How UK homeowners are coping with higher mortgage rates

Marathon mortgages, cutting pensions and raiding savings: how homeowners are coping as mortgage rates hover at their highest levels for 15 years.

Although mortgage rates have started to come down after continuously increasing since the start of 2022, mortgage costs are still sky high.

The average two-year fixed rate now stands at an eye-watering 6.47% while five-year fixes are at 5.97%, according to data from Moneyfacts.

This means that anyone remortgaging after their fixed rate has ended will get a shock as their monthly mortgage payments shoot up.

And first-time buyers are having to budget for higher mortgage costs than they might have originally expected.

To keep the costs at manageable levels, borrowers are doing what they can.

Research from KPMG’s latest Consumer Pulse survey found that:

-

18% of mortgage holders have used their savings to reduce their outstanding mortgage balance

-

16% have switched to an interest-only mortgage

-

12% have increased their mortgage term

-

And 8% have downsized to a cheaper home.

A worrying figure is that another 11% have said they are paying less into their pensions to cope with higher mortgage costs, while a further 20% are considering doing this, which means they could have less money to live on in retirement.

‘The cost of living and rising interest rates has made life all the more difficult for aspiring buyers and existing homeowners alike,’ says David Hollingworth from mortgage broker London & Country Mortgages.

‘The rapid increase in mortgage rates from the historic lows of only a couple of years ago means that borrowers are facing much higher mortgage costs. Affordability is therefore under fire.’

Marathon mortgages

The number of homeowners choosing to take out ‘marathon mortgages’ with repayment terms of 35 years or more – way beyond the standard term of 25 years – to make their monthly payments more affordable has surged.

Data from credit reference agency Experian shows that a quarter of homeowners under 30 have a mortgage with a term of 35 years or more compared to just one in 10 in 2020.

This means they could still be paying back their mortgage when they’re close to retirement.

Emily Summersgill took out a marathon mortgage from Nationwide through London & Country when she bought her first home.

‘As a first-time buyer I wanted to make sure I had absolute certainty that I could pay both my mortgage and all the new bills that came along with being a homeowner,’ she says.

‘Although I knew my monthly outgoings and that I could afford those, I wanted to be sure I always had enough surplus income to pay for the unexpected – like broken down boilers and leaking pipes. I set my mortgage term at 40 years – the maximum possible and within my retirement age.’

While choosing a lengthy mortgage term may be the only way some people can afford to borrow the amount they need, there are downsides to be aware of, warns Hollingworth.

He says: ‘There is a price to pay as the interest payable over the life of the loan will increase substantially. Shifting to a longer term could add tens of thousands of pounds in interest.

‘For example, a £200,000 25-year mortgage at a rate of 5% would cost £1,169 a month and total interest would amount to £150,754.

'Over 35 years the payment would drop to £1,009 but the total interest would be £223,940.’

Fortunately for Summersgill, while she took out the 40-year term to be sure she would always be able to afford her mortgage, she has been able to overpay to keep the overall interest costs down.

‘After completion I changed my direct debit so that I was overpaying each month as if I had taken out a 25-year mortgage,’ she adds. ‘That left me able to drop down to my minimum 40-year payment as and when unexpected costs arose but, for the most part, I’ve actively overpaid to get the balance down quicker.’

Other ways to reduce mortgage costs

Many of the ways borrowers have been making their mortgage more manageable have downsides.

Switching to an interest-only mortgage, for example, will also increase your overall interest costs.

While you're paying the interest, the amount of mortgage debt won’t shrink and you’ll still need to somehow pay off the loan at the end of the mortgage term.

There are other things you can do that have fewer negatives, though. ‘Arguably, the first place to start in managing payments is to consider whether you could be getting a better deal,’ says Hollingworth.

‘As you approach the end of a current deal, it’s a good idea to get ahead and have an option in place to avoid slipping onto a lender’s standard variable rate, which can be well in excess of 8% and even above 9%. It’s possible to secure a deal up to six months in advance.’

If you can afford it and your mortgage deal allows, you could also overpay if you’re currently still on a relatively low fixed rate, so that your mortgage balance is as low as possible by the time you have to remortgage at a higher rate.

This will help you to get used to spending more on your mortgage payments each month too.

Key takeaways

- With mortgage rates still high, borrowers are doing what they can to be able to afford their mortgage

- Options they’re choosing include extending their mortgage term and switching to interest only

- A quarter of young homeowners now have mortgage terms of 35 years or more

- Many of these options have downsides but there are other things you can do to put yourself in a better position

7 ways to help on World Homeless Day

We’re standing with Crisis’ Make History campaign, which calls for a future free from homelessness. Here’s how you can help this World Homeless Day.

Homelessness is rising. Soaring bills, rising rents and a lack of affordable housing are making it harder for us all to have a safe, secure and affordable home.

But it doesn’t have to be this way. We’re standing with Crisis’ Make History campaign, which calls for a national mission to end homelessness.

We need the UK government and all political parties to commit to ending all forms of homelessness.

Join the Make History campaign: add your name to help build a future free from homelessness.

While we’re calling for major change, there are ways we can all help in our communities.

Here are some key ways to help, what to do if someone you know is at risk, and what to do if you see someone sleeping rough.

How to help with homelessness in the UK

1. Donate

We’re all feeling the squeeze, but even a small donation has a big impact on the fight against homelessness.

A few spare quid each month can help fund essential services and train specialist coaches who work closely with people experiencing homelessness.

Your money can help them learn how to manage housing, benefits, wellbeing and work, and set them on a path out of homelessness.

You can donate to Crisis or other homelessness charities.

2. Fundraise

Fundraising is a fun and effective way to join the mission to end homelessness.

There’s a whole world of ways to do it, whether you rally your colleagues at work, fundraise for a race or hold an event.

Or go your own way and get creative. You can fundraise any way you like, from organising a bake-off to hosting a film night.

Charities rely on fundraising to raise most of their income, so you’ll make a difference no matter how much you raise.

3. Volunteer

There’s a local volunteering opportunity for everyone who wants to help fight homelessness.

You could organise donations, look after a shop floor, or give direct coaching in education, employment, housing or health.

After a short application process, you’ll take core training modules on topics like safeguarding, equality and diversity, and data protection.

Volunteering is a great way to build your skills and get stuck in for a fantastic cause.

How to help if someone you know is at risk of homelessness

4. Call Shelter

Shelter is the first port of call if you or someone you know is at risk of homelessness.

It offers a range of support, including one-to-one advice, online chat and lots of resources that could help.

Visit Shelter England or Shelter Scotland, or call its free helpline on 0808 800 4444.

5. Get in touch with other support services

People lose their homes for lots of different reasons. Rising pressure from high rents and low pay, or sudden life events like losing a job or family breakdown, can quickly force people into homelessness.

Whatever someone’s going through, there are some free services that can help – including:

How to help if you see someone sleeping rough

6. Contact StreetLink or Simon Community

Let a specialist charity know if you see someone forced to sleep rough on the street.

Contact Streetlink in England or Wales, or Simon Community in Scotland.

They’ll send someone out to find them, and will connect them with local services to keep them safe.

When you call, give the person’s location, as well as their estimated age, gender, appearance and any belongings they have with them. It can also help to mention if they look unwell or at risk of harm.

7. Stop for a chat

Rough sleeping is both dangerous and isolating, and it often leads to mental and physical health problems.

If you feel comfortable, stop for a chat or say hello to someone who is forced to beg or rough sleep. It might be the only contact they have that day.

Give money or food

When it comes to giving someone change or food, make the decision that feels right for you.

And always consider if it’s the best way to support them. It might be that sharing information or suggesting a service is a better option.

Some people buy gift vouchers from shops to give to people who are having to sleep rough.

If you want to buy them a cup of tea or something to eat, ask them what they’d like first to make sure it’s right for them.

Most importantly, don’t let stereotypes influence your judgement of an individual.

Share information

Giving information can be an excellent way to support someone who is experiencing homelessness.

But bear in mind that some people might find it hard to take in detailed information. Or they might be wary of support services because of past experiences, which can result in frustration or distress.

So before you go ahead, ask if they’d find information useful and make sure you’re both comfortable and safe.

If they’re happy to chat, you could recommend they approach their local authority’s housing team.

Councils have an obligation to advise and assist people who are homeless or about to become homeless. Find your local council.

Another option is calling or visiting their local Crisis Skylight centre, if there’s one nearby.

You can find more local homelessness services – and sometimes make a direct referral – on databases like:

Shelter has advice on getting into a hostel or night shelter in England and emergency accommodation in Scotland.

Or you can search for a night shelter on The Pavement.

Rents for new lets rise 10.3% over the last year

The average rent for a new tenancy has increased by 10.3% since September 2022, with renters now paying £1,164 per month on average.

An ongoing supply-demand imbalance continues to push rents higher, despite demand for rental properties peaking earlier than usual this summer.

Over the last year, the average rent for a new tenancy has increased by 10.3% to stand at £1,164 per month.

The average annual rental bill is now £1,320 higher than a year ago at nearly £13,970 a year, compared to £12,670 last September.

This marks the 19th consecutive month of our index reporting a rental inflation of over 10%.

Rental growth for renters staying in their existing home is much lower at 5.5%, according to the Index of Rental Prices from the Office for National Statistics.

Rental inflation in Scotland boosted by rent controls

Scotland is registering the highest level of rental inflation in the UK at 12.8%.

Landlords in Scotland are maximising rents for new tenancies to cover increased costs and allow for the fact that future rent increases will be limited over the life of the tenancy.

The average rent in Scotland is now £750 per month, which is £90 higher than a year ago.

Rental inflation in Scotland has now started to moderate from 13.7% six months ago, but we expect the above-average rental inflation to continue.

Rents are growing at the fastest rate in the cities of Edinburgh (16.3%), Dundee (14.6%) and Glasgow (13.6%). Renters looking for new lets in areas neighbouring Edinburgh and Glasgow are also seeing double-digit increases compared to August 2022.

| Region | Annual rental price change (%) | Annual rental price change (£) | Average rent (per calendar month) |

|---|---|---|---|

| United Kingdom | 10.3% | £110 | £1,164 |

| Scotland | 12.8% | £90 | £750 |

| London | 11.5% | £210 | £2,055 |

| North West | 11.3% | £80 | £796 |

| Wales | 10.2% | £80 | £815 |

| West Midlands | 10.1% | £80 | £853 |

| East of England | 9.8% | £100 | £1,112 |

| East Midlands | 9.8% | £70 | £817 |

| South East | 9.8% | £110 | £1,254 |

| North East | 9.2% | £50 | £649 |

| Yorkshire and the Humber | 8.3% | £60 | £759 |

| South West | 8.1% | £80 | £1,017 |

| Northern Ireland | 4.4% | £30 | £744 |

Zoopla Rental Index, September 2023

Cardiff, Southampton and York are now £1,000 rent cities

The number of cities in which renters pay more than £1,000 per month on average when they start a new tenancy is growing.

In 2023, new additions to this group were Southampton and York, where it now costs £1,057 and £1,045 per month to rent a home.

The latest place to join the club is Cardiff, where average rents increased by 11.2% over last year to reach £1,012.

High rents in London makes renting expensive, pushing demand into more affordable areas. This boost in demand in commuter areas in the South East has led to an increase in the number of commutable towns with average rents exceeding £1,000.

Here are the towns and cities where average rents on new lets have just breached £1,000 per month.

| Town/city | Average rent (per calendar month) | Annual rental price change (%) | Annual rental price change (£) |

|---|---|---|---|

| Worthing | £1,104 | 10.7% | £110 |

| Basingstoke | £1,096 | 11.3% | £110 |

| Luton | £1,096 | 15.3% | £150 |

| Southend-on-Sea | £1,085 | 9.3% | £90 |

| Eastbourne | £1,046 | 7.6% | £70 |

| Colchester | £1,044 | 6.0% | £60 |

Rental Index, September 2023

Manchester next in line to become a city with £1,000 average rent

Manchester is in the top 5 for cities recording the highest rates of rental growth.

Average rents in the city are £996 per month, making it the most expensive city to rent in northern England. We can expect average rent to increase to £1,000 by the end of this year.

Central Manchester, Trafford and Salford already have average rents in excess of £1,000.

Higher rents in these central Manchester areas are likely to turn value-seeking renters towards neighbouring areas such as Bolton, Oldham or Rochdale. This will boost demand and is likely to lead to rental growth in those areas as well.

What are renters doing to minimise the impact of higher rents?

Faced with higher rents and limited supply of homes on the market, renters are more commonly considering renting smaller homes, moving to cheaper areas or sharing a property with other renters to reduce costs.

House sharing reduces the cost per renter but comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We expect rental inflation to remain above 9% for the rest of the year, as earnings growth remains strong while high mortgage rates stop many renters from moving into home ownership.

We anticipate national rental growth of 5% to 6% in 2024. Cities are likely to continue registering rental inflation above this level.

Key takeaways

- Residential rents for new tenancies are 10.3% higher than in September 2022

- Rents have increased the most in Scotland, where new rent controls are encouraging landlords to secure higher rents at the start of a tenancy

- More cities have breached the £1,000 average rent mark - new additions include Cardiff, Southampton and York

- Average rent in Manchester is on track to reach £1,000 by the end of 2023

Southerners searching further for their next home while Northerners stay local

The average buyer looks for their next home 3.9 miles down the road, but people in the south and in cities are much more likely to spread their wings.

As a nation we don't look far for our next home. We tend to think local first, and search in areas that we know and love.

But looking in a wider search area may give you more affordable options or help you buy a bigger property.

Let’s explore the trends in how far people are looking to move and how this varies across the country.

People search for a home 3.9 miles away on average

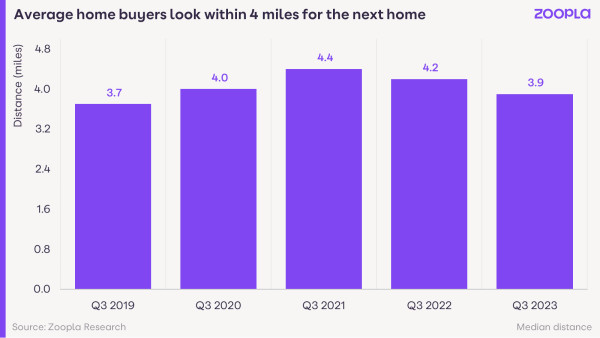

Our data shows that the average buyer is looking for their next home 3.9 miles down the road, while 3 in 4 people only enquire on homes in one or two neighbourhoods.

In 2021, the distance between someone's home and a home they enquired about was slightly higher at 4.4 miles.

During the pandemic, many households were open to a change in lifestyle and, as markets became more competitive, buying further away was a useful tactic. It helped people find a home that fitted within their budget as house prices soared.

Back in summer 2019, buyers only searched 3.7 miles away on average. The difference now is that there are more properties for sale across the UK, which is creating greater choice locally and supports people to search closer to home.

Southerners look further away while buyers in the North stay local

Our data shows large regional differences in where people are looking for their next property.

Half of buyers in the East of England and 43% of buyers in the South East are looking for a home 10 miles away or further. They're more open to the idea of moving to a town down the road or to the other side of a city.

On the other hand, buyers in the North of England and Midlands are generally enquiring for local properties. 60% of buyers in these regions look for their next home within a 5-mile radius - higher than the national average of 50%.

Importantly, these trends mirror the pre-pandemic moving patterns. They tell us that distance is inherent in moving decisions for many buyers in the south. People may choose to buy further away because of different local economies, the availability of different property types and how expensive properties are in a given area.

In the peak of the Covid-19 home-moving boom, headlines cited a mass exodus from the capital. Our data shows that the proportion of London-based buyers enquiring about properties located 20 miles or further away from their home increased from 18% in summer 2019 to 24% in summer 2021. This is a meaningful change, but not enough to call it a mass exodus.

Londoners are looking closer to home now, but a third of buyer demand from Londoners is for homes at least 10 miles away. Housing unaffordability and lack of houses in inner London create pressure on buyers to move further away.

| Buyer's home region | Median distance to enquiry property (miles) | Proportion of buyers looking for their next home beyond 10 miles |

|---|---|---|

| East of England | 8.9 | 50% |

| South East | 5.7 | 43% |

| Scotland | 4.7 | 35% |

| London | 4.6 | 34% |

| South West | 3.4 | 31% |

| Wales | 3.3 | 25% |

| North West | 3.0 | 25% |

| North East | 2.9 | 22% |

| West Midlands | 2.9 | 21% |

| East Midlands | 2.8 | 26% |

| Yorkshire and the Humber | 2.6 | 20% |

| UK | 3.9 | 32% |

September 2023

City dwellers search further so they can buy houses over flats

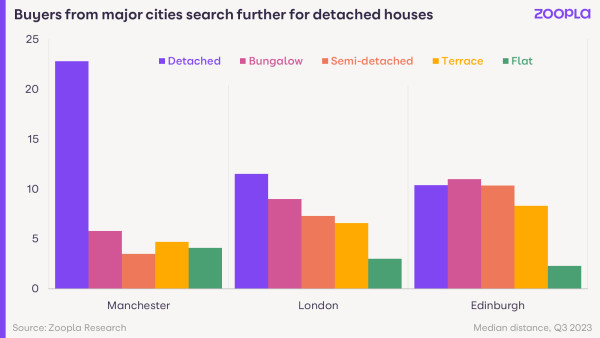

People looking for less common property types, such as bungalows or detached houses, are more likely to look further afield. Certain property types are simply not available to buy in some areas.

For instance, people in Manchester, where only 1 in 27 properties on the market is a detached house, look 23 miles away on average to buy such a home.

Similarly, London-based buyers looking for detached houses enquire for properties typically located 11.5 miles away from their current home.

In Edinburgh, where 64% of homes on the market are flats, those aspiring to buy a house typically look for them 10 miles away from their current location.

What are the benefits of moving further away?

For many, choosing where to move next is a balancing act of selecting areas that have the right type of homes at the right price point and fit well with your lifestyle.

People with jobs in the market services sector, which are concentrated in major UK cities but allow for remote working, have more flexibility to move further afield. For others, moving choices will be more driven by employment opportunities.

It also comes down to what type of home you want to live in. People in cities struggle to find larger houses, while those based in more rural locations have limited options when it comes to flats. As a buyer, you may have to explore more than one or two areas to find your dream property type.

If you're based in a region where it’s more expensive to buy, looking further afield into more affordable areas could mean better value for money and smaller mortgage repayments.

Key takeaways

- Most people search for their next home locally, with the average buyer looking just 3.9 miles away

- Those in the South East and East of England are more likely to move beyond 10 miles to find more space and value

- People in the North of England and the Midlands are more likely to stay local - 60% of buyers in these regions search for their next home within a 5-mile radius

- City dwellers look as far as 23 miles away to find larger properties

- Looking further away for a home can open up your options to different types of properties and more affordable house prices

New legal support service for tenants at risk of losing their home

The new Housing Loss Prevention Advice Service gives free legal support to tenants if their landlord is seeking possession of their home.

The government has today updated its How to Rent Guide with information about how to get free support if you are at risk of losing your rental home in England or Wales.

The new Housing Loss Prevention Advice Service means you can get government-funded legal advice and representation as soon as you receive written notice from your landlord or a creditor.

The update to the How to Rent Guide comes after a string of changes in March 2023, including a mandatory requirement to have smoke and carbon monoxide alarms in rental homes with combustible gas appliances.

What is the Housing Loss Prevention Advice Service?

The Housing Loss Prevention Advice Service offers legal advice and representation if you are at risk of losing your rental home.

The new service replaces the previous Housing Possession Court Duty Schemes (HCPDS).

You can apply for legal help from the moment you receive written notice that your landlord (or a creditor) is seeking possession of the property. It does not matter what your financial situation is and you will not need to pay for the service.

A housing expert will work with you to find a potential solution. They can advise you on:

-

illegal eviction

-

disrepair and other problems with housing conditions

-

rent arrears

-

mortgage arrears

-

welfare benefits payments

-

debt

If you’re asked to attend a court hearing as part of the eviction, the housing expert can give you free legal advice and representation at the court.

How to apply

Find your nearest Housing Loss Prevention Advice Service provider. Type in your postcode and tick the box for the service.

You’ll be shown all the providers nearest to you, along with their websites and contact details.

To apply, you’ll need to:

-

Contact a provider directly

-

Have the written notice from your landlord or creditor ready to show you’re facing losing your home

There’s no government guidance on which provider you should choose, but we recommend contacting the closest ones to you first. Some firms may only support those in their local area, plus it’ll be more practical if you need them to represent you in court.

The service is only available to tenants living in England or Wales. If you live in Scotland, there are other ways to get help with a rent dispute.

What is the How to Rent Guide?

The How to Rent Guide is a government document that outlines the rental process in England.

It details your rights and responsibilities as a tenant, as well as what your landlord is legally responsible for.

When you start a new tenancy, your landlord must provide you with a copy of the latest How to Rent Guide. They’ll normally send you a link to the government website rather than provide a printed version.

If they don’t provide you with the latest How to Rent Guide, they lose the right to evict you using a Section 21 notice.

Key takeaways

- The Housing Loss Prevention Advice Service offers free legal support to tenants at risk of losing their home

- Anyone can use the support service - it doesn’t matter what your financial situation is and you will not have to pay

- You can get help as soon as you receive written notice that your landlord or a creditor wants to possess your home

- Apply by finding a service provider on the government’s website and contacting them directly

- If you end up having to attend a court hearing, a housing expert will represent you in court for free

Mortgage rates expected to go down this autumn

Mortgage rates are on track to drop below 5% this autumn, boosting buyer confidence as more return to market.

What's happening with mortgage rates right now?

Mortgage rates are on track to fall below 5% this year.

The latest pause in the Bank of England’s base rate rises, amid better than expected inflation news, is good news for buyers, mortgagees and sellers.

The amount banks need to pay for borrowing money has now fallen, giving them wiggle room to reduce mortgage rates - and they are starting to creep downwards.

What 4% mortgage rates mean for the housing market

The closer mortgage rates get to 4%, the more buyers will come back to market.

That’s good news for sellers, as it will support both house sales and house prices.

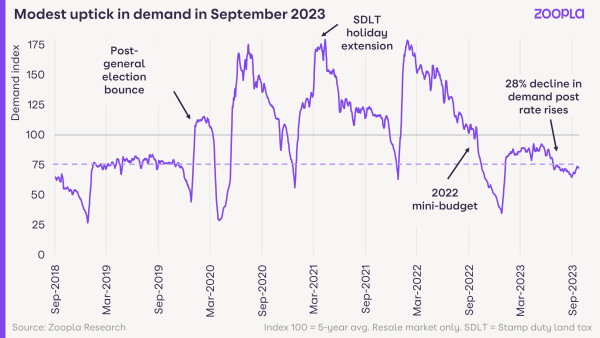

Our Executive Director of Research, Richard Donnell, says: ‘Our consistently held view is that mortgage rates over 5% mean lower sales and year-on-year price falls.

‘We expect mortgage rates to start falling slowly in the coming weeks into the high 4% range.’

Right now, across the UK’s biggest lenders, the average cost of a 5-year 75% LTV fixed-rate mortgage is 5.1%.

Back in spring 2023 it fell to 4.2%, which boosted buyer demand and the number of sales agreed.

There is still some uncertainty over the outlook for inflation and how quickly it will fall back to the Bank of England’s 2% target, but it is ultimately lower mortgage rates that will increase buying power over the next 12-18 months.

More buyers will come to market once mortgage rates get below 4.5%

House prices have fallen at a modest rate this year, despite the 20% hit to buying power triggered by mortgage rates increasing since early 2022.

However, a silver lining is beginning to emerge in the housing market: this September saw more buyers coming back to the market.

And enquiries to estate agents are up 12% since the August bank-holiday weekend.

While this improvement comes from a low base (demand remains 33% down on what it was a year ago), it means the housing market is now tracking more closely to where it was in 2019.

And while this uptick is partly seasonal, it also reflects improving consumer confidence, which is now at a two-year high, amid expectations of lower mortgage rates.

Donnell adds: ‘It’s clear that some buyers are returning to the market this autumn, having delayed home moving decisions as base rates moved ever higher.

‘Many others are waiting on the outlook for mortgage rates and holding their requirements for their next purchase.

‘The quicker average mortgage rates (for 5-year 75% LTV fixed-rates) move towards 4.5% or lower, the sooner we will see buyers return to the market.

‘This doesn't mean prices will start to rise but it will support sales volumes.’

Why house prices aren’t tumbling in 2023

Stricter lending regulations, where mortgagees are stress-tested to prove they can still pay their mortgages at up to 8% rates, have prevented larger house price falls this year.

That’s because we’re not seeing high numbers of forced sales, where mortgagees can no longer afford their repayments.

Instead, homeowners are using alternative routes, like extending their mortgages over a longer period of time, to lower their monthly repayments amid higher borrowing costs.

A buoyant jobs market is also helping mortgagees to keep up with those repayments.

But it remains a buyers’ market right now, with the average seller offering a £12,125 discount to sell their home.

Key takeaways

- Lenders reduce mortgage rates as bank rate holds

- Buyer confidence increases as borrowing rates edge closer to sub 5%

- Estate agents report 12% increase in enquiries

Bank Rate unchanged: what does it mean for mortgage rates?

The Bank of England has kept its base rate at 5.25%, despite a surprise drop in inflation. This is the highest level in 15 years, but borrowers can expect to see mortgage rates fall further in the coming weeks.

Why has the Bank of England kept the Bank Rate the same?

The Bank had been increasing the Bank Rate to get inflation under control but the latest figures showed that inflation had fallen unexpectedly.

Previous rate increases have begun to hurt the economy, with economic growth weaker than expected and unemployment rising. The Monetary Policy Committee, which decides the Bank Rate, voted by a majority of 5 to 4 to keep the Bank Rate at 5.25% today.

“Better than expected inflation figures have put an end to successive Bank Rate increases,” comments Richard Donnell, Executive Director of Research at Zoopla.

“This will be welcome news to homebuyers who have already felt the impact of mortgage rates rising higher over the summer and remaining well over 5%. This has led to demand for homes falling by 25% since the spring as buyers wait to see whether mortgage rates start to fall.”

How does the Bank Rate decision impact the housing market?

“There has been some softening in mortgage rates but as long as rates stay over 5% then house prices will continue to fall,” Richard continues.

“The concern is that money markets expect the Bank Rate to stay higher for longer in the face of higher inflation, which will keep two- and five-year fixed mortgage rates higher as well.”

“As we saw this spring, mortgage rates in the low 4% range would bring buyers back into the market. This would require money markets to expect cuts to the Bank Rate, rather than just an end to the increases.”

Housing demand and sale numbers depend on how far mortgage rates fall and the expectations of home buyers about what rate will get them back into the market. The trajectory of mortgage rates is largely down to the view of financial markets on how stubborn inflation is and how the Bank Rate is set in the future.

What will happen to mortgage rates?

The chart below compares the mortgage rate for new five-year 75% loan-to-value mortgages against the five-year swap rate – the cost of five-year fixed-rate finance to banks – and the average mortgage rate for all 9.5m outstanding mortgages.

The swap rate has fallen back below 5% so rates for new mortgages are expected to follow.

The vast majority (82%) of outstanding mortgages are fixed-rate deals according to industry body UK Finance, so most borrowers haven’t been affected by the recent rate rises.

However, 800,000 homeowners are on fixed rates that are due to end in the second half of 2023, so they are likely to face a jump in their mortgage costs at this point.

More households fixing for five years in recent times means the average mortgage rate for all outstanding loans is now 3.0%, up from its low of 2.1% at the end of 2021.

But as households remortgage onto higher rates, this average will continue to increase, putting more pressure on the household finances of existing borrowers.

“Today’s homebuyers and remortgagers are taking what they will hope is short-term pain to get a better, lower rate in two years' time - 40% of new mortgages are being taken at the higher 2-year fixed rate,” says Richard.

“The chart also raises some questions over the margin on new mortgage business for banks. They don't fund solely from the money markets - they also use money from savings, current accounts and other sources to get a blended cost of funds.

“Margins looked much better for banks pre-2021 and this will be supporting their profits. Banks are fully capitalised and ready and willing to lend but they can only price against the underlying cost of finance.”

When will mortgage rates fall below 5%?

“Our view is that we will get to sub-5% rates in the second half of 2023," Richard adds.

“Demand for homes is lower since rates started to rise in June but we are still seeing new sales being agreed. It shows there are committed buyers in the market, who are benefiting from many more homes for sale than we have seen in recent years.”

Key takeaways

- The Bank of England has today kept the Bank Rate at 5.25% after it was previously expected to increase it to 5.5%

- It’s thought that the Bank Rate may have peaked but is likely to remain high in an attempt to bring inflation closer to the target of 2%

- Experts were split as to whether the Bank would increase the rate as previously anticipated following a surprise drop in inflation from 6.8% in July to 6.7% in August

- Swap rates – the cost to banks of fixed-rate borrowing – have already fallen so fixed-rate mortgage rates are expected to follow

The highest yielding areas for buy-to-let property in the UK

Thinking of buying a rental property? One strategy for investment is to focus on higher yielding markets. Here are the top investor hotspots in the UK.

Ready to become a landlord and want the biggest return on your investment?

It’s worth getting to grips with rental yield if you’re purchasing a buy-to-let property.

Gross rental yield is the amount of money you make from a rental property each year, after you take away the cost of buying it. Net rental yield also factors in the cost of maintaining the rental property.

Both are usually expressed as a percentage and can help you decide if a property is a good investment.

But it’s not just yield that you need to think about with a buy-to-let property. A high-yielding market might not deliver much house price growth or tenant demand, which can be a key consideration as to whether you’ll get a return down the line.

The highest-yielding rental regions in the UK

The average rental yield in the UK is currently 5.03%, as the average buy-to-let property costs £263,000 and the average rental rate is £1,163.

Yields are running higher than this time last year, when the average gross yield was 4.8%. The average investment property cost the same but average rents were lower at £1,053.

The region with the highest rental yields is currently the North East, where the average gross yield is 7.2%.

Locations with cheaper house prices tend to offer the greatest yields, even though rent is also usually cheaper.

The average buy-to-let property costs only £109,000 in the North East, so an average rent of £649 offers a greater return in comparison to the cost of the property.

The North East’s yield appeal is largely thanks to the investment triangle of Sunderland, Middlesbrough and Hartlepool, where gross yields sit between 8.01% and 8.39%.

On the other hand, London has the lowest gross yield in the UK as it’s so expensive to buy a rental property there - despite average rents reaching £2,053 this month. However, this is higher than the average gross yield in London this time last year of 4.16%.

| Region | Average gross yield | Average monthly rent | Average price of a buy-to-let property |

|---|---|---|---|

| North East | 7.2% | £649 | £109,000 |

| Scotland | 7.1% | £748 | £127,000 |

| North West | 6.3% | £795 | £151,000 |

| Northern Ireland | 6.2% | £744 | £143,500 |

| Yorkshire and the Humber | 6.1% | £758 | £150,000 |

| Wales | 6.0% | £814 | £163,500 |

| West Midlands | 5.6% | £852 | £182,500 |

| East Midlands | 5.5% | £816 | £178,000 |

| South West | 5.0% | £1,016 | £242,500 |

| East of England | 5.0% | £1,111 | £266,500 |

| South East | 5.0% | £1,254 | £301,000 |

| London | 4.7% | £2,053 | £522,000 |

Rental Market Report for September 2023 (data to July 2023)

The 10 highest yielding rental cities in the UK

When it comes to cities, you’re generally better off focusing your search in the North of England if you’re after a high yield.

In Sunderland, the average rental property costs a little over £80,000, meaning a high 8.39% gross yield with a £582 rental rate.

Burnley, Liverpool and Blackburn are top investor cities in the North East while Dundee and Glasgow are buy-to-let hotspots in Scotland.

| City | Average gross yield yield | Average monthly rent | Average price of a buy-to-let property |

|---|---|---|---|

| Sunderland | 8.39% | £582 | £83,000 |

| Dundee | 7.85% | £768 | £117,500 |

| Burnley | 7.73% | £530 | £82,000 |

| Glasgow | 7.73% | £898 | £139,500 |

| Middlesbrough | 7.53% | £578 | £92,000 |

| Liverpool | 7.21% | £764 | £127,000 |

| Blackburn | 7.12% | £622 | £105,000 |

| Hull | 7.03% | £578 | £98,500 |

| Grimsby | 6.92% | £579 | £100,500 |

| Newcastle | 6.89% | £763 | £133,000 |

Rental Market Report, September 2023 (data to July 2023)

The highest yielding areas in each region of the UK

Looking for a buy-to-let property near where you live? It can be useful as you know the local area and can work closely with a local letting agent.

So you might want to consider which parts of your region offer the greatest rental yield. Here are the top 3 local authorities for yields in each UK region.

East Midlands

-

Nottingham - 6.8% gross rental yield

-

Boston - 6.34% gross rental yield

-

Mansfield - 6.36% gross rental yield

East of England

-

Great Yarmouth - 5.93% gross rental yield

-

Peterborough - 5.93% gross rental yield

-

Fenland - 5.92% gross rental yield

London

-

Barking and Dagenham - 5.81% gross rental yield

-

Newham - 5.56% gross rental yield

-

Bexley - 5.38% gross rental yield

North East

-

Sunderland - 8.39% gross rental yield

-

Middlesbrough - 8.16% gross rental yield

-

Hartlepool - 8.01% gross rental yield

North West

-

Burnley - 8.11% gross rental yield

-

Barrow-in-Furness - 7.43% gross rental yield

-

Liverpool - 7.32% gross rental yield

Scotland

-

West Dunbartonshire - 9.05% gross rental yield

-

Renfrewshire - 8.96% gross rental yield

-

East Ayrshire - 8.58% gross rental yield

South East

-

Southampton - 6.16% gross rental yield

-

Portsmouth - 6.05% gross rental yield

-

Gosport - 5.93% gross rental yield

South West

-

Gloucester - 6.01% gross rental yield

-

Plymouth - 5.98% gross rental yield

-

Swindon - 5.80% gross rental yield

Wales

-

Blaenau Gwent - 7.25% gross rental yield

-

Merthyr Tydfil - 6.94% gross rental yield

-

Neath Port Talbot - 6.89% gross rental yield

West Midlands

-

Stoke-on-Trent - 6.90% gross rental yield

-

Coventry - 6.28% gross rental yield

-

Newcastle-under-Lyme - 6.22% gross rental yield

Yorkshire and the Humber

-

Hull - 7.03% gross rental yield

-

North East Lincolnshire - 6.92% gross rental yield

-

Bradford - 6.86% gross rental yield

What is rental yield?

Rental yield is the amount of money you make from a rental property each year against the cost of purchasing and running it. It’s always expressed as a percentage.

The gross yield only takes the cost of the property and the rental income into account.

The net rental yield, on the other hand, considers the extra costs of running the property, like maintenance and property management.

To figure out the best investment property for you, it’s worth looking at both of these yields as well as other factors.

Why is rental yield important?

Before you jump into buying a property to rent out, you've got to figure out if it’s a worthwhile venture.

If your rental income doesn't cover your costs, or you're just breaking even, unexpected expenses like fixing a broken boiler or a leaky roof can impact your finances.

So looking at the potential rental yield will help you do the maths and make sure it’s a good investment.

What else to think about with a buy-to-let property

There’s more to choosing a good buy-to-let property than just the rental yield.

You could buy a property with a strong yield, but if house prices aren’t rising or you can’t find tenants, it might not be the best investment.

House price trends

Get a feel for house price growth to see if the property is likely to rise in value. Look at historic sale prices for individual properties as well as value increases for the postcode and local area.

The cost of a buy-to-let mortgage

At the same time, you need to think about the costs of taking out a buy-to-let mortgage and all the other associated costs of running a rental property.

Tenant demand

It also helps to understand what tenant demand is like in the area and what sort of properties they’re looking for.

Speak to a letting agent to find out what’s happening in the local rental market. They’ll be able to share what tenants are looking for and which properties could be a strong buy-to-let investment.

How to work out your gross rental yield

Let’s say you want to buy a property worth £200,000. You plan to charge £1,000 per month in rent, which works out to £12,000 per year. Divide 12,000 by 200,000, then multiply by 100. That equals a gross yield of 6%.

(Annual rent / property value) x 100 = gross rental yield

How to work out your net rental yield

To work out your net rental yield, you need to take your extra costs off your annual rental income.

So add up the amount of money you think you’ll spend over the year. This will include paying the mortgage, agency fees, property maintenance, and any costs you might incur to keep up with regulations.

Then deduct these costs from your annual rental income, and do the same sum from there.

[(Annual rent - annual costs) / property value] x 100 = net rental yield

Let’s say you’re buying the same £200,000 property and charging the same £12,000 per year in rent.

But you’re spending £300 on maintenance and agency fees, which comes to £3,600 over the year.

That means your net rental yield for this property is 4.2%.

Key takeaways

- If you’re looking for a buy-to-let property, rental yield can help you decide if the cost of the property is worth the potential rental income

- Take other factors into account, like the potential for house price growth and tenant demand in the area

- The North East is top of the yield charts right now – investors here make an average gross yield of 7.2%

- The highest yielding cities in the UK are Sunderland, Dundee and Burnley, which offer a gross yield of between 7.7% and 8.4%

- We reveal the three highest yielding areas in every region of the UK

The cheapest places to rent a home in 2023

Looking for a rental home that doesn’t cost an arm and a leg? Here’s your complete guide to the cheapest places to rent in the UK.

Rents for new lets have risen by an average of £1,320 over the last year. It’s driven by rental demand sitting 51% above the five-year average, while the availability of rental homes is down 30% compared to normal for this time of year.

This supply and demand mismatch has pushed rents 10.5% higher over the last 12 months - although this is a little slower than the 12.1% growth we saw a year ago.

With rents still rising and the cost-of-living squeeze pushing all our purses to the limit, you might be looking for a cheaper home to rent.

The good news is there are some places where it’s much cheaper to rent a home than others.

Let’s take a look at the regions, cities and local areas with the cheapest rents in the UK.

The cheapest places to rent in the UK - regions

For the cheapest rents in the country, set your sights on the North East - tenants spend an average of £649 per month on rent here.

Northern Ireland, Scotland, Yorkshire and the Humber, and the North West all sit at the cheaper end of the scale too, with rents averaging less than £800 per month.

Rents in the South of England are much more expensive than anywhere else in the country.

London is by far the most expensive region to rent in the UK (£2,053 per month), followed by the South East (£1,254), East of England (£1,111) and South West (£1,016).

| Region | Average rent | Annual % change |

|---|---|---|

| North East | £649 | +9.5% |

| Northern Ireland | £744 | +4.2% |

| Scotland | £748 | +12.7% |

| Yorkshire and the Humber | £758 | +8.4% |

| North West | £795 | +11.0% |

| Wales | £814 | +9.9% |

| East Midlands | £816 | +9.5% |

| West Midlands | £852 | +10.0% |

| South West | £1,016 | +7.8% |

| East of England | £1,111 | +9.8% |

| South East | £1,254 | +9.5% |

| London | £2,053 | +12.4% |

Rental Market Report, September 2023 (data to July 2023)

The cheapest UK cities to rent a home in 2023

Just because you want cheaper rent, it doesn’t mean you have to move out to the sticks.

The cost of rent varies a huge amount across UK cities, with Belfast, Liverpool and Sheffield offering the cheapest average rents.

In Belfast, rents are currently averaging £759 per month - plus it has affordable living costs compared to mainland Britain.

Renters in Liverpool are paying £764 per month to live in the UK’s friendliest city, where rents have risen 8.7% in the last year.

The only other major city where rents are below £800 per month is Sheffield, the vibrant Yorkshire city that’s home to a lively student scene.

Cities in the Midlands tend to be fairly cheap to rent, with Birmingham and Nottingham both posting average rents of below £900 per month.

When it comes to Scotland, you’ll find a dynamic city lifestyle and cheap rents in Glasgow, where rents average £898 per month. Edinburgh is much pricier with an average rent of £1,199 per month.

In southern cities, you can expect to pay higher rent than anywhere else in the country. London and Bristol have the highest monthly rents of any UK city, with Southampton also posting an expensive average rate of £1,057.

| City | Average monthly rent | Annual % change |

|---|---|---|

| Belfast | £759 | +4.7% |

| Liverpool | £764 | +8.7% |

| Sheffield | £772 | +7.9% |

| Birmingham | £880 | +10.6% |

| Nottingham | £896 | +10.1% |

| Glasgow | £898 | +13.7% |

| Leeds | £908 | +8.6% |

| Manchester | £994 | +13.1% |

| Cardiff | £1,011 | +10.7% |

| Southampton | £1,057 | +10.6% |

| Edinburgh | £1,199 | +15.6% |

| Bristol | £1,315 | +9.1% |

| London | £2,053 | +12.4% |

Rental Market Report, September 2023 (data to July 2023)

The cheapest places to rent in every region

Getting cheaper rent doesn’t mean you have to move to a whole new part of the country, either.

Here’s a breakdown of the cheapest districts to rent in each UK region. It might be that you could get a cheaper rent just by moving a few miles.

| Region | Cheapest local authority to rent | Average monthly rent |

|---|---|---|

| East Midlands | East Lindsey | £626 |

| East of England | Waveny | £724 |

| London | Bexley | £1,455 |

| North East | Hartlepool | £497 |

| North West | Burnley | £521 |

| Scotland | East Ayrshire | £502 |

| South East | Isle of Wight | £862 |

| South West | North Devon | £753 |

| Wales | Powys | £594 |

| West Midlands | Stoke-on-Trent | £632 |

| Yorkshire and the Humber | Hull | £578 |

Rental Market Report, September 2023 (data to July 2023)

Key takeaways

- UK rents have risen by 10.5% in the last year, bringing the average monthly rent to £1,163

- The North East is the cheapest region to rent a home in the UK with an average rent of £649 per month

- The cheapest major cities to rent are Belfast, Liverpool, Sheffield and Birmingham, where average rents are below £900 per month

- London rents have hit £2,053, making it twice as expensive to rent a home in London than in the South West (£1,016)

Why is the cost of renting so expensive right now?

A supply and demand problem in the rental market is pushing rents to sky high levels. When will renting prices come down?

The number of homes currently available for rent is nearly a third below the five year average.

This, coupled with demand for rental properties running at 51% above the five year average, is creating a major housing supply problem for renters - and has been doing so for quite some time.

However, a silver lining is beginning to emerge: demand for new rental properties is starting to come down - and is now 20% lower than this time last year.

Equally, the number of homes now available for rent is 20% higher than this time last year.

When will the cost of renting come down?

The cost of renting has been rising at such a rate that it’s outpaced the rate at which wages are rising for the last 22 months - and rents have now hit their worst affordability level in over a decade.

Rental inflation has been running in double digits for 18 months, meaning the average rent has increased by £110 per month over the last year – an annual increase of £1,320.

Over the last 3 years, rents for new lets are up by an average of £2,772 per year, compounding the cost of living for renters.

However, again, there is a glimmer of hope on the horizon, as rental inflation is now starting to come down.

This time last year, rental inflation was running at just over 12%. Today, it is running at 10% and by the end of the year, we believe it will begin to track at 9%.

In 2024, we expect rental inflation to slow to 5-6%.

What’s happening with rents across the UK?

What’s going on with rents in Scotland?

In Scotland, where a rent cap was introduced to prevent landlords from raising rents by more than 3% for tenants in situ, rents are rising fast.

A system designed to be fairer for tenants is creating issues when the property becomes vacant.

Landlords, unsure of how long a new tenancy might last, are charging the full market price for new lets, meaning rents in Scotland are now rising faster than the rest of the UK.

Our Executive Director - Research, Richard Donnell, says: ‘The introduction of rent controls in September 2022 is a key factor here.

‘Landlords are seeking to maximise the rent for new tenancies to cover increased costs and allow for the fact that future rent increases will be capped over the life of the tenancy.’

This means Scotland has now overtaken London in terms of rental inflation.

In Edinburgh and Dundee, rents are up 15.6%, while in Glasgow they are up 13.7%. In London, rents are up 12.4%.

What’s going on with rents across the UK?

Across the UK as a whole, the rental market is stuck in a state of low supply and high demand.

While growing the supply of rented homes available is a clear solution, higher borrowing costs are causing the number of new investments from landlords to fall - alongside the level of new homes being built.

'New investment from corporate landlords via 'build to rent' is a bright spot, boosting supply in many city centres,' says Donnell.

'However, rental levels set by corporate landlords are above-average and not at a scale to impact the wider market.'

Renters in existing tenancies are also reluctant to move in a rising costs market, meaning fewer rental properties are becoming available.

This has led to the average letting agent now having just 10 rental properties on their books, compared to 16-17 before the pandemic.

Why is rental demand so high right now?

Rental demand is rising for three main reasons:

-

Higher mortgage rates, preventing would-be first-time buyers from entering the housing market

-

The strength of the labour market and job creation

-

Record levels of immigration, particularly apparent a year ago as international borders re-opened with an influx of overseas students returning to study in the UK.

When mortgage rates hit 5.5%, repayments for a first-time buyer become more expensive than rental costs.

Unfortunately, the supply/demand imbalance doesn’t look set to ease in 2024. But the cost of renting cannot keep rising beyond what renters can afford - and it is this that will have the greatest impact on rental costs going forward.

‘Increasingly unaffordable rental costs should temper demand and lead to a reduction in the rate of growth, says Donnell.

‘However, the scale of the mis-match between supply and demand means that rental growth will reduce more slowly than might be expected.

‘If supply remains low then a weaker labour market, lower immigration and falling mortgage rates would all be needed to reduce demand to a level that would reduce rental growth back towards 5% per annum.’

How can I spend less on my rent each month?

To help cope with the increased cost of renting, renters are:

-

Renting smaller properties

-

Sharing homes

-

Moving to more affordable areas

'More renters sharing does reduce the cost per renter, but this comes at the personal expense of less private space,’ says Donnell.

'It also supports headline rental values. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

'In our view, sharing is supporting high rents in inner London where the reduction in floorspace per renter has been greatest.’

In fact, increased levels of sharing could be a key factor in rents continuing to rise above earnings across regional cities in the next 12-24 months.

Elsewhere, the rates at which rents are rising varies across the UK - and renters are now choosing more affordable areas to live in.

In London particularly, renters are heading to the suburbs to seek better value for money, causing rental prices in inner London to slow.

Will the cost of renting come down in 2024?

Rents for new lettings are expected to keep rising ahead of earnings growth in 2024.

Wages are projected to rise by 3.6% next year, while we expect rents to increase by 5-6%, due to the lack of supply and sustained higher mortgage rates.

Regional cities across the UK are likely to see the highest rental increases, apart from inner London, where affordability constraints are likely to slow rental inflation.

This inner London slowdown is significant, as it will act as a drag on UK rental inflation as a whole and may potentially halve it to more sustainable levels.