What Jeremy Hunt's autumn statement means for the housing market

Stamp duty cuts reversed and rising council tax rates on the way - but the energy price cap remains in place. And what does it all mean for mortgage rates?

Chancellor Jeremy Hunt today set out plans to fill a £55 billion hole in the government’s finances through a combination of tax rises and spending cuts.

The deficit was created by former Chancellor Kwasi Kwarteng’s now infamous mini-Budget, which sparked chaos in the financial markets and led to a steep increase in government borrowing costs.

Just under half of the £55 billion will come from tax rises, with just over half coming from cuts to government spending, Hunt said.

He added that once the UK’s economy had recovered, the pace of fiscal consolidation would be increased, to reduce pressure on the Bank of England to raise interest rates.

What’s the big picture?

The Office for Budgetary Responsibility (OBR), which provides independent analysis on the government’s finances, confirmed that the UK is already in recession.

But Hunt said the OBR expects the downturn to be shallower as a result of the measures in the Autumn Statement.

The OBR forecast the economy will grow by 4.2% this year, before contracting by 1.4% in 2023, with growth recovering to 1.3% in 2024.

Meanwhile, inflation will average 9.1% this year, before starting to fall steeply from the middle of next year.

Unemployment is expected to rise from its current rate of 3.6% to reach 4.9% in 2024, before falling back to 4.1%.

Which taxes are going up?

Income tax

The Chancellor announced that the thresholds at which the different rates of income tax kick in will be frozen at their current level for six years.

This means the basic rate of 20% will be charged on all earnings over £12,570 until April 2028, while the 40% rate will be charged on earnings over £50,270 until the same date.

Meanwhile, more high earners will be pulled into the top rate of income tax, with the level of income on which the 45% rate is charged being reduced to £125,410 from £150,000 now.

The move will cost those earning more than £150,000 around £1,200 a year.

The thresholds for National Insurance for individuals will also be frozen.

Stamp duty

Kwarteng’s increase to the threshold at which stamp duty is paid to £250,000 was one of the few mini-Budget measures that were not reversed by Hunt when he took office.

But he announced today that the increase will be temporary, with the threshold falling back to its previous level of £125,000 after 31 March 2025.

The threshold for first-time buyers will also be cut to £300,000 from £425,000, on properties costing up to £500,000, rather than £625,000.

He justified the measure by saying that activity in the housing market was expected to slow down over the next two years, and reverting back to the former stamp duty threshold in 2025 would encourage people to bring forward purchases.

The move will cost people purchasing a home for more than £250,000 an extra £2,500 in higher stamp duty payments.

Executive Director of research and insight, Richard Donnell, says: "The government's announcement of a reversal of the recently announced stamp duty changes in 2025 signifies a real need to reform stamp duty - a tax that is now starting to resemble income tax where it's the top tax bands generating the greatest receipts.

"This reversal will make it increasingly difficult for prospective first-time buyers to get on the housing ladder in the coming years, particularly in London and the South East which accounts for the majority of stamp duty receipts."

Council tax

Hunt has lifted the cap on council tax increases to give local authorities more freedom to raise cash.

Local authorities will now be able to raise council tax by up to 5% without having to hold a referendum on their plans.

The impact of the move will vary from council to council, as well as according to individual property bands, but it could see the average amount charged on a band D property rise from £1,966 to as much as £2,064.

Capital gains tax

Capital gains tax is charged at a rate of 18% on residential property and 10% on other assets for basic rate tax payers, and 28% and 20% respectively for higher rate taxpayers. But the first £12,300 of gains are tax free.

However, Hunt announced today that he was reducing the tax-free threshold to £6,000 from April 2023, and to £3,000 from April 2024.

The move will impact investors who sell buy-to-let properties, but the tax is not charged on the sale of people’s main home.

Inheritance tax

The threshold at which inheritance tax starts has also been frozen at its current level of £325,000, although couples can still combine their allowances and assets left to a spouse or civil partner will not be liable for the tax.

In another blow for people planning to leave their family home to their children, the Chancellor also announce the introduction of a cap on social care costs would be delayed by two years.

The cap had been due to come in to force in October 2023, and would limit the total amount individuals had to spend on social care as they aged to £86,000, after which the state would step in to foot the bill.

The cap would have reduced the number of elderly people who had to sell their family home to pay for care.

What support is available?

Hunt had previously warned that the Energy Price Guarantee, which limited average household energy bills to £2,500 a year would be reviewed at the end of March, sparking concerns that it could be scrapped altogether.

But there was good news for struggling households, with Hunt saying it would remain in place but be increased to £3,000 a year for a further 12 months.

Although the move will cost the typical household an additional £500 a year, the sum is significantly less than they would have to pay if the guarantee was abolished altogether.

He also announced that people on means tested benefits would receive a one-off £900 cost-of-living payment, while pensioners would get £300, and those on disability benefits would receive £150.

In addition, the state pension and means tested benefits will be increased by 10.1%, in line with the level of inflation as measured by the Consumer Prices Index in September.

People who rent their home from a social landlord will have rent increases capped at 7% for 2023/24.

What does this mean for the mortgage market?

It’s too early to say how financial markets will react, but the statement is expected to reassurance them after the chaos caused by the mini-Budget.

Not only does Hunt set out exactly how he plans to fill the government’s budget deficit, but he has also published the OBR’s response to his plans.

The interest rates charged on fixed rate mortgages had already fallen before today’s statement, and they are likely to continue their downward trend following it.

Hunt’s announcement that the rate at which fiscal consolidation would take place would increase once the economy returned to growth also means the Bank of England will be under less pressure to raise interest rates, which is further good news for mortgage rates.

Director of estate agency Anderson Harris, Adrian Anderson, says: “In today’s Autumn Statement, Chancellor Jeremy Hunt highlighted the importance of getting inflation and mortgage rates under control before announcing a raft of measures, both tax rises and spending cuts, in an attempt achieve that goal.

“Whilst the medicine will be painful for many, for mortgage borrowers spiralling inflation combined with consequential higher interest rates is punishing and I am hopeful that these steps will result in the Bank of England base rate peaking around 4% as now predicted."

What does it all mean for the housing market?

The statement is a mixed bag for the housing market.

Activity has already slowed in the face of higher living costs, rising interest rates and economic uncertainty.

The freezing of the income tax thresholds, combined with higher council tax and energy bills will do little to change this.

That said, the continuation of the Energy Price Guarantee from April, albeit at a slightly higher level, will reassure consumers that they will not face a steep increase in their gas and electricity bills come the spring, and could go some way towards increasing confidence.

Meanwhile, news that the threshold at which stamp duty is charged will fall back to £125,000 in April 2025, may cause some people to bring forward their purchase.

The fact that unemployment should not increase significantly should also help to prevent a high level of forced sales, while the overall stability the statement brings is also good news for the housing market.

The one area of bad news is the decrease in the capital gains tax allowance in 2023 and 2024.

Some commentators have warned that the move could prompt small-scale buy-to-let landlords to sell their properties ahead of the decrease, further intensifying the shortage of homes in the private rented sector.

Key takeaways

- Stamp duty cuts to be reversed in April 2025

- Energy price cap, raised to £3,000, to stay in place for a further 12 months

- Councils given the power to increase council tax

- Capital gains tax threshold reduced to £6,000

- Inheritance tax threshold frozen at £325,000

Inflation expected to fall sharply next year

The Bank of England predicts inflation will be below its 2% target in two years time, and close to zero in three years, leading to lower mortgage rates.

Minutes from the Bank of England’s latest interest rate setting meeting triggered some alarming headlines.

But while some outlets warned that the UK was heading for its longest recession since records began, there was actually good news buried in the minutes of its meeting - including suggestions that interest rates may not need to rise by as much as previously expected.

We take a look at some of the positives from the report and how they will impact the housing market.

The recession will be long but may not be too deep

The most eye-catching prediction from the Bank’s Monetary Policy Committee’s (MPC) minutes was that the UK is likely already in a recession, which is expected to last for two years.

If this prediction is correct, it would be the longest recession for the country since records began in 1920.

But what received less attention is the fact that economic growth is expected to contract by 1.9% in 2023 and 0.1% in 2024.

This means that while the MPC is expecting the recession to be long, it does not think it will be too deep.

To put these figures in context, the current recession would be significantly less bad than the one in the wake of the global financial crisis, when GDP growth contracted by 2.6% in a single quarter, and by 7.1% across five quarters in 2008 and 2009.

During the Covid-19 pandemic, GDP dived by a record 19.4%.

Economists have also pointed out that the MPC’s forecast is based on current market predictions for interest rates.

But the MPC suggested interest rates will not need to rise by as much as markets think, suggesting the recession could be less severe than its forecast suggests.

Unemployment will remain reasonably low

The MPC also forecast a rise in unemployment in its minutes, predicting the proportion of people who are out of work would increase from 3.5% now to 4.9% by the end of 2023.

While the increase may sound alarming, it is important to see it in context.

Unemployment is currently at its lowest level since 1974. A rise to 4.9%, would put the number of people out of work broadly on the same level as in early 2021 during the pandemic.

Looking further ahead, the MPC expects unemployment to continue rising in 2024 and 2025 to reach 6.4% by the end of that year. That's still well below the peak of 10.7% seen in the 1992 recession.

The fact that the number of people likely to lose their job is expected to remain relatively low compared with previous recessions, is good news for the housing market.

In the past, steep rises in unemployment led to a high level of forced sales, as people were no longer able to keep up with their mortgage repayments, triggering house price falls.

But that looks unlikely to happen this time around. Not only are job losses expected to be limited, but lenders are also now required by regulators to work with people who run into difficulties repaying their mortgage, and only repossess their home as a last resort.

Inflation should peak soon, then fall sharply

A major factor contributing to the current slowdown in activity in the housing market is the cost-of-living squeeze.

Steep increases in the cost of food, petrol and energy have made consumers more cautious, and caused them to delay making big purchases, such as a buying a new home.

It also makes it harder for them to pass mortgage affordability tests, as more of their money is being spent on essentials.

But the MPC expects inflation to peak at 11% in the final three months of this year, before falling sharply from the middle of next year.

In fact, it predicts inflation will be below its 2% target two years from now, and be close to zero in three years’ time.

Getting inflation back under control will not only boost consumer confidence, but it will also enable the MPC to reduce the Bank Rate – the official cost of borrowing – which should lead to lower mortgage rates.

Interest rates may not rise by as much as expected

This one is a bit more speculative, as the MPC does not make predictions on interest rates.

But it did appear to signal that the Bank Rate may not need to increase by as much as markets currently expect.

When the MPC held its November meeting, money markets had priced in further increases to the Bank Rate to 5.25%.

As is customary, the MPC based its economic forecasts on interest rates peaking at this level.

Although it continued with its previous rhetoric that it will “respond forcefully, as necessary” to get inflation back down to its 2% target, it also said the impact of previous interest rate rises had not yet been fully felt.

In a press conference following the meeting, Bank Governor Andrew Bailey also said the Bank Rate would have to go up by less than currently expected by financial markets.

He said: “Our best view of where the rate should be … is nearer the constant rate curve [3.00%] than the market rate curve [5.25%].”

Economists have interpreted his comments as suggesting the Bank Rate could peak at between 3% to 4%, meaning it may not rise much further from its current level of 3%.

This is obviously good news for mortgage rates.

Variable rate mortgages, such as tracker products and standard variable rates, move up and down in line with changes to the Bank Rate.

Fixed rate mortgages are based on so-called swap rates, which are themselves based on what the money markets think will happen with interest rates in the future.

In both cases, if interest rates do not need to rise by as much as previously expected, mortgage rates will also be lower.

What does this mean for the housing market?

Activity in the housing market has been hit by a combination of the cost-of-living squeeze, economic uncertainty, and the recent increase in mortgage rates.

If inflation peaks soon and mortgage rates do not rise any higher, it could help to restore consumer confidence.

In fact, the cost of fixed rate mortgages, which has already come down since the mini-Budget, is expected to continue to fall during the final part of the year.

At the same time, a sharp spike in unemployment in 2023 is not expected, meaning there are unlikely to be a high level of forced sales.

Even so, mortgage rates still remain significantly higher than they were at the start of the year, which, combined with higher house prices, will impact affordability.

This is likely to lead to lower buyer demand, and house prices are likely to drop from their current record level in some areas.

Key takeaways

- Getting inflation back under control will enable the MPC to reduce the Bank Rate – the official cost of borrowing – which should lead to lower mortgage rates

- Economists are suggesting the Bank Rate could peak at between 3% to 4%, meaning it may not rise much further from its current level of 3%

- While the recession that the UK is already in will be long, it will not be too deep

What does the latest interest rate rise mean for home buyers?

The Bank Rate is up by 0.75% but the outlook for mortgage rates is unchanged, with the likelihood borrowing costs will be lower by the year end.

Bank Rate up, outlook for mortgage rate improves

The Bank Rate moved 0.75% higher this week. This does not mean the average mortgage rate of 6.25% will rise to 7%, making life even harder for new home buyers.

In fact, the outlook for fixed rate mortgages has improved off the back of the Bank of England's increase. This is great news but home buyers using a mortgage should still expect to pay higher mortgage rates than in the recent past.

The cost of fixed rate mortgages, used by 9 in 10 borrowers, is based on the how money markets expect the cost of Government borrowing to change over time. The Bank of England is acting more aggressively now to control inflation and hoping that they can reduce interest rates more quickly later in 2023. The Governor has also suggest financial markets are over-estimating the outlook for borrowing costs.

The all-important money market benchmark that underpins 5 year mortgage rates continues to fall from its high, just after the mini budget when lenders pulled mortgages products and pushed mortgage rates much higher. It has fallen over 1.25% in recent weeks and currently points towards mortgage rates of just over 5% later this year.

Home buyers adopt wait-and-see approach

These are uncertain times for everyone in the UK. Higher interest rates and talk of a drawn-out recession are not the backdrop to build confidence in making big home move decisions.

We have seen new buyer demand continue to fall - down almost 40% since the mini budget - as those without cheap mortgages or in the process of buying a home step back from the market. It is a uniform picture across the country. It mirrors what we tend to see at the end of November as the market slows in the run up to Christmas and the New Year.

How might buyers adapt in 2023?

5% mortgage rates are still much more than borrowers were paying a year ago and will dent home buyer demand in 2023. However, the impact of higher borrowing cost is far from equal and we expect some would-be home buyers to shift strategies.

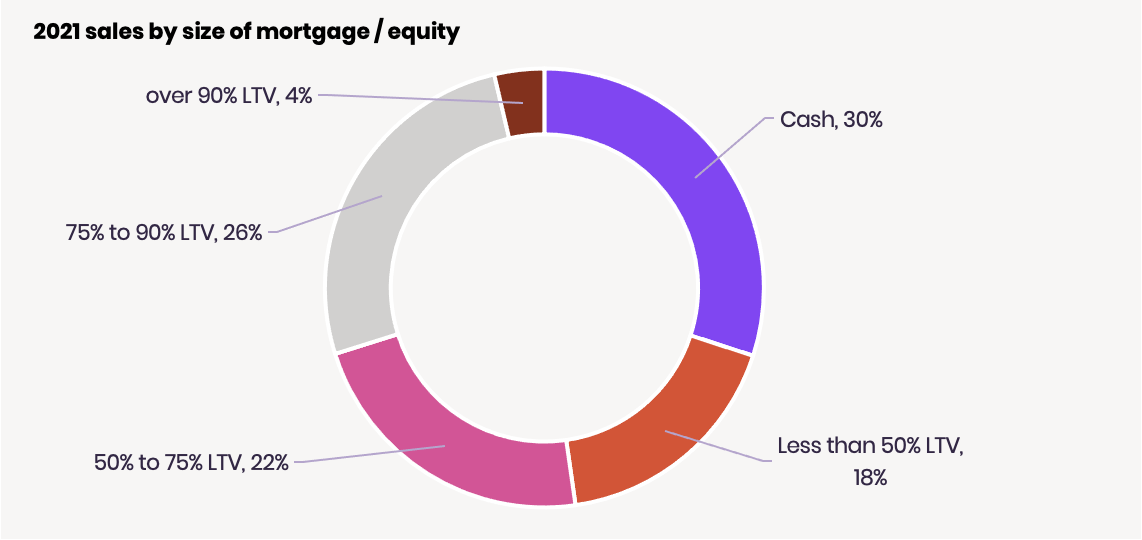

30% of home buyers use cash and a further 18% use smaller sized loans, groups that will be less affected by higher borrowing costs.

The pandemic and working from home means more buyers might look to move further, seeking out better value for money using a smaller mortgage. Others may look to move and transfer or 'port' their current mortgage to their new home without taking on any more debt.

First time buyers and those looking to take out big mortgages to trade up to a bigger homes will be more affected. First time buyers often sit at the bottom of many chains of housing sales which could have a wider impact.

Outside South East England, many first time buyers have been taking advantage of lower borrowing costs and buying larger 3 bedroom homes. There is scope for them look at smaller homes and we will have to see whether they are willing to compromise on space in the face of higher mortgage rates.

Don't stop your planning if you want to move

For those serious about moving in 2023, it's important not to stop all activities. Buying a home is a 3 to 9 month process and the wider economic backdrop can move fast.

With the pressure on budgets for what you can afford, we would encourage buyers to consider other markets and areas that might offer what they need at a lower price point. Do your research using Zoopla's tools and go and visit and speak to local agents who may be able to give you the inside story into local areas.

The cost of mortgages will be in flux over the coming months and lenders will be changing the product range and pricing, so stay in touch with your broker and lender to keep on top of the options available.

It's going to be a bumpy ride for the next few months but with improved planning and preparation there are still options to find that next home.

Key takeaways

- Bank of England pushes Bank Rate to 3% but outlook for mortgages improves (slightly)

- Would-be movers adopt a wait-and-see approach amid talk of a drawn-out recession

- A high proportion of buyers using cash or smaller mortgages are less exposed to higher mortgage rates

- Other buyers will adopt new strategies to buy in 2023

- Don't get caught out waiting too long: buying a home is a 3 to 9 month process and the wider economic backdrop can move fast

What’s the outlook for buy-to-let in 2023?

With many landlords weighing up their position, we take a look at what’s happening in the buy-to-let market.

With mortgage rates high and house prices expected to fall by up to 5% in some areas, many buy-to-let landlords are wondering if they should stay in the market.

But despite the uncertain economic outlook, demand for rental homes is growing, and a shortage of properties is pushing rents higher.

We take a look at what’s happening right now in the buy-to-let market, and what the future is likely to hold.

What’s happening to buy-to-let mortgages?

Like the rest of the mortgage market, buy-to-let loans were hit by former Chancellor Kwasi Kwarteng’s mini budget.

The number of products available dropped steeply to just 988 different deals in the wake of Kwarteng announcing his fiscal plans, compared with 1,942 before the mini budget.

But the good news is that lenders are returning to the market, with just over 1,400 different products currently available to choose from.

Are buy-to-let mortgage rates rising?

The less good news is that interest rates on buy-to-let mortgages have increased significantly since the beginning of the year.

The average cost of a two-year fixed rate mortgage for an investment property has jumped from 2.94% in January to 6.76% now.

Around 2% of this increase is the result of hikes to the Bank of England Bank Rate - the official cost of borrowing - the rest has been driven by the market’s response to the mini budget.

The cost of five-year fixed rate mortgages has followed a similar pattern, rising from an average of 3.18% at the beginning of the year to 6.73% now.

To put these increases into context, a landlord borrowing £200,000 on a two-year fixed rate mortgage would see their monthly payments on an interest-only mortgage jump from £490 in January to £1,127 now, if they borrowed at the average rate.

Tracker mortgages currently look better value than their fixed rate counterparts, with 2 year buy-to-let deals averaging 4.42%.

But it is important to remember that these mortgages move up and down with changes to the Bank Rate.

If the Bank Rate increases from its current level of 2.25% to 5%, as some economists are predicting, a tracker mortgage rate that is currently 4.42% would rise to 7.17%.

What should I do if I need to remortgage my rental property?

The mortgage market is currently in a state of flux.

Rates have fallen slightly after some market confidence was restored by the appointment of Jeremy Hunt as Chancellor, and they may fall further as the cost of government borrowing continues to drop.

But at the same time, the Bank Rate has risen to 3% in a bid to bring inflation down from its current level of 10.1%.

5 year fixed rate mortgages are currently slightly cheaper than two-year ones at 6.73%, compared with 6.76%.

Although economists expect interest rates to rise further, with the UK expected to go into recession, they are not expected to remain high for long.

If you are due to remortgage on more than one buy-to-let property in the near future, you may wish to hedge your bets by opting for different mortgage terms on the properties.

It is also important to note that the rates quoted are average rates, and more competitive deals are available on the market, particularly if you have a large equity stake in your property.

If you can afford to do so, it may be worth using savings to reduce the amount you need to borrow through a mortgage, if this enables you to qualify for a lower loan-to-value tier.

For example, if you are looking to borrow 70% of the property’s value, but can reduce this to just 60% by using savings, you are more likely to qualify for the most competitive rates a lender has.

Will higher interest rates make it harder to get a mortgage?

Lenders use specific affordability tests when assessing people for buy-to-let mortgages.

Known as the Interest Cover Ratio, lenders typically want rental income from the property to be equivalent to between 125% and 145% of the monthly mortgage interest payment.

So, if your mortgage rate is 6.76% and you are borrowing £200,000, your rental income would need to be between £1,408 and £1,634 a month.

If you are worried about passing this stress test, you can ask your lender for ‘top slicing’ which means they will include some of your income in their affordability calculations.

Not all lenders will do this, and if you want to go down this route, it might be worth using the services of a mortgage broker to help you.

What’s happening with rents?

Mortgage rates are rising, but so are rental rates.

New rental rates have increased by £115 during the past year to average £1,051, according to our latest Rental Market Report.

Rents are rising so sharply because there is a significant mismatch between supply and demand in the sector.

A combination of tax rises and increased regulation during the past few years have led to many investment landlords selling up and exiting the sector.

This has resulted in there being too few properties in the private rental sector to meet demand.

The number of homes on the market to rent are currently around half the level seen during the past five years.

Meanwhile, the number of people looking to rent a home is 142% higher than five years ago.

We expect this trend to continue in 2023, putting further upward pressure on rents.

Are house prices likely to fall?

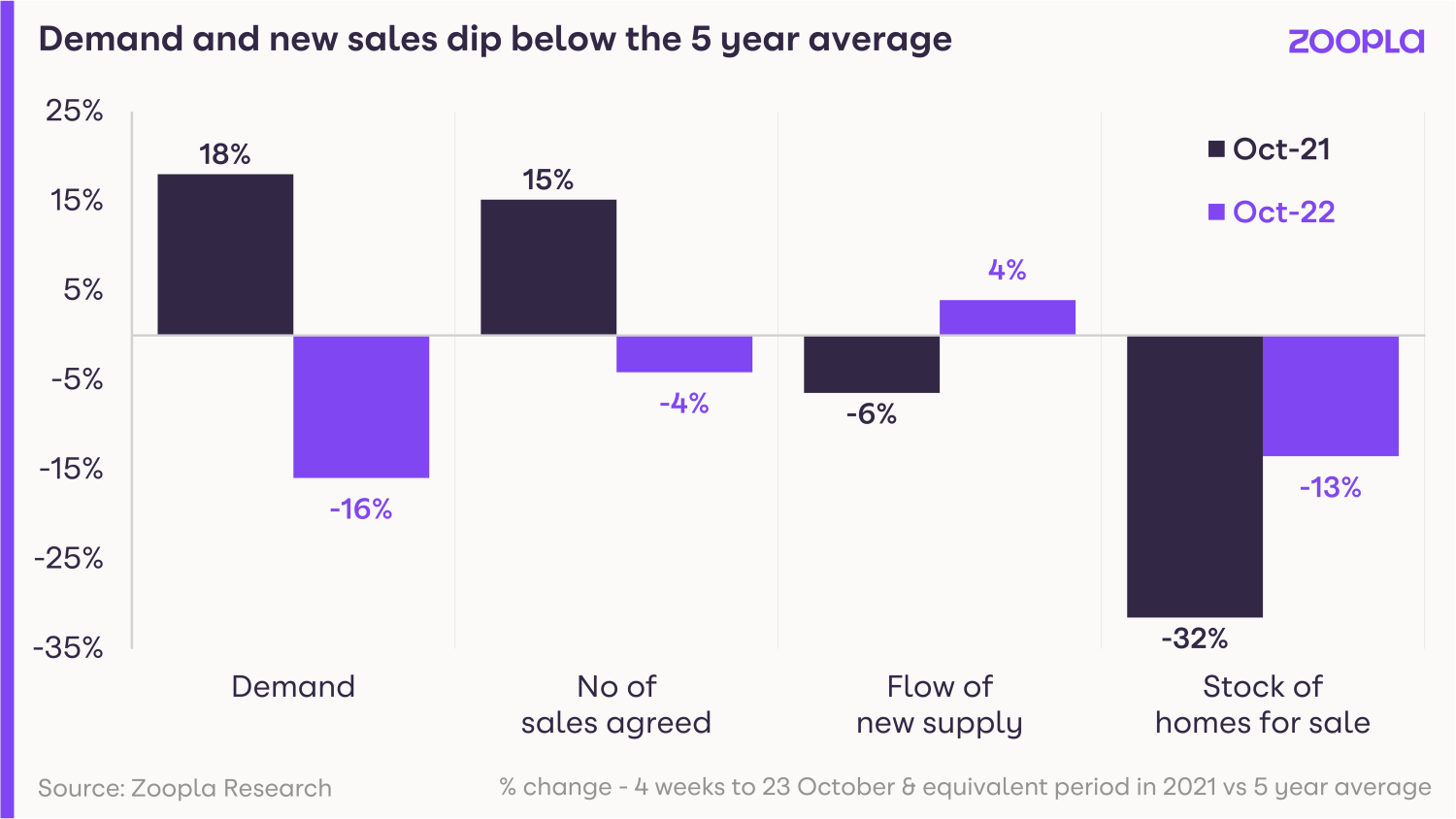

Unlike in the rental market, demand has fallen recently among people looking to buy a home.

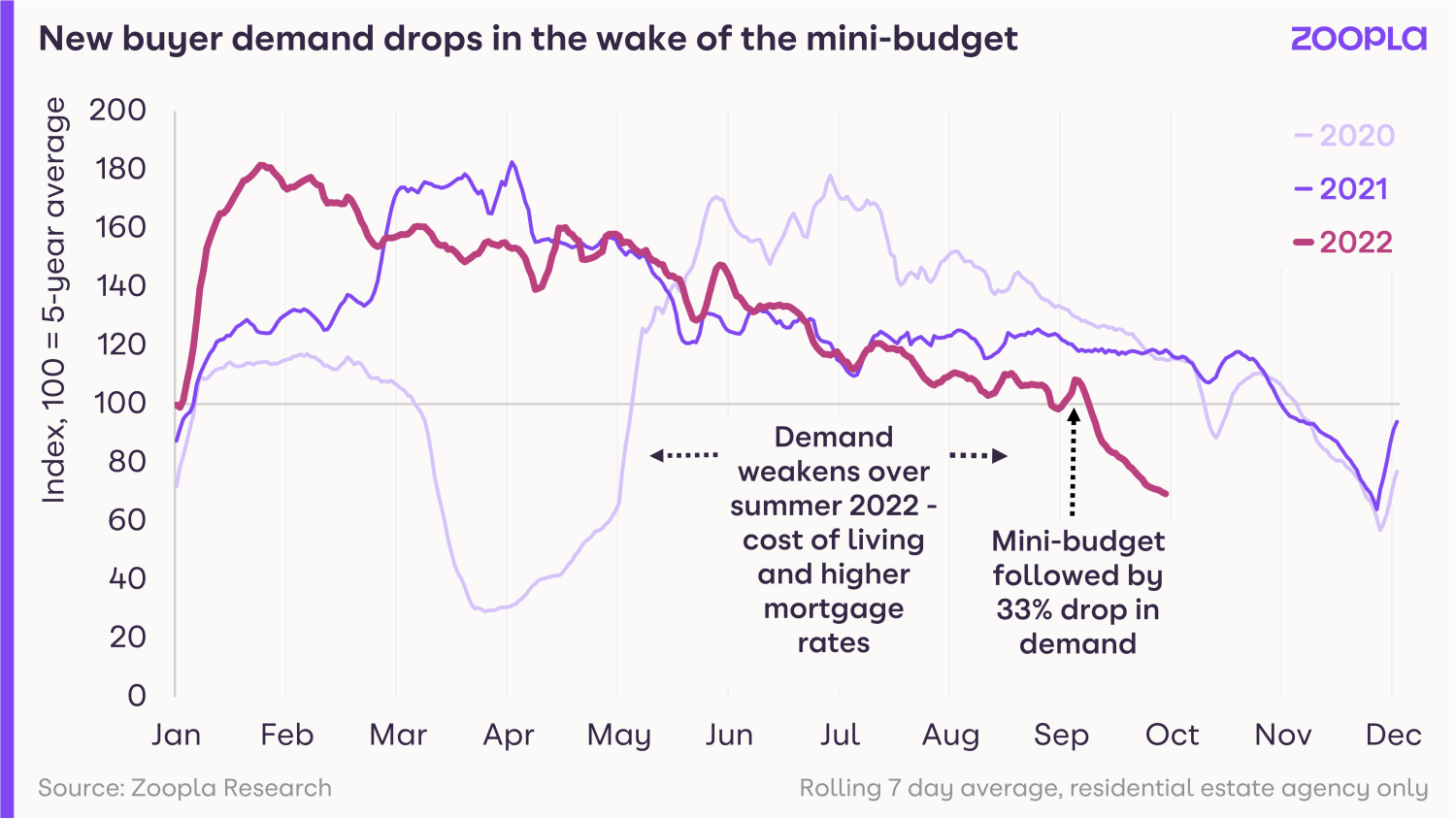

In fact, demand from potential buyers dropped by a third since the mini budget, according to our latest figures.

This fall in demand, combined with higher mortgage rates, which will impact affordability, is expected to lead to some localised house price falls next year.

But we are not anticipating steep drops. Instead, we think the average cost of a UK home may dip by around 5%.

It's important to see this in the context of the strong increase in property values since the start of the pandemic, with a 5% fall only taking house prices back to where they were in the first part of this year.

Over the longer-term, house prices are likely to resume their upward trend, as the UK continues to fail to build enough new homes each year to keep pace with rising population growth.

What new regulations are being introduced?

The government has pledged to introduce the Renters Reform Bill during this Parliament.

The Bill includes measures to protect renters from unfair rent increases, while no fault evictions will be banned, homes will have to meet minimum standards and it will be easier for renters to have pets.

The changes are largely focused on improving the quality of homes in the private rented sector, with the government estimating that 21% of properties are currently unfit.

But for landlords who already maintain high standards, the new bill is not expected to lead to significant extra costs.

Nor is the government reported to be considering any new tax changes for landlords, such as the previous changes to mortgage interest tax relief and the end of the ‘wear and tear’ allowance that caused many landlords to exit the sector a few years ago.

Should I purchase a buy-to-let property?

The answer to this question will very much depend on your individual circumstances.

But with buyer demand generally falling, first-time buyers delaying getting on to the property ladder, and house prices expected to dip, you are likely to be in a strong position to negotiate a discount on the asking price.

Meanwhile, demand from renters is strong, and rents are continuing to rise.

That said, with average mortgage rates currently high, it is important to make sure you do your sums to ensure a buy-to-let property is affordable.

With many households struggling with cost-of-living increases, you should also think about whether you would be able to afford monthly mortgage interest payments on a buy-to-let property if your tenant fell behind with their rent, or you had a period when the property was not rented out.

What’s the outlook for the buy-to-let market?

The buy-to-let property market is likely to encounter some ‘bumps’ in the coming year as a result of higher mortgage rates and the impact of the cost-of-living squeeze on renters.

House prices could also dip, reducing the value of investment properties.

But with demand for rental homes massively outstripping supply, and strong rent increases expected over the medium term, buy-to-let properties could still be a good bet over the long term for those who can afford to ride out short-term issues in the market.

Key takeaways

- Lenders are returning to the buy-to-let mortgage market following the chaos caused by the mini budget, with more than 1,400 different products currently available

- The average interest rate is 6.76% on a 2 year fixed rate buy-to-let mortgage and 6.73% on a 5 year one

- Rents have increased by £115 during the past year to average £1,051

- Demand from renters significantly exceeds supply, which will continue to push rents higher

Bank Rate rises to 3% to reach highest level since 2008

The UK Bank Rate has risen to 3% from 2.25% in the biggest single increase for 33 years. Here's what it means for you and your home.

The Bank of England has increased interest rates by 0.75% - the biggest single increase since 1989, apart from the almost immediately reversed rise on Black Wednesday in 1992.

The Bank Rate is now at 3%, its highest level since 2008.

It was the eighth meeting in a row at which the Monetary Policy Committee (MPC) has increased the official cost of borrowing, as it continues to battle high inflation.

The move adds around £86 a month to repayments for someone with a £200,000 variable rate mortgage.

The increase will impact the estimated 850,000 people who have a tracker mortgage, and the 1.1 million who are on their lender’s standard variable rate, both of which move up and down in line with the Bank Rate.

Homeowners with variable rate mortgages have now seen their mortgage payments rise by more than £300 a month since December, at a time when they are also grappling with steep increases to the cost of living.

"Money markets were expecting a hefty jump in the Bank Rate"

Director of Research and Insight at Zoopla, said: "Money markets were expecting a hefty jump in the Bank Rate today. Most borrowers used fixed rate loans so it's the cost of 2 and 5 year fixed rate money for banks that underpins mortgage rates more than the base rate.

"Today's jump does not worsen the outlook for mortgage borrowers but home buyers need to realise that 4% to 5% mortgages are set to be the norm in future, not the 1% to 2% of recent years."

What's going to happen to the housing market in 2023?

Why has the Bank Rate been increased?

The MPC has increased the Bank Rate by 2.9% since it first started to raise the official cost of borrowing in December last year, in a bid to bring inflation down.

Despite these increases, inflation – which measures the rate at which the cost of goods and services is rising – has remained stubbornly high at 10.1%.

The MPC’s job has been made significantly harder by former Chancellor Kwasi Kwarteng’s mini budget.

The markets were spooked by his plans to cut taxes and increase spending, leading to a steep drop in the value of the pound. This in turn made imports more expensive, and was expected to push inflation higher.

It also impacted the housing market, with the number of people looking to buy a home dropping by a third in the wake of the mini budget.

In the minutes on its latest meeting, the MPC warned that “further increases in Bank Rate may be required” in order to get inflation back down to its 2% target.

But there was some good news for homeowners, with the MPC adding that interest rates were likely to peak at a lower level than was being predicted by the financial markets.

Economists had previously expected interest rates to have to increase to around 5% by the middle of next year, but they have since trimmed their forecasts to 4.25%.

What should I do about my mortgage?

If you are on a fixed rate mortgage

If you are on a fixed rate mortgage you don’t need to do anything right away. The interest rate you are paying will stay the same until the end of your product term, usually two or five years.

If you are coming to the end of your deal, you should start thinking about your next one.

Most lenders will allow you to ‘book’ a new rate between three and six months before your current one ends.

But you need to be prepared for a significant increase in your monthly repayments, as interest rates are now likely to be much higher than they were when you took out your mortgage or last remortgaged.

Mortgage rates could fall slightly towards the end of this year and early next year as markets stabilise, so you may want to wait to see if this happens before committing to a new rate.

Mortgage rates expected to fall in 2023

But there is no guarantee that rates will fall, and the MPC could increase the Base Rate further at its December meeting.

If you are on a standard variable rate (SVR) mortgage

If you are on your lender’s standard variable rate (SVR), the rate you are automatically put on when your mortgage deal ends, you may want to remortgage soon.

The average interest rate charged on SVR mortgages was already 5.86% before the latest interest rate hike, its highest level for more than a decade, and it is likely to increase by a further 0.75% following today’s Bank Rate increase.

That said, if you are comfortable sitting on a higher rate for a couple of months, you may want to delay remortgaging to see whether rates do come down.

If you are on a tracker mortgage

If you are on a tracker mortgage, which moves up and down in line with changes to the Bank Rate, you may want to stay put.

Although the Bank Rate is widely expected to rise further, interest rates charged on fixed rate mortgages have already factored in some of these anticipated increases.

As a result, the average cost of a two year fixed rate mortgage is currently 6.47%, while interest charged on a five-year deal is only slightly lower at 6.32%.

It is important to remember that if you take out a fixed rate deal, you will be locking into the current high interest rates for two or five years, depending on which product term you opt for.

How can I reduce my mortgage repayments?

If you are worried about the increase in your monthly repayments that you might face when you come to remortgage, there are steps you can take to reduce them.

One way to lower your repayments is to borrow less. While this may be easier said than done, if you have a good level of savings, you may want to think about using some of the money you have set aside to make a lump sum overpayment to reduce the size of your mortgage.

You can also reduce your monthly repayments by increasing your mortgage term.

For example, monthly repayments on a £200,000 mortgage on a fixed rate of 6% would be £1,450 if the mortgage was being repaid over 20 years.

But monthly repayments would fall to £1,210 if the term was increased to 30 years, and to £1,150 if it was being repaid over 35 years.

But it is important to bear in mind that increasing your mortgage term will mean you pay more in interest over the entire life of your mortgage.

It is also worth remembering that although interest rates have increased, the value of your home is also likely to have gone up since you last remortgaged.

As a result, you will be borrowing a lower proportion of your property’s value than previously, known as the loan-to-value (LTV) ratio.

Lenders offer their most competitive rates to people with lower LTVs, so you may now qualify for a better rate than previously.

What should I do if I’m struggling to pay my mortgage?

If you are struggling to keep up with your mortgage repayments, or think you may do so in the near future, it is important to contact your lender as soon as possible.

There are a number of steps lenders can take to help you, including granting you a temporary payment holiday or putting you on to an interest-only mortgage for a short time.

But options become much more limited if you have already missed a payment.

Lenders are obliged by the regulator to work with customers who are struggling with mortgage repayments to find a solution, and they can only repossess a home as a last resort.

Key takeaways

- The Bank of England has increased interest rates by 0.75% - the biggest single increase in 3 decades

- The hike leaves the Bank Rate at 3%, its highest level since 2008

- It does not significantly worsen the outlook for mortgage borrowers, but home buyers need to realise that 4% to 5% mortgages are set to be the norm in future

What’s happening in the housing market right now?

Three different prime ministers within the space of three months, a mini-Budget and a mini-Budget reversal.

The political turmoil in recent weeks has compounded the rise in borrowing costs, resulting in mortgage rates spiking above 6% and growing uncertainty over the UK’s economic outlook.

The health of the housing market is inextricably linked to the health of the economy and, in particular, the cost of borrowing.

Higher mortgage rates squeeze out new buyers

The sudden increase in mortgage rates represents the largest interest rate shock for new buyers since the late 1980s.

The immediate impact has been felt by the households who don’t have mortgages arranged at the cheaper rates that were available prior to - and during - the pandemic.

It explains why new buyer demand has fallen by a third since the mini budget.

That drop in buyer interest has been spread across all UK markets, as the pool of buyers with cheap mortgage offers dwindles.

The South East has seen the biggest drop, with demand down 40%, followed by the West Midlands, where demand is down 38%.

What we’re seeing right now is very similar to what we typically see in late November ahead of the Christmas slowdown.

However, those with cheap loans secured, as well as cash buyers, are continuing to make offers and agree sales, albeit at a slower rate than this time last year.

Dwindling pool of interested buyers with cheap mortgages

The pent-up demand to move remains.

In fact, many households rushed to secure low-cost mortgages over the summer as the rates started to rise.

The Bank of England data for mortgage approvals in August showed an unseasonal jump of 17%.

This demonstrates an underlying desire to move among a proportion of households, largely driven by the pandemic-led search for space and cost-of-living factors.

Large pipeline of sales remains

All that being said, 2022 was a strong year for the housing market and there are still around 293,000 sales still going through in the pipeline, most of which we expect to complete.

The number of sales falling through is beginning to increase, mainly as a result of a lack of affordable finance, but in total, we are still on track for nearly 1.3m sales this year.

Large scale price reductions not expected this year

We don’t expect any pricing impact to materialise until the first quarter of 2023.

Typically, it takes several months for pricing to adjust in the face of weaker demand.

There has been a short-lived surge in the number of homes coming to the market, although the number of homes for sale still remains below average, which is supporting pricing.

At the same time, around 7% of homes for sale have seen their asking price reduced by more than 5% - an increase on recent months but still below 2018 levels.

Average house prices have increased by 8.1% over the last year, thanks to the strength of demand and the number of sales agreed over the last six months.

This demand, combined with an ongoing shortage of homes available for sale, will continue to push prices higher for the rest of 2022.

But the annual rate of growth is starting to slow across all areas, and this will accelerate further into 2023.

Key takeaways

- Buyer demand has dropped by a third since the mini-Budget, across all UK markets

- That said, 2022 was a strong year for property - and nearly 300,000 sales are still going through this autumn, taking the year's total sales to 1.3m

- A shortage of supply means prices will remain buoyant for the rest of the year and we don't anticipate any impact on house prices to be felt until 2023

Mortgage rates expected to fall in 2023

In good news for buyers and homeowners wishing to remortgage, mortgage rates look set to fall towards the end of this year and into 2023.

Events are moving fast in the worlds of politics and the financial markets.

Already, the money markets are adjusting to a changing political outlook, where stability in the UK’s public finances is an imperative.

The big unknown that remains is how much further central banks will need to raise interest rates to bring inflation back under control.

A recent speech from the Bank of England suggested markets were over-estimating how much higher interest rates will rise. Only time will tell.

What is clear is that mortgage rates are not going to return to the ultra-low levels of recent years and home buyers need to adjust to the fact that 4-5% rates are set to become the norm in future.

Spike in mortgage rates makes housing less affordable

Tighter lending criteria inevitably impacts the buying power of new borrowers.

Lenders will now be testing affordability at up to 8% mortgage rates, squeezing that buying power even further.

Will mortgage rates keep rising in 2023?

The outlook for transactions and pricing in 2023 will all depend on what happens with the economy and with mortgage rates.

As buyers are affected by higher borrowing rates, so in turn are sellers, since reduced buying power will impact the asking prices sellers are able to achieve when marketing their homes.

The most important part of this equation is how long mortgage rates for new buyers stay at over 6%, and how quickly they might fall back to a more manageable 5%, a level we see as a tipping point for house price reductions.

Should mortgage rates fall back quickly in the next quarter, the outlook for next year will be very different, compared with the prospect of mortgage rates remaining at or above 6% for the next 12 months.

A return to 5% will bring some stability to the housing market and is likely to reduce the need for sellers to drop their asking prices to achieve a sale.

Key takeaways

- The money markets are already adjusting to the changing political outlook, where stability for the UK's finances is essential

- Mortgage rates are expected to fall to 4-5% next year and this is likely to be the new norm. The days of ultra cheap money are now behind us

- A return to 5% mortgages will bring some stability to the housing market and is likely to reduce the need for sellers to drop their asking prices to achieve a sale

What's going to happen to the housing market in 2023?

Will mortgage rates rise or fall, will house prices remain stable and is negative equity a real concern? Get the latest with our House Price Index.

Mortgage rates look set to fall in 2023

Events are moving fast in the worlds of politics and the financial markets.

On balance, we believe that mortgage rates will start to decline before the start of 2023 and this decline will continue into next year.

There are signs that the money markets are already adjusting to a changing political outlook where stability in the UK’s public finances is an imperative.

The big unknown remains how much further central banks need to move on interest rates to bring inflation under control.

A recent speech from the Bank of England suggested markets were over-estimating how much higher interest rates will rise. Only time will tell.

What is clear is that mortgage rates are not going to return to the ultra-low levels of recent years.

Home buyers need to realise that mortgage rates of 4 to 5% are set to become the norm in future.

Spike in mortgage rates delivers a quick reality check for home buyers

Many homebuyers are continuing with their agreed purchases.

Others did not expect to be buying with mortgage rates three-times higher than they were at the beginning of the year and are sitting it out for the rest of 2022.

That said, the broader motivations to move home will remain into next year.

These searches will largely be supported by pandemic factors, including the need for more space and a home office, as well as cost-of-living pressures, including the need for homes that are cheaper to heat and run.

For many households, a move will come down to what they can get for their current home and what this value unlocks for their next one.

Are house prices set to fall in 2023?

Any price reductions will come out of equity for most households but it can take time before everyone who wants to move accepts these pricing adjustments.

However, we expect this adjustment process will be quicker than normal, given the step change in the outlook and the scale of recent price gains.

While the focus has mainly been on mortgage rates, it’s important to note that the labour market remains buoyant and on average, wages increased by 5.4% in the year leading up to August.

The proposed cuts to National Insurance and the government’s support for energy bills will also help to offset some of the financial pressures homeowners are currently experiencing.

The housing market in 2023 mainly looks set to be one of re-adjustment as we return to normal levels of mortgage rates.

How will the hit to buying power affect the market in 2023?

A rapid reversal in mortgage rates would have the greatest impact on buying power, enabling buyers to borrow for their next move without over-stretching themselves.

If a modest decline in house prices took place too, that desire to buy could be further accelerated.

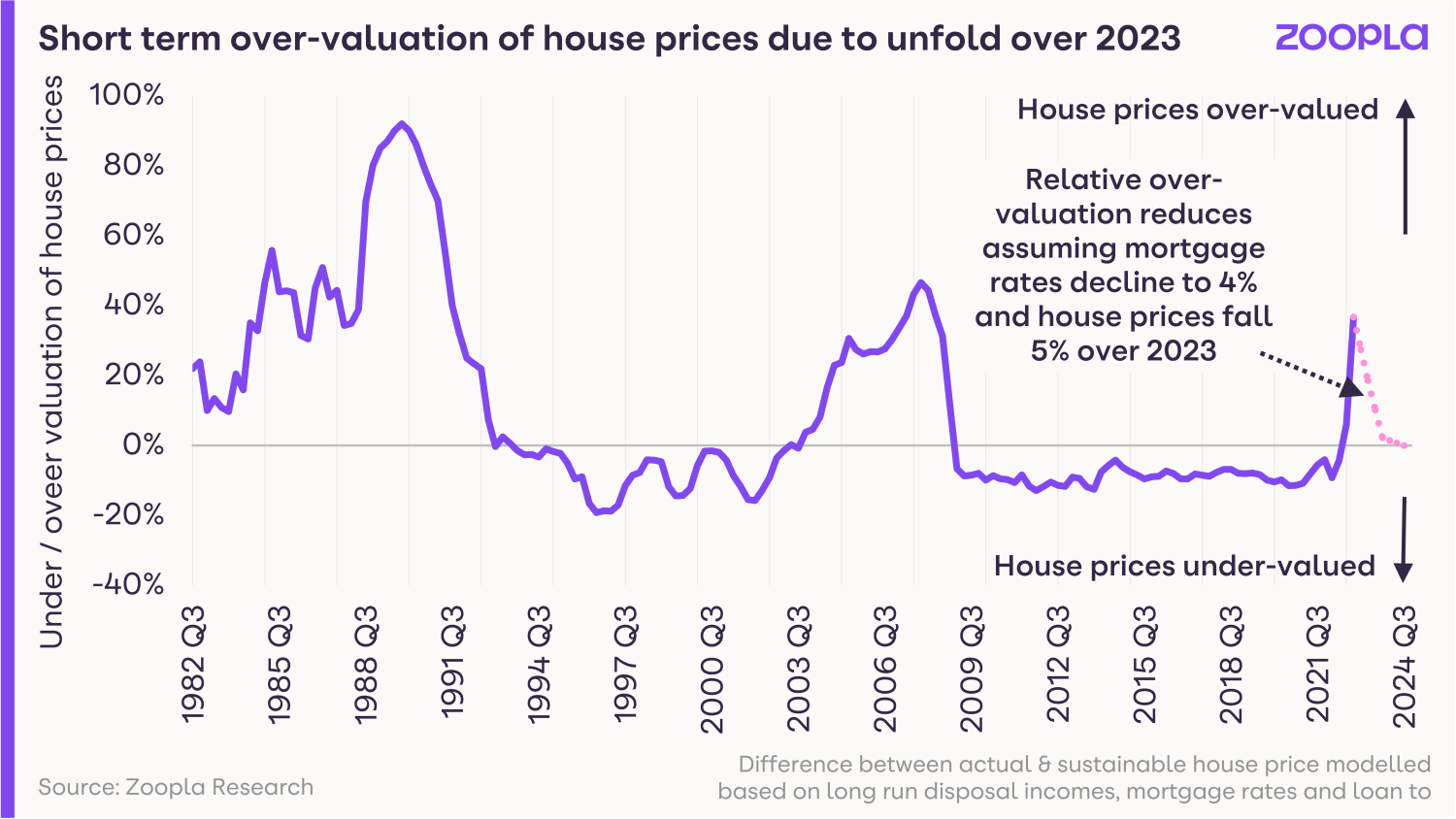

Mortgage rates moving back towards 4% by the end of 2023 and a 5% fall in house prices would see most of the market’s current over-valuation reversed by December next year.

At present, we believe this will be the most likely outcome, accompanied by a modest decline in sales volumes from 1.3m to 1m in 2023.

Key takeaways

- Mortgage rates look set to return to 4 to 5% next year - and these rates are set to become the norm in future. The days of ultra cheap money are behind us

- Pandemic and cost-of-living factors will continue to drive the search for new homes in 2023

- A 5% fall in house prices next year would see most of the market’s current over-valuation reversed by December 2023

What does a Rishi Sunak prime ministership mean for the housing market?

A new era of financial and economic stability, falling mortgage rates and rental market reforms. What Rishi Sunak has in store for the housing market.

It’s been a political roller coaster over the last few months, accompanied by growing economic uncertainty for UK households at a time when the cost of living is having a growing impact on financial decisions.

So what does the new prime minister have at the top of his inbox when it comes to the housing market and supporting people with their home-related decisions?

Financial and economic stability

It is fair to say everyone is looking for more stability and calm.

The arrival of Rishi Sunak as the new prime minister seems to have gone down well in financial markets, supported by several big policy U-turns from the new Chancellor Jeremy Hunt last week.

The top priority for the new prime minister is how to get the UK’s finances in order to help bring down borrowing costs for business and households and to help tackle the cost of living squeeze.

The health of the housing market is inextricably linked to the health of the economy and in particular the cost of mortgages, which have shot up to average over 6% in recent weeks.

This has delivered a big hit to buying power for those looking to move home, especially when we’ve been used to sub 2% mortgage rates.

Mortgage rates will start to fall

The cost of borrowing for government and business has fallen in the last 2 weeks and is set to fall further in the weeks ahead, as markets react to the messaging from the Government about balancing the books.

Mortgage rates for new business are starting to fall but still remain well above where they started the year.

The outlook for interest and mortgage rates is still out of the Government’s hands.

We don’t know how much further central banks will have to increase base rates to calm inflation, which is adding to everyone’s cost of living and eroding the value of our incomes.

There is hope that we are approaching the end of interest rate increases, which is good news for savers after a barren decade of low returns on savings, but means buying a home has become more expensive.

It looks like mortgage rates will return to 4-5% in 2023. But anyone looking to buy a home needs to realise that we are not going back to the days of ultra cheap money.

Home ownership and house building

Both Labour and the Conservatives have stated policies to increase home ownership. But it’s hard to grow home ownership if we aren’t building more homes.

The appointment of Michael Gove back into the housing and the levelling up ministerial role is a signal that the 2019 manifesto commitment remains to boost jobs and investment right across England. This will, in turn, boost housing delivery.

Gove was also the minister who pushed through the industry solution to address the cladding problems for homeowners in tall residential buildings, removing a big area of uncertainty for consumers and lenders.

Building more homes is often a contentious topic for local residents, who fear extra demands on local services.

Comments on house building from the new prime minister in the summer leadership election suggest he sees the importance of making sure we build homes and the infrastructure to support them.

This would help to ease any extra pressure on local services.

Sunak said he favours “reforms to increase density in our inner-cities, investing in regenerating brownfield land across the country, and pursuing developments that have community support.”

Sticking to reforms for private renting?

There are also big reforms planned in the private rented sector in England, aimed at improving standards of accommodation and shifting the balance of the relationship between landlords and renters.

Again, these were promoted by Michael Gove when he was the housing minister earlier this year.

The rental market is particularly stretched at present, with a lack of new investment by landlords since big tax changes and increased regulation were introduced from 2016 onwards.

The rental market has stopped growing in size, yet the demand for renting is growing, compounded by the rising cost of buying a home.

Rents are rising fast - up 12% in the last year according to our latest index - adding to cost of living pressures.

The case for reform in the rental market is important but it needs to be balanced against how much this pushes landlords out of the market, eroding supply and choice for renters.

This hits those on the lowest incomes hardest and drives calls to increase housing benefit to reduce the risk of people falling into homelessness.

Plenty of work to do on housing

So there is plenty for the new prime minister to cover on the housing brief at a time of rising prices and rents but with the additional risks from higher borrowing costs.

The reality is that the government shouldn’t worry about the short term outlook for housing.

They need to focus on delivering long term stability that gives businesses and households a steady platform to make long term decisions.

The top priority is keeping the economy growing and borrowing costs affordable, while creating an attractive environment to ensure we get the right glow of new investment into growing and improving our ageing housing stock across all areas and housing tenures.

Key takeaways

- Mortgage rates look set to return to 4-5% in 2023, but the days of ultra cheap mortgages are behind us

- On house-building, Sunak says he favours “reforms to increase density in our inner-cities, investing in regenerating brownfield land across the country, and pursuing developments that have community support”

- The rental market has stopped growing in size, yet the demand for renting is growing. The government needs to tread carefully with reforms to prevent more private landlords from leaving the sector

Mortgage market shows signs of stabilising

Mortgage product choice increases as nearly 900 deals are added, while mortgage rates could ease as the market shows signs of stabilising.

Mortgage rates have hit a 14-year high in the wake of the chaos caused by the mini-Budget.

The average cost of a two-year fixed rate deal has soared to 6.65%, while the typical interest rate charged on a five-year fixed rate product is 6.51%, according to financial information group Moneyfacts.

The rates on both deals are the highest since 2008, and significantly above the 4.24% and 4.33% that two-year fixed rate and five-year fixed rate deals respectively stood at in early September.

But the total number of products available to choose from has stabilised in recent days as lenders relaunch their ranges.

After hitting a low of just 2,258 different deals in the first weekend of October, availability has increased to 3,128 products now.

There are hopes that the market will stabilise further and mortgage rates could drop slightly following the resignations of both former Prime Minister Liz Truss and former Chancellor Kwasi Kwarteng.

Why is this happening?

The cost of fixed rate mortgages has been on an upward trend since the beginning of the year, when it became clear the Bank of England would have to increase interest rates significantly to get high inflation back down to its 2% target.

But the mortgage market became highly volatile following the former Chancellor’s mini-Budget in late September.

The unfunded tax cuts and the cost of the energy price guarantee spooked markets, leading to a steep increase in the cost of government borrowing – known as gilt yields.

Gilt yields influence the price of Swap rates – which is the cost lenders pay to borrow money for fixed rate mortgage deals.

The good news is that following the resignations of Truss and the reversal of many of the measures announced in the mini-Budget, gilt yields have fallen slightly.

It is hoped that they will fall further as political stability is restored, enabling lenders to reduce the interest they charge on fixed rate mortgages.

What should I do now?

The current situation is difficult for people who need to remortgage.

Anyone who takes out a fixed rate mortgage now will be locking into the current high rates for two to five years.

What type of mortgages are there?

While the cost of fixed rate deals may come down slightly as gilt yields fall, there is no guarantee that this drop will be passed on by lenders.

Meanwhile, with inflation remaining above 10%, the Bank of England’s Monetary Policy Committee is widely expected to raise interest rates when it meets in early November.

Some economists are predicting it could increase them by as much as 1% to 3.25%.

It is important to factor in the impact of future interest rate rises when deciding what to do.

At 5.63%, the typical standard variable rate – the rate borrowers are automatically moved to when their existing deal ends – is lower than both two-year and five-year fixed rate mortgages.

But if the MPC does increase rates by 1% in November, and lenders pass this on in full to customers on their standard variable rate, it will be on a par with fixed rate deals.

Meanwhile, tracker rates have started to look good value again, with interest on the average two-year product standing at 3.71%.

But it is important to remember that the rates charged on tracker mortgages automatically move up and down in line with changes to the Bank of England base rate.

Economists are predicting the Bank Rate could peak at 5% next year.

If this happens, a tracker rate of 3.71% now would rise to 6.46%.

For many borrowers the decision is likely to come down to whether they want the security that their monthly repayments won’t change with a fixed rate mortgage, or whether they are happy to risk interest rates peaking at 5% and opt for a tracker deal.

What’s the background?

With the mortgage market in such a state of flux, it may be a good idea to consult a mortgage broker, who can help you find the deal that is best for you.

Whatever you decide to do, you are likely to need to move quickly.

The final three months of the year is traditionally a busy time for remortgaging, and this year is likely to be even busier than usual, as homeowners scramble to remortgage before interest rates rise further.

The situation has recently led to lenders withdrawing mortgages in order to maintain their service standards, after receiving high levels of applications.

As a result, good deals are unlikely to be around for long.

Key takeaways

• After hitting a low of just 2,258 different deals in the first weekend of October, availability has increased to 3,128 products now

• Tracker rates have started to look good value again, with interest on the average two-year product standing at 3.71%

• The average cost of a two-year fixed rate deal has soared to 6.65%, while the typical interest rate charged on a fix-year fixed rate product is 6.51%