such as Mojo can help here, by looking for the best options for you.

Key takeaways

- The cost of living crisis is now the key barrier to purchasing a property for young people - with higher mortgage rates also having a strong impact

- Non-home owning under 40s are more likely to be living with their parents, than planning to buy a property

- But many are looking to ‘alternative’ ways to get on the ladder - from moving away from where they currently live to buying with friends, getting a ‘doer upper’ or even building their own home

Is it cheaper to rent a home in the countryside?

Generally, it is cheaper to rent a home in the countryside than in the city. This is because there is less demand for rental properties in rural areas, which means that landlords can charge lower rents. Additionally, the cost of living in rural areas is also lower, which can further offset the cost of rent.

However, the trend of renting in the countryside has been changing in recent years. During the COVID-19 pandemic, many people moved out of cities to the countryside in search of more space and a better quality of life. This increased demand for rental properties in rural areas led to higher rents. However, as the pandemic has subsided, some people have started to move back to the cities. This has led to a decrease in demand for rental properties in rural areas, and rents have started to become more affordable again.

Summer is one of the busiest times of year in the rental market.

And demand for new rentals this year is now even higher than the same time last year.

Meanwhile, the supply of homes to rent is only slightly ahead of last year’s levels.

That means the supply-demand gap for the rental market is continuing to put pressure on rents.

And as demand increases, so do the prices.

Our rental index of new lets shows that the average UK rent increased by 0.9% over June - the highest monthly increase since October 2022.

The average UK rent has now reached £1,163, which is £110 higher than a year ago.

Rents in urban areas rise faster than rural areas

A new trend is emerging in the rental market: rural areas are becoming more affordable than cities when it comes to new lets.

Rural areas are built out of Census output areas defined as those with a population of less than 10,000. They can include isolated dwellings, hamlets, villages and small hub towns.

Urban areas are built out of Census output areas that tend to have a population of 10,000 or more and include cities, towns and suburbs.

In England, the average city rent in major cities reached £1,300 in June, while in the countryside it remained £220 lower at £1,080.

The lettings market in UK cities is prone to seasonal summer spikes in rental inflation as demand from students, graduates and relocating families grows over the summer.

In recent months, some of the largest UK cities have experienced above national average inflation of more than 10%.

However, rural rents are now growing at a slower pace.

Over the last 12 months, rents in the English countryside increased by an average of 6.6% or £67 a year.

This new trend marks a reversal of what happened during the pandemic years of 2020-21, when rural rental properties were in hot demand.

The reopening of cities in 2021 has seen renters returning to urban areas. And by June 2022, their regained popularity led rental inflation in cities to exceed that of their rural counterparts.

Rental affordability in cities has become increasingly challenging.

Conversely, the average proportion of household earnings needed to rent in the countryside has stayed broadly the same over the last 12 months.

Having said that, this won’t be a universal experience of all renters in rural locations.

Some 2 out of 5 rural areas saw rental inflation rise above the national average wage growth (6.9%).

And renters in some rural areas are now having to put a higher proportion of their income towards housing costs.

8 UK cities where rents are rising fastest

| City | Average rent | % increase | annual increase pcm |

|---|---|---|---|

| Edinburgh | £1,136 | 14.2% | £140 |

| London | £2,005 | 13% | £230 |

| Manchester | £983 | 13% | £110 |

| Glasgow | £871 | 12.9% | £100 |

| Southampton | £1,052 | 10.9% | £100 |

| Cardiff | £1,031 | 10.9% | £100 |

| Birmingham | £865 | 10.2% | £80 |

| Nottingham | £899 | 10.1% | £80 |

Rental Market Index

In June, we identified 8 major UK cities where the prices of new rents increased by at least 10% in one year.

In Edinburgh, London, Manchester, Glasgow, Southampton and Cardiff, the cost of a new let rose by £80 pcm or more.

Top of the list was Edinburgh, where the average monthly rent for a new let in the city rose by £150 pcm, pushing the average rent close to £1,200 per month.

Manchester and Glasgow were next, with rents increasing by £120 and £100 pcm respectively.

Meanwhile, renters in Liverpool, Sheffield and Belfast saw the lowest rental growth among the largest UK cities.

In these locations, average monthly rents increased by less than £60 in the last year.

Cheaper urban areas to rent

While most renters across the UK saw steep rental increases in the last 12 months, there are a few exceptions.

When considering the UK’s largest urban areas, there are three towns where rental inflation was below 5%.

Annual rental increases in Blackpool were the lowest among all UK cities and large towns, with average rents increasing by £20 on average.

Blackpool is followed by Doncaster and Grimsby, both in Yorkshire and the Humber, where rent increases over the last 12 months were £30 and £20 respectively.

All three areas are among the least expensive large towns to rent in the UK.

|

Town |

Average Rent (PCM) |

Annual rental price change (%) |

Annual rental price change (£) |

|

Grimsby |

£579 |

4.7% |

£30 |

|

Doncaster |

£644 |

3.8% |

£20 |

|

Blackpool |

£651 |

3.2% |

£20 |

Rents rise fastest in London and Scotland

Scotland and London - the two largest rental markets in the UK - are experiencing the steepest growth.

In Scotland, rents increased by £80 per calendar month (or 13.1%) on average in the last 12 months.

In the Scottish Borders area of Tweeddale, the monthly cost of a new let increased by 17.1% - or £80 pcm.

In London, rents have risen £230 (or 12.7%) in the last year. That’s actually down from an annual rise of £273 (or 17.6%) in the 12 months leading up to June 2022.

The fact that rental inflation is coming down in the capital now suggests affordability is stretched in London, with less headroom for rents to grow further.

In reality, there is a lot of variation in how fast rents are going up in different London boroughs.

For the fifth month in a row, rents in Newham are growing faster than anywhere else in the capital (16.5%), whereas the lowest rental inflation is currently being seen in Kensington and Chelsea (11.0%).

Slower rental growth in Northern Ireland and South West England

Our data shows the lowest rental inflation is happening in Northern Ireland (4.3%) and the South West (7.7%).

Northern Ireland is currently among the regions with the lowest earnings growth in the UK, which limits how much rents can increase.

Meanwhile, demand for rentals in the South West has slowed down from the pandemic peak of 2021 and it has been lagging behind other UK regions since October 2022.

This has eased the pressure on rental inflation in the region, particularly in the more rural areas.

Key takeaways

- Rents in cities are now rising faster than in rural areas

- In 8 UK cities, rents have increased by more than 10%. In Edinburgh, rents are up 14%

- However in rural locations, rents have increased by 6.6% - or £67 on average

- The average monthly UK rent reached £1,163 in June, which is £110 higher than a year ago, with London and Scotland seeing the greatest increases

What do higher interest rates mean for the housing market?

The UK base rate continues to increase but mortgage rates are close to peaking.

Base rate up 0.25% - fewer increases expected

The Bank of England has raised rates again to 5.25% in an effort to cool inflation. City expectations of how much higher interest rates need to rise have moderated in recent weeks. Most expect only one more increase. This is an improvement on a few weeks ago when market expectations were for base rates to rise above 6%.

Mortgage rates for fixed rate deals are close to peaking

Changing market expectations for base rates has led to a fall in the underlying cost of finance for fixed rate mortgages. Some banks have already started to reduce mortgage rates as a result. These are modest reductions so far, but a sign mortgage rates are peaking.

We expect mortgage rates to fall further in the months ahead but how much depends on the outlook for inflation and what this means for City expectations for base rates. We could well see sub 5% mortgage rates return this autumn.

9 in 10 mortgage holders on fixed rates

The vast majority of people buying homes in recent years have taken mortgages with fixed rates. Almost 9 in 10 outstanding mortgages (87%) are on fixed rates meaning today’s rate rise will not have an impact on their monthly repayments.

However, 15% of mortgage holders will see their fixed deal come to an end in 2023, meaning the need to refinance onto higher rates and pay an extra £200-£250 per month on average. In some areas with higher property prices this increase will be much greater.

The remaining 13% of mortgagees are on variable rates which means higher mortgage repayments almost straight away. The fact over 1 in 10 loans are on variable rates probably reflects those with smaller loans where changes in rates have a much smaller impact on their monthly repayments.

Jump in borrowers paying down mortgages

Households with access to savings are paying down mortgage debt at a much faster rate as they look to reduce the impact of higher rates. This trend is being exacerbated by lower savings rates which makes paying down debt more attractive, especially for those who are higher rate taxpayers.

Bank of England data shows households paying off an extra £2.2 billion a month over and above regular debt repayments - this is 66% higher than the 10 year average.

Higher mortgage rates have a variable market impact

The rise in mortgage rates has hit demand from new buyers by 18% over the last 2 months. Sales have also slowed but Zoopla has not seen a drop in activity as severe as over the period immediately after 2022’s mini budget.

Home buyers are steadily accepting that we are returning to a period of more normal mortgage rates in the 4-5% range rather than the ultra low, sub 2% mortgage rates of recent years.

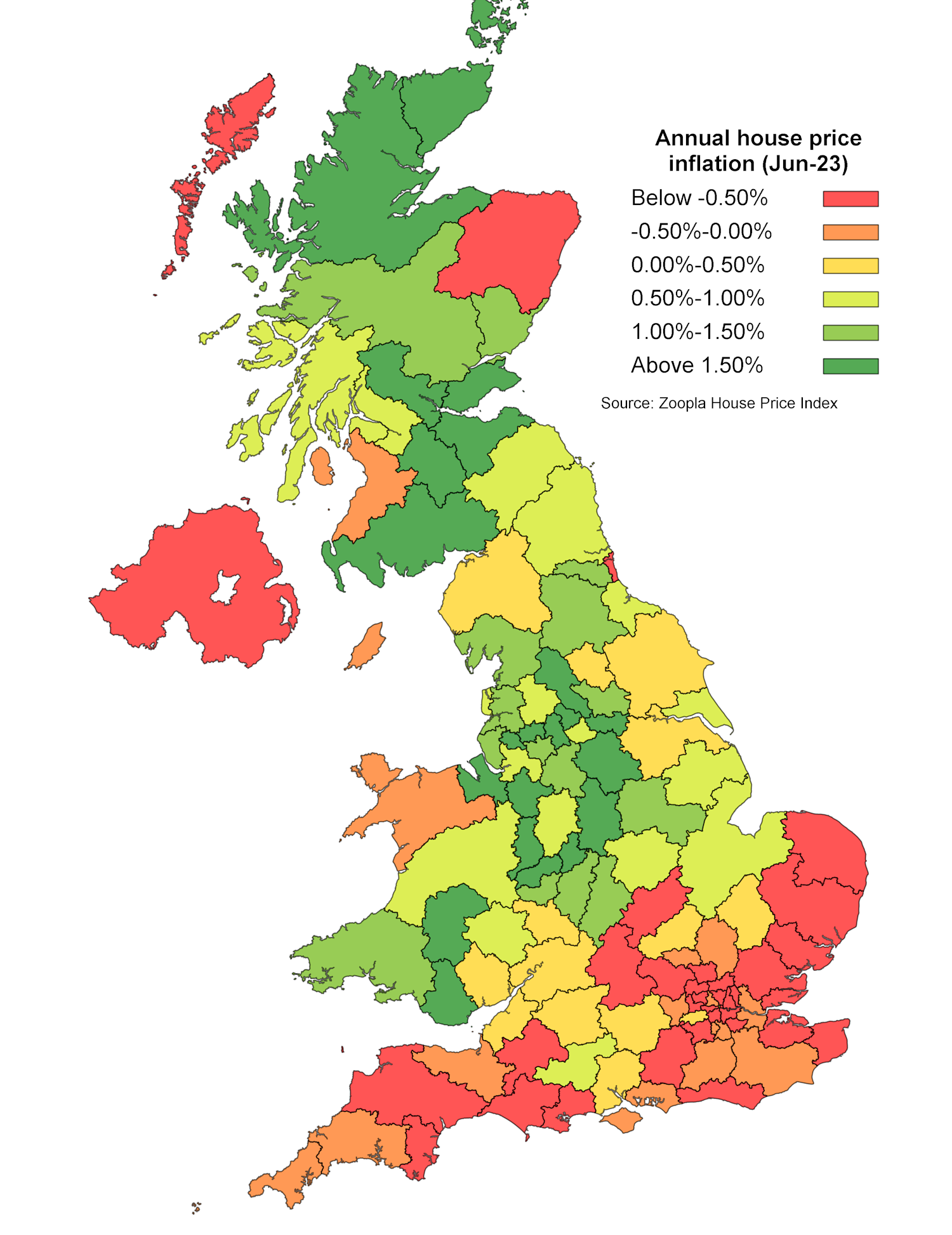

Higher mortgage rates hit buyers hardest in higher value housing markets where the size of the mortgage is larger and buyers need a larger income to buy. House Price Index shows prices falling across southern England as the hit to buying power pushes prices lower.

However, in the north of England and Scotland house prices are still rising as the impact of higher mortgage rates is less pronounced. These trends are explained by the income needed to buy and how accessible the market is for first-time buyers.

It’s cheaper to buy than rent at 5.5% mortgage rates across lower value housing markets in the north of England and Scotland. In contrast, in southern England, would-be first-time buyers face much greater challenges which weakens demand and keeps house prices under downward pressure.

UK house prices to fall 5% over 2023

Higher mortgage rates have reduced the buying power of households and this will need to be reflected in house prices which fell at the end of 2022 but started to increase this spring as mortgage rates reduced to 4%.

Now mortgage rates are rising again we expect further modest price falls in the second half of 2023. Overall we expect the average UK house price to fall 5% over 2023 but they will still remain 15% higher than the start of the pandemic.

The longer term outlook depends on the strength of the economy and labour market and how long mortgage rates remain over 5%. We expect house price growth to remain very low over 2024 and into 2025 as the market adjusts to higher borrowing costs.

There is no quick rebound in prospect as mortgage rates start to fall and anyone serious about moving needs to set their price carefully if they want to move home.

Key takeaways

- The Bank of England base rate has risen but the underlying cost of a fixed rate mortgage has been falling in recent weeks

- Mortgage rates are close to peaking

- 15% of households with a mortgage will need to refinance this year

- The impact of higher mortgage rates on demand and house prices is not uniform across the country

Are You Paying Too Much for Your London Mortgage?

27% of homeowners with a mortgage are on their lender’s standard variable rate. Could you be one of them?

When your mortgage deal period ends, you’ll normally move onto your lender’s standard variable rate.

A standard variable rate (or SVR) is usually a lot higher than your existing rate. Currently the average is around 7.5%, and it can change at any time your lender decides.

Some lenders move you onto a ‘follow on’ rate instead, which can be even higher than their standard variable rate.

According to recent research by mortgage broker Habito, one in 10 mortgagees believe that paying a more expensive rate on their mortgage meant they’d be paying off their mortgage quicker.

It doesn’t. It simply means you’re paying the lender more interest instead.

Your lender will be able to tell you in advance what your monthly payment will be once your current deal ends.

How much more expensive is a lender’s standard variable rate?

An SVR or ‘follow on’ rate can be between 2% and 3% higher than the average five-year or two-year fixed rate mortgage.

And the lender can raise the rate at any time.

When the Bank of England increases the Base Rate (which has currently risen 13 times since December 2021) SVR and tracker rate mortgages may increase too, as they usually follow the Base Rate.

However there are exceptions. And some lenders have opted not to increase the rate on their SVR mortgages when the Base Rate has risen.

Your lender will always let you know what’s happening with your mortgage rate.

Current SVRs and fixed rate deals from major lenders

Let’s take a look at the standard variable rate and fixed rate mortgage deals currently being offered by some of the major lenders.

|

Lender |

SVR |

10-year fixed |

5-year fixed |

2-year fixed |

|

Barclays |

7.99% |

5.15% |

5.32% |

5.9% |

|

Halifax / Lloyds |

8.49% |

5.33% |

5.83% |

5.23% |

|

HSBC |

6.99% |

- |

5.61% |

6.14% |

|

Nationwide |

7.99% |

5.04% |

5.59% |

6.09% |

|

Santander |

7.75% |

- |

5.84% |

5.44% |

|

The Mortgage Works (buy to let) |

8.49% |

5.49% |

5.74% |

6.19% |

|

Virgin Money |

8.74% |

5.18% |

5.63% |

6.13% |

|

Yorkshire BS |

7.99% |

5.72% |

5.6% |

5.34% |

If you had a £200,000 mortgage spread over 25 years on a £250,000 property, you could end up paying several hundred of pounds more in interest each month on the lender’s SVR.

To cite Virgin Money’s rates above as an example:

On the standard variable rate of 8.74%, you’d be paying £1,642 a month.

At the two-year fixed rate of 6.13%, you’d be paying £1,304 a month.

With the five-year fixed rate of 5.63%, you’d be paying £1,243 a month.

And with the 10-year fixed rate of 5.18%, you’d be paying £1,190 a month.

That’s a potential difference of £452 a month, or £5,424 a year, between a lender’s standard variable rate mortgage and fixed rate deal.

Use our mortgage calculator to work out what your monthly payments could be.

Why are so many people on standard variable rate mortgages?

Habito’s research suggests many homeowners are slipping onto their lender’s SVR without even realising it or knowing that they have an alternative.

But it’s always worth contacting a broker 3-6 months before your current mortgage deal is due to end.

You can book in a new deal up to six months in advance.

And if a better rate comes up between the time you booked the deal and the time it’s due to begin, you can simply book in that rate instead.

Your mortgage broker will be the best person to advise you on what to do.

Trusted partner is Mojo Mortgages, a free online mortgage broker.

Financial concerns

One in 10 homeowners were frightened of lenders scrutinising their finances, given the current economic climate.

This is where a broker can help. They have an in-depth knowledge of the mortgage market and know the rules that different lenders operate by.

Once your broker has an understanding of your financial circumstances, they’ll know which lenders to approach on your behalf.

Unaware of mortgage alternatives

One in 10 didn’t realise it could be possible to get a cheaper mortgage deal.

A mortgage broker will scour the market for you to find the cheapest mortgage rates available to you.

Too much hassle to switch mortgages

In a recent survey by Which?, 41% of homeowners on an SVR mortgage said they’d be unlikely to switch to a cheaper deal.

They felt it ‘wasn’t worth the hassle’ or they ‘hadn’t really thought about it’.

This in part may be because homeowners with smaller mortgages are less likely to feel the financial hit when moving onto an SVR.

But when the savings can run into hundreds of pounds a month, it’s a call to a broker that’s worth making.

Fears of being in negative equity

Other homeowners were concerned that they might be in negative equity.

Negative equity is when a property you own is worth less than the mortgage you're paying on it.

What is negative equity?

Most lenders won't let people with negative equity switch to a new mortgage deal when their existing one ends. Instead, they'll normally be moved onto their standard variable rate.

You can find out if you’re in negative equity by checking the balance left on your mortgage and inviting estate agents round to value your home.

If you are in negative equity, it could still be worth speaking with a mortgage broker, as they may be able to find a lender that could help.

Mortgage rates are set to come down this autumn

In good news for homeowners and buyers, mortgage rates look set to hit their peak this summer.

Inflation is now on its way down and so are swap rates - the rates the banks pay to borrow money.

Swap rates are based on what the markets think the interest rate will be in the future.

Right now, the average mortgage rate for a 5-year fixed rate at 75% loan to value has reached 5.4%, compared to 4% in the Spring.

The reduction in swap rates will take time to feed through into mortgage rates, but our Executive Director - Research, Richard Donnell, believes they could fall below 5% this autumn.

Whether you need to remortgage now or in six months time, if your current mortgage deal is coming to an end soon, it’s well worth contacting a mortgage broker.

They will be fully up to speed on the latest mortgage market trends and current rates available.

And they are in the best place to advise you on getting the cheapest possible mortgage deal for you.

Which Properties Are Selling Best in London Right Now?

The UK property market is currently in a state of flux, with rising mortgage rates and a cost-of-living crisis putting pressure on buyers. However, there are still some properties that are selling well, especially in London.

Family-sized homes are still in demand, but buyers are looking for bargains.

In the past, 3- and 4-bedroom family homes were the most popular type of property in London. However, rising mortgage rates have made these homes more expensive, and buyers are now looking for good deals.

Flats are also selling well, especially in central London.

Flats are often seen as a more affordable option than houses, and they are also becoming more popular with investors. In central London, flats are selling at a premium, and there is a shortage of supply.

What does this mean for sellers?

If you are selling a family-sized home in London, you may need to be prepared to negotiate on price. However, if you are selling a flat, you may be able to get a good price, especially if it is in a desirable location.

Here are some tips for sellers in London:

- Get your property valued by a professional.

- Price your property competitively.

- Make sure your property is in good condition.

- Market your property widely.

The London property market is always changing, so it is important to stay up-to-date on the latest trends. If you are thinking of selling your property, it is a good idea to speak to a property expert to get advice on the current market conditions.

Here are some additional details about the UK property market:

- The average house price in the UK is currently £280,000.

- The average house price in London is currently £525,000.

- The number of house sales in the UK fell by 12% in July 2022.

- The number of house sales in London fell by 10% in July 2022.

Key takeaways

- Demand falls as higher mortgage rates prompt buyers to reassess what they can afford

- Family-sized homes are hardest hit as buyers have less money to spend on larger properties

- Flats make a comeback, gaining popularity as buyers look for more affordable options

Will mortgage rates go down in autumn 2023?

Mortgage rates are expected to peak this summer, as inflation begins to fall and swap rates - the rates banks pay to borrow money - also decline.

The last six weeks have seen mortgage rates rise quickly towards 6%, impacting both buyers and sellers in the housing market. Some buyers, cautious about taking on higher rate mortgages, have stepped back and demand has fallen by 18% in the last two months. This marks a turnaround from the first half of the year, when rates were edging towards 4% and sales increased.

What happens in the housing market for the rest of 2023 all hinges on what happens with mortgage rates. Our Executive Director - Research, Richard Donnell, says: 'Higher mortgage rates have hit home buyer demand, but the impact is not uniform across the country. Southern England is set to experience above average price falls, while some areas may not post any.'

When will mortgage rates go down?

Inflation is now coming down and is currently running at 7.9%, compared with the recent high of 11.1% in October 2022. The Bank of England has stated that it expects it to fall significantly further this year because:

- Wholesale energy prices have fallen significantly

- The price of imported goods is falling as production difficulties ease

- Reduced spending power means less demand for goods and services in the UK

That means it now looks less likely that the Bank of England will need to raise rates as much as financial markets expected just a few weeks ago.

We believe mortgage rates are likely to peak this summer, because swap rates - the rates banks pay to borrow money - have fallen by 0.6% over the last 3 weeks. Swap rates are based on what the markets think the interest rate will be in the future.

Right now, the average mortgage rate for a 5-year fixed rate at 75% loan to value has reached 5.4%, compared to 4% in the Spring. The reduction in swap rates will take time to feed through into mortgage rates, but they could fall below 5% this autumn. That said, there is a risk that mortgage rates may remain higher for longer as the Bank of England works to get inflation back down to 2%.

What does all this mean for house prices?

Higher mortgage rates are having a detrimental effect on house prices, particularly in the south of England where homes are more expensive. However, the decline in buyer demand is not as marked as that seen in the wake of the mini budget. Overall, it's running at 6% below 2019 levels. When looking at the picture year on year, demand is 40% lower than it was this time last year. That said, the number of actual sales being agreed is only 17% lower, as buyers and sellers currently in the market remain committed to moving home.

Southern England, where the average house price is over £300,000, is being hit hardest in terms of prices. House prices here are falling by up to 0.6% year-on-year. However in the Midlands, Northern England, Wales and Scotland, where properties are cheaper, the picture is brighter and homes are registering growth of over 1% year-on-year. In Scotland, homes are up 2%.

On average across the UK, house price inflation is currently running at just 0.6%, whereas this time last year it was running at 9.6%.

First-time buyers are also feeling the strain of higher mortgage rates, weakening demand at the bottom end of the housing ladder.

'Weaker buyer demand will push down prices over H2 2023,' says Donnell. 'We expect modest price falls over the coming months, with UK house prices expected to fall by up to 5% over 2023. This would mean that prices are still 15% higher than at the start of the pandemic. Even if mortgage rates fall back into the 4-5% window later this year and into 2024 H1, we expect house price growth to remain very low for the next 1-2 years.'

Key takeaways

- Mortgage rates are set to peak this summer and look likely to return to 4-5% this autumn

- However, there is a risk that rates may stay higher for longer

- Higher mortgage rates have hit buying power in the south of England hardest

The 25 locations where homes sell the fastest in July 2023

We track the speed of property sales in the UK. We can tell you where homes are selling the fastest in July 2023.

We track the speed of property sales in the UK - the time it takes from a property being listed for sale to being sold subject to contract.

Our latest analysis into how long it takes to sell a house shows that UK homes are selling in 30 days on average.

But some homeowners could expect to sell in just 21 days, depending on where you live.

With all this data to hand, we can estimate how long it’d take to sell your house. Just track your home and head to your local market stats.

Time to sell a UK home matches the 5-year average

The current average sell time of 30 days is in line with the 5-year average and one day slower than in January 2023.

The amount of time a property spends on the market is a very seasonal measure. Generally, you’ll sell more quickly in the first half of the year than the second half.

However, the current time to sell is 10 days slower than this time last year, when more people were moving after the pandemic.

Higher mortgage rates, cost-of-living pressures and lower consumer confidence have hit buyer demand, which is translating into slower sales across much of the country.

The 25 fastest locations to sell a home in the UK

With value for money now playing a much bigger role in the housing market, there’s been a great deal of change to our list in the last year.

Only 8 of last year’s fastest housing markets are still in the top 25. Demand has dropped in locations that saw fast sales - and subsequently strong price growth - in 2022.

| Local authority area | Region | Average time to sell a home (days) | 5-year average time to sell a home (days) |

|---|---|---|---|

| Eden | North West | 21 | 32 |

| Newcastle upon Tyne | North East | 21 | 28 |

| Bristol | South West | 22 | 23 |

| Carlisle | North West | 22 | 28 |

| Knowsley | North West | 22 | 24 |

| Waltham Forest | London | 22 | 22 |

| Cardiff | Wales | 23 | 25 |

| North Tyneside | North East | 23 | 30 |

| Sheffield | Yorkshire and The Humber | 23 | 25 |

| Stoke-on-Trent | West Midlands | 23 | 24 |

| Gateshead | North East | 24 | 30 |

| Halton | North West | 24 | 27 |

| Newcastle-under-Lyme | West Midlands | 24 | 25 |

| Plymouth | South West | 24 | 26 |

| South Gloucestershire | South West | 24 | 25 |

| Woking | South East | 24 | 23 |

| Allerdale | North West | 25 | 32 |

| Bexley | London | 25 | 28 |

| Birmingham | West Midlands | 25 | 25 |

| Cambridge | East of England | 25 | 30 |

| Colchester | East of England | 25 | 27 |

| Copeland | North West | 25 | 32 |

| Methyr Tydfil | Wales | 25 | 31 |

| North East Derbyshire | East Midlands | 25 | 27 |

| Salford | North West | 25 | 22 |

rolling median time to sell, April to June 2023

Sale times slow where house prices rose sharply in 2022

Fast-moving housing markets tend to see above-average house price growth, as buyers compete for fewer houses.

But now mortgage rates are higher, many of last year’s fastest markets have slowed down. Buyers are increasingly unable to afford those places where homes sold the fastest and prices rose the most.

Southern locations are particularly affected due to the higher average house prices. Dartford, Exeter, Luton and Ipswich have all fallen off the list since last July.

The Midlands is seeing the same trend with homes selling more slowly in Rugby, Worcester, Coventry and Redditch.

And it’s a similar story in the North West, with buyers now turning away from the areas they were after last year, like central Manchester, Bury, Wigan and Chorley.

Properties selling fastest in new affordable locations

Different areas have risen to the top of our fastest-markets list as buyers find more value in new locations.

In the North West, buyers are moving the fastest in parts of Cumbria, with Eden, Carlisle, Allerdale and Copeland all appearing on our list for the first time.

Three parts of Newcastle make the list this year when nowhere in the North East featured a year ago. Homes in the city centre, North Tyneside and Gateshead are selling in 21, 23 and 24 days respectively.

In the West Midlands, homeowners are selling the quickest in Stoke-on-Trent, Birmingham and Newcastle-under-Lyme.

Cardiff and Merthyr Tydfil have sale times of 23 and 25 days, replacing last year’s Welsh entries of Neath Port Talbot and Bridgend.

Bexley and Waltham Forest - both in East London - offer relative affordability for Londoners, while the commutability of Woking, Basingstoke, Colchester and Cambridge is likely contributing to their fast sale times.

East Midlands and East of England see biggest slowdown in time to sell

When we look at regional trends, the East Midlands and the East of England have seen the biggest slowdown in time to sell. Homes now take 4 and 3 more days to sell respectively than they usually would have over the last 5 years.

Meanwhile, the North East, West Midlands and South West are the only 3 regions where homes are selling more quickly than the UK average.

It takes 27 days to sell a property in the North East - 5 days quicker than its 5-year average of 32 days.

Homes in the West Midlands have a 28-day sell time. This is a little slow for this region, as its average sell time over the last 5 years was 27 days.

The South West comes in at 29 days - quicker than the UK average, but a day slower than you’d expect in the region over the last 5 years.

At the bottom end of the table, homes in London and the South East are selling the slowest. It takes 35 and 34 days on average, although these are both only one day slower than their 5-year averages.

| Region | Average time to sell a home (days) | 5-year average time to sell a home (days) |

|---|---|---|

| North East | 27 | 32 |

| West Midlands | 28 | 27 |

| South West | 29 | 28 |

| North West | 30 | 29 |

| Wales | 30 | 31 |

| Yorkshire and the Humber | 30 | 28 |

| East Midlands | 34 | 30 |

| South East | 34 | 33 |

| East of England | 35 | 32 |

| London | 35 | 34 |

rolling median time to sell, April to June 2023

How long does it take to sell a house after you’ve agreed an offer?

Our data only looks at the time it takes between a property being listed for sale and being sold subject to contract.

After that, there’s still a lot that needs to happen before you can move.

The conveyancing and mortgage application process usually takes between 3 and 4 weeks, but it might be longer - especially if you’re in a chain.

Then you’ll exchange contracts, which is when you and the buyer are both legally locked into the sale.

The day you’re really waiting for is completion day, when you hand over the keys. This usually happens 1 to 3 weeks after exchange. But like a lot of things in the home moving process, it can be quicker or slower than that.

Key takeaways

- The average time to achieve a sale in the UK is 30 days, which was also the average speed over the last 5 years

- A year ago, UK homes were selling in an average of 19 days due to greater competition among buyers

- Only 8 of last year’s fastest areas remain in this year’s top 25 locations as buyers seek value for money in different places

- The major cities where properties sell the fastest are Newcastle, Bristol and Cardiff

- The North East of England is the fastest moving region in the country with homes selling in 27 days on average

Which areas are experiencing an increase in house prices?

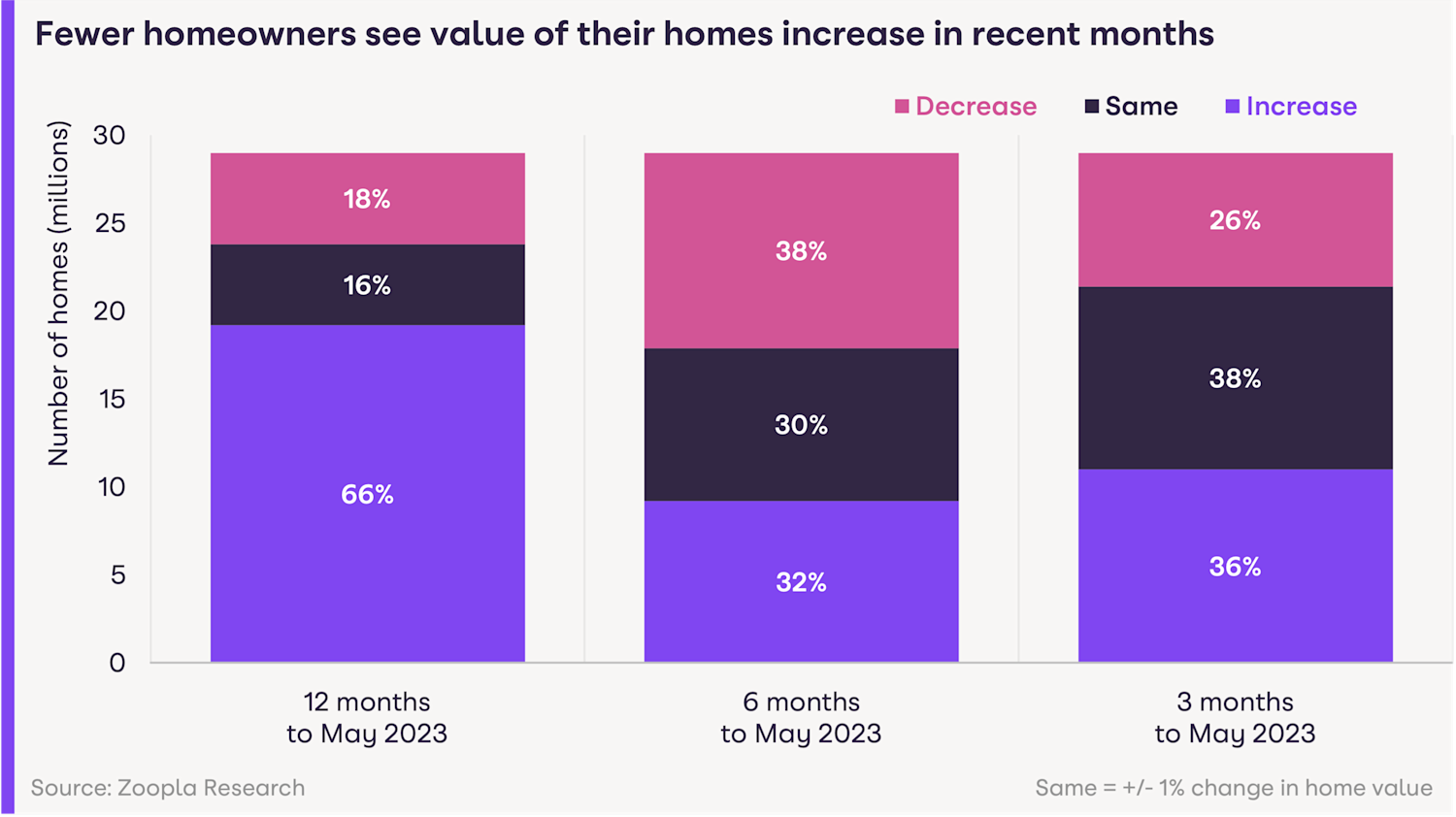

With two-thirds of homes experiencing a rise in value over the past year, is it possible that yours is among them?

we track the value of 30 million homes, updating our estimates every month.

Our latest analysis shows that the value of UK housing remains healthier than many may have anticipated.

In the last year, 2 out of every 3 homeowners saw the value of their home increase by at least 1%.

It’s a piece of positive news for many homeowners and sellers, who may have anticipated a different outcome.

However, house prices are now rising at a very slow pace - and some homes are posting small price falls.

Executive Director - Research, says: ‘Homeowners thinking about moving will be reading the news headlines but national averages can be dangerous when making decisions on your own home.

‘The reality is that market conditions can vary widely by local area and property type.’

Home values hold steady

From February 2020 to June 2022, the average UK home increased in value by an almost unprecedented £48 per day, adding around £36,000 to the overall value on average.

But the last 12 months tell a different story.

The average UK home has since increased by £19 per day, adding around £7,000 on average.

While our latest analysis shows 2 in every 3 homes increased in value by at least 1% over the last year, when looking at the last 6 months, this slows to just 1 in 3.

And falling values are increasing, with 1 in 4 homeowners experiencing a value loss of £7,700 (around 2.6%).

This shows that the impact of weaker demand is now affecting house prices.

Why aren’t house prices rising much any more?

Since the middle of last year, the economic backdrop has become more challenging, impacting housing value growth.

Tripling mortgage rates over the last 18 months and cost-of-living pressures are adding to the squeeze on household budgets, leading to weaker demand for homes.

That means the huge growth in house prices we saw over the pandemic years has now stalled and property prices are rising very slowly.

With anticipated price corrections, we expect more homeowners to see either more limited gains or modest decreases in their home values over the coming months.

Where are homes going up in value in the UK?

The impact of recent value changes will be felt differently across the country.

In northern England, the Midlands and Wales, 4 in 10 homeowners saw the value of their homes grow since November 2022.

Yorkshire and the Humber has four postal areas in the top 10 regions where values are up: Halifax (67%), Wakefield (65%), Huddersfield (59%) and Bradford (52%).

Top 10 regions where house prices are rising

| Postal area | Region | Proportion of homes with value increase since Nov 2022 | Number of homes increasing in value |

|---|---|---|---|

| Halifax | Yorkshire & The Humber | 67% | 40,000 |

| Derby | East Midlands | 65% | 1,734,000 |

| Wakefield | Yorkshire & The Humber | 65% | 126,000 |

| Huddersfield | Yorkshire & The Humber | 59% | 55,000 |

| Wolverhampton | West Midlands | 57% | 75,000 |

| Dorchester | South East | 56% | 46,000 |

| Chester | North West | 54% | 129,000 |

| Galashiels | Scotland | 53% | 16,000 |

| Hereford | West Midlands | 52% | 32,000 |

| Carlisle | North West | 52% | 62,000 |

| Bradford | Yorkshire & The Humber | 52% | 104,000 |

Zoopla

However it’s a different picture in southern England, Scotland and Northern Ireland, where only 1 in 4 homes has increased in value (3.1million).

In London, the South East and Eastern regions, 1 in 5 homes has increased in value.

That’s because property values in the south are higher, often exceeding £300,000, which means people need bigger mortgages to buy them.

With mortgage rates currently high buyers are wary, reducing demand for these more expensive homes.

From the South, only Dorchester makes our top 10, where 46,000 homes have increased in value since November 2022.

And homeowners holding off their next move until they grow more equity are unlikely to see meaningful additions in the coming months.

What types of homes are holding their value?

As cost-of-living pressures intensify, many buyers are looking for more affordable properties.

Smaller homes - terraced houses, semi-detached homes and apartments - are keeping their values better than the more expensive detached houses and bungalows.

But location is key.

Semis in Yorkshire, where 4 in every 5 homes have held or increased their value, are doing better than elsewhere in the UK.

In Scotland, only 50% of semi-detached homes have held or increased their value.

Flats are also holding up more than detached houses or bungalows, especially in the affordable markets that attract value-conscious buyers.

In Darlington, Lincoln and Wolverhampton, only 1 in 14 flats has lost any value.

Terraced homes are also holding their own, with more than 64% holding or gaining value since November 2022, especially in cities like Manchester, Leeds, Birmingham and Bristol.

However, the larger homes which became so popular during the pandemic: spacious detached houses, 4-bed homes and bungalows, are now less appealing to buyers, as they become more value-conscious in the face of rising mortgage rates and cost of living pressures.

And prices are adapting accordingly. More than 43% of detached houses and 42% of bungalows have lost 1% of their value in the last 6 months.

Coastal areas like Brighton, Norfolk and Southend-on-Sea are feeling the pinch, where 7 in 10 bungalows are losing value.

Sellers with bigger homes should be prepared for buyers wanting to negotiate harder on the prices.

That said, given the strong value gains these homes experienced during the pandemic, the growth in equity achieved may soften the impact of price reductions without limiting budgets for the next move.

Conclusion

What’s happening in the UK housing market is quite complex at the moment.

Home values are moving in different directions within different local contexts.

The state of the local economy, facilities in the area and differences in the types of homes available will continue to influence home values.

Key takeaways

- The average UK home has gone up £19 a day in value over the last 12 months, an annual increase of £7,000

- A third (9.2million) of UK homes saw their value increase in the last 6 months

- A further third of homes held their value

Properties Experiencing Significant Value Decline in June 2023

Introducing our "Value of Housing" report, which meticulously monitors the value fluctuations of 29 million homes across the UK. In the latest update for June 2023, we bring attention to the specific types of properties and locations that have experienced a decline in value.

More than a third of UK homes have lost value in the last 6 months, wiping £85 million from the housing market.

That’s 11.1 million properties that are less expensive than they were last November, each losing an average of £7,700.

But UK homes are split almost equally between those gaining value (32%), those seeing no real change (30%) and those losing value (38%) over the last six months.

So what types of properties are losing the most value? Are detached houses finally better value for money?

And where exactly should you look if you want to get a bargain?

We’ve got all the answers for you, whether you’re looking to buy your first house or your forever home.

After all, we track the value of 29 million homes in the UK - even if they’re not on the market.

So let’s see what type of property you should set your sights on - and which locations - to benefit from the latest shift in the UK housing market.

Which kinds of properties are losing value in June 2023?

The search for space has well and truly dwindled, and more larger homes are losing value than smaller ones in the UK.

Over the last 12 months, buyers have been scaling back their home requirements as the economics of buying a home have become more challenging.

It’s in stark contrast to 2020 to 2022, when extra space became the top need for buyers and high demand for larger properties boosted their value growth.

If you want to upsize from a smaller home, flat or terraced house, your current home should hold its value and you’re more likely to get money off a larger home.

43% of detached houses have fallen more than 1% value

Detached houses are losing value more than any other property type in the UK, with 43% losing at least 1% in the last 6 months.

Detached homes with falling values are most common in the St Albans, Perth and Worcester areas, where they make a 9 in 10 of such homes.

7 in 10 bungalows fall in value in the last 6 months

Bungalows account for 8% of all UK homes and 7 in 10 bungalows have recorded a fall in prices since November 2022.

Coastal areas such as Brighton, Norfolk and Southend-on-Sea are seeing the most hits to bungalow prices.

Homes losing value in the South of England, Northern Ireland and Scotland

In some respects, home values are more about where you want to buy a home, rather than what sort of house you want to live in.

The South of England, Northern Ireland or Scotland have the highest proportions of homes losing value, giving buyers the opportunity to buy at a lower price in these locations.

On the other hand, the most homes are rising in value in Northern England, Wales and the Midlands.

The top 10 locations where homes are losing value

While some regions are faring better than others, there’s a lot of complexity in the current UK housing market.

Home values move in different directions within different local contexts, such as the state of the local economy, local facilities and types of homes.

For example, West Central London is seeing a huge 68% of its homes lose value, with an average fall of £13,000 since November 2022.

One key trend we’re seeing is a fall in property values in coastal locations in the South of England.

| Postcode area | Region | Proportion of homes with value decrease since November 2022 | Number of homes decreasing in value |

|---|---|---|---|

| West Central London (WC) | London | 68% | 7,000 |

| Colchester (CO) | East of England | 67% | 109,000 |

| Canterbury (CT) | South East | 66% | 28,000 |

| Kilmarnock (KA) | Scotland | 65% | 19,000 |

| Norwich (NR) | East of England | 64% | 33,000 |

| Brighton (BN) | South East | 63% | 35,000 |

| Southend-on-Sea (SS) | East of England | 62% | 24,000 |

| Torquay (TQ) | South West | 59% | 25,000 |

| Truro (TR) | South West | 59% | 27,000 |

| Blackpool (FY) | North West | 58% | 21,000 |

Value of Housing Report - June 2023, Zoopla

67% of properties in Colchester (109,000 homes) have lost value by more than 1% in the last 6 months, while 66% have fallen in value in Canterbury.

Many homes in Norwich and Southend-on-Sea have also lost value - 64% and 62% respectively - while 63% of Brighton properties have lost value since November 2022.

Torquay and Truro in the South West also make the list, with 59% of homes in these areas declining in value over the last 6 months.

Buying a home that’s falling in value: what to think about

Your first thought when you see that home values are falling might be that it’s a good time to buy and get a bargain.

This is true to an extent, but you’ll also need to consider any potential for negative equity, as well as the fact that you’re likely to pay a higher mortgage rate now.

Negative equity unlikely with 5% house price falls this year

Our data suggests that house prices will fall by 5% over the course of 2023.

That means you’re unlikely to move into negative equity if you were to buy today - as long as your loan-to-value ratio is lower than 95%.

However, it’s worth knowing that the years of strong price growth are behind us.

It’s always best to buy your next home based on your personal needs and circumstances, rather than looking to make gains or play the market.

A high fixed rate might be worth a lower property price

Higher mortgage rates might be limiting your move right now, and understandably so.

Our recent analysis showed that buying power is hit by up to 20% with a 6% mortgage rate compared to a 4% one - which is putting a strain on home buyers despite falling house prices.

Our mortgage calculator can help you work out how your monthly repayments are impacted by a higher mortgage rate.

Adrian Anderson from property finance specialists Anderson Harris says a high fixed rate mortgage may be worth it now prices are falling, if you’re sure you can afford it.

“It’s usually better to purchase a property at a lower purchase price with a more expensive mortgage in the short term, than pay a higher price for a property and a cheaper mortgage in the short term.”

Always talk to a specialist mortgage advisor to understand the best option for you.

Look for value-adding potential to buck the trend

One way to offset potential price falls for a home you buy is to consider its value-adding potential.

By renovating a doer-upper, you can buy for a lower price and look to increase your return when you sell.

Key takeaways

- Over the last 6 months, 11.1 million or a third of UK homes have decreased in value by at least 1%

- Larger detached homes and bungalows are more likely to be falling in value than any other property type

- Some coastal areas in the South of England are seeing more than 65% of their homes lose value

- Across UK regions, home values are falling the most in the South of England, Scotland and Northern Ireland

- If you want to buy a home that’s dropping in value, think about the risk of negative equity and the impact of higher mortgage rates

The future of energy efficient homes

Our homes are the second-highest producers of carbon every year in the UK. New-build developers want to change that. Here's how.

From avoiding single-use plastic to upgrading to an all-electric car, as a nation we’re becoming increasing environmentally conscious – even when considering a house move.

Research continually shows that buyers are prioritising the energy performance of new homes, but what about carbon emissions?

All buildings in the UK are the second highest carbon emissions contributor, with residential properties making up a large proportion of this.

However, the country’s home builders are taking action to produce increasingly ‘green’ homes, powered by less energy to help reduce the UK’s carbon emissions and save household running costs.

Our Watt a Save July 2023 report finds the average new-build property consumes 55% less energy, cutting energy bills by £135 a month and reducing carbon emissions by an impressive 60%.

This is despite new-build homes being larger than older properties.

With 247,000 new-build homes issued with an EPC in the year to 31 March 2023, we can see that last year’s new-build homeowners helped to reduce emissions by a collective 500,000 tonnes, compared to if they had been built to the same standards as the average older property.

Why are new builds better for the environment?

New-builds have long offered a cheaper and more environmentally option for the running of a home.

Improved energy efficiency is embedded from the point of design through to construction, thanks to the use of modern building practices, technologies and materials.

Energy usage and carbon emissions: new-builds vs traditional homes

| Property type | Energy usage (kWh) | Bills | Carbon emissions (tonnes) |

|---|---|---|---|

| New-build | 9,400 | £1,320 | 1.4 |

| Existing | 21,000 | £2,950 | 3.6 |

| Saving | 11,600 | £1,630 | 2.2 |

| % Saving | 55% | 55% | 60% |

Home Builders Federation

Additionally, more rigorous building standards exist now than ever before.

Last year, changes to building regulations were introduced to set standards specifically related to the energy performance of buildings.

Our research has found that homes now built to these standards will emit 71% less carbon than the average older property.

And the energy savings and carbon reductions won’t stop there.

In 2025, the Future Homes Standard is due to come into force which will require new homes to reduce carbon emissions by a further 75% to 80% on current building regulations.

This will partly be achieved by moving away from the use of conventional gas boilers to modern heating systems, like heat pumps.

In other words, homes built from 2023 will emit 29% of the amount of carbon of the average existing property, and homes built from 2025 will emit just 10%.

If we assume that housing delivery levels in 2025 are around the same as current levels, under the Future Homes Standard, the changes to new homes will see carbon emissions reduced by a further 270,000 tonnes per year.

What does this mean for home buyers?

In recent years, a high EPC rating has crept up the lists of priorities for prospective buyers – particularly those purchasing their first home.

Amid the cost-of-living pressures and with energy bills still stubbornly high, potential customers are also driven by the running costs of a home.

Research we published earlier this year found that 53% of respondents agree that lower utility bills and running costs would encourage them to buy a new home.

The reduction in carbon emissions that new build homes offer come from consistent improvements to the energy efficiency of homes.

In the year to March 2023, 85% of new-build homes were rated A or B for energy performance, while just 4% of existing properties reached the same standards.

Unsurprisingly, this improved energy performance translates to significantly lower utility bills.

In the year to March 2023, the average older property saw monthly energy bills of around £245, while the average new-build energy costs were £110 – a 55% saving.

And as we move towards greener homes, these savings will only become greater. Under the Future Homes Standard mentioned above, a new-build property will use 12% of the amount of energy compared to an older home.

Despite future new homes being 100% electric – which is a more expensive source of energy than gas – it’s anticipated a new-build property built after 2025 will cost a little less than £900-a-year to power.

This is just 30% of the cost of the average existing property which, using a mix of electricity and gas, will cost £2,945 a year.

What next?

As you might know if you are in the process of applying for a mortgage, the affordability criteria are somewhat inflexible.

So, despite the enormous potential savings of high performing energy and thermal-efficient homes, affordability assessments are based on the same assumptions about monthly utility costs. That needs to change.

We’re trying to encourage lenders to develop mortgage products that offer tangible, financial incentives for home buyers to make environmentally conscious, energy-saving choices. Which will in turn support more people to get on that property ladder and become homeowners.

In the meantime, this year’s new homeowners can enjoy lower energy usage, reduced carbon emissions, cheaper energy bills and less eco-guilt so they can get on with living. Sounds ideal to me.

Key takeaways

- New homes built from 2023 will emit 29% of the amount of carbon of the average existing property

- Homes built from 2025 will emit just 10%

- From 2025, the energy bills for a new-build home are projected to be under £900-a-year, compared to £2,945-a-year for an older home