What does the Autumn Budget mean for the housing market?

Second home stamp duty raised to 5% from tomorrow, but relief for first-time buyers and home movers remains until April 2025. Capital Gains Tax increased and thousands of affordable homes to be built. How the Autumn Budget impacts the housing market.

In Labour’s first budget for 14 years, the country’s first female Chancellor, Rachel Reeves, emphasised she’d inherited a ‘dire’ situation from the Conservatives and had to make difficult choices to fix the foundations for the UKs economy.

Overall, taxes were raised by £40 billion, the upper end of what economists had predicted. The bulk of the money raised will come from National Insurance contributions paid by employers, which will make up £25 billion of the total.

Further revenue will be raised by Capital Gains Tax, closing inheritance tax loopholes and increases in stamp duty for second home buyers, which will raise a further £9 billion.

So what does it all mean for the housing market?

Stamp duty on additional homes raised from 3% to 5%

From tomorrow, people buying an additional home will need to pay an extra 2% of the entire property cost in stamp duty.

Second-home stamp duty rates today are currently 3%, meaning buyers pay an additional 3% of the entire value of the property on top of any standard stamp duty that's payable.

But from tomorrow, that 3% rate rises to 5%.

So, the new stamp duty bands will be:

For the portion between £0 - £250,000 - 5% stamp duty

For the portion between £250,000 - £925,000 - 10% stamp duty

For the portion between £925,00 - £1.5m - 15% stamp duty

For the portion above £1.5m - 17%

The move is likely to unsettle property investors, in a market where many landlords are already selling and 12.5% of homes currently for sale are former rental properties.

This is reducing the amount of rented accommodation available to renters, causing competition for homes and in turn pushing up the cost of renting.

Our Executive Director of Research, Richard Donnell, says: ‘The private rented sector has seen static supply since tax changes were introduced in 2016. There is a steady net selling by landlords in response to changes in tax policies, alongside greater regulation of housing and higher mortgage rates.

‘We need to keep as many landlords as possible in the market to provide choice for renters who are currently facing limited options. Rents rising faster than earnings is hitting those on the lowest incomes the hardest.’

Reeves said this increase has been made to support people buying their first home or moving home, and kept the current raised stamp duty threshold in place for first-time buyers and home movers until April 2025.

Stamp duty threshold held for first-time buyers and home movers until April 2025

First-time buyers will continue to benefit from a raised stamp duty threshold until April 2025, meaning they won’t have to pay any stamp duty on properties costing up to £425,000.

However, from next April, the stamp duty threshold will be lowered to £300,000.

For now, for properties costing between £425,000 and £625,000, first-time buyers will need to pay 5% tax on that particular portion of the property. And for properties costing over £625,000, normal stamp duty rates apply.

But from April 2025, first-time buyers will need to pay stamp duty of 5% on the portion of the property between £300,000 to £500,000.

For home movers selling their home to buy their next home, the stamp duty threshold of £250,000 also remains in place until April 2025:

For homes costing over £250,000 you'll need to pay 5% on the portion up to £925,000.

For homes costing over £925,000, you'll need to pay 10% on the portion up to £1.5m.

And for homes costing over £1.5m, you'll need to pay 12% on the portion over £1.5m.

However from April 2025, the stamp duty threshold for home movers will be lowered to £125,000 and 2% stamp duty will need to be paid on the portion between £125,000 and £250,000.

Capital Gains Tax increased but rates on property left untouched

Capital Gains Tax is the tax charged on profits made from the sale of assets, including second homes.

Today the chancellor increased Capital Gains Tax for lower rate taxpayers (those earning under £50,270 a year) from 10% to 18% and the rate for higher rate taxpayers (those earning over £50,270) from 20% to 24%.

However, the rates on residential property sales will remain at 18% and 24%.

‘This means the UK will still have the lowest capital gains tax rate of any European G7 economy,’ said Reeves.

Inheritance tax rules for property held until 2030

The inheritance tax rules for property will remain the same until 2030.

Currently the first £325,000 of a property’s value can be inherited tax-free. This rises to £500,000 if the property is passed on to direct descendants: children and grandchildren.

And £1 million if a property is passed onto a spouse and then inherited by direct descendants.

However, the inheritance tax rules are set to change when it comes to inherited pensions from April 2027, when unused pension funds and death benefits will be included within the value of a person’s estate for inheritance tax purposes.

£500 million for affordable housing

Reeves announced £500 million for affordable housing as part of a package worth £5 billion to deliver 33,000 new homes, boost supply and support small housebuilders.

Several sites across the country have already been earmarked for development, including Liverpool Docks, where 2,000 new homes are to be built, and Cambridge, 'to help realise its full growth potential'.

The government also plans to increase the supply of affordable housing by reducing Right to Buy discounts so that more council homes remain within the sector.

In a statement, the government said England’s existing social housing supply is ‘depleted every year by the Right to Buy scheme, while also disincentivising councils to build new social housing’.

Local authorities can now retain full receipts from transactions so that the money can be reinvested back into housing stock.

Donnell says: ‘The Budget focus on housing is rightly on the long term plan to grow housing supply and inject funds to support more affordable homes alongside a much needed rent settlement for social housing providers.

‘Many of the pressures in the housing market come from a lack of supply or not enough of the right kind of homes, so growing supply is a top priority but it is far from a quick fix.

‘The housing market needs long term solutions that lead to a better market for all over 5, 10 and 20 years. Growing supply is the no 1 priority and this needs a multi pronged approach, which involves much more than simply adding a bit more money to the affordable housing program.’

Dangerous cladding

Following the Grenfell Tower fire in 2017, Reeves also pledged £1 billion of investment to remove dangerous cladding from high rise apartment blocks next year.

Key takeaways

- Stamp duty increased to 5% on second homes

- Higher stamp duty thresholds remain in place for first-time buyers and home movers until April 2025, but are set to be lowered after then

- Capital Gains Tax increased but rates on residential property sales to remain at 18% and 24%

- £500 million pledged for affordable housing

What does the Autumn budget mean for household budgets?

How does Rachel Reeves's Autumn Budget affect household budgets? As the minimum wage rises to £12.21 an hour, National Insurance is frozen for employees and pensions increased, let's take a look.

‘On July 4 the country voted for change,’ said Chancellor Rachel Reeves in the UK’s first Labour budget in 14 years.

‘And change must be felt through more money in people’s pockets, an NHS that is there when you need it and through an economy that is growing, creating wealth and opportunity for all, because that is the only way to improve living standards.’

Reminding people that it was a Labour government that rebuilt Britain from the rubble of the Second World War in 1945, Reeves added: ‘Today, it falls to this Labour government to rebuild Britain once again.’

In the first budget in our country’s history to be delivered by a woman, Reeves commented: ‘I’m deeply proud to be Britain’s first ever female Chancellor of the Exchequer. To girls and young women everywhere, let there be no ceiling on your ambition, your hopes and your dreams.’

Adding that Labour had a responsibility to pass on a fairer society and a stronger economy to the next generation of women.

Of the last Conservative government, Reeves said: ‘Their austerity broke our NHS, their Brexit deal harmed British business and their Mini budget left families paying the price for higher mortgages.’

All of which left ‘a black hole in the British finances and public services on their knees.’

Reeves said there was a £22 billion black hole in the public finances which showed hundreds of under-funded pressures in the public finances, adding: ‘Never again will we allow a government to play fast and loose with the public finances.’

Outlining a plan to implement in full the 10 recommendations from the OBR, Reeves planned to tackle ‘inherited broken public finances and services too,’ which included:

-

NHS waiting lists at record levels

-

Children in Portakabins as school roofs crumble

-

Trains that don’t arrive

-

Prisons overflowing

-

Criminals who are not punished.

She also outlined ‘vital compensation schemes for victims of two terrible injustices: the infected blood scandal and the Post Office horizon scandal,’ with £11.8bn outlined for victims of the infected blood scandal and £1.8bn for the victims of the Post Office Horizon scandal, which were ‘long overdue for the pain and injustice people have suffered.’

In a budget designed to raise taxes by £40bn, Reeves pledged to ‘rebuild our public services’ while maintaining the Bank of England’s 2% inflation target, reducing borrowing and enabling real GDP growth, predicted to reach 1.6% by 2029.

Government savings

Reeves pledged to set a 2% savings target for all government departments to meet next year.

She also appointed a Covid Corruption Commissioner to uncover the companies that used a national emergency to line their own pockets.

And outlined plans for a crackdown on fraud in the welfare system, which is ‘often the work of criminal gangs’.

Counter fraud teams will be appointed to prevent illegal activity alongside new legal measures - including direct access to bank accounts to recover debt - which is intended to raise £4.3bn.

Tax and the cost of living

To ensure people pay what they already owe, Labour plan to modernise HMRC’s systems, cracking down on umbrella companies that exploit workers, while going after promoters of tax avoidance schemes. This will raise £6.5bn for the treasury.

Minimum wage rises to £12.21 an hour

‘Family finances are stretched and paychecks don’t go as far as they once did,’ said Reeves. ‘Today we are supporting people with the cost of living.’

Labour introduced the national minimum wage in 1999 and today Reeves announced plans to increase the National Living Wage by 6.7% to £12.21 an hour, worth up to £1,400 a year for a full-time worker.

‘For the first time, we will move towards a single adult rate phased in over time by initially increasing the National Minimum Wage for 18-20 year olds by 16.3%, as recommended by the Low Pay Commission, taking it to £10 an hour.’

Carers allowance weekly earnings limit increased

‘Carers are looking to increase the hours they work,’ said Reeves.

Carers allowance currently provides £81.90 a week to help those with additional caring responsibilities.

‘Today, I can confirm that we are increasing the weekly earnings limit to the equivalent of 16 hours at the National Living Wage per week, the largest increase in Carer’s Allowance since it was introduced in 1976.

‘That means a carer can now earn over £10,000 a year while receiving Carer’s Allowance, allowing them to increase their hours where they want to and keep more of their money.’

Universal debt repayments percentage lowered

Reeves announced £1 billion to extend the household support fund and discretionary housing payments to help those facing financial hardship.

She also pledged to reduce the level of debt repayments taken from universal credit from 25% to 15% of a standard allowance.

This means ‘1.2 million of the poorest households will keep more of their money each year, up to £420 a year.’

Workers’ rights

Reeves outlined plans to protect working people from unfair dismissal, safeguard them form bullying and provide better access to maternity and paternity leave.

Pensions triple lock kept

Pledging to keep the pensions triple lock, Reeves said spending on pensions will rise to £31 billion by 2029/30.

The new state pension will be uprated by 4.1% in 2025-26, meaning 12 million pensioners will gain up to £470 next year.

The Pension Credit Standard Minimum Guarantee will also rise by 4.1% from around £11,400 per year to around £11,850 for a single pensioner.

Fuel duty frozen

‘Increasing Fuel duty next year would be the wrong choice,’ said Reeves. ‘So I’ve decided to freeze fuel duty next year and save the 5p cut next year too. There will be no higher taxes at the petrol pumps next year.'

National insurance frozen for employees

‘I will not increase your national insurance, VAT or Income Tax,’ said Reeves.‘Working people will not see higher taxes in their payslips. A promise made and a promise fulfilled.

‘But to raise the revenues required to fund our public services & to restore public stability, I will increase employers' national insurance by 1.2% to 15% by April 2025.’

There will be no extension of the freeze in income tax and national insurance thresholds and instead personal tax thresholds will be uprated inline with inflation once again.

‘This government chooses to protect working people every single time,’ said Reeves.

Tobacco and soft drinks

The price of tobacco will rise inline with the Retail Price Index +2% and duty will be added on vapes from 2026.

A soft drinks industry levy will also be introduced, increasing duty inline with Consumer Price Index going forward.

These measures are designed to raise £1 billion a year.

Air passenger duty

Has not kept up with inflation in recent years, so Labour are introducing an adjustment, which will mean an increase of no more than £2 for a standard economy flight.

However, for those lucky enough to fly by private jet, the news is not so good. Air passenger duty will rise by 50%, costing around £450 per passenger for a private jet to California.

Alcohol duty

Duty rates on non-draught products are set to increase along with the Retail Price Index next year. However draught duty will be cut by 1.7%, cutting ‘a penny off the pint in the pub’.

Private schools and VAT

Currently 94% of the UK’s children attend state schools.

In a move designed to raise £9 billion for the treasury, ‘We will introduce VAT on private school fees from January 2025, and remove business rates relief too,’ said Reeves.

Breakfast clubs at schools

'Every child deserves to have very best start in life and the very best start to the school day too, so we’re tripling investment in breakfast clubs to fund them in thousands of schools,’ said Reeves.

The core schools budget will also be increased by £2.3 billion to hire thousands more teachers into key subjects.

A further £300m was pledged for further education, as SEN provision to improve outcomes for the most vulnerable children is to receive a £1 billion uplift in funding, up 6% from this year.

Schools in general will be given a 19% increase in funding through £6.7bn of capital investment to the Department for Education.

£1.4 billion has been earmarked for the schools in greatest need and a further £2.1 billion more for school maintenance.

NHS funding

The NHS will receive a £22.6 billion increase in its day to day health budget and a £3.1 billion increase in its capital budget. ‘The largest real terms growth outside of Covid since 2010,’ said Reeves.

The funding is designed to deliver repairs and upgrades to NHS buildings, increase capacity for tens of thousands of procedures and fund additional new beds.

Labour also plans to launch new surgical hubs and diagnostic centres, so people waiting for treatment can get it as quickly as possible.

‘We can now begin to bring waiting lists down,’ said Reeves. ‘Our target for waiting list times will be no longer than 18 weeks.’

‘These are the right choices to fix our NHS, protect working people and rebuild Britain.

‘More teachers in our schools, more appointments in our NHS and more homes being built.’

Key takeaways

- Minimum wage rises to £12.21 an hour as National Insurance is frozen for employees

- Pensions triple lock kept and fuel duty freeze continued

- Carers allowance weekly earnings limit increased and Universal debt repayments percentage lowered

Unmissable things to do and events in London in November 2024

Your comprehensive guide to the best events, pop-ups and things to do in London this November

We know what you’re thinking, but November isn’t just a non-month sandwiched in between Halloween and Christmas. Despite the long dark evenings now the clocks have gone back, November is sparkling, and not just because of all the Diwali celebrations, Bonfire Night antics and Christmas light switch-ons that happen around the city at this time of year.

And that’s just some of the exciting stuff happening throughout November 2024 in London. For more ideas on how to spend the early part of the festive season, check out our full roundup of the best events and things to do in London this November.

1. Skate at Somerset House

Somerset House’s iconic ice rink has become a Christmas tradition for Londoners and visitors heading to the capital for some festive cheer. There’s good reason – gliding (or, at least, attempting to) around the rink, gazing upon the Georgian architecture and 40ft Christmas tree feels like you’ve skated onto a movie set. There’s more to this rink than just skating, with pop-up gourmet dining and DJ takeovers.

2. Hyde Park Winter Wonderland

Each year, Hyde Park gets transformed from pretty park to Winter Wonderland. The annual favourite returns in 2024 for its seventeenth year, bringing a sleigh-load of festive fun with it. As you make your way around the space, you’ll find fairground rides, a child-friendly Santa Land (including Santa’s Grotto, where presents may be waiting) and traditional Christmas markets where you’ll be able to buy gifts for all your loved ones. Other highlights include circuses and, of course, the biggest outdoor ice rink in the UK, the Real Ice Slide, ice scultpting workshops and a German-style Bavarian Village.

3. Thanksgiving in London

Need an opportunity to get stuck into an utterly decadent feast just a month before Christmas dinner? Then let us present Thanksgiving: the American holiday dedicated to eating piles of turkey and lashings of pumpkin pie. There’s a bunch of different ways you can celebrate in London come November 25 – here are a few of our faves.

4. EFG London Jazz Festival

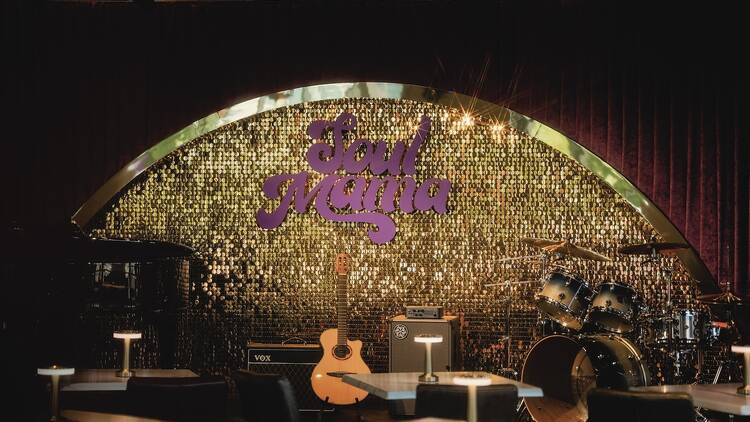

Every year, the EFG London Jazz Festival brings together the best and brightest of the genre in venues across the city, from jazz staples like Ronnie Scott’s to the capital’s arts venues like Southbank Centre and new spots like Soul Mama. This year is no different. The 2024 line-up promises a bounty of bops, whether you’re looking to discover new artists on the scene (LCCM Presents Emerging Sounds Of London, Nov 15), want to celebrate past masterpieces (Hejira Duo Celebrate The Jazz Side Of Joni Mitchell, Nov 16), or want to witness some legends in action (Robert Glaser, Nov 18 and 21). As well as tons of concerts every day, there’s also sessions, workshops, talks and more to take part in and enjoy.

5. London Palestine Film Festival

London Palestine Film Festival’s programme features films that both reflect on Palestine and share the political realities and experiences of Palestinian people both in their homeland and around the world. Many of the screenings are accompanied by talks, so you can get deeper context and understanding on the visuals, too. Look out for the likes of ‘The Fifth War’, a document of Israel’s 1978 invasion of Lebanon, ‘Familiar Phantoms’’ personal storytelling from Larissa Sansour, and ‘To A Land Unknown’, which follows a Palestinian refugee on the hunt for revenge in Athens.

Where can you get more space for your money?

Which homes offer the best value when it comes to price per square foot? Let’s take a look at the property types and locations that offer more bang for your buck.

Different ways of looking at property size

Buyers in the UK tend to focus on the number of bedrooms a property has when deciding what to buy.

But beyond the British Isles, the cost of floor space is the big deciding factor for home movers.

Looking at a home’s asking price per square foot (sq ft) is a logical way to assess its value for money, which is increasingly important in today’s affordability-challenged times.

Price per sq ft also deals with the challenge of homes and bedrooms coming in different shapes and sizes.

Some homes will have extra receptions, bathrooms and storage all adding to the total floor space, meaning the largest 3-bed semis can have 55% more space than the smallest ones.

Many buyers only find out about these differences during the viewings, whereas comparing homes on a price per sq ft basis can help you eliminate the ones that are simply too small and save you precious viewing time.

Average price per sq ft of different property types

While differences in the amount of floor space in homes can be subtle, the variations in price can be significant.

Looking at the cost per sq ft allows you to easily compare the value for money offered by each property type.

Which properties offer the best value in terms of space?

Our research finds that terraced homes offer the best value for money.

The price per sq ft of a terraced property ranges from £225 for a 2-bed to £235 for a 4-bed house.

Detached and semi-detached homes come with a higher price tag per sq ft but tend to offer more space and external features, such as off-street parking options.

Flats are often seen as offering the least value for money. However, that’s not always the case.

Outside of London, the average of a 2-bed flat is £245 per sq ft. That’s 9% lower than the average price of a 2-bed semi-detached house (£270 per sq ft).

Having said that, in the North West, Wales and London we find flats are some of the most expensive options when measured by cost per sq ft.

This is likely due to a rise in new developments featuring plenty of amenities in the cities of London, Manchester and Cardiff.

Most expensive areas per sq ft of property

In reality, what someone pays for a unit of space will vary by region as well as property type.

Outside of London, the average price per sq ft of property is £260. This means the space taken by a double-bed typically costs around £7,176 on average.

In London, that figure more than doubles to £585 per sq ft, meaning a double bed’s worth of space would cost £16,146.

However, buyers looking for a home in areas such as Erith (DA8), eastern Dagenham (RM10) and Belvedere (DA17) can pay less than £400/sq ft.

Those searching in neighbouring regions in southern England will pay £295 per sq ft, with prices rising to £295 in the South West and £375 in the South East.

Key takeaways

- The average UK home costs £300 per square foot

- A standard size double bed takes up 27.6 sq ft, costing buyers £8,280 on average

- Hartlepool is the cheapest area to buy when looking at pounds per square foot at £118 compared to Kensington and Chelsea at £1,373

- Homes in Inverclyde have seen the biggest percentage increase outside of London: up 13.2 per cent since 2023

- Terraced homes offer best value for money, ranging between £225 for a 2-bed and £235 for a 4-bed

- The average price per square foot ranges between £145 in the North East and £585 in London

- Historical seaside resorts and port towns offer the lowest prices, with Portsmouth, Plymouth, Dover, Great Yarmouth and Queensborough sitting at 38 to 45 per cent below their regional averages

Two fifths of workers unable to access home ownership in Great Britain

New report explores the affordability of housing to rent and buy across Great Britain.

In-depth analysis into the affordability of housing to rent and buy

Research team have published a new, comprehensive analysis into the affordability of housing to both rent and buy. This is important and timely as the ability of workers to access housing is shaping macro trends in the housing market with implications for home building, labour mobility and economic growth.

Access to housing and affordability is important for consumers making moving decisions. Moving home is often associated with positive themes such as trading-up to a larger home or moving to a better area.

However, the reality is that for a growing number of households it’s becoming more a question of what housing can be afforded and then considering compromises on location, size of home and accessibility to work.

The report highlights how single earner households and those on low incomes face much greater affordability challenges where the safety net of low cost rented homes is also inaccessible to cater for those in need.

The research report finds that the options to improve affordability are often limited due to the underlying structure of supply and limited choice of smaller sized homes to buy.

The analysis has important implications for the type and tenure of homes that need to be built as part of the 1.5m new homes target in England. The cross subsidy model of development is being challenged by weaker buying power of new home buyers. The report identifies three key focus areas for policy makers to start alleviating affordability challenges and improving access to housing.

A link to the full report is available at the end of this article.

Two fifths of working households are unable to buy

The headline finding is that 40% of full time workers in Great Britain are unable to afford to buy an average priced 2 or 3 bed home with an 80% loan to value mortgage.

Access to home ownership is most constrained in southern England and London where over half of workers can’t afford to buy an average priced 2 or 3 bed home.

The report finds that buying smaller homes and/or using a larger deposit are options to improve buying power and boost affordability but these may not be an option for many households.

Buying smaller homes delivers minimal gains highlighting the growing importance of equity as the key enabler of access to home ownership. Mortgage regulations introduced in 2015 stopped households taking on too much debt and creating a house price bubble but they have restricted access to housing, primarily across southern England.

Renting affordable to more workers than buying

While private rents have jumped by over 30% in the last 3 years, the ability of workers to access private rented housing is a better than for buying.

Just over a quarter of workers are unable to afford renting across Britain. However, in London the picture is much worse with two thirds unable to afford rental costs.

Better access to renting is, in part, down to the greater availability of smaller sized homes in the private rented sector. However, workers on the lowest 20% of earnings face major rental affordability challenges across Britain.

The lack of growth in the stock of social housing for 30 years, and the stalling of growth in private rented housing since 2016 has compounded the pressure on low income households which has driven demand for temporary accommodation.

Affordability becoming more of a problem across regional cities

While there is a clear north-south divide in affordability at the national level, housing affordability is becoming more challenging across regional cities outside southern England as growth in jobs and incomes pushes house prices and rents higher.

There are 18 local authority areas outside southern England where more than 40% of workers are unable to buy. The worst position is in York where 61% of workers are unable to buy. This is followed by areas including Trafford (57%) in Greater Manchester as well as Leicester (46%) and Edinburgh (45%).

The list is different for renting which is led by Manchester where 56% of workers are unable to afford to rent a 2/3 bed home. This is followed by Edinburgh (48%) and then a further 7 areas where more than 30% of workers are unable to afford rental costs led by Nottingham (38%), Salford (36%) and Glasgow (35%).

Three focus areas to start tackling affordability

The analysis shows Britain has a varied pattern of housing affordability with clear differences between buying and renting across the country. There is a link between tenures where pressures in one tenure can have impacts on another. This is most obvious in the rental market where the growing inaccessibility of home ownership increases the demand for renting.

There are no easy solutions for policy makers - the top 3 areas for focus identified in the report are as follows:

-

Build more smaller sized 1 and 2 bed homes for home purchase

-

Build more rented homes - social and private rented housing

-

Government to support creation of a market for long term fixed rate

Addressing housing affordability requires targeting supply into the market pinch-points of the market and taking a cross tenure view. Urgent attention is needed on the mortgage market and the extent to which lenders can support access to housing to a wider range of consumers.

While the narrative on building more homes is welcome, it’s important to shift the discussion on to the types and tenures of homes needed to support economic growth and boost access to housing for people on all incomes.

The home building model in the UK is changing and we will not deliver the homes the country needs without a clearer understanding and appreciation of who will buy them and what they can afford to pay. This applies to both consumer home owners and corporate investors buying homes for rent.

A reset in thinking is needed in policy circles on the new homes business model and the levers to support increased home building across Britain.

Key takeaways

- Affordability of housing increasingly shaping housing market trends with implications for home building, mortgage lending and economic growth

- New analysis finds 40% of full time workers are unable to buy an average priced 2 or 3 bed home in Great Britain

- Renting is more accessible than buying, with 27% of workers unable to afford rental costs despite fast growth in rents

- There is a wide north-south divide in affordability and access to housing is worst for single earners and those on low incomes

- Building more smaller homes to buy, boosting the supply of rented homes and launching a market for long term fixed rate loans are key focus areas for Government to start improving access to housing

- Without any policy response, market forces will shape affordability in the coming years mainly through very low nominal house price inflation and below average sales

London events in October 2024

Your guide to the best stuff to do, see, eat and drink across London during October 2024

This autumn, London comes alive with seasonal events and cultural highlights. Halloween celebrations take over the city with both family-friendly and adult events. Culture vultures can enjoy the BFI London Film Festival, London Literature Festival, and Black History Month events. Art enthusiasts shouldn't miss new exhibitions at the British Museum, Serpentine, and Barbican, plus the Frieze art fair. Theatre highlights include David Tennant in 'Macbeth' and a new musical version of 'The Devil Wears Prada'. For food and drink lovers, Oktoberfest and London Cocktail Week offer plenty of opportunities to raise a glass to the season.

1. Watch some brilliant new movies at the 68th BFI London Film Festival

This year’s BFI London Film Festival will kick off on Wednesday, October 9 with Steve McQueen’s World War II drama Blitz at the Royal Festival Hall. From there, the UK’s biggest film festival will be pressing play on its 68th edition, featuring 11 days and nights of movies, archive works, short films VR and XR experiences, talks, panels and parties. As in recent years, screenings will take place at Royal Festival Hall, BFI IMAX, BFI Southbank, and Bargehouse for the LFF Expanded XR strand, as well as at five London partner cinemas: Curzon Mayfair, Curzon Soho, the ICA, Prince Charles Cinema and Vue West End. Very much not a festival that’s just for the critics and VIPs, the LFF remains the most accessible of the world’s big film festivals, so you’ve got every chance of scoring seats to its packed line-up of new movies when tickets go on sale in September.

2. Get your skates on at Canary Wharf Ice Rink

Canary Wharf shakes off its business image a little with the return of its long-running ice rink this winter. From October through to late February, you’ll be able to spin and drift around the 1,200-square-metre arena, so whether you’re looking for a pre-Christmas activity or a fun way to kick off the New Year, this bad boy’s got you covered. Talking of covered, the whole thing is under a canopy that means not even the unpredictable British weather can spoil a sesh here. There’ll also be a ringside bar and themed DJ nights to ramp the good vibes up even higher.

3. See Elton John’s music adaptation of hit noughties comedy ‘The Devil Wears Prada’

In 20

4. Let down your synthetic wig at one of these Halloween events in London

5. Dive into the city’s macabre past at London Month of the Dead talks and tours

London Month Of The Dead’s annual programme returns this spooky season to get you in the mood for Halloween with some chilling – and fascinating – events. Ramp up to the big day throughout October with ghostly tours and talks that will take you inside cemeteries and other eerie locations across the city, from Brompton Cemetery to along the Thames. Each event delves into a different topic related to death and the afterlife, whether that’s the scientific side of things (‘Dissection And Dissipation – Life as a medical student in Victorian London’ and ‘The Golden Age Of Death – The dawn of modern forensic science’) or the scarier side (‘A Warehouse Of Homicide – The Metropolitan Police Crime Museum’ and ‘Buried Alive – The horror of premature internment’). These events are frighteningly popular, so book your ticket now.

6. Check out our roundup of perfect autumnal days out in London

Is that the saccharine scent of pumpkin spice in the air? Surprised to see lots of orange orbs taking over your local supermarket? It can only mean one thing: autumn is upon us in all its crispy-leafed, russet splendour.

From glowing sunsets, to bracing walks and cosy pubs, there are lots of things that make up the ultimate autumnal day trip and London has them in spadefuls. Whether it’s nestling up in an old-school whisky tavern with a wee dram, collecting up armfuls of pumpkins from the city’s premier markets or exploring Gothic cemeteries.

7. Celebrate the season and pick your favourite pumpkin for just £5

This autumn, celebrate the season by picking your perfect pumpkin straight from Hobbledown’s patch for just £5! Whether it's a family day out, a fun date, or a trip with toddlers, enjoy seasonal delights, street food, and Instagram-worthy photo spots in a hidden green oasis in West London. Located near Hounslow Heath, the pumpkin patch offers a variety of pumpkins to choose from. With a combined ticket, make it a full day by exploring Hobbledown's adventure playground and zoo before heading to the patch!

Find you perfect pumpkin for just £5* at Hobbledown Heath, only through Offers.

8. Give your brain a workout at New Scientist Live

Come get your brain tickled by talks from the smarties at top universities and scientific institutions and get interactive with some hands-on experiences that bring the latest research and technology in science to life. Explore everything from how hospitals will change in the future to taking a VR rollercoaster ride and getting up close with a bug zoo. Saturday and Sunday are for everyone, while the Monday is a special day for school visits.

Top Tips

- Book theatre tickets early to avoid disappointment

- Check weather forecasts and dress appropriately for outdoor events

- Many Black History Month events are free but may require booking

- Consider a London Cocktail Week pass for drink discounts citywide

Bank of England base rate held at 5%: what does this mean for mortgages?

What’s happened to the base rate?

The Bank of England has held the base rate, following last month's drop to 5% from 5.25%.

The base rate held at 5.25% for 11 months prior to last month's cut, having risen rapidly from a low of 0.1% in November 2021.

Higher base rates were needed to control inflation, which reached 10% in early 2023 and is currently hovering at 2.2%, just above the Government’s target of 2%.

The decision to hold the base rate, rather than increase it, will be welcome news for businesses and households alike, as it’s a sign that borrowing costs are not likely to increase.

As we look to next year, city economists are forecasting that it’s likely the base rate will fall to 4% by the end of 2025.

What does the base rate hold mean for mortgages?

The cost of a mortgage is not directly set by the Bank of England official base rate. Lenders mainly source their finance for fixed rate mortgages in the money markets.

The cost of this money is influenced by the expected direction of base rates, among other things.

Most borrowers using a mortgage to buy a property are on fixed rate loans for 2 or 5 years.

In the days leading up to the base rate announcement, two-year swap rates, that's the rates at which banks borrow money, started to drop from 4.3% to 4%.

Five-year swap rates dropped from 3.9% to 3.7%.

The situation has been improving for fixed mortgage rates too.

The latest Bank of England data for a five year fix 75% LTV has fallen to 4.3%, the lowest level seen in the last 2 years.

Based on current predictions, the mortgage rate forecast for 2025 is that rates will continue to go down, falling to around 4% by the end of next year.

Our Director of Research and Insight, Richard Donnell, says: “There is a mix of hope and expectation that average mortgage rates starting with a 3 will become the norm at some point soon, supporting those refinancing and breathing more life into the sales market by supporting home buyers.

“The underlying cost of finance for fixed rate loans has fallen in recent months as expectations for base rate cuts ebb and flow.

“This means average mortgage rates of 4-4.5% for a 5 year fix.”

But to help buyers, mortgage stress-testing needs to come down from around 8% to 6%.

“While the 'pay rate' for loans is falling, affordability stress tests continue in the background,” says Donnell. “This used to be 3% over the Standard Variable Rate and is now 1% over the revert rate once the initial deal comes to an end.

“This means lenders are typically stress testing new business at around 8%, although this appears an area where lenders are likely to be innovating to support new business and affordability.

“With city forecasts that the base rate will plateau at 3-3.25% by 2025/2026 it’s not unreasonable to assume the 5 year SWAP rate might plateau at this level.

“This will put average mortgage rates in the high 3% and low 4% range as the new normal.”

How will the base rate holding impact home buyers and the housing market?

The housing market is steadily adjusting to higher mortgage rates, with the worst of the impact felt in 2023.

2024 got off to a good start: households that put decisions on hold last year have returned to the market knowing that base rates aren’t going to rise any higher.

“The housing market is on track for 10% more homeowners moving compared to last year, and Zoopla expects average house prices to be 2% higher by the end of the year,” says Donnell.

"A key sign of confidence returning to the sales market is that buyers are paying almost 97% of the asking price. This is the highest it’s been for 18 months..

"Mortgage rates of 4-5%, while higher than the ultra low rates of 2019-2021, are becoming more manageable for home buyers. This is demonstrated by more sellers and more sales being agreed.

"Further growth in household incomes will help improve affordability, especially as we expect incomes to rise faster than house prices over the next 18 months."

What’s the impact on the mortgage market?

The mortgage market remains very competitive with lenders offering a wide range of mortgage deals for all types of buyer. Rates are changing all the time and responding to the outlook for the cost of borrowing.

If you’re looking to take out a new mortgage within the next six months, you can lock in the best rates available today.

When booking in a new mortgage deal, you can approach individual banks and building societies to find out their best rates. Or, you can work with a mortgage broker who will scour the market to find the best deals available to you.

Mojo Mortgages is part of the Zoopla family and works with over 70 different lenders across thousands of mortgage products.

Mojo won’t charge you for their services, because they charge the lender you choose to go with instead.

And if mortgage rates drop between now and the time your deal is due to start, you can ask your broker to rescan the mortgage market for you.

Key takeaways

- Bank of England base rate holds at 5%

- But swap rates, the rates banks pay to borrow money, have been falling in the last few days

- And the latest Bank of England data reveals 5-year, fixed-rate deals have fallen to 4.3%, the lowest level seen in the last 2 years

Should I buy my first home in 2024?

Mortgage rates have fallen by 1.2% since this time last year, saving the average first-time buyer £100-a-month in mortgage payments and £4,000 on a deposit.

A third of homes sold in the UK each year are bought by first-time buyers (FTBs).

But last year’s spike in mortgage rates meant buying a first-home became prohibitively expensive for many.

Highly motivated buyers either saved for bigger deposits or bought a smaller home than originally planned.

Others paused in their search, waiting for the cost of borrowing to fall.

Since the beginning of this year however, things have started to look up and our data shows demand for first homes has risen 20% year-on-year.

In fact, many first-time buyers are now looking at more expensive properties, averaging £249,100.

Mortgage repayments fall by £1,160 per year

According to Bank of England data, average mortgage rates have fallen from 5.7% last year to 4.5% today for those taking out a new 5-year, fixed-rate mortgage with a 25% deposit.

As a result, we estimate the average deposit is now £4,000 less than this time last year, despite many FTBs looking for larger homes and taking out larger mortgages.

Lower mortgage rates also mean lower monthly repayments, which have dropped from £1,076 to £979* for a typical first-time buyer home.

This translates to a monthly saving of £97 and an annual saving of £1,160.

However, as deposits fall and the prices of what FTBs are looking to buy increase, many are now borrowing more than they would have a year ago.

This, in turn, means that lenders will require a higher income to buy: £57,500 on average, up from £55,800 a year ago.

| Measure | July 24 | Jan 24 | July 23 |

|---|---|---|---|

| Most in-demand price point | £249,100 | £247,200 | £245,700 |

| Average deposit | £56,000 | £59,600 | £60,400 |

| Average mortgage size | £193,900 | £187,600 | £185,300 |

| Monthly repayment | £979 | £943 | £1,076 |

| Income to buy | £57,500 | £56,500 | £55,800 |

Zoopla research using UK Finance and Bank of England data

3-bed houses unquestionably the favourite choice

Half of first-time buyers outside of London are looking to buy a 3-bed house.

Despite mortgage rates rising in recent years, the more affordable end of the 3-bed market is still in reach for many households, especially for those looking to add value to their homes.

The exceptions are London and Scotland, where around a third of FTBs are looking to buy a 2-bed flat, making it the most popular choice in these regions.

This is largely down to the availability of stock in these areas, with flats being most commonly available, and the fact that affordability remains an important factor in the capital, given the high cost of buying a house there.

First-time buyers plan to spend £3,400 more on a home in 2024

Our data reveals FTBs are looking to buy homes costing £3,400 more than this time last year, an increase of 1.4%.

Yet mortgage rates have moderated over the same period, meaning monthy mortgage repayments have now dropped 9% for the average first-time buyer.

The prices of homes FTBs are looking to buy have risen the most in the North West (+4.4%) and East of England (+4.3%) since July 2023.

Prices for these homes were falling this time last year, but today’s reversal demonstrates that FTBs are now prepared to spend more on a home as the cost of borrowing comes down.

As well as being willing to pay higher prices, first-time buyers are also looking for larger homes in the North West and East of England, with three bedrooms or more.

However, in the North East and South of England, buyers are now looking for less expensive homes than in previous years.

This shows that mortgage rates haven’t fallen enough to ease affordability pressures in the South.

And while affordability looks stronger in the North East, first-time buyers are more sensitive to changes in the cost of living, which is why FTBs continue to look for lower-value homes here.

The prices of homes first-time buyers are looking to buy

| Location | July 24 | July 23 | Year-on-year change |

|---|---|---|---|

| South West | £244,400 | £250,900 | -2.6% |

| North East | £126,500 | £128,100 | -1.2% |

| South East | £327,700 | £331,400 | -1.1% |

| East Midlands | £213,800 | £213,700 | 0% |

| Scotland | £158,200 | £157,700 | +0.3% |

| Wales | £176,500 | £174,500 | +1.1% |

| Yorkshire & The Humber | £157,600 | £154,800 | +1.8% |

| London | £411,900 | £401,800 | +2.5% |

| West Midlands | £294,600 | £199,400 | +2.6% |

| East of England | £320,800 | £307,700 | +4.3% |

| North West | £171,500 | £164,200 | +4.4% |

| UK | £249,100 | £245,700 | +1.4% |

What’s the outlook for first-time buyer homes?

In 2024, the situation has improved for first-time buyers.

Growing earnings, modest house price growth and more attractive mortgage rates have boosted buying power for some, encouraging them to return to market.

However, affordability remains a key issue for many households interested in buying for the first time.

We expect mortgage rates to remain above 4% for the foreseeable future.

First-time buyers for whom this remains a barrier may choose to move further afield to access more affordable markets or consider purchasing a smaller property.

Looking to buy in 2024? Our Buying a Home guide has everything you need to know.

* Assumuming same mortgage term of 30 years; mortgage rates of 5.7% in 2023 and 4.5% in 2024; LTV of 75.4% in 2023 and 77.5% in 2024; and average price of £245,700 in 2023 and £249,100 in 2024.

Key takeaways

- Mortgage rates fall from 5.7% to 4.5% in a year, cutting £4,000 off the average deposit needed to buy a first home

- Monthly mortgage repayments are also less hefty, down £97-a-month compared to July 2023

- First-time buyers are now looking to spend £3,400 more on their first home as a result

Amazing things to do in London in September 2024

The best events, exhibitions and all-round great things to do in London in September 2024

September in London may be ‘back to school’ time, but it’s also when the city comes alive. A lot of London’s cultural scene goes into semi-hibernation mode over the summer, but come autumn it kicks back into gear with landmark museum exhibitions, new theatre and art shows and brand new food and drink openings.

There’s also a whole host of city-wide fests taking over the capital, including Open House London – giving us a chance to get a sneak peek inside usually private buildings – London Design Festival and Totally Thames – the brilliant celebration of London’s watery main artery complete with an illuminated flotilla installation.

While autumn is still on the horizon, summer isn’t over yet. So make sure you grab your final chance to enjoy the spoils of the season by booking a seat at some of London’s best rooftop bars and alfresco restaurants and lolling about in the city’s best urban beaches, parks and lidos. Get your diary out and start filling it up now.

1. Keep up with the spectacular programme of outdoor theatre at Greenwich + Docklands International Festival

London’s spectacular free outdoor Greenwich + Docklands International Festival. As the programme continues thrugh September look out for theatre from international companies Gecko and Good Chance which will join forces for ‘From Here On’ (Sep 6 and 8), a new work marking the eighty-fifth anniversary of the Kindertransport and the return of the beloved Dancing City programme of dance in, er, The City.

2. Watch Ben Whishaw and Lucian Msamati head up this major revival of Beckett’s ‘Waiting for Godot’

Despite the late Irish titan’s estate being famously resistant to any sort of major innovation when it comes to revivals of his work, Samuel Beckett’s existential masterpiece ‘Waiting for Godot’ still gets wheeled out semi-frequently. But, this is the first time it’s had a full-on West End production since Ian McKellen and Patrick Stewart did it in 2009, though, as heavyweights Lucian Msamati and Ben Whishaw take on the role of tramps Estragon and Vladimir, lolling about in a no-man’s land while kidding themselves that the mysterious Godot is going to visit them sometime soon. The great director James Macdonald will helm things.

3. Enjoy the sights and stories of the river at Totally Thames Festival

Every year, London’s famous river gets a whole festival of art installations, performances, and talks devoted to her watery charms, many of which are free to check out. This year’s Totally Thames Festival has scores of events throughout September, all dotted along riverside locations from Richmond to Barking & Dagenham.

The month's biggest event is the Great River Race (Saturday September 21) from Tower Hamlets to Richmond, where 330 crews from across the world spend the morning speeding down the Thames on wooden rowboats, many of them in jaunty fancy dress costumes. But there are plenty of other, less splashy highlights. You can clamber aboard antique vessels at St Katharine Docks Classic Boat Festival and see site-specific, river-inspired dance performances, visit a mudlarking exhibition, walk and masterclass, take the Tideway boat tour, listen in to special lectures and see a performance from a kids’ choir.

4. Get inspired at London Design Festival

London is widely recognised as one of the design capital’s of the world. Cementing this title is the annual Design Festival, a colourful and thought-provoking celebration of some of the world's best designers, who interrogate the boundaries of design through events, exhibitions and installations.

This year, the festival will showcase special projects and installations embodying major

themes across society such as sustainability, AI and inclusivity. For this edition, there will be new insights into the ideas of play and creativity. Lookout for ground-breaking projects such as ‘Vert’, a design which is looking to transform city life through the creation of sustainable wooden structures covered in plants designed to cool urban areas.

As ever, the festival is spread across 11 Design Districts including spots like Chelsea College of Art and the V&A Museum, where the events will reflect the unique identity of each area.

5. Immerse yourself in the eras on the Taylor Swift Songbook Trail

Unless you’ve been living under a rock, you’ll know that 2024 is Taylor Swift’s year – again, largely thanks to her continued Eras Tour. As the tour rumbles on, The Taylor Swift Songbook Trail will take over the V&A this summer, with 13 installations celebrating not just the success and achievements but also the creative process of a modern pop history maker. The trail will take visitors around the museum’s permanent galleries, offering a look at costumes and accessories worn by Swift and insights into her songwriting, storytelling, and music videos at each stop.

Along the way, there’ll be stations dedicated to her self-titled debut album, her 2008 hit single ‘Love Story’, her first completely self-written album ‘Speak Now’, the crossover landmark of the ‘Red’ album and its follow-up ‘1989’ and her darker turn in ‘Reputation’. Elsewhere, you’ll find odes to ‘Lover’, the ‘folklore’ and ‘evermore’ eras, ‘Midnights’ and ‘The Tortured Poets Department’, plus the pioneering pursuit of re-recording her first six albums as ‘Taylor’s Version’s.

6. Party in the street at Camden Inspire

Community-powered street festivals are an essential staple of London summertime and Camden’s celebration of grassroots culture is a must-visit. Partnered with the likes of The Roundhouse, Green Note, Fiddlers Elbow and Camden Open Air Gallery, expect a jam-packed programme of topnotch live music, spoken word, poetry and dance. There’ll also be street art galleries, creative workshops and plenty of delicious local food on offer.

7. Catch new drama about the extraordinary true story of the first Black woman to enter an English beauty contest

The first new play proper to run outdoors at the Globe since ‘I, Joan’, actor Anne Odeke’s play tells the extraordinary story of Princess Dinubolu, the first woman of colour to enter a beauty pageant in the UK: way back in 1908, Southend-on-Sea. Almost certainly not a princess, the mysterious woman was initially barred from the contest, but insisted upon entering – and succeeded after no rules were found stopping her. Odeke stars, in a production directed by Robin Belfield.

8. See into the future at Regent Street and St James’s Future of Food Festival

Foodies, pay attention – the culinary hotspots of Regent Street and St James’s will play host to the Future Of Food Festival in September, with a range of events to tickle your tastebuds. Join panel talks with industry experts to get some insight into where food is heading in the coming years, tuck into some unique dining experiences and meet some of the most innovative chefs, restaurateurs and suppliers in the country. There’ll be the opportunity to try dishes by 2-Michelin-starred chef Alex Dilling and feast on sustainable treats at Bentley’s Oyster Bar & Grill and Wilton’s. Across the whole of September, the area will be a treasure trove of promotions, with select restaurants offering £10 dishes and other discounts, while the Discovery Zone will take you on a journey via taste, smell and touch to find out what the future of food is.

9. See a snapshot of the UK’s art scene at The Turner Prize 2024

The Turner Prize is returning once again to London (every other year it goes to a different city, last year it was at the Towner Gallery in Eastbourne), bringing with it its annual celebration of the best artists in the country. This year’s shortlisted artists are Pio Abad, Claudette Johnson, Jasleen Kaur and Delaine Le Bas. The Turner Prize has lost almost all of its old ability shock, and even a lot of its ability to annoy, but it’s always an interesting snapshot of art in the UK.

10. Tour the city’s architectural wonders at Open House London

Ever wanted to have a nosy around some of London’s coolest private buildings? Open House London gives city dwellers free access to some of the capital’s architectural wonders that aren’t usually open to the public – from schools and offices to domestic homes and places of worship.

The hugely popular, capital-wide fortnight-long festival is back for 2024, with properties open for you to peak in – for free – all across the capital’s 33 boroughs. All you need to do is create an account online and you can register to see as many buildings in the programme as you like. As well as the festival’s usual line-up of community events, drop-in sessions and tours, this year, there are also plenty of events tailored specifically to young people.

Rents start falling in major cities

Our exclusive research for the BBC reveals rents are starting to fall in parts of the UK, as the pace of rental inflation hits its lowest level in nearly 3 years.

We’re past peak rental inflation

The recent boom in rent rises for new lets is coming to an end.

Rents have been rising faster than earnings for the past 3 years but they are now increasing at their slowest pace since 2021.

In news that will be welcomed by under-pressure renters looking to move, this is a clear sign that we’ve passed peak rental inflation.

Demand for rented homes has fallen by 39% over the last year, albeit off a high base, and the rental market has moved from ‘red-hot’ to still ‘hot’.

Our data shows there are 17 people still chasing every home for rent, which is double the pre-pandemic average seen between 2017-2019.

But the supply of rental homes available per estate agent has slowly started rising, increasing by 17% in the last year.

This is because more homes are being bought by corporate landlords, while lower mortgage rates are making it a little easier for renters to buy their first home, freeing up rental properties.

However, the general availability of homes for rent remains a major challenge for renters: the average agent still has a third fewer rental homes available than the pre pandemic average.

Rents rise at slowest pace in nearly 3 years

Rents for new lets have risen by 5.7% over the last 12 months, reaching an average £1,232 per month across the UK.

But in the last 6 months, they’ve risen by just 1.6%, the lowest increase seen since 2021.

The heat is coming out of the rental market, mainly as a result of affordability pressures.

If rises remain on this trajectory, rents for new lets are on track to be 3-4% higher over 2024, versus 8% in 2023 and 11% in 2022.

75% of cities record lower rent inflation

Changes in supply and demand at a city and local level are impacting rents to different degrees.

A slowdown in overseas student applications and a weaker labour market both explain some of this weakening in demand for renting.

Falling mortgage rates are also helping some renters to become first time buyers, freeing up rental homes for others.

In some cities, rents have been rising so fast they have ‘over-shot’ what renters are prepared to pay. As a result, we’re now seeing rents falling in some areas.

Our rental index tracks rents across 64 cities. In the first 6 months of 2024, rents have fallen in 5 cities: Nottingham, London, Worthing, Brighton and Glasgow. Meanwhile, the rate of inflation has dropped significantly across 75% of cities.

However, rents are still rising fast in some, for example Bradford and Liverpool, where there is headroom for rents to rise at an increased rate.

Overall, rents are rising fastest in accessible suburbs, larger cities and areas where rental properties are still offering some value for money.

Rochdale, Doncaster, Sunderland, Southend and Telford have all recorded rental inflation of over 4% in H1 2024.

Rents fall across a third of London boroughs

London is the UK’s most expensive market to be a renter.

With an average monthly rent of £2,172, almost 70% higher than the UK average, rents here are more than twice the price of many other regions.

The high cost of renting in the capital means affordability is a growing constraint on rental inflation and our index shows rents have fallen in more than a third of London boroughs in the first half of 2024.

The falls have been concentrated in inner east London, led by Tower Hamlets, Newham and Greenwich. And rental inflation has now slowed across all areas of the capital.

Corporate investors are buying new homes for rent, boosting supply and increasing choice, which also explains why rents have been rising more slowly across London, alongside affordability constraints.

However, higher growth rates are still being registered in outer London areas, led by Merton and Havering, where rents are below the London-wide average.

Key takeaways

- Rents start falling in London, Brighton, Glasgow, Nottingham and Worthing

- A third of London’s boroughs see rents come down

- Across the UK, rents are expected to rise by just 3-4% in 2024, a big drop from the increases seen in 2022 (11%) and 2023 (8%)