With two-thirds of homes experiencing a rise in value over the past year, is it possible that yours is among them?

we track the value of 30 million homes, updating our estimates every month.

Our latest analysis shows that the value of UK housing remains healthier than many may have anticipated.

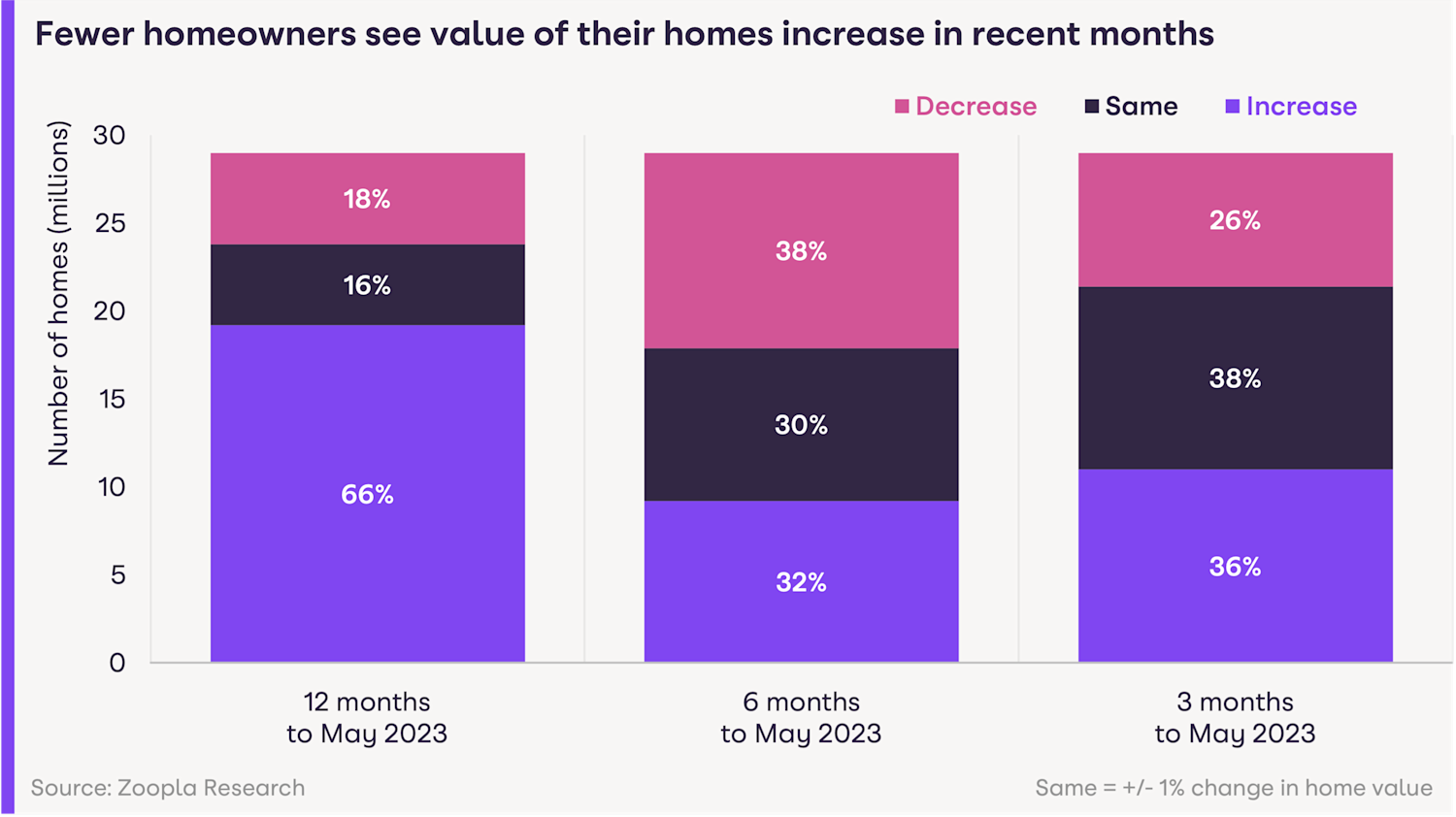

In the last year, 2 out of every 3 homeowners saw the value of their home increase by at least 1%.

It’s a piece of positive news for many homeowners and sellers, who may have anticipated a different outcome.

However, house prices are now rising at a very slow pace – and some homes are posting small price falls.

Executive Director – Research, says: ‘Homeowners thinking about moving will be reading the news headlines but national averages can be dangerous when making decisions on your own home.

‘The reality is that market conditions can vary widely by local area and property type.’

Home values hold steady

From February 2020 to June 2022, the average UK home increased in value by an almost unprecedented £48 per day, adding around £36,000 to the overall value on average.

But the last 12 months tell a different story.

The average UK home has since increased by £19 per day, adding around £7,000 on average.

While our latest analysis shows 2 in every 3 homes increased in value by at least 1% over the last year, when looking at the last 6 months, this slows to just 1 in 3.

And falling values are increasing, with 1 in 4 homeowners experiencing a value loss of £7,700 (around 2.6%).

This shows that the impact of weaker demand is now affecting house prices.

Why aren’t house prices rising much any more?

Since the middle of last year, the economic backdrop has become more challenging, impacting housing value growth.

Tripling mortgage rates over the last 18 months and cost-of-living pressures are adding to the squeeze on household budgets, leading to weaker demand for homes.

That means the huge growth in house prices we saw over the pandemic years has now stalled and property prices are rising very slowly.

With anticipated price corrections, we expect more homeowners to see either more limited gains or modest decreases in their home values over the coming months.

Where are homes going up in value in the UK?

The impact of recent value changes will be felt differently across the country.

In northern England, the Midlands and Wales, 4 in 10 homeowners saw the value of their homes grow since November 2022.

Yorkshire and the Humber has four postal areas in the top 10 regions where values are up: Halifax (67%), Wakefield (65%), Huddersfield (59%) and Bradford (52%).

Top 10 regions where house prices are rising

| Postal area | Region | Proportion of homes with value increase since Nov 2022 | Number of homes increasing in value |

|---|---|---|---|

| Halifax | Yorkshire & The Humber | 67% | 40,000 |

| Derby | East Midlands | 65% | 1,734,000 |

| Wakefield | Yorkshire & The Humber | 65% | 126,000 |

| Huddersfield | Yorkshire & The Humber | 59% | 55,000 |

| Wolverhampton | West Midlands | 57% | 75,000 |

| Dorchester | South East | 56% | 46,000 |

| Chester | North West | 54% | 129,000 |

| Galashiels | Scotland | 53% | 16,000 |

| Hereford | West Midlands | 52% | 32,000 |

| Carlisle | North West | 52% | 62,000 |

| Bradford | Yorkshire & The Humber | 52% | 104,000 |

Zoopla

However it’s a different picture in southern England, Scotland and Northern Ireland, where only 1 in 4 homes has increased in value (3.1million).

In London, the South East and Eastern regions, 1 in 5 homes has increased in value.

That’s because property values in the south are higher, often exceeding £300,000, which means people need bigger mortgages to buy them.

With mortgage rates currently high buyers are wary, reducing demand for these more expensive homes.

From the South, only Dorchester makes our top 10, where 46,000 homes have increased in value since November 2022.

And homeowners holding off their next move until they grow more equity are unlikely to see meaningful additions in the coming months.

What types of homes are holding their value?

As cost-of-living pressures intensify, many buyers are looking for more affordable properties.

Smaller homes – terraced houses, semi-detached homes and apartments – are keeping their values better than the more expensive detached houses and bungalows.

But location is key.

Semis in Yorkshire, where 4 in every 5 homes have held or increased their value, are doing better than elsewhere in the UK.

In Scotland, only 50% of semi-detached homes have held or increased their value.

Flats are also holding up more than detached houses or bungalows, especially in the affordable markets that attract value-conscious buyers.

In Darlington, Lincoln and Wolverhampton, only 1 in 14 flats has lost any value.

Terraced homes are also holding their own, with more than 64% holding or gaining value since November 2022, especially in cities like Manchester, Leeds, Birmingham and Bristol.

However, the larger homes which became so popular during the pandemic: spacious detached houses, 4-bed homes and bungalows, are now less appealing to buyers, as they become more value-conscious in the face of rising mortgage rates and cost of living pressures.

And prices are adapting accordingly. More than 43% of detached houses and 42% of bungalows have lost 1% of their value in the last 6 months.

Coastal areas like Brighton, Norfolk and Southend-on-Sea are feeling the pinch, where 7 in 10 bungalows are losing value.

Sellers with bigger homes should be prepared for buyers wanting to negotiate harder on the prices.

That said, given the strong value gains these homes experienced during the pandemic, the growth in equity achieved may soften the impact of price reductions without limiting budgets for the next move.

Conclusion

What’s happening in the UK housing market is quite complex at the moment.

Home values are moving in different directions within different local contexts.

The state of the local economy, facilities in the area and differences in the types of homes available will continue to influence home values.

Key takeaways

- The average UK home has gone up £19 a day in value over the last 12 months, an annual increase of £7,000

- A third (9.2million) of UK homes saw their value increase in the last 6 months

- A further third of homes held their value